Analytical Model for Analyzing Construction Claims

and Opportunistic Bidding

S. Ping Ho, A.M.ASCE,

1and Liang Y. Liu, M.ASCE

2Abstract: Construction claims are considered by many project participants to be one of the most disruptive and unpleasant events of a project. Construction claims occur for various reasons. There is a need to understand the dynamic nature between construction claims and opportunistic bidding. An analytical model, the Claims Decision Model 共CDM兲, based on ‘‘game theory,’’ was developed to study opportunistic bidding and construction claims. This model explains 共1兲 how people behave during a potential or existing claiming situation, 共2兲 how different claiming situations are related to opportunistic bidding behavior, and 共3兲 what situations encourage or discourage opportunistic behavior. The results of this pilot study indicate that the equilibrium solution of a construction claim is to negotiate and settle, which concurs with most of the claim cases in the industry. The possible range of a negotiation settlement is obtained in this paper. The model provides the rationale for recent innovations to manage disputes. The model can also help project owners identify the possibility of opportunistic bidding, and can assist the project participants in analyzing construction claims.

DOI: 10.1061/共ASCE兲0733-9364共2004兲130:1共94兲

CE Database subject headings:Claims; Contracts; Litigation; Analytical techniques; Bids; Construction industry.

Introduction

It is a commonly recognized fact that the number of construction claims and disputes has been increasing and has become a burden to construction industry, particularly during the economic slow-down 共Rubin et al. 1983; Adrian 1993; Jergeas and Hartman 1994; Kangari 1994; Levin 1998. Kangari共1994兲 argued the fol-lowing: ‘‘The sluggish global economy has created an environ-ment in which construction firms are forced to bid projects at or below minimum profit level. ...it is not surprising that the num-ber of disputes within the construction industry continues to in-crease.’’ Levin共1998兲 further suggested that claims have become an integral part of the building process. Especially in a competi-tive bidding scheme and public funded projects, it is not unusual for contractors to bid low on a project and hope to recover the loss through negotiations or claims. Zack Jr. 共1993兲 calls this phenomenon ‘‘bid your claims,’’ or as we call it in this paper, ‘‘opportunistic bidding.’’ Opportunistic bidding is more common during a slow-moving economy or recession. In general, oppor-tunistic bidding may include a contractor’s intentional ignorance of possible risks involved that may significantly increase costs or decrease profitability, such as the use of the most optimistic cost estimation for the bid price.

Although Ioannou and Leu共1993兲 and Kangari 共1994兲 suggest that the number of claims and disputes is related to opportunistic

bidding, we do not suggest that most claims happen because of opportunistic bidding. In this paper we will focus on how oppor-tunistic behavior is related to claims, and how to analyze a poten-tial or existing claiming situation. An analytical model for analyz-ing opportunistic biddanalyz-ing and construction claims will be presented in this paper. The objective of developing the model is to help owners and contractors understand the underlying eco-nomic mechanism of a claim so that they can develop effective project procurement strategies and claim administration programs or policies.

This paper begins with a short discussion of existing research on opportunistic bidding and construction claims. Next is a brief introduction of game theory, the underlying principle of the model. Then we will present an analytical framework based on game theory for analyzing the claims and opportunistic bidding. Following is an illustrative example to demonstrate how the ana-lytical framework can be applied in practice to forecast potential claims and opportunistic bidding and to prescribe helpful procure-ment strategies. Then we will formally state and prove the propo-sitions and corollaries resulting from the analysis, and derive the decision rules and strategies for owners and contractors.

Existing Research

A claim can be defined as a right given to the party who deserves a request for compensation for damages incurred by the other party 共Simon 1979兲. A construction claim can be defined as ‘‘a request by a construction contractor for compensation over and above the agreed-upon contract amount for additional work or damages supposedly resulting from events that were not included in the initial contract’’共Adrian 1993兲. However, the existence of a right is very subjective because of the complexity of the con-struction contract and process. Furthermore, the amount of money involved in a construction project is usually so large that a small discrepancy in the contract interpretation will cause significant impact on the project profit. Thus, Adrian 共1993兲 and Levin 1Assistant Professor, Dept. of Civil Engineering, National Taiwan

Univ., Taipei 10617, Taiwan. E-mail: spingho@ntu.edu.tw

2Associate Professor, Civil and Environmental Engineering, Univ. of Illinois at Urbana-Champaign, IL 61801. E-mail: lliu1@uiuc.edu

Note. Discussion open until July 1, 2004. Separate discussions must be submitted for individual papers. To extend the closing date by one month, a written request must be filed with the ASCE Managing Editor. The manuscript for this paper was submitted for review and possible publication on March 19, 2002; approved on August 9, 2002. This paper is part of the Journal of Construction Engineering and Management, Vol. 130, No. 1, February 1, 2004. ©ASCE, ISSN 0733-9364/2004/1-94 –104/$18.00.

共1998兲 argue that the increased complexity and scale of the build-ing process is one of the major reasons for increasbuild-ing the number of claims.

A survey study by Semple et al. 共1994兲 concludes that the most common causes of claims are ‘‘increase in scopes,’’ ‘‘cold weather,’’ ‘‘restricted access,’’ and ‘‘acceleration.’’ Adrian共1993兲 summarizes other major reasons, such as the relatively low prof-itability of the construction industry, and the changing of the project delivery systems. Jergeas and Hartman 共1994兲 list some other well known reasons that claims may arise, such as inad-equate bid information, faulty or late owner-supplied equipment and material, inferior quality of drawings or specifications, and stop-and-go operations. Kumaraswamy and Yogeswaran 共1998兲 conclude, based on 91 projects, that the most crucial sources of claims include unclear or inadequate documentation, late instruc-tions, variations initiated by the employer/engineer, measurement related issues, inclement weather, and time extension assessment. However, Semple et al.共1994兲 point out that the fundamental causes and real costs associated with claims and disputes are not well understood. Thus, there is a need to further investigate the following fundamental issues: when opportunistic bidding will occur, what is the relationship between opportunistic bidding and construction claims, and how to quantitatively evaluate the claims due to opportunistic bidding. In this pilot study, an analytical economic model was developed based on game theory to provide a practical tool to analyze opportunistic bidding and construction claims and provide an alternative research methodology. The fol-lowing sections outline the basic concept of game theory and explain the details of the model.

Game Theory

Game theory can be defined as ‘‘the study of mathematical mod-els of conflict and cooperation between intelligent rational decision-makers’’共Myerson 1991兲. Therefore, it is critical that readers avoid making any negative ethical implications on ‘‘play-ing games.’’ Among economic theories, game theory has been successfully applied to many important issues, such as negotia-tions, finance, and imperfect markets. In construction, conflicts among builders and owners are very common, particularly in a bidding or claiming situation, and game theory can be used to analyze the situation systematically. The following sections de-scribe the basic concepts of game theory that are closely related to opportunistic bidding and construction claims.

Types of Games

There are two basic types of games, static games and dynamic games, in terms of the timing of decision making. In a static game, the players act simultaneously. Note that ‘‘simultaneously’’ here means that each player makes decisions without knowing the decisions made by others. On the contrary, in a dynamic game, the players act sequentially. Due to the nature of bidding and claim, the dynamic game will be used to model and analyze claims and opportunistic bidding.

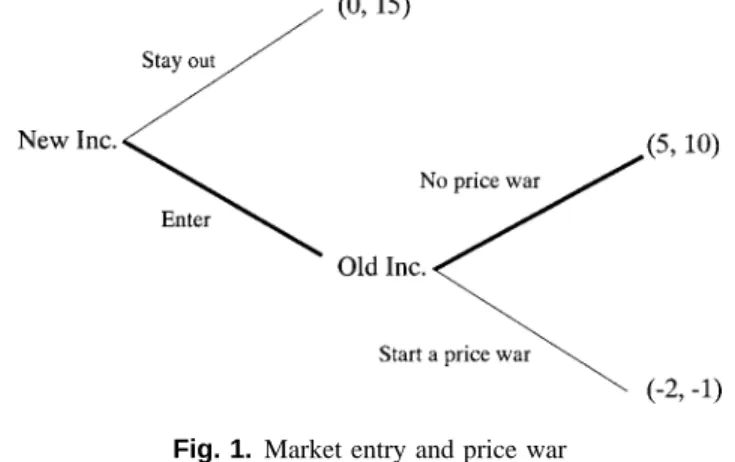

Players in a dynamic game move sequentially instead of si-multaneously. It is more intuitive to represent a dynamic game by a treelike structure, also called the ‘‘extensive form’’ representa-tion. We will use the following Market Entry example to demon-strate the concepts of a game analysis. A new firm, New Inc., wants to enter a market to compete with a monopoly firm, Old Inc. The monopoly firm does not want the new firm to enter the

market because the new entry will reduce the old firm’s profits. Therefore, Old Inc. threatens New Inc. with a price war if New Inc. enters the market.

Fig. 1 shows the extensive form of the market entry game. If the payoff matrix shown in Fig. 1 is known to all players, the payoff matrix is a ‘‘common knowledge’’ to all players and this game is called a game of ‘‘complete information.’’ Conversely, if each player’s possible payoff is privately known by that player only, the game is called a game with incomplete or asymmetric information. The game tree shows共1兲 first, New Inc. chooses to enter the market or not, and then Old Inc. chooses to start a price war or not, and共2兲 the payoff of each decision combination. Note that the players of a game are assumed to be rational. This is one of the most important assumptions in most economic theories. In other words, it is assumed that the players will always try to maximize their payoffs. Also, for clarity and convenience we shall assume that the players are risk neutral; that is, the player’s utility function is: u(x)⫽x, where x is the player’s monetary payoff. In general, the utility function can be modified according to the player’s risk attitude共Clemen 1991兲.

Game Solution: Subgame-Perfect Nash Equilibrium In order to answer what each prisoner will play/behave in this game, we shall introduce the concept of ‘‘Nash equilibrium,’’ one of the most important concepts in game theory. The Nash equi-librium is a set of actions that will be chosen by each player. In other words, in a Nash equilibrium, each player’s strategy should be the best response to the other player’s strategy, and no player wants to deviate from the equilibrium solution. Thus, the equilib-rium or solution is ‘‘strategically stable’’ or ‘‘self-enforcing’’ 共Gibbons 1992兲.

A conjecture of the solution of the Market Entry game is that New Inc. will ‘‘stay out’’ because Old Inc. threatens to ‘‘start a price war’’ if New Inc. plays ‘‘enter.’’ However, Fig. 1 shows that the threat to start a price war is not credible because Old Inc. can only be worse off by starting a price war if New Inc. does enter. On the other hand, New Inc. knows the incredibility of the threat, and therefore will maximize the payoff by playing ‘‘enter.’’ As a result, the Subgame-Perfect Nash equilibrium of the market entry game is 共enter, no price war兲 a strategically stable solution that does not rely on the player to carry out an incredible threat. The game in Fig. 1 is called a ‘‘dynamic game of complete informa-tion.’’ A dynamic game can be solved by maximizing each play-er’s payoff backward recursively along the game tree 共Gibbons 1992兲. We shall apply this technique in solving the construction bidding and claiming game.

Claims Decision Model for Analyzing Opportunistic Bidding and Claims

Based on game theories and authors’ own experiences, we devel-oped a model for analyzing opportunistic bidding and construc-tion claims. This analytical model, named the Claims Decision Model共CDM兲, starts by using a game tree to express the claiming and potential opportunistic bidding behavior in construction. All important underlying assumptions will be explicitly pointed out. In Case I the solution of the bidding and claiming game will be obtained by assuming that there is no counteroffer in a claim negotiation. In Case II the ‘‘no counteroffer’’ assumption is re-laxed and the equilibrium solution is further refined. In Case III the game and its solution are generalized.

Assumptions and the Extensive Form of the Claiming and Bidding Game

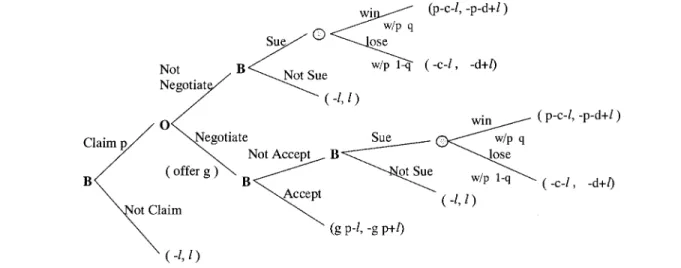

The framework for analyzing opportunistic bidding and claiming in a dynamic game expressed in an extensive form as shown in Fig. 2, where B is the builder and O is the owner. First, we shall consider the builder’s actions: suppose that in order to outbid other competitors in a very competitive situation, the builder op-portunistically cuts down a portion of the minimum profit by $l and wins the contract. In this case, the owner will obtain the bid cutting benefit $l if there is no claim. Therefore, if the builder does not claim, then the payoffs for the builder and the owner will be $(⫺l,l), respectively.

Second, we have the owner’s actions: if the builder claims and the amount is $ p, it will come to the owner’s decision. Note that here we ignore the time value of money for the time period of the claiming and litigation process. After a claim is filed, the owner has two choices: the owner will either ‘‘negotiate’’ with the builder and prepare to offer $g p, where g is a ratio between 0 and 1, or ‘‘not negotiate’’ at all and reject the claims.

Third, we have the builder’s actions: according to Fig. 2, if the owner’s decision is not negotiate, the builder has to decide to ‘‘sue’’ or ‘‘not sue.’’ If the owner decides negotiate, the builder’s question is to ‘‘accept’’ or ‘‘not accept.’’ Consider the case that the builder decides to sue, the tree specifies that he will win with probability q and get compensation $ p from the owner. The total payoff if the builder wins the lawsuit would be p⫺c⫺l, where c is defined as the builder’s litigation opportunity cost. Opportunity cost is defined as ‘‘the lost benefit that the best alternative course

of action could provide’’共Maher 1997兲. Note that by this defini-tion, the alternative other than sue should be not sue. Not sue will cost the builder $0, but sue will not only incur the attorney and court fees but also cause possible interruptions and spoil the re-lationship with the owner, hence reducing the builder’s opportu-nity to work for the owner again in other future projects. There-fore the litigation opportunity cost c should include the explicit cost, such as attorney fees and the expenses of preparing the lawsuit, and the implicit cost of possible interruptions and the damage of his credit worthiness. On the other hand, the total payoff for the owner if the builder wins would be ⫺p⫺d⫹l, where d is the owner’s litigation opportunity cost. Note that d also includes the owner’s explicit and implicit cost as the result of litigation.

Let us now turn to the builder’s actions if the owner decides to negotiate. If the owner offers $g p to settle, then the builder will have to decide to accept or not accept. If the negotiation fails, everything is the same as if there were no negotiation in the first place. However, although the payoff has a tie between negotiate and not negotiate, a rational decision maker should choose not negotiate, since negotiation will take extra efforts. Note that the tree in Fig. 2 implies an assumption that the negotiation is a one-time negotiation; that is, there is no counteroffer from the builder. This assumption will be relaxed later in this paper to allow the counteroffer for a more general analysis. The equilib-rium solutions can be solved backward recursively through the aid of the extensive form tree. The conditions for the builder to claim or not will also be obtained.

Case I. No Counteroffer: g Is Fixed

The analysis starts from the simplest case when there is no coun-teroffer. The negotiation offer ratio, g, as shown in Fig. 2 is given in advance before the negotiation takes place and is assumed to be fixed and known by both parties. However, readers should keep in mind that g will become flexible later in Case II because of the counteroffer. We will solve the game backward recursively through the following steps.

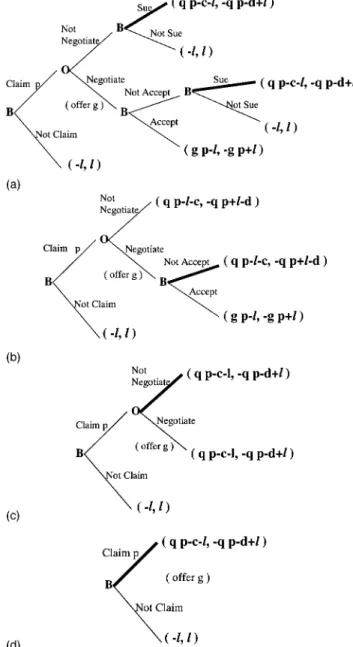

共1兲 Solution I: Builder ‘‘claim’’→Owner ‘‘not negotiate’’

→Builder ‘‘sue.’’

1. Solving from the back, the expected payoff from the lawsuit could be calculated by Eq.共1兲 under the risk-neutral assump-tion. The tree shown in Fig. 3共a兲 can be obtained,

„q共p⫺c⫺l兲⫹共1⫺q兲共⫺c⫺l兲, q共⫺p⫺d⫹l兲⫹共1⫺q兲 ⫻共⫺d⫹l兲…⫽共q p⫺c⫺l, ⫺qp⫺d⫹l兲 (1) 2. The builder will sue if the payoff from the lawsuit is greater than or equal to the payoff from not sue. The condition for the builder to sue would be q p⭓c as shown in the following equation and the game tree in Fig. 3共a兲 can be obtained:

qp⫺c⫺l⭓⫺l⇒qp⭓c (2)

Given that the builder’s optimal choice is to sue under the condition q p⭓c, the solution of the subgame of sue or not sue shown in Fig. 3共a兲 can be given by Eq. 共1兲. The game tree in Fig. 3共b兲 can be obtained.

3. Observing the subgame of not accept or accept in Fig. 3共b兲, the builder will not accept the negotiation offer if the follow-ing equation is met, and this subgame will be replaced by the payoffs matrix of not accept as shown in Fig. 3共c兲:

qp⫺c⫺l⭓gp⫺l⇒qp⫺c⭓gp (3) The intuition of condition共3兲 is that if the expected litigation

payoff, q p⫺c, is greater than the payoff from the negotia-tion offer, gp, the builder will reject the owner’s offer. 4. As shown in Fig. 3共c兲, the owner has the same payoff for not

negotiate and negotiate. However, as discussed above, the owner should decide not negotiate, because the not negotiate decision does not incur negotiation cost, which is suppressed in the game tree. Therefore, this subgame will be replaced by the payoffs of not negotiate as shown in Fig. 3共d兲.

5. As shown in Fig. 3共d兲, the builder will claim if qp⫺c⫺l ⭓⫺l, that is, qp⭓c. Note that qp⭓c will be satisfied given Eq.共3兲. Therefore, under the conditions that qp⫺c⭓gp, the equilibrium path is as follows: Builder ‘‘claim $ p’’

→Owner ‘‘not negotiate’’ 共because he knows that the builder

will ‘‘not accept’’ his offer)→Builder ‘‘sue.’’ The equilib-rium of each subgame and the equilibequilib-rium path for the game are shown in Fig. 4. Here the equilibrium path means the path through the game tree followed in equilibrium and the path should be unique in each game tree.

共2兲 Solution II: Builder ‘‘claim’’→Owner ‘‘negotiate’’

→Builder ‘‘accept.’’ By the same token, we may solve the game

and obtain the solution shown in Fig. 5. The following equation shows the conditions for solution II:

q p⫺c⭐gp⭐qp⫹d (4)

The intuition in condition共4兲 is that if the negotiation offer, gp, is greater than the builder’s litigation payoff, q p⫺c, and less than the owner’s litigation loss, q p⫹d, the owner and builder would choose to negotiate.

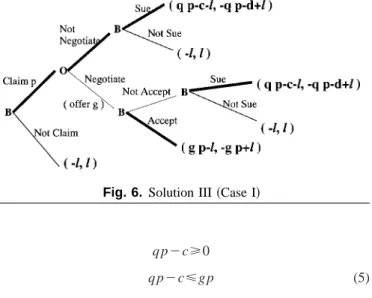

共3兲 Solution III: Builder ‘‘claim’’→Owner ‘‘not negotiate’’

→Builder ‘‘sue.’’ Similarly, we can find the third solution shown

in Fig. 6 and solve for the equilibrium conditions expressed in Fig. 3. 共a兲 Game solved backward—共1兲; 共b兲 game solved

backward—共2兲; 共c兲 game solved backward—3; 共d兲 game solved backward—共4兲

Fig. 4. Solution I共Case I兲

q p⫺c⭓0

q p⫺c⭐gp (5)

q p⫹d⭐gp

共4兲 Solution IV: Builder will ‘‘not claim.’’ The last solution shown in Fig. 7 is that the builder will not claim. The equilibrium conditions are expressed in

q p⬍c (6)

The intuition is that the builder will not claim when the chance of winning the lawsuit is low and/or the litigation’s opportunity cost is relatively high.

Case II. Counteroffer is Allowed: g is Flexible

A counteroffer is allowed in this section so that the negotiation offer ratio, g, is changeable in the process of negotiation, like most cases in the real world. We will show that when the coun-teroffer is allowed, solutions I and III in case I will converge to solution II.

共1兲 Solution I to solution II. Compare the two solutions shown in Figs. 4 and 5. The total payoff for the builder and owner is (q p⫺c⫺l,⫺qp⫺d⫹l) in solution I, and is (gp⫺l,⫺gp⫹l) in solution II. Note that if the payoff of the negotiate and accept path in solution II, (g p⫺l,⫺gp⫹l), is greater than the payoff in so-lution I, (ql⫺c⫺l,⫺qp⫺d⫹l), i.e., (gp⫺l,⫺gp⫹l)⭓(qp ⫺c⫺l,⫺qp⫺d⫹l), then both parties will want to switch from not negotiate to negotiate and accept. To achieve (g p⫺l,⫺gp ⫹l)⭓(ql⫺c⫺l,⫺qp⫺d⫹l), for the builder, the following con-dition has to be satisfied:

g p⫺l⭓qp⫺l⫺c⇒gp⭓qp⫺c (7) and for the owner, the following condition has to be satisfied:

⫺gp⫹l⭐⫺qp⫺c⫹l⇒gp⭐qp⫹d (8)

Conditions共7兲 and 共8兲 can be combined and become

q p⫺c⭐gp⭐qp⫹d (9)

Note that for all q, c, d, p⭓0 it must be true that qp⫺c⭐qp ⫹d. Thus there must be a negotiation offer ratio, g, such that condition 共9兲 is satisfied. As a result, to negotiate and accept is always a better alternative than solution I since both parties can always determine a ratio ‘‘g’’ through the negotiation process to meet condition共9兲. Also in the negotiation, no one can be better off without someone being made worse off; that is, it has reached the so-called ‘‘Pareto-efficiency’’共Binmore 1992兲.

共2兲 Solution III to solution II. Similarly, solution III will also converge to solution II since both parties can seek to achieve Pareto optimal by changing g to satisfy condition共9兲.

共3兲 Equilibrium solution: the Nash equilibrium. As argued in case I, the builder will always want to claim given that q p⭓c. Once the builder decides to ‘‘claim,’’ the only plausible and stable solution will be solution II, to negotiate and accept. This solution is this game’s Nash equilibrium. Two important results are ob-tained:

1. The relationship among q, c, and p determines whether the builder will claim or not. The builder will claim if and only if q p⭓c.

2. The relationship among q, c, d, and p determines a set of possible negotiation offer ratios. The final negotiation offer ratio will have to satisfy condition共9兲, i.e.,

g苸兵x:qp⫺c⭐xp⭐qp⫹d其

Case III. pÄa C and qÄq„a…: General Case

From case I, the builder’s payoff from litigation is q p⫺c⫺l. However, suppose that p has no upper limit and can be any large amount, one may find that the builder’s payoff q p⫺c⫺l can also be infinitely large and the builder will always want to ‘‘sue’’ to get this payoff. Obviously, the conjecture that q p⫺c⫺l can be infi-nitely large is not reasonable. Careful readers may have found that when we say ‘‘q p⫺c⫺l can also be infinitely large,’’ q is being incorrectly assumed to be fixed as p grows, and this error makes qp get unreasonably large. This problem leads us to a more general and realistic analysis of the bidding/claiming game.

共1兲 Probability of winning the lawsuit. Let C be the cost of a construction project. Define the claim ratio, a, as the claim amount divided by the project cost; that is, a⫽p/C. It can be rewritten as

p共a兲⫽aC, 0⭐a⭐1 共most cases兲, or a⬎1 共seldom兲 (10) Let q be the probability of winning as defined previously except that now q depends on the builder’s claim amount, p, or more precisely, the builder’s ‘‘claim ratio,’’ a. It is straightforward and reasonable to assume that for the same claim case, the probability of winning a lawsuit is negatively related to the claim ratio. For example, for the same claim, the probability of winning a lawsuit, q, with claim ratio a⫽0.1 must be much higher than the probabil-ity with claim ratio a⫽0.5. In other words, one cannot raise the claim amount dramatically without lowering his probability of winning significantly. Mathematically, the winning probability of a specific lawsuit can be expressed as a decreasing共not strictly兲 or nonincreasing function of the claim ratio; that is, q(a1) ⭐q(a2) for any claim ratios a1⭓a2. An example of q(a) can be depicted as shown in Fig. 8. This illustrative q(a) will be used as Fig. 6.Solution III共Case I兲

a base case for our further analyses. In fact, q(a) will be depend-ing on the unique situations in different cases. It can be shown that we do not need to know the exact form of q(a) as long as the existence of the maximum of an expected lawsuit payoff, q(a*) p(a*), is guaranteed, where a* denotes the ‘‘optimal claim ratio.’’ The uniqueness of the maximum is not required either. The attorneys are considered experts that can identify a* in each spe-cific case.

It is very important not to confuse q(a) depicted in Fig. 8 with probability density functions. A probability density function specifies the probabilities of the random outcomes of an event. It is a function of a random variable, e.g., a variable represents win or lose. Nevertheless, q(a) in Fig. 8 is a function of a decision variable, a, instead of a random variable. Therefore, q(a) is by no means a probability density function, and兰q(a) will not be equal to 1. Furthermore, q(a) should depend on the project’s/contract’s characteristics, industrial conventions and legal systems. In this model, we assume that q(a) is known by legal experts, and that the attorneys hired by both players are equally good.

共2兲 Expected compensation ratio. Note that qp is the builder’s expected compensation from the owner. As a result, qp is the builder’s positive payoff but the owner’s negative cost in a law-suit. According to the formulation above, qp can be rewritten as

q p⫽q共a兲p共a兲⫽aq共a兲C (11) Therefore we may define the expected compensation ratio from lawsuit, given a, as the ratio of qp to C. That is,

q p/C⫽aq共a兲 (12)

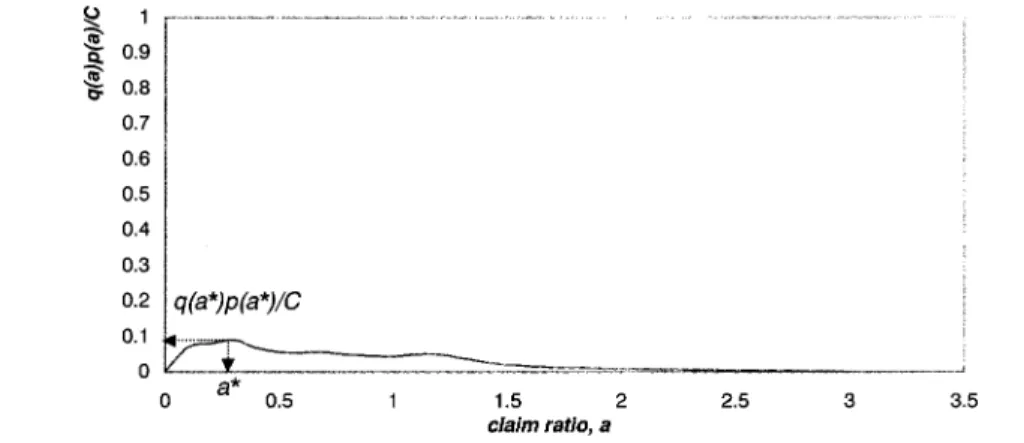

Following our base case in Fig. 8, Fig. 9 shows the lawsuit’s expected compensation ratio, a q(a), with respect to a.

Also note that q(a) is bounded between 0 and 1, whereas it is reasonable to assume that the upper bound of the claim ratio, a, is

a small positive number, e.g., 10. Thus we can show that the set

兵x:x⫽a q(a)其is bounded. In a bounded set, the existence of the maximum of the set is guaranteed. Therefore, the existence of the maximal expected compensation ratio in the lawsuit for any con-struction project is guaranteed. The maximum will be denoted as a*q(a*). The attorney is assumed to be the expert on deciding the optimal claim ratio given a specific case. Taking q(a) in Fig. 8 as an example, the optimal claim ratio is around 0.3 as shown in Fig. 9 and its maximal expected compensation ratio would be around 0.18. A rational builder will always claim at his optimal claim ratio in order to maximize his total payoff from lawsuit, q(a*) p(a*)⫺c⫺l.

共3兲 Generalized Nash equilibrium. Again, our discussion fo-cuses on the equilibrium that the builder decides to ‘‘claim’’ since there is not much to say about ‘‘not claim.’’ Back to the equilib-rium derived in case II, the negotiation offer has to satisfy condi-tion 共9兲, i.e., qp⫺c⭐gp⭐qp⫹d. Multiply the whole equation by 1/C; it becomes

q p/C⫺c/C⭐gp/C⭐qp/C⫹d/C (13)

Eq.共13兲 can be simplified as

共q p⫺c兲/C⭐gp/C⭐共q p⫹d兲/C (14) When a rational claimant claims at optimal claim ratio, Eq.共14兲 will become

关q共a*兲p共a*兲⫺c兴/C⭐gp共a*兲/C⭐关q共a*兲p共a*兲⫹d兴/C (15) Now the only variable left to be decided by both players in Eq. 共15兲 is the negotiation offer ratio, g. Since it is always true that 关q(a*) p(a*)⫺c兴/C⭐关q(a*) p(a*)⫹d兴/C, there must exist a set of g’s that will satisfy Eq.共15兲 for the generalized Nash equi-librium. Examples expressed by graphics are given below to il-lustrate the dynamics of the equilibrium.

The equilibrium solution in Fig. 10 shows the Pareto optimal and the Nash equilibrium condition, i.e., Eq.共15兲, 关q(a*) p(a*) ⫺c兴/C⭐g p(a*)/C⭐关q(a*) p(a*)⫹d兴/C. Both parties will benefit from the negotiate and accept solution by choosing a g such that g p(a*)/C would lie in the shaded area shown in Fig. 10. The shaded area is defined herein as a negotiation offer ratio zone. Compared to the payoff from ‘‘sue,’’ both players will have higher payoffs.

Illustrative Example

We shall use an example to illustrate the analysis of the claim and opportunistic bidding game discussed above.

Fig. 8. Builder’s probability of winning with respect to different a

University Library versus Gamble Construction Company

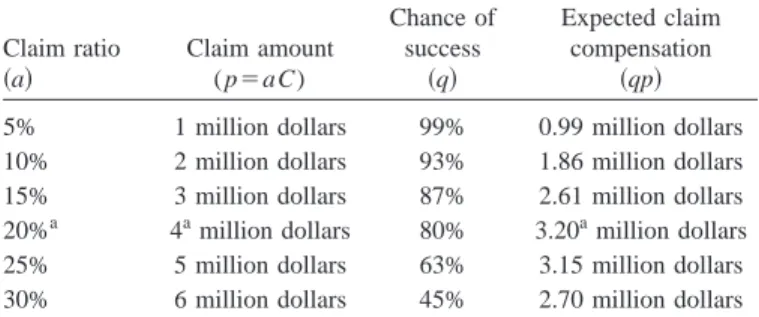

Suppose a university is building a new library. The university decides to award the contract based on the competitive bidding. Suppose the engineer’s estimate is between $19 million and $21 million, and five contractors’ bids range from $17 million to $22 million. Gamble Construction’s bid is $17 million, whereas the second lowest bid by Honest Construction is $19 million. The university suspects that Gamble Construction has opportunisti-cally cut his bid price by $3 million to win the project. However, there is not enough evidence to prove this conjecture, so the uni-versity needs to award the project to Gamble Construction.

After one and half year of construction, there have been sev-eral major claims filed by Gamble Construction and these claims amount to $4 million. Most of these claims are attributed to the inadequate bid information/inferior quality of specifications, working in congested areas, and change of site conditions. If both parties do not reach an agreement regarding the claims in the next two months, a litigation will take place. The estimated litigation opportunity cost for the university is $1.5 million. On the other hand, suppose Gamble Construction has many claim and litiga-tion experiences so that Gamble’s litigalitiga-tion opportunity cost is only $0.5 million. Suppose that it is not difficult for an experi-enced construction claims attorney to assess the chance of success in the litigation with respect to various claims amount as depicted

in Table 1. Note that in Table 1 the construction cost, C, is Gam-ble’s true cost, $20 million, as mentioned earlier.

Questions

1. What are the possible negotiation offers which are accept-able to both parties?

2. Given that Gamble Construction is an opportunistic bidder, how much would Gamble consider to cut from original costs?

3. What could have been done to discourage opportunistic bid-ding?

Analysis

1. What are the possible negotiation offers that are acceptable to both parties? First, Gamble carefully reviewed all the bid documents, discussed with its claims attorney, and concluded an assessment as shown in Table 1. Gamble also estimated both parties’ litigation opportunity costs, c⫽$0.5 million and d⫽$1.5 million. According to Table 1, Gamble’s attor-ney then suggests that Gamble’s optimal claim ratio in the future is 20% of the true costs, $4 million, and the expected compensation from the university is q*p*, which equals $3.20 million. Therefore, the expected payoffs from litiga-tion for Gamble and the university are q*p*⫺c ⫽$2.7 million gain and q*p*⫹d⫽$4.7 million loss, re-spectively. In this case, any offer that is greater than $2.7 million is acceptable to the builder. And the owner will offer no more than $4.7 million. In other words, the possible ne-gotiation offers will fall within the range of $2.7 million and $4.7 million. The most possible negotiation settlement that will be reached depends on other factors such as their risk attitude or patience of the parties involved.

2. Given that Gamble Construction is an opportunistic bidder, how much would Gamble consider to cut from the original price? Since the possible negotiation offers are in the range of $2.7 million and $4.7 million, Gamble Construction can consider to cut in the range of $2.7 million and $4.7 million without sacrificing its minimum profit after the claims. Our analysis shows that it is possible that Gamble Construction did cut $3 million to win the project.

Fig. 10. Equilibrium and its negotiation offer zone

Table 1. Chances of Success in Litigation with Respect to Various Claims Amount

Claim ratio

共a兲 Claim amount( p⫽aC)

Chance of success 共q兲 Expected claim compensation 共qp兲 5% 1 million dollars 99% 0.99 million dollars 10% 2 million dollars 93% 1.86 million dollars 15% 3 million dollars 87% 2.61 million dollars 20%a 4amillion dollars 80% 3.20amillion dollars 25% 5 million dollars 63% 3.15 million dollars 30% 6 million dollars 45% 2.70 million dollars aDenotes the optimal claim ratio/amount and its expected compensation.

3. What could have been done to discourage opportunistic bid-ding? If the university can deny certain contractors based on bidders’ past performances, an opportunistic bidder will suf-fer the denial in the future bidding invitation/awarding. Such punishment increases Gamble Construction’s litigation op-portunity costs. For example, if the potential loss from losing future business with the university is $1 million, Gamble’s litigation opportunity costs will become $1.5 million, that is, c⫽$1.5 million.

Plus, the university can also build an effective claims admin-istration program to lower its litigation opportunity costs, say, to $0.5 million, i.e., d⫽$0.5 million. The negotiation offer range will then become $3.2⫺1.5 million and $3.2⫹0.5 million, i.e., $1.7 million and $3.7 million. If the university further improves the quality of the drawings, specifications, and construction con-tracts, then q*p* can be reduced, say, to $1.5 million. The nego-tiation offer range would be reduced to $0, $2 million. This result dramatically discourages the Gamble’s opportunistic bidding be-cause the chance for Gamble Construction to become a low bid-der will be reduced even if Gamble Construction tried to cut the price within $2 million.

Propositions, Decision Rules, and Strategies Proposition I

Assume that c, d, a, q(a), and p(a) are non-negative real num-bers and common knowledge, that q(a) is a decreasing function of claim ratio, and that both parties are rational and risk-neutral. If q(a) p(a)⫺c is non-negative, then to negotiate is a weakly domi-nant strategy for both parties and the negotiation offer will be no less than q(a) p(a)⫺c and no greater than q(a)p(a)⫹d, where the weakly dominant strategy is the strategy that is better than or equal to all others.

Proof. Since l is sunk already, the relevant elements for decid-ing to claim or not is the bidder’s expected compensation, q(a) p(a), and litigation opportunity cost, c. Therefore, a rational builder will claim if and only if q(a) p(a)⫺c⭓0, that is, q(a) p(a)⫺c is non-negative. If all assumptions above hold, the builder and the owner will both know the curves of q p⫹d and q p⫺c, where qp⫹d is the loss of the owner, and qp⫺c is the payoff of the builder.

Since c,d are non-negative, we have (q p⫹d)/C⭓(qp⫺c)/C ᭙a⭓0. Therefore, for any a⭓0, there must exist g苸R such that g苸兵x:(q p⫹d)/C⭓xp(a)/C⭓(qp⫺c)/C其, where x is the set of plausible negotiation offer ratios. Here (q p⫹d)/C⭓gp(a)/C implies that the owner will be better off by offering g p(a) in negotiation, and g p(a)/C⭓(qp⫺c)/C implies that the builder will also be better off by accepting the offer in negotiation. And for any a, if g p(a)/C⭓(qp⫹d)/C⭓(qp⫺c)/C, then the equi-librium solution is ‘‘sue’’ and the payoffs for both parties are (q p⫹d,qp⫺c), which are weakly dominated by the payoff of negotiation equilibrium solution. Similarly, when (q p⫹d)/C ⭓(qp⫺c)/C⭓gp(a)/C, the payoffs for both parties are domi-nated by the negotiation equilibrium solution. Therefore, to nego-tiate is a weakly dominant strategy for both parties. 共End of proof兲

The insight of Proposition I is that if q(a) p(a)⫺c is non-negative, there will be a non-negative surplus, c⫹d, shared by both parties. We will name this surplus the ‘‘negotiation surplus.’’ The negotiation surplus can either be shared by both parties through the negotiation process or be abandoned totally if there is a lawsuit. An interesting question is how this surplus can be

di-vided. The division of the surplus will depend on each party’s negotiation power and risk attitude 共Binmore 1992兲. The party that has more negotiation power and is less risk averse will get more surpluses than the other. Detailed analysis along this path is beyond the scope of this paper but worth further investigating. Levin 共1998兲 argues that the key to ‘‘a successful project is the successful resolution of contract disputes without resorting to liti-gation.’’ He emphasizes the importance of preventing and han-dling claims and an effective claims administration program. Our analytical model confirms that resolving the claims through nego-tiation, instead of litigation, is desired by both parties and ex-plains why more and more construction projects are utilizing the ADR共Alternative Dispute Resolution兲 and the DRB 共Dispute Re-view Board兲 to reduce construction claims and their impacts on projects.

Corollary I

If all assumptions in Proposition I hold and there exists an a* such that q(a*) p(a*) is a non-negative maximum, a rational builder will claim at a* and the negotiation offer will be no less than q(a*) p(a*)⫺c and no greater than q(a*)p(a*)⫹d, if and only if q(a*) p(a*)⫺c is a non-negative maximum of qp⫺c.

Proof. According to the profit maximization rationality and Proposition I, a rational builder will claim at a* if and only if q(a*) p(a*)⫺c⭓0; that is, q(a*)p(a*)⫺c is a non-negative maximum. Furthermore, by Proposition I, the payoff of the claim-ant is no less than q(a) p(a)⫺c and no greater than q(a)p(a) ⫹d. Therefore the negotiation offer will be no less than q(a*) p(a*)⫺c and no greater than q(a*)p(a*)⫹d, if and only if there exists a non-negative maximum q(a*) p(a*)⫺c. 共End of proof兲

Note that according to Corollary I, the builder’s claim ratio has nothing to do with the amount $l cut by the builder during the bidding. The builder will follow his profit maximization rational-ity to decide an optimal claim ratio. As a result, it is possible that the claim ratio a* will exceed the cut down ratio l/C.

One question that might also be raised is why are there still many claim lawsuits in the real world? A plausible reason for the failure of a negotiation solution is that functions q(a), c, and d are not actually common knowledge as assumed in this study. In the real world q(a), c, and d are not common knowledge. They may be perceived by each player quite differently. To a degree, a player may try to utilize this asymmetry and bluff during the negotiation process. In these cases, the perceived q(a*) p(a*) ⫹d may not always be greater than q(a*)p(a*)⫺c. When q(a*) p(a*)⫹d⭐q(a*)p(a*)⫺c, the negotiation surplus, c ⫹d, will no longer exist and the solution will become litigation. Game theory has further treatment toward this information asym-metry; nevertheless, it is beyond the scope of this research. Corollary II

If all assumptions in Proposition I hold, the sign and amount of l and the amount of d are irrelevant to the builder’s claim or not claim decision.

Proof. According to Proposition I, only q, p, and c determine the claim decision made by the builder; thus l and d are irrelevant to the builder’s claim decision.共End of proof兲

As Corollary II suggests, the owner should be aware that even though the builder did not lower his bid to win the contract, that is, l⫽0, if there are potential profits from claiming identified by the builder, the builder will have motives to claim to maximize his profits.

Corollary III

If all assumptions in Proposition I hold and q(a*) p(a*)⫺c is a non-negative maximum, then the bidding price cut down by a rational opportunistic builder will be no less than q(a*) p(a*) ⫺c and no greater than q(a*)p(a*)⫹d, i.e., l苸关q(a*) p(a*) ⫺c,q(a*)p(a*)⫹d兴.

Proof. An opportunistic bidder is the one who bids lower than his minimum profit level and seeks to recover from the future claims. From Proposition I and Corollary I, if it is in the builder’s interest to claim, that is, q(a*) p(a*)⫺c is a non-negative maxi-mum, his expected payoffs will be no less than q(a*) p(a*)⫺c and no greater than q(a*) p(a*)⫹d, and so will the bid be cut down by a rational opportunistic builder. That means l 苸关q(a*) p(a*)⫺c,q(a*)p(a*)⫹d兴. 共End of proof兲

Note that if q(a*) p(a*)⫺c is a negative maximum, the only solution is ‘‘not claim’’ and the only possible value for l is l⫽0. One might think that the builder can hold up the owner to nego-tiate by threatening to have a litigation even when q(a*) p(a*) ⫺c is negative. The problem of this reasoning is that the threat of a lawsuit is incredible when q(a*) p(a*)⫺c is negative because if the owner ignores the threat and chooses to ‘‘not negotiate,’’ a rational builder will not go for a lawsuit.

Note that Corollary III confirms the argument regarding the causes of claims by Rubin et al.共1983兲. They argue that typical harsh contracts used by owners would discourage responsible bid-ders and attract those opportunistic bidbid-ders who expect to recover their profit from claims. The major reason is that responsible bid-ders will include a higher contingency in their bid when facing a harsh contract, whereas irresponsible bidders will not, and that ‘‘judges almost always rule against the party who drew up the ambiguous 共or harsh兲 contract—the owner’’ 共Rubin et al. 1983兲. According to Corollary III, if harsh or ambiguous contracts in-crease the expected compensation ruled by judges, q(a*) p(a*), then the magnitude of关q(a*) p(a*)⫺c,q(a*)p(a*)⫹d兴will be larger, and then the opportunistic bidders can cut the bid price more freely and have more chances to outbid responsible bidders. Corollary III also confirms Adrian’s 共1993兲 analysis on why most of the number and dollar amount of construction claims is filed on public construction projects. He argued that since the public funded projects are awarded to the lowest bidder, ‘‘a con-tractor is less inclined to offend the project owner via the filing of a claim.’’ On the other hand, ‘‘a private construction project owner often engages his contractors via an invitational letting and thus can revert to keeping off a future invitation list a con-tractor who files a questionable claim’’共Adrian 1993兲. Given the assumption that the builder’s litigation opportunity cost, c, is sig-nificantly large in private projects but small in public projects, according to Corollary III, q(a*) p(a*)⫺c will be small in pri-vate projects but large in public projects, and thus pripri-vate projects will discourage opportunistic bidding more effectively than public projects. If c is big enough, it is possible that q(a*) p(a*)⫺c becomes negative and there will be no opportunistic bidding at all according to Corollary I.

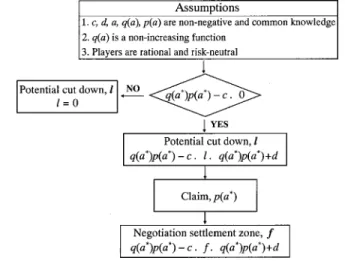

Decision Rules

The proposition and corollaries can be translated into the decision rules to assist practitioners analyzing a claiming situation and making decisions. Fig. 11 shows the flow chart of the claiming and opportunistic bidding analysis framework and the rules of claims decision making.

Assumptions

Assume that c, d, a, q(a), and p(a) are non-negative real num-bers and common knowledge, that q(a) is a decreasing function of claim ratio, and that both parties are rational and risk neutral.

Rules

1. If the builder’s maximal expected lawsuit compensation, q(a*) p(a*)⫺c, is negative, then the builder has no incen-tive to bid opportunistically and will not claim.

2. If the builder’s maximal expected lawsuit compensation, q(a*) p(a*)⫺c, is non-negative, then the builder has incen-tives to bid opportunistically and the builder will claim. 3. If the builder’s maximal expected lawsuit compensation,

q(a*) p(a*)⫺c, is non-negative, the bidding price may be opportunistically cut down by the amount l, where l is no less than q(a*) p(a*)⫺c and no greater than q(a*)p(a*) ⫹d, that is, l苸关q(a*) p(a*)⫺c,q(a*)p(a*)⫹d兴. 4. If the builder’s maximal expected lawsuit compensation,

q(a*) p(a*)⫺c, is non-negative, then negotiation gives bet-ter payoffs than a lawsuit for the owner and builder and the negotiation offer will be the amount f, where f 苸关q(a*) p(a*)⫺c,q(a*)p(a*)⫹d兴.

Strategies for the Owner and Builder

According to the CDM, proposition, and corollaries, we can de-rive the strategies for the owner and builder to avoid opportunistic bidding and construction claims.

共1兲 Owner’s strategies. According to Proposition I and Corol-lary I, the negotiation offer will be within the range of 关q(a*) p(a*)⫺c,q(a*)p(a*)⫹d兴. Therefore, the strategies for discouraging the opportunistic bidding practice are as follows:共1兲 to reduce the builder’s probability of a winning curve, q(a); 共2兲 to increase the builder’s litigation opportunity cost, c, and共3兲 to reduce the owner’s litigation opportunity cost, d. Note that the three strategies have various implications during different project phases such as procurement, construction, and claims negotiation. These implications may lead to, but are not limited to, the follow-ing implementations:

1. Improving the quality of a contract and its implementations. In construction the probability of winning a claim litigation may depend on the quality of a contract and the implemen-tation of the contract. A contract includes all documenimplemen-tation, specifications, and drawings. A high quality contract will

prevent the builder from finding ‘‘excuses’’ or ‘‘evidences’’ that are against the owner in a claim litigation. In other words, q(a*) p(a*) can be reduced because of higher con-tract quality and the concon-tract’s implementation. As a result, the values of q(a*) p(a*)⫺c and q(a*)p(a*)⫹d will be reduced, and then according to Corollaries I and III, the op-portunistic bidding behavior will be discouraged and l will be reduced.

2. Being aware of the claims from non-opportunistic bidders. An important discovery is that even if a low bidder is not an opportunist, the owner is still exposed to the builder’s poten-tial future claiming actions due to the builder’s profit maxi-mization rationality. According to Corollary I, the builder will have incentives to claim if q(a*) p(a*)⫺c is positive and q(a*) p(a*)⫹d is sufficiently large, even when he did not cut his bid price opportunistically. In this case, the owner may lose even more than facing an opportunistic bidder be-cause the owner did not gain the benefit from the bidder’s price cut in the first place.

3. Being well prepared for any claims, possible litigation, and their impacts. The owner should be well prepared in advance for any possible claims and litigation. For example, the owner should hire an ‘‘excellent’’ legal advisor to reduce q(a*) p(a*). The owner should also prepare backup plans to reduce the loss from the contractor’s delaying work due to litigation or negotiation, i.e., to reduce d. Furthermore, all work done by the owner should be clearly demonstrated to the builder before and after the bidding so that bidders would acknowledge the fact that q(a*) p(a*) and d are small. 4. Changing the project procurement/contracting scheme to

focus on the long-term relationship and bidders’ past perfor-mance. To change the procurement scheme to focus on the long-term relationship and bidders’ past performance, such as design-build and NEC共New Engineering Contract兲, will increase the builder’s litigation opportunity cost, c, if a builder chooses to file a claim. According to Corollary III, such a change can help the owner discourage the opportunis-tic bidding and also reduce the owner’s possible loss. 共2兲 Builder’s strategy. According to Proposition I and Corol-lary I, the strategies for maximizing the bidder’s payoff in the claim situations are as follows:共1兲 to increase the builder’s prob-ability of a winning curve, q(a), 共2兲 to increase the owner’s litigation opportunity cost, d, and共3兲 to reduce the builder’s liti-gation opportunity cost, c. Note that these strategies also have various implications during different project phases. These impli-cations may also lead to, but are not limited to, the following implementations for the builder.

1. Follow the specifications closely and keep good documenta-tion. As the owner strives to improve contract quality, the builder should follow the contract and specifications very closely, find out the deficiency of the contract, and keep good documentation. By doing so, q(a*) p(a*) will be increased so that the builder could receive a higher offer from negotia-tion.

2. Be aware that the litigation opportunity cost is more than the direct litigation cost. The builder should understand that op-portunity cost also includes indirect litigation costs, such as schedule interruption, idle labor, damaged reputation, and contractor-owner relationships.

3. Be prepared for any claims, lawsuits, and their impacts. A contract cannot specify every detail ex ante or in advance. There must be some inevitable ambiguities or deficiencies in the contract. The builder should be well prepared for the

need to recover the damage or loss caused by the contract’s deficiencies no matter what partnering scheme is applied. The builder should have good legal counselors to increase q(a*) p(a*), and have back up plans to reduce c. During the claim and negotiation process, it is also very important to demonstrate these efforts to the owner.

4. Improve the builder’s productivity and cost structure. Oppor-tunistic builders with low productivity or high cost structure can make profit only when owners are not well prepared for opportunistic behavior. Whereas opportunistic bidding be-comes common in practice, experienced owners will learn how to discourage opportunistic bidding behavior, and to reduce their loss caused by claims. The best way for the builder to make a long-term profit is to strengthen himself by improving the builder’s competitive advantages instead of bidding opportunistically.

Conclusions

Claims and disputes have become burdens to the construction industry because of intensive competition. We recognize that there are many parts to the equation of a construction claim. This paper is an attempt to present a model that provides a step-by-step approach to analyzing decisions and strategies in construction claims. The Claims Decision Model may help owners, contrac-tors, and legal consultants to analyze construction claims system-atically and rationally. With a theoretical foundation, this model helps various parties in a claim to understand and analyze their positions and decisions, so that both parties can combine the state of information with the assessments from the experts involved. Game theory is used as an analytical framework to derive an economic model. We found the conditions where opportunistic bidding is encouraged, showed that to ‘‘negotiate’’ was the Nash equilibrium in a construction claim, and derived the possible range of a negotiation settlement. Decision rules and strategies for the owner and builder are proposed according to the model.

It is our sincere hope that all construction projects will be executed without claims. However, if claims are inevitable, the model can serve as a template to analyze a claim situation and help to bring quick solutions to an interruptive event. This model may provide project participants a systematic way of analyzing claims from the perspectives of both owners and builders as to answer the critical questions of why, how, how much, and what to do.

The writers believe that some abstractions and assumptions in this paper are necessary. Readers are encouraged to extend the model, or relax some of our assumptions to study the claim deci-sion process more realistically. With further research, we envideci-sion that this model can be extended to analyze many other important issues, such as design-build contract negotiation, dispute resolu-tion, contractor-labor bargaining, and transaction negotiations be-tween project participants.

Notation

The following symbols are used in this paper:

a ⫽ the claim ratio, the amount claimed by the builder divided by the project’s costs;

a* ⫽ the optimal claim ratio; C ⫽ the total costs of the project;

d ⫽ the owner’s litigation opportunity cost; f ⫽ the negotiation offer amount;

g ⫽ the negotiation offer ratio;

l ⫽ the profit cut down by the builder during the bidding;

p ⫽ the amount claimed by the builder; p(a) ⫽ p expressed as a function of a;

q ⫽ the builder’s probability of winning the lawsuit; and q(a) ⫽ q expressed as a function of a.

References

Adrian, J. J.共1993兲. Construction claims: A quantitative approach, Sti-pes, Champaign, Ill.

Binmore, K.共1992兲. Fun and games: A text on game theory, D. C. Heath and Company, Lexington, Mass.

Clemen, R. T.共1991兲. Making hard decisions—An introduction to deci-sion analysis, PWS-KENT, Boston.

Gibbons, R.共1992兲. Game theory for applied economists, Princeton Uni-versity Press, Princeton, N.J.

Ioannou, P. G., and Leu, S.共1993兲. ‘‘Average-bid method—Competitive bidding strategy.’’ J. Constr. Eng. Manage., 119共1兲, 131–147. Jergeas, G. F., and Hartman, F. T. 共1994兲. ‘‘Contractor’s

construction-claims avoidance.’’ J. Constr. Eng. Manage., 120共3兲, 553–560. Kangari, R.共1995兲. ‘‘Construction documentation in arbitration.’’ J.

Con-str. Eng. Manage., 121共2兲, 201–208.

Kumaraswamy, M. M., and Yogeswaran, K.共1998兲. ‘‘Significant sources of construction claims.’’ Int. Constr. Law Review, 15共1兲, 144–160. Levin, P.共1998兲. Construction contract claims, changes and dispute

reso-lution, 2nd Ed., ASCE, Reston, Va.

Maher, M.共1997兲. Cost accounting: Creating value for management, 5th Ed., Irwin/McGraw-Hill, New York.

Myerson, R. B.共1991兲. Game theory: Analysis of conflict, Harvard Uni-versity Press, Cambridge, Mass.

Rubin, R. A., Guy, S. D., Maevis, A. C., and Fairweather, V. 共1983兲. Construction claims, Van Nostrand Reinhold, New York.

Semple, C., Hartman, F. T., and Jergeas, G.共1994兲. ‘‘Construction claims and disputes: Causes and cost/time overruns.’’ J. Constr. Eng. Man-age., 120共4兲, 785–795.

Simon, M. S.共1979兲. Construction contracts and claims, McGraw-Hill, New York.

Zack, J. G., Jr.共1993兲. ‘‘‘Claimsmanship’: Current perspective.’’ J. Con-str. Eng. Manage., 119共3兲, 480–497.