Hitotsubashi University Repository

Title

and Challenges

Author(s)

Tsui, Steve Waicho

Citation

Hitotsubashi Journal of Economics, 43(2): 87-104

Issue Date

2002-12

Type

Departmental Bulletin Paper

Text Version publisher

URL

http://hdl.handle.net/10086/7686

Hitotsubashi Journal of Economics 43 (2002), pp.87- ro4. C Hitotsubashi University

REFORMlNG THE PENSION SYSTEMS IN TAIWAN:

OPTIONS AND CHALLENGES*

STEVE WAICHO TSUI* *

National Chengchi University Taipei, Taiwan steve@nccu.edu.tw

Received July 2002; Accepted October 2002

A bStrac t

Three different schemes on income security for old-aged and retired in Taiwan were

submitted to the government before and after the last presidential election. To provide first

pillar economic protection for the four million persons not covered by any form of social

insurance or social welfare programs, these three proposals vary in their scope of coverage and

their means of finances. The National Pension Plan is a PAYG social security program providing pension benefit amounts to 60 to 30% of the average per capita consumption. The optional National Pension Saving Insurance System combines individual retirement saving

accounts for the insured and a public balancing account. Finally, the last, non-contributory

system is merely a social allowance program for the old-aged funded by the proposed

two-percentage point rate increase in the value-added tax. The final decision on the govern-ment's choice is expected to be made by mid-2003 when the next presidential campaign begins.

I . In trOd uctiOn

Public income security provided for the old-aged and retired in Taiwan takes various forms depending mainly on the occupation of the benefit recipients. Different insurance

systems and retirement schemes are established for government employees, servicemen,

laborers, and farmers. In addition, to veterans and low-income aged persons, special programs are available to provide cash payment or in-kind assistance. As for 1997, out of a total 23 million inhabitants in Taiwan, 12.7 million, slightly higher than half of the population, are covered by one of the various insurance schemes, retirement fund programs, or social relief

* A paper presented in the International Symposium on Pension Reforms in Asian Countries, February l" and 2"d, 2002, organized by the Graduate School of International Corporate Strategy, Hitotsubashi University, Tokyo, Japan.

* * Professor of Economics and Public Finance, Department of Public Finance, Nationa] Chengchi University, and member, Financial Reform Committee, the Executive Yuan. The author wishes to thank Professor LF Chou, Chairman of the Department of Public Finance for the most updated information on the proposed changes in the pension and retirement benefit system in Taiwan's Labor Insurance Scheme. Miss Jean Su's editorial assistance is

plans implemented by the central or local government. Besides public support, economic needs after retirement are also met by personal savings and family support in Taiwan, as in most Asian economies. After the successful implementation of the National Health Insurance (NHI) in March 1995, a general, or alternatively, a supplementary system for those not covered by the existing plans and schemes, on providing economic safety after retirement became the focus of social welfare policy in Taiwan.

A proposal of a universal National Pension Plan (NPP) with the option available to the already protected workers of joining the plan or staying at their original programs was completed by an ad-hoc task force set up by the government in June 1998. The essence of the

plan was to establish a first pillar social security system for all citizens in Taiwan to meet their

basic needs. The main purpose of the NPP was to provide basic economic security after retirement for the remaining three million plus in Taiwan who have not been covered by either one of the three major retirement programs, namely, the GEI, the LI, and the Serviceman Insurance (SI). The structure of the NPP was a gradual fully funded system, Pay-As-You-Go

(PAYG) to begin with.

With the successful implementation and high level of popularity, especially in the part of the general public, of the NHI, a consensus on reforming the existing pension systems, in terms of its coverage and enrollment, was reached by both the private and public sector.' The timing was right in this regard.

On the other hand, in light of existing social insurance programs, the funding arrange-ment of a more comprehensive pension or retirearrange-ment program will certainly add to the already heavily indebted government finance a higher burden.

The NPP was submitted by the Council of Economic Planning and Development

(CEPD) to the Cabinet, even with an uncertain answer on how did the government raise fund to meet its financial responsibility. It was later approved by the government and set to be implemented in 2000. The feasibility and desirability of the proposed NPP was a heated debate topic and seriously attacked by the opposition party during the 1999-2000 presidential election cam paigns.

A new proposal on a more comprehensive pension system in Taiwan was submitted by the new Cabinet inaugurated with the new president in May 20th, 2000. Politics had changed drastically when the opposition DPP's candidate won the presidential election in March 2000 which also signaled the beginning of the end of an era in Taiwan's politics where the Nationalist Party had dominated for over 50 years. Government's attitude toward social policy on labor relation, economic security after retirement, aids to the needed, and social services for women and children became more liberal, and perhaps the idea of building Taiwan a welfare state, to a certain extent, is not as unacceptable by the government as in the old era. The new pension proposal actually consists of two plans: one a contributory scheme such that premium will be collected for the insured; alternatively, the non-contributory scheme put the whole financial cost on general tax collection of the government, basically, the central government, such that a raise in the Business Tax rate to 7 percent, two percentage points increase from the current 5 percent, is needed to finance the program.

' Estabhshment ot economic safety nets tor sickness, arter retirement and unemployed periods was stated as a national policy goal of the government since mid-1970's when Taiwan had recovered from the upset on its rigorous economic growth due to externat shock activated by the first om cnsrs. Since unemployment had had seldom be a topic of major concern, the next step after the NHI was togicany aiming at a national pension plan.

2002] REFORMING THE PENSION SYSTEMS IN TAIWAN: OPTIONS AND CHALLENGES 89

These three schemes of proposed pension reforms in Taiwan vary in their coverage for aged persons, the benefit levels, and other aspects. Even though the original NPP, adopted by the previous government, had received little attention, if not completely abandoned, by the present government, it is more popular among the interest groups. We will discuss and compare the essentials of these three proposed schemes in this paper.

Following this introduction, the rest of the paper is organized as follows: Section 2 will brief on some macroeconomic and social indices which include the projected population dynamics in the future that will provide evidence on how rapidly Taiwan will become an aged society and how urgent old-aged economic security system is in need; Section 3 discusses the current, formal provision for income security for the aged and after retirement in Taiwan. Various forms of retirement benefits in different mandatory insurance programs and generous supplementary arrangement specially provided for those on the government's payrolls will be given in this section. Problems arising from implementation of the current systems will also be depicted. The three reform proposals will be discussed in section 4. The last section will brief on the most recent development of pension reform in Taiwan in May 2002 followed by some concluding remarks on the issue.

II. Some Econormcs about Talwan

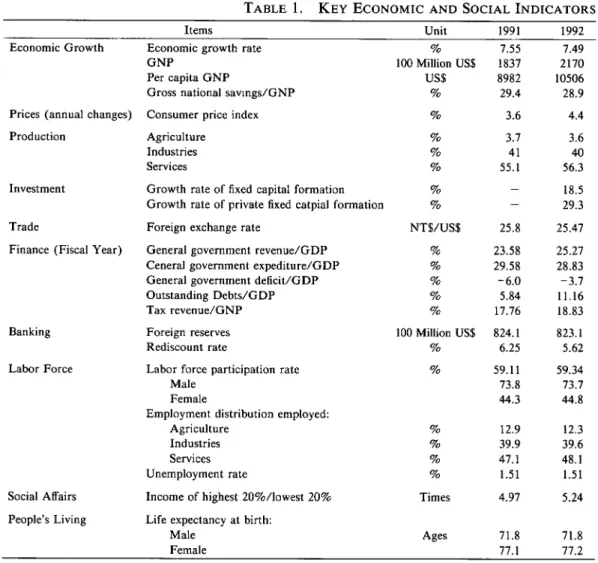

Entering the 1990's, economic growth of Taiwan maintains its momentum yet at a much lower rate. As shown in Table 1, the average annual growth rate of real GNP fell to 6.3%, lower than the 8.1% in the 1980's,2 and significantly lower than the 9.4% in the 1970's. The slowing down of economic growth was more evident if per capita GNP in US$ is used as a measure since the domestic currency, the New Taiwan Dollar (NT), had depreciated against the dollar since 1992. Following the 1997 Asian Financial Crisis, the NT dived heavily along with currencies of other Asian economies.

Aggregate saving ratio as a percentage of GNP in Taiwan has been able to keep at relative high levels in the last decade, but it slid down steadily mainly due to existence of huge amount of government budget deficit since 1992. Excess saving in the private sector was evident if we compared the saving ratio with the investment figure. Growth rates of fixed capital formation as a whole dropped to a recorded low 1.7% before the 1997 Asian Financial Crisis then rebounded in the following two years, again fell to another low of 1.85%. The slowing down of investment in the private sector was less serious than that of the public sector which included investment in infrastructure, as well as expansion in plants and facilities by public enterprises. Slugging public investment activities refiected the shortage of fund available to the heavily indebted government and other hindrance, such as resistance from local residents to major public construction projects, encountered in public investment on transportation systems and environmental conservation and protection facilities.

Summaries on financial statistics in this table clearly showed nothing other than the incapability of the Taiwan government in its fiscal management. Over the years, the tax

2 More detailed data on Taiwan's economic, social and demographic conditions are available in Taiwan Statisti-cal Data Book, an annual publication of compiled data in Taiwan by the Council for Economic Planning and Development, the Executive Yuan, Republic of China. The data book is also available via the website http://www.

TABLE 1.

KEY EcoNoMrc AND SOCIAL INDICATORS

Items Unit 1991 1992

Economic Growth

Prices (annual changes) Production

Investment

Trade

Finance (Fiscal Year)

Banking Labor Force

Social Affairs

People's Living

Economic growth rate

GNP

Per capita GNP

Gross national savmgs/GNP Consumer price index Agriculture

Industries Services

Growth rate of fixed capital formation Growth rate of private fixed catpial formation Foreign exchange rate

General government revenue/GDP

Ceneral government expediture/GDP General government deficit/GDP

Outstanding Debts/GDP Tax revenue/GNP

Foreign reserves Rediscount rate

Labor force participation rate

Male Female

Employment distribution employed: Agriculture

Industries

Services Unemployment rate

Income of highest 20%/lowest 20% Life expectancy at birth:

Male Female

%

ICO Million US$

US$

%

%

%

%

%

%

%

NT$/US$

%

%

%

%

%

100 Million US$%

%

%

%

%

%

Times A ges 7,55 1837 8982 29.4 3,6 3.7 41 55,l 25.8 23.58 29.58 -.0

5.84 17.76 824. l 6.25 59. I l 73.8 44.3 12.9 39.9 47, l 1.51 4.97 71.8 77. 1 7.49 2 1 70 10506 28.9 4.4 3.6 40 56.3 18.5 29.3 25.47 25.27 28.83 -3.7 11.16 18.83 823. 1 5.62 59.34 73.7 44.8 12,3 39.6 48. l 1.51 5.24 71.8 77.2 source: http://www.dgbas.gov.tw/dgbas03/english/key/kesi.xlsburden, measured by total tax revenue collection as a ratio of GNP fell from a peak of 18.83% to a low of 13.79% in the last year,= the lowest among major industrialized and newly developed economies (OECD, 2001). A Iow tax collection ratio, even the government had been working very hard to control and even tried to cap the public spending level, unavoidably resulted in an ever-increasing outstanding debt level for the government. As a percentage to GNP, government unpaid debts in forms of public bonds and borrowings from the commercial banks,+ has inflated by four times, from 5.84% to over 25% at the end of the decade. Current

3 Finance statistics in Table I are data for fiscal year (FY) which, before 2001, began six months ahead of the calendar year and ended at June 30*h. A revision to the Budget Law passed by the Legislative Yuan, the parliament in Taiwan, has harmonized the two years, and to meet the change, we had the last fiscal year before FY 2001 "Second Half of 1999 and Fiscal Year 2000" which covered to a period of 18 months.

2002] REFORMING THE PENSION SYSTEMS IN TAIWAN: OPTIONS

AND

CHALLENGES 91IN TAIWAN:

l 99 1 -2000 1993 l 994 1995 1996 1997 1998 1999 2000 7.01 2286 1 0964 28.8 2,9 3.6 39*4 57.0 l 2 .O 16.7 26.63 24, l 28,3 -4.0 14.2 17.8 835,7 5.50 58.8 72,6 44 , 8 7. 1 1 2483 l 1 806 27.6 4. 1 3.5 37.7 58.8 7.4 l0.3 26.24 23.9 27.6 -3.8 14.8 18.0 924.5 5.50 59.0 72.4 45.4 6,42 2 ,69 l 12,686 27.0 3.7 3.5 36.4 60. 1 7.3 1 1 .4 27,30 22.8 27.3 -4.6 16.5 17.0 903. 1 5.5 58.7 72.0 45.3 6. I O 2,836 13,260 26.7 3.1 3.2 35.7 61.1 l.7 3.4 27.5 2 1 .4 26.5 -5.3 16.81 15.3 880.4 5.0 58.4 71.1 45.7 6.68 2,933 13,592 26.4 0.9 2.6 35.3 62. 1 10.7 18.6 32.6 22. 14 25.98 -4.0 17.5 l 6. 24 835.0 5.3 58.3 71.1 45.6 4.57 2,692 12,361 26,0 1.7 2.5 34.5 63.0 8.0 11.8 32.2 22.73 26. I l -3*4 16.08 l 5 .24 903.4 4. 8 58.0 70,6 45,6 5.42 2,905 12,325 26. 1 0.2 2.6 33.2 64. 2 l.8 -0,7 31.4 20.0 26.02 - . 1 14.8 14.2 1062 4.5 57.9 69.9 46.0 5.86 3,139 14,188 25.4 1.3 2. 1 32.4 65.5 8.6 15.7 3 1 .4 1 9. 1 23.9 -4.7 25.58 13.79 1 ,067 4.6 57.7 69.4 46.0 11.5 39. 1 49.4 l .45 5.42 l0.9 39.2 49 . 9 l . 56 5.38 10.5 38.7 50.8 1 . 79 5.34 1 O. 1 37.5 52.4 2.60 5.38 9.6 38.2 52.2 2.72 5.41 8.9 37.9 53.2 2.69 5.51 8.3 37.2 54.5 2.92 5.50 7.8 37.2 55.0 2.99 5.55 71.6 77.5 71.8 77.8 71.9 77.7 7 1 .9 77.8 7 1 .9 77.8 72.2 78 72.5 78. l 72.7 78.4government deficit amounted to as high as 6.1% of GNP (rv 1999), doubles the 3% Iimit set in the Maastricht Treaty for members of the European Monetary Union.

The fiscal stance of the government after 2000 was actually getting worse. In 2001 , - I .90 rate of economic growth is recorded; both domestic investment and value of international trade dropped by more than 10%; actual tax collection fell short of the estimated figure by NT 70 billion, or by more than 7%. These negative economic signals dropped the government into a paradox in decision-making. On the one hand, expansionary fiscal policy may be needed to help simulate the sluggish economy, yet, it will further increase the level of public debts, and even if the government decides to take the risk on trading-oif of economic growth with expanding deficit, the ceiling on the level of borrowing in the Public Debt Law - 15% Iimit of annual borrowing to the level of spending for all levels of government - actually left very small space for further deficit financing. On the other hand, if slowing down of the economy

is mainly induced by external factors, such as the soft landing of the US economy which happened to be the most important exporting partner for Taiwan's computer chips and 3C products, domestic stimulating policy can offer little, if any, help. Additional weakening of the fiscal stance by higher spending and, or, Iower tax collection, might merely result in more serious problems in inter-generational transfer and rigidity in future public spending.

The rest of Table I reports selected social indictors in Taiwan. Labor participation rates for the female increases steadily over the years with an opposite tendency of the men. The total labor participation ratio decreases slightly. As will be discussed in the following sections, the current format of pension and retirement systems in Taiwan are mainly schemes provided for the workers. With a decreasing labor participation rate, a higher percentage of the total population will be lacking of any form of public protection in their old ages.5 Furthermore, life expectancy for the female is always five and a half to six years higher than the male, given a lower labor participation rate, the current occupational retirement programs no only leave a higher percentage of female uncovered by any form of pension or retirement plan, but also has them to suffer longer. The unemployment rate, as the economy grows and higher ratio of the work forces is engaged in the non-agricultural sector, steadily increases.

Population projections for Taiwan6 reveal that in about 35 years, total population will stop growing. The proportion of population over 65 will exceed lO% in year 2012, 15% in

2022, and when the population ceases to increase, it will have already exceeded 20%.

According to the CEPD projection, at the end of 2050, the old-aged ratio in Taiwan will be 24%, with the total dependence ratio, including both ends of the age distribution of the population, will be as high as 71.2%. Financial burden on provision of retirement living will certainly be one of the major problems facing the society.

III. A Review ofthe Current Retirement Plans

In Taiwan, various government-administered or publicly implemented programs provide cash or in-kind transfers to old-aged or the retired. They may be in the forms of a compulsory social insurance scheme, social relief or social assistance, and special caring arrangement for veterans. Table 2 gives a very brief picture of these various types of benefits available to the aged and retired workers and estimates of numbers of persons covered in these programs in the end of 2001. Three separate insurance schemes set for different occupations, the Government Employee's Insurance (GEI), the Labor Insurance (LI), and the Servicemen Insurance (SI), provide retirement benefits to the insured. As in their current format, the GEI and the SI allow its beneficiaries to choose between a lump-sum retirement benefit and a monthly retirement payment, similar to that of a pension, subject to eligibility conditions. Only lump-sum retirement benefit is provided in the LI.

Table 2 also indicates that out of a total of 12 million persons between 25 and 64, approximately 3.84 million, or 32% are not enrolled in any public retirement programs. Adding the additional 450,000 persons over the aged of 65 not receiving public retirement

s Except for an aged person who passes the low and medium income threshold, such that low-income aged allowance will be given.

2002] REFORMING THE PENS【ON SYSTEMS IN TAIWAN:OPTIONS AND CHALLENGES 93

TABLE2. PoPuLATloN SHAR.Es IN OLD−AGED INcoME SEcuRITY

PRoGR・AMs IN TAIwAN:2000

PoPulation over25 Number of Persons (1,000) Shares Percentage as Population over25 Total Between25to64 L Not−enrolled in GEl,LI少nor SI 2.Recipients of Old−aged Bene行ts from GEI, LI,or SI 3.Insured of GEl,Ll,or SI Over65

1

2

3

4

Uncovered by any Insurance or Allowance Programs Reclpients of Oid−aged Benents from GEI, LI,or Sl Recipients of Both Retirement Benentξmd Welfare Allowance Recipients of Various Old−aged Welfare Allowance 13,980 12,010 3,840 600 7,570 1,970 450 710 150 950 100% 32% 5% 63% 100% 23% 36% 8% 48% 100% 86% 27% 4% 54% %% 14 5% 1% 7% So曜αBrie6ng Notes on Plaming of the National Pension System in Taiwan,CEPD,May2002,Taipei. benents of any kin(1,a total of4.3million persons will be the primary target group ofTaiwan}scurrentpensionrefom,

In l997,within the age of25to64,total enrollment in the LI was6。2million,620,000in the GEl,and the exact number of enrollment in SI was not release(1,but was estimated at about250,000to260ラ000persons.The latest statistics on the LI enrollment is7,92million,and a small increase to630,000persons in the GEI. Not included in the social insurance schemes,a mean−tested old−aged allowance,Aged Low−lncome Family Subsidy,will be available to persons over65classi丘ed as low and mediumincomelevel,andforfamersabovetheageof65,01d−agedlivingallowanceisgivenwithout

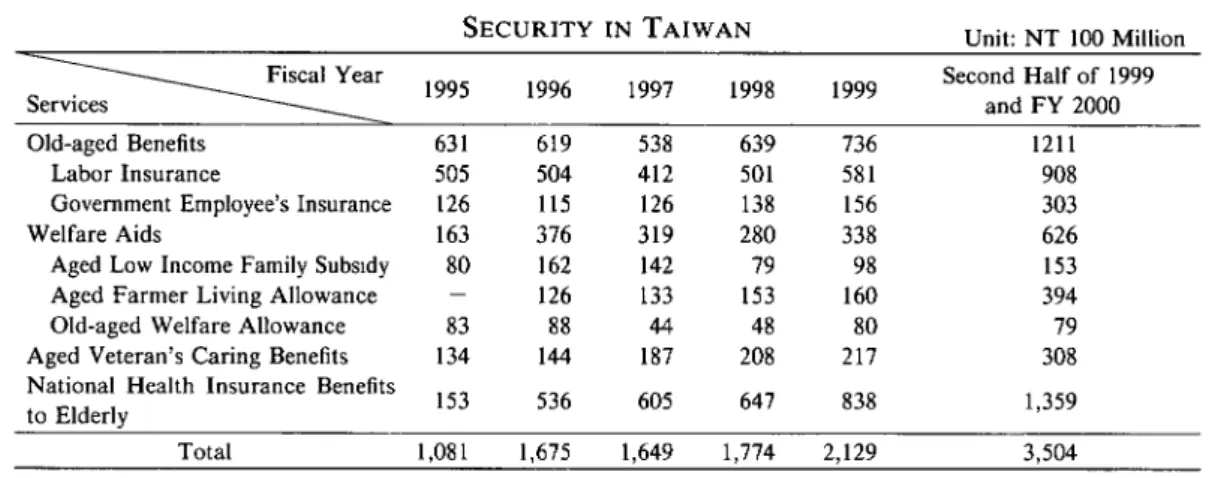

any hmitation.Finally,in−kind transfers including housing,food and(1aily caring are provided by the Veteran Agency to veterans in nee(1。The last three items of ol(1−aged services cover another770,000persons above65。 Old aged,retirement an(l other forms of allowance to the aged are part of the overall social security and social welfare service in Taiwan。Total spend量ng in social welfare services from all sources in Taiwan in the past six and a half years increased more than70%,while social insurance had taken a larger share ofthe total sum。Social assistance or social relief,an(l social services shared as low as l6%(FY1999)to a high of about25%(FY l995)。Spendlng on public health dropped continuously since1996,mainly renecting the implementation of theNHI.

In the18months period begiming July l999,the elderly received a total of NT350.4 billion,more than ll%ofthe total govemment spending,cash and in−kind benents.Over NT 120billion was disbursed in the form ofold−aged bene五ts and NT135.9billion,about one third of the overall medical benefit in the NHIシwas utilized in health caring for the elderly,Table 3briefs on the level and structure ofgovemment spending on the provision ofold−aged incomeTABLE 3. GOVERNMENT SOCIAL WELFARE OUTLAYS ON OLD-AGED INCOME

SECURITY IN TAIWAN Unit: NT 100 Million

Services

Hscal Year 1995 Second Half of 1999

1996 l 9971998 1999

and FY 2000O]d-aged Benefits Labor Insurance

Government Employee's Insurance Welfare Aids

Aged Low Income Fami]y Subsrdy Aged Farmer Living Allowance Old-aged Welfare Allowance Aged Veteran's Caring Benefits National Health Insurance Benefits to Elder]y 63 1 505 1 26 1 63 80 83 1 34 153 619 5 04 115 376 1 62 1 26 88 144 536 538 412 126 319 142 133 44 187 60 5 639 501 138 280 79 153 48 208 647 736 581 156 338 98 1 60 80 217 838 1211 908 303 626 153 394 79 308 1,359 Total

1,08 1 1 774 2, 129

l,675 1,649 3,504Source.' Budgets and final budgets in Talwan, central and local government, various years.

supporting service in Taiwan for the last six plus years.

Major social insurance schemes providing retirement benefits will be introduced briefly as

follows.

The Government Emp]oyee's Insurance

The mandatory GEI in Taiwan began as early as 1958. The original insurance was

basically a PAYG mixed system providing old-aged, survivor, and medical benefits. Since 1995, the medical insurance part was integrated into the NHI. The current format has all government employees, not including those in military service, in government agencies, teachers, faculties and staffs in public schools, and private schools, which has fulfilled the requirement set by the educational authorities. The current premium rate is set at 7.15%. Premium is calculated based on the insured income, which is about 40 to 50% of average total pay to the employees. Premium is collected from both the employers and the employees, by 65% and 35%, respectively. For teachers and staffs in private schools, the 65% will be paid equally by the government and the employers.

Cash benefits are available to the insured in the following three forms: 1. Disability Payment:

A minimum of 6 times of the insured income (premium base) to a maximum of 36 times will be given to the insured in case of disability from sickness or casualties depending on the degree

of disability.

2. Survivo]' Benefit and Dependent's Funeral Subsidy:

Survivor benefit ranges from 30 times to 36 times the insured income in case of death of the insured and 100 to 300% of the insured premium base in case of the death of the parents, spouse and dependent children of the insured.

3. Old-aged Benefits:

Retirement benefits for the insured are computed according to both the insured income and the duration of enrollment. The mandatory retirement age is 65, which may be extended to 70 for certain cases. Early retirements are encouraged for those over 55 and have been insured for

2002] REFORMING THE PENSION SYSTEMS IN TAIWAN: OPTIONS AND CHALLENGES 95

over 15 years. For each year of enrollment, 1.2 points (base units) is given, and a maximum of 36 points is allowed. For each point, one month of insured income will be paid as the retirement benefit. The original format of retirement benefits is a lump-sum payment with a preferential 18% interest rate on the amount of total retirement benefit if put on a special saving account. In the 1970's, the government decided to be more flexible, basically due to financial consideration that time, to let the retired have the option of taking a monthly retirement benefits, or a lump-sum amount, or a mix of both. As increasing number of GEI retirement choosing the pension form and life after retirement become longer as time passes by, the financial security of the GEI has been in danger for some time.

As explained above, the GEI is a PAYG and defined benefit system with an adjustable

premium rate. Surplus or deficit in running the insurance are combined with the general government budget. Recently, it had been operated with annual deficits which were supple-mented by general government revenue.

A new type of retirement benefit, mainly in the form of a pension was established from 1995, that is, the Government Employee's Retirement Fund (GERF) which covers all employees in the government's payroll, including military personnel. The fund is functioned independently of the GEI old-aged benefit and can be considered as the second pillar for government employee's income security after retirement. 8 to 12% contribution rate on monthly income (more exactly, 200% of the base salary which amounts to about 85 to 95% of the total pay), but the actual burden on the insured is only 35% while the rest will be paid by the employers. The most recent amendment to the contribution rates of the GERF treats differentially general government employees against school teachers, staffs, and service personnel. For the first category, the withholding rate is 8.8%, while it is now 10.8% for school employees and 12% for servicemen. With the combined benefits provided in the GEI and GERF, the replacement ratio of a beneficiary having tenure in the government sector for 30 years or longer easily exceeds 85%. What is more pleasurable, at least to the retired, is that the retirement benefit is not related to income earned after retirement. For those who are able to find another job, counting the retirement income and income from the after-retirement-job, the replacement ratio easily exceeds 100%.

The Labor Insurance

The Labor Insurance in Taiwan was established since 1950. It is a mandatory insurance for all employees not in the government sector, except for workers who only take temporary or part-time jobs and are not members of labor unions of any forms. The LI is the largest occupation-related social insurance in Taiwan in terms of its enrollment. Cash benefits provided in the LI include maternity, sickness and injury, disability, old-aged, survivor and unemployment, where the last item was added in 1999. Two types of insurances are combined in the LI: the regular insurance and occupation casualty insurance. For the former, a fiexible premium rate on monthly income received from the insured job from 6.5 to I I % is applied for all insured, with the current rate set at 6.5% for those covered by unemployment benefits, and a one percentage point discount is yielded to those not covered. As for occupational casualty, risk factors are applied to determine the premium rates, ranging from 0.29 to 3%.

Premium is collected according to the insured monthly income of the insured, with a minimum level equal to the minimum wage set in the Labor Standard Law and also a ceiling.

On average, the insured monthly income is about 80% of the average monthly pay counting all cash income and fringe benefits. In most of the cases, namely, the insured working for definite employer, the employers, the employees, and the government share the financial burden by a distribution ratio of 70%, 20% and lO% in the regular insurance component; for the occupation casualty component, the employers solely bear the cost. Distribution ratios are

different in other cases.

Old-aged and retirement benefits in the LI can be claimed by:

(1) male workers over 60 and female workers over 55 with at least 12 months of enrollment; (2) the insured over 55 with a length of enrollment for at least 15 years;

(3) the insured with the same employers covered by the LI for over 25 years.

Retirement benefit in the LI is given as a lump-sum payment only. For the first 15 years of enrollment, one month of the insured income will be paid by the system, and for enrollment over 15 years, two months of the insured income will be paid with a maximum of 45 months.

For insured workers over 60, a maximum of 50 months is allowed. Given the present NT

60,000 plus ceiling on insured income, theoretically, the highest retirement benefit available is about NT 3 million, while in actual cases, on average, claimed retirement benefits are below NT I million which represents a replacement ratio of less than 20% for most of the retired.

Survivor benefits range from 15 months to at most 45 months of the insured income, and in case of the death of the parents and dependents, 1.5 to 3 months will be disbursed.

A second pillar retirement benefit for those covered by the LI is provided via the Labor Retirement Fund as stipulated in the Labor Standard Law enacted since 1984. Under this Law, employers are required to set up and contribute solely to an employee retirement fund reserve account. Employees working with the same employers may claim voluntary retirement when one of the following conditions is met: (1) Over 15 years of tenure and over 55; or (2) over 28 years of tenure. The labor retirement benefit will also be paid on a lump sum format, such that for the first 15 years, two months of the average monthly salary will be disbursed for each year of employment. Beginning from the 16 year, one month of average monthly salary will be added. The maximum of the retirement benefit is 45 months. This retirement benefit is not portable such that workers changing their jobs, voluntarily or involuntarily, will bear the risk

of losing the benefit.

Earlier this year, a draft of the Labor Retirement Fund Law has been completed by the

Labor Commission and passed by the Legislative Yuan. In this Law, a more flexible

arrangement of retirement benefits for workers insured in the LI is provided. One of the following three types of labor retirement systems can be chosen by the worker: Individual

Retirement Account (IRA), Supplementary Pension Scheme, and Alternative Pension

Scheme. Once implemented options on staying in the original LI retirement scheme, or shift to the new system are open to the LI insured workers if they work with the same employor. All new workers or workers changed their job are required to join the new system.

The IRA is a forced saving account for each qualified workers where contribution from

the employers at a rate of not less than 6% of the individual's monthly salary,7 and

contribution from the employees is voluntary at a rate not higher than 6%. A Iump-sum retirement benefit equal to total accumulated contribution plus earnings of the account, can be

7 In the firs.t year of the new system, contribution rate for the employers is not less than 2%, 4% for the second year, and 6% hereafter.

2002] REFORMING THE PENSION SYSTEMS IN TAIWAN: OPTIONS AND CHALLENGES 97

claimed at the age of 60, or in case that the insured is unable to work. In addition, survivor benefits will be paid in case of death before the retirement.

The Supplementary Pension Scheme is a defined benefit pension system such that the maximum contribution rate for the employers is set at 69; o, and the actual collection rate is actuarially calculated. If the later exceeds 6%, the excess contribution is chargeable on the insured. Laborers aged over 60 with enrollment in this system longer than 15 years are eligible for pension benefits. Lump-sum benefit will be paid if these two conditions are not fulfilled. Pension benefit is calculated according to the length of enrollment and also average wages of the previous 36 months of all labor workers when the claim is made. Survivor benefits are also provided in this program.

The Alternative Pension Scheme provides the opportunity for large enterprises to pur-chase commercial pension insurances for their employees, with the agreement of the workers or unions. The premium of the insurance should be paid by the employers and the employees. But the employers have to pay for the premium not less than 6 : o of the total wage bill. Servicemen Insurance

Taiwan established its Servicemen Insurance scheme in June 1950 for all military

personnel. Insurance benefits include survivor, disability and retirement payments. Premium is collected according to the base of insurance (base unit) of the insured with an 8% contribution rate. For officers, 65% and 35% of the premium payable are charged to the government and the insured. The government will pay for other insured of lower rankings all premiums. Retirement benefits, as in the GEI, can be applied as a lump-sum payment, or as a pension type, monthly payment for those applicants insured over 15 years. The pension form usually has the replacement ratio about 50 to 80%. Survivor benefits range from 36 to 42 months of the base unit, and disability benefits range from 6 to 40 base units dependent on the cause of disability. It has to be noted that retirement benefit in SI applies to professional servicemen only and the total number of this group is, according to some estimates, about 120,000.

Finally, the Farmer Insurance (FI) provides survivor benefit, maternity benefit and funeral subsidy to the insured, but not retirement benefit. Instead, a special type of living allowance is given to aged farmers.

Major Problems in Taiwan's Income Security Systems for the Aged In brief, the following are the most urgent issues to be addressed.

( 1) Over 4 million of the total population is still left uncovered by social insurance retirement schemes. The majority of these unprotected are housewives and farmers.

(2) Even for those covered in the LI net, the lump-sum retirement benefit is hardly adequate for economic needs after retirement. In addition, higher risk in management of the retirement payment is associated with the lump-sum transfer, and a fixed amount of fund is certainly more venerable to price inflation during old-aged. An estimate reported by the Ministry of Interior has pointed out that as an individual getting older, the ratio of

retirement benefit received to total financial sources for living decreases, a clear signal on

the inadequacy of the current retirement arrangement in the LI.

(3) The occupation-related characteristics of the three major insurance systems introduced above have failed to become a coordinated one. Therefore, years of enrollment in the GEI and SI can not be transferred to the LI such that changes of employment in the public

sector to one in the private sector usually imply a reduction of retirement benefits. lronically, years of enrollment in the LI can be added to the GEI if one decides to join the government service. Furthermore, there are huge discrepancies in retirement benefits from diiferent schemes also.

(4) To supplement the social insurances, two major social allowance programs are provided for the aged, namely, the Aged Low-Income Family Subsidy and the Aged Farmer Living Allowance. Both measures are meant to be a social relief program such that aids will be provided to the needed aged. However, political reality turned the later service into a non-contributory pension system which pays, without means-tested, to aged farmers and fishermen monthly allowance. It will be difficult to argue that this is an equitable or fair means for income redistribution goals.

IV . Reform Proposals on the Pension Systems

The National Pension PlanA comprehensive study on the establishment of a National Pension Plan which would provide the first pillar public pension benefit for the whole population in Taiwan was

completed in 1998 and the new, additional to the existing GEI, SI and LI, system was

originally scheduled to begin from the year 2000. The scheduled time was first delayed due to the devastative "921" earthquake, and later, after the handover of the executive power by the ex-government, the plan became only one of the options available to the new government.

The proposed NNP combined basic pension benefits with other welfare measures to the elderly. For those over 65, persons eligible for Low-Income Aged Subsidy, Aged Farmer's

Living Allowance, and veterans in caring institutes will not be affected in terms of their benefit.

For senior lacks of any types of public assistance, under a rather generous means-tested procedure, a monthly welfare allowance of NT 3,000 (adjusted for the average of infiation rate and growth rate of real wage in subsequent years) will be disbursed, yet for those who had already received retirement benefits from various social insurances, the actual amount paid will be deducted according to the benefit received in these entitlement programs.

Persons between the age of 25 to 64, including social insurance retirement benefits recipients, not in the labor force, or not enrolled in any one of the four social insurance

schemes, are required to join the NPP. They will have the option to join the program

voluntarily in the first year of the plan, and after the third year, all are required to enroll.

As fo]' employees between the age of 25 and 64, the situation is a little bit complicated. All

four major social insurances related to retirement and old-aged benefits will be adjusted accordingly to integrate the old system with the NPP. For farmers under 54, they are required to join the new FI and NPP immediately. Farmers above the age of 55 have an option to choose the most advantageous scheme: the old FI and the new, revised FI with the NPP. All government employees, Iabor workers, and servicemen under the age of 64 originally covered by their respective systems will also have the option to join the NNP and also the new GEI, LI and SI, revised in order to be compatible with the NPP.

Finally, for persons under 25 who are not in the labor market, they will have to join the NPP and also, if applicable, the new social insurance schemes for different occupations when

2002] REFORMING THE PENSION SYSTEMS IN TAIWAN: OPTIONS

AND

CHALLENGES 99they are 25.

The full monthly payment of pension in the NPP was NT 8,700, an amount equivalent to 55 to 60% of the average per capita consumption spending in the previous two years and gradually decrease to about 30% in 2031 since the annual adjustment of the benefit will fall short of projected increases in consumption spending.

Benefits of the NPP include: l. Retirement Pension

Depending on the age when enrollment begins, the full amount or a portion of NT 8,700 will be paid to the insured in times of retirement. For example, for workers at the age of 40 or above when the NPP is implemented, they will be paid the full amount after 25 years of enrollment. Yet for workers at the age of 25 to 39, the eligibility condition on receiving full amount extends from 40 years to 26 years, that is, enrollment periods will be one year shorter for one year older.

A minimum enrollment period of 10 years is required for the insured under the age of 55 when the NPP is implemented. For those over 55, no minimum duration is set.

During the transition period, pensioners receiving payments less than NT 3,000 will also receive a supplementary grant to fill in the gap.

2. Disability Benefit

In case of serious disability occurred within the period of enrollment, and the length of actual enrollment exceeds two thirds of the period that is required to enroll, a disability benefit equal to the entitled pension will be paid.

3. Survivor Benefit

In case of death of the insured during enrollment, if the length of actual enrollment exceeds two thirds of the period that is required to enroll, survivor benefit equal to the entitled pension will be paid. In addition, the difference between total contributions collected, plus imputed interest, by the NPP and aggregate benefits received will be reimbursed to the survivors.

4. Funeral Subsidy

In case of death of the insured, an amount equal to ten payments of the full monthly pension benefit will be paid.

Financial costs of the NPP are designed to be shared by the insured, the government, and the employers. The estimated monthly premium is at about 10% of the full pension benefit, that is, NT 870 in 2000, and will be adjusted in line with benefit increment as time goes on. Government subsidies to insurance premium chargeable on the insured vary from the normal

20% to 40 - 100% for the low-income and serious disabled. In case of emergency or

unemployment, other welfare measures will be taken to help. The distribution ratio between employees and employers has not been definitely determined yet.

The proposed NPP provides income sufficient for a subsistence consumption level for

individuals after retirement, the first pillar in the World Bank's scenario. In fact, second pillar

occupation pension is available to workers on the government's payroll. To be insured and protected in the GEI and SI, the NPP is unattractive at all as a substitute of the existing insurance schemes. To safeguard the benefit of those already insured, the NPP Ieaves an option for them to join the accordingly revised GEI or SI, and the NPP, or to stay in the old systems. However, for all new government employees, they are required to play the new game.

TABLE 4. FINANCIAL BURDEN ON GOVERNMENT: THE THREE OpTIONS

Unit: NT Billion

Scheme

NPP

Contributory System Non-contributory CurrentSystem System

Projected Infiation Rate

Year 2002 20 1 6 203 1 19 (; 77.5( 24.0) 77.9( 3.4) 60.6(-61.7)

3%

77.5( 24.0) 72.7( -1.8) 74.6(-47.7) 19 o 77 ( 23.5) 87.2( 12.7) 67.4(-54.9)3%

77 ( 23.5) 90.2( 15.7) 75.4(-46,9)1%

63 ( 9.5) 90 (15.5) 146,3(24.0)3%

63 ( 9.5) 53.5 96.5(22.0) 74.5 168.7(46.4) 122.3 Source: Briefing Notes on Planning of the National Pension System in Taiwan, CEPD, May 2002, Taipei, Remark: Figures in brackets are additional spending or saving in government expenditure as compared to thecurrent system on providing old-aged economic welfare allowance for those uninsured.

aged 25 or older. These three million beneficiaries consist mainly of small business owners, farmers, the unemployed, housewives. If public pension will crowd out personal savings for retirement living, the impact of the NPP on aggregate savings will certainly be a popular research topic. Hu ( 1998)8 reports in his study that discouraging effect on aggregate savings is found under all assumptions on the ratio of perfectly foresighted households among the total population, the rate of interest prevailing in the credit market, and whether income taxes or business tax is used as a means to raise additional revenue. However, in the short run, since myopic households may actually save more, counting forced saving in the NPP together, Taiwan's aggregate saving rate may increase, while, when the system gets mature, the higher consumption ability to the myopic proportion of the population will reduce the size of total national savings. Hu concluded that, based on the evidence from simulations, the NPP will have no significant effect on Taiwan's overall saving rate.

The latest development of the NNP narrows the coverage of the system to persons not

already enrolled in GEI, LI and SI. The planned integration of the NNP and the three

retirement programs is temporarily put aside. The monthly premium is adjusted downward to

NT 783 of which at least 20%, NT 157, will be paid by the government. The burden on

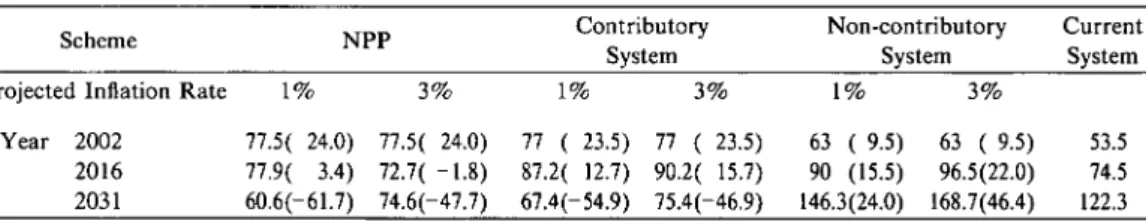

government finance of the NPP is estimated to be NT 77.5 billion in 2002 and NT 74.6 billion in 203 1 which will be, respectively, NT 24 billion higher and NT 41.7 to 61.7 billion lower than the financial needs for the various allowance programs provided for the target groups,' as shown in Table 4. The major risk of the NPP in its current format is a high and increasing level of contingent debt on the program is expected.

The Proposed Contributory System

Four months after the inauguration of the new government, another two versions on planning a more comprehensive social security system were proposed. The first one is a contributory system incorporated with an element of individual retirement account (IRA),

8 Hu, Sheng-cheng, The Eifect of the National Pension Plan on National Savings, The Compi]ed Volume of Commissioned Research Projects on The National Pension Plan, Council of Economic Planning and Development, pp.6-1 -6-37 (in Chinese).

9 Since the NPP benefit will be linked with the rate of inflation, and the old-aged welfare allowance is assumed to be fixed at NT 3,000 per month, a higher inflation rate (3% as compared to 1%) will reduce the amount of savings in government spending.

2002] REFORMING THE PENSION SYSTEMS IN TAIWAN: OPTIONS AND CHALLENGES 101

and the second program calls for an increase in business tax such that no contribution or premium will be collected directly from the insured.

The contributory system is called the National Pension Saving Insurance System. It

combines forced savings in IRA and a public supplemental Balancing Fund. Again, this

program is designed as supplementary to the existing GEI, LI, and SI, not as a substitute. As in the NPP, this contributory system combines basic pension benefit to the retired with other welfare measures to the elderly. The insurance requires every individual insured has his or her own IRA, and a pooled fund, called Balancing Fund, is set up to finance the spending needs for allowance paid to the qualified recipients when the new system is launched. The two components of the system are "Saving Insurance" and "Welfare Subsidy". Benefits of the Saving-Insurance part consist of:

1 . Old-aged Benefit

At the age of 65, an individual insured is allowed to withdraw from his or her IRA retirement benefit in a pension form. The maximum amount of withdrawal, the so-called full pension benefit, is set according to 50% of the average monthly consumption spending in the previous two years when the program is implemented.10 If the pension benefit is lower than the welfare subsidy level, funds from the Balancing Fund will fill up the gap. Furthermore, the Balancing Fund will also pay for the pension benefit when the beneficiary has exhausted his or her IRA, and in cases where the aged receives a pension benefit lower than the welfare subsidy payment, because of short enrollment period, provided a means

test is passed.

2. Severe Disability Benefit

In case of severe disability occurred within the period of enrollment, and the length of enrollment exceeds two third of the period that is required to enroll, a disability benefit equal to the full pension benefit, or 80% of it, will be paid.

3. Survivors Benefit

In case of death of the insured occurred within the period of enrollment, and the length of enrollment exceeds two thirds of the period that is required to enroll, survivor benefits will be available to the spouse at a rate of 40% of the full pension benefit, provided the surviving spouse is over 55 and the marriage has lasted longer than 5 years; survivor benefit will also be paid to dependent child or children under the age of 18, or in case of severely disabled child (children) under the age of 20. A maximum of a full pension benefit will be paid. Survivor benefit will also be available to the insured's parents over the age of 55. The survivor benefit in this form amounts to 40% to 100% of the full pension. Finally, a funeral subsidy of ten months of the full pension will be paid.

4. Welfare Subsidy

The following welfare subsidy items are all supported by the Balancing Fund. First, an old-aged subsidy of NT 3,000 per month will be given to citizens over 65 when the program begins. Yet for those who have previously received public retirement benefits of any kind, a waiting period for these benefits will be computed. Secondly, a severe disability subsidy of NT 3,000 per month will be available for the qualified. Again, if any form of disability benefit is received, there will be a waiting period for this benefit payment. Finally, for

lo In 2000 when this proposed system is revealed, the amount of full pension is estimated to be NT 7,500 per month and the welfare subsidy payment, to be discussed later, is NT 3,000.

orphans under the age of 18, a NT 2,000 orphanage subsidy is provided.

The premium, or contribution, collected in this program is set at 10( o of the full pension benefit, which will be adjusted according to the average of the rate of price changes and growth rate of real wage in subsequent years. 80% of the premium paid will be put on the IRA and 20% of it will be put on the pooled Balancing Fund account. The government normally will share 20% of the total contribution; therefore, premiums pooled in the Balancing Fund are in

fact appropriated by the government. For low-income households, the government will

contribute a higher share, 40%, of the financial cost of the insurance. Other sources for the Balancing Fund include appropriation for various types of old-aged subsidies in the budget,

revenue from the sales of lotteries, and earmarked revenue from sale of public-owned

properties or enterprises.

The main beneficiaries of this contributory social insurance system are the insured in the FI, which runs at an accumulated deficit over NT 80 billion currently, and those not insured for retirement and old-aged at all. The new insurance program calls for adjustments in the FI, but leaving the other three major special insurances intact. The estimated cost of the new program to the government as compared to those of the current systems of social insurances and old-aged assistances, only counting the provision of the newly insured and the insured in the FI, also shown in Table 4, will be NT 23.5 billion more than the current format in 2002, the hypothetical first year of the new program, yet, in 2031, the new program actually save more than NT 54.9 to 46.9 billion, depending on the assumption on the rate of inflation.

No detailed analysis on the possible impact of this proposed program on, for example the aggregate saving ratio, is available yet.

The Non-contributory System

Another reform possibility for the pension systems in Taiwan proposed by the govern-ment is basically a direct transfer program to persons over 65. The monthly transfer is estimated to about 25% of the average per capita consumption spending recorded in the previous twenty-four months when the program begins, and the amount should not be lower than NT 3,000. Benefits are old-aged benefit, severe disability benefit, both at NT 3,000 per month, and orphanage benefit at NT 2,000 per month. Waiting periods for old-aged and severe disability benefit recipients who have been paid the same type of benefits before, as in the contributory system, also apply.

Since no contribution or premium are collected from the potential beneficiaries, a two-percentage point increase in the Business Tax rate is proposed to raise the needed revenue, as well as projected revenue from the sales of lotteries, proceeds from sales of public property and shares, and also the appropriated revenue for social welfare programs for the aged.

This non-contributory program requires the insured of FI over 65 to terminate their coverage in the FI once they receive the old-age benefit provided in the new system, thus reduce the financial loss of the FI. Estimated additional burden to the government is NT 9.5 billion in 2002, and will increase to NT 24 to 46,4 billion in year 2031, dependent on the assumption on the rate of inflation.

It is obvious that the contributory system has some elements of a social insurance program, and the non-contributory program is nothing but a social welfare policy financed by general fund.

2002] REFORMING THE PENSION SYSTEMS IN TAIWAN: OPTIONS AND CHALLENGES 1 03

V . Concluding Remarks

Rather strong public support for retirement and old-aged benefits is available for government employees and military personnel, but these two well-treated groups only consist of less than 10% of the total population. For labor workers covered in the LI, even retirement benefit in a lump-sum form is available, it is hardly sufficient for economic needs in the old-aged. Personal savings and, or family support are indispensable for the majority of the aged to safeguard their income security.

The proposed NPP intends to open a wider net to house the unprotected and the

under-protected with the establishment of a PAYG basic pension scheme, the first pillar as it is advocated in the World Bank's model. The basic protection, that is, the benefit level is calculated to 55 to 60% of the per capita consumption spending which is about the subsistence level of consumption in Taiwan. With this benefit, along with the preferential treatment on health insurance, plus the availability of the special allowance for the aged passed the low-income threshold, income security for old-aged will be satisfactorily provided. Financial burden on the government, if the NPP is implemented, will actually decline as compared to the current format as the system goes mature. Among the three proposed system, the NPP is the most desirable.

As for the contributory National Insurance-Saving Scheme, the basic structure of

contribution and benefit does not diifer from the NPP significantly, at a lower level. However, the requirement of setting up IRA for every one insured will cause the administration cost of the program be significantly higher than those of alternatives. In addition, the operation of an IRA or any individual saving account within a social insurance system is a brand new business

in this country. It is doubtful that it will be operated effectively and efficiently. It is also not

indefensible to require the target insured to set up their own IRA's even a significant proportion of them are actually unemployed and even not in the labor force. Finally, the non-contributory system is merely an extension of the existing welfare programs available to aged, to low-income aged family, and to aged farmers, while ironically, it will actually pay welfare subsidy to the rich aged. It is not a pension system of any sense. More important, the NT 3,000 maximum monthly benefit at most amounts to half of subsistence level of living. The

protection shield will be too thin, if it exists at all.

The NPP has the most possibility of becoming a successful pension system to supplement the current ones if the government is going to choose among the three. Yet, the potential risk of bankruptcy due to rapidly accumulated debt in the system is a hurdle that must be treated seriously. The most recent development on the choice of the pension reform is that under the pressure of the interest groups, the President had promised to select the NPP over the contributory system which would actually reduce the financial on the government as the system matures. The final decision is still to be announced. Given the fact that next president election campaign will begin June 2003, the decision should be known within this twelve month period.