The Schema Analysis of Emergent Bargaining Strategies in

Agent-Based Double Auction Markets

Shu-Heng Chen

AI-ECON Research Center Department of Economics National Chengchi University

Taipei, Taiwan 11623 E-mail: chchen@nccu.edu.tw

Bin-Tzong Chie

AI-ECON Research Center Department of Economics National Chengchi University

Taipei, Taiwan 11623 E-mail: chie@aiecon.org

Abstract

In this paper, we simulate the double auction markets with AIE-DA Ver. 2. Given that all traders are truth tellers and non-adaptive, we find that the GP trader can always find the most profitable trading strategies. Furthermore, the analysis shows that the trading strategies discovered by GP are very market-specific, which makes our artificial bargaining agent behave quite intelligently.

Keywords: Double Auctions, Bargaining Strategies, Predatory Pricing, Truth-Tellers, Genetic Programming

1

Motivation and Introduction

The agent-based double auction market, AIE-DA Version 2, as introduced in [ 1], can potentially be very complex so that a detailed track and analysis of all its rich dynamics may be extremely difficult, if not impossible, to get. Therefore, before we can have a full-fledged implementation of the artificial market, it is desirable to test this artificial market in its simplest versions so that we can easily examine some fundamental properties of the system. For example, a question concerning this paper is whether the software agent driven by genetic programming (GP) can eventually develop some types of “intelligent” bargaining strategy? This question in general is very difficult to answer, because in its full-fledged implementation, all traders in AIE-DA are evolving. So, if one claims that one GP-trader behaves intelligently, then some other traders must not. In this case, the answer itself seems to be paradoxical, and hence the question can be misplaced. Nonetheless, the intelligence issue can be perfectly legitimate if we assume that one and only one trader gains access to GP to adapt and to learn. All other traders are either not being able to learn or learning with some other algorithms.

This paper simulates the AIE-DA in a context of single-population GP (SGP), i.e., we assume that only one trader can evolve with GP. Moreover, we assume that other traders’ strategies are all fixed (to be specified below). We then ask whether the GP trader can exhibit intelligent behavior by discovering profitable bargaining strategies. The rest of the paper is organized as follows. Section 2 describes the general environment in which all experiments were conducted. Section 3 and Section 4 detail two experiments conducted in this paper. Concluding remarks are given in Section 5.

([WUD *DLQ

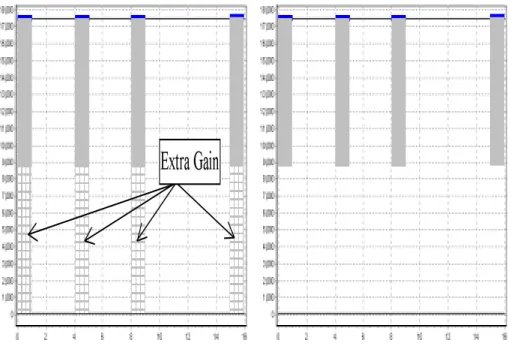

Figure 1. The Demand and Supply Schedules of Market 3

2

Experimental Designs

All the experiments conducted in this paper are based on the following basic ideas. • First, we assume that all traders, except the first buyer (or the first seller), are all

truth-tellers.

• We then examine how the first buyer (seller), whose behavior is driven by GP, will react to this set of truth-tellers.

20 experiments were conducted with the general features outlined above, each with its own randomly generated demand and supply schedules (token-value table). We, however, would only report two of them below. The two experiments reported here are Market 3 (Experiment 1 called in this paper) and Market 11 (Experiment 2). As we shall see, the general environment with the randomly generated demand and supply schedules makes the analysis of the optimal bargaining strategies available so that we can have a test on the capability of GP to discover intelligent strategies.

3

Experiment 1: Flat Demand and Supply Schedules

Experiment 1 is characterized by the demand and supply schedule given in Figure 1. The demand and supply curves in this market are so flat that they never intersect, which means all traders are potentially profitable. In fact, simply telling the truth can be profitable. Therefore, discovering profitable trading strategies is trivial; however, discovering the profit-maximization ones is not. Notice that when all traders are all truth-tellers, the competition is keen. Consider the case of a GP buyer. All the buyers would like to bid the price as high as they can. This leaves the GP buyer very difficult to bid a different and lower price at the beginning of trade. So, what she can do is simply to wait. She has to wait till when all her competitors finish their trades and leave her the only buyer in the market. She, then,

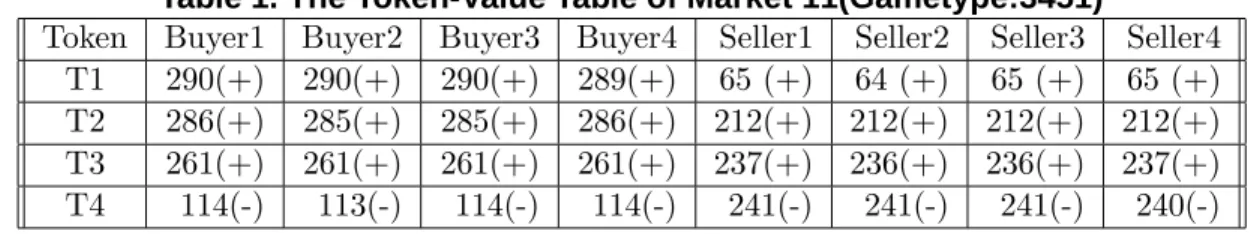

Table 1. The Token-Value Table of Market 11(Gametype:3451)

Token Buyer1 Buyer2 Buyer3 Buyer4 Seller1 Seller2 Seller3 Seller4 T1 290(+) 290(+) 290(+) 289(+) 65 (+) 64 (+) 65 (+) 65 (+) T2 286(+) 285(+) 285(+) 286(+) 212(+) 212(+) 212(+) 212(+) T3 261(+) 261(+) 261(+) 261(+) 237(+) 236(+) 236(+) 237(+) T4 114(-) 113(-) 114(-) 114(-) 241(-) 241(-) 241(-) 240(-)

jumps in the market and makes a giant profits by cutting the bid down to lowest possible level. Figure 1 shows the extra profits she can earn by this doing (See the squares on the left half of Figure 1).

A trading strategy corresponding to what discussed above is (CAsk) (bidding the min-imum ask in the previous step), or, in plain English, to take whatever proposed. While this bidding strategy will miss the a series of early trades due to its extremely unattractive offer, eventually it will come to good effect (see the arrows shown in the left half of Figure 1.) Similarly, the best trading strategy for the GP seller is (CBid).

We ran a 100-generation simulation for each of the market, once for the GP buyer, and once for the GP seller. The best strategy observed in the last generation goes well with our intuition, i.e., (CAsk) for the GP buyer and (CBid) for the GP seller. In both cases, our GP traders fully exploited all potential gains available for them, and were not too greedy to bargain for an impossible deal.

4

Experiment 2: Steep Demand and Supply Schedules

The second demand and supply schedules are characterized by Figure 2, Market 11 (see also Table 1). In contrast to Experiment 1, these schedules show sharp differences. First of all, instead of being flat, both curves have many discrete jumps, either ups or downs. Secondly, the jump size are very irregular, indicating that the next available price can be dramatically different from the previous one. Take the supply function as an example. The cost of the four cheapest units is no more than 70 dollars. They are 64, 65, 65, and 65 (Table 1). But, suddenly, it jumps to 212 dollars, i.e., three times higher. If a buyer misses these four cheapest units, then she may suffer a great loss in her potential profits.

However, if we look at the redemption values assigned to the GP buyer (Buyer 1), we find that she does not have too much competitive power to gain access to these four cheapest units. Her highest redemption value is 290, and coming to the next is only 286, which is lower than the highest redemption value of other traders (they are 290, 290 and 289). Consequently, given that they are truth-tellers, the GP buyer might at best buy one unit out of these four. To make this figure clear, on the right half of Figure 2, we highlight the profits which the GP buyer can earn were she also a truth-teller (see the shaded area). Therefore, this can be a challenge issue for GP.

We ran AIE-DA in the market for 100 generations, and the best strategy found by GP is very simple, namely,

( + HT 29 ). (1)

Originally, it is not immediately clear for us why the GP trader is interested in this trading strategy. Where does the figure “29” come from? Is it just by chance? Or, there is a good reason. After a careful analysis, we were suddenly impressed by how respectable our GP

([WUD

/RVV ([WUD *DLQ

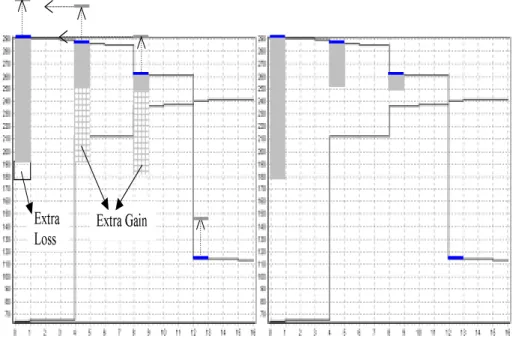

Figure 2. The Demand and Supply Schedules of Market 11

trader is. First, “29” is a magic number. Notice that, from Table 1, the redemption value of the third token for the GP buyer (Buyer 1) is 261. Adding this number by 29, we have exactly 290. In other words, our GP buyer tried to make this otherwise not competitive bid be just attractive enough for her to earn the first three offers (because any thing lower than 290 will cause her lose the deal). By doing this, her first two bids were also raised. Her first bid would be 319 instead of 290, and second bid 315 instead of 286 (see the up arrows in the left half of Figure 2). Since these bids were so high that no one could beat it, the GP buyer actually did take up the first three units.

One may wonder how it can be possible by bidding so high without losing profits. The answer is it did hurt profits. But, that was only for the first unit. Get back to the left half of Figure 2, there is a loss about 292 for the first unit (see the area indicated by “Extra Loss”). However, this loss was compensated when the GP buyer also won the second and the third cheapest deals, which she could not possibly do it were she a truth teller. The extra profits earned is also highlighted in the squares. In sum, she ended up with earning a profit of 278, which is 70% higher than the one earned were she a truth teller.

The trading strategy discovered by the GP buyer is known as the predatory pricing in industrial practice. The GP buyer is so intelligent that she could find a way to reduce her profits in the first unit, but earned it back on other deals.

5

Conclusions

In this paper, we conducted two experiments of the double-auction market with AIE-DA Ver. 2. In these experiments, the GP trader were dealing with a set of truth-tellers. At the first sight, it seems very difficult to develop an intelligent bargaining strategy under this extremely competitive circumstance. However, our GP trader was able to find a room for extra profits. In the first experiment 1, he learned to defer her trades to the end of the market. Once she became the monopsonist, she just took whatever being offered without

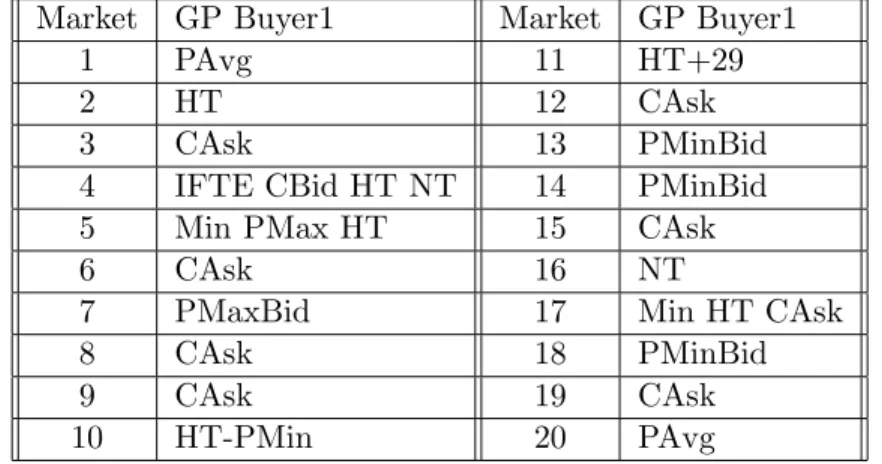

Table 2. The Best Strategy Discover by the GP Buyer at the 100th generation

Market GP Buyer1 Market GP Buyer1

1 PAvg 11 HT+29

2 HT 12 CAsk

3 CAsk 13 PMinBid

4 IFTE CBid HT NT 14 PMinBid

5 Min PMax HT 15 CAsk

6 CAsk 16 NT

7 PMaxBid 17 Min HT CAsk

8 CAsk 18 PMinBid

9 CAsk 19 CAsk

10 HT-PMin 20 PAvg

any further bargaining. Is this smart? In contrast to Experiment 1, Experiment 2 gives a quite different structure. Now, she can no longer afford deferring the trade. Instead, she raised the bid and became the early bird in the market.

In both cases, we see that the GP trader could take advantages of the specific information hidden in the demand and supply schedules and adapted to them by developing market-specific bargaining strategies. In one case, it is “Go Slow”, and in the other case, it is “Be Hasty”. In both cases, the profit-maximization strategy is discovered by GP.

Table 2 summarizes the best trading strategies discovered by GP in other experiments not detailed in this paper. They are different because the corresponding demand and supply schedules are also different. One interesting thing to notice is that all strategies evolved here are very simple. Partially, it is because that the environment faced by them is very static (a set of non-adaptive opponents); partially it is because that the strategies discovered by GP are highly market-specific.

There are several interesting directions for further extensions. First, one may like to replace those truth tellers with some non-adaptive but more sophisticated strategies, and see how well GP react to it. We have the conjecture that in general GP can successfully find a way out of it. The point here is that adaptive traders can always take advantages of non-adaptive traders. In other words, all traders have the incentive to adapt. So, this comes to our second extension, i.e., to simulate the DA market in the context of a multi-population GP (MGP), where all traders are adaptive. But, it would then become hard to ask what is the best strategy, because the system may never converge, but, instead, continuously evolve.

References

[1] S.-H. Chen, B.-T. Chie, and C.-C. Tai (2001), “Evolving Bargaining Strategies with Genetic Program-ming: An Overview of AIE-DA Ver. 2, Part (I) and Part (II)” in Proceedings of Fourth International Conference on Computational Intelligence and Multimedia Applications, IEEE Computer Society Press (this volume).