Chiao Da Management Review Vol. 29 No. 1, 2009

pp.41-78

台灣股市投資人交易動態效果之分析

The Dynamic Analysis of Investors'

Tr

ading in The

Taiwan Stock Market

蕭朝興1 Chao-Shin Chiao

國立采摹大學 財務金融學~

Dep訂個lentofFinance, National Dong Hwa University

王子泊 Zi-Mei Wang

銘傳大學 財務金融學~

Dep訂伽lentof Finance, Ming Chuan Universi可 黃常和 Chang-Ho Huang

國立東華大學 國際經濟學系

Graduate Institution ofIntemational Economic, National Dong Hwa University

摘要:本文檢測三大法人、個別投資人對於臺灣 50 交易行為與股票報酬的每 日與日內關條,發現三大法人(個別投資人)每日淨買賣超與當日股票報酬之 間具有強烈的正(負)中目闕,同時也有追逐動能(反向交易)的傾向。進一步利 用逐筆委託資料來探討這正相關的可能原因,發現法人沒有預測日內短期報 酬能力,雖然法人會正向追隨過去日內報酬變化,但相較之下,法人交易產 生的價格壓力才是主要因素;同時,當個別投資人與法人同步且大搞買賣超 時,才能對股價產生較大的街擊。 關鍵字:法人;個別投資人;可市價化限績單;委託不均衡比率

Abstract: This paper examines the daily and intraday relationship between stock retum and the trading of institutional and individual investors on the TSEC 50 securities. First

,

the contemporaneous relation between stock retum and the trade imbalance by institutions (individuals) at the daily level is strongly positive (negative) and institutions (individuals) tend to be trend-chasing (contrarian).1 Corresponding author: Department ofFinance, National Dong Hwa Universi旬" Hualien Ci紗,

42 The Dynamic Analysis 01 Investors' Trading in the Taiwan Stock Market

Second, applying intraday order data, this paper finds that the observed positive

contemporaneous relation is largely driven by the price pressure from institutional

trading. Third, no consistent evidence supports that institutional order imbalance

predicts future stock returns. Finally, the stock prices wi11 move more when the

trading direction of individuals is consistent with that of institutions.

Keywords: Institutional investor; Individual investor; Marketable limit order;

Order imbalance

1.

Introduction

Since the early 1980s, the Ministry of Finance of Taiwan has made efforts

to globalize its stock market, widely dominated by individual investors (Harrison,

1994)

,

in order to enhance its efficiency. After two decades,

its institutionalizationand globalization achievements have been recognized. For instance, up to 37.1 %

of dollar trading volume in the Taiwan stock market is attributable to 甘ades by

profi巴ssionalinstitutional investors 企om2002/9 to 2004/12, 的 drawnin Figure 1 Figure 1

Percents ofTotal Dollar Trading Volume 50 ~食一一一-FIs ] 40 30 20 10

This figure draws Ihe proportion of dollar trading volwne by each group of inslitutional inveslors from 2月'/20021031112/2004, for a lolal of580 trading days. FIs, MFs, and SDs stand for foreign inveslors, mutual funds, and securities dealers, respectively. Sample averages of FIs, M訟,個d SDs 缸e23.53%, 7.91%, and 5.66%, respectively

Chiα'0 Da Management Revi,凹陷1. 29 No. 1. 2009 43

Con仕的ted with a mere 3% in 1989 (Schwartz and Shapiro

,

1991),

institutional trading has increased fast over recent years. Given the growing

importance of institutional 討ading, it would be instructive and even profitable to

understand the relation between institutional trading pa出msand stock retums

Recent studies document that institutional investors not only tend to herd

(Wermers, 1999; S恤, Chen, and Huang, 2005), but also follow past price

movements (Grinbla缸,Titman, and Werm帥, 1995; Lee et 祉,2006). Additionally,

the contemporaneous relation between changes in institutional ownership and

stock retum is stronger than the trend chasing effect (Nofsinger and Si的, 1999).

Employing the limit-order data for the Taiwan Stock Exchange (TSE), a purely

order-driven market, this paper aims to explain 也e posltJve contemporaneous

relation between changes in institutional ownership and stock retums found in previous studies and examine the relative importance among possible causes. We also analyze the roles of the trading behaviors of institutional and individual

investors 扭曲eshort-run (daily and intraday) price movements

According to the literature, one possibility resulting in the positive

contemporaneous relation be趴reeninstitutional trading activities and stock retums

is that institutional investors successfully forecast retums (Wermers, 1999; Choe,

Kho, and Stulz, 2005; Yu and L剖, 1999). Another possibility is about the

institutional positive-feedback tendency (Grinbla說, Titman, and Wermers, 1995;

Lin and 1\缸, 2002) and/or the concurrent price pressure (French and Roll, 1986;

Lee et a1., 2004; Chakrav訂旬, 2001). Dueωthe lack of high frequency dat

a,

theprevious literature mainly uses quarterly ownership data to compute the changes

in institutional holdings. For exampl巴, in order to examine the relation between

changes in institutional ownership and stock retum, Nofsinger and Sias (1999) use

annual institutional holdings on the NYSE stocks, while Sias, Starks, and Titman

(2001), Boyer and Zheng (2004) and C訓, Kaul, and Zheng (2000) employ the

qu訂teriyinstitutional ownership.

Even with intraday data, Griffin, Harris, and Topaloglu (hereafter GHT,

2003) still cannot identi

fY

the types of investors, such as institutional or individualinvestors. As the authors are obliged to estimate both sides of all trades as

44 The Dynamic Analysis olIn間的悶 ,Trading in the Taiwan Stock Market

some measurement errors. In contrast, our data recording all orders submitted to the TSE can unambiguously classify each limit order into one of five groups,

including foreign investors, mutual fun品, securities dealers, individual investors, and corporate institutions.2 Due ωdifferent investor compositions and market microstructures, the conclusions 企'om other developed markets may not entirely be applied to the Taiwan stock market. Therefore

,

this paper may provide investors with not only a broader view of a fast emerging market but also a potentially profitable application. To our knowledge, there is no empirical study related to this issue for 也eTaiwan stock market.Furthermore, from the angle of order submission behaviors, our conclusions help us gain a better understanding of the relation between the short-run price movements and the trading behaviors of investors. To distinguish investors' trading behaviors and jntentions, we calculate the imbalanc巳 of orders seeking

3

immediacy for the TSEC 50 stocks. J Specifically, we pay attention to the

“

marketable" limit orders, defined by Ch帥, Wang, and Lai (2007), in the likelihood that private information is encapsulated in such orders (Lee et al., 2004).4 The observed relations are expected to clarify the timing ability and thes甘engthwith which institutional and individual investors move stock prices. As a result,位rst, the contemporaneous relation between stock retum and

個de imbalance by institutions (individuals) at the da句 level is s仕ongly positive (negative) and institutions (individuals) tend to be trend-chasing (con個rian).

Second, applying a vector auto-regressions (V AR) analysis, this paper shows the persistence of institutional and individual trading, but institutional trading cannot

2 Mutual 恤血, formally called securities inv由加ent trust companies,缸e solely composed of

domestic mu阻al-fund fim阻,while foreign investors cover a wide variety of foreign institutions, including 自orei伊 (inves加ent)banks, insur閉目 companies,mutual fu帥, penSlon 伽ds,hedge funds, and so on.τùe corporate institutions consist of all domestic institutional investors 0由訂 出an the domestic professional institutional investors, such as mutual funds 阻d securities dealers

3 We choose the TSEC 50 because they are the most liquid and actively traded stocks on the TSE,

consistent with institutional investors' preference (Gompers and Metricks, 2001; Choe, Kho, and

sωIz, 1999). The TSEC 50 stocks are the most highly capitalized blue chip stocks representing around 70% of the market and the correlation between TSEC 50 阻dTSE index is above 98%, indicating that our results are representative.

Chiao Da Managem帥tReview Vol. 29 No. 1, 2009 45

predict future daily retums τbird, the intraday analyses still find no consistent

evidence that the institutional order imbalances predict future 30-minite retums.

Although the institutional trading positively follows past intraday returns, the

positive contemporaneous relation is largely driven by the price pressure 企om

concurrent institutional trading. F our血,the stock prices will move more when th巳

trading direction of individuals is consistent with that of institutions

,

implying thatindividual inv的tors play a deterministic role in the observed price behaviors.

Finally, we find that the information content of daily institutional 甘ade

imbalances lasts only for a short period, indicating that their 仕ading has limited

contribution to the process of incorporating information into stock prices.

This remaining paper proceeds as follows. Section 2 briefly reviews the related literature. Section 3 reports our datasets and summary statistics. Section 4

discusses the empirical results. Finally, we conclude this paper in Section 5

2. Literature Review

There is a growing body of literature on 甘le relation between 甘ading

pattems of institutional and individual investors and stock retums. Many existing studies document that institutional investors tend to engage in momentum

investing (also recognized as trend chasing or positive-feedback 甘ading) (e.g.,

DeLong et al., 1990; Froot, Scharfstein, and Stein, 1992; Hong and Stein, 1999;

Scharfstein and Stein, 1990; C剖, Kaul, and ZI隨時, 2000). Lakonishok, Shleif1仗,

and Vishny (1992) find only weak evidence supporting momentum trading and

herding for pension funds. Grinbla仗, Titman, and Wermers (l995) observe that

77% of mutual funds in the US are momentum traders and Choe, Kho, and Stulz

(1999) find strong evidence of trend chasing by foreign investors in Korea. As to

empirical studi巴s on the TSE, most studies document that institutional investors

positively follow past stock retums (e.g., Chen, Sh戶, and Wang, 2002; Lin and

Ma, 2002; Lee et al., 2006).

The studies on the trading behavior of individual investors find evidence of

the contrarian investment tendency. Barber and Odean (2002) document that

46 The Dynamic Analysis olInvestors' Trading in the Taiwan Stock Market

Odean (1998) finds that individl叫 1師estors are reluctant to realize their loss and

selling the past winners, which is so called disposition effect. Similarly, Hsu and

Lin (2005) find evidence sustaining the disposition effect of individual trading on the TSE. Grinblatt and Keloharju (2000) find that Finnish individual investors are

contrarian investors, while foreigners tend to be momentum investors.

Additionally, recent studies document a strong positive cross-sectional

relation between changes in institutional ownership and returns. For example,

Wermers (1999) find positive contemporaneous relation between quarterly

institutional trading and stock returns in the US. Chiao, Cheng, and Shao (2006)

argue that daily institutional trade imbalances are positively associated with the concurrent stock returns on the TSE. One possibility is related to the presumption that institutions are able to forecast returns. If institutional investors are better

informed, the stocks that institutions buy are expected to outperform those that

they sell (Chen, Jegade帥, and Werme悶,2000; Yu and Lai, 1999).

The second possibility is that institutional trading activities can move stock

prices (French and Roll, 1986; Barclay, Litzenberger, and Warner, 1990;

Chakrava旬', 2001;S帥,Starks, and Titman, 2001). For instance, Lee et al. (2004) find that institutional order imbalances are persistent due to herding and order splitting exerts greater impacts on stock prices. Another possibility is about the

positive-feedback trading (Grinblatt, Ti加an,and Werm帥, 1995). If, for instance,

the price impact of institutional buying is offset by the price impact of

non-institutional selling, then changes in institutional ownership are still

correlated with same period returns if the institutional investors follow a

short-term positive-feedback trading strategy (DeLong et al., 1990; GHT, 2003;

Lee et al., 2006).

3. Data

3.1

Data SourceThis paper employs two datasets to gather all required information. The

first dataset, maintained by the Taiwan Economic Journal, comprises the daily

Chiao Da Management Revi~ Vol. 29 No. 1, 2009 47

aIl listed individual stocks. In addition, this dataset provides in仕aday bid and ask

quotes information of each listed stock.

前le second dataset

,

obtained from the TSE,

contains the intradayinformation on every originallimit orders and 仕泌的 throughthe FuIly Automated

Securiti的 Trading σAST) system. Explicitly, for each order (trade), our sample

includes the time stamp to the nearest one hundredth second

,

stock code,

investorty阱, a buy-sell indicator, order (trade) si蜀, and limit (trade) price. Odd-lot and

bulk orders, separately drafted by the FAST, are excluded from our sample. The

corporate institutions are not professional investors and eliminated in the

following analyses. Therefore, the institutional investors in this paper only include

foreign investors, mutual fun品, and securities dealers. Our data cover 企om

2/912002 to 12/3112004, for a total of 580 tt'ading days. 3.2 Descriptive Statistics

Table 1 reports the descriptive statistics on trades and limit orders by each

investor group for the TSEC 50 stocks. The daily number of trades and 甘ading

volume are recorded in Panel A. First, individual investors are certainly main

participants. In terms of the average number of trades and trading volume, theirs

r缸1ks first and foreign investors' ranks second. For instance, the number of buy

trades and volume by individual investors are respectively 180,173 and 932,824

and account for 82.588% and 75.766% oftotal buy 仕泌的 andvolume. Those by

foreign investors respectively account for 13.338% and 17.239%.

Second, as reported in Panel B,位le pa位em of the number of limit orders

submitted by each type of investors is similar to that of trades. However, the order

size by iùdividuals is the smallest (7.98 =1206.623/151.179). As to foreign

investors, mutual funds, and securities dealers, their order sizes are 22.94, 61.68

and 55.52, respectively. The evidence further suggests that foreign investors are

likely to split their limit orders into smaller ones to camouflage their trades and

minimize possible price impacts, consistent with Chan and Lakonishok (1995),

Kyle (1985), and Chakravarty (2001).

Regarding the aggressiveness of the executed orders, we employ the

48 The Dynamic Anal)叫 olInvestors'Trading in the Taiwan Stock Market

for investors' demand for immediacy (e.g., Cooney, Van Ness, and Van Ness,

2003; Ranaldo, 2004). Higher submitted prices for buy limit orders (and lower prices for sell limit orders) should result in higher execution rates and shorter time

to execution. If the exe叫tion rate of orders by an investor is high or the time to

execution is short, he/she is likely to be impatient and acts as a liquidity demander.

Conversely, a value-motivated or patient trader, acting as liquidity provider, may

not be willing to trade until trading opportunities arise.

Reported in Panel C ofTable 1, the execution rate and the time to execution

of orders by professional institutions are respectively larger and shorter than those of individual investors. It follows that the professional institutions place orders in

a more aggressive way. Among professional institutions' orders, the execution

rate of mutual funds' orders is the highest while the time to execution of foreign

investors' orders is the shorte泣, indicating that foreign investors and mutual funds

are more impatient and willing to pay more to liquidity providers.5

5 One may question why the results measured by the execution rate 由ldthe time to execution for

foreign investors and mutual funds are con回dictory. From the angle of the execution ra妞,出e

limit- orders submitted by foreign investors are more aggressive; however, short time to

execution for the limit orders by mutual funds impli自由atthey are less patient. To solve the

mconslsten句,we attempt to examine the executed limit orders in more detail. First, we p盯tition

these orders into marketable and non-marketable limit orders,品 tobe defined in Section 4.2.1

In brief, since lhere is n自由era pre-trade period nor order informalion disseminaled before the

opening auction, we re且.ard the orders submitted before the opening 晶 the markelable limit

orders, if their buy (sell) prices are grealer (l自s) 曲曲 orequal to 血ecorresponding preceding

day's closing prices. After the opening auction, a marketable buy (sell) order is a limit order

whose limit price is grealer (lower) lh阻 orequal 10 the concurrent best offer (bid) price.

The u叮eported results show that, first, the executed marketable limit buy (sell) orders

submitted by foreign investors and mutual 臼nds respectively account for 52.9% and 51.1 %

(52.4% and 52.6%) of their own total limit buy (sell) orders. Hence, foreign investors and

mutual 如nds exhibit a similarity in the preference for marketable limit orders. Second, the observed buy (sell) order aggressiveness of foreign investors and mutual funds are respectively

0.0114 and 0.00354 (0.0112 個d0.0027), the inequality that is consistent with their observed 由c

time to execution. Overall, the two observations above show a better skill of mutual funds in

pricing non-marketable limit orders. Narnely, albeit mutual funds are relatively patient and

willing to wait a longer time, their submitted orders still can be executed. We 仰的cularlythank

Table 1

Descriptive Statistics

Buy Se1l

INDIs FIs MFs SOs INDIs FIs MFs SOs

Panel A: Trade data

Oaily no. oftrades (1000) 180.173 29.099 4.504 4.382 180.434 26.724 5.344 4.696 (82.588) (13.338) (2.065) (2.009) (83.074) (12.304) (2.460) (2.162) 932.824 212.249 42.606 43.509 945.767 193.615 42.737 43.644 Oaily trading volume (1000)

(75.766) (17.239) (3.461) (3.534) (77.157) (15.795) (3.487) (3.561) Panel B Order data

151.179 10.786 0.753 0.933 155.091 8.759 0.796 0.898 Oaily no. oforders (1000)

(92.379) (6.591) (0.460) (0.570) (93.686) (5.291) (0.481) (0.542)

Oaily order vo1ume (1000) 1206.623 247.458 46.443 51.797 1303.285 230.491 46.444 53.693 (77.730) (15.941) (2.992) (3.337) (79.765) (14.107) (2.843) (3.286)

Panel C Executed orders

Executionrate (%) 75.352 84.819 91.172 82.615 70.887 83.472 92.119 80.891

Time 個 execution(seconds) 826.887 347.341 504.526 552.280 758.941 354.439 496.958 509.726

Note: This table 間portsthe descrip叫vestatistics on trades 阻dlimit orders by each group of investors 五orthe TSEC 50 stocks. The ratios of the number ofbuy (se1l) trades by each investor type 個 thetotal b叫.y(se1l) trades and the trading volume to the total trading volume a間 reportedin parentheses. The average execution rate (%) oflimit orders by a given group ofinv自如rs18 研pressedas a percentage

of totallimit 叫dersby that give沮 groupof investors. The average time to execution is the average time of orders betw帥nbeing submitted and executed over the select叫“ocl曲, ignoring orders cancelled before execution. FIs, MFs, SOs, and INDIs stand for foreign investors, mutual funds, sec九1fitÎesdealers, and individual investors, respec地ively.

的

3E。

.

1?

h e=2

、

芯 片 趴~ 見。 』 趴CC、Jb D >....

心D50 The Dynamic Analysis oflnvestors 叮泊的ngin the Taiwan Stock Market

4.

Empirical Results4.1

Daily AnalysisEmploying trade data, this section examines the daily relation between

甘ading activities, concurrent retums, past retums, and institutional trading

persistence. It studies whether institutional trading activi旬, measured by the

institutional 甘ade imbalance, predicts daily stock retums as well. F or each stock, the 仕ade imbalance is defined as the difference between the buy and sell volumes

scaled by the daily trading volume.6 Then, for each day, we sort the TSEC 50

stocks equally into quintiles,企om low to high, based on the daily institutional

trade imbalance. With the five portfolios, we examine the institutional trade

imbalances and retums over the formation day (day 0) and the 5 days before

formation (days -1 toδ). Finally, we introduce a VAR analysis to examine the

lead-lag relation between stock retums and 仕adingactivities of each investor type

4.1.1 On The Basis ofInstitutional Trade Imbalance

'Table 2 reports 也e result耳, on the basis of institutional 仕ade imbalance.

First,由ere is a significantly positive contemporaneous relation between the

institutional trade imbalances and stock returns

,

consistent with Chiao and Lin(2004) and Chiao, Cheng, and Shao (2006). On day 0, the portfolio return is

monotonically increasing with the trade imbalance. The portfolio with the largest

institutional sell imbalances has a lower average return of -0.907%, whereas the

portfolio with the largest institutional buy imbalances yields 1.285%. The

differenc巳 between the highest and the lowest portfolios 但也) is 2.192% and significant at the 1 % level.

Second, institutional investors tend to engage in momentum 仕ading. The

returns over days -1 through -5 generally increase with the trade imbalance. For

the portfolio with the largest institutional selling imbalances on day 0, there is a

return “0.540% on day -1, whereas the portfolio with the highest net buy

imbalance yields 0.858%. The H-L return is 1.398% on day -1 and 0.569% on day

6 We also calculate the institutional trading imbalance in terms of the dollar trading volume and

Chiao Da Management Review Vol. 29 No. !, 2009 51

-2, clearly revealing the institutional positive-feedback trading tendency,

supporting Grinbla前, Titman, and Wermers (1995), Wermers (1999), and GHT

(2003). 切lird, pertaining to the persistent of institutional trade imbalances, we observe that the portfolio with the highest institutional trade imbalances on day 0

has significantly higher trade imbalances over days -1 to -5 as well, confirming

the persistence ofthe institutional 仕ading activity

Finally, the average daily correlation between the institutional and

individual 甘ade imbalances is -0.63. Although the 泌的tutional and individual

imbalances are not perfectly negatively correlated, it seems safe to make a

statement on the relation between individual trading and stock returns. That is, the

presumably negative contemporaneous relation between the individual trade imbalance and stock return preliminarily suggests that individuals behave as contrarian traders.

4.1.2 00 The Basis of Stock Return

Adopting a similar procedure to the one in 也e previous sub-section, we

divide the TSEC 50 stocks equally into quintiles based on daily return. For each

portfolio, the ratios of stocks for which institutions and individuals are net buyers

over day +1 (the day after formation) 的 drawn in Figure 2. Stocks wit11 the

highest daily stock returns are net bought with a probability of 67% by institutions

on day + 1, whereas the stocks wit11 the lowest returns are net bought only with a

probability of 37%. Conversely, individuals are more likely to net sell (buy) the

stocks wit11 the highest (lowest) daily stock returns. Therefore, even on the basis

of daily stock return, we still find that institutions (individuals) tend to be

山 公、2

Table 2

La~~ed Returns and Institutional Trade Imbalances for Portfolios ßased onlnstitutional Tradelmbalances Day -5 Day -4 Day -3 Day -2 Day -1 Day 0 Day -5 Day -4 Day -3 Day -2 Day -1 Day 0

1nstitutiona1 trade imba1ance (%)

HJFGHM 可 EER 』 Ehy 句目。\皆可 BEZ ‘ HVS 且骨肉 ssnMVEbw 吋勻。的持 pm 泊、再見 句 15.633 -6.286 -3.640 -2.281 -1.793 -1.061 -0.540" -0.907 (-7.260) (-12.259) -0.213" -0.374 (-3.162) (-5.261) Retum (%) Rank -0.137 (-1.846) -0.017 (-0.230) 0.021 (0.276) 0.056 (0.736) -0.047 (-0.675) 0.013 (0.187) 0.040 (0.579) 。 065 (0.932) L -4.811 -1.781 -1.089 -0 .455 -0.427 -0 .485 。 553 17.307 6.163 。 627 2.830 8.071 0.405 1.896 5.786 。 212 1.310 4.438 0.313 1.149 3.873 。 182 0.963 3.422 。 318 -0.007 (0.475) (-0.110) 。.362" 0.488 (5.318) (7.109) 0.858" 1.285 拿 (11.143) (17.842) 1.398" 2.192 (29.211) (47.082) 、, J. 、',壘,、 BJen 叮/ ζJny--J A 岫Tro 弓 J 勻, e 勻, BronwJAU O675 日 8 而 A -E1.4.fl OOL215L: (OCO(OO 0.047 (0.709) 。.149' (2.157) 0.274" (3.71) 。 291" (6.945) 0.079 (1.174) 0.067 (0.972) 2 。 118 (1.708) 。 211" (2.85) 。.1 90" (4.609) 0.101 (1.474) 。.149' (2.036) 0.093' (2.305) 3 4 H 32.940 14.357

Note: This table repo吋sthe lagged retums and institutional trade imbalances for portfolios based on institutional trade imbalances. For each trading day, the TSEC 50 stocks are divided into quintiles, from low to hi叭,based on the daily institutional trade imbalance. For each stock, institutional trade imbalance is the difference between the institutional buy and sell volumes for that day and scaled by the daily 伽ding volumes. We report the average of la銘ed and concurrent institutional trade imbalances and stock retums for each portfolio. The last row reports the difference between the highest and the lowest portfolios (H-L) for each variable. The I-ratios are reported in parentheses. " •• indicate significance at the 5% and 1 % levels, respectively

9.426 6.719

5.666 4.483

53

ChiaoDaManαgement Review Vol. 29 No. 1, 2009

Figure 2

Institutional and Individual Trade Imbalances on The Return-Based

Portfolios Over Day + 1

固 Individuals 區 Institutions 0.8 。 4 。 1 。 2 0.7 。 6 。 5 0.3 aoogaw 苟且 E 呵 ω-ue 扭 ωba 司的。晶晶叫偉 au 晶。。話徊。。但也也出 H 4 2 3 Return-based Portfolio L

。

For each trading day from 9/2/2002 to 12β112004, the TSEC 50 stocks are equally divided into quintiles, from 10w to high, based on their daily return. For each portfolio, the ratios of stocks for which institutions and individuals are net buyers over day + 1 are reported

4.1.3 Daily VARAnalysis

甘lÍs section will conduct a VAR analysis to explore the lead-lag relation

between 仕ade imbalances and stock returns on a daily basis. Because the TSE

change the members of the TSEC 50 once a quarter, we focus only on the stocks

that are in the TSEC 50 stocks throughout the whole sample period. There are

totally 34 stocks selected. Then, we ca1culate the daily returns, institutional and

individual trade imbalances for each stock. In order to extract the common

market-wide effec紹, these variables are subtracted by the equal-weighted TSEC

return, institutional trade imbalance, and individual trade imbalance,

respectively. Finally, for each stock, the following equations are estimated

The 勾mamicAnalysis olInvestors 'Trading 的 theTaiwan Stock Mar,岫 54 ) l ra 、、 Rt= 的 +

L

ß"

RRt (2)L=α1

+ Lßi.IRt-i +LÅiλ-j

+ LYi,

I Jt-i+ 丸,

(3)

A=αJ

+ Lßi,JRt-i + LÅi,J1t_i + LYi,JJtwhere Rt_i is the TSEC-50-adjusted retum at day -Î relative to time t and ιzmdJiz

are respectively the 叫justed institutional and individual trade imbalances at

day -Î. We present the cross-sectional averages of the coefficient estimates and

the percentages of stocks with significantly positive or negative coe伍cientsat the

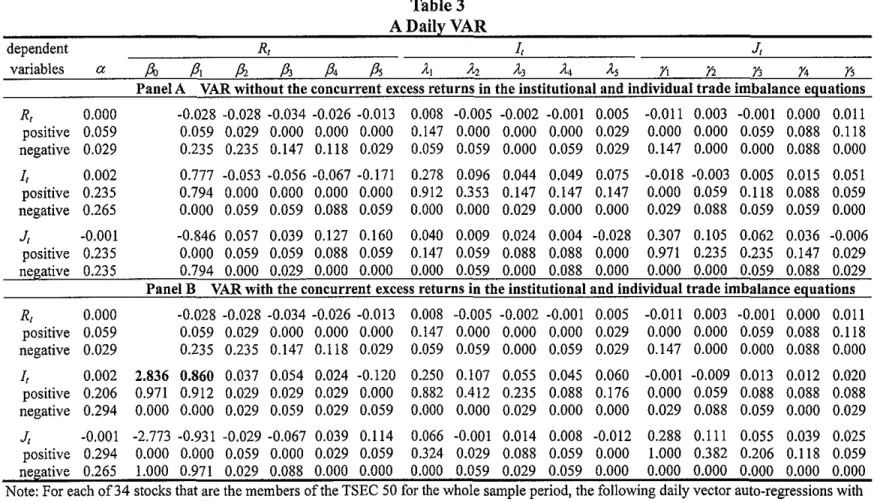

10% level in PanelA ofTable 3.

(individual) trade imbalances are positively

the previous day's retums. F or the institutional and

equations, equations (2) and (3), the average

coe宜icientson the previous day's retum are 0.777 and -0.846, respectively. There (79.4%) of stocks that have significantly positive (nergative)

coefficients at the 10% 1巳:vel. Although the institutional (individual) net buying

activity increases (decrease) with the previous day' s retum

,

the pa位.em reversesquickly, as shown by slightly negative (positive) coefficients on the day -2's to

day -5's retums. institutional related to First, (negatively) individual trade the imbalance 79.4% are

Second, institutional investors persistently trade in the same stocks for

several days, consistent with Sias and Starks (1997). The average coefficient on

the previous d旬's institutional trade imbalance is 0.278 and 91.2% of stocks have

a significantly positive coefficient. The coefficients on the day -2's to day -5's

institutional trade imbalances are sti11 positive. AIso, we find that individual trade

imbalances are positively related to their own past trade imbalances.

Third, th巳 institutional trade imbalance cannot predict daily

Although the average ∞efficient on the previous day' s institutional trade

imbalance in the retum equation (equation (1)) is 0.008, only 14.7% of stocks

have a signifiωntly positive coefficient. Additional1y, al1 ofthe lagged individual

Table 3 ADaily VAR

dependent R

,

L J,

variables G A βl ß, A ß4 A λ1 λg λ3 A λ5 y

,

Y2 均 月 丹Panel A VAR without the concurrent excess returns in the institutional and individual trade imbalance equations

R

,

0.000 -0.028 -0.028 -0.034 -0.026 -0.013 0.008 -0.005 -0.002 -0.001 0.005 -0.011 0.003 -0.001 0.000 0.011 positive 0.059 0.059 0.029 0.000 0.000 0.000 0.147 0.000 0.000 0.000 0.029 0.000 0.000 0.059 0.088 0.118 negative 0.029 。 .235 0.235 0.147 0.118 0.029 0.059 0.059 0.000 0.059 0.029 0.147 0.000 0.000 0.088 0.000 L 0.002 0.777 -0.053 -0.056 -0.067 -0.171 0.278 0.096 0.044 0.049 0.075 -0.018 -0.003 0.005 0.015 0.051 positive 0.235 0.794 0.000 0.000 0.000 0.000 0.912 0.353 0.147 0.147 0.147 0.000 0.059 0.118 0.088 0.059 negative 0.265 0.000 0.059 0.059 0.088 0.059 0.000 0.000 0.029 0.000 0.000 0.029 0.088 0.059 0.059 0.000 A -0.001 -0.846 0.057 0.039 0.127 0.160 0.040 0.009 0.024 0.004 -0.028 。 307 0.105 0.062 0.036 -0.006 positive 0.235 0.000 0.059 0.059 0.088 0.059 。 147 0.059 0.088 0.088 0.000 0.971 0.235 0.235 0.147 0.029 negative 0.235 0.794 0.000 0.029 0.000 0.000 0.000 0.059 0.000 0.088 0.000 0.000 0.000 0.059 0.088 0.029Panel B VAR with the concurrent excess returns in the institutional and individual trade imbalance equations

R

,

0.000 -0.028 -0.028 -0.034 -0.026 -0.013 0.008 -0.005 -0.002 -0.001 0.005 -0.011 0.003 -0.001 0.000 0.011 positive 0.059 0.059 0.029 0.000 0.000 0.000 。 .147 0.000 0.000 0.000 0.029 0.000 0.000 0.059 0.088 0.118 negative 0.029 。 235 0.235 0.147 0.118 0.029 0.059 0.059 0.000 0.059 0.029 0.147 0.000 0.000 0.088 0.000 L 0.002 2.836 0.860 0.037 0.054 0.024 -0.120 0.250 0.107 0.055 0.045 0.060 -0.001 -0.009 0.013 0.012 0.020 positive 0.206 0.971 0.912 0.029 0.029 0.029 0.000 。 .882 0.412 0.235 0.088 0.176 0.000 0.059 0.088 0.088 0.088 negative 0.294 0.000 0.000 0.029 0.059 0.029 0.059 0.000 0.000 0.029 0.000 0.000 0.029 0.088 0.059 0.000 0.029 A -0.001 -2.773 -0.931 -0.029 -0.067 0.039 0.114 0.066 -0.001 0.014 0.008 -0.012 0.288 0.111 0.055 0.039 0.025 positive 0.294 0.000 0.000 0.059 0.000 0.029 0.059 0.324 0.029 0.088 0.059 0.000 1.000 0.382 0.206 0.118 0.059 negative 0.265 1.000 0.971 0.029 0.088 0.000 0.000 0.000 0.059 0.029 0.059 0.000 0.000 0.000 0.000 0.000 0.00。Note: For each of34 stocks that are the members ofthe TSEC 50 for the whole s缸npleperiod

,

the following daily vector auto-regressions with5 lags are estimated

的

F NZ。

b ~i;;'電告、

EN F 、N2 。見 』 趴E河旦J D v> υ、v.

。、

Rg= 的 +I 丸.RR'_i + 主 λi.R1'_1 + LYi.RJ'-i + ð,仙

It=α/+ 主ßuRt-i + 乏人 [l[-j + 主叭,叫 p'

Jr=αJ + I ßi,JRH + IÂi

,

J1'_i + Iri,

JJH + 系,J MJFmNM宮。 ENbhEYM 切』芷若 EEE ‘ HVGKE 岫宮志的 MER 宅 S 勻。 &hhR 』E

where R'_i is the adjusted return at day -i andζi and J1-l.lre the a句ustedinstitutional and individual trade imbalance at day -i, r自:pectively,These three variables are adjusted by separately subtracting the equal-weighted average over the stocks comprising the TSEC 50 stocks for the corresponding day, This table reports the cross-sectional averages of the coefficient estimates, and the percentage of stocks with positive and

Chiao Da Manag凹'11ent Reviel伊始l.29 No. 1, 2009 57

trade imbalance coefficients are close to 0 and less than 12% of the coefficients

are significant at the 10% level. Therefore, consistent with the finding from

Odean (1999), there is no clear evidence that the past individual trade imbalance

forecast daily returns.

In order to compare 也e contemporaneous relation between stock retums

and 甘le institutional trade imbalances with the effect of the lagged retums on the

institutional trade imbalances

,

we propose a structural VAR including thecontemporaneous returns as an independent variable in the institutional and

individual 仕adeimbalance equations, (2) and (3), respectively (GHT, 2003). From

Panel B ofTable 3, we observe that the contemporaneous relation is stronger than

the relation between the lagged returns and the institutional trade imbalances. In

institutional trade imbalance equation, the average coe旺icient on the concurrent

retum is 2.836 and larger than the average coefficient on the lagged one-period

retum (0.860), shown in bold. Mor,∞ver, up to 97.1% of stocks have a

significant1y positive coefficient on the concurrent retum at the 10% level.

According to the related literature, this strong daily contemporaneous

relation may arise 企omprice pressure 企ominstitutional trading (French and Roll,

1986; 由此ravar旬, 2001), positive-feedback tendency (GHT, 2003), or

forecasting capability (Wermers, 1999; Grinblatt and Titman, 1993; Nofsinger

andS悶, 1999; Cho巴, Kho, and Stulz, 2005). Thanks to the richness of our data,

the next sub-section will apply an intraday analysis to justify the three possibilities.

4.2 Intraday Analysis

We intend to explore several competing explanations for the strong daily contemporaneous relation between imbalances and retums in the following ways

similar to those proposed by GHT. First, we use an intraday V AR analysis to

disclose the time-series properties of the order imbalances and retums. Secon吐,

we examine retums and order imbalances surrounding extreme institutional and individual order imbalances events as well as extreme retums.

In the intraday analysis similar to the previous daily analysis, we only focus

58 The Dynamic Analysis 01 Investors' Trading in the Taiwan Slock Market

period. Each trading day is divided into 54 five-minute intervals from 9:00 a.m. to

1:30 p.m. For each selected stock, we calculate the institutional and individual

order imbalances and use the trade prices to compute the returns over intervals.7

One major difference 企'om the approach proposed by GHT (2003) results

企omthe employed data. Because the TSE is an order-driven market where stock

prices are purely driven by order flows, this sub-section uses limit-order data

rather than 仕adedata. Thereby, we can expect to leam mor巴 abouthow the trading

intentions of investors affect short-term price movements, from the angle of order

submission behavior.

Generally speaking

,

investors seeking immediacy tend to submit ordersmore aggressively and exert more pr.臼sure on stock prices. However, unlike

limit-order data, trade data act as 血e ex-post realizations rather than the ex-ante

intentions of investors because execution prices may not be equal to the submitted

order prices. More importantly, trade data cannot cover the part oflimit orders not

executed. Therefore, comp紅巴dto trade data, limit-order data capture more clearly

the timing and strength with which the orders by investors move the stock prices

Furthermore, we adopt the method advanced by Chiao, Wang, and Lai (2007) and

analyze the imbalances of orders that seek immediacy, i.e., market且.ble limit

orders, to measure the extent to which trading activities immediately impact the

stock prices.

4.2.1 Order Imbalances

Order imbalances

,

often indicating private information,

could reduceliquidity at least temporarily and move the market price permanently. A positive

order imbalance signals the prevalence of demanders, engendering an upward

price pressure, a positive 伽nsitory volatili紗,and a tighter spread (Ranaldo, 2004).

Blume, MacKinley, and Terker (1989) argue that 品的 isa strong relation between

order imbalances and stock price movements, in the analyses of both time series

and cross sections.

Nevertheless, a total order imbalance 一- total buy orders less total sell

orders - may fail to provide an unambiguous association between investors'

Chiao Da Management Review Vol. 29 No. 1, 2009 59

order submission behaviors and the price impact. For instance, under the rule of

the single-price opening auction, the buy (sell) orders with very low (high)

submitted prices would not impact the concurrent stock prices. In order to

distinguish the orders that can effectively and immediately move stock prices, this

sub旬sectionanalyzes the imbalance ofmarki巴tablelimit orders

Like prior studies (e.g., Lee et al., 2004; Peterson and Sirri, 2002), a

marketable limit order is a buy (sell) limit ord巳r that is immediately executable

upon its receipt if the limit price is greater (lower) than or equal to a benchmark

price. Before the opening auction, no order information is disseminated;

afterwards information pe由ining to the limit order book (包r upω 卸的 est bid

and ask queues) 的 disseminated to the public on a real-time basis. From the

standpoint of investors, before the opening auction, the benchmark price of a

selected stock is defined as its ciosing price on the preceding 伽ding day (Chi帥,

Wang, and L訓, 2007). For a buy (sell) limit order submitted afterwards, the

benchmark price is assigned to the prevailing best ask (bid) price. Traders seeking

immediacy tend to use the marketable limit orders, while patient traders submit

non-marketable limit orders 4.2.2 Intraday VAR Analysis

In the intraday analysis, we calculate the returns and institutional and

individual order imbalances during each interval for each stock. The institutional

(individual) order imbalance is defined as the difference between the institutional (individual) marketable buy and selllimit orders for that 5-minute interval scaled

by the daily order volume.8 In order to control for common market-wide effec俗,

these variables are subtracted by the equal-weighted TSEC 50 re仙rn,institutional

or individual order imbalance, respectively. Then, the following equations are

estimated for each stock

8 Marsh and Rock (1986) find that the price impact of order imbalances varies with the stock sizes

F or instance, given 由e 10,000 of order imbalances, the larger stocks with deeper depths will

60 The Dynamic Analysis oflnvestors 'Trading in the Taiwan Stock 且也rket

Rr

zαR

+

Lßi,

RR,

-i+

L Å.i,

R1,

-i+ 乏丸,叫 i+ 系,R'

(4)Ir=α[

+ Lßi,lR'-i + L Å.i,

[It-i + LYi,

[Jt-i + 0,,[

(5)久 =αJ+ L ßi,JR (6)

where R'_i is the adjusted return at interval -Î and It_i and Jt_i are respectively the

a吐justed institutional and individual order imbalance at interval -Î. To avoid

crossing day boundaries for the lagged returns and order imbalances, the first half

hour of each trading day(9:00 a.m. ~ 9:30 a.m.) is excluded 企'om the analysis.

There are tot耳lly48 five-minute intervals for each tradingday. Table 4 reports 也e

cross-sectional averages of the coefficient estimates 組 dthe percentages of stocks

with significantly positive or negative coefficients at the 10% level.

Panel A of Table 4 reveals several interesting findings. F irst, the

institutional order imbalances are positively related to the past returns. The

average coefficient on the lagged one-period return is 0.110 and 73.5% of stocks

having a significant coefficient. There are at least 32.4% of stocks with a

signifiωntly positive coefficient on the lagged three-period returns, the

institutional positive-feedback s甘ategy that lends support to GHT (2003) but is

inconsistent with Nofsinger and Sias (1999).

Second, the institutional order submission behaviors are persistent since the

institutional order imbalances are positively autocorrelated. F or instance, the

average coe伍cient on the lagged one-period institutional order imbalance in

equation (5) is 0.120 and all of stocks have statistically significant coefficients

τbis is possibly because institutional investors tend to split their large orders to

smaller ones so as to camoutlage their 仕ades to minimize possible price impacts

(Chan and Lakonishok

,

1995; Admati and Ptleiderer,

1988). However,

thefindings is contrary to those by GHT (2003) who find that the institutional order imbalance is negatively related to the lagged own one-period order imbalance but

dependent variables α R

,

ß, j3, ß4 ß,

Table 4 An Intraday VAR L ß6-<,

-<,

λ3 ,t, Âs 7名 J,

1'3 Y4ßo

ß,

A y,

y, 丹 PanelA R,

0.000Vl\.R without the concurr四lt 阻cessretnrns in the institutional and individual order imbalanc海 equations

-0.38 -0.24 -0.15 -0.11 -0.06 -0.04 0.070 0 日 20 0.020 0.010 0.000 0.000 0.1700.0300.0200.0200.0100.010 0 0 0 0 0 0 0.000 0.000 0.000 0.000 0.000 0.000 0.941 0.441 0.412 0.176 0.088 0.029 1.0000.8530.7650.5590.5590.294 1.000 1.000 1.000 1.000 1.000 1.000 0.000 0.029 0.000 0.118 0.029 0.176 0.0000.0000.0000.0000.0000.000 positive 0.176 negative 0.176 1

,

0.000 positive 0.294 negative 0.235 J,

0.000 。 .110 0.040 0.020 0.010 0.000 0.000 0.7350.412 0.324 0.147 0.235 0.118 0.0290.0290.0590.1180.088 0.059 0.220 0.120 -0.09 -0.05 -0.03 -0.01o

0 0 0 0.971 1.000 0.000 0.000 0.000 0.000 0.029 0.000 1.000 0.824 0.588 0.294 。 .120 0.020 0.020 0.010 0.000 0.020 0.0300.0100.0100.0000.0000.000 1.000 0.735 0.529 0.235 0.147 0.294 0.6760.1180.0880.0880.0290.059 0.000 0.000 0.029 0.118 0.059 0.059 0.0290.0590.0290.0590.0000.029 0.0000.000 0.000 -0.01 -0.01 -0.01 0.1800.1200.0200.0200.0100.000 0 0 0 0.176 0.000 0.088 0.029 0.000 0.029 1.000 0.706 0.529 0.529 0.2940.000 0.118 0.147 0.059 0.088 0.206 0.147 0.0000.0000.0000.0000.0000.029 positive 0.265 些昆虫已型豆P'anel B VAR with the concurrent exc曲sreturns in the institutional and individual order imbalance equations

R

,

0.000 -0.38 -0.24 -0.15 -0.11 -0.06 -0.04 0.070 0.020 0.020 0.010 0.000 0.000 0.1700.0300.0200.0200.0100.010 0 0 0 0 0 0 positive 0.176 0.000 0.000 0.000 0.000 0.000 0.000 0.941 0.441 0.412 0.176 0.088 0.029 1.0000.8530.7650.5590.5590.294 negative 0.176 1.000 1.000 1.000 1.000 1.000 1.000 0.000 0.029 0.000 0.118 0.029 0.176 0.0000.0000.0000.0000.0000.000 1,

0.000 0.530 0.080 0.080 0.050 0.050 0.030 0.020 0.080 0.030 0.000 0.020 0.000 0.020 -0.05 0.000 -0.01 -0.01 -0.01 0.000o

0 0 0 positive 0.294 1.000 0.706 0.882 0.735 0.676 0.618 0.559 1.000 0.853 0.059 0.882 0.000 0.618 0.0000.0590.0000.0590且 000.029 negative 0.235 0.000 0.029 0.000 0.000 0.000 0.000 0.000 0.000 0.000 0.059 0.029 0.029 0.000 0.7350.2350.2350.1180.2060.088 J, 0.000 0.540 -0.01 0.000 -0.01 0.000 -0.01 .0.010 -0.04 -0.02 -0.01 -0.01 -0.01 -0.01 0.1000.0400.0200.0200.0000.000o

0 0 0 0 0 0 0 0 positive 0.235 1.000 0.265 0.235 0.118 0.265 0.088 0.265 0.000 0.000 0.029 0.000 0.000 0.029 1.0000.9120.735 0.5880.1470.000 negative 0.294 0.000 0.471 0.294 0.412 0.235 0.206 0.118 0.529 0.294 0.088 0.118 0.206 0.118 0.0000.0000.0590.1180.0000.176Note: For each of34 stocks that are the rnernbers ofthe TSEC 50 for the who1e sarnple pe口的 d,the following d副ly v自岫rauto-regressions with

6 lags are estimated

的甘心。 bhN 〉 KSRM 岫 nESNhs 宮、 FrhhE 宅。 iFN-bE "、

-o、 N Rf ;::::.aR + 乏 β'i.RRr-i + 主 λ"ι 1

,

= a,

+L,

ß'

,1RH + L, λ;,1 11_1 + Lri,I九 J, = a,

+L,

ß"

,

R,_, +L,

Â",

IH + L, y" ,J,刊+伐" 泣。均可 EERhEY 背曳 HERE2. 旬之 5 個吉普白宮。這句一。已是堅宮where R,.; is the adjusted 間turnat interval -i andιand .!,';J.fe respect附lythe adjusted institutional and individual order imbalance at interval -i,

These three variables are adjusted by separately subtracting the equal-weighted average over the stocks comprising the TSEC 50 stocks for the corresponding 5-minute interval. The institutional (individual) order imbalance is the difference between the institutional (individual) marketable buy and selllimit orders scaled by the daily order volumes 必rthat 5-minute interval. For limit orders placed prior to the opening, a marketable limit order is a buy (sell) limit order whose price is greater (lower) than or equal to the corresponding closing price on the preceding trading day. For the orders submitted after the opening, a marketable limit order is a buy (sell) limit order whose price is greater (lower) than or equal to the prevailing best offer (bid) To avoid crossing day boundaries for lagged retums and or甘erimbalances, the first half hour of each trading day is excluded from the analysis. This table reports the cross-sectional averages of the coefficient estimates and the percentage of stocks with positive and negative coefficients that are significantly different from 0 at the 10% level

Chiao Da Management R目前vVol. 29 No. 1, 2009 63

positively related ωthe lagged own two-period to six-period order imbalances for

the NASDAQ100 stocks. This difference may result from the microstructure of

NASDAQ that the market makers tend to smooth inventory around block 仕adesto

control inventory risk (Reiss and Wemer, 1998). Conversely, the TSE is a p前ely

order-driven market without designated market makers, so our results are immune

from the inventory effect. Moreover, we observe that individuals tend to herd

across 仕ading days. Even for 甘le lagged four-period individual order imbalance,

more than 52% of stocks have a significantly positive coe宜icient.

Third, both the institutional and individual order imbalances are positively

related to the future returns

,

and the relation is s甘ongestfor the lagged one period.In the retum equation (equation (4)), for 94.1% (100%) ofthe stocks, the lagged

one-period institutional (individual) order imbalances exert a significantly

positive influence on the concurrent retums. Finally, there is no clear evidence

that the lead-lag relation between institutional and individual order imbalances

exists. For instance, the average coefficients on the lagged institutional order

imbalances in individual order imbalance equation (equation (ô)) 訂巳 close to 0

and there are only a few stocks with significant coefficients

4.2.3 Intraday Event study

To emphasize the timing at which the order imbalances by each investor

type take place, this section will pay atiention to the five-minute periods of order

imbalances and stock retums surrounding events of intensive 加ding or ex仕eme

retum.

(1) Events ofExtreme Institutional Order Imbalance

We first seek to examine all investors' order imbalances and retums around the events of extreme institutional order imbalance. We divide each trading day

into 54 five-minute intervals 企om 9:00 a.m. to 1:30 p.m. There are totally 24,360

intervals for each stock. Around 20% of them一 the 2

,4

36 intervals of the largestand the smallest institutional order imbalances, separately- are then selected for

each stock. This application is essentially similar to that of GHT (2003). To avoid

crossing daily boundaries while examining intervals -6 to +6, the events starts

64 The Dynamic Analysis of Investors' Trading in the Taiwan Stock Market

Figure 3 plots the cumulative average retums and institutional and individual order imbalances for the thirty-minute periods (-6 to +6) sUITounding the events of the extreme institutional order imbalances,

Figure 3

Intraday Returns and Order Imbalances Around The 5-1\位nute

Intervals of Extreme Ins組組組onalOrder Imbalances

Panel A Top 20% intervals of the largest institntional bny order imbalances 0.6 c - lnstitutional order imbalance

,

1.2區噩噩Individualorder imbal祖ce

。 5 哼一t 印血咖ve re恤 0.4 0.8 0.3 0.2 。 1 0.2

。

。

-0.1 -0.2 -6 -5 -4 -3 -2 -1 0 1 2 3 4 5 6Panel B Top 20% intervals of the largest institntional sell order imbalances

[問Jr

1""

,1""

,rLJEiii

d

t

。

-0.1 r- .. ---.~ _ . - - ~ -j -0.1 。.2 ←?\ .

。.3kB

l …恥 !l43

-j -0.4 -0.5 J -0.5 -6 -5 -4-3

-2。

1 23

4 5 6Chiao Da Management Review Vol. 29 No. !, 2009 65

Each trading day is divided into 54 five-minute intervals from 9:00 a.m. to 1:30 p.m. For each interval, the return and order imbalance are computed for each ofthe 34 stocks that is a member of the TSEC 50 throughout the sample period from 2/9/2002 to 31112/2004 訂單 institutional

(individual) order imbalance for each stock is the di宜èrence between the institutional (individual) marketable buy and seII limit orders scaled by the order volumes of the sarne stock over the trading day for that 5-minute interval. There are totaIIy 24,360 intervals for each stock. Around 20% of them-the 2436 intervals of the largest and the smaIIest institutional order imbalances, separately-are then selected. To avoid crossing day boundaries while exarninin皂, the events are selected from the 7也 interval(9:30-9:35 a.m.) through the 48th interval (12:55-1 :00 p.m.)

Panel A of Figure 3 examines the activities around the events of the largest institutional buy imbalances. Before extreme institutional buy imbalances, the individual investors' order imbalances are smaI1 and negative for intervals -6 to -2 whereas institutional net buying activity is persistent. Therefore, stock pric巴:s are pushed up graduaI1y and the retums range 企om 0.06% to 0.09% in each ofthe six 5-minute intervals preceding the event. It indicates that institutional investors demonstrate cIear positive-feedback trading pattems, consistent with the preceding intraday VAR results.

Unlike the observations documented by GHT (2003), the retum over interval 0 (0.30%) is significant and quite distinguishable. Not until interval -1, individual investors start to net buy 甘leTSEC 50 stocks. Over interval 0, the order imbalances by institutional and individual investors reach the top simultaneously, moving the 5-minute retum to its peak. The institutional order imbalances are 3 times more than the individual order imbalances over interval O. It is clear that the order imbalances by institutions are the main driving force of the concurrent retums and, to a less extent, investors also plays a role. After interval 0,

institutions continu巴 to net buy with smaI1er scales while individual investors switch to net seI1 those stocks. The retums are relatively smaI1 with a cumulative 30-minute retum ofO.08% only

In Panel B ofFigure 3, the retum pattem and trading activities looks mirror reflections of those demonstrated in Panel A. Institutional investors tend to persistently net seII the TSEC 50 stocks over the entire I3 five-minute intervals The order imbalances by individual investors, on the other hand, are cIose to 0 in alI intervals except interval O. The cumulative retums over intervals [-6, -1] and [+ 1, +6] are -0.16% and -0.08%, respectively. Institutions and individuals

66 The Dynamic Analysis olInvestors' Trading 的 theTaiwan Stock Market

simultaneously net sell the selected stocks over interval 0 with a return of -0.24%.

We sti11 find that the institutional order imbalance is the main driving force of the

concurrent return

(2) Events of Extreme Individual Order Imbalance

Figure 4 draws the 仕ading activities surrounding the extreme individual order

imbalances. The cumulative returns over interval [-6, -1] are 0.310% and 0.044%,

的 shown in Panels A and B, respectively. 官le difference in cumulative returns

(0.266%) is significant at the 1 % level, implying that individual investors submit

more marketable buy (sell) limit orders before stock prices soars (plungès). The

institutional investors also net buy the selected stocks on a small scale over

interval O. The return over this period is 0.36% and larger than the return over

interval 0 with the largest institutional buy imbalance, as drawn in Panel A 甘11S

is perhaps because individual investors are the main market participants, as

reported in Table 2, and play an important role in moving stock prices. The

cumulative return over interval [+ 1, +6] is almost zero.

(3) Events of Extreme Return

In the preceding sub-sections, we have learned 也e intraday linkage 企om

the order imbalances by each investor type to the short-terrn returns on the TSEC

50 stocks. To understand in more detai! whether individual and institutional

trading activities forecast,合lV巴, or follow stock returns, we select the top 10%

five-minute intervals separately with the largest and the smallest returns for each

stock, and then examine institutional and individual trading activities over the

thirty minutes surrounding the events.

Panels A and B of Figure 5 plot the trading activities around the events of the

largest and the smallest returns, respectively. In general, the stock prices move

little prior to interval 0 and the order imbalances by all investors are rather small.

Not until interval -1, the institutional and individual investors simultaneously act

as net buyers and push up the stock prices by 0.066%. Following interval 0,

institutional investors still persistently net buy those stocks but individual

investors st訂t to net sell stocks and the stock prices start to fall. Noteworthy is

that, the trading directions of institutional investors are opposite to those of

Chiao Da Management Review 均1.29 No. 1, 2009 67

Figure 4

Intraday Returns And Order Imbalances Around The 5-Minute lutervals of Extreme Individual Order imBalances

Panel A Top 20% intervals ofthe largest indi吋dualbuy order imbalances

。 8 _lnstitutional order imbalance

區墨璽 lndividual order imbalance //,Ã_企~ι由

一念一 Cmnulativereturn ~ 于官聖哲 / / 位主 。。 ro4. 弓, h Aυnυnunυ 11titil--→ liIlli--1iIJ 「 4 月 SEZEESEδ 。 6 。 4 。 2 全~

。

。

-6 -5 -4 2 3 4 5 6 -0.2 -0.2Panel B Top 20% intervals of the largest indi吋dnalsell order i血balances

串串串 CR

,It ,1,

L.

,

1

,. ,. '. ,.

。自圓圓凶個層…『臼『可『臼b;, ! . " " " .~Uo\是L

æ

~ ~

-0.2 ( 法 ) Eω

a M J-04自04L

Ji

EE D G -0.6 •i。品i ~

-0.6告。

δ

E -0.8 L ~ -0.8 -6 -5 -4 -3 -2 。 2 3 4 5 6Each trading day is divided into 54 five-minute intervals from 9:00 a.m. to 1:30 p.m. For each

interval, the retum and order imbalance are computed for each ofthe 34 stocks 由atis a member of

the TSEC 50 throu的out the sarnple period from 2/9/2002 to 31112/2004. The institutional

(individual) order imbalance for each stock is the difference betwe聞出einstitutional (individual)

68 The Dynamic Analysis olInvestors' 卦。dingin the Taiwan Stock Market

甘ading day for that 5-minute interval. There are totally 24,360 intervals for each stock. Around 20% of 也em-the 2436 intervals of 也e largest and the smallest individual order imbalances,

sep缸ately 一缸'ethen selected. To avoid crossing day boundaries while ex缸nini嗯.the even臼缸C

se!ected from the 7血 interva!(9:30-9:35 a.m.) through the 4日thinterva! (12:55-1 :00 p.m.).

rather limited, the cumulative returns over intervals [-6, -1] and [+ 1, +6] are only

0.006% and 0.104%

,

respectively.The returns over interval 0 reported in Panels A and B are 0.586% and

-0.515%, respectively. It is obvious that th巴 order imbalances by individual

investors are the main driving force of the ex仕eme returns whereas institutional

trading activities still have an impact on stock prices. For example

,

in Panel A,

albeit both institutions and individuals are net buyers, the order imbalance by

individual investors (0.294%) more than doubles that by institutional investors

(0.146%). In addition, the results 企'om the intraday event-study show that the

extreme institutional order imbalances engender price pressure and have li社Ie

ability to forecast subsequent stock price movements. The stock prices move more

when the trading direction of individuals is in line with that of institutions. Our

results con仕adict the observation for NASDAQ by GHT (2003) who find that

prices move little in the 5-minute interval with large individual order imbalances.

Particularly note th前, despite that the intraday V AR results in Panel A of

Table 4 show that institutional order imbalances are positively related to the next

5-minute returns

,

Panels A and B of Figure 5 reveal that the returns following theextreme events are relatively smaller and close to O. Therefore, there is no

consistent evidence that the institutional order imbalances can predict future 30-minite returns.

Given the inconsistency observed above, one may wonder what driving

force makes the positive correlation between institutional order imbalances and the stock returns on the same day. Is it the positive-feedback tendency or the price

impact? To answer this question

,

we estimate regressions similar to those in PanelA of Table 4, except that the concurrent returns are additionally included for the

Chiao Da Management Review Vol. 29 No. 1, 2009 69

Figure5

Intraday Returns And Order Imbalances Around The 5-Minute Intervals ofExtreme Returns

0.4

Panel A Top 20% intervals of the extreme positive returns

圓圓圓 InstitutionuaIorder imbalance

監翠皇宮Individualorder imbalance

一傘一 Cumulativereturn 0.8 。 6 0.3 (法 )BE 苟且自己 ω 宮。 0.4 。 2 0.1 0.2 。 }崗藍E 呵EJ~I~ 圖【 L唔,-圓圓腎。闢圓圓 -6 -5 -4 -3 -2" -1 0

PanelB Top 20% intervals ofthe ex甘'emenegative returns

O K 金 l 嚕一述自γ這金1團 l

•

l.

電壓

• • • 色品 -0.1 f 至三 -0.2 -0.2 r ]ω

o E E \關 J企----A_ _ _ 一一一企---A~-1 -0.4。 3

I

i

弓-1 -0.6 。 4 L υJ -0.8 可6 -5 4 -3 -2 。 2 3 4 5 6Each 甘adingday is divided into 54 five-minute intervals from 9:00 a.m. to 1 :30 p.m. For each

interval, the return and order imbalance 缸ecomputed for each ofthe 34 stocks that is a member of

也e TSEC 50 throughout the sample period from 2/9/2002 to 31112/2004. The institutional

(individual) order imbalance for each stock is the di旺erencebetween the institutional (individual)

marketable buy and sell limit orders scaled by the order volumes of the same stock over the

trading day for that 5-minute interval. There are totally 24,360 intervaIs for each stock. Around

20% of them -the 2436 intervals of the largest 缸,d the smallest retums, separately-are then

selected. To avoid crossing day boundaries while exarnining, the events are selected from the 7th

interval (9:30-9:35 a.m.) through the 48th

70 TheL沙namicAnalysis olInvestors' Trading in the Taiwan Stock Market

First, the contemporaneous relation is stronger than the relation between the

lagged one自period returns and institutional order imbalances. In the institutional

order imbalance equation, the average coefficient on the concurrent retum is

0.530, shown in bold, and larger than the average coefficient on the lagged

one-period retum 0.080. Second, all stocks have significantly positive coefficients

on the concurrent return at the 10% level. It indicates that, although the

institutional trading positively follows the past intraday retums

,

the positivecontemporaneous relation is largely driven by the price pressure from the

concurrent institutional order submissions. These results support Sias, Starks, and

Titman (2001) that the price impact of institutional buys is not 0位et by that of

non-institutional sells.

4.3 Post-Formation Returns

If buying (selling) activity by positive-feedback 仕aders moves prices

beyond the fundam巴ntal values of stocks, then the activity has a destabilizing

effect on stock prices. Nevertheless, it is also possible that those traders can move

prices towards fundamentals if interring useful inforrnation 企om other traders

(Bikhchandani et al., 1992; Hong and Stein, 1999). In this section, we will

examine whether institutional trading activities contribute to the process of incorporating inforrnation into stock prices.

We adopt the ideas proposed by Werrners (1999) and GHT (2003), arguing

that one obvious testable implication of destabilization is that excessive

institutional net trades will be followed by stock price reversals, if the effect of

positive-feedback trading is transitory; otherwise, the traders are inforrned and the

price adjustments could be accelerated and long-lasting. To justify whether the

effect is transitory or long-lasting, we first follow the procedures similar to those

in the daily analysis to examine retums on the quintiles based on the institutional trade imbalances over the 5 days after forrnation.

Table 5 reports the post-forrnation retums. [+1, +5] represents the 5-day

cumulative return after forrnation. On day + 1, there is a monotonic relation

between stock retum and the order imbalance. The stocks with the largest

Chiao Da Management Review 101. 29 No. 1, 2009 71

on stocks with the largest institutional buying activity is 0.355%. However

,

thestock prices start to reverse 企om day +2. The difference in the day +2's returns

between the high的t and the lowest institutional trade imbalances portfolios is

-0.121 % and significant at the 1% level.在le cumulative-retum difference over

[+ 1, +5] between the two quintiles reduces to 0.007% and insignificant. In sum,

our results show that institutional trading activities only have temporary information content and have limited contribution to process of incorporating information into stock prices.

Table 5

Post-Formation Returns

portfolio Post-Formation Retums (%)

Day+l Day+2 Day+3 Day+4 Day+5 [+1,+5]

L 。 123 0.142 0.163' 0.149' 。 142 0.474" (-1.668) (1.950) (2.199) (2.058) (1.914) (2.868) 2 0.011 。.133 。.106 0.097 0.100 0.448" (0.163) (1.855) (1.495) (1.381) (1.439) (2.838) 3 (1.30.090 0.096 0.069 。 126 0.056 0.441 艸 54) (1.455) (1.03) (1.849) (0.848) (2 日 68) 4 。 123 0.060 0.090 0.018 0.088 0.384' (1.852) (0.867) (1.357) (0.283) (1.324) (2.496) H 0.355" 0.021 。.016 0.062 。 036 0.482" (4.845) (0.296) (0.222) (0.84) (0.486) (3.124) H-L 0.478" -0.121" -0.147" -0.087' -0.107' 。 .007 (10.750) (-2.645) (-3.297) (-1.978) (-2.510) (0.078)

Note: This table reports the 阻turnsover the 5 days after formation for the 5 portfolios based on the

i nstitutional trade imbalance. For each trading day, the TSEC 50 stocks are divided into

quintiles, from low to hi叭, based on the daily institutional trade imbalance. The average

stock returns for each portfolio are reported. The last row reports tM difference between the

higbest and the lowest portfolios (H-L). The t-ratios are reported in parentheses. [+1, +5]

represents 也e5-day cumulative returns 弋..indicate significance at the 5% and 1 % levels,

respectively.

4.4 Robustness Test

Even among institutions, their trading strategi巳s could be substantially

different (Dennis and Strickland, 2002; Grinblatt, Titman, and Wermers, 1995;