Competitive Dynamics, Global Industry Cycles, Integration-Responsiveness, and Financial Performance in Emerging and Industrialized Country Markets

全文

(2) 62. International Journal of Business and Economics. 1. Introduction The research presented here examines the competitive dynamics, competitive strategies, and financial performance within a fast-cycle industry, i.e., the global information technology (IT) industry in the emerging market environment in Taiwan as compared to the global construction equipment industry in the developed US market, a standard cycle industry through the lens of the integration-responsiveness (IR) framework. The study utilizes causal modeling and multigroup analysis to validate prior research (e.g., Johnson, 1995; Roth and Morrison, 1990) and to test the performance impacts of competitive strategies that are matched to firm strategic orientations. According to the framework and other studies, it is commonly assumed that environmental forces primarily determine global integration and local responsiveness. As a consequence, on the one hand, pressures for global integration include forces that necessitate worldwide business resource deployment and global integration of dispersed businesses across national boundaries (e.g., Harzing, 2000; Yip, 1995; Roth and Morrison, 1990; Ghoshal, 1987; Prahalad and Doz, 1987). On the other hand, pressures for local responsiveness include forces that necessitate local, context-sensitive, strategic decision-making and quick responses to each local market or industrial setting (e.g., Bartlett and Ghoshal, 1989; Prahalad and Doz, 1987; Doz, 1976). Competitive dynamics of multinational enterprises (MNEs), which evolved from an early focus on specific actions of firms to an emphasis on action repertoires (which results from a series of competitive actions and competitive responses from firms competing within a particular industry and in emerging and developed markets), has received increased attention in the literature in recent years (e.g., Hitt et al., 2005; Rugman and Verbecke, 2004; Yip, 2003; Luo, 2003a, 2003b, 2003c; Luo, 2002; Tung, 1999; DeMartino, 1999; Ferrier et al., 1999; Birkinshaw et al., 1995; Miller and Chen, 1994; Williams, 1992; Porter, 1990; Hout et al., 1982). In the study presented here, we examine two research questions: How do emerging economy MNEs that participate in fast-cycle industries, i.e., where core competencies change very quickly and are not shielded from competition, integrate their foreign expansion with home-country operations? What are the similarities, dissimilarities, and determinants of success of firms in an industrialized country that participate in a standard-cycle industry, i.e., where the firm’s competitive strategies are moderately shielded, and that integrate their foreign expansion in emerging markets? Following this line of reasoning in previous research, a dominant conceptualization for examining the global strategy of MNEs in developing and developed markets is the IR framework, first introduced by Prahalad (1975) and further extended and applied by a number of authors including Doz et al. (2000), Roth and Morrison (1990), and Doz (1976). This framework has been widely used, and various aspects of the framework have been investigated, including structural determinants (e.g., Birkinshaw et al., 1995; Yip, 1995; Kobrin, 1991; Porter, 1986), operational flexibility (Bartlett and Ghoshal, 1989), subsidiary mandates and initiative (e.g., Birkinshaw, 1997; Birkinshaw, 1996; Roth and Morrison, 1992), and.

(3) Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang. 63. strategic groups (e.g., Devinney et al., 2000; Taggart, 1998; Johnson et al., 1997; Johnson, 1995; Jarillo and Martinez, 1990; Roth and Morrison, 1990). However, despite the intuitive theoretical richness of the IR framework, it has been difficult to design studies to test the framework in emerging and developed country markets. In part, this difficulty is due to different assumptions about how firms’ international orientations are formed (e.g., Venaik et al., 2005, 2004). In other words, are orientations determined by managerial perceptions (Johnson, 1995)? Or are they determined through analyses of structural drivers in the industrial environment as a consequence of specific industry cycles (fast, standard, and slow) and competitive dynamics (e.g., Yip, 2003; Birkinshaw et al., 1995; Williams, 1992; Porter, 1990; Hout et al., 1982; Caves, 1977). In line with these arguments and the focus of our research questions, we contend that the structural drivers in the industry and the firm’s assessment of their task and general environments should cause firms in the industry to formulate appropriate competitive strategies to try to improve their performance in specific industries in emerging and developed markets. The research model for this study is described in Figure 1. In this causal model, based on the IR framework, we suggest that managers in the global IT and construction equipment industries face one central issue in emerging and developed markets: the strategic integration of their operations in various countries in the presence of forces for global integration and national responsiveness. In addition, the Prahalad-Doz framework assumes that within a single industry, individual competitors will perceive these forces differently due to the structural drivers in the industry, industry cycles, and industry competitive dynamics. Essentially, the competitive dynamics of the industry span national borders, thereby creating a specific competitive profile in the global IT industry in Taiwan and the global construction equipment industry in the US. At the theoretical extremes, businesses that perceive a high level of pressure for integration use a strategy of global integration. Locally responsive businesses perceive pressures to respond to local needs. Multifocal businesses perceive the need to respond simultaneously to both integration and responsiveness needs. Moreover, the choice of corporate strategies by managers in these industries will determine which strategic orientations or competitive attributes have a positive impact on performance. 2. Conceptual Development Hagel and Brown (2005), Lucas (2005), Luo (2003a, 2003b, 2003c), Bartlett and Ghoshal (2000), and Doz and Prahalad (1991) find that in recent years international firms from both developed and developing countries have invested heavily in transitional economies. In this regard, theoretically the benefits accrued from foreign direct investment established in these economies are common to all investors regardless of their country of origin: these benefits include market access, cost reduction, efficiency improvement, market expansion, risk diversification, and internalization synergies. Furthermore other research has documented that advances in technology and communication have increased the pace of internationalization in.

(4) 64. International Journal of Business and Economics. many industries, such as the global IT and construction equipment industries. Because the decision to internationalize requires substantial investment with an uncertain payback period, firms have had to change their strategies and structures to adapt to the competitive landscape of their industries. Figure 1. The Research Model. Conservative Cost Control. H14a. Quality Reputation. H1. H14b. GI pressures H2. Complex Innovation. H3. H14c. H4 H5. Marketing Differentiation. H6. Multifocal pressures. H7. H14d. Performance. H8. H14e H9. H10. Premium Positioning. H11. LR pressures. H12. H14f. Breadth. GI: Global Integration LR: Local Responsiveness. As companies expand their international reach, the executives of these firms must cope with increasing levels of complexity as they try to leverage firm resources across geographically and culturally dispersed regions (Datta, 1988). They subsequently are faced with greater information-processing needs (Sanders and Carpenter, 1998). Bartlett and Ghoshal (2000) suggest that firms can use three distinct strategic orientations to deal with the challenges of operating in international markets and create competitive advantage. These three orientations have been.

(5) Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang. 65. developed over the past three decades based on the seminal works of Prahalad and Doz (1987), Doz (1976), and Prahalad (1975). The three orientations are commonly referred to as global, multidomestic, and transnational (or multifocal) strategies, and in the international business literature the framework has become known as the IR framework, which “is one of the most enduring approaches to thinking about international business strategy and the organizational structure of global firms” (Venaik et al., 2005). Based on prior research (e.g., Johnson, 1995; Roth and Morrison, 1990; Prahalad and Doz, 1987), we identify the important industry variables that determine these three strategic orientations: global integration (buyers/customers are standardized worldwide, standardized purchasing practices exist worldwide, concentrated channels exist worldwide, product awareness is worldwide, product technology exists worldwide, and competitors market standardized product worldwide), multifocal (inventory management is an important element in final cost, local customer service is important, factor costs differ from country to country, and competitors have information systems and order processing), and local responsiveness (competitors exist in all key markets, domestic competition is intense, international competition is intense, business activities are susceptible to scale economies, and international activities are restrained by government). 3. IR Framework in US Construction Equipment and Taiwanese IT Industries Schexnayder and David (2002) and Gross and Hester (2000) argue that the development of the global construction equipment industry has followed the major changes in global transportation. For example, the development of the steam shovel was driven by a demand for an economical mass excavation machine to support the era of railroad construction. In addition, the Cummins diesel engine was developed in the early 1900s as the road-building phase of transportation construction began. The global US construction equipment industry and its capital intensive products (earth moving equipment, off-highway trucks and tractors, loaders, graders and rollers, cranes and draglines, mixers and pavers, and attachments and parts) was selected for this study because the industry products are capital intensive with long product life cycles. An examination of the industry landscape shows that the leading seven players in the global construction equipment industry are Caterpillar, Deere & Company, CNH Global, Komatsu, Kubota, AGCO, and Ingersoll Rand. Each of these companies holds multinational interests in the sector. Caterpillar is the world’s largest manufacturer of construction equipment. Komatsu is the world’s number two maker of construction equipment. The largest market for these products is in the US, which generated 19.2% of the industry’s $109.3 billion in revenues in 2003 (Datamonitor, 2004). From a comparative standpoint, Chen (2005), Cheng and Chun (2005), Shee et al. (2003) and Chiou et al. (2002) find that the IT industry, which dates back to 1954, has become a strategic industry in Taiwan supported by both the government and private business interests and has contributed immensely to the growth of the Taiwanese economy, making it one of the major players in this sector in the world..

(6) 66. International Journal of Business and Economics. The IT industry in Taiwan was selected for this study because IT products (personal computing products, network equipment, communication devices, and parts) are characterized by high product values and short product life cycles according to Chiou et al. (2002). Though the competitive dynamics of the IT industry in Taiwan span national borders, thereby creating a global industry context, segments within the industry exist wherein firms attempt to compete based on their response to competing IR forces. As a result, some firms may perceive a high pressure for global integration. Other firms will likely perceive high pressures to be responsive to local needs. Finally, other firms may perceive the need to respond simultaneously to both integration and responsiveness pressures. From the structural drivers, industry cycle, and competitive dynamics perspective, differences in perceptions of industry pressures in the global IT and construction equipment industries will lead to differences in resource allocation among businesses. Stated another way, Jeannet (2000), Murtha et al. (1998), and Hedlund (1993) argue that there as been a shift in the international management literature from the “fit” between strategy and structure and a “process perspective” that relies on the assumption that the ways that organizations’ members make sense of their organizations and the global environment enhance or inhibit competitive advantage. In line with this observation, Devinney et al. (2000) find that MNEs belonging to the same industry may coordinate and configure their value chains due to the choices that they make to manage environmental pressures in support of their corporate strategies. For example, Taiwanese businesses in the global IT industry and US companies in the global construction equipment industry enact strategies or competitive profiles in similar ways that align with industry structure, competitive dynamics, industry cycles, and their perceptions of the environment. In other words, internationalization and international competition are viewed as cognitive processes by Taiwanese IT and US construction equipment firms in these industries. When the firms perceive pressures for global integration, they will respond with global strategies, while businesses that perceive pressures for responsiveness will respond with locally responsive strategies. Finally, Taiwanese IT and US construction equipment firms that perceive pressures for both integration and responsiveness will respond with multifocal strategies. The difference in strategic response will be reflected in how Taiwanese IT and US construction equipment firms emphasize competitive strategies such as marketing differentiation, conservative cost control, breadth, complex innovation (Miller, 1987), quality reputation, and premium positioning (Johnson, 1995). These competitive attributes ultimately combine to form the firm’s strategy. Businesses that perceive global integration pressures will place emphasis on cost control. By capitalizing on intra-firm efficiencies and global market coverage of a wide line of products that benefit from the same brand name and distribution system, such firms can achieve significant cost savings (e.g., Yip, 2003; Devinney et al., 2000; Porter, 1990; Hamel and Prahalad, 1985). Furthermore, they emphasize marketing differentiation because markets may react to standardized products.

(7) Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang. 67. differently. An understanding of local market sentiments, biases, and culture would help secure a successful marketing campaign. Thus we hypothesize: H1: H2:. Businesses that perceive global integration pressures will place emphasis on conservative cost control. Businesses that perceive global integration pressures will place emphasis on marketing differentiation.. Businesses that perceive pressures for both global integration and local responsiveness simultaneously will place emphasis on complex innovation because of the divergent nature of the pressures they face (Hosskisson et al., 2005). The strategy of complex innovation involves the degree to which the firm introduces major new products or services (Miller, 1987). While facing pressures for global integration, these firms develop structures and processes that encourage standardization. In contrast, while facing pressures for local responsiveness, they produce a diverse set of products. Simultaneously, then, these businesses face pressures for both process and product innovation. The complex demands made on these businesses are similar to the complex demands made on prospectors in Miles and Snow (1978). Stated another way, such businesses require managerial or administrative complexity, in that organizational structures and systems require sufficient differentiation to accommodate both types of innovation. In addition, they require engineering acumen sufficient to meet the requirements for both types of innovation. They also possess the need that locally responsive firms have for quality reputation, marketing differentiation, premium positioning, and breadth along with needs that globally integrated firms have for conservative cost control (e.g., Gross and Hector, 2000; DeMartino, 1999). Specifically, because customers expect high quality and low cost in global markets, these businesses are expected to emphasize premium positioning because they require a source of economic rents to cover the costs of their complex administration over balancing pressures for global integration and local responsiveness (e.g., Luo, 2003a; Chakravarthy and Lorange, 1991; Douglas and Craig, 1989; Ghoshal, 1987). Stated another way, firms in fast and standard cycle industries face difficulties of maintaining competitive advantages in response to the pressures of this corporate strategy, protecting how they manage their strategic intent and strategic mission. Kim et al. (2003) and Grein et al. (2001) argue that MNEs in integrated industries coordinate and control R&D, manufacturing, and marketing functions across borders with significant implications for performance. Thus we hypothesize: H3: H4: H5:. Businesses that perceive multi-focal pressures will place emphasis on conservative cost control. Businesses that perceive multi-focal pressures will place emphasis on quality reputation. Businesses that perceive multi-focal pressures will place emphasis on complex innovation..

(8) 68 H6: H7: H8:. International Journal of Business and Economics Businesses that perceive multi-focal pressures will place emphasis on marketing differentiation. Businesses that perceive multi-focal pressures will place emphasis on premium positioning. Businesses that perceive multi-focal pressures will place emphasis on breadth.. Taiwanese IT and US construction equipment firms perceive pressures for local responsiveness in terms of high levels of domestic competition. Simultaneously, these businesses, as members of the global IT and construction equipment industries, face significant pressures from worldwide competitors, many of whom may have cost advantages. The need to differentiate from competitors and to respond to host government pressures, in concert with potential cost disadvantages, places the locally responsive competitors in a position that demands some form of competitive response. Since these businesses typically lack cost advantages, the default choice for the locally responsive competitors is some form of differentiation (Porter, 1986). Differentiation can take place through product, customer, or geographic specialization, or some form of quality advantage. These businesses will strive for quality reputation (i.e., the reputation of the business products in the industry), premium positioning (i.e., the extent to which the business services certain market niches), and a wide breadth (i.e., the scope of the market that the business serves). Such businesses also face demands for complex innovation. However, the innovation problems are less complex since the solutions are imposed by the requirements of the local environments. Stated another way, other researchers (e.g., Luo, 2002; Tallman, 1992; Kogut, 1989) argue that the importance of these strategic dimensions in helping Taiwanese IT and US construction equipment firms manage the pressures of local responsiveness cannot be understated. These dimensions include: strategic flexibility, its use of scope to adapt products in the industry for the local market, and how these firms develop strategies to respond to environmental uncertainty. Thus we hypothesize: H9:. Businesses that perceive pressures emphasis on quality reputation. H10: Businesses that perceive pressures emphasis on complex innovation. H11: Businesses that perceive pressures emphasis on premium positioning. H12: Businesses that perceive pressures emphasis on breadth.. for local responsiveness will place for local responsiveness will place for local responsiveness will place for local responsiveness will place. Studies of businesses struggling in worldwide competition, like Taiwanese IT and US construction equipment firms, show that the competing pressures for global integration and local responsiveness commonly exist, assuring that in any single industry a variety of strategic options would be possible (e.g., Ghoshal and Bartlett, 1990; Porter, 1990; Doz, 1986). We argue that the environment in which businesses.

(9) Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang. 69. operate can influence the perceptions of managers in that environment. Furthermore, researchers have suggested that managerial interpretations can result in shared mental models in industries as competitors in industries observe and interpret the same environment (e.g., Jeannet, 2000; Murtha et al., 1998; Hedlund, 1993; Porac and Thomas, 1990). As a consequence, managerial perceptions of similarities and differences in competitive dynamics, market characteristics, and industry cycles will determine the strategic options followed (i.e., competitive strategies chosen). These choices will presumably lead to performance differences as measured by return on total assets (ROA), return on investment (ROI), and total sales. In addition, firms in Taiwanese IT and US construction equipment industries use complex innovation differently to manage the product life cycle of their products to create and sustain competitive advantages. Thus we hypothesize: H13: Due to differences in competitive dynamics and industry cycles in Taiwanese IT and US construction equipment industries, the emphasis placed on the competitive dimensions by firms in these industries experiencing pressures for global integration, multifocal orientation, and local responsiveness will be different. The relationship to performance has been an enduring theme for strategy literature (Campbell-Hunt, 2000). Researchers have proposed that the successful performance of design, manufacturing, and marketing functions is necessary for competitive advantage (Droge et al., 1994). In a longitudinal study, Craig and Douglas (1982) find that product quality is significantly related to ROI and market share, a finding corroborated by Phillips et al. (1983). Many studies in the innovation literature have identified innovation as a key determinant of firm performance, especially growth (Droge et al., 1994). Cooper and Kleinschmidt (1987) identified product superiority (i.e., product quality, lower price, and product innovativeness) as the key success factor for new products, with other significant factors being pre-development activities (e.g., preliminary market assessment) and protocol (e.g., clear definition of the target market). Roth and Millet (1990) related critical firm capabilities, such as consistent quality, high performance products, low prices, broad distribution, and effective advertising, to absolute economic outcomes. Thus, researchers have proposed that following a specific competitive strategy (Dess and Davis, 1994) or a mix of strategies (Devinney et al., 2000) can lead to superior performance. It has been posited, however, that innovation, particularly product innovation, is a central differentiating strategic theme (e.g., Bartlett and Ghoshal, 1989; Roth and Morrison, 1990) that can lead to improved performance (Venaik et al., 2005). Correspondingly, a meta-analysis of generic competitive strategy literature indicated that only one meta-design, i.e., innovation and operations leadership, showed significantly higher-than-average odds of superior financial performance (Campbell-Hunt, 2000). That analysis further suggested that any competitive strategy design is as capable as any other of producing above-average financial performance. Thus we hypothesize:.

(10) 70. International Journal of Business and Economics. H14a-f: The competitive strategies of conservative cost control, quality reputation, marketing differentiation, premium positioning, and breadth will lead to better financial performance, but the competitive strategy of complex innovation will distinguish the financial performance of Taiwanese IT firms from US construction equipment firms. 4. Methods and Data 4.1 US Construction Equipment Industry Questionnaire A random listing of 1800 firms in the US construction equipment industry generated the data used in our examination of the hypotheses stated above. Research studies (e.g., Gross and Hector, 2000; Johnson, 1995; Hamel and Prahalad, 1989; Prahalad and Doz, 1987; Hout et al., 1982) identify the US construction equipment industry as a global industry. Cvar (1984) and Prescott (1983) have argued that a strong indicator of the globalness of an industry can be determined by trade flows (exports plus imports divided by US consumption) that exceed 50%. The 50% threshold is used here to provide additional support for the globalness of the US construction equipment industry (Datamonitor, 2004). Questionnaires were mailed to the CEO or president of the 1800 firms in the US construction equipment industry. Executives and managers of 349 firms in the industry returned the questionnaire. Of the respondents, 82% reported that they were manufacturers of commercial and industrial products, 6% reported that they were manufacturers of consumer products, and 6.5% reported that they were wholesalers and distributors. The remaining 5.5% did not report a classification. An analysis of 40 non-responding business units suggested that the respondents did not differ from the non-respondents based on three-year average return on assets, three-year average return on investments, and three-year average return on sales. Therefore, the sample does not show evidence of response bias on these variables. With respect to profiles, as noted earlier, the sample evidenced a wide variation in size; results, though, did not vary when groups were divided on the basis of size. The questionnaire included five-point Likert scale items (1 = “strongly agree” to 5 = “strongly disagree”) to measure the three IR constructs (local responsiveness pressures, multifocal pressures, and global integration pressures) using the items displayed in Table 1 (Johnson, 1995). The six competitive strategies (conservative cost control, quality reputation, complex innovation, marketing differentiation, premium positioning, and breadth) were also measured using the five-point Likert scale items shown in Table 1, which were adapted from Johnson (1995) and Roth and Morrison (1990). The respondents rated the importance of each competitive attribute to their business’ current strategy on another five-point scale (1 = “not at all important” to 5 = “extremely important”). The questionnaire wording was adapted from similar measures used by Luo (2002), Taggert (1997), Johnson (1995), Roth and Morrison (1990), Robinson and Pearce (1988), Dess and Davis (1984), Bourgeois (1980), and Miller and Freisen.

(11) Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang. 71. (1978). To measure firm performance, respondents were asked to indicate on categorical scales the average performance of the business over the past three years based on after-tax return on total assets, after-tax ROI, and annual increase in total sales. ROI was selected as an indicator of financial performance and sales growth was selected as an indicator of competitive performance. Following Lou (2002), Taggert (1997), Johnson (1995), and Roth and Morrison (1990), these indicators were selected for two reasons. First, they are commonly used indicators in strategic management research and therefore provide a degree of comparability with other strategy studies. Second, ROI and sales growth are among the most frequently used criteria to evaluate subsidiary performance within multinational organizations (Morsicato and Radebaugh, 1979). 4.2 Taiwanese IT Industry Questionnaire The same questionnaire that was used to collect data for the US construction equipment industry dataset was also used for the Taiwanese dataset. The instrument was pretested on Chinese executives of multinational firms who were participants in a university Executive Master of Business Administration program. In line with recommendations by Brislin (1986), the questionnaire was translated into Chinese and back-translated into English to ensure accuracy of translation. The sampling frame or sources used for data in this study were identified from the Ministry of Economy (MOE) in Taiwan. This agency provided documentation on IT firms that applied to the MOE for approval for cross-country transactions and activities, which included business transactions between Taiwan and China such as joint ventures and subsidiaries. To provide further documentation of the accuracy of the listing of firms in the IT industry, the list was cross-checked using the annual publication of Taiwan Business Annual, published by the China Credit Information Service. As before, based on arguments by Cvar (1984) and Prescott (1983) that a strong indicator of the globalness of an industry can be determined by trade flows of exports plus imports divided by consumption that exceeds 50%, we were able to assess the value-added activities taking place in this sample of Taiwanese firms by using imports and exports as a proxy, which resulted in the confirmation of the global nature of this industry (e.g., Chen, 2002; Colecchia et al., 2002). In the initial stage of the data collection process a cover letter and questionnaire were prepared in Chinese; 1,150 copies of this cover letter and questionnaire were mailed to the CEO or president of businesses in the IT industry in Taiwan. As suggested by Dillman (1978), mail order surveys were utilized to boost the response rate for this study. Executives and managers of 351 businesses in the industry returned the questionnaire for a 30.5% response rate. The responding businesses on average had 527 employees (SD = 1,083 employees, median = 170 employees). Their average total domestic sales in Taiwan were $4.6 million (SD = $5.5 million, median = $5.0 million) and their average total international sales were $4.2 million (SD = $2.2 million, median = $4.0 million)..

(12) 72. International Journal of Business and Economics. 4.3 Common Method Variance Harman’s single-factor test was performed to test for the presence of common method variance in the US construction equipment industry data as well as for the Taiwanese IT industry data (e.g., Podsakoff and Organ, 1986; Harman 1967). All the self-reported variables in the survey were entered into a principal components factor analysis with varimax rotation. According to Harman’s technique, if a single factor emerges from the factor analysis or one general factor accounts for most of the covariation in the variables, common method variance is present. However, the results of the analysis revealed 14 factors with eigenvalues greater than 1, and no single factor accounted for more than 17.3% of the covariation in the US construction equipment industry data. In the Taiwanese IT industry data, the results again revealed 14 factors with eigenvalues greater than 1, and no single factor accounted for more than 19.7% of the covariation. These results are consistent with the absence of common method variance in both data sets. 4.4 Convergent Validity The partial least squares procedure utilizing PLS-Graph version 3.0 was used to assess convergent validity for the study’s constructs in both datasets (Chin, 1998). The stability of the estimates was tested using a bootstrap sampling procedure with 1,000 samples (Mooney and Duval, 1993). For each of the latent constructs in the study (i.e., local responsiveness pressures, multifocal pressures, global integration pressures, conservative cost control, quality reputation, complex innovation, marketing differentiation, premium positioning, and breadth), the observed variables loaded significantly ( p < 0.05 ) on their respective latent factors for both the US data and the Taiwanese data. These results support the convergent validity of the constructs. A multigroup analysis was conducted to compare the strength of the item-construct loadings in the two datasets. The t-values of the loadings were compared using the following formula: t=. Path(sample1 ) − Path(sample 2 ) (m − 1) (n − 1) 2 × SE (sample1 ) 2 + × SE (sample 2 ) 2 (m + n − 2) (m + n − 2) 2. 1 1 + m n. where sample1 and sample2 denote US construction equipment data and Taiwanese IT data, m =349 is the number of cases in sample1, n =351 is the number of cases in sample2, and SE denotes the standard error of the path. Each computed t-value had n + m − 2 = 698 degrees of freedom. Table 1 presents these results along with the convergent validity analysis..

(13) 73. Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang Table 1. Convergent Validity and Multigroup Analysis of Item-Construct Loading Analysis Construct. Items. Global Integration Pressures. Buyers/customers are standardized worldwide Standardized purchasing practices exist worldwide Product awareness is worldwide Competitors market a standardized product worldwide Inventory management is an important element in final cost Local customer service is required in all markets Factor costs differ from country to country Competitors use order processing and information systems Competitors exist in all key markets Domestic competition is intense International competition is intense Business activities are susceptible to scale economies Use innovative manufacturing Use innovative warehousing Emphasize modern plant and equipment Promote innovative human resource management Use order processing and information systems Emphasize production planning and purchasing Emphasize customer/service quality Emphasize product quality Build reputation in industry Promote new product development Develop engineering and R&D expertise Develop innovative marketing techniques Price competitively Monitor marketing opportunities constantly Develop unique product features Emphasize specialty products Produce high priced products for market niches. Multifocal Pressures. Local Responsiveness Pressures. Conservative Cost Control. Quality Reputation Complex Innovation Marketing Differentiation Premium Positioning. Breadth. Performance. Service a wide variety of customers Influence channels of distribution Operate in wide range of geographic markets Offer a broad number of products/services After tax return on total assets After tax return on total investment. US Construction (Standard Cycle) Loadings. Taiwan IT Loadings (Fast Cycle) Loadings. Multigroup TValue. 0.74*** 0.72***. 0.79*** 0.67***. −0.58 0.44. 0.76*** 0.69***. 0.50*** 0.79***. 2.07* −1.39. 0.72***. 0.67***. 0.61. 0.71***. 0.68***. 0.26. 0.41** 0.43***. 0.43*** 0.62***. −0.11 −1.27. 0.68*** 0.66*** 0.72*** 0.51***. 0.41*** 0.70*** 0.74*** 0.56***. 2.08* −0.38 −0.21 −0.39. 0.69*** 0.57*** 0.72*** 0.72***. 0.63*** 0.77*** 0.71*** 0.70***. 0.54 −2.35* 0.16 0.31. 0.75*** 0.74*** 0.86*** 0.88*** 0.80*** 0.64*** 0.79*** 0.81*** 0.67*** 0.81*** 0.79*** 0.82*** 0.57***. 0.77*** 0.77*** 0.81*** 0.79*** 0.69*** 0. 94*** 0.73*** 0.82*** 0.63*** 0.82*** 0.86*** 0.82*** 0.75***. −0.35 −0.60 1.03 1.48 1.53 −3.69*** 0.38 −0.12 0.37 −0.13 −0.33 −0.06 −0.59. 0.68*** 0.63*** 0.69*** 0.63*** 0.83*** 0.88***. 60*** 0.70*** 0.69*** 0.75*** 0.90*** 0.89***. 0.58 −0.44 0.00 −0.88 −0.93 0.89. Notes: *, **, and *** denote significance at 5%, 1%, and 0.1% levels..

(14) 74. International Journal of Business and Economics. Only four items differed significantly between the US construction equipment industry and the Taiwanese IT industry in the path loadings on their respective constructs. These were “product awareness is worldwide,” which had a stronger loading on the US construction equipment industry dataset ( p < 0.05 ), “competitors exist in all key markets,” which had a stronger loading on the US construction equipment industry dataset ( p < 0.05 ), “use innovative warehousing,” which had a stronger loading on the Taiwanese IT dataset ( p < 0.05 ), and “promote new product development,” which had a stronger loading on the Taiwanese IT dataset ( p < 0.001 ). The similarities in the loadings in the two datasets show support for the validity of the instruments used in the current study for measuring industry pressures and competitive strategies. 4.5 Discriminant Validity Support for discriminant validity is shown through the use of the average variance extracted (AVE) test (Hatcher, 1994). In this test, the square root of the AVE for each pair of constructs was compared to the correlation between them (Chin, 1998). The results of the tests appear in Tables 2a and 2b for the US and Taiwanese industries, respectively, for global integration pressures (GI), multifocal pressures (MP), local responsiveness, pressures (LR), conservative cost control (CCC), quality reputation (QR), complex innovation (CI), marketing differentiation (MD), premium positioning (PP), breadth (B), and performance (P). In each case the square root of the AVE was greater than the correlation. Moreover, no observed variable crossloaded on another construct, i.e., each observed variable had a higher correlation with its own construct as compared to its correlation with other constructs (Chin, 1998). The table of cross-loadings can be obtained upon request from the authors. Thus, discriminant validity was supported (e.g., Anderson and Gerbing, 1988; Hatcher, 1994). Table 2a. Discriminant Validity for the US Construction Industry Construct. AVE. GI. GI. 0.52. 0.72. MP. LR. CCC. QR. CI. MD. PP. B. MP. 0.34. 0.45. 0.58. LR. 0.39. 0.56. 0.46. 0.62. CCC. 0.49. 0.30. 0.41. 0.34. 0.70. QR. 0.72. 0.13. 0.23. 0.27. 0.38. 0.84. CI. 0.57. 0.21. 0.29. 0.34. 0.58. 0.46. MD. 0.59. 0.23. 0.26. 0.23. 0.45. 0.30. 0.39. 0.76. PP. 0.54. 0.16. 0.20. 0.21. 0.44. 0.30. 0.41. 0.30. B. 0.44. 0.27. 0.29. 0.28. 0.51. 0.37. 0.43. 0.67. 0.28. 0.66. P 0.78 −0.10 −0.12 −0.14 −0.14 −0.04 −0.09 Notes: The square root of AVE is shown in bold down the diagonal.. −0.02. 0.12. −0.07. P. 0.75 0.77 0.84.

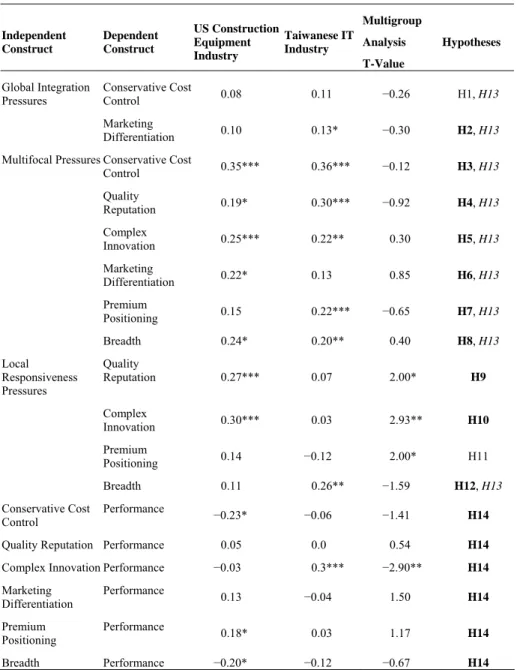

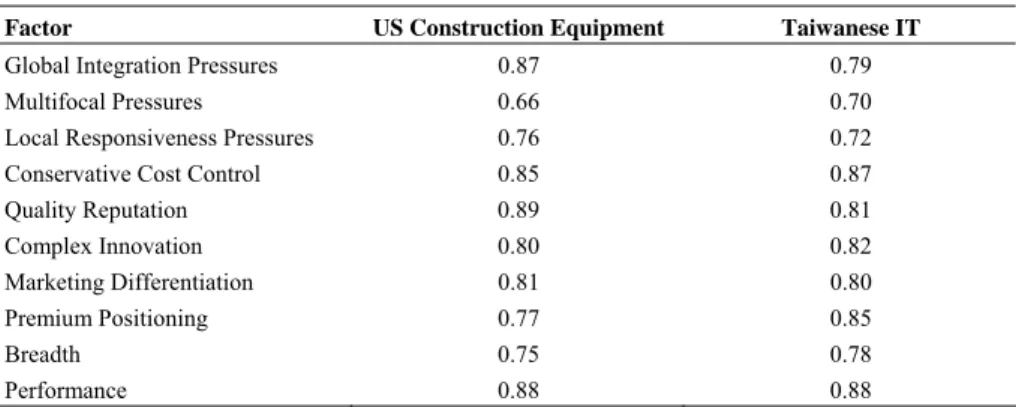

(15) 75. Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang Table 2b. Discriminant Validity for the Taiwanese IT Industry Construct. AVE. GI. GI. 0.49. 0.70. MP. LR. CCC. QR. CI. MD. PP. B. MP. 0.37. 0.34. 0.61. LR. 0.35. 0.35. 0.38. 0.59. CCC. 0.53. 0.26. 0.43. 0.24. QR. 0.59. 0.19. 0.30. 0.15. 0.35. CI. 0.70. 0.13. 0.22. 0.11. 0.40. 0.37. MD. 0.58. 0.26. 0.22. 0.22. 0.45. 0.24. 0.28. PP. 0.66. 0.17. 0.23. 0.05. 0.43. 0.31. 0.55. 0.37. B. 0.47. 0.33. 0.21. 0.21. 0.53. 0.40. 0.32. 0.60. 0.43. 0.69. P 0.71 0.00 0.01 −0.13 −0.02 0.03 0.21 Notes: The square root of AVE is shown in bold down the diagonal.. −0.03. 0.08. −0.07. P. 0.73 0.77 0.84 0.76 0.81 0.84. 4.6 Reliability Table 3 shows the composite reliabilities of the study’s constructs (e.g., Stratman and Rothm, 2002; Gerbing and Anderson, 1988; Fornell and Larcker, 1981). Reliabilities should be greater than 0.70 (Nunnally, 1978). All but one of the constructs meets this criterion, i.e., multifocal pressures in the US construction equipment industry; however, its composite reliability score of 0.66 remains acceptable. Table 3. Composite Reliabilities of Constructs Factor. US Construction Equipment. Taiwanese IT. Global Integration Pressures. 0.87. 0.79. Multifocal Pressures. 0.66. 0.70. Local Responsiveness Pressures. 0.76. 0.72. Conservative Cost Control. 0.85. 0.87. Quality Reputation. 0.89. 0.81. Complex Innovation. 0.80. 0.82. Marketing Differentiation. 0.81. 0.80. Premium Positioning. 0.77. 0.85. Breadth. 0.75. 0.78. Performance. 0.88. 0.88. 4.7 Structural Model The bootstrap procedure with 1,000 samples was used to calculate the significance of the path coefficients (Chin, 1998) as shown in Table 4. Table 4 also shows the multigroup comparison of the paths of the two samples. Significant differences were found in firms perceiving local responsiveness pressures in the US construction equipment industry as compared to their counterparts in the Taiwanese IT industry in the emphasis on quality reputation ( p < 0.05 ), complex innovation ( p < 0.01 ), and premium positioning ( p < 0.05 ). In the relationship of competitive.

(16) 76. International Journal of Business and Economics. strategies to performance, complex innovation was the only significantly different competitive strategy ( p < 0.01 ) between the US construction equipment industry and the Taiwanese IT industry. Table 4. Multigroup Analysis of the Structural Model Multigroup US Construction Taiwanese IT Analysis Equipment Industry Industry T-Value. Independent Construct. Dependent Construct. Global Integration Pressures. Conservative Cost Control. 0.08. 0.11. −0.26. H1, H13. Marketing Differentiation. 0.10. 0.13*. −0.30. H2, H13. 0.35***. 0.36***. −0.12. H3, H13. Quality Reputation. 0.19*. 0.30***. −0.92. H4, H13. Complex Innovation. 0.25***. 0.22**. 0.30. H5, H13. Marketing Differentiation. 0.22*. 0.13. 0.85. H6, H13. Premium Positioning. 0.15. 0.22***. −0.65. H7, H13. Breadth. 0.24*. 0.20**. 0.40. H8, H13. Quality Reputation. 0.27***. 0.07. 2.00*. H9. Complex Innovation. 0.30***. 0.03. 2.93**. H10. Premium Positioning. 0.14. 2.00*. H11. Breadth. 0.11. Multifocal Pressures Conservative Cost Control. Local Responsiveness Pressures. Conservative Cost Control. Performance. −0.12 0.26**. −1.59. H12, H13. −1.41. H14. 0.54. H14. −2.90**. H14. −0.04. 1.50. H14. 0.03. 1.17. H14. −0.23*. −0.06. Quality Reputation Performance. 0.05. 0.0. Complex Innovation Performance. −0.03. Marketing Differentiation. Performance. Premium Positioning. Performance. 0.13 0.18*. Hypotheses. 0.3***. Breadth Performance −0.20* −0.12 −0.67 H14 Notes: Notes: *, **, and *** denote significance at 5%, 1%, and 0.1% levels. Supported hypothesis are in bold and contradicted hypotheses are in italics..

(17) Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang. 77. 5. Results For the US construction equipment industry dataset, significant paths were found from multifocal pressures to conservative cost control ( p < 0.001 ) (H3), quality reputation ( p < 0.05 ) (H4), complex innovation ( p < 0.01 ) (H5), marketing differentiation ( p < 0.01 ) (H6), and breadth ( p < 0.01 ) (H8); and from local responsiveness pressures to quality reputation ( p < 0.01 ) (H9) and complex innovation ( p < 0.001 ) (H10). Furthermore, the paths from conservative cost control, premium positioning, and quality reputation to performance were each significant ( p < 0.05 ). For the Taiwanese IT industry dataset, significant paths were found from global integration pressures to marketing differentiation ( p < 0.05 ) (H2); from multifocal pressures to conservative cost control ( p < 0.001 ) (H3), quality reputation ( p < 0.001 ) (H4), complex innovation ( p < 0.01 ) (H5), premium positioning ( p < 0.001 ) (H7), and breadth ( p < 0.001 ) (H8); and from local responsiveness pressures to breadth ( p < 0.01 ) (H12). Furthermore, the path from complex innovation to performance was significant ( p < 0.001 ). Interestingly, as seen in Table 4, the multigroup comparison of the standard cycle (US construction equipment) and fast cycle (Taiwanese IT) industries showed that only firms in the locally responsive subgroup differed across the samples on the competitive dimensions of quality reputation, complex innovation, and premium positioning. The similarities in the structural models of the US construction equipment industry and the Taiwanese IT industry therefore contradict H13, which predicted that the models would be different due to competitive dynamics and industry cycles. The significant difference in the structural path of complex innovation to performance ( t = −2.9 , p < 0.01 ) between the samples provides support to H14a-f. 6. Discussion and Contributions First, one purpose of this study was to examine how emerging economy MNEs integrate their foreign expansion with home country operations (competitive dynamics and industry cycles) through the lens of the IR framework in the global IT industry, a fast cycle industry, and compare patterns to the capital intensive US construction equipment industry, a standard cycle industry, to examine similarities and dissimilarities of the competitive strategies that predict financial performance. The study finds that firms competing in global industries in emerging markets have benefited from the massive infusion of capital, technology, and managerial expertise from industrialized country MNEs and identifies the most important competitive strategies (through the comparison of MNEs industry cycles) that drive success and create and sustain competitive advantages (e.g., Luo, 2003a, 2003b, 2003c, 2002; Tung, 1999; DeMartino, 1999; Ferrier et al., 1999; Birkinshaw et al., 1995; Miller and Chen, 1994; Williams, 1992; Hout et al., 1982). In addition, in extending the test of the Prahalad-Doz (1987) IR model in Johnson (1995) and Roth and Morrison (1990) in fast and standard cycle industries, the research confirms the validity of the.

(18) 78. International Journal of Business and Economics. psychometric characteristics of the instrument developed by Roth and Morrison (1990) and modified by Johnson (1995), providing further evidence of the value of the IR framework to define differences through the examination of competitive dynamics, competitive strategies, and industry cycles of MNEs participating in global industries in emerging and industrialized country markets. Moreover, similar to findings by Roth and Morrison (1990) and Johnson (1995), the study confirms that MNEs competing in the global IT industry and the US construction equipment industry fit their competitive strategies to their strategic orientations. However, this research shows that matching the similarities and dissimilarities of competitive strategies and the determinants of success with strategic orientations does not necessarily lead to insignificant performance differences among firms with different strategic orientations. Rather, another important finding of this research, depending on the industry structure or cycle, is that certain competitive strategies can be more successful than others, as suggested by Anderson and Joshi (2004). For instance, in the global IT industry in Taiwan, “complex innovation” is the only competitive strategy that predicts performance. From a comparative standpoint, in the global construction equipment industry in the US, the competitive strategy of “premium positioning” predicts performance while the strategies of “conservative cost control” and “breadth” were not as important to success as the other strategic dimensions. Given that the global IT industry in Taiwan is a fast cycle and highly competitive industry, it is not surprising that complex innovation is a critical competitive strategy for success for firms that promote new product development to sustain temporary competitive advantages. In contrast, the demand for construction equipment is highly cyclical (e.g., highways, airports, rail lines, energy operations, and buildings), production requires substantial capital (e.g., Datamomitor, 2004; Gross and Hester, 2000), and companies focus on niche markets. Therefore, it is evident that cost control and the servicing of a broad range of products and markets are not feasible strategies. Second, we find that the breadth of construction equipment product lines and advances are on an incremental basis. Some examples of conservative cost controls are that “given the capital intensive nature of most construction projects, project owners and equipment operators find it economical to rent equipment for a few hours or days rather than purchase it” (Gross and Hector, 2000). The findings of the importance of the competitive strategies in the global IT industry in Taiwan and the US construction equipment industry are not unique and are in fact similar to the findings of other researchers (e.g., Chuang, 2005; Murtha et al., 2001; Hitt et al., 1997; Damanpour and Evans, 1984). These studies describe how firms in various industries have made strategic and structural adjustments to stimulate financial performance for firms participating in various industries through the introduction of innovation, conservative cost controls, and breadth. These firms have utilized these competitive strategies in these industries to transform technologies and to promote access for their products in emerging and industrialized markets. Furthermore, it is important to note that the global IT industry in Taiwan is a strategic industry which is a partnership between government and private interests, universities, and.

(19) Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang. 79. consulting firms in Taiwan (e.g., Lazonick, 2004; Vinaja, 2004; Chen, 2002). These researchers argue further that these various public and private organizations in Taiwan constitute the development infrastructure for this industry to help firms in the global IT industry in Taiwan manage rapid technological obsolescence for their products in this emerging market. Similar strategic alliances were used in the development of the global construction equipment industry in the US (Datamonitor, 2004). On the one hand, the study did not find support for five competitive dimensions for the corporate strategies for the Taiwanese IT industry: global integration (conservative cost control), multifocal (marketing differentiation), and local responsiveness (quality reputation, complex innovation, and premium positioning). On the other hand, the study also did not find support for five competitive dimensions for the corporate strategies for the US construction equipment industry: global integration (conservative cost control and marketing differentiation), multifocal (premium positioning), local responsiveness (premium positioning and breadth). Other specific relationships that were positive from a comparative standpoint for the fast and standard cycle global industries for corporate strategies and strategic dimensions are instructive: global integration (Taiwanese IT industry: marketing differentiation) and local responsiveness (US construction equipment industry: quality reputation and complex innovation; Taiwanese IT industry: breadth). These positive findings suggest that Taiwanese IT and US construction equipment firms who compete in emerging and industrialized market environments use these competitive strategies to manage brand identification, location-specific advantages, and product life cycles of the breadth of its products to create and sustain competitive advantages. Third, it is also interesting to note the importance of the positive findings on five of the six relationships (conservative cost control, quality reputation, complex innovation, premium positioning, and breadth) for the multifocal or transnational corporate strategy and the competitive dimensions in the Taiwanese IT industry. Similar results were found in the US construction equipment industry for this corporate strategy (relationships to conservative cost control, quality reputation, complex innovation, marketing differentiation, and breadth). This suggests that the Taiwanese IT and the US construction equipment industries are challenged to coordinate and configure their strategies and structure to respond to the competitive dynamics of global integration and local responsiveness in their task environment (e.g., Brown, 2002; Martinez and Jarillo, 1991; Habib and Victor, 1991; Roth and Morrison, 1990; Egelhoff, 1988; Gupta, 1987). Stated another way, other researchers (e.g., Rugman, 2005; Hagel and Brown, 2005; Pearson, 2002; Porter and Stern, 2002; Devinney et al., 2000; Peng, 2000; Williams, 1992) argue that firms in these industries must craft strategies that take full advantage of their internal capabilities and external partnerships (and value-added upstream and downstream activities of their total value system) to manage the competitive turbulence in their task environment. It is also important to note that another important dimension of this finding is that many firms participating in global industries concentrate the majority of their activities at the regional level in support of their corporate.

(20) 80. International Journal of Business and Economics. strategies (Rugman and Verbecke, 2004). In other words, these researchers argue that “the benefits of integration resulting from global-scale economies can be reaped only if accompanied by strategies of national responsiveness, guided by external pressures for local adaptation.” To be more specific, the multigroup analysis comparison of the structural models for the Taiwanese IT and US construction equipment industries showed similarity in the samples for nine relationships for corporate strategies and competitive dimensions: global integration (conservative cost control and marketing differentiation), multifocal (conservative cost control, quality reputation, complex innovation, marketing differentiation, premium positioning and breadth), and local responsiveness (breadth). From an institutional theory perspective, these similarities are not that surprising when you consider the competitive similarities and differences between the Taiwanese IT and the US construction equipment industries (e.g., Giacobbe-Miller et al., 2003; Makino and Yiu, 2002; Blodgood and Bauerschmidt, 2002). Stated another way, “managerial perceptions of similarities and differences between their firm and competitors are the basis for collective recognition and action by a firm” (Deephouse, 1999). The major findings of the comparisons of the structural models for the fast cycle and standard cycle global industries are that the strategic dimension of complex innovation has a dominant effect on competitive dynamics and organizational performance. Furthermore, Khurana and Rosenthal (2002) argue that this finding on product innovation suggests that firms in the IT and construction equipment industries understand the importance of implementing clear product visions that go beyond the traditional marketing view of having products for every segment, market, and price point. They argue that this type of portfolio planning helps these firms manage product innovations to balance risk and potential return, short- and long-term horizons, for the emerging and mature markets in which these global firms compete. Fourth, taken together, the lack of significant distinguishing relationships for organizational performance for Taiwanese IT and US construction equipment firms for the other competitive strategies (besides complex innovation) might suggest that they are not as pertinent or critical success factors for these industries due to structural uncertainty or the “extent to which the structure of the industry in which Taiwanese firms and the US construction equipment industry participates in is volatile or variable” (Luo, 2003b). On the other hand, this finding on these competitive strategies also suggests that, due to the industry environment that Taiwanese IT and US construction equipment firms face, there are many constraints that include: how firms use resources and capabilities to protect how they define themselves (e.g., Rugman, 2005; Hagel and Brown, 2005; Pearson, 2002; Devinney et al., 2000; Peng, 2000; Williams, 1992). These researchers also find that these firms are dependent on new ideas and the innovations that result from new product offerings and innovative improvements to build distinctive comparative advantages for their products to sustain or maintain temporary competitive advantages. In this regard, Hosskisson et al. (2004) argue that “innovation has a dominant effect on competitive dynamics in fast- and standard-cycle markets,” such as the global IT industry in Taiwan as compared to its importance in the global construction.

(21) Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang. 81. equipment industry in the US. What this means for firms competing in these industries, according to these researchers, is that these firms enact competitive postures in support of their global integration, multifocal, and local responsiveness strategies that allow them to take actions and formulate strategic and tactical responses to the behavior of competitors. In other words, these researchers argue that strategies are characterized by environments of “competitive dynamics in fastcycle markets, in which all firms seek to achieve new competitive advantages before competitors learn how to effectively respond to current ones, which often result in rapid product upgrades as well as quick product innovations” (Hosskisson et al., 2004). All in all, as a consequence, the findings in this study suggest that the strategic dimension of complex innovation has a major effect on sustaining temporary competitive advantages in the global IT industry in Taiwan because firms’ advantages in fast cycle markets are not exclusive but rather are subject to rapid and relatively inexpensive imitation. These strategies differ in the global construction equipment industry, a standard cycle industry where the products are moderately shielded due the capital intensive nature of the industry (e.g., Rugman, 2005; Hagel and Brown, 2005; Pearson, 2002; Peng, 2000; Williams, 1992). More extensive research is required to further explain the prescriptive or descriptive value of the IR framework and the limitations of using perceptual data to model international strategy taxonomies. Stated another way, different methods might be developed either empirically or theoretically to assess competitive dynamics, competitive strategies, industry cycles, and performance of global industries competing in emerging and industrialized country markets. Two directions offer attractive opportunities for further inquiry. First, and perhaps more importantly, performance differences due to specific competitive dynamics and competitive strategies within other industries or footprints (e.g., those that follow a fast, standard, or slow cycle) should be observed. Second, in future research the framework might be replicated and extended in other country market settings. This could determine if the findings reported here in the global IT industry in Taiwan and the global construction equipment industry in the US would be similar in a another study that would include the analysis of other strategic issues for the MNE, such as structural configuration, or the extent to which the structure of an industry footprint, cycle pattern, or the actions and response of competitors in a specific industry determines the importance of strategic dimensions that predict financial performance for the industry. In summary, the IR framework is an important template that provides interesting insights into how businesses compete in global industries. In particular, the framework can be used to develop an understanding of the business-level strategies within this and other global industries. The work here suggests that individual industries deserve closer attention to identify the competitive attributes most likely to lead to success. More importantly, this study demonstrates how the IR framework can provide a framework for an ex-post analysis of competitive options to examine the competitive dynamics and industry cycles of MNEs competing in emerging and industrialized markets..

(22) 82. International Journal of Business and Economics. References Anderson, T. J. and M. P. Joshi, (2004), “Integration-Responsiveness Orientations among International Firms: The Performance Implications in Food Processing and Computer Products Industries,” AIB/JIBS Paper Development Workshop. Anderson, J. and D. Gerbing, (1988), “Structural Equation Modeling in Practice: A Review and Recommended Two-Step Approach,” Psychological Bulletin, 103(3), 411-423. Bartlett, C. and S. Ghoshal, (1989), Managing Across Borders: The Transnational Solution, Boston, MA: Harvard Business School Press. Bartlett, C. and S. Ghoshal, (2000), Transnational Management, Boston, MA: Irwin McGraw-Hill. Birkinshaw, J., A. Morrison, and J. Hulland, (1995), “Structural and Competitive Determinants of a Global Integration Strategy,” Strategic Management Journal, 16(8), 637-655. Birkinshaw, J., (1996), “How Multinational Subsidiary Mandates Are Gained and Lost,” Journal of International Business Studies, 27(3), 467-495. Birkinshaw, J., (1997), “Entrepreneurship in Multinational Corporations: The Characteristics of Subsidiary Initiatives,” Strategic Management Journal, 18(3), 207-229. Bloodgood, J. M. and A. Bauerschmidt, (2002), “Competitive Analysis: Do Managers Accurately Compare Their Firms to Competitors?” Journal of Managerial Issues, 14(4), 418-434. Bourgeois, L. J., (1980), “Performance and Consensus,” Strategic Management Journal, 1(3), 227-248. Brown, J. S., (2002), “Research that Reinvents the Corporation,” Harvard Business Review, 80(8), 105-115. Brislin, R. W., (1986), “The Wording and Translation of Research Instruments,” in Field Methods in Cross-Cultural Research, W. J. Lonner and J. W. Berry eds., Beverly Hills, CA: Sage. Campbell-Hunt, C., (2000), “What Have We Learned About Generic Competitive Strategy? A Meta-Analysis,” Strategic Management Journal, 21(2), 127-154. Chakravarthy, B. S. and P. Lorange, (1991), Managing the Strategy Process: A Framework for a Multibusiness Firm, Englewood Cliffs, NJ: Prentice Hall. Chen, T. S., (2005), “Joining the Global Village: Taiwan’s Participation in the International Community,” Harvard International Review, 27(2), 27-31. Chin, W., (1998), “The Partial Least Squares Approach to Structural Equation Modeling,” in Modern Methods for Business Research, G. Marcoulides ed., Mahwah, NJ: Lawrence Erlbaum Associates. Chen, S., (2002), “Global Production Networks and Information Technology: The Case of Taiwan,” Industry and Innovation, 9(3), 249-265..

(23) Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang. 83. Chiou, J. S., L. Y. Wu, and J. C. Hsu, (2002), “The Adoption of Form Postponement Strategy in a Global Logistics System: The Case of Taiwanese Information Technology Industry,” Journal of Business Logistics, 23(1), 107-124. Chuang, L., (2005), “An Empirical Study of the Construction of Measuring Model for Organizational Innovation in Taiwanese High-Tech Enterprises,” Journal of American Academy of Business, 6(1), 299-305. Cooper, R. G. and E. J. Kleinschmidt, (1987), “New Products: What Separates Winners from Losers?” The Journal of Product Innovation Management, 4(3), 169-184. Colecchia, A., E. Anton-Zabalza, A. Devlin, and P. Montagnier, (2002), “Measuring the Information Economy,” Organisation for Economic Co-Operation and Development, Paris, France: OECD Publication. Craig, C. and S. Douglas, (1982), “Strategic Factors Associated with Market and Financial Performance,” Quarterly Review of Economics and Business, 22, 101-112. Cvar, M., (1984), “Competitive Strategies in Global Industries,” unpublished dissertation, Boston, MA: Harvard Business School. Damanpour, F. and W. M. Evans, (1984), “Organization Innovation and Performance: The Problem of Organizational Lag,” Administrative Science Quarterly, 29(3), 392-409. Datta, D. K., (1988), “International Joint Ventures: A Framework for Analysis,” Journal of General Management, 14(2), 78-91. Deephouse, D. L., (1999), “To Be Different, or to Be the Same? It’s a Question (and Theory) of Strategic Balance,” Strategic Management Journal, 20(2), 147-166. DeMartino, G., (1999), “Global Neoliberalism, Policy Autonomy, and International Competitive Dynamics,” Journal of Economic Issues, 33(2), 343-350. Dess, G. and P. Davis, (1984), “Porter’s Generic Strategies as Determinants of Strategic Group Membership and Organizational Performance,” Academy of Management Journal, 27(3), 467-488. Devinney, T. M., D. F. Midgley, and S. Venaik, (2000), “The Optimal Performance of the Global Firm: Formalizing and Extending the Integration-Responsiveness Framework,” Organization Science, 11(6), 674-695. Dillman, D. A., (1978), Mail and Telephone Surveys: The Total Design-Method, New York, NY: John Wiley. Douglas, S. P. and C. S. Craig, (1989), “Evolution of Global Marketing Strategy: Scale, Scope, and Synergy,” Columbia Journal of World Business, 24, 47-59. Doz, Y., (1976), “National Policies and Multinational Management,” unpublished doctoral dissertation, Boston, MA: Harvard Business School. Doz, Y., (1986), “Government Policies and Global Industries,” in Competition in Global Industries, M. Porter ed., Boston, MA: Harvard Business School. Droge, C., S. Vickery, and R. Markland, (1994), “Sources and Outcomes of Competitive Advantage: An Exploratory Study in the Furniture Industry,” Decision Sciences, 25(5-6), 669-689..

(24) 84. International Journal of Business and Economics. Egelhoff, W. G., (1988), “Strategy and Structure in Multinational Corporations: A Revision of the Stopford and Wells Model,” Strategic Management Journal, 9(1), 1-14. Fornell, C. and D. Larcker, (1981), “Evaluating Structural Equation Models with Unobservable Variables and Measurement Error,” Journal of Marketing Research, 18(1), 39-50. Gerbing, D. and J. Anderson, (1988), “An Updated Paradigm for Scale Development Incorporating Unidimensionality and Its Assessment,” Journal of Marketing Research, 25, 186-192. Ghoshal, S. and C. Bartlett, (1990), “The Multinational Corporation as an Interorganizational Network,” Academy of Management Review, 15(4), 603625. Ghoshal, S., (1987), “Global Strategy: An Organizing Framework,” Strategic Management Journal, 8(5), 425-440. Giacobbe-Miller, J. K., D. J. Miller, W. Zhang, and V. I. Victorov, (2003), “Country and Organizational-Level Adaptation to Foreign Workplace Ideologies: A Comparative Study of Distributive Justice Values in China, Russia and the United States,” Journal of International Business Studies, 34(4), 389-406. Global Construction & Farm Machinery & Heavy Trucks, (2004), Datamonitor. Gross, A. C. and E. D. Hester, (2000), “Heavy Construction Equipment: Vitality in an ‘Old Economy’ Sector,” Business Economics, 35(3), 66-71. Grein, A. F., C. S. Craig, and H. Takada, (2001), “Integration and Responsiveness: Marketing Strategies of Japanese and European Automobile Manufacturers,” Journal of International Marketing, 9(2), 19-50. Gupta, A. K., (1987), “SBU Strategies, Corporate-SBU Relations, and SBU Effectiveness in Strategy Implementation,” Academy of Management Journal, 30(3), 477-500. Habib, M. M. and B. Victor, (1991), “Strategy, Structure, and Performance of U.S. Manufacturing and Service MNCs: A Comparative Analysis,” Strategic Management Journal, 12(8), 589-606. Hagel, J. H. and J. S. Brown, (2005), The Only Sustainable Edge: Why Business Strategy Depends on Productive Friction and Dynamic Specialization, Boston, MA: Harvard Business School Press. Hamel, G. and C. K. Prahalad, (1985), “Do You Really Have a Global Strategy?” Harvard Business Review, 63(4), 139-149. Hamel, G. and C. K. Prahalad, (1989), “Strategic Intent,” Harvard Business Review, 67(3), 63-76. Harman, H., (1967), Modern Factor Analysis, Chicago, IL: University of Chicago Press. Harzing, A., (2000), “An Empirical Analysis and Extension of the Bartlett and Ghoshal Typology of Multinational Companies,” Journal of International Business Studies, 31, 101-120. Hatcher, L., (1994), A Step-by-Step Approach to Using the SAS System for Factor Analysis and Structural Equation Modeling, Cary, NC: SAS Institute..

(25) Julius H. Johnson, Jr., Dinesh A. Mirchandani, and Seng-Su Tsang. 85. Hitt, M. A., R. D. Ireland, and R. E. Hoskisson, (2005), Strategic Management: Competitiveness and Globalization, 6th edition, Cincinnati, OH: Thomson, South-Western, Mason. Hitt, M. A., R. E. Hoskisson, and H. Kim, (1997), “International Diversification: Effects on Innovation and Firm Performance in Product-Diversified Firms,” Academy of Management Journal, 40(4), 767-798. Hout, T., M. E. Porter, and E. Rudden, (1982), “How Global Companies Win Out,” Harvard Business Review, 60(5), 98-108. Hosskisson, R. E., M. A. Hitt, and R. D. Ireland, (2004), Competing for Advantage, Cincinnati, OH: Thomson, South-Western, Mason. Hedlund, G., (1993), “Assumptions of Hierarchy and Heterarchy: An Application to the Multinational Corporation,” in Organization Theory and the Multinational Corporation, S. Ghoshal and D. E. Westney eds., London, UK: Macmillian, 211-236. Huang, C. J. and C. J. Liu, (2005), “Exploration for the Relationship between Innovation, IT and Performance,” Journal of Intellectual Capital, 6(2), 237-252. Jarillo, J. C. and J. I. Martinez, (1990), “Different Roles for Subsidiaries: The Case of Multinational Corporations in Spain,” Strategic Management Journal, 11(7), 501-512. Jeannet, J., (2000), Managing with a Global Mindset, London, UK: Prentice Hall. Johnson, Jr., J. H., (1995), “An Empirical Analysis of the IntegrationResponsiveness Framework: U.S. Construction Equipment Industry Firms in Global Competition,” Journal of International Business Studies, 26(3), 621-635. Johnson, Jr., J. H., D. J. Lenn, and H. M. O’Neill, (1997), “Patterns of Competition among American Firms in a Global Industry: Evidence from the U.S. Construction Equipment Industry,” Journal of International Management, 3, 207-239. Kim, K., J.-H. Park, and J. E. Prescott, (2003), “The Global Integration of Business Functions: A Study of Multinational Businesses in Integrated Global Industries,” Journal of International Business, 34(4), 327-344. Kobrin, S. J., (1991), “An Empirical Analysis of the Determinants of Global Integration,” Strategic Management Journal, 12, 17-31. Kogut, B., (1989), “Research Notes and Communications: A Note on Global Strategies,” Strategic Management Journal, 10(4), 383-389. Khurana, A. and S. R. Rosenthal, (2002), “Integrating the Fuzzy Front End of New Product Development,” in Innovation: Driving Product, Processes, and Market Change, E. B. Roberts ed., Jossey-Bass, New York, NY: John Wiley & Sons. Lazonick, W., (2004), “Indigenous Innovation and Economic Development: Lessons from China’s Leap into the Information Age,” Industry and Innovation, 11(4), 273-297. Yiu, D. and S. Makino, (2002), “The Choice between Joint Venture and Wholly Owned Subsidiary: An Institutional Perspective,” Organization Science, 13(6), 667-683..

(26) 86. International Journal of Business and Economics. Luo, Y. D., (2002), “Organizational Dynamics and Global Integration: A Perspective from Subsidiary Managers,” Journal of International Management, 8(2), 189-215. Luo, Y. D., (2003a), “Determinants of Local Responsiveness: Perspectives from Foreign Subsidiaries in an Emerging Market,” Journal of Management, 27(4), 451-477. Luo, Y. D., (2003b), “Market-Seeking MNEs in an Emerging Market: How ParentSubsidiary Links Shape Overseas Success,” Journal of International Business Studies, 34(3), 290-309. Luo, Y. D., (2003c), “Industrial Dynamics and Managerial Networking in an Emerging Market: The Case of China,” Strategic Management Journal, 24(13), 1315-1327. Lucas, H., (2005), Information Technology: Strategic Decision-Making for Managers, New York, NY: John Wiley & Sons. Martinez, J. I. and C. J. Jarillo, (1991), “Coordination Demands of International Strategies,” Journal of International Business Studies, 22(3), 429-444. Miles, R. and C. Snow, (1978), Organizational Strategy, Structure and Process, New York, NY: McGraw-Hill. Miller, D. and P. Freisen, (1978), “Archetypes of Strategy Formulation,” Management Science, 24, 921-933. Miller, D., (1987), “The Structural and Environmental Correlates of Business Strategy,” Strategic Management Journal, 8, 55-76. Miller, D. and M. Chen, (1994), “Sources and Consequences of Competitive Inertia: A Study of the U.S. Airline Industry,” Administrative Science Quarterly, 39, 123. Mooney, C. and R. Duval, (1993), “Bootstrapping: A Nonparametric Approach to Statistical Inference,” Sage University Paper Series on Quantitative Applications in the Social Sciences, Series No. 07-095, Newbury Park, CA: Sage Publications. Morrison, A. J. and K. Roth, (1992), “A Taxonomy of Business-Level Strategies in Global Industries,” Strategic Management Journal, 13(6), 399-417. Morsicato, H. and L. Radebaugh, (1979), “Internal Performance Evaluation of Multinational Enterprise Operations,” International Journal of Accounting Education and Research, 15, 77-94. Murtha, T. P., S. A. Lenway, and J. A. Hart, (2001), Managing New Industry Creation: Global Knowledge Formation and Entrepreneurship in High Technology, Stanford, CA: Stanford University Press. Murtha, T. P., S. A. Lenway, and R. P. Bagozzi, (1998), “Global Mind-Sets and Cognitive Shift in a Complex Multinational Corporation,” Strategic Management Journal, 19(2), 97-114. Nunnally, J., (1978), Psychometric Theory, 2nd edition, New York, NY: McGrawHill..

數據

相關文件

Like the governments of many advanced economies which have formulated strategies to promote the use of information technology (IT) in learning and teaching,

In view of the large quantity of information that can be obtained on the Internet and from the social media, while teachers need to develop skills in selecting suitable

From these characterizations, we particularly obtain that a continuously differentiable function defined in an open interval is SOC-monotone (SOC-convex) of order n ≥ 3 if and only

• A way of ensuring that charge confinement does occurs is if there is a global symmetry which under which quarks (heavy charges) are charged and the gluons and other light fields

exegetes, retrospectively known as the Shan-chia and the Shan-wai. In this essay I argue that one especially useful way of coming to understand what was truly at stake in

Transparency International (2013), Global Corruption Barometer, National Results (Taiwan), 2014/10/12 Retrieved from http://www.transparency.org/gcb2013/country/?country=taiwan

In addressing the questions of its changing religious identities and institutional affiliations, the paper shows that both local and global factors are involved, namely, Puhua

To explore different e-learning resources and strategies that can be used to successfully develop the language skills of students with special educational needs in the