Market Risk

Consultation paper | CP 19.01

June 2019

Contents

I INTRODUCTION ... 5

1 Purpose ... 5

2 Background ... 5

3 Scope of Application ... 6

4 Approaches to Calculation of Market Risk ... 8

5 Implementation Timeline ... 9

6 Application and Approval Process ... 10

II BOUNDARY BETWEEN BOOKS ... 11

7 Scope of the Trading Book ... 11

7.1 Standards for Assigning Instruments to the Regulatory Books... 11

7.2 Supervisory Powers ... 13

7.3 Documentation of Instrument Designation ... 14

7.4 Restrictions on Moving Instruments between the Regulatory Books ... 14

8 Treatment of Internal Risk Transfers ... 16

8.1 Internal Risk Transfer of Credit and Equity Risk ... 16

8.2 Internal Risk Transfer of General Interest Rate Risk ... 17

8.3 Internal Risk Transfers between Trading Desks ... 18

8.4 Eligible Hedges for the CVA Capital Charge... 18

9 Definition of Trading Desks ... 20

III STANDARDISED APPROACH ... 23

10 Structure ... 23

11 Sensitivities-based Method (SBM) ... 24

11.1 Main Definitions ... 24

11.2 Components of the SBM ... 24

11.3 Instrument Prices and Sensitivity Calculation ... 25

11.4 Instruments Subject to Delta, Vega and Curvature ... 25

11.5 Delta and Vega Risks... 26

11.6 Curvature Risk... 28

11.7 Correlation Scenarios and Aggregation of Risk Charges ... 30

12 SBM: Risk Factor and Sensitivity Definitions ... 32

12.1 Risk Factor Definitions ... 32

12.2 Sensitivity Definitions ... 38

12.3 Other Requirements on Sensitivity Computations ... 40

12.4 Instruments with Multiple Constituents ... 41

13 SBM: Delta Risk Weights and Correlations ... 45

13.1 General Interest Rate Risk (GIRR) ... 45

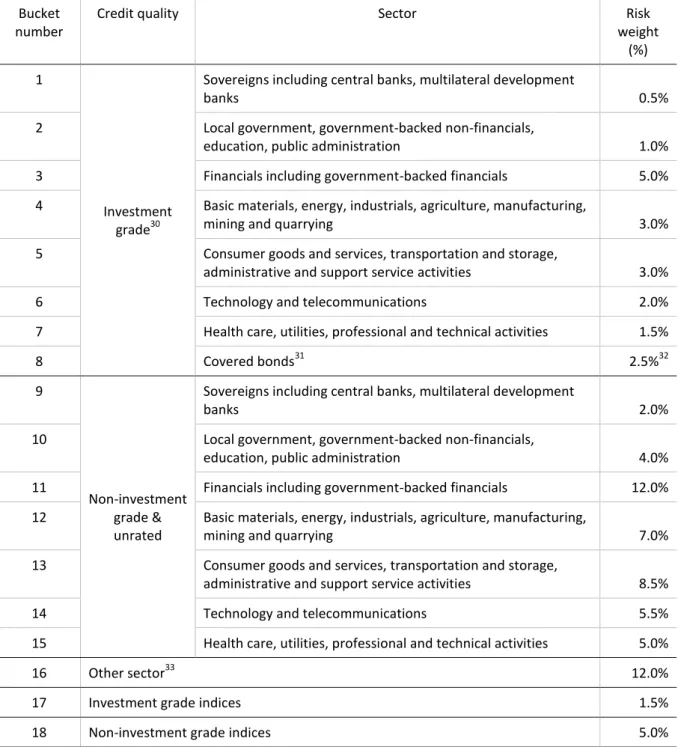

13.2 Credit Spread Risk for Non-securitisation (CSR non-SEC) ... 47

13.3 Credit Spread Risk for Securitisations (CTP) (CSR SEC (CTP)) ... 52

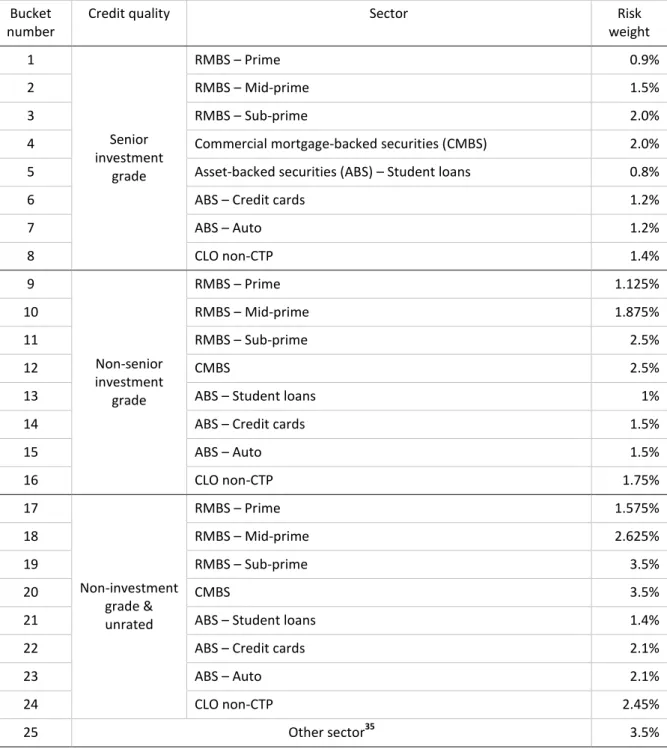

13.4 Credit Spread Risk for Securitisations (non-CTP) (CSR SEC (non-CTP)) ... 54

13.5 Equity Risk ... 56

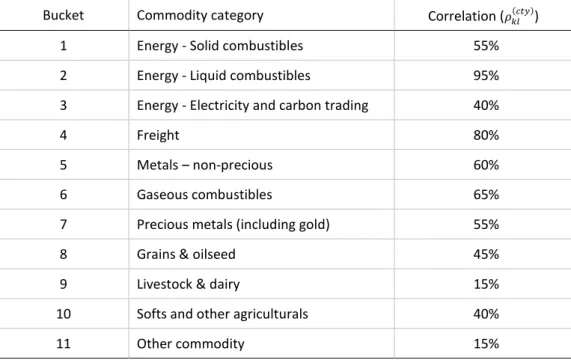

13.6 Commodity Risk ... 59

13.7 Foreign Exchange Risk ... 62

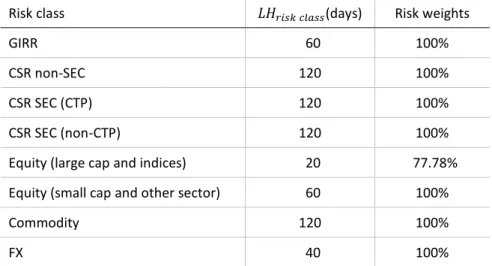

14 SBM: Vega Risk Weights and Correlations ... 63

15 SBM: Curvature Risk Weights and Correlations ... 65

16 Residual Risk Add-on (RRAO) ... 67

16.1 Instruments subject to the RRAO ... 67

16.2 Calculation of the RRAO ... 69

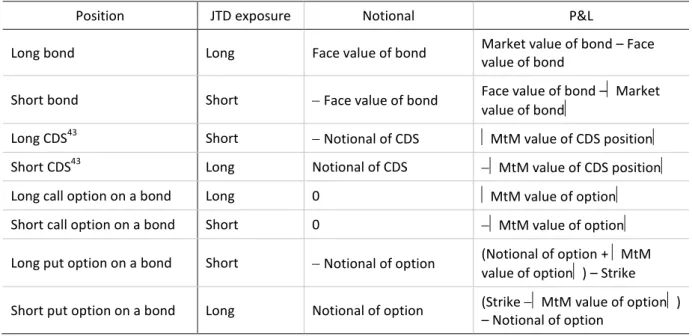

17 Standardised Default Risk Charge (SA-DRC) ... 70

17.1 SA-DRC for Non-securitisation... 71

17.2 SA-DRC for Securitisations (Non-CTP) ... 75

17.3 SA-DRC for Securitisations (CTP) ... 78

IV INTERNAL MODELS APPROACH ... 81

18 General Provisions ... 81

18.1 Modular Concept of IMA Use ... 81

18.2 General Criteria ... 81

18.3 Qualitative Standards ... 83

18.4 Model Validation Standards ... 86

18.5 External Validation ... 87

18.6 Stress Testing ... 88

19 Specification of Risk Factors ... 90

19.1 For Interest Rate Risk ... 90

19.2 For Foreign Exchange Risk ... 91

19.3 For Equity Risk ... 91

19.4 For Commodity Risk ... 92

19.5 For the Risks Associated with Equity Investments in Funds ... 92

20 Model Eligibility of Risk Factors ... 93

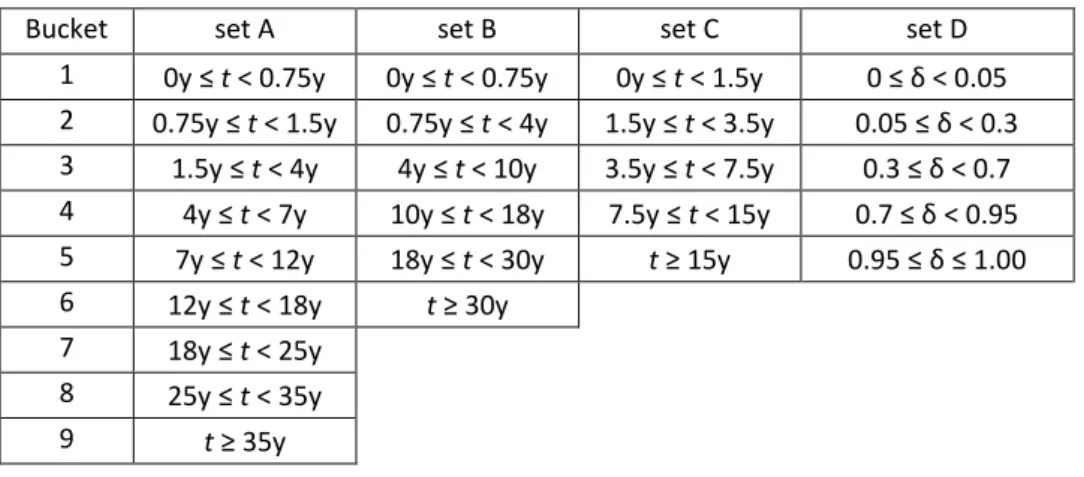

20.1 Bucketing Approach for the RFET ... 95

20.2 Modellability of Risk Factors Passing the RFET ... 97

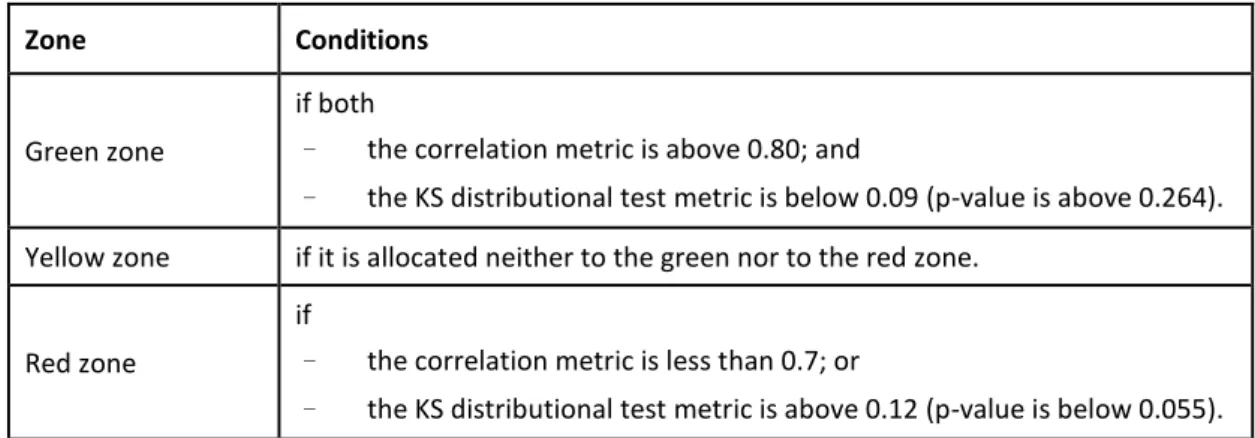

21 Backtesting and PLAT ... 100

21.1 Backtesting Requirements ... 100

21.2 PLAT Requirements ... 103

21.3 Transitional arrangements ... 108

22 Capital Charges under the IMA ... 109

22.1 Expected Shortfall for Modellable Risk Factors ... 109

23 Capital Charges for Non-modellable Risk Factors ... 115

24 IMA Default Risk Charge ... 117

25 Aggregation of Capital Charge ... 121

V SIMPLIFIED STANDARDISED APPROACH ... 123

26 Eligibility Criteria ... 123

27 Capital Charges under the SSA ... 124

I INTRODUCTION

1 Purpose

1 This consultation paper sets out the Hong Kong Monetary Authority’s (HKMA) proposal for revising the current regulations on the market risk capital charges in the Banking (Capital) Rules (BCR).

2 The HKMA invites comments on the proposal of this paper by 30 September 2019.

3 Following the close of this consultation, the HKMA will further refine its proposals taking into account the feedback received.

2 Background

4 In January 2019, the Basel Committee on Banking Supervision (BCBS) issued its revised Minimum capital requirements for market risk, commonly referred to as the

“Fundamental Review of the Trading Book” (FRTB)1. The framework aims at addressing the structural shortcomings of the market risk framework under the Basel 2.5 regime. It follows up on an original version published in January 20162 and includes a set of amendments to address issues that have been identified through input from a wide spectrum of stakeholders. It also takes into account extensive feedback received on a consultative document3 issued by the BCBS in March 2018 and it is calibrated based on the most recent set of the BCBS’ quantitative impact study (QIS) data.

5 This consultation paper outlines the HKMA’s plans for implementing the revised market risk framework in Hong Kong. It covers the new Standardised Approach, the new Internal Models Approach, the Simplified Standardised Approach, requirements related to the boundary between the trading book and banking book, as well as details on the qualifying criteria for using de-minimis exemptions.

6 The HKMA intends to implement the revised market risk framework closely aligned with the standards issued by the BCBS. Therefore, the wordings in this consultation paper follow closely the standards set out in the Minimum capital requirements for market risk.

1 http://www.bis.org/bcbs/publ/d457.htm

2 http://www.bis.org/bcbs/publ/d352.htm

3 http://www.bis.org/bcbs/publ/d436.htm

3 Scope of Application

7 Under the revised market risk framework, market risk is defined as the risk of losses arising from movements in market prices. The risks subject to market risk capital charges include:

Interest rate risk, credit spread risk, equity risk, foreign exchange risk, commodities risk and default risk for trading book instruments; and

Foreign exchange risk and commodities risk for banking book instruments.

8 All transactions, including forward sales and purchases, should be included in the calculation of capital charges as of the date on which they were entered into.

Although regular reporting will in principle take place only at intervals, an authorized institution (AI) is expected to:

manage its market risk in such a way that the capital charges are being met at any time. The AI must not window-dress by showing systematically lower market risk positions on reporting dates; and

maintain strict risk management systems to ensure that intraday exposures are not excessive. If an AI fails to meet the capital charges at any time, it should take immediate measures to rectify the situation.

9 A matched currency risk position will protect an AI against loss from movements in exchange rates, but will not necessarily protect its capital adequacy ratio. If the AI has its capital denominated in HKD and has a portfolio of foreign currency assets and liabilities that is completely matched, its capital/asset ratio will fall if HKD depreciates. By running a short risk position in HKD, the AI can protect its capital adequacy ratio, although the risk position would lead to a loss if HKD were to appreciate. The AI is allowed to protect its capital adequacy ratio in this way and exclude certain currency risk positions from the calculation of net open currency risk positions, subject to meeting each of the following conditions:

The risk position is taken or maintained for the purpose of hedging partially or totally against the potential that changes in exchange rates could have an adverse effect on its capital ratio.

The risk position is of a structural (i.e. non-dealing) nature such as positions stemming from:

– investments in affiliated but not consolidated entities denominated in foreign currencies; or

– investments in consolidated subsidiaries or branches denominated in foreign currencies.

The exclusion is limited to the amount of the risk position that neutralises the sensitivity of the capital ratio to movements in exchange rates.

The exclusion from the calculation is made for at least six months.

The establishment of a structural FX position and any changes in its position should follow the AI’s risk management policy for structural FX positions. This policy should be pre-approved by the HKMA.

Any exclusion of the risk position needs to be applied consistently, with the exclusionary treatment of the hedge remaining in place for the life of the assets or other items.

The AI should document and have available for supervisory review the positions and amounts to be excluded from market risk capital charges.

10 No FX risk capital charge need apply to positions related to items that are deducted from an AI’s capital when calculating its capital base.

11 Holdings of capital instruments that are deducted from an AI’s capital or risk- weighted at 1,250% are not allowed to be included in the market risk framework.

This includes:

holdings of the AI’s own eligible regulatory capital instruments; and

holdings of other AIs’, securities firms’ and other financial entities’ eligible regulatory capital instruments, as well as intangible assets, where the HKMA requires that such assets are deducted from capital.

12 As usual, for the purposes of calculating the capital adequacy ratio of an AI that has one or more than one subsidiary, the HKMA may require the capital adequacy ratio of the AI to be calculated:

on an unconsolidated basis in respect of the AI;

on a consolidated basis in respect of the AI and one or more of such subsidiaries;

or

on an unconsolidated basis in respect of the AI and on a consolidated basis in respect of the AI and one or more of such subsidiaries.

13 An AI should include the net short and net long risk positions, no matter where they are booked. However, there will be circumstances in which the HKMA may demand that the individual risk positions be taken into the measurement system without any offsetting or netting against other risk positions. This may be needed, for example, where there are obstacles to the quick repatriation of profits from a foreign subsidiary or where there are legal and procedural difficulties in carrying out the timely management of risks on a consolidated basis.

4 Approaches to Calculation of Market Risk

14 For the purpose of determining the risk-weighted amount for market risk, all locally incorporated AIs will be required to calculate the market risk capital charge in accordance with the new market risk standards, except for locally incorporated AIs mentioned in paragraph 16. AIs may choose to calculate the market risk capital charge under the Standardised Approach, subject to approval the Internal Models Approach or the Simplified Standardised Approach.

15 All AIs, except for those that are allowed to use the Simplified Standardised Approach as set out in section V or qualify for the de-minimis exemption as set out in paragraph 16, should calculate the capital charges using the Standardised Approach.

AIs that have an HKMA approval to use the Internal Models Approach for market risk capital charges should also report the capital charges calculated as set out below.

An AI that uses the Internal Models Approach for any of its trading desks should also calculate the capital charge under the Standardised Approach for all instruments across all trading desks, regardless of whether those trading desks are eligible for the Internal Models Approach.

In addition, an AI that uses the Internal Models Approach for any of its trading desks should calculate the Standardised Approach capital charge for each trading desk that is eligible for the Internal Models Approach as if that trading desk were a standalone regulatory portfolio (i.e. with no offsetting across trading desks). This will serve as an indication of the fallback capital charge for those desks that fail the eligibility criteria for inclusion in the AI’s internal model as outlined in section IV.

16 The HKMA intends to continue allowing de-minimis exemptions for AIs with market risk positions permanently below (i) HKD 60 million and (ii) 6% of total assets in accordance with section 22 of the BCR. An AI that qualifies for the de-minimis exemption shall not include market risk in the calculation of its capital adequacy ratio.

17 The HKMA will incorporate the new standards into the BCR either through an amendment of Part 8 of the BCR or by replacing Part 8 with a new Part. The revised framework will also necessitate some consequential changes to other Parts of the BCR. Where appropriate, technical provisions may be set out in a new Code of Practice to be issued under section 97M of the Banking Ordinance.

5 Implementation Timeline

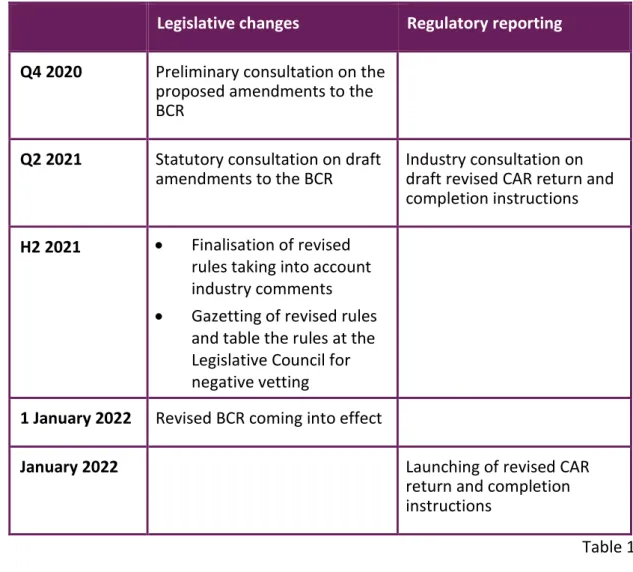

18 The HKMA intends to implement the new standards by 1 January 2022, in line with the BCBS timeline.Locally incorporated AIs would be required to start regulatory reporting based on the new standards starting from 1 January 2022. The first regulatory reporting date would be 31 January 2022.

甲、 Legislative changes Regulatory reporting Q4 2020 Preliminary consultation on the

proposed amendments to the BCR

Q2 2021 Statutory consultation on draft amendments to the BCR

Industry consultation on draft revised CAR return and completion instructions H2 2021 Finalisation of revised

rules taking into account industry comments

Gazetting of revised rules and table the rules at the Legislative Council for negative vetting

1 January 2022 Revised BCR coming into effect

January 2022 Launching of revised CAR

return and completion instructions

Table 1 19 As the revised market risk capital framework in effect represents a significant overhaul of the current market risk capital framework, it is likely to have impacts on, among other things, the capital charges, systems, data and resources of AIs, particularly for those with material market risk exposures. All relevant AIs are therefore strongly recommended to consider the implications of implementation for

their institutions, and start preparing for the local implementation of the revised framework in 2019.

6 Application and Approval Process

20 AIs planning to adopt the Internal Models Approach with effect from 1 January 2022 should start discussing their implementation plans with their usual supervisory contact at the HKMA by December 2019, and inform the HKMA of such plans in writing by 31 March 2020. An implementation plan should at least include an outline of key characteristics of the internal models and clearly state the intended implementation timeline, the proposed trading desk structure and the market risk exposures intended to be covered. We will provide the industry with more details regarding the application and/or validation procedures for use of the Internal Models Approach at a later stage.

21 AIs planning to adopt the Simplified Standardised Approach with effect from 1 January 2022 should submit a written application to their usual supervisory contact at the HKMA by 31 December 2020. The AIs are expected to fulfil all of the eligibility criteria as set out in paragraph 428 on an ongoing basis. The HKMA will notify individual AIs by 29 January 2021 whether they are considered eligible to use the Simplified Standardised Approach.

22 AIs planning to adopt the FX base currency approach under the Standardised Approach with effect from 1 January 2022 (this is also applicable to AIs planning to adopt the Internal Models Approach) should submit a written application to their usual supervisory contact at the HKMA by 31 March 2021. The AIs should demonstrate to the satisfaction of the HKMA that they can fulfil the requirements as set out in paragraphs 113 to 118.

II BOUNDARY BETWEEN BOOKS

7 Scope of the Trading Book

23 A trading book consists of all instruments that meet the specifications for trading book instruments set out in paragraphs 24 to 35. All other instruments should be included in the banking book.

24 Instruments comprise financial instruments, foreign exchange (FX), and commodities.

A financial instrument is any contract that gives rise to both a financial asset of one entity and a financial liability or equity instrument of another entity. Financial instruments include both primary financial instruments (or cash instruments) and derivative financial instruments. A financial asset is any asset that is cash, the right to receive cash or another financial asset or a commodity, or an equity instrument. A financial liability is the contractual obligation to deliver cash or another financial asset or a commodity. Commodities also include non-tangible (i.e. non-physical) goods such as electric power.

25 An AI should only include a financial instrument, instruments on FX or commodity in the trading book when there is no legal impediment against selling or fully hedging it.

26 An AI should fair value daily any trading book instrument and recognise any valuation change in the profit and loss (P&L) account.

7.1 Standards for Assigning Instruments to the Regulatory Books

27 When an AI holds any instrument for one or more of the following purposes, the AI should designate it as a trading book instrument upon initial recognition on its books, unless specifically otherwise provided for in paragraph 25 or paragraph 30:

short-term resale;

profiting from short-term price movements;

locking in arbitrage profits; or

hedging risks that arise from instruments meeting the criteria above.

28 Any of the following instruments is seen as being held for at least one of the purposes listed in paragraph 27 and should therefore be included in the trading book, unless specifically otherwise provided for in paragraph 25 or paragraph 30:

instruments in the correlation trading portfolio;4

instruments that would give rise to a net short credit or equity position in the banking book;5 or

instruments resulting from underwriting commitments, where underwriting commitments refer only to securities underwriting, and relate only to securities that are expected to be actually purchased by an AI on the settlement date.

29 Any instrument which is not held for any of the purposes listed in paragraph 27 at inception, nor seen as being held for these purposes according to paragraph 28, should be assigned to the banking book.

30 An AI should assign the following instruments to the banking book:

unlisted equities;

instruments designated for securitisation warehousing;

real estate holdings, where in the context of assigning instrument to the trading book, real estate holdings relate only to direct holdings of real estate as well as derivatives on direct holdings;

retail and small or medium-sized enterprise (SME) credit;

equity investments in a fund, unless the AI meets at least one of the following conditions:

– the AI is able to look through the fund to its individual components and there is sufficient and frequent information, verified by an independent third party, provided to the AI regarding the fund’s composition; or

– the AI obtains daily price quotes for the fund and it has access to the information contained in the fund’s mandate or in the national regulations governing such investment funds;

hedge funds;

derivative instruments and funds that have the above instrument types as underlying assets; or

instruments held for the purpose of hedging a particular risk of a position in the types of instrument above.

31 There is a general presumption that any of the following instruments are being held for at least one of the purposes listed in paragraph 27 and therefore are trading book instruments, unless specifically otherwise provided for in paragraph 25 or paragraph 30:

4 The term “correlation trading portfolio” has the same meaning as defined in section 281 of the BCR.

5 An AI will have a net short risk position for equity risk or credit risk in the banking book if the present value of the banking book increases when an equity price decreases or when a credit spread on an issuer or group of issuers of debt increases.

instruments held as accounting trading assets or liabilities;6

instruments resulting from market-making activities;

equity investments in a fund excluding those assigned to the banking book in accordance with paragraph 30;

listed equities;7

trading-related repo-style transaction;8 or

options including embedded derivatives9 from instruments that the institution issued out of its own banking book and that relate to credit or equity risk.

32 An AI is allowed to deviate from the presumptive list specified in paragraph 31 according to the process set out below.

If an AI believes that it needs to deviate from the presumptive list established in paragraph 31 for an instrument, it should submit a request to the HKMA and receive explicit approval. In its request, the AI should provide evidence that the instrument is not held for any of the purposes in paragraph 27.

In cases where this approval is not given by the HKMA, an AI should designate the instrument as a trading book instrument. The AI should document any deviations from the presumptive list in detail on an ongoing basis.

7.2 Supervisory Powers

33 Notwithstanding the process established in paragraph 32 for instruments on the presumptive list, the HKMA may require an AI to provide evidence that an instrument in the trading book is held for at least one of the purposes of paragraph 27. If the HKMA is of the view that the AI has not provided enough evidence or if the HKMA believes the instrument customarily would belong in the

6 Under HKAS 39, these instruments would be designated as held for trading. Under HKFRS 9, these instruments would be held within a trading business model. These instruments would be fair valued through the P&L account.

7 Subject to the HKMA’s review, certain listed equities may be excluded from the market risk framework. Examples of equities that may be excluded include, but are not limited to, equity positions arising from deferred compensation plans, convertible debt securities, loan products with interest paid in the form of “equity kickers”, equities taken as a debt previously contracted, bank-owned life insurance products, and legislated programmes. The set of listed equities that an AI wishes to exclude from the market risk framework should be made available to, and discussed with, the HKMA and should be managed by a desk that is separate from desks for proprietary or short-term buy/sell instruments.

8 Repo-style transactions that are (i) entered for liquidity management and (ii) valued at accrual for accounting purposes are not part of the presumptive list of paragraph 31.

9 An embedded derivative is a component of a hybrid contract that includes a non-derivative host such as liabilities issued out of an AI’s own banking book that contain embedded derivatives. The embedded derivative associated with the issued instrument (i.e. host) should be bifurcated and separately recognised on the AI’s balance sheet for accounting purposes.

banking book, the HKMA may require the AI to assign the instrument to the banking book, except if it is an instrument listed under paragraph 28.

34 The HKMA may require an AI to provide evidence that an instrument in the banking book is not held for any of the purposes of paragraph 27. If the HKMA is of the view that the AI has not provided enough evidence, or if the HKMA believes such instruments would customarily belong in the trading book, the HKMA may require the AI to assign the instrument to the trading book, except if it is an instrument listed under paragraph 30.

7.3 Documentation of Instrument Designation

35 An AI should have clearly defined policies, procedures and documented practices for determining which instruments to include in or to exclude from the trading book for the purposes of calculating their regulatory capital, ensuring compliance with the criteria set forth in this subsection, and taking into account an AI’s risk management capabilities and practices. The AI’s internal control functions should conduct an ongoing evaluation of instruments both in and out of the trading book to assess whether its instruments are being properly designated initially as trading or non-trading instruments in the context of the AI’s trading activities. Compliance with the policies and procedures should be fully documented and subject to periodic (at least yearly) internal audit and the results should be available for the HKMA to review.

7.4 Restrictions on Moving Instruments between the Regulatory Books

36 Apart from moves required by subsection 7.1, there is a strict limit on the ability of an AI to move instruments between the trading book and the banking book by their own discretion after initial designation, which is subject to the process in paragraphs 37 and 38. Switching instruments for regulatory arbitrage is strictly prohibited. In practice, switching should be rare and will be allowed by the HKMA only in extraordinary circumstances. Examples are a major publicly announced event, such as an AI restructuring that results in the permanent closure of trading desks, requiring termination of the business activity applicable to the instrument or portfolio or a change in accounting standards that allows an item to be fair-valued through P&L. Market events, changes in the liquidity of a financial instrument, or a change of trading intent alone are not valid reasons for reassigning an instrument to a different book. When switching positions, the AI should ensure that the standards described in subsection 7.1 are always strictly observed.

37 Without exception, a capital benefit as a result of switching will not be allowed in any case or circumstance. This means that an AI should determine its total capital charge (across the banking book and trading book) before and immediately after the switch. If this capital charge is reduced as a result of this switch, the difference as measured at the time of the switch will be imposed on the AI as a disclosed Pillar 1 capital surcharge. This surcharge will be allowed to run off as the positions mature or expire, in a manner agreed with the HKMA. To maintain operational simplicity, it is not envisaged that this additional capital charge would be recalculated on an ongoing basis, although the positions would continue to also be subject to the ongoing capital charges of the book into which they have been switched.

38 Any reassignment between books should be approved by senior management and the HKMA as follows. Any reallocation of securities between the trading book and banking book, including outright sales at arm’s length, should be considered a reassignment of securities and is governed by requirements of this paragraph.

Any reassignment should be approved by senior management; thoroughly documented; determined by internal review to be in compliance with an AI’s policies; subject to prior approval by the HKMA based on supporting documentation provided by the AI; and publicly disclosed.

Unless required by changes in the characteristics of a position, any such reassignment is irrevocable.

If an instrument is reclassified to be an accounting trading asset or liability there is a presumption that this instrument is in the trading book, as described in paragraph 31. Accordingly, in this case an automatic switch without approval of the HKMA is acceptable.

39 An AI should adopt relevant policies that are updated at least yearly. Updates should be based on an analysis of all extraordinary events identified during the previous year. Updated policies with changes highlighted should be sent to the HKMA. Policies should include the following:

The reassignment restriction requirements in paragraphs 36 to 38, especially the restriction that re-designation between the trading book and banking book may only be allowed in extraordinary circumstances, and a description of the circumstances or criteria where such a switch may be considered.

The process for obtaining senior management and supervisory approval for such a transfer.

How the AI identifies an extraordinary event.

A requirement that re-assignments into or out of the trading book be publicly disclosed at the earliest reporting date.

8 Treatment of Internal Risk Transfers

40 An internal risk transfer is an internal written record of a transfer of risk within the banking book, between the banking and the trading book or within the trading book (between different desks).

41 There will be no regulatory capital recognition for internal risk transfers from the trading book to the banking book. Thus, if an AI engages in an internal risk transfer from the trading book to the banking book (e.g. for economic reasons) this internal risk transfer would not be taken into account when the regulatory capital charges are determined.

42 For internal risk transfers from the banking book to the trading book, subsections 8.1 and 8.2 apply.

8.1 Internal Risk Transfer of Credit and Equity Risk

43 When an AI hedges a banking book credit risk exposure or equity risk exposure using a hedging instrument purchased through its trading book (i.e. using an internal risk transfer),

The credit exposure in the banking book is deemed to be hedged for capital charge purposes if and only if:

– the trading book enters into an external hedge with an eligible third-party protection provider that exactly matches the internal risk transfer; and – the external hedge meets the requirements in section 99 of the BCR.10

The equity exposure in the banking book is deemed to be hedged for capital charge purposes if and only if:

– the trading book enters into an external hedge from an eligible third-party protection provider that exactly matches the internal risk transfer; and – the external hedge is recognised as a hedge of a banking book equity

exposure.

External hedges for the purposes of this paragraph can be made up of multiple transactions with multiple counterparties as long as the aggregate external hedge exactly matches the internal risk transfer, and the internal risk transfer exactly matches the aggregate external hedge.

10 With respect to section 99 of the BCR, the cap of 60% on a credit derivative without a restructuring obligation only applies with regard to recognition of credit risk mitigation of the banking book instrument for regulatory capital purposes and not with regard to the amount of the internal risk transfer.

44 Where the requirements in paragraph 43 are fulfilled, the banking book exposure is deemed to be hedged by the banking book leg of the internal risk transfer for capital purposes in the banking book. Moreover both the trading book leg of the internal risk transfer and the external hedge should be included in the market risk capital charges.

45 Where the requirements in paragraph 43 are not fulfilled, the banking book exposure is not deemed to be hedged by the banking book leg of the internal risk transfer for capital purposes in the banking book. Moreover, the third-party external hedge should be fully included in the market risk capital charges and the trading book leg of the internal risk transfer should be fully excluded from the market risk capital charges.

46 A banking book short credit position or a banking book short equity position created by an internal risk transfer11 and not capitalised under banking book rules should be capitalised under the market risk rules together with the trading book exposure.

8.2 Internal Risk Transfer of General Interest Rate Risk

47 When an AI hedges a banking book interest rate risk exposure using an internal risk transfer with its trading book, the trading book leg of the internal risk transfer is treated as a trading book instrument under the market risk framework if and only if:

the internal risk transfer is documented with respect to the banking book interest rate risk being hedged and the sources of such risk;

the internal risk transfer is conducted with a dedicated internal risk transfer trading desk which has been specifically approved by the HKMA for this purpose;

and

the internal risk transfer should be subject to trading book capital charges under the market risk framework on a stand-alone basis for the dedicated internal risk transfer desk, separate from any other GIRR or other market risks generated by activities in the trading book.

48 Where the requirements in paragraph 47 are fulfilled, the banking book leg of the internal risk transfer should be included in the banking book’s measure of interest rate risk exposures for regulatory capital purposes.

49 The approved internal risk transfer desk may include instruments purchased from the market (i.e. external parties to an AI). Such transactions may be executed directly

11 Banking book instruments that are over-hedged by their respective documented internal risk transfer create a short (risk) position in the banking book.

between the internal risk transfer desk and the market. Alternatively, the internal risk transfer desk may obtain the external hedge from the market via a separate non-internal risk transfer trading desk acting as an agent, if and only if the GIRR internal risk transfer entered into with the non-internal risk transfer trading desk exactly matches the external hedge from the market. In this latter case the respective legs of the GIRR internal risk transfer are included in the internal risk transfer desk and the non-internal risk transfer desk.

8.3 Internal Risk Transfers between Trading Desks

50 Internal risk transfers between trading desks within the scope of application of the market risk capital charges (including FX risk and commodities risk in the banking book) will generally receive regulatory capital recognition. Internal risk transfers between the internal risk transfer desk and other trading desks will only receive regulatory capital recognition if the constraints in subsection 8.2 are fulfilled.

51 The trading book leg of internal risk transfers should fulfil the same requirements under section II as instruments in the trading book transacted with external counterparties.

8.4 Eligible Hedges for the CVA Capital Charge

52 Eligible external hedges that are included in the credit valuation adjustment (CVA) capital charge should be removed from an AI’s market risk capital charge calculation.

53 An AI may enter into internal risk transfers between the CVA portfolio and the trading book. Such an internal risk transfer consists of a CVA portfolio side and a non-CVA portfolio side. Where the CVA portfolio side of an internal risk transfer is recognised in the CVA risk capital charge, the CVA portfolio side should be excluded from the market risk capital charge, while the non-CVA portfolio side should be included in the market risk capital charge.

54 In any case, such internal CVA risk transfers can only receive regulatory capital recognition if the internal risk transfer is documented with respect to the CVA risk being hedged and the sources of such risk.

55 Internal CVA risk transfers that are subject to curvature, default risk or residual risk add-on as set out in section III may be recognised in the CVA portfolio capital charge and market risk capital charge only if the trading book additionally enters into an external hedge with an eligible third-party protection provider that exactly matches the internal risk transfer.

56 Independent from the treatment in the CVA risk capital charge and the market risk capital charge, internal risk transfers between the CVA portfolio and the trading book can be used to hedge the counterparty credit risk exposure of a derivative instrument in the trading or banking book as long as the requirements of paragraph 43 are met.

9 Definition of Trading Desks

57 For the purposes of market risk capital calculations, a trading desk is the level at which model approval is granted for the Internal Models Approach and is defined as a group of traders or trading accounts that implements a well-defined business strategy operating within a clear risk management structure.

58 Trading desks are defined by the AI but subject to the regulatory approval of the HKMA for regulatory capital purposes under the Internal Models Approach.

59 The HKMA will consider the definition of the trading desk as part of the initial model approval for the trading desk, as well as ongoing approval.

The HKMA shall determine, based on the size of the AI’s overall trading operations, whether the proposed trading desk definitions are sufficiently granular.

The HKMA shall review the policy document prepared by the AI documenting how the proposed definition of trading desk meets the criteria listed in this subsection.

60 An AI may further define operational subdesks for internal operational purposes without the HKMA approval.

61 A trading desk for regulatory capital purpose is an unambiguously defined group of traders or trading accounts12.

The trading desk should have one head trader who has direct oversight of the group of traders or trading accounts. The trading desk can have up to two head traders provided their roles, responsibilities and authorities are either clearly separated or one has ultimate oversight over the other.

Each trader or each trading account in the trading desk should have a clearly defined specialty (or specialities).

Each trading account should only be assigned to a single trading desk that has a clearly defined risk scope (e.g. permitted risk class and risk factors) consistent with its pre-established objectives.

There is a presumption that traders (as well as head traders) are allocated to one trading desk. An AI can deviate from this presumption provided it can be justified to the HKMA on the basis of sound management, business and/or resource allocation reasons. Such assignments should not be made for the only

12 A trading account is an indisputable and unambiguous unit of observation in accounting for trading activity.

purpose of avoiding other trading desk requirements (e.g. to optimise the likelihood of success in the backtesting and profit and loss attribution tests).

The trading desk should have a clear reporting line to the senior management, and should have a clear and formal compensation policy clearly linked to the pre-established objectives of the trading desk.

62 A trading desk should have a well-defined and documented business strategy.

There should be a clear description of the economics of the business strategy for the trading desk, its primary activities and trading/hedging strategies.

The management team at the trading desk should have a clear annual plan for the budgeting and staffing of the trading desk.

The documented business strategy of a trading desk should include regular management information reports, covering revenue, costs and risk-weighted assets for the trading desk.

63 A trading desk should have a clear risk management structure.

The AI should identify key groups and personnel responsible for overseeing the risk-taking activities at the trading desk.

A trading desk should clearly define trading limits (e.g. sensitivity or notional limits) based on the business strategy of the trading desk and these limits should be reviewed at least annually by senior management of the AI. In setting limits, the trading desk should have well-defined trader mandates.

A trading desk should produce, at least weekly, appropriate risk management reports. This would include, at a minimum:

– profit and loss reports, which would be periodically reviewed, validated and modified (if necessary) by Product Control; and

– internal and regulatory risk measure reports, including trading desk value-at-risk (VaR) / expected shortfall (ES), trading desk VaR/ES sensitivities to risk factors and backtesting.

64 The AI should prepare, evaluate, and have available for the HKMA the following for all trading desks:

inventory ageing reports;

daily limit reports including exposures, limit breaches, and follow-up action;

reports on intraday limits and respective utilisation and breaches for AIs with active intraday trading; and

reports on the assessment of market liquidity.

65 Any foreign exchange or commodity positions held in the banking book should be included in the market risk capital charge as set out in paragraph 7. For regulatory capital calculation purposes, these positions will be treated as if they were held on notional trading desks within the trading book.

III STANDARDISED APPROACH

10 Structure

66 An AI should calculate and report the capital charges under the Standardised Approach to the HKMA on a monthly basis, except for AIs that qualifies for the de-minimis exemption mentioned in paragraph 16 or, subject to approval of the HKMA, uses the Simplified Standardised Approach.

67 An AI should also determine its regulatory capital charge for market risk according to the Standardised Approach at any time at the demand of the HKMA.

68 An AI should calculate the capital charge for market risk with the Standardised Approach for all its trading book positions and the foreign exchange and commodity risks from its banking book positions as the sum of the following three components, as well as any capital surcharge specified elsewhere in the framework:

Sensitivities-based method (SBM) allows the use of sensitivities to capture delta, vega and curvature risks within a prescribed set of risk classes. The SBM entails expanding the use of sensitivities across the Standardised Approach;

Residual risk add-on (RRAO) is introduced to capture any other risks beyond the main risk factors already captured in the sensitivities-based method and the default risk charge. It provides for a simple and conservative capital treatment for the universe of more sophisticated instruments; and

Standardised default risk charge (SA-DRC) is intended to capture jump-to-default risk for equity and credit instruments.

Capital charge under the sensitivities-based method (SBM) for delta, vega and curvature risk factor sensitivities within a prescribed set of risk classes:

General interest rate risk;

Credit spread risk for non-securitisation;

Credit spread risk for securitisations

(non-correlation trading portfolio);

Credit spread risk for securitisations (correlation trading portfolio);

Foreign exchange risk;

Equity risk; and

Commodity risk.

Total capital charge under Standardised Approach for market risk

Capital charge for standardised default risk (DRC) for prescribed risk classes:

Standardised default risk charge for

non-securitisation;

Standardised default risk charge for securitisations (non-correlation trading portfolio); and

Standardised default risk charge for securitisations (correlation trading portfolio).

Capital charge for residual risk add-on (RRAO):

Risk weights applied to notional amounts of instruments with

an exotic underlying;

and/or

bearing other residual risks.

SBM RRAO SA-DRC

11 Sensitivities-based Method (SBM)

11.1 Main Definitions

69 Risk class means one of the following seven risk classes for the sensitivities-based method: (i) general interest rate risk, (ii) credit spread risk for non-securitisation, (iii) credit spread risk for securitisations13 (non-correlation trading portfolio), (iv) credit spread risk for securitisations (correlation trading portfolio), (v) equity risk, (vi) commodity risk and (vii) foreign exchange risk.

70 Risk factor means a variable, e.g. a tenor of an interest rate curve or an equity price, that affects the value of an instrument falling within the scope of the risk factor definitions in subsection 12. Risk factors are mapped to a risk class.

71 Risk position is the main input that enters the risk charge computation. For delta and vega risks, it is a sensitivity to a risk factor. For curvature risk, it is based on the worse of upward and downward stress scenarios.

72 Bucket means a set of risk factors within one risk class which are grouped together by common characteristics, as defined in paragraphs 141, 148, 154, 157, 163 and 174.

73 Risk charge is the amount of capital that an AI should hold as a consequence of the risks it takes; it is computed as an aggregation of risk positions first at the bucket level, and then across buckets within a risk class defined for the sensitivities-based method.

11.2 Components of the SBM

74 An AI should calculate the risk charge for market risk under the sensitivities-based method by aggregating the following risk measures:

Delta risk which captures the risk of changes in the market value of an AI’s position due to movements in its non-volatility linear risk factors, as defined in paragraphs 85, 95, 99, 103, 106, 109, 112 and 113;

Vega risk which captures the risk of changes in the market value of an AI’s position due to movements in its volatility linear risk factors, as defined in paragraphs 92, 96, 100, 104, 107, 110 and 115; and

13 The term “securitisation” has the same meaning of “securitization exposure” as defined in section 2(1) of the BCR.

Curvature risk which captures the risk of changes in the market value of an AI’s position due to movements in its non-volatility risk factors not captured by the delta risk, as defined in paragraphs 93, 97, 101, 105, 108, 111, 116 and 117.

Curvature risk is based on two stress scenarios involving an upward and a downward shock to a given risk factor.

75 The above three risk measures specify risk weights to be applied to the regulatory risk factor sensitivities. To calculate the overall capital charge, the risk-weighted sensitivities are aggregated using specified correlation parameters to recognise diversification benefits between risk factors. In order to address the risk that correlations may increase or decrease in periods of financial stress, three risk charge figures should be calculated for each risk class defined under the sensitivities-based method (see paragraphs 83 to 84 for details), based on three different scenarios on the specified values for the correlation parameter 𝜌𝑘𝑙 (i.e. correlation between risk factors within a bucket) and 𝛾𝑏𝑐 (i.e. correlation between risk factors across buckets within a risk class). There should be no diversification benefit recognised between individual risk classes.

11.3 Instrument Prices and Sensitivity Calculation

76 In calculating the capital charge under the sensitivities-based method, an AI should determine each delta and vega sensitivity and curvature scenario based on instrument prices or pricing models that an independent risk control unit within the AI uses to report market risks or actual profits and losses to senior management.

77 A key assumption of the Standardised Approach for market risk is that an AI’s pricing model used in actual profit and loss reporting provides an appropriate basis for the determination of regulatory capital charges for all market risks. To ensure such adequacy, an AI should at minimum fulfil the requirements in section 4A of the BCR and the Supervisory Policy Manual (SPM) Module CA-S-10 “Financial Instrument Fair Value Practices”.

11.4 Instruments Subject to Delta, Vega and Curvature

78 All instruments held in trading desks and subject to the sensitivities-based method (i.e. excluding instruments where the value at any point in time is purely driven by an exotic underlying as set out in subsection 16), are subject to delta risk capital charge.

Additionally:

An instrument with optionality, or with non-zero vega sensitivities14 is subject to risk charges for vega risk and curvature risk;

An instrument with an embedded prepayment option15 is an instrument with optionality. Accordingly, the embedded option is subject to risk charges for vega and curvature risk with respect to the interest rate risk and credit spread risk (non-securitisation and securitisation) risk classes. When the prepayment option is a behavioural option, the instrument may also be subject to the residual risk add-on as per paragraph 198. The pricing model of the AI should reflect such behavioural patterns where relevant. Instruments in the securitised portfolio may have embedded prepayment options as well. In this case they may be subject to the residual risk add-on;

Instruments whose cash flows cannot be written as a linear function of underlying notional are subject to vega risk and curvature risk charges. For example, the cash flows generated by a plain-vanilla option cannot be written as a linear function (as they are the maximum of the spot and the strike).

Therefore all options are subject to vega risk and curvature risk. Instruments whose cash flows generated by a coupon-bearing bond can be written as a linear function, are not subject to vega risk nor curvature risk charges.

Curvature risks may be calculated for all instruments subject to delta risk, not limited to those subject to vega risk as specified above. For example, where an AI manages the non-linear risk of instruments with optionality and other instruments holistically, the AI may choose to include instruments without optionality in the calculation of curvature risk. This treatment is allowed subject to the following restrictions: (i) use of this approach shall be applied consistently through time; and (ii) curvature risk should be calculated for all instruments subject to the sensitivities-based method.

11.5 Delta and Vega Risks

79 An AI should apply the delta and vega risk factors defined in subsection 12 to calculate the risk charge for delta and vega risks.

80 For each risk class, an AI should determine its instruments’ sensitivity to a set of prescribed risk factors, risk-weight those sensitivities, and aggregate the resulting

14 There are some instruments that are not options, but are still subject to risk charges for vega risk and curvature risk. For example, convexity adjustments on constant maturity swaps (CMS) can generate significant vega risk, which are subject to vega and curvature risk charges.

15 An instrument with a prepayment option is a debt instrument which grants the debtor the right to repay part or the entire principal amount before the contractual maturity without having to compensate for any foregone interest. The debtor can exercise this option with a financial gain by obtaining funding over the remaining maturity of the instrument at a lower rate in other ways in the market.

risk-weighted sensitivities separately for delta and vega risk using the following step-by-step approach.

Step 1: For each risk factor, a sensitivity is determined as set out in subsection 12.

Step 2: Sensitivities to the same risk factor should be netted to give a net sensitivity 𝑠𝑘 across all instruments in the portfolio to each risk factor k. In calculating the net sensitivity, all sensitivities to the same given risk factor (e.g. all sensitivities to the 1-year tenor point of the HKD 3-month swap curve) from instruments of opposite direction should offset, irrespective of the instrument from which they derive.

Step 3: The risk-weighted sensitivity 𝑊𝑆𝑘 is the product of the net sensitivity 𝑠𝑘 and the corresponding risk weight 𝑅𝑊𝑘 as defined in subsections 13 and 14.

𝑊𝑆𝑘= 𝑅𝑊𝑘𝑠𝑘

Step 4: Within bucket aggregation: The risk position for delta (respectively vega) bucket 𝑏, 𝐾𝑏, should be determined by aggregating the weighted sensitivities to risk factors within the same bucket using the corresponding prescribed correlation 𝜌𝑘𝑙 set out in the following formula:

𝐾𝑏 = √𝑚𝑎𝑥 (∑ 𝑊𝑆𝑘2

𝑘

+ ∑ ∑ 𝜌𝑘𝑙𝑊𝑆𝑘

𝑙≠𝑘

𝑊𝑆𝑙

𝑘

, 0)

Step 5: Across bucket aggregation: The delta (respectively vega) risk charge is determined from risk positions aggregated between the delta (respectively vega) buckets within each risk class, using the corresponding prescribed correlations 𝛾𝑏𝑐 as set out in the following formula:

Delta (respectively vega) = √∑ 𝐾𝑏2+

𝑏

∑ ∑ 𝛾𝑏𝑐

𝑐≠𝑏

𝑆𝑏𝑆𝑐

𝑏

where Sb= ∑ WSk kfor all risk factors in bucket b and Sc= ∑ WSk kin bucket c.

If these values for Sb and Sc produce a negative number for the overall sum of

∑ 𝐾𝑏 𝑏2+ ∑ ∑𝑏 𝑐≠𝑏𝛾𝑏𝑐𝑆𝑏𝑆𝑐, an AI should calculate the delta (respectively vega) risk capital charge using an alternative specification whereby Sb = max [min (∑ WSk k,Kb), − Kb] for all risk factors in bucket b and Sc = max [min (∑ WSk k,Kc), − Kc] for all risk factors in bucket c.

11.6 Curvature Risk

81 An AI should apply two stress scenarios on given risk factors which are defined in subsection 12 to calculate the risk charge for curvature risk. The two stress scenarios are to be computed per risk factor (an upward and a downward shock) with the delta effect being removed. They are shocked by risk weights and the worst loss is aggregated by correlations provided in subsection 15.

82 An AI should apply the following step-by-step approach to each risk class separately to capture curvature risk:

Step 1: For each instrument sensitive to curvature risk factor k, an upward shock and a downward shock should be applied to k. For example for GIRR, all tenors of all the curves within a given currency (e.g. HKD 1-month swap curve, HKD 3-month swap curve) should be shifted upward. The potential loss, after deduction of the delta risk positions, is the outcome of the upward scenario (𝐶𝑉𝑅𝑘+). The same approach should be followed on a downward scenario (𝐶𝑉𝑅𝑘−). If the price of an option depends on several risk factors, the curvature risk is determined separately for each risk factor.

Step 2: The net curvature risk capital charge, determined by the values of 𝐶𝑉𝑅𝑘+ and 𝐶𝑉𝑅𝑘− for risk factor k is calculated as follows.

𝐶𝑉𝑅𝑘+ = − ∑ {𝑉𝑖(𝑥𝑘𝑅𝑊(𝐶𝑢𝑟𝑣𝑎𝑡𝑢𝑟𝑒)+) − 𝑉(𝑥𝑘) − 𝑅𝑊𝑘𝐶𝑢𝑟𝑣𝑎𝑡𝑢𝑟𝑒∙ 𝑠𝑖𝑘}

𝑖

𝐶𝑉𝑅𝑘− = − ∑ {𝑉𝑖(𝑥𝑘𝑅𝑊(𝐶𝑢𝑟𝑣𝑎𝑡𝑢𝑟𝑒)−) − 𝑉(𝑥𝑘) + 𝑅𝑊𝑘𝐶𝑢𝑟𝑣𝑎𝑡𝑢𝑟𝑒∙ 𝑠𝑖𝑘}

𝑖

This calculates the aggregate incremental loss beyond the delta capital charge for the prescribed shocks, where:

i is an instrument subject to curvature risks associated with risk factor k;

𝑥𝑘 is the current level of risk factor k;

𝑉𝑖(𝑥𝑘) is the price of instrument i depending on the current level of risk factor k;

𝑉𝑖(𝑥𝑘(𝑅𝑊

(𝑐𝑢𝑟𝑣𝑎𝑡𝑢𝑟𝑒)+)

) and 𝑉𝑖(𝑥𝑘(𝑅𝑊

(𝑐𝑢𝑟𝑣𝑎𝑡𝑢𝑟𝑒)−)

) both denote the price of instrument i after 𝑥𝑘 is shifted (i.e. “shocked”) upward and downward;

under the FX and Equity risk classes:

- 𝑅𝑊𝑘(𝑐𝑢𝑟𝑣𝑎𝑡𝑢𝑟𝑒)

is the risk weight for curvature risk factor k for instrument i determined in accordance with paragraph 191; and

- 𝑠𝑖𝑘 is the delta sensitivity of instrument i with respect to the delta risk factor that corresponds to curvature risk factor k.

under the general interest rate risk (GIRR), credit spread risk (CSR) and commodity risk classes:

- 𝑅𝑊𝑘(𝑐𝑢𝑟𝑣𝑎𝑡𝑢𝑟𝑒)

is the risk weight for curvature risk factor k for instrument i determined in accordance with paragraph 193; and

- 𝑠𝑖𝑘 is the sum of delta risk sensitivities to all tenors of the relevant curve(s) of instrument i with respect to curvature risk factor k.

Step 3: Within bucket aggregation: The curvature risk exposure should be aggregated within each bucket using the corresponding prescribed correlation 𝜌𝑘𝑙 as set out in the following formula:

𝐾𝑏 = max(𝐾𝑏+, 𝐾𝑏−)

𝑤ℎ𝑒𝑟𝑒 {

𝐾𝑏+ = √max (0, ∑ 𝑚𝑎𝑥(𝐶𝑉𝑅𝑘+, 0)2+ ∑ ∑ 𝜌𝑘𝑙𝐶𝑉𝑅𝑘+𝐶𝑉𝑅𝑙+𝜓(𝐶𝑉𝑅𝑘+, 𝐶𝑉𝑅𝑙+)

𝑙≠𝑘 𝑘 𝑘

)

𝐾𝑏− = √max (0, ∑ 𝑚𝑎𝑥(𝐶𝑉𝑅𝑘−, 0)2+ ∑ ∑ 𝜌𝑘𝑙𝐶𝑉𝑅𝑘−𝐶𝑉𝑅𝑙−𝜓(𝐶𝑉𝑅𝑘−, 𝐶𝑉𝑅𝑙−)

𝑙≠𝑘 𝑘 𝑘

)

where:

the bucket level capital charge (𝐾𝑏) is determined as the greater of the capital charge under the upward scenario (𝐾𝑏+) and the capital charge under the downward scenario (𝐾𝑏−). Notably, the selection of upward and downward scenarios is not necessarily the same across the high, medium and low correlations scenarios specified in paragraph 83.

- Where 𝐾𝑏=𝐾𝑏+, this shall be termed “selecting the upward scenario”.

- Where 𝐾𝑏=𝐾𝑏−, this shall be termed “selecting the downward scenario”.

- In the specific case where 𝐾𝑏+,= 𝐾𝑏−, if ∑ 𝐶𝑉𝑅𝑘 𝑘+ > ∑ 𝐶𝑉𝑅𝑘 𝑘−, it is deemed that the upward scenario is selected; otherwise the downward scenario is selected.

(𝐶𝑉𝑅𝑘 , 𝐶𝑉𝑅𝑙) takes the value 0 if 𝐶𝑉𝑅𝑘 and 𝐶𝑉𝑅𝑙 both have negative signs. In all other cases, (𝐶𝑉𝑅𝑘 , 𝐶𝑉𝑅𝑙) takes the value of 1.

Step 4: Across bucket aggregation: Curvature risk positions should then be aggregated across buckets within each risk class, using the corresponding prescribed correlation 𝛾𝑏𝑐.