國立臺灣大學法律學院法律學系 博士論文

Department of Law College of Law

National Taiwan University Doctoral Dissertation

T AX S TATE AND F ISCAL C ONSTITUTION

Comparing《Discourse on Salt and Iron》and《The Crisis of the Tax State》

租稅國家與財政憲法

對照《鹽鐵論》與《租稅國危機》

Yuan-Chun (Martin) LAN 藍元駿

Advisor:Keh-Chang, GEE 指導教授:葛克昌 教授

J

ULY

,2009民國九十八年七月

D

EDICATE TOM

YF

AMILY&

IN MEMORY OF FOREVER BELOVED GRANDMA

(1930~2008)

ACKNOWLEDGEMENTS

I owe countless debts of gratitude to the world despite my incompetence revealed in this paper.

An overall heartfelt appreciation to you all is here in expression.

I firstly appreciate the support from faculty members in the Law Department of National Taiwan University, who, with great generosity, granted me permission to write my thesis in English so that some parts of ideas and efforts of mine could be tuned in to international channels.

Prof. Tran-Nam Binh of ATAX in University of New South Wales, Australia provided interdisciplinary assistance in economics as well as in writing methodologies. Senior Lecturer Nolan Sharkey pictured a comparative perspective of Taxation of China. Prof. Martin Kryiger had kindly given an interesting portrait on Max Weber. Prof. Yuri Grbich, being a sharp advisor had given me perfect diagnosis.

Prof. Fuke and Prof. Isobe, as my supervisor during my stay in Nagoya University in Japan, offered challenging but inspiring views on the formation of my thesis. Prof. Kanayama, Dean of the philosophy department, Prof. Kobori, Prof. Nagao of the Economic department, Prof. Ikeda of the linguistic department, and Prof. Jimbo, Prof. Moto, Prof. Bennett, and Prof. Morigiwa in the faculty of Law has provided substantial comments. Prof. Emura of the history department had been the best tour guide into the researches of Han Dynasty in Japanese Academia.

Prof. Keh-Chang Gee as my overall academic supervisor as well as my mentor, has readily laid before me a thorny path yet in full blossom. Thanks to Prof. Wang Tay-Sheng and Prof. Tsai Maw-In, it is them who gave me the courage to stand up again to face the over-flooded difficulties through the writing process. Thanks to Dean of college, Professor Tsai Ming-Cheng, his timely pep talks guided me and accompanied me through torrents of danger. Additionally, my heartfelt thanks would like to voice to Ms. Li Sz-Yi, whose timely assistance with warm-hearted kindness in administrative procedures always wells up in mind.

Finding documents has always been part of the training in the process. Prof. Lai Cheng-Chung in Department of Economics in National Tsing Hua University offered impeccable resources.

The help from Prof. M. McLure of University of Western Australia is never forgotten during my short visit in Perth. The research team as well as the secretary of Prof. P. Kirchhof in University of Heidelberg, Germany also extended surprising hospitality. Lecturer Tang Jie-Yin in law department of Bei-Jing University also extended heart-warming friendship. Mr. Ishida of Mori Hamada law firm had been generous enough to provide great care during my visit in Tokyo.

Prof. Lin Chun-Hung of the department of political science, have always been considerate and resourceful since my freshman year. Constant encouragement from Prof. Li Hsien Feng of the Economic department always passes impetus. Last but not least, Grandpa had raised the torch high up in the air with his wealth of knowledge, which became definite guidance especially in reading Japanese references.

May my speechless yet unrelenting impulse be in awe of support from my family. The shortest alphabet would ever be such a redundancy.

Yuan-Chun Martin LAN 2009.7.

ABSTRACT

A quick answer to the question of legitimacy of taxation on the public character of tax or its democratic endorsement may often ease the pain from taxpayers. However, if we proceed, to question the legitimacy of tax obligation or tax power in the context of

traditional Chinese ideologies, we are bound to face the following question: whether

such characters nourished in the west could its resemblance be found in China? If yes, what are the similarities and disparities? If no, whether these characters are worth to be transplanted?

Aiming at the fact that numerous westernized institutions with such foreign characters being implanted as the present situation in the Chinese society, how to mitigate possible contradictions between such western ideologies and intrinsic values rooted deeply in our own tradition is all the more pressing. Discouragingly, such issue in the field of tax jurisprudence seldom raises attention.

Taking the concept of “limitations of taxation” into account, two corresponding issues could be raised. First, whether such western-bred concept could find its resemblance in traditional China? Secondly, if yes, what are the disparities in between? To simply put,

the former deals with the question of “Commonality”, the latter, the question of

“Intrinsity”. Such inquiry, in our opinion, has to some extent touched upon the issue of social values underlying norms.

In reply to the greetings from the westernized tax normality so as to tax morality, how do Chinese commence communication with its own ideas of taxation thus becomes the core issue. To be explicit, this paper attempts to clarify the foundations of tax normality in the traditional Chinese thoughts through reflections on the limitation theory of taxation harbored in the west.

Through socio-psychological factors indicated by the limitations of taxation in the west, we tend to sort out common features out of the background in the text of 《Discourse on Salt and Iron》. In fact, the two strongly-opposed parties appeared in the “Salt and Iron Meeting” reveals two versions of tax morality, governing the development of two

contrasting ideologies of taxation, thus resulting in the confrontations of two interests.

In terms of jurisprudence, the above-raised question—that is, the reply of traditional Chinese values (hereinafter “Intrinsity”)—shall be seen as a question of “possibility of reception” (hereinafter “Receptionability”) in the Constitutional level. To further, the

question of Receptionability intends to argue whether the question of people’s tolerance to tax burden falls in the category of jurisprudence or not, namely, the question of the relativity of discipline. In reply to this question, we try to find possible answers through the process of how man reaches his understanding of knowledge.

We hold the belief that when intrinsic values encounter a foreign culture, be it confrontation or integration, only on a premise of communicability and mutual understandability could interactions between the both sides be of significance and of plausibility.

Modern State being a tax state, its revenue shall depend on tax revenue as a principle. At the same time, under a state ruled of law, taxation must be in the form of law, thus contributes to the protection of the people. Through constitution, imposition of proper

“limitations” on state’s taxation behaviors has been the very mechanism for the protection of taxpayer’s rights. The functioning of the mechanism is centered on the

“rights” of taxpayers. To further, once the rights, protected by the constitution, are being infringed by taxation, the constitution could limits such taxation (namely, to nullify such infringement to rights), and reach the goal of protecting taxpayer’s rights.

However, two things could be questioned here. First, whether such limitations—in other words, the approach to simply nullify the source of infringement—could fulfill the purpose of the protection of the rights of the taxpayers is in doubt. Second, even more seriously is the situation that whether the protection of “rights” could actually be the protection of “taxpayers” is dubious. By paying attention of the on-going tax reforms over the years, discussions over tax equity continues to rage. Two things might worth mentioning according to such phenomenon. First, the issue of tax equity to the mass is all the more pressing. Secondly, the problem remains unsolved. Hence, maybe it should worth a try to first look at the constitutionality of the mechanism before we bury ourselves again into the floods of efficiency-oriented schemes in tax reformations. The main focus of this paper, therefore, is how to make revisions or adaptations to limitation in the constitution.

PREFACE

《The Crisis of the Tax State》and《Discourse on Salt and Iron》, two famous fiscal economic debates on state intervention into markets, both assume similar concern yet appear in different contexts. This paper focuses on the limitation of taxation reflected in both texts and projects different images according to their individual backgrounds.

By a revisit on limitation of tax state, we come to a recognition that under spurious silhouettes also lies commonalities in actual appearances.

Additionally, this English-written paper intends to present to English readers the interaction between Chinese and western ideas, especially in the field of tax jurisprudence (Steuerrechtswissenschaft, 税 法 学 ), from an insider’s perspective, namely, someone brought up in traditional Chinese ideologies.

From such insider’s point of view, Chinese people are isolated by English language from outer worlds, generalized as the Western world, compared to other civilizations.

However, such isolation also implies that for the western world to understand Chinese world, western people are left with limited resources due to the overwhelming power of English language, despite the fact that whether the two worlds are willing to engage in interactions or not.

Taking the contemporary situation into account, the world at present is rapidly under integration. As we insiders explore the universe more, it is us people living on earth isolated from other possible civilizations that we might gradually come to awareness of.

In this sense, the communication of civilizations between Western and Chinese becomes a less difficult meanwhile plausible task.

Back to modern earth where communication is possible through a human English language, the question of willingness to communicate should be brought up. To create a mutually beneficial cross-bordered transaction simply means that both sides of participants should all thereby stay in a mentality of satisfaction. But if such satisfaction of the one side is to be evaluated or judged by the other side based on their own image of satisfaction, misinterpretations are likely to happen. A resultant possibility would be the failure of the transaction.

Aside from the language matter, the case is the same with ideologies, no matter ideologies referring to knowledge or thoughts or values or culture, etc. An outsider’s point of view, just like an observer whose values or ideologies nurtured from a separate origin or historical background, may likely to be disinterested in judgment but at the

same time become either inconsistent or irrelevant. In spite of that, the introduction of this insider’s civilization to the outer world can none the less be overemphasized more, on earth.

This paper certainly refuses to assert the impossibility of cross-cultural understanding.

Rather, quite a significant part of the content is devoted to the promotion of the communicability between different values. Thus, this paper only attempts to express to outer worlds our own values in our own views, while the evaluation is left to the readers.

Nevertheless, the author is aware of the risk of neutrality (disinterestedness) of his perspective but painstakingly eager to maintain such character of Chinese-wise articulation.

As for the efforts made to tax jurisprudence, a strong urge for an elaborated consideration on taxpayer’s behavior is to be proposed. That is an emphasis on the

intrinsic values originated from tax payers’ societal upbringings yet expressed in their choices of value, affecting their imagination of freedom which they act in accordance with in the daily life present.

OUTLINE

Key words: limitation of taxation, legitimacy of taxation, tax morality, tax normality, intrinsic values (Intrinsity), Reservation of law (Vorbehalt des Gesetzes), Rule of law in taxation (Gesetzmäßigkeit der Besteuerung), obligation to pay tax, rule and principle, language relativity

Introduction: Intrinsity and Commonality

Part I: Commonalities in Chinese-Western Tax Norms Part II: Limitations on Taxation in Constitution

Part III: Constitutionality of Legitimacy of Taxation Part IV: Moral Grounds for Rule of Law in Taxation Part V: Tax Normality: An Intrinsic Concretization Conclusion: Intrinsic Value Judgments in Taxation Law

TABLE OF CONTENTS

TAX STATE AND FISCAL CONSTITUTION ... 1

ACKNOWLEDGEMENTS ... 3

ABSTRACT ...- 1 -

PREFACE ...- 1 -

OUTLINE ... I INTRODUCTION INTRINSITY AND COMMONALITY ... 1

PART ICOMMONALITIES IN CHINESE AND WESTERN TAX NORMS ... 9

I. Possibility of Chinese-Western Tax Morality Comparison ... 9

A. 《The Crisis of the Tax State》vis-à-vis《Discourse on Salt and Iron》 ... 10

B. Possible comparison of Tax Morality– Legitimacy of Tax power as starting point ... 18

C. Concrete Benchmark Comparison – the System-and-People Relation ... 25

D. Re-examination of Limits of Taxation ... 26

II. Constitutional Limits of Taxation – Elimination of Contradiction between the Power to Tax and the Property Right ... 31

A. From Limits in Public Finance to Limits in Constitution ... 32

B. Amplifying Contradiction ... 34

C. Attempts on elimination of the Contradictory Relation ... 39

D. Moral Foundation of Tax Obligation ... 43

III. Choice of Values in Fiscal Constitution – In Search of Intrinsity in Tax Normality ... 49

PART IILIMITATIONS ON TAXATION IN CONSTITUTION ... 52

I. Tax State as a choice of value in Constitution ... 53

A. Inferences from theories of tax state ... 54

B. The constitutional significance of the tax state theory ... 54

C. Between tax power and protection of property right—limitations on state’s power to tax... 55

D. The concept of “limitation” and the protection of human rights ... 55

II. The societal character of private property ... 56

A. Historical sketches of the development of tax power ... 56

B. The reflection of taking “property rights” as a protection mechanism ... 61

III. Constitutional limits of legitimacy of taxes ... 63

A. Recognition of social-functioned taxation ... 64

B. Shift of moral grounds in legitimacy of taxation ... 65

C. The application to taxpayer’s basic rights ... 66

PART IIICONSTITUTIONALITY OF LEGITIMACY OF TAXATION ... 67

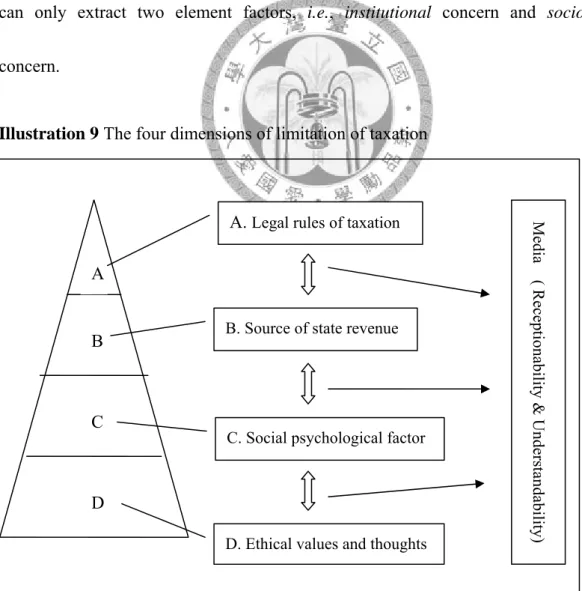

I. Attaching limitation of taxation to taxpayer’s rights ... 67

A. Two perspectives of taxpayer’s human rights: basic rights & civil rights ... 69

B. The limitations of taxation in the level of Constitution ... 70

II. Approaches for protection of taxpayers in the Constitution ... 70

A. Typical legal approach—protection of property rights... 70

B. Specifications in different constitutional contexts ... 71

C. A standardized mechanism of traditional approach ... 75

III. Generalization—an attempt for a normative account ... 77

A. A Pursuit of Equity over Efficiency ... 77

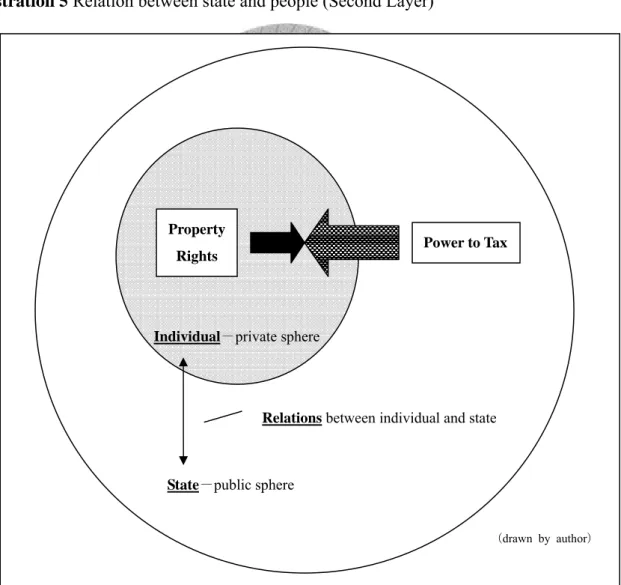

B. Relations of private interests, public welfare, tax obligation ... 78

C. Setting priorities to the three elements: prioritization of protection ... 86

IV. Reflections on the limitations ... 89

PART IV MORAL GROUNDS FOR RULE OF LAW IN TAXATION ... 93

I. Detachment of Form from Substance revisited ... 93

II. Functioning of rule of law in taxation ... 94

A. The internal connection between tax system and legal system ... 94

B. Rule of law in taxation is a multifaceted notion ... 95

C. The essential quality of tax power and its over-respected character ... 97

D. Re-examination of the concept of protection of taxpayers’ rights ... 98

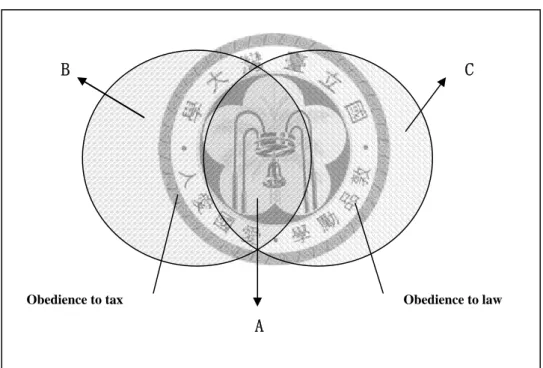

III. Reception of tax state theory and its reflections towards legal norms ... 109

A. Conversion among disciplines—the disparity between law and economics ... 110

B. Tax state as an ideal type: transformation of moral grounds from public finance to jurisprudence ... 110

C. An aspect reflexive of legal norms—obedience to tax obligation and obedience to law ... 111

IV. Amplification of rule of law in taxation ... 112

A. The concept of Intrinsity: An amplification of Freedom and equality of taxpayers ... 113

B. The premise of Instrinsity... 115

C. Further inference from the limitations of taxation ... 116

PART VTAX NORMALITY :AN INTRINSIC CONCRETIZATION ... 123

I. Substance and Form of a tax norm ... 123

A. Re-defining of the Detachment ... 124

B. Concretization of Similarities: logical vis-à-vis societal ... 124

II. Understandability and Receptionability ... 125

A. Borrowed concept (entlehnter Begriff) and Intrinsic concept (eigener Begriff) ... 125

B. Receptionability and Understandability ... 127

C. Reception and Transplant of rules and principles ... 137

D. Language as Media for communications ... 142

E. Communication in rules and in principle ... 145

III. Mitigation between rule and principle ... 150

A. Communicability in values ... 150

B. Knowledge and Language ... 150

C. Communication both in principles and in rules ... 155

CONCLUSION INTRINSIC VALUE JUDGMENTS IN TAXATION LAW ... 161

I. Fiscal Constitution—positioning the relation of taxpayers and tax systems ... 161

A. Two factors: Society and Constitution ... 162

B. The people-institution relation ... 162

II. Taxpayer’s behavior in tax jurisprudence ... 163

A. reconstruction of objective and subjective ... 165

B. Starting from Interpretation ... 165

C. Analogy to thoughts ... 167

III. Taxpayer within the institution and within the society ... 168

A. A portrait of the behavior of taxpayers ... 168

B. freedom and equality in tax law: connection between motivation and behavior... 170

C. Institutional effects on taxpayer’s behavior ... 171

D. Legal premise for homo economicus : adaptation towards homo sociologus... 173

IV. Ancient Voices, Modern Echoes—aiming at the moral grounds for tax obligation ... 174

BIBLIOGRAPHY ... i

APPENDIX:TRANSLATIONS &ANNOTATIONS OF THE TWO TEXTS ... xxiii

《Die Krise des Steuerstaats》=The Crisis of Tax State ... xxiii

《Yiantielun》=鹽鐵論=Discourse on Salt and Iron ... xxiv

附:中文摘要暨背景說明 ... 1

租稅國家與財政憲法 ... 1

中文摘要 ... 6

壹、 導論 ... 12

一. 楔子-國家社會主義或自由市場經濟 ... 12

二. 問題概說-中西課稅界限之憲法基礎及其現代意義 ... 13

(一) 租稅國家之現代意義:租稅國與社會國之「對立關係」 ... 14

(二) 固有性、現代法、繼受法-「對立關係」之產生與解消 ... 15

(三) 憲法上課稅界限—租稅法律主義之實質意義 ... 17

三. 研究方法:中西課稅界限之「固有性」與「共通性」 ... 17

(一) 財政社會學與固有性:租稅國理論之繼受 ... 17

(二) 中西課稅界限之憲法基礎-對照《鹽鐵論》與《租稅國危機》 ... 18

四. 論文架構 ... 19

(一) 「社會市場經濟與財政憲法」之圖像 ... 19

(二) 納稅人與課稅制度關係之具體化-課稅界限 ... 21

貳、 課稅界限之中西對照-固有性與共通性 ... 21

一、共通性(commonality)與固有性(Intrinsity) ... 21

(一) 對照之前提:法繼受之現實性 ... 22

(二) 異中求同-課稅界限之外見共通性 ... 22

(三) 同中見異-課稅正當性基礎與固有性 ... 23

二、財政憲法上意義及比較實益 ... 23

(一) 財政憲法上意義 ... 23

(二) 比較實益 ... 24

三、具體比較方式-以「租稅倫理(tax morale)之異同」為中心 ... 25

(一) 課稅之正當性基礎-利益說與義務說 ... 25

(二) 兩種國家觀 ... 27

(三) 兩種社會觀 ... 28

(四) 管見-租稅倫理與基本價值預設... 28

四、小結-課稅界限在作為比較法上之具體模型 ... 29

參、 中西課稅界限、財政社會學與財政憲法 ... 31

一、概說-租稅國家界限及其財政社會學上意義 ... 31

(一) 「財政社會學」之觀察視角-以《租稅國危機》為中心 ... 31

(二) 財政社會學與現代憲政國家 ... 32

二、財政社會學之實踐性-以Schumpeter 方法論為中心 ... 33

(一) 財政社會學之內涵 ... 33

(二) 財政社會學之影響 ... 34

(三) 財政社會學之繼受 ... 34

(四) 財政社會學方法論之現代意義 ... 35

三、固有性與財政社會學之應用-傳統中國租稅制度之演進及定位 ... 37

(一) 以租稅為中心之財政史 ... 37

(二) 賦稅型態之演變 ... 42

(三) 小結-傳統中國稅役制度之現代意義及回應 ... 47

四、以《鹽鐵論》為線索觀察課稅界限之固有性 ... 50

(一) 《鹽鐵論》文本及其背景 ... 51

(二) 《鹽鐵論》在傳統中國財稅思想之定位 ... 53

(三) 《鹽鐵論》之政經背景及危機 ... 57

(四) 小結:《鹽鐵論》中之各種對立狀態-以「義利之辯」為中心 ... 65

肆、 課稅正當性、倫理基礎與固有性 ... 77

一、概說:課稅正當性之反思 ... 77

二、課稅界限之修正與調整-固有與繼受觀點 ... 78

三、課稅界限論之固有理解... 80

(一) 課稅界限之定性 ... 80

(二) 課稅界限之理解方式:從客觀到主觀 ... 80

(三) 東西課稅界限之對照及其固有性──三個問題 ... 84

四、租稅倫理與固有性 ... 90

(一) 概述-西方之兩套租稅倫理系統... 90

(二) 傳統中國之思想論辯 ... 91

(三) 西方重商主義與重農主義之異同... 93

(四) 現代國家租稅國理論之對照-以日本為例 ... 99

伍、 稅法與繼受法-理解可能性與繼受可能性 ... 100

一、問題概說 ... 100

(一) 溝通可能性之前提:理解與繼受... 100

(二) 外來文化之理解方式 ... 100

二、對於納稅人主觀心理因素之理解─「繼受之客體」為何 ... 101

(一) 對於「繼受對象」之理解:稅法規範之理解 ... 101

(二) 對於「繼受對象之正當性」的理解:租稅倫理之理解 ... 102

三、固有概念(eigener Begriff)與借用概念(entlehnter Begriff) ... 102

四、稅法上價值判斷:以「固有性」為中心 ... 103

(一) 稅法上原則與規則之二分 ... 103

(二) 具體之溝通機制:以「被理解」為前提 ... 104

(三) 納稅人行為取捨之分析可能性 ... 105

五、財政憲法借鏡財政社會學之可行性評估 ... 106

(一) 財政社會學視野下《鹽鐵論》圖像-財政憲法之借鏡 ... 106

(二) 租稅國家作為一憲法理念 ... 107

陸、 「租稅法律主義」概念之定性與內容擴充-以「義利之辯」為中心 ... 108

一、納稅人之行為取捨:「主觀理解」與「客觀理解」 ... 108

二、「繼受問題」之導入與「課稅倫理」之系統化 ... 108

三、「義務」作為觀察原點... 109

四、倫理基礎之討論:所謂「固有性」(Intrinsity) ... 110

五、中西之價值共性:「義、利」、「Equality、Liberty」與「自由平等」 ... 111

(一) 財政社會學在方法上之意義與固有意義之自由、平等 ... 112

(二) 納稅人之自由:主觀之客觀化 ... 112

(三) 納稅人間之平等:客觀之主觀化... 113

(四) 自由平等之「固有化」:二者之「關係」 ... 113

柒、 租稅法律主義與固有法:以稅法上形式與實質之二分為例 ... 113

一、問題之所在-「納稅人基本權保障」與「納稅人憲法上基本權之保障」 ... 114

(一) 「納稅人之自由」之保障-制度經濟學之兩面刄 ... 115

(二) 納稅人間之負擔之實質平等 ... 116

二、「租稅法律主義」與「實質課稅原則」二者「對立」之成因 ... 117

(一) 「形式」與「實質」之二分與對立 ... 117

(二) 「對立關係」(confrontation)之理解 ... 118

(三) 「對立關係」係對課稅權之形式理解,尚應顧及其實質意義 ... 122

(四) 小結:租稅國家課稅權與納稅人財產權自由之辯證關係 ... 124

三、租稅法規範,應同時具有形式與實質意義-「租稅倫理」之提出 ... 125

(一) 租稅法規範之具有多層次意義 ... 125

(二) 課稅界限之負擔上限,取決於不同社會中各自之課稅倫理基礎 ... 126

四、「納稅義務論」較具理論完整性與華人傳統之親近性 ... 126

(一) 納稅義務與人民基本義務之關聯──解消「對立關係」之嘗試 ... 127

(二) 納稅義務之「倫理基礎」 ... 129

五、「稅法規範基礎」之探求:稅法規範其形式與實質之重塑 ... 132

(一) 稅法上之「私利」(稅負極小)與「私益」(個人滿足極大) ... 132

(二) 行為與偏好-本文所謂「主觀」與「客觀」之提出 ... 133

(三) 主觀理解與客觀理解-主觀係一種「固有理解」 ... 134

(四) 語言與知識-溝通作為理解之前提 ... 135

(五) 規則與原則-利益模式與價值模式之相互性 ... 135

捌、 課稅界限、稅法規範與固有性-結論 ... 137

一、社會市場經濟下財政憲法之定位-固有性與預見可能性 ... 137

(一) 民生福利國思想之調和:以固有性為中心 ... 138

(二) 稅捐立法:給予納稅人行為之裁量空間 ... 138

(三) 稅捐行政:疑則為有利於國庫解釋之「義利之辯」說明義務 ... 138

(四) 稅捐司法:在有限之租稅負擔選項之中,納稅人在主觀價值取捨之後,納稅人採取合法節稅之 行為是否仍具期待可能性。(否則即是限制納稅人之價值判斷、裁量之自由。) ... 138

二、納稅人之價值判斷模式、補充性原則與稅捐違憲審查基準 ... 139

(一) 人權保障-國家權力「補充性」之反證 ... 139

(二) 課稅界限之特質及其四層意義:從制度到個人 ... 139

(三) 課稅界限對納稅人行為之「限制」:規範機制之建構為例 ... 140

(四) 以「納稅人」為保護主體之稅捐違憲審查基準:抽象到具體 ... 143

(五) 小結:制度要素與社會要素 ... 144

玖、 展望-民生福利國思想之挑戰與願景 ... 144

一、固有性與課稅界限之歷史脈絡及其現代意義 ... 144

(一) 實質法治國原則之形骸化危機 ... 144

二、體制轉軌與課稅之正當性 ... 145

(二) 體制轉軌:「共通性」作為溝通基礎 ... 145

(三) 「固有性」作為社會心理因應:納稅人主觀要素之重視 ... 146

附:本文思考脈絡 ... 148

參考文獻 ... i

附錄 兩文本之校注、譯本與註釋一覽表 ... xxi

《Die Krise des Steuerstaats》=The Crisis of the Tax State=租稅國危機 ... xxi

《Yen tieh-lun》=鹽鐵論=Discourse on Salt and Iron ... xxii

Table of Illustrations

ILLUSTRATION 1STRING OF THOUGHTS ... 8

ILLUSTRATION 2SCHEMATIC FOR COMPARISON BETWEEN THE TWO WRITTEN WORKS ... 17

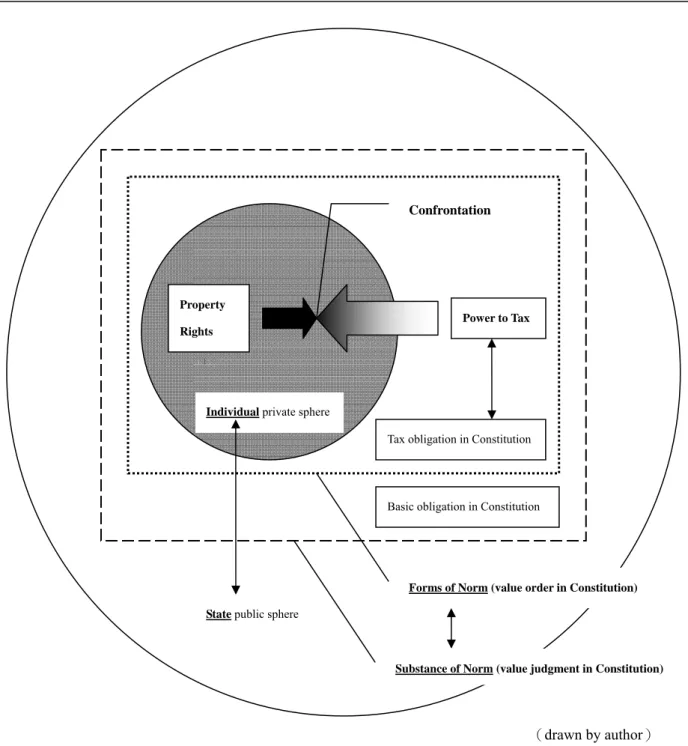

ILLUSTRATION 3RELATIONS AMONG TAX OBLIGATION,PRIVATE PROPERTY AND PUBLIC WELFARE ... 81

ILLUSTRATION 4CONTRASTING POSITION AND CONFRONTATION RELATION BETWEEN PROPERTY RIGHTS AND THE POWER TO TAX (FIRST LAYER) ... 103

ILLUSTRATION 5RELATION BETWEEN STATE AND PEOPLE (SECOND LAYER) ... 104

ILLUSTRATION 6RELATIONS OF TAX OBLIGATION AND BASIC OBLIGATION IN CONSTITUTION (THIRD LAYER) ... 105

ILLUSTRATION 7APANORAMA OF CONFRONTATION (INTEGRATION OF THE THREE LAYERS) ... 108

ILLUSTRATION 8OBEDIENCE TO TAXATION AND OBEDIENCE TO LAW ... 112

ILLUSTRATION 9THE FOUR DIMENSIONS OF LIMITATION OF TAXATION ... 122

ILLUSTRATION 10DEMONSTRATION OF RELATIVITY AND RECIPROCITY ... 149

ILLUSTRATION 11APPLICATION OF LOGIC TO RULE-PRINCIPLE RELATION ... 160

ILLUSTRATION 12TAXPAYER’S BEHAVIOR WITHIN INSTITUTION AND WITHIN SOCIETY ... 170

I

NTRODUCTIONI

NTRINSITY ANDC

OMMONALITYAll we are concerned with is…… the fact that for the tax load……as a whole there exists

a level beyond which further tax increases mean not an increase but a decrease of yield.

Schumpeter, Die Krise des Steuerstaats∗

Main Issue: Revision and Adaptation of Limitation of Taxation

As Schumpeter indicates, there exists a level (eine Höhe) of tax revenue which draws clear the limitations of the function of taxes. Ignorance of this limitation amounts to being irrespective of the economic capacity of the tax state.2

Such limitation of tax state, however, does not in its appearance seem to bear relations with State’s power to tax. That is to say, if, by inference, the legitimacy of taxation does not take into account the endurableness of tax burden, of which taxpayers bound to

∗ Quoted from Joseph A. Schumpeter(1883-1950) in the original German text appears „Uns genügt...es für die Belastung...im ganzen genommen jeweilig eine Höhe gibt, über die hinaus eine weitere Steuerhöhung keinen Zuwachs, sondern eine Minderung des Ergebnisses bringt.“, Zeitfragen aus dem Gebiete der Soziologie, Graz und Leipzig, 1918, S.346. English translation by W. F. Stopler and R. A.

Musgrave, in : The Foundations of Public Finance, P. M. Jackson (ed.), Vol. II, Edward Elgard Publishing Ltd., pp.330-363.[hereinafter Schumpeter(1918/1996)] Additionally, the first translation appears to be in Japanese by Kimura(1951) and Kimura & Kotani (1983).

disagree to, such legitimacy of tax power simply can justify the legitimacy of

taxpayer’s tax obligation.

Furthermore, whether Schumpeter’s limitation of tax state is applicable nowadays requires discussion. Not only does the theory have to overcome the challenge of out-datedness, but also the appropriateness of the theory in other environment, namely, its applicability, needs to be examined.

This paper recognizes the applicability of limitations of taxation but takes an active attitude towards a revision or an adaptation of such limitation of tax state upon its application according to individual context. The focus of the paper is within the context of Chinese civilization with special concern with 《Discourse on Salt and Iron》, which is of crucial relevance in terms of the development of state’s power to tax in the history of traditional China.

1. The power to tax and obligation to pay tax

The question of “Why should people pay tax?” or “Why should people be taxed?” could be a question in daily life. In legal terms, the question could be rephrased as “What is

the legitimacy of tax obligation?” or “What is the legitimacy of tax power?” A quick reply of the public character of tax or its democratic endorsement may be able to ease the pain from taxpayers to a certain degree. However, if we proceed, to question the legitimacy of tax obligation or tax power in the context of traditional Chinese

ideologies, we are bound to face the following question: whether such characters

nourished in the west could its resemblance be found in China? If yes, what are the similarities and disparities? If no, whether these characters are worth to be transplanted?

2. Status-quo: Reception of limitations of taxation

More seriously, aiming at the fact that numerous westernized institutions with such

foreign characters being implanted as the present situation in the Chinese society, how

to mitigate possible contradictions between such western ideologies and intrinsic values rooted deeply in our own tradition is all the more pressing. Discouragingly, such issue in the field of tax jurisprudence seldom raises attention. Taking the concept of “limitations

of taxation” as an example, two corresponding issues could be raised. First, whether

such western-bred concept could its resemblance be found in traditional China? Second, if yes, what are the disparities in between? To simply put, the former deals with the question of “Commonality”, the latter, the question of “Intrinsity”. Such inquiry, in

our opinion, has to some extent touched upon the issue of social values underlying norms.

3. Tax Normality and Tax Morality

In reply to the greetings from the western concepts of taxes and the legal institutions concerned (hereinafter “Tax Normality”) so as to western ideas of values and justification underlying taxation (hereinafter “Tax Morality”), how do Chinese people commence communication with his/her own ideas of taxation thus becomes the core issue. To be explicit, this paper attempts to clarify the foundations of tax normality

in the “traditional Chinese values” through reflections on the limitation theory of

taxation harbored in the west.

In other words, it is of our opinion that tax normality should always be derived from tax morality and that tax morality takes shape and is nourished in individual social values respective society it underlies.

4. Intrinsity and Commonality

In terms of jurisprudence, the above-raised question—the reply of traditional Chinese values—could be taken as one of “possibility of reception” (hereinafter

“Receptionability”) in the Constitutional level. Further, the question of Receptionability tends to argue whether the question of people’s tolerance to tax burden falls in the category of jurisprudence or not, namely, the question of the relativity of discipline. In reply to this question, we try to find possible answers through the process of how man reaches his understanding of knowledge.

5. Protection of taxpayers’ rights by means of limitation of taxation

Modern State being a Tax State (Steuerstaat), indicates that its revenue shall depend on tax revenue as a principle. However, under a state ruled of law (Rechtsstaat), taxation must be exercised in the form of law so as to contribute to the protection of people.

Through constitution, imposition of proper “limitations” on state’s actions of taxation has been the very mechanism for the protection of taxpayer’s rights. The functioning of the mechanism is centered on the “rights” of taxpayers. To further, once the rights, protected by the constitution, are being infringed by taxation, the constitution could

limit such actions of taxation (namely, to nullify such infringement to rights), and reach

the goal of protecting taxpayer’s rights.

However, two possible corollary questions are to be reconsidered here:

First, whether such limitations—in other words, the approach to simply nullify the

source of infringement—could fulfill the purpose of the protection of the rights of the

taxpayers is in doubt.

Second, even more seriously is the situation that whether the protection of “rights”

could actually be the protection of “taxpayers” is dubious. That is, the “object” in need of protection is not explicit enough when using the term “rights”.1

6. A pragmatic pursuit of times

Turning to the seemingly never-ending tax reforms over the years, discussions over tax

equity continue to rage. Not only does this phenomenon imply the issue of tax equity to

the mass is all the more pressing, but as well the problem still remains unsolved with

tax efficiency as the ultimate resolution.

1 There had been restless efforts made in the German literature by either offering more comprehensive explanations of the concepts of “rights” or more interpretative concepts in replace, such as attaching the concept of “social obligation”(sozialbindung) to property rights, or the concept of institutional guarantee (institutionelle guarantie).

Hence, another plausible approach might be to try to first look at the constitutionality of the mechanism before we bury ourselves again into the floods of efficiency-oriented schemes in tax reformations. The main focus of this paper is how to make revisions or adaptations to limitation of taxation in the constitution.

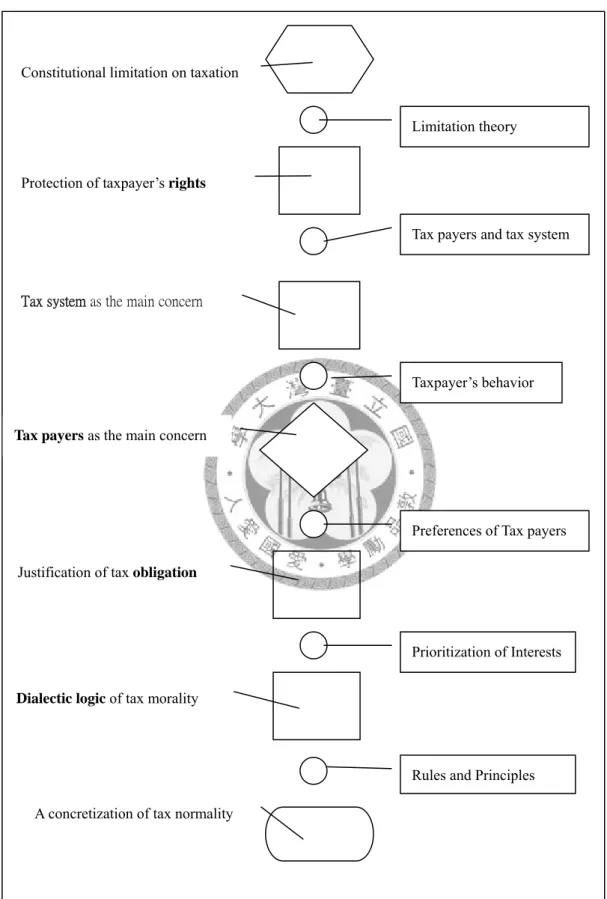

An attempted illustration is provided below to show a flow chart of shifting in argumentations in a string of major key words.

Illustration 1 String of thoughts

Constitutional limitation on taxation

Protection of taxpayer’s rights

Tax payers as the main concern Tax system as the main concern

Justification of tax obligation

Dialectic logic of tax morality

A concretization of tax normality

Limitation theory

Prioritization of Interests

Rules and Principles Taxpayer’s behavior

Preferences of Tax payers Tax payers and tax system

P

ARTI C

OMMONALITIES INC

HINESE ANDW

ESTERNT

AXN

ORMSNatura non facit saltum.∗

I. Possibility of Chinese-Western Tax Morality Comparison

In spite of several large-scale interactions throughout history, variations between Chinese societies and Western nations have resulted in dissimilar directions of development. It is interesting, nonetheless, that these different directions have led to the same dilemma waiting the right solution. The subject of this paper is an appropriate example in jurisprudence. When facing enormous spending on war against another nation, how a country optimizes profits from its economic system through its financial policy to cover the expenses relies on the choice of the economic system. However, the choice of the economic system often creates full impact on the economic life of the people and thus becomes a key issue in constitutional jurisprudence in modern nations.

Nevertheless, since the standpoints of constitutional jurisprudence and public finance

∗ Crisis(1918/1996), p.334, Note.6, in full text: „Social conditions always contain remnants of the past and seeds of the future; and it is these seeds that are especially noticeable to the researcher looking back through the spectacles of a later time. Natura non facit saltum, and it is only by way of abstraction that

are not the same after all and the underlying choice of value has to be differentiated.

What is certain is that the same old question of “whether the state exercises market intervention” has attracted concerns in both the East and the West. This paper focuses on analysis of two texts—《Discourse on Salt and Iron》and《The Crisis of the Tax State》—two major debates on financial and economic policies.

A. 《The Crisis of the Tax State》vis-à-vis《Discourse on Salt and Iron》

Undeniably, the two debates [hereinafter Crisis and Discourse] in focus all rooted deeply in their respective backgrounds. In the hope of creating an outlined sketch of understanding to accentuate the focus of discussion, an introductory as well as an interpretation of relevant materials is portrayed below.

1. Issue in Crisis – State Capitalism or Free Economy

In 1917, Rudolf A. Goldscheid1, an Austrian finance scholar, while facing the question of whether the Austrian tax system would be able to pull the country out of its financial plight after WWI, cast out a gigantic question mark – his conviction that reforming the

1 For a recent biographical work, see W. Fritz et al., Rodulf Goldscheid: finanzsoziologie und ethische sozialwissenschaft, 2007, Berlin.

order of public goods would be the right solution. In other words, in the realm of public finance the theory of public goods must be practiced to the maximum degree to become the foundation of law and order to protect as well as improve public goods and upgrade their productivity.1

Goldscheid asserted: 2「The natural social result of such a development would be a

State which gradually needs to take less and less and yet can give more and more.」 He

thought, from the view of financial sociology (Finanzsoziologie), the natural outcome of social development would be the state asking for less and less from and giving more and more to its people. As a consequence, planning a perfect public economic system would be essential for the income sources of the entire society. 3In other words, the fiscal system of a tax state could no longer meet the demand of the time.

Schumpeter, however, opposed the above assertion. For him a war-incurred financial crisis was not the crisis of the tax state. War could not expose the intrinsic, structural imperfections of the system of the tax state. At the most, it would only show the tax state was under external impact. It would be spontaneous for a tax state to handle its

1 Goldscheid, Rudolf(1925), A Sociological Approach to Problems of Public Finance, in Musgrave, Richard A. and Alan T. Peacock(ed.)(1958), p.202-213. Extracts from “Staat, öffentlicher Haushalt und Gesellschaft, Wesen und Aufgaben der Finanzwissenschaften vom Standpunkete der Soziologie”, Handbuch der Finanzwissenschaft, edited bz W. Gerloff and F. Meisel, Vol. 1, Tübingen 1925, pp.

146-185.

2 Goldscheid (1925), p.213.

crisis through taxation. Therefore, Schumpeter, in his effort to defend economic freedom, advocated that utilizing the tax state system would be enough to cope with the crisis. On the contrary, if the state intended to plunder the private economic sector for financial gains, it might damage the market mechanism and slow down economic progress.

In response to Goldscheid’s assertion, Schumpeter proposed the famous Crisis in the last year of WWI, 1918. In Crisis, apart from criticizing the political status quo, Schumpeter also applied Goldscheid’s methodology and established his own set of tax state theories from the origin, nature and boundaries of the tax state as an attempt to overcome the difficulties in the so-called “crisis of the tax state” at the time.

The attraction of Crisis is the calm, unwavering attitude exhibited in its handling of crises which made the study on Schumpeter’s tax state philosophy even more thrilling.

2. Issue in Discourse—State Monopoly or Free Economy

The work Discourse was essentially the arranged and compiled record of a court

meeting.1 It chiefly contains the debate on the advantages and disadvantages of various state monopolies promoted during the reign of the Wu Emperor of the Han Dynasty and on the question of whether these fiscal measures of revenue collection should be kept or abolished.

One side of the debating parties, Wen Xue(文學) and Xian Liang(賢良) (hereafter referred to as Literati et al) claiming their identity as public opinions2 that the fiscal policy of the time was vying with private citizens for profits and therefore should be repealed. The opposing side, the court officials led by Sang Hong-yang (hereinafter

Sang et al) represented state interests and retorted the assertion of Literati et al by

claiming that state monopoly has its own justification paralleling the justification of agriculture, and shall not be neglected.3

In the debate on Chinese financial and economic policies in Discourse, the Literati regarded the economic policy the Wu Emperor of the Han Dynasty promoted was

“vying with people for profits” which limited agricultural development. Instead, they

1 Some people believe that Huan-kuan was touched by the words of Zhu Zi-bo(朱子伯) of Ru-nan so he collected the record that had been passed down, arranged the order, polished the language, added some clauses and produced the version available today. Please refer to History of Thoughts in the East Han and West Han Dynasties by [Hsu](1979), P.125. For verifications of whether “Discourse on Salt and Iron”

was a fabrication, see [Lai](1996/1998).

2 See Discourse, §1.[鹽鐵論本議第一]

advocated, “restraining from trivial gains to cultivate righteousness” and “valuing the essential part and suppressing the insignificant elements.” In contrast, the court officials believed Wu Emperor’s policy was not only to reinforce national defense but also to curtail private businesses from growing out of control and endangering the central regime. Therefore, they were convinced that the economic measures were in fact advantageous for private citizens and beneficial to agricultural development.1

Some suggests, on the surface, the Confucian Literati et al seem to have won the debate, yet in reality the victory of Literati et al was a result of the convergence of Confucianism and Legalism and therefore it should have been a victory of the Legalists as well.”2 However, as we investigate further: In which basic ideas did Confucianism and the Legalism converge and in which ones did they vary? Whether this can be associated with issues such as the argument of “big government v. small government” is already enough for contemporary researchers to ponder upon.

In reality, however, the argument over the policies of price control and even allocation of salt and iron reappeared itself from the Chin-Han period to the Ming and Ching Dynasties, but in different forms and to various degrees. These policies were adopted

1 [Qiao](2002), Discourse on Salt and Iron, annotation edition, Huaxia Publishing, pp.1-3

2 [Tang & Chen](2004), History of Economical Ethics of Ancient China, Renmin Chu Ban She, p.276

for the same causes and failed for similar reasons. It was a consistent phenomenon in Chinese economic history. 1 Various Chinese dynasties being similar in scale and structure, frontier defense was nearly always a heavy burden on state finances; in consequence, the government was unable to extend its economic power externally and, being incapable of overcoming its existent economic boundaries, which had to turn inward and squeeze out all possible civilian resources without mercy, fighting for profits with the people with it political power.2 This feature of state fiscal authority seeking financial resources internally began with the “Discourse on Salt and Iron” and had its significance in the transformation of economic social structure.

On the other hand, however, Hsu offers an insightful comment that “Under imperial

authoritarian rule, intellectuals have the opportunity to reflect political realities only

when they are caught in a contradicting standoff and this is where the true value of

Discourse on Salt and Iron lies.” 3 Regardless of the complexity of the conflicts of interests between both sides of the debate i.e., Literati et al vs. Sang et al., the fact that this dialogue content reflected the life of the people at the time, which reached the ears of the emperor, already has its referential value.

1 See [Lai] (1996/1998), p.29.

2 See [Lai] (1996/1998), p.29.

3 [Hsu] (1979), History of Thoughts in the East Han and West Han Dynasties, p.124

3. Taxation as Defined in Both Debates –Standpoints of Dissimilar Foundations of Taxation Ethics

The argument in both debates was concentrated on the relation between the state and economy. To be specific, both debates were intended to do nothing more than drawing the line between the state and the people based on their respective historic backgrounds and cultural contexts in order to secure their positions and continue with their lives. On the surface, the two debates could not have possibly had any association in the space-time continuum and therefore can never be compared. In reality, however, exactly because of the absence of intersection between these two debates, identification of the ethic foundation in the separate development of tax regulations in China and in the West this paper has initially set to define becomes a possibility.

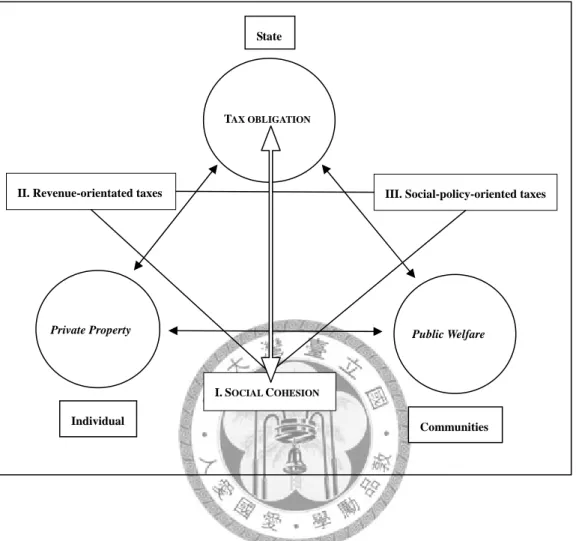

Illustration 2 Schematic for Comparison between the Two Written Works

《Discourse on Salt and Iron》 vis-à-vis 《The Crisis of the Tax State》

1 and 2: There are commonality and practical benefits in comparison between “Discourse on Salt and Iron” and “The Crisis of the Tax State”.

1 and 3: The contradicting views in the financial and economic debate in Discourse on Salt and Iron are explained through the conflict between Legalism and Confucianism.

2 and 4: The standpoint of The Crisis of the Tax State is made conspicuous through Entrepreneur State and Tax State.

3 and 4: Through the focuses of debates in China and the West, it is made clear that the pivotal question lies in the choice of value of the fiscal system.

3 and 5: The Legalist and Confucianist theories are adopted as an attempt to explain the type of market economy in system transformation.

4 and 5: The state fiscal system is used as an attempt to explain the type of market economy in system transformation.

1. Sang et al vs. Literati et al

(Should state control monopoly businesses?)

3. Legalism vs. Confucianism (an ideological conflict)

4. Entrepreneur State vs. Tax State

( choice of value of the state fiscal system)

2. State Capitalism vs. State Socialism

(Does the state exercise market intervention systematically?)

5. Possibility of legislation on system transformation

( fiscal sociology )

(fiscal sociology)

(fiscal constitution)

B. Possible comparison of Tax Morality– Legitimacy of Tax power as starting

point

1. Taxation and Private Property

In modern state, taxation and private property are like the two sides of a coin. It is even appropriate to say that the tax system is the means to safeguard private property1. In other words, the fiscal system of a constitutional polity that acknowledges private property has to be a financial revenue system (the system of a tax state) centering on taxation in order to stay in line with historical evolution.

2. The Power to Tax as symbol of Modern State Sovereignty

When viewing the functioning of the tax state system from the ruler’s angle, i.e., the various fiscal measures of a state with the power to tax as the center, the power to tax is not only the symbol of state authority but also becomes a major approach of the state to intervene in the life of private citizens and establish different relations with the people.

Simultaneously, the power to tax also becomes the most potential influence on the life

1 Refer to [Endo] Taxation and Private Property for the outline. For the relation between constitutional protection and taxation, see [Lan](2007)

of the people.

3. taxpayers-centered idea in the protection of basic rights

The basic rights are the objects of protection of constitution. People, as the subjects of basic rights, are naturally the focus in terms of constitutional jurisprudence. By the same principle, in the realm of fiscal constitution, the direction of the core issue therefore has to be the protection of basic rights focusing on taxpayers.1

In terms of constitution in its modern sense, however, tax power can easily be regarded as a violation of people’s basic rights when seeking absolute enforcement of their constitutional protection. In other words, how to restrain tax power with constitutionally recognized values, so as to ensure the protection of basic rights has always been a rudimentary question in terms of fiscal constitution in a modern state. However, when exercising such restraint, we find certain degree of detachment is at the same time created between regulations and the reality aims to be regulated. Reasons are developed more explicitly as follows:

i. First of all, a certain contradictory relation arises between state’s tax power and people’ property right.

Tax imposition on its people1 in a modern state is actually a prerequisite for the people’s freedom to have property and the foundation of private property. Without taxes financing state’s public services, basic subsistence for people is deprived. When evaluating the approaches of a state’s power to tax, taxpayers may realize a certain part of their income becomes out of their disposal and thus ascribe the blame to taxation.

Such ascription representing taxpayers’ mentality is particularly noticeable in modern society partly because of money being the principal medium in business transactions.

Once people are unable to fulfill their needs by consumption (or usufruct) of property, they attribute to the loss of their property. And the most influential factor resulting in the diminishing of property is state’s taxation. Consequently, it is state’s tax power taking away people’s money that leads to decrease in money and one’s inability to fulfill one’s needs. In the end, a violation of their freedom or right to fulfill oneself due to one’s property being taken away from the state is to be perceived.

1 The term taxation here refers to a modern nation’s imposition of taxes on the results of the people’s profitable activities in order to pay for public needs. See §3 Abs.1 of Abgabenordnung (AO) (General Tax Code of Germany) for concrete legal definition. For Chinese translation, refer to the German General Tax Code, translated by Chen Min (陳敏), Training Institute, Ministry of Finance. For legal discussion on differences between taxation and state revenues of other nations, see [Fuke] (2006).

Even more seriously, when their disposable property increases as a result of tax reduction or exemption or inapplicability of tax imposition in some special situations, taxpayers may conveniently interpret it as a concession of tax power to the property right. Thus, in the minds of the people, especially taxpayers, thinking of the decrease in their disposable property, a contradictory or conflicting mentality engenders against tax power.

Here, we assume that such psychological factor has invisibly contributed to tax power and property right in contradictory positions. Therefore, the research on the emergence of such contradictory relation is necessary in terms of discussions on the limits of taxation.

ii. Secondly, a gap appears between the will of the ruling agency and the legitimacy of taxation.

Judging from historical evolution, we found that the development of the concepts of human rights in the West was the consequence of suppression – an ideology that gradually took shape after resisting and overthrowing the rulers over and again. In other words, the formation of the concept of rights was the reaction of the ruled towards the