科技部補助專題研究計畫成果報告

期末報告

企業合併之系統整合衡量─自多重利益關係者角度分析

計 畫 類 別 : 個別型計畫 計 畫 編 號 : MOST 102-2410-H-004-183- 執 行 期 間 : 102 年 08 月 01 日至 103 年 08 月 31 日 執 行 單 位 : 國立政治大學資訊管理學系 計 畫 主 持 人 : 尚孝純 計畫參與人員: 碩士班研究生-兼任助理人員:劉瀚徽 碩士班研究生-兼任助理人員:陳怡臻 碩士班研究生-兼任助理人員:莊英杰 碩士班研究生-兼任助理人員:楊欣庭 博士班研究生-兼任助理人員:吳君怡 報 告 附 件 : 出席國際會議研究心得報告及發表論文 處 理 方 式 : 1.公開資訊:本計畫涉及專利或其他智慧財產權,2 年後可公開查詢 2.「本研究」是否已有嚴重損及公共利益之發現:否 3.「本報告」是否建議提供政府單位施政參考:否中 華 民 國 103 年 11 月 13 日

中 文 摘 要 : 在企業併購專案中,兩家公司資訊系統的整合工作十分關鍵 而複雜。許多研究探討業合併過程中資訊系統整併的組織與 文化管理,然仍缺乏企業併購之後資訊系統整合績效的評估 研究。本研究企圖從不同關係人的角度探討企業併購時資訊 系統整合之衡量準則,四個企業關係人分別為執行長、資訊 長、業務經理人、以及企業之顧客。本研究之預期結果除了 提供企業併購時資訊系統整合之衡量準則之外,更期待能對 資訊系統成功理論提出不同解釋。 中文關鍵詞: 資訊系統整合、企業併購、衡量準則、資訊系統成功理論 英 文 摘 要 : While information systems have been an important tool

to coordinate the daily activities of a company, systems integration has become one of the most critical and complex tasks during a merger and

acquisition (M&A). M&A projects are highly complex in terms of the number of deliverables and the amount of communication among a wide range of stakeholders. The strategy of IS integration requires significant input from stakeholders on both strategic business needs and technological capabilities so that organizations can build a clear and comprehensive picture of the connection between business and IS and devise solutions that transcend functional boundaries. Studies on M&A IS integration have spent much effort on studying integration project management mainly trying to explain the impact of cultural differences on the implementation of IS integration. A few

studies have explored the existence of relatively divergent viewpoints between business and IT managers that could cause a “stakeholders' conflict". An M&A project usually involves stakeholders of

different interest parties with different objectives. The objective of this paper is to develop a

comprehensive IT integration measurement from

multiple stakeholder perspectives—i.e., CEOs, CIOs, business managers, and customers of the merged

companies. Based on the literature review of system integration in M&As from different viewpoints, the research forms a framework of measurements of system integration and plans to verify deeply with different stakeholders of M&A cases in the banking industry in

Taiwan. The banking industry in Taiwan has faced a fiercely competitive environment and M&As are taken as a major means for banks to improve their operation performance and prosperity. IS plays an important role in the daily operations and has a direct impact on banks' competitiveness. A good alignment among stakeholders will lead to successful M&A systems integration and project management. The results will reveal the different measurements from multiple stakeholders' viewpoints and could correspond to an alternative explanation of the information system success theory.

行政院國家科學委員會補助專題研究計畫

□期中進度報告

■期末報告

Measuring the Systems Integration in Mergers and Acquisitions

- A Multiple-stakeholder Perspective

企業合併之系統整合衡量─自多重利益關係者角度分析

計畫類別:■個別型計畫 □整合型計畫

計畫編號:NSC 102 - 2410 - H - 004 - 183

-

執行期間:2013 年 8 月 1 日至 2014 年 8 月 31 日

執行機構及系所:國立政治大學資訊管理學系

計畫主持人:尚孝純

計畫參與人員:碩士班研究生-兼任助理人員:劉瀚徽

碩士班研究生-兼任助理人員:陳怡臻

碩士班研究生-兼任助理人員:莊英杰

碩士班研究生-兼任助理人員:楊欣庭

博士班研究生-兼任助理人員:吳君怡

本計畫除繳交成果報告外,另須繳交以下

出國

報告:

■出席國際學術會議心得報告及發表之論文

處理方式:

除列管計畫及下列情形者外,得立即公開查詢

□涉及專利或其他智慧財產權,□一年■二年後可公開查詢

中 華 民 國 103 年 11 月 12 日

Measuring the Systems Integration in Mergers and Acquisitions:

A Multiple Stakeholder Perspective

While information systems have been an important tool to coordinate the daily activities of a company, systems integration has become one of the most critical and complex tasks during a merger and acquisition (M&A). M&A projects are highly complex in terms of the number of deliverables and the amount of communication among a wide range of stakeholders. The strategy of IS integration requires significant input from stakeholders on both strategic business needs and technological capabilities so that organizations can build a clear and comprehensive picture of the connection between business and IS and devise solutions that transcend functional boundaries.

Studies on M&A IS integration have spent much effort on studying integration project management mainly trying to explain the impact of cultural differences on the implementation of IS integration. A few studies have explored the existence of relatively divergent viewpoints between business and IT managers that could cause a “stakeholders’ conflict”. An M&A project usually involves stakeholders of different interest parties with different objectives. The objective of this paper is to develop a comprehensive IT integration measurement from multiple stakeholder perspectives—i.e., CEOs, CIOs, business managers, and customers of the merged companies. Based on the literature review of system integration in M&As from different viewpoints, the research forms a framework of measurements of system integration and plans to verify deeply with different stakeholders of M&A cases in the banking industry in Taiwan. The banking industry in Taiwan has faced a fiercely competitive environment and M&As are taken as a major means for banks to improve their operation performance and prosperity. IS plays an important role in the daily operations and has a direct impact on banks’ competitiveness. A good alignment among stakeholders will lead to successful M&A systems integration and project management. The results will reveal the different measurements from multiple stakeholders’ viewpoints and could correspond to an alternative explanation of the information system success theory.

Keywords: M&A, IS integration, Multiple stakeholder perspectives.

※ 本文之前期研究曾刊登於國際研討會之論文集,完整研究亦在期刊投稿送審之中。

Meng-Hsien Lin and Shari Shang, "An Examination of the Success of Post-merger IT Integration" (July 29, 2012). AMCIS 2012 Proceedings. Paper 22.

INTRODUCTION

Mergers and acquisitions (M&As) have been a strategic approach for enterprises to reconstruct competitive resources. Since the early 1990s, businesses have begun to adjust their scope to improve operational efficiencies, access to new products, and increase market share (Gadiesh et al., 2002; Harrell & Higgins, 2002; Song et al., 2010). Managers in charge of M&A projects have even explained that “acquiring (external growth) is much faster than building (internal growth)” and that companies nowadays need “the speed to market, the speed to positioning, and the speed to becoming a viable company” (Carey 2000; Giacomazzi et al., 1997; Bien, 2009; Hendrickson, 2003).

While companies nowadays increasingly depend on information systems (IS) to coordinate transactions, manage operations, and aid the pursuit of new market opportunities, the performance of systems integration after an M&A becomes more critical (Chang et al., 2002; Curtis & Chanmugam, 2005; Harrell & Higgins, 2002; Honoré & Maheia, 2003; Sarrazin & West, 2011). Evidence has suggested that one of the main reasons for poor acquisition performance in the merger wave of the late 1980s was the failure of organizations to fully consider the implications of merging the information technology (McKiernan & Merali, 1995). System integration is a vital component of business mergers (Harrell & Higgins, 2002). A conventional belief is that if the IS integration is not effective, the business will not be effective in its operations, and if the IS integration fails, the business will most likely fail as well (Schmid et al., 2012).

The success of IS integration has often been defined as a favorable result or outcome. However, early definition of how this outcome should be characterized, or for whom the result should be favorable, is ambiguous (Alaranta, 2005). Evaluation studies may take many forms and have different functions but commonly assume consensus on evaluation criteria. Reasoning from a theory of value pluralism, it is more likely that stakeholders will have different, and sometimes conflicting, views on an evaluated program (Abma, 2000). In order to acknowledge this plurality, Guba and Lincoln (1989) proposed taking different stakeholder constructions as a departure point for a negotiation process towards consensus or a heightened personal and mutual understanding. The explicit consideration of potential trade-offs between different policy objectives and conflicts between stakeholder interests helps to avoid the unexpected, facilitates good design, improves the likelihood of successful implementation, and assists the assessment of outcomes (Grimble & Wellard, 1997).

M&A projects are highly complex in terms of the number of deliverables and the amount of communication among a wide range of stakeholders (Meckl, 2004; Shrivastava, 1986).The strategy of IS integration requires significant input from stakeholders on both strategic business needs and technological capabilities so that organizations can build a clear and comprehensive picture of the connection between business and IS (Zee, 2002) and devise solutions that transcend functional boundaries (Peterson et al., 2000). Studies on M&A IS integration (Merali & McKiernan, 1993; McKiernan & Merali 1995; Stylianou et al. 1996; Mehta & Hirschheim 2004; Wijnhoven et al. 2006) have spent much effort on studying integration project management mainly trying to explain the impact of cultural differences on the implementation of IS integration. A few studies have explored the existence of relatively divergent viewpoints (Curtis & Chanmugam, 2005) between business and IT managers that could cause a “stakeholders’ conflict” (Abma, 2000). An M&A project usually

involves stakeholders of different interest parties with different objectives. These stakeholders may include the CEO of the project who is concerned more about the timely completion of the project, whereas the IT manager may be focused more on the technical side of the project. In the meantime, there are great demands from business managers who reply on the integrated systems for daily operations as well as critical decisions. Last, and garnering the least attention, is the customer of the merged enterprises who receives services mainly from the integrated system. An IS integration project of such an M&A project would need to take into consideration the different stakeholder views and manage the various conflicts and objectives. Moreover, these objectives may affect each other and result in contradictory requests. For instance, the tradeoff between time and quality requested by the top manager and the operation manager is always a critical decision in a system integration project and can lead to different views of the project’s success. In complex decision-making situations with conflicting interests, the problem may be addressed from the perspective of different stakeholders using a multiple-stakeholder approach.

The objective of this study is to clearly distinguish stakeholders’ measures of the success of IS integration and examine the interrelationship among the stakeholders. Explicit analysis of the interests and impact of intervention on different stakeholders (including the poor and less powerful) can help ensure that costs are borne and benefits realized for those intended (Grimble & Wellard, 1997). The goal of this variation is not to find a single, best solution (i.e., linear programming), nor to find an equilibrium (as in game theory), but to clarify the values and opinions of the stakeholders, to pinpoint the sources of disagreement, and to develop compromise solutions (Winterfeldt, 1992). A good alignment among stakeholders will lead to successful M&A systems integration and project management.

First, the study categorizes the stakeholders into CEO, CIO, business managers, and customers of the merged companies. Based on the literature review of system integration in M&As from different viewpoints, the research forms a framework of measurements of system integration and plans to verify deeply with different stakeholders of M&A cases in the banking industry in Taiwan. The banking industry in Taiwan has faced a fiercely competitive environment and M&As are taken as a major means for banks to improve their operation performance and prosperity. IS plays an important role in the daily operations and has a direct impact on banks’ competitiveness. While M&As have become difficult and complex tasks that have joined varied stakeholders and different expectations, a comprehensive system-integration measurement is an especially important tool towards achieving M&A success.

LITERATURE REVIEW

Systems integration has been described as both an essential and troublesome part of an M&A project (McKiernan and Merali 1995; Mehta and Hirschheim 2007). This research tries to build an analysis framework in evaluating the systems-integration performance in an M&A project from a wide aspect. The following sections provide a brief review of the extant literature on different views of systems integration.

Systems integration in an M&A project

Systems integration involves changes in system strategy, system structure, and the systems supporting the combined technology and business units that allow them to function as a whole (Mehta & Hirschheim, 2007).

There are four methods with which to complete IS integration in M&A projects. First, abolish all IS of both merger partners and replace it with completely new IS, which is renewal. Second, closing down all the IS of one-sided partners and using the IS of the other side as the IT for both firms, which is takeover. Third, combining the best parts of both partners’ IS as the new standard for the new organization, which is standardization. Finally, there is co-existence, which maintains the current IS, and introduces some (periodic) synchronization of the redundant systems of both merger partners (Harrell & Higgins, 2002; Johnston & Yetton, 1996).

As with all business initiatives, it is essential that a company identify its M&A strategy first and then align its IS integration strategy to support the M&A activities (Chang et al., 2002; Harrell & Higgins, 2002; Sarrazin & West, 2011). Given the fact that IS enables 60% of post-M&A transactions, the alignment is particularly crucial in the M&A realm (Chang et al., 2002).

CEOs’ perspectives on systems integration

Companies that become involved in M&As aim to cut costs and gain a competitive advantage (Weber & Pliskin, 1996). As regards the advantages of integrating new capabilities, realizing synergy, obtaining knowledge and assets, and gaining access to new customers, 66% of CEOs take M&As as one of the most important strategies to rapidly expand global reach (IBM, 2008). As leaders and decision-makers, CEOs seek to increase revenue (by market expansion, value chain expansion), decrease costs (by scale/operational economies), realign portfolios, strengthen the balance sheet and financial flexibility, and bolster competitive positioning (by acquiring commercial skills, such as trading, risk management, and marketing) through M&As. CEOs play five essential roles in M&As: visionary (establishing and communicating the strategic vision for the merger); cheerleader (generating enthusiasm and confronting investors' fears of stock-price falloff, regulator concerns about unfair competition, executives' fears of losing status to counterparts from the merging company, employees' concerns over job losses, customers' and suppliers' worries about potential disruption in service); closer (resolving the agreement and closing the M&A deal); captain (leading change by managing the integration of the two entities); and crusader (crusading for the new entity) (Gadiesh et al. 2002).

During the beginning of an M&A, a CEO is not only concentrating on combining the company’s business portfolio and activities and switching people and processes, but also constantly communicating to avoid paralysis and maintain morale. CEOs see losing people and customers as the biggest risk of an M&A, so enabling a smooth channel of communication between the business operation, managers, employees, and customers is extremely important. In many cases, CEOs quickly need to obtain accurate information to make a timely decision, especially in the early days (Carey 2000). The integrating of the basic work processes, computer systems, financial systems, and the solid combination of data becomes important as well. Summarizing from a CEO, they see achieving operational synergies and obtaining new technologies as important in the IT integration of M&As.

CIOs’ perspectives on systems integration

integrated communication and interaction platform for information transportation and exchange within the merged companies. Although the decision of M&A strategy is often made by the CEO, the CIO is the one in charge of a wide range of tasks that support effective business processes within a merged company (Albayrak & Gadatsch, 2009; Honoré & Maheia, 2003). The CIO is related to the definition of the new corporate IS, infrastructure requirements, and a reluctance to define both IS and IT before the M&A.

In an M&A scenario, a CIO is required to ensure that the establishment of connectivity and consolidation of key infrastructural aspects are given the utmost priority. This involves all activities that have to be completed immediately after the M&A deal is closed, as well as all critical infrastructure-related activities such as a common network setup, e-mail, the Internet, and a help desk setup. During an M&A process, the CIO pursues the consolidation of technology, such as consolidating data centers, rationalizing vendor contracts, and renegotiating software licenses (Agrawal, 2010; Harrell et al. 2002).

Continuing the delivery of daily operational services and capabilities to enable the integration of the business is important to the CIO (Chang et al., 2002). Processes such as a service desk, procurement, security policies, and software development must be stabilized in order to achieve organizational stability. While those processes are the key to acting like a single organization, the process consistency has become a major element of a firm’s perception of a well-integrated IT (Agrawal 2010; Albayrak & Gadatsch, 2009; Honoré & Maheia, 2003; Zelinger, 2011). In other words, the service gap is neither acceptable for in-house functional departments nor for external customers (Albayrak & Gadatsch, 2009).

Finally, there is a great deal of pressure on IT managers to be overly optimistic about the expense and speed of the project. Most CIOs are requested to achieve M&A integration within the desired costs (Agrawal 2010; Alvarez et al. 2007; Curtis & Chanmugam, 2005; Harrell & Higgins, 2002; Honoré & Maheia, 2003; Pratt, 2011; Shearer, 2004; Zelinger 2011) and time frame (Agrawal 2010; Honoré & Maheia, 2003; Shearer, 2004; Pratt, 2011).

Business managers’ perspectives on systems integration

Business managers are responsible for the alignment between business strategy and operations through tactical planning and operational control (Anthony, 1965). Whereas CEOs are the strategic planners and tend to focus mainly on financial performances (e.g., cost, sale, profitability, market share) and organizational problems (e.g., cooperation broadening and growth), business managers are more likely to be interested in operational processes and the capabilities, ease, and use of working tools.

Much research has argued that a key element in achieving the expected benefits from the integration of two organizations lies in the successful delivery of the M&A’s integration phase, where synergies and economies of scale are key objectives of top management in a successful M&A deal (Epstein, 2005; Fubini et al., 2007; King et al., 2004; Marks & Mirvis, 2000; Picot, 2002; Quah & Young, 2005; Shrivastava, 1986). As individual managers weigh the uncertainty of due-diligence estimates against their own performance risk, they often translate synergy estimates to be even more conservative and easily achievable, that is, the cost and revenue targets (Agrawal et al., 2011). However, only half of the senior executives polled in a 2006 Accenture/Economist Intelligence Unit survey believed that their companies had achieved the revenue

synergies they had expected from their M&A activities, and just 45% affirmed that expected cost synergies had been captured (Kristin et al., 2007). Also, executives from companies with prominent competitive exposure were significantly more bullish on the value-creation potential of acquisitions and somewhat less focused on cost efficiencies as the primary driver (Hendrickson, 2003).

Customers’ perspectives on systems integration

It has been noticed that companies typically focus on revenue extending and cost saving after the M&A deal and neglect the daily business, thereby “prompting nervous customers to flee” (Bekier & Shelton, 2002). Facing the M&A announcement of their service provider, customers usually want to obtain “sweetheart deals” from suppliers and avoid adjustment costs associated with the changes in merger-firm operations (Chang et al., 2002; Fee and Thomas, 2004), while they also worry about potential disruption in services (Gadiesh et al., 2002) or providing less services (Bekier and Shelton, 2002). As a result, customers need to be reassured that their needs will continue to be met after an M&A (Thach and Nyman, 2001). In a survey of customer satisfaction regarding services after an M&A, 50% of the consumers gave the company lower marks in the company’s prices, quality, or ability to meet expectations. Customers thought they received better service or prices from only 29% of mergers (Thornton et al., 2004). Accenture survey indicated that 51% of respondents blamed mergers as a cause of higher prices and 38% for declining customer service (Sikora, 2005). Indeed, a 2004 Business Week study found that 50% of consumers reported they were less satisfied with the company service, even two years after the merger. Thus, staying on top of customers’ needs and satisfaction can safeguard market performance during the merger process. It is vital that the newly merged company communicates and responds to customer concerns in a timely manner (Homburg and Bucerius, 2005). Based on the perspective of the customer, we propose the indicators of service continuity and obtain better service.

RESEARCH METHODOLOGY

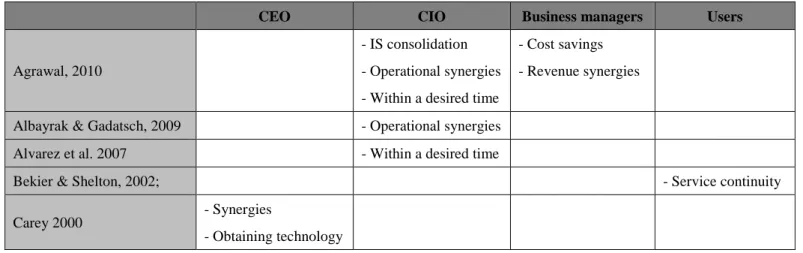

This research attempts to understand the different measurements of IT integration from multiple stakeholders’ perspective in M&A. The whole research can be divided into two stages. In the first stage, the research plans to collect data to verify and enhance initial analysis framework and to elaborate the stakeholders’ expectations toward a successful M&A’s IS integration. By means of the literature review and second-hand data analysis, an initial analysis framework was developed as table 1.

Table 1. Literatures with Stakeholders’ Measurements of IS integration in M&A

CEO CIO Business managers Users

Agrawal, 2010

- IS consolidation - Operational synergies - Within a desired time

- Cost savings - Revenue synergies

Albayrak & Gadatsch, 2009 - Operational synergies Alvarez et al. 2007 - Within a desired time

Bekier & Shelton, 2002; - Service continuity

Carey 2000 - Synergies

CEO CIO Business managers Users

Chang et al., 2002 - Service continuity

Curtis & Chanmugam, 2005

- Cost savings

- Within a desired time

Epstein, 2005

- Cost savings - Revenue synergies

Fee & Thomas, 2004 - Service continuity

Fubini et al., 2007 - Cost savings - Revenue synergies

Harrell & Higgins, 2002

- IS consolidation - Within a desired time

Hendrickson, 2003 - Cost savings Homburg

and Bucerius, 2005

- Service continuity

Honoré & Maheia, 2003 - Operational synergies - Within a desired time

King et al., 2004

- Cost savings - Revenue synergies

Marks & Mirvis, 2000

- Cost savings - Revenue synergies

Picot, 2002 - Cost savings - Revenue synergies Pratt, 2011 - Within a desired time

Quah & Young, 2005

- Cost savings - Revenue synergies Shearer, 2004 - Within a desired time

Shrivastava, 1986 - Cost savings - Revenue synergies

Thach & Nyman, 2001 - Service continuity Thornton et al., 2004 - Better service

Zelinger, 2011

- Operational synergies - Within a desired time

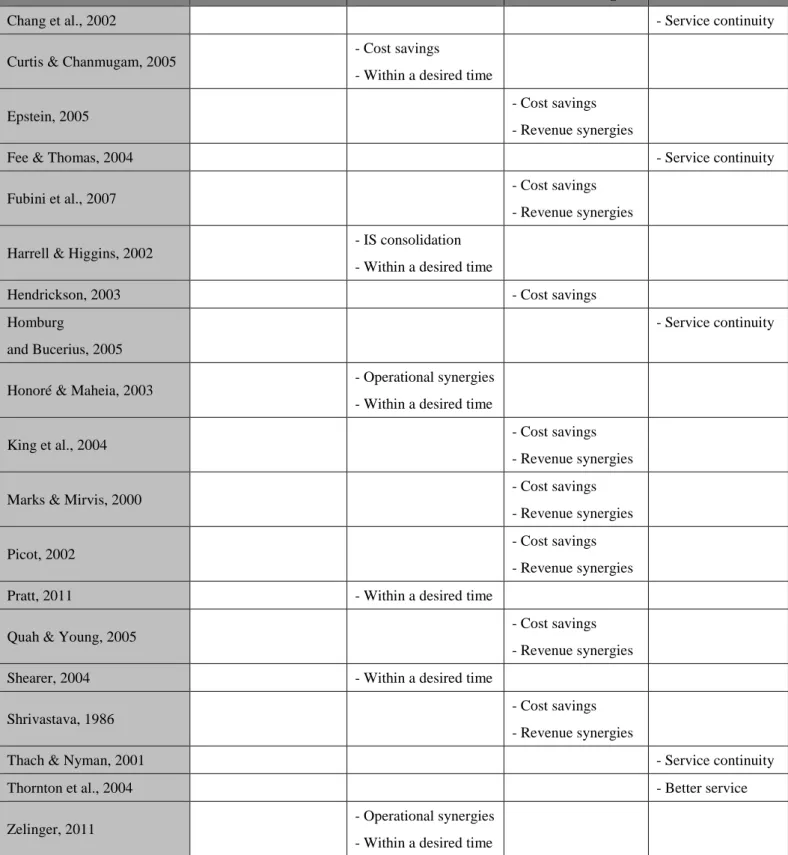

According to the collection of related literatures, the research provide a research framework for examining the IS integration in M&A from multiple stakeholders’ perspectives as table 2 shows.

Table 2. Indicators of the research framework

Stakeholder Measurement

CEO

Achieving operational synergies Obtaining new technologies

Achieving operational synergies Achieving cost savings

Integrating IT within a desired time

Business managers

Achieving cost savings Achieving revenue synergies

Customers

Obtaining service continuity Obtaining better service

The research plans to collect data from eight M&A cases in the banking industry in Taiwan. The banking industry is selected because it is in fiercely competitive environment and M&A approach is taken as a major means for banks in to improve operation performance and result in prosperity. IS plays an important role in the daily operation and has a direct impact on its competitiveness. According to the Financial Supervisory Commission R.O.C. (FSCEY) which was established in 2004 to provide unified financial supervision (Tan, 2009), the growth of M&A in the banking industry was happened between 2004 and 2011 because most banking M&A occurred after 2004. Eight cases were selected because 1) they have been through merging process between 2004 and 2012, and 2) consumer banking services are the major part of the service which reply heavily on IS to serve retail customers. The selected M&A cases of the banking industry are listed in Table 3. This table contains the credit card numbers to show the customer bases of those banking.

Table 3. Description of Selected Cases (The Banking Industry in Taiwan)

Merger The Merged Current Bank Year of M&A

Taipei Fubon Bank International Bank of Taipei Taipei Fubon Bank 2005 Taiwan Cooperative Bank Farmers Bank Taiwan Cooperative Bank 2006 Chinatrust Commercial Bank Grand Commercial Bank Chinatrust Commercial Bank 2003 Bank of Taiwan Central Trust of China Bank of Taiwan 2007 Citibank Bank of Overseas Chinese Citibank (Taiwan) 2007 HSBC The Chinese Bank HSBC 2008 Far Eastern International Bank AIG Credit Card Co. Far Eastern International Bank 2009 Taishin International Bank Chinfon Bank Taishin International Bank 2010

To track and analyze the measurements of IT integration in M&A from multiple stakeholders, the empirical evidence will be collected from representatives of different levels who were involved in the system integration during the M&A. The research will collect data from the CEO, CIO and business managers by interviews, reviewing secondary data from publish report, and collecting data from customers by questionnaire. The interview questions mainly focus on interviewees’ expectations about the IS integration. Their perceptions about other stakeholders’ expectation will be verified to understand the interrelationship among different stakeholders.

In the second stage, the research plans in-depth interviews with six experienced field experts such as project managers and consultants who have involved in at least two merging projects in the industry. The goal of the expert interview is to attain the best synergy on the studied topic with reliable findings.

In the end, analyzed results and confirmed patterns about stakeholders’ interrelationship will be consolidated and verified to form the study’s findings. These findings will give greater insight into the dynamic perceptions of system integration of an M&A project.

CASE ANALYSIS

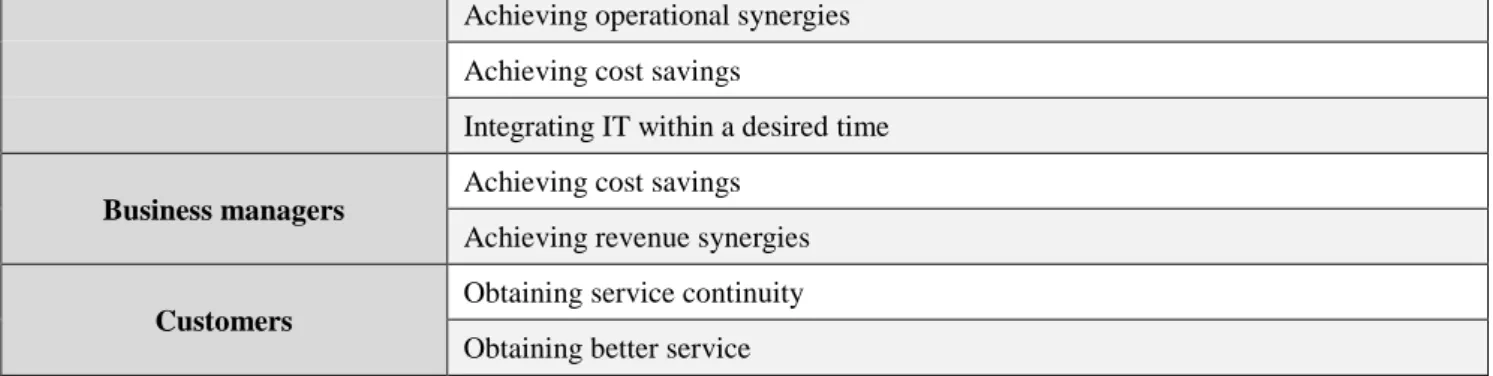

To develop a comprehensive IS integration measurement from multiple-stakeholder perspectives the research tries to collect and analysis from the banking industry in Taiwan. The main data resources are public statement, interviews and questionnaires. Although interviews have been sketched by the research framework, it should be further confirmed whether there are other indicators. The result of case analysis shows in Table 4. In this section, the analyzed results and confirmed patterns about stakeholders’ interrelationship will be consolidated and verified to form the study’s findings. These findings will give greater insight into the dynamic perceptions of system integration of an M&A project.

Table 4. Case analysis results

CEO CIO Business managers Users

Revenue Synergies O → O O → O

Increase market share O → O

Cost saving O → X O → X O → X

Obtaining new technologies O → X

Operational continuity O → O X → O O → O

IS consolidation O → O

In time O → O

IS flexibility for new business X → O X → O

Customer satisfaction X → O

Better services O → X

Customer information accuracy X → O

No rights encroachment X → O

Changes of operation steps and user interface

X → O

“O → O” means the measurement appeared in the literature and in this research result; “O → X” means the measurement

appeared in the literature but not in this research result; “O → X” means the measurement not appeared in the literature and in

this research result

RESEARCH RESULT

According to the resource data, the research results of case analysis are show in Table 3. The results reveal several findings.

First, the alignment of business needs and IS flexibility

IT managers and business managers have similar measurements toward post-merger IT integration. With the fierce competition in Taiwan’s banking industry, the speed of releasing new financial products and services is

very important. Hence, not only business units but also IT units must pay attention to the flexibility of post-merger information systems. This highlights the importance of a bank’s IT system, as there are so many services and financial products that rely upon it. For example, customers use online ATM or mobile banking. In these cases, business opportunities arise from IT technology development. As a result, losing market share, which means losing considerable competitiveness, might occur due to lack of IT support and effectiveness, which is it why it plays such a key role in the current banking industry. This measurement has not been enthusiastically emphasized in the past literature discussion, although it seems quite critical for an IT manager who is planning an integration. Flexibility must be taken into consideration in response to the rapid innovations within the competitive business-opportunity environment. To some extent, IT capability can influence how quickly a company can react to a newly initiated challenge from a competitor.

Second, improvement in value beyond cost savings on a post-merger IT integration

It is clear that IT managers are not particularly concerned with saving costs. This is highly correlated to the attributes of the banking industry. As we mentioned in previous chapters, the banking industry is a very competitive and volatile environment. Each bank wants to project an image of professionalism by delivering high-quality services to their customers. IT support, in this respect, takes on a very important role. This can be seen more clearly if we talk about the necessity and importance of business continuity. Furthermore, as banking operations must rely on mass, rapid, and sometimes complex calculations, the IT service provided to both internal and external customers is expected to be accurate, instead of being economical. This explains why IT managers placed their emphasis on other aspects rather than costs. Doing things correctly is much more important than doing things in an inexpensive way.

Third, carefully design the user interface and operation steps

Currently, with the advance of web-banking technology, there are more and more customers using electronic financial services. From the interview results, customers showed a measurement about the possible change of a bank’s user interfaces, which is direct media interaction. This kind of human-computer interaction problem is hard to track and fix until a customer addresses the service desk. If the interface is unfriendly or the operation steps changed due to the integration, customers may become unhappy or frustrated, customer satisfaction declines, and the bank may lose market share. It seems that a habitual website and a user-friendly user interface have to take into concern for maintaining customers’ satisfaction while dealing with IT integration.

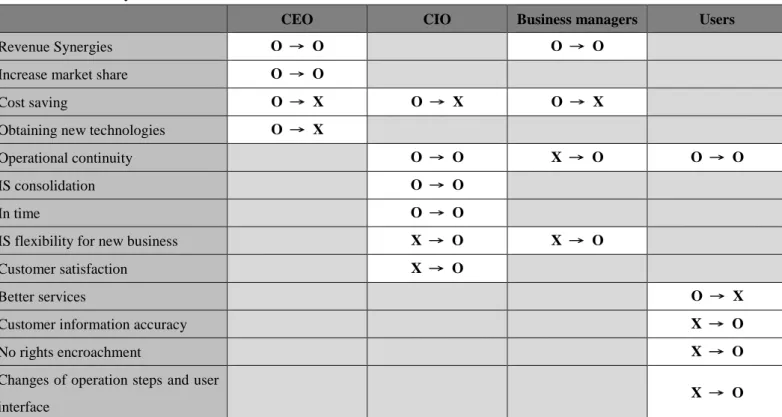

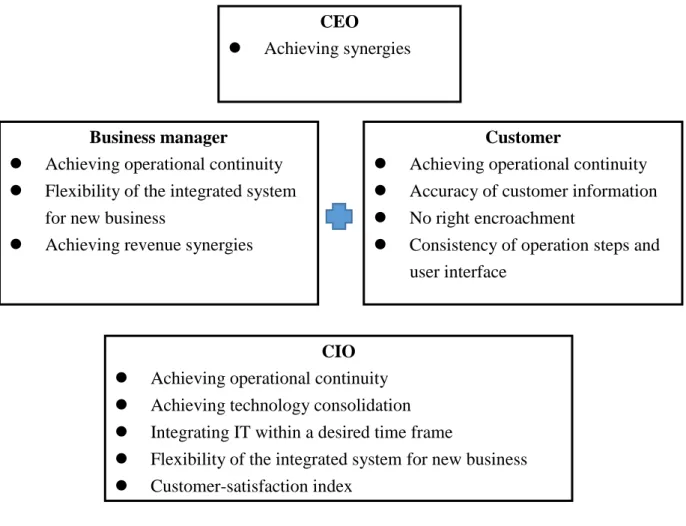

Fourth, the interrelationship of measurement between stakeholders

To clearly clarify the interrelated measurements among stakeholders, the stakeholders are classified into three levels as Figure 1. The top level is CEO. The middle level is user including business manager and customer. The bottom level is CIO. From Figure 1, we discover some of the measurements are interrelated level by level. For example, the user level measurement such as “operational continuity” and “the flexibility of the integrated system for new business” also shown in CIO’s measurement. These CIO measurements are driven by user level because information system plays as a supporting role to meet the user’s need. So does the measurement “achieving synergies” shown in both CIO’s and business manager’s measurement. The business measurement

is driven by the CEO’s measurement. Moreover, we discover that the user measurement may influence the CIO’s IT integration strategy from the interviews and Figure 1.

Figure 1. Interrelation of measurement between different stakeholders

To meet the customer’s measurement “consistency of operation steps and user interface”, most of the CIO take the information system with bigger user base rather than the advanced information system as their remain information system so that they can maintain the most user’s benefits in our four cases. This strategy makes the most of users pay less efforts to adapt to new system so that the operational errors and user resistance may decrease to the minimum. Last, the measurement of customer, “no right encroachment”, is a complementary effort which the non-IT department must take into concern and reference. To fulfill this customer requirement, it’s not merely the business of IT department but more heavily relies on the business unit to carefully maintain and arrange the customer right after a merger.

CONCLUSION

The objective of this study is to build a complete understanding of stakeholders’ views on the success of IT post-merger integration. Instead of providing a single IT perspective, we propose a broad, and hopefully more objective, criteria for evaluating success. The stakeholders include: CEO, CIO, business managers, and the customers. There are two phases in this research. First, we develop a preliminary table of stakeholder’s measurements from the literature. Then, we used a multi-case study with in-depth interviews and secondary data to validate and enhance the data. Finally, by consolidating the literature and practitioners’ view of the

CEO

Achieving synergies

Business manager

Achieving operational continuity Flexibility of the integrated system

for new business

Achieving revenue synergies

Customer

Achieving operational continuity Accuracy of customer information No right encroachment

Consistency of operation steps and user interface

CIO

Achieving operational continuity Achieving technology consolidation Integrating IT within a desired time frame

Flexibility of the integrated system for new business Customer-satisfaction index

success of IT integration post-merger, the study develops findings about the measurement of the success of integrating IT in M&A with a multi-stakeholder perspective.

The results show that the CIO’ measurements about IT integration after a merger are business synergy and the increase of market share. These measurements rely highly on a smooth transition of the information systems for operational continuity. The IT managers’ measurements are operational continuity, technology consolidation, integrating IT within a desired time frame, the flexibility of an integrated system for new business, and customer satisfaction. The business managers’ measurements are operational continuity, revenue synergies, and the flexibility of the integrated system for new business. The customers’ measurements are operational continuity, the accuracy of customer information, rights encroachment, and consistency of operation steps and user interface.

In additional, the research result can be applied into the theory of Information System Success (ISS). According to DeLone and McLean (2003), they indicated that ISS can be examined by six dimensions, i.e., System quality, Information quality, Service quality, Use, User satisfaction, and Net benefit. Respond to the ISS theory, the research result concluded several measurements for IT integration in M&A from four different stakeholders. The detailed relationship within this are worthy to invest more efforts to research.

Considering the heavy use of IT in the current banking industry, both the IT and business managers agreed upon the importance of information-technology flexibility. Moreover, the IT integration directly influences the front-end service point—that the IT managers, business managers, and customers take as one of their top measurements—which is operational continuity. Five findings were derived from the in-depth data collection. The first finding is the importance of IT flexibility in dealing with the new business and competitive environment. The second finding explains that IT managers are less focused on saving costs than integrating IT for the sake of better performance. The third finding is that the increased usage of electronic and mobile ATM illustrates the importance of the user-interface design and the operational process of Internet service. The fourth finding shows that IT plays a passive role in the merger of two enterprises today. The last finding reveals some of the measurements are interrelated level by level due to the relationship between stakeholders. The user’s measurement may influence the other stakeholder’s measurement.

This study provides a basis for developing a useful benchmark of post-merger IT integration for managerial use and explores a foundation in the field of evaluation of IT integration for future research.

In regards to academic contribution, Table 2, which shows stakeholders’ measurements, establishes a base for future research and fills the gap in the field of post-merger, IT-performance evaluation. Moreover, from the discussion, the first finding supports Lee et al. (2003), who proposed the importance of IT flexibility to rapid-response, new business opportunities and that a successful IT department embraces the concept of flexibility, and adopts temporary work-around when they make business sense (Sarrazin & West, 2011). However, our finding 2 differs from past studies. Under the pressure of good IT performance, the interviewee indicated that cost savings is less of a measurement. This opposite opinion toward the measurements of post-merger IT integration is needed for future researchers to reexamine and verify. Finding 3 supports the customer’s opinion on the relationship between user interface and customer satisfaction as past literature has demonstrated (Ribbink, Riel, Liljander, & Streukens, 2004; Zviran, Glezer, & Avni, 2006). Finding 4 shows

that current enterprises view post-merger IT integration in a conservative way. Hence, this provides motivation for researchers to examine if the performance of IT integration is different when an enterprise views IT integration in an aggressive way. Finding 5 support the past literature which indicated that the performance measurement is hierarchical and cascading to different organizational level (Neely, 2002).

For practical use, this study provides an applicable tool for IT managers who are responsible for post-merger IT integration planning and management. It’s obvious that an enterprise will meet stakeholder’s expectation when doing a post-merger IT integration, and this table provides a check list and reference for better project management and integration optimization. Simultaneously, with combined opinions from each stakeholder, this integrated system would bring more benefits to companies. On the other hand, this study offers some findings to remind the IT manager to pay attention and provides some direction through which to view the role of IT integration in M&A. First, the IT manager has to keep the importance of flexibility and user interface in mind while planning information system integration. These factors influence the business’s development in the future and the satisfaction of customers. Second, IT integration may be viewed in different ways. If IT integration is viewed as an opportunity to restructure the business process or even increase revenue, it will bring the enterprise more benefits and competitive advantages. The post-merger IT integration is not merely for achieving operational requests but for a business strategy.

Although this study offers many insights into post-merger IT integration, numerous limitations still need to be mentioned and clarified. First, the CEO’ measurements in Table 6 are derived from website data and the company’s public announcements. These second-hand data is perhaps less complete in describing the exact measurements of CEO. Besides, this study takes IT managers in place of CIO as our interview target. Hence, the proposed CIO’s measurement here is also perhaps less complete in describing the exact CIO’ measurement. Last, because this study focuses on the banking industry in Taiwan, the proposed measurements here may differ while applying in other industries such as the service or high-tech industry.

This paper provides an elementary understanding about stakeholders’ measurements toward post-merger IT integration. Most of the measurements proposed here are qualitative indicators. If quantitative indicators could be derived from qualitative indicators in this review, it would provide enterprise stakeholder with a better measurement to more easily track and evaluate their post-merger IT integration performance. With quantitative indicators, this would be a more useful tool.

REFERENCES

Abma, T. A. 2000. Stakeholder conflict: A case study. Evaluation and Program Planning, 23(2): 199-210.

Agrawal, A., Ferrer, C., & West, A. 2011. When big acquisitions pay off. McKinsey Quarterly, 39: 14-19.

Agrawal, S. 2010. CIOs Role in a M&A. Report, Data Quest, India.

Alaranta, M. 2005. Evaluating success in post-merger IS integration: A case study. Electronic Journal of Information Systems Evaluation, 8: 143-150.

Albayrak, C. A., & Gadatsch, A. 2009. Managing mergers and acquisitions or post-merger cookbook for CIOs and IT management. Paper presented at the Third Conference of the European Conference on Information

Management and Evaluation, Gothenburg, Sweden, September.

Alvarez, E., Dawson, D., & Sen, S. 2007. Utility M&A: Betting on the CIO. Fortnightly Magazine, 145(3): 33-34.

Anthony, R. N. 1965. Planning and control systems: A framework for analysis. Harvard University Press, Boston, MA.

Bekier, M. M., & Shelton, M. J. 2002. Keeping your sales force after the merger. McKinsey Quarterly, 4: 106-115.

Bertoncelj, A., & Kovač, D. 2007. An integrated approach for a higher success rate in mergers and acquisitions. Journal of Economics and Business, 25(1): 167-188.

Bharadwaj, A. S. 2000. A resource-based perspective on information technology capability and firm performance: An empirical investigation. MIS Quarterly, 24(1): 169-196.

Bien, M. L. 2009. Information technology merger and acquisition. Unpublished master’s thesis, Youngstown State University, Ohio.

Bresman, H., Birkinshaw, J., & Nobel, R. 1999. Knowledge transfer in international acquisitions. Journal of International Business Studies, 30(3): 439-462.

Broadbent, M., & Weill, P. 1997. Management by maxim: How business and IT managers can create IT infrastructures. Sloan Management Review, 38(3): 77-92.

Bruner, R. F. 2004. Applied mergers & acquisitions. New Jersey: John Wiley & Sons.

Carey, D. 2000. Lessons from master acquirers: a CEO roundtable on making mergers succeed. Harvard Business Review, May/June, 153-162.

Carlsson, S., Henningsson, S., Hrastinski, S., & Keller, C. 2011. Socio-technical IS design science research: Developing design theory for IS integration management. Information Systems and E-Business Management, 9(1): 109-131.

Chang, R. A., Curtis, G. A., & Jenk, J. 2002. Keys to the kingdom: How an integrated IT capability can increase your odds of M&A success. Report, Accenture, New York.

Cullinan, G., Roux, J. M. L., & Weddigen, R.M. 2004. When to walk away from a deal. Harvard Business Review, 82(4): 96-104.

Curtis, G. A., & Chanmugam, R. 2005. Reconcilable differences: IT and post-merger integration. Outlook, (2), 81-85.

Epstein, M. J. 2005. The determinants and evaluation of merger success. Business Horizons, 48(1): 37-46.

Fee, C. E., & Thomas, S. 2004. Sources of gains in horizontal mergers: Evidence from customer, supplier, and rival firms. Journal of Financial Economics, 74(3): 423-460.

Palgrave Macmillan.

Gadiesh, O., Buchanan, R., Daniell, M., & Ormiston, C. 2002. A CEO's guide to the new challenge of M&A leadership. Strategy & Leadership, 30(3): 13-18.

Giacomazzi, F., Panella, C., Pernici, B., & Sansoni, M. 1997. Information systems integration in mergers and acquisitions: A normative model. Information & Management, 32(6): 289-302.

Grimble, R., & Wellard, K. 1997. Stakeholder methodologies in natural resource management: A review of principles, contexts, experiences and opportunities. Agricultural Systems, 55(2): 173-193.

Guba, E. G., & Lincoln, Y. S. 1989. Fourth generation evaluation. Newbury Park, CA: Sage Publications.

Haes, S. D., & Grembergen, W. V. 2005. IT governance structures, processes and relational mechanisms: Achieving IT/business alignment in a major belgian financial group. Paper presented at the Thirty-eighth Hawaii International Conference on System Sciences, Big Island, Hawaii, USA, January.

Hakanson, L. 1995. Learning through acquisitions: Management and integration of foreign R&D laboratories. International Studies of Management and Organization, 25(1/2): 121-157.

Harrell, H. W., & Higgins, L. 2002. IS integration: Your most critical M&A challenge? Journal of Corporate Accounting & Finance, 13(2): 23-31.

Hendrickson, J. 2003. Mergers and acquisitions as a vehicle to create value in uncertain times. Electricity Journal, 16(6): 66-75.

Homburg, C., & Bucerius, M. 2005. A marketing perspective on mergers and acquisitions: How marketing integration affects post-merger performance. Journal of Marketing, 69(1): 95-113.

Honoré, R. A., & Maheia, M. W. 2003. The secret to a successful RIM merger or acquisition. Information Management Journal, 37(5): 57-63.

IBM. 2008. Enterprise of the Future: Global CEO Study, Somers, NY: IBM Corporation.

James, A. D., Georghiou, L., & Metcalfe, J. S. 1998. Integrating technology into merger and acquisition decision making. Technovation, 18(8-9): 563-591.

Jaspers, F., & van den Ende, J. 2006. The organizational form of vertical relationships: Dimensions of integration. Industrial Marketing Management, 35(7): 819-828.

Johnson, A. M., & Lederer, A. L. 2005. The effect of communication frequency and channel richness on the convergence between chief executive and chief information officers. Journal of Management Information Systems, 22(2): 227-252.

Johnson, M. P. 1989. Compatible information systems a key to merger success. Healthcare Financial Management, 43(6): 56-61.

Johnston, K. D., & Yetton, P. W. 1996. Integrating information technology divisions in a bank merger Fit, compatibility and models of change. Journal of Strategic Information Systems, 5(3): 189-211.

King, D. R., Dalton, D. R., Daily, C. M., & Covin, J. G. 2004. Meta-analyses of post-acquisition performance: Indications of unidentified moderators. Strategic Management Journal, 25(2): 187-200.

Ko, D., & Fink, D. 2010. Information technology governance: An evaluation of the theory-practice gap. Corporate Governance, 10(5): 662-674.

Kristin, F., Tom, H., & Bill, P. 2007. Where has all the synergy gone? The M&A puzzle. Journal of Business Strategy, 28(5): 29-35.

Larsen, M. H. 2005. ICT integration in an M&A Process. Paper presented at the Ninth Pacific Asia Conference on Information Systems, Bangkok, Thailand, July.

Lee, J., Siau, K., & Hong, S. 2003. Enterprise integration with ERP and EAI. Communications of the ACM, 46(2): 54-60.

Luftman, J., Papp, R., & Brier, T. 1999. Enablers and inhibitors of business-IT alignment. Communications of the AIS, 1(3es): 1-33.

Marks, M. L., & Mirvis, P. H. 1998. Joining forces: Making one plus one equal three in mergers, acquisitions and alliances. CA: Jossey-Bass, San Francisco.

Marks, M. L., & Mirvis, P. H. 2000. Managing mergers, acquisitions, and alliances: Creating an effective transition structure. Organizational Dynamics, 28(3): 35-47.

McCartney, L., & Kelly, J. 1984. Getting away with merger. Datamation, 30(20): 24-28.

McKiernan, P., & Merali, Y. 1995. Integrating information systems after a merger. Long Range Planning, 28(4): 54-62.

Meckl, R. 2004. Organising and leading M&A projects. International Journal of Project Management, 22(6): 455-462.

Mehta, M., & Hirschheim, R. 2004. A framework for assessing it integration decision-making in mergers and acquisitions. Paper presented at the Thirty-seventh Hawaii International Conference on System Sciences, Big Island, Hawaii, USA, January.

Mehta, M., & Hirschheim, R. 2007. Strategic alignment in mergers and acquisitions: Theorizing IS integration decision making. Journal of the Association for Information Systems, 8(3): 143-174.

Merali, Y., & McKiernan, P. 1993. The strategic positioning of information systems in post-acquisition management. Journal of Strategic Information Systems, 2(2): 105-124.

Neely, A. 2002. Business performance measurement: Theory and practice. Cambridge: Cambridge University Press.

Quah, P., & Young, S. 2005. Post-acquisition management: A phases approach for cross-border M&As. European Management Journal, 23(1): 65-75.

methodological approach for avoiding common pitfalls. Industrial Marketing Management, 36(5): 589-603.

Picot, G. 2002. Handbook of international mergers and acquisitions preparation, implementation and integration. London: Palgrave Macmillan.

Pratt, M. K. 2011. Get into the M&A game. Computerworld, 45(10): 16-20.

Reinicke, B. A. 2007. Building a systems level theory of IS integration in mergers and acquisitions. Unpublished doctoral dissertation, Indiana University, Indiana.

Peterson, R. R., O'Callaghan, R., & Ribbers, P. M. A. 2000. Information technology governance by design: Investigating hybrid configurations and integration mechanisms. Paper presented at the Twenty-first

International Conference on Information Systems, Brisbane, Australia, December.

Ribbink, D., Riel, A. C. R. V., Liljander, V., & Streukens, S. 2004. Comfort your online customer: Quality, trust and loyalty on the internet. Managing Service Quality, 14(6): 446-456.

Robbins, S. S., & Stylianou, A. C. 1999. Post-merger systems integration: the impact on IS capabilities. Information & Management, 36(4): 205-212.

Sagner, J. S. 2012. M&A failures: Receivables and inventory may be key. Journal of Corporate Accounting & Finance, 23(2): 21-25.

Sarrazin, H., & West, A. 2011. Understanding the strategic value of IT in M&A. McKinsey Quarterly, 12(1): 1-6.

Schmid, A. S., Sánchez, C. M., & Goldberg, S. R. 2012. M&A today: Great challenges, but great opportunities. Journal of Corporate Accounting & Finance, 23(2): 3-8.

Shearer, B. 2004. Avoiding the IT integration blues. Mergers & Acquisitions: The Dealermaker's Journal, 39(11): 10-15.

Sherman, A. J. 2006. Preventing post-M&A problems. Journal of Corporate Accounting & Finance, 17(2):19-25.

Shrivastava, P. 1986. Post-merger integration. Journal of Business Strategy, 7(1): 65-76.

Sikora, M. 2005. Consumers are a hot issue for merging businesses. Mergers and Acquisitions, 40(7): 16-18.

Song, S. I., Kueh, C. C., Rahman, R. A., & Chu, E. Y. 2010. Performance of cross-border mergers and acquisitions in five East Asian countries. International Journal of Economics and Management, 4(1): 61-80.

Stylianou, A. C., Jeffries, C. J., & Robbins, S. S. 1996. Corporate mergers and the problems of IS integration. Information & Management, 31(4): 203-213.

Thach, L., & Nyman, M. 2001. Leading in limbo land: The role of a leader during merger and acquisition transition. Leadership & Organization Development Journal, 22(4): 146-150.

Winterfeldt, Detlof von. 1992. Expert knowledge and public values in risk management: The role of decision analysis. Westport, CT: Praeger Publisher.

Weber, Y., & Pliskin, N. 1996. The effects of information systems integration and organizational culture on a firm's effectiveness. Information & Management, 30(2): 81-90.

Wijnhoven, F., Spil, T., Stegwee, R., & Fa, R. T. A. 2006. Post-merger IT integration strategies: An IT alignment perspective. Journal of Strategic Information Systems, 15(1): 5-28.

Yin, R. (1994) Case Study Research: Design and Methods, 2nd ed. Sage Publications, Thousand Oaks Park, CA.

Zee, H. v. d. 2002. Measuring the value of information technology. Hershey, PA: Idea Group Publishing.

Zelinger, S. 2011. Addressing the lack of transparency in subsidiary operations. Manufacturing Business Technology, Madison, WI: Advantage Business Media.

Zviran, M., Glezer, C., & Avni, I. 2006. User satisfaction from commercial web sites: The effect of design and use. Information & Management, 43(2): 157-178.

國科會補助專題研究計畫出席國際學術會議心得報告

日期: 103 年 8 月 31 日

一、參加會議經過

美國資訊管理年會(Americas Conference on Information Systems,AMCIS)固定於

每年八月期間由資訊系統協會(Association for Information Systems,AIS)所舉辦,

是美洲區資訊系統領域的年度大會。每次年會都能累積上達七百多篇的發表量,

並收集成冊出刊,在資訊管理領域學術上具有重要的論文發表與學者交流意義。

第二十屆美國資訊管理年會於美國的薩凡納國際商務中心(Savannah International

Trade & Convention Center)舉辦,為期三天(八月七日至九日)

。本年度研討會以

『SMART SUSTAINABILITY: the Information Systems Opportunity』為主題,並且

設置了三十個單元:Accounting Information Systems、Adoption and Diffusion of

計畫編號

NSC102-2410-H-004-183

計畫名稱

企業合併之系統整合衡量─自多重利益關係者角度分析

出國人員

姓名

尚孝純

服務機構

及職稱

國立政治大學資訊管理學系

會議時間

103 年 8 月 7 日至

103 年 8 月 9 日

會議地點

薩凡納(Savannah, Georgia, USA)

會議名稱

20th Americas Conference on Information Systems

發表題目

An Empirical Study of The Gratifications of Customer Resonance On

Purchase Intention

Information Technology、Business Intelligence, Analytics, & Knowledge

Management、Celebrating the 20th Anniversary of AMCIS: Examining IS History、Data

Quality & Information Quality、e-Government、e-Business、End-User Information

Systems, Innovation, and Organizational Change、Enterprise Systems、Global,

International, and Cross Cultural Issues in IS、Green IS and Sustainability、Healthcare

Information Systems and Technology、Human Capital in Information Systems、Human

Computer Interaction、ICTs in Global Development、Information Systems Security,

Assurance, and Privacy Track、Intelligence and Intelligent Systems、IS in Education, IS

Curriculum, Education and Teaching Cases、IS Philosophy、IT Enabled Organizational

Agility、IT Project Management、Mobile Computing、Research Methods、Service

Systems、Social Computing、Social-Technical Issues and Social Inclusion Track、

Spanish & Portuguese Track、Strategic and Competitive Use of Information

Technology、Systems Analysis & Design、Virtual Communities and Virtual Worlds。

二、與會心得

本次投稿文章為 An Empirical Study of The Gratifications of Customer Resonance On

Purchase Intention,為一進行中的研究。幸得年會評審青睞,認為本研究深具研究

潛力、前期研究甚為完備,因此接受本論文至研討會上與其他學者交流、討論。

三、發表論文摘要

In recent years, social networks have become incredibly popular. Online communities

such as Facebook, YouTube, and Flicker offer freely available user-created content that

has enabled individuals to express their ideas and communicate their opinions to many

people. People can create, modify, discuss, and share on networks. These social

networks have gradually become interpersonal communication platforms—away from

traditional face-to-face and word-of-mouth interaction toward new forms of online

communication referred to as electronic word-of-mouth such as user-generated content.

Messages resonate when information is shared among individuals. We want to have a

better understanding of the use and gratification that users obtain from social networks

when topics resonate with them. The purpose of this study is to investigate what drives

people to share or reply to content on social networks while customers’ resonance

arises and understand the impact of customer resonance on purchase intention in the

social networks.

四、建議

(一)美國資訊系統年會上與會者多、極富學術涵養,都是領域內的專業學者,

很能為學術後進提供許多寶貴的見解與討,因此建議台灣學子或新進教師應多多

參與此類的研究盛會,增進國際觀之餘、更能提高學術研究與思辨上的能力。

(二)國際研討會的地點通常會在幾個地區之間輪流,並非每次都在交通便利、

生活機能豐富的地區,因此建議未來在審核學者參與研討會的預算核准時,能多

方參考相關資訊,以降低學者出席國際研討會的負擔、提高其意願。

五、攜回資料名稱及內容

無(註:美國資訊系統年會論文集全數位化、上線,因此大會並無紙本論文集)

六、其他

無

科技部補助計畫衍生研發成果推廣資料表

日期:2014/11/12科技部補助計畫

計畫名稱: 企業合併之系統整合衡量─自多重利益關係者角度分析 計畫主持人: 尚孝純 計畫編號: 102-2410-H-004-183- 學門領域: 資訊管理無研發成果推廣資料

102 年度專題研究計畫研究成果彙整表

計畫主持人:尚孝純 計畫編號: 102-2410-H-004-183-計畫名稱:企業合併之系統整合衡量─自多重利益關係者角度分析 量化 成果項目 實際已達成 數(被接受 或已發表) 預期總達成 數(含實際已 達成數) 本計畫實 際貢獻百 分比 單位 備 註 ( 質 化 說 明:如 數 個 計 畫 共 同 成 果、成 果 列 為 該 期 刊 之 封 面 故 事 ... 等) 期刊論文 0 0 100% 研究報告/技術報告 0 0 100% 研討會論文 0 0 100% 篇 論文著作 專書 0 0 100% 申請中件數 0 0 100% 專利 已獲得件數 0 0 100% 件 件數 0 0 100% 件 技術移轉 權利金 0 0 100% 千元 碩士生 4 0 100% 博士生 1 0 100% 博士後研究員 0 0 100% 國內 參與計畫人力 (本國籍) 專任助理 0 0 100% 人次 期刊論文 0 0 100% 研究報告/技術報告 0 0 100% 研討會論文 0 0 100% 篇 論文著作 專書 0 0 100% 章/本 申請中件數 0 0 100% 專利 已獲得件數 0 0 100% 件 件數 0 0 100% 件 技術移轉 權利金 0 0 100% 千元 碩士生 0 0 100% 博士生 0 0 100% 博士後研究員 0 0 100% 國外 參與計畫人力 (外國籍) 專任助理 0 0 100% 人次其他成果