On: 28 April 2014, At: 15:08 Publisher: Routledge

Informa Ltd Registered in England and Wales Registered Number: 1072954 Registered office: Mortimer House, 37-41 Mortimer Street, London W1T 3JH, UK

Total Quality Management & Business

Excellence

Publication details, including instructions for authors and subscription information:

http://www.tandfonline.com/loi/ctqm20

Measuring customer satisfaction of

Internet banking in Taiwan: scale

development and validation

Rai-Fu Chen a , Ju-Ling Hsiao b & Hsin-Ginn Hwang c a

Department of Information Management , Chia Nan University of Pharmacy & Science , Tainan , Taiwan , ROC

b

Department of Hospital and Health Care Administration , Chia Nan University of Pharmacy & Science , Tainan , Taiwan , ROC c

Institute of Information Management, National Chiao Tung University , Hsinchu , Taiwan , ROC

Published online: 15 Aug 2012.

To cite this article: Rai-Fu Chen , Ju-Ling Hsiao & Hsin-Ginn Hwang (2012) Measuring customer satisfaction of Internet banking in Taiwan: scale development and validation, Total Quality Management & Business Excellence, 23:7-8, 749-767, DOI: 10.1080/14783363.2012.704284

To link to this article: http://dx.doi.org/10.1080/14783363.2012.704284

PLEASE SCROLL DOWN FOR ARTICLE

Taylor & Francis makes every effort to ensure the accuracy of all the information (the “Content”) contained in the publications on our platform. However, Taylor & Francis, our agents, and our licensors make no representations or warranties whatsoever as to the accuracy, completeness, or suitability for any purpose of the Content. Any opinions and views expressed in this publication are the opinions and views of the authors, and are not the views of or endorsed by Taylor & Francis. The accuracy of the Content should not be relied upon and should be independently verified with primary sources of information. Taylor and Francis shall not be liable for any losses, actions, claims, proceedings, demands, costs, expenses, damages, and other liabilities whatsoever or howsoever caused arising directly or indirectly in connection with, in relation to or arising out of the use of the Content.

This article may be used for research, teaching, and private study purposes. Any substantial or systematic reproduction, redistribution, reselling, loan, sub-licensing, systematic supply, or distribution in any form to anyone is expressly forbidden. Terms &

Conditions of access and use can be found at http://www.tandfonline.com/page/terms-and-conditions

Measuring customer satisfaction of Internet banking in Taiwan:

scale development and validation

Rai-Fu Chena, Ju-Ling Hsiaoband Hsin-Ginn Hwangc∗

a

Department of Information Management, Chia Nan University of Pharmacy & Science, Tainan, Taiwan, ROC;bDepartment of Hospital and Health Care Administration, Chia Nan University of Pharmacy & Science, Tainan, Taiwan, ROC;cInstitute of Information Management, National Chiao Tung University, Hsinchu, Taiwan, ROC

Internet banking is one of the most important e-services in electronic commerce; however, the lack of standardised instrument for evaluating its satisfaction may inhibit the further development of Internet banking. This study aims to develop and validate a standardised measurement regarding customer satisfaction with Internet banking (IBCS). The development process included examinations of user satisfaction literature, expert panels, and pilot studies. Web survey was used for data collection, with subjects of Internet banking customers. The result was a parsimonious 18-item instrument with six subscales (content, accuracy, format, ease of use, timeliness, and safety) tapping into dimensions of IBCS. Further, this study not only affirms that all items in prior user satisfaction studies are still valid in the context of Internet banking, but also reveals that safety issues need to be addressed by banks to improve user satisfaction of Internet banking. Because of this rigorous and systematic study, researchers can use this valid measurement as a standardised instrument for measuring customer satisfaction of Internet banking.

Keywords:scale development and validation; customer satisfaction; Internet banking; Internet safety

1. Introduction

Over the past decade, Internet banking or online banking has become one of the most important e-services provided on the Internet. As reported in the 2004 Pew Internet & American Life Project, approximately 53 million Americans are banking online, or about one in four adults (Mintel International Group Ltd, 2006). A recent survey indicated that about 50% of the 14.76 million Taiwan Internet users have used online financial ser-vices and the estimated number of Taiwan Internet banking users is more than 2.5 million (ACNielson Online, 2009). Actually, Internet banking is an integrated system that can provide customers flexible, convenient, and inexpensive platforms with integrated services of online personal banking products including online checking and savings accounts, money market accounts, certificates of deposit, credit cards, home equity loans, home mortgage, insurance, investment services, portfolio management, and other related finan-cial services (Bhattacherjee, 2001). Using Internet banking, banks’ customers can conduct the same banking transactions provided by a brick-and-mortar branch at any time and any place through a simple and user-friendly browser. Polatoglu and Ekin (2001) argued that

ISSN 1478-3363 print/ISSN 1478-3371 online # 2012 Taylor & Francis

http://dx.doi.org/10.1080/14783363.2012.704284 http://www.tandfonline.com

∗Corresponding author. Email: hghmis@iim.nctu.edu.tw

Internet banking could reduce the operating costs of service and lead to higher levels of customer satisfaction and retention compared with a physical bank.

Due to the rapid development of Internet banking services worldwide, many studies have been undertaken to examine broader issues of Internet banking, including adoption (Liao, Shao, Wang, & Chen, 1999; Cheng, Lam, & Yeung, 2006), acceptance (Alsajjan & Dennis, 2010; Al-Somalia, Roya Gholami, & Clegga, 2009; Liao & Li, 2005; Polatoglu & Ekin, 2001), customer attitude and preference (Liao & Cheung, 2002; Sohail & Shan-mugham, 2003), security and trust (Smith, 2006; Suh & Han, 2002), service quality (Ho & Lin, 2010; Santouridisa, Trivellasa, & Reklitisb, 2009), and systems continuance (Bhatta-cherjee, 2001). While Internet banking has become a necessary service in the competitive banking industry, customer satisfaction and retention of Internet banking is a critical issue because the Internet provides customers with services at limited costs when a switching of Internet banking providers is needed. Nath, Schrick, and Parzinger (2001) indicated that banks must address user satisfaction and retention for Internet banking to become well accepted. Parthasarathy and Bhattacherjee (1998) further demonstrated that acquiring new customers might cost as much as five times more than retaining existing ones, given the costs of searching for new customers, setting up new accounts, and initiating new customers to information systems (IS). Furthermore, Bhattacherjee (2001) argued that IS continuance at the individual user level is the key to the survival of many business-to-consumer electronic commerce (EC) firms, and the study found that satisfac-tion with IS is the strong predictor of users’ continuance intensatisfac-tion for Internet banking. Moreover, user satisfaction is often acknowledged as the most useful measurement for IS success in the IS discipline (DeLone & McLean, 1992). As shown, exploring the under-lying factors of user satisfaction with Internet banking is critical leading to the develop-ment of a dedicated instrudevelop-ment for measuring these factors. However, there is little research on developing a psychometric instrument for measuring customer satisfaction with Internet banking (IBCS). Therefore, there is an urgent need to provide appropriate diagnostic tools for understanding customers’ reactions to the value of Internet banking and for providing suggestions for further improvements, particularly from the perspective of customer satisfaction.

The purpose of this study is to demonstrate a rigorous and complete research cycle for developing a standardised measurement for Internet banking. A complete research cycle for developing a standardised measurement was conducted, which involves (1) an explora-tory factor analysis (EFA), and (2) a confirmaexplora-tory factor analysis (CFA) (Mackenzie & House, 1979; McGrath, 1979). The result was a parsimonious 18-item instrument with six subscales (content, accuracy, format, ease of use, timeliness, and safety), tapping into dimensions of customer satisfaction of Internet banking. Because of this rigorous and systematic study, researchers can use this valid measurement as a standardised instru-ment for measuring customer satisfaction of Internet banking.

2. Literature review

The concept of consumer satisfaction was first proposed by Cardozo (1965). Anderson, Fornell, and Lehmann (1994) indicated that consumer satisfaction has been linked to cor-porate profitability and repurchase probability. Thus, the investigation of consumer satis-faction is valuable for explaining why consumers purchase or repurchase products/ services, and exposes the motivations that underlie consumer behaviour and psychology. In the IS discipline, user satisfaction has been well acknowledged as the most useful measure of system success (DeLone & McLean, 1992; Guimaraes & Gupta, 1988). 750 R.-F. Chen et al.

Despite efforts to investigate the issue of measuring user satisfaction or appreciation of IS (Bailey & Pearson, 1983; Chen, Soliman, Mao, & Frolick, 2000; Doll & Torkzadeh, 1988; Ives, Olson, & Baroudi, 1983), most existing user satisfaction instruments cannot be directly used for measuring online services because the security and trust issues involved in the Internet are not well addressed (Jung, Han, & Lee, 2001; Mintel International Group Ltd, 2006; Polatoglu & Ekin, 2001; Smith, 2006; Suh & Han, 2002). Among existing user satisfaction instruments, Doll and Torkzadeh’s (1988) 12-item instrument (consisting of five factors: information content, accuracy, format, ease of use, and timeliness) for measuring end-user computing satisfaction (EUCS) is more suitable for our research because the instrument is derived from the prior results of Bailey and Pearson (1983) and Ives et al. (1983). Furthermore, the instrument has been well validated and used for specific applications (Doll, Xia, & Torkzadeh, 1994; McHaney, Hightower, & Pearson, 2002; Somers, Nelson, & Karimi, 2003). In addition, Internet banking is a typical end-user computing application on the Internet and the major end-users are non-IS professionals. Although some researchers have tried to develop an instrument for evaluating websites or investigating customer satisfaction with electronic services (Loiacono, Watson, & Goodhue, 2007; Massad, Heckman, & Crowston, 2006), those studies focus on too broad issues regarding the Internet to provide in-depth understandings for a specific Inter-net banking application. Some studies focus on investigating service quality issues rather than customer satisfaction of Internet banking (Ho & Lin, 2010; Santouridisa et al., 2009). As shown, the instrument issues have generally been ignored in the Internet banking domain, particularly for customer satisfaction perspective. This may arise two serious pro-blems over time: (1) ‘lack of validated measures in confirmatory research raises the specter that no single finding . . . can be trusted’ (Straub, 1989, p. 148); and (2) it will be difficult to ‘compare and accumulate findings and thereby develop syntheses for what is known’ (Churchill, 1979, p. 67). Researchers should consider the unique characteristics of the Internet banking before developing of an instrument. For example, Chen et al. (2000) demonstrated an excellent example for developing a new instrument to measure end-user satisfaction with data warehousing based on Doll and Torkzadeh’s (1988) end-end-user satisfaction instrument and the roles and performance of organisation information centre. Similarly, a new standardised instrument for measuring user satisfaction with Inter-net banking can be obtained based on Doll and Torkzadeh’s (1988) end-user satisfaction instrument and specific considerations regarding Internet banking.

Past studies provide ways to complete the research cycle regarding CFA on user sat-isfaction where the structure and dimensionality of user satsat-isfaction are clarified (Doll et al., 1994; McHaney et al., 2002; Somers et al., 2003). However, the developed measure-ment may be improper for the context of Internet banking because of the lack of consider-ation for Internet security issues. Furthermore, prior studies indicated that security of Internet transactions is of paramount concern to most customers, particularly where finan-cial information is involved (Hedberg & Taylor, 2001; Stafford, 2001). Ratnasingham (1998) defined the EC security as the protection of an information resource and system from assaults against its integrity, confidentiality, authenticity, no-repudiation, availability and access control of the electronic transactions transmitted, and more importantly ‘the reliability of the direct parties involved in electronic commerce’. Because Internet banking is a typical EC application, Ratnasingham’s security definition can be extended to Internet banking. Keen (1997) asserts that trust is the major obstacle in constraining business on Internet. Safety is more than security; it also partially involves psychology. Trust is what the question of Internet security really about: trust in contracting, payments, privacy, and safety. Based on the EUCS instrument and the Internet safety concerns, the

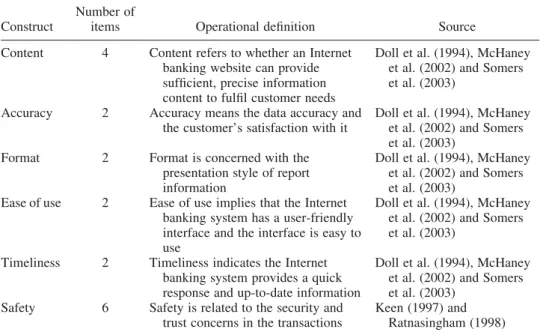

proposed initial questionnaire was an 18-item instrument with six potential constructs (content, accuracy, format, ease of use, timeliness, and safety) for measuring customer sat-isfaction of Internet banking. In this study, the safety construct is operationalised as the customer concerns on security and trust issues of Internet banking, and it is derived from the results of Keen (1997) and Ratnasingham (1998). Table 1 summarises the number of items, operational definitions, and sources of the investigated constructs for measuring customer satisfaction of Internet banking.

3. Methods

The objective of this research was the development and validation of an instrument to measure customer satisfaction of Internet banking. As suggested by previous studies (Mackenzie & House, 1979; McGrath, 1979), the research cycle for developing a standar-dised measurement involves two major steps. First, exploratory studies for developing hypothesised measurement model(s) by analysis of empirical data from a representative population are undertaken. Secondly, confirmatory studies are then deployed for testing the hypothesised measurement models with new data gathered from a similar representa-tive population to complete the research cycle.

3.1 Procedures for EFA

In the early stage of the instrument development, an iterative process is used to (1) specify the domain and dimensionality of a construct, (2) generate a sample of items, and (3) assess content validity of these items (Churchill, 1979; Cronbach, 1971). An initial ques-tionnaire, an 18-item instrument measured by a seven-point Likert scale (1 for strongly disagree and 7 for strongly agree), was developed based on the results of literature reviews. Based on the input of expert panels and suggestions of pilot tests with relevant

Table 1. Measurements and operational definition of constructs.

Construct

Number of

items Operational definition Source

Content 4 Content refers to whether an Internet banking website can provide sufficient, precise information content to fulfil customer needs

Doll et al. (1994), McHaney et al. (2002) and Somers et al. (2003)

Accuracy 2 Accuracy means the data accuracy and the customer’s satisfaction with it

Doll et al. (1994), McHaney et al. (2002) and Somers et al. (2003)

Format 2 Format is concerned with the presentation style of report information

Doll et al. (1994), McHaney et al. (2002) and Somers et al. (2003)

Ease of use 2 Ease of use implies that the Internet banking system has a user-friendly interface and the interface is easy to use

Doll et al. (1994), McHaney et al. (2002) and Somers et al. (2003)

Timeliness 2 Timeliness indicates the Internet banking system provides a quick response and up-to-date information

Doll et al. (1994), McHaney et al. (2002) and Somers et al. (2003)

Safety 6 Safety is related to the security and trust concerns in the transactions

Keen (1997) and Ratnasingham (1998)

752 R.-F. Chen et al.

samples, scale items of the questionnaire were modified for ensuring that the wording and semantics descriptions of the questionnaire are suitable for the intended respondents. The expert panel was composed of three experts, including academicians and practitioners of Internet banking. They were asked to rate the relevance (1 for strongly irrelevant and 7 for strongly relevant) of the items in terms of IBCS, and the average score of the item greater than 3.5 would be retained. A pilot study was conducted by five Internet banking users to validate the questionnaire for further minor revisions. The questionnaire was divided into two sections. The first section investigates the respondents’ basic knowledge, their use of Internet banking systems, and their demographic information. The second section measures the IBCS using 18 questions. A preliminary version of the instrument is admi-nistered to the users of Internet banking through a web survey and EFA is utilised to assess the items. Only those customers with one online bank account and having experience in the use of Internet banking are considered potential respondents. To encourage partici-pation, the content and purpose of this study was posted on several banking websites and as banner advertisements on popular search engines. Therefore, potential users of Internet banking can fill in the IBCS questionnaire through the hyperlinks posted on the mentioned websites or banner advertisements. Several promotions were launched using motivational gifts and offers to freely share study results to encourage respondents to answer this questionnaire.

3.2 Procedures for CFA

In the later stage, this study employed CFA to complete the research cycle for developing a standardised measurement of IBCS. CFA involves the specification and estimation of one or more feasible models on factor structure. Each model proposes a set of variables (factors) to describe the covariance among a set of observed variables (Bagozzi, 1980; Bollen, 1989; Joreskog & Sorbom, 1989). To ensure the theoretical and practical impli-cations of the proposed models, model development must be based on previous theoretical reasons or empirical evidence. This research follows the procedures used by the Doll et al. (1994) study that provided for the confirmatory study on the investigations of EUCS measurement. The research steps involve the following: (1) specify the alternative models and test the fitness of each hypothetical model with the collected data through several appropriate goodness-of-fit indexes (GFIs), (2) select the most suitable model as the representative IBCS model, and (3) evaluate the reliability and validity of the factors and items in the model. LISREL VIII was used as the analytic tool to assist with comparisons among the alternative models and to evaluate the models’ fit with the col-lected data.

4. Instrument validation results – EFA

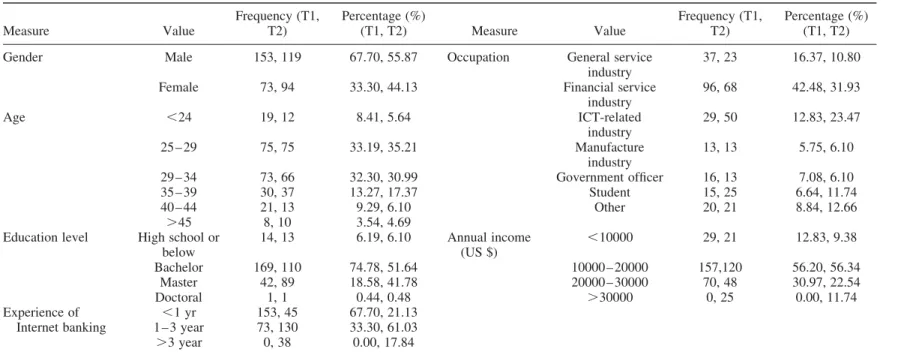

In the first stage of data collection, 265 questionnaires were collected in a six-week period since September, 2006. Excluding 39 copies of incomplete or redundant data, 226 valid questionnaires (valid response rate ¼ 85%) were obtained. The participants’ demographics showed that 67.70% of respondents were male and 54.4% of respondents were married. About 65.49% of participants were aged between 25 and 34, and 93.80% of the subjects had a bachelor’s degree or above. All respondents are experienced Internet banking users. Above half of the respondents’ annual income range was between US$ 10,000 and US$ 20,000. Compared with the distribution of Internet users’ demographics in Taiwan, respondents were not significantly different in age, education, and income. More detailed

Table 2. Descriptive statistics of respondents’ characteristics (NT1¼ 226, NT2¼ 213). Measure Value Frequency (T1, T2) Percentage (%) (T1, T2) Measure Value Frequency (T1, T2) Percentage (%) (T1, T2)

Gender Male 153, 119 67.70, 55.87 Occupation General service

industry

37, 23 16.37, 10.80

Female 73, 94 33.30, 44.13 Financial service

industry 96, 68 42.48, 31.93 Age ,24 19, 12 8.41, 5.64 ICT-related industry 29, 50 12.83, 23.47 25 – 29 75, 75 33.19, 35.21 Manufacture industry 13, 13 5.75, 6.10 29 – 34 73, 66 32.30, 30.99 Government officer 16, 13 7.08, 6.10 35 – 39 30, 37 13.27, 17.37 Student 15, 25 6.64, 11.74 40 – 44 21, 13 9.29, 6.10 Other 20, 21 8.84, 12.66 .45 8, 10 3.54, 4.69

Education level High school or below 14, 13 6.19, 6.10 Annual income (US $) ,10000 29, 21 12.83, 9.38 Bachelor 169, 110 74.78, 51.64 10000 – 20000 157,120 56.20, 56.34 Master 42, 89 18.58, 41.78 20000 – 30000 70, 48 30.97, 22.54 Doctoral 1, 1 0.44, 0.48 .30000 0, 25 0.00, 11.74 Experience of Internet banking ,1 yr 153, 45 67.70, 21.13 1 – 3 year 73, 130 33.30, 61.03 .3 year 0, 38 0.00, 17.84

Note: T1 and T2 represented data collection for EFA and CFA, respectively.

754

R.-F.

Chen

et

al.

information regarding respondents’ demographics can be found in Table 2 (data collection in T1). To ensure the data quality and sample representative of the collected data (used for EFA and CFA), the testing of non-response bias and common method var-iance (CMV) were conducted. Based on the Armstrong and Overton (1977) approach, we examined the non-response bias of this study by dividing the early 30 samples and the last 30 samples of the collected data into two groups and their demographic data (gender, age, education level, and annual income) were tested by the chi-square test. The chi-square results demonstrated no significant differences between respondents and non-respondents in terms of gender (p ¼ 0.791), age (p ¼ 0.580), education level (p ¼ 0.544), and annual income (p ¼ 0.949) of the collected data (T1). Thus, the effects of non-response bias can be ignored. Podsakoff, MacKenzie, Lee, and Podsakoff (2003) argued that Harman’s single-factor test is one of the most widely used techniques to address CMV in an EFA and the test was employed to examine CMV of the collected data (T1). The technique examines the unrotated factor solution to determine the number of factors that are necessary to account for the variance in the variables. A substantial amount of CMV is presented, either a single factor will emerge from the factor analysis or one general factor will account for the majority of the covariance among the measures (Podsakoff et al., 2003). The results of Harman’s single-factor test showed that a three-factor model accounts for a substantial portion of explained variance (71.315%). Thus, the CMV was not a problem.

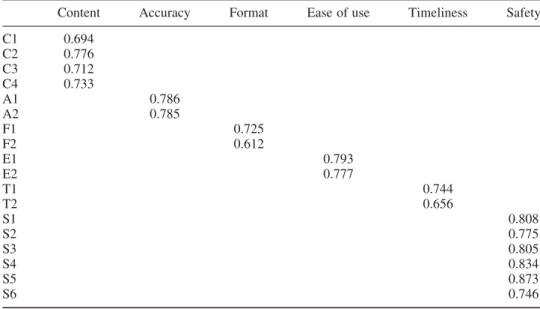

A factor analysis examined and identified the underlying dimensions of the constructs and their relationships with each other. The ratio of sample size to number of items was 12.6:1, Bartlett’s test of sphericity had an x2value of 3576.88 (p ¼ 0.000), the Kaiser – Meyer – Olkin measure (0.924) showed high sampling adequacy indicating suitability for factor analysis. The collected data were examined using principle component analysis as the extraction technique and varimax (orthogonal) as the method of rotation. After the analysis, the specified six factors (content, accuracy, format, ease of use, timeliness, and safety) revealed the most interpretable structure with an explained 82.74% of the variance.

Table 3. Rotated factor matrix of 18-item instrument.

Content Accuracy Format Ease of use Timeliness Safety

C1 0.694 C2 0.776 C3 0.712 C4 0.733 A1 0.786 A2 0.785 F1 0.725 F2 0.612 E1 0.793 E2 0.777 T1 0.744 T2 0.656 S1 0.808 S2 0.775 S3 0.805 S4 0.834 S5 0.873 S6 0.746

Note: Suppress absolute values ,0.5.

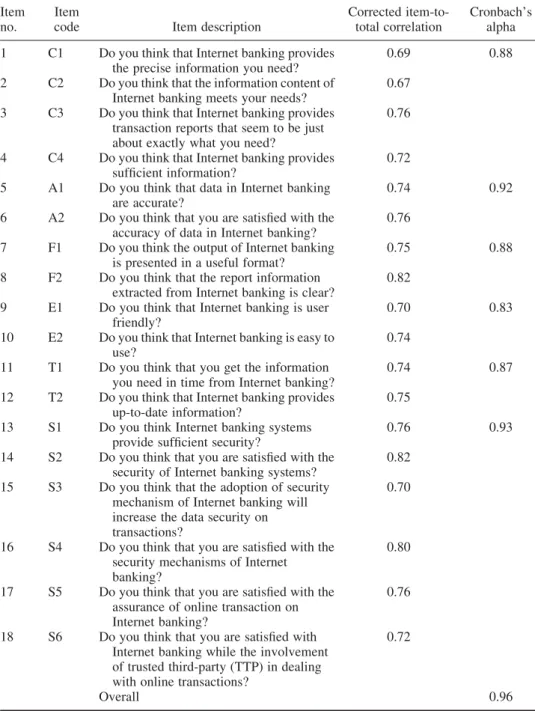

The rotated matrix of the 18 items of IBCS instrument is shown in Table 3. The reliability of the instrument was measured by corrected item-to-total correlation and Cronbach’s alpha with recommended values of 0.5 and 0.7, respectively (Hair, Anderson, Tatham, & Black, 1998). The values of the corrected item-to-total correlation range from 0.67 to 0.82, while the values of Cronbach’s alpha for the questionnaire ranged between 0.88 and 0.94. In addition, the reliability of this instrument was 0.96, indicating a high

Table 4. Item description and reliability of IBCS instrument.

Item no.

Item

code Item description

Corrected item-to-total correlation

Cronbach’s alpha

1 C1 Do you think that Internet banking provides the precise information you need?

0.69 0.88

2 C2 Do you think that the information content of Internet banking meets your needs?

0.67

3 C3 Do you think that Internet banking provides transaction reports that seem to be just about exactly what you need?

0.76

4 C4 Do you think that Internet banking provides sufficient information?

0.72

5 A1 Do you think that data in Internet banking are accurate?

0.74 0.92

6 A2 Do you think that you are satisfied with the accuracy of data in Internet banking?

0.76

7 F1 Do you think the output of Internet banking is presented in a useful format?

0.75 0.88

8 F2 Do you think that the report information extracted from Internet banking is clear?

0.82

9 E1 Do you think that Internet banking is user friendly?

0.70 0.83

10 E2 Do you think that Internet banking is easy to use?

0.74

11 T1 Do you think that you get the information you need in time from Internet banking?

0.74 0.87

12 T2 Do you think that Internet banking provides up-to-date information?

0.75

13 S1 Do you think Internet banking systems provide sufficient security?

0.76 0.93

14 S2 Do you think that you are satisfied with the security of Internet banking systems?

0.82

15 S3 Do you think that the adoption of security mechanism of Internet banking will increase the data security on transactions?

0.70

16 S4 Do you think that you are satisfied with the security mechanisms of Internet banking?

0.80

17 S5 Do you think that you are satisfied with the assurance of online transaction on Internet banking?

0.76

18 S6 Do you think that you are satisfied with Internet banking while the involvement of trusted third-party (TTP) in dealing with online transactions?

0.72

Overall 0.96

756 R.-F. Chen et al.

degree of reliability. The detailed item description and reliability of the IBCS instrument are shown in Table 4.

For the validity analysis of this instrument, construct validity (convergent validity and discriminant validity) was assessed. For assessing construct validity, four decision rules derived from Hair et al. (1998) and Straub (1989) were employed: (1) using a minimum eigenvalue of 1 as the cut-off value for extraction, (2) deleting items with factor loadings less than 0.5 or greater than 0.5 on two or more factors, (3) a simple factor structure, and (4) exclusion of single-item factors from a parsimony viewpoint. The results showed that each item’s factor loading corresponds to a factor greater than 0.5, no item has factor loadings greater than 0.5 on two or more concepts, and all items can be attributed to six constructs. Thus, the validity of this instrument is demonstrated.

As a result, the developed IBCS measurement is considered a second-order factor model consisting of six major constructs: content (measured by four items), accuracy (measured by two items), format (measured by two items), ease of use (measured by two items), timeliness (measured by two items), and safety (measured by six items). Among them, the first five constructs show high consistency in accordance with prior studies (Doll & Torkzadeh, 1988; McHaney et al., 2002), where the safety construct is heavily emphasised on Internet banking regarding the security and trust concerns of Internet transactions. The safety construct is measured by six measures derived from the concepts of system security, security mechanisms for ensuring Internet banking trans-action security, third-party trust, and post-transtrans-action protection mechanisms.

5. Instrument validation results – CFA

The sample data were obtained following the identical data collection procedures and methods (through a web survey) used in the previous stage. Over one year after the finish-ing of previous exploratory factor study, a total of 260 cases were gathered for CFA in a four-month period. Excluding 47 copies of incomplete or redundant data, 213 valid ques-tionnaires (valid response rate ¼ 82%) were obtained. In this survey, 71.83% respondents were customers of eight major commercial banks out of the 20 banks that provide Internet banking services. In addition, 55.87% of the respondents were male, and 60.09% of par-ticipants were married. The age range of 66.20% of the subjects was between 25 and 34, and 93.90% of participants had a bachelor’s degree or above. All participants are experi-enced Internet banking users with 1 – 3 years of experience. The respondents come from various occupations, with about 54.30% of the respondents working in the financial ser-vices industry or the information and computer-related industry. The annual income range of 56.34% of respondents was between US$10,000 and US$20,000. As shown, the samples’ characteristics represent a good approximation of the average, or most common type of user. Furthermore, the demographic data of the respondents collected in the early and later time periods indicate a high consistency in age, education, and income. More detailed information regarding respondents’ demographics can be found in Table 2 (data collection in T2). We also employed the identical Armstrong and Overton (1977) approach for testing the non-response bias of the collected data (T2). The chi-square results showed no significant differences between respondents and no-respondents in terms of gender (p ¼ 0.795), age (p ¼ 0.114), and education level (p ¼ 0.098) of the collected data (T2). Based on the Sanchez, Korbin, and Viscarra (1995) approach, a CFA test were conducted to examine the appropriateness of a single factor model (X2139 ¼ 964.86, CFI ¼ 0.742, RMSEA ¼ 0.087, p , 0.05) and a multiple (six) factor model (X2120 ¼ 274.89, CFI ¼ 0.952, RMSEA ¼ 0.026, p , 0.05) of the

collected data (T2). As shown, a multiple (six) factor model is better than a single factor model in this study. Therefore, the CMV is not a serious problem in this study.

5.1 Alternative models

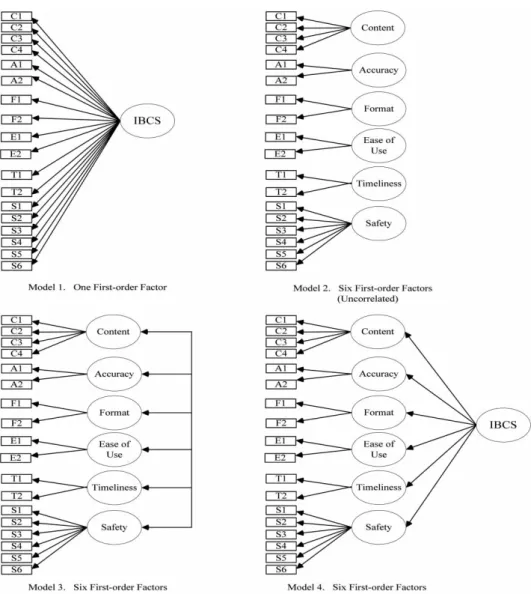

Based on the theoretical foundations and empirical work of EUCS and IBCS, four feasible IBCS models are proposed and summarised as shown in Figure 1. Model 1 hypothesises IBCS as one first-order factor accounting for all the common variance among the 18 items. This model provides a consistent viewpoint with the theory and substantive research studies considering user satisfaction as a single first-order construct. This assumption is implicitly demonstrated in the typical scaling on the satisfaction construct by adding indi-vidual items to obtain a total score. As previously mentioned, a total score of the 18-item

Figure 1. Alternative models for the IBCS instrument.

758 R.-F. Chen et al.

IBCS instrument can be obtained from Hwang, Chen, and Lee (2007). Therefore, this model implies that one first-order factor is a feasible IBCS model that can fulfil its under-lying factor structure. Model 2 hypothesises IBCS as consisting of 18 items that are divided into six uncorrelated or orthogonal first-order factors (content, accuracy, format, ease of use, timeliness, and safety). Model 2 is considered a plausible alternative model of the underlying factor structure as shown in the varimax (orthogonal) rotation of Hwang et al. (2007). Furthermore, testing this model will provide enough evidence for incorporating correlated factors by enabling fit comparisons between uncorrelated and correlated models.

Model 3 hypothesises IBCS as six first-order factors and these factors are correlated with one another. Doll and Torkzadeh (1988) highlighted this model in their discussion of the large common variance among the 12 items. In Hwang et al.’s (2007) study the resulting 18-item measurement also shows substantial common variance among these items. Although the factor scores from a varimax rotation are orthogonal, the subscales are not necessarily orthogonal or uncorrelated. This implies that this model is plausible because of the common variance among the 18 items of IBCS measurement. Model 4 hypothesises IBCS as consisting of six first-order factors and one second-order factor. Prior studies have shown that user satisfaction is a second-order factor construct (Doll et al., 1994; Doll, Raghunathan, Lim, & Gupta, 1995; Somers et al., 2003) and the second-order factor EUCS instrument has been validated in Taiwanese applications (McHaney et al., 2002). Tanaka and Huba (1984) mentioned that if first-order factors are correlated, it is possible that the correlations between first-order factors are statistically ‘caused’ by a single second-order factor. In fact, the IBCS is a special case of user satis-faction research focusing on Internet banking; therefore, this model seems plausible and should be further assessed.

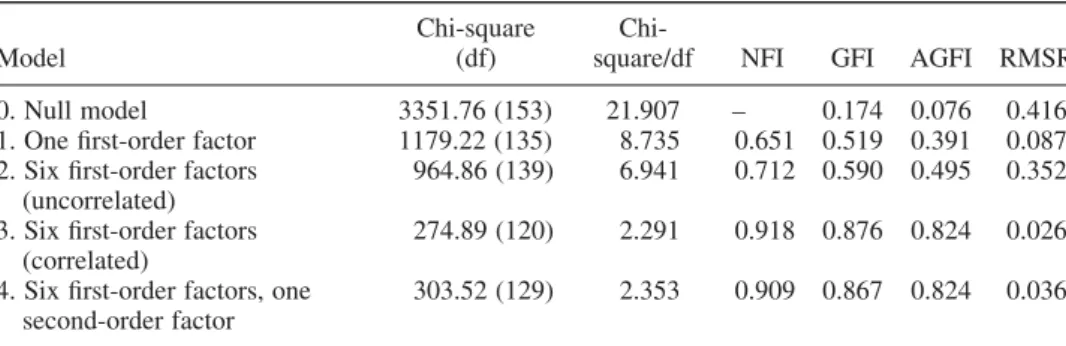

5.2 Criteria for comparing model-data fit

Because no single statistic is widely accepted as an index for model adequacy, this study employs absolute indexes of goodness-of-fit and relative or incremental fit indexes used in prior user satisfaction studies to assess the appropriateness of the proposed plausible models (Doll et al., 1994, 1995; Somers et al., 2003). Absolute indexes of goodness-of-fit [including chi-square, GFI, adjusted goodness-of-goodness-of-fit (AGFI), and root mean square residual (RMSR)] provide evidence for evaluating individual models. Alternatively, rela-tive or incremental fit indexes [including ratio of chi-square to degrees of freedom, normed fit index (NFI), and target coefficient], demonstrating the improvement in fit of one model over an alternative model, are utilised for model comparisons. Several studies examined the criteria of relative or incremental fit indexes especially for the ratio of chi-square to degrees of freedom (Marsh & Hocevar, 1985), normed fit index (Bentler & Bonnet, 1980; Harvey, Billings, & Nilan, 1985), and target coefficient (Marsh & Hocevar, 1985). Researchers consider the index of chi-square statistic as a global test of a model’s ability to reproduce the sample variance/covariance matrix; however, this index is sensi-tive to sample size and departures for multivariate normality (Bollen, 1989) and thus this statistic should be interpreted with caution (Joreskog & Sorbom, 1989). While the GFI and AGFI scores in the 0.80 and 0.89 range represent reasonable fit, scores of 0.90 or higher are considered a good fit. The value of RMSR with a score below 0.05 is considered a good fit, and the smaller the value the better the model fit (Byrne, 1989; Joreskog & Sorbom, 1984). The ratio of chi-square to the degrees of freedom demonstrates the efficiency of competing models and provides a basis for models’ comparisons. Marsh and Hocevar

(1985) suggested ratios as low as 2 or as high as 5 are considered evidence of a reasonable fit. The NFI is used to assess the fit of a model relative to the fit of a null model by scaling the chi-square value from 0 to 1, with larger values indicating better models (Bentler & Bonnet, 1980). A NFI with value of more than 0.9 shows evidence of a good model fit because of the relatively small amount of variance unexplained by the model (Harvey et al., 1985). The target coefficient is an index obtained from the ratio of chi-square of the first-order model to the chi-square of the higher-order model and provides sufficient evidential support for the existence of a higher-order construct (Marsh & Hocevar, 1985). The target coefficient explains the extent to which the higher-order factor model accounts for covariation among the first-order factors. The value of the target coefficient can be interpreted as the percentage of variation of first-order factors explained by the second-order construct (Doll et al., 1994).

5.3 Evaluating validity and reliability

For CFA, the validity and reliability are assessed by factor loadings and the proportion of variance (R-square), respectively. While factor loadings are represented as regression coefficients in the regression of observed variables on latent variables, the proportion of variance (R-square) indicates the observed variables that are accounted for by the latent variables. The standard factor loadings of observed variables (items) on latent variables (factors) of the first-order model are estimates of the validity of the observed variables where the standard structural coefficients of factors on higher-order constructs of the second-order or higher-order model are regarded as estimates of the validity of the factors. The proportion of variance (R-square) in the observed variables accounted for by latent variables can be viewed as an estimate of the reliability of the observed vari-ables (items) in the first-order model. The R-square in the latent varivari-ables (factors) accounted for by the higher-order construct can be explained as an estimate of the reliability of the latent factors (Bollen, 1989; Mueller, 1996). This study employs the total coefficient of determination for observed variables to assess the overall reliability of the IBCS instrument.

Before comparisons among the proposed models can be undertaken, a null model must be added to provide the zero-point for the NFI. The mentioned GFIs were used for asses-sing the proposed models and the null model. Table 5 summarises the results of GFIs for model comparisons. In this investigation, the null model has a ratio of chi-square to

Table 5. GFIs for alternative models (NT2¼ 213). Model

Chi-square (df)

Chi-square/df NFI GFI AGFI RMSR

0. Null model 3351.76 (153) 21.907 – 0.174 0.076 0.416 1. One first-order factor 1179.22 (135) 8.735 0.651 0.519 0.391 0.087 2. Six first-order factors

(uncorrelated)

964.86 (139) 6.941 0.712 0.590 0.495 0.352

3. Six first-order factors (correlated)

274.89 (120) 2.291 0.918 0.876 0.824 0.026

4. Six first-order factors, one second-order factor

303.52 (129) 2.353 0.909 0.867 0.824 0.036

Note: NFI, normed fit index; GFI, goodness of fit index; AGFI, adjusted goodness of fit index; RMSR, root mean square residual.

760 R.-F. Chen et al.

degrees of freedom of 21.907, revealing a poor fit to the data. Model 1 shows a relatively better fit than the null model for all GFIs. Model 2 further improves all indexes compared to Model 1 except for the RMSR. As shown, neither Model 1 nor Model 2 can provide a suitable model for IBCS measurement.

Compared with Model 2, Model 3 presents a good fit among all relative or absolute indexes of goodness-of-fit and it provides significant improvements in the indexes of NFI (from 0.712 to 0.918) and the ratio of chi-square to degrees of freedom (from 6.941 to 2.291). Model 3 shows a reasonable fit of absolute indexes (GFI ¼ 0.876, AGFI ¼ 0.824, and RMSR ¼ 0.026) and good fit of relative indexes (NFI ¼ 0.918 and the ratio of chi-square to degrees of freedom ¼ 2.291). Therefore, Model 3 presents a reasonable factor structure for an IBCS model. Model 4 demonstrates similar results with a slightly lower value than Model 3 in all GFIs. Model 4 presents a good fit among all relative or absolute indexes of goodness-of-fit. The model provides significant improvements in the NFI (from 0.712 to 0.909) and the ratio of chi-square to degrees of freedom (from 6.941 to 2.353) compared with Model 2. Model 4 also shows reasonable fit of absolute indexes (GFI ¼ 0.867, AGFI ¼ 0.824, and RMSR ¼ 0.036) and good fit of relative indexes (NFI ¼ 0.909 and the ratio of chi-square to degrees of freedom ¼ 2.353).

According to the results of this comparison, both Model 3 and Model 4 provide suffi-cient support for the underlying structure of the IBCS instrument. For assessing the com-peting models, the target coefficient is used to assess the best fitting model. For calculating the target coefficient, Model 3 is used as the target model and the ratio of the chi-square of Model 3 to the chi-square of Model 4 is obtained. The target coefficient (90.567) of this study provides significant evidence for the existence of a second-order IBCS model. It shows 90% of the variation in the six first-order factors in Model 3 can be explained by the IBCS construct of Model 4. Although Model 4 provides a more parsimonious way than Model 3 for explaining the covariation among first-order models, the GFIs of Model 4 cannot provide a better fit than that of Model 3.

In this study, both Model 3 and Model 4 can estimate validity and reliability of indi-vidual items. Doll et al. (1994) indicated that the estimation of item validity and reliability is not sensitive to adding a second-order factor. Therefore, either Model 3 or Model 4 can be used for further item assessment. However, Model 4 has the advantage over Model 3 in estimating validity and reliability of the latent factors (content, accuracy, format, ease of use, timeliness, and safety). Therefore, Model 4 is selected as the target model for the IBCS instrument because of its suitability to the factor structure.

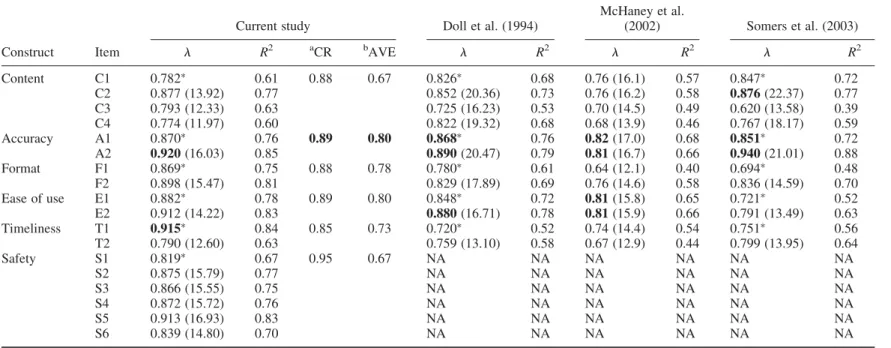

Tables 6 and 7 show and compare LISREL’s maximum likelihood estimates of the stan-dardised parameter estimates for observed variables and latent variables of Model 4. This investigation conducted an analysis to compare the results obtained in the current study with prior confirmatory studies related to various end-user computing applications (Doll et al., 1994; McHaney et al., 2002; Somers et al., 2003). Because this study is based on the results of Doll et al.’s (1994) EUCS instrument and extended with questions regarding Internet safety, the results of this study can be compared with other similar user satisfaction instruments on the common five subscales (content, accuracy, format, ease of use, and time-liness). Table 6 presents the factor loading, t-value, and R-square (the proportion of var-iance) of the observed variables, while Table 7 shows the standard structural coefficients and corresponding t-values as well as the R-square values for the latent variables. The factor loadings relating the items to factors for confirmatory studies are regarded as indi-cators of validity for the 12 items. Bagozzi and Yi (1988) indicated that convergent validity is established if the loadings of the measures to their corresponding constructs are at least

Table 6. A comparison of Model 4 standardised parameter estimates (l) and t-values for l.

Construct Item

Current study Doll et al. (1994)

McHaney et al. (2002) Somers et al. (2003) l R2 aCR bAVE l R2 l R2 l R2 Content C1 0.782∗ 0.61 0.88 0.67 0.826∗ 0.68 0.76 (16.1) 0.57 0.847∗ 0.72 C2 0.877 (13.92) 0.77 0.852 (20.36) 0.73 0.76 (16.2) 0.58 0.876(22.37) 0.77 C3 0.793 (12.33) 0.63 0.725 (16.23) 0.53 0.70 (14.5) 0.49 0.620 (13.58) 0.39 C4 0.774 (11.97) 0.60 0.822 (19.32) 0.68 0.68 (13.9) 0.46 0.767 (18.17) 0.59 Accuracy A1 0.870∗ 0.76 0.89 0.80 0.868∗ 0.76 0.82(17.0) 0.68 0.851∗ 0.72 A2 0.920(16.03) 0.85 0.890(20.47) 0.79 0.81(16.7) 0.66 0.940(21.01) 0.88 Format F1 0.869∗ 0.75 0.88 0.78 0.780∗ 0.61 0.64 (12.1) 0.40 0.694∗ 0.48 F2 0.898 (15.47) 0.81 0.829 (17.89) 0.69 0.76 (14.6) 0.58 0.836 (14.59) 0.70 Ease of use E1 0.882∗ 0.78 0.89 0.80 0.848∗ 0.72 0.81(15.8) 0.65 0.721∗ 0.52 E2 0.912 (14.22) 0.83 0.880(16.71) 0.78 0.81(15.9) 0.66 0.791 (13.49) 0.63 Timeliness T1 0.915∗ 0.84 0.85 0.73 0.720∗ 0.52 0.74 (14.4) 0.54 0.751∗ 0.56 T2 0.790 (12.60) 0.63 0.759 (13.10) 0.58 0.67 (12.9) 0.44 0.799 (13.95) 0.64 Safety S1 0.819∗ 0.67 0.95 0.67 NA NA NA NA NA NA S2 0.875 (15.79) 0.77 NA NA NA NA NA NA S3 0.866 (15.55) 0.75 NA NA NA NA NA NA S4 0.872 (15.72) 0.76 NA NA NA NA NA NA S5 0.913 (16.93) 0.83 NA NA NA NA NA NA S6 0.839 (14.80) 0.70 NA NA NA NA NA NA

Note: Values in bold represent the three highest loadings for each study.

∗Indicates a parameter fixed at 1.0 in the original solution. t-values from factor loadings are indicated in parentheses.

aCR (rc): composite reliability,bAVE (rv): average variance extracted.rc¼ (Sl)2/[(Sl)2+ S(u)];rv¼ (Sl2)/[(Sl2)+ S(u)],l¼ factor loadings relate the observed variables to

the latent variables,u¼ Eerror variance of observed variables ¼ 1 2 R2

. 762 R.-F. Chen et al.

Construct

Current Study Doll et al. (1994) McHaney et al. (2002) Somers et al. (2003)

b R2 b R2 b R2 b R2 Content 0.906(10.52) 0.82 0.912(17.67) 0.83 0.74 (22.4) 0.55 0.972(18.33) 0.95 Accuracy 0.830 (10.04) 0.69 0.822 (16.04) 0.68 0.80(26.8) 0.64 0.784 (14.32) 0.62 Format 0.849(10.26) 0.72 0.993(18.19) 0.98 0.90(40.9) 0.80 0.938(13.81) 0.88 Ease of Use 0.720 (8.84) 0.52 0.719 (13.09) 0.52 0.78 (25.6) 0.62 0.869 (13.24) 0.76 Timeliness 0.819 (10.44) 0.67 0.883 (13.78) 0.78 0.72 (20.8) 0.52 0.842 (13.40) 0.71 Safety 0.719 (8.88) 0.52 NA NA NA NA NA NA

Note: Values in bold represent the two highest loadings for each study.

Total Qualit y M anagement 763

0.60. In addition, Fornell and Larcker (1981) proposed three criteria to measure convergent validity: (1) all factor loadings (l) of each item should be significant and greater than 0.7; (2) construct reliability (CR) should be greater than 0.8; and (3) average variance extracted (AVE) by each construct should exceed 0.5. In this study, all items have significant loadings, ranging from 0.774 to 0.920 on their corresponding factors and the values of CR and AVE of the factors (constructs) are greater than the suggested criteria proposed by Fornell and Larcker (1981), showing good convergent validity. The R-square (the proportion of variance) values range from 0.60 to 0.85 providing evidence of acceptable reliability for all individual items. The value of total coefficient of determination is 0.989 indicating excel-lent reliability. The standard structure coefficients (ranging from 0.719 to 0.906) are all more than 0.70 and are statistically significant, and both indicate good construct validity of the latent constructs of the IBCS. The R-square (the proportion of variance) values of the latent variables accounted for by their corresponding observed variables range from 0.52 to 0.82, showing acceptable reliability for all factors. The total coefficient of determi-nation is used to assess overall reliability of the second-order model; the value of the total coefficient of determination is 0.989, indicating excellent reliability. The results also demonstrate consistent findings with prior studies in that the high-order factor can explain all variance and covariance related to the first-order factors in user satisfaction with Internet banking. Further, this study shows the generalisation and robustness of the EUCS instrument.

6. Discussion and conclusions

The objective of this research was the development and validation of an instrument to measure customer satisfaction of Internet banking. As demonstrated above, the IBCS model is a second-order factor model consisting of six major constructs: content (measured by four items), accuracy (measured by two items), format (measured by two items), ease of use (measured by two items), timeliness (measured by two items), and safety (measured by six items). Although the Doll and Torkzadeh’s EUCS instrument has been validated in Taiwan applications (McHaney et al., 2002), it cannot be directly applied in the context of Internet banking in Taiwan without adding characteristics unique to Internet banking. From a theoretical viewpoint, this study verifies that the EUCS instrument is valid for Internet banking in Taiwan. Further, this study finds that the IBCS model heavily emphasised customer perceptions of Internet safety. This study highlights customers’ focus on the issue of Internet safety regarding security technology and customers’ trust of the service. Study results are consistent with that of Suh and Han (2002) in that perceptions of security control should be the customers’ focus. In addition, the higher degree of reliability and validity for this representative second-order IBCS model provides evidence that the model is a foundation for further research on other similar Internet services in Taiwan. As suggested by Doll et al. (1994), the results of CFA should be explained with caution because the criteria for comparing models and recommended GFIs are relative rather than absolute.

Our study found that content and format have the highest loadings, revealing their criti-cal roles in IBCS. These results are similar to those of replicated EUCS studies. The rela-tive importance of the other factors for explaining IBCS are followed by accuracy, timeliness, ease of use, and safety. A possible explanation is that the content, format, accu-racy, and timeliness are fundamental requirements for accessing private financial infor-mation on Internet banking. The constructs of ease of use and safety are key concerns for banks to attract customers to use this e-service, and customers do have higher 764 R.-F. Chen et al.

expectations for a user-friendly interface and for security of Internet transactions; however, the lower loadings on ease of use and security imply huge gaps between designers, implementers, and users of the Internet banking services. Therefore, designers and implementers should address the problems encountered in user interface and security in Internet banking. Furthermore, managers of Internet banking should pay close attention to those factors comprising IBCS in order to increase customer satisfaction and loyalty.

The developed IBCS instrument in this study not only provides an important diagnos-tic tool for evaluating Internet banking effectiveness, but can also help the banking indus-try take appropriate actions to keep this innovation and obtain a competitive advantage. This study also completes a research cycle in developing a standardised measurement for confirming IBCS proposed by Hwang et al. (2007). The results of this study confirm that IBCS is a second-order factor model consisting of multidimensional factors of content, accuracy, format, ease of use, timeliness, and safety. Coupled with this rigorous and systematic confirmatory study, this valid measurement can now be used as a standar-dised instrument of user satisfaction for Internet banking. Researchers and practitioners can use these subscales with confidence because of its validity and reliability. From the viewpoint of theoretical development of IBCS, the developed instrument should be extended and validated in other similar e-services.

The results also provide practical guidelines for the design and implementation of Internet banking with respect to its content, accuracy, format, ease of use, timeliness, and safety. This study further confirms the findings of Koufaris and Hampton-Sosa’s (2004) study that perceived usefulness and ease of use of the website as well as perceived security control of the site were significant antecedents of the initial trust of new custo-mers. Therefore, our study can provide useful insights for the system design of Internet banking to attract new customers. The findings of this study can also help the banking industry assess the impact of information technologies, and formulate appropriate strat-egies for building Internet customer satisfaction, thereby enabling banks to keep existing customers and improve service quality.

References

ACNielson Online. (2009). The number of Taiwanese internet banking users has more than 2.5 million. Retrieved June 3, 2009, from http://www.ectimes.org.tw/shownews.aspx?id=10135 Alsajjan, B., & Dennis, C. (2010). Internet banking acceptance model: A cross-market examination.

Journal of Business Research, 63(9 – 10), 957 – 963.

Al-Somalia, S.A., Roya Gholami, R., & Clegga, B. (2009). An investigation into the acceptance of online banking in Saudi Arabia. Technovation, 29(2), 130 – 141.

Anderson, E.W., Fornell, C., & Lehmann, D.R. (1994). Customer satisfaction, market share, and profitability: Findings from Sweden. Journal of Marketing, 58(3), 53 – 66.

Armstrong, J.S., & Overton, T.S. (1977). Estimating nonresponse bias in mail surveys. Journal of Marketing Research, 14, 396 – 402.

Bagozzi, R.P. (1980). Causal modeling in marketing. New York: Wiley.

Bagozzi, R.P., & Yi, Y. (1988). On the evaluation of structural equation models. Journal of the Academy of Marketing Science, 16, 74 – 84.

Bailey, J.E., & Pearson, S.W. (1983). Development of a tool for measuring and analyzing computer user satisfaction. Management Science, 29(5), 530 – 545.

Bentler, P.M., & Bonnet, D.G. (1980). Significance tests and goodness-of-fit in the analysis of covariance structure. Psychological Bulletin, 88(3), 44 – 59.

Bhattacherjee, A. (2001). Understanding information systems continuance: An expectation-confir-mation model. MIS Quarterly, 25(3), 351 – 370.

Bollen, K.A. (1989). Structural equations with latent variables. New York: Wiley.

Byrne, B.M. (1989). A primer of LISREL: Basic applications and programming for confirmatory factor analytic models. New York: Springer-Verlag.

Cardozo, R.N. (1965). An experimental study of consumer effort – expectations and satisfaction. Journal of Marketing Research, 5(2), 224 – 249.

Chen, L.D., Soliman, K.S., Mao, E., & Frolick, M.N. (2000). Measuring user satisfaction with data warehouses: An exploratory study. Information & Management, 37, 103 – 110.

Cheng, T.C.E., Lam, D.Y.C., & Yeung, A.C.L. (2006). Adoption of internet banking: An empirical study in Hong Kong. Decision Support Systems, 42, 1558 – 1572.

Churchill, G. (1979). A paradigm for developing better measures of marketing constructs. Journal of Marketing Research, 16, 64 – 73.

Cronbach, L. (1971). Test validation. In R.L. Thomdike (Ed.), Educational measurement (2nd ed., pp. 443 – 507). Washington, DC: American Council on Education.

DeLone, W.H., & McLean, E.R. (1992). Information system success: The quest for the dependent variable. Information System Research, 3(1), 60 – 95.

Doll, W.J., Raghunathan, T.S., Lim, J.S., & Gupta, Y.P. (1995). A confirmatory factor analysis of the user information satisfaction instrument. Information System Research, 6(2), 177 – 188. Doll, W.J., & Torkzadeh, G. (1988). The measurement of end-user computing satisfaction. MIS

Quarterly, 12(2), 259 – 274.

Doll, W.J., Xia, W., & Torkzadeh, G. (1994). A confirmatory factor analysis of the end-user computing satisfaction instrument. MIS Quarterly, 18(4), 453 – 461.

Fornell, C., & Larcker, D.F. (1981). Evaluating structural equations with unobservable variables and measurement error. Journal of Marketing Research, 18, 39 – 50.

Guimaraes, T., & Gupta, Y.P. (1988). Measuring top management satisfaction with the MIS department. Omega International Journal of Management Science, 16(1), 17 – 24.

Hair, J.F., Jr., Anderson, R.E., Tatham, R.L., & Black, W.C. (1998). Multivariate data analysis (5th ed.). Upper Saddle River, NJ: Prentice-Hall.

Harvey, R.J., Billings, R., & Nilan, K.J. (1985). Confirmatory factor analysis of the job diagnostic survey: Good news and bad news. Journal of Applied Psychology, 70(3), 461 – 468. Hedberg, A., & Taylor, N. (2001). Net banking must do better. Marketing Week, 23(50), 36 – 37. Ho, C.T., & Lin, W.C. (2010). Measuring the service quality of internet banking: Scale development

and validation. European Business Review, 22(1), 5 – 24.

Hwang, H.G., Chen, R.F., & Lee, J.M. (2007). Measuring customer satisfaction with Internet banking: An exploratory study. International Journal of Electronic Finance, 1(3), 321 – 335. Ives, B., Olson, M., & Baroudi, J.J. (1983). The measurement of user information satisfaction.

Communications of the ACM, 26(10), 785 – 793.

Joreskog, K., & Sorbom, D. (1984). LISREL VI: Analysis of linear structural relationships by the method of maximum likelihood. Chicago, IL: National Educational Resources.

Joreskog, K., & Sorbom, D. (1989). LISREL VII: User’s guide. Mooresville, IN: Scientific Software. Jung, B., Han, I., & Lee, S. (2001). Security threats to internet: A Korea multi-industry investigation.

Information & Management, 38, 487 – 498.

Keen, P.G.W. (1997). Future of the internet relies on trust. Computerworld, 31(7), 70.

Koufaris, M., & Hampton-Sosa, W. (2004). The development of initial trust in an online company by new customers. Information & Management, 41, 377 – 397.

Liao, S., Shao, L.P., Wang, H., & Chen, A. (1999). The adoption of virtual banking: An empirical study. International Journal of Information Management, 19, 63 – 74.

Liao, V.S., & Li, H. (2005). Technology acceptance model for internet banking: An invariance analysis. Information & Management, 42, 373 – 386.

Liao, Z., & Cheung, M.T. (2002). Internet-based e-banking and consumer attitudes: An empirical study. Information & Management, 39, 283 – 295.

Loiacono, E.T., Watson, R.T., & Goodhue, D.L. (2007). WebQual: An instrument for consumer evaluation of web sites. International Journal of Electronic Commerce, 11(3), 51 – 87. Mackenzie, K.D., & House, R. (1979). Paradigm development in the social sciences. In R.T.

Mowday & R.M. Steers (Eds.), Research in organizations: Issues and controversies (pp. 22 – 38). Santa Monica, CA: Goodyear Publishing.

Marsh, H.W., & Hocevar, D. (1985). Application of confirmatory factor analysis to the study of self-concept: First- and higher-order factor models and their invariance across groups. Psychological Bulletin, 97(3), 562 – 582.

Massad, N., Heckman, R., & Crowston, K. (2006). Customer satisfaction with electronic service encounters. International Journal of Electronic Commerce, 10(4), 73 – 104.

766 R.-F. Chen et al.

McGrath, J. (1979). Toward a ‘theory of method’ for research on organization’. In R.T. Mowday & R.M. Steers (Eds.), Research in organizations: Issues and controversies (pp. 4 – 21). Santa Monica, CA: Goodyear Publishing.

McHaney, R., Hightower, R., & Pearson, J. (2002). A validation of the end-user computing satisfac-tion instrument in Taiwan. Informasatisfac-tion & Management, 39, 503 – 511.

Mintel International Group Ltd. (2006). Online banking in the United States. Retrieved June 3, 2009, from http://www.researchandmarkets.com/reports/c40160, 79

Mueller, R.O. (1996). Basic principles of structural equation modeling: An introduction to LISREL and EQS. New York: Springer.

Nath, R., Schrick, P., & Parzinger, M. (2001). Bankers’ perspectives on internet banking. e-Service Journal, 1(1), 21 – 36.

Parthasarathy, M., & Bhattacherjee, A. (1998). Understanding post-adoption behavior in the context of online services. Information Systems Research, 9(4), 362 – 379.

Podsakoff, P.M., MacKenzie, S.B., Lee, J.Y., & Podsakoff, N.P. (2003). Common method biases in behavioral research: A critical review of the literature and recommended remedies. Journal of Applied Psychology, 88(5), 879 – 903.

Polatoglu, V.N., & Ekin, S. (2001). An empirical investigation of the Turkish consumers’ acceptance of internet banking services. International Journal of Bank Marketing, 19(4), 156 – 165. Ratnasingham, P. (1998). Internet-based EDI trust and security. Information Management and

Computer Security, 6(1), 33 – 39.

Sanchez, J.I., Korbin, W.P., & Viscarra, D.M. (1995). Corporate support in the aftermath of a natural disaster: Effects on employee strains. Academy of Management Journal, 28(2), 504 – 521. Santouridisa, I., Trivellasa, P., & Reklitisb, P. (2009). Internet service quality and customer

satisfaction: Examining internet banking in Greece. Total Quality Management & Business Excellence, 20(2), 223 – 239.

Smith, A.D. (2006). Explore security and comfort issues associated with online banking. International Journal of Electronic Finance, 1(1), 18 – 45.

Sohail, M.S., & Shanmugham, B. (2003). E-banking and customer preferences in Malaysia: An empirical investigation. Information Sciences, 150, 207 – 217.

Somers, T.M., Nelson, K., & Karimi, J. (2003). Confirmatory factor analysis of the end-user computing satisfaction instrument: Replication within an ERP domain. Decision Sciences, 34(3), 595 – 621.

Stafford, B. (2001). Risk management and Internet banking: What every banker needs to know. Community Banker, 10(2), 48 – 49.

Straub, D.W. (1989). Validating instruments in MIS research. MIS Quarterly, 13(2), 147 – 169. Suh, B., & Han, I. (2002). Effect of trust on customer acceptance of Internet banking. Electronic

Commerce Research and Application, 1, 247 – 263.

Tanaka, J.S., & Huba, G.J. (1984). Confirmatory hierarchical factor analysis of psychological distress measures. Journal of Applied Psychology, 74(2), 621 – 635.