This article was downloaded by: [National Chiao Tung University 國立交 通大學]

On: 27 April 2014, At: 22:45 Publisher: Routledge

Informa Ltd Registered in England and Wales Registered Number: 1072954 Registered office: Mortimer House, 37-41 Mortimer Street, London W1T 3JH, UK

Transport Reviews:

A Transnational

Transdisciplinary Journal

Publication details, including instructions for authors and subscription information: http://www.tandfonline.com/loi/ttrv20Considering the financial

ratios on the performance

evaluation of highway bus

industry

Cheng-Min Feng & Rong-Tsu Wang Published online: 26 Nov 2010.

To cite this article: Cheng-Min Feng & Rong-Tsu Wang (2001) Considering the financial ratios on the performance evaluation of highway bus industry, Transport Reviews: A Transnational Transdisciplinary Journal, 21:4, 449-467, DOI: 10.1080/01441640010020304

To link to this article: http://dx.doi.org/10.1080/01441640010020304

PLEASE SCROLL DOWN FOR ARTICLE

Taylor & Francis makes every effort to ensure the accuracy of all the information (the “Content”) contained in the publications on our platform. However, Taylor & Francis, our agents, and our licensors make no representations or warranties whatsoever as to the accuracy, completeness, or suitability for any purpose of the Content. Any opinions and views expressed in this publication are the opinions and views of the authors, and are not the views of or endorsed by Taylor & Francis. The accuracy of the Content should not be relied upon and should be independently verified with primary sources of information. Taylor and Francis shall not be liable for any losses, actions, claims, proceedings, demands, costs, expenses, damages, and other liabilities

connection with, in relation to or arising out of the use of the Content. This article may be used for research, teaching, and private study purposes. Any substantial or systematic reproduction, redistribution, reselling, loan, sub-licensing, systematic supply, or distribution in any form to anyone is expressly forbidden. Terms & Conditions of access and use can be found at http://www.tandfonline.com/page/terms-and-conditions

Considering the ® nancial ratios on the performance evaluation

of highway bus industry

CHENG-MINFENGand RONG-TSUWANG

Institute of Tra c and Transportation, National Chiao Tung University, 4F, 114, Sec. 1, Chung Hsiao W. Road, Taipei, Taiwan

(Received 20 December 1999; revised 26 September 2000; accepted 23 October 2000) This paper tries to construct a performance evaluation procedure for highway buses with the ® nancial ratio taken into consideration. First, a conceptual framework is redeveloped, based on the one created by Fielding et al., to help form evaluation items and performance indicators involving both transport and ® nance aspects. Second, the total performance is divided into three major kinds of e ciencyÐ production, marketing, executionÐ according to the cycle of opera-tion activities. Third, to overcome the problems of small sample size and unknown distribution of samples, the grey relation analysis is used to select the representative indicators, and the TOPSIS method is used for the outranking of highway bus. In addition, a case study is conducted using four highway bus companies as example. The empirical result shows that the performance evaluation for highway buses could become more comprehensive if ® nancial ratios are considered.

1. Introduction

In the general aŒairs of business management, ® nancial ratios are one of the tools commonly used to evaluate a company’s performance. Generally speaking, ® nancial information relating to the status of a company’ s business operations will be reported in the yearly ® nancial statements, and it is the ratio of any two accounting items in the ® nancial statement that composes a ® nancial ratio. The observation and analysis of appropriate ® nancial ratios can serve as a preliminary reference for the diagnosis of the results of business operation. However, when looking over related documents, one will discover that most transport researchers in the process of evaluating the results of the transport industry place the focus on the eŒective use of resources between transport input (employees, vehicles, fuel) and transport output (passengers, passenger-km, vehicle-km). The relationship between operative results and a company’s operative performance represented by ® nancial ratios is less discussed in the studies of performance evaluations, especially in academic journals. The operative results of a company can be seen in ® nancial ratios via currency ¯ ow. A portion of the operation performance represented by ® nancial ratios is what the traditional method of using the eŒective use of resources and output between transport input and transport output to evaluate performance cannot measure. For example, short-term liquidity measured by the current ratio, long-term solvency represented by the debt ratio, and company pro® tability shown by the gross pro® t ratio. These ratios directly or indirectly demonstrate certain aspects of a company’s operating situation. For example, are funds being used properly? Is the ® nancial

Transport Reviews ISSN 0144-1647 print/ISSN 1464-5327 onlineÓ 2001 Taylor & Francis Ltd http://www.tandf.co.uk/journals

DOI: 10.1080/01441640010020304

leverage appropriate? And are pro® t earnings at an average level? All in¯ uence the existence and continued development of the company. Therefore, if the only basis for performance evaluation is the ratio between transport input and output, it is probable that the overlooking of certain results re¯ ected by ® nancial ratios will make the evaluation model incomplete. This research is based on the conceptual framework raised by Fielding and Anderson (1984), a set of evaluation models for operation performance that take ® nancial ratios in to consideration. This set makes the evaluation process of highway bus eŒectiveness much more comprehensive and thorough.

This research is composed of ® ve parts. Section 2 discusses the development of the conceptual framework. Section 3 focuses on the production of a set of performance evaluation indicators. Section 4 uses information from 1997 of four highway bus companies operating in the Taipei region as a practical object of research. Section 5 discusses the relationship between transport indicators and ® nancial ratios. Section 6 concludes the study.

2. Conceptual framework 2.1. Literature review

There is an abundance of studies of highway bus performance evaluations and they can be roughly divided in to two main types. One constructs a hierarchy programme of related factors that in¯ uence performance from diŒerent perspectives (consumer, operator, supervisor), thus forming a basis of selection indicators. Alter (1976) used the perspective of the consumer to select six items for evaluation of mass transport service quality. Talley and Anderson (1981) selected 12 items from the perspective of the operator and evaluated bus system service standards. Fielding et al. (1985) also took the view of the operator, selecting seven items of evaluation of bus system operation and service performance. Allen and Dicease (1976) on the other hand, considered both the operator and the consumer, dividing the evaluation items into three: quantity of service, quality of service and ratio of bene® t± cost, and selecting a total of 30 indicators to evaluate the performance of operation and service of a transport system. In this kind of research, the weighing of various perspectives will enlarge the gaps in evaluation indicators, thereby limiting the scope of research.

The others are based on the conceptual framework provided by Fielding and Anderson (1984). Fielding et al. (1978) and Fielding and Anderson (1984) developed a conceptual framework commonly used by UMTA (1981a, 1981b), TRB (1984), Tanaboriboon et al. (1993), etc., to produce a set of performance indicators. In his model, three elements of transit operations, namely resource input (labour, capital, fuel, etc.), service output (vehicle-h, vehicle-km, capacity-km, etc.), and service consumption (passenger trip, passenger-km, operating revenue, etc.) constitutes three corners of a triangle. The three sides represent resource-e ciency (measuring service output against resource input), resource-eŒectiveness (measuring service consumed against resource input) and service-eŒectiveness (measuring service consumed against service output) respectively. However, using this model makes it di cult to recognize the role of ® nance in a highway bus and to identify the relation between transport and ® nance.

The aim of this paper is to construct a conceptual framework based on the one created by Fielding et al. (1978) and Fielding and Anderson (1984) to help form

C-M. Feng and R-T. Wang

performance indicators involving both transport and aspects of ® nance. Further-more, this framework also provides a powerful method to divide the total performance of a highway bus into three parts: production, marketing and execution. This division is helpful for operators to recognize the performance of a department of a bus company and to identify the responsibility of that department. Finally, the case study shows that performance evaluations of highway buses could become more comprehensive if ® nancial ratios were considered.

2.2. Cycle of operation activities

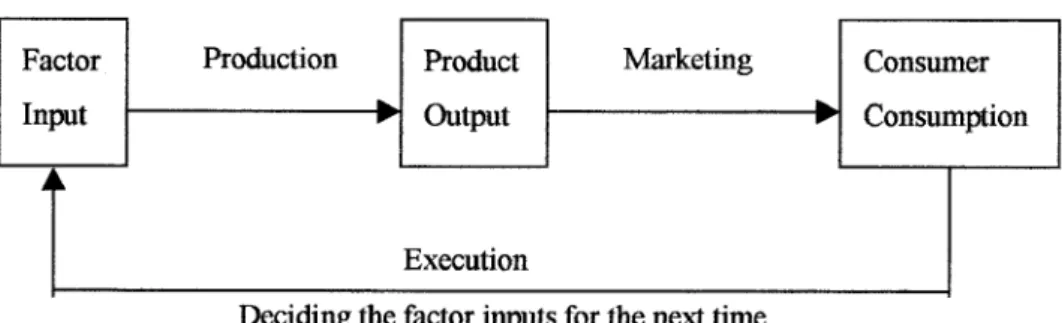

The objective of an enterprise is to maximize pro® ts, so whether the activities of an enterprise are e cient has direct in¯ uence on pro® tability, thereby potentially threatening the survival of the enterprise. As shown in ® gure 1, the operation activities of a highway bus include three parts: factor input, product output and consumer consumption. These also constitute three stages of the operation cycle: production, marketing and execution.

The activities of a highway bus can be viewed as a consecutive and cyclic process, and the operators decide on the most suitable factor input (e.g. labour, vehicle, assets, capital, etc.) for the current period based on customer consumption during the previous period. At the same time they pursue the maximum product output (e.g. vehicle-km, total debts, interest expense, etc.) in the production stage under a given factor input. Likewise, they seek maximum consumer consumption (e.g. passenger-km, operation revenue, net income, etc.) in the marketing stage given the existing output level. The ® nal result of sales during this period can be used to calculate the remuneration of factor input for this period in the execution stage and then to decide the amount of factor input for the next period.

2.3. Organization characteristics of a highway bus

Organizations such as a highway bus that have special safety needs with routine and highly standardized activities are likely to be a machine bureaucracy (Robbins 1990). The key concept that underlies all machine bureaucracies is standardization. One characteristic of this structure is the reliance on functional departmentation, with similar and related specialties grouped together. According to this functional departmentation structure, the three stages of highway bus operation (® gure 1) represent three types of performance categories: production e ciency, marketing e ciency and execution e ciency respectively, corresponding to the departments of production, marketing and management.

Figure 1. Cycle of operation activities of a highway bus.

Financial ratios on performance evaluation of highway bus industry

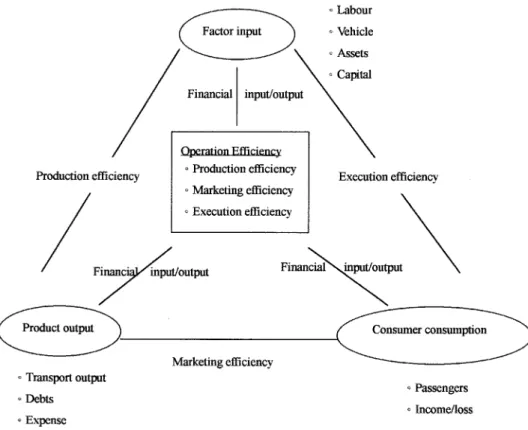

As ® gure 2 illustrates, the production e ciency of factor input and product output measures a bus company’ s degree of resource usage. Given the same factor input, the e ciency increases as the output level increases. The marketing e ciency of product output and consumer consumption measures a bus company’s marketing planning capability. Given the same output level, the marketing e ciency increases if consumers are willing and able to buy more products. The execution e ciency of consumer consumption and factor input measures planning and execution capability during its preliminary and interim period. Given the same consumption level, the execution e ciency increases as factor input decreases, which means that the operator can plan objectives in the preliminary period better and execute them in the interim period.

In this paper, the total performance of a highway bus is divided, based on the characteristics of operation activities and organization structure, into production e ciency, marketing e ciency and execution e ciency.

2.4. Evaluation items of operational performance

Taking ® nance into consideration, the paper ® rst makes a classi® cation based on ® ve accounting elements: assets, debts, owner’ s equity, revenue and expense. Assets and the capital of the owner’ s equity are categorized as the input of ® nancial factors, debts and expense as the output of the ® nancial factors and income/ loss as the outcome of ® nancial factors. Furthermore, the study incorporates the special

Figure 2. Conceptual framework of the operation performance evaluation for the highway bus.

C-M. Feng and R-T. Wang

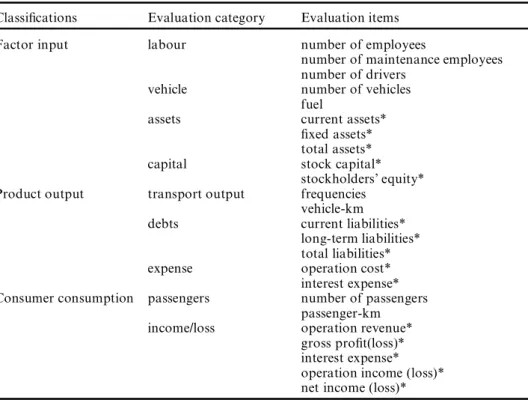

characteristics of the highway bus industry to assist in the selection of items for evaluation. Highway bus is a capital- and labour-intensive business. Its factor input is characterized by a sunk cost, while its output by intangible products and its consumption by not-stored services. In view of the characteristics of sunk cost, interest expense is included in the ® nancial factors to evaluate performance, in addition to the fundamental items of the classi® ed ® nancial statements. Besides, inventory is not included among the ® nancial factors because of its intangible products and not-stored service characteristics. The evaluation items are shown in table 1.

As the evaluation items are shown in table 1, there are three evaluation items representing the labour category: number of employees, number of maintenance employees and number of drivers. The vehicle category has two: number of vehicles and amount of fuel. Assets are represented by three items: current assets, ® xed assets and total assets. Capital has two: stock capital and stockholders’ equity. Transportation output is divided into frequency and vehicle-km. The liability category has three: current, long-term and total liabilities. In the cost category, there are two: operation cost and interests expense. The passenger category includes number of passengers and passenger-km; and as for income/loss, the total number of items is ® ve: operation revenue, operation gross income (loss), interest expense, operation income (loss) and net income (loss).

3. Performance indicators set

Before producing the performance indicators set, two criteria were used for choosing the indicators. First, an evaluation indicator should have a preliminary explanatory meaning. For example, the ratio of debts per employee, the ratio of interest expense per passenger, and the ratio of passenger-km per current assets are not included in the set because they bear no relevant meaning. Second, if a priori knowledge can be employed to judge the high correlation among evaluation indicators, one of the indicators is chosen as the performance indicator. For example, for marketing e ciency, operation income/loss is closer to the operation of a highway bus than operation income/loss before tax and net income/ loss, according to the accounting de® nition. Therefore, the ratios of operation income/loss in relation to frequencies, operation-km, number of seats and seat-km were chosen as the performance indicators.

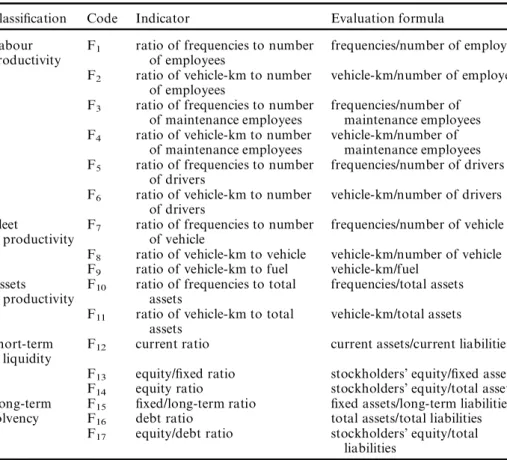

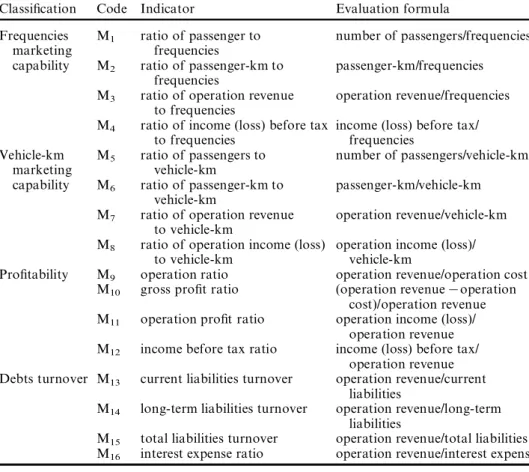

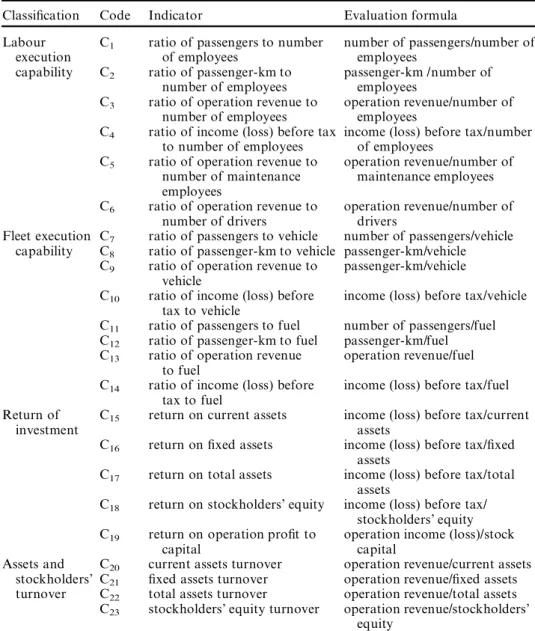

Based on the above two selection criteria and the ratios of both evaluation items in table 1, the set contains 56 evaluation indicators, which are classi® ed into three main classi® cations: production, marketing and execution. Among them, 17 in the production category are recategorized into ® ve groups, including labour productiv-ity, vehicle productivproductiv-ity, assets productivproductiv-ity, short-term liquidity and long-term solvency (table 2). Sixteen indicators in the marketing category are recategorized into four groups, including frequencies, marketing capability, seat marketing capability, pro® tability and liabilities turnover, while 23 evaluation indicators in the execution category are recategorized into four groups, including labour execution capability, vehicle execution capability, return of investment, and assets and stockholder’ s turnover (tables 3 and 4).

4. Applications

This study is based on the operation data from 1997 of each highway bus company. In dividing the 32 operators in the region according to the area covered by

Financial ratios on performance evaluation of highway bus industry

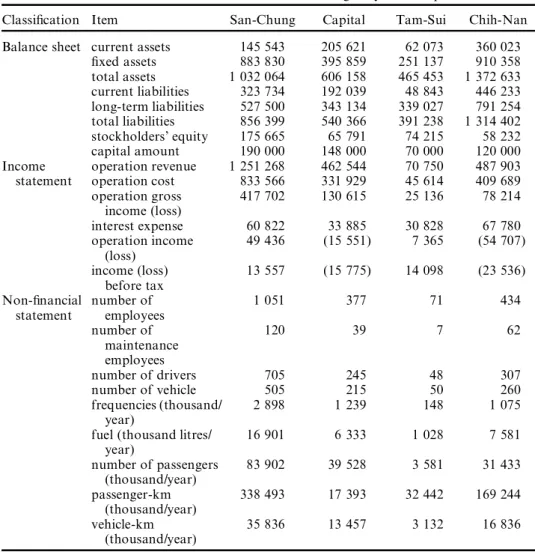

their bus routes, there are 12 companies within the northern region, and seven of those, namely San-Chung, Capital, Taipei, Tam-Sui, Fu-Ho, Hsin-Tien and Chih-Nan, together cover Taipei in their operating range. This study selected these seven companies as its object of research. However, obtaining the complete ® nancial statements of each of the companies proved extremely di cult. It was only possible to calculate necessary ® nancial information based on data already in possession, so three companies whose data were insu cient had to be eliminated, leaving the four companies of San-Chung, Capital, Tam-Sui and Chih-Nan as the objects of this performance evaluation study. The four operators are engaged mainly in both urban and long-distance work. The details of each bus company’s characteristics are summarized in table 5.

4.1. Value for evaluation items of each highway bus

Based on table 1, the evaluation items listed are classi® ed into three categories: balance sheet, income statement and non-® nancial statement. The value of each bus company is stated in table 6.

4.2. Grouped indicator and representative indicators

During the accumulation of performance evaluation indicators, it was discovered that the number of indicators was extremely high, and the relationship between each of them was unclear. If it were possible to separate the indicators

Table 1. Items for performance evaluation. Classi® cations Evaluation category Evaluation items Factor input labour number of employees

number of maintenance employees number of drivers

vehicle number of vehicles fuel

assets current assets* ® xed assets* total assets* capital stock capital*

stockholders’ equity* Product output transport output frequencies

vehicle-km debts current liabilities*

long-term liabilities* total liabilities* expense operation cost* interest expense* Consumer consumption passengers number of passengers

passenger-km income/loss operation revenue*

gross pro® t(loss)* interest expense* operation income (loss)* net income (loss)* *Accounting items in ® nancial statements.

C-M. Feng and R-T. Wang

into groups, with loose intergroup relations and close intragroup relations, then to select a representative indicator from each group, it would assist in the clari® cation of the complex relations between indicators as well as making it easier to explain the evaluation results. When the amount of sample data is large enough and conforms to normal distribution, then most researchers use the mathematical statistic method (factor analysis, cluster analysis, discriminate analysis, regression analysis) to conduct the selection of representative indicators. However, in the analysis of the highway bus industry, data are often incomplete or unclear, and this paper, therefore, is bound by realistic limits, con® ning itself to a situation where the amount of data is small and its signi® cance inde® nite. This paper follows the work of Professor Deng Ju-Long, who in 1982 proposed the selection of representative indicators based on the grey relation analysis. The basic concept and mathematical model of grey relation analysis are shown in appendix A. Moreover, this study calculates the performance score and ranking status of each case (highway bus operators) utilizing TOPSIS multiple criteria decision-making.

4.2.1. Distribution of representative indicators

For the convenience of calculating the grey relation coe cient of the indicators, this study produced a computer program with Turbo PASCAL 7.0. Based on the

Table 2. Performance indicators set in production. Classi® cation Code Indicator Evaluation formula Labour

productivity

F1 ratio of frequencies to number of employees

frequencies/number of employees F2 ratio of vehicle-km to number

of employees

vehicle-km/number of employees F3 ratio of frequencies to number

of maintenance employees

frequencies/number of maintenance employees F4 ratio of vehicle-km to number

of maintenance employees

vehicle-km/number of maintenance employees F5 ratio of frequencies to number

of drivers frequencies/number of drivers F6 ratio of vehicle-km to number

of drivers vehicle-km/number of drivers Fleet

productivity

F7 ratio of frequencies to number of vehicle

frequencies/number of vehicle F8 ratio of vehicle-km to vehicle vehicle-km/number of vehicle F9 ratio of vehicle-km to fuel vehicle-km/fuel

Assets productivity

F10 ratio of frequencies to total assets

frequencies/total assets F11 ratio of vehicle-km to total

assets

vehicle-km/total assets Short-term

liquidity

F12 current ratio current assets/current liabilities F13 equity/® xed ratio stockholders’ equity/® xed assets F14 equity ratio stockholders’ equity/total assets Long-term F15 ® xed/long-term ratio ® xed assets/long-term liabilities solvency F16 debt ratio total assets/total liabilities

F17 equity/debt ratio stockholders’ equity/total liabilities

Financial ratios on performance evaluation of highway bus industry

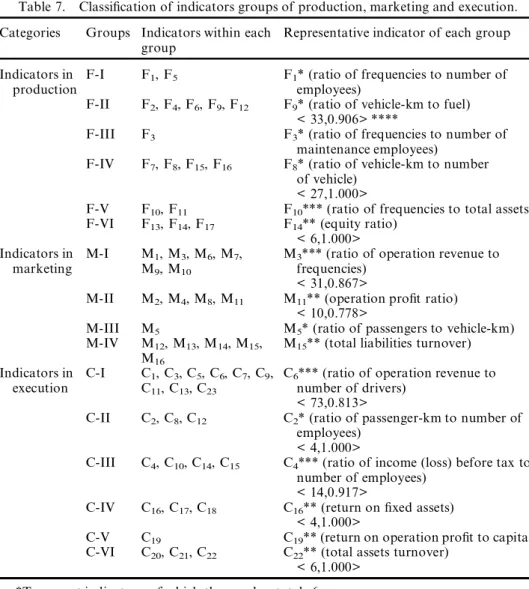

results of this program, indicators are grouped into three classi® cations: production, marketing and execution, in accordance with the coe cient of each indicator (table 7).

There are three types of indicators, divided up according to their composition: transport indicators, ® nancial ratios and mixed indicators. A transport indicator consists of two items of transport data divided by each other; while a ® nancial ratio is one item divided by another in the ® nancial statement. A mixed indicator is one item of transport data and another in a ® nancial statement divided by each other. As table 7 shows, 16 representative indicators are selected for evaluating highway bus performance.

Among them, six representative indicators are in the category of production, F14 represents the ® nancial ratio, F10represents the mixed indicator, while F1, F3, F8and F9represent transport indicators, which implies that transport indicators are more suitable for measuring the production e ciency of a highway bus than either the ® nancial ratios or mixed indicators. The representative indicators M3, M5, M11and M15represent marketing e ciency, in which M11and M15are ® nancial ratios, while M5is the transport indicator, and M3is the mixed indicator. The result shows that

Table 3. Perfomance indicators set in marketing. Classi® cation Code Indicator Evaluation formula Frequencies

marketing

M1 ratio of passenger to frequencies

number of passengers/frequencies capability M2 ratio of passenger-km to

frequencies

passenger-km/frequencies M3 ratio of operation revenue

to frequencies

operation revenue/frequencies M4 ratio of income (loss) before tax

to frequencies

income (loss) before tax/ frequencies

Vehicle-km

marketing M5 ratio of passengers tovehicle-km number of passengers/vehicle-km capability M6 ratio of passenger-km to

vehicle-km passenger-km/vehicle-km M7 ratio of operation revenue

to vehicle-km

operation revenue/vehicle-km M8 ratio of operation income (loss)

to vehicle-km

operation income (loss)/ vehicle-km

Pro® tability M9 operation ratio operation revenue/operation cost M10 gross pro® t ratio (operation revenue7operation

cost)/operation revenue M11 operation pro® t ratio operation income (loss)/

operation revenue M12 income before tax ratio income (loss) before tax/

operation revenue Debts turnover M13 current liabilities turnover operation revenue/current

liabilities

M14 long-term liabilities turnover operation revenue/long-term liabilities

M15 total liabilities turnover operation revenue/total liabilities M16 interest expense ratio operation revenue/interest expense

C-M. Feng and R-T. Wang

Table 4. Performance indicators set in execution. Classi® cation Code Indicator Evaluation formula Labour

execution

C1 ratio of passengers to number of employees

number of passengers/number of employees

capability C2 ratio of passenger-km to number of employees

passenger-km /number of employees

C3 ratio of operation revenue to number of employees

operation revenue/number of employees

C4 ratio of income (loss) before tax to number of employees

income (loss) before tax/number of employees

C5 ratio of operation revenue to number of maintenance employees

operation revenue/number of maintenance employees C6 ratio of operation revenue to

number of drivers

operation revenue/number of drivers

Fleet execution C7 ratio of passengers to vehicle number of passengers/vehicle capability C8 ratio of passenger-km to vehicle passenger-km/vehicle

C9 ratio of operation revenue to vehicle

passenger-km/vehicle C10 ratio of income (loss) before

tax to vehicle

income (loss) before tax/vehicle C11 ratio of passengers to fuel number of passengers/fuel C12 ratio of passenger-km to fuel passenger-km/fuel C13 ratio of operation revenue

to fuel

operation revenue/fuel C14 ratio of income (loss) before

tax to fuel

income (loss) before tax/fuel Return of

investment

C15 return on current assets income (loss) before tax/current assets

C16 return on ® xed assets income (loss) before tax/® xed assets

C17 return on total assets income (loss) before tax/total assets

C18 return on stockholders’ equity income (loss) before tax/ stockholders’ equity C19 return on operation pro® t to

capital

operation income (loss)/stock capital

Assets and C20 current assets turnover operation revenue/current assets stockholders’ C21 ® xed assets turnover operation revenue/® xed assets turnover C22 total assets turnover operation revenue/total assets C23 stockholders’ equity turnover operation revenue/stockholders’

equity

Table 5. Details of the operators’ characteristics. Operators Total route length

(km) vehiclesNo. of Total vehicle-km(thousand/year) Total passenger-km(thousand/year)

San-Chung 1027.9 505 35 876 338 493

Capital 414.5 210 13 457 12 393

Tam-Sui 700.1 50 3 132 32 442

Chih-Nan 801.3 260 16 836 169 244

Financial ratios on performance evaluation of highway bus industry

the three types of indicators should measure the marketing e ciency all together. Six representative indicators exist in the category of execution: C2, C4, C6, C16, C19and C22. The ® rst one is the transport indicator, while the following two are the mixed indicators, and the last three are all ® nancial ratios. This result shows that the ® nancial ratios are more suitable for measuring the execution e ciency than the other two types.

4.2.2. Implications of the representative indicators

Four of the six representative transport indicators belong to the

production category of evaluation indicators, whereas the other two belong to the marketing and execution categories respectively. This demonstrates that transport indicators are more suited to measuring the production e ciency between the input and output of transport. The evaluation indicators are

Table 6. Value for evaluation items of four highway bus companies.

Classi® cation Item San-Chung Capital Tam-Sui Chih-Nan Balance sheet current assets 145 543 205 621 62 073 360 023

® xed assets 883 830 395 859 251 137 910 358 total assets 1 032 064 606 158 465 453 1 372 633 current liabilities 323 734 192 039 48 843 446 233 long-term liabilities 527 500 343 134 339 027 791 254 total liabilities 856 399 540 366 391 238 1 314 402 stockholders’ equity 175 665 65 791 74 215 58 232 capital amount 190 000 148 000 70 000 120 000 Income operation revenue 1 251 268 462 544 70 750 487 903 statement operation cost 833 566 331 929 45 614 409 689

operation gross income (loss) 417 702 130 615 25 136 78 214 interest expense 60 822 33 885 30 828 67 780 operation income (loss) 49 436 (15 551) 7 365 (54 707) income (loss) before tax 13 557 (15 775) 14 098 (23 536) Non-® nancial statement number of employees 1 051 377 71 434 number of maintenance employees 120 39 7 62 number of drivers 705 245 48 307 number of vehicle 505 215 50 260 frequencies (thousand/ year) 2 898 1 239 148 1 075

fuel (thousand litres/

year) 16 901 6 333 1 028 7 581 number of passengers (thousand/year) 83 902 39 528 3 581 31 433 passenger-km (thousand/year) 338 493 17 393 32 442 169 244 vehicle-km (thousand/year) 35 836 13 457 3 132 16 836 Values are NT$1000. (), Negative value. Source: each highway bus (1997).

C-M. Feng and R-T. Wang

centred around the frequencies ratio (F1, F3) produced by the separation of number of employees from number of maintenance employees, and the vehicle-km ratio (F9, F8), produced by the separation of fuel amount from number of vehicles. Among the six ® nancial ratios there are three belonging to the execution category, two belonging to the marketing category and only one from the production category. This shows that using ® nancial ratios to evaluate highway bus performance favours the executive eŒectiveness of input and consumption. The evaluation indicators are also founded on the income (loss) before tax created by ® xed assets (C16), the operation income (loss) created by stock capital (C19) and the operation revenue created by total

Table 7. Classi® cation of indicators groups of production, marketing and execution. Categories Groups Indicators within each

group

Representative indicator of each group Indicators in

production

F-I F1, F5 F1* (ratio of frequencies to number of employees)

F-II F2, F4, F6, F9, F12 F9* (ratio of vehicle-km to fuel) < 33,0.906> ****

F-III F3 F3* (ratio of frequencies to number of maintenance employees)

F-IV F7, F8, F15, F16 F8* (ratio of vehicle-km to number of vehicle)

< 27,1.000>

F-V F10, F11 F10*** (ratio of frequencies to total assets) F-VI F13, F14, F17 F14** (equity ratio)

< 6,1.000> Indicators in

marketing

M-I M1, M3, M6, M7, M9, M10

M3*** (ratio of operation revenue to frequencies)

< 31,0.867>

M-II M2, M4, M8, M11 M11** (operation pro® t ratio) < 10,0.778>

M-III M5 M5* (ratio of passengers to vehicle-km) M-IV M12, M13, M14, M15,

M16

M15** (total liabilities turnover) Indicators in

execution

C-I C1, C3, C5, C6, C7, C9, C11, C13, C23

C6*** (ratio of operation revenue to number of drivers)

< 73,0.813>

C-II C2, C8, C12 C2* (ratio of passenger-km to number of employees)

< 4,1.000>

C-III C4, C10, C14, C15 C4*** (ratio of income (loss) before tax to number of employees)

< 14,0.917>

C-IV C16, C17, C18 C16** (return on ® xed assets) < 4,1.000>

C-V C19 C19** (return on operation pro® t to capital) C-VI C20, C21, C22 C22** (total assets turnover)

< 6,1.000> *Transport indicators, of which the number totals 6. **Financial ratios, of which the number totals 6. ***Mixed indicators, of which the number totals 4.

****< a,b> is the < total score, the distance from the worst solution> .

Financial ratios on performance evaluation of highway bus industry

assets (C22). As for the four representative mixed indicators, they are arranged into three categories, acting as support for the transport and ® nancial indicators. F10 represents the degree of utilization of assets (production category), M3 represents marketing results of marketing (marketing category), and C6 and C4 represent the pro® t-making ability of labour power (execution category).

4.3. Evaluation result of highway bus

After the selection of representative indicators, the next stage is to calculate the performance score of a highway bus and to rank it. There are many diŒerent ways to calculate the performance score and ranking. TOPSIS, developed by Hwang and Yoon (1981), will be used as the ranking method here. The advantage of this method is simple and yields an indisputable order of preference. But it assumes that each indicator takes monotonically (or decreasing) utility. The calculation steps are shown in appendix B.

TOPSIS is based on the concept that the chosen indicator should have the shortest distance from the ideal solution and the farthest from the worst. The ideal solution is the one that enjoys the largest bene® t indicator and the smallest cost indicator among each of the substitutive bus companies. The worst solution is the one that enjoys the smallest bene® t indicator and the largest cost indicator among each of the substitute bus companies.

4.3.1. Outranking of highway bus companies

The TOPSIS method was used to calculate the total performance score of each highway bus. This performance can be divided into three classi® cations: production, marketing and execution, according to the normalized value of each representative indicator in table 8, followed by the preference order:

the outranking of bus companies in total performance:

San-Chung (0.663)4Tam-Sui (0.649)4Capital (0.376)4Chih-Nan (0.182); the outranking of bus companies in production e ciency:

San-Chung (0.767)4Capital (0.639)4Tam-Sui (0.394)4Chih-Nan (0.151); the outranking of bus companies in marketing e ciency:

San-Chung (0.743)4Tam-Sui (0.614)4Capital (0.445)4Chih-Nan (0.128); the outranking of bus companies in execution e ciency:

Tam-Sui (0.731)4San-Chung (0.623)4Capital (0.297)4Chih-Nan (0.203). The ® gures in the parentheses refer to the relative closeness to the ideal solution. The higher the ® gure is, the closer the distance is.

4.3.2. Implications of the evaluation result

Taking San-Chung as an example, although in the total performance evaluation it holds ® rst among the four companies, after making more detailed analysis of its e ciency, one discovers that in execution e ciency it does not compare to Tan-Sui. It is necessary to examine the company’ s ® nancial situation to correct its execution e ciency, and to ask such questions about whether the ® nancial leverage is being utilized improperly, or whether it is too far in debt, thus creating a heavy interest burden, etc. Although Tan-Sui occupies the second spot in overall ratings, its performance in production e ciency is lacking. This shows that its production department is not making full use of its current capacity. For instance, perhaps

C-M. Feng and R-T. Wang

T ab le 8. V ec to r n o rm al iz at io n va lu e o f re p re se n ta ti ve in d ic at o rs . C o m p an ie s F1 F3 F8 F9 F1 0 F1 4 M 3 M5 M 1 1 M1 5 C2 C4 C6 C1 6 C1 9 C2 2 S an -C h u n g 0. 51 3 0. 49 9 0. 56 1 0. 44 0 0. 78 5 0. 65 3 0. 49 5 0. 53 5 0. 24 8 0. 83 8 0. 47 1 0. 06 1 0. 52 5 0. 20 0 0. 47 7 0. 81 7 C ap it al 0. 61 1 0. 65 7 0. 49 4 0. 44 1 0. 57 2 0. 41 9 0. 42 8 0. 68 0 70. 21 0 0. 49 1 0. 06 8 70. 19 9 0. 55 9 70. 53 3 70. 19 2 0. 51 4 T am -S u i 0. 38 8 0. 43 7 0. 49 5 0. 63 2 0. 08 9 0. 61 1 0. 54 8 0. 26 2 0. 64 4 0. 10 4 0. 66 9 0. 94 4 0. 43 6 0. 74 6 0. 19 2 0. 10 2 C h ih -N an 0. 46 1 0. 35 8 0. 44 3 0. 46 1 0. 21 9 0. 16 1 0. 52 1 0. 42 7 70. 69 3 0. 21 3 0. 57 1 70. 25 8 0. 47 0 70. 34 6 70. 83 6 0. 23 9

Financial ratios on performance evaluation of highway bus industry

there are too many unnecessary employees, vehicles are not being fully utilized or assets are being improperly employed, etc. The Capital Company should be placed under the double heading of the marketing and execution categories. In the former case, due to the intended marketing mix strategy (4P), designed to increase growth of product sales. The latter refers to critical reviews of the company’s ® nancial strategy. As for Chih-Nan, it ranked lower than the other companies in all categories, falling far below the ideal. Chih-Nan needs to make a complete overhaul.

5. Relationship between ® nancial ratios and transport indicators

Among the 16 representative evaluation indicators selected by case study, six belong to transport indicators, six belong to ® nancial ratios and the remaining four belong to mixed indicators. This result demonstrates that if one only considers ® nancial ratios or transport indicators, it is impossible to express the overall performance of highway bus industries. After closer analysis of the characteristics of the indicators within each of the groups, it was discovered that there are parts between transport indicators and ® nancial ratios that are independent of each other and parts that can be mutually substituted. This is explained below.

5.1. Substitute relationship

As shown in table 7, within the production evaluation indicator group, the F-II group includes F2, F4, F6, F9 and F12. This group’ s representative indicator (F9) is a transport indicator and can replace the ® nancial ratio F12(current ratio). Group F-IV includes F7, F8, F15 and F16. This group’ s representative indicator (F8) also belongs to the transport indicator category, and can replace ® nancial ratio F15 (® xed/long-term ratio) and F16 (debt ratio). Within the marketing evaluation indicator group, group M-II includes M2, M4, M8 and M11. This group’ s representative indicator is a ® nancial ratio, and can replace the transport indicator M2 (ratio of passenger-km to frequencies). No mutual replacement possibility exists in the execution category between transport indicators and ® nancial ratios.

In observing the mixed indicators, one can see that group M-I includes M1, M3, M6, M7, M9 and M10. Its representative indicator, M3, is a mixed indicator and can replace two transport indicators (M1 and M6) and two ® nancial ratios (M9 and M10). Group C-I includes C1, C3, C5, C6, C7, C9, C11, C13 and C23. Its representative indicator, C6, is a mixed indicator and can replace three transport indicators (C1, C7, C11) and one ® nancial ratio (C23). Group C-III includes C4, C10, C14 and C15. Its representative indicator, C4, is also a mixed indicator and can replace ® nancial ratio C15. The substitutive relationship among indicators is shown in table 9.

5.2. Independent relationship

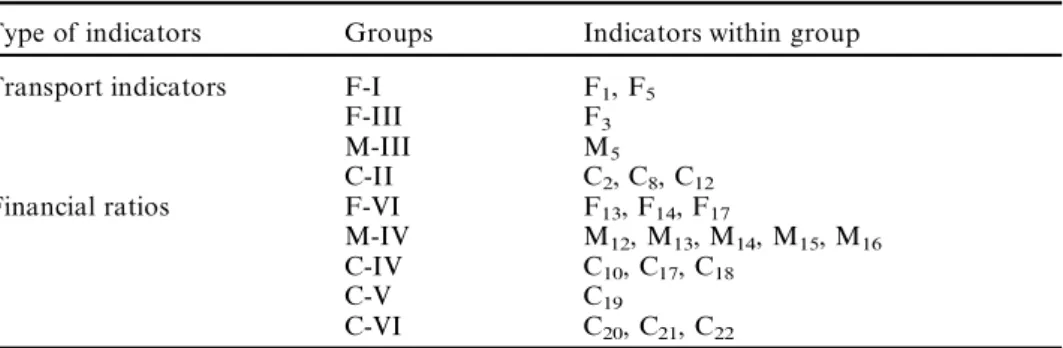

As shown in table 7, the evaluation indicator groups in the production category, F-I (F1, F5), F-III (F3) are transport indicators and F-VI (F13, F14, F17) are composed of ® nancial ratios. Other categories of indicators do not exist within these three groups. Also, these three groups are not replaceable by other types of indicators, and neither can they enclose other types within themselves. This study views this as an independent relation. This phenomenon of independent groups demonstrates that performance evaluation for highway bus

C-M. Feng and R-T. Wang

companies that use only transport indicators or ® nancial ratios will have non-comprehensive and incomplete results, due to its inability to enclose the independent relations of other categories of evaluation indicator groups. In the marketing group, M-III (M5) is a transport indicator and M-IV (M12, M13, M14, M15, M16) is a ® nancial ratio. These two groups are also independent. In the execution group, C-II (C2, C8, C12), C-V (C19), and C-VI (C20, C21, C22) are all ® nancial ratios. These three groups are all independent. The independent relation among indicators is shown in table 10.

6. Conclusions

This paper developed a performance evaluation model for a highway bus including the consideration of ® nancial ratios, and this model was then applied to the case study for the performance evaluation of four bus companies. The conclusions are as follows:

. The conceptual framework here is more complete than a framework in which only the transport indicators are considered.

. To overcome the limitation of sample size and distribution type, grey relation analysis should be utilized for selecting the representative indicators. It provides a solution for grouping the indicators when the sample size is small and the distribution type is unknown.

. Total performance of a highway bus is divided into three categories

(production, marketing, execution), based on the cycle of operation and the

Table 9. Substitute relationship among indicators. Groups Representative indicators The indicators are represented

F-II F9* F12** F-IV F8* F15**, F16** M II M11** M2* M-I M3*** M1*, M6*, M9**, M10** C-I C6*** C1*, C7*, C11*, C23** C-III C4*** C15*×

*Transportation indicators, **® nancial ratios, ***mixed indicators.

Table 10. Independent relationship among indicators. Type of indicators Groups Indicators within group Transport indicators F-I F1, F5

F-III F3

M-III M5

C-II C2, C8, C12 Financial ratios F-VI F13, F14, F17

M-IV M12, M13, M14, M15, M16 C-IV C10, C17, C18

C-V C19

C-VI C20, C21, C22

Financial ratios on performance evaluation of highway bus industry

characteristics of organization. The division of the total performance can successfully be used as a diagnostic tool to provide a preliminary insight into a highway bus for operators.

. From the case study done here, the total performance of a highway bus is not fully equal to its performance in production, marketing or execution. For example, although San-Chung and Tam-Sui rank ® rst and second respectively in total performance, the execution e ciency of San-Chung and the production e ciency of Tam-Sui still need improvement. This reveals that it is more di cult to discover problems in operation if the focus is only on the evaluation of total performance.

. As shown in tables 9 and 10, it can be seen that any one of the three types of indicators can be replaced by another or can stand independent of another. This result reveals that transport indicators or ® nancial ratios can not alone measure all performance aspects of a highway bus. Advanced analysis of table 7 reveals that the transport indicators are more suitable to measuring the production e ciency than ® nancial ratios and mixed indicators, and the execution e ciency is best measured by ® nancial ratios.

. The research here is based on cases of small sample size. If it is possible to secure more data in the future, it is suggested that the evaluation procedure presented here could be adopted to conduct the comparison between evaluation results of diŒerent sample sizes.

Appendix A. Basic concept and mathematical model of grey relation analysis A.1. Basic concept

Grey system theory was originated by Deng in 1982. The fundamental de® nition of `greyness’ is information that is incomplete or unknown, thus an element from an incomplete message is considered to be a grey element. `Grey relation’ means the measurements of changing relations between two systems or between two elements that occur in a system over time. The analysis method, which is based on the degree of similarity or diŒerence of development trends among elements to measure the relation among elements, is called `grey relation analysis’. Namely, during the process of system development, should the trend of change between two elements be consistent, it then enjoys a higher grade of synchronized change and can be considered as having a greater grade of relation. Otherwise, the grade of relation would be smaller. Grey relation analysis will be applied in the selection of representative indicators.

A.2. De® nition and model in mathematics

Let X be a factor set of grey relation, x02X represents the referential sequence, xi2X represents the comparative sequence. x0(k) and xi(k) represent the respective numerals at point k for x0and xi. If the average relation valueg (x0(k),xi(k)) is a real number, then it can be de® ned as:

g…X0; Xi† ˆ 1 n Xn kˆ1 g…X0…k†; Xi…k††:

The average value ofg (x0(k),xi(k)), must satisfy the following four axioms: normal interval, duality symmetric, wholeness and approachability.

C-M. Feng and R-T. Wang

Axiom 1. Norm interval

05g…X0…k†; Xi…k†† µ 1; 8…k†

g…X0…k†; Xi…k†† ˆ 1 iff X0…k† ˆ Xi…k†

g…X0…k†; Xi…k†† ˆ 0 iff X0…k†; Xi…k† 2 ¬

where ¬ is an empty set. Axiom 2. Duality symmetric

x; y 2 X

g…x; y† ˆ g…y; x† iff X ˆ fx; yg Axiom 3. Wholeness

Xi; Xj2 X ˆ fXsjs ˆ 0; 1; 2; . . . ; ng; n42

g…Xi; Xj† 6ˆ g…Xj; Xi† Axiom 4. Approachability

g…X0…k†; Xi…k†† decrease along with jX0…k† ¡ Xi…k†j increasing:

If the foregoing four axioms are satis® ed,g…x0; xi† is then designated as the grade of grey relation in xi correspondence to x0:g; …x0…k†; xi…k†† is said to be the grey

relational coe cient of the same at point k. Deng has proposed a mathematical equation that will satisfy these four axioms of grey relation:

g…X0…k†; Xi…k†† ˆ min

i2I minkjX0…k† ¡ Xi…k†j ‡ zmaxi2I maxk jX0…k† ¡ Xi…k†j

jX0…k† ¡ Xi…k†j ‡ zmaxi2I maxk jX0…k† ¡ Xi…k†j

;

where z is the distinguished coe cient …z 2 ‰0; 1Š†, the function of which is to reduce its numerical value by max

i2I maxk jx0…k† ¡ xi…k†j getting large, so as to eŒect its

loss-authenticity and to heighten the remarkable diŒerence among relation coe cients.

Appendix B. Calculation steps of TOPSIS Step 1: Normalization of indicator values

Normalization aims at obtaining comparable scales. There are diŒerent ways of normalizing the indicator values. This paper uses vector normalization, which utilizes the ratio of the original value (xij) and the square-root of the sum of the original indicator values. The advantage of this method is that all indicators are measured in dimensionless units, thus facilitating inter-indicator comparisons. This procedure is usually utilized in TOPSIS. The formula is:

rijˆ Xij Xm iˆ1 X2ij s ;

Financial ratios on performance evaluation of highway bus industry

where i is the highway bus, j is the jth evaluation indicator, rijis the indicator value after vector normalization for the ith highway bus company and jth evaluation indicator, xijis the original value of indicators for the ith highway bus company and jth evaluation indicator and, m is the number of highway bus companies.

A‡ˆ f…maxi rijj j 2 J†; …mini rijj j 2 J0†ji ˆ 1; 2; . . . ; mg ˆ fA‡1; A‡2; . . . ; A‡j; . . . ; A‡kg A¡ˆ f…mini rijj j 2 J†; …

max

i rijj j 2 J0†ji ˆ 1; 2; . . . ; mg ˆ fA¡1; A¡2; . . . ; A¡j; . . . ; A¡kg Step 2: To determine ideal (A+) and worst (A7) solution

Jˆ fj ˆ 1; 2; . . . ; kjk belongs to bene® t criteriag, bene® t criteria implies a larger indicator value and a higher performance score; J0ˆ fj ˆ 1; 2; . . . kjk belongs to cost

criteriag, cost criteria implies a smaller indicator value and a higher performance score.

Step 3: To calculate the separation measure S‡i ˆ Xk jˆ1 …rij¡ A‡j †2 v u u t ; S¡ i ˆ Xk jˆ1 …rij¡ A¡j†2 v u u t ; iˆ 1; 2; . . . ; m

The separation of each highway bus from the ideal one (S‡

i ) and the worst one (S¡i )

is then respectively given by:

c¤i ˆ S¡i S‡

i ‡ S¡i

05c¤

i51

Step 4: To calculate the relative closeness to the ideal solution (C¤

i)

Step 5: To rank the preference order according to the descending order of C¤ i

References

ALLEN, W. G. and DICEASE, F., 1976, Transit service evaluation: preliminary identi® cation of variables characterizing level of service. Transportation Research Record, 606, 41 ± 47. ALTER, C. H., 1976, Evaluation of public transit services: the level-of-service concept.

Transportation Research Record, 606, 37 ± 40.

DENGJU-LONG, 1982, Control problems of grey systems, Systems and Control Letters, 5, 288 ± 294.

FIELDING, G. J. and ANDERSON, S. C., 1984, Public transit performance evaluation: application to Section 15 Data. Transportation Research Record, 947, 1 ± 7.

FIELDING, G. J., BABITSKY, T. T. and BRENNER, M. E., 1985, Performance evaluation for bus transit. Transportation Research, 19A, 73 ± 82.

FIELDING, G. J., GLAUTHIER, R. E. and LAVE, C. A., 1978, Performance indicators for transit management. Transportation, 7, 365 ± 379.

HWANG, C. L. and YOON, K., 1981, Multiple Attribute Decision Making: Methods and

Applications (New York: Springer).

ROBBINS, S. P., 1990, Organization Theory: Structure, Design, and Applications, 3rd edn (Englewood CliŒs: Prentice-Hall).

C-M. Feng and R-T. Wang

UMTA (Urban Mass Transit Administration), 1981a, Prototype Bus Service Evaluation

System (USA: DOT).

UMTA (Urban Mass Transit Administration), 1981b, Transit System Performance Evaluation

and Service Change Manual (USA: DOT).

TALLEY, W. K. and ANDERSON, P. P., 1981, EŒectiveness and e ciency in transit performance: a theoretical perspective. Transportation Research, 15A, 431 ± 436.

TANABORIBOON, Y., QUIUM, A. S. and CHANGSINGHA, C., 1993, Performance indicator analysis: a theoretical perspective. Transportation Research, 15A, 431 ± 436.

TRB (Transportation Research Board), 1984, Simpli® ed Guidelines for Evaluation Transit

Service in Small Urban Areas (USA: TRB).

Financial ratios on performance evaluation of highway bus industry