Advertising and Entry Deterrence: How the Size of the Market Matters

全文

(2) 200. International Journal of Business and Economics. The remainder of the paper is organized as follows. In Section 2, we specify the model and notation. Section 3 derives the Stackelberg equilibrium and its properties. Section 4 presents a comparative statics analysis. Section 5 concludes. 2. The Model Consider an incumbent firm X and a rival Y who considers the possibility of entering into the incumbent’s market. Let x and y denote the advertising spending of the incumbent and the entrant, respectively. These quantities measure the number of ads that firms send to consumers. The size V of the market is fixed. We assume that firms have constant marginal production costs equal to c and no fixed costs and that the price is regulated at the level p > c . Let m = p − c denote the profit margin. The incumbent makes its advertising decision x and then the potential entrant chooses its advertising effort y under full knowledge of x . Let c X (⋅) be the advertising cost of firm X . We assume that c X is convex and strictly increasing with c′X (0) > 0 . The advertising cost of firm Y is described by the convex and strictly increasing function cY (⋅) with cY (0) = 0 , cY′ (0) > 0 , cY′′ ( y ) ≥ 0 , and cY′′′( y ) ≤ 0 . We also assume that the market share S of firm X has the following form: −1. ⎛ y ⎞ S = ⎜1 + ⎟ , ⎝ θx⎠. (1). where θ is a positive parameter that indicates the effectiveness of the incumbent’s advertising relative to that of the entrant. This implies that, even if two firms expend the same amount of advertising effort, they may not have the same market share. If the incumbent’s advertising effort is twice as effective as that of its competitor (i.e., if θ = 2 ) and the two firms choose the same advertising spending, then the incumbent will achieve a market share twice as large as the entrant’s share. The relationship given in (1) has been employed in a number of fields, including the economics of advertising (Schmalensee, 1972), rent-seeking (Nitzan, 1994), and the economics of conflict (Hirshleifer, 1995). A large empirical and theoretical literature, published in marketing journals (Cooper and Nakanishi, 1988), has also adopted this relationship, which is referred to as a market share attraction form. The market share received by the incumbent, S , is increasing in its effort x and is decreasing in the effort of its competitor, y , as it obviously should. The optimization problem for firm X is: max {π X } = max{SmV − c X ( x)} , x ≥ 0 ,. (2). and the problem for firm Y is: max {π Y } = max{(1 − S ) mV − cY ( y )} , y ≥ 0 .. (3).

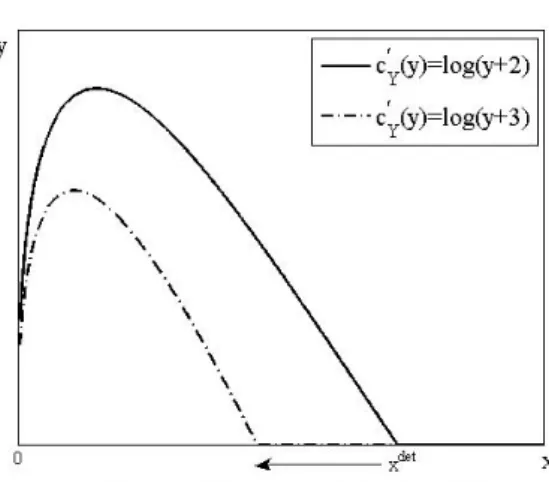

(3) Khaled Bennour. 201. 3. Equilibrium To analyze the allocation of the advertising spending in this scenario, we begin by considering the second-stage choice of firm Y . At this second stage, firm Y takes x as given and chooses the solution y to the program (3). We are interested in deriving the conditions under which Y chooses not to enter, that is, when y = 0 . Since π Y is strictly concave in the strategy y , the maximizer is unique. The solution is given in the following proposition. Proposition 1: Let x det = mV θ cY′ (0) . Given the advertising spending x of the incumbent, the potential entrant’s optimal reaction y is null for x ≥ x det and strictly positive for 0 < x < x det with x and y satisfying:. θ mVx = (θ x + y ) 2 cY′ ( y ) .. (4). In (4), x det is the minimum spending of firm X to advertising necessary to prevent entry. x det depends positively on the size V of the market and the profit margin m and depends negatively on the relative effectiveness θ of the incumbent’s advertising. The threshold x det depends negatively on the value of cY′ (0) , which approximates the entrant’s average cost of small levels of advertising spending. Figure 1 depicts the best-reply y of the potential entrant to the advertising spending of the incumbent, x , for two different marginal cost functions cY′ (⋅) . For x < x det , there is an inverted-U shaped relationship between y and x . Otherwise, y equals 0. Figure 1. The Best-Reply Function of Y. When entry is allowed and the incumbent choice is fixed, there is a positive relationship between the advertising spending of the entrant and the attractiveness of the market, measured by mV , but the effect of an increase in the relative.

(4) 202. International Journal of Business and Economics. effectiveness of the incumbent’s advertising on the advertising spending of the entrant is ambiguous. We consider now the choice of the first stage of the incumbent. At this first stage, the incumbent chooses its advertising spending x to solve program (2). When choosing x , the incumbent firm takes into account the reaction of the potential entrant. If x ≥ x det , then y = 0 and S = 1 . Equation (2) implies that the profit of the incumbent, for x ≥ x det , is a decreasing function of x . Consequently, the optimal choice of the incumbent is obtained at x not greater than x det . We begin by showing that the constraint x ≥ 0 is not binding. Proofs are provided in the Appendix. Lemma 1: When x → 0 then y → 0 and y x → +∞ . Lemma 2: When x → 0 , then d π X dx → +∞ .. It follows from Lemma 2 that the incumbent’s optimal advertising spending is positive. We show next that the type of equilibrium, with or without entry, depends on the sign of the (left-hand) derivative of π X at x = x det . Consider first the case in which the (left-hand) derivative dπ X dx is negative for x = x det . The profit function of the incumbent has an interior maximum at a value of x that satisfies: ⎛ ∂S dy ∂S ⎞ det + ⎜ ⎟ mV = c′X (x) with 0 < x < x . ⎝ ∂x dx ∂Y ⎠. (5). The first term on the left-hand side of (5) captures the direct effect of greater advertising effort x by the incumbent on its profit. The second term represents the strategic effect of x on the choice of the potential entrant. In this case, the incumbent maximizes its profit by choosing its advertising spending such that the marginal revenue equals the marginal cost. Given that this advertising level is smaller than x det , the entry is allowed. Consider now the case in which the (left-hand) derivative dπ X dx is not negative at x = x det . We need the following lemma. Lemma 3: The marginal revenue of the incumbent for all x such that 0 < x < x det is greater than its marginal revenue at x = x det .. Let R = ∂S ∂x + (dy dx)(∂S ∂Y ). By Lemma 3 we find that R ( x)mV > R ( x det )mV ≥ c′X ( x det ) ≥ c′X ( x ) for all 0 < x < x det . Hence, dπ X dx is positive for 0 < x < x det and the profit function of the incumbent is strictly increasing. Consequently, the incumbent chooses an advertising spending equal to x det and entry is prevented. We summarize this as follows..

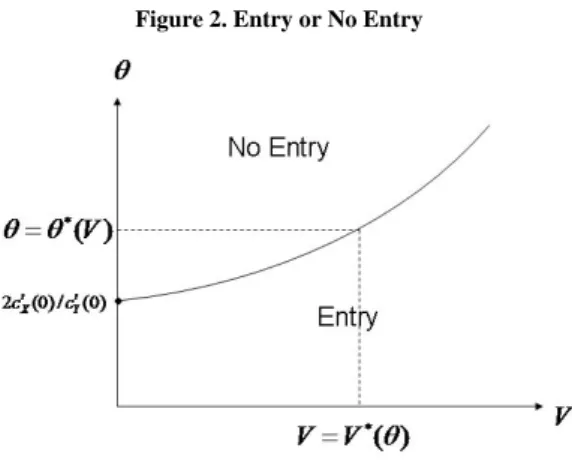

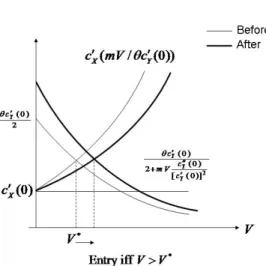

(5) Khaled Bennour. 203. Lemma 4: The type of equilibrium, with or without entry, depends on the sign of the (left-hand) derivative of π X at x = x det . Entry is prevented if and only if this derivative is not negative. 4. Comparative Statics. Depending on the parameters θ and V , the incumbent may or may not seek to deter entry. If the relative effectiveness of the incumbent’s advertising, θ , is less than or equal to a critical level, then entry will be allowed for all values of the market size. Otherwise, the incumbent finds it profitable to deter entry provided that the market size is not large. We show easily that the (left-hand) derivative of π X at x = x det is given by: d πX dx. = x = x det. ⎛ mV ⎞ − c ′X ⎜ ⎟. 2 + mV cY′′ (0) [cY′ (0)] ⎝ θ cY′ (0) ⎠. θ cY′ (0). 2. (6). Let’s consider the special case in which c X ( x) = x and cY ( y ) = y . In this case, an explicit solution for (4) and a well-behaved reduced-form profit function are obtained. Equation (6) becomes: d πX dx. = x = x det. θ 2. −1 ,. and we obtain the result derived by Schmalensee (1974), which we state as a proposition. Proposition 2: When marginal advertising costs are constant, with c′X = cY′ = 1 , the type of equilibrium does not depend on the market size. Furthermore, entry is prevented only when the incumbent has an advantage in terms of the effectiveness of its advertising, with θ ≥ 2 .. When considering changing its advertising spending, the incumbent compares its marginal revenue with its constant marginal cost. One can show easily that the marginal revenue, for 0 < x < x det , is positive and decreasing. The equilibrium does not depend on the market size since marginal revenue at x = x det depends only on the relative effectiveness θ of the incumbent’s advertising. In contrast, when advertising costs are nonlinear, the market size does matter. Figures 2, 3, and 4 illustrate the following results. Proposition 3: For a given value of θ , there are two cases: (i) if θ ≤ 2c′X (0) cY′ (0) , then entry is allowed for all values of V and (2) if θ > 2c′X (0) cY′ (0) , there exists a threshold level V * such that entry is prevented when the market size V is not larger than V * and entry is allowed when V is larger than V * . Furthermore, θ and V * are monotonically and positively related..

(6) 204. International Journal of Business and Economics. Proposition 4: For a given value V , there exists a threshold level θ * such that for θ not smaller than θ * entry is prevented and for θ smaller than θ * entry is allowed. Furthermore, V and θ * are monotonically and positively related.. Proposition 4 shows that a larger market size implies a higher probability of the entry accommodating equilibrium. The intuition is as follows. When the market size is high, strong incentives exist for the potential entrant to advertise in order to gain market share. It follows that the incumbent needs to spend heavily on advertising to deter the entry of its competitor. But in this situation, since the advertising exhibits increasing marginal cost, marginal revenue will be smaller than the marginal cost. Consequently, the incumbent prefers to moderate its spending in advertising and thus entry occurs. Figure 2. Entry or No Entry. Figure 3. θ * Increases as V Increases.

(7) Khaled Bennour. 205. Figure 4. V * Increases as θ Increases. Considering more general specifications for advertising costs yields another striking result which contrasts with the result obtained in Proposition 2. The incumbent may have an incentive to deter entry even though it does not have an advantage in terms of the effectiveness of its advertising. For example, the entry deterring equilibrium may hold for θ not larger than one. In this case, 2c′X (0) cY′ (0) is smaller than θ and the market size is small enough (i.e., V < V * ); see Figure 2. 5. Conclusion. We show that market size matters when analyzing a Stackelberg model in which an incumbent and a potential entrant compete to gain market share and advertising is the only strategic variable. Ellison and Ellison (2000) report evidence that drugs with higher revenues are most likely to attract generic entry. Scott Morton (2000) analyzes the US pharmaceutical industry and questions whether preexpiration brand advertising deters generic entry. She shows that market attractiveness, measured by pre-expiration brand revenue, is the most important factor determining the number of entrants. Appendix Proof of Lemma 1: Equation (4) yields θ mVx ≥ y 2 cY′ ( y ) ≥ y 2 cY′ (0) . Then 0 < y 2 ≤ θ mVx cY′ (0) . It follows that y → 0 for x → 0 . Also, from (4) y θ x = mV (θ xcY′ ( y )) − 1 . Since xcY′ ( y ) → 0 for x → 0 , y x → +∞ for x → 0 . Proof of Lemma 2: Using (4) and by applying the envelope theorem, we obtain the derivative dy dx and obtain:.

(8) 206. International Journal of Business and Economics cY′ ( y ) θ mV − 2θ (θ x + y )cY′ ( y ) mV 2(θ x + y )cY′ ( y ) + (θ x + y ) 2 cY′′ ( y ) (θ x + y ) y cY′ ( y ) cY′ ( y ) mV (θ x + y ) − 2θ mVx = − x mV mV 2mVx + mVx(θ x + y )cY′′ ( y ) cY′ ( y ) y cY′ ( y ) cY′ ( y ) mV ( y x − θ ) . = − x mV mV 2mV + mV (θ x + y )cY′′ ( y ) cY′ ( y ). R=. θy. 2. −. Hence, R = A + B , with A = ( y x)[cY′ ( y ) mV ]{1 − [1 2 + (θ x + y )cY′′ ( y ) cY′ ( y )]} and B = [cY′ ( y ) mV ][θ 2 + (θ x + y )cY′′ ( y ) cY′ ( y )]. By Lemma 1, we find that B → θ cY′ (0) 2mV and A → +∞ as x → 0 . Proof of Lemma 3: For x = x det , A = 0 and B = [cY′ (0) mV ] θ 2 + θ x det cY′′ (0) cY′ (0) . For 0 < x < x det , A > 0 . We then need to show that: cY′ ( y ) c′ (0) θ θ . ≥ Y det mV 2 + (θ x + y )cY′′ ( y ) cY′ ( y ) mV 2 + θ x cY′′ (0) cY′ (0). Since cY′ ( y ) ≥ cY′ (0) and cY′′ ( y ) ≤ cY′′ (0) , we need to show that (θ x + y ) ≤ θ x det for every ( x, y ) satisfying (4). But (4) yields θ mVx = (θ x + y ) 2 cY′ ( y ) . Consequently, for every x such that 0 < x < x det we have: (θ x + y ) 2 cY′ ( y ) ≤ θ mVx det = θ 2 ( x det ) 2 cY′ (0) ≤ θ 2 ( x det ) 2 cY′ ( y ) .. References. Cooper, L. G. and M. Nakanishi, (1988), Market-Share Analysis, Boston: Kluwer. Ellison, G. and S. F. Ellison, (2000), “Strategic Entry Deterrence and the Behavior of Pharmaceutical Incumbents Prior to Patent Expiration,” MIT Working Paper. Hellerstein, J., (1998), “The Importance of the Physician in the Generic versus Trade-Name Prescription Decision,” The Rand Journal of Economics, 29, 108136. Hirshleifer, J., (1995), “Anarchy and Its Breakdown,” Journal of Political Economy, 103, 26-52. Nitzan, S., (1994), “Modeling Rent-Seeking Contests,” European Journal of Political Economy, 10, 41-60. Schmalensee, R., (1972), The Economics of Advertising, Amsterdam: North Holland. Schmalensee, R., (1974), “Brand Loyalty and Barriers to Entry,” Southern Economic Journal, 40, 579-588. Scott Morton, F. M., (2000), “Barriers to Entry, Brand Advertising, and Generic Entry in the U. S. Pharmaceutical Industry,” International Journal of Industrial Organization, 18, 1085-1104..

(9)

數據

相關文件

volume suppressed mass: (TeV) 2 /M P ∼ 10 −4 eV → mm range can be experimentally tested for any number of extra dimensions - Light U(1) gauge bosons: no derivative couplings. =>

incapable to extract any quantities from QCD, nor to tackle the most interesting physics, namely, the spontaneously chiral symmetry breaking and the color confinement..

• Formation of massive primordial stars as origin of objects in the early universe. • Supernova explosions might be visible to the most

Monopolies in synchronous distributed systems (Peleg 1998; Peleg

Corollary 13.3. For, if C is simple and lies in D, the function f is analytic at each point interior to and on C; so we apply the Cauchy-Goursat theorem directly. On the other hand,

The difference resulted from the co- existence of two kinds of words in Buddhist scriptures a foreign words in which di- syllabic words are dominant, and most of them are the

• elearning pilot scheme (Four True Light Schools): WIFI construction, iPad procurement, elearning school visit and teacher training, English starts the elearning lesson.. 2012 •

(Another example of close harmony is the four-bar unaccompanied vocal introduction to “Paperback Writer”, a somewhat later Beatles song.) Overall, Lennon’s and McCartney’s