論文 ID: 075

Open Banking: A Case Study for Open API Economy

Ku-Hsien Hsieh, NCCU Ph.D. Candidates 103356506@nccu.edu.tw

Abstract

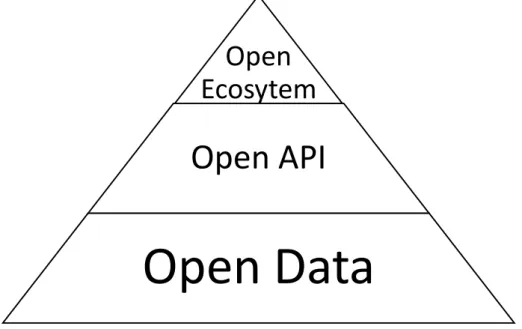

Openness is a movement toward creating a more effective ecosystem regardless this ecosystem is different type of entity such as a government or the industry. Basically, the openness can be three levels: open data, open API, open ecosystem. From the previous research, the study had identified the movement of open data to open API in Taiwan government. This research will focus the movement from open API to open ecosystem and uses Taiwan financial industry as the case study. This study finds the success open economy is an API economy and successful API economy is the cross-domain collaboration, which the participants collaborate together to create better marketplace.

Open Banking: A Case Study for Open API Economy

I. Introduction

Open access to government data has become the global movement to improve the government efficiency. In 2011, the United Nations had issued guidelines for open data program for the purpose of transparency and citizen services. (UN, 2013) By 2013, more than 95 nations had adopted the open government date initiative and had provide the portal for the government open data. However, the open government date movement is not stopped at this stage. According the open government data stage model, Stage 3 and 4 is the integration of government data with non-government formal data. (Kalampokis, 2011) Since more non-government is mostly in JSON format instead the XML, XLS or CSV format, REST API become better data access channel that provide the real time data access.

The API economy is the ecosystem that business or society benefit from the data transactions that are enabled by APIs. So, both government and business are benefit with this real time data exchange. One of the reason why the API economy has grown is due to the simpler data exchange standard such as REST (Representational State Transfer) protocol based on web-based technology. Using REST protocol, data can be exchange using JSON (JavaScript Object Notation) format. Such light weighted data transfer standard had transfer the Open Data to Open API and help Open Ecosystem.

Figure 1 – Open Ecosystem Stages

Open

Ecosytem

Open API

II. Open Banking Development

According to UK Open Banking Working Group, Open banking is a financial services term as part of financial technology that refers to: (UK Open Banking Group, 2017)

1. The use of open APIs that enable third-party developers to build applications and services around the financial institution.

2. Greater financial transparency options for account holders ranging from open data to private data.

3. The use of open-source technology to achieve the above.

Open banking is one of the trend from the Fintech evolution. The driven factors behind the open banking is the payment service innovation within Fintech. According to the WEF (2017) “Beyond Fintech: A Pragmatic Assessment of Disruptive Potential in Financial Services”, payment and insurance are two of most promising Fintech innovations. Even since the Fintech movement in 2015, the European Parliament (EU) adopted a revised Payment Services Directive, known as PSD2, to assist European nations to promote the standard in payment technology. The PSD2 includes the online and mobile payment.

Later in 2016, the United Kingdom Competition and Markets Authority (CMA) had issued “Retail banking market investigation” report found that older, larger banks do not have to compete hard enough for customers’ business, and smaller and newer banks find it difficult to grow and access the market. (UK Open Banking website) In order to compete with PSD2, The Open Banking Implementation Entity (OBIE) is the company set up by the CMA in 2018 by new regulation to deliver Open Banking. The objective of UK Open banking is to allow Fintech startups using open APIs direct access to bank’s data at account based level transaction.

In UK OBIE has divided the third party providers into Account Information Service Provider (AISP), Payment Information Service Provider (PISP), and Account Servicing Payment Service Providers (ASPSP) based on specific API standards. The API specifications are shown in Table 1. Some of specifications such as Financial-grade APIs are still under development to align with EU PSD2 Regulatory Technical Standards (RTS).

Source: Retrieved from https://www.openbanking.org.uk/providers/standards/

Read/Write API

Specifications Security Profiles

Customer Experience Guidelines

Operational Guidelines

These specifications consist of technical

documentation, usage examples and swagger files: Account and Transaction API Specification Payment Initiation API Specification Confirmation of Funds API Specification Event Notification API Specification

These profiles have been developed together with the Open ID Foundation and cover third party on-boarding, re-direct and decoupled flow. Dynamic Client Registration Specification Open Banking Security Profile Financial-grade API –

Part 2: Read and Write API Security Profile Financial-grade API – Client Initiated Backchannel Authentication (CIBA) Flow

These guidelines bring together regulatory requirements and extensive customer research to help third party providers and account providers deliver a great customer experience and avoid any unnecessary delay or friction as required under PSD2. Customer Experience

Guidelines

These guidelines support account providers

implementing effective and high-performing dedicated interfaces while assisting them in fulfilling their regulatory obligations relating to performance and availability, design and testing, problem

resolution, and

management information. Operational

Guidelines

III. Open Banking in Taiwan

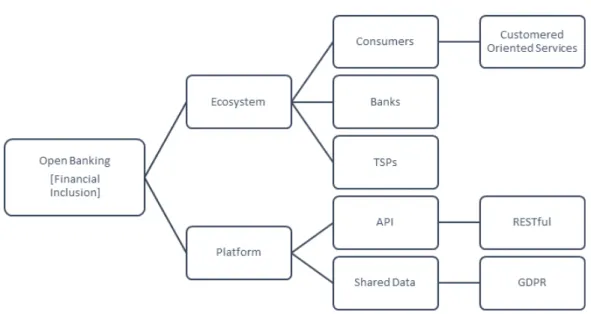

The open banking had adopted into the financial industry objectives in many countries’ financial authority institution. In this research had developed the open banking diagram, shown in Figure 2, to explained the construction of open banking implementation. The main objective of the open banking is the financial inclusion, which is the benchmark that consumers, both person or business, that have banking account which can use the affordable financial products and services. In order to build such financial inclusion open banking system, there are two factors need to be considered:

1. Ecosystem – Consumers, banks, and third party providers (TSPs) must all benefit in this system. Consumer will be the center of this ecosystem with new data privacy standard such EU General Data Protection Regulation (GDPR) and uses the combined financial services provided by banks and TSPs.

2. Platform – An API Platform is needed to for the stakeholders in ecosystem to exchange data and use the services easily by using web-based open technology. In UK open banking, the REST protocol and JSON data are used in RTS. Such open standard helps bank and TSPs can easily adopt the technology and development the financial services quickly.

Figure 2 – Open Banking Diagram

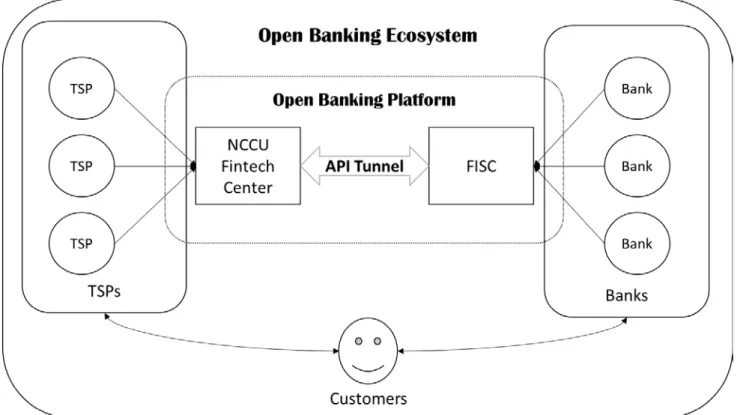

Taiwan had followed this open banking trend closely. In 2018, Financial Supervisory Commission (FSC), Taiwan financial authority, had start the open banking initiative. In this project, FSC had selected Financial Information Service Co. Ltd (FISC) as the role of ASPSP to be the intermediary between Banks and TSPs. In March, 2018, the Open API Commission had established between Banks and FISC. To align with TSPs, FISC had joined with National Chengchi University (NCCU) to setup the review community for APIs specification and setup a API testing sandbox environment to test out the open banking APIs.

This research uses the open banking diagram to explain Taiwan open banking environment. In this open banking ecosystem, three stakeholders are shown in the left, right and bottom of the ecosystem circle. FISC and NCCU provide the API management platform that connects banks and TSPs through standardized APIs. This open banking initiative is now under testing and preview stage. FSC believes this API economy can help to improve the financial inclusion without regulation changes.

Figure 3 – Taiwan Open Banking Ecosystem: current state Source: NCCU Fintech Center

IV. Future Research

As this research reported, this open banking initiative is still under testing and review phase. So, there are more exploratory and action research need to be conducted in the future.

Reference

Competition and Markets Authority (CMA). (2016). Retail banking market investigation. Retrieved from https://assets.publishing.service.gov.uk/media/57ac9667e5274a0f6c00007a/

retail-banking-market-investigation-full-final-report.pdf.

Dawes, S.S., Vidiasova, L., & Prkhimovich, O. (2016). “Planning and designing open government date programs: An ecosystem approach”. Government Information Quarterly (33). pp 15-27. Kalampokis, E., Tamboruis, E., & Tarabanis, K. (2011) “Open Government Data: A Stage Model”. In

10th IFIP WG 8.5 International Conference on Electronic Government. EGOV 22011, pp

235-246.

United Kingdom (UK) The Open Banking Working Groups. (2017). The Open Banking Standard. Retrieved from https://www.paymentsforum.uk/sites/default/files/documents/

Background%20Document%20No.%202%20-%20The%20Open%20Banking%20Standard%20 -%20Full%20Report.pdf.

United Nations Division for Public Administration and Development Management. (2013). Guidelines on open government data for citizen engagement. Retrieved from http://workspace.unpan.org/sites/Internet/Documents/Guidenlines%20on%20OGDCE%20M ay17%202013.pdf.

World Economic Forum (WEF). (2017). Beyond Fintech: A Pragmatic Assessment of Disruptive Potential in Financial Services. Retrieved from http://www3.weforum.org/docs/Beyond _Fintech_-_A_Pragmatic_Assessment_of_Disruptive_Potential_in_Financial_Services.pdf.