1

Return to Basics: An Empirical Legal Study on Directors’ and Officers’

(D&O) Liability Insurance and Litigation Risk in Taiwan

Chun-Yuan Chen*

CONFERENCE DRAFT

Please do not cite, quote, or circulate without author’s permission

This paper empirically analyzes the functions of directors’ and officers’ (D&O) liability insurance in corporate governance in Taiwan, also reexamining the fundamental issue— litigation risk of directors and officers. This research argues that litigation risk of directors, which is critically related to the fundamental function of insurance about indemnity, should be clarified before any legal revolution. This papers starts with examining if the demand and functions of D&O insurance are influenced by directors’ and officers’ litigation risk. The monitoring hypothesis suggests that firms with weak corporate governance have a greater incentive to purchase D&O insurance. Intuitively, firms with higher litigation risks are intended to purchase more insurance. Meanwhile, D&O insurance and other monitoring mechanisms are substitutes for each other. Firms which have better corporate governance have less demand for D&O insurance. However, after empirically examining D&O insurance purchases and relevant litigations in Taiwan from 2008 to 2014, it is found that the monitoring hypothesis is not supported. The second part of this research moves on the detailed empirical test of signal effect of D&O insurance and finds the hypothesis is supported. Considering risking behavior after insurance purchase may affect the functions of insurance, the third part analyzes possible opportunistic behavior caused by D&O insurance. It is found that the evidence about opportunistic behavior is not significant. Based on these findings, the paper further argues that it is not necessary to mandate D&O insurance in Taiwan. The findings of this paper are also helpful for other Asian countries, where the issue about D&O insurance and liability risk is emerging.

Keywords: D&O insurance, corporate governance, monitoring hypothesis, signal hypothesis, Ohlson model, opportunistic behavior, moral hazard

* Assistant Professor, National Chiao Tung University School of Law. J.S.D., University of Illinois at

Urbana-Champaign. Ph.D., China University of Political Science and Law, China. Ph.D. in Law, National ChengChi University, Taiwan. Email: jchen@g2.nctu.edu.tw.

2 I. Introduction

A. Research background

Directors’ and officers’ (D&O) liability insurance is an agreement to indemnify corporate directors and officers against judgments, settlements, and fines arising from negligence suits, shareholder actions, and other business-related lawsuits1. D&O insurance is a type of liability insurance whose primary purpose is to compensate for the losses experienced by directors and officers when specific legal liabilities arise. D&O insurance may also serve the function of monitoring the governance of companies. For example, when underwriting is in progress, insurers may examine the financial status of insured companies, which will allow outside investors to understand more about the financial situation of company. D&O insurance can both transfer risk and offer incentives for insured companies to improve their corporate governance. After the problems experienced by Enron, Worldcom and other companies in various financial crises, the monitoring function of D&O insurance has been discussed more frequently, particularly in common law. Given this tendency2, discussions of this issue have become more popular in Taiwan3. Many proponents even argue that D&O insurance should be more promoted or mandated.

Exploring this issue in Taiwan should be meaningful and worthwhile, because of its special background and relationship to the D&O insurance issue. Taiwan primarily follows a civil law tradition,4 but private laws of it are also affected by common law.5 D&O insurance originated in, and was developed in, common law countries, including the United Kingdom, the United States and Canada. Most companies in the US purchase D&O insurance. This research will examine the function of D&O insurance in corporate governance in the context of civil law countries.

The general development of the insurance industry in Taiwan is significant. The first D&O insurance policy was issued in 1997, and the percentage of listed companies that purchase D&O insurance is approximately 50% to date. The D&O insurance industry developed in a stable manner in Taiwan. The first issued D&O insurance policies were issued in Taiwan in 1997 and 60% of listed companies are currently insured by D&O. This is lower than in the United States, Canada and United Kingdom, but higher than

1 See Black's Law Dictionary (9th ed. 2009).

2 After Enron and WorldCom scandals, reforms of the Sarbanes-Oxley and New York Stock Exchange

Listing standards, the 1997-98 financial crisis in Asia had a similar effect on Taiwan. See Ronald J. Gilson & Curtis J. Milhaupt, Choice as Regulatory Reform: The Case of Japanese Corporate Governance, 53AM. J.COMP.L. 343, 343 (2005). More discussion about financial crisis in Taiwan, see Lawrence L. C. Lee,

Taiwan's Current Banking Development Strategy: Preparing for Internationalization by Preventing Insider Lending, 17 UCLAPAC.BASIN L.J. 166, 206 (Fall 1999/Spring 2000).

3 This can be found by prospering relevant researches, such as: Jui-I Chang, ESSAYS ON DIRECTORS’ AND

OFFICERS’LIABILITY INSURANCE AND FIRM BEHAVIOR, Ph.D. Dissertation of National Chengchi University (2009). Tsai-Jyh Chen & Chia-Hui Pang, An Analysis of Determinants of the Corporate Demand for

Directors' and Officers' Liability Insurance, 18:2NTUMGMT.REV 171 (2008).

4 See Michael M. Hickman, Protecting Intellectual Property in Taiwan — Non-Recognized United States

Corporations and Their Treaty Right of Access to Courts, 60 WASH.L.REV. 117, 119 (1984).

5 See Andrew Jen-Guang Lin, Common Law Influences in Private Law - Taiwan's Experiences Related to

3

China.6 In Taiwan, according to the articles of incorporation or resolution adopted in the shareholders' meeting, a TSEC/GTSM listed corporation may take out liability insurance for directors with respect to their liabilities resulting from exercising their duties during their terms of occupancy.7 It is important to observe the development of D&O insurance and its monitoring function with respect to the background of Taiwan.

This study attempts to analyze the role of D&O insurance in corporate governance in Taiwan. What will be discussed here includes the monitoring hypothesis, signal hypothesis, the attributes and problems of corporate governance in Taiwan, the differences between common law and civil law, and the function that D&O insurance serves in Taiwan. This paper proposes that the purchase of D&O insurance is roughly and positively related to the corporate governance of insured companies in Taiwan. Even given that the industry is not as well developed as is the case the United States, the positive relationship still can be observed. Conversely, the reason why a difference exists between Taiwan and the United States can be explained by the attributes of the conditions in Taiwan, such as the design of corporate governance structures, the prevalence of D&O insurance, the development of the litigation system and so on. In addition to the rejection of monitoring hypothesis, the signal hypothesis that D&O insurance can emit positive signal is proposed and tested in this dissertation. By a series of empirical tests, sufficient evidence will be offered to establish signal theory.

B. Research process

This study begins with an introduction of the research background, hypothesis development, and methodology. Afterwards, rival theories regarding the purpose of director and officer insurance are introduced and discussed. Previous literature concerning D&O insurance and corporate governance will be reviewed, and arguments for and against it will be presented. Then, this dissertation will develop an alternative hypothesis to the monitoring hypothesis, which is a signal hypothesis. The monitoring hypothesis and the signal hypothesis are two main arguments which will be tested in this study. This provides the background for the following hypothesis development and empirical tests. Afterwards, a series of empirical tests will be carried out to examine the monitoring hypothesis and the signal hypothesis. This dissertation proposes that D&O insurance is an index for corporate governance and can emit positive signals to the market. Firms in Taiwan could purchase D&O insurance to increase their reputation and even attract more investment. However, D&O insurance does not have a monitoring function and the quality of corporate governance is not inversely related to the demand for D&O insurance. Thus, the monitoring hypothesis is rejected and the signal hypothesis is supported. Because the monitoring function of D&O insurance may be affected by exogenous factors, like moral hazard and opportunistic behavior, this study will clarify these concerns after the test for the monitoring hypothesis. This research proposes that there is no moral hazard problem in the Taiwanese market. Hence, D&O insurance does not imply the problem of opportunism and moral hazard, and the reasoning of the monitoring function would not be affected. Similarly, this study also hypothesizes that

6 This can be obtained in the website of Taiwan Financial Supervisory Commission,

http://www.fscey.gov.tw/Layout/main_en/AllInOne_Show.aspx?path=1871&guid=5da0af18-fb31-4ffb-8dfc-05c37d3d0d0e&lang=en-us (last visited Jul. 31, 2015).

4

transaction bargaining and underwriting function well, there is no problem of asymmetric information or adverse selection, and the market is close to being homogenous.

In conclusion, this study will explore theories of D&O insurance and structures of corporate governance in Taiwan in detail. The monitoring and signal hypotheses will be developed by examining the differences between the United States and Taiwan, reviewing relevant literature and conducting analyses using a comparative viewpoint. Then, this study will test the proposed hypotheses by theoretical and empirical methods, and propose optimal suggestions for D&O insurance and corporate governance systems in Taiwan.

C. Empirical methodology

This dissertation will collect empirical data of D&O insurance and corporate governance in Taiwan, and test the proposed hypotheses by empirical methods. The data used in this study is obtained from databases or websites below: Taiwan Economic Journal (TEJ),8 Taiwan Stock Exchange Corp.,9 Market Observation Post System (MOPS),10 Financial Supervisory Commission, Executive Yuan, R.O.C.,11 Taiwan Insurance Institute,12 and Securities and Futures Investors Protection Center.13 This study will empirically analyze the purchase of D&O insurance by public companies in Taiwan during 2008 to 2014. Data about all public companies will be collected. Relevant arguments discussed in this research include whether or not the purchase of D&O insurance is positively related to the corporate governance of the insured companies, and whether D&O insurance have monitoring or signaling effect or not. A series of empirical works will be processed to test these hypotheses. Finally, this dissertation will synthesize the results of these methods and propose suggestions.

II. Monitoring effect of D&O insurance, corporate governance, and litigation risk

A. Rival Theories of the Purpose of Director & Officer Insurance 1. Monitoring Hypothesis

The difference between other outside monitors, such as credit rating agencies and auditors, is that insurers will suffer from the insured loss directly if the damage occurs. Hence, insurers have more incentive than other monitors to watch out for the quality of insured companies.14 Similarly, because D&O insurance is quite competitive, insurers

8 Taiwan Economic Journal, http://www.finasia.biz/ensite/ (last visited Jul. 31, 2015).

9 Taiwan Stock Exchange Corp., http://www.twse.com.tw/ch/index.php (last visited Jul. 31, 2015). 10 Market Observation Post System, http://emops.tse.com.tw/emops_all.htm (last visited Jul. 31, 2015). 11 Financial Supervisory Commission, Executive Yuan,

http://www.fscey.gov.tw/Layout/main_ch/index.aspx?frame=1 (last visited Jul. 31, 2015).

12 Taiwan Insurance Institute, http://www.tii.org.tw/ (last visited Jul. 31, 2015).

13 Securities and Futures Investors Protection Center, http://www.sfipc.org.tw/english/main.asp (last visited

Jul. 31, 2015).

14 Lea H. Stern & M. Martin Boyer, Is Corporate Governance Risk Valued? Evidence from Directors’ and

5

have to more carefully and seriously scrutinize the insured firms.15 In addition, insurers can use insurance clauses, obligations of disclosure and exclusions to control the insured risk and encourage the insured to mitigate risk.16 In other words, insurers in Taiwan can use the regulations in Insurance Law to increase monitoring function. After considering the proposal of Clifford G. Holderness, in which the monitoring function of D&O insurance has three dimensions,17 the monitoring function of D&O insurance in Taiwan is analyzed in similar approach. First, before a policy is issued, the insurer will investigate the factors which affect exposure. This information is critical for the determination of premiums. Corporate governance issues of the insured affect both the potential legal risks of the insured and the indemnification liability of the insurer. In addition, the monitoring function is also revealed in policy coverage, and the conditions and duration of litigation18. Given the possibility of being forced to pay compensation, insurers have substantial incentives to monitor the status of the insured and prevent the occurrence of losses. Hence, the corporate governance of the insured will be monitored.

However, some researchers argue against the monitoring hypothesis and the positive relationship between the purchase of D&O insurance and corporate governance. Tom Baker and Sean J. Griffith found that what underwriters are concerned about are “deep governance” variables such as culture and character, variables which are not confined to the financial analysis of the insured companies19. Moreover, the advice given by insurers is usually ignored by insured companies20. Joshua Dobiac proposed that the governance role of D&O insurance is minor and whatever effect poor governance has on pricing is not adequate to change corporate behavior21. Boyer and Delvaux-Derome conclude that firms with weak governance systems facilitate opportunistic behavior and are likely to buy D&O insurance22. This means that the positive relationship between the purchase of D&O insurance and corporate governance of the insured companies is questionable.

2. Proposal of signal hypothesis

Different from previous arguments, this paper proposes an alternative hypothesis, the signal hypothesis, to the monitoring hypothesis. The argument is that D&O insurance has a significant effect in signal transmission. In addition to indemnification, the signal effect is another important consideration in insurance purchase. Signal effect aside, other

15 Id.

16 Wallace Wang, The Relationship between the Deterrence Effect of D&O Insurance and Corporate

Governance, 156 TAIWAN L.REV.141,150-1(2008).

17 See Clifford G. Holderness, Liability Insurers as Corporate Monitors, 10INT'L REV.L.&ECON.115,

118-20(1990).

18 Id.

19 See Tom Baker & Sean Griffith, Predicting Corporate Governance Risk: Evidence from the Directors' &

Officers' Liability Insurance Market, 74 U. CHI.L.REV. 487, 543 (2007).

20 See Tom Baker & Sean Griffith, The Missing Monitor in Corporate Governance: The Directors' and

Officers' Liability Insurer, 95 GEO.L.J. 1795, 1808-12 (2007).

21 See Joshua Dobiac, I Came, I Saw, I Underwrote: D & O Liability Insurance's Past Underwriting

Practices and Potential Future Directions, 14 CONN.INS.L.J. 487, 508 (2008).

22 See M. Martin Boyer & Mathieu Delvaux-Derome, The Demand for Directors' and Officers' Insurance in

6

functions of D&O insurance are disputable; this is especially true regarding monitoring function. D&O insurance is not a component of the monitoring mechanism for firms, and its monitoring function is limited. The argument for the monitoring hypothesis that states that firms with poor corporate governance will have more demand for D&O insurance is not sustainable.

B. Research design 1. Variables

(a) D&O insurance

The purpose of this paper is to test whether or not there is a relationship between purchases of D&O insurance and the corporate governance of the insured companies. In this model, the dependent variable is whether or not the listed companies purchased D&O insurance. The variable Purchase is a dummy variable which denotes whether or not companies purchased D&O insurance. This equals 1 if companies purchased D&O insurance and 0 if they did not. The amount of D&O insurance coverage is the dependent variable for another panel. Insurance coverage indicates how much insurers must indemnify insured companies when losses take place. The variable Coverage denotes how much coverage a company purchased. Individual coverage of every firm is calculated respectively. If a company had more than one policy, the sum of all of that company’s coverage was calculated. If a company simultaneously purchased insurance for individual directors and the entire board of directors, all of that coverage was combined as well.

(b) Business structure

A company’s industry is an important consideration in assessing its corporate governance.23 The industry of a company may affect its tentative litigation risk. Especially in Taiwan, it is believed that high-technology companies have more litigation risk24 and have more demand for D&O insurance. Hence, the variable Industry is used to denote the industry group to which the companies belong. This paper defines “Semiconductor Industry,” “Computer and Peripheral Equipment Industry,” “Optoelectronic Industry,” “Communications and Internet Industry,” and “Electronic Parts/Components Industry” as high-technology companies and grant them the value “1.” Other groups, which are not high-technology companies, are defined with the value “0.” The variable Industry is a dummy variable.

(c) Financial performance

Litigation risk of firms may be related to their financial performance. The firms with poor financial performance may have more demand for D&O insurance. Regarding this, a firm’s return of equity is usually used as proxy of financial performance.25 It is expected

23 1849 PLI/Corp 453. 24 Id. at 178.

25 See John E. Core, The Directors’ and Officers’ Insurance Premium: An Outside Assessment of the Quality

7

that this will be negatively related to the demand of D&O insurance.26 ROE is used in this paper to indicate the financial performance of the listed companies during 2008 in Taiwan. All of this information was obtained from the Taiwan Economic Journal (TEJ).27 (d) Corporate governance

There are several variables used to indicate the quality of corporate governance. Ownership structure and inter risk are important issues regarding corporate governance. When insiders’ control over firms increases, the preference of outside shareholders may be ignored and the demand for insurance may increase.28 Actually, D&O insurance applicants are typically asked to disclose the information about insider ownership and significant outside blockholdings.29 So two variables are set up to test this factor. The variables Sdirector indicates the number of shares held by directors. The variable Ctrldirector indicates the number of directors nominated or controlled by the parent company or the largest controlling group within the company, such as family members, relatives, or the parent company.

As mentioned above, D&O insurance may be considered an important part of compensation packages for managers30 and directors, especially for outside directors, as they often will not serve unless the package meets their reservation utility.31 By this reasoning, the compensation for directors and officers and D&O insurance are substitutes and are negatively related. However, there is an opposite argument, which proposes that the evidence to support this reasoning cannot be found.32 A different possible reasoning is that more compensation implies more liability for directors and officers, and thus there is more demand for D&O insurance.33 By this reasoning, compensation and D&O insurance are positively related. In order to clarify this problem, the variable Remuneration is be set to indicate the compensation package offered to the directors of each listed company. An independent or outside director is usually viewed as an important mechanism for corporate governance. The more independent directors, the more closely the firms are overseen.34 Possible mistakes may be prevented via this mechanism. In this way, litigation risk will be decreased and thus the demand for D&O insurance will also decrease.35 The monitoring hypothesis can also suggest this reasoning. For the purpose of improving corporate governance, D&O insurance and other mechanisms, such as an independent director, are substitutes and therefore they are negatively related. However, M. Martin Boyer proposes a different argument, which is the risk aversion hypothesis.

26 Id.

27 See http://www.tej.com.tw/twsite/, (last visited Jul. 31, 2015).

28 See John E. Core, On the Corporate Demand for Director’ and Officers’ Insurance, 64 J. RISK &INS. 63,

68 (1997).

29 Tom Baker & Sean Griffith, Predicting Corporate Governance Risk: Evidence from the Directors' &

Officers' Liability Insurance Market, 74 U. CHI.L.REV. 487, 522 (2007).

30 See Boyer & Delvaux-Derome, supra note 22. 31 See Core, supra note 28, at 73.

32 Id. at 84.

33 See Chen & Pang, supra note 3, at 179.

34 See Boyer & Delvaux-Derome, supra note 22. However, the function of independent director is also

arguable, see Victor Brudney, The Independent Director— Heavenly City or Potemkin Village?, 95 HARV. L.REV. 597, 611 (1982).

8

Compared to inside directors, independent directors receive less compensation and fewer benefits from firms, and, as such, they usually request more D&O insurance coverage.36 The number of independent directors is positively associated with D&O insurance. In order to evaluate this factor, the variables Indptdirector and Auditcomitee is used to indicate the number of independent directors and members of auditing committee in each listed company. Additionally, the dummy variable Dual equals 1 if the chairman of the board of directors is also the CEO, and is otherwise 0.

(e) Litigation risk

The main purpose of D&O insurance is to cancel out litigation risk. A high number of prior litigations may indicate bad corporate governance of firms. Under this reasoning, prior litigation may cause D&O claim or negative reputational effect. This may be positively related with the demand for D&O insurance.37 The variable Litigation is to indicate the number of litigations that are significant and are disclosed by law.38 If the number of litigations is in a positive relationship with the demand of D&O insurance, then monitoring the hypothesis is supported; otherwise, it is not.

Similarly, debt-asset ratio indicates firms’ tentative financial problems. Firms with higher debt-asset ratios are usually in worse financial situations and thus have more risk of litigation.39 Therefore, the variable DAratio indicates the debt-asset ratio of each listed company during 2008-2014. In sum, all of the variables and their descriptions are provided in Table 1.

Table 1 Table of variables

Variables Definition

Coverage The total coverage companies purchased

Purchase Dummy variable. This equals 1 if companies purchase D&O insurance and 0 otherwise.

Industry Dummy variable. This equals 1 if companies are high

technology industry and 0 otherwise.

ROE Return on equity of companies

Remuneration The total of compensation package offered to directors Indptdirector The total number of independent directors

Sdirector The percentage of shares held by directors (%)

Ctrldirector Controlled directors. This indicates the number of directors who are nominated or controlled by the largest controlling group of the company, such as family, relatives, or parent company.

Dual Dummy variable. This equals 1 if chairman of board of

directors is identical to CEO and 0 otherwise.

DAratio Debt-asset ratio of firms

Litigation The number of disclosed significant litigation of firms

36 See M. Martin Boyer, Directors' and Officers' Insurance and Shareholder Protection, 10 (March 2005),

available at http://ssrn.com/abstract=886504.

37 See Core, supra note 25,at 462.

38 Securities and Exchange Act (Amended 24. Sept. 2010) Article 36 section 2. 39 See Chen & Pang, supra note 3, at 178.

9

lnmv Natural logarithm of market value of firms.

bv Book value of firms

EPS Earnings per share of firms

S_ROE Standard deviation of ROE

S_ROA Standard deviation of ROA

S_EPS Standard deviation of EPS

S_DAratio Standard deviation of debt-asset ratio

S_Sti Standard deviation of short-term investment

2. Methods

This paper follows Clifford G. Holderness’s approach in descriptive statistics.40 This type of analysis is helpful in understanding the attributes of the types of companies that purchase D&O insurance and the companies that do not. Also, this research generally follows the regression analysis applied in many previous researches, like models developed by O’Sullivan41, M. Martin Boyer42 and Core43. They use OLS regressions when the dependent variable, which is numeric value, is the limit of policy, and use logistic, which is binary, when the dependent variable is whether D&O insurance was purchased or not. 44 Thus, regression with panel data and robust standard errors are applied here. In model (1), the dependent variable is a binominal variable regarding whether or not firms purchase D&O insurance. This model is to test how D&O insurance purchase behavior relates to firms’ governance and whether D&O insurance purchase behavior is a signal for corporate governance and thus whether monitoring function can be exerted. Because the dependent variable is binary, logistic regression is applied in this section.45 Afterwards, insurance purchase is substituted with coverage in dependent variable in mode (2), to test the correlation between insurance coverage and previous variables. The regression models are shown in equations below. The statistical software package used is SPSS and STATA.46

ℎ = + + ROE + + +

+ + Dual + + +

(1)

40 See Holderness, supra note 17, at 123-24.

41 See Noel O'Sullivan, Insuring the Agents: The role of directors’ and officers’ insurance in corporate

governance, 64 J.RISK &INS.545, 554 (1997).

42 See M. Martin Boyer, Is the Demand for Corporate Insurance a Habit? Evidence of Organizational

Inertia from Directors' and Officers' Insurance, 13 (2004). CIRANO - Scientific Publications 2004s-33,

available at http://ideas.repec.org/p/cir/cirwor/2004s-33.html.

43 See Core, supra note 28, at 77.

44 This approach is also used to test the association between D&O insurance and the enactment of

Sarbanes-Oxley Act, and whether this act influence D&O insurance transaction. See Anna Oh, Insuring

against Another Enron: The Role of Cross-listing Status of Canadian Firms on the Purchase of Directors' and Officers' Insurance in the aftermath of Sarbanes-Oxley Act of 2002, Cornell University working paper

(2009), available at http://ecommons.cornell.edu/bitstream/1813/14231/2/AnnaOhFinalThesis1.pdf.

45 See David W. Hosmer &Stanley Lemeshow, APPLIED LOGISTIC REGRESSION 1 (2000).

46 Unless otherwise mentioned, all empirical works in this dissertation are conducted by these two software

10

= + + ROE + + +

+ + Dual + + +

(2)

C. Empirical result and analysis 1. Descriptive statistics

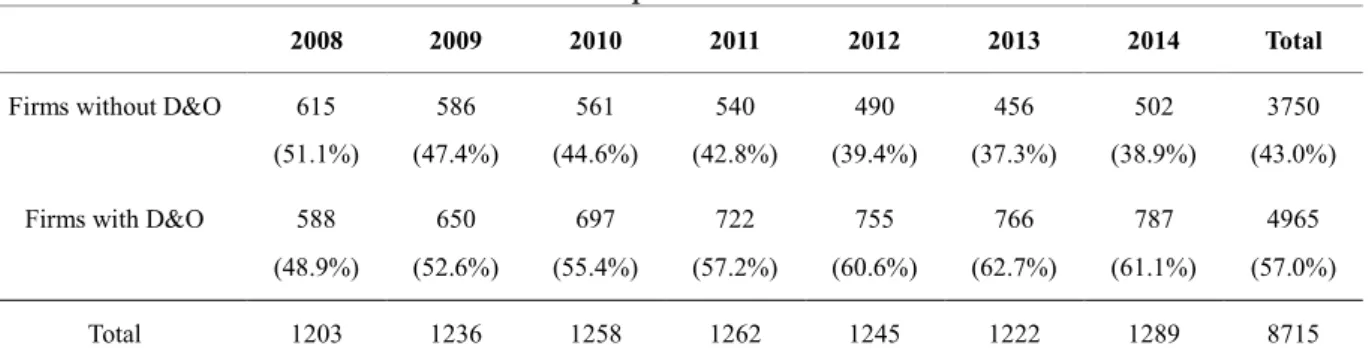

In 2008, when data of D&O insurance began to be available, 588 firms (49.4%) purchased D&O insurance and 615 (51.1%) did not. Afterwards, firms purchasing D&O insurance keeps on gradually and constantly increasing, indicating that more and more listed firms in Taiwan began to purchase D&O insurance. In recent three years, the percentage of firms purchasing D&O insurance is around 60%.

Table 2 Descriptive Statistics

2008 2009 2010 2011 2012 2013 2014 Total

Firms without D&O 615

(51.1%) 586 (47.4%) 561 (44.6%) 540 (42.8%) 490 (39.4%) 456 (37.3%) 502 (38.9%) 3750 (43.0%)

Firms with D&O 588

(48.9%) 650 (52.6%) 697 (55.4%) 722 (57.2%) 755 (60.6%) 766 (62.7%) 787 (61.1%) 4965 (57.0%) Total 1203 1236 1258 1262 1245 1222 1289 8715

After testing the difference between firms that purchased D&O insurance and firms without D&O insurance, it is found that insured firms usually have better performance and governance than uninsured companies. They have more independent directors, more audit committee members, smaller percentages of company stock being held by major shareholders, fewer controlled directors, and fewer managers and officers who have been appointed by the controlling company or parent group. This means that companies with better corporate governance and monitoring mechanisms purchase more D&O insurance. This is contrary to the previous monitoring hypothesis that monitoring mechanisms and D&O insurance are substitutes and are negatively related.

The percentage of remuneration all paid to directors of companies with D&O insurance is lower than among companies that do not purchase D&O insurance. This implies that companies that pay out less remuneration to company directors have greater demand for D&O insurance. This does support the hypothesis that remuneration and D&O insurance are substitutes for each other and are negatively related. The differences of duality, debt-asset ratio and litigation are not significant. Especially in litigation, the means of firms with and without D&O insurance are very similar, implying they do not have significant difference in litigation risk. This does not support the intuitive hypothesis that firms with more risk should have more demand for insurance, and not support monitoring hypothesis.

11

Table 3 Comparison between firms without and with D&O insurance (1)

Firms without D&O Firms with D&O Total

Mean N Std. Dev. Mean N Std. Dev. Mean N Std. Dev.

ROE 2.4294 3407 15.12183 2.4235 4878 19.93992 2.426 8285 18.11341 Remuneration* 15.8876 2699 1.35815 15.0153 3936 14.17866 15.3701 6635 10.9626 Indptdirector* 0.8136 3403 1.1399 1.5571 4492 1.22735 1.2366 7895 1.24601 auditcomitee* 0.01 3407 0.096 0.10 4885 0.302 0.06 8292 0.244 Ctrldirector* 3.0022 3403 2.58074 2.6962 4492 2.31918 2.8281 7895 2.43992 Sdirector* 24.7604 3375 14.52494 21.6103 4480 14.5052 22.9638 7855 14.59631 Dual 0.3 3412 0.46 0.31 4885 0.461 0.31 8297 0.461 Daratio 104.0407 3403 394.97267 110.5088 4856 310.07387 107.8437 8259 347.56796 Litigation 0.15 3413 0.904 0.15 4885 0.581 0.15 8298 0.731

* indicates that the difference is significant in independent sample test.

2. Regression analysis

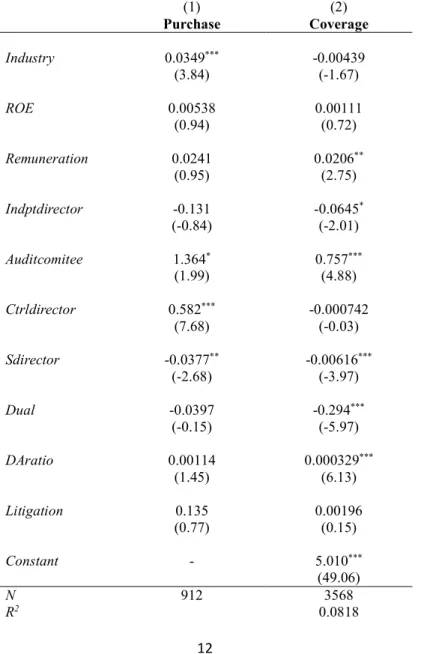

The variable concerning whether or not listed companies purchased D&O insurance is used as the dependent variable. The result shows that the variables Industry, Auditcomitee, Ctrldirector, and Sdirector are significant. The industry of the companies is positively related to their demand for D&O insurance. This does support the hypothesis developed from a review of the previous literature in that high technology industry in Taiwan has a greater need for D&O insurance. Auditcomitee is positively related to the purchase of D&O insurance, suggesting firms with more members in audit committee are intended to purchase D&O insurance. Additionally, Sdirector is negatively significant, implying firms with less percentage of shares held by directors purchase more insurance. These results are quite similar to the results of previous descriptive analyses, implying that the companies with better corporate governance have more demand for D&O insurance. In other words, the purchase of D&O insurance in Taiwan is related to the quality of corporate governance, but how corporate governance affects purchases of D&O insurance in Taiwan is contrary to the assumption of the monitoring hypothesis. The variable Litigation is not significant, and, therefore, no evidence could support the assumption that prior litigation will cause the demand for insurance. As a result, the theory of monitoring hypothesis may not be supported. On the contrary, signal hypothesis provides possible explanation for this empirical result. The firms with good corporate governance care more about corporate governance. In contrast to the firms with poor corporate governance, they are more willing to improve governance and reputation. Therefore, even though they have better governance, they are still willing to purchase D&O insurance. This may be because they care about corporate governance, so they do

12

not mind doing everything possible to promote governance and reputation in order to attract greater investments.

For the robustness test, which is different from the previous model for which the dependent variable is whether a company is insured or not, the amount of coverage is used as the dependent variable. The result is similar to the previous specification. Remuneration is positively significant, and this indicates that remuneration and D&O insurance for directors may not be substitutes. Significances of Auditcomitee and Sdirector are the same as the previous result. This implying firms with more remuneration, more audit committee members, and less shares held by directors, tend to purchase more insurance coverage. This once again provides evidence for rejecting monitoring hypothesis. Similarly, Litigation is still not significant, either. Thus, there is no evidence supporting the correlation between insurance coverage and litigation risk, which should be one of important consideration of insurance purchase.

Table 4 Result of regressions with panel data (1)

(1) (2) Purchase Coverage Industry 0.0349*** -0.00439 (3.84) (-1.67) ROE 0.00538 0.00111 (0.94) (0.72) Remuneration 0.0241 0.0206** (0.95) (2.75) Indptdirector -0.131 -0.0645* (-0.84) (-2.01) Auditcomitee 1.364* 0.757*** (1.99) (4.88) Ctrldirector 0.582*** -0.000742 (7.68) (-0.03) Sdirector -0.0377** -0.00616*** (-2.68) (-3.97) Dual -0.0397 -0.294*** (-0.15) (-5.97) DAratio 0.00114 0.000329*** (1.45) (6.13) Litigation 0.135 0.00196 (0.77) (0.15) Constant - 5.010*** (49.06) N 912 3568 R2 0.0818

13 Hausman test 0.0000 0.0001 Model fe xtscc Mean VIF 1.92 1.84 t statistics in parentheses * p < 0.05, ** p < 0.01, *** p < 0.001 D. Summary

This section has discussed monitoring hypothesis and tested it within the context of Taiwan. The empirical evidence shows that the monitoring hypothesis is not supported in Taiwan. Firms with good corporate governance and less risk intend to purchase more D&O insurance. In contrast, firms with bad corporate governance and more risk intend to purchase less D&O insurance. A possible alternative explanation of this phenomenon is signal hypothesis. Firms with good corporate governance are usually more concerned about corporate governance. Even though they are of better quality and have less potential risk, they are still willing to purchase insurance to convey that they are good firms and thus improve their reputations and attract investors. Hence, more tests for signal hypothesis and opportunistic behavior will be provided in following sections.

III. Alternative hypothesis: Signal effect of D&O insurance

Following the previous test, this section will examine signal effect of D&O insurance more closely. The release of economically relevant information is important for the evaluation of firms’ outstanding securities and the ability to attract investment in the future.47 According to the reasoning of signal hypothesis, the purchase of D&O insurance will release signal to investors and investors will evaluate the purchase of D&O insurance positively. Thus, D&O insurance purchase should have positive effect on firms’ stock price. However, with the protection of insurance, directors might have more opportunistic behavior or moral hazard.48 Then the purchase of D&O insurance will no longer emit positive signal. In contrast, investors will worry about D&O insurance because the insurance may encourage risky behavior. Therefore the signal effect of D&O insurance is disputable.

In order to clarify this issue, two major empirical works will be conducted in this paper. In the first part, this paper uses the famous model proposed by Ohlson concerning evaluating value of firms to test the effect of D&O insurance. If there is positive relationship between D&O insurance and stock price, the positive effect of D&O insurance is implied. In contrast, inverse association between D&O insurance and stock price implies D&O insurance emits negative signal to the market. In the second part, this paper will analyze moral hazard and opportunistic behavior raised from D&O insurance. If the answer is positive, then as concerned by literatures, D&O insurance would induce

47 See Robert M. Lawless et al., The Influence of Legal Liability on Corporate Financial Signaling, 23 J.

Corp. L. 209 (1998).

48 See Chen Lin et al., Directors’ and Officers’ Liability Insurance and Acquisition Outcomes, 27 (July 18,

14

moral hazard and opportunistic behavior and thus convey negative signal to the market. A. Corporate governance and market value of firms

Albeit the discussion of corporate governance is sprouting, it should be wondered that firm’s corporate governance behavior indeed increase their market value? However, in the United States, many empirical works cannot provide strong evidence for the relationship between corporate governance behavior and increase of market value.49 Similar problems are also addressed in emerging market. Bernard S. Black, Hasung Jang and Woochan Kim test the relationship between corporate governance and market value of firms in Korea by OLS regression and instrument variables.50 They find that corporate governance is an important but maybe casual factor of market value of firms.51 Bernard S. Black also carries out empirical analysis in Russian.52 He concludes that firm’s corporate governance will affect their market value significantly if countries’ constraints on corporate governance are limited.53

However, different argument advocates corporate governance would substantially affect market value and shareholders.54 Lawrence D. Brown and Marcus L. Caylor test the association between firms’ performance and Gov-Score, which is composed by 51 corporate governance factors. They find firms with better governance indeed have better profit, more value and more benefit for shareholders.55 Lucian A. Bebchuk, Alma Cohen and Allen Ferrell test the association between market value and corporate governance arrangements which are based on six provisions: staggered boards, limits to shareholder bylaw amendments, poison pills, golden parachutes, and supermajority requirements for mergers and charter amendments. They find the index of such arrangements is inversely associated with market value.56 Literatures also proposes that market value of firms would be affected their corporate governance in Russia.57

B. D&O insurance, signal effect and market value of firms

Some literature proposes the positive effect of D&O insurance on firm’s performance and market value. Sanjai Bhagat, James A. Brickley and Jeffrey L. Coles find that D&O

49 See Bernard S. Black, Does Corporate Governance Matter? A Crude Test Using Russian Data, 149 U.

Pa. L. Rev. 2131, 2131 (2001). Different argument like corporate governance can increase Apple’s market value, see In re Apple Computer, Inc. Derivative Litig., No. C 06-4128 JF (HRL), 2008 WL 4820784, at 2 (N.D. Cal. Nov. 5, 2008)

50 See Bernard S. Black et al., Does Corporate Governance Predict Firms' Market Values? Evidence from

Korea, 22J.L.ECON.&ORG. 366, 366 (2006).

51 Id.

52 See Bernard S. Black, Does Corporate Governance Matter? A Crude Test Using Russian Data, 149 U.

Pa. L. Rev. 2131, 2131 (2001).

53 Id.

54 See Lucian A. Bebchuk et al., What Matters in Corporate Governance?, 1 (September 1, 2004). Review

of Financial Studies, Vol. 22, No. 2, 783-827, February 2009; Harvard Law School John M. Olin Center Discussion Paper No. 491 (2004), available at http://ssrn.com/abstract=593423.

55 See Lawrence D. Brown & Marcus L. Caylor, Corporate Governance and Firm Performance, 1

(December 7, 2004), available at http://ssrn.com/abstract=586423.

56 Id. at 39.

15

insurance has positive on shareholder wealth and no negative effect is found.58 Jinyoung Park also finds the D&O insurance can positively contribute shareholder’s wealth.59 He tests the association between D&O insurance coverage and the quality of firms’ voluntary disclosure.60 He finds that there is an association between insurance coverage and forecast frequency and precision.61 The more insurance coverage, the more disclosure occurs. There is also more precise and timely.62 Besides, positive response from market is given to such information.63 All these results imply the positive signal effect of D&O insurance.

However, it is controversy that whether D&O insurance increase firm performance and shareholder’s wealth. The negative viewpoint mainly bases on the problem and risk that might be induced by D&O insurance. If D&O insurance represents the potential risk, opportunistic behavior and moral hazard, firms would avoid purchasing D&O insurance to damage the reputation and value of firms. Irene Y. Kim tests Canadian market and confirms the hypothesis that opportunism in financial reporting can be predicted by excess D&O insurance coverage.64 Besides, litigation risk, corporate governance quality, high-tech industry, and leverage are inversely related to D&O insurance coverage.65 In consequence, opportunistic behavior is implied. Narjess Boubakri and Nabil Ghalleb again test Canadian market and have more negative conclusion. D&O insurance indeed induces opportunistic behavior and has negative impact on firms’ performance in the future.66 Besides, their findings show that insurer cannot distinguish opportunistic risk and mandatory reporting is not so helpful.67 Under such circumstance where asymmetric information and moral hazard are obvious, regulation and limitation are recommended.68 C. Research design

1. Application of Ohlson model

When evaluating firm value, non-accounting is usually and relatively less explored.69 The

58 See Sanjai Bhagat, James A. Brickley, Jeffrey L. Coles, Managerial Indemnification and Liability

Insurance: The Effect on Shareholder Wealth, 54.4 The Journal of Risk and Insurance 721, 733 (1987).

59 See Jinyoung Park, The Effect of Directors’ and Officers’ Liability Insurance and Indemnification on

Voluntary Disclosure: Evidence from Canadian Firms, University of Michigan working paper, 30,

available at http://som.umflint.edu/research/docs/20052006/200506_JP_I.pdf.

60 Id. at 3. 61 Id. at 4. 62 Id. 63 Id.

64 See Irene Y. Kim, Directors’ and Officers’ Insurance and Opportunism in Accounting Choice, Duke

University working paper, 21 (2005), available at

http://www.efmaefm.org/efma2006/papers/764024_full.pdf.

65 Id.

66 See Narjess Boubakri & Nabil Ghalleb, Does Mandatory Disclosure of Directors’ and Officers’ Liability

Insurance Curb Managerial Opportunism? Evidence from the Canadian Secondary Market, Ninth Annual

Asian Academic Accounting Association Conference Program,. 29-30 (November 29, 2008), available at

http://69.175.2.130/~finman/Reno/Papers/Does_Mandatory_Disclosure_Curb_Managerial_Opportunism.p df.

67 Id. at 30. 68 Id.

16

Ohlson model can give a direct link between accounting amount and firm value. With the following refinement, the Ohlson model has been frequently applied in the valuation model of firms in accounting research.70 The model postulates abnormal earnings by following two equations:71

1 1 1 ~ ~ t t a t a t x v x (3) 1 2 1 ~ ~ t t t v v (4) Where vt indicates the information not yet captured by accounting and

~ is mean 0disturbance term.72 The Ohlson model is applied to evaluate how D&O insurance and corporate governance might affect firms’ market value.

2. Hypothesis development

In addition to the Ohlson model, this paper also follows the thoughts of Lawrence D. Brown and Marcus L. Caylor which tests the relationship between firm performance and corporate governance,73 to test the relation between firm performance, corporate governance and D&O insurance purchase. This paper assumes D&O insurance have positive effect on firms’ market value. The core issue that should be defined first is, is D&O insurance a positive or negative signal to the market? Even though D&O itself is positive news, if it is accompanied by other information such as more internal risks, will this negatively affect firms’ performance and market price? If D&O insurance protects directors and officers and lets them concentrate on management without worrying about litigation risk, D&O insurance will have positive signal effect. In contrast, if D&O insurance implies that firms might be not confident about their businesses, and firms might be in potential litigation trouble. Even worse, if the problems of moral hazard and adverse selection have been induced, then the purchase of D&O insurance is a bad news to the market. In this way, whether or not D&O insurance can spur firms to optimize their corporate governance is an important signal to the market.74 Under the theory of signal hypothesis, the purchase and coverage of D&O insurance will convey a positive signal to the market and thus improve the market value of insured firms.

In addition to the main hypothesis, other relevant variables are used as control variables. As discussed in the literature review, the effect of corporate governance on firms’ market

privately-held firms, 29(6) Journal of Accounting and Public Policy 517, 520 (2010).

70 See Chii-Shyan Kuo, THE PRICING AND DETERMINANTS OF THE DISCRETIONARY COMPONENT OF

EMPLOYEE STOCK OPTION VALUE 51,ProQuest (2007) .

71 See Kin Lo & Thomas Z. Lys, The Ohlson Model: Contribution to Valuation Theory, Limitations, and

Empirical Applications, 12 (February 2000). Sauder School of Business Working Paper, available at http://ssrn.com/abstract=210948 or doi:10.2139/ssrn.210948.

72 Id.

73 See Lawrence D. Brown and Marcus L. Caylor, supra note 55, at 1.

74 See Sean J. Griffith, Unleashing a Gatekeeper: Why the SEC Should Mandate Disclosure of Details

Concerning Directors' & Officers' Liability Insurance Policies, 28(March 24, 2005). U of Penn, Inst for

Law & Econ Research Paper No. 05-15, available at http://ssrn.com/abstract=728442 or doi:10.2139/ssrn.728442.

17

value is controversial. If D&O insurance is an outside monitoring mechanism for corporate governance, it would be reasonable to believe that D&O insurance and other governance mechanisms affect insured firms’ market value. This paper assumes other corporate governance mechanisms would positively affect firms’ market value.

3. Variables

Utilizing the Olhson model, accounting and non-accounting information affects firms’ market value. Researchers traditionally use stock price as market value. In D&O insurance literature, M. Martin Boyer also uses market value of equity as the measure of the wealth of shareholder.75 This study uses the market value of firms as the dependent variable. Regarding independent variable, the variables bv and EPS represent the book value of and earnings per share of firms. Regarding the proxy variable of D&O insurance, purchase is a binary variable, which is coded as “1” when firms with insurance and “0” otherwise. Then variable coverage is the natural logarithm of D&O insurance coverage. In order to analyze the effect of D&O insurance on firms’ performance completely, this paper will use these two D&O insurance proxy variables in separate panels. The variable purchase would be used in panel A, and the variable coverage would be used in panel B. In terms of the proxy variables of corporate governance, this paper would like to follow the previous section and consider them as important non-accounting information. First of all, it is usually believed that the duality of the chairman of board (COB) and Chief Executive Officer (CEO) is negatively related to market value of firms. Under agency theory, the duality of COB and CEO might cause interest conflict and damage the benefit of firms. Maria Carapeto, Meziane Lasfer and Katerina Machera test this issue by event study, and their research strongly support agency theory. 76 They find that the announcement of split of COB and CEO would cause positive abnormal returns and vice versa.77 In order to test the influence of duality of COB and CEO on the performance of firms, this section considers the variable dual. Ideally, independent directors are not affected by interest conflict and it is usually considered as a good mechanism for corporate governance.78 Accordingly, appointment of independent or outside directors should convey positive signal to the market and have a significant positive price effect. However, Bernard S. Black, Hasung Jang and Woochan Kim argue that even in developed countries there is no evidence to prove that firms with more independent directors have better performance or higher share price.79 Moreover, appointment of additional independent directors may signal that firms plan to address business problem.80 Some empirical research propose that more independent directors have no statistically significant effect on board’s performance. Some literature even argue that more

75 See M. Martin Boyer, Directors' and Officers' Insurance and Shareholder Protection, 9 (March 2005),

available at http://ssrn.com/abstract=886504 .

76 See Maria Carapeto, Meziane Lasfer and Katerina Machera, Does Duality Destroy Value?, 15 (January

12, 2005). Cass Business School Research Paper, available at http://ssrn.com/abstract=686707.

77 Id.

78 See Perry E. Wallace, Accounting, Auditing and Audit Committees after Enron, Et Al.: Governing outside

the Box without Stepping off the Edge in the Modern Economy, 43WASHBURN L.J. 91, 114 (2003).

79 See Bernard S. Black et al., supra note 50, at 408.

80 See Sanjai Bhagat & Roberta Romano, Event Studies and the Law: Part Ii: Empirical Studies of

18

independent directors would make board’s performance worse.81 In emerging market, Rajesh Chakrabarti, Krishnamurthy Subramanian and Frederick Tung test India market and find that independent director is indeed an importance component of monitoring function and adds the value of firms.82 Even though the results are controversial, but the importance of independent director is undisputable. This paper hypothesizes that the number of independent directors is positively or negatively related to market value of firms, and the variable Indptdirector is contained in regressions. Similarly, the variable Auditcomitee, indicating the number of audit committee members, is also included in this section.

The value of shares may be affected the ownership structure of firms. In firms with dispersed ownership, individual shareholders have less possibility and more cost to control the firms. They also have less incentive to monitor firms. As a result, control is in the hand of management.83 On the other hand, in firms with concentrated ownership, controlling shareholders and blockholders have more incentive to monitor management.84 However, blockholders are also a source of agency cost because they may act for their own benefits and other investors may have to pay for such costs. If investors expect more cost than benefit from ownership, they will discount the shares. In contrast, if investors expect more benefit than cost, they may be willing to pay more.85 Every ownership structure may have different impacts on investors. This is also why securities law regulates the disclosure of ownership structure.86 Besides, dominant owner might also influence firms’ performance and corporate governance.87 Jayesh Kumar tests Indian market and finds that the shares of directors would significantly influence firms’ performance beyond a certain threshold.88

These factors such as board and ownership structure also affect the risk of directors and related with D&O insurance. Thus, the variable Ctrldirector which indicates the number of controlled directors is also included in this section. This paper hypothesizes that it is negatively related to market value of firms. The variable Sd captures the number of shares of directors. These variables are also expected to be negatively related to market value of firms. Similarly, Remuneration, DAratio, and Litigation, which are important proxies for corporate governance, are also included in specification here. In conclusion, in order to consider the effect of D&O insurance and corporate governance on firms’ market value, this paper adds D&O insurance and corporate governance into Ohlson model and

81 See Sanjai Bhagat & Bernard Black, The Uncertain Relationship Between Board Composition and Firm

Performance, 54BUS.L.REV.921, 943 (1999).

82 See Rajesh Chakrabarti, Krishnamurthy Subramanian and Frederick Tung, Independent Directors and

Firm Value: Evidence from an Emerging Market, 20 (June 28, 2010), available at http://ssrn.com/abstract=1631710.

83 See Michael C. Schouten, The Case for Mandatory Ownership Disclosure, 15STAN.J.L.BUS.&FIN.

127, 135 (2009).

84 Id. 85 Id. 86 Id.

87 See Jayesh Kumar, Agency Theory and Firm Value in India, Indira Gandhi Institute of Development

Research, 23, available at

http://unpan1.un.org/intradoc/groups/public/documents/APCITY/UNPAN023822.pdf.

19

reformulates the new equation below. DO represents the proxy variable of D&O insurance, including Purchase and Coverage. CG represents the proxy variables of corporate governance, including Dual, Idirector, Sd, ctrldirector, Remuneration, DAratio, and Litigation. The definitions of variables can be found in Table 1.

MV = a0 + a1BV + a2 EPS + a3 CG+a4 DO

(3)

C. Empirical result and analysis 1. Descriptive analysis

Considering the new variables in this model, it is found that the difference of means between insured and uninsured firms is significant. This indicates that insured firms have significantly higher market value and EPS than uninsured firms. Two implications can be drawn from this result. First, this result echoes to the previous findings that firms with better performance have more demand for D&O insurance, and this is different from the monitoring hypothesis. Secondly, firms that purchase D&O insurance also have higher market value, and this implies D&O may be beneficial for firms’ market value. Thus, the signal hypothesis may be supported. In this way, the effect and magnitude of D&O insurance will be tested by following regression analyses.

Table 5 Comparison between firms without and with D&O insurance (2)

Firms without D&O Firms with D&O Total

Mean N Std. Dev. Mean N Std. Dev. Mean N Std. Dev.

BV* 14.5040 3340 1.31944 14.8240 4682 1.46317 14.6908 8022 1.41386

EPS* 1.1884 3340 2.49344 1.6212 4682 4.14476 1.4410 8022 3.55798

* indicates that the difference is significant in independent sample test.

2. Regression analysis

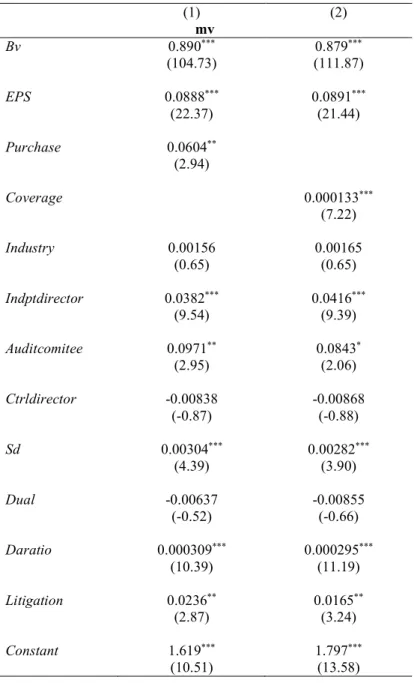

In the first panel, the dummy variable, insured or not, is used as proxy variable of D&O insurance. It is found that the variables of D&O insurance purchase and the number of independent directors are positively significant. Furthermore, its coefficient 0.0604 is large, compared with other significant variables. This demonstrates that the purchase of D&O insurance is positively correlated to market value of firms. In the second panel, D&O insurance coverage is used as a proxy variable of D&O insurance and still positively significant. This provides more obvious evidence than the previous panel and indicates a positive association between D&O insurance and market value. From such positive correlation, the positive signal effect of D&O insurance will be one possible explanation. Regarding proxy variables of corporate governance, the empirical result is roughly similar to the result of previous section. More firms with more independent director and

20

audit committee members have more D&O insurance purchase and coverage. And thus monitoring hypothesis is more likely to be rejected, and signal hypothesis is more likely to be supported.

Moreover, debt-asset ratio and prior litigation of firms are also positively correlated to the market value of firms. The possible explanation may be that firms which are more active may not only have better performance in market value and EPS, but also induce more controversies and litigations. This can be understandable. However, if over risk-taking behavior is induced by D&O insurance, this may mitigate the function of insurance and thus create more problems. Thus, more tests about opportunistic behavior and D&O insurance will be provided in the next section.

Table 6 Result of regressions with panel data (2)

(1) (2) mv Bv 0.890*** 0.879*** (104.73) (111.87) EPS 0.0888*** 0.0891*** (22.37) (21.44) Purchase 0.0604** (2.94) Coverage 0.000133*** (7.22) Industry 0.00156 0.00165 (0.65) (0.65) Indptdirector 0.0382*** 0.0416*** (9.54) (9.39) Auditcomitee 0.0971** 0.0843* (2.95) (2.06) Ctrldirector -0.00838 -0.00868 (-0.87) (-0.88) Sd 0.00304*** 0.00282*** (4.39) (3.90) Dual -0.00637 -0.00855 (-0.52) (-0.66) Daratio 0.000309*** 0.000295*** (10.39) (11.19) Litigation 0.0236** 0.0165** (2.87) (3.24) Constant 1.619*** 1.797*** (10.51) (13.58)

21 D. Summary

From the empirical tests in this section, they demonstrate a positive association between D&O insurance purchase and market value of firms. Purchasing D&O insurance and increasing insurance coverage are positively correlated to the increase of market value of firms. This result not only matches with the previous empirical results, but also sheds light on the effect of D&O insurance. A possible explanation is the signal hypothesis – a firm may purchase D&O insurance for bettering its reputation. Even though insurance costs premium, but it can convey a positive signal which is as important as the book value and EPS of firms. Hence, the empirical result provides possible support for the signal hypothesis and explains why firms will do so even though they have good corporate governance.

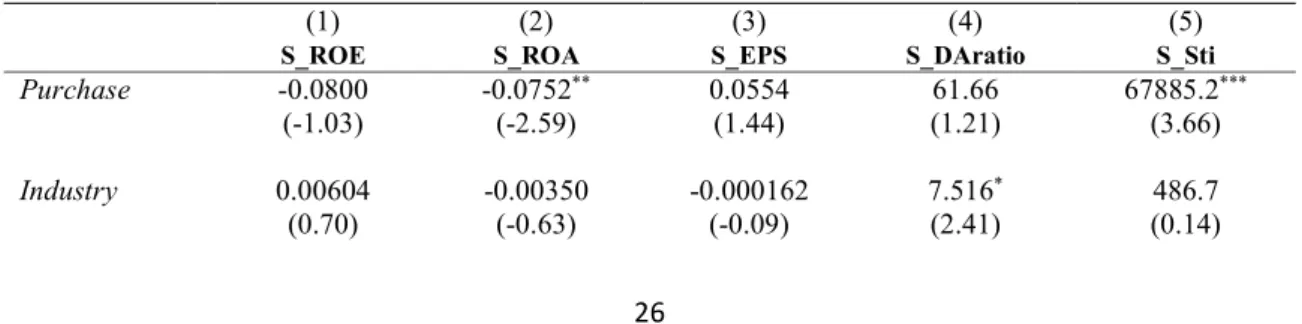

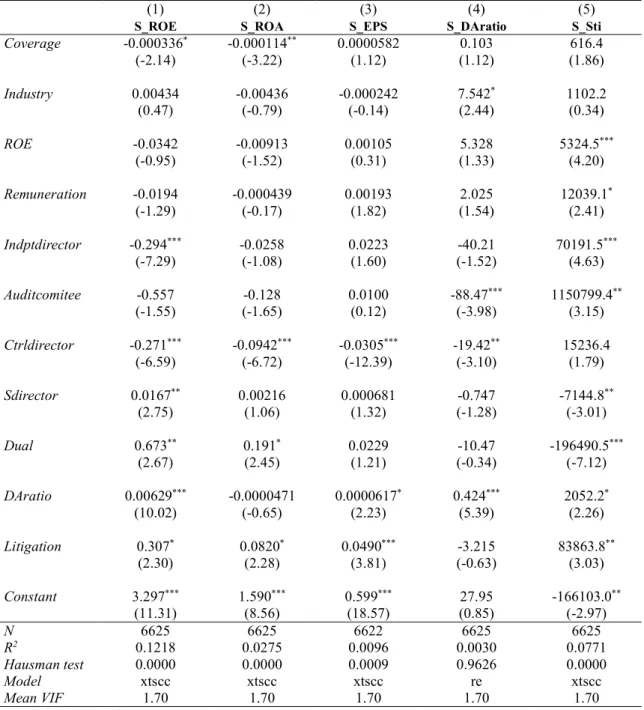

IV. Risk taking and opportunistic behavior

Following the previous tests, this section further tests if the opportunistic problem happens in Taiwanese D&O insurance market, and thus affects the function of D&O insurance. In literature review, previous researches concerning moral hazard in insurance, especially in D&O insurance, will be introduced and hypotheses will be developed. By hypothesizing that D&O insurance will not increase insured firms’ volatility of returns and short term investments, this research will test whether D&O insurance induces more risky behavior of insured firms. In the end, the empirical results and relevant discussion will be presented. This dissertation will conclude whether D&O insurance produces moral hazard and thus affect insurers’ monitoring function.

A. Insurance and risk taking

Regarding the effect of D&O insurance, there are mainly two opposite arguments. As mentioned before, monitoring hypothesis propose that insurer can monitor insured firms and even improve their corporate governance. In contrast, opponents argue that D&O insurance weaken managerial control device such as litigation.89 Many recent researches find that managerial opportunism is one factor of D&O insurance purchase.90 The reason

89 See Jinyoung Park, supra note 59, at 6. 90 Id. at 6. N 7795 8083 R2 0.8846 0.8831 Hausman test 0.0000 0.0000 Model xtscc xtscc Mean VIF 2.42 2.22 t statistics in parentheses * p < 0.05, ** p < 0.01, *** p < 0.001