326 CORPORATE GOVERNANCE

Blackwell Publishing Ltd.Oxford, UK CORGCorporate Governance: An International Review0964-8410Blackwell Publishing Ltd. 2005 March 2005132INSIDER OWNERSHIP STRUCTURE AND FIRM PERFORMANCECORPORATE GOVERNANCE

*Address for correspondence: Department of Management Science, National Chiao Tung University, 1001 Ta-Hsueh Road, Hsin Chu, Taiwan 30050. Tel: +886-3-5131309; Fax: + 886-3-5713796; E-mail: ccyang@ mis.must.edu.tw

Insider Ownership Structure and Firm

Performance: a productivity

perspective study in Taiwan’s

electronics industry

Her-Jiun Sheu and Chi-Yih Yang*

In the context of agency theory (Jensen and Meckling, 1976. Journal of Financial Economics, 3, 305–360), how insider stock ownership relates to firm performance is explored in this paper. The relevant performance measure used is total factor productivity. Insiders are classified into executives, board members and blockholders so as to facilitate a detailed study. Five-year (1996–2000) panel data of 333 Taiwanese listed electronics firms are examined. It is observed that total insider ownership remains steady while the executive-to-insider holding ratio increases significantly. In terms of the effect on total factor productivity, neither the total insider ownership nor the board-to-insider holding ratio shows any influence on productivity. However, productivity first decreases then increases with the executive-to-insider holding ratio, forming a U-shaped relationship. The results indicate that stock ownership of top officers in high-tech firms should be encouraged to enhance productivity.

Keywords: Agency theory, insider ownership, firm performance, total factor productivity

Introduction

uring the past two decades, a great deal of attention concerning the per-formance of Taiwan’s economy has been paid to the electronics industry. In 2000, the electronics industry alone accounted for 40 per cent of the total sales and 72 per cent of the total profits (before taxes) generated by all firms listed on the Taiwan Stock Exchange Corporation. In addition, Taiwan’s integrated circuit (IC), computers and peri-pherals, and telecommunication industries have also played prominent roles on the international platforms. The value of infor-mation hardware products of the major countries from around the world is sum-marised in Appendix A. Notably, Taiwan

D

ranked in the top four in both 1999 and 2000 in terms of domestic production. Since many Taiwanese businessmen have made vast amounts of investments in China during the past ten years, the aggregate value of the “Greater China” area should provide valu-able information. By aggregating the outputs of Taiwan and China together, the Greater China area would be the second largest information hardware producer in the world. Given the nature of the high-tech industry, high-tech firms are often characterised by rapid growth and abundant investment opportunities, and thus are expected to face a high degree of information asymmetry between managers and shareholders (Gaver and Gaver, 1995). This can lead to potential agency problems as the objectives of the

prin-INSIDER OWNERSHIP STRUCTURE AND FIRM PERFORMANCE 327

cipal (shareholders) and the agent (managers) are not always identical.

Corporate governance is defined as “the set of mechanisms that induce the self-interested controllers of a company to make decisions that maximize the value of the company to its owners” (Denis and McConnell, 2003, p. 2). Governance mechanisms can be broadly char-acterised as being either internal or external to the firm. The internal mechanisms of primary interest are the board of directors, executive compensation, as well as managerial owner-ship. The external mechanisms are the threat of takeover, competition of products, institu-tional ownership and the legal system. Since emerging markets generally suffer from a lack of shareholder protection (Lins, 2003), the fact that there is neither an active takeovers market nor the existence of strong institutional inves-tors in Taiwan (Chow et al., 1996) suggests that corporate governance in Taiwanese firms appears to consist principally of internal mechanisms rather than external controls.

Since the early 1990s, stock-based compen-sation plans have been adopted by many Tai-wanese high-tech firms. It is often claimed that one of the major reasons for the success of Taiwan’s information technology sector is due to the adoption of these unique employee financial participation schemes (often referred to as the “Taiwanese-style profit sharing and employee stock ownership plans”) (Han, 2003). In 2000, the Securities and Futures Com-mission in the Ministry of Finance, Taiwan, further established systems of “employee stock option” and “treasury stock” to allow firms to buy back their shares for the purpose of issuing stock warrants or options to employees. Following the experience of the US,1 the stock-based compensation plans in

Taiwanese firms should also be mainly tar-geted towards management. In order to pro-vide a valuable lesson for other developing economies, empirical evidence on whether managerial stock ownership affects agency cost in a country such as Taiwan (which has industrialised fairly rapidly) is explored.

Most prior studies in this area have merely documented the effects that insider ownership has on financial performance measures such as accounting rate of return and Tobin’s Q, with little attempt to assess its impact on eco-nomic performance measures such as produc-tivity or efficiency. However, the core of a business organisation is its operational func-tion – that is, the process of transforming inputs into outputs; and the importance of productivity has been the subject of much research. For example, the pioneering work by Solow (1957) concludes that approximately 90 per cent of the increase in real per capita

out-put (and thus the standard of living) is attrib-utable to efficiency growth. From an agency theory perspective, Hill and Snell (1989) also theorise that managerial stock ownership does affect a firm’s posture toward strategies of diversification (either related or unrelated) and investment in R&D (product and process innovations), which in turn explain differences in productivity among firms. It is the empirical effect of insider ownership on total factor pro-ductivity (as associated with the production processes of a firm) that is the focus of this paper.

This paper attempts to bring together the literature on corporate finance and produc-tivity and differs from prior studies in the fol-lowing ways. First, it investigates the agency problem by examining a more fundamental economic measure of firm performance than those used in prior studies. Second, since there is a reason to believe that not all insiders have equal access to non-public information (Nunn

et al., 1983), examining a sub-group of insiders

might provide additional insights into corpo-rate governance structures. The insiders (a broad definition of management) are sub-classified into executives, board members and large shareholders in this paper in order to allow for more detailed analysis. Third, a longitudinal mixed model is employed in this study to control for any unobservable firm heterogeneity. Hill and Snell (1989) support the optimal use of panel data by stating the limitation of their cross-sectional analysis: “We use static data to test for what are undoubtably dynamic relationships. Longitu-dinal analysis would have been preferable . . .” (p. 43). Fourth, in order to ensure that our results are not affected by endogeneity of own-ership, we use lagged insider ownership as the independent variable.

The rest of the paper is organised as follows. In the next section, the relevant corporate governance and production theories are pre-sented. This is followed by a description of the empirical model and the samples used. The fourth section presents the empirical results and their managerial implications, and is fol-lowed by conclusive remarks.

Theoretical framework

In this section, three aspects of the pertinent literature – i.e. the relationship between insider ownership and firm performance, the concept of total factor productivity, and the link between productivity and financial per-formance measures – are reviewed to provide a thorough theoretical background to this study.

328 CORPORATE GOVERNANCE

Insider ownership and firm performance

Despite the importance of the potential impli-cations, no theoretical or empirical consensus currently exists on whether insider equity ownership affects firm performance. Jensen and Meckling (1976) suggest that managers deviate from the goal of shareholder wealth-maximisation by consuming perquisites when they do not have an ownership stake in the firm. Accordingly, higher managerial stock ownership is hypothesised to align manag-erial interests with shareholder interests. Chung and Pruitt (1996) examine 404 publicly-held US companies in 1987 via a simultaneous equations model and find that executive (CEO) equity ownership did in fact positively influence Tobin’s Q. Palia and Lichtenberg (1999) investigate 255 US manufacturing firms between 1982 and 1993 and observe a positive relationship between firm productivity and managerial ownership (here managers were defined as top officers and board members of a firm). Core and Larcker (2002) examine 195 US firms that had adopted target ownership plans for top executives from 1991 to 1995 and find that excess accounting returns and stock returns were higher after the plans were adopted.

In a seminal study by Morck et al. (1988), the existence of a nonlinear relationship between insider ownership and firm performance was proposed. Morck et al. examine 371 Fortune 500 firms for the year 1980 using piecewise linear regression and find a positive relation-ship between Tobin’s Q and management ownership for the 0 per cent to 5 per cent board ownership range, a negative relation-ship in the 5 per cent to 25 per cent board ownership range (where managers are entrenched), and a positive relationship for board ownership exceeding 25 per cent. McConnell and Servaes (1990) examine 1173 NYSE/AMEX firms for the year 1976 and 1093 firms for the year 1986 and find an inverted U-shaped relationship between Tobin’s Q and insider ownership (here insiders were defined as officers and directors collectively). Short and Keasey (1999) use the market value to book value of equity and the return on share-holders’ equity as measures of firm perfor-mance and observe, in their sample of UK firms, a similar cubic relationship to the one found by Morck et al. in 1988; the difference being that UK management becomes entrenched at higher levels of director owner-ship than their US counterparts.2

In contrast, other investigations have pro-posed that insider ownership and firm perfor-mance are unrelated. Demsetz (1983) argues that the ownership structure of a firm ought to

be influenced by the profit-maximising inter-ests of shareholders, so that, as a result, there should be no systematic relationship between ownership structure and firm performance. Demsetz and Lehn (1985) and Demsetz and Villalonga (2001) provide evidence of the endogeneity of a firm’s ownership structure by examining cross-sectional data in the late 1970s and show that there is no relationship between corporate performance and owner-ship structure. Cho (1998) uses cross-sectional data from 326 Fortune 500 firms in 1991 and finds, from the results of his simultaneous regression, that Tobin’s Q affects ownership structure but not vice-versa. However, Cho’s results might be caused by measuring insider ownership and Tobin’s Q at the same time (i.e. the end of 1991). Since top management are likely to have inside information about a firm’s future prospects, they have an incentive to adjust their portfolios based on their own estimates of future performance. Therefore, Hermalin and Weisbach (1991) point out that “cross-sectional regressions of Q on owner-ship may be misleading as well as statistically incorrect because the results are contaminated by the effects of Q on ownership”, and they further suggest the use of time-series data on ownership as a control for the possible simul-taneity between ownership and Q. Himmel-berg et al. (1999) use panel data of 398 US firms from 1982 to 1992 and control for firm fixed effects to re-examine the ownership– performance relationship. They find no meaningful correlation between managerial ownership and Tobin’s Q. However, Zhou (2001) criticises the methodology of Himmel-berg et al. by pointing out that fixed effects estimators may not be able to detect the effect that ownership has on firm performance (even if such a relationship exists).

Following the lead of La Porta et al. (1999), some scholars began to identify the single ulti-mate controlling shareholders for corporations in East Asian countries (Claessens et al., 2000) and emerging markets (Lins, 2003). However, the process of constructing ultimate owner-ship requires data sources that capture the full breadth of any overlaps among family mem-bers, other companies and other institutions. In the absence of detailed ownership data, Lins (2003) follows the convention of La Porta

et al. (1999) by matching managers and

fami-lies based on family surname, but this match is obviously imperfect when family members do not share the same surname (Lins, 2003, p. 180). This potential misclassification may cause a serious bias in the ownership measure. Therefore, given the lack of comprehensive pyramid structures and cross-holdings data up to now in Taiwan, we are precluded from

INSIDER OWNERSHIP STRUCTURE AND FIRM PERFORMANCE 329

conducting an analysis of ultimate control in the present study. Instead, our attention is focused on another critical and largely ignored aspect of ownership structure – namely, the composition of insider (management) ownership.

Nunn et al. (1983) propose a hierarchy

among the insiders regarding their functional roles within a firm. With direct responsibility for promoting all major corporate policies, top officers are expected to have the greatest access to non-public information. Directors, as members of the board, are responsible for advising top officers on all strategic decisions but have no day-to-day operational duties. Blockholders (i.e. those holding 10 per cent or more of the outstanding shares) on the other hand, do not take part in the day-to-day operations of the firm and would not normally be consulted on major corporate decisions. Therefore, in this current study we have classified insiders into top officers, directors and large shareholders so as to examine the effect of insider ownership structure on firm performance. In addition, to attenuate the potential simultaneity bias caused by contem-poraneous cross-sectional analysis, we have taken the 1-year lagged insider ownership as the independent variable to ensure that our “cause” (ownership) precedes the “conse-quence” (performance). A longitudinal mixed-model regression technique that incorporates both fixed effects and variance components is also employed to control for any unobservable firm heterogeneity.

The concept of firm productivity

Production theory suggests a transformation process in which firms employ and transform different inputs such as labour and capital into outputs. As a relative concept, a natural measure of productivity is the ratio of outputs to inputs. Productivity in this study is referred to total factor productivity (TFP), which is defined as the “ratio of total output to the sum of associated labor and capital (factors) inputs” (Edosomwan, 1985, p. 3). Other tradi-tional measures of productivity, such as labour productivity in a factory and land produc-tivity in farming, are what is known as partial productivity. The partial productivity measure can provide a misleading indication of overall productivity because it overemphasises one input and neglects others (Ghalayini and Noble, 1996). A good index of efficiency must account for the services of all or at least most of the inputs employed by the firm – and the TFP is such an index. However, since inputs are not homogeneous and some are intangible, representing them using an aggregate

produc-tivity measure such as TFP is a difficult task (Ghalayini and Noble, 1996). For simplicity, this study takes total value added as the aggre-gated measure of outputs for a firm and assumes that the firm employs two major fac-tors of production, namely, labour and phy-sical capital. Let L denote labour input, and K

denote capital input. TFP is thus defined as (1) where Y is total output and f(·) denotes total input. Equation (1) could be rewritten in a form of production function:

(2) Without loss of generality, we take f(·) as a Cobb-Douglas function and represent output accordingly:3

(3) where aL and aK represent how output responds to changes in labour input and capi-tal input respectively. In other words, they rep-resent the technical parameters for factor elasticity. Taking the logarithm of both sides (for an individual firm i) will result in:

(4) For a set of firms in a homogeneous in-dustry, each firm’s TFP can be inferred from regressing the above production function if the technical parameters aLi and aKi are invari-ant across firms, i.e. aLi=aL and aKi=aK. The justification for this simplified approach is that Taiwan has developed what is known as the “Cluster Effect” – an effect characterised by the centralisation of firms that facilitates the production of related products as a result of the close proximity of both suppliers and com-petitors. In fact, most of Taiwan’s information technology products are made in the Hsinchu Science Park (HSP) area, which is touted as “the closest that Asia has come to replicating California’s Silicon Valley” (The Wall Street

Journal, 24 October 1995). Moreover, the Park

Administration, the major authority of HSP, provides companies within the Park with a one-stop service in areas such as development planning, construction and landscaping, labour administration, information networks, and warehousing services etc. As a result, aLi and aKi are taken in this study to be invariant across firms within the Park. If this is the case, Equation (4) could be simplified in this manner:

(5) If we let g(·) be the effect of firm character-istics (including insider ownership) on the productivity of Taiwanese electronics firms,

TFP Y f L K = ( , ), Y TFP f L k= ◊ ( , .) Y TFP L= ◊ aL◊KaK , lnYi=ln(TFPi)+aLilnLi+aKilnKi. lnYi=aLlnLi+aKlnKi+ln(TFPi).

330 CORPORATE GOVERNANCE

i.e. ln(TFPi) =g(·) + vi with vi as the error term, Equation (5) could be rewritten as

(6) The functional form of g(·) will be detailed later on in the empirical model section. The production function will then be numerically estimated using regression techniques.

The link between productivity and financial performance measures

As discussed above, previous studies (e.g. Morck et al., 1988; McConnell and Servaes, 1990; Chung and Pruitt, 1996; Cho, 1998; Himmelberg et al, 1999; Demsetz and Villa-longa, 2001; Lins, 2003) have mostly focused on the effect that insider ownership has on Tobin’s Q. However, since Tobin’s Q is buf-feted by investor psychology pertaining to forecasts of a multitude of world events (Demsetz and Villalonga, 2001), caution is needed when viewing Q as a performance measure. In addition, since Tobin’s Q incorpo-rates only a single day’s stock price informa-tion at the end of a year, the fact that the Taiwanese stock market is so volatile means that Tobin’s Q might not be able to represent firm performance of an entire year adequately. However, unlike prior research, this study attempts to measure firm performance based on a more primitive variable – productivity – and further aims to identify specific insider holding strategies that improve this economic measure of firm performance.

Several economic and business studies have demonstrated that productivity growth does intrinsically determine the equilibrium value of a set of endogenous variables (such as profits and stock prices). Gordon and Parsons (1985) demonstrate that profit changes can be measured as a function of productivity and changes in price recovery. Grifell-Tatje and Lovell (1999) point out that profit change can be decomposed into three sources, namely, a productivity change effect, an activity effect and a price effect. These findings apparently suggest that productivity gains have the potential to contribute to an increase in busi-ness profits. Palia and Lichtenberg (1999) find a strong positive relationship between produc-tivity and Tobin’s Q, which suggests that the stock market does reward firms when they increase their level of productivity. Conse-quently, measuring firm performance by way of productivity as opposed to profitability or Tobin’s Q may filter out noises such as price change or stock market volatility and allow us to better measure the true operating perfor-mance of a firm.

lnYi=aLlnLi+aKlnKi+ ◊g( )+vi.

Data and empirical model

A comprehensive firm-level panel data set for 5 years (1996–2000) is employed. The sample includes 333 Taiwanese electronics companies listed either on the Taiwan Stock Exchange Corporation (TSEC) or on the Over-The-Counter Securities Exchange (GRETAI). The number of effective observations totals 1113. The data are gathered from the Taiwan Eco-nomic Journal Database.

There are several reasons why we chose to employ a large sample of firms from within a single industry rather than using data from a cross-section of industries. First, a production function can only be estimated for a set of firms within a homogeneous industry. Second, as stated in the introduction section, the elec-tronics industry of Taiwan plays a prominent role on the international platform and is one of the most important contributors to eco-nomic growth of Taiwan. For example, the electronics industry alone accounted for 52 per cent (222 out of 423) of total IPOs issued in Taiwan during 1996–2000. Lastly, on account of the Cluster Effect of Taiwanese electronics firms mentioned previously, the parameters of factor elasticity, aLi and aKi, can be taken as firm-invariant in our study.

Panel data require special statistical meth-ods because the set of observations on one subject tends to be inter-correlated. To control for firm-specific heterogeneity (i.e. corporate culture, good leadership, quality of workforce etc.) that are not measurable but have a signi-ficant impact on firm performance, a longitu-dinal mixed model is employed in this study to estimate the production function. The mixed model incorporates problems relating to the estimation of both fixed effects and ran-dom effects in the same equation, and an infer-ential method named Restricted (or Residual) Maximum Likelihood (REML) has been derived for the linear mixed models (McCul-loch and Searle, 2000). Letting g jXjit

j p ◊ ( )= =

Â

b 1 and vit= ui + eit and substituting longitudinal variables into Equation (6), it follows that(7) where ln represents the natural logarithm, subscript it refers to the i-th firm at the t-th time period, X1, . . . , Xp are the observable firm characteristics and b1, . . . , bp are unknown fixed-effect parameters to be estimated. vit is the composite error term, i.e. vit=ui + eit where

ui is an unobservable firm-specific effect and eit refers to the white-noise disturbance. ui’s are

lnYit LlnLit KlnKit jXjit u , j p i it = + + + + =

Â

a a b e 1INSIDER OWNERSHIP STRUCTURE AND FIRM PERFORMANCE 331

i.i.d. normal random variables with zero mean and a variance of su2 and are independent of the eit’s.

The relationship between firm character-istics and total factor productivity is then hypothesised as

(8a) with RDit being defined as research and devel-opment (R&D), AGEit as firm age, INSit as total insider holding ratio and dt as the year effect. R&D and firm age are included in the empiri-cal model as control variables since Hill and Snell (1989) and Huang and Liu (1994) have shown that these two variables have signifi-cant impact on productivity or efficiency. According to Palia and Lichtenberg (1999), the inclusion of the year effect eliminates the need to deflate any of the dollar-denominated variables.

The Securities and Exchange Law of Taiwan defines insider as board members (directors and supervisors), managers and shareholders holding more than 10 per cent of the total shares of a company. This study classifies insiders into three sub-groups, executives, board members and blockholders, in order to further examine the effect of insider owner-ship structure on total factor productivity. The Equation (8b) is constructed accordingly:

(8b) where EXEit denotes the proportion of insider ownership attributable to executive stock-holding, and BODit denotes the proportion of insider ownership attributable to non-executive director stockholding.

After substituting Equations (8a) and (8b) into Equation (7) respectively, we obtain the following two mixed-model equations, where each firm is assigned its own random-effect intercept and each year is attributed a fixed-effect dummy variable.

(9a) (9b) ln , TFP u RD AGE AGE INS INS it i it it it it it t it ( )= + + + ( ) + + ( ) + + b b b b b d e 1 2 3 2 4 5 2 ln , TFP u RD AGE AGE

EXE EXE BOD

BOD it i it it it it it it it t it ( )= + + + ( ) + + ( ) + + ( ) + + b b b b b b b d e 1 2 3 2 6 7 2 8 9 2 lnY u lnL lnL RD AGE AGE INS INS it i L it K it it it it it it t it = + + + + + ( ) + + ( ) + + a a b b b b b d e 1 2 3 2 4 5 2 lnY u lnL lnL RD AGE AGE EXE EXE BOD BOD it i L it K it it it it it it it it t it = + + + + + ( ) + + ( ) + + ( ) + + a a b b b b b b b d e 1 2 3 2 6 7 2 8 9 2 i=1, . . .N; t=1, . . .Ti

with N as the number of firms and Ti as the number of periods for firm i. Since an un-balanced panel is allowed in the mixed model, the number of periods for each firm does not have to be the same.

To avoid the possible effects of reverse causality from performance to ownership, the independent variable of insider stockholding takes value at the beginning of the year. This approach of lagging the endogenous variables by one-period is commonly used in longitudi-nal studies (see Palia and Lichtenberg, 1999; Han, 2003). Detailed definitions of the vari-ables are given as follows:

Output (Y) = value added of a firm = revenue – intermediate inputs = annual net sales – total materials expenditure.

Labour input (L) = annual salary and wage expenditure.

Capital input (K) = book value of net prop-erty, plant and equipment.

Research and development (RD) = annual R&D expenditure.

Firm age (AGE) = the number of years passed since the firm was established. Total insider ownership (INS) = (the num-ber of shares owned by insiders including top officers, non-executive directors and large shareholders) ∏ (the number of total outstanding shares for the firm).

Executive-to-insider holding ratio (EXE) = (the number of shares owned by top offi-cers) ∏ (the number of outstanding shares owned by insiders).

Board-to-insider holding ratio (BOD) = (the number of shares owned by non-executive directors) ∏ (the number of outstanding shares owned by insiders).

Blockholder-to-insider holding ratio (BLK) = (the number of shares owned by large shareholders who own more than 10 per cent of total shares, but are neither offic-ers nor directors of the firm) ∏ (the number of outstanding shares owned by insiders).

Empirical results and discussion

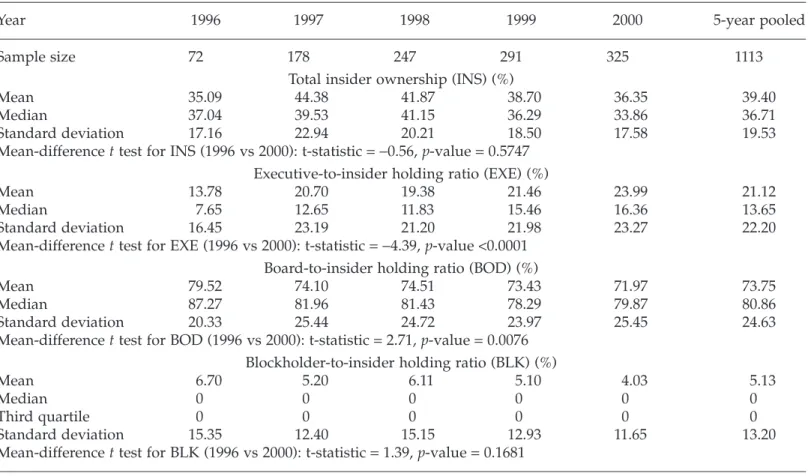

Descriptive statistics of insider ownershipThe descriptive statistics for the insider ownership variables are presented in Table 1. For the total insider ownership (INS), the 5-year pooled mean is 39.40 per cent and the median is 36.71 per cent. As for the trend, both the mean and the median increase first and

332 CORPORATE GOVERNANCE

then decrease, but both remain at about the same level as they were 5 years ago. From the mean-difference t test it can be found that the mean of INS in 1996 (35.09 per cent) is not significantly different from the mean in 2000 (36.35 per cent).

Regarding the executive-to-insider holding ratio (EXE), the 5-year pooled mean is 21.12 per cent and the median is 13.65 per cent. The mean of EXE in 2000 (23.99 per cent) is signi-ficantly greater than that in 1996 (13.78 per cent), indicating that the proportion of insider equity owned by top officers almost doubled over the 5-year period. In contrast, the mean of board-to-insider holding ratio (BOD) decreased significantly from 79.52 per cent in 1996 to 71.97 per cent in 2000. Lastly, it should be noted that for the 5 years that are under analysis, all of the third-quartile blockholder-to-insider holding ratios (BLK) are zero. In other words, 75 per cent of our sample firms have no large shareholders that own more than 10 per cent of the total shares but are neither executives nor directors of the firm. This may be due to the fact that non-management blockholders in Taiwan usually seek out voluntary anonymity by allocating their equity stakes to some nominal

share-holder so that legal constraints on insider trading can be evaded.

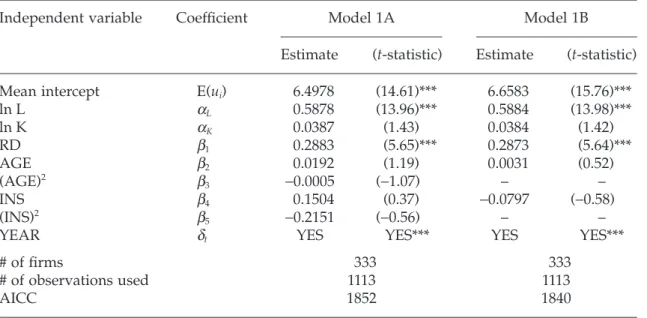

Effect of total insider ownership on productivity

Results of estimating Equation (9a) with total insider holding ratio as the ownership vari-able are listed in Tvari-able 2, while the year effects and the random intercepts are omitted. In Model 1A, it is observed that the estimate for b5 is not statistically significant (t-statistic =

-0.56, p-value > 0.10), suggesting no quadratic relation between total insider ownership and productivity. In Model 1B we re-estimate Equation (9a) after eliminating the insignifi-cant independent variables (INS)2 and (AGE)2.

The estimate for b4 is still not significantly

dif-ferent from zero (t-statistic = -0.58, p-value > 0.10), indicating no correlation between total insider ownership and productivity.

Summing up the results in Table 2, it is found that insider ownership as a whole has no impact on total factor productivity for Tai-wanese electronics firms. However, since specific sub-groups of insiders may have dif-ferent levels of involvement concerning the strategic development and daily operation

Table 1: Descriptive statistics of insider ownership

Year 1996 1997 1998 1999 2000 5-year pooled

Sample size 72 178 247 291 325 1113

Total insider ownership (INS) (%)

Mean 35.09 44.38 41.87 38.70 36.35 39.40

Median 37.04 39.53 41.15 36.29 33.86 36.71

Standard deviation 17.16 22.94 20.21 18.50 17.58 19.53

Mean-difference t test for INS (1996 vs 2000): t-statistic = -0.56, p-value = 0.5747 Executive-to-insider holding ratio (EXE) (%)

Mean 13.78 20.70 19.38 21.46 23.99 21.12

Median 7.65 12.65 11.83 15.46 16.36 13.65

Standard deviation 16.45 23.19 21.20 21.98 23.27 22.20

Mean-difference t test for EXE (1996 vs 2000): t-statistic = -4.39, p-value <0.0001 Board-to-insider holding ratio (BOD) (%)

Mean 79.52 74.10 74.51 73.43 71.97 73.75

Median 87.27 81.96 81.43 78.29 79.87 80.86

Standard deviation 20.33 25.44 24.72 23.97 25.45 24.63

Mean-difference t test for BOD (1996 vs 2000): t-statistic = 2.71, p-value = 0.0076 Blockholder-to-insider holding ratio (BLK) (%)

Mean 6.70 5.20 6.11 5.10 4.03 5.13

Median 0 0 0 0 0 0

Third quartile 0 0 0 0 0 0

Standard deviation 15.35 12.40 15.15 12.93 11.65 13.20

INSIDER OWNERSHIP STRUCTURE AND FIRM PERFORMANCE 333

within a firm, it is believed that examining the composition of insider ownership can result in additional insights into corporate governance structures. Therefore, our research continues with a detailed analysis of executive owner-ship, board member ownership and large shareholder ownership, respectively.

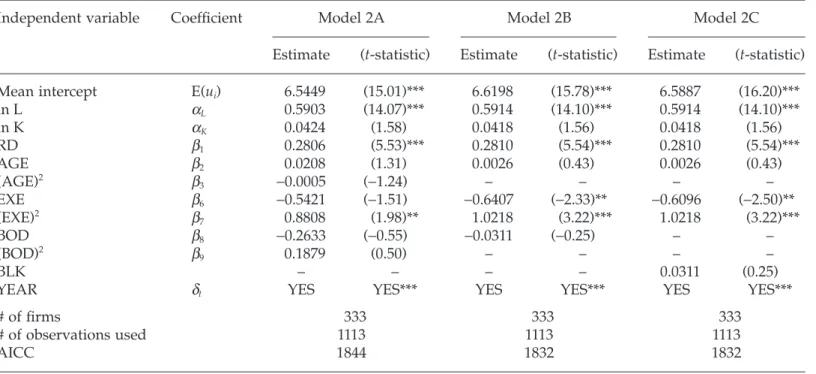

Effect of insider ownership structure on productivity

Results of estimating Equation (9b) with the executive-to-insider and the board-to-insider holding ratios as the ownership variables are presented in Table 3, while the year effects and the random intercepts are omitted. In Model 2A, it is observed that the estimate for b9 is not statistically significant (t-statistic =

0.50, p-value > 0.10), showing no quadratic relationship between board member owner-ship and productivity. Consequently, in Model 2B we re-estimate Equation (9b) after eliminating the insignificant independent variables (BOD)2 and (AGE)2, and observe

that the estimate for b7 is significantly positive

(t-statistic = 3.22, p-value < 0.01), indicating a U-shaped relationship between executive ownership and productivity. However, the estimate for b8 is still not significantly

differ-ent from zero (t-statistic = -0.25, p-value > 0.10), showing no correlation between board member ownership and productivity. Finally, in Model 2C we replace the board-to-insider holding ratio (BOD) with the blockholder-to-insider holding ratio (BLK) and find a similar

result as in Model 2B, in that large share-holder ownership does not affect productivity. As for the goodness of fit, both Model 2B and Model 2C demonstrate the same lower AICC (= 1832) than the other three models, suggest-ing that the quadratic specification of the executive-to-insider holding ratio did better capture the relationship between insider ownership and firm productivity.

In terms of control variables, Model 2B and Model 2C report the same positive effect of R&D expenditure on productivity (b1 = 0.2810,

p-value < 0.01), consistent with the findings of

Hill and Snell (1989) and Huang and Liu (1994). However, there exists no significant contribution of firm age on productivity (b2 =

0.0026, p-value > 0.10); therefore, we cannot conclude that there is a learning effect for older firms in Taiwan’s electronics industry.

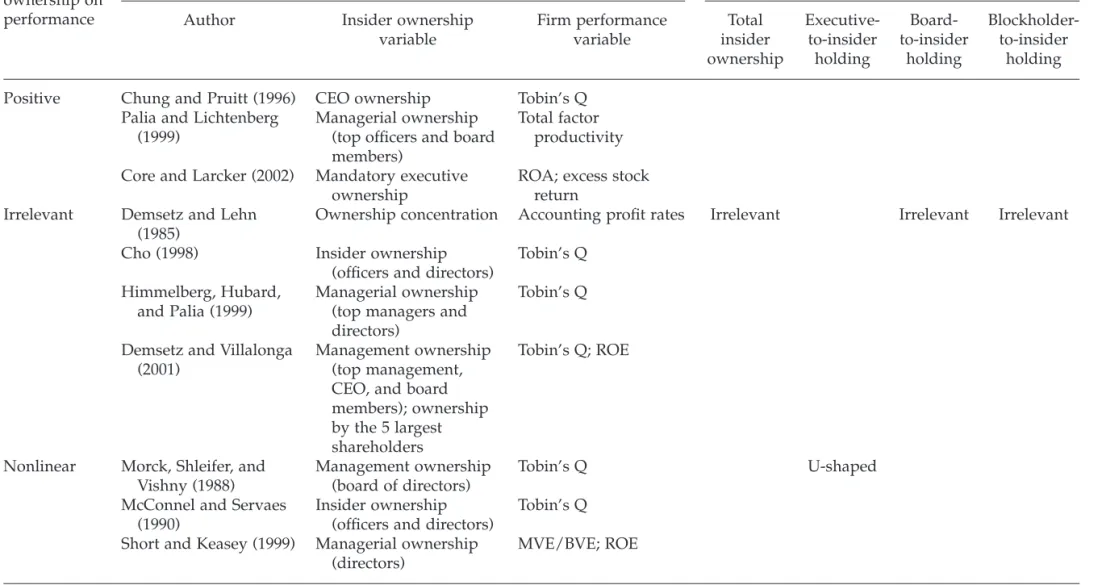

Discussion and implication

This study documents the importance of exec-utive stock ownership to total factor produc-tivity for Taiwanese electronics firms. Table 4 summarises our empirical results and compar-ison with prior works is also provided. When employing total insider stockholding to check for its relationship with productivity, our find-ing is consistent with those of Demsetz and Lehn (1985), Cho (1998), Himmelberg et al. (1999), and Demsetz and Villalonga (2001) in that insider ownership does not affect firm performance. However, different results are reached if insiders are classified into three

dif-Table 2: Production function estimates – total insider ownership

Independent variable Coefficient Model 1A Model 1B

Estimate (t-statistic) Estimate (t-statistic)

Mean intercept E(ui) 6.4978 (14.61)*** 6.6583 (15.76)***

ln L aL 0.5878 (13.96)*** 0.5884 (13.98)*** ln K aK 0.0387 (1.43) 0.0384 (1.42) RD b1 0.2883 (5.65)*** 0.2873 (5.64)*** AGE b2 0.0192 (1.19) 0.0031 (0.52) (AGE)2 b 3 -0.0005 (-1.07) – – INS b4 0.1504 (0.37) -0.0797 (-0.58) (INS)2 b 5 -0.2151 (-0.56) – –

YEAR dt YES YES*** YES YES***

# of firms 333 333

# of observations used 1113 1113

AICC 1852 1840

***: significant at the 1%, 5%, and 10% level, respectively. YES: The year effects are estimated, but not reported.

334 CORPORATE GOVERNANCE

ferent sub-groups (executives, board members and large shareholders).

Regarding executive ownership, the U-shaped relationship between the executive-to-insider holding ratio and productivity indicates the importance of top officers’ com-mitment to the efficiency of Taiwanese elec-tronics firms. In other words, increasing executive ownership beyond a certain percent-age will help reduce percent-agency costs. One pos-sible explanation for this phenomenon might be the fact that the magnitude of information asymmetry between shareholders and man-agers in the electronics industry is enhanced, because most executives own proprietary high-tech expertise. If the executive-to-insider holding ratio rises above a certain level, these top officers might be able to exert their pro-fessional knowledge in making strategic decisions concerning firm survival and devel-opment. Thus, firm productivity is likely to improve and agency costs to reduce; and this supports the convergence-of-interest hypoth-esis of Jensen and Meckling (1976).

With regards to board member ownership, no significant correlation is observed between the board-to-insider holding ratio and produc-tivity. A potential reason for this failure to find a relationship might be the fact that individu-als or institutions are not necessarily endowed with both managerial talent and financial capital (Denis and McConnell, 2003). In

parti-cular, outside investors are less likely to pos-sess the professional know-how needed to run a high-tech company. Even if they were elected as board members, they probably do not have the expertise to direct the strategic development of the firm nor can they super-vise an efficient utilisation of firm resources. That is to say, non-executive directors in Taiwanese electronics firms probably do not assume responsibilities typical of manage-ment and behave more like an ordinary inves-tor. Therefore, it is argued that a change in the board-to-insider holding ratio is not related to firm productivity. Similarly, no relationship is found between the blockholder-to-insider holding ratio and productivity. The reason for this might be that most of the sample firms in our study do not have non-management large shareholders (as shown in Table 1). Thus the impact of blockholder ownership on firm performance cannot be observed.

Conclusions

Theories and some previous empirical investi-gations suggest that insider equity ownership may influence firm performance. On the other hand, although productivity is also an impor-tant indicator of firm performance, few pro-duction-function studies have taken insider stockholding into account, let alone its

Table 3: Production function estimates – insider ownership structure

Independent variable Coefficient Model 2A Model 2B Model 2C

Estimate (t-statistic) Estimate (t-statistic) Estimate (t-statistic)

Mean intercept E(ui) 6.5449 (15.01)*** 6.6198 (15.78)*** 6.5887 (16.20)***

ln L aL 0.5903 (14.07)*** 0.5914 (14.10)*** 0.5914 (14.10)*** ln K aK 0.0424 (1.58) 0.0418 (1.56) 0.0418 (1.56) RD b1 0.2806 (5.53)*** 0.2810 (5.54)*** 0.2810 (5.54)*** AGE b2 0.0208 (1.31) 0.0026 (0.43) 0.0026 (0.43) (AGE)2 b 3 -0.0005 (-1.24) – – – – EXE b6 -0.5421 (-1.51) -0.6407 (-2.33)** -0.6096 (-2.50)** (EXE)2 b 7 0.8808 (1.98)** 1.0218 (3.22)*** 1.0218 (3.22)*** BOD b8 -0.2633 (-0.55) -0.0311 (-0.25) – – (BOD)2 b 9 0.1879 (0.50) – – – – BLK – – – – 0.0311 (0.25)

YEAR dt YES YES*** YES YES*** YES YES***

# of firms 333 333 333

# of observations used 1113 1113 1113

AICC 1844 1832 1832

***, **: significant at the 1%, 5%, and 10% level, respectively. YES: The year effects are estimated, but not reported.

INSIDER OWNERSHIP STRUCTURE AND FIRM PERFORMANCE © Blackwell Publishing Ltd 2005

V

olume 13

Number 2

M

ar

Table 4: Results of prior empirical works and this study

Impact of ownership on performance

Prior empirical work Ownership variable in this study

Author Insider ownership

variable Firm performance variable Total insider ownership Executive-to-insider holding Board-to-insider holding Blockholder-to-insider holding

Positive Chung and Pruitt (1996) CEO ownership Tobin’s Q Palia and Lichtenberg

(1999)

Managerial ownership (top officers and board members)

Total factor productivity Core and Larcker (2002) Mandatory executive

ownership

ROA; excess stock return

Irrelevant Demsetz and Lehn (1985)

Ownership concentration Accounting profit rates Irrelevant Irrelevant Irrelevant Cho (1998) Insider ownership

(officers and directors)

Tobin’s Q Himmelberg, Hubard,

and Palia (1999)

Managerial ownership (top managers and directors)

Tobin’s Q

Demsetz and Villalonga (2001)

Management ownership (top management, CEO, and board members); ownership by the 5 largest shareholders

Tobin’s Q; ROE

Nonlinear Morck, Shleifer, and Vishny (1988)

Management ownership (board of directors)

Tobin’s Q U-shaped

McConnel and Servaes (1990)

Insider ownership (officers and directors)

Tobin’s Q Short and Keasey (1999) Managerial ownership

(directors)

MVE/BVE; ROE

336 CORPORATE GOVERNANCE

composition. This study brings together vari-ous aspects of corporate finance and produc-tivity literature and examines the relationship between insider ownership structure and total factor productivity in Taiwan’s electronics industry. Insiders, the broad definition of man-agement, have been classified into executives, board members and large shareholders to carry out a detailed study.

Empirical results demonstrate that for the study period of 1996–2000, although increas-ing at first and then later decreasincreas-ing, the mean of total insider ownership has remained at about the same level of 35 per cent in 2000 as in 1996. However, the average executive-to-insider holding ratio has increased significantly from 14 per cent to 24 per cent. As for its impact on firm perfor-mance, the total insider ownership shows no influence on total factor productivity. Look-ing further into the structure of insider ownership, it is found that total factor pro-ductivity first decreases and then increases with the executive-to-insider holding ratio, forming a U-shaped relationship. However, neither the board-to-insider holding ratio nor the blockholder-to-insider ratio affects total factor productivity.

These results seem to reflect the reality in Taiwan’s high-tech sector in the last decade. Under circumstances characterised by high growth in the 1990s, Taiwan-style profit shar-ing and employee stock ownership plans have been often used as a strategic scheme to attract and to retain talented knowledge workers. The important implication of this study is that for Taiwanese electronics firms, increasing

execu-tive stock ownership over a certain level will

improve firm productivity and reduce agency costs. The recent legislation of “employee stock option” system in Taiwan should also be considered as a positive factor in terms of aligning managerial and shareholders’ interests. From a corporate governance per-spective, stock ownership of top officers in high-tech firms should be encouraged to enhance firm performance.

It should be noted that our analyses of insider ownership structure primarily refer to the allocation of equity stakes among the sub-groups of insiders. The exercise of calculating ultimate ownership, i.e. a firm’s controlling shareholder, is beyond the scope of this study and will be left for future research when more reliable data sources of stock pyramids and cross-holdings become available in Taiwan.

Appendix

Appendix A: Major producers of information hardware products

Country Year 1999 Year 2000 Growth rate

(2000 over 1999) Value* (US$1 million) Rank Value* (US$1 million) Rank US 85,085 1 88,489 1 4% Japan 44,051 2 45,468 2 3.2% China 18,455 4 25,535 3 38.4% Taiwan 21,023 3 23,081 4 9.8% UK 16,007 5 16,167 5 1% Germany 10,910 6 12,001 6 10%

*Value includes only domestic products of information hardware.

Source: Information Technology Industry Yearbook, Industrial Economics & Knowledge Center, Industrial Technology Research Institute, Taiwan, R.O.C.

Notes

1. American Compensation Association (now known as WorldatWork) surveyed 915 US com-panies in August 2000, and reported that stock-based compensation plans were adopted among 51 per cent of the sample companies and were available to 100 per cent of top executives and 95 per cent of senior executives. However, no such study is currently published for Taiwan.

2. Short and Keasey (1999) state that ownership data in the U.K. are only available for directors of the firm, and not for other officers/managers. 3. Maddala (1979) shows that, at least within a limited class of functions such as Cobb-Douglas, generalised translog, and generalised Leontief, differences in the functional form pro-duce a negligible difference in the measures of multi-factor productivity.

INSIDER OWNERSHIP STRUCTURE AND FIRM PERFORMANCE 337

References

Cho, M. (1998) Ownership Structure, Investment, and the Corporate Value: An Empirical Analysis, Journal of Financial Economics, 47, 103–121. Chow, E. H., Chen, J. T. and Chen, K. H. (1996)

Family Business, Affiliated Groups, and the Value of Taiwanese Firms, Journal of Financial Studies, 4(1), 115–139 (in Chinese).

Chung, K. H. and Pruitt, S. W. (1996) Executive Ownership, Corporate Value, and Executive Compensation: A Unifying Framework, Journal of Banking and Finance, 20, 1135–1159.

Claessens, S., Djankov, S. and Lang, L. H. P. (2000) The Separation of Ownership and Control in East Asian Corporations, Journal of Financial Eco-nomics, 58(1–2), 81–112.

Core, J. E. and Larcker, D. F. (2002) Performance Consequences of Mandatory Increases in Execu-tive Stock Ownership, Journal of Financial Eco-nomics, 64(3), 317–340.

Demsetz, H. (1983) The Structure of Ownership and the Theory of the Firm, Journal of Law and Eco-nomics, 26, 375–390.

Demsetz, H. and Lehn, K. (1985) The Structure of Corporate Ownership: Causes and Conse-quences, Journal of Political Economy, 93(6), 1155– 1177.

Demsetz, H. and Villalonga, B. (2001) Ownership Structure and Corporate Performance, Journal of Corporate Finance, 7(3), 209–233.

Denis, D. K. and McConnell, J. J. (2003) In-ternational Corporate Governance, Journal of Financial and Quantitative Analysis, 38(1), 1–36. Edosomwan, J. A. (1985), Integrating Productivity and

Quality Measurement. New York: Marcel Dekker. Gaver, J. J. and Gaver, K. M. (1995) Compensation

Policy and the Investment Opportunity Set, Financial Management, 24(1), 19–32.

Ghalayini, A. M. and Noble, J. S. (1996) The Changing Basis of Performance Measurement, International Journal of Operations & Production Management, 16(8), 63.

Gordon, P. N. and Parsons, J. (1985) Productivity: Its Impact on Profits, Corporate Accounting, 3(2), 82–84.

Grifell-Tatje, E. and Lovell, C. A. K. (1999) Profits and Productivity, Management Science, 45(9), 1177–1193.

Han, T. S. (2003) The Economic Effects of Profit Sharing and Taiwan-style Employee Stock Own-ership Plans: Evidence from Taiwan’s High-tech Firms, Taiwan Academy of Management Journal, 3(1), 1–22.

Hermalin, B. E. and Weisbach, M. S. (1991) The Effects of Board Composition and Direct Incen-tives on Firm Performance, Financial Management, 20(4), 101–112.

Hill, C. W. L. and Snell, S. A. (1989) Effects of Own-ership Structure and Control on Corporate Pro-ductivity, Academy of Management Journal, 32(1), 25–46.

Himmelberg, C. P., Hubbard, R. G. and Palia, D. (1999) Understanding the Determinants of Managerial Ownership and the Link between

Ownership and Performance, Journal of Financial Economics, 53(3), 353–384.

Huang, C. J. and Liu, J. T. (1994) Estimation of Non-neutral Stochastic Frontier Production Function, Journal of Productivity Analysis, 5, 171–180. Jensen, M. C. and Meckling, W. H. (1976) Theory of

the Firm: Managerial Behavior, Agency Costs and Ownership Structure, Journal of Financial Eco-nomics, 3, 305–360.

La Porta. R., Lopez-de-Silanes, F. and Shleifer, A. (1999) Corporate Ownership Around the World, Journal of Finance, 54(2), 471–517.

Lins, K. V. (2003) Equity Ownership and Firm Value in Emerging Markets, Journal of Financial and Quantitative Analysis, 38(1), 159–184.

Maddala, G. S. (1979) A Note on the Form of the Production Function and Productivity. In: Panel to Review Productivity Statistics (eds) Measure-ment and Interpretation of Productivity. Washing-ton, DC: National Academy of Sciences.

McConnell, J. J. and Servaes, H. (1990) Additional Evidence on Equity Ownership and Corporate Value, Journal of Financial Economics, 27, 595–612. McCulloch, C. E. and Searle, R. S. (2000) Generalized, Linear, and Mixed Models. New York: John Wiley. Morck, R., Shleifer, A. and Vishny, R. (1988)

Man-agement Ownership and Market Valuation, Journal of Financial Economics, 20, 293–315. Nunn, K. P., Madden, G. P. and Gombola, M. J.

(1983) Are Some Insiders More “Inside” than Others? Journal of Portfolio Management, 9(3), 18– 22.

Palia, D. and Lichtenberg, F. (1999) Managerial Ownership and Firm Performance: A Re-examination Using Productivity Measurement, Journal of Corporate Finance, 5, 323–339.

Short, H. and Keasey, K. (1999) Managerial Owner-ship and the Performance of Firms: Evidence from the UK, Journal of Corporate Finance, 5, 79– 101.

Solow, R. M. (1957) Technical Change and the Aggregate Production Function, Review of Eco-nomics and Statistics, 39, 214–231.

Zhou, X. (2001) Understanding the Determinants of Managerial Ownership and the Link between Ownership and Performance: Comment, Journal of Financial Economics, 62(3), 559–571.

Her-Jiun Sheu is a Professor in the

Depart-ment of ManageDepart-ment Science and the Gradu-ate Institute of Finance, National Chiao Tung University, Taiwan. He served as Dean of the College of Management at National Chi Nan University, Taiwan from 2001 to 2003. His research interests include Derivatives, Corpo-rate Finance, Performance Evaluation and Sustainable Development.

Chi-Yih Yang is a Lecturer at Ming-Hsin

Uni-versity of Science and Technology, Taiwan. She is currently a PhD candidate in the Depart-ment of ManageDepart-ment Science at National Chiao Tung University. Her doctoral research topic is Managerial Ownership Structure and Firm Performance.