The U.S.-China Trade War and Its Implications

for Taiwan’s Economic Structure

Chien-yi Chang

President, Taiwan Institute of Economic ResearchAbstract

In response to the potential uncertainties caused by the U.S.-China trade war, China-based Taiwanese businesses returning to Taiwan have surged. It is unlikely that this returning investment trend be a short-lived one, but rather this trend will bring about concrete investments and become a main source of funding for innovative industries. Additionally, a new value chain structure, a non-Chinese based structure, has gradually formed, and in the future Taiwan will play a very important role in this new value chain structure. Taiwan needs a new growth engine to boost industrial development and economic dynamism. This paper seeks to analyze and suggest macro-economic strategies for Taiwan in the face of the ongoing U.S.-China trade war and, in particular, formulate strategies for Taiwan’s economic and industrial development. Taiwan should accelerate the pace of industrial upgrading and try to construct a new, more flexible production structure, more professional and advanced, than the Chinese supply chain. At the same time, challenges and opportunities for returning China-based Taiwanese businesses should be analyzed. It is also important to strengthen the capability of technology protection for Taiwanese businesses in the future to prevent the outflow of Taiwanese technologies to China.

Keywords: U.S.-China Trade War, Global Supply Chain, Economic and Industrial

Development, Taiwan’s Economic Structure, Technology and Innovation Taiwan is facing major economic and trade development changes amid the slowdown of the global economic recovery, reindustrialization of advanced countries, and the rise of China’s own supply chain during the transformation of its industrial economic development. It is difficult to replicate any previous manufacturing models and the current economic model has encountered development bottlenecks. Taiwan

needs a new growth engine to boost industrial development and economic dynamism. Taiwan’s overall economy has faced many challenges in recent years, such as the decline in global trade volume, the slowdown in exports and investment momentum during the post-financial crisis period, the relative lack of domestic demand and consumption, and long-term stagnant wage growth. Changes in the global economic and trade with the continuing U.S.-China trade war have accelerated the transformation of the global industrial supply chain.

In response to the uncertainties caused by the U.S.-China trade war, China-based Taiwanese businesses returning to Taiwan have surged, driving the demand for related investment funds, forming the largest Taiwanese investment returning tide in the past two decades. In the future, in terms of the opportunities that comes with the restructuring of the global supply chain, Taiwan will significantly benefit from the returning mainland-based investments. It is unlikely that this returning investment trend be a short-lived one; instead, it is likely that this trend will bring about concrete investments and become the main source of funding resources for innovative industries. Eventually, Taiwan will be in a phase of new economic development planning and related prospective components industries will be a potential growth area when Taiwan drafts its future industrial development.

I. Taiwan’s Macroeconomic Strategies in the U.S.-China Trade War

1. Continuing of Trade War and Arising Financial and Currency Issues Since China’s accession to the WTO in 2001, it has not really emerged into a market system. On the contrary, China is now state-led, and far from being a market economy. U.S. imports from China grew since the 1990s, reaching more than U.S. $50 billion in 2017. It is estimated that, although the U.S. unemployment rate has declined as service and technological innovation continue to change its industrial structure, the global industrial supply chain shift has caused the U.S. to lose 3.4 million manufacturing jobs in the period 2001-2017. The economic strength that China has accumulated through trade was achieved by using unfair subsidies and illegal means in a “military-like” expansion, disrupting global supply chains and conducting unfair investment mergers and acquisitions.

Figure 1. U.S. President Donald Trump Signs an Executive Memorandum on the Investigation of Steel Imports

Source: Ana Swanson, “Trump administration launches national security investigation into steel imports,” The Washington Post, April 20, 2017, <https://www.washingtonpost.com/news/ wonk/wp/2017/04/20/trump-administration-launches-national-security-investigation-into-steel-imports/>.

The U.S.-China trade war began in April 2017 when the U.S. launched a national security investigation into international steel and aluminum products. A series of trade measures were aimed at China. China faced increased tax pressure, while it imposed tariffs on some products as retaliation. The nature of the U.S.-China trade conflict is a trade issue involving tariffs on products. However, not only does the U.S. wish to solve the trade deficit problem, but it also wants to target China’s unfair trade measures, such as its continuing subsidies for state-owned enterprises (SOEs), infringement of intellectual property rights (IPRs), and forced technology transfer, which are seen as damaging U.S. interests.

In addition, in recent years, the development of digital technology applications in China has been greatly successful. The United States is worried that China will threaten its leadership in advanced technologies, such as AI and 5G, rather than it becoming a national security threat.

Based on the above factors, the U.S.-China trade conflict has escalated from just a trade war to different areas, such as a science and technology, and currency, and the impacts have expanded. This will hinder the development of the global economy and trade, and the impact of the U.S.’s extensive increase of tariffs on China products could accelerate the dismantling and reconstructing of the global supply chain. This could increase the national security issues from the containment of technology chips and 5G technology, while rapid currency depreciation could eventually lead to a weakening of monetary policy tools.

2. Impact of U.S.-China Trade War on Global and Taiwan Trade and Investments As mentioned above, the impact of the U.S.-China trade war on the global market is not limited to trade. In the longer term, overall global economic uncertainty has increased. IHS Markit in September 2019 lowered its global economic growth rate estimate from 2.9% in January to 2.7%, and revised downwards the U.S., EU and China figures to 2.3%, 1.1%, and 6.2%, respectively. The growth rate of global merchandise exports is also negative and poses an increased risk to trade policies. The increase in risks may have a direct impact on business operations and investment as the consumer market turns conservative and overall growth slows down gradually. The outlook for 2020 continues to be bleak. For example, increased purchasing costs of consumers in importing countries, the disrupted global supply chain, and transferring of orders to third-party areas that are not affected by tariff measures.

Figure 2. U.S. Economic Growth and the PMI**

Source: IHS Markit, “Global PMI: Global slowdown gathers pace at start of 2019,” February 8, 2019, p. 8, IHS, <https://cdn.ihs.com/www/pdf/0219/IHSM-PMI-overview_201902.pdf>. Note: * Manufacturing PMI only pre-October 2019.

** PMI shown above is a GDP-weighted average of the survey manufacturing and services indices.

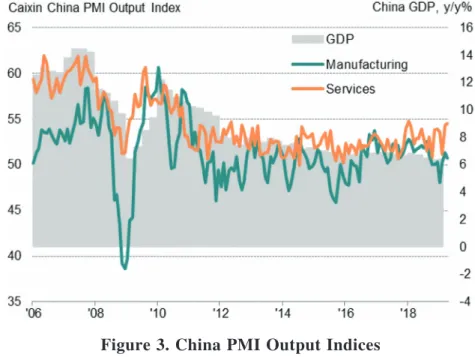

Figure 3. China PMI Output Indices

On the other hand, with regards to the impact on Taiwan’s economy, currently, its economic growth rate is expected to be more than 2%. IHS Markit released its Asia economic performance in 2019 report and mainly showing a declining growth rate. The economic growth rates for Taiwan and South Korea was expected to be 2.0% and 1.4% respectively, while Hong Kong and Singapore were both sluggish. In terms of domestic forecasts, the Directorate General of Budget, Accounting and Statistics has raised Taiwan’s economic growth forecast this year and next year. From the supply chain perspective, the triangular trade model, where Taiwan taking orders, China produces and the U.S. consumes, the U.S.-China trade war will disrupt this kind of Taiwanese investment and production structure. Although Taiwan’s trade performance has been affected, with the annual growth rate of exports in the first half of this year at -3.4%, it benefited from a transfer effect/transfer production base, such as ICT and audiovisual products, and Taiwan’s trade with the U.S. showed a breakthrough growth as well.

Figure 4. Taiwan Manufacturing PMI

Source: IHS Markit, “Taiwan Manufacturing PMI: Operating conditions unchanged in September,” October 1, 2019, p. 1, IHS, <https://www.markiteconomics.com/Public/Home/PressRe-lease/1f0607074bc64d7c889f686021445102>.

3. Strategies of Future Taiwan Economic and Industrial Development In the face of global economic and trade turmoil, global demand slowed down, and the existing economic and industrial development model needs to be adjusted

accordingly. Although the supply chain of China and Taiwan is quite close, following China’s import substitution policy, the original vertical supply chain relationship has been replaced by a horizontal competitive supply chain relationship. The development of a “red supply chain” in China has only made China stronger and more prominent, and other non-Chinese countries have gradually been marginalized in the global division of labor supply chain. Nowadays, due to the impact of the U.S.-China trade war, a new value chain structure, a non-Chinese structure, has gradually formed, and in the future, Taiwan will play a very important role in this new value chain structure. Taiwan’s focus in the past was on manufacturing and mostly standard intermediate products, involving cost down production for high profit margins. The rapid changes in the consumer market and the trend of customized demand, coupled with the digital transformation brought about by trends in digital technology, have put limitations on the continuation of this kind of cost down, profit maximization production model. Future lifestyle consumption models involve AI, IoT, big data, 5G, cloud computing development. Looking forward, through the integration of soft and hard infrastructure, development of cross-domain applications, creating more innovative services, precise industrial production and marketing, Taiwan should be accelerating a comprehensive industrial digital transformation.

Therefore, on the basis of the existing production supply chain structure and industrial clusters, Taiwan should accelerate the pace of industrial upgrading and try to construct a new, more flexible production structure, more professional and more advanced than the Chinese supply chain. In view of the policy direction for the value chain architecture, Taiwan should be able to expand concrete industrial linkages with advanced countries based on the foundation of the current “5+2 innovation” industrial development, and eventually develop a new value chain structure that replaces efficiency with innovation as its development engine. It is important not to confuse this with the existing supply chain structure, since failing to do so may push away European and American brands, and once they lose trust in “made in Taiwan”, it would be difficult for Taiwan to promote and develop industrial upgrading.

By observing the stagnation of global trade in recent years, Taiwan is indeed vulnerable to global sentiment. In view of the strategic direction of Taiwan’s future economic development, it is important to pay attention to the growth of domestic

demand. For example, Japan’s industrial policy planning has shifted from a single economic problem in the past to an overall industrial plan under a domestic economic and social development vision, focusing on domestic demand issues, such as the Japanese Society 5.0 blueprint. Therefore, Taiwan’s economic development strategy can move toward the direction of “both internal and external manufacturing services, sharing of economic results,” building an industrial ecosystem of domestic demand, emphasizing the importance of domestic demand industries, developing cross-border industries and integrating services, and serving future domestic consumers and enhancing citizen well-being.

II. Challenges and Opportunities of Returning China-based Taiwanese

Businesses

1. Rapid Reform of Supply Chain Structure in U.S.-China Trade War Since China’s rise in power, through the guidance of national policies and fostering an independent supply chain model, China has become an important production supplier and major trading partner. Due to cross-Strait relations and the division of industrial structure that has been established for a long time, the triangular trade model of orders from Taiwan, made in China, and consumed by the U.S. (with Taiwan overseeing R&D and semi-finished manufacturing, and processing products and exports to China for mass production to finally exporting the final products to U.S. to fulfill U.S. demand), the U.S.-China trade war will affect Taiwanese investment production structure and the operation of international trade.

As a result, the U.S.-China trade war conflict has clearly prompted the accelerated transfer of supply capacity in Taiwan and the United States. In the short term, although some Taiwanese companies may benefit from the transfer effect/transfer production base, such as netcom equipment, low-end bicycles and components, etc., due to the increasing trade conflicts, manufacturers are gradually withdrawing and adjusting production under the global layout, the tariff costs, and avoiding risks of uncertainty. This may damage the existing supply chain system network; but on the other hand, in the long run, due to the high value-added value created by Taiwan’s exports from Taiwan, the future will see an increase in Taiwan’s exports.

2. Returning Taiwanese Businesses Brings Increasing Industrial Development Opportunities

The U.S.-China trade conflict has created an opportunity to restructure international industrial division. In addition to reducing the influence of China on the global supply chain system, it is expected that a new supply chain system will be formed for Taiwan’s exports to the United States. In view of this development, Taiwanese companies in China are under pressure to increase trade tariffs. Taiwanese companies are considering the possibility of adjusting production base and returning investment. In addition to the China production line to supply local domestic demand market, the export of U.S. products is transferred. Other countries have in turn prompted Taiwan’s largest Taiwanese businesses to return to Taiwan in the past two decades.

Figure 5. Welcoming Taiwanese Investment Back to Taiwan

Source: Executive Yuan, Republic of China (Taiwan), “Actively promote Taiwanese Investment Back to Taiwan,” April 26, 2019, Executive Yuan, Republic of China (Taiwan), <https:// www.ey.gov.tw/Page/5A8A0CB5B41DA11E/d0fa20f9-27f7-460e-a3e7-775f272a9cf8>.

Taiwan’s investment has become vulnerable to the international economic climate after the financial crisis. Overall domestic investment growth has slowed down. The government is now taking advantage of the current positive sentiment of investments,

and implemented a “welcoming Taiwanese investment back to Taiwan 2.0” policy, integrating investment elements such as land, water, electricity, labor and talent, taxation and capital, and providing a single window to actively assist Taiwanese businesses returning to Taiwan. In addition to welcoming Taiwanese companies returning to Taiwan, in order to promote the investment momentum of Taiwanese companies and accelerate the upgrading and transformation of firms, the government has also rolled out a “rooting Taiwan enterprises plan” and accelerated small and medium enterprise (SME) investments with an “SME investment program” to create a global industrial supply chain hub. By investing in these three major programs, it is believed that Taiwan will occupy a critical position in the new supply chain structure. According to the Ministry of Economic Affairs, more than 146 manufacturers have responded to the Taiwanese business returning to Taiwan 2.0 program, totaling more than NT$600 billion, which can bring more than 53,000 domestic employment opportunities. It is expected that the cumulative investment in the next two to three years will reach NT$1 trillion. At present, the major developments in Taiwan are quite diverse, including high-end servers, Netcom, 5G, high-value transmission, and automated production lines. Among them, “Ten Electronic Brothers” have already returned to Taiwan to invest, which has already developed Taiwan’s high value-added industries. More importantly, however, this wave of investment is regarded not as a short-term boom, but should eventually be transformed or upgraded into an engine for growth for Taiwan’s overall development in the next decade or two. In addition to short-term problems involving the falsifying of product origin, from a longer term perspective, it is essential to guard against the possibility of indirectly supporting the red supply chain in China. Therefore, under the considerable scale of investment in Taiwan, it is necessary to strengthen the implementation of this wave of Taiwan investment. In addition, the government should have a forward-looking plan on the overall future development and initiate an integrated assessment of investment for the next generation of industrial development.

Taiwan has been experiencing a low level of investment for many years, and because of the U.S.-China trade war, it is now beginning to receive a large scale of investment with the return of Taiwanese businesses. On top of this, the global supply chain structure is in the process of breaking up and being reshaped. So, how exactly will Taiwan shape the new restructured supply chain? Taiwan should continue its

investment momentum and develop the next generation of key industries in order to take a key position in the future global supply chain.

The supply chain based in China has rapidly grown in the past two decades. China has mastered more and more upstream key technologies through technology knowledge and R&D investment. Under its industrial import substitution policy, the economy has been transformed to a domestic demand-oriented economy and the industrial chain has become more complete.

In the past, Taiwan’s division of global trade supply chain was mainly carried out through cross-Strait trade integration and the industrial division of supply. Overall industrial development was accelerated by the substitution of Chinese imports and industry moved toward a linear development, gradually hollowing out Taiwan’s economy. Taiwan will make less and less profits given the situation and will be at a disadvantage, which is a potential concern.

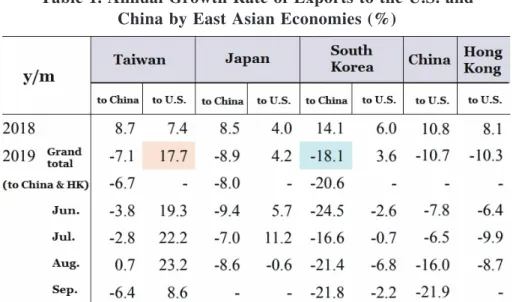

However, the impact of the U.S.-China trade war and the slowdown in China’s domestic demand have caused the Chinese to face both internal and external pressures. As a result, manufacturers located in China have begun to re-shape their strategies by moving out of the Chinese market. Looking at Taiwan, the proportion of Taiwan’s direct exports to the U.S. has increased significantly during the U.S.-China trade conflict. According to the Ministry of Finance, Taiwan, Taiwan’s exports to the U.S. from January to August this year were about U.S.$30.2 billion, imports were about U.S.$24.1 billion, meaning that both exports and imports grew and to 18.7% and 8.1% respectively. A new global supply chain other than the so-called “red supply chain” based in China has emerged. The “triangular trade relationship” between Taiwan, U.S. and China has begun to be disengaged. The future connection with advanced countries will not only be providing final products, but engaging deeper into the global supply chain and becoming more acquainted with the consumer market. There will also be expanded linkages in terms of technology, talent, investment, industrial cooperation, and international exchange.

Table 1. Annual Growth Rate of Exports to the U.S. and China by East Asian Economies (%)

Source: Ministry of Finance, Republic of China (Taiwan), “亞洲主要經濟體出口概況及對美、 中消長情形,” October 16, 2019, p. 6, Ministry of Finance, Republic of China (Taiwan), <https://www.mof.gov.tw/download/21844>.

In view of the trends in the digital economy and new technological innovations, innovative services are now perceived as a major competitiveness indicator for exporting countries, while at the same time, the ability to drive economic growth through import and export trade is declining. Taiwan faces the challenge of reshaping the global supply chain and should grasp new business opportunities in this emerging supply chain associated with digital transformation and technological innovation.

First of all, Taiwan should take advantage of its existing ICT manufacturing hardware advantages, so as to build its critical position and be a major key player in the export industry within the cross-border value chain. In addition, industry in Taiwan should also adopt the integration of hard and soft infrastructures, and a system integration output model to develop advanced intelligence technology (AI, next generation communication), cross-cutting applications (smart medical, smart energy, smart home, smart transportation), innovative business models (platform economy). Strategically, this kind of domestic cross-cutting consumption market experience could be introduced to the Asian market.

The issue of supply chain security can be divided into two major areas. The first relates to the different areas of standards along the global supply chain, and the

security issue associated with digital economy in the global supply chain. First of all, in this current digital technology trend, the integration of upstream and downstream supply chain products from countries is increasing, and at the same time, advanced countries are paying more attention to national security threats. In this regard, Taiwan should also take this trend into consideration and differentiate properly according to factors that include product quality, key technologies, sales pipelines, etc., and provide products catering to the different needs within this global supply chain.

In addition, during the period of industrial digital transformation, technologies such as automation, cloud services, driverless cars and the Internet of Things are developing rapidly. In the future, technology platforms such as applications, cloud, big data and artificial intelligence will mean that the security of information networks will be deemed critical. Taiwan should then put information security as priority issue when planning for the next generation of industrial development, so that Taiwan can gain a better competitive advantage in the global supply chain.

III. Influence and Opportunities of Taiwanese Industries Amid

U.S.-China Trade War

There is little sign of an end to the U.S.-China trade war and in the short term, there is no way out of the U.S. punitive tariffs on China, and this has a negative effect on sentiment toward the international economic and trade situation. The U.S.-China trade war has three main impacts on Taiwan’s industry.

1. Change of Global Industrial Supply Chain

Looking at the current situation, the impact of the U.S.-China trade war on the im-provement of the U.S.-China trade deficit is limited, but the changes to the global supply chain system may have substantial and far-reaching effects. In the long term, U.S. commodity buyers are affected by tariff increases and expenditure will increase. On the one hand, U.S. brand manufacturers may request their intermediate suppliers in China to consider relocating their production bases or factories to countries that are not affected by the tariff measures. In addition, a more serious scenario could be that it may reduce the procurement of supply chain manufacturers in China. This will prompt the growth of exports from Taiwanese manufacturers which will increase their profits.

2. Increasing Number of Returning Taiwanese Businesses

The U.S.-China trade conflict directly impacts China’s overall export situation, which will also impact on Taiwanese business operations in China. In general, when the final products produced by Taiwanese businesses in China are mainly exported to U.S., under the current situation when tariffs are in place, there may be short-term transfer-to-order effects or medium- and long-term transfer production bases and other supply chain changes. There are three likely strategic directions for Taiwanese businesses.

Figure 6. The 21st Outstanding Overseas Taiwanese SMEs Award Ceremony

Source: Makoto Lin, “President Tsai Ing-wen attends the 28th National Award of Outstanding

SMEs and The 21stOutstanding Overseas Taiwanese SMEs Award Ceremony,” October

29, 2019, Office of the President, Republic of China (Taiwan), <https://www.flickr.com/ photos/presidentialoffice/48978671323/in/album-72157711515786893/>.

Firstly, for those manufacturers with production bases in both Taiwan and China, there have been adjustments to the management of production planning, and hence government and manufacturers should build a better understanding of both the investment environment while also understanding the needs of this type of manufacturer. Secondly, for those who currently do not have any production base in Taiwan, but are planning to create one in Taiwan, the government should understand their

investment plans and needs, integrating these into domestic industry development planning, and strengthening relevant assistance.

Thirdly, for those who currently have no production bases in Taiwan, but are planning to invest in southbound countries, the government should understand their investment plans and needs, and integrate these into Taiwan’s southbound partner countries to help garner preferential investment treatment.

All in all, for those Taiwanese businesses who are based in China and are planning to return to Taiwan, Taiwan can provide assistance to promote Taiwan’s investment through the “Action Plan for Welcoming Overseas Taiwanese Businesses to Return to Invest in Taiwan,” to strengthen the industrial supply chain or promote high value-added industry; or Taiwanese businesses with a large demand for labor can further gain access to such needs through the promotion of the new southbound policy to further expand market and business opportunities in Southeast Asia.

Figure 7. New Southbound Policy

Source: Executive Yuan, Republic of China (Taiwan), “New Southbound Policy,” September 3, 2017, Executive Yuan, Republic of China (Taiwan), <https://ws.ey.gov.tw/001/EyUpload/2/ relpic/7864/219900/1fcef5fc-7b4b-4ff1-863d-4af45e2bc9f6.jpg>.

3. Issues Relating Technology and IPR

One of the important goals behind the U.S.-China trade conflict is to solve unfair market conditions, especially China’s unfair means that damage U.S. interests, such as business subsidies, violations of intellectual property rights, and forced technology transfer. Hence, dealing with technology associated issues and IPR issues is more important than before, especially as one of the deeper issues associated with the U.S.-China trade war is the rivalry in technology and innovation.

For high-tech industries, in the short run, China still relies on U.S. technology and key components. The scale of China’s semiconductor industry is still mostly supported by foreign-funded enterprises. The U.S. may implement containment measures against Chinese technology for national security considerations. In light of trends in advanced technology development cooperation, China’s indirect access to U.S. international technology through Taiwanese manufacturers may be hindered. If this is not handled well, Taiwanese businesses could be implicated and become a target for U.S. sanctions, hurting Taiwan-U.S. cooperation and relations. The trust that was built through bilateral cooperation in high-tech areas could be lost. Therefore, it is important to strengthen technology protection for Taiwanese businesses in the future to prevent the outflow of Taiwanese technologies to China.

Secondly, 5G technology development is part of the United States technology containment, and 5G will be an area of strategic competition in the future. Judging from the trend in U.S.-China technology competition, there are two 5G technology specifications, China’s Hi-silicon (Huawei’s chip design subsidiary) and the U.S.’s Qualcomm. When the U.S.-China agreement is reached, Taiwan’s upstream supply chain manufacturers, especially IC design and foundry-related companies, will still be in a favorable position in the global supply chain. It is advisable to assess risks early and adopt strategies. Therefore, Taiwan should closely observe and closely follow the evolution of 5G mainstream specifications.

Thirdly, as U.S. semiconductor manufacturers expressed that they do not want semiconductors to be included in the U.S.-China trade procurement list, their main consideration is that the high production costs of U.S. semiconductors will prompt U.S. chip manufacturers to open new bases in China and will increase purchasing

orders of U.S.-made semiconductors, which will in return increase China’s influencing power on the U.S. semiconductor industry, and thus U.S. semiconductor companies will become even more dependent on China. In view of this situation, the semiconductor industry in Taiwan will be put in a difficult position, where they will need to take into consideration complying with investment regulations in Taiwan and receiving purchasing orders from China companies.