行政院國家科學委員會專題研究計畫 成果報告

具收費彈性機制之網路品質管理

計畫類別: 個別型計畫

計畫編號: NSC92-2213-E-004-002-

執行期間: 92 年 08 月 01 日至 93 年 07 月 31 日

執行單位: 國立政治大學資訊科學系

計畫主持人: 蔡子傑

計畫參與人員: 林士發,吳明儒,周裕傑

報告類型: 精簡報告

處理方式: 本計畫可公開查詢

中 華 民 國 93 年 10 月 15 日

行政院國家科學委員會補助專題研究計畫成果報告

※※※※※※※※※※※※※※※※※※※※※※※※※

※ ※

※ 具收費彈性機制之網路品質管理 ※

※ ※

※※※※※※※※※※※※※※※※※※※※※※※※※

計畫類別:■個別型計畫 □整合型計畫

計畫編號:NSC 92-2213-E-004-002-

執行期間:

92 年 08 月 01 日至 93 年 07 月 31 日

計畫主持人: 蔡子傑

共同主持人: 無

本成果報告包括以下應繳交之附件:

□赴國外出差或研習心得報告一份

□赴大陸地區出差或研習心得報告一份

□出席國際學術會議心得報告及發表之論文各一份

□國際合作研究計畫國外研究報告書一份

執行單位:國立政治大學 資訊科學系

中 華 民 國

93 年 10 月 07 日

行政院國家科學委員會專題研究計畫成果報告

具收費彈性機制之網路品質管理

計畫編號:NSC 92-2213-E-004-002

執行期限:92 年 8 月 1 日至 93 年 7 月 31 日

主持人:蔡子傑 國立政治大學 資訊科學系

計畫參與人員:林士發、吳明儒、周裕傑 國立政治大學 資

訊科學系

一、中文摘要 利用經濟理論以及分析網路資源數量與價錢 的關係,提供網路供應者,可以依據目前網路壅塞 的情況,讓網路使用者可以彈性選擇個人化網路服 務等級,動態保證網路使用者的網路服務品質。透 過經濟效益分析,建構出定價策略來保障使用者最 大利益、供應者最大利益和社會最大福利。在差異 性服務環境下,我們不僅支援多種網路服務等級, 而且允許網路使用者動態選擇適當資源。實驗結果 顯示我們的定價方法,確實有效支援網路服務品 質,及增加網路供應者的利潤。 關鍵詞:經濟效益、使用者最大利益、供應者最大 利益、社會最大福利、服務品質、差異性服務 AbstractBy adopting an appropriate economics theory and analyzing a close connection between quantity and price , a service provider will be able to offer the necessary incentives for each customer to choose the service and price that perfectly matches his or her needs without wasting any resource. Our approach enables network service providers to react instantaneously to network congestions and provides customer with high flexibility in service class selection. Economic efficiency is well deployed in pricing strategies to maximize customers’ net benefit , provider’s surplus and efficiently allocate network resources. To design the differential pricing structures in our researches , we define a DiffServ-based architecture not only to support multiple QoS classes but also allow customers to make personal QoS class selection. However , it also brings about the question of how to provide sufficient quantity and adequate QoS to heterogeneous applications and in network market dynamically In this article , we outline these challenges and discuss pricing strategies.

Keywords: Customers’ net benefit, Economic Efficiency, Provider’s surplus, Social Welfare , QoS, DiffServ

二、緣由與目的、結果與討論

1. Introduction

For years , it has been clear that the integration of multiple services into a single network infrastructure

differentiation brings a clear need for incentives to be offered to encourage customers to choose the service that is most appropriate for their needs , thereby , discouraging over-allocation of resources . In commercial network ,resource allocation and congestion control can be most effectively achieved through pricing . Pricing has recently attracted significant attention for the purpose of achieving economic efficiency on the Internet . Many researchers have proposed distinct pricing scheme as an mechanism for managing both resource allocation and network congestion . In our pricing architecture , we are concerned for the production , sale and purchase of network resources that are in limited supply and for how customers and ISP interact in market for them .The purpose of our research is to investigate how pricing depends on the nature of competition and regulation , and whether the price is driven by competition of customer , the profit-maximizing of producer , or the social welfare maximization in the network market .

1.1. Economics Theory

Communication services , such as network resource and architecture are valuable economic products . The price for which they can be sold depend on factors of demand , supply and how the market operates . The key player in the market for communications services are suppliers , consumers , and regulators. The demand for a service is determined by the value users place on it and the price they are willing to pay to obtain it . The quantity of the service that is supplied in the market depend on the efficiency of their network operations . The nature of competition is among suppliers . How they interact with customers and how the market is regulated all have dependence of the price of network resources . One of the most important factor is competition . Competition is important because it tends to increases economic efficiency : that is , it increases the commercial value of the service that are produced and consumed in the economy . Moreover , the regulator can take account of welfare dimensions that suppliers and customers might be inclined to ignore . For example , a regulator might require that some essential network resource be available to everyone , no matter what their ability to pay . In summary , charging for network resources totally is a essential method to manage elaborate network perfectly . Our researches are to define valuable pricing strategies for our network market by adopting economics theory .

could be determined on per-hop basis. By using DiffServ , traffic is classified based on DSCP(differentiated service code point). Then the traffic is forwarded according to PHB mechanism defined by IETF. This approach allows applications with similar characteristics to be forwarded with the same traffic guarantees. That is an crucial feature because the current Internet is exactly a network of multiple service provider networks . DiffServ network allows for three main categories of service differentiation such as EF , AF and BE. The DSCP is mapped to the PHB and this technique allows providers to control what QoS class the customers purchase. In order to switch into different PHB, each time a packet entering a network domain would be remarked .

2. Economics Efficiency

An innovative pricing concept has come to our attentions that promise to significantly improve economic efficiency such as customers’ surplus , provider’s surplus and social welfare maximization . We use economic theory to analyze the relationship between demand and supply in DiffServ network in order to perform effective network resource allocation and meet customer’s application requirements. Theorems of economics can guarantee that demand and supply control dynamically movies the system to an equilibrant point where resources are used efficiently

2.1. The Customer’s Problem

Utility is actually an abstract concept rather than a concrete. Utility means the aggregate sum of satisfaction or benefit an consumer gains from consuming a given amount of goods or services in an economy . Although utility usually increases as more of a good is consumed, marginal utility usually decreases with each additional increase in the consumption of a good. This decrease demonstrates the law of diminishing marginal utility. Because there is a certain threshold of satisfaction, the consumer will no longer receive the same pleasure from consumption once that threshold is crossed. In other words, total utility will increase at a slower pace, as an individual increases the quantity consumed.

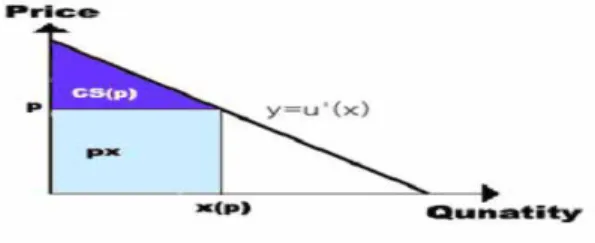

Fig.1. Net Benefit

The Fig1 shows that the customer has a utility u(x) for a quantity x of a service . In this figure , u(x) is increasing and concave . Given the price vector p , the consumer chooses to purchase the amount x=x(p) that maximizes his net benefit . Note that at x=x(p) we have δu(x)/δx = p

We can think of u(x) as the amount of money customer is willing to pay in pursuit of products and px means the money customer actually pays. The expression that is maximized is called the customer’s net benefit or consumer surplus. It presents the net benefit the consumer obtains as the utility of x minus the amount paid for x.

]

)

(

[

max

u

x

p

x

CS

i T x i=

−

The Fig2 shows that the demand curve for the case a single customer and a single good . The derivative of u(x) , denoted u’(x) , is downward sloping , here for simplicity shown as a straight line . The area under u’(x) between 0 and x(p) is u(x(p)) , and so subtracting px (the area of the shaded rectangle) gives the consumer surplus as the area of the shaded triangle

Fig.2. Consumer Surplus 2.2. The Supplierr’s Problem

Profit , or producer surplus , is the difference between the revenue that is obtained form selling these services , say r(y) , and the cost of production , say c(y) , Denote y=(y1,…,yk) the vector of quantities

of these services. A independent firm having the objective of profit maximization , seeks to solve the problem of maximizing the profit.

)] ( ) ( [ max r y c y PS i − =

An important simplification of the problem takes place in the case of linear prices , when r(y)=pTy for

some price vector p. Then the profit is imply a function of p, say PS(p) , as is also the optimizing y , say y(p) . Here y(p) is called the supply function , since it gives the quantities of the various services that the supplier will produce if the prices at which they can be sold is p

2.3. Welfare Maximization

Social welfare (social surplus) is defined as the sum of all consumer and producer surpluses . . We speak interchangeably of the goals of social welfare maximization ,social surplus maximization , or economic efficiency . The key idea is that , under certain assumptions about concavity and convexity of utility and cost functions , the social welfare can be maximized by setting an appropriate price and then allowing producers and consumers to choose their optimal level of production and consumption . This has the great advantage of maximizing social welfare in decentralized way. Suppliers and consumers see these prices and then optimally choose their level of production and demand . They do this on the basis of information they know . A supplier sets his level of production knowing only his own cost function .

∑

∈ − = N i i i x c x u S ( ) ( )The Fig3 shows that a simple illustration of the social welfare maximization problem for a single good . The maximum is achieved at the point where the customer’s aggregate demand curve u’ intersects the marginal cost curve c’.

We have the remarkable result that the social planner can maximize social surplus by setting an appropriate price vector p , In practice , it can be easier for him to control the dual variable p , rather than to control the primal variable x1 , … , xn . This

price control both production and consumption . Among this price vector , the consumers maximize their surpluses and producer maximizes his profit . Moreover , prices equal the supplier’s marginal cost and each consumer’s marginal utility at the solution point , We call these price marginal cost prices.

3. Pricing Strategies

To introduce our pricing strategies, we have several main parts to stress. We will introduce utility functions for customers and cost function for provider to construct our pricing model. Our pricing strategies include third-degree price discrimination and hybrid pricing. Third-degree price discrimination is one kind of flat pricing by charging customers the same prices for the same product. Hybrid pricing ,a brilliant pricing strategy , changes the price for personal customers in reaction to instantaneous network congestion conditions.

3.1. Utility Function

Utility function is strictly increasing and strictly concave , so we define utility function like below . RA is resource allocation , CS means customer distribution and D means personally average delay of each class . Therefore , we define three utility functions for three classes in DiffServ network.

D x CS RA x u( ) = ( ) a − , 0<a<1

There are three QoS classes in our DiffServ network . Since we refer to some ISP companys , the network resource of three classes is allocated as (5/10,3/10,2/10) and the customer distribution is as (24/100,35/100,41/100) . The average delay time of each class is (0.004 , 0.007 , 0.012). In this case , the utility we define for class1 service is more valuable than that we do for class2 service.

Ultimately , we can generate three utility functions for EF , AF and BE such as U1= 2.083*x0.6-0.004 ,

U2=0.857*x0.6-0.007 and U3=0.487*x0.6-0.012.

3.2. Cost Function

The cost function we want to find are concerned with the effects of congestion and pricing that take congestion into account . Because users share a common network resource such as bandwidth , we model cost function by supposing that user i has a net benefit that depends on the amount service demanded by other users . That is , he enjoys net benefit of a form like

y x x C i i = − 1 ) ( y=Σi xi / k

where y=Σi xi / k , for some constant k , Here k

parameterizes the resource capacity of the system . The intuition is that congestion depends on the load of the system , as measured by y . Full load may correspond to Σi xi= k, If user i requests a quantity of

service that is small compared with the total requests of all users , then y does not vary much with different choices of xi , and so the problem is maximizing (8) , with y taken as fixed . We suppose y is not fixed , and

the market is in equilibrant we maximize some measure such as social welfare or the service producer’s profit

The definition of the load y=Σi xi / k is natural for a

single link network in which xi is an average flow and k is the bandwidth of the link . In the principle , congestion measures , such as delay and packet loss , can be directly determined given the statistics of the traffic and service discipline of the link . Our cost function is powerful and useful for more general situations , in which we desire to price dynamic parameters of the contract and yearn to find the rules to avoid the occurrence of congestion. Here , D(y)xi is a congestion cost . For example , this congestion cost might arise as the product of xi and the average delay experienced by a packet belonging to user i when packets are served at a M/M/1 queue , Assuming service rate 1 and Poisson arrival at rates x1 ,…, xn ,

the average delay in the queue is 1/(1-y), so we define cost function like that.

3.3. Third-Degree Price Discrimination

ISP with a degree of monopoly power has the ability to discriminate price in diverse markets. This means being able to charge a different price to different region or market. ISP company may find that by charging different markets different prices for a common product may actually increase the profits of the firm. This charging of different prices for a particular good is known as price discrimination and is very common in various markets around the globe. Third degree price discrimination can be achieved to design the price for three QoS classes in DiffServ network because the network resources can be segmented and the segments have different elasticity of demand.

Fig.4. Calculation of Third-Degree Price Discrimination

Fig4 illustrates simply the demand and marginal revenue of two different markets and how a provider decides his prices. Demand function , the derivative of utility function , equals to average revenue. In addition , total revenue is the sum of quantity cross average revenue . By equating MC with MR (MRA+MRB), we can generate the equilibrium point (E). By drawing a horizontal line through the MC=MR point until it intersects with the MR curves , like MRA and MRB , and then reading the price off the respective demand curves DA and DB the price in each segment is determined, PA and PB. In the equation of total revenue , M is the total customers in market1 and N is the total customers in market2 .

Q TR MR ∂ ∂ = Revenue= PA*qA*M+PB*qB*N

Airlines are often cited as pioneers in differential pricing . Airline pricing can actually be seen as an example of both price discrimination and product differentiation . It is easy to search for convenient flights , but finding the least expensive rate is cumbersome , because the number of differential tariffs is huge . The third-degree price discrimination is not so flexible that the price too fixed to change . So we define a brilliant hybrid pricing strategy which is the combination of differential pricing and dynamic pricing. The price customers pay will dynamically change according to the current congestion condition. In hybrid pricing , social welfare reach maximization. (Through utility function and cost function , they offer truly fairness to consumer and producer) When the derivative of utility function for three QoS classes and the derivative of cost function are equal (when u’(x) and c’(x) intersect) the economy is said to be in equilibrium. At this point, the allocation of network resource is at its most efficient because the amount of network resource being supplied is exactly the same as the those being consumed . Thus, both consumer and producer is satisfied with the current economic condition. Table1 shows the tariff charge table for customers .

Table 1. Tariff In Hybrid Pricing

Differentiated Charge

(P) User 1 User 2 User 3 User 4 User 5 Class 1 1.230 3 1.336 1 1.440 7 1.544 2 1.646 3 Class 2 1.037 4 1.055 7 1.073 8 1.091 8 1.109 7 Class 3 1.0090 1.0135 1.0181 1.0225 1.0270 The money which the first consumer pay for class 1 is called c1p1 and is chapter than that second consumer

pay for the same class service, c1p2 . When consumers

subscribe network service subtly late , they need to pay much money .As congestion occurs , the consumer who subscribe network service pay much money than before. Competition can prevent the occurrence of congestion .Consumers and producers should follow quantity and demand in table 1 to sell and buy . If m flows are served in class 1, the revenue form class1, called TR1 , is equals c1p1*q1+

c1p2*q2+ c1p3*q3+…+ c1pm*qm .The total revenue is

like below.

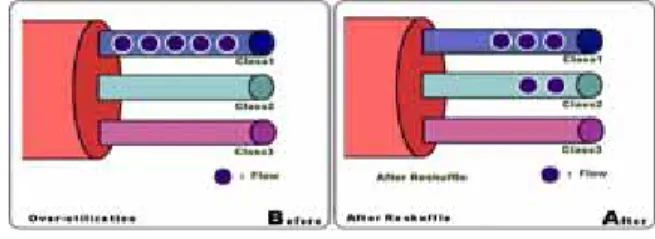

4. QoS Class Reshuffle

Note that we are responsible for solving the resource over-utilization and guarantee QoS in the Internet. QoS class reshuffle is created to handle the occurrence of congestion . When there are existing resources in others classes . customer suffering from congestion problem can choose to switch into higher or lower class just for better QoS service.

4.1. Class Reshuffle

How can supplier provide incentives that avoid the overusing problem? A remedy is to charge a customer for what he actually consumes. Now each customer chooses the network resource that provides

him with the greatest satisfaction and value-for-money. The customer has complete control over his choice of network resource , they can see its price on the tariff and predict the charge. However, producer must offer a set of customized services to consumers . so meeting customers’ satisfaction is also bring in tremendous profit to producer. That is why our system provides three differential classes to customer to choose on their demand. In Fig.5,it shows fairness to some customers to choose their personal service resources and change their classes by modifying the DSCP as their need vary over time

Fig.5. QoS Class Reshuffle 4.2. Event Trigger

In hybrid pricing , when n flows are served in class 1 and the n+1th flow arrive , traffic congestion occurs and some flows suffer from increasing end-to-end delay time. After the end-to-end delay time of some flows exceed the trigger bound , these flows can obtain better service by shuffling into other classes to obtain more resource to offer . This action is called QoS class reshuffle. This is done by our system , which sort flows in decreasing order of pi*di , where pi is the unit price flow i pay and di is the terrible end-to-end delay time flow i suffer from . If pi*di > pj*dj , this implies flow i come to class 1 later than flow j and get worse QoS service. Therefore , flow i is the first choice to be reshuffled. Our class reshuffle strategy indicated that a later coming flow would use other classes instead and pay less money for the service.

We achieve “We-Win” target by introducing pricing concept into our system . It is not only beneficial for customer to get perfect service and pay less money , but also help ISP accommodate more customers and earn much revenue .

5. Simulations and Results

Here we conduct simulations to evaluate our pricing strategies , such as third-degree price discrimination and hybrid pricing , and compare them with QoS class reshuffle in DiffServ network. We perform our simulations using QualNet simulator. Fig.6 shows the topology of differentiated network.

∑

∑

∑

= = = × + × + × o k k k n j j j m i i i q c p q c p q p c 1 3 1 2 1 1Fig.6. Topology of Simulation 5.1. Simulation Parameters

To generate two kinds of traffic applications , we describe VoD and VoIP by their characteristics. The

table below shows traffic characteristics of them. We model the VoD as CBR flows with constant packet-generated intervals and constant packet size. The VoIP is modeled as VBR flows with constant packet-generated intervals and various packet size of exponential distribution.

Table2 Simulation Parameter

Traffic Application Characteristics

Mean Rate Packet Size Trigger bound VO D 384Kbps 210Byte 150ms VoI P 24Kbps 20Byte 100ms 5.2. Scenarios

We introduce two scenario to evaluate the performance. In scenario1, we evaluate QoS improvements of supporting QoS class reshuffle . We start simulation by generating two kinds of traffic applications , such as VoD and VoIP , into EF class , AF class , and BE class in DiffServ network. Among the most excellent improvement of QoS class reshuffle is that each flow could maintain perfect QoS service even with the increase of traffic load.

Fig.7. Average Delay Time

The Fig.7 shows that average delay times in EF service soar with the increase of traffic load . When the delay time exceed reshuffle trigger bound , our system switch flows suffering bad QoS into other classes and using the rest of resource. After the reshuffle , the delay time deterioration would be solved completely. The Fig 8 shows packet loss is reduced and alleviated by adopting QoS class reshuffle.

Fig.8. Packet Loss Rate

In scenario 2 , we are concerned about the economic efficiency in our network market. The detailed comparison between third-degree price discrimination and hybrid demonstrates the profits provider could receive. Fig.9 implies that hybrid pricing brings more profits than third-degree price discrimination

Fig.9. Total Revenue

5. Conclusions and Future work

In this article, we propose the innovative pricing strategies to achieve economic efficiency for provider and customer to acquire better profit and QoS services in network market. Our QoS class reshuffle allots network resources more efficiently and provides guaranteed QoS to maintain the network at stable and good performance. By adopting economic methods to better manage network resources , customers and provider could be in pursuit of “We-Win” excellent outcome.

The future work to is to conduct research on the combination of network and economics. We could develop mechanisms within revenue-maximizing and well-distributed resource pricing architecture for the next-generation network to dynamically formulate reasonable prices to our the customers.

References

[1] Murat Yukset and Shivkumar Kalyanaraman , “A Strategy for Implementing Smart Market Pricing Scheme on Diff-Serv” GLOBECOM 2002 – IEEE Global Telecommunication Conference, no.1 pp.1439-1443 , November 2002

[2] Jörn Altmann , Hans Daanen , Huw Oliver and Alfonso Sánchez-Beato Suárez ,"How to market-manage a QoS Network", IEEE INFOCOM 2002 - The Conference on Computer Communications, no. 1, pp. 284-293, June 2002 [3] Luiz A. DaSilva, "Pricing for QoS-enabled

networks: A survey", IEEE Communications Surveys & Tutorials, no. 2, pp. 2-8, Second

[4] Adam J. O'Donnell and Harish Sethu, "A novel, practical pricing strategy for congestion control and differentiated services", ICC 2002 - IEEE International Conference on Communications, no. 1, pp. 986-990 , April 2002

[5] Sungwon Yi , Xidong Deng , George Kesidis and Chita R. Das,"Providing fairness in diffserv architecture", GLOBECOM 2002 - IEEE Global Telecommunications Conference, no. 1, pp. 1444-1448, November 2002

[6] Xin Wang and Henning Schulzrinne, "An integrated resource negotiation, pricing, and QoS adaptation framework for multimedia applications", IEEE Journal on Selected Areas in Communications, no. 12, pp.2514-2529, December 2000.

[7] Eleni Mykoniati , Charalampos Charalampous, Panos Georgatsos, Takis Damilatis, Danny Goderis, Panos Trimintzios, George Pavlou and David Griffin, "Admission control for providing QoS in DiffServ IP networks: The TEQUILA approach", IEEE Communications Magazine, no. 1, pp. 38-44, Jan 2003. [8] Matthias Falkner, Michael Devetsikiotis and Ioannis

Lambadaris, "An overview of pricing concepts for broadband IP networks", IEEE Communications Surveys & Tutorials, no. 2, pp. 2-13 , Second Quarter 2000

三、計畫成果自評 本計畫為蔡子傑教授在研究網路服務品質方面 的先導研究。利用經濟理論的量價關係,提出 完 善 的 定 價 策 略 以 達 成 所 謂 的 social welfare。這兼顧到網路資源提供者(ISP)追求 最大盈收與顧客追求最大滿足取得平衡。我們 在定價策略與顧客的滿意度方面,曾與本校經 濟系王國樑教授等請益過。我們認為未來的網 路服務是分級的,分級收費也是必然的,如何 達到一個合理的網路定價與服務品質保證是網 路經濟行為這個跨領域研究的重要的議題。