1

View of Shenzhen’s skyline across fish ponds in Hong Kong. Photo by Joseph Chan on Unsplash.Do Place-Based Policies Work?

Lessons from China's

Economic Zone Program

Jin Wang

Issue

Can Special Economic Zones (SEZs) be an effective policy tool to increase foreign direct investment (FDI) and employment? A hotbed for experimentation, such zones allow governments to try out trade-oriented industrial

policies before broader implementation. In China, SEZs have provided corporate tax breaks, property rights protection, and preferential land policies to attract foreign investors.

KEY POINTS

In the right environment, Special Economic Zones (SEZs) are an effective policy tool for attracting foreign direct investment (FDI) and increasing employment. There are large agglomeration benefits. The majority of FDI attracted by Chinese SEZs creates new activity rather than being diverted or reallocated from other non-SEZ areas.

Due to poorly-developed institutions and markets in emerging China, SEZs provided better institutions which improve economic efficiency. The economic gains substantially outweigh the costs.

But SEZs tend to cause more relocation distortions than agglomeration benefits in developed economies with better institutions and in areas that already have SEZs.

2

During the last 30 years, SEZ proliferation in China has been strongly associated with increases in exports, FDI and foreign exchange reserves. Globally, Special Economic Zones (SEZs) account for over 68 million direct jobs and over US$ 500 billion in trade-related value added within zones. According to a 2008 World Bank report, there are approximately 3000 Special Economic Zones across 135 countries in 2008. Moreover, although SEZ programs are pervasive, thirty years of experience shows that zones have not been uniformly successful. Successes in East Asia and Latin America have been difficult to replicate, particularly in Africa, and many zones have failed. Thus, better understanding of SEZs’ impact on local economies carries great policy relevance.

Several questions loom especially large. Can SEZs help develop the local economy? Who benefits and who loses? Do the economic gains outweigh the costs? What program design features and characteristics of targeted areas make them more effective?

There is disagreement over the benefits of SEZs. Proponents argue that SEZ policies cluster firms in dense, urban areas that promote interaction among firms which creates agglomeration economies that increase productivity. Yet, critics argue that the programs merely shift activity from other regions to targeted areas without creating net benefits overall. Many are wary of cities competing to provide corporate tax breaks, which they fear will encourage arbitrage behavior by firms and workers and create negative distortions for local economies.

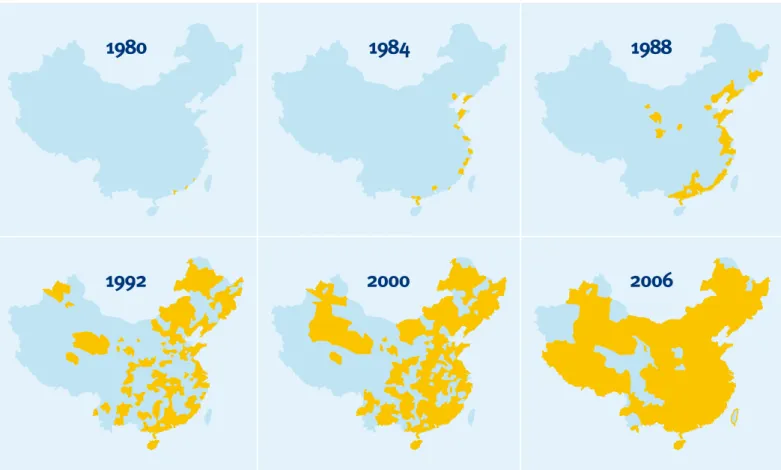

Figure 1. The Geographic Evolution of The Special Economic Zone Experiment

Our studies are the first to provide rigorous empirical evidence based on regional- and firm-level data on how local economies gain from place-based, SEZ programs in China. Given the relative lack of evidence on the impact of SEZs globally despite their widespread prevalence, these results should be informative to policy makers seeking greater clarity about the potential benefits of SEZs, especially in developing and emerging economies. Our study quantifies the impact of the SEZs by estimating their benefits and distortions, and examines what factors account for zone effectiveness.

Assessment

The gradual spread of SEZs across different regions in China provides a unique opportunity for assessing impacts. For our purposes, SEZs include various types of development zones. We compare the change in development outcomes between cities establishing SEZs earlier and later.

Since 1979, SEZs have expanded from the coastal, more industrially developed areas inland, to less industrially developed areas, as shown in Figure 1. What is interesting is that early-adopter municipalities have better infrastructure than those in later rounds, which is evident from data on highway density, numbers of airports, ports, telecommunications infrastructure, and financial development. Source: Wang (2013)

1980

1988

2000

2006

1992

1984

33

Figure 2. The wave of SEZs established between

2005 and 2008

Source: Lu, Wang and Zhu (2018) Investment and agglomeration benefits

The agglomeration benefits are strong enough to justify SEZ policies which encourage new business investment in targeted areas.

Evidence shows that SEZs do attract investment, mainly in the form of export-oriented and foreign-invested industrial enterprises. They have not crowded out domestic investment. When examining total factor productivity (TFP) growth, it is clear the dense investment in the SEZs does in fact yield agglomeration benefits, increasing the technological progress of the hosting municipalities by 1.6 percentage points. What is more, SEZ policies have also led to wage increases for workers, oftentimes in excess of increases in the local cost of living.

Creation or diversion?

The worry is that, investors are encouraged to divert their business activity to provinces or municipalities under SEZ policies, away from locales without SEZ benefits. For investment outcomes, both creation and diversion could contribute to the overall effect.

Analysis shows that the municipality's own SEZ program on average increased its FDI per capita by 112% while SEZs in adjacent municipalities had diverted 33% of its FDI per capita away. Thus, the economic creation effect is larger than the diversion effect, so SEZs do not merely move economic activity from one region to another but rather create new growth and increase aggregate output.

The large net benefits of such policies should allay the efficiency concerns of SEZ skeptics. SEZ’s positive contribution to aggregate production demonstrates to policy-makers how SEZ policies are worthwhile policy tools.

Early versus late zones

This is not the end of the story – our analysis finds that SEZs established earlier were more effective. While SEZs on average benefited local economies, later zones generated larger distortions than earlier ones. Wage increases in later zones were also not as pronounced as in earlier zones. These results imply that later zones are closer substitutes with zones established earlier and have less of an impact. This suggests that overuse of SEZs creates unnecessary distortions, especially in more mature economies with higher labor and capital mobility.

A companion paper builds on the initial study and extends it to firms, aimed at understanding the micro-foundations of SEZ policies. This study focuses on the wave of SEZs established between 2005 and 2008, which are shown in Figure 2 and account for 42 percent of all SEZs in China. Comprehensive geocoded information on Chinese firms and rich administrative information on SEZ boundaries were compiled and analyzed.

Assessment of local economic impacts

By comparing the changes in performance among SEZ villages (and counties) with the changes among non-SEZ counterparts during the same period, the evidence confirms that the SEZ program had a positive impact on the areas targeted. After two years, the SEZ areas had 58 percent more capital invested, 35 percent greater employment, and 49 percent more output than non-SEZ areas. The number of firms in the SEZs increased by 29 percent, productivity increased by 1.5 percent within one year, and wages increased by 2.9 percent within two years, reflecting the productivity benefits of agglomeration. Moreover, the effects of SEZs mostly come from firm creation, with limited effects from the previously existing firms.

Reassuringly, evidence also shows that SEZs do not significantly harm the development of firms in nearby non-SEZ areas through competition, etc. However, in interpreting the results on firm creation, we caution that some firm births could be considered relocations if the SEZs attracted new-born firms from other regions. Some new investors may simply have changed their location choices in establishing a new firm in response to an SEZ.

SEZ benefits versus costs

How do SEZs' overall benefits compare to the costs? We consider various stakeholders influenced by the SEZs. The main benefits include potential increases in firms' profits, workers' wages, and landlords’ rental income. The corporate tax concessions that firms in SEZs typically enjoy are regarded as the main costs of the program.

In monetary terms, firm-level evidence reveals that the program has brought a net benefit of US$15.62 billion within three years of its implementation. These findings again may help to dispel the general pessimism about zone programs in developing countries.

44

Read all HKUST IEMS Thought Leadership Briefs at http://iems.ust.hk/tlb T: (852) 3469 2215 E: iems@ust.hk W: http://iems.ust.hk A: Lo Ka Chung Building,

The Hong Kong University of Science and Technology, Clear Water Bay, Kowloon

Recommendations

In the light of our findings, we are cautiously optimistic that SEZ policies can attract investment to emerging markets and deliver benefits of employment and agglomeration economies. This makes SEZs an attractive policy tool for governments where growth and development tops the agenda.

Furthermore, benefits and distortions caused by place-based programs depend crucially on a country’s institutional and contextual setting. For example, Chinese SEZs achieved significant net benefits largely due to the institutional improvement brought by them. China also may have witnessed larger benefits because the mobility of labor and capital is much lower than in developed countries. Ironically, it is largely because of the underdeveloped market institutions that emerging markets could benefit more from location-based policies. SEZ program benefits also are more concentrated around target areas, and it is difficult for outsiders to arbitrage the benefits away.

In contrast, advanced economies tend to see more costs than benefits. In the United States and Europe, because markets are

well developed with high labor and capital mobility, location-based programs can generate much larger distortions without improving aggregate welfare.

Also, the Chinese case shows that later zones are less effective than earlier ones, likely because relocations happen more easily with highly substitutable locations. In other words, in a mature economic environment with many existing SEZs, additional SEZs can create bigger distortions and provide fewer benefits.

Recently, there have been studies on India and Poland echoing the results in China. In practice, when governments implement policies to attract FDI, they should bear in mind various factors including the design of policy subsidies, geographical endowments, infrastructure and industrial development – which contribute to how effective an SEZ will be, and they should be more selective in choosing the sites. Location-based development policies have the potential to create growth in emerging markets, thus serving as an important policy tool.

Jin Wang is Associate Professor of Social Science and a Faculty Associate of the Institute for Emerging Market Studies at the Hong Kong University of Science and Technology. She was educated at the Tsinghua University of China for her BA and MA in Economics before getting her PhD in Economics from the London School of Economics and Political Science. Her research, which mostly has a policy focus, is mainly in the areas of Development Economics, Public Economics and Chinese Economy. She has worked on a variety of topics – place-based policies, government hierarchy and incentives, and the labor mobility barriers that are embedded in the hukou household registration system of China. Her work has appeared in a range of economics journals including Journal

of the European Economic Association, American Economic Journal: Economic Policy, Journal of Development Economics and Journal of Comparative Economics.

Reference

I Jin Wang (2013), “The Economic Impact of Special Economic Zones: Evidence from Chinese Municipalities”, Journal of Development Economics, vol. 101, 133–147. II Yi Lu, Jin Wang and Lianming

Zhu (2018), “Place-Based Policies, Creation, and Agglomeration Economies: Evidence from China’s Economic Zone Program”, American Economic Journal: Economic Policy, 11(3): 325–360.