Evaluation of Prepayment and Default Behaviour of Mortgage Customers :

With a Case Study of the Banking Industry in Taiwan

Shuo-Fen Hsu1

Professor, Department of Risk Management and Insurance, National Kaohsiung First University of

Science and Technology

Kaohsiung, Republic of China (Taiwan) shuofen@ccms.nkfust.edu.tw

Po-Sheng Ko2

Associate Professor, Department of Public Finance and Taxation

National Kaohsiung University of Applied Science Kaohsiung, Republic of China (Taiwan)

psko@cc.kuas.edu.tw Cheng-Chung Wu3

Doctoral student, Graduate School of Management National Kaohsiung First University of Science and

Technology

Kaohsiung, Republic of China (Taiwan) wu_0110@yahoo.com.tw

Abstract̶This study analyzes the mortgage loans of five Taiwanese commerce banks to identify the key factors that influence prepayments and defaults. Using data from a total of 16,215 data entries of mortgage loans of five Taiwanese commerce banks in 2002 through 2007, this study first conducts Logistic regression to analyze the behavior of prepayments and default. As far the overall predictability is concerned, this paper finds that the logistic regression model is able to provide simplified results in the measurement of model variables concerning defaults and prepayments.

Keywords- Prepayment; Default Behaviour; Banking Industry I. Introduction

Prepayments and default probabilities are a risk to real estate mortgages as they both affect the value of creditors’ rights. There must be incentives that drive borrowers to be engaged in these two risky behaviours. The profiling of certain borrowers can shed light to which type of borrowers are more able to make prepayments or simply less reliable (hence likely to default). These are all the issues that financial institutions take into careful consideration in risk management of mortgage businesses. Meanwhile, in order to establish an understanding of the characteristics of prepayments and overdue repayments across borrowers, the analysis of the historical data of mortgages offered by the banking industry in Taiwan is the first priority and essential. Therefore, this paper summarizes its purposes into the following two aspects:

(1) This paper analyzes a total of 16,215 data entries of mortgage loans of a Taiwanese bank from 2002 through 2007, so as to identify the key factors that influence prepayments and defaults and compare the results with past relevant studies for similarities and differences.

(2) This paper adopts Logistic regression to analyze the behavior of prepayments and default risks in order to provide a reference to the banking industry in credit decisions and risk management of real estate mortgage businesses.

II. Literature Review

Kau, Keenan, Muller and Epperson (1993) adopt the strategy of value maximization for defaults and prepayments in the analysis of FRMs and ARMs. The result indicates that without taking into account prepayments, the value of default options for FRMs is greater than that of ARMs. However, if prepayments are taken into consideration, the result is otherwise. In contrast, the higher the leverage, the higher value of defaults and lower value of prepayments. Vander Hoff (1996) refers to the data of 1985-1992 to analyze the early repayment rate and default rates of FRMs and ARMs. The result shows that the probability of prepayments for 30-year FRMs depends on the rising rates of housing prices and growth of personal incomes. The probability of prepayments for 15-year FRMs mainly

depends on the changes of interest rates. When the rates go down, the probability of prepayments of ARMs is lower than that of FRMs, but the probability of defaults of ARMs is higher than that of FRMs.

The biggest restriction in the aforesaid researches is a lack of massive and detailed data. Therefore, Lawrence et al. (1992) expand the scope by analyzing a wider range of data. They refer to the characteristics of the borrowers at the beginning of the period and at that time, mortgage durations, terms and conditions, economic factors and default costs. The result shows that credit history, age, mortgage years, pressure of repayments and mortgage leverage of the borrowers all have significant influence on default behavior. Among these factors, mortgage leverage and pressure of repayments carry the most weight.

Smith et al. (1996) suggest that the percentage of mortgages, locations of the real estates, interest rates and amounts borrowed all influence defaults and prepayments. The result suggests that the percentage of mortgages, amounts borrowed and interest rates show significant and positive correlation with defaults. Meanwhile, the percentage of mortgages, locations of the real estates, interest rates and amounts borrowed also have significant influence on prepayments. The percentage of the mortgages and prepayments are negatively corrected; whereas the amounts borrowed and interest rates are positively correlated.

Therefore, in the consideration for prepayments, the borrowers will gauge whether the contractual rates are high or low and whether prepayments are appropriate. In the consideration for defaults, they will examine whether the present value of the real estates is equivalent with the balance of the remainder of the mortgage. If the housing prices have been plummeting to a very low level, the borrowers will consider whether it is still necessary to keep repayments. As to the purchase prices and the original low contractual rates may be things of the past and falling outside the scope of consideration.

III. Research method A. Research Data & Sources

The main purpose of this study is to compare different prediction models for defaults and prepayments

2009 International Conference on Information Management and Engineering

978-0-7695-3595-1/09 $25.00 © 2009 IEEE DOI 10.1109/ICIME.2009.116

529

2009 International Conference on Information Management and Engineering

978-0-7695-3595-1/09 $25.00 © 2009 IEEE DOI 10.1109/ICIME.2009.116

of mortgage loans. The key is to identify a better mix of predictive variables. Therefore, this paper analyzes the mortgage data of a Taiwanese bank over the past 6 years. There are a total of 16,215 entries of sample data. The sample is highly representative.

B. Data Analysis Method

This paper compares different prediction models for defaults and prepayments of mortgage loans so as to identify a better mix of predictive variables (rather than a better analysis method). Therefore, this paper only uses the traditional Discriminant Analysis and Binary Logistic Regression to analyze the mix of predictive variables.

C. Selection of Research Variables

In terms of research variables selection methods, this

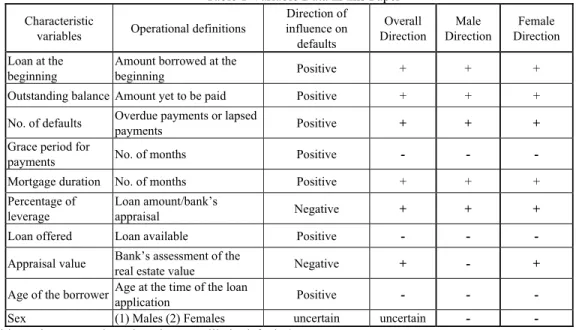

paper refers to the variables used in the past literature and the feasibility of accessing data to define the variables in this research project. Secondly, the author interviews the senior managers whose tenures are over 20 years in financial institutions or credit review personnel who has over 10 years’ experience to discuss the empirical implications of the 5P credit principles, i.e. people, purposes, payments, protection and perspectives of credit. Finally, based on the interview results and the possibility of data access, this paper collates data by combining the variables selected in past studies and under the restriction of data accessibility. Table 1 summarizes the influence of the adopted variables on defaults.

Table 1 Variable Data in this Paper Characteristic

variables Operational definitions

Direction of influence on defaults Overall Direction Male Direction Female Direction Loan at the beginning

Amount borrowed at the

beginning Positive + + +

Outstanding balance Amount yet to be paid Positive + + + No. of defaults Overdue payments or lapsed

payments Positive + + +

Grace period for

payments No. of months Positive - - -

Mortgage duration No. of months Positive + + +

Percentage of leverage

Loan amount/bank’s

appraisal Negative + + +

Loan offered Loan available Positive - - -

Appraisal value Bank’s assessment of the

real estate value Negative + - +

Age of the borrower Age at the time of the loan application Positive - - -

Sex (1) Males (2) Females uncertain uncertain - -

Positive: The greater the value, the more likely defaults/prepayments Negative: The smaller the value, the more likely defaults/prepayments Sex: Listing as a dummy variable so as to assess its influence IV. Construction of Logistic Regression Models

A. Logistic Regression Analysis of Defaults of Mortgage Borrowers

To sample mortgage borrowers, this paper analyzes, assesses and compares 16,215 entries of data. This

section uses the logistic model to examine the forecast model for the behavior of mortgage borrowers. A comparison on the construction of the logistic regression functions (Table 2) is performed after the analysis. Table 2 Logistic Regression Analysis of Predications of Defaults of Mortgage Borrowers

95.0% C.I.for EXP(B) B S.E. Wald df Sig. Exp(B)

Lower Upper

Step 1 Loan offered at the

beginning -.120 .028 18.547 1 .000 .887 .840 .937 Balance outstanding .046 .004 159.326 1 .000 1.047 1.040 1.055 Financial situation -.076 .006 138.959 1 .000 .927 .915 .939 Grace period .057 .022 6.781 1 .009 1.058 1.014 1.105 Mortgage duration -.094 .065 2.086 1 .149 .910 .801 1.034 Percentage of leverage .537 .101 28.156 1 .000 1.710 1.403 2.085 Loan offered .087 .140 .383 1 .536 1.091 .828 1.436 Appraisal value -.212 .140 2.295 1 .130 .809 .615 1.064 Age of the borrower -.030 .036 .702 1 .402 .970 .904 1.041 Constant (intercept) -.168 .521 .104 1 .747 .845

a. Variable(s) entered on step 1: Loan offered at the beginning; balance outstanding; financial situation (average monthly income), grace period; mortgage duration; percentage of leverage; loan offered; appraisal value and age of the borrower

530 530

No. of defaults Overdue payments or lapsed payments Positive + +

Grace period No. of months Positive - -

Mortgage duration No. of months Positive + + Percentage of

leverage Available loan amounts Negative + - Loan offered Loans available Positive + -

Appraisal value Bank’s assessment of the real estate value Negative - + Age of the

borrower Age at the time of the loan application Positive - + Meanwhile, the better financial situation, the more

likely prepayments will occur (in contrast with the finding of discriminant analysis). This may be consistent with the prevalent perception in the society. It is possibly because that many borrowers with good incomes make prepayments in the case study. (More precise and detailed data may be required to tell the difference). Also, this paper infers that it may due to the prevalence of double-income families these days. In other words, double income families are more likely to make prepayments. By and large, this paper supports the finding of past empirical studies.

The result of the logistic regression model shows that the variables that cause the prepayments of mortgage borrowers are the loan offered at the beginning, financial situation, mortgage duration, percentage of leverage, loan offered and number of defaults (positive influence) and grace period, appraisal value and age of the borrower (negative influence). Based on the data analysis of the logistic regression model, this paper finds that financial institutions usually need to dedicate considerable manpower (almost the entire department) to the reviewing of the possibilities whether mortgage borrowers make prepayments or not by analyzing a massive amount of data. This may result in a reduction of efficiency and a cost overrun. Therefore, if a simplified reference can be provided, it is able to effectively cut down the manpower and resources required and to enhance operational efficiency.

V. Conclusions

According to the analysis on defaults of mortgage borrowers in the logistic regression model, under the significance level of p-value<0.000, the loan at the beginning, balance outstanding, financial situation and percentage of loans offered are the influence factors. Under the significance level of p-value<0.000, the grace period, as a variable, boasts the explanatory power. Those variables without significant explanatory power include

the appraisal value, age of the borrower, mortgage duration and loan offered. According to the significant tests on the logistic regression model on an overall level, the results of this paper exhibit significant explanatory power. According to the analysis on variables affecting prepayments of mortgage borrowers in the logistic regression model, under the significance level of p-value<0.000, the loan at the beginning, financial situation, grace period, mortgage duration, percentage of leverage, number of defaults and age of the borrower are the influence factors. Those variables without significant explanatory power include the appraisal values and loans offered.

According to the significance tests of the logistic regression model in the prepayments on an overall level, this paper finds that the explanatory power reaches the significance level of p-value<0.005. This paper finds that financial institutions usually need to dedicate considerable manpower (almost the entire department) to the reviewing of the possibilities whether mortgage borrowers make prepayments or not by analyzing a massive amount of data. This may result in a reduction of efficiency and a cost overrun. Therefore, if a simplified reference can be provided, it is able to effectively cut down the manpower and resources required and to enhance operational efficiency.

The empirical study of this paper shows that the logistic regression model yields better results in simplified analysis.

VI. Suggestions to future studies

(1) Further examinations on the detailed variables summarized in this paper with extended data.

(2) Data analysis on the clients of different banks. (3) Modelled forecasts after the classification of variables according to the different attributes of variables. (4) Examination of the potential influence behind respective variables and analysis of in-depth implications presented by these variables.

References

[1] H. C. Chiang, “Commercial loan borrower's optimal borrowing and prepayment decisions under uncertainty, ” Applied Economics, vol.39, pp.1013-1020.

[2] J. B., Kau, D. C., Keenan, W. J. Muller Ⅲ, and J. F. Epperson “Option theory and floating-rate securities with a comparison of adjustable and fixed-rate mortgages, ” Journal of Business, vol.66, pp.595-618.

[3] E. C., Lawrence, L. D. Smith, and M. Rhoades, “An analysis of default risk in mobile home credit, ” Journal of Banking and Finance, vol.16, pp.299-312.

[4] L. D., Smith, E. C. Lawrence, and S. M. Sanchez, “A comprehensive model for managing credit risk on home mortgage portfolios, ” Decision Sciences, vol.27, pp.291-317.

[5] J. Vander Hoff, “Adjustable and fixed rate mortgage termination, option values and local market conditions: an empirical analysis, ” Real

Estate Economics, vol.24, pp.379-406.

533 533