亞 東 學 報 第 36 期 民國 105 年 12 月 251 - 254 頁

Journal of Oriental Institute of Technology Vol. 36, December 2016 pp. 251 - 254

251

The value relevance between intellectual capital and company stock price

Hsiu-Feng Huang

1,*Abstract

The main purpose of this study is to explore the value relevance between IC and the company, that is, whether IC has effects on company stock price. Evaluation of the theoretical structure was based on the Ohlson Model. The findings show that a negative relationship existed between share prices and average R&D expenses in the last five years and researcher creativity for the semiconductor industry in Taiwan.

Keywords: intellectual capital, company value, Ohlson Model

1. The introduction

As financial statement inability in evaluating firms’ true value, and results the difference between market and book value. Previous researches considered that the difference was caused from intellectual capital or intangible asset, and they are both the determinants of the valuation( E. Amir and B. Lev,1996), (M. E. Barth et al.,1998), (L. Edvinsson and M. S. Malone,1997),( B. Lev and T. Sougiannis,1996), (T. A. Stewart,1997).

The residual income model (Allen et al., 2000), an assumption from the Ohlson Model, suggests that equity value combines both accounting information and information function that does not react to the accounting system, which can replace dividends with future abnormal returns in predicting equity value. In 2002, the Science and Technology Institute published the results of its research on the IC of the information industry in Taiwan. The following were the findings in eight directions: information technology applications, R&D capacities, human resources, innovation and creativity, decision making and strategy, customer relations, business networking, and productivity and quality.

Following the Institute for Information Industry III and Roos et al. (1997), the current study developed four IC indices:

(1) Each researcher creativity (ERC) = operating income/number of research and development personnel proxy for human capital.

(2) Research and Development (RD) expenses for last five year average proxy for structure capital.

(3) Professional Board Directors (PBD): where there are two or more board directors with electronic and management experience

1 Department of Industrial Management Oriental Institute of Technology * Correspondence author: Hsiu-Feng Huang

亞東學報 第 36 期

252

(4) Market share Rate = year in market share, proxy for customer relationship capital , creativity in every research and development personnel, developed products of each researcher can create higher revenues, said developers have higher productivity, greater contribution to corporate value creation.

2. The Literature review and Hypothesis Development

This study examined whether human capital has relevance to firm value. Therefore, R&D staff creativity is added to the pricing model as a measure of human capital. Therefore, this study developed Hypothesis 1 as follows:

Hypothesis 1: Human Capital is positive relation to market value

Investments in the R&D of better company performance and R&D spending on company market value had significant impact. The expected shares of spending on R&D in this study are significant, and the company’s R&D cost amortization for five more years, as well as product development for more than one year, is used in the last five years as the average R&D costs as capital structure variables. Therefore, Hypothesis 2 was developed as follows:

Hypothesis 2: Research and Development expenses (RD) , proxy for structural capital, is positive relation to market value.

Enterprises adopt the corporate governance rules of related statutes, and expect company directors to participate in major decisions. Therefore, this study sought to investigate whether company directors with relevant professional background create value, taking professional directors as structured capital variables. Legislation empowering competent authorities depending on company size, shareholding structure, nature, and other necessary conditions for business requires listing firms offering set independent company directors of not less than two persons and not less than one-fifth of directors’ seats. Therefore, the hypothesis determining whether professionals are set to two or more than the number of directors and supervisors is given below:

Hypothesis 3: Professional Board Directors (PBD), proxy for the structural capital, is positive relation to market value.

Customer resources are critical in this competitive environment. Companies bet on building brand awareness, acquire customers, and enhance customer loyalty process to increase market share, company competitiveness, and value creation. Therefore, we hypothesize that companies for customers arising out of capital invested market share have a positive relationship with company values:

Hypothesis 4 : Market share Rate, proxy for customer relationship capital, is positively related to market value.

2. Sample Selection

This research used companies from the semiconductor industry listed on the Taiwanese stock exchange as research objects. The sample period was 2012 to 2014 Sample companies had four variables for complete information: data resource included price, dividend data obtained from the market observation post system, R&D personnel, and expense data obtained from the company prospectus and the annual report of shareholders’ general meeting (excluding missing

The value relevance between intellectual capital and company stock price

253

data). This study finally included 28 samples.

Most previous studies divide IC into three: human, structural, and relational capital. Studies should take innovation and process capital into structural capital to provide a complete expression of IC in the investigation of organizational influence on firm value.

Therefore, this study divided IC into human, structural, and relational capital to explore the relationship between firm value and IC. The study used stock price as a proxy for firm value and followed the Ohlson Model to examine the value relevance of IC. The regression model between IC and market value is as follows:

t , i t , i t , i t , i t , i t , i t , i

BV

ERC

RD

PBD

MS

P

0

1 1

2

3

4

5

which:Each researcher creativity (ERC) = net income/number of research and development personnel proxy for human capital. Research and Development (RD) =last five year average proxy for structure capital. Professional Board Directors (PBD) = two or more board directors with electronic and management experience. Market share Rate (MS) = year in market share, proxy for customer relationship capital , creativity in every research and development personnel, developed products of each researcher can create higher revenues, said developers have higher productivity, greater contribution to corporate value creation.

3. Empirical results

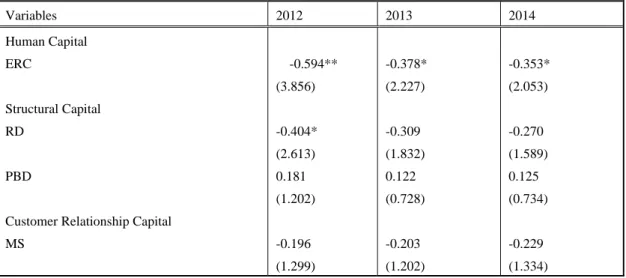

Based on Roos et al. (1997), the present study developed four IC indices (i.e., each researcher’s creativity = operating income/number of R&D personnel as a proxy for human capital). Human capital variables were significantly and negatively related to market value, with coefficients of 0.594, 0.378, and 0.353 (Table 1). Only one year and one variable (R&D of structural capital; coefficient, 0.404) were significantly and negatively related to market value. The reset of variables were not significantly related to market value in all years. The R squares for the three models were 8.5%, 10.6%, and 9.8%, respectively (Table 1).

Table 1 Regressions of Intellectual Capital and market value

Variables 2012 2013 2014 Human Capital ERC Structural Capital RD PBD

Customer Relationship Capital MS -0.594** (3.856) -0.404* (2.613) 0.181 (1.202) -0.196 (1.299) -0.378* (2.227) -0.309 (1.832) 0.122 (0.728) -0.203 (1.202) -0.353* (2.053) -0.270 (1.589) 0.125 (0.734) -0.229 (1.334)

亞東學報 第 36 期 254 N R2 28 8.5% 28 10.6% 28 9.8% Note: *p<0.1;** p<0.05; *** p<0.01, βis coefficient for regression model.

4. Conclusions

The findings show that a negative relationship existed between share prices and average R&D expenses in the last five years and researcher creativity for the semiconductor industry in Taiwan. The IC index was not visible to value creation. Results inconsistent with the expected direction may have the following several points: First is share price, which indicates market value in addition to being under the influence of the company’s financial position and of nonfinancial factors.

Second, the semiconductor industry is transitioning from contract manufacturing to the development of branding and design. Current R&D is not mature, leading to recent input that may be ineffective. Finally, from the investor psychology perspective, investors in Taiwan aim for short-term arbitrage, but companies for research input cannot have short-term response. Therefore, investors might regard research expense as an inverse index of stock price for future expectation. Therefore, this study suggests that, as IC has numerous elements, future researchers should establish more indices. Given the many elements within the enterprise, this study recommends that future researchers apply a questionnaire as an auxiliary tool to obtain relevant data.

References

1. B. Lev and T. Sougiannis, “The Capitalization, Amortization and Value-relevance of R&D”, Journal of Accounting Economics, vol. 21, pp. 107-138 (1996)

2. Brooking ,A., “Human Capital: What Is It and Why people Invest It”, SF: Jossey-Bass. (1996)

3. C. J. Liang and Y. L. Lin, “Which IC is More Important? A Life-cycle Perspective”, Journal of Intellectual Capital, vol. 9, no. 1, pp. 62-76 (2008)

4. Dunford, B.B., Snell, S.A., Patrick, M.W., “Human resource and resource view of firm”, CAHRS Working paper series, pp. 66. (2001) 5. E. Amir and B. Lev, “Value-relevance of Non-financial Information: the Wireless Communications Industry”, Journal of Accounting

and Economics, vol. 22, no. 1-3, pp. pp.3-30 (1996)

6. E.M. Kohlbeck and T. Warfield, “Unrecorded Intangible Assets: Abnormal Earnings and Valuation”, Accounting Horizons, vol. 21, no. 1, pp. 23-41 (2007)

7. Kaplan, R. S. and D. P. Norton, “The stratey focus orgnation”, Harvard Business school press, Boston, MA (2000)

8. L. Edvinsson and M. S. Malone, “Intellectual Capital, Realizing Your Company’s True Value by Finding Its Hdden Roots”, Harper

Business, New York, (1997)

9. M. E. Barth , B. Clement, G. Foster, and R Kasznik,“Brand Values and Capital Market Valuation”, Review of Accounting Studies, vol. 3, pp. 41-68 (1998)

10. Roos, G., & Roos, J.,“Measuring your company’s intellectual performance”, Long Range Planning, Vol, 30, no.3,pp. 413-426(1997) 11. T. A. Stewart, Intellectual Capital: The New Wealth of Organizations, Bantam