國

立

交

通

大

學

經營管理研究所

碩 士 論 文

上游獨占下之外部授權者的最適授權策略

The Optimal Licensing Strategy of an Outsider Patentee under

the Single Upstream Supplier

研 究 生:林錦宏

指導教授:胡均立 教授

上游獨占下之外部授權者的最適授權策略

The Optimal Licensing Strategy of an Outsider Patentee under

the Single Upstream Supplier

研 究 生:林錦宏 Student: Chin-Hung Lin

指導教授:胡均立 Advisor: Dr. Jin-Li Hu

國 立 交 通 大 學

經 營 管 理 研 究 所

碩 士 論 文

A Thesis

Submitted to Institute of Business and Management College of Management

National Chiao Tung University in Partial Fulfillment of the Requirements

for the Degree of Master

of

Business Administration

May 2009

Taipei, Taiwan, Republic of China

i

上游獨占下之外部授權者的最適授權策略

研究生:林錦宏 指導教授:胡均立 教授

國立交通大學

經營管理研究所碩士班

摘要

本論文探討加入上游獨占廠商後,對外部授權者授權策略的影

響。我們建立一個模型,其中包含了單一外部授權者、提供中間財的

獨占上游廠商以及兩個進行數量競爭的下游廠商。隨後我們比較外部

授權者透過單位權利金和固定權利金所獲得的利潤,結果我們發現不

論是在非劇烈創新和激烈創新下,單位權利金是外部授權者的最適策

略。這與 Kamien 和 Tauman (1986)在無上游供應商模型下所提出的論

點不同,他們推論固定權利金才是外部授權者的最佳策略。除此之

外,透過單位權利金可以影響上游廠商對中間財的定價以及削弱上游

廠商的議價能力。

關鍵詞:授權、單位權利金、固定權利金、Cournot 競爭

ii

The Optimal Licensing Strategy of an Outsider Patentee

under the Single Upstream Supplier

Student: Chin-Hung Lin Advisor: Dr. Jin-Li Hu

Institute of Business & Management

National Chiao Tung University

Abstract

This thesis examines the impact of incorporating an upstream supplier to the outsider patentee‟s licensing decision. The basic model includes an outsider patent holder, an upstream supplier providing the intermediate good, and two downstream firms competing in quantity. The outsider patentee can receive profits by means of either fixed fee licensing or royalty licensing. The optimal licensing for the outsider patentee is royalties in both drastic and non-drastic innovation cases. This result compares to Kamien and Tauman (1986) in which without an upstream supplier a fixed fee is always the optimal licensing strategy for an outsider patentee. Besides, the royalty licensing can affectively affect the price setting on the intermediate good, which weakening bargaining power of the upstream supplier.

iii

誌謝

能順利完成論文,首先我要感謝指導教授胡均立老師開了賽局

論,這門課除了使我見識到賽局的魅力外,更讓我有這個能力來完成

本篇文章的推導過程;也感謝老師讓我自行選擇研究題目,並且在旁

提醒與協助。另外,也感謝張民忠老師在授權議題上的建議與指導,

讓我在模型的建構上更有想法。也承蒙口試委員楊雅博老師和曾芳代

老師對於本論文的諸多建議,讓本篇論文可以更加完善。

其次,我要感謝我的家人,謝謝他們的陪伴與支持,並且讓我有

這個機會在交大專心完成學業。最後,感謝這兩年陪我運動打球的學

長、同學和學弟妹,讓我可以遺忘論文寫不出來時的痛苦與煩悶。在

研究所的歲月中,感謝大家的幫助讓我可以完成六月畢業的美夢。謹

以此論文獻給所有敬愛的師長、家人、同學、學弟妹,謝謝你們!

林錦宏 謹誌

中華民國九十八年 六月

iv

Table of Contents

Abstract (Chinese)…….…………..………. i

Abstract……….………ii

Acknowledgements (Chinese)……...………..iii

Table of contents…...………..……….iv

List of Figures………...…………v

1. Introduction……….1

2. Benchmark model………5

3. The strategy of the outsider patentee………..………...7

3.1 Non-Drastic innovation case………...7

3.1.1 Fixed Fee………..8

3.1.2 Royalty………....11

3.2 Drastic innovation case………..15

3.2.1 Fixed Fee………16

3.2.2 Royalty………...18

4. Conclusion……….………….24

Reference……….26

v

List of Figures

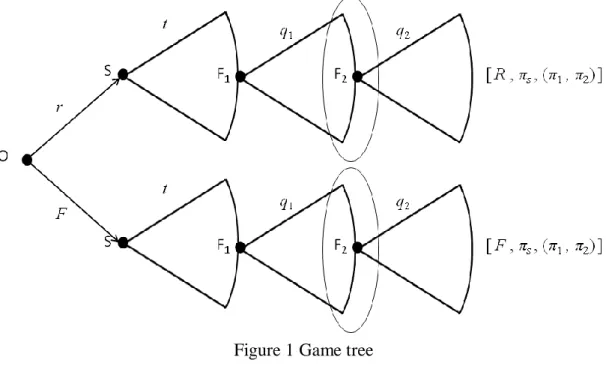

Figure 1 Game tree……….3

1

1. Introduction

Although R&D is a powerful means to grow the corporations, it not only takes

much money and time but also faces vast risks. For many companies, they do not

have budget to invest in R&D; therefore, they adopt the paten licensing. Patent

licensing has been a very popular strategy for corporations in almost all industries

recently. Through licensing, the licensee can acquire the external knowledge to

improve their technology. On the other hand, the innovator (patentee) can earn the

rent; furthermore, patent licensing is also a way to transform proprietary technology

into an industry standard. Consequently, the patent licensing has become a growing

business, and the revenue is estimated more than $100 billion annually in the US

(Kline, 2003).

There is vast literature focusing on the optimal licensing decision by the

patentee. The formal analysis on the profit of the patentee through the licensing

innovations that reduce the production costs can be traced back to Arrow (1962).

Afterwards, many papers showed up and various situations have been discussed to

infer different results. For example, they analyze the patentee, who may be an

outsider or an insider, and the firms compete in quantities or price. Therefore, we

can classify the early literature into four cases. The first case considers the outsider

2

licensing by means of a fixed fee is superior to that by means of a royalty for both the

paten holder and consumers. The second case considers the outsider patentee with

Bertrand competition. Muto (1993) considered licensing policies under price

competition in a duopoly model with differentiated goods, demonstrating that a

royalty is superior to a fixed fee and auction when innovations are not large. Poddar

and Sinha (2004) introduced a spatial framework, considering the Hotelling‟s linear

city model, and showed that the royalty is always better than auction and the fixed fee

for the patentee in both drastic and non-drastic innovation. In contrast to the outsider

cases, the following cases consider the insider patentee. The third case considers the

insider patentee with Cournot competition. Wang (1998) found that the

patent-holding firm licenses by means of royalty when innovation is non-drastic, and

chooses to be monopoly when innovation is drastic. The last case considers the

insider patentee with Bertrand competition. Wang and Yang (1999) showed that

royalty licensing is better than fixed fee licensing for the patent-holding firm,

irrespective that the innovation is drastic or non-drastic. Poddar and Sinha (2004)

found that the patent-holding firm offers no license when the innovation is drastic,

while licenses by means of royalty when the innovation is non-drastic.

However, only few papers consider the outsourcing. Arya and Mittendorf

3

the model including one supplier that provides the intermediate good, and two firms

in homogeneous-good Cournot competition, where one of the firms has a

cost-reducing innovation. Arya and Mittendorf (2006) found that the paten-holding

firm prefers royalty licensing to fixed fee licensing when the innovation is drastic.

Therefore, we introduce the single supplier idea into our model. We built the model

which includes the single upstream supplier, an outsider patentee, and two

downstream firms competing in quantity.

In this article, we consider the game that consists of three stages. In the first

stage, the outsider patentee will decide the fixed licensing fee or the royalty rate. In

the second stage, the suppler will set the price of intermediate good to maximize his

profit. In the last stage, the two firms compete in qualities. We analyze the game

with backward induction. Figure 1 shows the game tree.

4

In the following sections, section 2 describes the benchmark model that only

considers the single upstream suppler and the two firms in the downstream. Next,

we will introduce the outsider patentee in the model in section 3; furthermore, we will

discuss the two cases: non-drastic innovation and drastic innovation. Finally, we

5

2. Benchmark Model

In the section, we only consider the downstream firms and the upstream

supplier. There are two firms playing Cournot competition and one supplier

providing the intermediate good in the model. Both firms produce the homogeneous

product and face the consumer (inverse) demand function p = a - Q, where p and Q

are the price and the quantity of the product, respectively.

To make the product, the firms require an intermediate good that is provided by

the single supplier. We assume: (1) one unit of the final product requires one unit of

the intermediate good, (2) the unit cost of the intermediate good is zero, and (3) the

supplier sets its per unit price of the intermediate good at t. Furthermore, we assume

the unspecified constant unit production cost of c1 (0 < c1 < a) and c2 (0 < c2 < a) for

firm 1 and firm 2, respectively. The c1 (c2) will change after firm 1 (2) acquiring the

new innovation through licensing. Throughout this study, subscripts 1, 2 and s

denote firm 1, firm 2 and supplier, respectively.

The two firms‟ profit functions are represented as follows:

We can choose q1 (q2) to maximize π1 (π2) and yield firm 1‟s (2‟s)

6

According to the two firms‟ quantities, the supplier sets the prices to maximize

his profit, solving:

. (3)

The first-order condition of (3) with respect to yields the supplier‟s prices:

Subsequently, we substitute the prices into (1) and (2), yielding the product

quantities and profits of firms, equal:

If the unit production costs of both firms are equal c, the equilibrium quantity

and profit of the firms are and . In addition, the supplier will

7

3. The strategy of the outsider patentee

We now assume the two firms have the same old technology, and the unit

production cost equals c. An outsider patentee has a cost reducing innovation, which

can reduce the unit production cost by . In the section, we will consider two

cases: drastic innovation and non-drastic innovation, which depend on the magnitude

of the innovation. According to Wang‟s (1998) definition that a drastic innovation is

one firm with new technology will become a monopoly. In other words, the

innovation is drastic if one firm that buys the new technology becomes monopoly,

while the unlicensed firm produces nothing and drops out of the market. As a result,

we can verify that if the innovation is drastic when , and the innovation is

non-drastic when .

3.1 Non-Drastic innovation case

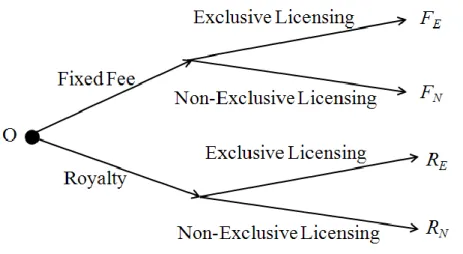

First of all, we consider the non-drastic innovation case. Figure 2 illustrates

the decision tree of the outsider patentee that can choose to license the new

technology to the firms by means of fixed fee or royalty. Furthermore, the outsider

patentee can decide to issue exclusive licensing or non-exclusive licensing in each

8

3.1.1 Fixed Fee

(i) Exclusive Licensing

Firstly, we consider the case that the outsider patentee decides to license a new

technology to one of downstream firms by fixed fee. Subsequently, the supplier

decides the prices of the intermediate good for the licensee and the non-licensee.

The unit production cost of licensee is , and the non-licensee is c. We

substitute the costs into (5) and (6), yielding:

Subscripts F denotes the licensee by the means of fixed fee and NF denotes the

non-licensee in the fixed fee contract. Subscript E denotes the exclusive licensing

case. We can find that acceptance is the dominant strategy for the firms when

is at least as good as . is the license fee that the outsider patentee Figure 2 The decision tree of the outsider patentee

9 charge.

In the stage 2, the supplier chooses the prices for the intermediate goods to

maximize his profit; as a result, the price and the profit are given by:

Comparing and shows that the supplier increases the price for the

licensee since the average of the production cost decreasing by the licensing.

Besides, the supplier can receive more profit since the output quantity is increased.

In the stage 1, the outsider patentee will charge the license fee, which is the

difference in the profits of the licensee and :

(ii) Non-Exclusive Licensing

Next, we consider the outsider patentee decides to license the new technology

to both firms by fixed fee l. Their unit production costs equal ; meanwhile, we

substitute it into (5) and (6), yielding :

10

will accept the license when minus the license fee is at least as good as .

In the stage 2, the supplier chooses the price for the intermediate goods to

maximize his profit; as a result, the prices and the profit are given by:

Comparing and , it also shows that the supplier increases the price since

the average of the production cost decreasing by the licensing and receives more

profit than that under no license since the total quantity in the market increases.

Comparing the conditions between exclusive and non-exclusive licensing, it shows

that the supplier will offer the higher price and obtain more profit when the outsider

patentee licenses the new technology to both firms. If the two downstream firms are

licensed, then the output quantities in the market and the derived demand in the

intermediate good are more than that under one licensed firm. Therefore, the

supplier is pleasure to see that the outsider patentee licenses the innovation to both

firms.

In the stage 1, the outsider patentee will charge the license fee, which is the

difference in the profits of the licensee and :

11 result, we can show the proposition.

Proposition 1. Under the fixed-fee licensing and a non-drastic innovation case, the

outsider patentee will license to only one downstream firm.

When the outsider patentee licenses to single firm, the firm can obtain more

revenue than that under non-exclusive licensing case. In other words, the

cost-reducing innovation can make the licensed firm obtain more competitive

advantage. Therefore, the difference in the revenue of the licensed firm and the

orange revenue, , is lager. That is the reason why the outsider patentee chooses to

license the innovation to single firm. Indeed, it benefits not only the outsider

patentee but also the licensed firm in the exclusive licensing case.

3.1.2 Royalty

(i) Exclusive Licensing

First of all, we consider the case that the outsider patentee decides to license

one downstream firm under royalty ( ) per unit of production. The unit production

cost of licensee is , and the non-licensee is c. Then, we substitute it into (5)

12

Subscript R denotes the licensee by the means of royalty and NR denotes the

non-licensee in the royalty contract.

In the stage 2, the supplier sets the price for the intermediate goods to maximize

his profit:

In the stage 1, the outsider patentee sets the royalty to maximize his profit,

solving:

The outsider patentee will choose r = ε; consequently, the equilibrium qualities

and profits of both firms are given by:

Subsequently, we substitute r = ε into (19) to yield the prices of the intermediate

goods, and obtain the profit of the supplier:

It is obvious that the supplier will keep the same price since the royalty equals

13

Consequently, the qualities of output remain the same and the supplier receives the

same revenue.

Finally, we substitute r = ε into (20) to yield the revenue of the outsider

patentee:

(ii) Non-exclusive Licensing

Next, we consider the outsider patentee decides to license both downstream

firms under a royalty ( ); therefore, their unit production cost equals . We

substitute it into (5) and (6), yielding:

In the stage 2, the supplier sets the price for the intermediate goods to maximize

his profit:

In the stage 1, the outsider patentee sets the royalty to maximize his profit,

solving:

14

revenue. The equilibrium quantities and profits of both firms are given by:

We then substitute r = ε into (28) to yield the prices of the intermediate goods,

and obtain the profit of the supplier:

Similarly, since the royalty equals the product-reducing cost, the supplier will

keep the same price. As a result, the qualities of output remain the same and the

supplier receives the same revenue.

Finally, we substitute into (29) to yield the revenue of the outsider

patentee:

Comparing and , it shows that is larger than under the

non-drastic innovation case. The reason is that the production cost can affect the

supplier on price setting. When the outsider patentee make r remains at ε, the

production cost also remains the same and the supplier can not change the price.

Thus, the firms produce the same quantities under the exclusive licensing case and the

non-exclusive licensing case. When the outsider patentee licenses the innovation to

both firms, he can obtain double revenue. Indeed, we can show the proposition.

15

better for the outsider patentee to license to both downstream firms.

Summarizing the revenues of the outsider patentee in non-drastic innovation

case, it is demonstrated that licensing by means of royalty is better than means of

fixed fee. Consequently, we can have the proposition.

Proposition 3. Under non-drastic innovation case, licensing the new technology to

both firms by means of royalty is better for the outsider patentee.

When the outsider patentee licenses by means of royalty, the outsider patentee

can weaken the supplier‟s advantage. The reason is that royalty affects the

production cost. Thus, the price strategy of the supplier also can be affected by the

royalty. When the outsider patentee sets the r at ε, the supplier can not change the

price of the intermediate good and the production cost keeps the same. As a result,

the outsider patentee can obtain all the benefits caused by the innovation.

3.2 Drastic innovation case

Similarly, we use the same idea to discuss the conditions in the drastic

innovation case. Firstly, we discuss the means of fixed fee in exclusive licensing and

non-exclusive licensing conditions. Second, we discuss the means of royalty in the

16

3.2.1 Fixed Fee

(i) Exclusive Licensing

First of all, we consider that the outsider patentee decides to license the new

technology to one of the firms by fixed fee licensing. The unit production cost of the

licensee is , while the non-licensee drops out of the market. Therefore, we

solve the monopoly problem, yielding the equilibrium quantity and the profit of the

licensee:

Subsequently, the supplier sets the price of the intermediate good to maximize

his profit:

It is obvious that the supplier will increase the price since the average of the

production cost of the firm decrease. In other words, the supplier increases the price

to compete with the outsider patentee.

In the first stage, the outsider patentee will set the fixed fee. For the drastic

innovation, the licensee will accept the fee that is less than his profit. Hence, the

17 (ii)Non-Exclusive Licensing

Next, we consider that the patentee decides to license the new technology to the

two firms by fixed fee licensing; therefore, their unit production costs equal .

We substitute it into (5) and (6), yielding:

According to qualities of the firms, the supplier will set the price of the

intermediate good to maximize his profit:

It also shows that the supplier increases the price contrast with . The total

output also increases under both firms obtaining the innovation; thus, the supplier will

receive more profit than . Comparing (36) and (41), we can find that the supplier

will receive more revenue when the outsider patentee licenses the innovation to both

firms. The reason is that the firm produces less output as monopoly; that is, the total

output increases when the outsider patentee licenses the innovation to both firms.

Besides, the supplier sets the same price in both exclusive and non-exclusive licensing

18 firms acquire the innovation.

Similarly, the outsider patentee will charge all of the profits from both firms:

Comparing (37) and (42), it shows that is larger than . The reason is

that the revenue of the outsider patentee equals the profit of the firms. It is obvious

that the monopoly can obtain most revenue; thus, the outsider patentee chooses to

license the drastic innovation to one firm. Therefore, we have the following

proposition:

Proposition 4. Under the fixed-fee licensing and a drastic innovation case, the

outsider patentee will license to only one firm.

3.2.2 Royalty

(i) Exclusive Licensing

Firstly, we consider the case that the outsider patentee chooses to license the

new technology to one firm under royalty ( ) per unit of production. The unit

production cost of licensee equals , while the non-licensee drops out of the

market. We can solve it as a monopoly problem, yielding the quantities and the

19

In the stage 2, the supplier sets the price of the intermediate good to maximize

his profit:

In the stage 1, the outsider patentee sets the royalty rate in order to maximize

the revenue:

Since the royalty rate is restricted, , the maximum is attained at

The outsider will choose when . We substitute it

into (43) and (44), yielding:

Subsequently, we substitute r = ε into (45) to yield the price of the intermediate

goods and obtain the profit of the supplier:

20

decreases when the firm is monopoly and he keeps the same price of the intermediate

good.

Consequently, the outsider patentee will obtain the revenue:

On the other hand, the outsider will choose when .

We substitute it into (43) and (44), yielding:

We then substitute into (45) to yield the price of the intermediate

goods and obtain the profit of the supplier:

Consequently, the outsider patentee will obtain the revenue:

(ii) Non-Exclusive Licensing

Next, we consider the outsider patentee chooses to license two firms under a

royalty ( ); hence, the both firms‟ unit production costs equal . We

21

In the stage 2, the supplier sets the price of the intermediate good to maximize

his profit:

In the stage 1, the outsider patentee sets the royalty rate to maximize the

revenue, solving:

Since the royalty rate is restricted, , the maximum is attained at

The outsider will choose when . We then

substitute it into (58) and (59), yielding:

Next, we substitute r = ε into (60) to yield the price of the intermediate goods

and obtain the profit of the supplier:

22

keep the same price. As a result, the qualities of output remain the same and the

supplier receives the same revenue.

Finally, the outsider patentee will obtain the revenue:

On the other hand, the outsider patentee will set when .

We substitute into (58) and (59), yielding:

Subsequently, the supplier also decides the price and his profit by :

Consequently, the outsider patentee will obtain the revenue:

The above results show that is larger than . The supplier will choose

the same price in the same royalty no matter in exclusive or non-exclusive licensing

conditions. Besides, the output increases when the outsider patentee licenses the

innovation to both firms. As a result, the outsider patentee receives more revenue in

the non-exclusive licensing condition. Thus, we have the proposition:

23

patentee can receive more revenues if he licenses to both downstream firms.

Comparing the revenues of the outsider patentee in drastic innovation case, it is

demonstrated that is also the best. Consequently, we can obtain the following

proposition.

Proposition 6. Under the drastic innovation case, for the outsider patentee licensing

to both downstream firms by royalties is superior to the fixed fee.

Similarly, the outsider patentee can weaken the supplier‟s advantage when he

licenses by means of royalty. The royalty affects the production cost and the price

strategy of the supplier. As a result, the outsider patentee can obtain more the

24

4. Conclusion

In the last section, we discuss the impact of the supplier. It is demonstrated

that licensing by fixed fee contract is better than royalty contract under the situation

that both firms compete in quantity and no supplier (see Appendix 1). The result is

almost the same with Kamien and Tauman (1986). In the study, we introduce the

impact of a supplier; as a result, we find that the outsider patentee will choose the

means of the royalty licensing and license the innovation to both downstream firms no

matter in the drastic or the non-drastic innovation cases. Besides, we also find that

the supplier will use the price strategy to compete with the outsider patentee. The

supplier will set the price that is higher or equal to the price under no innovation since

he knows that the average production cost decrease. Furthermore, the outsider

patentee can weaken the supplier‟s advantage in royalty licensing condition. In other

words, through the royalty, the outsider patentee can obtain more benefits caused by

the innovation.

Next, we discuss the difference between our result and Arya and Mittendorf‟s

(2006). They considered the impact of the supplier and built the model, including

one suppler and two firms that one is the paten-holding and compete in quantity.

They found that the paten-holding firm prefers royalty licensing to fixed fee licensing

25

outsider; therefore, we can find the different result that the patentee will choose to

license the innovation by royalty not only in the drastic innovation case but also in

non-drastic innovation case.

Finally, we consider that the firms compete in quantity in this study. In the

future, we can discuss that firms compete in price. Besides, we consider that the

firms produce the homogeneous goods and the innovation only reduces the cost of

production. In the future, we can introduce the idea of horizontal differentiation into

the model. For instance, the same quality good includes different colors. In the

other hand, we can also introduce the idea of vertical differentiation into the model.

The innovation not only reduces the cost of production but also change the quality of

the good for the consumer. Furthermore, we analyze the license contract in fixed fee

26

References

Arrow, K. (1962), “Economic Welfare and the allocation of resource for invention,” in: Nelson, R. (ed), The Rate and Direction of Inventive Activity, Princeton University Press, Princeton, 609-626.

Arya, A. and B. Mittendorf (2006), “Enhancing vertical efficiency through horizontal licensing,” Journal of Regulatory Economics, 29, 333-342.

Kamien, M.I. (1992), “Patent licensing”, in: Aumann, R.J. and Hart, S. (eds),

Handbook of Game Theory, vol. 1. North-Holland, Amsterdam, 331-354.

Kamien, M.I. and Y. Tauman (1986), “Fee versus royalties and the private value off a patent,” Quarterly Journal of Economics, 101, 471-491.

Kline, D. (2003), “Sharing the corporate crown jewels,” MIT Sloan Management

Review, 44(3), 89–93.

Muto, S. (1993), “On licensing policies in Bertrand Competition,” Games and

Economic Behavior, 5, 257-267.

Poddar, S. and U.B. Sinha (2004), “On patent licensing in spatial competition,”

Economic Record, 80, 208–218.

Wang, X.H. (1998), „Fee versus royalty licensing in a Cournot duopoly model‟,

Economic Letters, 60, 55-62.

Wang, X. H. and B. Yang (1999), “On licensing under Bertrand completion,”

27

Appendix 1

Consider the mode only includes the firms and the outsider patentee; thus, the

firms have to produce the intermediate good by themselves. The cost of equals the

original production cost plus the intermediate good cost. The two firms‟ profit

functions are represented as follows:

Solving the intersection of the reaction functions:

We discuss the cases as in section 3.

Fixed Fee

(i) Exclusive Licensing

28

Royalty

(i) Exclusive Licensing

Since the royalty rate is restricted, , the maximum is attained at

The outsider patentee will choose r = ε when

The outsider patentee will choose r = when

29 The outsider patentee will choose

Summarizing the results, we can demonstrate that fixed fee licensing is better

for the outsider patentee.

Next, we consider the drastic innovation case

Fixed Fee

(i) Exclusive Licensing

30

Royalty

(i) Exclusive Licensing

The outsider patentee will choose .

(ii) Non-Exclusive Licensing

The outsider patentee will choose

Summarizing the results, we can also find that it is better to license the