The Mediating Role of Information Searches in Risky Investment Preferences:

Does More Digital Information Search Have a Stronger Effect?

Shun-Yao Tseng

Department of International Trade / Institute of Business and Management

College of Hsing Wu / National Chiao Tung University Taipei, Taiwan

e-mail: 078013@mail.hwc.edu.tw

Chyan Yang

Institute of Business and Management National Chiao Tung University

Taipei, Taiwan

e-mail: professor.yang@gmail.com

Abstract—Purchasing higher risk financial investments have been a means to maximize individual wealth. This phenomenon is seen while there is a high uncertainty about the higher risk financial investments. Facing uncertainty, an individual may assess psychological or economic loss, and then develop reducing strategies. Viewing information searches as risk-reducing strategies in this study, we attempted to propose a mediated model of the determinants of higher risk investment decision making where theorizing that the effect of risk aversion on higher risk investment decisions was mediated by information searches. Moreover, heuristics, a simplified information research method, is proposed to extend information searches. 500 investors with investment experiment from financial holding companies were surveyed and structural equation modeling was employed. We expected that the results could provide empirical support for (1) greatly expanding our understanding for the heuristics reliance in information search, and (2) validating the usefulness of the mediated model which views information search as a mediator of effects on higher risk investment preferences, especially in the mediating role of professional advice and heuristics. Thus, the practical implications for professional advisors or governments could be addressed.

Keywords-risk aversion; information search; heuristics; higher risk investments

I. INTRODUCTION

Purchasing higher risk financial investments has been a means to maximize individual wealth. This phenomenon is seen when there is a high uncertainty about higher risk financial investments. When faced with uncertainty about the outcomes and sensing a higher perception of risk, risk aversion is a major psychological determinant in individual investment decisions under uncertainty [1][2][3]. Moreover, an individual may assess psychological or economic loss, and then develop risk-reducing strategies, such as acquiring and handling information, to reduce the uncertainty [4].

Most researchers seem to agree that risk aversion has an important role in the financial domain [5][6]. Empirical studies have shown that more risk-averse individuals are less interested in higher risk investments [3][6][7]. Some studies, focusing on a specific risk investment (such as stocks or options), indicated superior results with risk aversion in their

risk decision-making behavior [5][7]. Although there is extensive support in the prior research for the prominence of risk aversion, most prior studies were limited to the consideration of the specific investments. Peress [8] has urged that more studies need to be conducted to comprehensively ascertain the particular effects of risk aversion on distinct risk investments. This is one purpose of the present study.

Facing perceived risk under uncertainty, many studies have found that investors often use information searches as a means to overcome perceived risk in investment decision-making [4][9][10][11]. Individual information acquisition usually comes from digital and human sources [12][13]. Peress [8] documented that more information acquisitions with higher precision have induced investors to purchase more high-risk investments, such as stocks. He indicated that they do so because this information has reduced the risk of this type of investment. Recent advances in the technology of information searching from Internet services makes it easier to acquire additional digital information. This results in an information explosion [9]. The fact that investors suffer from information overload leads them to want to simplify information processing, such as relying on advisors [8][9]. To simplify the investment decision processes, people may also employ heuristics to reduce the associated effort with information processing [14] since heuristics can select information according to an effort-reduction framework [15]. These heuristics are generally useful, although a reliance on the heuristics from an intuitive judgment based on psychological factors may lead to serious errors [16]. Therefore, the second objective of the study was to extend the information search aspects to discuss heuristics reliance, a simplified information research method, across distinct higher risk investment preferences.

We investigated the use of information searches as a way to overcome perceived risks under uncertainty. Most of the studies have focused on discussing either the simple and direct effects of information searches on the investment decision behavior or the simple and direct effects of risk aversion on information search. These findings have shown that risk aversion increased seeking help to reduce risks through information searches [9][17]. But the results of the studies examining the effect of information search on higher risk investments have been mixed. To better understand ___________________________________

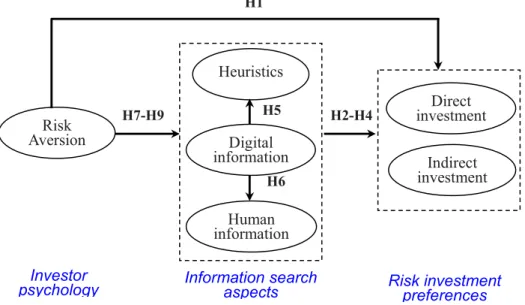

individual information searches to be a risk-reducing strategy in a risk investment decision behavior, this study proposes a mediating model of information searches. Figure 1 shows the proposed theoretical model that extends the direct effect approaches to develop the mediating role of information search.

II. RESEARCH MODEL AND HYPOTHESES A. Risk aversion

Most of researchers studying higher risk choice behavior recognize that risk aversion is a crucial determinant affecting personal decisions under uncertainty [2][18][19]. Scholars studying from different theoretical perspectives differ in their interpretations about the features of risk aversion.

The expected utility theory [20] and the prospect theory have dominated the analysis of decision making under risk. The former is generally accepted as a normative model of rational choice and argues that investors are risk-averse, wealth maximizing, and completely rational to deal with complex choices [20][21]. The latter, proposed by Kahneman and Tversky [22] who develop an alternative model against the expected utility theory to suggest that an individual is irrational and has inconsistent risk tendencies under higher risk choices, argues that an individual will tend to be “risk averse in choices involving sure gains and to risk seeking in choices involving sure losses” [22: p. 263]. In addition, more researches believe that the tendency of an individual’s risk aversion or risk seeking is inconsistent across situations [18][19][23]. Weber and Milliman [23] propose a definition that considers the individual’s risk tendency after factoring out situational differences in risk perception to show greater stability across situations to an

individual’s risk preference. Weber et al., [18], moreover, propose a psychometric scale to measure risk taking (i.e. risk-averse or risk-seeking) in five content domains. They conclude that an individuals’ risk attitude differs greatly from these domains, (i.e. people are not consistently risk-averse or risk-seeking across different situations). On the basis of the literature reiew described above, the notion that individuals do not appear to have a consistent degree of risk aversion across different higher risk investments in financial domains is expected.

1) Risk aversion and risky investments

The effect of risk aversion on an individual’s higher risk decision-making behavior has been widely investigated [7][10][11]. Most researches have focused on incorporating the others determinants of higher risk decision-making behavior [7][9][10][24]. Shum and Faig [7] found that compared with the unique variables in SCF (such as investment advice and motives for saving), the relationship of risk aversion and stock holding is negative and highly significant. Pennings and Smidts [3] found that the more risk-averse individuals will “express stronger intentions to reduce their fluctuations in net income” [3: p. 1344]. Thus they are less likely to prefer higher risk investments and are even more willing to pay for a professional advisors’ consultation when decisions involve high degrees of uncertainty and importance [9][10]. Hence:

Hypothesis 1˖The lower the investor’s risk aversion, the higher the degree of his/her preference for risky investments.

Risk

Aversion

Human

information

Digital

information

Heuristics

Indirect

investment

Direct

investment

Information search

aspects

Risk investment

preferences

H1 H6 H5 H2-H4 H7-H9

Investor

psychology

Hypothesis 1aΚThe lower the investor’s risk aversion, the higher the degree of his/her preferences for direct risky investments.

Hypothesis 1bΚThe lower the investor’s risk aversion, the higher the degree of his/her preference for indirect risky investments.

B. Information Search

Information searches are often used to overcome perceived risk [9][10][11] due to individual uncertainty about higher risk investments. The individual uncertainty could be reduced through the acquisition of available information [9][10][11]. Thus, the use of diverse sources of information is one of the main influences on individual decision-making behavior in purchasing financial products [10]

1) Information search and risky investment preferences: a) Digital information search: Previous studies of individual financial investment decisions have examined the determinants from an economic perspective. These crucial determinants, representing the criteria of classic wealth-maximization and company’s accounting information [21], include expected dividends [21][25][26], long-term growth [25], financial stability [24][26], and future expectations [21][26]. These economic determinants coming from non-human sources of information, called digital information in this study, not only were the primary consideration in individual risky investment decisions, even when combined with diverse other variables [21], but also were valuable criteria, though investors seemed more concerned about human skill in management [24]. Thus, it is expected that investors will be more interested in risky invesments if they are more willing to search for digital information..

Hypothesis 2˖Digital information searches positively influence the investors’ preferences for risky investments.

Hypothesis 2a˖Digital information searches positively influence the investors’ preferences for

direct risky investments.

Hypothesis 2b˖Digital information searches positively influence the investors’ preferences for

indirect risky investments.

b) Human-information search: Today, investors have a greater choice of investment products due to the diversification of financial investment options [27]. This leads individuals to make investment decisions in increasing complexity and uncertainty [24] due to the lack of knowledge and understanding of various higher risk investments [10][11]. To reduce uncertainty from the decision-making process, investors will undertake a search through a large amount of information [10]. On the other

hand, today’s advances in technology of information search have made the acquisition of information much easier and cheaper than ever before [28]. It has generated a problem of information overload for investors [29], and more information is not always better [30]. In order to find the needs information, unsophisticated investors prefer to seek professionals’ help (e.g. [9][11]). Howcroft et al., [10] identify that individuals seek help to overcome uncertainty through the use of consulting a professional advisor and by seeking a more diverse source of information. They tend to rely much more on human information, such as the opinions of friends and experts. Hence:

Hypothesis 3˖Human information searches positively influence the investors’ preferences for risky investments.

Hypothesis 3a˖Human information searches positively influence the investors’ preferences for

direct risky investments.

Hypothesis 3b˖Human information searches positively influence the investors’ preferences for

indirect risky investments.

c) Heuristics: Heuristics are methods people use to reduce the effort associated with a task [14][15]. Limited to bounded rationality [14], people employ heuristics as “methods for arriving at satisfactory solutions with modest amounts of computation” [14: p.11] to reduce the effort they expend on the decision-making processes. Shah and Oppenheimer [15] summarized heuristics as “methods that use principles of effort-reduction and simplification.” Heuristics are usually useful for simplifying information processes [13][15][16]. However, reliance on heuristics from intuitive judgment under uncertainty may lead to severe errors [16]. Some studies on why people employ heuristics have noted that individuals will suffer from both information overload [8][9] and investment complexity [11][27] due to bounded rationality [14]. Kozup, Howlett, and Pagano [31] empirically supported the influence of prior fund performance on fund evaluation. They noted that investors “seemed to gravitate towards prior fund performance in a significant way” (p. 53). Thus, it is expected that heuristics, such as viewing a company with strong prior performance as a good investment, may increase an investor’s interest in higher risk investments. Shah and Oppenheimer [15] posited that heuristics made the decision process easier. Hence, we investigate a hypothesis as follows.

Hypothesis 4: The degree of heuristics employed positively influences the investor’s interest in risky investments

Hypothesis 4a˖The degree of heuristics employed positively influences the investor’s interest in direct

risky investment.

Hypothesis 4b˖The degree of heuristics employed positively influences the investor’s interest in

indirect risky investment.

Moreover, based on Shah and Oppenheimer’s [15] effort-reduction framework, we also propose hypotheses that greater digital information searches increase both human information search and the use of heuristics due to overloaded digital information [8][9] and are limited to individual bounded rationality [14].

Hypothesis 5˖Digital information searches positively influence human information searches. Hypothesis 6˖Digital information searches positively

influence the use of heuristics. 2) Risk aversion and information search:

Risk-averse individuals tend to “weight potentially negative outcomes greater than positive outcomes” [19: p.1577][32] under uncertainty, and thus overestimate the likelihood of loss [19] Their dislike for taking risks psychologically leads to a stronger desire to avoid risk [33]. Thus, the more risk-averse individuals favor to seek help through information search. Hence:

Hypothesis 7˖The investor’s risk aversion positively influences digital information searches. Hypothesis 8˖The investor’s risk aversion positively

influences human information searches. Hypothesis 9˖The investor’s risk aversion positively

influences the use of heuristics. III. RESEARCH METHODOLOGY A. Data collection

For the actual experiment, 500 investors who were holding or had experienced investing in higher risk investments were randomly selected. The reason for selecting individuals with some investment experience was that, based on the feedback from the pilot study, they were more likely to understand and complete the questionnaire and seemed to be more interested in participating.

B. Instrument development

Considering the investors’ opinion and risk tendency across situations of different risk investments, the survey instrument was measured by applying a psychometric scale approach and developed by adapting from the literature wherever possible.

C. Data analysis and discussions

A data analysis was performed following a two-stage methodology [34] where the development of the measurement model was the first stage and then, the evaluation of a structure model was the second stage. LISREL was used to analyze the data with CFA (confirmatory factor analysis) for the initial stage and path analysis for the latter stage.

The data analysis, results and discussions will be presented in the future related Journals.

IV. CONTRIBUTIONS AND LIMITATIONS A. Contributions

This study on risk-reducing strategy is an attempt to better understand the following. How do consumers evaluate risk-reducing strategies related to higher risk investment preferences? And how does the influence of risk aversion affect the risk-reducing strategies model? Several contributions to the understanding of individual investment decision-making are as follows. (1) Dividing higher risk investments into the two dimensions of direct and indirect investment, our analysis attempted to demonstrate the inconsistent effect of risk aversion across different investment preferences. (2) Viewing information searches as risk-reducing strategies in this study, our results suggest that the usefulness of a mediating role of information searches to reduce uncertainty in a higher risk investment. (3) Heuristics is proposed to extend information searches. Thus, the results of this study could provide preliminary empirical support for the mediated model which views information search as a mediator for the effects on indirect higher risk investment preferences, especially in the role of professional advice. Thus, the practical implications for professional advisors or governments could be addressed. Moreover, this model may promote the current understanding of the direct effect models applied in most of the previous research studies on higher risk decision-making behavior.

B. Limitations

This study has investigated the effect of determinants, focusing on both psychological and information search aspects, on individual higher risk investment preferences. The results may be influenced by demographic variables, such as age, gender, wealth, education and income [7]. However, the effect of demographic variables on investment decision-making behavior was not one of the critical objectives of this paper and therefore further studies related to this angle may be necessary.

REFERENCES

[1] A. Tversky, and D. Kahneman, “ The framing of decisions and the psychology of choice,” Science, vol. 211, pp. 453-458, 1981.

[2] H. Shefrin, and M. Statman, “ The disposition to sell winners too early and ride losers too long: theory and evidence,” The Journal of Financial, vol. 40(3), pp. 777-791, 1985.

[3] M. E. Pennings, and A. Smidts, “ Assessing the construct validity of risk attitude,” Management Science, vol. 46(10), pp. 1337-1348, 2000. [4] J. W. Taylor, “The Role of Risk in Consumer Behavior,” Journal of

Marketing, vol. 38 (April), pp. 54-60, 1974.

[5] E. U. Weber, and C. Hsee, “ Cross-cultural differences in risk perception, but cross-cultural similarities in attitudes towards perceived risk,” Management Science, vol. 44(9), pp. 1205-1217, 1998.

[6] B. Donkers, and A. van Soest, “ Subjective measures of household preferences and financial decisions,” Journal of Economic Psychology, vol. 20(4), pp. 613-642, 1999.

[7] P. Shum, and M. Faig, “ What explains household stock holdings?” Journal of Banking & Finance, vol. 30, pp. 2579-2597, 2006. [8] J. Peress, “Wealth, Information Acquisition, and Portfolio Choice,”

The Review of Financial Studies, vol. 17(3), pp. 879-914, 2004. [9] J. Lee, and J. Cho, “ Consumers’ use of information intermediaries

and the impact on their information search behavior,” Journal of Consumer Affairs, vol. 39(1), pp. 95-120, 2005.

[10] B. Howcroft, P. Hewer, and R. Hamilton, ” Consumer decision-making styles and the purchase of financial services,” Service Industries Journal, vol. 23(3), pp. 63-81, 2003.

[11] K. L. Fisher, and M. Statman, “ Investment advice from mutual fund companies,” Journal of Portfolio Management, vol. 24(1), pp. 9-25, 1997.

[12] C. Loibl, and T. K. Hira, “Investor Information Search,” Journal of Economic Psychology, vol. 30(1), pp. 24-41, 2009.

[13] H. K. Baker, and J. R. Nofsinger. “Psychological Biases of Investors,” Financial Services Review, Vol. 11(2), pp. 97-116, 2002. [14] H. A. Simon, “Invariants of Human Behavior,”Annual Review of

Psychology, vol. 41(1), pp. 1-19, 1990.

[15] A. K. Shah, and D. M. Oppenheimer, “Heuristics Made Easy: An Effort-Reduction Framework,” Psychological Bulletin, vol. 134(2), pp. 207-222, 2008.

[16] A. Tversky, and D. Kahneman, “Judgment Under Uncertainty: Heuristics and Biases,” Science, vol. 185 (September). pp. 1124-1131, 1974.

[17] R. Bluethgen, A. Gintschel, A. Hackethal, and A. Miiler, “ Financial advice and individual investors’ portfolios,” unpublished, 2008. [18] E. U. Weber, A. Blais, and N. E. Betz, “ A domain-specific

risk-attitude scale: Measuring risk perceptions and risk behaviors,” Journal of Behavioral Decision Making, vol. 15(4), pp. 263-290, 2002. [19] S. Sitkin, and L. R. Weingart, “ Determinants of risky

decision-making behavior: A test of the mediating role of risk perceptions and propensity,” Academy of Management Journal, vol. 38(6), pp. 1573-1591, 1995.

[20] Von Neumann, J., and O. Morgenstern, Theory of Games and Economic Behavior, Princeton: Princeto University Press, 1947. [21] R. A. Nagy, and R. W. Obenberger, “ Factors influencing individual

investor behavior,” Financial Analysts Journal, vol. 50(4), pp. 63-68, 1994.

[22] D. Kahneman, and A. Tversky, “ Prospect theory: An analysis of decision under risk,” Econometrica, vol. 47(2), pp. 263-290, 1979. [23] E. U. Weber, and R. A. Milliman, “ Perceived risk attitudes: relating

risk perception to risky choice,” Management Science, vol. 43(2), pp. 123-144, 1997.

[24] Marilyn, C. M., and G. N. Soutar, “ What individual investors value: Some australian evidence,” Journal of Economic Psychology, vol.25, pp. 539-555, 2004.

[25] Potter, R. E. “An empirical study of motivations of common stock investors,” Southern Journal of Business, vol. 6, pp. 41-48, 1971.

[26] H. K. Baker, and J. A. Haslem, “ Toward the development of client-specified valuation models,” Journal of Financial, vol. 29, pp. 1255-1263, 1974.

[27] E. W. Warren, R. E. Stevens, and C. W. McConkey, “ Using demographic and lifestyle analysis to segment individual investors,” Financial Analysts Journal, vol. 46(2), pp. 74-77, 1990.

[28] E. J. Johnson, “Digitizing consumer research,” Journal of consumer Research, vol. 28, pp. 331-336, 2001.

[29] Gifford, S., “Endogenous information costs,” Rutgers University, 2001.

[30] R. H. Thaler, A.Tversky, D. Kahneman, and A. Schwartz, “ The effect of myopia and loss aversion on risk taking: An experimental test,” The quarterly Journal of Economics, vol. 112(2), pp. 674-661, 1997.

[31] J. Kozup, E. Howlett, and M. Pagano, “The Effects of Summary Information on Consumer Perceptions of mutual Fund Characteristics,” Journal of Consumer Affairs, vol. 42(1), pp. 37-59, 2008.

[32] S. L. Schneider, and L. L. Lopes, “Reflection in preferences under risk: Who and when may suggest why,” Journal of Experimental Psychology: Human Perception and Performance, vol. 12, pp. 535-548, 1986.

[33] S. Sitkin, and A. L. Lablo, “ Reconceptualizing the determinants of risk behavior,” Academy of Management Review, vol. 17(1), pp. 9-38, 1992.

[34] J. C Anderson, and D.W. Gerbing, “Structural equation modeling in practice: A review and recommended two-step approach, “ Psychological Bulletin, vol. 103, pp. 411-423, 1988.