The Core and Productivity-Improving Mergers

全文

(2) 182. International Journal of Business and Economics. were assumed to produce heterogeneous products, and the decision to merge by the firms was analyzed. In contrast, Coloma (2006) considered the case where two firms produce homogeneous products and made welfare comparisons among possible market structures. There are two respects in which our paper contributes to the literature on mergers in mixed oligopoly. First, although neither Bárcena-Ruiz and Garzόn (2003) nor Coloma (2006) considered a synergy effect, we assume that a merger yields a synergy effect to the technology of the merged firm that entails improvement in productivity. Without assuming any synergy effects of a merger, Bárcena-Ruiz and Garzόn (2003) obtained the result that, in their setting, both the private firm and the public firm want to merge only when the degree to which the two heterogeneous products are substitutes is sufficiently low; moreover, the merger does not take place when the two products are perfectly substitutable. Since, in the real world, there are many examples of mergers among firms that produce highly substitutable products, this result is counterintuitive. In this paper, we re-examine mergers among firms producing homogeneous (i.e., perfectly substitutable) products in mixed triopoly under the assumption that a merger yields improvement in productivity. It seems very natural to assume that a merger between firms that produce highly substitutable heterogeneous products entails a synergy effect because merger participants may assimilate strengths of the counterpart’s production skills and/or share patented technology. In a study of horizontal mergers in private oligopoly, Farrell and Shapiro (1990) showed that a merger could improve social welfare if the merged firm exploits economies of scale well. In order to analyze mergers that entail the improvement in productivity, we follow McAfee and Williams (1992). In our paper, the technology of each of the three firms is identically represented by the quadratic cost function C (qi ) = qi2 , where qi is the production level of firm i and, as in McAfee and Williams (1992), the merged firm operates the plants which were previously owned by the pre-merged firms most efficiently so that the cost function becomes C (q) = q 2 n with q the production level the merged firm and n is the number of merger participants. The cost function of the merged firm clearly reflects greater cost-effectiveness that we ascribe to improvement in productivity. The other respect in which our analysis is clearly distinguished from earlier work is that we focus on the stability of market structures. We extend the usual analysis of mergers, where only the decision to merge is discussed, by treating merger activities as coalition formations among firms that are freely allowed to merge and to break off mergers. For example, a merger between firms 0 and 1 with firm 2 standing alone can be considered as the coalition formation {{0, 1}, {2}}. Viewing merger activities as coalition formations among firms, we are particularly interested in finding stable coalition formations (i.e., stable market structures). To analyze coalition formation stability, we adopt the concept of the core, a well-established solution concept in cooperative game theory. Specifically, we examine which of all possible market structures is stable in the sense that, once any such market structures is actually realized, none of the firms wants to change the market structure by merging with another firm or by breaking off an existing merger..

(3) Kohei Kamaga and Yasuhiko Nakamura. 183. The motivation to analyze the stability problem of merger activities perhaps needs elaboration. In our paper, we consider the industry of mixed triopoly. In the mixed triopoly market, the variation of possible forms of mergers among firms increases and becomes more complicated than that in mixed duopoly. Consequently, it might be the case that, while firms 0 and 1 have an incentive to merge into one firm after comparing payoffs obtained in the initial market structure (i.e., the coalition structure {{0}, {1}, {2}}) and the one realized after the potential merger (i.e., resulting in structure {{0, 1}, {2}}), firm 0 could receive higher payoffs if it merges instead with firm 2 (i.e., resulting in structure {{0, 2}, {1}}). In this case, if firm 2 also has an incentive to merge with firm 0, the merger between firms 0 and 2 will be realized, and the merger between firms 0 and 1 can never be realized. Therefore, in the presence of more than two firms, it is not sufficient to analyze the decision to merge in each particular case; we should examine merger activities in terms of stable coalition formations. In the literature on mergers in private oligopoly, Barros (1998), Horn and Persson (2001), and Straume (2006) similarly considered market formations. However, with the only exception Kamijo and Nakamura (2007), there have not been any studies that analyze mergers in mixed oligopoly using the core property. Among these works, there is a slight difference in the definitions of core property. The definition of core property considered in this paper is the same as the one considered in Barros (1998) and Kamijo and Nakamura (2007). See Brito and Gata (2006) for the detailed discussion about the difference in the definition adopted by Barros (1998) and the one considered in Horn and Persson (2001) and Straume (2006). Using the core property definition in Barros (1998) and Kamijo and Nakamura (2007), this paper shows that, in our mixed triopoly model, the core of market structures is non-empty and contains only the market structure with a merged public-private firm with about 57% of shares owned by the public firm. This paper is organized as follows. The next section introduces our model and presents the Cournot-Nash equilibrium for the four possible regimes: mixed triopoly, merger between private firms, merger between a public firm and a private firm, and merger across all three firms. Results are provided in Section 3. Section 4 concludes. 2. The Model 2.1 Basic Setup of Mixed Oligopoly. We analyze stable market structures in the industry composed of one public firm, denoted firm 0, and two private firms, firm 1 and firm 2. Each firm produces a single homogeneous good and is assumed to be entrepreneurial (i.e., the owners themselves make every managerial decision). The public firm is owned by the government and each of the private firms is owned by a single private shareholder. In accordance with whether a merger among the firms is realized or not, we have four possible market regimes: (a) mixed triopoly {{0}, {1}, {2}}, (b) merger between private firms {{0}, {1, 2}}, (c) merger between a public firm and a private.

(4) 184. International Journal of Business and Economics. firm {{0, i }, { j }} ( i, j = 1, 2 , i ≠ j ), and (d) merger among all the three firms {{0, 1, 2}}. Although the formal descriptions of the four regimes are slightly different, we mainly detail the setup of the mixed triopoly. The other regimes are easily understood as an extension of the mixed triopoly. As usually considered in the literature on mixed oligopoly, the inverse demand function is given as a linear function of the total output Q : P (Q) = a − Q ,. (1). where a is a sufficiently large positive number. As assumed in Bárcena-Ruiz and Garzόn (2003), each firm i ( i = 0,1, 2 ) has an identical technology represented by the quadratic cost function: C (qi ) = qi2 ,. (2). where qi is the quantity of the good produced by firm i . The profit function of firm i is given as: Π i = (a − Q)qi − qi2 .. (3). As usual, social welfare W is measured by the sum of consumer surplus CS = Q 2 2 and firm profits. Bárcena-Ruiz and Garzón (2003) did not discuss the case where a merger yields improvement in productivity. However, productivity-improving mergers were analyzed in McAfee and Williams (1992), Nakamura and Inoue (2007) and Heywood and McGinty (2007a, 2007b). Following these studies, we assume that a merger improves productivity. The market regimes derived by mergers (i.e., regimes (b), (c), and (d)) show differences particularly in the forms of cost functions. If the private firms merge, the total cost of the merged firm Cm is: Cm (qm ) =. qm2 , n. (4). where qm is the output of the merged firm m . The form of this cost function is supported by the assumption that the merged firm adopts the most efficient operation plan among merger participants. More precisely, the cost function in (4) corresponds to the case of the most efficient operation rates (λ1* , K , λ*n ) = (1 n , K ,1 n) of the plants derived from the total cost minimization problem: min. ( λ1 ,K, λn ). n. ∑ (λ q i =1. i. m. ) 2 subject to. n. ∑λ i =1. i. = 1 and λi ≥ 0 for i = 1,K , n .. The profit of the merged firm is given by replacing qi2 with qm2 n in (3).. (5).

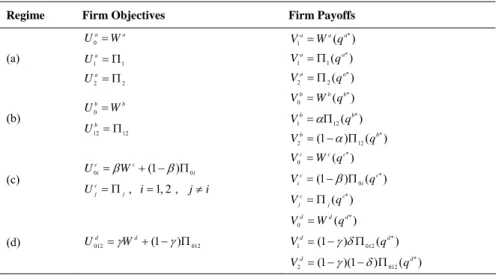

(5) Kohei Kamaga and Yasuhiko Nakamura. 185. 2.2 Equilibrium Outcomes in Regimes (a) to (d). We now examine the Cournot equilibrium for each regime. Let U ir denote an objective function that firm i maximizes in regime r ( r = a, b, c, d ). Henceforth, superscripts r qualify functions and variables considered in regime r . (a) Mixed triopoly {{0}, {1}, {2}}: In this regime, the three firms have the following objective functions: 2. U 0r (q0a ; q1a , q2a ) = W a =. 2 1⎛ a 2 a⎞ ⎜ q0 + ∑ qi ⎟ + Π 0 + ∑ Π i 2⎝ i =1 i =1 ⎠. U ir (qia ; q0a , q aj ) = Π i , i, j = 1, 2 , i ≠ j ,. (6) (7). where Π i , i = 0,1, 2 , denotes profits for firm i . The first order conditions of the maximization problems give the following Cournot equilibrium: q0a* =. 3 2 a and qia* = a , i = 1, 2 . 13 13. (8). Therefore, in the Cournot equilibrium, we obtain the following equilibrium profits, consumer surplus, and social welfare: Π 0a =. 9 2 8 2 49 2 99 2 a , Π ia = a , i = 1, 2 , CS a = a and W a = a . 169 169 338 338. Notice that, in this regime, the equilibrium profit of the public firm is larger than that of either private firm. As has been shown in extensive literature on mixed oligopoly, in the case of quantity competition, a public firm that seeks to maximize welfare chooses higher output levels than does a private profit-maximizing firm because the output by the public firm is largely determined by consumer surplus. Consequently, this leads to a larger market share and higher profit for the public firm. The payoffs to the firms are: V0a = W0a =. 99 2 8 2 a and Vi a = Π ia = a , i = 1, 2 . 338 169. (b) Merger between private firms {{0}, {1, 2}}: Next, we consider the case where the two private firms merge into a new private firm denoted 12. Let q12b be the output level of firm 12. The objective of firm 12 is to maximize its profit: U 12b (q12b ; q0b ) = Π12 = [a − (q0b + q12b )]q12b −. 1 b 2 (q12 ) . 2. In this case, the objective function of the public firm is:. (9).

(6) 186. International Journal of Business and Economics. U 0b (q0b ; q12b ) = W b = CS b + Π 0 + Π12 =. (10a). 1 b (q0 + q12b )2 + [a − (q0b + q12b )]q0b − (q0b )2 + [a − (q0b + q12b )]q12b − 1 (q12b )2 . 2 2. (10b). Note that, in the last term of its profit function, the merged firm 12 shows the improvement in productivity. In the Cournot equilibrium, we obtain: q0b* =. 1 3 2 1 9 2 1 1 a , q12b* = a , Π b0 = a 2 , Π12b = a , CS b = a 2 , and W b = a . 4 4 16 32 8 32. Let α ∈ [0, 1] be the shareholding ratio by firm 1 in the merged firm 12. Then, the payoffs are: V0b = W b =. 3 9 2 3 a , V1b = αΠ12b = αa 2 , and V2b = (1 − α )Π12b = (1 − α )a 2 . 32 32 32. (c) Merger between a public firm and a private firm {{0, i }, { j }}: In this regime the public firm 0 and the private firm i , i = 1, 2 , merge into a new firm 0i . Let q0ci and Π c0 i denote the output and profit of the merged firm 0i . As the objective function of the merged public-private firm 0i , we consider the weighted average of social welfare and the profit of the merged firm: U 0ci (q0ci ; q cj ) = βW c + (1 − β )Π 0 i. (11a). 2 ⎡1 ⎤ = β ⎢ (q0ci + q cj ) + Π 0 i + Π j ⎥ + (1 − β )Π 0 i , i, j = 1, 2 , i ≠ j , 2 ⎣ ⎦. (11b). where β ∈ [0, 1] is the shareholding ratio by the government in the merged firm 0i and Π 0 i and Π j are the profit functions of firms 0i and j :. [. ]. Π 0 i = a − (q0ci + q cj ) q0ci −. 1 c 2 (q0i ) 2 2 U cj (q0ci ; q cj ) ≡ Π j = a − (q0ci + q cj ) q cj − (q cj ) .. [. ]. (12) (13). The weighted average of social welfare and the profit in the objective of a merged public-private firm was first suggested in Matsumura (1998) and was adopted in Bárcena-Ruiz and Garzón (2003). In the Cournot equilibrium of this regime, we get: q0c*i =. 9(3 − 2 β ) 2 3 2−β a , a , q cj* = a , Π 0c i = 11 − 4 β 11 − 4β 2(11 − 4 β ) 2. Π cj =. 2(2 − β ) 2 2 (5 − β ) 2 68 − 44 β + 5β 2 2 c 2 c = = a CS a , , and W a . 2(11 − 4 β ) 2 (11 − 4 β ) 2 2(11 − 4 β ) 2. The payoffs to firms 0 and firm i are:.

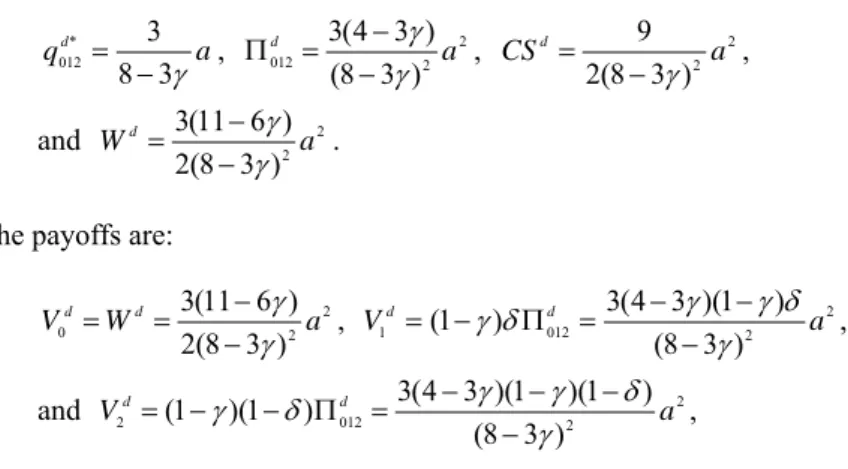

(7) Kohei Kamaga and Yasuhiko Nakamura. 187. 9(3 − 2 β )(1 − β ) 2 68 − 44 β + 5β 2 2 a , a , Vi c = (1 − β )Π 0c i = 2 2(11 − 4β ) 2(11 − 4β ) 2. V0c = W c =. and the one to the non-merged private firm j ≠ i is: V jc = Π cj =. 2(2 − β ) 2 2 a . (11 − 4β ) 2. (13). (d) Merger among all the three firms {{0, 1, 2}}: Finally, we examine the case where all the three firms merge into one firm denoted by 012. Similar to that in regime (c), the objective function of the merged firm is defined as follows: d d U 012 (q012 ) = γW d + (1 − γ )Π 012. (14a). ⎡1 d 2 ) + Π 012 ⎤⎥ + (1 − γ )Π 012 , = γ ⎢ (q012 ⎣2 ⎦. (14b). where γ ∈ [0,1] is the shareholding ratio by the government and the profit function of the merged firm is: d )q012d − Π 012 = (a − q012. 1 d 2 (q012 ) . 3. (15). Note that the merged firm in this regime shows further improvement in productivity than in regimes (b) and (c). In the Cournot equilibrium, we obtain: d* q012 =. 3(4 − 3γ ) 2 9 3 d = a , CS d = a2 , a , Π 012 8 − 3γ (8 − 3γ ) 2 2(8 − 3γ ) 2. and W d =. 3(11 − 6γ ) 2 a . 2(8 − 3γ ) 2. The payoffs are: V0d = W d =. 3(11 − 6γ ) 2 3(4 − 3γ )(1 − γ )δ 2 d = a , V1d = (1 − γ )δ Π 012 a , 2 2(8 − 3γ ) (8 − 3γ ) 2. d = and V2d = (1 − γ )(1 − δ ) Π 012. 3(4 − 3γ )(1 − γ )(1 − δ ) 2 a , (8 − 3γ ) 2. where γ ∈ [0,1] is the profit ratio for firm 1 among firms in the private sector so that (1 − γ )δ is the shareholding ratio for firm 1 in the merged firm 012. Table 1 summarizes objective functions and payoffs of the firms in each of the four regimes..

(8) 188. International Journal of Business and Economics Table 1. Firm Objectives and Payoffs. Regime. Firm Objectives. Firm Payoffs. U =W. V1a = W a (q a* ). a 0. (a). a. U = Π1. V1a = Π 1 (q a* ). U = Π2. V2a = Π 2 (q a* ). a 1 a 2. (b). (c). U 0b = W b U 12b = Π 12 U 0ci = β W c + (1 − β )Π 0i U cj = Π j , i = 1, 2 , j ≠ i. V0b = W b (q b* ). V1b = αΠ12 (q b* ) V2b = (1 − α )Π 12 (q b* ). V0c = W c (q c* ) Vi c = (1 − β )Π 0i (q c* ). V jc = Π j (q c* ) V0d = W d (q d * ). (d). d U 012 = γW d + (1 − γ )Π 012. V1d = (1 − γ )δ Π 012 (q d * ) V2d = (1 − γ )(1 − δ ) Π 012 (q d * ). 2.3 Market Structures and the Core. Except for the mixed triopoly, each regime includes more than one market structure. Each market structure can be identified in terms of merger participants and the shareholding ratio. For example, in regime (c), we find a market structure containing merged firm 01 with the government shareholding ratio at β = 0.5 and private firm 2. Which of the possible market structures will actually occur depends on the dynamic managerial decision making of the three firms: merge, don’t merge, or break off existing mergers. In the preceding subsection, we examined the Cournot equilibrium for each possible market structure. Now, a natural question to ask is which of the market structures will occur as a consequence of the firms’ coalition formation. This problem can be analyzed in terms of the game of coalition formation among the firms. As discussed in the introduction, in the case of more than two firms, it is not sufficient to analyze the decision by firms for each particular case since the persistence of the market structure becomes important. Thus, we focus on which market structure will be stable in the sense that, once realized, it will not shift into another market structure. To analyze this stability problem we use the concept of the core, a well-established solution concept in cooperative game theory. We assume that each firm makes merger decisions based by maximizing its payoff Vi . The reader may notice that the market structures and the payoffs in our framework correspond to feasible allocations and agent utilities (or preferences) in the market game in an exchange economy, a well-established topic in microeconomic theory; see, for example, Varian (1992, p. 387-388). To define the cores of the market structures, we start with the definition of a blocking market structure. A market structure M is said to block another market structure M ′ if there exists a deviant coalition of firm(s) such that:.

(9) 189. Kohei Kamaga and Yasuhiko Nakamura. (i) M can be constructed from M ′ solely based on the decisions by the firms in the deviant coalition, and (ii) every firm in the coalition achieves a strictly higher payoff in M than in M′. An example will help to explain blocking. Let M β be the market structure composed of the merged firm 01 with shareholding ratio β = 0.5 and firm 2. In this case, for example, the coalition of firms 0 and 2 can construct, if they choose, a new market structure that consists of the merged firm 02 with shareholding ratio β = 0.45 and firm 1, denoted M β . If both firms 0 and 2 achieve higher payoffs in M β than in M β , then M β blocks M β . Note that it is also possible that a deviant coalition consists of a single firm. In the example, it is possible for both firms 0 and 1 to deviate from the structure by breaking off the merger and to operate their own firms (i.e., to shift into the mixed triopoly) as well. The core of the market structure is defined as the set of market structures that are never blocked by any other market structure. We denote the core of the market structures Co . If a market structure is in the core, no participant has an incentive to shift to a different market structure. In this sense, the market structure(s) in the core can be regarded as stable. In the next section, we examine the core of the market structures. {{ 0 , 1}, { 2 }} = 0.5. {{ 0 , 2 }, {1}}. {{ 0 , 2 }, {1}} = 0.45. = 0.45 {{ 0 , 1}, { 2 }} = 0.5. {{ 0 , 2 }, {1}}. {{ 0 , 1}, { 2 }}. = 0.45. = 0.5. 3. Results. We now explore the core of the market structures. Our argument proceeds through several lemmas, each of which designates the market structures that are blocked by another market structure. Our first lemma shows that the market structure of the merged firm 012 is not in the core no matter what shareholding ratio is adopted. Lemma 1: For any shareholding ratios γ ∈ [0, 1] and δ ∈ [0,1] , the market structure of the merged firm 012, M γ δ , can not belong to the core. {{ 0 , 1, 2 }} ,. Proof: The proof proceeds in two steps. First, let M γ be the market δ structure of the merged firm 012 with γ ∈ [0, 1] and δ = 1 2 , and M β be that of the merged public-private firm 01 and firm 2 with shareholding ratio β ∈ [0,1] in the merged firm. We show that firm 2 wants to deviate from the merger. Since: {{ 0 , 1, 2 }} ∈[ 0 , 1 ],. =1 2. {{ 0 , 1}, { 2 }} ∈[ 0 , 1 ]. dV2c ( β ) 12(2 − β ) 2 = a < 0 , β ∈ [0,1] , dβ (−11 + 4 β ) 3. we have. (16).

(10) 190. International Journal of Business and Economics min V2c ( β ) = V2c ( β ) β =1 =. β ∈[ 0 , 1]. 2 2 a . 49. (17). Then, solving the equation: V2d (γ , δ ) δ = 1 = 2. 2 2 a , 49. (18). we obtain the result: V2d (γ , δ ) δ = 1 = βmin V2c ( β ) if γ = ∈[ 0 , 1] 2. 93 − 7 41 ≈ 0.5353 . 90. (19). Since d (V2d (γ , δ ) δ =1 2 ) dγ = − 3(32 − 27γ )a 2 2(8 − 3γ ) 3 < 0 , γ ∈ [0,1] , we obtain: ⎛ 93 − 7 41 ⎤ c ⎜ V2d (γ , δ ) δ = 1 < βmin V ,1⎥ . 2 (β ) , γ ∈ ∈[ 0 , 1] ⎜ 90 2 ⎥⎦ ⎝. (20). Therefore, if γ > (93 − 7 41) 90 , firm 2 deviates from M γ and operates δ independently regardless of what a ratio β is (i.e., M β blocks M γ ). δ In cases where δ ≠ 1 2 , the same conclusion also follows for one of the private firms because one of them inevitably receives strictly less payoff than when δ =1 2 . Next let I be the interval [0, (93 − 7 41) 90] . To complete the proof, we have to show that M γ I δ is blocked by another market structure. Consider the market structure of the merged public-private firm 01 and firm 2 with shareholding ratio β = γ (i.e., M β γ ). We show that the coalition {0, 1} has an incentive to deviate from the merger among the three firms if δ = 1 2 . Let β : R → R be such that β (t ) = t . When γ = (93 − 7 41) 90 , the difference between the payoffs to firm 0 across the two market structures is: {{ 0 , 1, 2 }} ∈[ 0 , 1 ],. =1 2. {{ 0 , 1}, { 2 }} ∈[ 0 , 1 ]. {{ 0 , 1, 2 }} ∈[ 0 , 1 ],. =1 2. {{ 0 , 1, 2 }} ∈ ,. =1 2. {{ 0 , 1}, { 2 }} =. V0c (β (γ )) − V0d (γ ) γ = 93−7. 41. =. 90. 25(1024237 + 79947 41) 98(32396969 + 4258989 41). a2 > 0 .. (21). Moreover, we have for all γ ∈ [0,1] : γ 2 − 2682γ 3 + 279γ 4 ) 2 d (V0c (β (γ )) − V0d (γ )) = − 3(6859 − 13655γ + 9324 a <0. 3 (8 − 3γ ) (11 − 4γ )3 dγ. (22). Therefore, firm 0 can achieve higher payoff (i.e., higher social welfare) in Mβγ than in M γ I δ . Similarly, we obtain for firm 1: {{ 0 , 1}, { 2 }}. =. {{ 0 , 1, 2 }}. ∈ ,. =1 2. V1c (β (γ )) − V1d (γ , δ ) γ = 93−7. 90. 41. , δ=. 1 2. =. 2267 + 51177 41 196(309 + 14 41). 2. a2 > 0 .. (23).

(11) Kohei Kamaga and Yasuhiko Nakamura. 191. and for all γ ∈ [0,1] : d dγ. 2 3 4 ⎛V c (β (γ )) − V d (γ , δ ) ⎞ = − 3(5024 − 8031γ + 5460γ − 1759γ + 216γ ) a 2 < 0 . 1 ⎟ ⎜ 1 3 3 1 δ= 2 ⎠ 2(8 − 3γ ) (11 − 4γ ) ⎝. (24). Thus, firm 1 can gain more in M {{β =0γ, 1}, { 2}} than in M {{γ ∈0I, 1,, δ2}}=1 2 . Thus, the joint deviation by firm 01 is beneficial to both firms 0 and 1. The same argument as that presented above can be directly applied to any case of δ ≠ 1 2 to show that the market structures of the merger among the three firms is blocked through the joint deviation of the public and one of the private firms. The intuition behind the lemma is explained as follows. In the cases of high values of γ , the merged firm 012 sets relatively high output because of the considerable influence of the public firm, and this hurts the payoffs to the private firms. On the other hand, for low values of γ , the merged firm attaches relatively high importance to its profit, and the public firm can do better by breaking off the merger. This trade-off in the owners’ interests in the merged firm makes the merger unstable. Indeed, as shown in the proof of the lemma, if γ ∈ [ (93 − 7 41) 90 , 1] , either of the private firms, say i , has an incentive to deviate from the merged firm 012. On the other hand, if γ ∈ [0, (93 − 7 41) 90] , the public firm has an incentive to break off the three-way merger and to offer to enter a two-way merger with firm i . In both cases, the key is that the positive effect of the improvement in productivity in the merger among the three firms is relatively small compared to that in the merger between two firms. Next, we provide our second lemma, which tells that at least one of the two private firms prefers the mixed triopoly rather than the merger between these two private firms regardless of what shareholding ratio is adopted between them. In other words, the market structure of the merger between the private firms is not in the core no matter what shareholding ratio is negotiated. Lemma 2: For any ratio of shareholding α ∈ [0,1] , the market structure of the merger between the private firms, M α , is blocked by the mixed triopoly, M {{0}, {1}, { 2}} . {{ 0 }, {1, 2 }}. Proof: Since we have ∑i =1 Π ia = 16a 2 169 > 3a 32 = Π 12b , it is obvious that there exists no α ∈ [0,1] such that αΠ12b ≥ Π1a and (1 − α )Π12b ≥ Π a2 . 2. This result is due to the strengthened market share of the public firm. It is known that two-firm mergers in the Cournot oligopoly often tend to be unprofitable due to the aggressive response from the firms not participating in the merger (see, for example, Salant et al., 1983). Although the private merged firm 12 gets an advantage due to improved productivity, the market share of the public firm 0, which aims to maximize not profit but social welfare, becomes larger than in the case of the private Cournot oligopoly. Consequently, the profit of the merged firm 12 cannot exceed the sum of the profits gained by the private firms operating independently, and the merger between the private firms will never be beneficial..

(12) 192. International Journal of Business and Economics. We now move to our third lemma. While the mixed triopoly, as stated in Lemma 2, blocks regime (b) and, consequently, excludes it from the core, the following lemma shows that the mixed triopoly cannot belong to the core either. Let:. β=. 638 − 39 31 6197 − 39 6001 ≈ 0.56950 and β = ≈ 0.56996 . 739 5572. (25). Lemma 3: The mixed triopoly, M , is blocked by the market structure containing the merged public-private firm 0i and private firm j ≠ i , M β , if the shareholding ratio β in the merged firm 0i is in the interval ( β , β ) . {{ 0 }, {1}, { 2 }}. {{ 0 , i }, { j }}. Proof: In the Cournot equilibrium, both (a) and (c), we have: V0a =. 99 2 8 2 68 − 44 β + 5β 2 2 a , V0c = a , Vi a = a , 338 169 2(11 − 4 β ) 2. and Vi c =. 9(3 − 2β )(1 − β ) 2 a . 2(11 − 4 β ) 2. Consequently, we obtain: ⎧⎪0 ≤ β ≤ β ⇒ V0a ≥ V0c ⎧⎪0 ≤ β < β ⇒ Vi c > Vi a and ⎨ ⎨ a c ⎪⎩β ≤ β ≤ 1 ⇒ Vi c ≤ Vi a . ⎪⎩β < β ≤ 1 ⇒ V0 < V0. Thus, both firms 0 and i have an incentive to merge into 0i if the shareholding ratio β is in [0, β ) ∩ ( β , 1] = ( β , β ) .. As shown in the proof of Lemma 3, if the shareholding ratio by the public firm is greater than β , it will agree to merge with a private firm i since it can achieve higher social welfare due to the productivity improvement. However, firm i can gain more payoff in the merged firm 0i than in the mixed triopoly whenever β < β . Therefore, for any β ∈ ( β , β ) , both firms have an incentive to merge into a new public-private firm 0i . From this observation, we immediately obtain the following lemma. Lemma 4: The mixed triopoly, M , blocks the market structure of the , whenever merged public-private firm 0i and the private firm j ≠ i , M β shareholding ratio β in the merged firm 0i is in the set [0, β ) ∪ ( β ,1] . {{ 0 }, {1}, { 2 }}. {{ 0 , i }, { j }}. Proof: This lemma immediately follows from the proof of Lemma 3 where we saw that if β ∈ ( β ,1] ( β ∈ [0, β ) ) then private firm i (the public firm 0) has an incentive to deviate and change the present market structure into the mixed triopoly.. From Lemmas 1 to 4, we know few if any market structures are in the core. Specifically, regimes (a), (b), and (d) are not in the core. Moreover, in regime (c), the market structures with β ∈ [0, β ) ∪ ( β ,1] cannot belong to the core, either. As a.

(13) Kohei Kamaga and Yasuhiko Nakamura. 193. consequence, the only remaining possibilities are the market structures of the merged public-private firm 0i and the private firm j ≠ i , with the ratio of shareholding by the public firm in the interval [ β , β ] . We now state our main result, which shows that this market structure is in the core. Proposition 1: The market structure of the merged public-private firm 0i and the , is in the core whenever the shareholding ratio in the private firm j ≠ i , M β merged firm 0i , β , is in the interval [ β , β ] . {{ 0 , i }, { j }}. Proof: See the Appendix.. From this proposition, it can be concluded that market structures composed of the merged public-private firm 0i and the private firm j ≠ i with β ∈ [ β , β ] are stable in the sense that these market structures are never blocked by other market structures. In other words, once this form of market structures is realized, it will remain intact indefinitely. It should be emphasized that the interval of the admissible ratio β in the core [ β , β ] is very narrow, with β − β ≈ 0.00047 . This result is fairly remarkable in that it shows a considerable contrast to the result obtained in Kamijo and Nakamura (2007). They analyzed an industry composed of two symmetric private firms and a less efficient public firm. Assuming that each firm has constant marginal costs of production, they showed that all regimes except (b) belong to the core. Therefore, the stable market structures in a mixed oligopoly crucially depend on the assumptions of firms’ technology. Finally, we briefly examine the case where the industry is composed only of private firms and compare the results of mixed and private oligopolies. In the case of a private oligopoly, we need to change the model summarized in Table 1 as follows: U 0a = Π 0 , V0a = Π 0 (q a* ) , U 0b = Π 0 , V0b = Π 0 (q b* ) , U 0ci = Π 0 i , V0c = βΠ 0 i (q c* ) , d U 012 = Π 012 , and V0d = γΠ 012 (q d * ) . Consequently, regimes (b) and (c) are identical, which we henceforth denote regime (b). The Cournot equilibria of regimes (a), (b), and (d) are: 3 3 ⎞ ⎛a a a⎞ ⎛2 d* (qia* , q1a* , q 2a* ) = ⎜ , , ⎟ , (q 0b* , q12b* ) = ⎜ a, a ⎟ , and q012 = a. 8 ⎝6 6 6⎠ ⎝ 11 11 ⎠. The payoffs to the firms are as follows: ⎛ a2 a2 a2 ⎞ 27 ⎛ 8 2 27 ⎞ (V0a , V1a , V2a ) = ⎜⎜ , , ⎟⎟ , (V0b , V1b , V2b ) = ⎜ αa 2 , (1 − α )a 2 ⎟ , a , 242 242 ⎝ 121 ⎠ ⎝ 18 18 18 ⎠ 3 3 ⎛ 3 ⎞ and (V0d , V1d , V2d ) = ⎜ γ a 2 , (1 − γ )δ a 2 , (1 − γ )(1 − δ )a 2 ⎟ . 16 16 36 ⎝ ⎠. Given these payoffs, we obtain Proposition 2. Proposition 2: In the case where the industry is composed only of private firms, none of the market structures belongs to the core..

(14) 194. International Journal of Business and Economics. Proof: The proof is similar to those of Lemmas 1 to 4. Thus, we limit ourselves to providing examples of blocking market structures for each market structure. A is blocked by detailed proof is available upon request. For regime (a), M Mα whenever α ∈ (121 243 , 122 243) . For regime (b), M α is if α ∈ [0, 121 243) or α ∈ (122 243 , 1] , and (ii) by blocked (i) by M Mγ δ with γ = 9 25 and 1 2 if α ∈ [121 243 , 122 243] . For regime (d), Mγ δ is blocked by M α with α ∈ [0, 1] . By the same argument as in the proof of Lemma 1, the case of (γ , δ ) = (1 3 , 1 2) is sufficient to complete the proof of regime (d). {{ 0 }, {1}, { 2 }}. {{ 0 }, {1, 2 }}. {{ 0 }, {1, 2 }}. {{ 0 }, {1}, { 2 }}. {{ 0 , 1, 2 }}. , {{ 0 , 1, 2 }} =1 / 3 ,. {{ 0 }, {1, 2 }}. =1 / 2. The never-ending coalition formation increases transaction costs unboundedly. This feature eliminates our ability to predict which of the market structure will actually occur and also implies that it is difficult to prescribe economic policies in an effective way. Comparing Propositions 1 and 2, we conclude that the presence of the public firm has a stabilizing effect in the current framework and allows us to avoid the costs involved in market instability. 4. Concluding Remarks. This paper explores stable market structures in a mixed oligopoly when a single public firm and two symmetric private firms in a homogeneous good market are allowed to freely merge and break off existing mergers. We adopt the core as the solution concept to analyze the stability of market structures. We show that the core contains only those market structures with a merger between the public firm and one of the private firms, with the shareholding ratio by the public firm between β ≈ 0.56950 and β ≈ 0.56996 . These market structures are stable in the sense that, by the definition of the core, once realized, it will never be replaced by another market structures. The admissible interval of β that ensures the stability of market structures is very narrow. This strong result relies on the assumption that a merger yields an improvement in productivity. Without such a benefit, our result would change, and the mixed triopoly would be the unique stable market structure. Two interesting extensions of our model remain. The first is to consider the model in which the foreign shareholders are taken into account. In the real world, some firms are foreign-owned. In this case, social welfare that the government is to maximize may not include the profits of the foreign-owned firms. Thus, the existence of foreign shareholders will change the public firm’s decision making and, consequently, the equilibrium outcomes as well. The other possible extension is to introduce the asymmetry across the production technologies of firms (e.g., Ci (qi ) = ki qi2 ). In the present paper, we assumed that all the three firms have identical technologies (k 0 , k1 , k 2 ) = (1, 1, 1) . It seems more natural to assume that a public firm is less efficient relative to private firms (e.g., X-inefficiency in a public firm). In the case of (k 0 , k1 , k 2 ) = (3, 1, 1) , the reader may easily check that the core becomes empty by following methods similar to the proofs of Lemmas 1 to 4 and Proposition 2. The analysis of more general cases of k = (k 0 , k1 , k 2 ) and the.

(15) 195. Kohei Kamaga and Yasuhiko Nakamura. comparison across different weight vectors k is left for future research. Appendix Proof of Proposition 1: Let M β β β be the market structure of the merged firm 0i with shareholding ratio β ∈ [ β , β ] and private firm j ≠ i . In a series of claims is never blocked by any other market structure. We below, we show that M β β β assume, without loss of generality, that i = 1 and j = 2 . {{ 0 , i }, { j }} ∈[ ,. ]. {{ 0 , i }, { j }} ∈[ ,. ]. Claim 1. M β β β is never blocked by the mixed triopoly in any case of β ∈ [ β , β ] . By Lemma 3, M β β β is not blocked by the mixed triopoly if β ∈ ( β , β ) . Moreover, in the proof of Lemma 3, we show that, in the case of β = β , the public firm in M β β β can achieve the same level of social welfare as in the mixed triopoly and has thus has no incentive to deviate from M β β β . Also, firm 1 in M β β higher payoff than in the mixed triopoly. Thus, neither firm wants to break off the merger. The case of β = β can be proved by the symmetric argument to the case of β = β . {{ 0 , 1}, { 2 }} ∈[ ,. ]. {{ 0 , 1}, { 2 }} ∈[ ,. ]. {{ 0 , 1}, { 2 }} ∈[ ,. ]. {{ 0 , 1}, { 2 }} ∈[ ,. {{ 0 , 1}, { 2 }} =. ]. Claim 2. M β β β is never blocked by the market structure of the public firm 0 , for any α ∈ [0, 1] . By and the private merged firm 12 with α ∈ [0, 1] , M α (16), V2c ( β ) is decreasing on [0,1] , and thus we have: {{ 0 , 1}, { 2 }} ∈[ ,. ]. {{ 0 }, {1, 2 }} ∈[ 0 , 1 ]. min V2c ( β ) = V2c ( β ) =. β ∈[ β , β ]. When β = β in M β β β with firm 1 if and only if:. {{ 0 , 1}, { 2 }} ∈[ ,. V2b (α ) > V2c ( β ) ⇔. ⇔α <. ]. (1649 + 13 6001) 2 1352(234 + 6001) 2. (i.e., when M β. a2 .. {{ 0 , 1}, { 2 }} =β. (26). ), firm 2 will agree to merge. (1649 + 13 6001) 2 2 3 (1 − α )a 2 > a 32 1352(234 + 6001) 2. 401707 − 1768 6001 ≈ 0.4263 . 621075. (27a) (27b). On the other hand, for any α < 401707 − 1768 6001 621075 , we obtain: 3 8 2 αa 2 − a 32 169 3 < αa 2 401707 −1768 32 α=. V1b (α ) − V1c ( β ) =. 621075. =. (28a) − 6001. 8 2 a 169. 88107 − 1768 6001 2 a ≈ −0.0074a 2 < 0 6624800. (28b) (28c).

(16) 196. International Journal of Business and Economics. Thus, by (27b) and (28c), the joint deviation by firms 1 and 2 cannot be realized if β = β . Since V2c is decreasing with respect to β , by (27a) to (28c) together, the joint deviation by the private firms is still impossible for any β ∈ [ β , β ) . Claim 3. M β β β is never blocked by M β for any β ′ ∈ [0, 1] . We start rather with the case of β = β in M β β β . In this case, firm 2 prefers M β is strictly greater than the than M {{β =0β,1}, {2}} if and only if the payoff in M β payoff gained in M {{β =0β,1}, {2}} ; thus, we must have Δ ( β ′) > 0 , where: {{ 0 , 1}, { 2 }} ∈[ ,. ]. {{ 0 , 2 }, {1}} ′∈[ 0 , 1 ]. {{ 0 , 1}, { 2 }} ∈[ ,. {{ 0 , 2 }, {1}} ′∈[ 0 , 1 ]. ]. {{ 0 , 2 }, {1}} ′∈[ 0 , 1 ]. Δ ( β ′) := (1 − β ′)Π c02 ( β ′) − Π c2 ( β ) =. (29a). 9(3 − 2β ′)(1 − β ′) 2 (1649 + 13 6001) a − a2 2(11 − 4β ′) 2 1352(234 + 6001) 2 2. (29b). = a 2 ⋅ Ξ( β ′) ,. (29c). and Ξ( β ′) = [28(12134951 + 89440 6001)( β ′) 2 − 2(379922845 + 2615912 6001) β ′ + 328599497 + 1677091 6001] /[676(234 + 6001) 2 (11 − 4β ′) 2 ] . Solving Δ( β ′) = 0 subject to β ′ ∈ [0, 1] , we obtain: ⎛ ⎞ ⎜ 379922845 + 2615912 6001 − 39 31920488675573 + 391144962052 6001 ⎟ ⎝ ⎠ β′ = 339778628 + 2504320 6001 *. ≈ 0.5151 .. (30). Since for all β ′ ∈ [0,1] we have: dΔ ( β ′) d ((1 − β ′)Π c02 ( β ′)) 9(31 − 24 β ′) 2 = = a <0, dβ ′ dβ ′ 2(11 − 4 β ′) 3. (31). we obtain the intermediate result that firm 2 prefers M β only if:. {{ 0 , 2 }, {1}}. β ′ ∈ [0, β ′* ) .. ′∈[ 0 , 1 ]. to M β. {{ 0 , 1}, { 2 }} =β. if and (32). On the other hand, since we have for all β ∈ [0, β ] : dV0c ( β ) 3(10 − 11β ) 2 = a >0, dβ (11 − 4 β ) 3. (33). to M β if β ′ < β ′* < β , and thus the public firm strictly prefers M β β can never be realized. Note that, the joint deviation by firms 0 and 2 from M β β from (16), the payoff for firm 2 in M β β β is decreasing with respect to β , which in turn implies that, by (29a) to (29c) and (31), a decrease in β leads to a decrease in β ′* . Thus, using β ′* < β and (33), firm 0 never agrees to a deviant merger with firm 2 for any β ∈ [ β , β ) . {{ 0 , 1}, { 2 }}. {{ 0 , 2 }, {1}} ′. =. {{ 0 , 1}, { 2 }}. = {{ 0 , 1}, { 2 }}. ∈[ ,. ].

(17) Kohei Kamaga and Yasuhiko Nakamura. 197. Claim 4. M β β β is never blocked by the three-way merger M γ δ regardless of the ratios γ ∈ [0, 1] and δ ∈ [0, 1] . We start with the case of β = β . In this case, V0c ( β ) = 99a 2 338 . Since dV0d (γ ) dγ = 27(1 − γ )a 2 (8 − 3γ ) 3 ≥ 0 for all γ ∈ [0, 1] (equality holds only when γ = 1 ), for any γ ∈ (23 / 33,1] : {{ 0 , 1}, { 2 }} ∈[ ,. {{ 0 , 1, 2 }}. ∈[ 0 , 1], ∈[ 0 , 1 ]. ]. V0d (γ ) − V0c ( β ) =. 3(11 − 9γ )(−23 + 33γ ) 2 a > 0. 338(8 − 3γ ) 2. (34). On the other hand, for any γ ∈ [0,1] :. (. d V2d ( γ , δ ) dγ. δ =0. − 27γ ) a ) = 3(32 (−8 + 3γ ) 3. 2. <0. (35). and V2d ( γ , δ ). γ=. 23 , δ =0 33. − V2c ( β ) =. 4(817 − 260 31) 2 a ≈ −0.0041a 2 < 0 . 616005. (36). Note that the case of δ = 0 is the most favorable case of δ for firm 2. Hence, when β = β , by (34) to (36), firms 0 and 2 can never reach an agreement about shareholding in the merged firm 012, and thus the merger among the three firms can never be realized. Now, we examine the other cases of β ∈ [ β , β ] (i.e., β ∈ ( β , β ] ). By (33), the value of γ * that solves the equation V0d (γ ) − V0c ( β ) = 0 is higher for any β ∈ ( β , β ] than when β = β (i.e., γ * > 23 33 ). From (16) and (35), we have: V2d (γ * , δ ). δ =0. − V2c ( β ) β∈( β , β ] < V2d (γ , δ ) =. − V2c ( β ). (37a). 13739 − 221 6001 2 a ≈ −0.0041a 2 < 0 . 828100. (37b). γ=. 23 , δ =0 33. Therefore, by the same argument as in the case of β = β , the merger among the three firms is impossible for any β ∈ ( β , β ] . From (33) and the fact that dV1c ( β ) dβ = − 9(31 − 24β )a 2 2(11 − 4β ) 3 < 0 , for all β ∈ [0,1] , no alteration in the ratio β improves the payoffs to both firms 0 and 1 simultaneously. Therefore, combining the assertions of the claims, we is in the core whenever β is in the closed interval have shown that M β [β , β ] . {{ 0 , 1}, { 2 }}. References. Bárcena-Ruiz, J. C. and M. B. Garzón, (2003), “Mixed Duopoly, Merger and Multiproduct Firms,” Journal of Economics, 80, 27-42. Barros, P. P., (1998), “Endogenous Mergers and Size Asymmetry of Merger.

(18) 198. International Journal of Business and Economics. Participants,” Economics Letters, 60, 113-119. Brito, D. and J. Gata, (2006), “Merger Stability in a Three Firm Game,” Portuguese Competition Authority Working Paper, No. 10. Coloma, G., (2006), “Mergers and Acquisitions in Mixed-Oligopoly Markets,” International Journal of Business and Economics, 5, 147-159. De Fraja, G. and F. Delbono, (1989), “Alternative Strategies of a Public Enterprise in Oligopoly,” Oxford Economic Papers, 41, 302-311. Deneckere, A. F. and C. Davidson, (1985), “Incentive to Form Coalitions with Bertrand Competition,” Rand Journal of Economics, 16, 473-486. Farrell, J. and C. Shapiro, (1990), “Horizontal Mergers: An Equilibrium Analysis,” American Economic Review, 80, 107-126. Heywood, J. S. and M. McGinty, (2007a), “Convex Costs and the Merger Paradox Revisited,” Economic Inquiry, 45, 342-349. Heywood, J. S. and M. McGinty, (2007b), “Mergers among Leaders and Mergers among Followers,” Economics Bulletin, 12(12), 1-7. Horn, H. and L. Persson, (2001), “Endogenous Mergers in Concentrated Markets,” International Journal of Industrial Organization, 19, 1213-1244. Kamijo, Y. and Y. Nakamura, (2007), “Stable Market Structures from Merger Activities in Mixed Oligopoly with Asymmetric Costs,” 21COE-GLOPE Working Paper, No. 21, Waseda University. McAfee, R. P. and M. A. Williams, (1992), “Horizontal Mergers and Antitrust Policy,” Journal of Industrial Economics, 40, 181-187. Matsumura, T., (1998), “Partial Privatization in Mixed Duopoly,” Journal of Public Economics, 70, 473-483. Nakamura, Y. and T. Inoue, (2007), “Mixed Oligopoly and Productivity-Improving Mergers,” Economics Bulletin, 12(20), 1-9. Salant, S. W., S. Switzer, and R. J. Reynolds, (1983), “Losses from Horizontal Merger: The Effects of an Exogenous Change in Industry Structure on Cournot-Nash Equilibrium,” Quarterly Journal of Economics, 98, 185-199. Straume, O. R., (2006), “Managerial Delegation and Merger Incentives with Asymmetric Costs,” Journal of Institutional and Theoretical Economics, 162, 450-469. Varian, H. R., (1992), Microeconomic Analysis, 3rd edition, New York: Norton..

(19)

數據

相關文件

In order to achieve the core competencies of the twelve-year compulsory education curriculum and to further develop test items for science literacy assessment, it is

In this class, we will learn Matlab and some algorithms which are the core of programming world. Zheng-Liang Lu 26

Teachers may consider the school’s aims and conditions or even the language environment to select the most appropriate approach according to students’ need and ability; or develop

(d) While essential learning is provided in the core subjects of Chinese Language, English Language, Mathematics and Liberal Studies, a wide spectrum of elective subjects and COS

Students are asked to collect information (including materials from books, pamphlet from Environmental Protection Department...etc.) of the possible effects of pollution on our

Wang, Solving pseudomonotone variational inequalities and pseudocon- vex optimization problems using the projection neural network, IEEE Transactions on Neural Networks 17

Define instead the imaginary.. potential, magnetic field, lattice…) Dirac-BdG Hamiltonian:. with small, and matrix

In this paper, motivated by Chares’s thesis (Cones and interior-point algorithms for structured convex optimization involving powers and exponentials, 2009), we consider