行政院國家科學委員會補助專題研究計畫成果報告

※※※※※※※※※※※※※※※※※※※※※※※※

※

※

※

資訊不對稱與融資契約設計之研究

-重設選擇權之應用

※

※

※

※※※※※※※※※※※※※※※※※※※※※※※※

計畫類別:þ個別型計畫 □整合型計畫

計畫編號:NSC89-2416-H-002-069-

執行期間:89 年 8 月 1 日至 89 年 7 月 31 日

計畫主持人: 李存修 教授

共同主持人: 葉銀華 教授

執行單位:國立臺灣大學財務金融學系

輔仁大學國際貿易與金融學系

中 華 民 國 九 十 年 八 月 三 十 一 日

Financing Contr act under Infor mation Asymmetry:

An Application of Resettable Convertible Bond

Lee, Tsun-sioua, Yin-hwa Yehband Mei-hwie Yanga*

Preliminary Draft July 31, 2001

Abstract

We first discuss the problem of information asymmetry between money demanders and capital lenders, which may cause the stagnation of fund raising activities. With a financing contract that changes the conversion ratio according to the performance of the borrower the lemon delimma can be solved. The financing contract can be applied to the fund raising between venture capitals and start-up firms as well as between banks and SMEs. This contract will help the borrowers to raise fund at fair price and at the same time capital lenders are relieved of possible losses resulted from adverse selection.

We also develop a pricing model for the financing contract by integrating the CB pricing model of trinomial tree structure with an algorithm on reset option. Default risk is also taken into account. For the private companies without public stock prices, we employ EPS and P/E ratio to estimate the conversion value. The pricing model enjoys stable convergence and computational efficiency.

I. Introduction

A venture capital is a fund management company specialized in investing on start-up

a Graduate Institute of Finance, National Taiwan University

b Department of International Trade and Finance, Fu-jen Catholic Unviersity

* The authors would like to thank National Science Council of Taiwan, ROC for the financial support under

NSC89-2416-H-002-069 project. Corresponding author: Tsun-siou Lee

Department of Finance, National Taiwan University No.50, Lane144, Keelung Rd. Sec.4, Taipei, Taiwan, 106 e-mail:tsunsiou@mba.ntu.edu.tw

companies. Capital is injected into infant companies which are deemed promising. A venture capitalist also plays the role of a consultant when the invested companies face difficulties. The investment is beneficial to both sides. On one hand, with sufficient resources to fuel their research, a start-up firm can concentrate on expanding its business without being pulled back due to the lack of financial supports. On the other hand, once the invested firm becomes a hit, the venture capital, as a shareholder, will make a windfall profit from the rocketing stock price.

However, information asymmetry between venture capitalist and management of the invested firms holds back the investment activities. A detailed study of today’s venture capital industry indicates that among the investments that venture capitals make, the percentage of the investment on new companies at start-up and seed-growing stages is rather low (30%) comparing to those in maturing as well as expanding phases (70%).1 It

shows that speculative behavior in management resulting from information asymmetry reduces the willingness of venture capitals to invest in start-up firms. Even when venture capitalists agree to invest, for self-protection they are prone to set strict clauses, such as equity participating in low price, on the financing contract. Such a contract may be rejected by firms with good constitutions, yet the venture capitals can hardly tell. This situation leads to the lemon dilemma between the two parties.

The same problem also exists in the small and medium enterprises (SMEs). As we know, SMEs have been playing an important role in may emerging economies both as export creators and as employment providers. However, SMEs have difficulties raising funds from capital and money markets. They don’t have adequate accounting systems and their credibility of financial statements is yet to be established. Banks thus have more lending risk and concern with the problem of moral hazard. For those SMEs who do not have sufficient collateral for the loans, they may be charged with high interest rate from the lending party and hence lose the will to implement new programs. Therefore, it is crucial to develop a financing contract that overcomes the problems caused by information asymmetry so that capital can be efficiently injected into the star-up high-tech companies and SMEs. For example, Yeh, Ko,and Lee(1999) design an incentive-based financing contract for SMEs, which is a loan contract with lower interest rate plus an option to share future profit.

Lee,Yeh, Chiu, and Shao(2001) showed that convertible debt with embedded reset option can solve the lemon problem from information asymmetry. With a mechanism that

Fax:886-2-23633269

1For more details, please refer to 1999 Venture Capital Industry Annual Report, published by Taiwan Venture

changes the conversion ratio of contract according to the realized performance of a certain period, capital lenders are relieved of loss that results from adverse selection, and the financing cost of a company is adjusted. Detailed discussion on this topic will be presented in the next chapter.

The main purpose of this paper is to develop the concept of financing contracts mentioned above into a workable framework of financial instrument and to price the financing contracts using the techniques of financial engineering. Before engaged in model building, we will discuss the concept of financing contract and how it works to mitigate the problem of information asymmetry in Section II. Section III constructs the pricing model for the financing contract with the technique of financial engineering. Section IV presents a brief case to which the pricing model is applied together with some sensitivity analysis. Section V concludes the research and proposes possible extensions.

II. The Financing Contract

Compared with management’s advantageous position of possessing more information about the operating performance or new investment opportunities, investors are on the weak side. For self-protection, they may be hesitate to invest in the common shares.

For that reason, the problem of information asymmetry between money demanders and capital providers is an important issue to be solved by financial researchers. Many approaches have been proposed to solve the problem through designing financing contracts that are able to efficiently distinguish the qualities of companies who have capital demands. Ross (1977) pointed out the signal effect of debt issuance. A company with good quality will raise fund by debt because it has the ability to clear off debt and there is little chance of getting into financial distress. Myers and Majluf (1984) showed that equity issue is usually greeted by negative stock-price response for investors often interpret it as a signal of stock overvaluation.

Stein (1992) stated the separating equilibrium in respect to different conditions: good firms issue debt, bad firms issue equity, and medium firms issue convertible bonds. A medium firm with lower uncertainty of future cash flow does not want to issue equity because of the negative influence on its stock price, and straight debt is also unattractive because of the cost of financial distress. A convertible allows a medium firm to change equity into capital, at the same time conveying a more positive message to the market. Nevertheless, this model may not be practicable in the real world due to the oversimplified assumptions. Even so, convertible bonds do represent an indirect mechanism for implementing equity financing that alleviates the adverse-selection costs associated with direct sales. That is why Stein(1992) claimed that convertible bonds are the backdoor to

equity financing.

Lee, Yeh, Chiu and Shao(2001) provide a simple model to show that Stein’s (1992) separating equilibrium under information asymmetry does not exist if companies of medium quality have the potential of becoming good firms, and the management of the firms with new projects may commit embezzlement. Venture capitalists will not be able to distinguish target firms’ quality through the choices of financing instruments by the firms’ manager under these circumstances. Lemon dilemma would prevail and good firms would be undervalued2.

Two scenarios can happen if debt financing is chosen by the medium firms. Under scenario 1 in which the medium firms turn into good firms. In this case the face value of debt will be repaid to the debtholders for sure, making the present value of the debts equal to the fund originally raised. No mispricing occurs. Under scenario 2 where the medium firms remain medium, The benefit of issuing debt is less than the expected cost of financial distress. As a result, if the management of medium firms realize that they will remain medium, debt issuance would prove to be a mistake. On the investors’ side, if they find out that medium firms are always medium firm, they would be more cautious in monitoring the management. The management, being afraid of more severe surveillance, and being reluctant to incur the cost of financial distress may choose to embezzle at most the amount equal to the difference between initial investment and fired cost3.

In both scenarios we find that the management gains at the expense of outside investors so that medium firms will mimic good firms to choose debt offering at the beginning. Stein’s (1992) separating equilibrium fails to exist between good and medium firms as both groups of firms behave exactly the same, i.e., they both issue debts.

It follows that firms issuing ordinary debts may or may not be good firms in the eyes of potential outside investors. Debts are not acceptable by rational investors. What would good firms do if the only way of funding at fair terms (issuing debts) is not acceptable to outside investors? Since internal funds are insufficient, leaving convertible debt or equity the only sources of external funding. Rational outside investors would accept convertible debt and equity offerings of firms of medium quality or better, provided that both the convertible debt and equity are offered at the terms of medium firms. The investors would also accept the equity offered by bad firms, if they are fairly priced at the terms of bad firms. The problem of adverse selection emerges as an obstacle for investors to buy ordinary debts

2 Lee, et al.(2001) assume that the expertise of venture capitalists enables them to separate bad firms at the

very beginning.

3 Other than embezzlement, the management personally may also transact with the firm in favor of themselves,

for the fear of defaults and moral hazard. Good firms are mostly discriminated against under information asymmetry.

Lee et al.(2001) further investigate how this lemon dilemma can be solved and what types of financing contracts will let all types of firms receive fair terms of financing and at the same time mitigate the fear of the potential investors. The solution depends on a design of convertible debts with reset option. The initial conversion ratio is set as if the issuing firm is of medium type4. As private information becomes public, information asymmetry

disappears. The conversion ratio is allowed to reset once based on the outcome. It the firm turns out to be of medium type, then the conversion ratio stays at its initial level, otherwise the conversion ratio will be reset downward since the issuer has proved itself to be of good type. In both cases, the contract terms though may be unfair to good issuers at the beginning, become fair to all parties involved after resetting.

A financing contract so designed can be applied to fund raising between banks and SMEs as well as between venture capital and start-up companies. Banks may replace the traditional tool of loan making, i.e. debt, with this convertible debt contract with embedded reset option, and venture capitals may make it an alternative to equity participating. With the financing contract, although banks undertake the same risk as that of traditional debt, they share the future return of the borrower through conversion and get equity participating after a certain period of time. When the risk assessment of a borrower indicates that the firm has a growth potential, it would be beneficial for the lenders to have a long-term relationship with the firm.

As to venture capitalists, they acquire better protections since debt has a superior priority to discharge, and they can still be stockholders after exercising the conversion option. The reset scheme is appealing to those firms who are trying to raise fund at a fair price to implement some profitable project. It effectively lowers the borrower’s cost and increases the probability of future success. Because the lender’s profit is tied to the future success of the borrower, the lender will have a stronger motivation to assist the borrower to establish good accounting information system and to provide reliable financial consulting services so as to improve business operation and reduce information asymmetry.

III. The Pricing Model

The financing contract discussed in the previous sections is a convertible debt with reset option. Hence to understand the contract, it is essential to consider existing models for convertible bond pricing and reset option valuation.

A. Convertible Bond Pricing -Credit Risk is Introduced

The valuation of convertible bonds was first introduced in 1960’s. The idea was to compare the conversion value and the straight bond value at a certain point of time and discount the greater of the two. However, the model didn’t take into account earlier conversions nor did it consider the call and put provisions of convertible bonds and thus was overly simplified.

A contingent Claim approach to valuation of convertible bonds appeared in the late 1970’s. Ingeroll (1977), Brennan and Schwartz (1977) proposed similar valuation models in which the price of a convertible bond depends on one underlying variable: the firm value. This underlying variable is assumed to follow a diffusion-type stochastic process, and the price of the convertible bond is derived from solving the resulting partial differential equation under appropriate terminal and boundary conditions.

Brennan and Schwartz (1980) extended their previous work to allow for uncertainty inherent in interest rates by introducing the short-term risk-free interest rate as an additional stochastic variable. As a result, the model captures the stochastic nature of interest rate and the impact of the correlation that is likely to exist between firm value and the risk-free interest rate. Comparing the two-factor model with the one-factor model developed in 1977, they found that the results were not conspicuously different if the interest rate didn’t fluctuate too much. This is an important discovery that has often been quoted to support the use of one factor model. McConnell and Schwartz (1986) used stock price as an underlying variable to price LYON (Liquidity Yield Option Note). Their approach is more practical and workable in valuing securities whose underlying is stock rather than those whose underlying is firm value. However, default risk is neglected in McConnell and Schwartz(1986) since stock price can never go negative.

An important implication in CB pricing comes from the fact that the value of a CB has components of different default risks. Tsiveriotis and Fernandes(1998) pointed out that the part of a CB’s value that is related to future payment in cash should be valued by credit risk rate. They created a new formulation of CB valuation as a system of two coupled Black-Scholes equations: ) 1 ( 0 ) ( ) ( 2 2 2 2 2 = + -¶ ¶ + ¶ ¶ + ¶ ¶ v r r v u r S u S r S u S t u c g s ) 2 ( 0 ) ( 2 2 2 2 2 = + -¶ ¶ + ¶ ¶ + ¶ ¶ v r r S v S r S v S t v c g s

where

S is the price of the underlying stock

u

is the value of CBv

is the cash-only part of CBr

is the risk-free rateg

r is the growth rate of the stock

c

r is a credit spread reflecting payoff risk

Equation (1) and (2) are the same except for their discounting terms

v r r and v r r v u

r( - )+( + c) ( + c) . We know that CB can be converted into equity or receive cash flow just like straight bonds during the holding period. The former has a zero default risk since the issuer can always deliver its own stock, and thus in this part (u - isv) discounted by the risk-free rate

r

. On the other hand, the latter depends on the issuer’s timely access to the required cash amount, so for this part, (r +rc) is used as the discounting factor. These two equations reflect the different credit treatments of cash payments and equity upside potentials. Our pricing model will also take into account possible default risk involved.B. Using Trinomial Tree to Deal With Reset Clauses

In our financing contract, a reset option is included so that borrowers can readjust their conversion ratio according to their performance. Due to the complexity of derivatives, numerical procedures are often employed to evaluate them when exact formulas are not available. They include trees, Monte Carlo simulation, and finite difference approaches. We will adopt trees to price the financing contract for its ease of implementation.

Before discussing how the reset clauses are to be handled by tree models, we first discuss barrier option pricing because reset option is a special case of barrier option. Boyle and Lau(1994) first noted the problem of misalignment that causes saw-toothed convergence. They developed a formula to pick up the proper partition n to make the barrier hit exactly on the note of a binomial tree. However, it loses the flexibility of partition variable n. Derman, Kani, Ergener and Bardhan (1995) used interpolation to make the binomial tree converge faster and modify pricing errors resulted from misalignment. However, interpolation leads to another type of error in estimation.

The trinomial lattice implementation developed by Kamrad and Ritchken (1991), is well known to be computationally more efficient than binomial trees. With a stretch parameter l that enables the barrier to hit on the node exactly, the pricing error can be eliminated. Exhibit 1 shows the lattice construction.

t j e S ( +1)l D 0 t j e S l D 0 t j e S l D 0

Exhibit 1. construction of trinomial tree

Matching the first two moments with those of the risk-neutral return distribution leads to the following probability expressions:

. 1 ) 3 ( 2 2 1 ) 3 ( 1 1 ) 3 ( 2 2 1 2 2 2 ³ D -= -= D + = l ls m l l ls m l where C t P B P A t P d m u

Suppose that the barrier b is smaller than the initial stock price, we can then compute the number of consecutive moves downward that lead to the lowest layer of nodes above the barrier. This value n is the largest integer smaller than ç, where ç is given by0

t b o s D = s h ln( ( )/ ) (4) and the stretch parameter l is defined as

0

n h

l = (5)

Under this construction, the trinomial tree will result in a lattice that will produce a layer of nodes coinciding with the barrier.

t j

e

S ( -1)l D 0

C. EPS and P/E ratio

The first problem we encounter is how to determine the conversion value and how to evaluate the performance. The lender needs the stock price to estimate the conversion value so that it can decide whether to convert the financing contract into equities or not. On the other hand, the borrower needs a criterion to show its growth.

Active markets may exist for publicly held companies, whereas the stocks of privately held corporations are not traded. The value of a public company’s stock is readily available in the market. Yet there is no such information for evaluating start-up firms or SMEs. As a way out, we employ two financial parameters-- earning per share (EPS) and price-earning ratio (P/E ratio) to from an estimate for the price of untraded shares.

EPS is the part of earning that is available to common stockholders on a per share basis. It is often used to represent the probability of a firm. We can use EPS not only to evaluate the performance of a corporate but also to get a projected stock price by multiplying it by a P/E ratio. P/E ratio is the ratio of the market price of a firm’s stock over the firm's earning per share.

To choose a proper P/E ratio for borrowers such as start-up firms or SMEs, it is helpful to adopt a pure-play procedure and to examine public companies in the same industry. An industry average P/E can also be considered. After choosing a benchmark to proxy the P/E ratio for the firm, we can multiply the EPS of the borrower by this P/E ratio and derive a projected stock price.

D.Settings and assumptions

1.EPS

The EPS is assumed to follow geometric Brownian motion that describes the variation of EPS. The process is expressed as the following equation:

(6) Here ì denotes the expected rate of change in EPS per unit of time, where s denotes the instantaneous volatility of the EPS. Both parameters are assumed to be constants. Note that the assumption has rules out the possibility of negative EPS.

2.Initial conversion price (a)

a is the reference price per share. It is used to calculate how many shares the lender

eps eps epsdt dz

EPS

can get when the debt is converted into equity. a is rather low since we assume the worst case for the initial situation in which the borrower is a bad company.

3. Blocked period

Blocked period refers the period from the commitment date to the time of reset. During this period, contract holders can’t exercise the conversion, and borrowers will make efforts to better their performance, which will determine the new conversion price at reset time t.

4. Reset time ( t )

It is an appointed date to check the operation of the firm and revise the conversion price. The operation performance depends on the firm’s EPS at that time. We assume that the firm’s financial statements are audited by a CPA approved by the lender, so that the EPS is reliable in reflecting the quality of the company and the financing contract is effective in reducing information asymmetry. If the reported EPS satisfies certain predetermined conditions, αis reset to a higher level. Note that this type of resetting is just the opposite to what we usually see in the CB market, where conversion price(α) is reset to a lower level after the underlying stock price hit a certain level lower than the initial conversion price. Our reset provision is consistent with what Lee, Yeh Chiu and Shoa(2001) proposed. It is proved by Lee, et. al.(2001) to be an effective way of solving lemon delimma.

5. Barriers (H1, H2) and new conversion prices (a ,H1 a )H2

Barriers are the appointed standards that are consulted at the reset time. They are compared to each other at the beginning. If the EPS exceeds the barrier H1(H2) at reset time, conversion price will be increased from a toa (orH1 a ). That means the firm has provenH2 itself a good company and the initial conversion price is too low to reflect the true value of the firm.

6.credit spread (r ) and risk-free rate (c

r

)According to Bronna and Schwartz(1980), interest rate does not affect the result too much when there is little fluctuation. Therefore for simplicity in manipulation, both credit spread and free interest rate are assumed to be constants.

E. The Algorithm

To handle the reset option, we apply the algorithm developed by Lee & Lin (1999). The advantage of this algorithm is its flexibility and ease of use. For derivatives with specific reset clauses, generalizing a formula to include all relevant paths is not easy. This algorithm provides an intuitive way to cover the case of n reset periods, each having m rest

prices. The following steps are employed.

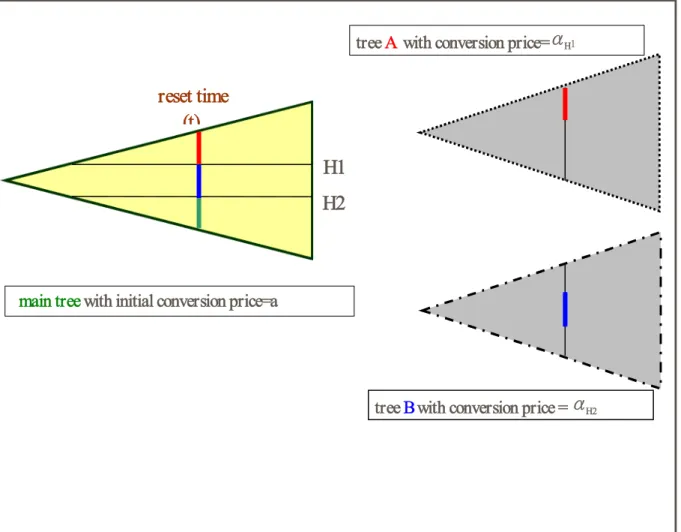

Step.1

Construct three trinomial trees with conversion prices a ,a and H1 a respectively.H2 The relation between the three variables is a <a <H2 a . Do backward induction along theH1 until the time point just prior to the reset time ( t ).

Step. 2

At the reset time ( t ), the following decision rules are used. Figure 1 shows the decomposition of the three trees at this step.

Ø EPS³H1

Do backward induction at tree A and assign the value of tree A to the main tree. Ø H1>EPS³H2

Do backward induction at tree B and assign the value of tree B to the main tree. Ø EPS<H2

Do backward induction at main tree.

Step. 3

After appropriate values are assigned to each node on the main tree, we do backward induction again along the main tree for time steps posterior to t until the apex of the triangle is reached, and value of the last node is the initial price of the financing contract.

Figure 1: Decompositions of the relevant tree

F. An Numerical Example

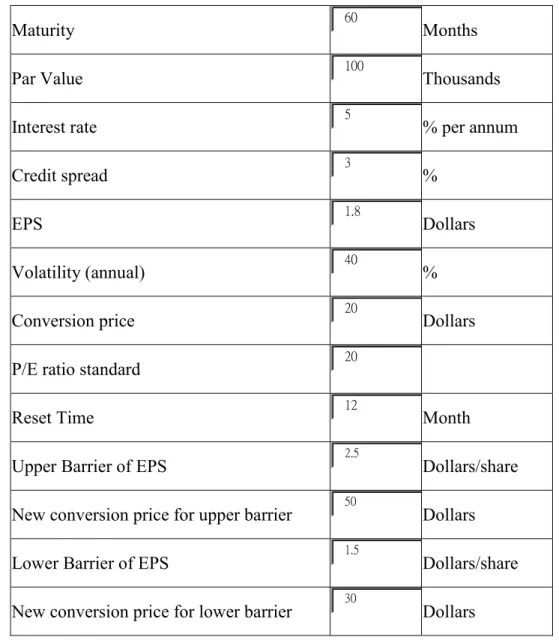

1. The basic ter ms of the financing contract

To demonstrate our approach, let us consider a realistic example. The terms used in the example are given in Table 1. This is a five-year contract between a fund supplier and a borrower. The two parties negotiate on the time to reset, the credit spread, the initial and the reset conversion provisions. As shown in the table, they agree to set a low initial conversion price at 20 dollars. If the company operates well, it can raise the conversion price on the reset date. The reset conversion price depends on the EPS of the following year. That is, it will be 30 dollars if EPS exceeds 1.5 dollars or 50 dollars if EPS exceeds 2.5 dollars. On the other hand, if the capital borrower doesn’t make enough profit that goes beyond the barriers, the conversion price will remain 20 dollars. We can see that in this setting, the better the company’s performance is, the higher the conversion price and hence the lower the conversion ratio will be. Although at first the financing contract might undervalue a good issuer, it becomes fair after the reset.

H1

H2

tree B with conversion price = αH2 tree A with conversion price=αH1

main tree with initial conversion price=a reset time (t)

TABLE 1: Terms of a hypothetical resettable convertible financing contract

Maturity 60 Months

Par Value 100 Thousands

Interest rate 5 % per annum

Credit spread 3 %

EPS 1.8 Dollars

Volatility (annual) 40 %

Conversion price 20 Dollars

P/E ratio standard 20

Reset Time 12 Month

Upper Barrier of EPS 2.5 Dollars/share

New conversion price for upper barrier 50 Dollars

Lower Barrier of EPS 1.5 Dollars/share

New conversion price for lower barrier 30 Dollars

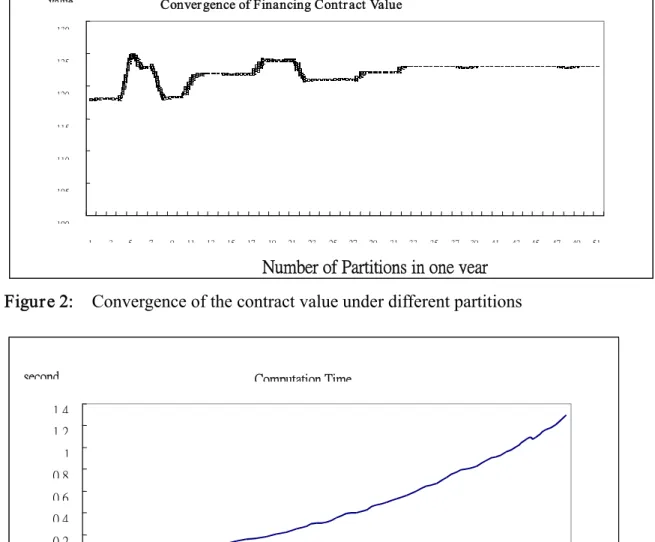

2. Convergence

Convergence is an important property in numerical analysis. As the number of partitions of a trinomial tree grows, the price computed by the model converges to a stable value. Figure 2 shows the convergence of our pricing model. The x-coordinate represents the number of partitions of a year. Under the specific settings of the parameters listed above, the value of the financing contract converges to somewhere between 122 and 123, and the total number of partitions for the stable value is about 200 steps (40 steps per year times 5 years). In theory, the price of this contract should be 123.08, which is higher than its par value because of the expected benefit of equity conversion. Figure 3 shows the computation time. It is obvious that the more partitions there are, the more computational time it takes. But even when the number of partitions is large, our pricing model is still very efficient. It takes less than 1.5 seconds for a total of 250 partitions.

Figure 2: Convergence of the contract value under different partitions

Figure 3: Computation time under different partitions

IV. Sensitivity Analysis

A. Risk-free rate and credit spread

Table 2 shows the valuation results under different credit spreads and risk-free interest rates. The credit spread represents the premium for which the lender demands as a compensation for the borrower’s default risk. A company with a higher default risk will entail a higher financing cost. As we can see from Table 2, the higher the credit spread is, the lower the value of the financing contract is. As to the risk-free interest rate, used for discounting, we see the same pattern as that of credit risk.

Convergence of Financing Contract Value

100 105 110 115 120 125 130 1 3 5 7 9 11 13 15 17 19 21 23 25 27 29 31 33 35 37 39 41 43 45 47 49 51

Number of Partitions in one year

value Computation Time 0 0.2 0.4 0.6 0.8 1 1.2 1.4 1 4 7 10 13 16 19 22 25 28 31 34 37 40 43 46 49

Nu,mber of Partitions in one year second

TABLE 2: The Impact of Changes in Credit Spread and Risk-free Rate on the value of the financing contract

Risk-free Interest Rate Contact value 5% 5.5% 6% 6.5% 7% 2% 124.2834 123.3384 122.4226 121.5345 120.6728 3% 123.0756 122.2023 121.3549 120.532 119.7323 4% 121.9268 121.1218 120.3395 119.5786 118.8378 Credit Spread 5% 120.8343 120.0943 119.374 118.671 117.9876

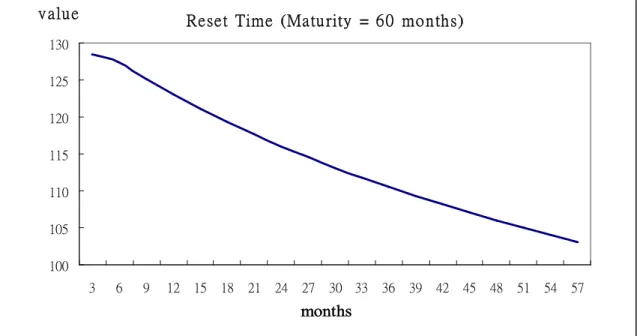

B. Reset time (

t)

Figure 4 exhibits the relationship between reset time and contract value. It is required that a blocked period exists prior to reset time. The contract holders are not allowed to exercise their conversion option during this period. Therefore, setting the reset time earlier raises the contract value. In the special case in which the reset time is set to be close to maturity, the value of the financing contract approaches its par value.

Figure 4: Impact of Changes in Reset Time on Contract Values

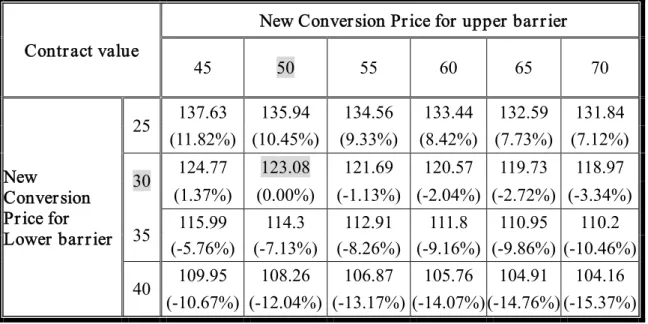

C. New conversion price setting

Table 4 presents the valuation results under different new conversion price settings. We see that the lower the adjusted conversion price is, the higher the contract value will be. This is because when other conditions being equal, with a lower conversion price, lenders can acquire more shares, which results in a higher conversion value. Moreover, the impact of changes in the new conversion price of the lower barrier is much greater than that due to changes in the new conversion price of the upper barrier. In other words, the new

Reset Time (Matu rity = 60 mo nths)

100 105 110 115 120 125 130 3 6 9 12 15 18 21 24 27 30 33 36 39 42 45 48 51 54 57 months v alue

conversion price setting for the lower barrier has more influence on the values of the financing contract. The reason lies in the high probability that EPS in the coming years will be located in the area between the upper and the lower barrier.

TABLE 4: The Impact of Changes in New Conversion Price on the Value of the Financing Contract

New Conversion Price for upper barrier Contract value 45 50 55 60 65 70 137.63 135.94 134.56 133.44 132.59 131.84 25 (11.82%) (10.45%) (9.33%) (8.42%) (7.73%) (7.12%) 124.77 123.08 121.69 120.57 119.73 118.97 30 (1.37%) (0.00%) (-1.13%) (-2.04%) (-2.72%) (-3.34%) 115.99 114.3 112.91 111.8 110.95 110.2 35 (-5.76%) (-7.13%) (-8.26%) (-9.16%) (-9.86%) (-10.46%) 109.95 108.26 106.87 105.76 104.91 104.16 New Conversion Price for Lower barrier 40 (-10.67%) (-12.04%) (-13.17%) (-14.07%)(-14.76%) (-15.37%)

TABLE 5: Comparison of Price Under Different reset clauses

D.

Comparison of Different ContractsTable 5 shows the comparison among prices of three financing contracts. With other conditions being identical, single reset CB has the highest price and our financing contract has the lowest. For reset CB, the lower barrier provides a better protection to investors because when EPS goes above a certain level($1.5), the conversion price will be raised to 30, once and for all. Our financing contract goes one step further by allowing a second EPS barrier ($2.5) above which the conversion price is raised again to the disadvantage at the

Conversion Price

Ordinary CB,

no reset clauses Single Reset CB Our financing contract

EPS>2.5 30 30 50

2.5>EPS>1.5 30 30 30

1.5> EPS 30 20 20

investor. As a result, the price of our financing contract is only 123.08, which is even lower than ordinary CB.

V. Conclusions and Extensions

Information asymmetry between money demanders and capital lenders has adverse effects on fund raising activities. With a scheme that changes the conversion ratio of a convertible debt according to the performance of the borrowers in a certain period, lenders can be freed from the fear of adverse selection, and the financing vehicle of the borrowers can be fairly valued.

By integrating CB pricing model under a trinomial tree structure with an algorithm of reset option pricing, we develop a new pricing model for the financing contract which incorporate the possibility of default. It is shown that the model enjoys the advantages of stable convergence and computational efficiency. Furthermore, we have also shown the price of the financing contract may be cheaper than ordinary CB or single reset CB. This is because the contract gives up part of the upside benefits due to the upward adjustment of conversion price. Companies with growth potentials will be willing to issue this type of financing contract. Investors will also be willing to accept the arrangement since it starts with the worse case and won’t be upgraded unless more favorable information is released later on. The financing contract can be applied to the fund raising activities between venture capitalists and start-up firms as well as the funding from banks to SMEs.

Two directions for future research are ready in hand. First, the reset point can be set more than once. (e.g. once per year during the life of the contract). It will serve to be a more effective scheme to decrease information asymmetry periodically. In addition, it also stimulates borrowers to pursue better performance in order to obtain a lower financing cost. Second, the P/E ratio and credit spread can be made more flexible to reflect the changes of economic circumstances during the life of the financing period. This will involve the employment of more complicated techniques of financial engineering, however.

Reference

Brennan, M. J., and E. S. Schwartz (1977), “ Convertible Bond : Valuation and Optimal Strategies for Call and Conversion,” Journal of Finance, Vol.32 , No.5 , pp1699-1715. Brennan, M. J., and E. S. Schwartz (1980), “ Analyzing Convertible Bonds,” Journal of

Financial and Quantitative Analysis, Volume XV, No.4 , p.p.907-929.

Boyle, P. P., and S.H. Lau (1994), “ Bumping Up Against The Barrier With The Binomial Method, ” Journal of Derivative,1, pp.6-14.

Cheuk, T., and T. Vorst (1996), “ Complex Barrier Options,” Journal of Derivatives vol.4, no.1, p.p.8-22.

Derman, E., I. Kani, D. Ergener, and I. Bardhan (1995), “ Enhanced Numerical Methods for Options with Barriers,” Financial Analysts Journal, 51(6), pp.65-74.

Hull, J. (2000), Options, Futures and Other Derivatives, 4th edition, Prentice-Hall International, Inc.

Ingersoll, J. E. (1977), “ A Contingent-Claims Valuation of Convertible Securities,” Journal of Financial Economics 4, p.p.289-322.

Kamrad, B., and P. Ritchken (1991), “ Multinomial Approximating Models for Option with k-state Variables,” Management Science, 37 12, pp. 251-265.

Lee, T. S., and Y. X. Lin (1999), “ Reset Options Pricing and Hedging, ” Chinese Financial Association Annual Conference

Lee, T. S., Y. H. Yeh, S. B. Chiu, and T. P. Shao (2001), “ Financial contracting under Information Asymmetry –The Application of Convertible Debt with Reset Provision,” 8th Asia Pacific Finance Association Conference, Bangkok, Thailand.

Myers, S.C., and N. S. Majluf (1984), “ Corporate Financing and Investment Decisions When Firms Have Information that Investors Do not Have,” Journal of Financial Economics, 13, pp. 187-221.

Ritchken, P. (WINTER 1995), “ On Pricing Barrier Options,” Journal of Derivatives 3, 2 p.p.19-28.

Ross, S. A. (1977), “ The Determination of Financial Structure: The Incentive Signaling Approach, ” Bell Journal of Economics 27, p.p.23-40.

Stein, J. C. (1992), “ Convertible Bonds as Backdoor Equity Financing,” Journal of Financial Economics, Vol. 32, pp. 3-21.

Taiwan Venture Capital Association(2000), 1999 Taiwan Venture Capital Industry Annual Report, pp.25.

Tsiveriotis, K., and C. Fernandes (1998), “ Valuing Convertible Bonds with Credit Risk,”

Journal of Fixed Income, vol. 8, no.2, p.p.95-102.

Yeh, Y. H., C. E. Ko, and T. S. Lee (1999), “ Incentive-Based Financing Contract For Small And Medium Business: Design And Survey,” Advance in Pacific Basin Business, and Finance, Volume 4, p.p. 81-104.