6

thWorld Media Economics Conference

Centre d’études sur les médias and Journal of Media Economics

HEC Montréal, Montréal, Canada

May 12-15, 2004

Co-opetition between Digital TV and Multimedia

on Demand in Taiwan

Yu-li Liu, National Chengchi University, Taiwan

Introduction

In recent years, the development of digital television and broadband networks has been a major focus of the government in Taiwan. “Challenge 2008, ” Taiwan’s new six-year National Development Plan launched in 2002, lists ten major projects, one of which involves promoting broadband deployment and digital content. While the terrestrial television stations have been planning to migrate to digital services by 2006, some cable operators have already been offering digital services sin ce 2003. Chunghwa Telecom (CHT) launched its Multimedia on Demand (MOD) service in March 2004, which is now competing with cable television service. As they are faced with various digital and broadband video platforms, the consumers in Taiwan will have m any types of service to choose from.

The first part of this paper sets out to analyze the government policies, driving forces, barriers, and success factors behind the digital terrestrial TV stations, digital cable TV and CHT’s MOD. The second part of the paper then synthesizes the discussion regarding the competition, cooperation and complementarities in relation to the three above-mentioned video platforms by applying the co-opetition value net model and the five forces competition model.

The Development of Digital Terrestrial TV

Taiwan started to experiment with HDTV in 1992 (GIO, 2003). Since digital TV was becoming a trend in the developed countries, Taiwan also started to develop digital terrestrial TV. In 1998, the Ministry of Transportation and Communications announced that Taiwan was adopting the US standard—ATSC for its digital terrestrial TV. Although the terrestrial TV stations had planned to perform the experiment in 1998, this was eventually postponed until 2000. During this period, the terrestrial TV stations found that the European standard—DVB-T was more appropriate for Taiwan because of its greater stability in relation to mobile

communications. Therefore, the Directorate General of Telecommunications announced that it was adopting a “technology neutral” stance, whereby it allowed the terrestrial TV stations to decide which digital TV system they wished to adopt. They consequently unanimously decided to abide by the European standard—DVB-T. The four commercial terrestrial TV stations and one public TV station opted to perform the experiments together. By April 2003, the digital terrestrial TV signals were able to cover the whole of Taiwan successfully. Plans were put in place to launch 10 digital channels in May 2004 and to expand these to 15 digital channels by August 2004 (Liu, et al., 2004).

Government Policy

The government has set up an agenda for the terrestrial TV stations. The agenda basically follows the US schedule, in that, by 2006 when the digital TV penetration is expected to reach 85%, the government will take back the analogue frequencies from the five terrestrial TV stations. The governing agency—the Government Information Office (GIO)—plans to revise the Broadcasting Law of 1976 to allow digital audio broadcasts and digital TV to provide telecommunications and information services.

Another important policy is that the GIO has accepted some scholars’ suggestions to separate transmission from content within digital TV (Lee, 2001). Initially, the TV stations were against this policy, because they were afraid of losing control of the transmission. Later, they agreed to jointly establish a transmission company and launch the digital services together.

Generally speaking, the government seems to have become more active in promoting digital terrestrial TV than digital cable TV. For example, it allocated NT$400 million to build a common transmission platform as well as the digital facilities. Altogether, the government plans to allocate NT$1.8 billion in order to assist with the construction and development of digital terrestrial TV.

Driving Forces

1. The government’s policy

The terrestrial TV stations were at first very passive when it came to developing digital TV, and it was the government that brought pressur e to bear on the terrestrial TV stations to develop digital TV service. If they did not migrate to digital TV, their analogue frequencies would be taken back.

2. Pressure from the cable TV stations

The terrestrial TV’s ratings and advertising revenues were badly influenced by cable TV. They thus needed to expand their business in order to be more competitive.

3. The development of new business

be compressed into 4 to 5 channels. Since the terrestrial TV stations have more capacity, they can try to develop new business in order to fully utilize their frequencies.

4. Improve the quality of reception

Digital TV technology can improve the quality of video reception. However, this is not the main driving force, because the terrestrial stations will not spend money to improve the quality of reception if they do not earn extra revenue.

Barriers

1. The separation of transmission from content

When some scholars raised this issue and looked into the possibilities of separating the transmission from the content of the terrestrial TV stations, most of the terrestrial TV stations were hesitant regarding such a suggestion. After they estimated that a terrestrial TV station needed approximately NT$1.2 billion to completely migrate to digital TV in terms of facilities and equipment, they decided to organize a transmission company together in order to avoid each of them making the same investment.

2. The government policy is uncertain

Since each terrestrial TV station can have at least three more channels by compressing the band, it is not clear what percentage of datacasting the digital terrestrial TV stations can provide. It is also not clear whether the terrestrial TV stations can rent their expanded channels to third parties.

3. The advertising revenue is not guaranteed

Since 2001, the total advertising revenue of the terrestrial TV stations has been less than that for the cable TV stations. Therefore, if the digital terrestrial TV is to be provided free of charge, its main revenue will come from advertising. It may then experience difficulty generating enough budget for channels being newly developed.

4. The operators have to bear "must carry" responsibility

According to the current Cable Radio and TV Law, the cable operators are obligated to preserve channels for all the terrestrial TV signals. There is currently a debate over how many digital terrestrial channels the cable operators should carry. The revised version of the law states that the cable TV operators are obligated to carry more than one free channel for each terrestrial TV station. Since the digital terrestrial TV stations provide TV free of charge, does this mean that the cable operators must carry all the expanded digital terrestrial channels as well?

Success Factors

1. Business m odel: Free TV

Terrestrial TV stations right from the beginning wanted to provide one free channel and several other subscription channels. After visit ing the digital TV stations in the United

Kingdom, they saw the failure of iTV Digital. They thus decided to adopt the UK’s new Freeview model for the digital terrestrial TV stations in Taiwan, with the result that the extra digitized channels are all free, all revenues being derived from carrying commercials. The four commercial terrestrial TV stations plus the public TV station plan to provide 10 channels in May 2004 and to expand these to 15 channels by August 2004 in readiness for the Olympic games. However, it has been difficult for them to reach a consensus about how to differentiate their channels. The following is the preliminary plan for the digital TV channels:

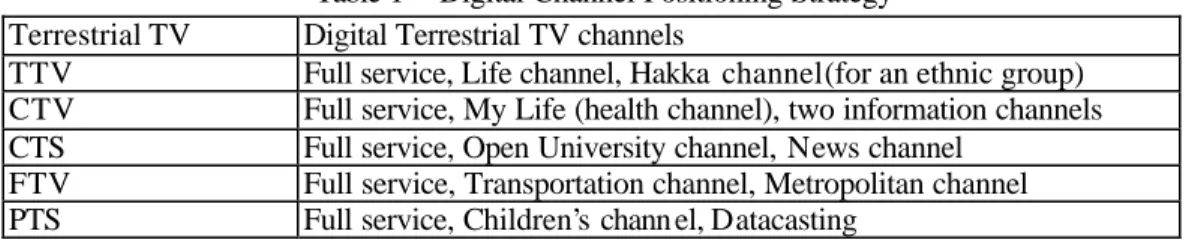

Table 1 Digital Channel Positioning Strategy Terrestrial TV Digital Terrestrial TV channels

TTV Full service, Life channel, Hakka channel (for an ethnic group) CTV Full service, My Life (health channel), two information channels CTS Full service, Open University channel, News channel

FTV Full service, Transportation channel, Metropolitan channel PTS Full service, Children’s chann el, Datacasting

2. High penetration of the set-top box

The terrestrial TV stations made two smart decisions regarding the digital set-top box (STB). First, they adopt ed the same standard for the five terrestrial TV stations and, secondly, they did not get involved with sales of set-top box es. However, viewers are still price sensitive, and before they can see good programs on the digital TV platform, they will not purchase the set-top box. This is a chicken- and- egg situation, for before there are many people who can receive digital signals either by buying a new digital TV set or by purchasing a set-top box, the terrestrial TV stations will not be in a position to provide competitive programs on digital TV. Therefore, achieving a high penetration of the set-top box has become crucial for the

development of digital TV. The price of the digital set-top box has to go down.

3. Attractive digital content

Before viewers purchase the digital set-top box, they hope to see good and competitive programs on dig ital TV. If the digital content is not sufficiently attractive, they will not consider it necessary to purchase the digital set-top box or to buy a new digital TV set.

4. Strategic alliances with the m obile phone and data industry

Since the terrestrial TV stations have decided to adopt the free-TV model, the only way they can generate revenues from viewers is by providing datacasting and mobile content. Therefore, the terrestrial TV stations need to consider how to build strategic alliances with the mobile phone and electronic equipment companies.

The Development of Digital Cable TV

In Taiwan, there are 64 cable systems and more than one hundred satellite channels. The penetration of cable TV is 76%, the highest in Asia. There are three major multiple-system operators (MSOs): the Eastern Multimedia Company (EMC), the China Network System (CNS), and the Taiwan Broadband Company (TBC). While all three MSOs tried to provide digital cable TV service in 2003, the first two did not have a good start because they could not accept the results of the Taipei City government’s decisions regarding the rates for digital set-top boxes and pay channels. TBC did not have any system in Taipe i, as m ost of its systems w ere in Taichung (the central part of Taiwan), and it did not intend to sell set-top boxes to its subscribers, as the set-top box w as included in the digital basic package for subscribers. Therefore, TBC did not face the same problems as EMC and CNS.

Government Policy

Cable TV operators often compla in that the government has only subsidized the terrestrial TV stations in order to develop digital TV, and that it has not provided any encouraging mechanism to help the cable TV operators to migrate to digital TV. Its regulations regarding the rates to be charged for the set-top box and pay channels are even stricter, there being two levels of regulation in operation. The central government sets the standard and the local governments approve the rate. However, most of the time, the local governments tend to approve rates that are lower than those of the central government. Some critics say the reason for this is because the local governments are under pressure from their voters.

The Cable Radio and TV Law does not specify whether the set-top box and pay channels are regulated; therefore, they are regarded as being regulated by the central and local governments. The revised draft of the Law tends to deregulate the pay channel rate and gives the controlling power to the central government only.

Driving forces

1. To fully utilize the compressed channels

Due to the developments in digital technology, one channel can be compressed into six channels. Therefore, theoretically speaking, most of the cable systems can provide 500 to 600 channels with compression technology.

2. To increase revenue

When the cable systems have 500 to 600 channels, they can lease the extra channels to other content providers. They can increase revenues by renting their channels or collecting pay channel and pay- per-view fees. Moreover, they will also earn extra revenue from interactive services.

About 10 to 20 percent of the cable signals in Taiwan are illegally received. If the cable systems digitize their programs, they will be able to prevent the illegal reception of their programs.

Barriers

1. Rate regulation

The regulations regarding cable TV rates are vague and over -inclusive. According to the current Cable Radio and TV Law, the screening committee of the GIO is responsible for setting up the standard and the ceiling of the cable TV rate. The local government is responsible for approving the rate proposed by the cable operators. The Law does not say whether the government has to approve the rate for the digital set-top box, and only says that the

government has to approve the cable TV rate. Some local governments tend to approve a lower rate under pressure from the city or county councils. Many city councilors would think it their duty to lower the cable TV rate for their voters. T herefore, an issue regarding a cable TV rate can sometimes turn into a political issue. In the United States, pay channels and pay-per-view are not regulated. The local government will regulate the basic channel rate only when there is no effective competition. In Taiwan, the rate for pay channels is still regulated. The cable operators w ould like the government to deregulate the cable TV rate or only allow the central government to regulate the rate. They believe it is easier to negotiate with the cen tral government instead of with the local government.

2. Digital Set-top box

In order to receive the digital programs, the subscribers need to have a set-top box

connected to their TV sets before they acquire digital TV sets with the box built in. However, how to provide the digital set-top box has become an important issue. The Government Information Office (GIO) has asked the providers to offer subscribers with four ways of getting a digital set-top box. These are: (1) purchase the set-top box from the cable TV system; (2) rent the set-top box from the cable TV system; (3) pay a deposit to the cable system ; (4) purchase the box separately (i.e. purchase it from non-cable TV systems).

The central and local governments have set ceilings on the rates. The local governments tend to be stricter than the central government. The Taipei City Government previously announced that the cable system providers in Taipei could not charge more than NT$3,500 for the digital set-top box. However, CNS could not accept this ruling, because it said that the digital set-top box cost NT$6,000. It therefore appealed to the GIO and won the case, at which point it decided to wait until the Taipei City Government changed the rate ceiling. However, the Taipei City Government replied to the GIO that it was still maintain ing its earlier decision about the price ceiling. The appeals process has not yet been exhausted, and so no final conclusion has been reached. Another MSO, EMC, also did not promote the digital set-top box

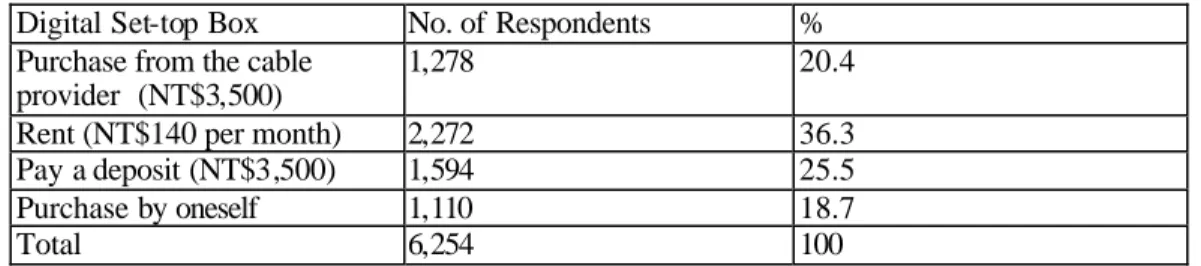

because of its dissatisfaction with the Taipei City Government’s decision regarding the rate. According to a survey conducted in October 2003, only 2.2% of the cable TV subscribers have set-top box es (Liu, et al., 2003). The same survey showed that 36.3% of the subscribers prefer to rent the digital set-top box; 25.5% prefer to pay a deposit; 20.4% prefer to purchase the box from the cable TV systems, and 18.7% prefer to purchase it on their own (Liu, et al. , 2003). This survey suggests that CNS was not smart enough to spend much time fighting with the local government over the ceiling imposed on the rate for the set-top box. The cable operators should encourage subscribers to rent the set-top box instead of buying it.

Table 2 Subscribers’ Preferred Choices for Obtaining the Digital Set-top Box Digital Set-top Box No. of Respondents %

Purchase from the cable provider (NT$3,500)

1,278 20.4

Rent (NT$140 per month) 2,272 36.3

Pay a deposit (NT$3,500) 1,594 25.5

Purchase by oneself 1,110 18.7

Total 6,254 100

(Source: Liu, et al., (2003).

Success factors

1. Deregulation of the setting of rates for pay channels and set-top boxes

Some critics cite the examples of the U.S. Telecommunications Act of 1996 that states that the rates for set-top box es and pay channels are not regulated. Only when there is no effective competition, can the local government regulate the rate for the basic tier. Therefore, the cable system operators have asked the government not to regulate the rates for set-top boxes and pay channels. They even hope that the local governments will not regulate the rates for cable TV, and that only the central government will regulate the cable TV rate.

2. Fast penetration of digital set-top boxes

The two MSOs mentioned above, i.e. EMC and CNS, should not be haunted by the rates for the set-top box. They should think about the long-term revenue generated by pay channels and interactive services instead of short-term sales of set-top boxes. The high penetration of the set-top box is one of the success factors of digital cable TV. If the subscribers do not have the set-top box, they do not have access to the pay channels and the value-added services provided by the cable systems. Both EMC and CNS thought about providing free set-top boxes to their subscribers subject to certain conditions in 1997. However, they can not afford to provide them free today because of the economic recession and their tight budgets. TBC provides a package of 25 audio and 25 video channels to its subscribers for NT$200. Its set-top box is free, because it can be subsidized by the revenues generated by the basic digital package.

3. Provision of attractive content

Content is the king. The cable operators need to find more program sources for the pay channels, otherwise the subscribers will not think it is necessary to subscribe to the digital cable TV. The cable operators have not adopted the tiering system in Taiwan. The subscribers pay a flat fee (NT$550-600, about US$16-17) to receive about 95 channels. The government has stipulated that if the cable operators adopt a tiering system, the quantity and quality of channels has to be guaranteed as of now. This means that some popular channels like HBO and Cinemax cannot be moved from the current package to pay channels, even though they are pay channels in the United States and other countries. Therefore, it is very difficult for the cable systems to find other new program sources for the pay channels. EMC has developed some new channels such as a golf channel, a health channel, a children’s English learning channel, and a folk drama channel for digital cable TV. CNS has also developed some simple interactive services such as weather reports, travel, news, etc . However, they have both slowed dow n the investment in the new channels and services because of the low penetration of the digital set-top box es.

4. Provision of attractive interactive service

From the perspective of the viewers, the advantages of subscribing to digital cable TV include not only watching attractive digital content, but also receiving certain interactive services. The cable TV technology is mature enough to provide interactive services. In the mid-1990s, there were over 40 interactive service or VOD trials all over the world (Liu, 1997). Because the audiences were not ready to pay for the interactive services, they were delayed for almost a decade.

A New Alternative in the Video Service Market: CHT’s MOD

Chunghwa Telecom dominated the telecommunications services market until 2000 when the government opened up three new fixed networks. Chunghwa in October 2003 sought the approval of the GIO to offer “multimedia- on-demand” (MOD) services to its ADSL subscribers. When CHT launched its MOD service in Taipei county in March 2004, it had only thirteen basic channels, including five terrestrial channels, some religious channels and two locally originated channels. (CHT paid NT$90 million to CTS, a terrestrial TV station, to run the two channels on behalf of CHT.) CHT also announced that its set-top box would be provided free of charge. If the customers subscribed to their MOD service before the end of the promotion period, there would be no installation fee and the basic channel fee (NT$150, about US$4.5) could be waived for the first six months. A cable operators’ association considered CHT’s promotion to constitute unfair competition and filed a complaint with the Fair Trade

Commission.

Government policy

In more than half of the designated cable TV areas in Taiwan, there is only one cable provider. Therefore, the GIO and the various local governments believe that CHT’s MOD service can provide the general public with another entertainment alternative. In addition, this new service will bring competition to the existing cable services. However, the government needs to make sure that there is no discrimination exercised against CHT’s MOD in terms of providing programs, because the cable operators might boycott the cable channels that provide programs to CHT’s MOD. Furthermore, since CHT’s MOD provides a free set-top box to its subscribers, there should be no cross subsidization for the box.

Driving forces

Foley (1992) found four main reasons why telecommunications carriers w ish to enter video markets: (1) the local phone revenue does not increase; (2) they wish to fully utilize the extra broadband; (3) the home video market may have the potential for more revenue; and (4) they can more fully exploit the economies of scale. The above four reasons can also explain why CHT is eager to provide MOD. Dr. C.K. Mao, the former chairman of CHT , said that CHT was not interested in acquiring cable systems or cable channels, because whatever the cable industry could do, CHT could also do.

Barriers

1. State-owned enterprises are inefficient

CHT is in the process of being privatized. Until it is completely privatized, its budgets and rate structure have to be approved by the Legislative Yuan. Therefore, CHT is not very efficient in terms of its management.

2. Cable TV boycott

Cable operators used to warn the cable channels that provide content to Direct Broadcast systems. Now, they have adopted a similar attitude towards MOD service. That is why CHT’s MOD only obtained 200 film titles in March 2004.

3. Not specialize d in managing content

CHT is a huge telephone company that has many experts in the field of

telecommunications. However, it does not have experts that are specialized in planning, producing and managing the content. MOD is a new adventure for CHT, and it will take time for CHT to learn how to manage a video platform and interactive services.

Success factors

1. Lowering the barriers to entry

CHT’s ADSL circuit fee for a speed of 512K is NT$499. If people w ish to subscribe to CHT’s MOD, they have to be CHT’s ADSL subscribers in the first place. This is an entry barrier to CHT’s MOD subscribers. If CHT lowers the ADSL circuit fee, more people may wish to try this new service. Otherwise, it will be considered more expensive than cable TV service, even though CHT’s MOD provides interactive services.

2. Content is the key

CHT’s MOD lacks programs. Because it does not have a large enough customer base, some channels are too expensive to become part of the MOD service. CHT has announced to the public that it is going to offer many program choices. However, the reality is that when CHT launched its MOD service in March 2004, there w ere only 13 basic channels. CHT needs to expand its program sources otherwise its subscribers will no longer subscribe to the service.

11

3. VOD and interactive service s are strengths

When CHT launched its MOD service, it announced that it would provide interactive services , such as music, educational programs, travel information, stock prices and shopping services. As for video-on-demand, it emphasized that the customers would be able to fast forward and rewind the movie. However, it admitted that it was experiencing difficulties provid ing the service before it had a sufficiently large customer base. Even though CHT has wanted to differentiate MOD from cable TV by strengthening its VOD and interactive

characteristics, CHT had not provided any attractive interactive service by March 2004. It only has 200 titles for its VOD. After the 6-month promotion period, it will be a big test for CHT to keep its MOD customers when they have to pay an extra NT$150 for the basic channel fees.

Competition, Cooperation, and Complementarities among the Three Video Platforms

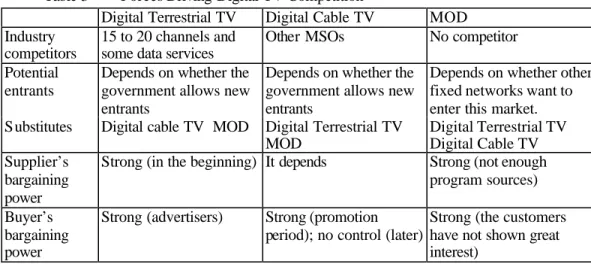

1. Forces driving Digital TV competition

Very intertwined and complicated relationships exist among the three video platforms. Porter ’s “five forces competition model” can be applied here. First, we need only focus on the terrestrial TV market. When each of the four commercial terrestrial TV stations expand to become three or four digital channels individually, they will compete among themselves for ratings and advertising revenues. If their channels are not attractive enough, they will be confronted with the threat of being substituted by digital cable TV or MOD service. When the four commercial stations cannot reach large audiences, the bargaining power of the advertisers as buyers will become stronger. If there is only a little channel space available for rent, the bargaining power of the channel tenants as buyers will be weak. The bargaining power of the program or data providers as suppliers will become stronger when the digital channels want to fill up the channel space. It should also be noted that there is no potential entrant if the government does not open up this market to third parties (see Figure 1).

Bargaining power Threat of Bargaining power of suppliers new entrants of buyers

POTENTIAL ENTRANTS SUPPLIERS Program, data provider E-commerce INDUSTRY COMPETITORS (Digital TV) BUYERS Advertisers Channel tenants SUBSTITUTES

Threat of substitute products or services

At this point, we would like to analyze the competition in the digital cable TV market. The competition among the cable operators in the same designated area is no longer as fierce as before, because the MSOs have mutually agreed not to cut down their prices even though this is in violation of the Fair Trade Law. If the digital cable TV is too expensive or is not attractive, it can be substituted by the digital terrestrial TV or MOD. The subscribers as buyers have more bargaining power during the promotion period. However, once the digital cable TV reaches a large enough customer base, prices become more fixed than in earlier periods. In the United States, there is an abundance of program suppliers, and the supplier’s bargaining power is not very strong. However, in Taiwan some of the suppliers’ bargaining power is strong, while that of others is not. It all depends on what kinds of channels are involved and whether or not they are already included in the current package. If the government does not open up this market, there are no potential entrants either.

In the MOD market, there are no other competitors, because the three new fixed networks do not have sufficiently large economies of scale to cross into the video market. Both the bargaining power of the program providers as suppliers and that of the customers as buyers are very strong. If the MOD cannot obtain enough programs or provide diverse interactive services, it might be substituted by digital terrestrial TV or digital cable TV (see Table 3).

Table 3 Forces Driving Digital TV Competition

Digital Terrestrial TV Digital Cable TV MOD Industry

competitors

15 to 20 channels and some data services

Other MSOs No competitor

Potential entrants

Depends on whether the government allows new entrants

Depends on whether the government allows new entrants

Depends on whether other fixed networks want to enter this market. Substitutes Digital cable TV MOD Digital Terrestrial TV

MOD Digital Terrestrial TV Digital Cable TV Supplier’s bargaining power

Strong (in the beginning) It depends Strong (not enough program sources)

Buyer’s bargaining power

Strong (advertisers) Strong (promotion period); no control (later)

Strong (the customers have not shown great interest)

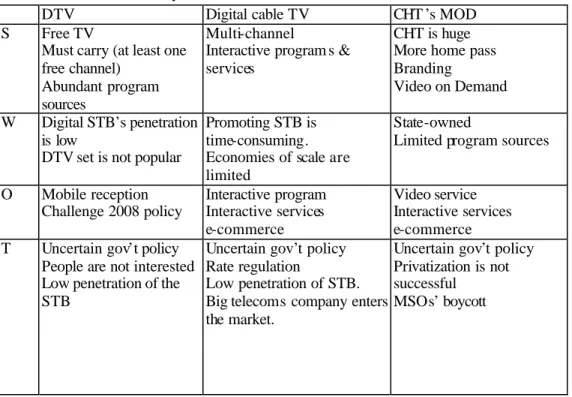

2. SWOT Analysis of Digital Terrestrial TV, Digital Cable TV and MOD

Digital terrestrial TV’s strengths are its free TV model and abundant program sources. Cable operators will carry at least one free digital terrestrial channel for each terrestrial station. Digital Cable TV’s strengths are its multi-channel capacity and interactive services. CHT’s MOD’s strengths are its branding, home pass, and on demand characteristics.

Digital terrestrial TV’s major weakness is that its digital set-top box and digital TV set have not been popularized. Digital cable TV’s weaknesses are its limited economies of scale and the low acceptance rate for the digital set-top box. CHT ’s MOD’s main weakness is its

limited program sources. Its state-owned characteristic is also a burden.

The opportunities for digital terrestrial TV are the mobile reception it provides and the government’s policy to encourage it as exemplified by Challenge 2008. As for digital cable TV, its opportunities stem from its interactive services and e-commerce. The same applies in the case of CHT ’s MOD.

Uncertain government policies are seen as a threat for all of the video platforms discussed here. The low penetration of the digital set-top box is regarded as a threat for both digital terrestrial TV and digital cable TV. The cable operators also consider CHT ’s entering the video market to be a threat. CHT also regards MSO’s boycott of the cable channels as a threat.

Table 4 SWOT Analysis of Three Video Platforms

DTV Digital cable TV CHT ’s MOD

S Free TV

Must carry (at least one free channel)

Abundant program sources

Multi-channel

Interactive program s & services

CHT is huge More home pass Branding

Video on Demand

W Digital STB’s penetration is low

DTV set is not popular

Promoting STB is time-consuming. Economies of scale are limited

State-owned

Limited program sources

O Mobile reception Challenge 2008 policy Interactive program Interactive services e-commerce Video service Interactive services e-commerce T Uncertain gov’t policy

People are not interested Low penetration of the STB

Uncertain gov’t policy Rate regulation

Low penetration of STB. Big telecoms company enters the market.

Uncertain gov’t policy Privatization is not successful

MSOs’ boycott

Co-opetition in the Digital TV Market

In the world of video markets, there is not only competition but also complementarity as well. In their book Co-opetition, Brandenburger & Nalebuff (1996) presented a complete picture of the game of business. They explored the roles of four types of players—customers, suppliers, competitors, and complementors—and the interdependencies among them. They also introduced a map, the Value Net to visualize the whole game of business. The Value Net model can be applied to analyze the business of digital TV and MOD as well.

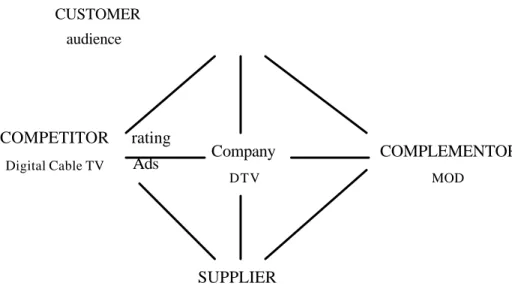

Suppose that a digital terrestrial TV company is the company within the Value Net below (Figure 3). Its competitors are digital cable TV companies because they compete for rating and advertising. Its complementor is CHT ’s MOD. CHT ’s MOD carries five digital terrestrial

channels. CUSTOMER audience

Figure 3 The Value Net

Source: Brandenburger & Nalebuff, 1996

Now suppose that a digital cable TV company is the company within the Value Net. Its competitor is CHT’s MOD because it competes with MOD for subscribers. Its complementor comprises the digital terrestrial TV companies, because they provide the digital cable platform with five free channels.

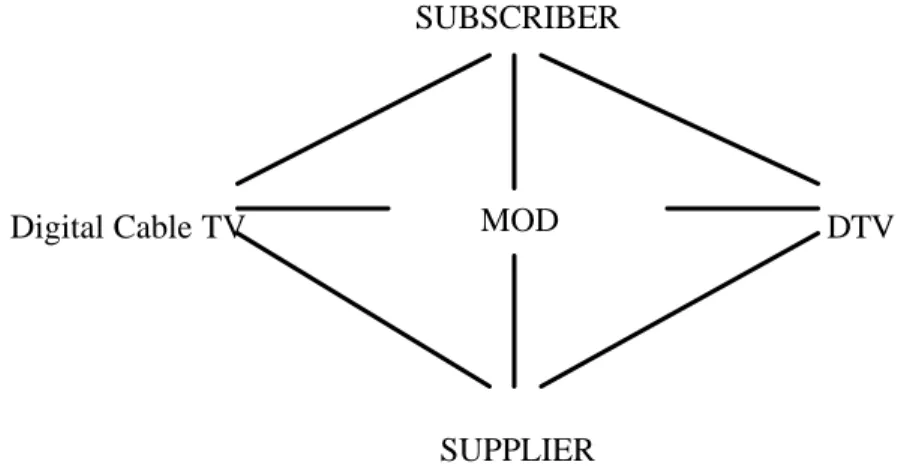

COMPETITOR Digital Cable TV SUPPLIER

Program, data provider

Company DTV COMPLEMENTOR MOD rating Ads SUBSCRIBER MOD SUPPLIER Digital Cable DTV

Figure 4 The Value Net (1)

Again, suppose that CHT ’s MOD is the company within the Value Net. Its competitor is the digital cable TV companies because they compete with it for subscribers. Its complementor comprises the digital terrestrial TV companies, because they provide five free channels to the MOD.

Figure 5 The Value Net (2)

In the game of competition, if any players find a situation unfavorable to them, they can adopt the following measures to improve the situation for themselves:

1. Change the players : by becoming a player, or bringing in customers, suppliers, complementors or competitors.

The way to bring in customers is to educate the market or subsidize some customers. For instance, before the customers subscribe to digital TV, they need to be educated. Some customers would like to be subsidized before they try a new service.

SUPPLIER MOD SUBSCRIBER

CHT ’s MOD provides a good example of bringing in suppliers. Since CHT’s MOD has experienced difficulties obtaining programs, it has adopted a “do it yourself” strategy, i.e. become your own supplier to ensure supply and create competition. CHT paid CTS NT$90 million to develop two channels for it s own use, just because it wanted to make sure it had a supply of programs in order to compete with cable TV.

2. Provide added value: by offering interactive services, free set-top boxes and free installation.

3. Change the rules: w hen the rules of the game prove unsuitable for victory, one should then change the rules. One example of this is to deregulate the rate regulation regarding the set-top box and the pay channel.

4. Adopt tactics: by offer ing a guarantee, giving free trials, advertising, emphasizing credibility or branding, hid ing high prices, preserv ing an image of quality.

5. Change the scope : by chang ing the scope of the game. Since CHT ’s management area is the whole country, cable operators will wish to expand their designated areas in order to compete with CHT or expand their economies of scale.

Conclusion

Terrestrial TV companies have been under pressure from the government to develop digital TV. If the terrestrial TV stations do not migrate to digital TV, their analogue channels will be taken back. Cable TV companies are looking for extra revenue to develop digital cable TV. CHT’s MOD is seeking to fully utilize the extra broadband it has and to look for potential revenue in the home video market.

Competition, cooperation and complementarity exist among these three video platforms. The success factors of digital terrestrial TV and digital cable TV are their set-top box

penetration and their digital content. The digital commercial terrestrial TV stations have been under pressure to obtain more advertising revenue for their expanded channels since they have adopted the free TV model. The MSOs should not spend too much time fighting with their respective local governments over the price ceiling for the set-top box. They should use every possible means to encourage the general public to adopt their set-top box.

CHT’s MOD should lower the entry barriers to subscribers by lowering the ADSL circuit fee and the basic channel fee. It should not have to develop its own channels, but rather its positioning strategy should be a VOD platform or interactive services. If CHT ’s MOD does not establish its own channels and only plays the role of video aggregator, it can be the

complementor of digital terrestrial TV. If CHT ’s MOD is still worried about being boycotted by cable TV companies or being discriminated against in relation to satellite channels, it can lobby the government to revise relevant laws and ask for non-discrimination protection in relation to its buying programs, otherwise the digital terrestrial TV stations might not decide to

allow CHT ’s MOD to carry their channels as a “must carry” obligation of cable TV.

Reference

Brandenburger, A.M. & Nalebuff, B.J.(1996). Co-opetition. New York: Currency Doubleday.

Foley, J.M. (1992). “Economic factors underlying telephone company efforts to enter home video distribution. ” Journal of Media Economics, Fall, 57-68.

Gerbarg, D. (1999). The economics, technology and content of digital TV. Ed. Boston: Kluwer Academic Publishers.

Government Information Office (2003). The white paper of radio and TV. Taipei: Government Information Office.

Li, S.C. (2001). The regulation of digitized terrestrial TV channels. Taipei: Government Information Office.

Liu, Y. L. (1994). Cable TV management and programming strategy. Taipei: Cheng-chung.

Liu, Y. L. (1997). Multi-channel TV and audience. Taipei: Shih-ying.

Liu, Y. L. (2004). Telecommunications. Ed. Taipei: Yeh yeh book publisher.

Porter, M. E. (1980). Competitive strategy: techniques for analyzing industries and competitors. New York: The Free Press.

Tsai, N. C. (2003). The studies of digital and broadband communication industry. Taipei: Yang Chih.