Exchange Rates Forecasting Using

a Hybrid

Fuzzy and

Neural Network

Model

An-Pin

Chen'

and Hsio-YiLin21)Institute ofInformationManagement,National Chiao-TungUniversity, HsinChu, Taiwan300

2)Deartmectt

nc

oF u ty2)DepartmentofFinance,

Ching-Yun University, Jung-Li,

Taiwan 320Abstract-Artificialneural networks(ANNs)arepromising approaches forfinancial time series predictionand have been widely appliedtohandlefinance problemsbecauseof its nonlinear structures.However,ANNshave somelimitationsinevaluatingthe outputnodes as a resultofsingle-pointvalues.This study proposed ahybrid model,calledFuzzy BPN,consisting of backpropagation neural network(BPN)andfuzzy membership function for taking advantage of nonlinear featuresandintervalvaluesinstead ofthe shortcoming of single-point estimation. Inaddition,the experimental processingcandemonstrate thefeasibility of applyingthehybrid model-FuzzyBPN and theempiricalresults show thatFuzzyBPNprovidesauseful alternativetoexchange rateforecasting.

Keywords- backpropagationneuralnetwork, FuzzyMembership Function,Exchange rate.

I. INTRODUCTION

Recentlyinternational investment activitiesare morefrequent andglobal trades becomemoreliberal, floating exchangerate system causeuncertainty of exchangerateintheinternational trade and investment.Thus, exchangeratesforecasting, using linear time seriesmodels, non-linear time series models, and artificialintelligence models, becomes animportantfinancial problem and has beena recurrentsubject of research during the lasttwodecades.

Meese and

Rogof[115]

demonstrated the forecasts ofexchange rate predictability from structural model based on

monetary and asset pricing theories of exchange rate

determination performnobetter than theonesgenerated by the

simplest of all models in terms of out-of sample forecasting

ability. Further, many literatures[1,3,17,21] also pointed out

the standard econometric methods are unable to produce

significantly better forecasts than the random walk model and supportive of theefficient-markethypothesis.

Although these findings are strength advocated that the

exchange rates trend is random walk, many researchers have

attemptedtosearch various alternative methods formodeling of exchangerates forecasting. Oneof thefirst studiestooverthrow

the random walk model is the proposal made by MacDonald

and Taylor[14]. Many literatures haveproposed several proofs

explaining thatExchange rates belongtononlinear behavior. In addition, Kilian and Taylor[12] also signified that the forecast

efficiency of econometric exchange models is not able to

achieve its optimum because it is constrained by the linear

quality of the traditional statistics models. Afterwards, the

exchange rates time-series property has beenproven to existin

the family of Autoregressive conditional

heteroskedasticity(ARCH) effect.

In the past ten years, following the rapid advancement of

technology and the vast application of artificial intelligence,

researchers have become more tend to use artificial neural

network(ANN) as an alternative method in exchange rates

forecasting andBackpropagation neural networks(BPNs) isone

of the most popular ANN used. Lisi and Schiavo[13] used

BPNs, chaotic modelswereseparately appliedontheexchange

rate prediction and the results from both were better than the

random walk hypothesis. Funahashi[8] and Hornik et al.[10]

believed thatANNis moresuitable for time seriesprediction. Inaddition, mostof the studies done recently hybridize several

artificial intelligence techniques, for instance [9, 20], or

integrate ANN statistics methods, for example, Chen and

Leung[5] used the GeneralRegression Neural Network(GRNN)

to predict foreign exchange rates and through actual proofs

discovered that GRNN approach not only results better

exchange rate forecasts but also products in higher investment returnsthan thesingle-stage model.

However,thepredictiveoutputsofANN aregenerally

single-pointvalues. It seemsunreasonable that"single-point

values"outperformaninterval forforecasting certain financial predicting

problems,

thatis,

stockprices indexes,returns,

andexchangerates. Asingle-pointvalue indeed hasmore

difficulty thananinterval valueinforforecastingatargetvalue. Inordertotakeadvantage ofBPNsnon-linear feature and

improve the single-point values problemsin BPNs,thispaper attempts to propose a BPNsusingafuzzysetarchitecture, and modified neuralnetwork is designedtocombine the non-linear learning characteristic ofBPNsand the interval estimation of statistics, thuscanbeadynamical model forrecognize the financial time seriespatternsand for forecast theexchangerate trend.

The remainder of thispaperconsists of five sections.

Section2 introduces the basicconceptofBPNandGARCH

models. Section3 then describesafuzzysetintervalapproach basedontheBPNmodel forforecastingexchangerates

movement inthis part, a casestudy of theUS New Taiwan

Dollarexchangeratesis alsodesignedtoexamine the influence of thepredictive performance of the modifiedBPNs(short-call

Fuzzy BPNsbelow) suggested by thisstudy, andacomparison

is drawn between the traditionalBPNmodel,Fuzzy BPNsand

AR-GARCHmodel. Subsequently, theempirical results are

presented and discussedinsection4. Finally, the concluding remarksarepresentedin section5.

II.ARTIFICIAL NEURAL NETWORK AND GARCH

MODEL

A.

Artificial

Neural Network ModelTheANNusedinthispaperisBPN,whichuses

Backpropagation trainedby gradient descentalgorithm. This algorithmsupposesthat the jthneuronof the hiddenlayer

receives that activation function:

H Z xiwh (1)

Where xi is thesignaltotheinputneuron iand

wh

is theweight of the connection between the i th inputneuronand

the he jthneuronof the hiddenlayer.,then this activation functionproducesasoutputbyatransfer function

f

of the hiddenlayerhj

=fr

(Hi)=

f

(2)Then eachoutput neuron

k

receivesasinput from theoutputof theprevious layer(hidden layer)andproducesthe final result

°k Z wojk X hj (3)

where

wo

jk is theweightof the connection between hiddenneuron

j

andoutput neuronk,

and it istransformedagaintoT kernk

(ok

) k (4)The

goal

ofthelearning

processistodetermineasetofweights when the actualoutput Yk by the networkgiven

xi

asinput beascloseaspossibletothe desiredoutput ok' the function ofsquarederrorsfor eachneuron,which istobe minimized,

E = ZE (Yk -

°k)'

2k

(5)

The data fed to aninput nodearemultiplied bya setof weights; all suchweighted inputsaretotaledusinganactivation function thatdependsonthelearning algorithmateach node of thenextlayer. Theoutputof the activation function then transforms therawinput foranodeinthenextlayer, this processis called "feed-forward"

Inaddition, theweightsaremodifiedtoreduce thesquared error. Thechangeinweights,

(6)

Awkj

71-Where 7 is thelearningrate,0< 7 <1, Rumelhartet

al.(1986)[16]

introduceda momentum term a in(6), thus obtaining thefollowing learning rule,Aw.

(t+ 1) = -7aWkj + aAw.(t)

(7)

Themomentum a isusuallysetinthe interval[0,1] and itcan also behelpfultokeep the learningprocessfrom fell into the local minima.

Thatis,inthe finallayer, the predictive values of the outputnodesmaydiffer from thetargetvaluesowingtothe

weights beingrandomly initialed. Theerrorbetween the

predictive and thetargetvaluescanbeadjusted by adjusting the weights oflearning epochs, usingadelta rule derived froma

costfunction of theerror.Thisprocessistermed "backward".

B. GARCHModel

TheGARCHmodel ofEngle[7] andBollerslev[2] requires

joint estimation of thecurrentconditionalmeanmodelas

formula(8) and thepastconditional variance(9)inorderto

capturethenon-linearityinvolved the distribution of financial data isleptokurtic. TheGARCH(p,q)modelcanberepresented

by the following model:

(8)

m n

Et = aO + E aEi + E b et-j

i=l j=l

where Et is series of continuousexchange rate(normalized),

the

ao,

aiandbj

aretheconstantparameters,Et N

(0,

h) and the conditional variance oferrors,ht

is given by:p q

ht = Zto+ a

±2

+ E6jhtj (i=l j=l

Where ao

>O,ai/j

>.0 and Ziai +,j,ij

<1These restrictionsontheparameter preventnegative variances

and theGARCH(1,1)wasfoundtobe themostpopular.

III. THE HYBRIDMETHODOLOGY AND RESEARCH

DESIGN

A. Fuzzy BPNs

Thispaper proposesfuzzy-interval architecture using fuzzy setforimproving the single-point shortcoming of BPNs, call

Fuzzy BPNbelow. Further, afuzzysetis completely

characterizedby it membership function (MF), theMFof fuzzy-interval approach is defined in thispaperis the Gaussian

MFand specified bytwo parameters {c, G}:

1 (x-C)2 f(X;c,c7)= e 2 o7

C,.2T(

(10) where cis the Gaussian MFscenterand Gydetermines the MFs width.Inthispaper,the cindicatesthemeanofweekly

exchangeratesand the Gyintentsthe standard deviation of weekly exchangerates,the MFoffuzzy-interval is also decided completely by candc. Note that GaussianMFisadirect

generalization of the normal distributionuseinprobability

theory, when fuzzy-intervalMFis centeredon c and the

extent towhich itspreadsoutaround c is added and

subtracted1.96Gy(+1.96u) of 95% probability of confidence

interval(see Fig. 1).

Fig.1Gaussian MF offuzzy-interval approachinthispaper

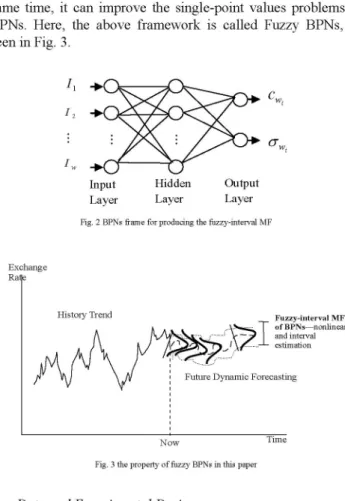

According to the assumption of the MF above mentioned,

this research tries tolearn the parameter c and Gy using BPN. Fig. 2 is shown the BPNs frame for producing the fuzzy-interval

MF, then used c and Gy to find the fuzzy-interval MF, in this

way,notonlycanit maintain theBPNs non-linearfeature,atthe

same time, it can improve the single-point values problems in

BPNs. Here, the above framework is called Fuzzy BPNs, as

seeninFig. 3.

I2

cWi

Input Hidden Output Layer Layer Layer

Fig. 2 BPNsframe for producing the fuzzy-intervalMF

Exchange Ra4e

HistoryTrend Fuzzy-intervalMF

ofBPNs-nonlinear

A.... andinterval

..1 estimation FutureDynamic Forecasting

Now Time

Fig.3thepropertyof fuzzyBPNsinthispaper

B. Data and Experimental Design

The data sets werebilateral exchange rates between New

Taiwan Dollar and US dollar (NTD/USD), and composed of

daily rates covering almost 14-year period from the beginning

of Central Bank of China, Republic of China (Taiwan), on

January 3, 1993 to October 14, 2006 and including 3425

observations.

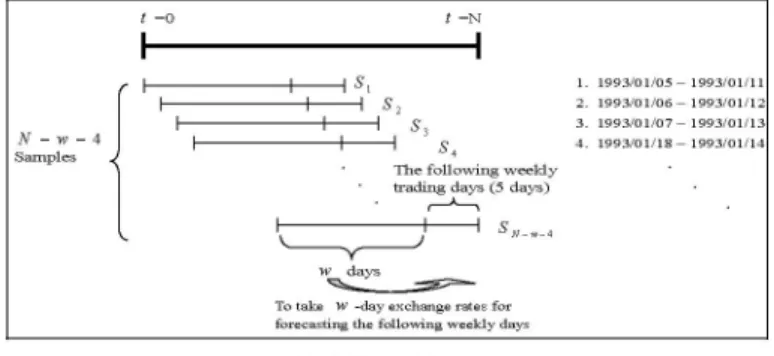

This study attempts to take w days for predict the

following weekly (5 trading days) exchange rate. To put it

plainly, when we want to forecast the next unknown weekly

exchange rate, we can use the past w days ahead the future

next weekly days to training model for get predicted values.

Consequently, a "sliding window" was proposed as shown in

Fig. 4 with different window width w + 5 moving from the

first period to the last period of the entire data set labeled by

S (i is from oneto N-w-4) resultingin all N (N =3425)

observations being divided again into N- w-4 samples.

Consulting Chen and Tsao[4] and Tay and Cao[19], there are

five different w, their being5,10,15,20 and 25, considered in this paper. Many investigations have used a convenient ratio to separate in-samples form out-of samples ranging from

C

-1.96 cy +1.96cy

70%:30% to 90%:10%[22]. Hence, about approximately 25% of the samplesareused fortest, 75%for traininginthispaperand every sample comprises a time series data containing

w + 5 exchange-rateobservations. tO tN

l

I

Sl 1. 1993/01/05 1993/01/11 5 s 2. 1993/01/06 1993/01/12 l I| S 3. 1993/01/07 1993/01/13 N-W s 4 1993/01/18 1993/01/14 Samples i4n ~~~~~~~Thefollowing weekly

*tradinlg days (5 days)

<

~

ISN--W days

Totake W-day exchangeratesfor

forecastingthefollowing weekly days

Fig. 4.Slidingwindow

Foreffective predictive performance ofBPNandGARCH

processing, thispapertakes the natural logarithmic

transformationtostabilize the time series ofexchangeratevia normalization. The normalizations oftwo outputvariables of theexchangerates inthispaperseparatelyare

mean Si(=

K.)

-11

SD

jt (ln(pI|

- mean s)

where Pw denotes the normalized basic day of the following

weekly exchangerates for theprevious w days, while

means

andSDS

representsthemeanand standard deviation for thefollowing week exchangeratesduring periodSi

.IV. EMPIRICAL RESULTS

This sectioninterprets andpresentsthe bestspecificationsof

Fuzzy BPNs,traditionalBPNsandGARCHmodel fordaily

NTD/USDexchange-rate series.

A. BPNsModel

TheBPNsmodel usedinthis study isathree-layer feed forwardnetwork, and is trainedtomapthenextweekly-day

meanand standard deviation for thecoming w days usinga

backpropagation algorithm. This study varies the number of nodesinthe hiddenlayer and stopping criteria for training, TABLE Iis theparameterssetting list and Matlab7.0program languagewas runfor theexperiments ofBPNsinthisstudy.

TABLE I BPNs parameters setting inthis study

parameters settingvalue Hidden layer I layer and 2 layers

Ilayer 5, 15, 30, 50, 100

Hidden nodes 2 layers :5, 15, 30

Learningepochs 10000

Learningrate 010.3,05,07 10

Momentum tenn DefaultedbyMatlabprogramlanguage Total number of 350 1layer 5 x5x 5 (w) 125

trial-and-error 2 layers 3x3 x5x 5 (w) 225

Severalperformance criteria are used to model BPNs, this

study includingthe Meansquarederror(MSE) suggested by

Coakley et al.[6]to determine the point at which the training stopsandassesstheforecasting performance.

n,

Z

(F

i)2

MSE = i

nw-1

where

nw

is the number of theexamplesequences,(13)

n =

N-

w-4,

0 is thetargetvalue,

F is thepredicted

value,the final determined parameters of each w-daysBPNs arebasedonthe smallestconvergedMSEtheir ownrespectively. 1) Since themajorpurposeof thispaperistoinvestigate the effects

ofBPNsparameters onthemodeling and forecasting

performance ofBPNs,the values ofMSEbetweentrainingset

(in-sample) and testingset(out-of-sample) will be compared,

2) with theemphasisput ontheout-of-sample analysis, because it

is only using the testing data that theBPN parameter setting with the bestforecasting capabilitycanbeprovenand found.

Alltheset parametersafter passing through Trail andError, then basedonthe smallestMSEvalue of the5differentw,the MSEvalue is chosenasitsfirstmeasurementstandard,ifthe training dataMSEvalue is thesamethen thetraining data becomes the secondscreening standard,TABLEIIis the best parametersetting model (the best performance) chosenand arrangedasfollows.

TABLE II BPNsbestparameter settingmodel

trainingdata testingdata

W Hidden learningrate

MSE MSE 5 0.000010357 0.000010723 30 0.5 10 0.000009428 0.000009566 15X15 0.3 1 5 0.000005957 0.000008403 30X30 0.7 20 0.000007632 0.000012630 1 5 1.0 25 0.000008058 0.000010245 5X15 0.5 B. GARCHModel

Variousgoodness-of-fitstatisticsareusedtocomparethe all estimatedGARCHmodelinthispaper,thediagnosticsare the MSE, the likelihood-ratiotests, testsfor the standard

residuals, Schwarz's Bayesianinformationcriterion (SBC) by Schwarz(1978)[18] and Akaike's information criterion

(AIC)[11].The GARCH models were tried for p=1,2, *

,5

and q =1,2,. .,5 usingSAS programsoftware,TABLE III

shows that thestatistically significantparameters for every AR( w)-GARCH(p,q) model and the last resultswaslisted,the

estimated values of parameters

a0o,

l and y allsatisfyao > 0, al >0, ,8> 0 and

a+,8/<1.

This indicates the weaknesses of imposing the parameter estimates of a GARCH model to certain constraints such as stationary.TABLE III Estimationresults of GARCH models for NTD/USD exchangerates

t -value Model

a0(xlO6)

t-value 1 t-valuet1

/ 3 4 p p-v3

4 AR(5)GARCH(1,4) 4.5487 17.5 0.001401 0.03 0.0421 0.0276 0.0231 0.0281 - 27.95 7.07 4.24 6.72AR(lO)GARCH(1,4) 4.5564 17.21 0.001382 0.03 0.0421 0.0275 0.0229 0.0278 - 27.13 6.69 3.98 5.67

AR(15)GARCH(1,5) 4.5185 13.35 0.001567 0.02 0.0423 0.0256 0.0183 0.0171 0.0228 25.64 5.23 2.83 2.95 5.39

AR(20)GARCH(1,5) 5.9404 9.55 0.0172 0.17 0.0399 0.0256 0.0186 0.0182 0.0212 20.59 3.73 2.3 2.23 3.44

AR(25)GARCH(1,3) 0.67168 13.51 0.4395 14.28 0.1156 0.0804 0.0907 - - 24.38 4.67 3.86

TABLEIVindicates allfinal AR( w)-GARCH(p,q) models

that their own MSEvalues,Log Lvalues,the lowest AIC and

SBC,dividedly. Inthenextsection, theFuzzy BPNsand

traditionalBPNsmodels will becompared the forecasting

performance with finalAR-GARCHmodels.

TABLE IV Thegoodness-of-fitstatisticsvalues of allfinal AR(W)-GARCH(p,q)models

Model Goodness-of-Fit Statistics

MSE LogL SBC AIC

AR(5)-GARCH(1,4) 0.0000204 11061.0956 -22028.009 -22098.191 AR(10)-GARCH(1,4) 0.0000204 11045.7559 -22057.512 -21958.113 AR(15)-GARCH(1,5) 0.0000203 11044.3184 -22042.637 -21908.183 AR(20)-GARCH(1,5) o0ooi099 11031.2324 -22006.465 -21842.826 AR(25)-GARCH(1,3) 00000198 11739.1774 -23416.355 -23235.244 C. ForecastingPerformance

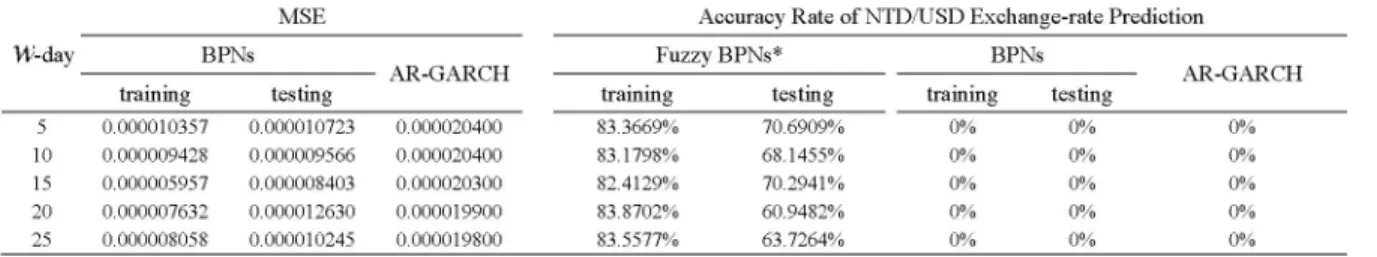

Fuzzy BPNs, traditional BPNs, and AR-GARCH models all

used similar measurement standard- MSE values as its

MSE

W-day BPNs

measurementstandard. It canbe known fromTABLEVthat the

MSEvalue of different W BPNsmodels areall lower than

those with AR-GARCH models, which shows that the

forecasting ability of the BPNs models are better than the

AR-GARCH models; in addition, from the point of view of

forecasting accuracy rate as the judgment standard, the

exchange rates oftraining data of the Fuzzy BPNsare between

the fuzzy-intervalMF's forecastingareas, which are 83.3669%,

83.1798%, 82.4129%, 83.8702%, and 83.5577% respectively,

while the accuracy rateof the exchangerates of training data

to be guessed correctly are 70.6909%, 68.1455%, 70.2941%,

60.9482%, 63.7264%, while theaccuracy rate of the traditional

BPN models and the AR-GARCH models is 0%. It can be

known than that aside from the Fuzzy BPNs having a better

forecasting ability than the AR-GARCH models, the study

made use of the sector characteristic offuzzy MF to improve

the single point forecasting shortcoming of the traditionalBPN models.

TABLE V Theperformancecomparisonof FuzzyBPNs,traditionalBPNsand AR-GARCH models

Accuracy Rate ofNTD/USD Exchange-ratePrediction

IXKAD 1XAD

IFuzzy

BPNs* BPNstraining testing training testing

5 0.000010357 0.000010723 0.000020400 83.3669% 70.6909%

10 0.000009428 0.000009566 0.000020400 83.1798% 68.1455%

15 0.000005957 0.000008403 0.000020300 82.4129% 70.2941%

20 0.000007632 0.000012630 0.000019900 83.8702% 60.9482%

25 0.000008058 0.000010245 0.000019800 83.5577% 63.7264%

*Assumption of 95%probabilityinGaussiandistribution,theFuzzy-intervalMFswereextended basedonc±1.966yw

training 0% 0% 0% 0% 0% testing 0% 0% 0% 0% 0% 0% 0% 0% 0% 00 31--ADIIIJ

V. CONCLUSIONS

The applications ofANNs in financial areahave obtained

increasing popularity in the past decades. Nevertheless, a

strictmethodologyonhowtoproperly designasystemofANNs

for forecasting time series data is still a difficult problem; the

disadvantages of ANNs also have be widely discussed and

solved, suchas"blackbox", single-point prediction, etc. Inthis

study, amethod called Fuzzy BPNs consisted offuzzy-interval

MF was suggested for the purpose of improving upon the

shortcomings of single-point estimations in conventional

artificial neural networks, and still has possession ofANNs

nonlinear capabilities. This paper also provides evidence for

the forecast performance ofFuzzy BPNs in terms of interval

evaluation is not only much better than traditional BPNs in

terms of single-point evaluation, but more well than

AR-GARCH models. To conclude, this contribution presents

that a combination ofBPNs with Fuzzy membership function

proposed by this research offers auseful approach for predicting time seriespatterns inexchange market data.

VI.REFERENCES

[1] D.Alexander,L.R.Thomas,"Monetary/asset Models ofExchangeRate Determination: How Well HaveTheyPerformedinthe 1980's?" International JournalofForecasting,vol. 3, pp53-64, 1987.

[2] T.Bollerslev,"GeneralisedAutoregressive ConditionalHeteroskedasticity,"

JournalofEconometrics, vol. 31,pp3O7-327,1986.

[3] G.Canarella,S. K.Pollard, "EfficiencyinForeignExchangeMarkets:a

VectorAutoregressionApproach,"JournalofInternational Money and Finance,vol. 7, pp33 1-346, 1987.

[4]S.-H.Chen,C. YTsao, "Information Content of the Trajectory-Domain

Models,"9hinternationalConferenceonComputinginEconomicsand Finance,Seattle, USA,July2003.

[5] A.-S.Chen,M. T.Leung,"Regression Neural Network for Error Correction

inForeignExchangeForecastingandTrading,"Computers and Operations Research, vol. 31,ppl049-1068,2004.

[6]J.R.,Coakley,D. D.Mcfarlane,WG.Perley,Alternativecriteriafor

evaluatingartificial neural networkperformance, presentedatTIMS/ORSA JointNationalMeeting,April1992.

[7] R. F.Engle,"Autoregressive ConditionalHeteroskedasticity withEstimates of the Variance of U.K.Inflation,"Econometrica,vol.50, pp267-287,

1992.

[8]K.Funahashi,"OntheApproximateRealization of ContinuousMappings

byNeuralNetworks,"NeuralNetworks,vol.2,ppl 83-192,1989. [9] K. Huarng, T. H.-K. Yu, "TheApplicationofNeural NetworkstoForecast

Fuzzy TimeSeries," PhysicaA,vol.363, pp481-491,2006.

[10]K.Hornik,M.Stinchcombe,H.White, "MultilayerFeedforward Networks AreUniversalApproximateors,"NeuralNetworks,vol.2, pp359-366,1989.

[11] G. G. Judge, W E. Griffiths, R. C. Hill, H. Lutkepohl, T. C. Lee, :The Theory and Practice of Econometrics,"2nd ed., New York:Wiley, 1985. [12] L.Kilian, M. P. Taylor, "Why Is It So Difficult to Beat theRandom Walk

Forecastof Exchange Rates?" in: European Central Bank Working Paper

Series,WP No.88,November 2001.

[13] F. Lisi, R. A. Schiavo, "A Comparison between Neural Networks and Chaotic Models forExchange Rate Prediction," Computational Statistics and DataAnalysis, vol. 30, pp87-102, 1999.

[14] R. MacDonald, M. P. Taylor, "The Monetary Model ofthe Exchange Rate: Long-runRelationships, Short-run Dynamics and How to Beat aRandom Walk," Journal ofInternational Money and Finance, vol. 13, pp276-290, 1994.

[15] R. A. Meese, K. Rogoff, "Empirical Exchange Rate Models ofthe Seventies: DoThey Fit Out of Sample?" Journal ofInternational Economics,vol. 14, pp3-24, 1983.

[16] D. E. Rumelhart, G. E. Hinton, R. J. Williams, "Learning Internal Representationsby Error Propagation." in: D. E. Rumelhart,J. L. McClelland, (Eds.), Parallel DistributedProcessing,vol. 1,MIT press,

Cambridge,MA, pp 318-362, 1986.

[17]N.Sarantis, C. Stewart,"Structural, VAR and BVAR Models ofExchange RateDeterminate:AComparisonof Their ForecastingPerformance,"

JournalofForecasting, vol. 14, pp201-215, 1995.

[18] G. Schwarz, "Estimating the Dimension of a Model", Annals of Statistics, vol.6,pp461-464,1978.

[19] F. E. H. Tay, L. J. Cao, "Modified Support Vector machinesinFinancial Time Series Forecasting," Neurocomputing,vol. 48, pp.847-861, 2002. [20] M. Versace, R.Bhatt,0.Hinds,MShiffer, "Predicting theExchange

Traded Fund DIA with a Combination of GeneticAlgorithms and Neural

Networks,"Expert systems withApplications, vol. 27, pp417-425,2004. [21] C. C. P.Wolff, "Time Varying Parameters and theOut-of-sample

ForecastingPerformance of StructuralExchange RateModels,"Journalof Business Economicsand Statistics,vol. 5, pp87-103, 1987.

[22] G. P.Zhang, "Business Forecasting with Artificial Neural Networks: An overview", in: G.PZhang(Ed.),Neural NetworksinBusinessForecasting, Idea GroupPublishing, Hershey, PA, 2004.