國

立

交

通

大

學

企業管理碩士學程

碩

士

論

文

越南金融與匯款機構的市場

FINANCIAL INSTITUTIONS AND REMITTANCES MARKET IN VIETNAM

研 究 生:杜氏紅好

指導教授:劉芬美 教授

National Chiao Tung University

College of Management

Global Master of Business Administration Program

Thesis

FINANCIAL INSTITUTIONS AND REMITTANCES MARKET

IN VIETNAM

Student: DO Thi Hong Hao

Advisor: Professor FEN May Liou

國 立 交 通 大 學

企業管理碩士學程

碩 士 論 文

越南金融與匯款機構的市場

FINANCIAL INSTITUTIONS AND REMITTANCES MARKET

IN VIETNAM

研 究 生:杜氏紅好

指導教授:劉芬美 教授

ABSTRACT

This thesis examines the competitive advantage of the inward remittance market in Vietnam. I reviewed the Vietnamese inward market first and investigate the competitive advantage of a representative company as a case study subsequently. Inward remittance has slightly gone downward as the economic crisis. The case company is a major Vietnamese Money Transfer Company. For confidential reasons, the company is called ABC in this thesis. Adapting to changes in the general market, ABC Money Transfer Company is maintaining market share and customer service improvement through strengthening its organization. It started with some changes in the old system. This thesis focuses on ABC Money Transfer Company as a case to identify the competitive advantage of this leading remittance market in Vietnam. This thesis reviews the remittance market in general and in Vietnam first. Three frameworks are used subsequently to examine ABC‟s competitive advantage in Vietnamese remittance market: SWOT analysis, five-force analysis and the BGC positioning framework. Suggestions are given according to the findings from the competitive advantage analysis.

Acknowledgements

The completion of the Master‟s degree and of the Master‟s thesis was not done without the support of others. I needed guidance, ideas, challenges and encouragement of many to be successful. I was lucky enough to receive this kind of aid from many sources.

First, I would like to thank you very much my advisor, Prof. Fen May Liou who helped me a lot for completing the thesis and showed me again that encouragement and pushes can be fantastic motivating tools.

Secondly, I want to thank the professors who taught me courses at National Chiao Tung University, especially those who helped me on the journey toward the completion of my thesis.

Thirdly, I appreciate all the input that I received from my classmates. I learned a lot from everyone that I worked with during the program. Those experiences enriched my life. I will try to take knowledge and the friendships with me wherever I go.

ABSTRACT ... IV Acknowledgements ... V List of Tables ... VIII List of Figures ... VIII

Chapter 1: Introduction ... 1

1.1 Research objectives and research motivation: ... 1

1.2 Problem identified : ... 1

1.3 The research framework ... 2

Chapter 2: Competitive Advantage and the Research Methodology ... 3

2.1 Sources of competitive advantage ... 3

2.1.1 Structure-conduct-performance school ... 3

2.1.2 Porter‟s genetic strategies ... 3

2.1.3 Blue ocean strategy ... 5

2.1.4 Resource-based view ... 6

2.2 Research methodology ... 6

2.2.1 SWOT analysis ... 6

2.2.2 Five forces framework ... 7

2.2.3 BCG framework ... 10

Chapter 3: The Remittance Market ... 11

3.1 What is remittance:... 11

3.2 The benefits of Workers‟ remittances: ... 12

3.3 Outlook for remittance flows to developing countries, 2009-11……….13

3.4 Factors affecting the development of the remittance service industry ... 16

3.5 The remittance service industry in Vietnam………...……….17

Chapter 4: Case Study ... 20

4.1 The case company: ABC Money Transfer Company ... 20

4.1.1 The remittance business in ABC Money Transfer Company ... 27

4.1.2 ABC‟s strategy in remittance business………27

4.2 SWOT analysis ... 29

4.3 Five-force analysis ... 30

4.3.1 Major competitors on remittance business in the market ... 30

4.3.2 Threat of substitute products or services ... 35

4.3.3 The threat of new entrants... 36

4.3.4 The bargaining power of suppliers ... 37

4.3.5 The bargaining power of customer ... 37

4.4 BCG framework ... 38

Chapter 5: Conclusion and Suggestions ... 41

a. Conclusion: ... 41

b. Suggestions: ... 41

c. Limitation of the study: ... 43

d. Future study suggestions: ... 43

References ... 44

Appendices ... 47

I. Interview Transcript: ... 47

II. Inward Remittance process in Vietnam: ... 53

III. Risks for remittance services providers: ... 54

List of Tables

Table 1: Outlook for remittance flows to developing countries, 2009-11 ... 15

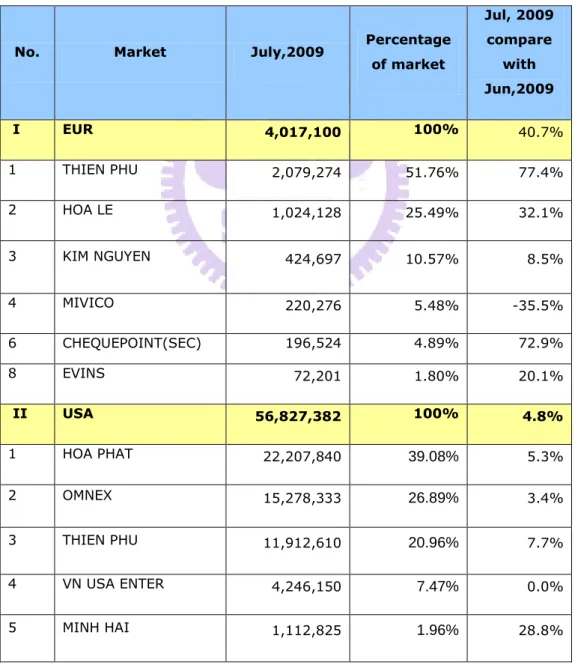

Table 2: Analyzing Sales in ABC Company in July,2009 according to market ... 24

Table 3: Network of rivals ... 33

List of Figures

Figure 1: Five forces framework ... 8

Figure 2: BCG framework ... 10

Figure 3: The top 10 recipients list ... 14

Figure 4: Number of inward remittances in Vietnam from 2001 to 2008 ... 19

Figure 5: ABC Money Transfer company‟s market share in Vietnam in 2008 ... 22

Figure 6: Revenues of ABC Money Transfer Company from 2003 to 2008... 23

Figure 7: Sales of 7 months of 2009 against 2008 in ABC Money Transfer Company .... 23

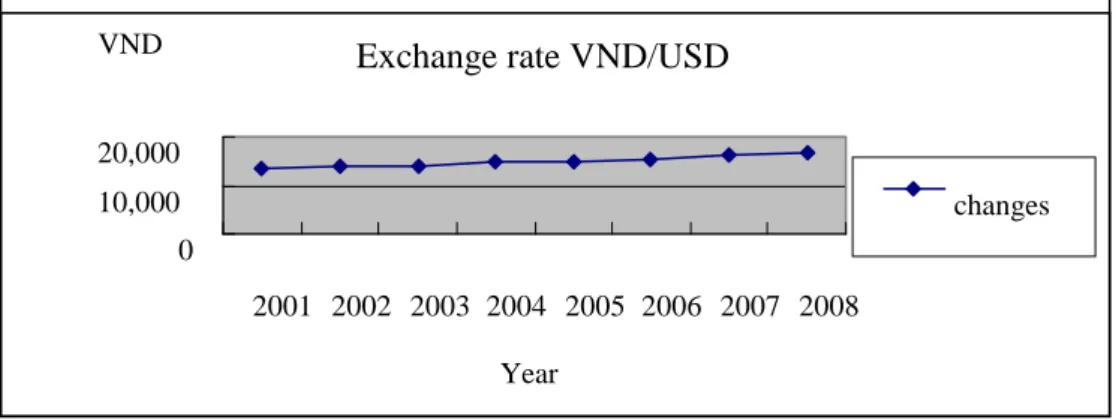

Figure 8: Exchange rate VND/USD from 2001-2008 ... 31

Figure 9: Three biggest companies in Home delivery service ... 34

Chapter 1: Introduction

1.1 Research objectives and research motivation

Remittances have traditionally been an important source of foreign currency for many emigration countries. Vietnam has increasing migration spreading all over the world. As the scale, scope and complexity of migration have grown, the remittance service industry becomes essential for social network linking local and global process. A thorough review of the remittance market helps the related parties including financial institutions and the government authorities to improve the market efficiency. Moreover, we can learn more about remittance process and the benefit of each party from this research.

The objectives of this research are two folds: first, it reviewed the general remittance service market in developing countries, especially in Vietnam; and second, it used SWOT, Five-force, and BCG frameworks to investigate ABC Money Transfer Company as a case study to reveal the competitive advantages of remittance business. The case company is a major Vietnamese Money Transfer Company. For confidential reasons, the company is called ABC in this thesis. The case study derived several interesting findings, based on which I provided recommendations for operating remittance business in Vietnam. The financial institution and money transfer companies should know their competitive advantages in order to have the right strategies to improve their better organization and service.

1.2 Problem identified

Vietnam differs substantially from other remittance markets in that they have not yet widened the range of products available to remittance receivers, and they almost have the old organization system that takes a long time for customers. Both senders and receivers have not been integrated into the formal financial sector.

Inward remittance service is a competitive element for remittance companies in Vietnam in particular and for Vietnam in general, how these companies improve this service to support better customer' satisfaction.

1.3 The research framework

Research objective and motivation

Brief introduction to the remittance market (1) The role of remittance in developing countries (2) Remittance market in Vietnam

Literature review on:

(1) Sources of competitive advantage (2) SWOT framework

(3) Five-force analysis (4) BCG framework

Case study: ABC Money Transfer Company

Chapter 2: Competitive Advantage and the Research

Methodology

2.1 Sources of competitive advantage

2.1.1 Structure-conduct-performance school

The core issue of strategic management is why some firms outperform others. Mainstreams of strategic management attribute superior performance to competitive advantage of the firm. A competitive advantage is an advantage over competitors gained by offering consumers greater value, either by means of lower prices or by providing greater benefits and service that justifies higher prices (Porter, 1985). When the firm sustains profits that exceed the average for its industry, the firm is said to possess a competitive advantage over its rivals (Porter, 1980; 1985). The goal of much of business strategy is to achieve a sustainable competitive advantage. According to Porter (1980; 1985), competitive advantage is created by using resources and capabilities to achieve either a lower cost structure or a differentiated product. A firm position itself in its industry through its choice of low cost or differentiation. Once the firm has identified its position in the market, it should build up barriers to prohibit potential competitors enter into this market segment. The hiher concentration the market is, the more competitive advantage the firm would have. Therefore, the industry structure determines the competitive advantage of the firm (Porter, 1987: p. 46).

However, many empirical studies showed that the high-concentrated industries were not significantly superior to lower-concentrated industries (Gale and Branch , 1982; Ravenscraft, 1983). Other studies showed that there is no consistent relationship between market concentration and profitability (Jacobson, 1988; Jacobson and Aaker, 1985).

2.1.2 Porter’s genetic strategies

Michael Porter identified two basis types of competitive advantage:

- Cost advantage

A competitive advantage exists when the firm is able to deliver the same benefits as competitors but at a lower cost (cost advantage), or deliver benefits that exceed those of competing products (differentiation advantage). Thus, a competitive advantage enables the firm to create superior value for its customers and superior profits for itself.

Cost advantage: This strategy emphasizes efficiency. By producing high volumes of

standardized products, the firm hopes to take advantage of economies of scale and experience curve effects. The product is often a basic no-frills product that is produced at a relatively low cost and made available to a very large customer base. Maintaining this strategy requires a continuous search for cost reductions in all aspects of the business. The associated distribution strategy is to obtain the most extensive distribution possible. Promotional strategy often involves trying to make a virtue out of low cost product features.

To be successful, this strategy usually requires a considerable market share advantage or preferential access to raw materials, components, labour, or some other important input. Without one or more of these advantages, the strategy can easily be mimicked by competitors. Successful implementation also benefits from:

- Process engineering skills

- Products designed for ease of manufacture

- Sustained access to inexpensive capital

- Close supervision of labour

- Tight cost control

- Incentives based on quantitative targets.

- Always ensure that the costs are kept at the minimum possible level.

Examples include retailers such as Wal-Mart and KwikSave as well as IT firms such as Dell and Lenovo.

Differentiation advantage: Differentiation is aimed at the broad market that involves the

creation of a product or services that is perceived throughout its industry as unique. The company or business unit may then charge a premium for its product. This specialty can be associated with design, brand image, technology, features, dealers, network, or customers

service. Differentiation is a viable strategy for earning above average returns in a specific business because the resulting brand loyalty lowers customers' sensitivity to price. Increased costs can usually be passed on to the buyers. Buyers loyalty can also serve as an entry barrier-new firms must develop their own distinctive competence to differentiate their products in some way in order to compete successfully. Examples of the successful use of a differentiation strategy are Hero Honda, Asian Paints, HLL, Nike athletic shoes, Perstorp BioProducts, Apple Computer, and Mercedes-Benz automobiles.

2.1.3 Blue ocean strategy

- Blue ocean strategy (BOS) is the result of a decade-long study of 150 strategic moves spanning more than 30 industries over 100 years (1880-2000).

- BOS is the simultaneous pursuit of differentiation and low cost.

-The aim of BOS is not to out-perform the competition in the existing industry, but to create new market space or a blue ocean, thereby making the competition irrelevant.

-While innovation has been seen as a random/experimental process where entrepreneurs and spin-offs are the primary drivers – as argued by Schumpeter and his followers

– BOS offers systematic and reproducible methodologies and processes in pursuit of blue oceans by both new and existing firms.

- BOS frameworks and tools include: strategy canvas, value curve, four actions framework, six paths, buyer experience cycle, buyer utility map, and blue ocean idea index.

-These frameworks and tools are designed to be visual in order to not only effectively build the collective wisdom of the company but also allow for effective strategy execution through easy communication.

- BOS covers both strategy formulation and strategy execution.

- The three key conceptual building blocks of BOS are: value innovation, tipping point leadership, and fair process.

- While competitive strategy is a structuralist theory of strategy where structure shapes strategy, BOS is a reconstructionist theory of strategy where strategy shapes structure.

- As an integrated approach to strategy at the system level, BOS requires organizations to develop and align the three strategy propositions: value proposition, profit proposition and people proposition.

2.1.4 Resource-based view

Another school, resource-based view emphasizes that a firm utilizes its resources and capabilities to create a competitive advantage that ultimately results in superior value creation. The resource-based view (RBV) is an economic tool used to determine the strategic resources available to a firm. The fundamental principle of the RBV is that the basis for a competitive advantage of a firm lies primarily in the application of the bundle of valuable resources at the firm‟s disposal (Wernerfelt, 1984; Rumelt, 1984).

According to the resource- based view, in order to develop a competitive advantage the firm must have resources and capabilities that are superior to those of its competitors. Without this superiority, the competitors simply could replicate what the firm was doing and any advantage quickly would disappear.

Resources are the firm-specific assets useful for creating a cost or differentiation

advantage and the few competitors can acquire easily as following:

- Patents and trademarks

- Proprietary know-how

- Installed customer base

- Reputation of the firm

- Brand equity

To investigate competitive advantage of firms, mainstreams of strategic management have developed many frameworks, among which SWOT, Porter‟s five-market-force analysis and BCG framework are the most popular.

2.2 Research methodology 2.2.1 SWOT analysis

It involves specifying the objective of the business or project and identifying the internal and external factors that are supportive or unfavourable to achieving that objective. SWOT is often used as part of a strategic planning process. SWOT is an acronym for Strengths, Weaknesses, Opportunities, and Threats (Albert Humphrey). A process generates information that is helpful in matching an organization or group‟s goals, programs, and capacities to the social environment in which it operates.

1. Strengths

- Positive tangible and intangible attributes, internal to an organization.

- They are within the organization‟s control.

2. Weaknesses

- Factors that are within an organization‟s control that detracts from its ability to attain the desired goal.

- Which areas might the organization improve?

3. Opportunities

- External attractive factors that represent the reason for an organization to exist and develop.

- What opportunities exist in the environment, which will propel the organization?

- Identify them by their “time frames”

4. Threats

- External factors, beyond an organization‟s control, which could place the organization mission or operation at risk.

- The organization may benefit by having contingency plans to address them if they should occur.

- Classify them by their “seriousness” and “probability of occurrence”.

2.2.2 Five forces framework

Porter's five forces (1980) include - three forces from 'horizontal' competition: threat of substitute products, the threat of established rivals, and the threat of new entrants; and two

forces from 'vertical' competition: the bargaining power of suppliers and the bargaining power of customers.

A five forces analysis allows an organization to consider the relative attractiveness of different industry sectors when making strategic choices about exiting or entering particular sectors and markets. Close analysis of these forces can allow an organization to find a position in the sector where it can best defend itself against them or, most effectively, influence them. Five forces includes as following:

Source: From the internet Figure 1: Five forces framework

1. The threat of entry.

- Economies of scale e.g. the benefits associated with bulk purchasing.

- The high or low cost of entry e.g. how much will it cost for the latest technology?

- Ease of access to distribution channels e.g. Do our competitors have the distribution channels sewn up?

- Cost advantages not related to the size of the company e.g. personal contacts or knowledge that larger companies do not own or learning curve effects.

- Will competitors retaliate?

- Government action e.g. will new laws be introduced that will weaken our competitive position?

- How important is differentiation? e.g. The Champagne brand cannot be copied. This desensitises the influence of the environment.

2. The power of buyers.

- This is high where there a few, large players in a market e.g. the large grocery chains.

- If there are a large number of undifferentiated, small suppliers e.g. small farming businesses supplying the large grocery chains.

- The cost of switching between suppliers is low e.g. from one fleet supplier of trucks to another.

3. The power of suppliers.

- The power of suppliers tends to be a reversal of the power of buyers.

- Where the switching costs are high e.g. Switching from one software supplier to another.

- Power is high where the brand is powerful e.g. Cadillac, Pizza Hut, Microsoft.

- There is a possibility of the supplier integrating forward e.g. Brewers buying bars.

- Customers are fragmented (not in clusters) so that they have little bargaining power e.g. Gas/Petrol stations in remote places.

4. The threat of substitutes

- Where there is product-for-product substitution e.g. email for fax Where there is substitution of need e.g. better toothpaste reduces the need for dentists.

- Where there is generic substitution (competing for the currency in your pocket) e.g. Video suppliers compete with travel companies.

- We could always do without e.g. cigarettes.

5. Competitive Rivalry

This is most likely to be high where entry is likely; there is the threat of substitute products, and suppliers and buyers in the market attempt to control. This is why it is always seen in the center of the diagram.

2.2.3 BCG framework

The BCG growth / market share matrix. The tool was developed by the Boston Consulting Group in the 70s. The objective is to identify priorities of specific products within a business unit, or priorities of different business unit in a larger corporate setting. The fundamental assumption is that an enterprise should have a portfolio of products that contains both high-growth products in need of cash and low-high-growth products that generate cash. The BCG matrix has two dimensions: market share and market growth.

Source: From the internet Figure 2: BCG framework

- Stars (high growth, high market share): Stars are leaders in the business. They are frequently roughly in balance on net cash flow. The goal is to hold or expand market share.

- Cash Cows (low growth, high market share): Cows are often the stars of yesterday and they are the foundation of a company. Because of the low growth, investments needed should be low.

- Dogs (low growth, low market share): Avoid and minimize the number of Dogs in a company. Watch out for expensive „rescue plans‟. Dogs must deliver cash, otherwise they should be liquidated.

- Question Marks (high growth, low market share): Question Marks have the worst cash characteristics of all, because they have high cash demands and generate low returns, because of their low market share. Either invest heavily, or sell off, or invest nothing and generate any cash that you can.

Chapter 3: The Remittance Market

3.1 What is remittance

Generally, the term “remittances” refers to the transfers, in cash or in kind, from a migrant to household residents in the country of origin. The International Monetary Fund (IMF) has a broader definition about remittances, which includes three categories as follows: (Akkoyunlu & Vickerman, 2000).

(i) workers remittances or transfers in cash or in kind from migrants to resident households in the country of origin;

(ii) compensation to employees or the wages, salaries and other remuneration, in cash or in kind, paid to individuals who work in a country other than where they legally reside; and

(iii) migrant transfers which refer to capital transfers of financial assets made by emigrants as they move from one country to another and stay for more than one year.

Similar to the determinants of migrations, the analytical literature on motives for remittances (Solomolo, 2001) fall in four main approaches: (1) altruistic motive; (2) self-interest motive; (3) loan repayment; and (4) co-insurance. The altruistic motive suggests that the emigrant send remittances back home because he/she cares about the well being of his or her family in the home country. The self-interest motive drives the successful emigrant has savings, and an obvious place to invest, at least part of his assets, is in the home country buying property, land, financial assets, etc. The motive of loan repayment sssumes that the family invest in the education of the emigrant and usually finances the costs of migrating; the migrant repay the loan back to the family in the form of remittances once he/she settles in the foreign country and as income profile starts rising over time

This thesis focus on international remittances including all money sent from:

- Oversea Vietnamese to relatives in Vietnam to support meaningful consumer

- Vietnamese workers in foreign countries to their home,

- Oversea Vietnamese to Vietnam for investments

- International students‟ relatives to Vietnam to support for these students in studying in Vietnam

The channel of inward remittance includes through banks, non-bank financial institutes, the business to provide financial services and international postal, and people bring foreign currency to Vietnam by themselves.

3.2 The Benefits from Workers’ Remittances

They provide balance of payments support and can contribute to economic growth and poverty reduction

A Stable Unrequited Source of Foreign Exchange: Remittances can be an important

source of support to the country‟s balance of payments because of their nature as non-debt creating flows

Contribution to Growth: As unrequited receipts, remittances contribute to increasing

the absorptive capacity of the recipient economy (consumption plus investment). They can therefore raise economic welfare and contribute to financing both physical and human capital investments, leading to enhanced productivity and higher growth rates

Complementing Nascent Financial Systems and Transfer of Knowledge: Remittances

can provide a much-needed source of financing both informally and formally (through the banking sector), and thus promote both financial sector development and the growth of the private sector. This may be of particular importance in a developing-transition economy such as Vietnam. The professional and business background of a large number of Vietnamese migrants could bring additional benefits similar in part to those associated with FDI. By influencing the way part of the remittances are invested, migrants can transfer their entrepreneurial skills and technological knowledge to the private sector in their homeland, thus mitigating, and possibly more than compensating for, possible negative consequences of a “brain drain.”

Poverty Reduction: Remittances are expected to contribute importantly to poverty

reduction as they are often received by lower-income groups and help improve their housing conditions, nutritional intake, health care, and education. In addition, by financing small businesses, remittances contribute to employment creation.

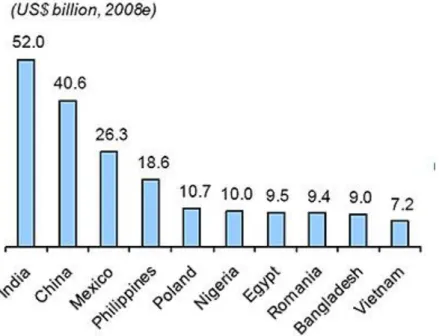

Recent trends Newly available data show that remittance flows to developing countries reached $328 billion in 2008, up 15 percent from $285 billion in 2007. These estimates are higher than our previous estimates of $305 billion in 2008 and $281 billion in 2007. All regions experienced stronger growth than our previous estimates. South Asia registered a 33 percent growth in remittance flows as India reported $52 billion in 2008, sharply higher than our earlier estimate of $45 billion. Remittances to East Asia and the Pacific rose 20 percent as China and the Philippines reported strong growth. In contrast, flows to Latin America and the Caribbean grew by a modest 2 percent in 2008, reflecting continuing weakness in the job market in the United States. After the latest data revisions for 2008, India, China and Mexico retain their position as the top recipients of migrant remittances among developing countries (see figure 1). The top 10 recipients list also includes Philippines, Poland, Nigeria, Romania, Egypt, Bangladesh, and Vietnam. In contrast, the top recipients in terms of the share of remittances in GDP include many smaller economies such as Tajikistan, Tonga, Moldova, Lesotho, and Guyana; in these countries remittances exceeded a quarter of the GDP, providing a lifeline to the poor.

The slowdown in remittance flows that became evident in the last quarter of 2008 has continued into the first half 2009. As the US job market weakness continues, officially recorded remittance flows to the Latin America and the Caribbean region have dropped significantly in the first half of 2009. In Mexico, remittance flows in 2009 year-to-date have declined by 11 percent compared to a year ago, after a 4 percent decline in 2008. Jamaica has registered a sharper 17 percent decline during the same period. The slowdown in the US construction sector, a major employment sector for migrants from Mexico, is believed to have affected remittance flows to Mexico with a lag of about 3 months .

Source: Central banks of the respective countries. Figure 3: The top 10 recipients list

Risks to the outlook : There are three key sources of risk to the outlook for remittance flows. First, if the crisis were deeper and longer than currently projected, the decline in remittance and migration flows would be steeper. Unpredictable movements in the exchange rates pose a second source of risk. If the exchange rates of these remittance sources weaken, it would result in an even greater decline in remittance flows to developing countries. Finally, the political reaction to weak job markets in destination countries could lead to more tightening of immigration control

Base case forecast Low case forecast $ billion 2006 2007 2008e 2009f 2010f 2009f 2010f Developing countries 228 285 328 304 313 295 294 71

East Asia and Pacific 53 65 78 74 76 71 Europe and Central Asia 37 51 57 49 50 47 48 Latin America and Caribbean 59 63 64 60 61 58 57 Middle-East and North Africa 26 32 34 32 33 31 31 South Asia Sub-Saharan Africa Low-income countries Middle-income countries 40 55 74 71 74 69 69 18 29 13 19 20 18 19 18 20 25 31 29 30 29 208 261 297 275 282 266 265 .. World Growth rate (%) 309 380 433 .. .. .. Developing countries East Asia and Pacific Europe and Central Asia 17.2% 25.2% 14.8% -7.3% 2.9% -10.1% -0.3% 13.4% 23.4% 19.6% -5.7% 3.0% -8.8% -0.5% 0.5% 24.1% 36.5% 12.0% -14.9% 3.0% -17.2% Latin America and Caribbean 18.1% 6.6% 2.1% -6.9% 1.0% -9.4% -2.0% Middle-East and North Africa South Asia 4.6% 21.4% 8.6% -6.2% 3.3% -9.8% -0.4% 0.5% 1.1% 19.7% 40.1% 32.8% -3.6% 3.9% -6.4% Sub-Saharan Africa 34.5% 47.3% 6.5% -8.3% 4.4% -11.6% Low-income countries 23.8% 23.2% 25.3% -5.0% 3.8% -7.2% 0.7% Middle-income countries 16.7% 25.4% 13.9% -7.5% 2.8% -10.4% -0.4% World 14.3% 22.9% 14.0% .. .. .. ..

e = estimate; f=forecast Source: : Authors’ calculation based on data from IMF Balance of Payments Statistics Yearbook 2008 and data releases from central banks, national statistical agencies, and World Bank country desks. Remittances are defined as the sum of workers’ remittances, compensation of employees, and migrant transfers – see www.worldbank.org/prospects/migrationandremittances for data definitions and the entire dataset.

3.4 Factors affecting the development of the remittance service industry

Most of the studies as regards the determinant factors of workers remittances have a

microeconomic perspective. Variables that are mainly analyzed consist in migrant worker‟s and his family‟s socioeconomic characteristics on one hand, and his personal motives on the other.

According to Russell (1986), time passed abroad, income level of the migrant‟s family,

job situation of other members of the family, education level, work experience and marital

status of the migrant are among the main sociodemographic determinants of remittances.

Other factors such as the number of children, as well as their education level, and the

economic situation of the migrant before migration are added later on by Ilahi and Jafarey

(1999).

As far as the gender component is concerned, little work has been done but most of the

studies point out a differentiation in remittance behavior between men and women (e.g. De la

Cruz, 1995; Osaki, 1999; Tacoli, 1999; De la Brière, 2002). Women seem to remit more

regularly, especially because of the traditional family configuration observed in some

developing countries.

Among the macroeconomic factors affecting remittances number of migrants and their

income level, the economic situation of both of the origin and the host country, exchange rates,

interest rate differences between the worker ‐ sending and the receiving countries, the

potential political risks at the origin country and the remittance infrastructure have already

3.5 The remittance service industry in Vietnam

There have been a variety of theoretical models adduced to explain the motives

underlying remittance behavior, including altruism (Becker, 1974; Aggarwal and Horowitz,

2002), exchange (Cox, 1987) or self-interest (Lucas and Stark, 1985), insurance (Stark, 1991;

Gubert, 2002; Amuedo-Dorantes and Pozo, 2006), and consumption transfer (Quinn, 2005).

After conducting an empirical analysis for Vietnam overseas workers, Niimi (2008) suggests

that the remittance phenomenon in Vietnam could be explained by a combination of several

models including altruism, self-interest such as education investment, and the insurance

purpose. Generally, remittances take place after migration since the net flow of migrants are

from low wage to high wage areas (Massey et al., 1993).

According to the World Bank‟s report (Niimi, 2008), combination of government migration policies and the household registration system (ho khau) had strictly controlled

migration flows in Vietnam in the past. Urban to rural and intra-rural migration were

explicitly encouraged to redress imbalances in population density across the country (Dang et

al., 2003). Until the early 1990s, officially organized migration was the most common form of

internal movement observed in Vietnam (Guest, 1998; Dang et al., 2003). However,

organized migration has been replaced by a more spontaneous migration phenomenon since

the middle of the 1990s (Hardy, 2000) as the doi moi (renovation) program became the main

driving force behind the apparent shift (Dang et al., 2003).

Remittances sent to the country which is one of the important sources of balance in the

balance of foreign exchange in Vietnam. As reported by the World Bank announced in

mid-July 2009, Vietnam ranked 10th among the countries receiving remittances, most of the world

in 2008. With a total estimated value is 7.2 billion dollars. This increase is considered to be

positive, reaching 5.5 billion dollars, an amount that the World Bank is equivalent to 8%

Vietnam's GDP.

Vietnam has over 3 million Vietnam settled abroad, concentrated in countries with

high average income: United States (1.5 million), France (300,000), Australia (250,000),

Canada (200,000) ... With policies to encourage Vietnamese overseas to invest in Vietnam

like buying houses, the amount of remittances transferred to Vietnam will increase rapidly

when the world economy recovered.

To attract the amount of remittances, banks and money transfer companies have

launched several new products and channels such as delivery money at home, transfer money

through the account or card or online or by phone. In addition to exploiting traditional

markets like the U.S., Australia and some Asian countries, banks and money transfer

companies also focus on promotion of new markets, potential foreign currency higher because

many workers of Vietnam is working as the Middle East and Africa.

Authorities believe that remittances can only increase when there are system-wide pay and create favorable conditions for people. Actually, for people who are traveling abroad or

living in Vietnam as well is wishing to receive remittances from relatives. In many places in

the world, of course what they want is to receive money in any transaction any convenient

such as hotels, restaurants, supermarkets, etc. The banks have also launched into many points

of transactions but not strong enough, according to observers. However, the amount of money

which is sent back Vietnam by abroad workers constitute only a fraction of the remittances.

According to the U.S. daily newspaper Wall Street Journal, nearly two-thirds of the

remittances received in Vietnam last time from the United States, where a overseas

Although investment policies have not been opened completely, the amount of

remittances sent each year up to 3.8 billion. If this policy is more open, the volume of

remittances will be bigger and bigger.

U.S. economy is experiencing a difficult period, unemployment increased, and these

factors impact the amount of money which is sent back to Vietnam.

Labors working abroad can still send through the banking system and controls were

from the original, but the other s do not believe in some banks should find reclining quick,

discreet and more reliable , not to mention the cheaper commissions. This amount is not listed

in any books or bank statistics state. The impact of remittances in Vietnam can be studied in

terms of the monetary and financial markets, investment, the labor market, technology and

product factors government policies factors and the social aspects of development.

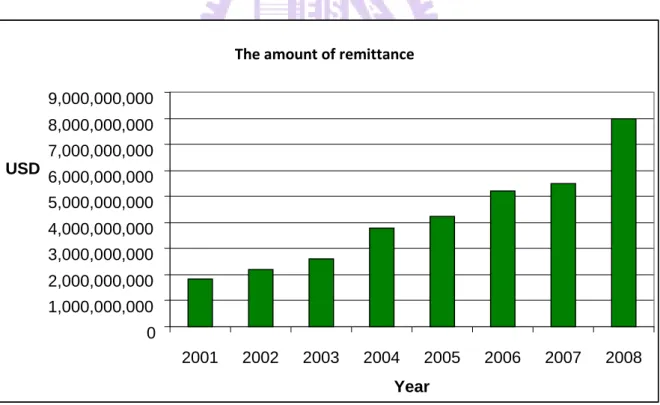

Source: Directory of the statistics in Vietnam

Figure 4: Number of inward remittances in Vietnam from 2001 to 2008

The amount of remittance

0 1,000,000,000 2,000,000,000 3,000,000,000 4,000,000,000 5,000,000,000 6,000,000,000 7,000,000,000 8,000,000,000 9,000,000,000 2001 2002 2003 2004 2005 2006 2007 2008 Year USD

Chapter 4: Case Study

4.1 The case company: ABC Money Transfer Company (ABCMTC)

4.1.1 The remittance business in ABC Money Transfer Company (ABCMTC)

The case company is a major Vietnamese Money Transfer Company. For confidential

reasons, the company is called ABC in this thesis. Founded in 1992, ABC Commercial Bank,

former Eastern Asia Commercial Bank, one of the leading joint stock commercial banks in

Vietnam immediately launched the remittance services thanks to the good experiences and

assistance from Phu Nhuan Jewelry JSC (PNJ), the 2nd biggest shareholders.

In order to specialize and enhance remittance services, ABC Money Transfer Company

was established in November 2001, originally from the Money Transfer Department of ABC

Commercial Bank.

ABC Money Transfer Company is recognized as the leader in money transfer services in

Vietnam. In 2006, almost 16 percent of the total USD 4.8 billion overseas remittance volume

into Vietnam went through ABC Money Transfer Company's system.

Beneficiaries can receive money at ABC Money Transfer Company‟s 103 transaction

offices and local agent network spreading out in the whole country.

ABC Money Transfer Company especially manages a strong and experienced home-delivery team that is able to provide door-to-door home-delivery to beneficiaries in almost 60 provinces amongst the total 64 provinces of Vietnam .

ABC Money Transfer Company is the leading company in Vietnam's remittance market.

They offer a wide range of money transfer services to clients in various regions of Vietnam.

ABC Money Transfer Company also was the pioneer of home delivery service in Vietnam.

- ABC Money Transfer Company has the employees who are high experience and profession.

- ABC Bank‟s Account: immediately with full amount, no charges or fees.

- To other banks‟ Account in Vietnam: from 1 – 3 days, depending on the destinating bank‟s

network and infrastructure. The fund amount will vary according to that bank‟s charges and fees

- No charges and fees for customers use counter pick up and home delivery services also.

- ABC bank possesses the second largest customers‟ base in Vietnam with over 2.8 million

individual bank accounts

- ABC Bank is also considered as the leading bank in technology with nearly 400,000

subscribers for E-banking services

- ABC Bank is among the leading joint-stock commercial banks in Vietnam

Resources Distinctive Competencies Capabilities Cost Advantage or Differentiation Advantage Value Creation

- ABC Money Transfer Company has expanded its network recently to over 164 branches and

offices across provinces in Vietnam

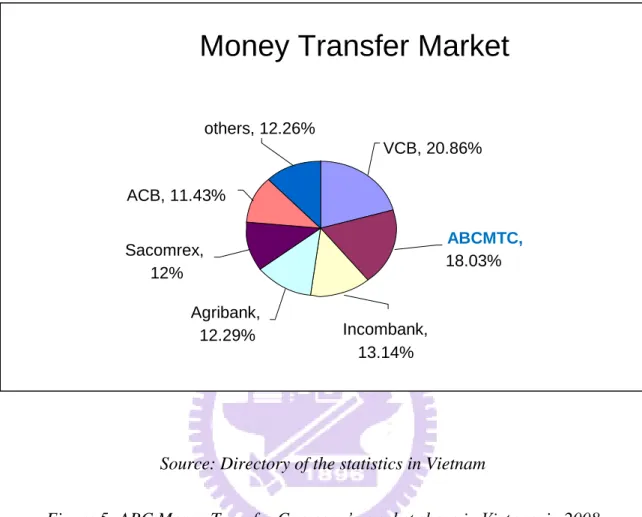

Source: Directory of the statistics in Vietnam

Figure 5: ABC Money Transfer Company’s market share in Vietnam in 2008

As the statistics, ABC Money Transfer Company was the second biggest market share in

money transfer from other countries to Vietnam up to at the end of 2008. They accounted

around 20% of remittance market in Vietnam with over 650 million USD of inward

remittance.

Money Transfer Market

Agribank, 12.29% ACB, 11.43% Sacomrex, 12% Incombank, 13.14% ABCMTC, 18.03% VCB, 20.86% others, 12.26%

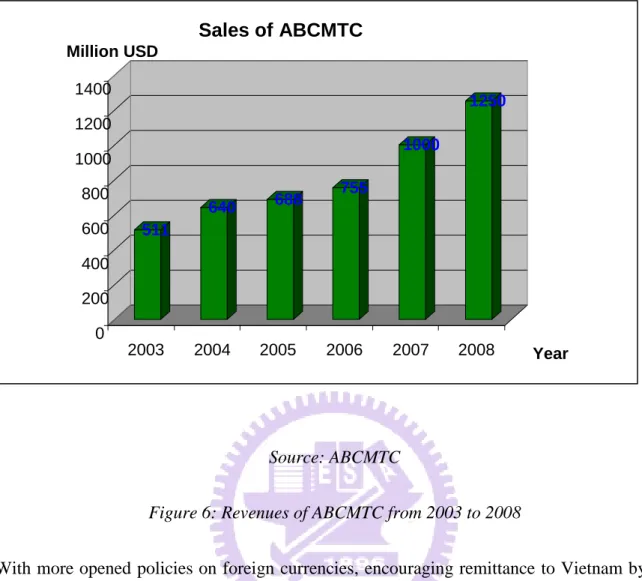

Source: ABCMTC

Figure 6: Revenues of ABCMTC from 2003 to 2008

With more opened policies on foreign currencies, encouraging remittance to Vietnam by the

State and the increasing of investment demand in Vietnam, the amount of money which

transfer through ABC Money Transfer Company grew very strongly in the recent years.

511 640 688 755 1000 1250 0 200 400 600 800 1000 1200 1400 Million USD 2003 2004 2005 2006 2007 2008 Year Sales of ABCMTC

Sales of 7 months of 2009 against 2008 in ABCMTC

0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 Jan 1 Feb 2 Mar 3 Apr 4 May 5 Jun 6 Jul 7 Aug 8 Sep 9 Oct 10 Nov 11 Dec 12 USD 2009 2008

Source: ABCMTC

Figure 7: Sales of 7 months of 2009 against 2008

Generally for 7 months of early 2009, sales just reached more than 578 million USD which

was less than the sales of the same previous quarter. Due to crisis, the amount has been

downward in 2009.

Table 2: Analyzing Sales in ABCMTC in July, 2009 according to market

Source: ABCMTC

No. Market July,2009 Percentage

of market Jul, 2009 compare with Jun,2009 I EUR 4,017,100 100% 40.7% 1 THIEN PHU 2,079,274 51.76% 77.4% 2 HOA LE 1,024,128 25.49% 32.1% 3 KIM NGUYEN 424,697 10.57% 8.5% 4 MIVICO 220,276 5.48% -35.5% 6 CHEQUEPOINT(SEC) 196,524 4.89% 72.9% 8 EVINS 72,201 1.80% 20.1% II USA 56,827,382 100% 4.8% 1 HOA PHAT 22,207,840 39.08% 5.3% 2 OMNEX 15,278,333 26.89% 3.4% 3 THIEN PHU 11,912,610 20.96% 7.7% 4 VN USA ENTER 4,246,150 7.47% 0.0% 5 MINH HAI 1,112,825 1.96% 28.8%

No. Market July,2009 Percentage of market Jul, 2009 compare with Jun,2009 6 SG FINANCIAL 472,300 0.83% -8.8% 7 CONTINENTAL 564,593 0.99% 0.5% 8 ĐONG PHUONG 279,905 0.49% -2.9% 9 SAIGON USA 378,310 0.67% 3.4% 10 IMP GROUP 244,576 0.43% -22.5%

11 THAI BINH DUONG 100,100 0.18% 14.7%

12 U.S MONEY 27,540 0.05% -6.1%

13 MINH HAI ĐANG 0

14 EAST WEST BANK 2,300 0 -8.0%

III CANADA 9,669,586 100% 4.7% 1 HAI VAN 4,690,742 48.51% 6.7% 2 OMNEX 2,396,236 24.78% 17.6% 3 TRANSAIGON 962,086 9.95% -16.6% 4 THIEN PHU 384,704 3.98% 36.5% 6 A & VY MONEY 470,190 4.86% 12.0% 7 VIETSTRAVEL 120,888 1.25% -15.3% 8 THE LE A.T.M. 4,584 0.05% 13.0% 9 VN KING 171,386 1.77% -44.7%

10 BEN THANH GIFT 468,769 4.85% 10.4%

11 VINAFAST 0 -100.0%

No. Market July,2009 Percentage of market Jul, 2009 compare with Jun,2009 IV Australia 2,735,526 100% 24.3%

1 ĐONG KHANH IMPORT 757,671 27.70% 76.9%

2 QUICK MONEY 471,737 17.24% -0.5% 3 THIEN PHU 373,497 13.65% 56.6% 4 KIM SON 381,778 13.96% 78.1% 5 ROS.HONGHOA 254,812 9.31% 57.2% 6 CHUCO 166,483 6.09% -31.1% 7 TOAN CAU 73,288 2.68% -42.8% 8 PHI LONG 234,943 8.59% -17.6% 9 HAI LAM 21,316 0.78% -27.8% V Asian 6,984,850 100% 10.9% 1 BKK FOREX 4,923,745 70.49% 8.7% 2 BKK FOREX-DAB 1,790,019 25.63% 19.5% 3 MERCHANTRADE 253,190 3.62% -1.4% 4 PIB 9,535 0.14% 234.6% 5 PAY2HOME 8,362 0.12% -20.9% VI Middle East 2,744 100% -38.0% 1 INSTANT CASH 2,744 43.43% -38.0% VII Global 2,770,030 100% -15.9% 1 MONEY GRAM 2,575,925 92.99% -16.5% 2 COINSTAR 63,092 2.28% -1.3% 3 XPRESS MONEY 131,013 4.73% -9.9%

No. Market July,2009 Percentage of market Jul, 2009 compare with Jun,2009 Total 83,007,218 6.3%

The biggest market of ABCMTC is USA, and this is the main remittance market for

Vietnam as well. ABCMTC has fourteen partners in USA, eight in EUR, twelve in Canada,

nine in Australia, five in Asia, one in Middle East, and three for global services.

Partners have the amount of money which is deposited in ABCMTC for enough so

that ABCMTC disburses to customers. There are four ways of disbursement to customers

such at counter pickup, home delivery, account transfer, ABC‟s card. At the end of a month,

partners make payment for ABCMTC. Partners transfer money to ABC‟s account. There are

three kinds of payment as the following basing that partners use to count commission for

ABCMTC:

- On the transfer times (fix fee)

- On the amount of money

- On charges on customers

4.1.2 ABCMTC’s strategy in remittance business

A. Clear strategies for future structure and good implementation in service expansion

Firstly, the management needs to have a clear vision and objectives for the year. Then

it has to translate sufficiently to subordinates and understand how they understand and apply

in the real work. They should have policy direction and explanation through good process in

implementation to guide everyone systematically. It will avoid the waste of time for each

should focus on process in term of supporting for employees and management. Along with

each strategy and new policy or work, it is essential to have clear process or description to

guide the achievements.

The company should guide clearly who is responsible for each activities and the way they

are linked together to work effectively. The middle and department managers have

importance roles to support for controlling with applying changes and improvements in the

process

There are many other factors to formulate and implement good strategies, which the

company should concern such as leadership development and cultures. The most challenge for

ABCMTC needs to pay attention is how to apply new strategic implementation in the obsolete

system and push it change to adapt to new market.

B. Development of training to enhance employees‟ values and corporate well

To improve customer service and avoid risk of conflict organization, ABC Money

Transfer Company can organize more regularly training activities to improve its service

staff‟s competence as well as their ethical practice. In fact, due to the old system, the company did not motivate enough employees and not provide them enough training course to improve

their professional skills in jobs. As a result, in reality, the company can rely on the

service-profit chain framework. The company should “have at the command to get them achieve extraordinary results”. It creates good environment, which can encourage response to customer satisfaction from service staffs. “Good environment with affective satisfying

employees through good rewards and fair punishment, the company can make them stay

longer, large commitment to the community. Then they will try to devote their talents to

Further, the company should empower staff‟s actively make decisions and solve problems. It is also the way to reduce the customers‟ waiting time. Therefore, they can be more confident to face the problems and improvise flexibly the situations as well as

encouraged to contribute to the business. Additionally, it can help them to understand and

cooperate effectively. Good communication will be improved and thus, working well among

departments will provide necessary supports for effective restructure and implementation.

Management, then, can develop the full potential ability in employees.

C. Enhancing control system and strong support for customer service system

Before launching a service, ABC Money Transfer Company should test the

performance under different market conditions to define the class of clients, and then test with

internal organization that approach customer and work on the services to let them understand

clearly new services, so that they can know when and whom they can recommend the service.

They should fully understand the complexity of service. Staffs, especially counter and home delivery staffs can understand their kinds of services as well as their clients‟ need well, which helps them provide suitable service, and then increases chance of success.

Base on resource-based view, ABCMTC should have promotion for their brand. They

should enter the blue ocean markets which are less competitive and create their own market

instead of red ocean markets.

4.2 SWOT analysis Strengths

- ABC Money Transfer Company, a subsidiary of ABC Bank, established in 2001 and is the leading player in Vietnamese remittance market

Weaknesses

- Service network haven‟t spread all provinces in Vietnam.

- The process of transfer money is sometime slow.

- ABC Money Transfer Company provides all services for remittance market including: home delivery, counter pickup, bank account transfer,…at excellent quality covering the nation wide with competitive price.

- Strong reputation, financial power, and infrastructure from ABC Bank

- Meet the demand of foreign currency adequately.

- Strong relationship with state.

- Strong home delivery

-Valued and motivated employees, good work environment.

- Marketing activities are not enough for promote their reputation.

- Organization system is bureaucratic

- They sometimes rely on agencies from foreign countries.

Opportunities

- Advanced techniques will reduce the time to pay for customers

- Types of payment are more various which will improve the quality of services.

- The number of people who live oversea is more and more increase in demand.

- Government policies have supported free duty for inward remittance services.

- Exchange rate is depreciating over the years.

Threats

- Relation between oversea Vietnamese to their relative in Vietnam is decreased by their age and difference generation

- Vietnamese workers who were out of job have to go back due to financial crisis

Source: This research

Figure 8: Exchange rate VND/USD from 2001-2008

As we know that exchange rate VND/USD increases year by year, so this is an

opportunity for ABC Money Transfer Company because customers who receive money can

have much more VND than before, and it encourages people to receive money from foreign

countries. The remittances market will have more opportunities.

From SWOT analyzing, we can see that ABC Money Transfer Company has a lot of

strengths thanks to ABC Bank, so ABC Money Transfer Company should take this advantage

to improve their services in order to expand their market. However, there are many

opportunities for ABCMTC in the market. By this I mean that they can be easy to pass over

threats which ABCMTC has to face so that they can increase their market share in near future.

4.3 Five-force analysis

As we can see from the following analyzing that ABC Money Transfer Company has high

opportunities in the market because of a few competitors, low threats of new entrants, low

power of buyers.

4.3.1 Major competitors on remittance business in the market

Exchange rate VND/USD

0 10,000 20,000 2001 2002 2003 2004 2005 2006 2007 2008 Year VND changes

Major competitors are not many. The direct competitors of ABCMTC current are Sacomrex and Incomex, which they have all kinds of services like counter pickup, account transfer or bank‟s card, home delivery. However, they still have lower market share in comparison with ABCMTC, meanwhile the demand of this service is more and more increased. These competitors can not cover all market, so the market for ABCMTC is always high.

(a)Formal channel

A remittance firm transfers funds from one person in one country to another person in another

country. Often, the international remittance is the monetary fruit of migrant labor that is being

transferred back to the migrant worker‟s family. This makes the remittance service a crucial

component of the logistics of migration. There are many remittance service providers in

certain country which cooperate with remittance service providers in other countries to help

customers transfer money to customers‟ home. They are banks, non-bank financial institutes

like Western Union, Moneygram, foreign remittance service providers. These are some

indirect competitors for ABCMTC.

At present there are some Vietnamese banks have cooperated with foreign banks to transfer

money for customer such as: Incombank, BIDV, Vietinbank, Vietcombank, Sacombank, Asia

Commercial bank, Agribank. Moreover, these banks cooperated with Western Union and

Moneygram in this service, and they keep in touch with Export labor companies to give

information about their services to Vietnamese worker.

Generally, services of the indirect competitors are also quite narrow, limited and lack of

profession. Most of their services primarily concentrated in the type of home delivery but still

limited. However, there are some small companies with large-scale activities and bring

extensive expertise as Sacomrex, Eden FSC, FINTEC, Incomex, and forms of operation,

Most of banks just focus on counter pickup, account transfer or bank‟s card, and other money

transfer companies specialize on home delivery. Meanwhile, ABCMTC has all those kinds of

services.

However, there are some informal small non-bank businesses that have especially served for

Vietnamese workers in Taiwan, but which is perceived to prevent a level playing field and

create a competitive disadvantage to the firms that are appropriately licensed.

(b) The threat of established rivals in each product

- Network Bank or Company Number of province BIDV 64 Agribank 64 ACB 64 ABC 57 Sacomrex 55 Incombank 54 VCB 38 Eximbank 16

Source: Directory of the statistics in Vietnam

Table 3: Network of rivals

Some competitors has their service in all 64 provinces in Vietnam, meanwhile ABCMTC has

57/64 provinces.

+ Home delivery:

Source: Directory of the statistics in Vietnam

Figure 9: Three biggest companies in Home delivery service

+ Counter pickup: The number of POD (places of delivery) of ABCMTC is ranked 5th comparison with Sacomrex, BIDV, VCB, ACB

+ Bank‟s card: The number of ATM in ABCMTC is ranked 3rd in comparison with VCB and VIDB.

Although ABCMTC has the infrastructure less than competitors, it has done business

better than these rivals.

(c) Informal channel

Traditionally, Most of Vietnamese worker is familiar with informal channel when they send

money to their relatives in Vietnam because they don‟t know much about the formal channel. Other reasons are language barriers, complex procedures in banks, regulations because these

Vietnamese workers are mainly the unskilled (including construction workers, domestic

workers, farming labour, etc) and semi-skilled (including electronic workers, factory workers,

etc) job categories. Moreover, IFT operators meet the demand of the recipients in the rural

Home delivery 50 55 60 65 ACB Sacomrex Number of provinces ABCMTC

areas in many ways. Not only do they offer distribution into rural areas where formal systems

have not penetrated, but they conform to the cultural and personal desire for anonymity – an

important factor for many recipients in Vietnam, especially in rural areas. Some rural

recipients refer IFTs because they do not want neighbors or officials to know they receive

money. In rural areas, local government oversight can be strong and, at times, intrusive from

the perspective of senders and recipients. One government officials or other community

members know that the person receives money from overseas, they question where the money

comes from, ask for loan or gift and monitor spending habit of recipients.

Global money transfer company: Money Gram

and Western Union

Banks Informal channels

Advantages: - Quickly - Safety. Disadvantages: - High fees Advantages: - Safety. Disadvantages: - High fees - Long time Advantages: - Quickly - Low fees Disadvantages: - Unsafe - Illegal

4.3.2. Threat of substitute products or services

In general, there are many substitute services of ABCMTC that are banks, foreign

remittance services, and informal services. Threat of substitute products here is medium

because customers can choose other services, but they have to pay higher cost with formal

channel or get high risks with informal channel. However, the scale of these substitute

services is not high enough to affect to ABCMTC.

Informal funds transfer system is still a matter of concern for ABCMTC. Informal funds

transfer systems (IFT) operate in the main markets in Vietnam like the jewelry shop in Ben

- A sender deposits money in a designated bank account in the originating economy.

- An IFT system operator in foreign countries confirms the deposit and provide a code

to the remitter

- The IFT system operator in foreign countries calls an IFT system operator in Vietnam

to transmit the code.

- The sender calls the recipient to convey the code

- The recipient receives the money in exchange for the code from the IFT system

operator in Vietnam.

Formal funds transfer systems have yet to match the speed and low prices of the IFT systems.

For example, transfers money from Canada to Vietnam through banks and other major Money

services business (MSBs), such as Western Union, can take 2-5 days in contrast to 24 hours

for IFT operators. In some cases a remittance through formal channels to a rural region in

Vietnam can take a month. An IFT agent typically charges 1-2 percent of the transferred

amount for each transaction, depending the size of the transaction. Fee in the formal sector

vary widely, from 2 to 10 percent. Some formal channels charge a smaller percentage but with

the addition of the flat fee. In the case of bank transfers, additional fee may be charged to

recipients by the intermediary and distributor in Vietnam. Remitters are thus likely to pay

more when using formal operators.

4.3.3 The threat of new entrants

The threat of new entrants is low as the following reasons:

- Government has tightly controlled in allowing registering for remittance service business

- Remittance service has required high knowledge about finance for people who want to

run business about this.

- Money Transfer Company has required a lot of investment in capital in cash or

infrastructure like place of delivery, agencies.

Therefore, there are so many difficulties for new entrants that they want to do this kind of

business. Most of new entrants are from banks which established new branch to specialize

about this. Moreover, Western Union and Money gram also set up more places of sales to

expand their business in Vietnam in recent years. Other new entrants are not so big.

4.3.4 The bargaining power of suppliers

The bargaining power of suppliers is medium. Suppliers are agencies in other countries.

This service has required worldwide network. It is not easy for ABCMTC to find out agencies

in foreign countries, but it is not difficult to keep long relationship with them thanks to

ABCMTC reputation in Vietnam.

4.3.5 The bargaining power of customer

The bargaining of customers is low because the number of customers who have money

transfer demand is high, but the good money transfer service is not so many. ABCMTC has a

full-product advantage, which customers are very easy to get the satisfactory from

ABCMTC‟services in comparison with others services. In addition, they use other substitute

services such as sending money through someone from foreign countries to Vietnam, which

will have limitation of the amount of money. If they send by informal channel, it will be risky.

In generally, customer habits and the existing industrial organization is so entrenched that

institutions with external financing or existing financial infrastructure will have the

habit, especially workers. They like services that are familiar with them and easy to access to

avoid risks in transaction.

Because of most customers are like home delivery service, ABCMTC needs to develop

more these services with other partners (Instant Cash, Money ... X-Press ) and expand

activities to the rest of provinces. ABCMTC needs to shorten delivery time to have better

services and compete with Sacomrex (4 hours in Ho Chi Minh City, 8h in center of other

provinces and 24h in the rural areas).

To attract customers, ABCMTC should set up more ATM machines to be more

convenience when customers use the card, and they should do some promotions such as free

cards and free transactions in the first 10 trading.

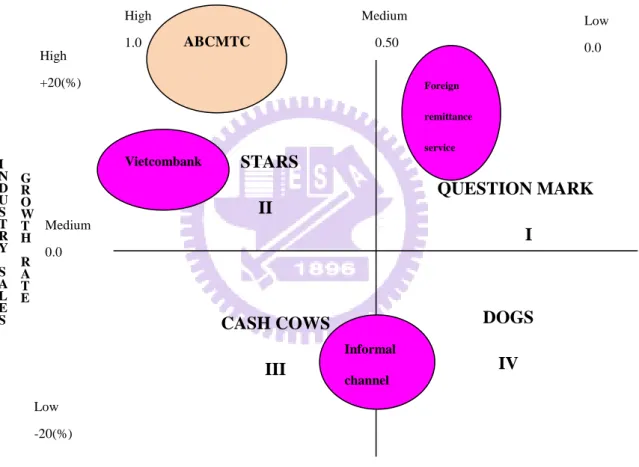

4.4 BCG framework

As the above analyzing, ABCMTC has the second biggest market share in remittance

service and still improve their service to adapt the market growth.

According to BCG matrix, the position of ABCMTC should be at “Stars”.The business has

high market share compared to competitors and it is doing business in high-growth market.

This business is a market leader. Successful Question Marks will grow their business and

capture more market share and will hopefully become Stars (move from the Question Marks

quadrant to the Stars quadrant). Successful and competitive organizations have at least one

star business unit or product. ABCMTC has to improve their business continuously in order to

keep their position in the marketplace. As long as this market is growing new question marks

will try to capture new business

Relative market share position is given on the x axis of the BCG Matrix. The midpoint on

leading firm in the industry. The y axis represents the industry growth rate in sales, measured

in percentage terms. The growth rate percentages on the y axis could range from 20 to +20

percent, with 0.0 being the midpoint.

ABCMTC is located at x=18.03/20.86=0.86 (ABCMTC‟s market share compared to

VCB‟s market share); y= (sales in 2008 – sales in 2007)/sales in 2007=(8-5.5)/5.5=45%. (The data is collected up to 2008)

Source: This research

Figure 10: BCG shows ABCMTC’s position

Remittance services have existed for a long time, but it was delivered by informal channel.

This is the reason why informal channel had the big market in the past. However, informal

channel is going to decrease its market share and growth because informal channel is reliable

and easy to use, and it lies between cash cows and dogs. As regards foreign remittance

RELATIVE MARKET SHARE POSITION

QUESTION MARK I CASH COWS III Low 0.0 Medium 0.50 High 1.0 High +20(%) Medium 0.0 Low -20(%) I N D U S T R Y S A L E S G R O W T H R A T E STARS II DOGS IV ABCMTC Informal channel Foreign remittance service Vietcombank