Do Non-profit Hospitals Change the Provision of Community Benefit

Services When Faced with the Law Amendment?

Jenn-Shyong Kuo, Ph.D.

Professor,

Department of Accounting, National Taipei University Email: jennkuo@mail.ntpu.edu.tw

Yi-Cheng Ho, Ph.D.

Professor,

Department of Public Finance, National Cheng-Chi University E-mail: yho@nccu.edu.tw

Abstract

Decision-makers often need to think about the appropriateness of the laws and regulations regarding the community benefit services of non-profit hospitals. Taiwan’s Medical Care Act was amended in 2004 to lower the minimum standards for non-profit hospitals in providing community benefit services, and the standard for the amount of community benefit services was modified into two independent criteria of medical community services activities and educational research activities. This study aimed to investigate the impact of the law amendment on the non-profit hospitals in setting aside funds for uncompensated care services expenditure, educational research expenditure and community benefit services expenditure. With the 2001-2008 data on 41 non-profit hospitals, this study used the panel data fixed effect model for analysis. The empirical results show that the amendment of the Medical Care Act in modifying the funds set aside for community benefit services has no significant impact on community benefit services expenditure on average. The amendment of the Medical Care Act in 2004 to modify the standards for setting aside the funds for community benefit services has not significantly reduced the non-profit hospitals’ expenditure on community benefit services. However, non-profit hospitals with high community benefit services expenditure significantly reduced the uncompensated care services expenditure, educational research expenditure and community benefit services expenditure following the law amendment. The empirical results of this study show that the agency theory can better explain Taiwan’s non-profit hospitals engaging in medical community services activities and other community benefit services.

1. Introduction

Previously, with Taiwan’s poor medical resources, profit hospitals, as non-profit organizations, provided charity medical care to poor families and patients lacking in medical care, as compensation for market failure and government failure in solving healthcare problems. To encourage non-profit hospitals to provide relevant services, the Taiwanese government granted to non-profit hospitals a number of tax breaks through the tax laws. Moreover, the Medical Care Act (Ministry of Health and Welfare, 1986) expressly stipulates the content and amount of community benefit services of non-profit hospitals.

The non-profit hospitals, highly public medical institutions, are often founded on the principles of religious belief (practice missionary work), humanitarian care (providing the sick, the poor and those in need of care with services) contributing to the community (benefiting society) and other altruistic perspectives (Wang, 2006), providing charity medical care services for the public good. Because the medical environment has changed, the present non-profit hospitals not only provide charity medical care to poor families, but also to the general public with charges for the medical services. In addition, because of the advances in medical technology and equipment, to maintain quality of care, hospitals need to purchase expensive equipment and recruit and train medical staff. Resources required by these investments and training cannot be satisfied by donation income through the philanthropic model. Therefore, non-profit hospitals tend to earn financial resources needed for investment by the corporate model, through medical services or other commercial activities, and thus develop both social and commercial roles of non-profit hospitals (Thorpe and Phelps 1991; Hansmann 1987). These two goals are often in conflict: when achieving the social purpose, it is difficult to accumulate resources for investment by engaging in free or activities below the operating charges. Managers often reduce charity medical care as discretionary expenditure, indicating that managers tend to sacrifice social goals to achieve business goals (Eldenburg and Vines, 2004).

In both theory and policy, to encourage non-profit hospitals to engage in charity medical care, the government will give tax breaks to non-profit hospitals, which constitutes an indirect subsidy for charity medical care. Therefore, when non-profit hospitals provide too little charity medical care, the government should abolish their

tax-exempt status (Nicholson, et al., 2000).1 Therefore, a non-profit hospital’s tax-exempt status is derived from tax incentives, which is the incentive to provide charity medical care and other community services. In practical operation, governments will regulate the amount of charitable activities that non-profit hospitals are engaged in. For example, the Texas community benefit law in the U.S. requires that non-profit hospitals provide charity medical care and other community welfare activities up to the pre-set limit (Texas Health and Safety Code, 2007); California community public law only requires non-profit hospitals to submit plans to the competent authorities with the obligation to fulfill the planning objectives (California Health and Safety Code, 2008). Taiwan’s Medical Care Act expressly stipulates the minimum amount of community benefit services of non-profit hospitals. However, the hospital is allowed to defer the implementation of the activities for two years (Medical Care Act, 2004).

Taiwan’s non-profit hospitals enjoy a variety of tax incentives, for example, linked to income tax, business tax, land tax, commodity tax, etc. However, the provision of community benefit services by non-profit hospitals and tax-exempt status are not linked. Only the tax-exempt status of income tax (business income tax) is based on the percentage of the annual expenditure against the annual revenue (Application Standards for Income Tax Exemption of Educational and Cultural Institutions or Charitable Organizations, 2003); moreover, this expenditure is not limited to community benefit services. For hospitals failing to meet the requirements of the Medical Care Act, as there are no specific laws or penalties for violations, thus it does not affect the tax-exempt status of such hospitals.

Although the Legislative Yuan passed the Medical Care Act in 1986, which provides that non-profit hospitals should engage in community benefit services accounting for at least 5% of medical services revenue, not all non-profit hospitals fulfill this legal requirement (Kuo, Ho and Lo, 2006; Kuo and Ho, 2007). When amending the Medical Care Act in 2004, Department of Health officials stated in the legislature committee review that it is unreasonable to calculate the tax exemption rate on the basis of medical revenue as hospitals with losses may have to engage in

1 In the United States, Utah Supreme Court cancelled the tax-exempt status of Intermountain Health Care in 1985 (Maiure et al., 2004); in 2004, Illinois tax authorities canceled Provena Covenant Medical

community benefit services; therefore, the minimum amount was changed to 20% of medical revenue balance (The Legislative Yuan, 2004).

The amendment of the Medical Care Act in 2004 changed the provisions regarding the community benefit services of non-profit hospitals. First, the basis for calculating the exempt status was changed from medical revenue to medical revenue balance. Since the medical revenue balance is derived by the deduction of net medical revenue by medical expenditure and management fees, the amount of calculating is substantially reduced2; second, the contribution rate was changed from 5% of net medical revenue to 20% of medical revenue balance. It can be concluded from the above two changes resulting from the law amendment that the contribution rate has increased while the contribution benchmark has been substantially reduced; therefore, the contribution amount should be reduced. Third, the limitation on the use of resources for programs, before the law amendment, meant that non-profit hospitals could use the resources according to organizational objectives or for different community benefit services programs; however, the use of resources should be spread more widely after the law amendment, as resources cannot be used for a few specific purposes.

2. Literature Review

In this section, first, we illustrate the provisions of the Medical Care Act on community benefit services; second, we illustrate literature relating to the community benefit services law and changes in accounting processing; finally, we illustrate the factors that may affect the non-profit hospitals’ community benefit services.

(1) Historical Development of Provisions of Taiwan’s Medical Care Act on Community Benefit Services

The provisions of the Medical Care Act regarding charity medical care and other community benefit services of non-profit organizations can be illustrated in three parts. The first part is the range of the community benefit services. In early times, the community benefit services of hospitals included charity medical care or uncompensated care (Frank and Salkever, 1991; Rosko 2004; Magnus Wheeler, Smith, 2004; Kim, McCue and Thompson, 2009). With the implementation and penetration of

2 When using the medical revenue balances as the contribution benchmark, the hospital may be inefficient in that the contribution amount may have to be reduced. The management has incentives to

social medical insurance, the range of community benefit services was expanded to include education research and development activities (Bryce, 2001; Nicholson, Pauly, Burns, Baumitter and Asch, 2000; Clement, Smith, Wheeler and John, 1994; Kuo et al, 2006; Kuo and Ho, 2007).

Taiwan’s Medical Care Act provides that non-profit hospitals should carry out relevant research and development, personal cultivation, health education, medical relief, community medical services and other social services. Medical relief and community medical services, by nature, belong to charity medical care. Research and development, personal cultivation and health education belong to research and development activities. In addition, other social services are the community benefit services in a broad sense. According to the services item connotations, the six activities can be divided into two categories: education research and development (research and development, personal cultivation, health education) and community benefit services (medical relief, community medical services, other social services).

Regarding the second part, the Medical Care Act provides the amount of community benefit services that profit hospitals should provide. In theory, non-profit hospitals should determine the actual amount of community benefit services according to the needs of the community. In practice, the non-profit hospitals will take into consideration their capabilities. Hence, the law often provides that the calculation basis and calculation ratio should be determined by the production capacity and financial capability of the hospital.

Before the law amendment in 2004, Article 34 of the Medical Care Act (Ministry of Health and Welfare, 1986) provided that non-profit hospitals should contribute at least “5% of annual medical revenue” to community benefit services, including: research and development, personal cultivation, health education, medical relief, community medical services and other social services.3

After the law amendment in 2004, Article 46 of the Medical Care Act (Ministry of Health and Welfare, 2004) provides that non-profit hospitals should contribute at

3 Article 34 of the Medical Care Act (1986) provides: “Medical institutions should set aside at least 5% of annual medical revenue for the research and development, personnel training, health education, medical relief, community health services and other social services; those with outstanding performance in this respect will be awarded by the central competent health authorities.”

least “10% of profit from medical operation” to the two categories of activities: education research and development (research and development, personal cultivation, health education) and community benefit services (medical relief, community medical services and other social services).4 By comparing the amount of contribution of non-profit hospitals to community benefit services, unless the net non-profit rate of the medical activities of the hospital is above 25%, the minimum amount of the contribution of the non-profit hospital to community benefit services will be reduced after the law amendment.5

Regarding the third part, before the law amendment in 2004, according to the willingness and objectives of the non-profit hospitals, resources could be used freely in six types of activities; after the law amendment in 2004, community benefit services are divided into two categories, one is the activities of education research and development (research and development, personal cultivation, health education), and the other is the activities of community benefit services (medical relief, community medical services and other social services). The minimum amount of contribution to the two categories of activities is 10% of the profit from medical operation. The Ministry of Health and Welfare (MHW) expressly provided in 2010 the range and expenditure limit of community benefit services (Rules for the Implementation of the Medical Care Act, March 12, 2010).6

4 Article 46 of the Medical Care Act (2004) provides: “Medical institutions should set aside at least 10% of annual medical revenue balances for research development, personal cultivation, health education; at least 10% of the annual medical revenue balances for medical relief, community medical services and other social services; those with outstanding performance in this respect will be awarded by the central competent health authorities”.

5 During the review by the Committee in the Legislative Yuan, according to the Department of Health officials, it is unreasonable to use medical revenue as the basis for calculating community services as the losses and gains of the hospital have not been considered. Hence, the original calculating basis of medical revenue (Executive Yuan version) was changed to the calculating basis of medical revenue balances (provisions of the amendment motion) (Legislative Yuan Gazette, 2004).

6 The Ministry of Health and Welfare expressly provided the range of medical social services in 2010 (Section 1, Article 30 of the Rules for the Implementation of the Medical Care Act: “the range of the medical relief, community medical services and other social services provided in Article 46 and Article 53 of the Medical Care Act is as follows: 1) medical expenses for patients from poor families,

According to the summary of the Medical Care Act provisions on community benefit services of non-profit hospitals, changes before and after the law amendment in 2004 include: first, regarding that the contribution calculation basis was changed from medical revenue to profit from medical operation, the calculation benchmark amount is substantially reduced, as the profit from medical operation is the reduction of the medical revenue by medical revenue deductions, medical expenditure and management fees. Hospital inefficiency (excessively high medical expenditure and management fees) may reduce the amount of contribution. In addition, the calculation is based on medical activities; therefore, the management has incentives to manipulate the cost allocation between medical activities and non-medical activities. Second, the contribution rate is changed from 5% of medical revenue to 20% of profit from medical operation. Although the calculation rate will increase and the calculation basis will be substantially reduced, the likelihood of the contribution amount decreasing will be very high. Third, the limitation on the use profits of the fund was changed from the six types of activities in accordance with organizational objectives or community needs to the two categories of activities: community benefit services (education research and development activities) and community benefit services activities in terms of the contribution minimum amount. The situation of inputting all resources in specific activities as in the past has been changed.

Apart from the above descriptions, the provisions of Taiwan’s Medical Care Act on community benefit services of non-profit hospitals have the following two features: the first is the relevance between community benefit services expenditure and tax-exempt status. In the historical evolution and theoretical development, non-profit hospitals were regarded as being able to compensate for market failure and government failure, and thus were granted the tax-exempt status. However, in recent years, due to environmental and technological changes, it is generally considered that the motivation of non-profit hospitals to engage in charity medical care has been reduced. To ensure

assistive devices, care, rehabilitation, funeral or other special needs; 2) related spending for counseling the patients or family groups; 3) related spending for community healthcare, health promotion and community feedback and other medical services; 4) public social services-related expenses; 5) related spending for international medical assistance in cooperation with governmental policies. Medical institutions should publish the range of the above expenditures and rules for the application for subsidies, in appropriate places and relevant information channels. The sum of the various funds of the first section

that the tax-exempt status is not abused, it should be determined according to the community benefit services. However, the tax-exempt status of non-profit hospitals in Taiwan is mainly recognized by identity. When the expenditure accounts for 70% of the income, it will be granted the income tax exemption. Namely, even if the non-profit hospitals are not engaged in community benefit services, the tax-exempt status is not affected; second, the resources for the community benefit services: should be measured by the amount of the community benefit services of the “current term”. Namely, the charity medical care expenditure is measured on a cash basis. However, Taiwan’s Medical Care Act provides that non-profit hospitals should “set aside” a specific amount for the community benefit services, and it is allowed to be listed in the period charges (accrual basis) rather than the current actual expenditure limit.

(2) Research on Changes in Regulations and Accounting Norms

The government may use laws and regulations to provide financial incentives or the accounting norms and expression to influence the conduct of the hospital, and encourage them to engage in charity medical care and take care of poor patients. Relevant studies include: first, regarding the literature on the use of financial incentives, Gaskin (1997) discussed the effectiveness of the establishment of an “uncompensated care trust fund” in New Jersey during the period of 1987-1992 to help hospitals provide uncompensated care. As the fund subsidies for uncompensated care will reduce the shadow price, it will increase the supply of uncompensated care. The empirical analysis suggests that the effect of an uncompensated care trust fund on inpatients is higher. In addition, as the state government implemented strict review procedure since 1987, no moral hazard to reduce the efforts to charge occurred. Duggan (2000) discussed the impact of financial incentives to the hospitals to provide the poor with medical care. The California state government implemented the financial incentive plan in 1990: if the hospital takes more than 25% of low income patients, it can get more than 25% additional financial benefits. The research findings of Duggan (2000) suggested that for-profit hospitals and non-profit hospitals had a significant response to the plan, while public hospitals were not affected by the plan. The empirical study suggested that for-profit hospitals and non-for-profit hospitals took high for-profit patients and avoided low for-profit patients (cream-skimmed). This means the financial incentive schemes of California cannot effectively increase the taking of poor patients into the hospitals.

Second, regarding literature on accounting policy, Eldenburg and Vines (2004) discussed the impact of the American Institute of Certified Public Accountants (AICPA) requirement on non-profit hospitals to separate charity medical care expenditure and bad debt expenditure. The research findings suggest that the accounting policy of full disclosure of the uncompensated care expenditure will not affect the operating decision about the amount dedicated for charity medical care. However, managers may change the uncompensated care categorization strategy based on consideration of reputation; in particular, hospitals with more cash will tend to categorize bad debt expenditure as charity medical care expenditure. Kennedy et al. (2010) discussed the law amendments in 1993 and 1995 in Texas, which required charity medical care services of non-profit hospitals, and changed the calculation of the amount of the community benefit services. Kennedy et al. (2010) discussed the permission in 1995 to subtract the minimum amount benchmark (net medical revenue) with the bad debt expenditure (the calculation benchmark is lowered). Empirical data suggest that reduction in calculation benchmark will significantly reduce charity medical care expenditure and high-profit non-profit hospitals will reduce more than the low profit hospitals. Hence, the agency theory is supported.

Third, Texas was the first state in the United State to regulate non-profit hospitals by law in terms of the minimum standards for charity medical care and/or community benefit services. Therefore, studies on rules and regulations on charity medical care often used Texas as the subject. Wood (2001) published the first article on the charity medical care and community benefit services of non-profit hospitals in Texas as provided by law. Wood (2001) compared the average values of the medical revenues (including total medical revenue, operating expenses and net medical revenue), community benefit services (including charity medical care, government subsidies for medical and other benefits to the poor), and imputed tax benefits (including license tax, sales tax, property taxes, bonds and donations, etc.). It was found that the increase in community benefit services and tax incentives was far higher than the medical revenue services. Holtzman and Averin (2003) used the data of hospitals in Texas during 1990-1995 to discuss the impact of the 1993 Bill 427 on the charity medical care of the hospital. The regression analysis suggests that non-profit hospitals and public hospitals provide significantly more charity medical care and uncompensated care than for-profit hospitals do. Moreover, after the implementation of Bill 427 in 1993, non-profit

hospitals are providing significantly more charity medical care. In addition, Holtzman and Averin (2003) found that hospitals with less charity medical care would increase charity medical care after the implementation of Bill 427. Conversely, hospitals with more charity medical care will reduce charity medical care to just meet the standards required by law.

According to the findings of Kennedy et al. (2010), the establishment of the minimum standard of charity medical care in 1993 in Texas would make the non-profit hospitals with expenditures below the standard increase their charity medical care expenditures; the non-profit hospitals with expenditures above the standard would reduce the charity medical care expenditure to slightly above the minimum standard. Since the former non-profit hospitals are fewer, the law amendment did not increase the overall charity medical care and community benefit services expenditure to achieve the desired effects.

(3) Influencing Factors of Non-profit Hospitals to Engage in Community Benefit Services

Studies on the relevance of non-profit hospitals engaging in community benefit services can be categorized according to two types: one type discusses the determinants of providing community benefit services; the other discusses the impact of community benefit services.

The first type of determinants affecting the non-profit hospitals in providing community benefit services can be categorized as: hospital characteristics, county market characteristics and environment, and government policy. The first is ‘hospital characteristics’: the hospital’s capacity affects the capability to provide charity medical care and community benefit services, such as supply-related factors. The common measurement variables include: physical capacity (e.g., number of hospital beds and number of medical staff), financial capacity (e.g., medical revenue, total income, etc.), wealth (e.g., the annual net income and endowment income), medical services prices (e.g., average salary of nurses), being teaching hospitals and having emergency rooms. The related empirical studies show that a hospital’s physical energy and financial energy have positive effects on providing uncompensated care (Bryce 2001; Gaskin 1997; Frank and Salkever 1991). Regarding the annual net income, there are no consistent results. Frank, Salkever and Mitchell (1990), Rosko (2004) and Hsing and

He (2007) found that higher annual net income can result in a higher amount of charity medical care, i.e. the income effect is positive. Gaskin (1997) and Frank and Salkever (1991) cannot validate the statistical relevance between the annual net income and charity medical care. Rosko (2004) found that a higher percentage of emergency treatment can result in a higher amount of charity medical care.

The second is county market characteristics: the demand of community residents for charity medical care and community benefit services affects the non-profit hospitals in providing community benefit services, i.e. the factor of demand respect. The dummy variable is to measure the community’s lack of medical insurance, or its insufficient medical insurance, for example, the proportion of people aged 65 and above, the median income, unemployment rate and number of local people without insurance. In addition, market competitiveness measures the hospital’s independence power, and higher competitiveness suggests a higher level of monopoly and that the hospital has a higher capacity of earning monopoly rent. If the hospital’s operating objective is altruistic, the monopoly rent will be used in charity medical care or community benefit services. Relevant studies have found that higher unemployment rate, higher percentage of senior population (65 years old and above) and lower community income will result in higher demand for charity medical care (Rosko2004; Guo and He, 2007). In addition, Gaskin (1997) found that market concentration and uncompensated care are positively correlated. Frank, Salkever and Mitchell (1990), and Frank and Salkever (1991) cannot validate the significant relevance between the two.

The third is environment and government policy: to control the time effect and government policy, the time trend variable, annual dummy variable or government policy dummy variable is used (Gaskin 1997). Gaskin (1997) found that the subsidies of uncompensated care can increase the amount of uncompensated care provided by hospitals.

The second type of studies on the impact of hospitals providing community benefit services mainly discussed the situation of CEO leaving office and the change in board structure. Brickly and Van Horn (2002) and Eldenbrug, Hermalin, Weisbach and Wosinska (2004) analyzed the American non-profit hospitals, and found that CEO replacement and director replacement are not significantly correlated to the providing of uncompensated care by hospitals. Financial performance (return on assets and net profit margin) and market competitiveness will significantly affect the percentage of

CEO replacement and director replacement. Eldenbrug, Hermalin, Weisbach and Wosinska (2004) further divided hospitals into religious hospitals, non-profit hospitals, for-profit hospitals, government hospitals, regional hospitals and teaching hospitals, and found that the percentage of board replacement and the providing of uncompensated care are significantly correlated in samples of the public hospitals and teaching hospitals. The CEO replacement and the providing of uncompensated care are significantly correlated in the case of religious hospitals and regional hospitals. Brickly and Van Horn (2002) used the amount of uncompensated care and high quality medical services as the dummy variables of community benefit services, including total income/patient days, the number of registered nurses/patient visits and target business expenses/total expenses.

3. Hypotheses

Before the amendment of the Medical Care Act in 2004, the amount of community benefit services for non-profit hospitals had to be “at least 5% of the annual medical revenue.” When amending the law in 2004, the MHW consulted with the Legislative Yuan, arguing that using medical revenue as the calculating basis does not consider the situation of hospitals operating at a loss to engage in community benefit services. Hence, the minimum amount was changed to “20% of profit from medical operation.” The amendment has considerably reduced the minimum amount of the community benefit services that non-profit hospitals should provide. However, before the law amendment in 2004, the MHW has not strictly reviewed the implementation of the non-profit hospitals. Therefore, most non-profit hospitals cannot meet the minimum standards of community benefit services expenditure (Kuo, Ho and Lo, 2006; Kuo and Ho, 2007). Hence, it is worth long term follow-up observation whether such a change can affect the non-profit hospitals to engage in charity medical care and other community benefit services.

The tax-exempt measures of the Taiwanese government for non-profit hospitals are determined mainly by the identity of medical institutions (registered as non-profit hospitals). When the total expenditure amounts to 70% of the total income, the hospital can enjoy the income tax exemption while the level of community benefit services is not considered. Hence, tax-exempt incentives cannot provide any incentive to the non-profit hospitals to provide community benefit services. For non-non-profit hospitals in the

United States, the amount and plan of charity medical care and other community benefit services should be reviewed, as there are tax incentives for them to engage in charity medical care and other community benefit services. Since the charity medical care provided by non-profit hospitals is the compensation measure for the government’s inability to provide such services, non-profit hospitals’ tax-exemption benefits can be regarded as the indirect expenditure of the government in purchasing medical services. Therefore, it is necessary to discuss the provision of charity medical care and community benefit services by non-profit hospitals. However, the tax-exempt status of Taiwan’s non-profit hospitals is not determined by community benefit services programs and amount. Hence, the possible impact of tax incentives does not need to be considered in the discussion on the provision of community benefit services by non-profit hospitals.

This study adopts the agency theory and altruism theory to predict the changes in the behavior of non-profit hospitals before and after the amendment of the Medical Care Act. First, the agency theory argues that the government (principal) commissions the agent (non-profit hospitals) to engage in charity medical care and other community benefit services. The agent makes the most beneficial decision according to utility function and private information. Without the direct control of the principal and tax incentives, due to financial pressure, non-profit hospitals have the motivation to reduce community benefit services expenditure. However, after the law amendment, MHW published the amount requirements on non-profit hospitals in providing community benefit services; for those hospitals failing to meet the requirements, there is no corresponding penalty. Accordingly, based on the agency theory, we expect that hospitals failing to meet the requirements will adjust the expenditure to just meet the legal requirements. By comparison, the hospitals that have already met the requirements will reduce their expenditure on charity medical care and other community benefit services to the level slightly above the legal requirements.

Second, the altruism theory argues that people with altruistic psychology will engage in selfless and altruistic behaviors (Jones, 2002). For example, doctors may provide consultation or charity medical care for patients during non-working hours or donate money or material to the poor without requiring rewards, etc.; based on the social objectives, non-profit hospitals will provide free or low-charge medical care to the people lacking in medical care or to patients without medical insurance (Schlesinger

et al., 1997). Since the MHW had no compulsory requirements on non-profit hospitals before the law amendment of the Medical Care Act in 2004, it can be inferred by the altruism theory that non-profit hospitals will provide community benefit services according to the needs of the community. After the law amendment in 2004, hospitals with expenditure above the legal requirement will not change their behaviors; however, the hospitals with expenditure lower than the legal requirement will increase the community benefit services expenditure to slightly above the legal requirement. According to the agency theory, we establish the following hypothesis:

H1: After the amendment of the Medical Care Act in 2004, non-profit hospitals’ expenditure on medical community services activities (educational research activities, community benefit services) will be reduced.

Before the amendment of the Medical Care Act in 2004 to modify the benchmark for community benefit services expenditure and contribution ratio, unless the net medical profit ratio of the hospital is above 25% and resources are spent on medical community services activities and educational research activities evenly, the minimum standard for non-profit hospitals to implement community benefit services will be reduced after the law amendment. According to the agency theory, the behaviors of profit hospitals will mainly comply with the legal requirements; therefore, non-profit hospitals will reduce charity medical care and other activities of community benefit services. The altruistic theory posits that the non-profit hospitals will provide medical social services and other community benefit services according to the needs of the community. Therefore, when the minimum standards as required by the law are lowered, it will have no impact on the non-profit hospitals in implementing charity medical care and other community benefit services activities. On average, if non-profit hospitals reduce community benefit services expenditure, it means the agency theory can better explain the average behavior of non-profit hospitals; if the expenditure of non-profit hospitals on charity medical care and other activities of community benefit services is not reduced, then the altruism theory can better explain the behavior of non-profit hospitals.

It should be noted that although the standard for most non-profit hospitals to engage in charity medical care and other activities of community benefit services was higher before the law amendment in 2004, MHW did not strictly enforce the provisions of the Medical Care Act. As a result, most non-profit hospitals did not meet the

requirements on community benefit services. However, after the law amendment in 2004, MHW immediately corrected the non-profit hospitals that had not met the legal requirements. Therefore, after the law amendment, some non-profit hospitals increased expenditure on charity medical care and other activities of community benefit services.

As the non-hospitals can be divided into two categories by the expenditure on charity medical care and other activities of community benefit services before the law amendment in 2004, this study investigated the law amendment of the Medical Care Act in 2004 in regard to the reduction of the standard of expenditure on charity medical care and other activities of community benefit services.

This study used 10% (20%) of profit from medical operation (excluding uncompensated care services expenditure and educational research expenditure) as the basis for the categorization of non-profit hospitals in terms of medical community services activities or educational research activities (community benefit services). According to the agency theory, this study expected non-profit hospitals’ high expenditure on community benefit services after the law amendment, and proposed H2 as follows:

H2: non-profit hospitals with expenditure on medical community services activities (educational research activities, community benefit services) higher than the minimum standard (high expenditure on community benefit services) will reduce expenditure on medical community services activities (educational research activities, community benefit services) after the law amendmen.

The agency theory predicts that non-profit high expenditure hospitals on medical community services activities will regard it as unnecessary to engage in too many charity medical care and other activities of community benefit services, and will reduce the level to the minimum standard after the law amendment; however, the altruism theory predicts that non-profit high expenditure hospitals on medical community services activities will not reduce their expenditure on medical community services activities and other community benefit services to meet the community needs of medical community services activities and other community benefit services. However, for non-profit low expenditure hospitals on medical community services activities, the agency theory and the altruism theory predict that non-profit hospitals will increase charity medical care and other activities of community benefit services to comply with the law.

In summary, the agency theory and the altruism theory predict that non-profit high expenditure hospitals on medical community services activities will have different behaviors after the law amendment; however, both theories predict the behaviors of the non-profit low expenditure hospitals on medical community services activities will be the same.

4. Empirical Model

With Taiwan’s non-profit hospitals as samples, this study investigated the impact of the amendment of the Medical Care Act 2004 regarding community benefit services on non-profit hospitals’ behavior of educational research and development, medical social services and community benefit services. In this section, the data source, data structure, variable definitions, empirical model and methods are illustrated.

(A) Data source

Among Taiwan’s 52 non-profit hospitals, 11 of them were in preparation or operating after the law amendment during the data period; therefore, we used the 2001-2008 data of 41 non-profit hospitals. This study investigated whether the behaviors of non-profit hospitals in medical community services activities, educational research activities and community benefit services changed after the amendment of the Medical Care Act in 2004.

Regarding the data sources of this study, the financial data were from the annual financial statements of the non-profit hospitals; non-financial data were from the survey of the medical institutions by MHW and the survey of the services amount of medical institutions by MHW; and the community economic and demographic statistical data were from the Ministry of Interior.

(B) Variable Definition and Measurement

We elaborated on the definitions of the dependent variables of regression analysis (medical social services expenditure, educational research and development expenditure, and community benefit services expenditure) and independent variables (policy variable, hospital production capacity, debt amount, the population of the elderly people and market concentration, etc.).

(1) Measurement of dependent variables

This study used educational research and development expenditure, medical social services expenditure and the added community benefit services expenditure of the

previous two items as the dependent variables, and the definitions were elaborated as shown below:

First, medical social services expenditure: charity medical care is the major work of non-profit hospitals, and is mostly recognized by society; it is often the social purpose as claimed by non-profit hospitals. Theoretically, medical social services is meant to provide residents lacking in medical resources with necessary medical services, prevention and control of communicable diseases and other community-based medical practices; however, in practice, hospitals will often classify items that cannot receive cash payments as free medical expenditure. Providing free medical and community health services can improve hospitals’ reputation, but reduce their net profits

Second, educational research and development expenditure: In theory, community benefit services should focus on educational research and development for the direct benefit of the community. The non-normal and unnecessary training or training and educational activities for business expansion should be excluded. In practice, hospitals often classify necessary normal training as teaching and research expenditure. The educational research and development expenditure includes expenditure on instruments and equipment investment, research project grants to doctors, and teaching activities.

Third, community benefit services expenditure: is the sum of the medical social services expenditure, and educational research and development expenditure.

(2) Measurement of Independent Variables

This study investigated the changes in the behavior of non-profit hospitals in engaging in community benefit services after the amendment of the Medical Care Act in 2004. According to Proportions I and II, we used dummy variables to measure the annual variables and the non-profit hospital variables in line with the provisions of the Medical Care Act. The control variables include hospital production capacity, debt amount, hospital assessment level, community poverty, unemployment rate, the population of the elderly people and market concentration.

First, law amendment policy variable (LawCh): this study investigated the impact of the amendment of the Medical Care Act 2004 in changing the amount of the community benefit services, on the behavior of non-profit hospitals in engaging in medical community services activities, educational research activities and community benefit services. We used the dummy variables to measure the behavior before and after the law amendment; when the data year is 2004 and any year after 2004, the LawCh is

set as 1, otherwise, LawCh is set as 0.

Second, high expenditure hospitals (greater than standard, GreThanSt): based on the establishment principles and/or environment of non-profit hospitals, they are likely to provide more medical community services activities and/or educational research. Regarding the medical community services activities, educational research activities and community benefit services, this study used the dummy variables to set high expenditure hospitals on medical social services, high expenditure hospitals on education and research and high expenditure hospitals on community benefit services. When the uncompensated care services expenditure (educational research and development expenditure, community benefit services expenditure ) was above 10% (10% and 20%) of annual medical net profit in 2001-2003 (not excluding educational research and development expenditure medical social services expenditure ) more than twice, the variable of GreThanSt =1; otherwise, GreThanSt=0.

Third, the multiplication item of the law amendment policy variable and non-profit high expenditure hospitals on welfare (LawCh * GreThanSt): this study investigated whether the non-profit high expenditure hospitals on welfare would change their expenditure on medical community services activities, educational research activities and community benefit services after the amendment of the Medical Care Act 2004. In this study, the law amendment policy variable (LawCh) was multiplied by the variable of non-profit high expenditure hospitals on welfare

(GreThanSt).

In addition, non-profit hospitals engaging in community benefit services are subject to the influence of other factors. For this reason, this study controlled the characteristics of non-profit hospitals and market characteristics. The hospital characteristic variables include hospital production capacity, debt ratio and medical assessment level. The variables are shown below:

Third, hospital production capacity (TR): the amount of community benefit services provided by the non-profit hospitals is limited by hospital production capacity. The commonly used variables to measure capacity include fiscal capacity and physical capacity. The dummy variables of fiscal capacity include: total revenue, medical revenue, medical net revenue and medical profitability; the dummy variables of physical capacity include number of beds (Schneider, 2004; Dyl, Frant and Stephenson 2000; Gaskin 1997; Morrisey et al., 1996; Mann et al., 1995; Frank and Salkever 1991)

and approximate number of medical staff (Dyl, Frant and Stephenson 2000). Previous studies suggested that total revenue, medical revenue, number of beds and approximate number of medical staff have a positive impact on free medical care (Dyl, Frant and Stephenson 2000). However, medical net revenue and free medical care are positively correlated (Frank, Salkever and Mitchell 1990) or not correlated (Gaskin 1997; Frank, Salkever and Mitchell 1990). Since the samples of this study include medical inspection centers, we used total revenue as the proxy variable of production capacity.

Fourth, debt ratio (DEBT): Traditional financial theory holds that debt can solve the agency problem between the manager and shareholders in profit-making organizations. If the debt amount is higher, to maintain the fixed interest expenditure, the manager will reduce privileged consumption and agency cost, and improve organizational performance. However, non-profit hospitals’ long term objective is not profit but community benefit services; the increase in debt amount will not reduce non-profit hospitals’ agency cost; increased community benefit services will increase the expenditure on the fixed interest to crowd out the resources of community benefit services (Magnus, Smith and Wheeler 2003). American empirical studies found that increased debt amount has a crowding out effect on free medical care (Magnus, Wheeler and Smith, 2004). However, the empirical studies in Taiwan suggested that debt has a crowding effect on community benefit services (Kuo, Ho and Lo, 2006). According to the inferences of Magnus, Smith and Wheeler (2003), this study measured the debt ratio by the ratio of the long term liabilities against total assets, expecting that debt ratio has a crowding out effect on community benefit services.

Variables of market characteristics: to measure the demand on community benefit services of local residents and the competitiveness of medical area. The relevant variables are as illustrated below:

Six, the demand on community benefit services of local residents: the community residents need charity medical care and community benefit services because of the lack of medical insurance, or insufficient insurance, or poor economic capabilities. In past studies, the direct measurement of residents lacking in medical insurance often used the local population’s proportion of elderly people (65 years old and above), local residents’ regular income and the local unemployment rate as dummy variables. As the elderly and the unemployed are out of the employment arena, they have no medical insurance provided by jobs; thus, the demand on charity medical care will increase. When the

residents’ regular income is lower, the capability for paying for medical insurance and purchasing additional insurance is lower; thus, the demand for free medical care is higher (Schneider, 2004). This study adopted the variable of the population’s proportion of those 65 years of age and above, expecting that the population of the elderly people and medical social services expenditure are positively correlated. It should be noted that the government pays for the insurance fee of the elderly people, the unemployed and the low income people since the implementation of health insurance. The regression coefficient’s significance level will be reduced.

Seven, medical care market concentration (HHI): the higher concentration of medical care market will reduce the competition among hospitals, so that the local hospitals can have higher profits (monopoly rent); conversely, if the medical care market concentration is lower, the competition between hospitals will increase and the profits of the hospitals will be lower. If the decision-making of non-profit hospitals is altruistic, the non-profit hospitals will pursue the maximization of overall social welfare, and thus tend to invest the remaining operating resources in community benefit services. If the medical care market concentration is higher, the monopoly rent of non-profit hospitals will be higher and the resources for community benefit services will be greater; conversely, if the medical care market concentration is lower, the resources for community benefit services will be fewer. Past studies suggested that market concentration and free medical care have no definite correlation (Rosko 2004; Davidoff, LoSasso, Bazzoli and Zuckerman 2000; Gaskin 1997; Mann et al., 1995; Thorpe and Phelps, 1991; Frank and Salkever 1991). This study used the Herfindahl-Hirschman Index to measure the level of bed concentration of Level 2 medical areas as the dummy variable, i.e. the market concentration is the square of the market shares of the number of beds of all hospitals in Level 2 medical areas. This study expects that the non-profit hospitals’ medical social services expenditure and market concentration are positively correlated.

Eight, year trend: year trend can capture the changes in the behavior of non-profit hospitals in regard to medical relief, educational research activities and community benefit activities over time, and medical industrial factors. The values of the variable of year trend during 2000-2008 are 1, 2... 9, respectively.

This study used the least squares dummy variable model (LSDV) for regression analysis; the empirical model is as shown below:

D ) ( * ) ( ' ,it 3 2 1 it j ct it kit t kit t

kit LawCh GreThanSt LawCh GreThanSt X Z u

Y

The dependent variables include: Ykit, which is the medical social services expenditure, educational research and development expenditure, and the community benefit services expenditure, which is the sum of the above two items,. Dju,it is the

dummy variable of individual non-profit hospitals: when i=j, it is 1; otherwise, it is 0. Where Du,it=(D1u,it,..., DNu,it)', u=(u1, ..., uN)'. ɛit is the random item. LawCht is the

variable of law amendment. In the year after the law amendment in 2004 (including 2004), LawCht=1; otherwise, it is 0. GreThanStkit is the dummy variable of the non-profit high expenditure hospitals on welfare. The dependent variables include high expenditure on medical community services, high expenditure on education and research, and high expenditure on community benefit services. When a non-profit hospital is of high expenditure on medical community services (high expenditure on education and research, high expenditure on community benefit services),

GreThanStkit = 1; in other cases, GreThanStkit = 0.

H1 aims to test whether non-profit hospitals’ expenditure on medical community services activities and other community benefit services will be reduced after the law amendment. After the estimation model (1), LawCht regression coefficient can be used to confirm the change in non-profit hospitals’ community benefit services expenditure after the law amendment. When β1<0, it supports H1, namely, the agency theory can be used to explain the behavior of the non-profit hospitals.

H2 aims to predict if the non-profit high expenditure hospitals on welfare will reduce medical community services activities and other community benefit services expenditure after the law amendment. H2 can be verified by the regression coefficient of the multiplication item of GreThanStkit and LawCht. When β3 <0, it supports H2, namely, the agency theory can be used to explain the behavior of the non-profit hospitals.

Xit is the control variable of hospital characteristics (facility-specific control

variables). In the past studies, the variables include: 1. non-profit hospital size: previous studies (Schneider, 2004; Morrisey et al., 1996; Mann et al., 1995) found that the provision of charity medical care has a size effect. This study used the total revenue as the proxy variable of size. 2. Non-profit hospital debt ratio: this study used the ratio of

long term liabilities against total assets to measure the financing amount of the non-profit hospitals from financial institutions.

Zct is the market characteristics of c market in year t (county market

characteristics), which will affect the level of hospitals providing charity medical care. 1) Poverty rate, unemployment rate and the population of the elderly people will affect the demand on charity medical care (Schneider, 2004). This study used the 65 years old and above population proportion (AGE65) to measure the demand on charity medical care of people without insurance. 2) If the market concentration is higher, the local non-profit hospitals can enjoy monopoly rent. If the non-non-profit hospitals have altruistic behavior, they can provide more charity medical care (Thorpe and Phelps, 1991; Mann et al., 1995). This study added up the square of the market share (number of beds) of hospitals with Level 2 medical area to calculate Herfindahl-Hirschman Index (HHI). This study used the variable of the number of beds to measure the market share. 3) The values of the variable of year trend (YEAR) in 2000-2008 are 1, 2... 9, respectively.

To fit the new policy, the non-profit hospitals may gradually adjust their behavior after the law amendment; therefore, this study deleted the data after 2004 for regression analysis as the sensitivity analysis.

5. Data Source and Statistical Survey Statistical Survey

Table 1 illustrates the statistical survey of 41 non-profit hospitals during 2001-2008. First, the average uncompensated care services expenditure is 39.64 million NTD, which is lower than the standard deviation of 851,100 NTD. After the law amendment in 2004, the average expenditure increased slightly, from 38.68 million NTD to 40.21 million NTD, and the standard deviation also increased. Second, the average educational research expenditure is 109.70 million NTD, which is lower than the standard deviation of 267.70 million NTD. After the law amendment in 2004, the average expenditure increased slightly, from 10.05 million NTD to 111.89 million NTD, and the standard deviation also increased. Third, the average community benefit services expenditure is 149.47 million NTD, which is lower than the standard deviation of 344.65 million NTD. After the law amendment in 2004, the average expenditure increased slightly, from 145.07 million NTD to 152.11 million NTD, and the standard deviation also increased. The standard deviations of the three items are higher than the

average value, indicating that the community benefit services expenditure varies greatly between medical institutions. Fourth, the average total revenue is 3,453 million NTD, and the standard deviation is 7,623.40 million NTD. Fifth, the average debt ratio is 0.3867, suggesting that 38.61% of the total assets of non-profit hospitals stem from debt financing on average. Sixth, the average 65 years old and above population proportion is 0.0999, suggesting that 9.99% population is above 65 years old. Seven, the average value of the variable of market concentration is 0.0651.

6. Empirical Results

This study used the LSDV model for regression analysis by using uncompensated care services expenditure, educational research expenditure and community benefit services expenditure as dependent variables. The independent variables include law amendment policy variable (LawCh), the multiplication term of non-profit hospitals with high expenditure on welfare (GreThanSt), LawCh and GreThanSt, total revenue (TR), debt ratio (DEBT), 65 years old and above population proportion (AGE65), market concentration (HHI) and year trend (TIME).

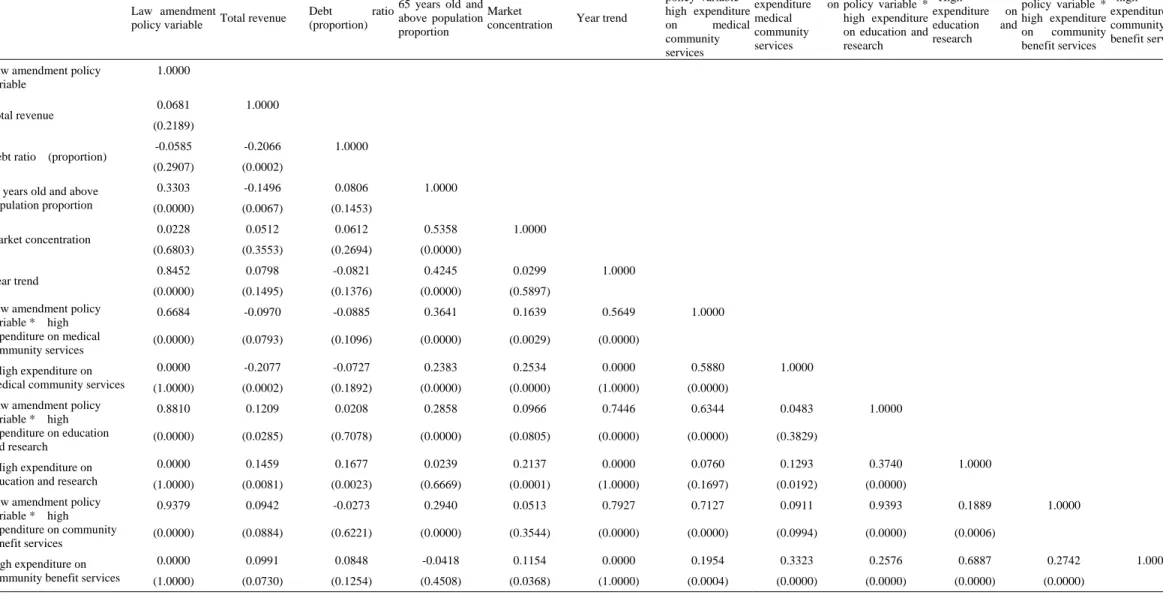

Regarding the co-linearity and heteroscedasticity, in the respect of co-linearity, it can be found from the Pearson correlation coefficient, as shown in Table 2, that correlation coefficients of the law amendment policy variable and the multiplication item of the law amendment policy variable, and non-profit high expenditure hospitals on welfare (non-profit hospitals with high expenditure on education and research, non-profit hospitals with high expenditure on community benefit services) are 0.8810 and 0.9379, respectively; the correlation coefficient of the law amendment policy variable and year trend is 0.8452; and the rest of the correlation coefficients are lower than 0.8. In addition, regarding the calculation of variance expansion coefficient (variance inflation factor), except for the dummy variable of individual non-profit hospitals and the dummy variable of law amendment variable, the variance expansion coefficients of various variables are below 5.68, suggesting that the co-linearity level of independent variables is within the tolerable range; in the respect of heteroscedasticity, we used Breusch-Pagen to test the null hypothesis that the residual item is the variance with the same nature. The Chi-square distribution statistics of regression equations of the uncompensated care services expenditure, educational and research expenditure and community benefit services expenditure are 129.63, 1446.57,

741.19, respectively, indicating that the three regression equations can reject the null hypothesis at the 1% significance level. To control the possible non-independent effect of non-profit hospitals in different years, we used the non-profit hospitals to set clusters (Froot, 1989). The regression results are shown in Table 2.

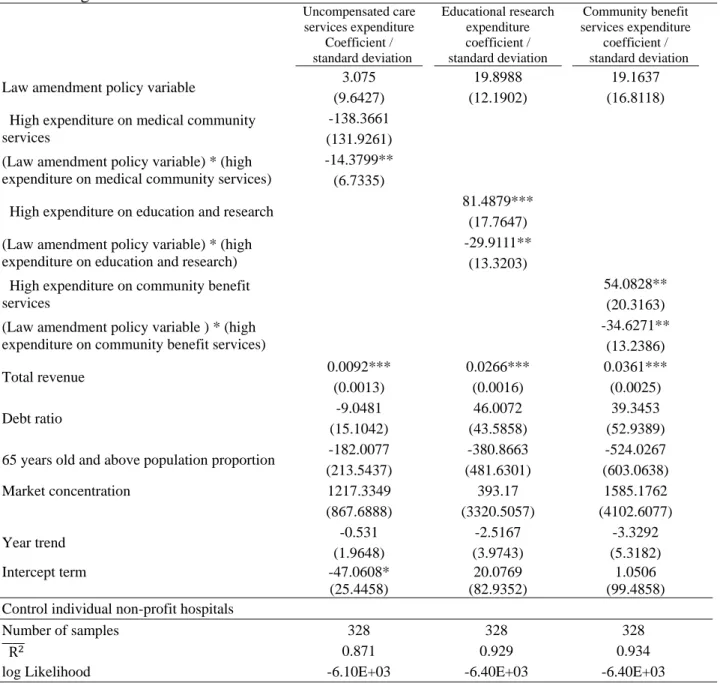

Regarding the regression analysis of the uncompensated care services expenditure, first, the regression of the law amendment policy variable (LawCh) is 3.075 million NTD, and the null hypothesis cannot be rejected at the 10% significance level. This suggests that the expenditure of non-profit hospitals on medical community services has not significantly changed after the law amendment. Therefore, H1 is not supported. In other words, the behavior of non-profit hospitals in uncompensated care services expenditure does not support the agency theory. Although the amount set aside for the expenditure on medical community services activities after law amendment is reduced, it may reduce the amount set aside for the expenditure on the medical community services activities. However, after the law amendment, the discretionary power of the amount set aside for the medical community services activities or educational research activities has become smaller, and the amount set aside for the medical community services activities and educational research activities should be at least 10% of the profit from medical operation. Hence, non-profit hospitals which previously tended to invest resources in educational research activities may increase their expenditure on medical community services. Hence, due to the trade-off result, the overall uncompensated care services expenditure will undergo no significant changes after the law amendment; second, high expenditure on medical community services (GreThanSt) regression coefficient is -138.3661 million NTD, and it cannot reject the null hypothesis that regression coefficient is zero at the 10% significance level. This suggests that the medical institutions of high expenditure on welfare expenditure (medical social services) will spend no more than other medical institutions will because non-profit high expenditure hospitals on medical community services will reduce uncompensated care services expenditure after the law amendment. However, the medical institutions of non-high expenditure on medical community services will increase uncompensated care services expenditure. The changes of the two types of medical institutions in uncompensated care services expenditure differ. Hence, the non-profit high expenditure hospitals on medical community services are not different from non-profit hospitals with high expenditure on uncompensated care services expenditure. Third, the

regression coefficient of the multiplication item of the law amendment policy variable and the variable of non-profit, high expenditure hospitals on medical community services (LawCh *GreThanSt) is -14.3799 million NTD, and it can reject the null hypothesis that non-profit high expenditure hospitals on medical community services will significantly reduce expenditure at the 5% significance. Hence, H2 is supported. Fourth, total revenue (TR) regression coefficient is 0.0092, and it can reject at the 1% significance level the null hypothesis that the regression coefficient is zero. This suggests that when the size of the non-profit hospital is bigger, the amount invested in medical social services will be higher. Fifth, debt ratio (DEBT) regression coefficient is negative as expected; however, it cannot reject at the 10% significance level the null hypothesis that the debt ratio has no impact on the uncompensated care services expenditure. Namely, it cannot verify whether debt has any crowding out effect on non-profit hospitals. Sixth, the regression coefficient of the market concentration (HHI) is significantly positive; however, it cannot at the 10% significance level reject the null hypothesis. Finally, the regression coefficients of the variables of 65 years old and above population proportion and year trend have not reached the significance level.

Regarding the regression analysis of the educational research expenditure, first, the regression coefficient of the variable of the law amendment policy (LawCh) is 19.8988 million NTD, and it cannot reject the null hypothesis at the 10% significance level. This suggests that the non-profit hospitals’ educational research expenditure has not significantly changed and H1 is not supported. Namely, the behavior of non-profit hospitals, setting aside educational and research expenditure, does not support the agency theory. Second, the regression coefficient of non-profit high expenditure hospitals on education and research (GreThanSt) is 81.4879 million NTD, and it can, at the 1% significance level, reject the null hypothesis that the regression coefficient is zero. This suggests that the expenditure of non-profit high expenditure hospitals on education and research is significantly higher than that of other non-profit hospitals. Third, the regression coefficient of the multiplication term of the law amendment policy variable and non-profit high expenditure hospitals on education and research (LawCh *GreThanSt) is -29.91111 million NTD, and it can, at the 5% significance level, support H2, i.e., non-profit high expenditure hospitals on education and research significantly reduce educational research expenditure after the law amendment, so that the agency theory can explain the behavior of non-profit high expenditure hospitals on education

and research. Fourth, total revenue (TR) regression coefficient is 0.0266 at the 1% significance level, rejecting the null hypothesis that the regression coefficient is zero. This suggests that if the size of the non-profit hospital is greater, the amount invested in medical social services will be higher. Finally, the regression coefficients of all the rest of the variables have not reached 10% significance level; thus, we did not illustrate the variables in this article.

Regarding the regression analysis of the community benefit services expenditure, first, the law amendment policy variable (LawCh) regression coefficient is 19.1637 million NTD, and it cannot, at 10% significance level, reject the null hypothesis. This suggests that the non-profit hospitals’ community benefit services expenditure has not significantly changed, and H1 is not supported, namely, the behavior of non-profit hospitals setting aside the community benefit services expenditure does not support the agency theory. Second, the regression coefficient of non-profit high expenditure hospitals on community benefit services (GreThanSt) is 54.0828 million NTD, and it can, at the 1% significance level, reject the null hypothesis that the regression coefficient is zero. This suggests that the community benefit services expenditure of non-profit high expenditure hospitals on community benefit services is significantly more than non-profit hospitals. Third, the regression coefficient of the law amendment policy variable and the variable of non-profit high expenditure hospitals on community benefit services (LawCh *GreThanSt) is -34.6271 million NTD; at the 5% significance level, it can reject the null hypothesis that regression coefficient is zero; thus, H2 is supported, namely, the non-profit high expenditure hospitals on community benefit services will significantly lower community benefit services expenditure after law amendment. Hence, the agency theory can explain the behavior of non-profit hospitals. Fourth, the regression coefficient of total revenue (TR) is 0.0361 million NTD, suggesting that greater size of the non-profit hospital can result in more expenditure on educational research. Finally, the regression coefficients of other variables have not reached the 10% significance level; thus, we did not illustrate the variables in this article.

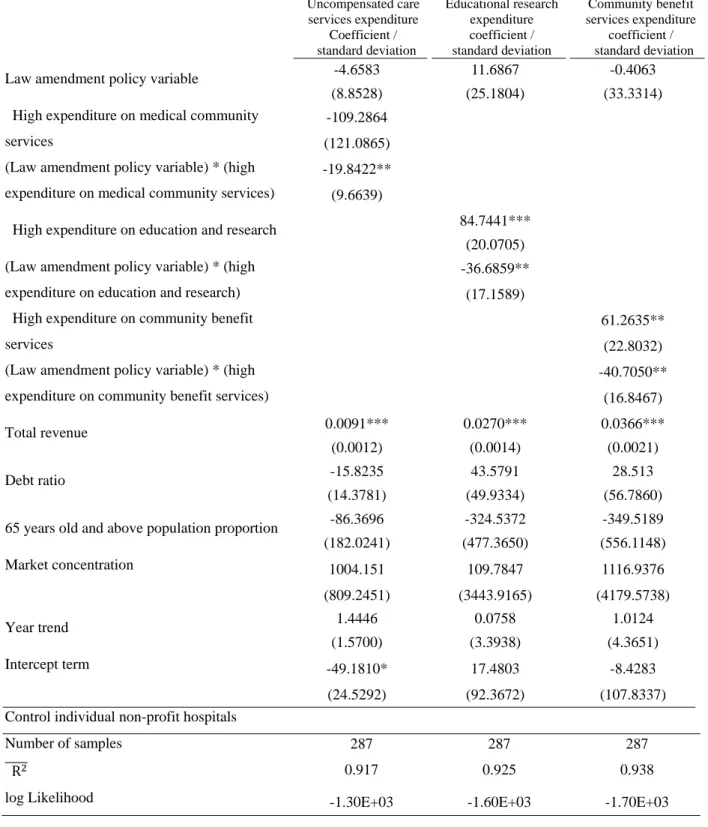

When faced with new legal requirements, it may take time for the non-profit hospitals to adjust their behaviors. To reduce the possible impact of behavior adjustment, this study deleted the data of 2004 and conducted the regression analysis as the sensitivity analysis. The regression results are shown in Table 3. By comparing the results shown in Tables 3 and 2, only some regression coefficients are slightly

different, and the directions and significance levels are consistent with the results shown in Table 3.

In summary of the above regression results, the amendment of the Medical Care Act in 2004 to change provisions of community benefit services can lead to the following results: first, the law amendment reduces the standards for non-profit hospitals to engage in charity medical care and other activities of community benefit services. However, it does not significantly reduce uncompensated care services expenditure, educational research expenditure and community benefit services expenditure, H1 is not supported. Second, non-profit high expenditure hospitals (non-profit high expenditure hospitals on medical community services, non-(non-profit high expenditure hospitals on education and research, or non-profit high expenditure hospitals on community benefit services) will reduce charity medical care and other activities of community benefit services expenditure (uncompensated care services expenditure, educational research expenditure or community benefit services expenditure ), indicating that the law amendment lowers the standards for setting aside the amount and the non-profit high expenditure hospitals will reduce charity medical care and other activities of community benefit services expenditure, so that H2 is supported. Finally, non-profit high expenditure hospitals on education and research, and non-profit high expenditure hospitals community benefit services spend more on educational research activities expenditure and community benefit services expenditure than other non-profit hospitals do. However, the uncompensated care services expenditure of non-profit high expenditure hospitals on medical community services is not continuously higher than other non-profit hospitals because non-profit high expenditure hospitals on medical social services will reduce uncompensated care services expenditure, and other non-profit hospitals will increase uncompensated care services expenditure. Therefore, non-profit high expenditure hospitals on medical community services will not be significantly different in uncompensated care services expenditure from those of other non-profit hospitals. In summary of the empirical results of this study, the agency theory can better explain the behavior of non-profit hospitals than the altruism theory can.

7. Conclusion

in 2004 to change the amount set aside for medical community services activities and educational research activities on their uncompensated care services expenditure, educational research expenditure and community benefit services expenditure. The changes regarding the amount set aside for such activities include: first, the calculation basis is changed from medical revenue to profit from medical operation. As the profit from medical operation are the deduction of the net medical revenue by medical cost and management expenditure, the calculation basis is considerably reduced. Second, the percentage of the amount is changed from 5% of the net medical revenue to 20% of the profit from medical operation. Although the percentage is higher, the amount should be lower, as the basis for setting aside the amount is considerably reduced. Third, regarding the limitation on the use of resources for programs, before the law amendment, non-profit hospitals could use the resources according to organizational objectives and community needs in different programs of community benefit services. By comparison, after the law amendment, the resources should be used in a scattered way and the resources cannot be used for a few specific purposes.

This study used the 2001-2008 data of 41 non-profit hospitals to analyze the impact of the amendment of Medical Care Act in 2004 to change the standards for setting aside the amount for community benefit services expenditure on their uncompensated care services expenditure and educational and research expenditure. The empirical results show that the impact of the amendment of Medical Care Act in 2004 to change the standards for setting aside the amount for community benefit services expenditure on the behavior of non-profit hospitals include: first, the law amendment reduces the standards for the non-profit hospitals to engage in charity medical care and other activities of community benefit services, but does not significantly reduce the uncompensated care services expenditure, educational research expenditure and community benefit services expenditure ; thus, fail to reject the null hypothesis. This may be caused by the fact that most non-profit hospitals did not abide by the provisions of the Medical Care Act before the law amendment. Therefore, the MHW has strengthened the inspections, and it will increase the expenditure of non-profit hospitals on charity medical care and other activities of community benefit services. Second, non-profit high expenditure hospitals on medical community services, non-profit high expenditure hospitals on education and research and non-profit hospitals with high community benefit services will reduce uncompensated care