A

Study of A/R Collection for IC Design Industry

in

Taiwan

Using Fuzzy MCDM

Methodology

1 -123

Chih-Young

Hung

,Yiming

Li'

,Yi-Hui

Chiang"3

'Institute ofManagementof Technology, National ChiaoTungUniversity, Hsinchu, Taiwan

2Department

of Communication Engineering, National ChiaoTungUniversity, Hsinchu, Taiwan3Department

of International Trade,Ta-HwaInstitute of Technology, Hsinchu, TaiwanAbstract--In this paper, we present a fuzzy multiple criteria decision-making (FMCDM) approach to the evaluation of

accountreceivable (A/R) collection instruments. By considering four collection alternatives, namely: the T/T advance (prepayment), the letter of credit (L/C), the documentary collection(including D/A and D/P), and the open account(O/A), theFMCDM approach is for the first timeapplied tochoose the A/R collection instrument for Taiwanese integrated circuit (IC) design industry. Our results show, when face withnewcustomer, the ranking of preference is the T/T advance, the L/C, the O/A and the documentary collection (D/A, D/P). International collection in modern unpredictable global market could be difficult unless firms have taken appropriate collection strategies. We believe that this study providesan alternative for making critical decisions, as in this case, the selection of A/R collection instruments.

I. INTRODUCTION

Since the lastdecade, theintegrated circuit (IC) industry

has played a key role in Taiwan's economic development.

Generally speaking, IC industry consisted four phases as of

designing, manufacturing, packaging and testing. According

to the data of Taiwan Semiconductor Industry Association (TSIA), Taiwan IC Industry has been characterized with the worldlargest foundryand the world second largestIC design

industry. However, they still face the pressure of the worldwide competition. Besides being supported by a solid infrastructure, various investment incentives, intellectual property protection, and integrated resource development

from the government, Taiwanese IC firms are pressed by

market environment to enhance theircompetitiveness through

research and development (R&D) efforts. Furthermore, the effective working capital management crucialto these firms

effort in product innovation and market response. Finance managers in these firms are struggling to find a foothold in the global market. However, the search for profits, market

share and shareholder value are rarely risk free. Every transaction involves certaindegree of risk. Sources of risk in

international trade include the country risk, the credit (or commercial)risk and the foreign exchange risk. The country risk influences levels of risk in the other three categories [1].

Generally, four alternative instruments exist for collecting

accountreceivables(A/R)inpractice. Each instrument has its own merits. These alternatives include the payment in advance (prepayment), the letter of credit (L/C), the

documentary collection (including documents against

acceptance(D/A)and documentsagainstpayment(D/P)),and

the open account (O/A). Difficulties in international collectionnowadays increase significantly. A firmseeking to establish a global presence must search for the most beneficial and cost-effective way to work with their customers when involving international trade. Firms are concerned with the reliability of payment for their operation overseas and longstanding partnerships with overseas suppliers. However, progress of technology bridges exporters and importers, and also help toestablish a sense of trustbetweentradingpartners. Itiscommonlyknown that the A/R is the principal source of cash flows for a firm, and the managementof this asset can have a significant impact on the firm's operations. The L/C has served as the primary

internationaltrade financetool, but it is no longer the optimal

possible financing solution in many situations. Intensely competitivepressures are forcing participants throughout the

supplychain toimprovetheirefficiencyand drive down costs [2]; offering international customers better financing terms plays a crucial role to any sales package. Selling on the O/A is fraught with danger, but favorable in the standpoints of marketing and sales [3-5]. Corporate financial decisions are mostly investigated in the context of optimization. For

example, thecapital structure theory and theportfolio theory

are analyzed in an optimization perspective. As for the individual collection instrument, various studies have discussed the effects ofusing L/C or O/A [2, 6-15]. Some work explored the international A/R risk [1, 16] and the

technique of A/R collections [17]. Some studies focused on trade credit [18-21]; The studies basically were concerned about the buyer/importer' working capital. Unfortunately,

these studies emphasized only single objective when they

handled A/R problems. A/R problems mainly relate to the management ofworking capital, involving finance, collection, risk, cost, market shares, etc. Approaches offuzzy multiple

criteria decision-making (FMCDM) have been reported in other decision making problems involving multiple criteria

evaluation/selection ofalternatives [3-5, 22-25], forexample.

Multi-criteria decision in solving financial decisionproblems

was discussed [26], but it did involve the A/R issues

marginally.

In this paper, we for the first time present a FMCDM

approach to the selection of A/R collection instruments. A

scientific framework is introduced for the evaluation of A/R collectionalternatives. Currently,inpractice, decision makers

rely on subjective criteria such as safety and convenience, along with other objective criteria such as total assets/sales

depend on their personal wisdom, past experience, professional knowledge, or information that is difficult to define and/or describe exactly. However, considering the fuzziness of subjective judgment and other relative evaluation procedure is essential to promote the decision quality. Linguistic values such as very good, very important or about 100 dollars can be used to convey an evaluation about the importance of criteria and superiority ofalternatives. Thus, a fuzzy-based decision model may play an appropriate and effective way than that of traditionalprecision-based models for international firms. To deal with thequalitative attributes in subjective judgment, we employ fuzzy analytic hierarchy process (AHP) to determine the weights of decision criteria for each expert. Then the FMCDM approach is used to

synthesize the group decision. It enables decision makers to formalize andeffectively solve thecomplicated, multi-criteria andfuzzy/vague perception problemof mostappropriateA/R collection alternative selection. We apply this approach to investigate the A/R collection for the IC design industry in Taiwan. Based on the results of this study, in the case of

facing with new customer, the preferred ranking in the industry is found to be as follow: the prepayment, the L/C, the O/A and the documentary collection. We believe that the currentstudy providesaneffective method formakingcritical decisions inselectingA/Rcollection instruments.

This paper isorganized as follows. In Sec. II, wereview the international A/R collection instruments. In Sec. III, we discuss the A/R collection evaluation model. In Sec. IV, we show the results for the ICdesign industry inTaiwan. Finally,

conclusionsweredrawn from thefinding.

II. INTERNATIONAL A/R COLLECTION INSTRUMENT ALTERNATIVES

In general, a seller/exporter and buyer/importer can choose from four methods of payment in international transactions. These options include payment by the T/T advance (prepayment), the L/C, the documentary collection,

and the O/A. Different methods means they may face different degreeand sourcesofrisk, such asthe country risk,

the credit (or commercial)risk and the foreign exchangerisk etc.

A. Telegraphic Transfer(TIT- Advance)

The T/T is the simplest and cheapest collection

instrument for the seller, but it createsthe greatestcredit risk

for thebuyer. Insuch asituation,thebuyerforwards payment before the seller ships thegoods. Ifsellers adopta policy of T/T advance, it usually means that they have stronger

bargaining

power.B. LetterofCredit(LIC)

sufficient evidence that the shipment has been made as

specified bythe documents under the L/C. For theseller, L/C is a protective but expensive and complicated instrument. C. DocumentsAgainst Acceptance(DIA), DocumentsAgainst

Payment(DIP)

The D/A and D/P are other types of

documentary-collection transactions. They belong to the instruments of "deferred payment" D/A and D/P are cheaper but lessprotective for the seller than the L/C transaction. The seller ships the goods without any previous action by the

buyer to effect payment. But a transport document will be transmitted through the banking channel that covers the

goods.These collection transactionsprovidearelativelymore secureoptionthan that of an O/Atransaction,tobe discussed next. Collection transactions (D/A, D/P), however, cost much less than an L/Ctransaction, with bank fees typically fixedat around 0.5 00 of transaction amount,regardless of the size of the transaction.

D. Open Account(OA)

The O/A is another kind of "deferred payment" instruments. Inan O/Atransaction, the seller ships the goods without any formalassurance that thebuyerwill forward the payment when the goods arrive. Thus, in each T/T advance and O/A transaction, one party first fulfills its obligation completely, trustingthat the other party will actresponsibly.

Like in the T/Tadvance, the O/A is also asimple and cheap

instrument that does not involvebankingchannels. III. A/R COLLECTION EVALUATION MODEL A.Evaluationcriteria

Multiple criteria evaluation problem examines a set of feasible alternatives and considersmore thanonecriterionto determine a priority ranking for alternative implementation.

To formulate the criteria, we have five principles, the

completeness, the operational, the decomposable, the

non-redundancy, and minimum size are considered. Thekey

dimensions of the criteria for evaluation of A/R collection were derived through comprehensive investigation and consultation with nine

experts,

including one professor ininternational trade, one professor in financial, and three senior managers of broadband network equipment

manufacturers in Hsinchu Science-Based Industrial Park of

Taiwan. These individuals were asked to rate the accuracy, theadequacyand the relevance of the criteria anddimensions,

andtoverifytheircontentvalidityinterms of A/R collection. Literatures' review [1, 2, 9-16] and the expert opinions provide the basis for developing the hierarchical structure used in thisstudy.

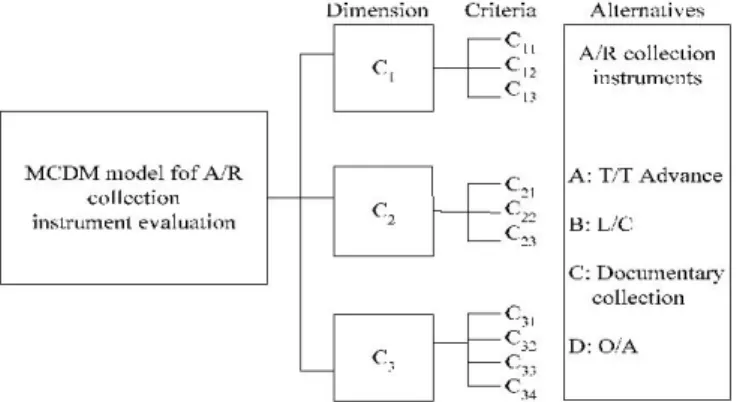

reduction in transaction costs, and the dimension C3 is the compliance with firm policy. The criterion

C1l

is the transaction partners' credit risk, the criterion C12 is the exchange-rate fluctuation risk, the criterion C13 is the political and economic risk, the criterion C21 is the financial fees, the criterion C22 is the convenience in collection procedures, the criterion C23 is the time efficiency of collection, the criterion C31 is the salesgrowth policy, the criterion C32 is the financial structurepolicy, the criterion C33 is the A/R period policy, and the criterion C34 is the collection method of the industry custom.Dimension Criteria

-Cil

CI C12

C1

MCDMmodel fofA/R

collection instrument evaluation C21 c2 C22 C23 C31 C32 33 C34 Alternatives A/Rcollection instruments A: T/TAdvance B:L/C C:Documentary collection D:O/A

interval. It is very difficult for conventional quantification to express reasonably those situations that are overtly complex orhard define [31-33]; thus, notion of a linguistic variable is necessary in such situations. A linguistic variable is a variable whose values are words or sentences in a natural or artificial language. Here we use this kind of expressions to compare four A/R collection instrument alternatives by five basic linguistic terms. Applications of the fuzzy theory in this study aredescribe as follows. Theprocedure is summarized below. 1) Fuzzy number

Fuzzy numbers are a fuzzy subset of real numbers, and they represent the expansion of the idea of confidence interval. According to the definition made by Dubois and Prade [34], Laarhoven and Pedrycz [35], triangular fuzzy number (TFN) should possess the following basic features [34, 35]. A fuzzy number A on R to be a TFN if its membership function

pA

(x):R];

[0,1] isequalto,L<x<M

YAC (x) =M xL

,U-M

(1)

Figure1. Amultiple criteria decision-making model for A/R collection instrument evaluation

B.Analytic hierarchy process

The analytic hierarchy process [27, 28] solves

complicated and subjective decision making problems. In

AHP,

multiple paired comparisons are based on a standardized evaluation scheme (1 =equal importance; 3 =weak importance; 5 = strong importance; 7 =demonstrated importance; 9 = absolute importance). The AHP uses pair-wise comparisons to compare n elements under given

condition. Then, we convert vague verbal response into a

9-point linguistic scale. The results of the pair-wise comparisons are used to construct a judgment matrix, and then the normalized eigenvector corresponding to the maximum eigenvalue (kmax) is calculated. The consistency

index (C. I.) serves as the indicator of closeness to

consistency. C. I. =

(2max-n)

/ (n-1), with2max

as the eigenvalue for the pair-wise comparison matrix of sizen. If the C.I.<0.1,ourjudgmentmaybe satisfied.C. Fuzzy settheory

The decision-making method in fuzzy environments is discussed. An increasing number of studies deal with uncertain fuzzy problems by applying fuzzy set theory [29, 30]. Fuzzy numbers are afuzzy subset of real numbers, and

they represent the expansion of the idea of confidence

,1A

(x)

= 0otherwise,

where L and U stand for the lowerand upper bounds of the fuzzy number

A,

respectively, and Mis for the modalvalue,shown inFig.2.1

0

L M U x

Figure2.Themembership function of the triangular fuzzy number

The TFN is denotedby A =

(L, M, U)

and the followingis the operationlaws oftwo TFNs

Al

=(L1,

M1, U1)

andA2

=(L2,M2,U2),

as shown:Addition oftriangularfuzzynumbere;

A1

(A2= (L1,M1,U1)

(L2,M2,U2)

=(L1

iL2,M1 iM2,U1

(U2)

Multiplication oftriangularfuzzynumber ;

A1

®A2

=(L1,M1,U1)

(L2,M2,U2) =(L1

®L2,M1

®M2,U1®U2)

for

Li

>-O, M

>-O,

U,

O

Subtractionoftriangularfuzzynumber ); A l)A 2=(L1,M,U1))(L2,M2,U2)

(L1

-U2,

M1-M2, U1-L2)

Divisionoftriangularfuzzynumber 0; A

10A

2=(LI,

MI,

U1)0

(L2, M2, U2)=(L/A2,

M1M2,

U1U2)

forLi>O, Mi>O, Ui>O

(2)

(3)

(4)

(5)

perception of each evaluator varies according to the evaluator's experienceandknowledge, and the definitions of thelinguisticvariable vary aswell,this studyusesthe notion of average value tointegrate the fuzzy judgmentvalues ofm

evaluators,thatis,

IL

1 3 5 7 9

Equally Weakly Essentially Very Absolutely important important important importantstrongly important

Figure3.Membership function oflinguistics variables forcomparingtwo

criteria

2)Linguistic variable

It is very difficult for conventional

quantification

to express reasonably those situations thatare overtly complexor hard define; thus, notion of a linguistic variable is necessary insuch situations [31, 32,33]. Alinguisticvariable is a variable whose values arewordsor sentences inanatural orartificiallanguage. Here we usethis kind ofexpressionsto compare two A/Rcollection evaluation criteria by five basic

linguistic terms, such as "absolutely important", "very strongly important", "essentially important", "weakly important", and "equally important" with respectto a fuzzy

five levelscale, shown inFig. 3.

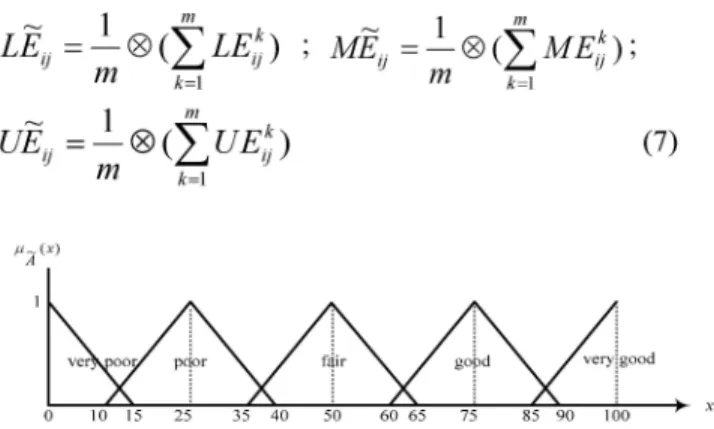

3)Fuzzy multiple criteria decision-making a.Alternativesmeasurement

Using the measurement of linguistic variable to demonstrate the criteria performance (effect-values) by expressions such as "very good",

"good",

"fair","poor",

"very

poor", the evaluators are asked forconducting

theirsubjectivejudgments, and eachlinguisticvariable is indicated

bya TFNwithin the scale range0-100,asshown in

Fig.

4.Inaddition, the evaluators can subjectively assigntheirpersonal

rangeoflinguisticvariable thatcan indicate themembership

functions of expression values of evaluator. Take EJ to

(6)

The sign 0 denotes fuzzy multiplication, the sign (i denotes fuzzy addition,

Ei,

shows the average fuzzy number of judgment of the decision-makers, and is expressedby

Eij

=(LEY

,

MEi,

UEU

)

.

Theend-point

values

LEi, MEij

and

UE,

are solvedby Buckley [36].

I m

LEi

=(

(LEij

)

;MEij

m km UEij

1-)(

Ej m k=l 1 m -(m(MEk)k

; m k=l(7)

HA (X)Figure4.Themembership function of linguistics variables forevaluatingthe collection alternatives

b. Fuzzysyntheticdecision

The weights of the each criterion of A/R collection evaluation as well as the fuzzy performance values mustbe

0 -y

-I

(k.

e

k.

. ..

)

weight wj derived by FAHP, the criteria

weight, w = (w1,*..., ~* * w

)'

, where the fuzzy performance matrix £of the alternatives is obtained from the fuzzy performance value of each alternative under ncriteria, £ =

(Eij)

. From the criteria weight vector w and the fuzzy performance matrix E, the final fuzzysynthetic decision isconducted, and the derived result will be thefuzzy syntheticdecision matrix

R,

thatis,R

=Eow.

(8)

Thesign" o "indicates the calculation offuzzy numbers,

including fuzzy addition and fuzzy multiplication. Since the calculation offuzzy multiplication is rather complex, it is

usually denoted by the approximate multiplied result of the fuzzy multiplication and the approximate fuzzy number Ri,

of thefuzzy synthetic decision of each alternative is given by

Ri

=(LRi

,

MRi,

UR1) ,

where

LRi, MRi

and

URi

are

the lower, middle and uppersyntheticperformance values of thealternative

i,

that is:n n

LR

=LEi

X

Lwj;

MRi

=

ME.

X

Mw;

j=1 j=1

n

UR1

=E

UEj

0

Uwj,

(9)

j=1

c.Rankingthefuzzynumber

The result of the fuzzy synthetic decision reached by

eachalternative is a fuzzynumber. Therefore, it is necessary that a nonfuzzy ranking method for fuzzy numbers be

employed forcomparison of each A/R collection alternative.

In other words, the procedure of defuzzification is to locate the Best Nonfuzzy Performance (BNP) value. Methods of such defuzzified fuzzy ranking generally include mean of

maximal, center of area (COA), and a-cut. To utilize the COAmethod to find outthe BNP is a simple and practical method, and there is no need to bring in the preferences of anyevaluators, soit is usedinthisstudy.

TheBNPvalue of thefuzzynumber

Ri

isgiven byBNP

(URi

-LR,

)

o)

(MR,

-LR,

)]

LRi

,Vi

(10)

According to the value of the derived BNP for each of the alternatives, the ranking of the A/R collection of each of the alternatives can then beproceed.

IV. APPLICATIONS TO IC DESIGN INDUSTRY According to the formulated structure of A/R collection alternatives evaluation, the weights of the dimension hierarchy and criterionhierarchy for the IC designindustryis

analyzed. Weights and ranking were obtained by using the FAHPmethod.

A. Basicdescriptions

According to Industrial Economics and Knowledge

Center of Industrial TechnologyResearch Institute (ITRI) in Taiwan, IC design products generally include consumer products, informationproducts, communication products and IC supporting. Consumer products include toys, DVD/CD player and personal digital assistant (PDA), etc. Information products include printed circuit board(PCB),DVD/CD ROM and NB, etc. Communication products include wirelessNIC, switch and cable modem, etc. Recently, Taiwan IC design

industry develop quickly, there have excess one hundred IC

design firms. Aboutfifty firms arethe initialpublic offerings (IPO) firms. Theranking of world is the second. Among the whole IC design firms in Taiwan, twenty firms, including

nine Consumers products firms, seven Information products

firms, three Communication products firms, and one

Supporting firms, are randomly surveyed in our study. Only

onefirm isnotthe IPO firm. The average exportrate is 53

00,

and theranking of average proportionexportareas areAsian(China,JapanandKorea),U.S.A. and European. Allsurveyed

experts are the senior financial managers with related

experience around five-ten years. Generally, the weighting

factors andranking affect A/R collection may be somewhat different in different situation. Therearethree scenarios when

consideringA/Rcollection: new customer, not new customer but with some credit concerned and good risk-rating or

reputation customer. In this paper, we focus on the first

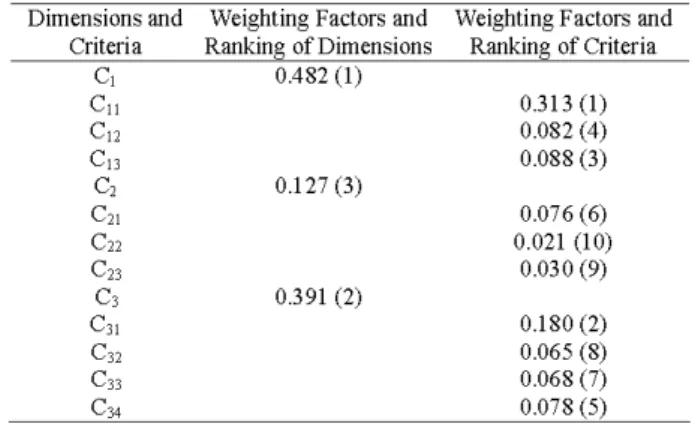

scenario; facingwith thenew customer. B. Weightingfactorsandranking ofdimensions

According to the formulated structure of A/R collection instrument evaluation, the weighting of dimension hierarchy and criterionhierarchycanbeanalyzed. After interviews with

twenty experts of IC design firms about the importance of evaluation dimensions and criteria, the weighting of each

surveyedfirmis obtainedbyExpert Choice[37]. The result is describedasfollow and listedasTable 1.

TABLE1. SUBJECT WEIGHTS OBTAINED BY THE AHP METHOD FOR EXPERTS OF IC DESIGN FIRM Experts/Weighting Factorsof Criteria 01 02 03 04 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 Cil C12 0.120 0.040 0.391 0.085 0.236 0.090 0.245 0.061 0.240 0.073 0.322 0.069 0.233 0.047 0.419 0.115 0.262 0.035 0.444 0.111 0.311 0.078 0.131 0.026 0.388 0.206 0.223 0.059 0.267 0.028 0.407 0.122 0.488 0.092 0.485 0.121 0.324 0.108 0.319 0.070 C13 0.040 0.149 0.103 0.122 0.132 0.075 0.047 0.127 0.055 0.111 0.078 0.016 0.073 0.094 0.046 0.049 0.086 0.061 0.108 0.183 C21 0.083 0.085 0.102 0.095 0.051 0.069 0.045 0.087 0.053 0.093 0.060 0.068 0.106 0.081 0.047 0.049 0.063 0.092 0.113 0.083 C22 C23 0.052 0.065 0.019 0.033 0.020 0.020 0.024 0.024 0.010 0.051 0.012 0.020 0.009 0.016 0.015 0.029 0.011 0.025 0.020 0.053 0.020 0.020 0.017 0.017 0.029 0.032 0.024 0.044 0.011 0.007 0.016 0.016 0.016 0.032 0.035 0.040 0.024 0.026 0.033 0.026 C31 0.262 0.118 0.227 0.209 0.245 0.185 0.327 0.096 0.201 0.061 0.188 0.334 0.058 0.133 0.278 0.182 0.113 0.077 0.138 0.171 C32 0.148 0.052 0.071 0.079 0.060 0.076 0.084 0.035 0.082 0.021 0.064 0.124 0.041 0.067 0.082 0.048 0.038 0.032 0.059 0.046 C33 C34 0.095 0.095 0.032 0.037 0.044 0.087 0.050 0.091 0.060 0.078 0.101 0.071 0.069 0.125 0.019 0.058 0.052 0.224 0.039 0.046 0.131 0.050 0.202 0.066 0.033 0.035 0.113 0.161 0.058 0.176 0.074 0.038 0.046 0.025 0.031 0.027 0.059 0.041 0.046 0.023 Average Weighting 0.313 0.082 CI+CC12+ C13=C1 0.481 0.088 0.076 0.021 0.030 2 C21+ C22+ C23= C2= 0.127 0.180 0.065 0.068 0.078 C31+ C32+ C33+ C34=C3=0.391

Weighting factors of evaluation criteria across firmpolicy(C3= 0.391); and (3) reduction in transaction costs

dimensions are: (C2=0.127). The priorities of the evaluation criteria used to

C11= (0.120 + 0.391+ 0.236 + 0.245 + 0.240 + 0.322+ measure the extent to which reduction in transaction risk are 0.233 + 0.419 + 0.262 + 0.444 + 0.311 + 0.131+ 0.388 + asfollows:

0.223 + 0.267 +0.407 + 0.488 +0.485+ 0.324 +0.319) (1) The transaction partners' credit risk (C11=0.313); (2) 20=0.313, (11) the exchange-rate fluctuation risk (C12= 0.082); (3) the politics and economy risk (C13= 0.089). The average C. I. of and weighting factors of dimensions (C1,

C2

, C3) iS 0.02; TheC21 = (0.083 + 0.085 + 0.102 + 0.095 + 0.051 + 0.069+ average C.I.ofweighting factors of evaluation criteria across 0.045 + 0.087 + 0.053 +0.093 + 0.060 +0.068+ 0.106+ dimensions

(C11,..,C34)

is 0.027. In the dimension of0.081 + 0.047 + 0.049 +0.063 + 0.092+ 0.113 + 0.083)/ compliance with firmpolicy, IC design firms place the sales 20=0.076, (12) growth policy as the most important. Regarding the

dimension of reduction in transaction costs, they place the and

C31 = (0.262 + 0.118 +0.227 + 0.209 + 0.245 + 0.185 +

0.327 + 0.096 + 0.201 + 0.061 + 0.188 + 0.334+ 0.058 +

0.133 + 0.278 + 0.182 +0.113 + 0.077+ 0.138 + 0.171)/

20=0.180 (13)

Weightingfactors of dimensionsare:

C1=0.313+0.082 +0.088=0.482, (14)

and

C2=

0.076+0.021+0.030=0.127, (15)and

C3= 0.180 +0.065+0.068+0.078 =0.391. (16)

financial fees as the mostimportant.

TABLE2. WEIGHTING FACTORS AND RANKING ACCORDING TO SURVEYED IC DESIGN FIRMS

Dimensions and WeightingFactorsand WeightingFactorsand Criteria Ranking of Dimensions Ranking of Criteria

C1 0.482(1) C1l C12 C13 C2 C21 C23 C3 C31 C32 C33 0.127(3) 0.391(2) 0.313(1) 0.082(4) 0.088(3) 0.076(6) 0.021 (10) 0.030(9) 0.180(2) 0.065(8) 0.068(7)

judgments for the four collection instruments. By employing

the eq. (6) toeq. (10), wederive theranking for the four A/R collection instruments. The result is listed in Table 3. The result ranking the T/T advance highest, with the L/C second, the O/Athird, and the documentary collection (D/A, D/P) last. This indicates that prepayment is the first choice in view of risk and cost consideration. However, when they are not able tochoose the favorite instrument,the next concern is the L/C. IC design firms of Taiwan are remarkable and have strong

bargaining power in international transaction. The L/C is helpful to reduce the related risk than the O/A. The reasons that the documentary collection (D/A, D/P) was ranked last could be that the reduction in transaction risk and costs are limited, and the sales growth opportunity offered is smaller than that of the O/A.

TABLE3. RANKING OFA/RCOLLECTION ALTERNATIVES

Alternative BNPi Ranking

T/TAdvance 65.06 1

L/C 40.99 2

Documentarycollection 27.08 4

O/A 39.15 3

D. Discussion

According to the result, IC design firms care about the dimensions of reduction in transaction risk(C1= 0.482) first;

the dimensions compliance with firm policy (C3= 0.391)

second. Among the ten criteria, they care about the transaction partners' credit risk

(C11=

0.313) first, the salesgrowth policy (C31= 0.180) second and the political and economic risk(C13= 0.088)third.They placethe convenience incollectionprocedures (C22= 0.021) last. This indicates that when facenew customer, Taiwan ICdesign firms care about the risk than the firm policy. Among the ten criteria, they

consider the transaction partners' credit risk is the most

important factor. As the China market growing, IC design export-orientedfirms view transactionpartners' credit and the

politics and economy risk are the important factors when

involvingtrade collection.

On the other hands, IC design firms most favor the prepayment and least favor thedocumentary collection (D/A, D/P) to be their choice for A/R collection instruments.

Choosingthe prepayment as theirmostfavored instrument is an indication that all firms triedto avoid transaction risk and costs. The reasons that the D/A and D/P were ranked last could be that the reduction in transaction risk and costs

provided by these instruments is very limited, and the sales growth opportunity provided is smaller than that of the O/A.

Besides, ICdesign firms cared about the related risk because of thediversity customers. The L/C ishelpfultothe reduction of risk.

V. CONCLUSIONS

In this study, we have constructed a FMCDMmodel to evaluate four A/R collection instrument alternatives. Todeal with the qualitative attributes in subjective judgment, this

study employed fuzzy AHP methodology to determine the weights of decision criteria for each expert. Then the FMCDM approach was usedto synthesize the group decision. This process enables decision makers to formalize an effective solution. It is capable of solving complicated, multi-criteria and fuzzy / vague perception problem, such as choosing the most appropriate A/R collection alternative. For IC design

firms,

four collection alternatives were used to exemplify the approach. We believe that it will assist thefinancial managers in making critical decisions during the selecting of A/R collection alternatives. The paper also revealed the concerns and preferences of those

export-oriented firms. The results of this study might be of interest to authorities in the banking sector or government agencies.

ACKNOWLEDGMENT

This work was supported in partby the National Science Council of Taiwan under Contract NSC-95-2221-E-009-336, Contract 95-2752-E-009-003-PAE and by the MoE ATU Program,Taiwan, under a 2006-2007 grant.

REFERENCES

[1] A.Boczko, "Internationalpaymentrisk," FinancialManagement,vol.5, pp.35-36,2005.

[2] N.Shister, "Newtrade financeapproachesto securethesupply chain," WorldTrade, vol. 18,no.12,pp.32-34,2005.

[3] C. Y Hung, Y H. Chiang. Using fuzzy MCDM approach on A/R collection instruments selectioninTaiwan's Hsinchu Science Park. in: Proc. of Inte. Conf. on Computational Methods in Sciences and

Engineering,Korinthos,Greece, pp.1039-1043,Oct.21-26,2005.

[4] C. YHung,YLi, andY H.Chiang. Evaluation ofAccountReceivable collection instruments alternatives withFuzzyMCDMmethodology,in: Proc. of IEEE Int. Conf on Service Operations, Logistics and Information, Shanghai, China,pp.1009-1013,Jun.20-23,2006.

[5] C. Y. Hung,Y. Li, andY. H. Chiang. Application of Fuzzy MCDM

ApproachtoA/R CollectioninTaiwan CommunicationIndustry,Proc.

ofInte. Conf. onIAMOTManagementofTechnology, Managementof Technologyfor theServiceEconomy,Miami, USA,May,13-17,2007.

[6] A. Ratay, "Moving beyond letters of credit in international trade finance",BusinessCredit, vol. 104,no.10,pp.22-25,2002.

[7] D. Gustin,"Canbanks redefine their roleincross-border trade?"AFP

Exchange, vol. 22,no.4,pp.54-57,2002.

[8] J. ICorre,"Reconciling the oldtheory and thenewevidence," Michgan

LawReview,vol. 98,no.8,pp.2548-2553,2000.

[9] K. Rahardjo, "Collateral products: Not just letter of credit," Risk

Management,vol.46,no.3,pp.36-38,1999.

[10] R. J MannandC. P. Gillette, "The role of letter of credit in payment

transactions,"MichganLawReview, vol.98,no.8,pp.24-32,2000. [11] P. A Buxbaum, "The end of a paperwork nightmare," Frontline

Solutions, vol. 5,no.11,pp.31-33,2004.

[12] B.Follini, "Asdiverse elementsconverge-supply chain finance takes

factoringto a newlevel,"ABFJournal,vol.3,no.4,pp.21,2005.

[13] H. S. Gross, "International factoring today - abird's eyeview,"ABF

Journal,pp.12, vol. 3,no.4,2005.

[14] L. Y. Faber, "Factor can helpyour bankhelp small-business client,"

AmericanBanker,pp.11, vol. 169,no. 1,2004.

[15] W. T. Callahan, "Understanding commercial factoring and credit insurance," Collections and CreditRisk, vol. 5,no.6,pp.53-56,2000.

[16] J.Cummings, "International A/R risk eases,"BusinessFinance, vol.10, no.12,pp.35-36,2004.

theory and evidence," Journal ofFinance,vol.47, pp. 169-201, 1992. [18] Yoshiro Miwa, J.Mark Ramseter. "Japanese industrial finance at the

close of the 19th centry: trade credit and finfncial intermediation,"

Explorations in EconomicHistory,vol. 43, pp. 94-118, 2006.

[19] J.Neelam, " Monitoring costs and trade credit," The Quarterly Review

ofEconomicsand Finance,vol.41, pp. 89-110, 2001.

[20] 0. Masanori, "Determinants of trade credit in the Japanese manufacturing sector," Journal of Japanese and International

Economies,vol.15, pp. 160-177, 2001.

[21] D. Aronson, R. W. Bostic, P. Hunk and R. Townsend, "Supplier relationships and small businessuseof trade credit," Journal of Urban

Economics,vol.55, pp. 46-67, 2004.

[22] T. Y. Hsieh, S. T.Lu, and G. H.Tzeng, "FuzzyMCDM approachfor

planning and design tenders selection in public office buildings," International Journal ofProject Management, vol. 22, pp. 573-584, 2005.

[23] F. G. Wu, Y. J. Lee,andM. C.Lin, "Using the fuzzy analytichierarchy

process on optimum spatial allocation," International Journal of IndustrialErgonomics,vol.33, pp. 553-569, 2004.

[24] K. Wang, C. K. Wang and C. Hu, "Analytic hierarchy process with fuzzy scoring inevaluating multidisciplinaryR&Dprojectsin China,"

IEEE Transactions on Engineering Management, vol. 52, no. 1, pp. 119-129, 2005.

[25] M. S. Kuo, G. H. Tzeng andW. C. Huang, "Group decision-making based on concepts of ideal and anti-ideal points in a fuzzy environment," Mathematical and Computer Modelling, 45,pp.324-339,

2007

[26] C. Zopounidis, "Multicriteria decision aid infinancial management,"

European Journal of Operational Research, vol. 119, pp. 404-415, 1999.

[27] T. L. Saaty, "A Scaling Method for Priorities in Hierarchical

Structures," Journalof Mathematical Psychology, vol. 15, no. 2, pp. 234-281, 1977.

[28] T. L. Saaty,"The analytic hierarchyprocess," NewYork:McGraw-Hill, 1980.

[29] L. A. Zadeh, "Fuzzy set",Information and Control, vol. 8, no. 2, pp.

338-353,1965.

[30] R. E. Bellman and L. A Zadeh, "Decision-making in a fuzzy environment,"ManagementScience, vol. 17,no.4,pp.141-146,1970. [31] L. A.Zadeh, "Theconceptofalinguistic variable and its applicationto

approximate reasoning, Part I," Information Science, vol. 8, pp. 199-249, 1975.

[32] L. A.Zadeh, "Theconceptofalinguistic variable and its applicationto

approximate reasoning, Part II," Information Science, vol. 8, pp.

301-357, 1975.

[33] L. A.Zadeh, "Theconceptofalinguistic variable and its applicationto

approximatereasoning, Part III," Information Science, vol. 9, pp. 43-80, 1975.

[34] D.Dubois, andH.Prade, "Operationsonfuzzy number,"International JournalofSystem Science,vol.9,no.6,pp.613-626,1978.

[35] P. Laarhoven and W. Pedrycz, "Afuzzy extension ofSaaty's priority theory,"Fuzzy SetsandSystems, vol. 11,no.3,pp.229-241,1983.

[36] J. J.Buckley, "Ranking alternatives using fuzzy numbers,"Fuzzy Sets andSystems,vol. 15,no.1,pp.21-31,1985.

[37] ExpertChoiceUser'sGuide: Version 11.Copyright (c)ExpertChoice,