Department of Business Administration

I-Shou University

Master Thesis

The Study of Service Quality and its Relationship with Customer Satisfaction and Loyalty – The Case of Agribank HaGiang

Advisor

: Dr. Wanching Chang

Co-Advisor

: Dr. Nguyen Quang Vinh

Graduate Student

: Tran Phuong Quynh

Acknowledgements

This study is completed and inline with the requirement of I-Shou University and Hanoi University of Business and Technology. I would like to thank to all professor from ISU and HUBT. Especially my advisor Dr. Wanching Chang and Dr. Nguyen Quang Vinh who give me many valuable supports.

I would like to thank all my colleagues in Agribank Ha Giang and my class mate during the time of MBA.

I would like to thank my parents, parents in low, my husband any my son, without their encourage I can not complete this course.

Abstract

The aims of this study is to better understand customer satisfaction and to better understand the research means customer satisfaction for banks. Questionnaires were sent to 270 customers who is using services of Ha Giang Agribank by convinience sampling method on June, 2016 in Ha Giang city. In which 207 questionaire were return. After remove 27 invalide questionaire ( 13%), there were 180 (86.9%) valid questionaire and inputed in to analysis systerm of SPSS 22.0. The result shows that 4 of five factor of SERVQUAL Model has positive relationship on the customer satisfaction with Ha Giang Agribank service however the result shows that empathy factor and customer satisfaction about service quality of AgriBank is not supported. Also this study indicates that customer satisfaction has positive effect on the customer loyalty with Ha Giang Agribank . From the t-test and anova, the result shows that customer with longer experience in using Ha Giang AgriBank service are more satisfied and loyalty than other group and result also indicates that personal customer have more satisfaction and loyalty level than organization customer. Base on the Five Gaps model, conclusion and recommendation also discussed in this study.

Keywords: Servqual model; Five Gaps model; Customer satisfaction; Customer loyalty; Agribank Ha Giang,.

Table of contents

Acknowledgements ... iii

Abstract ... iv

Abstract ... iv

Table of contents ... v

List of table ... vii

List of Figure ... viii

Chapter I. Introduction ... 1

1.1 Research background ... 1

1.2 Research Objectives ... 2

1.3 Question of research ... 2

1.4 Research significant ... 2

Chapter II. Literature review ... 4

2.1 Overview of Banking industry ... 4

2.2 Situation bank card market ... 4

2.3 Agribank Ha Giang ... 6

2.3 Service quality and its characteristic ... 8

2.4 Customer satisfaction ... 9

2.5 Customer loyalty ... 9

2.6 The relationship between service quality, customer satisfaction and loyalty ... 10

2.7 The model study on service quality and customer satisfaction ... 11

2.7.1 Model of five gap ... 11

2.7.2 Model of SERVQUAL ... 13

Chapter III Methodology ... 14

3.1 Research design ... 14

3.2 Sampling ... 16

3.3 Construct of variable ... 16

3.4 Method of data analysis ... 17

3.4.1 Descriptive Statistics ... 18

3.4.2 Testing of the reliability of the scale ... 18

3.4.4 Develop regression equation ... 18

4.1 Demographic of customer ... 19

4.2. Reliability ... 20

4.4 Regression analysis ... 21

4.4.1 Pearson correlation coefficient ... 21

4.4.2 Regression result ... 22

4.5 t-test and ANOVA ... 24

4.5.1 The different level of satisfaction and loyalty between gender of customer ... 25

4.5.2 The differnent of customer satisfaction and loyalty among age group ... 25

4.5.3 The differnent of customer satisfaction and loyalty among eudcation level... 27

4.5.4 The differnent of customer satisfaction and loyalty among experience transation with Ha Giang AgirBank ... 29

Chapter V. Conclusion and recommendation ... 32

5.1 Conclusion ... 32

5.2 Recommendation ... 32

5.3 Research contribution ... 36

5.4 Limitations of the study ... 36

List of table

Table 3.1 Variable and Items ... 16

Table 4.1 Customer information ... 19

Table 4.2 Reliability analysis ... 20

Table 4.5 Pearson correlation analysis... 21

Table 4.6. Results of regression analysis of five factors of SERVQUAL and customer ... 22

Table 4.7 Results of regression analysis of customer satisfaction and loyalty ... 24

Table 4.8 The different level of satisfaction and loyalty between gender of customer ... 25

Table 4.9 The different of customer satisfaction and loyalty among age group ... 26

Table 4.10 post-hoc test result of different satisfaction among age group of customer ... 26

Table 4.11 The different of customer satisfaction and loyalty among eudcation level ... 27

Table 4.12 post-hoc test result of different satisfaction among eudcation levelof customer .. 28

Table 4.13 The different of customer satisfaction and loyalty among experience transation with Ha Giang AgirBank ... 29

Table 4.14 post-hoc test result of different satisfaction any loyaty among experience of customer ... 29

Table 4.16 The different level of satisfaction and loyalty between Organization and Personal customer ... 31

List of Figure

Figure 2.1 Gap model of service quality ... 13 Figure 3.1 Research model ... 14

Chapter I. Introduction

1.1 Research background

Vietnam is in the process of innovation, mechanism innovation in management as well as market mechanisms. This has brought many opportunities and many challenges for businesses in Vietnam. Country’s economy is growing, and it can be said the banking sector played a very important role in economic development.

Therefore, in addition to the traditional services, the commercial banks in Vietnam are constantly expanding other services modern nature including card services, a service is being considered as new opportunities for the Bank quantities are very large potential customers. But the country was developed in the 90s and gained certain achievements but there are also many difficulties limited to developing this service. The competitive development of these services Bank cards are now making demands of consumers is increasingly being met. Therefore, understanding and meeting customer needs is essential especially in the context of increasing competition today. The study of Service quality becomes an important topic because it has relationships with costs, benefits, satisfaction customer (Bolton and Drew, 1991; Boulding et al., 1993), the possibility of customer acquisition. These findings are particularly meaningful to managers and employees service providers in order to improve products and services better and better meet customer needs.

Based on the advantages of a long development time (since 1980) make up a solid development platform and wide network (until neighbors communes in remote areas). In addition, local nature is provincial, local geography first take up the northernmost country ever since its inception here Agribank developed almost exclusively in the province until the 2000s and very well, customers do not have many choices, and until now, the majority are loyal customers.

But according to the situation of the current economic development, Ha Giang province has been more joint stock banks established and growing as: Viettin Bank, BIDV, Vietnam Post Bank.

So study, learn about the relationship between customers and the Bank, especially customer satisfaction with the products and services proposed by the banks is very important and necessary, to create good relationships with customers and retain them. These loyal customers generate a huge profit for the bank, customer loyalty is seen as a competitive advantage, an important asset.

So this study titled "Study of service quality and its relationship with customer satisfaction and loyalty with products of the Agribank - Ha Giang Province" aims to better understand customer satisfaction and to better understand the research means customer satisfaction for banking industry.

1.2 Research Objectives

This study set out a number of goals as follows:

- To review the quality of services that is being provided by the banking industry based on the SERVQUAL model.

- To discover the related factors for improving the quality of banking services in terms of customer satisfaction and loyalty.

- To evaluate differences in demographic factors can affect the level of satisfaction and customer loyalty of the customers.

1.3 Question of research

To reach the research objective this study is going to answer the question as fowling: - Is there any relationship among factors of servqual model and customer

satisfaction?

- Is there any relationship between customer satisfaction and customer loyalty? - Are there any difference among customer demographic with the level of

customer satisfaction and customer loyalty with service quality of AgriBank ? -

This research will help to complete of defining a full and accurate the factors that impact on the quality of the banking services, from this research result the bank will have the right to improve the service quality and customer satisfaction. In addition, on the basis of the study, the authors propose a number of measures to improve the quality of Ha Giang AgriBank ATM services.

Chapter II. Literature review

2.1 Overview of Banking industry

According to the assessment of the Al-Mulali et al. (2015), the internal factors and the objective of the business environment of credit institutions is more pronounced improvement in 2015 compared to 2014, including "Business conditions and customer financing goods "and" Bridge of the economy for products and services "is 2 objective factors are identified with the strongest improvements.

Customer demand for banking products and services has been identified this year increased significantly compared to last year and expected to continue to grow faster in the coming year, while demand for loans is expected to increase strongest.

More than 90% CIs identified risk level of customer groups at the end of 2015 is at normal and low, significantly decreased compared to 2014, and is expected to continue to trend stable or decreased in 2016 in all customer groups, which is the biggest drop TCKT customer groups, then the group of individual customers and other credit institutions. The banks expect the business environment in and out of the CI continued to improve even more positive in 2016. The survey results showed that 81% CI evaluate the business situation of their units have "improved" compared with 2014, of which 34% CI rated as "much improved". On that basis, the banks expect business conditions will continue a sustainable recovery in the first quarter / 2016 and throughout 2016, with 93% CIs expect overall business conditions of 2016 better than in 2015, while 32% CI expects the business situation will be improved.

2.2 Situation bank card market

Looking back at the moment is considered the beginning in 2003, when the market appears 2 local cards used on ATM (automated teller machine) is of Vietcombank Connect 24 and F @ asAcess of Techcombank, the total number cards issued (including domestic cards and international cards) reached 234,000 cards. But so far, the growth rate of the card market was very high, at over 300% of the year.

October, there were 52 commercial banks (CBs) in domestic and foreign banks with registered capital of card issuance, with over 57.1 million cards have been issued kinds, up 38.5% compared to 2011. This growth rate is very impressive. In particular, most debit cards (representing 93.6%), credit cards (3.1%). The proportion using bank cards than the means of non-cash payments other tends to increase.

Also according to the central bank, by the end of the month 3/2013, there are 46 commercial banks have ATMs and POS equipment (card payment machines), with the number of ATMs and more than 104,400 in 14,300 POS. Companies switching, the card-issuing bank has interconnect ATM system on a national scale, through which a bank card can be used at most ATM of other banks. Until now, basically completed more than 76,000 POS connection with over 720 branches of commercial banks; 20,600 POS units were linked together, mainly restaurants, hotels, supermarkets, airline ticket agents, tour companies ... The number and value of payments through POS increasing. Besides, awareness of card payments through POS has been a positive change of both cardholders and merchants to receive payments.

Legal framework to stimulate the use of cards are constantly being improved. Prime Minister signed Decision No. 2453 / QD-TTg dated 27/12/2011 approving the project Promoting non-cash payment in Vietnam in 2011-2015. Accordingly, the scheme should specify the goals to be achieved by the end of 2015 the proportion of cash in the total means of payment below 11%; increased the proportion of people with bank accounts to 35-40%; deploying 250,000 transaction amounts over 200 million transactions / year. Next is the Decree 101/2012 / ND-CP, dated 11/22/2012 on non-cash payments.

Date 12/28/2012, SBV issued Circular No. 35/2012 / TT-NHNN on service charges local debit cards, which stipulates the principle of charging, the frame according to the schedule charge, card issuers are not outside the framework additional cost service charges issued cards, the unit accepts no fee card POS transactions for cardholders, to ensure harmony between the interests of the stakeholders trousers. Implementing asynchronous parallel with Circular 35 as Circular No. 36/2012 / TT-NHNN dated 28/12/2012 regulations on equipment, management, operation and safety of ATM

operations, thereby strengthening the obligation and responsibility to ensure quality, efficiency ATM.

On the part of commercial banks, in addition to developing the number of cards, the quality of services is also increasingly been finalized, the majority have links with organizations, such as schools, taxi companies, airlines, super ... in the payment market. At the same time, the safety, the security of payment cards increasingly improved, such as chip technology applications in the issuance and payment, and release and accept EMV chip card payment.

The strong development of the card market has brought many benefits, promote non-cash payments and the first step to change habits as well as awareness of the people and businesses in the use of means of payment popular, is not new in many developing countries have long. Card service development banks helped add a channel to mobilize capital to lend and develop more value-added service to the many different interests of customer service. Card payments also reduce the cost compared to paying with cash, especially concerns about counterfeit money and confusion. 2.3

Agribank Ha Giang

Agribank Ha Giang has 19 wholesale transactions, including provincial base, 11

branches and 7 room category 3 transactions (up 2 branches and 2 district

transaction offices than in 1991). Mobilized capital reached 1,396, 8 billion,

increased 140 times over 1991; Loans outstanding reached 1755.7 billion;

increasing credit quality improved, the NPL ratio in 1991 accounted for over

7%, now only 0.7%. Agribank Ha Giang is an important fund channel serves to

meet the needs of capital for economic development, especially in rural areas

Agriculture. Credit capital of the Bank has covered 100% verified communes

and villages of the province.

Besides, the supply of products and services of banks increasingly rich, with

many modern facilities, attractive, and better meet customer needs, enhance

brand Agribank Ha Giang, such as: ATM card issuance, Mobile Banking,

payment via account salaries, agents selling airline tickets.

First 6 months of 2016, Agriculture Ha Giang has implemented promptly and

institutions to strictly implement the guidance of the senior branches and

committees local authorities on the work of credit, listened closely to serve

mission economic development, the province's social. Initiative, efforts to

find qualified clients to loan growth targeted, driven out, the credit growth

associated with improving credit quality priority areas for agricultural and

rural development village. Total funds mobilized locally to date reached

3,192 billion 06/30/2016, an increase compared to the same period of 2015

was 342 billion, total capital of Agribank Ha Giang 44% of total capital in

the province. Total outstanding domestic currency reached 2,999 billion, an

increase over the same period in 2015 is 407 billion, the NPL ratio was

0.87%. Outstanding loans reached 9% overall growth, debt collection has

handled 9216 million risk reaches 60% of the plan year, profit was 71 718

million stock financing contract

Discussion at the meeting, the delegates focused on analyzing the causes

exist, evaluate the competition is increasing by the introduction of other

commercial banks in the province. Target not reached the capital than

planned, the new service targets only 41.2% of the plan year, bad loans

increased 0.11%. On that basis, the Conference has launched measures to

promote business development last 6 months of 2016 were: Proactive,

flexible and efficient in operating the business plan oriented, ensure

discipline, discipline, implementation teams and stock to individual workers.

Executive deposit rates and lending quick, properly operating mechanism of

the interest rate of the State Bank, in accordance with local practice. To

intensify the mobilization of capital, diversification of products raise capital,

accelerate deployment of utility products and services, market expansion and

market share in the province. Striving to raise capital in local currency

reached 3.550 billion, 100% of the traffic plan, including deposits from

residents accounted for 89% of total mobilized capital. Striving to total loans

reached 3,178 billion, up 15% year to date, total revenue reached 19 967

million services, the NPL ratio of 0.8% under the sheet.

2.3 Service quality and its characteristic

pure service has features that distinguish compared to pure commodities. That is the characteristic: invisibility, integral calculation between supply and consumption calculation servicers uneven quality, no reserve, no change of ownership calculation. The main characteristic of this will lead to a difference of content versus Marketing Marketing Services tangible goods. (Parasuraman, Zeithaml, and Berry, 1988).

- Invisible

Goods with shape, size, color and even smell. Customers can review, evaluate whether it is appropriate for my needs. Conversely, identifiable intangible servicers, making the customer's senses are not aware of before buying the service. This is a big problem when selling a service compared to the sale of a tangible commodity, because servicers demanding customers try before buying, feel the quality is difficult, difficult choices servicers, providers ad difficult to service. Therefore, servicers more difficult to sell goods.

- Integral calculation between supplier and consumer servicers

Goods are produced concentrated in one place, and then transported to where they are needed. When out of the production line, the merchandise is complete. Such, manufacturers can achieve economies of scale by concentrating production, batch, quality management and product focus. Manufacturers also can produce when convenient, and then stored in warehouses and sell them when the need arises. Therefore, they are easy to implement supply-demand balance. But the service provider and service consumer occur simultaneously. Who provide services and the customer must contact with each other to provide and consumer services at the place and time that works for both parties. For some of the services, the customer must be present during service providers.

- Uneven in quality

Service can not be provided in bulk, concentrated as commodity production. Therefore, suppliers’ difficult quality control according to a uniform standard. On the other hand, the customer's perception of service quality is strongly affected by the skills, attitudes of service providers. Health, the enthusiasm of the staff providing services in the morning and afternoon sessions may be different. Therefore, difficult to achieve uniformity of quality of service within a day. servicers more people served, the harder it ensures uniformity of quality.

- No reserves

Servicers only exist at the time it is offered. Therefore, the DV can not mass production to take on stocks, while market demand is for sale.

2.4 Customer satisfaction

In market research, generally more frequent lessons about companies not to please the customer rather than the customer was satisfied like? When buying a product or service, we always hope that it is the right choice. Customers will not be glad to have a say, "it's not so great or so, it really is very good", because this is what they pay to get (Atilgan et al, 2003). In addition, customers are always demanding of standards. In the eyes of customers to evaluate standards will be increasingly higher. At the same time, daily life will become more complex with higher pressure, so customers feel satisfied and achieve high satisfaction in the current difficult environment than ever before (Chua and Luk, 2005). And even though customers are completely satisfied with the product or service you matter, the significant part of them also can leave you and move on to choose your competitors.

Enterprise is always trying to meet customers. Customer satisfaction will often come back and buy more, they tell others about their experience, and they can also pay for insurance for the franchise with a provider they trust. The statistics of market research showed that the cost of keeping a customer is only 1/10 compared to the addition of a new customer. So when a customer more, we should embrace them.

To build and maintain the relationships with loyal customers is always an effective strategy and proper for the development of a business. By the loyal customers are more likely to meet more often use the value-added services more and more important as they like to promote services or products your friends more than new customers. Many small business owners have achieved success by adopting radical 10 below effective method to maintain long-term customer loyalty.

Loyalty is classified quite simple: dependent factors and experience emotions. Whether the original is not always profitable immediately, but this long journey will make a connection and lobbying for business. Loyalty in terms of functionality will help consumers keep buying because it's easy or affordable or directly meet certain urgent needs. Brand success only if they meet both aspects of consumer behavior is emotional and functional. That is success on a large scale, diversity, and create a solid foothold (Lee, Lee and Feick, 2001)

Marketing professionals and brand managers are regularly reminded that they must be very general what action to "build customer loyalty," which is not actually have a clear concept or what specific KPIs phrase on expression. Listen as they share, what we had to learn more: challenges businesses are facing is what defines them as well as how to loyal customers. Because, if they are simply interested in how customers buy / use the product or service once, could very basic problems have been resolved and does not need too much attention to construction problems customer loyalty. All trademarks, whether large or small, should have a clear understanding of our customers, business challenges you're facing and long-term goals before actually entering the game on loyalty (Lam et al., 2004).

2.6 The relationship between service quality, customer

satisfaction and loyalty

The study showed that the Service quality and customer satisfaction has a close relationship with each other, the Service quality is the cause and the result satisfied. The relationship between service quality and customer satisfaction is the way relationships, service quality has a positive impact on customer perception.

According to Zeithaml (2000), Service quality and customer satisfaction are two different concepts, Service quality while focusing on the specific components of services, customer satisfaction is the concept generality. According to Cronin and Taylor (1992) and Spereng et al., (1996) service quality and customer satisfaction have been linked together.

2.7 The model study on service quality and customer

satisfaction

In the field of research and the Service quality meets customer seminar was the researchers carried out a systematic and years. Which must include a number of popular models such as the quality gap model (Parasuraman et al., 1985), functional quality models / technical quality (Grönroos, 1984), three models of product attributes of Kano (1984), SERVQUAL model (Parasuraman et al, 1988), the model index satisfying service satisfaction (CSI) of the country (Anderson and Fornell, 2000). So in this study will introduce some typical research model is used by many researchers.

2.7.1 Model of five gap

Model 5 the gap was introduced Parasuraman et al. (1998), started since 1995 in the Journal of Marketing. As Parasuraman et al., the expectation is seen as expected or desired by consumers, and expectations customers are formed on the basis of information outside of mouth, personal needs and their own experiences.

The first gap occurs when there is a difference between customer expectations for Service quality and service providers feel about customer expectations.

Second gap occurs when service providers have difficulty in moving on their perceptions of customer expectations into the area of service quality characteristics. Means that the service provider can not transfer customer expectations into specific performance criteria of the service due to the limitations on the ability to provide, the ability to respond.

Third, distances appear when service personnel are not transferred to the customer service in accordance with these criteria have been identified. Because the service

provider is a contact process between human beings should in some cases provide services staff

Service can not be transferred to the customer in accordance with the criteria set out from vendors.

Distance fourth is the impact of the advertising media and information on customer expectations of service quality. Advertising would make the expectations of customers change the direction set expectations on more services, so as to use the service if the quality is not the same as advertised, the promise of advertising services through not exactly as the customer experience will also make sense of service quality is declining.

Distance fifth is when there is a difference between the quality expected by the customer and the quality they perceive. For that service quality is a function of the way 5th visitors. Thursday gap depends on the distance before measurement, to shorten this distance to shorten the distance before, shortening the distance as well as increasing the quality of service. Service quality model 5 distance is expressed as follows:

Gap Model of Service Quality

External communication to customer Expected service Translation of perception Management perception Perceived service Service delivery - Word of mouth - Personal needs - Past experience Custom er provid er Gap 1 Gap 4 Gap 5 Gap 3 Gap 2

Figure 2.1 Gap model of service quality (Parasuraman et al., 1995)

2.7.2 Model of SERVQUAL

Parasuraman et al.(1988) gave SERVQUAL model applied in the field of retail and services include the following five elements:

Reliability: The confidence of the service agreement provided by businesses and organizations such as: timely, timely and flawless.

Response: As the desire and readiness of personnel system in providing services to customers.

Assurance: Demonstrate competence, professional qualifications of the staff to provide services such as job-solving skills, service attitude, respect, sense of duty. Empathy: Demonstrating understanding, learn interested in the unique needs of the client, attention to customer expectations.

Tangible: As the conditions, facilities, tools for process service provider of enterprise customer organizations.

Servqual has quickly become the most popular model to measure the quality of services in many different areas. So in this study will consider five factors used SERVQUAL model of how influential to the satisfaction of the patients at the hospital.

Chapter III Methodology

3.1 Research design

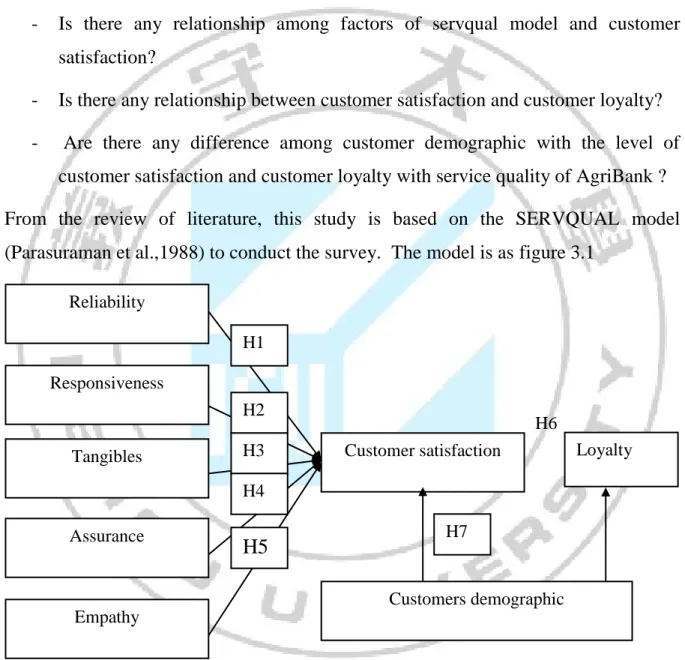

To reach the research objective this study is going to answer the question as fowling: - Is there any relationship among factors of servqual model and customer

satisfaction?

- Is there any relationship between customer satisfaction and customer loyalty? - Are there any difference among customer demographic with the level of

customer satisfaction and customer loyalty with service quality of AgriBank ? From the review of literature, this study is based on the SERVQUAL model (Parasuraman et al.,1988) to conduct the survey. The model is as figure 3.1

Figure 3.1 Research model

Reliability Responsiveness Tangibles Assurance Empathy Customer satisfaction Customers demographic H1 H2 H3 H4

H5

H7 Loyalty H6Research hypothesis:

H1: There is a relationship between tangible factor and customer satisfaction about service quality of AgriBank

H2: There is a relationship between reliability factor and customer satisfaction about service quality of AgriBank

H3: There is a relationship between responses factor and customer satisfaction about service quality of AgriBank

H4: There is a relationship between assurance factor and customer satisfaction about service quality of AgriBank

H5: There is a relationship between empathy factor and customer satisfaction about service quality of AgriBank

H6: There is a relationship between customer satisfaction and customer loyalty with service quality of AgriBank

H7: There are difference among customer demographic with the level of customer satisfaction and customer loyalty with service quality of AgriBank ?

3.2 Sampling

This study is going to conduct the survey with customers who are using services of Ha Giang Agribank.

Sampling method: non-probability sampling convenience is used in this study. This is a sampling method by which members are selected form a convenient and economic way.

3.3 Construct of variable

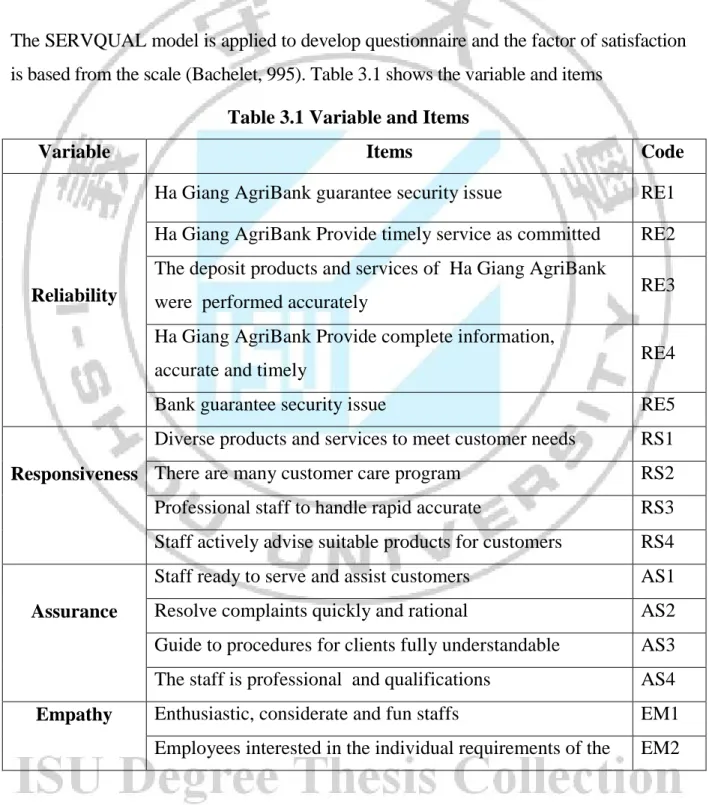

The SERVQUAL model is applied to develop questionnaire and the factor of satisfaction is based from the scale (Bachelet, 995). Table 3.1 shows the variable and items

Table 3.1 Variable and Items

Variable Items Code

Reliability

Ha Giang AgriBank guarantee security issue RE1

Ha Giang AgriBank Provide timely service as committed RE2

The deposit products and services of Ha Giang AgriBank

were performed accurately RE3

Ha Giang AgriBank Provide complete information,

accurate and timely RE4

Bank guarantee security issue RE5

Responsiveness

Diverse products and services to meet customer needs RS1

There are many customer care program RS2

Professional staff to handle rapid accurate RS3

Staff actively advise suitable products for customers RS4

Assurance

Staff ready to serve and assist customers AS1

Resolve complaints quickly and rational AS2

Guide to procedures for clients fully understandable AS3

The staff is professional and qualifications AS4

Empathy Enthusiastic, considerate and fun staffs EM1

Variable Items Code customer

Always listen to customers EM3

Always polite, friendly customer EM4

Tangible

The location of transaction is convenience and in

accordance with customer needs TA1

Spacious transaction, using modern technology TA2

Nice layout of the counter, identifiable for Customers

reasonable TA3

The staff dresses polite TA4

Paper forms to be used in transactions were designed easily TA5

Customer satisfaction

Ha Giang AgriBank offers more benefits than costs me

money CS1

Ha Giang AgriBank is the best among competing banks CS2

Ha Giang AgriBank is much better than what I expected CS3

Intention behavior

Ready to become long-term customers of banks IB1

Ready to introduce family and friends IB2

If there are minor issues and comments will continue to use

the services of the bank IB3

This study is a quantitative research, so the scale is selected hierarchical scales or scale ratio can not be used to identify the scale of the investigation. Scale levels can be used as scale or Likert scale Stapel, however Likert scale was selected because of its advantages is the use of a positive sequence. Specifically, in this study 5 point Likert scale was selected as a measurement scale survey questions.

3.4 Method of data analysis

Survey data were analyzed with the help of SPSS 20.0 Windows environment for analysis via the following steps:

3.4.1 Descriptive Statistics

Samples collected were analyzed using descriptive statistics: Classification criteria for classification of samples according to the survey, on average, maximum value, minimum value of the answers in the questionnaire.

3.4.2 Testing of the reliability of the scale

To test the reliability of the scale used in the study, the authors used Cronbach`s Alpha coefficients for verification and correlation coefficient of total variation. The variables are not reliable guarantee will be excluded from the research model and does not appear when exploring factor analysis (EFA). Selection criteria Cronbach`s minimum Alpha 0.6 (Hair et al, 2006), the correlation coefficient is less than 0.3 of the total variation is considered garbage and turn naturally eliminated from the scale (Nunally and Burstein, 1994).

3.4.4 Develop regression equation

Chapter IV Research result

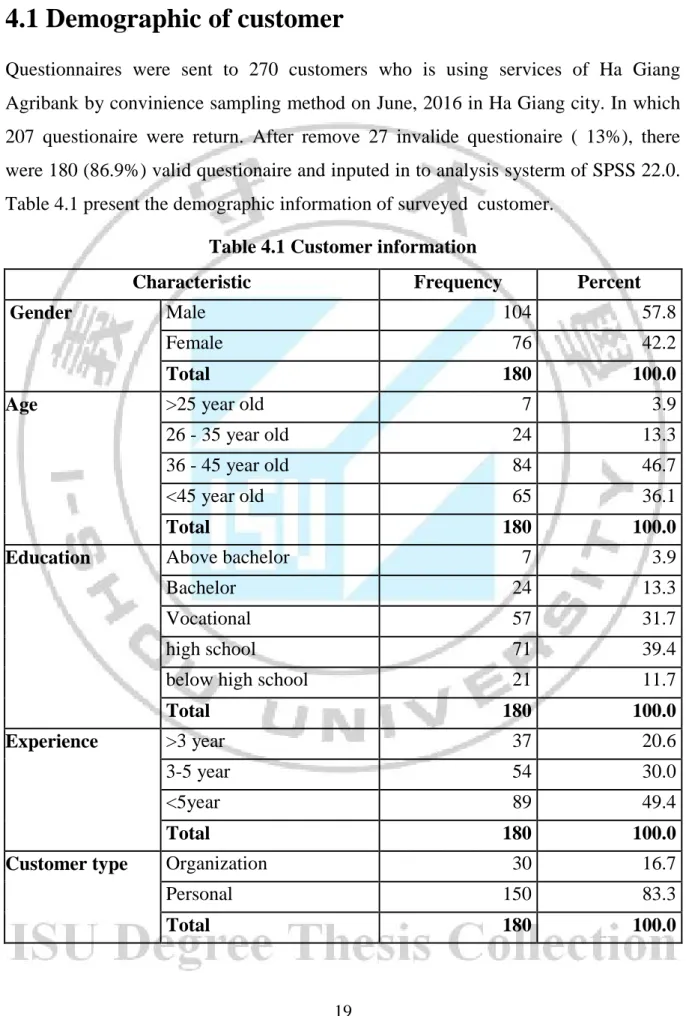

4.1 Demographic of customer

Questionnaires were sent to 270 customers who is using services of Ha Giang Agribank by convinience sampling method on June, 2016 in Ha Giang city. In which 207 questionaire were return. After remove 27 invalide questionaire ( 13%), there were 180 (86.9%) valid questionaire and inputed in to analysis systerm of SPSS 22.0. Table 4.1 present the demographic information of surveyed customer.

Table 4.1 Customer information

Characteristic Frequency Percent

Gender Male 104 57.8

Female 76 42.2

Total 180 100.0

Age >25 year old 7 3.9

26 - 35 year old 24 13.3

36 - 45 year old 84 46.7

<45 year old 65 36.1

Total 180 100.0

Education Above bachelor 7 3.9

Bachelor 24 13.3

Vocational 57 31.7

high school 71 39.4

below high school 21 11.7

Total 180 100.0

Experience >3 year 37 20.6

3-5 year 54 30.0

<5year 89 49.4

Total 180 100.0

Customer type Organization 30 16.7

Personal 150 83.3

Total 180 customers were surveyed in this study, there are 104 customers are male that count for 57.8% and 76 female counted for 42.2% of respondent.

Related to age of customer, this study result finds that customer who is >25-year-old is just 3.9%, from 26 - 35 year old is 13.3%, from 36 - 45 year old is 46.7% and <45 year old is 36.1%, indicate the high age of respondent in this study.

For the education of customer, this research result show that customer who have above bachelor is counted for 3.9% only, Bachelor is 13.3%, Vocational education level is 31.7%, customer who have high school degree in this study is 39.4% and below high school is 11.7%. It can be concluded that, with the high mountain city like Ha Giang, all most customer is not high education level.

Related to transaction experience of customer with Ha Giang AgriBank, this study survey shows that customer who have >3 year transaction experience is counted for 20.6%, from 3-5 year is 30.0% and <5year is 49.4% indicated long time experience transaction of customer. It should be noted that the high mountain city like Ha Giang, the banking is limited and almost banking transaction of people through Ha Giang AgriBank, and Ha Giang AgriBank is one bank with longest history in Ha Giang city. This study also asked for customer type, there are 30 customers who is Organization count for 16.7% and the rest of 150 customer said that they are personal customer that count for 83.3%.

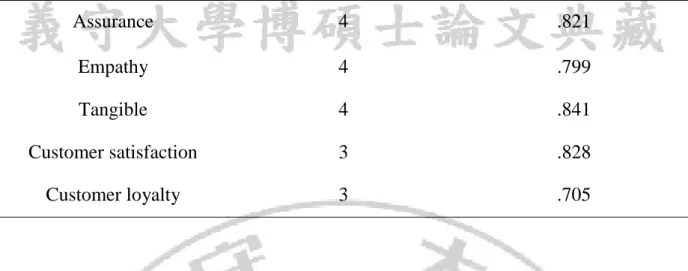

4.2. Reliability

Cronbach's alpha above 0. 6 is chosen as rcommened by Nunnally and Burnstein, (1994). Table 4.2 is shown the Reliability analysis after removed 1 observation have a corrected item - total correlation is less than 0.3 include: Paper forms to be used in transactions were designed easily (Tangible factor)

Table 4.2 Reliability analysis

Variable Number of item Cronbach's Alpha

Reliability 5 0.861

Assurance 4 .821

Empathy 4 .799

Tangible 4 .841

Customer satisfaction 3 .828

Customer loyalty 3 .705

Thus, after analysis showed Cronbach's alpha SERVQUAL model in the model proposed is 19 observation variable with 5 independent factors and 2 dependent factors, there is 01 variables were excluded from the model. All the scale chosen as Cronbach's alpha above 0. 7 are reliability as recommendation by Nunnally and Burnstein, (1994)

4.4 Regression analysis

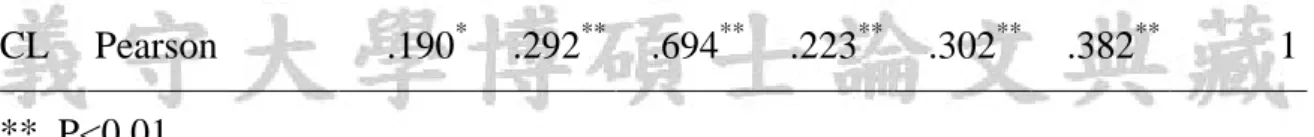

4.4.1 Pearson correlation coefficient

If the variables are correlated, they must pay attention to the problem multicollinearity when regression analysis (hypothesis H0: correlation coefficient equal to 0).

Table 4.5 Pearson correlation analysis

RE RS AS EM TA CS CL RE Pearson 1 RS Pearson .485** 1 AS Pearson .331** .390** 1 EM Pearson .296** .351** .359** 1 TA Pearson .465** .474** .284** .434** 1 CS Pearson .710** .607** .453** .434** .661** 1

CL Pearson .190* .292** .694** .223** .302** .382** 1 **. P<0.01

*. P<0.05

Correlation analysis results showed that the correlation coefficient between the independent and dependent variables are significant (sig <0.05), so the independent variables included in the regression analysis is appropriate. In addition, the results showed a number of independent variables are correlated with each other. Therefore, when regression analysis should pay attention to multicollinearity problems.

4.4.2 Regression result

To test the relationship among five factors of SERVQUAL and customer satisfaction with service quality of AgriBank. This study uses multiple regression analysis.

H1: There is a relationship between tangible factor and customer satisfaction about service quality of AgriBank.

H2: There is a relationship between reliability factor and customer satisfaction about service quality of AgriBank.

H3: There is a relationship between responses factor and customer satisfaction about service quality of AgriBank.

H4: There is a relationship between assurance factor and customer satisfaction about service quality of AgriBank.

H5: There is a relationship between empathy factor and customer satisfaction about service quality of AgriBank.

The regression results obtained are as follows:

Table 4.6. Results of regression analysis of five factors of SERVQUAL and customer

Model Unstandardized Coefficients Standardized Coefficients t Sig. B Std. Error Beta 1 (Constant) -.930 .223 -4.180 .000 RE .433 .053 .410 8.142 .000 RS .204 .058 .183 3.532 .001 AS .151 .053 .133 2.829 .005 EM .063 .049 .062 1.291 .198 TA .322 .052 .318 6.149 .000 R2/Adjusted R2 .700/692 F/Sig. 81.330/0.00

ANOVA analysis showed that F = 81.330 with sig = 0.000, thus the independent variables in the model have a relationship with the dependent variable (customer satisfaction).

From the regression results we see, Adjusted R2 = 0.692 is quite high. This shows a linear regression model is consistent with the data set of the sample at 69.2%, the independent variables explain 69.2% variance of the dependent variable.

From the regression of standardized model, this study can be concluded that 4 of five factor of SERVQUAL Model has positive relationship on the customer satisfaction with Ha Giang Agribank service include: H1, H2, H3,H4 are supported by the model. The result shows that H5: There is a relationship between empathy factor and customer satisfaction about service quality of AgriBank is not supported by the model (Beta = 0.62, P>0.05)

For the detail of each factor effecting, the result shows that the reliability factor has the biggest impact on customer satisfaction (beta = .410), the second is tangible (beta =.318) the third is response factor (beta=.183) and the forth is assurance factor (beta=.133).

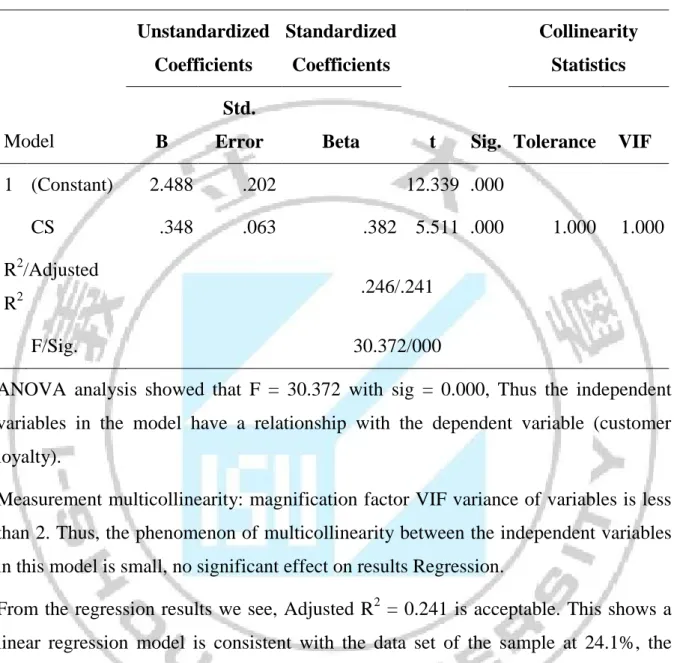

- H6: There is relationship between customer satisfaction and loyalty with

To find the relationship between overall service quality and customer satisfaction, the single regression is taken, Summary of regression coefficients:

Table 4.7 Results of regression analysis of customer satisfaction and loyalty

Model Unstandardized Coefficients Standardized Coefficients t Sig. Collinearity Statistics B Std.

Error Beta Tolerance VIF

1 (Constant) 2.488 .202 12.339 .000

CS .348 .063 .382 5.511 .000 1.000 1.000

R2/Adjusted

R2 .246/.241

F/Sig. 30.372/000

ANOVA analysis showed that F = 30.372 with sig = 0.000, Thus the independent variables in the model have a relationship with the dependent variable (customer loyalty).

Measurement multicollinearity: magnification factor VIF variance of variables is less than 2. Thus, the phenomenon of multicollinearity between the independent variables in this model is small, no significant effect on results Regression.

From the regression results we see, Adjusted R2 = 0.241 is acceptable. This shows a

linear regression model is consistent with the data set of the sample at 24.1%, the independent variables explain 24.1% variance of the dependent variable.

From the regression model, this study can be concluded that customer satisfaction has positive effect on the customer loyalty with Ha Giang Agribank (beta= .382, P<0.05).So hypothesis H6 is supported.

4.5 t-test and ANOVA

For further testing the hypothesis H7: There are difference among customer demographic with the level of customer satisfaction and customer loyalty with service

quality of AgriBank (Gender, age, education, experience and type of customer). This study uses the t-test and ANOVA.

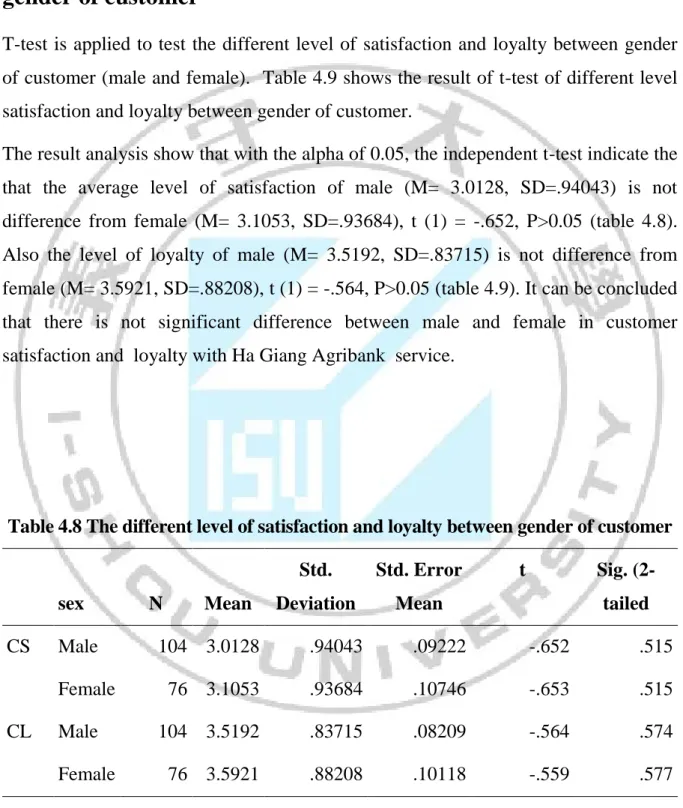

4.5.1 The different level of satisfaction and loyalty between

gender of customer

T-test is applied to test the different level of satisfaction and loyalty between gender of customer (male and female). Table 4.9 shows the result of t-test of different level satisfaction and loyalty between gender of customer.

The result analysis show that with the alpha of 0.05, the independent t-test indicate the that the average level of satisfaction of male (M= 3.0128, SD=.94043) is not difference from female (M= 3.1053, SD=.93684), t (1) = -.652, P>0.05 (table 4.8). Also the level of loyalty of male (M= 3.5192, SD=.83715) is not difference from female (M= 3.5921, SD=.88208), t (1) = -.564, P>0.05 (table 4.9). It can be concluded that there is not significant difference between male and female in customer satisfaction and loyalty with Ha Giang Agribank service.

Table 4.8 The different level of satisfaction and loyalty between gender of customer

sex N Mean Std. Deviation Std. Error Mean t Sig. (2-tailed CS Male 104 3.0128 .94043 .09222 -.652 .515 Female 76 3.1053 .93684 .10746 -.653 .515 CL Male 104 3.5192 .83715 .08209 -.564 .574 Female 76 3.5921 .88208 .10118 -.559 .577

age group

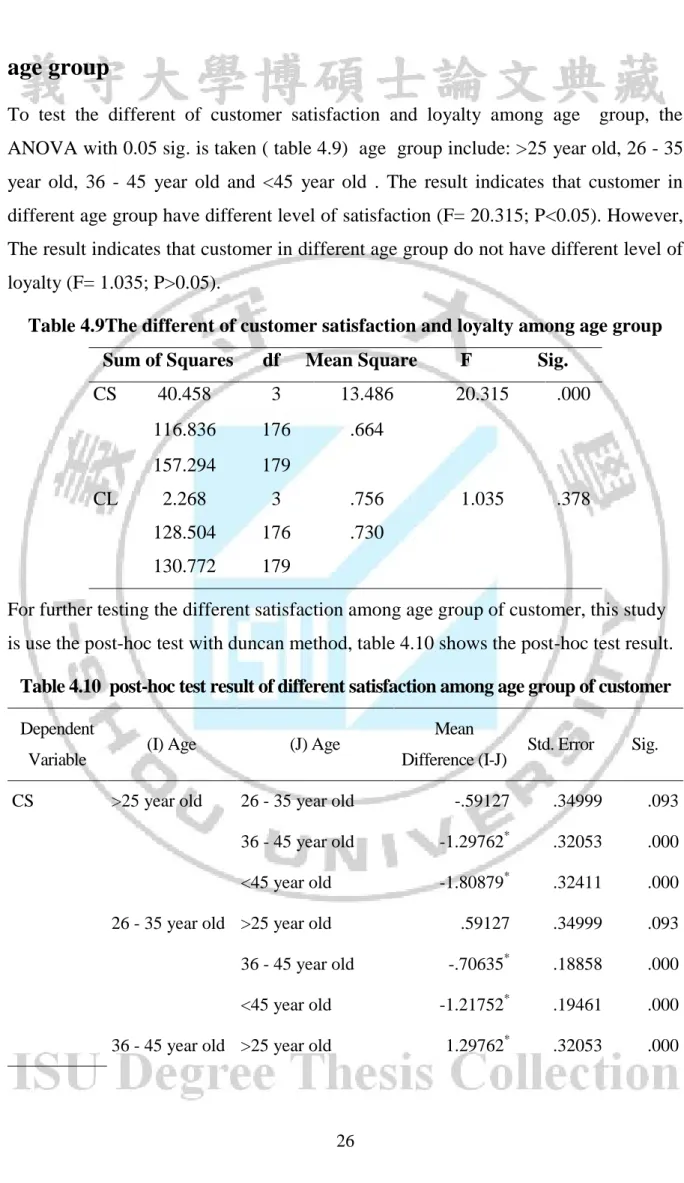

To test the different of customer satisfaction and loyalty among age group, the ANOVA with 0.05 sig. is taken ( table 4.9) age group include: >25 year old, 26 - 35 year old, 36 - 45 year old and <45 year old . The result indicates that customer in different age group have different level of satisfaction (F= 20.315; P<0.05). However, The result indicates that customer in different age group do not have different level of loyalty (F= 1.035; P>0.05).

Table 4.9The different of customer satisfaction and loyalty among age group

Sum of Squares df Mean Square F Sig.

CS 40.458 3 13.486 20.315 .000 116.836 176 .664 157.294 179 CL 2.268 3 .756 1.035 .378 128.504 176 .730 130.772 179

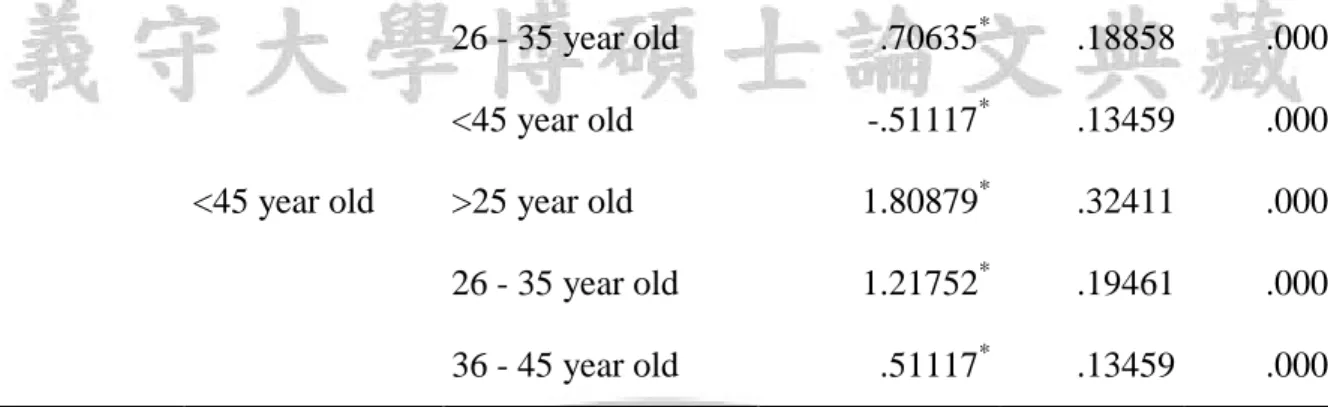

For further testing the different satisfaction among age group of customer, this study is use the post-hoc test with duncan method, table 4.10 shows the post-hoc test result.

Table 4.10 post-hoc test result of different satisfaction among age group of customer

Dependent

Variable (I) Age (J) Age

Mean

Difference (I-J) Std. Error Sig.

CS >25 year old 26 - 35 year old -.59127 .34999 .093

36 - 45 year old -1.29762* .32053 .000

<45 year old -1.80879* .32411 .000

26 - 35 year old >25 year old .59127 .34999 .093

36 - 45 year old -.70635* .18858 .000

<45 year old -1.21752* .19461 .000

26 - 35 year old .70635* .18858 .000

<45 year old -.51117* .13459 .000

<45 year old >25 year old 1.80879* .32411 .000

26 - 35 year old 1.21752* .19461 .000

36 - 45 year old .51117* .13459 .000

The result from table 4.10 shows that customer who is > 25-year-old and 26 - 35-year-old are not satisfied with the Ha Giang Agribank while the customer with the age of 36 - 45-year-old and <45-year-old have satisfied level (P<0.05).

4.5.3 The differnent of customer satisfaction and loyalty among

eudcation level

To test the different of customer satisfaction and loyalty among eudcation level, the ANOVA with 0.05 sig. is taken ( table 4.11) eudcation level include: Above bachelor, Bachelor, Vocational, high school, below high school. The result indicates that customer in different eudcation level have different level of satisfaction (F= 3.144; P<0.05). However, The result indicates that customer in eudcation level do not have different level of loyalty (F= .770; P>0.05).

Table 4.11 The different of customer satisfaction and loyalty among eudcation level

Sum of Squares df Mean Square F Sig. CS 10.545 4 2.636 3.144 .016 146.749 175 .839 157.294 179 CL 2.263 4 .566 .770 .546

128.509 175 .734

130.772 179

For further testing the different satisfaction among eudcation level of customer, this study is use the post-hoc test with duncan method, table 4.12 shows the post-hoc test result.

Table 4.12 post-hoc test result of different satisfaction among eudcation levelof customer

(I) Education (J) Education

Mean Difference

(I-J) Std. Error Sig.

Above bachelor Bachelor -.01190 .39336 .976

Vocational -.06015 .36675 .870

high school -.08115 .36278 .823

below high school -.80952* .39966 .044

Bachelor Above bachelor .01190 .39336 .976

Vocational -.04825 .22283 .829

high school -.06925 .21622 .749

below high school -.79762* .27363 .004

Vocational Above bachelor .06015 .36675 .870

Bachelor .04825 .22283 .829

high school -.02100 .16286 .898

below high school -.74937* .23376 .002

high school Above bachelor .08115 .36278 .823

Bachelor .06925 .21622 .749

Vocational .02100 .16286 .898

below high school -.72837* .22747 .002

below high school Above bachelor .80952* .39966 .044

Vocational .74937* .23376 .002

high school .72837* .22747 .002

The result from table 4.12 shows that customer who is below high school level of education is more satisfied with the Ha Giang Agribank than others education level (P<0.05).

4.5.4 The differnent of customer satisfaction and loyalty among

experience transation with Ha Giang AgirBank

To test the different of customer satisfaction and loyalty among experience, the ANOVA with 0.05 sig. is taken ( table 4.13) experience include: >3 year, 3-5 year and <5year. The result indicates that customer in different experience have different level of satisfaction (F= 9.248; P<0.05) and different experience have different level of loyalty (F= 2.538; P < 0.05).

Table 4.13 The different of customer satisfaction and loyalty among experience transation with Ha Giang AgirBank

Sum of Squares df Mean Square F Sig.

CS 14.882 2 7.441 9.248 .000 142.412 177 .805 157.294 179 CL 3.646 2 1.823 2.538 .042 127.126 177 .718 130.772 179

For further testing the different satisfaction and loyaty among experience of customer, this study is use the post-hoc test with duncan method, table 4.14 shows the post-hoc test result of different satisfaction among experience of customer

Table 4.14 post-hoc test result of different satisfaction any loyaty among experience of customer

Dependent Variable (I)

Experience (J)

Experience Mean Difference (I-J) Std. Error Sig.

CS >3 year 3-5 year -.37404 .19143 .052 <5year -.73428* .17546 .000 3-5 year >3 year .37404 .19143 .052 <5year -.36024* .15473 .021 <5year >3 year .73428* .17546 .000 3-5 year .36024* .15473 .021 CL >3 year 3-5 year -.20604 .18086 .256 <5year -.36785* .16578 .028 3-5 year >3 year .20604 .18086 .256 <5year -.16181 .14619 .270 <5year >3 year .36785* .16578 .028 3-5 year .16181 .14619 .270

The result from table 4.14 shows that customer who have more than five years experience in using the Ha Giang Agribank service is more satisfied with the Ha Giang Agribank than others groups (>3 year and 3-5 year, P<0.05).

For further testing the different satisfaction and loyaty among experience of customer, this study is use the post-hoc test with duncan method. The result from table 4.14 shows that customer who have more than five years’ experience in using the Ha Giang Agribank service is more loyalty than others groups (>3 year and 3-5 year, P<0.05).

4.5.6 The different level of satisfaction and loyalty between type of customer

T-test is applied to test the different level of satisfaction and loyalty between type of customer (Organization and Personal). Table 4.16shows the result of t-test of different level satisfaction and loyalty between Organization and Personal customer. The result analysis show that with the alpha of 0.05, the independent t-test indicate the that the average level of satisfaction of Organization (M= 2.7111, SD=.70972) is difference from Personal customer (M= 3.1200, SD=.96414), t (1) = -2.204, P<0.05. Also the level of loyalty of Organization (M= 3.2778, SD=.91007) is difference from Personal (M= 3.6044, SD=.83580), t (1) = -1.925, P=0.05 (table 4.9). It can be concluded that there is significant difference between Organization and Personal

customer in customer satisfaction and loyalty with Ha Giang Agribank service. Result from Table 4.16 indicates that Personal customer have more satisfaction and loyalty level than Organization customer

Table 4.16 The different level of satisfaction and loyalty between Organization and Personal customer

Customer type N Mean Std. Deviation Std. Error Mean t Sig. (2-tailed CS Organization 30 2.7111 .70972 .12958 -2.204 .029 Personal 150 3.1200 .96414 .07872 -2.697 .009 CL Organization 30 3.2778 .91007 .16616 -1.925 .050 Personal 150 3.6044 .83580 .06824 -1.819 .077

The result indicates that customer in different eudcation level have different level of satisfaction (F= 3.144; P<0.05). However, The result indicates that customer in eudcation level do not have different level of loyalty (F= .770; P>0.05).

From the t-test and anova, the result shows that customer with longer experience in using Ha Giang AgriBank service are more satisfied and loyalty than other group and result also indicates that Personal customer have more satisfaction and loyalty level than Organization customer

Chapter V. Conclusion and recommendation

5.1 Conclusion

This study is to review the real quality of services being provided by the banking industry on the main aspects of the five gaps model model. Then discover the significant factors for improving the quality of banking services in terms of satisfaction and customer loyalty. Also this study evaluate differences in demographic factors can affect the level of satisfaction of the customers. The result shows that 4 of five factor of SERVQUAL Model has positive relationship on the customer satisfaction with Ha Giang Agribank service include: H1, H2, H3, H4 are supported by the model. The result shows that H5: There is a relationship between empathy factor and customer satisfaction about service quality of AgriBank is not supported by the model (Beta = 0.62, P>0.05)

For the detail of each factor effecting, the result shows that the reliability factor has the biggest impact on customer satisfaction (beta = .410), the second is tangible (beta =.318) the third is response factor (beta=.183) and the forth is assurance factor (beta=.133). Also this study indicates that customer satisfaction has positive effect on the customer loyalty with Ha Giang Agribank (beta= .382, P<0.05).So hypothesis H6 is supported by the mode.

The result indicates that customer in different eudcation level have different level of satisfaction. However, The result indicates that customer in eudcation level do not have different level of loyalty. From the t-test and anova, the result shows that customer with longer experience in using Ha Giang AgriBank service are more satisfied and loyalty than other group and result also indicates that Personal customer have more satisfaction and loyalty level than Organization customer.

5.2 Recommendation

On the basis of the above assessments, I have a few recommendations and suggestions as follows:

Distance 1: The difference between customer expectations and perceptions of service providers expect that. Distance 1 usually occurs because providers do not fully understand what characteristics make up the quality of their services and evaluate not close to the customer's needs.

Before bringing services to market, Agribank Hagiang has conducted a preliminary investigation and careful consideration the needs of potential customers that their aim. Agribank Hagiang target customers is the customer who living in the city how ever with the high mountain city. Customer are interested in and supporting the deployment of the system's online and convince ATM service, time and manpower implementing in cashing. This was the premise for the company implementation of electronic services to help customers reduce other costs, increase investment efficiency and increase the competitiveness of enterprises. With this ATM, Customer can use the service of electronic transactions requires authenticity and integrity of data such as bill payment, e-tax, e origin

Distance 2: The difference between customer expectations and service quality criteria are now built. Difference is generated when the troubled supplier, objective obstacles and subjective expectations when moving is perceived to specific quality criteria to give customers

The ATM engineer at bank are trained and professional design services specifications to meet the exact needs of the customer. Marketing Division, Engineering, Research and Development of the Agirbank Hagiang were together very closely coordinated to provide specifications of the service based on the PDCA cycle First is planning, planning (Plan) for what to do, given the requirements and specifications for services to research, deployment. The second step is implemented (Do) of that work, such as research, construction and technical solutions to meet the demand for services, establish business processes, documentation, ... finish this step is stitched pilot service has been designed in practice. Designers check (Check) service is spelled correctly, there is no match, the mistake is not. From there, discovered the problems of service exists. Finally the action (Act) fix the flaws and shortcomings, these inconsistencies to improve our services. PDCA is considered as useful tools for the design specifications

and services are planned and implemented in a basically, limiting errors lead to damage or loss.

Distance 3: The difference between the standards of service quality and service is provided in practice. The difference formed when employees transfer to the customer service is inconsistent with the criteria that businesses have made in the course of providing services.

This distance depends on the quality of staff directly providing services and products. With digital signature service is still new in Vietnam, although services have been properly designed ideas, utilities, have the ability to meet customer needs, but if at the stage of supply, and the attitude qualification of staff is not guaranteed, no satisfactory answer questions and advise customers to understand and come to a decision to use products, making customers feel annoyance, the efforts of the ATM in understanding market needs, design specifications and service ... well no longer meaningful.

According to understanding, the service was transferred to customers as committed. Customers fully satisfied with the efficiency features that the service offers.

Distance 4: Those are exaggerated promises are not the main determine, beyond implementation of the service provider. This is very easy to lose the trust of the customer if the service provider to make advertisement and propaganda than truth. Customer expectations of service are: the security and safety of the services, costs when using the service, the level of service convenience, the enclosed utility when using the service ...

Agribank by using standard ATM service and technical equipment to the most advanced security and safety of services right with media messages that Agirbank Hagiang want to send to customers. Most of ATM media messages about certification services do not cause discrepancies between the number of services provided in practice so without causing the frustration that caused the trust of customers. Also services ATM diversified by integrating the benefits that come with each card also increases in customer expectations.

consumer products for ATM service department should mostly employees toward ATM business contacts and meet customers. But according to survey, now there's a lot of staff have not understood and correctly understand the service lead to false information and advice to customers. For example, many customers mistakenly thought the only use of cashing of ATM cards, it may serve multiple transactions with banks, securities, contracting, ordering, online payment.

Distance 5: Thus, the Service quality was rated high or low depends on the perception of the actual service of the customers like in the context of what customers expect from Agribank Ha Giang. Distance 5th is the last criteria administrators towards service quality. Size (large or small) and direction (positive or negative) of this distance depends on the distance related to market research, product design, marketing, distribution and sales. Mean gap 5 is a function of others 4 gap.

Gap5 = f (Gap1,Gap2,Gap3,Gap4)

ATM services want to meet some expectations and requirements of customers, or to improve, maintain the Service quality provision should apply synchronization solutions for governance, shortening the distance associated with the service provider. Distance 5 formed from the difference between perceived quality and expected quality when customers use services ATM service

Agirbank Hagiang has shown that they provide high-quality services, both technical and functional, to meet customer expectations.

Corporate image: the client can feel the Service quality through the initial recognition of bank image, brand reputation and quality services of international standards.

- Technical quality: what customers get from ATM that is good quality, highest security ATM to reduce up the paperwork is not needed, increase labor productivity, towards e-government.

The professional and knowledgeable customer applications as the main developer of the application which is a key element for conducting the process of ATM

ATM is guaranteed legal value, safety, security, registration and operation made simple, fast.

- Quality of functions:

Support registration using digital signatures at the customer location. Customers only need to call the support line, staff of Agribank system will be available to complete the remaining procedures.

Providing value-added for customers. In fact, the standard of living and quality of life, increasing the payment means also changing. Previously, the first non-cash payments are very few people have known it today a popular means of payment. Therefore, to increase the value of their supply for Ha Giang Agribank customers need: 1) Catching the wishes and interests of the customer search for products and services. 2) Keeping up the trend change in concern about products and services. 3) Interested attentive to customers.

5.3 Research contribution

This study is the reference for the theory of banking industry related to customer satisfaction by using the servqual model and five gap of service quality. Also this study will help the banking manager as reference source of improving the banking quality and improve the customer satisfaction. So this study have both contribution for academic and practice.

5.4 Limitations of the study

The limitation of this study is include: subjects to be investigated are only in Ha Giang city and around region. The research though was unprepared but still encounter some awkward issues unresolved, such as the interview was denied an interview by the interviewee with the busy common acquaintances, were from direct rejection when making an offer to be interviewed.

Reference

Al-Mulali, U., Saboori, B., & Ozturk, I. (2015). Investigating the environmental Kuznets curve hypothesis in Vietnam. Energy Policy, 76, 123-131.

Anderson, E. W., & Fornell, C. (2000). Foundations of the American customer satisfaction index. Total quality management, 11(7), 869-882

Atilgan, E., Akinci, S., & Aksoy, S. (2003). Mapping service quality in the tourism industry. Managing Service Quality: An International Journal, 13(5), 412-422.

Bolton, R. N., & Drew, J. H. (1991). A multistage model of customers' assessments of service quality and value. Journal of consumer research, 17(4), 375-384.

Boulding, W., Kalra, A., Staelin, R., & Zeithaml, V. A. (1993). A dynamic process model of service quality: from expectations to behavioral intentions. Journal of

marketing research, 30(1), 7.

Chua Chow, C., & Luk, P. (2005). A strategic service quality approach using analytic hierarchy process. Managing Service Quality: An International Journal, 15(3), 278-289.

Cronin Jr, J. J., & Taylor, S. A. (1992). Measuring service quality: a reexamination and extension. The journal of marketing, 55-68.

Grönroos, C. (1984). A service quality model and its marketing implications.

European Journal of marketing, 18(4), 36-44.

Hair, J. F., Black, W. C., Babin, B. J., Anderson, R. E., & Tatham, R. L. (2006). Multivariate data analysis (Vol. 6).

Lam, S. Y., Shankar, V., Erramilli, M. K., & Murthy, B. (2004). Customer value, satisfaction, loyalty, and switching costs: an illustration from a business-to-business

service context. Journal of the academy of marketing science, 32(3), 293-311.

Lee, J., Lee, J., & Feick, L. (2001). The impact of switching costs on the customer satisfaction-loyalty link: mobile phone service in France. Journal of services

marketing, 15(1), 35-48.

Nunnally, J. C., & Bernstein, I. H. (1994). The assessment of reliability. Psychometric

theory, 3(1), 248-292.

Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1985). A conceptual model of service quality and its implications for future research. the Journal of Marketing, 41-50.

Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1988). Servqual. Journal of

retailing, 64(1), 12-40.

Parasuraman, A., Zeithaml, V. A., & Berry, L. L. (1995). Moving forward in service quality research: Measuring different customer-expectation levels, comparing alternative scales, and examining the performance-behavioral intentions link.

Report-Marketing Science Institute Cambridge Massachusetts, 41-42.

Spreng, R. A., MacKenzie, S. B., & Olshavsky, R. W. (1996). A reexamination of the determinants of consumer satisfaction. The Journal of Marketing, 15-32.

Statistic office (2013) Banking industry report, State Bank of Vietnam

Zeithaml, V. A. (2000). Service quality, profitability, and the economic worth of customers: what we know and what we need to learn. Journal of the academy of