企業相對規模對併購後表現影響之研究

全文

(2) 企業相對規模對併購後表現影響之研究 Post-Merger Performance: Does Size Matter?. 研 究 生:石劭軒. Student:Shao-Hsuan Shih. 指導教授:洪志洋. Advisor:Chih-Young Hung 國 立 交 通 大 學 科 技 管 理 研 究 所 碩 士 論 文. A Thesis Submitted to Institute of Management of Technology College of Management National Chiao Tung University in partial Fulfillment of the Requirements for the Degree of Master In Management of Technology April 2008 Hsinchu, Taiwan, Republic of China. 中華民國九十七年四月.

(3) 企業相對規模對併購後表現影響之研究 學生:石劭軒. 指導教授:洪志洋. 國立交通大學科技管理研究所碩士班 摘. 要. 合併與收購是近二十年來相當熱門的企業活動,但實證研究上對於併購後的表現 仍具爭議,故許多學者嘗試從不同角度解釋影響併購後表現的原因。本論文從企 業的相對規模著眼,並分為短期與長期,研究企業之間相對規模對於併購後表現 的影響。本研究結合SDC與COMPUSATA資料庫,蒐集美國地區2000年到2001年曾經 從事併購活動的上市科技公司進行分析,並使用股票報酬與營運績效兩項指標來 衡量併購後的表現。短期方面運用事件研究法的分析果顯示,與併購前相比,併 購後不論是股票報酬或營運績效都較差。回歸分析則顯示:主併公司的絕對規模 與併購後表現成正比;兩公司的規模越相近,併購後表現越好。長期方面運用事 件研究法的分析結果顯示,與併購前相比,併購後不論是股票報酬或營運績效都 較差。此外觀察出當兩公司的相對規模越相近,長期的股票報酬較差,而營運績 效較好。整體而言,企業相對規模對於併購後表現確實造成不同影響。. 關鍵字:合併與收購;併購後表現;企業相對規模. i.

(4) Post-Merger Performance: Does Size Matter? Student: Shao-Hsuan Shih. Advisors: Chih-Young Hung. Institute of Management of Technology National Chiao Tung University ABSTRACT Mergers and acquisitions have been one of the most pronounced activities at the global level in the past two decades, but the overall empirical post-merger performance is still controversial. Researchers have been trying to explain various performances from different viewpoints. In this dissertation, the investigation aimed to analyze the performance in post-merger integration stages from the viewpoints of relative size of combining firms, discussing how various relative sizes between combining firms influence post-merger performance in the short-term and long-term. The data of this dissertation was collected from SDC platinum and COMPUSTAT, where the data were M&A deals of high-tech public companies announced between 2000 and 2001 in the U.S.A. The post-merger performance was assessed by using share returns as market performance and ROA and ROE as operating performance. As for short-term analysis, the event study analysis showed post-merger performance under both market assessments and operating performance assessments were significantly negative. The regression analysis results showed that percentage change in stock returns was significantly positively associated to the target sizes comparing to acquirers in M&A deals. Similarly, the event study analysis for the long-term showed that post-merger performance under both market assessments and operating performance assessments were significantly negative. Moreover, it could be observed that as the size of the target companies comparing to the acquirers become larger, the shareholders earned less comparing to which before mergers, but the operating performance become relatively better. Overall, it can be concluded that relative size between combining firms do result in different post-merger performance. Keywords: Mergers and Acquisitions, Post-Merger Performance, Relative Size. ii.

(5) ACKNOWLEDGEMENT. To complete the dissertation would never be an easy thing. From deciding the topics, collecting and analyzing data, to the final writing and editing, there were often dispiriting difficulties. Nevertheless, it was definitely a great opportunity for me to stretch my mind through overcoming those challenges. The completion of this dissertation would not be possible without the guidance of my supervisor, Dr. Chih-Young Hung. At each phase in the process of completing this dissertation, he has directed me by continuing giving me helpful feedback, reliable suggestions, and professional knowledge. I am very grateful for his committed assistance. Besides, the encouragement of my family and friends is a very important support to me as well, especially when I was depressed under stress. I would like to take this opportunity to express my appreciation to them. Above all, thank my dearest parents and beloved Angus.. iii.

(6) TABLE OF CONTENTS (CONDENSED). 1. INTRODUCTION…………………………………………………………………...1 2. LITERATURE REVIEW: A POST-MERGER PERFORMANCE………………7 3. THE MAIN ISSUE: DOES SIZE MATTER? ……………………………………21 4. METHODOLOGY, DATA, AND RESEARCH METHODS…………………….28 5. EMPIRICAL ANALYSIS RESULTS ……………………………………………..43 6. DISCUSSION OF FINDINGS …………………………………………………….57 7. CONCLUSIONS AND RECOMMANDATION …………………………………63. BIBLIOGRAPHY …………………………………………………………………….67. iv.

(7) TABLE OF CONTENTS. ABSTRACT (Chinese)………………………………………………………………...i ABSTRACT (English)……………………………………………………………...ii ACKNOWLEDGEMENT…………………………………………………………….iii TABLE OF CONTENTS (Condensed)………………………………………………iv TABLE OF CONTENTS……………………………………………………………….v LIST OF TABLES……………………………………………………………………vii LIST OF FUGURES………………………………………………………………....viii. 1.. 2.. INTRODUCTION ................................................................................................... 1 1.1. BACKGROUND ........................................................................................................................... 1. 1.2. CENTRAL QUESTION .................................................................................................................. 2. 1.3. AIMS.......................................................................................................................................... 3. 1.4. OBJECTIVES ............................................................................................................................... 3. 1.5. SCOPE ........................................................................................................................................ 4. 1.6. DISSERTATION STRUCTURE ........................................................................................................ 5. LITERATURE REVIEW: A POST-MERGER PERFORMANCE .................... 7 2.1. THE DEFINITION OF M&A ......................................................................................................... 7. 2.2. THE MOTIVES FOR M&A........................................................................................................... 8. 2.3. THE TYPES OF MERGER ............................................................................................................. 9. 2.4. THE PROCESS OF M&A AND THE POST-MERGER STAGE ...........................................................11. 2.5. MEASURING POST-MERGER PERFORMANCES .......................................................................... 13. 2.6. THE RESULTS OF EMPIRICAL POST-MERGER PERFORMANCE ................................................... 15. 2.7. DIFFERENT VIEWPOINTS FOR INVESTIGATING POST-MERGER PERFORMANCE.......................... 16. 2.8. SUMMARY AND CONCLUSION .................................................................................................. 20. v.

(8) 3. THE MAIN ISSUE: DOES SIZE MATTER?..................................................... 21. 4.. 5.. 3.1. RELATIVE SIZE OF THE COMBINING FIRMS IN M&A DEALS .................................................... 21. 3.2. THE DEFINITION OF RELATIVE SIZE ......................................................................................... 22. 3.3. THE IMPACT OF RELATIVE SIZE ON POST-MERGER PERFORMANCE IN THE SHORT-RUN ........... 23. 3.4. THE IMPACT OF RELATIVE SIZE ON POST-MERGER PERFORMANCE IN THE LONG-RUN ............ 25. 3.5. SUMMARY AND CONCLUSION .................................................................................................. 26. METHODOLOGY, DATA, AND RESEARCH METHODS............................. 28 4.1. PHILOSOPHICAL STANCE.......................................................................................................... 28. 4.2. DATA FROM SECONDARY RESEARCH ....................................................................................... 29. 4.3. REGRESSION ANALYSIS ........................................................................................................... 30. 4.4. EVENT STUDY METHODOLOGY ............................................................................................... 32. 4.5. CREDIBILITY OF THE RESEARCH .............................................................................................. 39. 4.6. SUMMARY AND CONCLUSIONS ................................................................................................ 41. EMPIRICAL ANALYSIS RESULTS................................................................... 43 5.1. ANALYSIS FOR MERGER IMPACTS IN THE SHORT-TERM AND THE CONNECTION TO RELATIVE. SIZES BETWEEN COMBINING FIRMS ....................................................................................................... 43 5.2. ANALYSIS FOR MERGER IMPACTS IN THE LONG-TERM AND THE CONNECTION TO RELATIVE. SIZES BETWEEN COMBINING FIRMS ....................................................................................................... 50 5.3. 6.. SUMMARY AND CONCLUSION .................................................................................................. 55. DISCUSSION OF FINDINGS .............................................................................. 57 6.1. POST-MERGER PERFORMANCE AND RELATIVE SIZE OF COMBINING FIRMS IN THE SHORT-RUN 57. 6.2. POST-MERGER PERFORMANCE IN THE LONG-RUN AND RELATIVE SIZE OF COMBINING FIRMS. 59. 6.3. SUMMARY AND CONCLUSION .................................................................................................. 61. 7. CONCLUSIONS AND RECOMMANDATION ................................................. 63 7.1. CONCLUSIONS ......................................................................................................................... 63. 7.2. RECOMMENDATIONS ON FURTHER RESEARCH ......................................................................... 66. BIBLIOGRAPHY......................................................................................................... 67 vi.

(9) LIST OF TABLES. Table 2.1. The Summary of Different Viewpoints for Investigating Post-merger Performance from the Previous Researchers…..…………………………... 19. Table 5.1 Percentage Change in Stock Returns and Operating Performance for the First Quarter after Mergers- Arranged by Absolute Sizes of Acquiring Companies…………………………………………………... Table 5.2 Percentage Change in Stock Returns and Operating Performance for the First Quarter after Mergers- Arranged by Relative Sizes of the Two Combining Companies…………………………………………………. Table 5.3 Multivariate OLS Analysis for the First-quarter Percentage Changes of Stock returns, ROA, and ROE…………………………………………... 49. Table 5.4 Long-term Post-merger Performance up to Five Years after Mergers…... 51. 44. 46. vii.

(10) LIST OF FUGURES. Figure 1.1. the Structure of the Dissertation ……………………………………………. 6. Figure 2.1. the Process of M&A………………………………………............................... 12. Figure 4.1. Time Line for Event Studies..………………………………………………. 17. Figure 5.1. Bar chart of merger impact as percentage change of performance for the absolute size groups from the first to the fourth quartile.………………… Bar chart of merger impact as percentage change of performance for the relative size groups from the first to the fourth quartile………………….... Figure 5.2. 45 47. Figure 5.3. Bar Chart of AAR for the Groups from the First to the Fourth Quartile.... 52. Figure 5.4. Bar Chart of ACAR for the Groups from the First to the Fourth Quartile....................................................................................................... 53. Bar Chart of AEROA for the Groups from the First to the Fourth Quartile…………………………………………………………………... 54. Bar Chart of AEROA for the Groups from the First to the Fourth Quartile…………………………………………………………………... 55. Figure 5.5. Figure 5.6. viii.

(11) 1.. INTRODUCTION. Chapter 1 provides an introduction and overview of this dissertation. Firstly in this chapter, the background of the research is introduced. Following this is the central question, the aim, and the objectives of the dissertation. Finally, the scope and the structure of the dissertation are presented. 1.1 Background Mergers and acquisitions (M&A) refer to two companies combined into one to achieve certain strategic and business objectives (Sudarsanam 2003). This activity aims to create value for the stakeholders who are connected to the companies such as shareholder and employees. According to Sudarsanam (2003), firms generally enter into M&A for different sorts of reasons, reasons which involve aspects that are economic, strategic, financial, managerial, and organizational. By considering the aspects above, companies are able to set proper plans and to conduct due diligence in advance, and thereby to realize all their plans carefully, and to achieve their corporate strategic goals.. M&A is certainly not an end but a start. When a firm effectively underwent M&A, simultaneously, a new challenge for the combined company, to integrate two different entities, had just started. Post-M&A integration is an important essential for further successfully achieving those objectives set before M&A deals; if a combined firm cannot integrate well, it might not achieve those objectives because the new team does not work smoothly. The results differ from firm to firm due to the different integration conditions. When M&A proceeds successfully and the set goals are realized, a higher value can be created for the stakeholders. On the contrary, when M&A does not go 1.

(12) well and fails to create any value, the M&A could prove to be a disaster for the companies’ stakeholders. In fact, the empirical evidence studies show both positive and negative post-M&A performance (largely negative) for the merged companies in the long-run. Therefore, an M&A initiative cannot be assured of a definite successful result.. Because the overall empirical post-M&A performance is still controversial, researchers have been trying to explain various performance from different viewpoints, such as different type of M&A (horizontal, vertical, or conglomerate), different medians of M&A (cash or stock swap), different market-to-book value of acquiring companies, and whether the business of combined companies are more focused or diversifies comparing to pre-M&A stages, etc. In this dissertation, the investigation is going to analyze the performance in post-M&A integration stages from the viewpoints of relative size of combining firms, discussing how various relative sizes between combining firms influence post-M&A performance. The analysis will start from investigating the effect in the short-term and then extend to which in the long-term. 1.2 Central Question To investigate the relative size of combing firms and connect it to combined firms’ performance in post-M&A integration phases, the central question asked in this dissertation is:. How does relative firm size between target and acquiring companies influence post-merger performance?. 2.

(13) 1.3 Aims Having described the background and developed the central question, two main purposes of this dissertation are as below:. 1. The dissertation aims to analyze the overall short-term performance within the first quarter after M&A and investigate how relative size of the combining firms influences post-M&A performance in the short-term.. 2. The dissertation aims to analyze the overall long-term post-M&A performance and investigate how relative size of the combining firms influences the long-term performance.. Overall, the dissertation aim to discuss the various post-M&A performance from the viewpoints of relative size of combing firms by seeing whether it is a factor for post-M&A performance, and how it influences post-M&A performance in the short-run and long-run. 1.4 Objectives To achieve the primary aim of the thesis above, five main objectives of the dissertations are divided into short-term and long-term analyses:. Short-term:. 1. To analyze the overall post-M&A performance in the short-term by conducting an event study analysis.. 2. To classify different relative sizes into various groups and compare if there is any. 3.

(14) different long-term post-M&A performance gap between different groups by conducting event study analyses.. 3. To figure out if there is any relationship between relative size of combing firms and the post-M&A performance in the short-run by conducting a regression analysis.. Long-term:. 4. To analyze the overall post-M&A performance in the long-term by conducting event study analyses.. 5. To classify different relative sizes into various groups and compare if there is any different long-term post-M&A performance gap between different groups by conducting event study analyses. 1.5 Scope The scope of the dissertation is defined by two dimensions:. 1. In the geographical aspect, due to availability and completeness of the data, the investigation will focus on firms which had undergone M&A activities in the U.S.A.. 2. In the time aspect, in order to observe both the short-term and the long-term performance of the combined firms, the investigation will concentrate in the M&A deals announced between. 2000 and 2001, so that the long-run post-M&A. performance can be tracked for as long as five years.. 4.

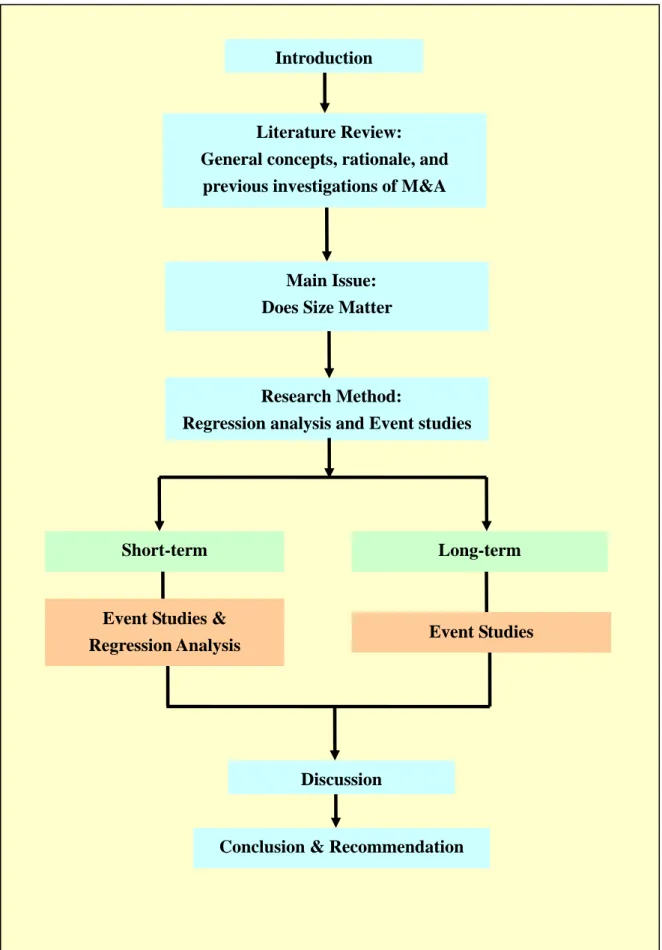

(15) 1.6 Dissertation Structure The dissertation begins with the introduction of Chapter 1. Chapter 2 will present an overall literature review, which introduces the general concepts and rationales of M&A. The critical post-M&A integration issues and the assessments of measuring post-merger performance will also be generalized.. Chapter 3 will introduce the main issue of the dissertation: the impact of relative size. The arguments and the hypotheses of this dissertation will be presented in this chapter.. Chapter 4 will introduce the research method of the dissertation; the investigating methodology of ‘regression analysis’ and ‘event study’ will be discussed in this chapter. The data sources would also be introduced in this chapter.. In chapter 5, the short-term and long-term post-M&A performance assessed by market and operating performance of the data firms will be analyzed through regression analysis and event studies.. Chapter 6 will discuss the overall research results.. Chapter 7 will present the conclusions and recommendations of the dissertation. The dissertation structure is shown in the figure 1.1 below.. 5.

(16) Introduction. Literature Review: General concepts, rationale, and previous investigations of M&A. Main Issue: Does Size Matter. Research Method: Regression analysis and Event studies. Short-term. Long-term. Event Studies & Regression Analysis. Event Studies. Discussion. Conclusion & Recommendation. Figure 1.1 the Structure of the Dissertation Source: Author 6.

(17) 2.. LITERATURE REVIEW: A POST-MERGER PERFORMANCE. Chapter 2 provides general information on and an explanation of the principles behind M&A, based on which the concepts of post-merger performance will be introduced, and the discussion will then be linked to the issue of relative size of combing firms. Further discussion in the sections will be as follows: Section 2.1 provides a definition of M&As. Section 2.2 generalizes the motives for M&A. Section 2.3 and 2.4 discuss the types and the process of a merger. Section 2.5 introduces the assessment measures which have been used for post-merger performance. Section 2.6 consolidates the empirical results of M&A. Section 2.7 discusses the probable factors of influencing post-merger performance which have been investigated by researchers. Finally, a summary and conclusions will be provided in section 2.8.. 2.1. The Definition of M&A. The terms ‘merger’ and ‘acquisition’ have different meanings, although they are often referred to in the same context and used interchangeably. A merger is a combination of two business entities, typically organizations of similar types, and results in the formation of a single business enterprise (Gauphan 2005). Usually, the shareholders of the combined firms remain as joint owners of the combined entity. In contrast to a merger, an acquisition is an activity where one firm purchases the assets or shares of another firm. When an acquisition takes place, the acquired firm becomes the subsidiary of the acquirer. (Sudarsanam 2003) In this dissertation, the term ‘merger’ is usually used to represent mergers and acquisitions.. 7.

(18) 2.2. The Motives for M&A. M&A is an activity by which two companies are combined into one in order to achieve desired strategic or business objectives. (Sudarsanam 2003) According to Gauphan (2005), the most common objectives of M&A can be classified into two categories: the objective of growth and the objective of synergy. In addition to those two certain motives of mergers, a hypothetical reason can also explain why mergers are conducted: the managers’ hubris. The motives and the reason are discussed below.. ¾. Growth. Firms are always seeking growth opportunities. M&A provides a route to growth that is an alternative to organic growth. M&A enables companies to expand their businesses with a ready-made business operation instead of having to develop a new business from the beginning (Gauphan 2005). Growth can be represented in several ways: expansion of market shares, increase in sales volume, and geographical extension of the business. M&A helps firms grow by achieving one of the above possibilities for business expansion.. ¾. Synergy. Another objective for M&A activities is synergy. Synergy is the benefits obtained through the amalgamation of two firms, with the aim of achieving 1+1>2. According to Sudarsanam (2003), synergy can be represented from several perspectives, including economies of scale, economies of scope, and economies of learning.. . Economies of scale come from reducing the per-unit cost, such as costs of R&D 8.

(19) investment, distribution, and advertisement, while increasing the size or scale of a company’s operation in a given period.. . Economies of scope refer to gaining competitive advantage by transferring existing skills instead of creating new ones. Examples of this advantage include products,. technology. know-how,. market. knowledge,. and. customer. relationships.. . The benefits of economies of learning occur when two companies share their accumulated knowledge and experience, so that there is a net increase in the overall organizational learning capacity.. ¾. Hubris. This reason for mergers relate to the issues of corporate governance and agency cost. The problem of hubris occurs when managers have an unrealistic sense of their own skills and talent, leading them to believe that they are capable of obtaining gains from the acquisition of another institution. In fact, however, they are no more capable than others (Pillof & Santomero 1997). Apart from over-confidence, in some cases it might be the managers’ self-interest or ambition that leads to the M&A activities. When the firms merge in relation to this motive, it is quite possible that the merged firms will not have improved performance due to over-confidence or self-interest.. 2.3. The Types of Merger. From the strategic managerial point of view, any merger can be one of several types, including: horizontal, vertical, congeneric, conglomerate M&A, and leveraged buyout (LBO), and M&A in fragmented industries, as described in the following paragraphs. 9.

(20) ¾. Horizontal Merger. A horizontal M&A is an amalgamation between two companies in the same line of business. This form of M&A results in the expansion of a firm’s operation in a given product line and simultaneously eliminates the competitors, i.e. it is designed to increase market power.. ¾. Vertical Merger. A vertical M&A is the consolidation with the company’s suppliers or customers. The benefit of this type of M&A is in terms of the firm’s ability to control the raw materials or the product distribution. Controlling either the supply or customer side makes the company’s operation chain more stable and predictable.. ¾. Congeneric Merger. Congeneric M&A is the combination of firms in the same industry but operating in different business lines. This type of M&A aims to capitalize benefits through sharing the same sales and distribution channels to reach the same customers of both businesses.. ¾. Conglomerate Merger. Conglomerate M&A is the combination of two firms in unrelated industries. Firms carry out this kind of M&A to reduce risks due to different seasonal or cyclical patterns of sales and earnings.. 10.

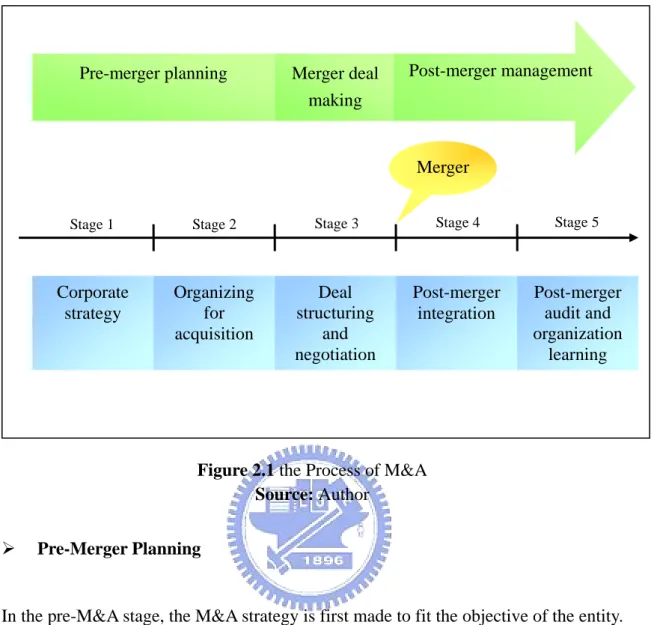

(21) ¾. LBO. LBO is the situation in which a small group of investors buy all the publicly-held shares and thereby transform the firm into private owned entity. The objective of LBO is to operate the firm privately for several years, and then take the firm public again. The small group of investors aims to ‘cash out’ after the assessed value of the firm increases after operating privately for a certain period of time.. ¾. M&A in Consolidating Industries. Fragmented industries contain a great number of very small firms selling a single product or a small range of related products. Consolidation between these firms enables them to create value through cost savings, revenue enhancement, and new growth opportunities.. 2.4. The Process of M&A and the Post-Merger Stage. An M&A activity unfolds in different stages. It can be divided into three main stages simply in terms of the different time phases: pre-merger planning, merger deal-making, and post-merger management. Apart from time-based division, Sudarsanam (2003) divided M&A process into five main stages with their own missions. The five-stage (5-S) model includes: corporate strategy, organizing for acquisition, deal structuring and negotiation, post-merger integration, and post-merger audit and organization learning. Figure 2.1 compares the different divisions. The following paragraph will discuss the different stages in the process of M&A.. 11.

(22) Pre-merger planning. Merger deal making. Post-merger management. Merger Stage 1. Stage 2. Stage 3. Stage 4. Stage 5. Corporate strategy. Organizing for acquisition. Deal structuring and negotiation. Post-merger integration. Post-merger audit and organization learning. Figure 2.1 the Process of M&A Source: Author ¾. Pre-Merger Planning. In the pre-M&A stage, the M&A strategy is first made to fit the objective of the entity. The firm then lays down the criteria for potential targets of M&A, according to the strategic objectives and value-creation logic of the firm’s corporate strategy and business model. This stage corresponds to the first and second stages of Sudarsanam’s 5-S model.. ¾. Merger Deal-Making. In this stage of the M&A deal-making, normally, proper negotiation should be carried out between two potential merger companies. The currency used to close the deal and the due diligence should be decided at this stage. This stage corresponds to the third stage in the 5-S model. 12.

(23) ¾. Post-Merger Management. In the post-merger management stage, two firms have already combined into one, and proper integration should be done in the merged company, so that the new organization can operate smoothly. In addition, a well-planned post-merger audit helps the firms to learn from the experience of M&A, which will be the foundation for possible further M&A in the future. The post-merger management stage refers to the fourth and fifth stage in the 5-S model. These two stages are also the main fields which this dissertation focuses on. Therefore, the discussion and analysis in the following sections and chapters will all be constructed on those two stages.. 2.5. Measuring Post-Merger Performances. Post-merger performance can be divided into short-run and long-run in consistent with the fourth and fifth stages of 5-S model discussed in the previous section. To measure how firms perform after mergers, it is determined by the impact on shareholders’ value, since shareholders are the owners of a company. Overall, post-merger performance review can be measured from two different aspects: market assessment and operating performance assessment (Sudarsanam 2003).. ¾. Market Assessment. Market assessment uses the abnormal return of shares to assess post-merger performance. Abnormal return can be measured by calculating the differences between the actual return and the expected return of shares. Sheng and Li (2000) consolidated three ways of measuring the expected return: Mean-Adjusted Return Model (MARM), Market-Adjusted Return Model (MKARM), and Capital Asset. 13.

(24) Pricing Model (CAPM). The difference between actual and expected return is viewed as the impact of the M&A on the merged companies.. When using MARM, the investigators compare the actual return to the company’s average return during a period of time before the merger. The investigator can use MKARM as well, comparing the actual return to the expected market return. Moreover, CAPM provides the expected return for a share by using the relationship between risks and the expected return on a company’s share. Using either way of calculating the expected return of a merged company and then comparing it to the actual return for the share, the post-merger performance can be measured by analyzing whether the abnormal returns are positive or negative.. ¾. Operating Performance Assessment. In contrast with the market assessment, when measuring the post-merger performance using the operating performance assessment, accounting data are used to observe how the returns on investment behave. Operating performances are usually measured by the ratios such as return on assets (ROA), return on equity (ROE), and operating cash flow return (OCFR). Sudarsanam (2003) collected several studies investigating long-run post-merger performance by using either ROA, ROE or OCFR.. Similar to the methods discussed under the market assessment, when measuring excess operating performance, three ways have been used by the previous investigators: first, comparing the actual performance to which of the firms in the same industry; second, comparing the actual performance to the average performance of the company in a pre-merger period; and third, comparing the actual performance to the matched non-merging firms. Using either way of calculating the expected 14.

(25) operating performance of a merged company and then comparing it to the actual ones, the post-merger operating performance can be measured by analyzing whether excess performance is positive or negative.. The two aspects above present different viewpoints: the assessment of the expected return of the share is forward-looking, while the assessment of accounting numbers of operating performance is backward-looking. Both perspectives make it possible to assess the post-merger performance.. 2.6. The Results of Empirical Post-Merger Performance. According to ground-breaking results from global research conducted by KPMG International, 83% of corporate mergers and acquisitions fail to enhance shareholder value (PR Newswire 1999). Similarly, from the viewpoints of academic community, the most results of empirical post-merger performance in the long run are, in fact, negative. It is concluded by the previous researchers that firms experience significantly negative abnormal returns over one to three years after the merger. The researchers who made the same conclusion include: Langetieg (1978), Asquith (1983), and Magenheim and Mueller (1988) (Agrawal et al. 1992).. The results hold under both market assessments and operating performance assessments. By reviewing post-merger performance using share market assessment, Agrawal & Jaffe (1999) collected and analyzed the empirical studies and concluded that the cumulative average abnormal return is negative in the long term. Similarly, the collection of empirical studies of the US, the UK, and Continental Europe by Sudarsanam (2003), using operating-performance assessment, showed that in the long-run, most post-merger performance declines. The results of the investigations 15.

(26) above converge to show that the post-merger performance of the merged companies can hardly be argued to have a positive performance in the long-run.. 2.7. Different Viewpoints for Investigating Post-merger Performance. Though the empirical results of post-merger performance are largely negative, new M&A deals are still being made each year. The question is: since most merger results are not as good as what have been expected, why firms are still merging? Maybe the real post-merger performance is not the same as the conclusions of the previous researchers. To answer this question, several investigators have done investigation of post-merger performance from various viewpoints and tried to find out the factors which influence post-merger performance.. Agrawal, Jaffe, and Mandelker (1992) have looked into three possible factors of influencing post-merger performance, which includes adjustment of firm size and beta risk, conglomerate or non-conglomerate between combing firms, and the relative size of the acquiring events. The investigation is based on a nearly exhaustive sample of mergers over 1955 to 1987 between NYSE acquirers and NYSE/AMEX targets by using market assessment. The conclusion of their investigation states that after adjusting for the firm size effect as well as beta risk, their results still indicate that stockholders of acquiring firms experience a statistically significant wealth loss of about 10% over five years after the merger completion date. In addition, there is no significant evidence for both conglomerate and relative firm size to conclude that they are factors influencing post-merger performance.. Rau and Vermaelen (1998) examined a sample of 3169 mergers and 348 tender in the U.S between 1980 and 1991 from the view points of different book-to-market ratios. 16.

(27) They found that the long-term underperformance of acquiring firms in mergers is predominantly. caused. by. the. poor. post-acquisition. performance. of. low. book-to-market (glamour) firms, who perform much worse than other glamour stocks and earn significant negative bias-adjusted abnormal returns of 17% in mergers. In addition, specifically, in contrast to value bidders, they concluded that glamour bidders in both 100% cash-financed and 100% equity-financed mergers significantly under-perform after the merger. They described the results by suggesting that companies with low book-to-market ratios tend to make relatively poor acquisition decisions, in general.. Cheng and Leung (2004) investigated the short-term return performance and long-term operating performance of 36 partial mergers in Hong Kong during the period 1984–1996. The main issue in the investigation is to see if there is different performance between diversifying and non-diversifying M&As. The conclusion of the research stated that both the short-term and long-term performance analyses demonstrate that the diversifying pairs of target and acquiring firms do indeed outperform the non-diversifying pairs.. Megginson, Morgan, and Nail (2004) found a significantly positive relationship between corporate focus and long-term merger performance: Focus-decreasing (FD) mergers result in significantly negative long-term performance with an average 18% loss in stockholder wealth, 9% loss in firm value, and significant declines in operating cash flows three years after merger. Mergers that either preserve or increase focus (FPI) result in marginal improvements in long-term performance. They also concluded that every 10% reduction in focus results in a 9% loss in stockholder wealth, a 4% discount in firm value, and a more than 1% decline in operating. 17.

(28) performance. In addition, they tested post-merger performance under different possible influencing factors and found out that cash-financed FPI mergers exhibit the best and stock-financed FD mergers the worst, long-term performance. This investigation was based on 204 corporate mergers occurring between 1977 and 1996 in the U.S.. Ragozzino (2006) examined whether the unique attributes of new ventures cause these firms to experience different M&A outcomes from established firms. The investigation was based on acquisitions of high-technology firms by the US bidders between the years 1992 and 2000. Drawing from a sample of high-technology acquisitions, the results showed that new ventures experience lower average performance in general, as well as when the target is itself a new venture. Yet, they outperform established firms when the target is a privately-held entity. The findings also demonstrated that the challenges and opportunities of firms shift through the first few years of their existence, directly affecting the outcomes of their M&A activity.. Kruse et al. (2007) examines the long-term operating performance following 69 mergers of manufacturing firms traded on the Tokyo Stock Exchange during 1969 to 1999. What worth mentioning is the evidence of improvements in operating performance for the entire samples. They investigated the post-merger performance by concluding that the pre- and post-merger performance is highly correlated; the long-term performance is significantly greater following mergers of firms operating in different industries; Increases in employment surrounding the mergers are positively related to post-merger performance among diversifying mergers and mergers completed before the peak of the equity bubble in 1989. However, they did not find existing relationships among merging firms a significantly factor for better. 18.

(29) post-merger performance.. The previous literatures reviewed in this section discuss the possible factors which might influence post-merger performance investigated by the previous researchers. Some of them proved their hypotheses with significant results, but some did not. The reviewed literatures are summarized in table 2.1. In the next section, the hypothesized factor to influence post-merger performance in this dissertation is to be introduced. Table 2.1 The Summary of Different Viewpoints for Investigating Post-merger Performance from the Previous Researchers Author Agrawal, Jaffe, and Mandelker (1992) Rau and Vermaelen (1998). Samples 765 mergers in the U.S., 1955-87. Factors 1. Firm size and beta risk 2. Conglomerate vs. non-conglomerate. Results Not significant. 3169 mergers and 348 tender offers in the U.S, 1980-91 Cheng and 36 partial Leung mergers in HK, (2004) 1984–1996 Megginson, 204 corporate Morgan, and mergers in the Nail (2004) U.S., 1977-96. Book-to-market ratios of the acquiring companies. Low book-to-market firms perform much worse. Diversifying vs. non-diversifying. Ragozzino (2006). New ventures vs. established acquiring companies. Diversifying pairs outperform the non-diversifying pairs Significantly positive relationship between corporate focus and post-merger performance in the long-term New ventures experience lower average performance in general 1. Positive correlated 2. Positive correlated 3. Not significant. Kruse et al. (2007). 445 high-tech firms by the US bidders, 19922000 69 mergers of manufacturing firms in JP, 1969 -99.. Preserve or increasing focus vs. focus decreasing. 1. Relationship between pre-merger and post-merger 2. Increasing employments surrounding the mergers 3. Existing relationship between the combing firms Source: Author. 19.

(30) 2.8. Summary and Conclusion. Chapter 2 reviews general concepts and principles of M&A. M&A is the consolidation of two companies in order to achieve desired corporate goals. By integrating the existing resources with the merged partners, the merged companies seek opportunities for growth and synergy, including business expansion, economies of scale, and economies of scope.. From the managerial viewpoint, each M&A activity falls under one of several categories, and different types of mergers aim at different results and benefits. The overall M&A process is divided into pre-merger planning, merger deal-making, and post-merger management. The investigation in this dissertation focuses on investigating the post-merger performance at the post-merger management stage. The stage contains two sub-stages in 5-S Model: post-merger integration and post-merger audit and organization learning. Two types of assessments can be used to measure the post-merger performances from different aspects, including market assessment and operating performance assessment.. The empirical evidence argues that most M&A activities do not necessarily have positive performance in the long-run. Due to the negative results being contrary to the motives of M&A, several investigators have done investigation of post-merger performance from various viewpoints and tried to find out the factors which influence post-merger performance. The investigated factors are such as: conglomerate vs. non-conglomerate mergers, diversifying business or focus businesses, different book-to-market ratios for acquiring companies, and existing relationship of combining firms, etc. Based on the discussion above, in the next section, the hypothesized factor to influence post-merger performance in this dissertation is to be introduced. 20.

(31) 3.. THE MAIN ISSUE: DOES SIZE MATTER?. This chapter discusses the main issues of the dissertation. The hypotheses and arguments will be discussed in the following sections: Section 3.1 will offer the introduction of the role which relative size plays in M&A deals. Section 3.2 will define what relative size of combing firms is. Section 3.3 will discuss the issue of relative size which relates to short-run (i.e. post-integration stage as the 4th stage in 5-S model) post-merger performance. Section 3.4 will discuss the arguments of relative size relating to long-run (the 5th stage in 5-S model) post-merger performance. Section 3.5 will provide the summary of this chapter.. 3.1 Relative Size of the Combining Firms in M&A Deals. Organization size shapes the structure design of company and plays an important in culture composition (Greenburg 1999). It could be inferred that different organization sizes would result in different cultures. Therefore, talking about mergers and acquisitions, two combing firms with different organization sizes might yield culture integration problems. Poor culture fit or incompatibility is likely to result in considerable fragmentation, uncertainty and cultural ambiguity, which may be experienced as stressful by organization members. Such stressful experience may lead to their loss of morale, loss of commitment, confusion and helplessness, and may have a dysfunctional impact on organizational performance (Carey 2000).. Relative firm size between two firms is also connected to the relative power of competition and cooperation. Intuitively speaking, when one power is largely greater than the other, the relatively smaller power might be integrated into the large one easily. On the other hand, when two powers are about equal, to integrate them 21.

(32) effectively might be harder.. The well-known merger example can be taken by the case of Daimler-Benz and Chrysler, which took place in 1998, however, did not turn out to be very successful. The major issue behind this merger case is believed to be the culture conflicts between two almost equal firms combining into one. The nine-year merger ended up with the Germany Daimler group selling 80.1% shares of Chrysler to a private equity group in the middle of May, 2007 (Carnews 2007).. Different from Daimler-Chrysler, the example of Cisco turns out to be a successful one. Cisco has acquired 125 companies since 1993, and is expected to acquire more in the future. The most acquired companies are relatively much smaller than Cisco. With acquiring those smaller firms, the net sales of Cisco have been grown from $2 billion in 1995 to its fourteen-times, $28.5 billion, in 2006 (Cisco 2007).. The two extremely different cases above might have released some information about the issue of relative size: though both mergers and acquisitions are combinations of companies, the results can be very different. Relative size of the combined firms could be assumed as a probable factor for post-M&A performance, because different sizes of combinations would lead to different levels of culture integration conflicts.. 3.2 The Definition of Relative Size. Relative size of the combining firms refers to the relative firm size between an acquiring company and its target company.. Agrawal et al. (1992) argued that the acquisition of a relatively large target is likely to be a more important economic event for the acquirer than is the acquisition of a 22.

(33) relatively small target. Thus, if the post-merger underperformance reflects the impact of the merger, underperformance should be greater when the target is relatively large. However, their investigation was only based on market assessment by measuring the share returns. Therefore, in this dissertation, the investigation would be further extent by using both market and operating performance assessments. In addition, the relatives size issue will be invested both in the short-term and long-term, seeing how relative size between combining firms influence the post-M&A performance.. In the short-term, the investigation would focus on relative size between combining firms and its connection to the performance percentage change comparing to the pre-merger stages of the newly combined firms. In the long-term, the investigation would be extent to how different relative size between combining firms would influence the long-term post-merger performance. Moreover, the impact of the relative size would also be observed by seeing if there is a trend as the merger integration time goes by. The following sections will lead more detailed discussion of the investigation.. 3.3 The Impact of Relative Size on Post-merger Performance in the Short-Run. This section is divided into two subsections, where section 3.3.1 will develop the first argument of the post-merger performance in the short-run, and section 3.3.2 will develop the argument of the relative size issue connects to post-merger performance in the short-term.. 3.3.1. The Argument for the Overall Short-run Post-merger Performance. Post-M&A integration is such a big deal because organizations have different. 23.

(34) personalities and attitudes of dealing things just like people (Drennan 1992). When it comes to M&A, culture differences between combining organizations become one of the most critical issues in corporate integration. Two reasons explain the hard points of integration: First, the compositions of culture are very complex. An organization’s culture is embodied in its collective value system, beliefs, norms, ideologies, myths and rituals. They motivate people and become valuable sources of efficiency and effectiveness (Sudarsanam 2003). Hence, there are so many dimensions have to be taken in to consideration for integrating two different entities well. Second, most employees resist change. Once employees having been used to one culture are forced to adjust or adapt to another culture, the culture change become stress and will negatively reduce employees’ performance (DuBrin 2005). Since the compositions of culture are very complex, and most people resist change, to completely integrate two organizations well takes numerous time and efforts.. Due to necessary time and efforts for complete integration, it could be implied that at the beginning of post-M&A stages, the new start integration might be in an anarchical condition, and this kind of condition could influence performance of the combined firms. It is pointed out by Angwin (2004) that the first 100 days is a critical period for post-M&A success, because most integration actions are launched at the time. Combing the arguments of the probable anarchical condition and the critical period of the first 100 days, the first issue in this dissertation is to investigate post-M&A performance of newly combined firms in the first quarter, seeing if the phenomenon of relatively negative performance exists in those firms.. 3.3.2. Connecting the Relative Size Issue to Short-run Post-merger Performance. As mentioned in section 3.1, relative firm size between two firms is connected to the 24.

(35) relative power of competition and cooperation. Thus, if the post-merger underperformance reflects the impact of the merger, underperformance should be greater when the target is relatively large (Agrawal et al. 1992). Due to the argument above, the investigation would be done by seeing the relation between relative size and post-merger performance in the short-term.. In addition to the issue of relative size between combining firms, ‘absolute size’ would also be discussed at the same time. The absolute sizes here refer to the size of an acquirer. The reason for discussing the absolute size is that though relative size between combing firms, representing the relative power between two entities, might play an important role in post-merger integration, the absolute size of the acquirer might also influence the integration results because larger acquirers might have much more sources and integrating ability than smaller acquirers, so that the results that how synergies are realized might be different. After all, to consider both relative size and absolute in merger deals make the overall discussion more completed and robust.. 3.4 The Impact of Relative Size on Post-merger Performance in the Long-Run. In the investigation of post-merger performance in the long-run, two main aims are presented in this section.. Firstly, because the empirical evidence of the overall post-merger performance is still controversial as discussed in the previous chapter, the dissertation aims to analyze how firms perform after mergers within five years.. Secondly, to continue the investigation of relative size in the short-run, the dissertation aims to investigate how the impact of relative firm size changes (if any) in. 25.

(36) the long-run.. Through the investigation of both short-run and long-run, the issue of relative firm size can be more completely analyzed and discussed.. 3.5 Summary and Conclusion. Chapter 3 discusses the main issues of the dissertation- Does relative size between combining firms matter? Because organization size shapes the structure design of company and plays an important role in culture composition, combining companies with different sizes in M&A deals might lead to different post-merger performance. Therefore, this dissertation assumes relative size of the combined firms to be a likely factor for post-M&A performance.. In order to verify the arguments above, the main investigating objectives in this dissertation are to:. 1. Analyze the short-run post-merger performance for the first quarter, seeing if the performance is relatively negative due to the anarchical condition of the newly combination.. 2. Analyze whether relative size of the combining firms is a factor for short-run performance change.. 3. In addition to relative size, analyze whether absolute size of the acquiring firms is a factor for short-run performance change.. 26.

(37) 4. Analyze the long-run post-merger performance for up to five years after mergers, seeing how the selected companies in this dissertation had performed.. 5. Analyze whether relative size of the combining firms is a factor for long-run performance change.. After generalizing the main objectives of the dissertation, next chapter is going to provide suitable research method and data selection criterion.. 27.

(38) 4.. METHODOLOGY, DATA, AND RESEARCH METHODS. Chapter 4 describes the research methods of this dissertation. First, the philosophical stance (i.e. Methodology) is discussed in section 4.1. Following this, the secondary research and the data used is introduced in section 4.2. Two methods of regression analysis and event study are used in this dissertation, so the two research methods are introduced in section 4.3 and 4.4 respectively. Finally, this chapter ends with a discussion of the quality of the research in section 4.5. A summary is provided in section 4.6.. 4.1. Philosophical Stance. The purpose of this dissertation is to investigate whether relative size of the combining firms in M&A deals is a factor for post-merger performance. The investigation first undertakes to collect the theories for mergers and acquisitions and post-merger performance. Based on the theories, the arguments are developed. By analyzing the collected market and the accounting data, the results of the dissertation would used to see whether the arguments are proved or not. Consequently, the investigation takes a deductive approach. Deduction is a type of reasoning that proceeds from general principles or premises to derive particular information (Wikipedia 2008). Rather than moving from fragmentary details to a connected view of a particular situation, the deductive approach enables researchers to find general answers to the arguments and hypotheses through testing the observed data (Gray 2004).. 28.

(39) 4.2. Data from Secondary Research. The overall investigation in this dissertation falls under the category of secondary research. The data needed for analyzing post-merger performance and its connection to relative size of the combining firms are collected from two data bases: Security Data Company (SDC Platinum) which provides worldwide data of global M&A events and Standard & Poor’s Research Insight COMPUSTAT (COMPUSTAT) which contains financial and market information for extensive coverage of the worldwide marketplace. The data collected are divided into two steps:. 1. Collecting data of M&A deals: The analyzed data in this dissertation is collected from SDC Platinum, concentrating in the 100%1 M&A deals between public high-technology (except biotechnology2 ) companies announced from 2000 to 2001 in the U.S.A.. 2. Collecting financial data of the merged firms: After selecting the data of M&A deals, the financial data of those firms would be collected by using COMPUSTAT. The financial data needed include return on assets, return on equity, return on operating cash flows, stock returns, market value, and book value of the acquired firms.. The data is collected via two-step data collecting processes: Firstly, the M&A events are collected from SDC Platinum. Secondly, those companies contained in COMPUSTAT are preserved for final research data. Overall, 266 M&A deals are collected from SDC Platinum, and 47 repetitions are taken out. Among those 219 1. It means the acquired companies are acquired or merged as a whole, but not partially. It is pointed out by Ragozzino (2006) that according to American Electronic Association, current U.S. government statistics do not allow clearly to identify which portion is bio and which is tech. Therefore, the biotechnology industry was not included.. 2. 29.

(40) deals, only 128 acquiring companies are contained by COMPUSTAT. The deals with completed financial data within the event windows defined in this dissertation are only 74; therefore, these 74 deals would be the final database of this dissertation.. 4.3. Regression Analysis. Regression analysis is a technique usually used to examine the relation of a dependent variable (response variable) to specified independent variables (explanatory variables) (Wikipedia 2008). The analysis method is also used in several previous researches related to M&A issues. For instance, Cheng and Leung (2004) conducted a regression analysis, using several independent variables to investigate long-term post-merger performance. Similarly, to test for a continuous relationship between changes in corporate focus and long-term performance, Megginson, Morgan, and Nail (2004) perform an ordinary least squares (OLS) regression with their performance metrics as dependent variables and independent variables. Moreover, Ragozzino (2006), as well, used regression analysis in his research for a comparison of new ventures and established firms.. In this dissertation, the regression analysis is used to analyze the relationship between relative firm sizes of the combining firms and the percentage change in stock returns as well as operating performance in the short-run (for the 1st quarter after M&A). The regression analysis is modeled as:. Δ Performanc e % ( +1Q ) = α + β 1 ( Acquirer ' sAbsoluteS ize ) + B 2 (Re lativeSize ) + β 3 ( B − T − M ( −1Q ) ) + β 4 D (Conglomera te ) + β 5 D (Cash ) + β 6 D ( Stock ) + ε i 30.

(41) The dependent variable refers to the percentage change in the 1st quarter after mergers and acquisitions. The variables will be measured by dividing the abnormal return or excess operating performance 3 to the two-year average performance in the pre-merger windows. For market performance, stock returns are used as the dependant variable; for operating performance, ROE, ROA, and operating cash flow returns are used as independent variables.. Acquirer’s absolute size refers to the market value of acquiring companies when M&A announcements are made in merger deals.. Relative firm size in this dissertation is defined by total assets of a target company divided by total assets of its acquiring company, where:. Relative Size =. TatalAssetst arg et TotalAssetsacquirer. The reason to use total assets as the measurement is due to the availability for collecting the needed data, especially for target companies, where the data of market values for them are unable to get in the database used in this dissertation. The target companies’ total assets are given by SDC Platinum. Regarding the relative size of the combining firms, the lower the relative size ratio, the acquirer is much larger than the target; the higher the relative size ratio, the acquirer is relatively less large than the target.. B-T-M refers to book to market ratio of the acquiring companies when the merger announcements were made.. 3. The abnormal return and excess operating performance will be explained in section 4.4. 31.

(42) For conglomerate, the dummy variable equal to 1 if the M&A deals is conglomerate. It is distinguished through the SIC codes provided by SDC Platinum.. For cash, the dummy variable equal to 1 if the deal is purely cash-financed.. For stock, the dummy variable equals to 1 if the deal is closed purely via stock swap.. 4.4. Event Study Methodology. The event study was introduced by Ray Ball and Philip Brown (1968) and Eugene Fama et al. (1969) in the late 1960s seminal studies. The methodology they introduced was essentially the same as that which is in use today, and has become the standard method of measuring security price changes in response to an event or announcement (Mackinlay 1997). This research method is widely used by a great number of researchers from different fields; some examples are: Palepu and Ruback (1992) used event study to investigate the post-merger performance for 50 largest U.S. merged corporate between 1979 to mid-1984; Rau and Vermaelen (1998) used event study to investigate the long-term underperformance of bidding firms in mergers and tender offers listed on the NYSE and AMEX covered by both CRSP and COMPUSTAT in 1980 to 1991; Flouris and Swidler (2004) conducted an event study to analyze the impact of American Airline’s takeover of. Trans World Airlines in. 2001. Basically, there are two major objectives when conducting an event study: first, to test the efficient market hypothesis, to see how efficiently the market incorporates new information; second, to examine the wealth impact of an event (Sudarsanam 2003). The purpose in this dissertation is the latter of the two.. 32.

(43) Usually, when this methodology is used, the focus is on short-horizon studies to measure the effects of an economic event (Sheng & Li 2000). For example, investigators can measure the abnormal return of shares in relation to an announcement of M&A, earnings, or issuing new debts, using short event windows of a few days around the event (Mackinlay 1997). However, in this dissertation, the investigation centers on the long-horizon event studies, where the post-event windows measuring post-merger performance of the collected data is up to five years (twenty quarters).. 4.4.1. Conducting an Long Horizon Adjusted Event Study. Sheng and Li (2000) have generalized four steps for conducting an event study with a large amount of data of short-run share returns. These steps are: Step 1, identifying the event Step 2, evaluating the abnormal return Step 3, testing the abnormal returns with statistical hypothesis testing Step 4, analyzing and explaining the results In this dissertation, the event study is applied to each M&A deals in the long-run; therefore, in step 2, the evaluation of the excess operating performance will be added in addition to the abnormal returns. The adjusted steps are: Step 1, identifying the event Step 2, evaluating the abnormal return and the excess operating performance Strep3, testing the abnormal returns and the excess operating performance with statistical hypothesis testing using a Z-test Step 4, analyzing and explaining the result Each step is described as below.. 33.

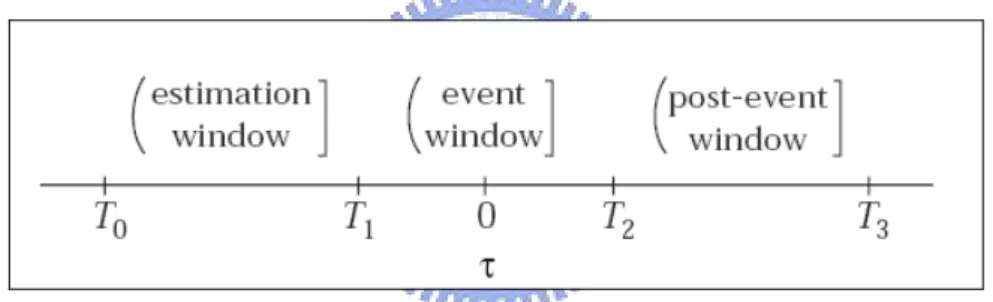

(44) Step 1, identifying the event. The event that this dissertation refers to is the merger activities of the collected data. The event window is defined by the effective date of legal completion of the merger. The reason for choosing the completion date instead of the announcement date is that, the investigation focuses on the post-merger performance in the long-term rather than the short-term effect of announcement. The estimation windows are set to be two years (eight quarters) before the mergers, while the post-event windows are set to be five years (twenty quarters) after the mergers, so that the post-merger performance can be observed more completely. The event study windows are presented in figure 4.1.. Figure 4.1 Time Line for Event Studies Source: MacKinlay 1997. Step 2, evaluating abnormal returns and excess operating performance. In this dissertation, ‘abnormal returns’ refers to the difference between expected and actual returns, while ‘excess operating performance’ refers to the difference between expected and actual operating performance. The abnormal returns and excess operating performance will be evaluated with the formula based on the model generalized by Sheng and Li (2000). Figure 4.1 helps to describe the models.. 34.

(45) Models used for evaluating abnormal returns and excess operating performance are mean-adjusted returns model and mean-adjusted operating performance model:. 1. Mean-Adjusted Return Model. (Model 1). The abnormal return for a single firm is. 1 t1 ARiE = RiE − ∑ Rit Ti t =t0 where E,. ARiE. RiE. E ∈W = [t2 ,t3 ]. refers to the abnormal returns of a company i in each post-merger time. refers to the actual returns of company i in each post-merger time E,. 1 t1 ∑ Rit Ti t = t 0. refers to the expected returns of company i calculated by averaging the. returns of that company in the pre-merger period between t 0 and t1 .. The average abnormal return (AAR) of the all data firms in each time E in the post-merger periods is:. 1 AARE = NE. NE. ∑ AR i =1. iE. where N is the number of the total merging deals in the whole sample.. The cumulated abnormal return for a single firm i from the effective merger time until the time E after mergers is:. 35.

(46) CARiE =. where. ARie. τE. ∑ ( ARie ) e ⊂ [t2 ,t3 ]. e=T2. refers to the abnormal return of each firm i in each time e after. mergers.. The average cumulated average abnormal return (ACAR) for all data firms from the effective merger time until the time E after mergers is:. 1 N ACARE = ∑ (CARiE ) N i=1. E ∈W = [t2 ,t3 ]. where N is the total number of the merging companies, and E refers to each time of the post-merger period.. 2. Mean-Adjusted Operating Performance Model (Model 2). The excess operating performance for a single firm is. 1 t1 APiE = PiE − ∑ Pit Ti t = t 0. where. APiE. E ∈ W = [t2 , t3 ]. refers to the excess operating performance of a company i in the. post-merger period time E,. PiE. refers to the actual performance of a company i in. 36.

(47) time the post-merger time E,. 1 t1 ∑ Pit Ti t = t 0. refers to the expected performance. calculated by averaging the performance of that company in the period between t 0 and t1 before merger.. The average excess operating performance (AAP) over all data firms in time E is:. 1 AAPE = NE. NE. ∑ APiE i =1. where N is the number of securities in the whole sample with a return in event time E.. Step 3, testing the abnormal returns and excess operating performance with statistical hypothesis testing using a Z-test. After the calculation in the previous step, the AR, CAR, and AP of each time period will be calculated. Based on those results, AAR, ACAR, and AAP would also be calculated. In step 3, these calculated data in the post-merger window will be tested through statistical hypothesis testing using a Z-test.. When a Z-test is conducted, the researcher aims to determine if the difference between a sample mean and the population mean is large enough to be statistically significant. In this dissertation, the sample means refer to the AAR and ACAR when conducting the market assessment, AAP when conducting the operating performance assessment. On the other hand, the population mean refers to zero because AAR, ACAR, and AAP for the estimation windows should equal to zero. The null and the 37.

(48) alternative hypotheses for both assessments are as below:. ¾. For the market assessment. AAR:. H 0 : The average abnormal returns = 0 H 1 : The average abnormal returns ≠ 0. ACAR:. H 0 : The cumulated average abnormal returns = 0 H 1 : The cumulated average abnormal returns ≠ 0. ¾. For the operating performance assessment. AAP:. H 0 : The average excess operating performance = 0 H 1 : The average excess operating performance ≠ 0. The p-value of the two-tailed Z-test is the criterion to judge if the sample means significantly differ from the population mean. When the p-value is small enough and. 38.

(49) shows strong evidence, the null hypotheses can be rejected, while the alternative hypotheses can be inferred. On the contrary, if the p-value is large and shows no evidence, the null hypotheses cannot be rejected. The p-value of a test is described as below according to Keller & Warrack (2003):. P-value: 0~0.01 : Highly significant (Overwhelming Evidence) P-value: 0.01~0.05: Significant (Strong Evidence) P-value: 0.05~0.1: Not Significant (Weak Evidence): P-value: 0.1~1.0 : Not Significant (No Evidence) Step 4, analyzing and explaining the result. The conclusion of the investigation is based on the results of the abnormal returns and the excess operating performance. By considering the abnormal returns of the shares and the excess operating performance using accounting data, the post-merger performance of the selected sample firms can be analyzed and explained.. 4.5. Credibility of the Research. The credibility of the research is evaluated in four distinct dimensions, as defined by Yin (2003). These dimensions are construct validity, internal validity, external validity, and reliability, as discussed below.. 4.5.1. Construct Validity. Construct validity is concerned with the measurement of abstract concepts and traits (Gray 2004). It helps to assure that the assessment can correctly measure the concepts. In this dissertation, the construct validity is based on the literature review, which provides the academic viewpoints on the proper measuring process and suitable 39.

(50) assessment of post-merger performance. Regression analysis is a technique used to examine the relation of a dependent variable to specified independent variables. Several researchers discussed in section 4.3 had used this analysis method to investigate firms’ performance in M&A issues. The event study is commonly applied when measuring the impact of an event, and the market and operating performance assessment is largely used when measuring the post-merger performance according to the literature.. 4.5.2. Internal Validity. The internal validity is assured by the data of SDC Platinum and COMPSTAT. The two databases are constructed by professional institutes providing the outstanding data for basic financial analysis.. SDC Platinum is the industry standard for information on new issues, M&A, syndicated loans, private equity, project finance, poison pills, and more. Backed by Thomson Financial’s international team of expert analysts, SDC Platinum satisfies the need for a global reach from a local perspective. As the world's foremost financial transactions database, SDC Platinum is the source for the most thorough and accurate account of the global financial marketplace (Thomson 2008).. Standard & Poor's Compustat data is a well-known database established since 1962. It is largely used by the global financial community for the vital company, index and industry information that supports their financial models and proprietary company and industry analysis. From global finance giants to boutique hedge funds, institutional investors count on Compustat data for its unparalleled quality, global history, breadth and depth (Standard & Poor’s 2008). 40.

(51) 4.5.3. External Validity. External validity is the extent to which is possible to generalize from the data to a larger population or setting (Gray 2004). Because the empirical research results are often influenced by different scopes of industry, geography, and time, the external validity is always not 100% assured. However, the research in this dissertation is conducted in objective research methods and processes, so that the analysis results could become valuable reference for future researchers in the same field.. 4.5.4. Reliability. Reliability is an indication of consistency between two measurements of the same thing (Gray 2004). In this dissertation, the measurement used for investigation is the fixed historical data, and the time period of measurement is defined. Besides, a standardized process of the event study is applied as well. Based on all these, no matter how many times the investigation might be repeated, the result of other measurements will be the same. Therefore, the reliability of this dissertation can in this way be ensured.. 4.6. Summary and Conclusions. The dissertation aims to investigate whether relative size of the combining firms in M&A deals is a factor for post-merger performance. By analyzing the collected market and the accounting data, the results of the dissertation would used to see whether the arguments are proved or not. Consequently, the investigation takes a deductive approach. The research in this dissertation is under the category of secondary research, and the data needed is collected from two databases of SDC. 41.

數據

Outline

相關文件

6 《中論·觀因緣品》,《佛藏要籍選刊》第 9 冊,上海古籍出版社 1994 年版,第 1

• One technique for determining empirical formulas in the laboratory is combustion analysis, commonly used for compounds containing principally carbon and

Teachers may consider the school’s aims and conditions or even the language environment to select the most appropriate approach according to students’ need and ability; or develop

Robinson Crusoe is an Englishman from the 1) t_______ of York in the seventeenth century, the youngest son of a merchant of German origin. This trip is financially successful,

fostering independent application of reading strategies Strategy 7: Provide opportunities for students to track, reflect on, and share their learning progress (destination). •

Now, nearly all of the current flows through wire S since it has a much lower resistance than the light bulb. The light bulb does not glow because the current flowing through it

The empirical results indicate that there are four results of causality relationship between Investor Sentiment and Stock Returns, such as (1) Investor

• Thresholded image gradients are sampled over 16x16 array of locations in scale space. • Create array of