客製化能力廠商的策略性選擇 - 政大學術集成

全文

(2) 謝辭 本篇論文之完成,首先,衷心感謝恩師王智賢教授的耐心指導,從一開始論 文題目的選定到後續論文內容的延伸討論,恩師對學生的慷慨協助令我銘記在心, 可以說沒有恩師,就沒有這一篇論文成果。自 2009 年 9 月,大二開始修習王智 賢老師的總經課程起直到碩二,認識了老師目前約六年的時間中,老師在我求學 過程中扮演極重要的角色,無論在思想、學術或做人處事上,均給我相當多的啟 發及指導。在 2012 年 9 月起擔任大學部的總經助教後,老師更對我多加照顧。 在撰寫論文期間,老師不厭其煩的指導、不斷的給予鼓勵及專業精闢的建議,是. 政 治 大 論文的口試委員,在口試過程中給予我相當多寶貴的意見,補足了我在其他領域 立. 我能完成這篇論文最需要感謝的。同時也感謝翁堃嵐教授及黃亮洲教授擔任本篇. ‧ 國. 學. 專業知識的不足,也讓本篇論文能更加完整。. 包括大學及研究所期間,在政大財政已經長達六年的時間,每天進出系辦已. ‧. 經像進出家一樣的自然而然,六年的時間聽起來很長,但實際上很快就過了,終. sit. y. Nat. 將離開學校前往下一個人生的旅程階段展翅翱翔,真的有些不捨。今日畢業我以. al. er. io. 政大為榮,希望未來能夠讓系上和學校也感到以我為榮。. v. n. 最後謹將我的論文,獻給所有曾經幫助、指導、關懷的老師、兩年之間一起奮. Ch. engchi. i n U. 鬥共同勉勵的研究所同學們、平日一起加油打氣的大學好友以及最愛最關心我的家 人們的支持。衷心的感謝你們,很開心有你們!有你們真好!永遠愛你們!!. 書寧. 2014.6.

(3) 客製化能力廠商的策略性選擇 國立政治大學財政學研究所碩士班 研究生:詹書寧. 論文提要: 近年來客製化需求日漸遽增,產生多樣化和客製化的產品及服務,使得議題 因應而生。本文建立模型討論一家擁有客製化產品能力的廠商,與另一家沒有客 製化產品能力但可以進行廣告投入或藉由市場定位來調整產品特性的廠商,進行. 政 治 大 將使得以市場定位方式競爭的其他廠商,選擇產品定位使自己更加專業化;具客 立. 市場競爭情況。最後研究發現:當擁有客製化能力的廠商選擇將產品客製化時,. ‧ 國. 學. 製化能力的廠商將具有對其他廠商產生利潤降低的潛在影響;以及當其他廠商不 同的市場定位的成本係數與廣告投入成本係數的相對大小,如何影響兩家廠商的. ‧. 策略性選擇的情況。. y. Nat. n. al. er. io. sit. 關鍵詞:客製化、廣告、市場定位、Hotelling、子賽局完全均衡. Ch. engchi. i n U. v.

(4) Abstract Title: The Strategic Choice of the Firm with Customization Capability School: Graduate Institute of Public Finance National Chengchi University Author: Shu-Ning Chan Keywords: Customization; Advertising; Market Location; Hotelling; Subgame Perfect Nash Equilibrium. The needs of customization are increasing gradually. It leads to various and. 政 治 大. customized products and service. The issue “Mass Customization” also comes out for. 立. discussion. We use a game-theoretical model to discuss the competition between the. ‧ 國. 學. firms with and without customization capability. We assume that the firm without customization capability can adjust the product characteristics by inputting. ‧. advertising or selecting market location. We find out that when the firm with. y. Nat. io. sit. customization capability chooses to customize products, the other firm that selects the. n. al. er. market location as competition strategy would make itself more professional.. i n U. v. Moreover, the firm with customization capability has the potential effect on. Ch. engchi. decreasing other firms’ profit. We also discuss how the relative size between the cost coefficient of market location and the cost coefficient of advertising input would affect the strategic choice of the two firms..

(5) CONTENTS 1.. Introduction ................................................................................................................................ 1. 2.. The Model .................................................................................................................................... 6 2.1. Situation 1: Firm A chooses not to customize products, firm B chooses to adjust market location to compete with. ................................................ 7. 2.2. Situation 2: Firm A chooses not to customize products, firm B chooses to advertise its products to compete with. .................................................. 8. 2.3. Situation 3: Firm A chooses to customize products, firm B chooses to adjust. 政 治 大 Situation 4: Firm A chooses to customize products, firm 立. market location to compete with. ........................................................... 9. 2.4. B chooses to. advertise its products to compete with. ................................................ 10. ‧ 國. Situation 1. ................................................................................................................. 12. 3.2. Situation 2. ................................................................................................................. 13. 3.3. Situation 3. ................................................................................................................. 14. 3.4. Situation 4. ................................................................................................................. 16. 【Proposition 1】. ................................................................................................................. 20. 【Proposition 2】. ................................................................................................................. 20. 【Proposition 3】. ................................................................................................................. 23. 【Corollary 1】. ................................................................................................................. 25. ‧. 3.1. y. sit. al. er. io. v i n Ch Equilibrium: the first stage. ..................................................................................................... 18 engchi U n. 5.. Equilibrium: the second and the third stage. ......................................................................... 12. Nat. 4.. 學. 3.. Conclusion ................................................................................................................................. 26. References .......................................................................................................................................... 28.

(6) 1. Introduction “Mass Customization” takes into account both the mass production to reduce costs and the customers' individual needs through digital technology and information technology industries combined. The customers should start from the various firms’ flexible choices, select the product characteristics which meets their own preferences, and then will enter into the production process. Through the rapid production, it would distribute to end customers in high efficiency. Its main aim is to provide required products and services with targeting individual. 政 治 大 with is “personalization”, which must be a little more communication with 立. needs by mass production. Moreover, there is another term easy to be confused. customers. In the definition, there are some differences between them, and we. ‧ 國. 學. refer to "mass customization." However, both of them focus on meeting. ‧. customers’ needs and the definition increasingly blurred and difficult to. sit. y. Nat. distinguish nowadays. A large number of customized services come out in early. io. er. 1990s in other countries. Generally believe that the U.S. Dell Computer Corporation, which launched personalized Internet direct sales model, is the. n. al. earliest implementation. v i n ofCcustomized services. h e n g c h i U Other. cases like Nike have. launched the customization sneakers.. The advertising commercial media generally include as follows: bulletin boards, flyers, radio, film, television, web banners, web pop-up ads, bus stops, magazines, newspapers, bus bodies, taxi body, packaging, music video, and the back side of some tickets. Any forms of media which advertisers are willing to pay to advertise their business and products to meet its expectation are advertising. The related studies of advertising, such as Irmen and Thisse (1996) show the games that firms could choose locations. Whenever firms have different 1.

(7) characteristics, they would choose to maximize the dominant characteristic between others. However, if the characteristics are alike between firms, they would minimize the differences between others. That is, the principle of minimizing differences will be established except there are no characteristic differences between firms. In addition, with the characteristics between products increasing close to each other, the price would not decline necessarily. It is because when the advantages of product difference between firms are sufficient, price competition will gradually relaxed. Bloch and Manceau (1999) show that. 政 治 大 in the market, persuasive advertising is deem to be one of the ways to change 立 when the customers have different preferences between two competitive products. product preferences of them. If both products are sold by the same firm, the. ‧ 國. 學. advertising would make the price of the advertised products increase, and the. ‧. price of the other one would decrease. Only when customer's preferences not too. sit. y. Nat. focused on one product in the beginning, advertising would be profitable. When. io. er. different firms sell two different products, advertising would lead to lower prices. It would make firms have no incentives to advertise its products. Johnson (2013). n. al. Ch. shows that when advertising have no effect. engchi. v i n on U consumers,. the firm would. continuously improve its ability to influence market. Though firms would benefit from increasing its ability, the customers don’t need it. In the article, they also point out that there may be too few obstacles in the advertising equilibrium. And the related studies of customization are like Logunova (2010) challenges the assumption in the general theory. The paper assumes that customers always could get their ideal product when they buy customization products. They use the Hotelling’s model. Assume initially, firms manufacture standardized products and the products locate at both ends of the interval point. Then one of the firms start to provide customization products, the customers who are more familiar 2.

(8) with the brand would more easy to convert their needs into the brand's product characteristics. On the contrary, others who are not familiar with the brand would encounter difficulties. In the paper, the knowledge of specific products is important. More knowledge they have, more ability they could analyze the information and more fit the products to their preferences. In the game, both of the firms would decide whether they choose to customize products at the same time, and then would enter into a price competition. In the article, they also note that when the differences between customization products become small, it. 政 治 大 equilibrium, only one firm would provide customization products. Loginova 立. would lead to co-design with customers to reduce price competition. In. (2012) described more in mass customization of today's theoretical description. ‧ 國. 學. that it would reduce the differences between products and enhance price. ‧. competition. However, in practice, management literature has shown the main. sit. y. Nat. objective of customization is to generate a difference between the company and. io. er. its competitors. Customers and product design influence each other so that customers may have emotion toward the firm. Then it would weaken the firm's. al. n. v i n C h provides an added competitive pricing. The literature customer factor model to engchi U explain the phenomenon of practical management class literature. In the. Hotelling line with two firms, a group customers with continuity and heterogeneous brand preferences, and a group of exogenously given customers who may more interested in customization products. The benefits which customers get from customization products are a special shopping experience and the product customization value (a more suitable product). When customers buy a customization product, they will have to pay the cost of waiting. Syam et al. (2005) show the mass customization competitive market. Competition leads to a surprising conclusion: firms would only customize one of the two 3.

(9) characteristics, and each firm would choose the same characteristics. When the firm chooses to customize in the beginning and then selects the price. In the equilibrium, customizing both two characteristics would not be sustained because customization would make opponents desperate to give the pressure by lowering prices. The equilibrium includes partial or no customization. In addition, Xia and Rajagopalan (2009) show that the standardization and customization decisions of two firms in the competition, which include product type, product design and the time gap between the actual production (lead time) and price. 政 治 大 convenience) and the heterogeneity of product characteristic preference. They 立 setting. The paper combines the customer’s preferences toward firms (or store. noted that the equilibrium would depend on the cost-effectiveness of. ‧ 國. 學. manufacturing technology, customer’s experience of suitability for the product. ‧. design and the lead time. Compared to previous studies, this paper found that. sit. y. Nat. when enough differences between firms already exist, increasing the range of. io. er. products does not make themselves more favorable in a price competition. However, if firms pay more attention to meet customers’ demand, the product’s. al. n. v i n Cpressure price would increase and the competition would release. h e n gof cprice hi U. Taking these discussions, although there are literatures that firms may affect. competition in the market on advertising or customization products, we still have no literatures that discuss the competition between the firm with customization capability and the firm without customization capability but can adjust the product characteristics by inputting advertising or selecting market location. We have the following conclusions: if the firm with customization capabilities chooses to customize the products, it would make the other firm with the ability of selecting market location choose to make the product more specialized. The firm with customization capability has potential impact on reducing the other 4.

(10) one’s profits. And the relative size between the cost coefficient of market location and the cost coefficient of advertising input would affect the strategic choice of the two firms. The structure orders of this article are as follows: section 1 is the introduction, section 2 is the basic model, section 3 is the equilibrium of the second and third phase, section 4 is the equilibrium solution of first phase, and Section 5 is the conclusion.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 5. i n U. v.

(11) 2. The Model We established a three-stage game model. In the first stage, firm A decide whether to customize the products and firm B decide whether to advertise the products or adjust the competitive market location at the same time. The second stage is Hotelling competition stage. If firm B choose the capability of market location in the previous stage, it would determine the exact market location point this stage. However, if firm B choose the capability of advertising, it would determine the exact quantities of advertising. Finally, in the third stage, the two. 政 治 大 Assume there are two firms in the market, which are firm 立. firms would enter into a price competition.. A and firm B .. And they produce two different products. Firm A produce product A and firm. ‧ 國. 學. B produce product B . Consumers in the market are equally distributed. The. ‧. product characteristics produced by the two firms locate at the each endpoint on. y. Nat. consumer preferences line separately. Firm A locate at x 0 and firm B locate. er. io. sit. at x 1 . We use a constant t , which represents the negative utility arose in the differences between the preference of consumers and the characteristics of the. n. al. iv. C the greater intensity product. The larger t means U n of their preference to the hengchi. product. Consumers could be satisfied only when their preference index exactly equal to 0 or 1. The farther between the product characteristics and their preferences are, the lower the utility consumers could get. In the following, we would introduce four situations at first. Two situations are whether firm A customizes products. And the other two are whether firm B chooses to advertise the products or adjust the market location. Then, we would introduce the Hotelling game of each situation in the second stage. The equilibrium of four situations under the second stage would be discussed in third stage. 6.

(12) 2.1 Situation 1: Firm A chooses not to customize products, and firm B chooses to adjust market location to compete with.. Before introducing that firm B can maximize its own profits by adjusting market location, we introduce the situation firm B without the capability at first. Because firms A and firms B locate at each endpoint on consumer preferences line, which are 0 and 1, the utility U ( x , y ) which consumer x gets from purchasing products A and B is:. 政 治 大. V tx PA1 ; if S A U ( x, S ) 1 V t (1 x ) PB , if S B. 立. (1). V is the highest price which consumers are willing to pay. Assume V is large. ‧ 國. 學. enough so that each consumer could buy exactly one unit of product A or B .1. ‧. Under the premise that firm B could maximize profit by adjusting the market. n. al. And if consumer. er. io. V tx PA1 ; if S A U ( x, S ) 1 V t ( y1 x ) PB , if S B. sit. y. Nat. location to y1 ( y1 (0,1]) , if consumer x y1 (1) can be rewritten as: ,. n U x y , (1) can e be n rewritten g c has:i 1. Ch. V tx PA1 ; if S A U ( x, S ) 1 V t ( x y1 ) PB , if S B. iv. (1a). (1b). In addition, to simplify our analysis, we only discuss the situations that both firms exist in the equilibrium. Under the situation 1, a market segmentation point x1 would split market into two parts which are [0, x1 ] and [ x1 ,1] . That is, whenever consumer x1 gets the same utility from purchasing products A or B , the profit 1. In the following, we also assume that V is large enough so that each consumer could buy exactly one unit of product A or B . 7.

(13) of firm A is 1A PA1 x1 and the profit of firm B is 1B PB1 (1 x1 ) (1 y1 )2 . Among them, we define as a cost coefficient of market location and (1 y1 )2 is the total cost of market location of firm B .2. 2.2 Situation 2: Firm A chooses not to customize products, and firm B chooses to advertise its products to compete with.. Assume the advertisement of firm B has positive effect on increasing. 政 治 大. consumers’ utility. That is, the more advertisement firm B input, the higher. 立. B , the utility of the consumer. 學. ‧ 國. utility consumers get from purchasing product B .3 Given the advertising input x gets from purchasing product A or B is:. (2). Nat. sit. y. ‧. V tx PA2 ; if S A U ( x, S ) 2 V B 2 t (1 x ) PB , if S B. io. al. er. Similarly, we only discuss the situations that both firms exist in the equilibrium.. n. Under the situation 2, a market segmentation point x2 would split market into. C. i n U. v. h [xn2 ,1]g. That c h is,i whenever consumer x2 gets the two parts which are [0, x2 ] and e same utility from purchasing products A or B , the profit of firm A is. A2 PA2 x2 , and the profit of firm B is B2 PB2 (1 x2 ) k (B 2 )2 . Among them, 2 we define k as a cost coefficient of advertising and k (B 2 ) is the total cost of. 2. The cost of adjusting market location of firm B will in the form of quadratic in the following. It is. the similar as the quadratic way of product transportation costs which is set in ’Aspremont et al. (1979). 3 Related literature are as follows: Cengiz et al. (2007) descript the efficiency of the advertisement will affect consumer loyalty for this product. Chung et al. (2012) descript ads will increase the motivation of consumers to buy products, and it would make closer relationship between consumers and the firm. 8.

(14) advertising of firm B .. 2.3 Situation 3: Firm A chooses to customize products, and firm B chooses to adjust market location to compete with.. We assume firm A can exactly meet the consumers’ preference by customizing products under the situation. And we followed the setting in Loginova (2010) that consumers would not have a negative effect on the. 政 治 大 doesn’t exist. In addition, 立 as situation 1, before introducing that firm. differences between the product characteristics and their own preferences. That is,. t. B can. ‧ 國. 學. maximize its own profits by adjusting market location, we introduce the situation firm B without the capability at first. Because firms A and firms B locate at. ‧. each endpoint on consumer preferences line, which are 0 and 1, the utility. y. sit. n. al. V PA3 ; if S A U ( x, S ) 3 V t (1 x ) PB , if S B. Ch. engchi. er. io. is A or B ). Nat. U ( x , S ) which consumer x gets from purchasing products A and B is: ( S. i n U. v. (3). Under the premise that firm B can maximize its profits by adjust its market location, if consumer x y3 , (3) can be rewrite as: if S A V PA3 ; U ( x, S ) 3 V t ( y3 x ) PB , if S B. (3a). And if consumer x y3 , (3) can be rewrite as: if S A V PA3 ; U ( x, S ) 3 V t ( x y3 ) PB , if S B. (3b). Similarly, we only discuss the situations that both firms exist in the equilibrium. 9.

(15) Under the situation 3, a market segmentation point x3 would split market into two parts which are [0, x3 ] and [ x3 ,1] .4 That is, whenever consumer x3 gets the same utility from purchasing products A or B , the profit of firm A is. A3 PA3 x3 CA , and the profit of firm B is B3 PB3 (1 x3 ) (1 y3 )2 . Among them, we follow the setting in Loginova (2010) that we define CA as the total cost of product customization of firm B .5. 政 治 大 chooses to advertise 立its products to compete with.. 2.4 Situation 4: Firm A chooses to customize products, and firm B. ‧ 國. 學. Similar to situation 3, consumers will not have a negative effect on the. ‧. differences between the characteristics of products and their own preferences.. sit. y. Nat. And we assume the more advertisement the firm B input, the higher utility. al. er. io. consumers get from purchasing product B as situation 2. Given the original. v. n. market location of firm B and the advertising input amount B 4 , under the. Ch. engchi. i n U. premise that firm A chooses to customize products, the utility which consumer x gets from purchasing products A and B is:. V PA4 ; if S A U ( x, S ) 4 V B 4 t (1 x ) PB , if S B. (4). Under the situations that both firms exist in the equilibrium, in the situation 3, there is a market segmentation point x4 would split market into two parts which In the following, we assume t is not big enough, so we don’t take the situation into account: some of the consumer close to x 1 might choose to buy the product of firm A .. 4. 5. In the following, we assume the customization cost. CA. as a fixed cost. In the future, we also can. assume the cost would be related to the distance between the firm and the consumer 10.

(16) are [0, x4 ] and [ x4 ,1] . That is, whenever consumer x4 gets the same utility from purchasing products A or B , the profit of firm A is A4 PA4 x4 CA , and the profit of firm B is B2 PB4 (1 x4 ) k (B 4 )2 . In the following, we adopt the concept of subgame perfect equilibrium to find the equilibrium. And we analyze the interaction of two firms’ decision by backward introduction.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 11. i n U. v.

(17) 3. Equilibrium: the second and the third stage. We would divide this section into four parts to introduce the equilibrium of each situation in the second and the third stage. And in the next section, we would analyze the equilibrium strategies of two firms in the first stage.. 3.1 Situation 1: Firm A chooses not to customize products, and firm B chooses to adjust market location to compete with. Given the market location y1 which firm B chooses in the second stage, we. 政 治 大. could know the market segmentation point x1 from formula (1a) is:. 立. ty1 ( PA1 PB1 ) 2t. (5). 學. ‧ 國. x1 . Then, put formula (5) into 1A and 1B , and use the first order condition of profit. maximization. to. simultaneous. solve. ‧. firm’s. Nat. y. ( 1A / PA1 ) 0 and. n. al. er. 6. io. third stage:. sit. ( 1B / PB1 ) 0 . And we would reach out the equilibrium price of each firm in the. Ch. t (4 y1 ) P 3 1 A. engchi PB1 . i n U. v. (6). t (5 2 y1 ) 3. (7). Put formula (6) and (7) into (5), and we could get the market segmentation point x1 (1 2 y1 ) / 6 . Then put the information such as the product’s price of each firm and the market segmentation point into 1B , find the first order. 1 1 1 1 6 At this time, A , P1 P1 2 / t , B , P1 P1 1/ t , A, P1 P1 1/ t , B , P1 P1 1/(2t ) and A A. . 1 A, PA1 PA1. . 1 B , PB1 PB1. . 1 A , PA1 PB1. B B. . 1 B , PB1 PA1. A B. B A. 3 /(2t ) 0 . They represent the second order condition and the 2. stable condition of profit maximization. 12.

(18) condition toward y1 , and we could get the optimal market location: y1 . 9 5t 9 2t. (8). Under the premise of (5 / 9)t ,7 the market location of firm B would be the internal solution between 0 and 1. And put the information such as the product’s price of each firm and the market location into two firms’ profit, we could reach out: ( 1A , 1B ) (. 3.2 Situation 2: Firm A. 立. t (9 t )(9 4t ) 9t , ) 2 2(9 2t ) 18 4t. (9). 政 治 大 chooses not to customize products, and firm. B. chooses to advertise its products to compete with.. ‧ 國. 學 ‧. Given that firm B chooses to advertise its products to compete with in the. io. segmentation point x2 from formula (2) is:. n. al. i n U. t B 2 ( PA2 PB2 ) 2t. Ch. x2 . engchi. er. sit. y. Nat. second stage and the advertising input is B 2 , we could know the market. v. (10). Then, put formula (10) into A2 and B2 , and use the first order condition of firm’s profit maximization to simultaneous solve ( A2 / PA2 ) 0 and. ( B2 / PB2 ) 0 . And we would reach out the equilibrium price of each firm in the third stage:8 7 Under the premise of (5 / 9)t , the market location is also correspond to the second order condition. 8. At this time,. . 2 A, PA2 PA2. . 2 B , PB2 PB2. A2 , P P 1 / t , B2 , P P 1 / t , A2 , P P 1 / (2t ) , B2 , P P 1 / (2t ) and 2 2 A A. . 2 A, PA2 PB2. 2 2 B B. . 2 B , PB2 PA2. 2 2 A B. 2 2 B A. 3 / (4t ) 0 . They represent the second order condition and the 2. stable condition of profit maximization. 13.

(19) PA2 . 3t B 2 3. (11). PB2 . 3t B 2 3. (12). Put formula (11) and (12) into (10), and we could get the market segmentation point x2 (3t B2 ) /(6t ) . Then put the information such as the product’s price of each firm and the market segmentation point into B2 , find the first order condition toward B 2 , and we could get the optimal advertising input:. 立. 3治 t 政 大 18kt 1 B2. (13). Under the premise of k 1/(9t ) , the advertising input of firm B would be. ‧ 國. 學. positive and it would correspond to the second order condition of the optimal. ‧. input of advertising, also the market segmentation point x2 would be the. sit. y. Nat. internal solution between 0 and 1. And put the information such as the product’s. al. n. out:. er. io. price of each firm and the market location into two firms’ profit, we could reach. v i n Ch 2t (9kt 1) U 9kt ( , e)n (g c h i , 2. 2 A. 2 B. 2. (18kt 1) 2 18kt 1. ). (14). 3.3 Situation 3: Firm A chooses to customize products, and firm B chooses to adjust market location to compete with.. Given the market location y3 which firm B chooses in the second stage, we could know the market segmentation point x3 from formula (3a) is: x3 . ty3 ( PA3 PB3 ) t 14. (15).

(20) Then, put formula (15) into A3 and B3 , and use the first order condition of firm’s. profit. maximization. to. simultaneous. ( A3 / PA3 ) 0 and. solve. ( B3 / PB3 ) 0 . And we would reach out the equilibrium price of each firm in the 9. third stage:. PA3 . t (1 y3 ) 3. (16). PB3 . t (2 y3 ) 3. (17). Put formula (16) and (17) into (15), and we could get the market. 政 治 大. segmentation point x3 (1 y3 )/3 . Then put the information such as the. 立. ‧ 國. 學. product’s price of each firm and the market segmentation point into B3 , find the first order condition toward y3 , and we could get the optimal market location:. ‧. y3 . y. Nat. 9 2t 9 t. (18). er. io. sit. Under the premise of (2 / 9)t ,10 the market location of firm B would be the internal solution between 0 and 1. And put the information such as the product’s. al. n. v i n C h location into twoUfirms’ profit, we could reach price of each firm and the market engchi out:. ( A3 , B3 ) (. t (6 t ) 2 t CA , ) 2 (9 t ) 9 t. 3 3 3 3 9 At this time, A, P3 P3 2 / t , B , P3 P3 2 / t , A, P3 P3 1 / t , B , P3 P3 1 / t and A A. . 3 A , PA3 PA3. . 3 B , PB3 PB3. . 3 A , PA3 PB3. B B. . 3 B , PB3 PA3. A B. B A. 3 / t 0 . They represent the second order condition and the 2. stable condition of profit maximization. Under the premise of (2 / 9)t , the market location is also correspond to the second order condition. 15 10. (19).

(21) 3.4 Situation 4: Firm A chooses to customize products, and firm B chooses to advertise its products to compete with.. Given that firm B chooses to advertise its products to compete with in the second stage and the advertising input is B 4 , we could know the market segmentation point x4 from formula (4) is: x4 . t B 4 ( PA4 PB4 ) t. (20). 政 治 大. Then, put formula (20) into A4 and B4 , and use the first order condition of. 立. firm’s profit maximization to simultaneous solve ( A4 / PA4 ) 0 and. ‧ 國. 學. ( B4 / PB4 ) 0 . And we would reach out the equilibrium price of each firm in the. t B 4 3. y. PB4 . (21). sit. io. 2t B 4 3. (22). n. er. Nat. al. PA4 . ‧. third stage:11. i n U. v. Put formula (21) and (22) into (20), and we could get the market. Ch. engchi. segmentation point x4 (2t B4 ) /(3t ) . Then put the information such as the product’s price of each firm and the market segmentation point into B4 , find the first order condition toward B 4 , and we could get the optimal advertising input:. B 4 . t 9 kt 1. (23). 4 4 4 4 At this time, A, P 4 P 4 2 / t , B , P 4 P 4 2 / t , A, P 4 P 4 1 / t , B , P 4 P 4 1 / t and. 11. A A. . 4 A , PA4 PA4. . 4 B , PB4 PB4. . 4 A, PA4 PB4. B B. . 4 B , PB4 PA4. A B. B. A. 3 / t 0 . They represent the second order condition and the 2. stable condition of profit maximization. 16.

(22) Under the premise of k 1/(6t ) , the advertising input of firm B would be positive and it would correspond to the second order condition of the optimal input of advertising, also the market segmentation point x4 would be the internal solution between 0 and 1. And put the information such as the product’s price of each firm and the market location into two firms’ profit, we could reach out: t (6kt 1) 2 kt 2 ( , ) ( CA , ) (9kt 1) 2 9kt 1 4 A. 立. 4 B. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 17. i n U. v. (24).

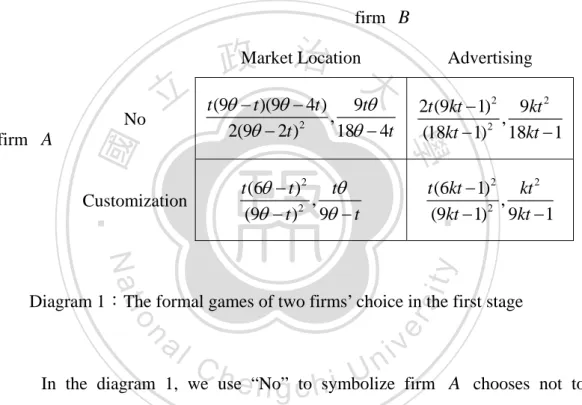

(23) 4. Equilibrium: the first stage. In this section, we would put the equilibrium which we found in the second and the third stage into the first stage to discuss the strategic choice of two firms. In addition, to reduce the random impact of firm A ‘s customization cost on the equilibrium, we assume CA 0 in the following. Combine the result of formula (9), (14), (19) and (24) with the choice of two firms in the first stage, we could get the formal games as follows: firm B. t (9 t )(9 4t ) 9t , 2(9 2t )2 18 4t. Advertising. 2t (9kt 1)2 9kt 2 , (18kt 1)2 18kt 1. 學. firm A. 立. t (6 t )2 t , (9 t )2 9 t. Customization. t (6kt 1)2 kt 2 , (9kt 1)2 9kt 1. ‧. ‧ 國. No. Location 政Market治 大. sit. y. Nat. n. al. er. io. Diagram 1:The formal games of two firms’ choice in the first stage. Ch. engchi. i n U. v. In the diagram 1, we use “No” to symbolize firm A chooses not to customize products, and use “Customization” to symbolize firm A chooses to customize products. On the other hand, we use “Market Location” to symbolize firm B chooses to adjust market location to compete with, and use “Advertising” to symbolize firm B chooses to advertise its products to compete with.. Before entering the equilibrium in the first stage, we could know. (5 / 9)t and k 1/(6t ) from the last section. And we could know y1 from formula (8) minus y3 from formula (18) would get: 18.

(24) y1 y3 . t (18 t ) 0 (9 2t )(9 t ). (25). It means firm B would be closer to firm A ‘s market location when firm. A chooses to customize products. It is mainly because when firm A chooses to customize products, firm B would choose to make itself more professional, which means the market location of firm B would farer away from firm A , to increase the market segmentation and the consumers’ utility. And we could know. B 2 from formula (13) minus B 4 from formula (23) would get: B 2 B 4 . t (9 kt 2) (18kt 1)(9 kt 1). (26) 治 政 Because we only assume k 1/(6t ) in the 大 previous, the sign of (26) isn’t 立. decided. When the coefficient of advertising is bigger (which is k 2 /(9t ) ), firm. ‧ 國. 學. B would have a higher advertisement input when firm A chooses not to. B. would have a lower. y. k (1/(6t ), 2 /(9t )) ), firm. sit. Nat. smaller (which is. ‧. customize the products. On the other hand, when the coefficient of advertising is. io. er. advertisement input when firm A chooses not to customize the products. It is mainly because the product advantages of firm B decrease when firm A. al. n. v i n C hAt the time, firmUB could consider increase the chooses to customize products. engchi. advertising input to increase the consumers’ utility to buy the products and decrease the product’s price to increase its competitiveness. This is what formula (27) shows: PB2 PB4 . 3t B 2 t B 4 3kt 2 (36kt 5) 0 3 3 (18kt 1)(9kt 1). (27). When the coefficient of advertising is smaller, firm B would choose to input more advertisement to compete with. And when the coefficient of advertising is bigger, firm B would strategically choose to lower the product price to compete with to relatively reduce the loss of benefits. To sum up all 19.

(25) description above, we could get the following proposition 1:. 【 Proposition 1 】 Under the premise that firm A chooses to customize the products, if firm B chooses market location to compete with, the products would be more professional. And if firm B chooses advertisement inputs to compete with, the advertisement inputs would be lower (higher) when the advertisement cost coefficient of firm B is larger (smaller). In addition, we could observe the effect of customization capability of firm. 政 治 大 formula (9) and we would get: 立 9t t t (63 5t ). A on the profit of firm. First, we substrate firm B ’s profit of formula (19) from. ‧ 國. 18 4t. . 9 t. . (18 4t )(9 t ). 學. 1B B3 . 0. (28). Then, we substrate firm B ’s profit of formula (24) from formula (14) and. ‧. we would get:. y. 9kt 2 kt 2 (63kt 8) kt 2 0 18kt 1 9kt 1 (18kt 1)(9kt 1). io. sit. Nat. B2 B4 . (29). n. al. er. Because both formula (28) and (29) are greater than 0, no matter that firm. i n U. v. B choose market location or advertising to compete with, it would have lower. Ch. engchi. profit when firm A choose to customize the products. It shows that the customization capability of firm A have the potential effect on lower firm B ‘s profit. It is the proposition 2:. 【 Proposition 2 】 Firm B always have a lower profit when firm A chooses to. customize its products. The proposition shows that the customization capability of firm A has. the potential effect on lower firm B ‘s profit. However, whether firm A choose to customize the products in reality would depend on the potential effect of 20.

(26) economic variables. In the following, we would derive at the equilibrium of the first stage. First, from the sight of firm A , given that firm B chooses the market location to compete with, we substrate firm A ’s profit of formula (19) from formula (9) and we would get:. 1A A3 . t (9 t )(9 4t ) t (6 t )2 t (729 4 567 3t 99 2t 2 51 t 3 4t 4 ) 2(9 2t ) 2 (9 t ) 2 2(9 2t ) 2 (9 t ) 2. (30) The sign of formula (30) is not decided yet and the numerator is the fourth power of . Through the software Mathematica 9.0 , we could find two. 政 治 大 and 立disregarding two imaginary roots, we could get: given. imaginary roots of and the other two roots, 0.849648t and 0.343848t . Because (5 / 9)t. ‧ 國. 學. that firm B chooses market location to compete with, if 0.849648t , firm. A would choose not to customize the products. It is mainly because firm B. ‧. would not choose to be too close to the market location of firm A when firm’s. sit. y. Nat. B cost efficient of market location is bigger, firm A would more easy to. n. al. er. io. choose not to customize the products and there are a optimal segmentation. i n U. v. between two firms to make the profit increase. On the other hand, when firm’s. Ch. engchi. B cost efficient of market location is smaller, firm B would easily to choose the market location close to firm A ’s. To prevent the market location too close so that it would more competitive, firm A would choose to customize the products and and firm B must make its products more professional (which is proposition 1). Then, given that firm B chooses to advertise its products to compete with, we substrate the firm A ‘s profit of formula (24) from formula (14) and we would get:. A2 A4 . 2t (9kt 1) 2 t (6kt 1) 2 t{1 6kt (9kt 2)[2 3kt (9kt 2)]} (18kt 1) 2 (9kt 1) 2 (18kt 1) 2 (9kt 1) 2 21. (31).

(27) Under the assumption of k 1/(6t ) , formula (31) is positive. That is, firm. A would choose not to customize its products when firm B chooses to advertise its products to compete with. It is mainly because when firm B chooses to advertise its products rather than adjust market location, the market locations between two products are farther away. Firm A need not choose to customize the products to decrease the segmentation between two firms. In the following, given that firm A chooses not to customize the products, let’s discuss the choice of firm B . We substrate the profit of formula (14) from formula (9) and we would get:. 1 B. 治 政 9t 9kt 大9t (4kt 2. 立 18 4t 2 B. 18kt 1. ) (18 4t )(18kt 1) 2. (32). ‧ 國. 學. The sign of formula (32) would relate to the relative size of and 4kt 2 . When bigger (smaller) than 4kt 2 , firm B would choose to advertise its. ‧. products (adjust the market location). The choice of firm B would depend on. sit. y. Nat. the relative size of the market location cost and of the advertising input. Under the. n. al. er. io. same condition that firm A chooses to customize its products, we substrate the. v. firm B ’s profit of formula (14) from formula (19) and we would get:. Ch. B3 B4 . etn g ckt h i 2. 9 t. 9kt 1. i n U t (kt. ) (9 t )(9kt 1) 2. (33). The sign of formula (33) would relate to the relative size of and kt 2 . When bigger (smaller) than kt 2 , firm B would choose to advertise its products (adjust the market location). The reason is similar as formula (32), and the only difference is that under the premise which firm A chooses to customize its products, firm B would more close to choose the advertisement to compete with. It is mainly because when firm A chooses to customize its products, the segmentation between two products is not clear so that firm B should choose to advertise its products to increase the profits. 22.

(28) Combine all the analysis above, we could start from the relative size between and kt 2 , there are three scenarios: 1.. 4kt 2 : Firm B must choose to advertise its products. Then, firm. A would choose not to customize its products to compete with. At the time, it exists the pure strategic subgame equilibrium (No, Advertising).12 2.. kt 2 : Firm B must choose to adjust its location. Then, firm A. would choose not to customize its products to compete with if 0.849648t . At the time, it exists the pure strategic subgame equilibrium (No, Market Location).. 治 政 the time, it exists大 the. And firm A would choose not to customize its products to compete with if. ((5 / 9)t , 0.849648t ) . At. 立. pure strategic subgame. equilibrium (Customization, Market Location).. ‧ 國. 學. 3.. (kt 2 , 4kt 2 ) : At the time, A2 A4 、 1B B2 、 B4 B3 and. ‧. 0.849648t . When 1A A3. and ((5 / 9)t , 0.849648t ) ,. 1A A3 .. Nat. io. sit. y. Therefore, we could get: when 0.849648t , it would exist the pure strategic. a. er. subgame equilibrium (No, Market Location) in the first stage. And when. n. ((5 / 9)t , 0.849648t ) , lit would exist the mixed strategic i v subgame equilibrium (. ( p,1 p ), (q,1 q ). n U i g c h first ine n the stage.. Ch. ). Among. this,. p ( B4 B3 )/( 1B B2 B4 B3 ) , q ( A2 A4 ) /( A3 1A A2 A4 ) .. It is the proposition 3 in the following: 【 Proposition 3 】 The equilibrium of two firms in the first stage are as follows: 1.. When firm B ’s cost efficient of market location is bigger than the. cost efficient of advertising (which is 4kt 2 ), it would exist the pure strategic 12. The strategic choices in the second and the third stages are in the third section. It is the same in the following. 23.

(29) subgame equilibrium (No, Advertising). 2.. When firm B ’s cost efficient of market location is smaller than the. cost efficient of advertising (which is kt 2 ), if 0.849648t , it would exist the pure strategic subgame equilibrium (No, Market Location). And if. ((5 / 9)t , 0.849648t ) , it would exist the pure strategic subgame equilibrium (Customization, Market Location). 3.. When the firm B ’s cost efficient of market location is close to the. cost efficient of advertising (which is (kt 2 , 4kt 2 ) ), if 0.849648t , it. 政 治 大 ((5 / 9)t , 0.849648t )立 , it would exist mixed strategic subgame equilibrium. would exist the pure strategic subgame equilibrium (No, Market Location). And if. ( p,1 p ), (q,1 q ). ‧ 國. ). in. the. first. stage.. 學. (. Among. this,. p ( B4 B3 )/( 1B B2 B4 B3 ) , q ( A2 A4 ) /( A3 1A A2 A4 ) .. ‧. The proposition 3 shows that when firm B ’s cost efficient of market. y. Nat. sit. location is bigger than the cost efficient of advertising (which is 4kt 2 ), firm. n. al. er. io. B would choose to advertise its products. And under the condition that two. i n U. v. products’ segmentation, firm A would choose not to customize its products to. Ch. engchi. prevent from the price competition due to their market location too close. When firm B ’s cost efficient of market location is smaller than the cost efficient of advertising (which is kt 2 ), firm B would choose to adjust market location. And under the condition that two products may get closer, firm A would choose to customize its products and firm B would make its products more professional to decrease the price competition due to their market location too close. In the end, when the firm B ’s cost efficient of market location is close to the cost efficient of advertising (which is (kt 2 , 4kt 2 ) ), the strategy of both firms would depends on the variables (It may exist mixed strategy perfect subgame 24.

(30) equilibrium.). Especially the relative size between and 0.849648t may affect the strategic choice of firm A and thereby affect the result of both strategies. By Proposition 3 we could get the following corollary 1: 【 Corollary 1 】 When firm B ’s cost efficient of market location is smaller. kt 2 ), and if. than the cost efficient of advertising (which is. ((5 / 9)t , 0.849648t ) , it would exist the pure strategic subgame equilibrium (Customization, Market Location). The remaining cases would not get the pure strategic subgame equilibrium that firm A chooses to customize the products.. 政 治 大 Corollary 1 shows that: when firm B ’s cost efficient of market location is 立. relatively lower, firm B is more convenient to adjust its market location. At the. ‧ 國. 學. same time, in order to segment from firm B , firm A would choose customize. ‧. io. sit. y. Nat. n. al. er. its products.. Ch. engchi. 25. i n U. v.

(31) 5. Conclusion Nowadays, the customization needs of the product attributes, functionality, design and other aspects increasingly dramatically, so here comes diverse and customized products and services. And the production function of “Mass Production” gradually formed, also makes a lot of customization issue being discussed. In practice, the use of mass customization is widespread, like in other electronic products, shoes and clothing. In other countries, mass customization. 政 治 大 success case is Dell company which launched the internet personal direct sells 立 services began forming in the early 1990s, it is generally believed that the earliest. ways. And other customization case, for example, Nike’s sneakers. You could. ‧ 國. 學. choose color combination and the leather by yourself, also you could make your. ‧. name being print on the shoes.. sit. y. Nat. Taking these discussions, although there are literatures that firms may affect. io. er. competition in the market on advertising or customization products, we still have no literatures that discuss the competition between the firm with customization. al. n. v i n C hcustomization capability capability and the firm without but can adjust the product engchi U characteristics by inputting advertising or selecting market location. So we start. from the aspect to build a model to discuss the competition between the firms with and without customization capability. We assume that the firm without customization capability can adjust the product characteristics by inputting advertising or selecting market location. We hope to enhance the breadth of customized product literature. We have the following conclusions: if the firm with customization capabilities chooses to customize the products, it would make the other firm with the ability of selecting market location choose to make the product more 26.

(32) specialized. The firm with customization capability has potential impact on reducing the other one’s profits. And the relative size between the cost coefficient of market location and the cost coefficient of advertising input would affect the strategic choice of the two firms: when firm B ’s cost efficient of market location is bigger than the cost efficient of advertising, firm B would choose to advertise its products. And under the condition that two products’ segmentation, firm A would choose not to customize its products to prevent from the price competition due to their market location too close.. 政 治 大 efficient of advertising, firm B would choose to adjust market location. And 立 When firm B ’s cost efficient of market location is smaller than the cost. under the condition that two products may get closer, firm A would choose to. ‧ 國. 學. customize its products and firm B would make its products more professional to. ‧. decrease the price competition due to their market location too close. In the end,. sit. y. Nat. when the firm B ’s cost efficient of market location is close to the cost efficient. io. n. al. er. of advertising, the strategy of both firms would depend on the variables.. Ch. engchi. 27. i n U. v.

(33) References Bloch, F. and D. Manceau, (1999), “Persuasive Advertising in Hotelling's Model of Product Differentiation,” International Journal of Industrial Organization, 17:4, 557-574. Cengiz,. E., H.. Ayyildiz,. and. B.. Er,. (2007),. “Effects. of. Image. and Advertising Efficiency on Customer Loyalty and Antecedents of Loyalty: Turkish Banks Sample,” Banks and Bank Systems, 2:1, 56-78.. 政 治 大 Perception, Advertising立 Effectiveness and Relationship. Chung, C. W., H. T. Chen, and C. Y. Lin, (2012), “A Study of Brand. ‧ 國. 學. Intention,” Journal of Data Analysis, 7:5, 137-157.. Quality on Purchase. d’Aspremont, C., J. Gabszewicz, and J. -F. Thisse, (1979), “On Hotelling’s Stability in. ‧. Competition,” Econometrica, 47:5, 1145-1151.. sit. y. Nat. io. er. Irmen, A. and J.-F. Thisse, (1996), “Competition in Multi-characteristics Spaces: Hotelling was Almost Right,” C.E.P.R. Discussion Papers: 1446.. n. al. Ch. engchi. i n U. v. Loginova, O. (2010), “Brand Familiarity and Product Knowledge in Customization,” International Journal of Economic Theory, 6:3, 297-309. Loginova, O. (2012), “Competitive Effects of Mass Customization,” Review of Marketing Science, 10:1, 1-32. Johnson, J. P. (2013), “Targeted Advertising and Advertising Avoidance,” RAND Journal of Economics, 44:1, 128-44. Syam, N. B., R. Ranran, and D. H. James, (2005), “Customized Products: A Competitive Analysis,” Marketing Science, 24:4, 569-84. 28.

(34) Xia, N. and S. Rajagopalan, (2009), “Standard vs. Custom Products: Variety, Lead Time, and Price Competition,” Marketing Science, 28:5, 887-900.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 29. i n U. v.

(35)

數據

相關文件

好了既然 Z[x] 中的 ideal 不一定是 principle ideal 那麼我們就不能學 Proposition 7.2.11 的方法得到 Z[x] 中的 irreducible element 就是 prime element 了..

Wang, Solving pseudomonotone variational inequalities and pseudocon- vex optimization problems using the projection neural network, IEEE Transactions on Neural Networks 17

volume suppressed mass: (TeV) 2 /M P ∼ 10 −4 eV → mm range can be experimentally tested for any number of extra dimensions - Light U(1) gauge bosons: no derivative couplings. =>

For pedagogical purposes, let us start consideration from a simple one-dimensional (1D) system, where electrons are confined to a chain parallel to the x axis. As it is well known

The observed small neutrino masses strongly suggest the presence of super heavy Majorana neutrinos N. Out-of-thermal equilibrium processes may be easily realized around the

Define instead the imaginary.. potential, magnetic field, lattice…) Dirac-BdG Hamiltonian:. with small, and matrix

incapable to extract any quantities from QCD, nor to tackle the most interesting physics, namely, the spontaneously chiral symmetry breaking and the color confinement..

(1) Determine a hypersurface on which matching condition is given.. (2) Determine a