Chiao Da A1anagement Review 均l.30 No. 1,2010 pp.1-45

私募宣告對股東財富及溢(折〉價福度

之影響

Effects on Shareholders' Wealth and Premium (Discount)

。f

Private Placement Announcement

林淑玲 1 Shu Ling Lin

國立台北科技大學經營管理系

Department of Business Management, College of Management, National T;剖pel University of Technology

莊小君Ri旭 Chuang

台灣工業銀行風險管理部

Asset Review Departmet哎,Industrial Bank of Taiwan

摘要:本研究針對金管會修訂私募法規後宣告辦理私募之上市(櫃)公司,採 用事件研究法檢驗私募宣告對股東財富影響效果,並進一步探討影響異常報 酬及溢(折)價幅度之因素。實證結果顯示:私募宣告前 30 日至宣告後 30 日 的累計平均異常報酬率達 9.38% '顯示金管會加強事後資訊揭露規範後,私 募宣告對股東財富其有顯著正面影響。此外,董事會決議辦理私募前 27 天起 股價已明顯呈正向反應,由於董事會決議前一般投資人無從得知該訊息,其 公告前之異常報酬意謂存在資訊不對稱情形。再者 r 經營權是否易主」為 影響私募宣告異常報酬之重要因素。經營權易主公司於事件期累計異常報酬 平均高達 40.28%' 小額投資人雖未能成為特定人參與私募獲得可能之投資利 得,惟可依此實證結論作為得失曰:私募宣告訊息後,是否跟進投資取得異常報 酬及持有期間之參考指標。最後 r 內部人應募比率」與溢(折)價幅度相關 性並不顯著,未如過去研究文獻所認為:折價與經理人自利交易(self-dealing) 攸關,顯示自金管會針對私募訂價強化規範後,企業並無明顯透過私募大幅 折價圖利應募內部人情形。其中在折價發行樣本中 r 應募人取得之董監事

I Corresponding author: Department of Business Management, CoUege of Management, National

2 EjJects on Shareholders' Wealth and Premium (Discounυ 01 Private Placement Announcement 席次」為影響私募折價幅度之因素,顯示企業有以折價增資吸引外部人投資

並進入公司經營管理階層之現象 。

關鍵詞:私募宣告;股東財富;溢(折)價幅度;事件研究法

Abstract: The study examines the effects of shareholder' s wealth and premium (discount) from private placement announcements after the Financial Supervisory Commission (FSC) announced regulations at October 2005, and analyzes the factors of cumulative abnormal returns and premium or discount on private placement announcement. The findings can be summarized as follows: Firstly, the average cumulative abnormal return of private placement announcement is significantly positive, and the stock price shows rising before 27 days of the announcement, it implies that the information content of private placement announcement exists with early information leakage and asymmet可. Furthermore, it shows that “the change of ownership" is a significant factor affecting 由e cumulative abnormal return from private placement announcement. The average cumulative abnormal return is up to 40.28%. Investors could take the result as a reference to make decision after receive the information of announcement. Finally,

the ratio of insider purchasers is not significantly related to the discount on private placements, which reject the hypothesis of managerial self恥dealing by literatures. The firms did not benefit managerial insiders though larger discount of private offerings after the FSC announced new enforced regulations. The findings show that

“

the changed numbers of chairs in board of directors" is a significant factor affecting private placement discount. It further evidenced that firms offer lower offering price to attract new investors to participate into the managerial board Keywords: Private placement announcement; Shareholder' s wealth; Premium orChiao Da Management Review Vol. 30 No. 1, 2010 3

1.

Introduction

In order to provide Taiwan's enterprises access to simpler, more convenient,

and diversified channels to financing capitals, in Jan., 2002, the Securities and Exchange Act was amended to include an a吋 cle allowing public offerings companies to make private placement of marketable securities. Because the procedures and the management of private placement are rather loose, in recent years, the number and amount of private placement cases of listed and OTC companies have both been increasing rapidly year by year. Till 2005, the number and amount of private placement cases had already exceeded those of public offering, which is a way to increase cash capital, and become one of the most important ways of financing.

Although the private placement system has the advantage in financing efficiency, some enterprises take advantages of its characteristics, leading to issues such as the right and interests of shareholders being harmed, insider trading, driving up stock prices, or shell companies. For example, Xepex Electronics Co.

issued private placements to attract investors in 2005. By raising the energy resource issue of Biodiesel, the stock price was driven up. After that, it financial crisis broke up. It is obvious 由at issuing private placement has become a tool for majority shareholders to embezzle company money. Or by declaring private placement related information, it is used to drive up stock prices and create abnormal retum in stock market. This is unfair to minority shareholders and may cause their right and interests being threatened

In the past, if an enterprise is to issue private placements, the only requirement is to repo前 to the authority for reference within 15 days after completing payment2. After the Xepex event, in October, 2005, the authority had made the

“

Directions of Private Placement of Marketable Securities for Public Offering Companies," according to which, the content of disclosed information on marketable securities has been extended, the rule to calculate reference prices for2 甘lerule ofprivate placement for marketable securities is according to the article 43-6 ofthe Securities and Exchange Act

4 Ejj全ctson Shareholders' Wealth and Premium (Discount) of Private Placement Announcement

private placements has been set Up3, and notices of shareholders' meeting are requested to include the principle that price for private placement cannot be lower than reference price, temporaηprice, pricing basis, justifiabili句, and investors' method choice and intentions. A1so, three years after settlement date, companies issuing private placements must obtain an agreement letter from a securities exchange or OTC market which meets the publicly listed or OTC standards to complete the procedure for public offering. As far as private placement system is concemed, the newly made rule is much more active than the rules made before However, it still cannot put an end to issues such as listing lower price private placements causing threats to minority shareholder's interests. Take A11ied Material Technology Corp. for example. In 2007, because of the company's financial crisis, a new person marched in and took over to be in charge. However,

under the circumstance that the person with management rights had only two shares and still made an announcement of private placement worth 3 billion with the per share price of $0.129, causing the inflation of the company's paid-in capital from 11.5 billion to 244.1 billion4, and the dilution of equity ofthe original shareholders. A1though the private placement was not completed, still, from that case, it is very obvious that, under the rather loose private placement system, there are phenomena of enterprises taking advantages of private placements, selling stock rights to specific investor with unreasonable price for private placements, diluting minority shareholders' equity, and threatening their interests. This is enough evidence to say that the completeness of private placement management

3 The "reference price" in the "directions" is ca1culated in publicly listed and OTC companies by

the arithmetic average of common stock closing prices in one of the days including 1, 3, or 5 business days before the pricing date. As for emerging company or unlisted companies wi曲 public offerings, because there is no clear and deflIÚte market pric巴, 也is kind of companies calculate "reference prices" by the book va1ue per share from the financia1 report signed by CPA in a date closest to the pricing date

4 The origina1 paid-in capita1 of Allied Materia1 Technology Corp was 11.511 billion (increased to 25 billion in March, 2007). The company planned to raise capita1s worth 3 billion dollars, with the per share price of 0.129, it needed to issuing another 23.256 billion shares. The face value of each share is 10 dollars. Therefore the paid-in capita1 would be increased to 232.56 billion dollars. Plus the origina1 paid-in capita1 of 11.511 billion dollar宮, it would be up to 244.071 billion dollars. Besides, on April 17, 2007, the board of directors approved the increase of paid-in capita1 to 280 billion dollars. The space for lowering priva能 placementprice or futu昀 increase/decrease capita1 has been preserved

Chiao Da Alanagement Re1付wVol. 30No. 1,2010 3

system is still in doubt, and there is still space for improvement.

Prior literatures emphases of researches on private placement system were mostly on whether or not the announcement of issuing private placement has influences on the creation of abnormal returns. For example, both Hertzel and Smith (1993) and Wruck (1989) had come up with the conclusion of positive influences on abnormal returns. In addition, Hsu (2003) had probed into the abnormal retums of private placement and the discount rate, Lu (2005) had probed into whether insiders5 make profit in private placements, Lu (2005) and Lin (2006) had probed into the information content of private placement announcements, etc. Summarizing the above-mentioned researches on private placement issues, it is found that some of them had been restricted by the small sample of private placements (for example, there were only 13 companies in Hsu's (2003), and 42 in Lu's (2005). Furthermore, Lin (2006) analyses the law was amended during the period of March, 2002 to February, 2006, due to the information content such as private placement announcements, the choice of financing channel, and active management, therefore the problem of different effects had occurred.

Accordingly, considering the laws had been amended in October, 2005, the analysis of this study was conducted with only listed and OTC company data collected after the amendment, in order to explore whether the abuses such as driving up prices through private placement information and pricing low which may harm original shareholders' interests have been stopped, after the authority improved the management in private placement pricing and. information disclosure, as the reference of fuωre amendment for the authority and the suggestion of determining private placement information content for investors. In summary, the objectives of this study includes: (1) exploring the influences of private placement announcements on shareholders' wea1th after the management system of private placement was changed. (2) Analyzing the influential factors of abnormal re仙m of private placement announcement. (3) Analyzing the influential factors of discount and premium of private placements pricing.

5 Insiders includes as follows: Board of director盲,supeIViso哼,manage時,block shareholders with shares holding more than 10%.

6 Effects on Shareholders' Wealth and Premium (Discount) of Private Placement Announcement

The remainder of this study is structured as follows: Section 2 summarizes the literatures on the abnormal return of private placements and the Causes, and the premium (discount) and Causes ofthe Offering Price. Section 3 introduces the current conditions of the Taiwan's private placement market. Section 4 describes our empirical methodology, including event study method and regression analysis had been applied in this study. Section 5 discusses empirical results analysis. Section 6 concludes the study.

2. Literature Review

2.

1.

Abnormal return and the Causes ofPrivate Placements

Announcement

Wruck (1989), Hertzel and Smith (1993), and Wu et al. (2005) studied the abnormal return of private equity placement had indicated that, within a short term after the announcement of private placements, the abnormal return is significant. In addition, Hsu (2003), Lu (2005), and Lin (2006) proposed that the abnormal returns of the companies issuing private placement of shares are significantly positive in short term. Table 1 summarizes the empirical results of the abnormal retums of private equity placement.

Shleifer and Vishny (1986) proposed that companies can attract extemal investors by private replacement, and c。中orate values can be promoted through supervision, management or professional consultant and suggestion by external block shareholders. Wruck (1989) found 血at private placement usually comes with a huge amount of equity transfer; the average percentage of equity transfer with voting-right is 19%. Results of cross analysis shows that there is a significant relationship between the changes of corporate value and ownership concen甘ation when private placement is announced. Consequently, this study concludes that the

“

change of ownership structure" is one of the causes of abnormal retum which occurs when private placement is announced. Furthermore, Hertzel and SmithChiao Da A!anagement Review Vo/. 30 No. 1, 2010 7

that company values are being underestimated. The higher the degree of value underesti mati on 泊, the stronger the signal effect of private placement would be. Corporate value changes with assets and changes in investment opportunities

Table 1

Evidences of abnormal return on private placement

Authors Study County Period Obser Abnonnal Event Window vation Retum

Wruck 刊 989) U.S.A 1979-1985 99 CAAR= 8.95% -60ω+20 days

Hertze/ and

Smìth (1 99砂 U.S.A 1980-1987 106 CAAR= 8.78% -29 to + 10 days

Wu et a/. (2005) Hong Kong 1989-1997 99 CAAR=8.35% -15 to +15 days

Hsu (2003) Taiwan 2002-2∞3 13 CAAR = 6.73%

o

to +1 daysLu (2005) Taiwan 2002-2004 59 CAAR=3.5% -4 to +100 days

Lin ρ006) Taiwan 2002-2006.2 75 CAAR=8.30% -30 to + 10 days

Source: Surnmarized by 出isstudy

Abnormal retums reflect positive internal information of companies. Thus, the “information asymmetry" theory does exist in private placement. Folta and Janney (2004) found that new technology companies through private placement can deliver information of co叩orate values, and ease the problem of information asymmetry. As a result, this study concludes that the “information asymmetry" is one of the causes of abnormal return which occurs when private placement is announced. Finally, Hertzel et al. (2002) found that in the short term, there is significantly positive abnormal retum in private placement. However, the average abnormal return among three years is -23.8%. If companies with poor operating performances haven't improve their performances within three years after issuing private equities, but in the short term the market-to-book ratios are rather high and the abnormal returns are significant. This means market investors are over-optimistic about improving operating performances ofthe companies issuing private equities. Therefore, this study concludes that the “investor over-optimism" is one of the causes of abnormal return which occurs when private placement is

8

announced

ξ百倍的 onShareholders' Wealth and Premium ρiscoun t) of Private Placement Announcement

In summa句, the causes of abnormal return which occurs when private

placement is announced are including the change of ownership structure, information asymmet旬, and investor over-optimism

2.2.

The Premium (Discount) and Causes of the Pricing in Private Equity PlacementThe premium (discount) is calculated by dividing private price by stock price of the record benchmark date. Although the benchmark date used in previous researches are different, it' s found by Barclay et al. (2007) and Wu (2004) th剖 most of private equities have been sold with discounts. In Taiwan' s empirical studies, most of the researches on the pricing of private equities have shown that averagely private price is issued with discounts. For example, Hsu (2006) found that the average discount of private equity placement is 19.76% of the first day after the day of private placement announcement. Lin (2006) showed that the average discount of private equity placement is 21.29% of the 10th day after the day of private placement announcement. Table 2 shows the empirical results of discount ofthe pricing by private equity placement.

In the aspect of the factors with influences on premium (discount) of private placement, Wruck (1989) showed that on the average, unregistered stocks are sold at a discounted of 86.5% of the market price on the date before the private placement announcement, while that ofregistered stocks is at a premium of 104% of the market price on the day before the private placement announcement Because there is a 2-3 year liquidity limitatioo 00 unregistered stocks, private

placement investors would ask for discounts to compensate for the transfer limitation. As a result, this study concludes that the

“

compensation for limited liquidity of private equity placement" is one of the causes of premium (discount) of private placement being made. In addition, Wruck (1989) found that the In the aspect of the factors with influences on premium (discount) of private placement, Wruck (1989) showed th剖 on the average, unregistered stocks are sold at a discounted of 86.5% of the market price on the date before the private placementChiao Da A1anagement Review Vol. 30 No. 1, 2010 9

announcement, while that of registered stocks is at a premium of 104% of the

market price on the day before the private placement announcement

Table2

Evidence of the discount on private equity placement

Authors Study County Period Obsenration Discount Rate

Unregistered equity is Wruck (J 989) U.S.A 1979-1985 99 86Registered equity is .5% of -1 day;

104~色 of-1 day. Hertzel and

U.S.A. 1980-1987 106 Discount rate is 20.14%

Smith (1993) of+lO days

Discount rate is 18.7% of

Barclay et al. + 1 day. lf people should

ρ00 η U.S.A. 1978-1997 594 be raised is manager, the

discount rate is 24.2% of

+1 day

Discount rate is 8.7% of + 10 days. lf people Wu (2004) HongKong 1986-1997 360 should be raised is

manager, the discount rate is 17% of + 1 0 days.

Discount rate is 13.26% Hsu (2003) Taiwan 2002-2003 13 of -1 day; 9.54% of +10 days; 8.89% of +20 to + 30days mean price

Hsu ρ006) Taiwan 2002-2006 99 of+l dayDiscount rate . is 19.76% So叮"Ce:S urnmarized by 血isstudy

Because there is a 2-3 year liquidity limitation on unregistered stocks, private

placement investors would ask for discounts to compensate for the transfer limitation. As a resuIt, this study concludes that the "compensation for limited liquidity of private equity placement" is one of the causes of premium (discount)

of private placement being made. In addition, Wruck (1989) found that the

average shareholding percentage of directors, managers, and block shareholders

10 EfJects 011 Shareholders' Wealth al1d Premium (Discoul1t)

ofPriva仿 PlacementA11110U附ement

private equities. Although the increase of ownership concentration wilI bring

supervision benefits for companies, however, supervision costs also occur at the

same time. The discount on private placement reflects the compensation for

proving professional suggestions or supervision services to private placement

investors. Consequently, this study concludes that the

“

concentrated inownership" is one of the causes of premium (discount) of private placement

announcement being made.

On the other hand, Hertzel and Smith (1993) argued that, discounts on

private placements reflect the information cost investors spend on evaluating of

co中orate values. The harder it is to find out the corporate value, the more cost wilI be spent on valuation. Therefore, higher discount wilI be requested. As a

result, this study concludes 由at the "compensation for investors' information

costs" is one of the causes of premium (discount) of private placement

announcement being made. Furthermore, Hertzel et al. (2002) argued that

discounts reflect the resuIts of investors' valuation on corporate intrinsic values.

Because of the poor performances after private placement, investors believe the

intrinsic values are supposed to be lower. Therefore, investors ask for discounts

on private placements. Thus, this study concludes that the “reflection ofinvestors'

valuation on c。中orate intrinsic values" is one of the causes of premium (discount)

of private placement announcement being made

Finally, Wu (2004) showed that the discount rate for managers who are also

private placement investors is significantly higher than those who are not. The

reason is managers' self-dealing. Especially when managers holds minority

amount of shareholdings, the incentive to participate in huge-amount discounts of

private placement and commit self-dealing is stronger. So that through diluting

existing shareholders' equities, the shareholders' weaIth can be transferred to

oneself. Therefore, this study concludes that 由e 可nanagerial self-dealing" is one of the causes of premium (discount) of private placement announcement being

made.

In summary, this study concludes that the causes of premium (discount) of

private placement announcement being made include: Compensation for limited

Chiao Da Managemenl Review Vol. 30 No. 1,2010 11

investors' information costs, reflection of investors' valuation on co叩orate

intrinsic values, and managerial self-dealing

3. The Private Placement System in Taiwan

In order to solve corporate financing problem, in Janua旬, 2002, the Securities and Exchange Act was amended to update an article allowing public offering companies to make private placement of marketable securities. The related articles are listed below

3.

1.

The Definition,

Targets,

and Investors ofPrivate PIacement According to the provisions of item 1 and 2, article 43 品, the definition of"private placement" is the behavior of companies which have issued shares, following the Securities and Exchange Act, issuing securities in private placement to specific targets. The targets of private placements include: (1) banking industry, bills finance industry, trust indust句, insurance industry, securities industry, or other legal person or organization authorized by the authority. (2) A natural person, a legal person, or a fund6 who/which meets the requirements of the authority. (3) Board of directors, supervisors, or managers of the companies or affiliated companies which issue securities in private placement. The total number of investors aforementioned in second and third category in should not exceed 35

3.2.

Inspection Procedure,

ResoIution Procedure,

and ResaIeRestrictions of Private PIacement

Issuing securities in private placement does not require declaration or approval in advance. The only thing that needs to be done is to repo忱的 the

6 A na個ralperson, a legal person or a foundation should meet the following conditions: (1). The natural person himselflherself has net asset value over 10 million NT dollars or total net asset value with his/her spouse over 15 million NT dollars. Or in the recent two years, with average income over 1.5 million NT dollar草, or with total average income wi也 his/herspouse over 2

million NT dollars. (2). The legal person or foundation has tot泌的set value over 50 million dollars, or trust asset value over 50 rnillion NT dollar百

12 Effects on Shareholders' Wealth and Premium (Discount) of Private Placement Announcement

authority for memorandum within 15 days after payment is complete. Not only the approval from the board of directors is required for private placements, half of the shareholders also have to attend meetings, and two thirds of the attendance must agree

Under the reason for subject described in the convening, the followings must be included: (1) the basis and rationality of pricing. (2) The criteria to choose specific targets. If investors were scheduled to be raised, the relationship between investor and company should be described. (3) The reason why private placement is necessa可In addition, investors cannot resale their securities in private placement until holding them for at least three years. For those who hold their securities for less than three years, if there are no other securities of the same category are available in the public market, it is allow to resale their securities to other qualified investors. Or those who meet the authority's requirements of holding period and trading amount are allowed to resale their securities to specific targets

3.3.

“

Notes of Private Placement of Marketable Securities forPublic Offering Companies" Improving the Management in Information Disclosure

In order to protect the right and interests of existing shareholders of public offering company, on Oct. 11, 2005, Financial Supervisory Commission (FSC)

announced “Notes of Private Placement of Marketable Securities for Public

Offering Companies" with FSC certification No. 0940004469 order, enhancing

the information content of marketable securities in private placement, and

specifying the rules of pricing for private placement7. In the aspect of enhancing information disclosure, the rules of pricing must be included in the convened

7 As for the "reference price" under "guidelines", for public and OTC companies: Choosing one of

the days which is one, 出ree, or five days before the business day to calculate the arithmetic average closing price of common stock. Because 也is kind of market price doesn't exist for emerging rnarket or UI山sted compani白, for 出is kind of compani白, the reference price is defmed 倡 “the book value per share" from the financial 時po此 signed by CP As which is the closest to the pricing day

ChiaoDa λ1anagement Review Vol. 30 No. 1,2010 13

meeting of shareholders. Besides that, if private placement investors are already chosen, the relationships between them and the companies and the reasons not to choose public offering should also be listed. After the date the prices of private placement are decided, information related to actual price of private placement, reference price, and investors should also be disclosed. If the difference between private placement price and reference price is over 20%, independent expert's opinions should also be disclosed

Altematively, in Jan. 5, 2006, Taiwan Stock Exchange had updated

“

Guidelines of Information Repor世ngPractices for Listed and OTC Companies," requesting listed or OTC companies to submit information on marketable securities in private placement to the “private placement area" of "Market Observation Post," within 2 days after notification for shareholders meeting is sent out, within 2 days after pricing, within 15 days after payments of shares are collected8, and within 10 days after the end of every season., so that pubic investors can search for publicly listed or OTC companies' private placement related information online4. Em pirical Methodology

4.

1. Hypotheses and Em pirical ModelsAccording to the research resu1ts from Wruck (1989), Hertzel and Smith

(1993), and Wu (2004), and by referencing previous cases of private placement in Taiwan and the current condition of the market, this study had summarized the causes of abnormal retums and premium (discount), proposes the following hypotheses and empirical models

8 For private placement of marketable securities, within 15 days after the payment is made, the

following information must be subrnitted: type of private placement, date of the board of directors resolution, sett1ement date, price per unit, pricing basis, number of shares issued in private placement, payment complete date, payment date, d自由此, reasons for private

placement, target, percentage of shares hold by investo時,the relationship between investors and issuing company, and expected number of seats of board of director百 orsupervisors owned by investors. If the investor is a legaI person, the shar它holdersof the legal person with shares over

14

4.1.1 Self-Dealing Hypothesis

Effects on Shareholders' Wealth and Premium (Discount) of Private Placement An110Uncement

Wu (2004) proposed that the cause of abnormal retums and discount in

private placement is related to managers' self-dealing. When managers hold a

minority amount of shares, they'd have very high incentive to conduct

self-dealing. Through the method of buying low and selling in high pric郎,

transfer existing shareholders' wealth to themselves. Therefore, this study

proposes the following hypothesis

H1l:The higher the percentage ofinsiders anwng private placement investors is,

the higher the discount of prÎl叫'eplacement share price is

,

and the higherthe cumulative abnormal return would be.

4.1.2 Ownership Structure Hypothesis

Wruck (1989) argued that there is a strong relationship between c。中orate

values when announcing private placements and changes in ownership

concentration after private placements. The higher ownership concentration

before private placements are, the higher degrees of co中orate value increases

would be. Private placement is a method to financing capitals in a short term for

the issuing company. To investors, a huge amount of equities can be altogether

Because a large number of shares transferred are involved, private placement can

be used as a method of mergers and acquisitions, transfer managerial rights, and

backdoor listing between enterprises. According to Wruck (1989) and the practice

of private placement, this study proposes following hypotheses and empirical

models:

H/:lfthe prÎl叫'eplacement ca仰的 the tran再fer of managerial rights, then the

higher private placement discount is, the higher cumulative abnornwl

return would be.

H/: The higher number of directors and supen'isors seats obtained in the

prÏl叫e placement

,

the higher discount of private placement andChiao Da A1anagement Review Vol. 30 No. 1, 2010 15

H戶 The higher percentage

01 pri

l'ate placement shares in 卸的1 number01

issued shares is

,

the higher discount01

private placement and cumula的'eabnormal return would be.

4.1.3 Information Asymmetry Hypothesis

Hertzel and Smith (1993) put forth the information asymmetry hypothesis

in private placement. They argued that abnormal retum and discounts of private

placement price reflect information asymmet可 phenomenon. If a manager of a

company knows about the companies with investment opportunities in the future

or the underestimation of corporate value, managers tend to go with private

placement to avoid the stockholders' wealth being transferred to public investors

Therefore, the announcement of private placement can deliver the signal of the

corporate value being underestimated to the market. The higher the degree of

underestimation is, the stronger the private placement signal would be

On the other hand, private placement discount reflects costs occur when

investors collect information to evaluate a c。中orate value. Because private

placement investors need to spend more resources evaluating a c。中orate value,

they usually request higher discount. Hertzel and Smith (1993) found that the

average abnormal retum is 18.7% for private placement companies with

“

tìnancial crises," and the average private placement discount rate is 34.8%. Inaddition, Folta and Janney (2004) found th前 the information asymmetric problem

exists in new technology companies, because it is not easy for extemal investors

to evaluate their values. However, participation by professional investors to assess

and complete the private placement may deliver the message of the value of

technology companies, and reduce the information asymmetry. Furthermore,

Folta and Janney (2004) showed that it is easier for technology companies which

have completed private placement to attract tìnancial capitals, research and

business partners. The shorter the time period which has passed after private

equity placement is, the stronger the power to attract resources, such as capitals

16 EjJects on Shareholders' Wealth and Premium (Discount)

of Private Placement Announcement

This study summarizes the literatures above and tìnds that, attracting

strategic pa此ners via private placement, and evaluating and participating

investments through strategic partne時, as mentioned in Folta and Janney (2004),

can deliver the information of a c。中orate value, and reduce the problem of

information asymmetry. As for managers of companies with tìnancial crises,

under the circumstance that knowing about positive information such as

companies with investment opportunities in the fu仙re and value underestimation,

they would choose private placement instead of public otTering. In addition,

private placement discount reflects the costs occur when investors collect

information to evaluate corporate values. According to the literatures men世 oned

above, this study proposes the following hypotheses and empirical models:

Hj5: When the purpose 01 a pr;l'ate placement ;s 的 attract str叫eg;cpartners

ifor αanψle, 均stream and downstream alliance ;n the technology

;ndust酬, then the h;gher pril'ate placement d;scount rate is

,

the h棺herabnormal return would be.

H正 For conψanies which had financial crises bφre, the h智her pr;mte

placement discount is, the higher abnormal return would bι

4.2.

Multiple Regression AnalysisAccording to the above hypotheses, this study puts forth the following

empirical models:

CARiE = ßo + ßI * ISDid + β'2 *CC~d +β~ *NC~d + β~ *PC

I;

d + β'5 *S~d(1)

+

ß

6 *FCiO +êiEDCid = β。 +β1* ISQd +β~ *CC~d +β~ *NC~d + β'4 *PC

I;

d + β5 *S~d+β~

*

FCiO +êi(2)

Where CA丸 is the cumulative abnormal re仙m of the i th private

placement share issuing company on the tth day. i

=

1,2,3.....N . E is the durationChiao Da Management Review Vol. 30 No. 1,2010 17

DCjd is the private placement discount of the 1 th private placement share

i = J.2.3...N .

issuing company, 1= 1,L-,J...IV ; d is the date when the payment for private placement shares is completed.

ISDjd is the percentage of private placement amount of insiders in the total

private placement amount of the lth private placement share issuing company; d

is the date when the payment for private placement shares is completed

CCRjd is whether or not the managerial rights of the 1 th private placement share issuing company are transferred; d is the date when the payment for private placement shares is completed.

NCRjd is the number of directors and supervisors that private investors

obtain from the lth private placement share issuing company; d is the date when the payment for private placement shares is completed.

PC

T;

d is the percentage of number of private placement shares in total number of shares issued for the ith private placement share issuing company; d is the date when the payment for private placement shares is completed.S

A;d is whether or not the ith private placement share issuing companywants to attract s仕ategic partners; d is the date when the payment for private placement shares is completed. If the i th private placement share issuing company wants to attract strategic partners, the value of SA is 1, otherwise, 0

FC;o is whether or not the ith private placement share issuing company has had financial crisis on the day of announcement. If the ith private placement share issuing company has had financial crisis before announcement, the value of FC is 1,。由erwise, O.

ßo is the constant; ß) is the inf1uential coefficient; & is the error term

4.3

Definition of Operational VariablesThis study verifies the hypotheses above and explores the causes of abnormal return and premium (discount) rate of private placement. Event sωdy and multiple regression had been conducted, and the variables are defined below 4.3.1. Dependent Variables

18 EjJects 011 Shareholders' Wealth and Premium (Discount)

of Private Placement Announcement

cumulative abnormal retum and premium (discount) rate, whose operational definitions are listed below.

Cumulative abnormal retum is measured according to the market model from event study. With reference of Wruck (1989), the "event period" is defined as the period from 30 days before announcement to 30 days after it. The

“

estimation period" is from 200 days before announcement to 60 days9 before it In addition, in this stu旬,出e “cumulativeabnormal retum (CAR)" is defined as:CAR(T1,T2)=

I,

AREE=Tl

(3)

Where ARiE is the abnormal retum of the lth company, i

=

1,2,3

...N; TJ means the date the event begins, which is 30 days before announcement; T2means the date the event ends, which is 30 days after announcement

Wruck (1989) compared private placement share prices with stock prices on the day before announcement day, to calculate premium (discount) rate. Hsu (2003) used the average excess returns and the average stock prices from the period with the smallest standard deviation (on the twenty to thirty days after announcement) after announcement of private placement and cash capital increase,

on the first day before announcement and the tenth day after announcement,的 basis, to calculate the corresponding premium (discount)

9 The previous literatures related to private placement include: Wruck (1989), Hertzel and Smith

(1993), Barclay et al. (2007), etc. Wruck (1989) did a private placement empirical study on NYSE & AMEX. Hertzel and Smith (1993) research 回mples include Nasdaq, which is a small-scale company, and is not consistent wi自由e research targets of tlùs study. The estimation period is -500~-30 days. Barclay et al. (2007) used -12~﹒ 11 as estimation period,

and -1O~120 as event period, wlùch is longer. And its obsetvation purpose of long-term

abnorm刮起個rnis different from 血isstudy's. Considering the fact 也at many researches later had followed Wruck's (1989) method (e.g. Kato and Schallheim, 1993; Alli and Thompso

n,

1993; Hertzel and Re郎, 1998; Chen et al, 2002), Hertzel and Smith's (1993) sample subjects are di宜erent from 血is study's, and the purpose of AR obsetvation in Barclay et al. (2007) is different from 血is s個dy's, the defmition by Wruck (1989) was therefore used in tlùs study. Inother words, Wruck's (1989) estimation period is -2∞-60 and the event period is -59~20. The

res叫t shows 也at AR and CAAR during the -59~-20 period are oot significant. In 血is study, research was conducted wi血 the period of 60 days before the event date to 60 days after the event date. And it is found that CAAR is oot significant from 60 days before the event date to

Chiao Da Alanagement Review Vol. 30 No. 1, 2010 19

The samples of this study are the listed and OTC companies in Taiwan. In

the

“

Directions of Private Placement of Marketable Securities for Public OfferingCompanies" announced in October, 2005, the

“

reference price" for listed and OTC companies is specifically defined as the arithmetic average of common stock closing prices from the first, the third, or the fifth business day before pricing day And it is requested to submit information such as reference price and ac仙alprivate placement share price to the "private placement area" of "Market Observation Post (MOPS)" to make known to shareholders and the extemal investors. Therefore, in this study, the private placement premium (discount) is calculated with the reference prices and actual private placement share prices

announced in the “Market Observation Post 仙10PS)'\

民 -Pn

DC _'~t'_二

id ~a

(4) Where DCid is the premium (discount) rate of the ith private placement share issuing company, i = 1,2,3...N ; d is the date when the payment for private pJacement shares is completed;

P;

a is the reference price for the Îth priv剖eplacement share issuing compan/o (arithmetic average of common stock closing

prices from the first, the third, or 血efi丘h business day before pricing day);

P;

p is the ac仙al private placement share price of the lth private placement share issuing company; P;p<

P;a means discount (the focus of this study), while P;p>

P;

a represents premium.4.3.2. Independent Variables

The operational definitions ofthe independent variables ofthe models in this study are listed below:

Insiders include: board of directors, supervisors, managers, and block

shareholders with 10% holdings or more.

JSD (Insider private placement ratio) = Insiders' private placement amount

10 It was calculated according to the "Dir它ctionsof Private Placement of Marketable Securities for

Public Offering Companies". The reference price of the sample company is from the price announced by “Market Obsen叫ionPost (MOPS)'\

20

/ total private placement amount

E.D全ctson Shareholders' Wealth and Premium ρiscount) of Private Placement Announcement

“Whether managerial rights are transferred" is a dummy variable. The

value is 1 if transferred, while its 0 otherwise. Because private placements must

be launched within a year after announcements, the sample companies in this

study are the ones with changes in board chairman or over half of directors or

supervisors seats within a year after announcements for private placements. And

with the m吋 orinformation announced in the

“

Market Observation Post (MOPS),"the Listed and OTC Companies Financial Event Database from Taiwan Economic

Joumal, and annual reports of the sample companies, whether managerial rights

have been transferred can be confirmed

Retrieving information on the number of directors or supervisor seats investors obtained after private placements from the information published in the

“

private placement area"With the information published in the

“

private placement area,"retrieving the ratio of number of private placement shares to number of total

shares after that private placement.

PCT

=

Number of private placement shares / number of total shares afterthat private placement

“Financial crisis" is a dummy variable, with the value of 1 if a company has

faced / is facing a financial crisis before / on the day of announcement, and is

listed as a company with financial crisis by TEJ, while 0 otherwise. The definition

of financial crises is from TEJ' s definition of companies with tìnancial crises,

which includes the following conditions: (1) announcing bankruptcy of a

company (2) applying for restructuring a company (3) checks being bounced or having a run on a bank (4) asking for outside relief help (5) a company being

taken over by outsiders (6) CPAs' opinion having doubts about a company's

continued operation (7) net value of a company being negative (8) securities being

re-listed as securities se前led in full delivery of share or leaving the market (9)

tìnancial shortage with suspension.

“

Whether pu中ose of private placement is attracting strategic partners" is aChiao Da Management Review Vol. 30 No. 1, 2010 21

published in the

“

private placement area" of“

Market Observation Post (MOPS)'\If the announced purposes include: strategic alliance, attracting strategic pa此ners,

enhancing cooperation relationship between upstream and downstream or vertical

integration, etc, the value of that dummy variable is 1. Otherwise, if the purposes

mentioned above are not included, the value is 0

4

.4.

Study Targets

,

Period

,

and Data Sources

In this study, analyses in the effects of private placement announcement and

premium (discount) had been conducted with data collected after the “Directions

of Private Placement of Marketable Securities for Public Offering Companies"

was established in October, 2005. Private companies with non-listed and

non-public offering were excluded in this research because the information on

their private placement and stock price trading is insufficier此, and their financial

characteristics and supervision are different between financial industries and general industries

OveraIl, from October, 2005 to March, 2008, 214 listed and OTC

companies (except financial companies) which have issued common stocks in

private placement and announced by the Market Observation Post' s (MOPS) were

used research targets ofthis study. Among the original 214 sample companies, 15

were excluded by the even study model for their estimation periods were not long

enough (10 of them had completed private placements, while 5 hadn't.). 199

sample companies were then included in the abnormal return statistical tests. In

addition, in the aspect of the causes of abnormal returns: the data of other

variables (e.g. "Ratio oflnsiders' Share Amount in Private Placement") can only be retrieved when data of abnormal return is available and private placement must

be completed. Originally there were 199 sample companies being included in the

event study, among them, 77 were then excluded for prospectus operation cannot

successfully completed after private placements announcements. Therefû時, the

sample size for research the causes in abnormal retum was 122. Finally, in the

aspect of the causes of premium (discount): because among the original 214

22 Effects 011 Shareholders' Wealth al1d Premium (Discoul1t)

of Private Placemel1t Al1l1oul1cemel1t

132 sample companiesl l which had completed private placement payments and can be used for analysis in the causes ofpremium (discount)

The data of the dependent and independent variables were retrieved and summarized from the "private placement area" of the “Market Observation Post (MOPS)" and the database from Taiwan Economic Joumal, and with the sample companies' annual reports and major information announcements to confirm the accuracy ofthe information is classified

4.5.

Definition of Event DateThe items which should be announced by public offering companies in Taiwan all must be disclosed in the "Market Observation Post (MOPS)," for it has already become investors' starting point to look for information on private placement events. Therefore, in this study, the event date for research was set to: The dates being public disclosed and announced in Market Observation Post after the board of directors meetings approves private placements

1n addition, after refer to Wruck (1989), the

“

event period" was defined as the period from 30 days before announcement to 30 days after 由前, and the“estimation period" was defined as the period from 200 days before the event date

to 60 days before that

4.6.

Statistical Methods: Event Study12Event Study method was used to explore whether the occurrence of certain events would cause abnormal changes in stock prices, leading to abnormal retums (AR). This information can be used to find out whether security prices are related

11 The sample for analysis on the cause ofpreIJÙum (discount) contains 132 companies while 伽I

on the cause of AR is 122. The lO-company difference is due to: When calculating AR, 10

companies which had launched private placements didn't have enough estimation days. So they were not included in the 阻mple used to study the cause of AR. Because of the above-mentioned reason, in empirical study, there is no single sample can be used to analyze all 出reepmposes mentioned above. It is 仕le same in the previous literatures (Hertzel and SIJÙth,

1993; Wruck, 1989;fluang,2∞6).

12 Please 1它fer to: Shen and Li (2∞0), Event Study Method: A Necessity for Finance and

Chiao Da Alanagement Review Vol. 30 No. 1, 2010 23

to certam event

Event study using statistical methods to test whether the expected abnormal re仙m is zero, the null hypothesis is expressed as:

H

0 :E(R

j I event) -E(R

j )=

0,in which E(尺 I event) and E(

R;)

means the expected rate of retum whether ornot there were events that happened, in order to explore the impact on the

corporate stock price

4.6.1. The Choice ofPrediction Model with Event Study Method: Market

Model

There are three types of prediction models in event study, including:

mean-adjusted retums model, market index adjusted method, and risk-adjusted

retums modeI. Among them, risk-adjusted retums model is the most wildly

applied one. In this study, the market model of the risk-adjusted retums model is

adopted to estimate the abnormal retum for each event. The market model is a

regression model built by ordinary least square (OLS) method with data from the

estimation period:

RiT 二 αi +β'iRmT +6iT (5)

Where RiT is the actual rate of retum of the 1 th private placement share

issuing company on the Tth day of the estimation period 斗,2,3...N (N is the

number of sample companies); T is the number of the estimation period.

(T=t2 -t1 +1), T ε [t} ,t2]; In which T 1 is the first day of the estimation

period, which is 200 days before announcement of private placement 乃 is the

termination day of the estimation period, which is 60 days before announcement

ofprivate placement (由at 白, t = -200 - -60 days). RmT is the rate ofretum of

market portfolio on the Tth day of the estimation period; aj is the intercept of

the market model for the 1 th private placement share issuing company; 民 is the

regression coefficient of the market model for the 1 th private placement share

issuing company; 6j( is the random error term, εjt - N(O, σ2)

Estimation parameters

â

j

andßj

were calculated through ordinary leastsquare (OLS) method. Therefore, the predicted rate of retum of the Eth period of

24 丘。老ctson Shareholders' Wealth and Premium ρiscount)

of Private Placement Announcement

E(R;E)=â; + β';RmE (6)

E

ε['1'

'2]'

where'J

is the first dayof 伽 event

period, which is 30days before announcement of private placement;

'

2

is the termination day of the event period, which is 30 days after announcement of private placement.4.6.2. Estimation of Abnormal Return

Abnormal retum is calculated by actual rate of retum minus expected rate of retum in the event period, which is:

ARiE = R;E - E(RiE ) (7)

Where ARiE is the abnormal retum in the E th term of the event period for

the ith company; RiE is the ac仙al rate of retum in the E th term of the event

period for the i 血 company; E(RiE) is the expected rate of retum in the E th

term ofthe event period for the

/h

companyHowever, many uncertain events may interfere during the process of estimation for every company. In order to lower the inf1uences of these

interferences on stock returns, before statistical tests are performed, average abnormal return (AAR) must be calculated first. It is defined as:

mm

N ZH

l-N

岫

(8)In addition, in order to explore the cumulative effects of abnormal return during announcement period, Therefore, in accordance with the pu中ose of cumulative average abnormal return (cumulative

AAR,

CAAR) can be used,which is defined as:

T2 1 N T2

C~的('1>

'2)

=

r.

AARE = 亡r.r.

AR;

E E=TI lV ;=lE=TI(9)

4.6.3. Test of Abnormal Return (AR)

The statistical test methods commonly used in event study include:

traditional t-test, standardized-residual method, ordinary cross-sectional method,

Chiao Da A1anagement Rel'iew Vol. 30 No. 1,2010 25

test. In this s仙旬, the t-test used to test the significant of abnormal retum

Testing if AAR of a certain term in the event period significantly equals to O. The formula is as below

叫一一指

(10)

Where Sj2 is the variance of the error term in the estimation period for the

h

什

t

2(&it 已 )2

ilIl

company, St 二 L ,-u -,

t=t1 冉一l

The traditional t-test was further used in this study. The formula is as below

~ r ARiE 1 t-A CAR圳 一 l 志 hI~ Si )

~~廿r(ACARm)-JFJIf三..r,;; 、 ‘, J ' ••• a ' •• A /a ‘、

Where 'f 1 is the first day of the event period, which is 30 days before announcement of private placement; T2 is the terrnination day of the event

period, which is 30 days after announcement of private placement. There are a total of m terms, m = T2 - Tl + 1 , that is, the event period days

5. Em pirical Resu

It

s

Following describes the descriptive statistics of the sample, the results of the cumulative average abnormal retums of the private equities announcement,

and the causes of abnorrnal retums after private placement announcements and private placement premium (discount), respectively

5.

1.

Descriptive Statistical

26 句話clson Shareholders' Wealth and Premium ρlscounυ

0

/

Private Placement Announcemen for financial companies) which had announced private equities during the period of October, 2005 to March, 2008. The data had been retrieved from the major information announcements and the private placement area of the Market Observation Post (MOPS). The sample was filtered according to the research purposes, a total of 199 companies were included in the sample for the event study analysis model, 122 for the analysis on the causes of abnormal retum afterprivate placement announcements, and 132 for the analysis on premium (discount)

rate of private placement

The descriptive statistics and frequency analysis for the sample companies are listed in Table 3-5. The average of cumulative abnormal retums for the 199 sample companies which had announced private placements during the research period is 10.05%. The phenomenon is in accordance with the results from literatures that the relationship between private placements and abnormal returns (for example, Hertzel and Smith (1993) and Wruck (1989) both had concluded that abnormal re仙ms are positive.). In addition, the average discount rate of the

132 sample companies which had completed private placements is 13.82%, which

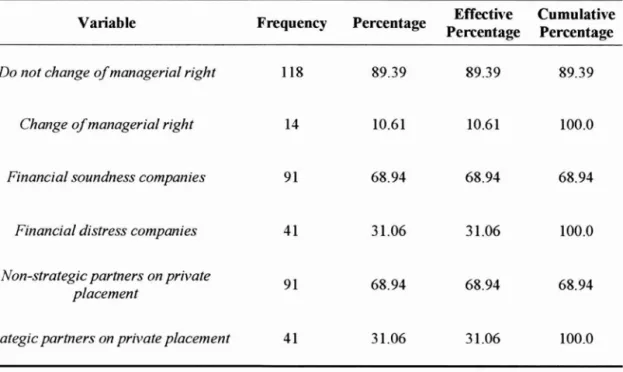

is also consistent with the literatures about private placement share prices are usually at discounts. The statistics show that the percentage of insiders' private placement shares is 40.98% for the 132 companies which had completed private placements during the research period, and the average percentage of the private placement share amount is 29.34% of the paid-in capital. 14 companies had their managerial rights transferred because of the private placements. 41 companies fit the definition of having financial crises. And 41 companies were trying to attract strategic partners by private placements

5.2. Test for Cumulative Average Abnormal Retums of Private

Equities

In this study, the event date of private placement was set to“the date being public disclosed in Market Observation Post (MOPS) after the boards meetings approve private placements." The event study module derived from Taiwan

Chiao Da λ fanagement Review Vol. 30 No. 1, 2010 27

Table 3 Statistics summary

Variables Obs. Minimum Maximum Mean Standard

Deviation

Cumulative abnormal return

ofprivate placement 199 -179.76% 207.30% 10.05% 的 46%

announcement (CAR)

Discount rate (DC) 132 -67.62% 128.31% -13.82% 24.01%

Jnternal should raise ratio

132 O 100% 40.98% 41.73% (JND)

Ratio ofprivate placement

132 O 220.27% 29.34% 28.06% over paid-in-capital 伊C刃

Table 4

Analysis of frequency statistics

Variable Frequency Percentage Effective Cumulative

Percentage Percentage

Do not change ofmanagerial right 118 89.39 89.39 89.39 Change ofmanagerial right 14 10.61 10.61 100.0

f刁nancialsoundness companies 91 68.94 68.94 68.94

Financial distress companies 41 31.06 31.06 100.0

Non-strategic partners on private

91 68.94 68.94 68.94 placement

28 EjJects on Shareholders' 悅。lthand Premium ρiscount)

of Private Placement Announcemen

Table 5

Statistics of directors or supervisors seat investors obtained in the private placement

Number of directors or

supervisors seat investors

O 2 3 4 5 6 7 8 9 Sum

obtained in the private

placement (NCR)

Fnquency 84 7 14 9 6 3 3 2 132

Economic Joumal Database was adopted. The cumulative average abnonnal retums during the announcement period were calculated according to the market model with the sample. In this study, the “estimation period" is from 200 days before announcement to 60 days before 祉, with data of at least 30 days. And the

“

event period" is defined as the period from 30 days before announcement to 30days after it. The estimation and test for the cumulative average abnonnal retums of listed and OTC companies which had launched private placements were perfonned.

Table 6

Results of Average Abnormal Return (AAR) and Cumulative Average Abnormal Return (CAAR)

Event day AAR t-value p-value CAAR t-value p-value

-30 -0.23 -1.01 0.31 -0.23 -0.95 0.34 -29 0.21 0.92 0.36 -0.05 。07 。.94 -28 0.31 1.35 0.18 0.27

。“

0.51 -27 0.87 3.83 0:∞ 1.22 2.34 0.02抖 -26 0.42 1.84 0.07* 1.47 2.85 o.∞*料 -25 0.13 0.57 0.57 1.53 2.81 0.01*** -24 012 0.96 0.34 1.73 2.93 o.∞*料Chiao Da Management Review Vol. 30 No. 1,2010 29 -23 0.46 2.ül 0.05** 2.31 3.37 。∞料* -22 0.36 1.57 0.12 2.62 3.66 。∞*料 -21 0.17 0.73 0.47 2.68 3.69 。 ω*料 -20 0.15 0.67 0.50 2.74 3.70 o.∞料* -19 023 0.99 0.32 2.~ 3.81 o.∞料* -18 0.62 2.72 O.ül *** 3.74 4.36 。-∞*料 -17 0.43 1.88 0.06* 4.25 4.67 o.∞料* -16 0.37 1.61 0.11 4.67 4到 o.∞料* -15 '{).78 -3.40 。ω料* 3.65 3.95 o.∞*料 -14 0.24 1.05 0.30 3.82 4.07 o.∞料* -13 0.48 2.10 0.04料 4.47 4.42 o.∞*** -12 0.41 1.82 0.08* 4.89 4.70 o.∞*料 -11 0.59 2.58 0.01** 5.39 5 日 o.∞料* -10 0.50 2.205 0.03** 5.79 5.46 。∞艸* -9 0.13 0.59 0.56 5.87 5.45 。助*** -8 '{).52 -2.27 0.02** 5.49 4.89 o.∞料* -7 '{).43 -1.87 0.06* 5.05 4.43 0.00紳* ~ '{).16 '{).71 0.48料 4.88 4.20 。∞料* -5 0.53 2.32 0.02** 5.54 4.55 o.ω*艸 4 '{).16 '{).69 0.49 5.34 4.34 。∞*艸 -3 '{).06 。.25 0.80* 5.11 4.22 。∞*** -2 0.57 2.52 0.01** 5.68 4.58 。 ω*料 0.19 0.85 0.40 5.89 4.66 o.∞科* O 0.42 1.82 0.07* 6.56 4.89 。 ω*** 。.42 1.85 0.07* 6.98 5.12 o.ω*** 2 0.32 1.39 0.17 7.51 527 o.ω*料 3 '{).29 -1.27 0.21 6.83 4.98 o.∞料* 4 0.49 2.14 0.03輛 7.40 5.26 o.∞*料 5 。.09 。 38 。.70 7.32 5.13 o.∞*料 6 0.15 0.64 0.52 7.24 5.16 。∞***

30 ξfJects on Shareholders' Wealth and Premium (Discount)

01 Private Placement Announcement

7 。 04 -0.20 0.85 6.29 5.師 。∞紳* 8 0.17 0.73 0.47 6.到 5.10 O.∞*料 9 0.38 l

“

0 .10* 7.29 529 O.∞料* 10 0.18 0.78 0.44 7.07 5.34 O.∞*料 11 0.37 1.63 0.10 7.64 5.5

2 。-∞*** 12 0.01 0.03 0.97 7.5

9 5 船 。ω*** 13 0.16 0.68 0.50 8.13 5.5

0 。-∞*料 14 -0.41 -1.79 0.08* 7.63 5.18 O.∞*料 15 0.28 1.21 0.23 7.72 5.30 。ω*** 16 0.10 0.45 0.65 8.20 5.30 O.∞*料 17 0.09 0.38 0.71 8.24 5.30 。∞*** 18 0.49 2.13 0.03** 8.10 5.5

3 。∞艸* 19 0.27 1.18 0.24 8.77 5.64 。∞料* 20 0.37 1.62 0.11 9.22 5.80 。∞*** 21 -0.36 -1.59 0.11 9.34 5.5

3 。 ω*** 22 0.05 023 0.82* 9.13 5.5

1 。 ω*** 23 0.31 1.37 0.17 9.76 5.63 O.∞料* 24 0.44 1.93 0.06* 10.37 5.83 。∞*** 25 0.61 2“

0.01料* 10.94 6.12 。∞*** 26 -0.31 -1.37 0.17 10.39 5.89 O.∞*料 27 。 25 -1.11 027 9.72 5.70 O.∞*料 28 -0.34 -1.48 0.14 9.15 5.47 。ω*** 29 。 07 。.30 0.77 9 ∞ 5.39 O.∞*料 30 。.55 2.43 0.02** 9.38 5.64 O.∞林*Note: *** significantly at 1 %; ** significantly at 5%; * significantIy at 10% (test of two-tail).

According to Table 6 and figure 1, the AAR of the period from two days before the announcement date to two days after that for the 199 sample companies

are all positive. The ARRs on the day of announcement and the next day shows significant at 10%. The ARR on the 4th day after the announcement date even

Chiao Da A1anagement Review Vol. 30 No. 1,2010 31 reaches the significant level of 5%. It is obvious that the private placernent inforrnation does have effects on the day of announcernent and the next day According to Table 6 and figure 2, the CAAR of the period frorn 30 days before the event date to 30 days after that (CAAR[-30,+30]) is 9.38%. This phenornenon is cornpatible with the results frorn literatures. It irnplies 出at private placernent event rnessages still have inforrnation content. And the reaction period is longer In other words, announcernents of private placernents have positive inf1uence on shareholders' wealth

Figure 1

Average abnormal return (AAR) of event period.

。9!IlO

』閉目

Figure 2

Cumulative average abnormal return (CAAR) of event period.

l肌u刪|……' B叩01XXl f卡卜.一….一…-…….一….一…-一…-一….一ι-一…-一….一…-…,ι ,…….…一…-一-_..一….一.一...-……-…-‘」↓,.ι-……-一…-一-斗↓-一…-…--r-…_. -~. --_..._...,

叫i

J

-

K?于;

(

:(;(;(1

:

:

(

!

:

;

401XXl 200CJJ .11 22 .14 -6 10 19 話In Table 7, using event day as benchmark, by cornparing the curnulative

32 EjJects 011 Shareholders' Wealth al1d Premium ρωCOUl1t)

ofP.仟rrvaνP羽G仿 Pl,仿ac臼emeωn叫 11110U附ω仰nentt

(CAAR[-30,-1]) with 由at from announcement day to 30 days after that (CAAR[0,+30]), it is found that the cumulative average abnormal re仙m from the event period to the day before announcement (CAAR[-30,-1]) is 5.89%, while the cumulative average abnormal retum from announcement day to 30 days after that (CAAR[0,+30]) is 3.66%, which is lower than the 5.89% of CAAR[-30,-1], although still positive. It shows that CAAR is higher before the announcement day than after that. And the cumulative average abnormal retum since 27 days before announcement to 30 days after that reaches the significant level of 5% This means since 27 days before submitting the proposal of private placement to the board' s meeting, the stock price of the company has already started to show a positive reaction. Because before announcement, only insiders or investors being contacted can know about the private placement while general investors can't, the significant cumulative average abnormal retum represents the information asymmetry does exist in private placement events. And those who know about it can obtain higher returns than those who know about it afterwards.

Table 7

Cumulative Average Abnormal Return (CAAR) Pre and Post Event Day

CAAR CAAR[-30,-l] 5.89% CAAR[O,+30] 3.66% CAAR[-30,-30] 9.38%

In summarize, although the Financial Supervisory Commission has already started to strengthen the management in private placement cases since October,

2005, because the time asking for information disclosure is usually posterior, for those who can know about private placement before announcement such as board of directors, there are still chances to participate before announcement and end up

with abnormal retums, while ordinary investors can only participate and obtain abnormal returns after announcement, their chances and opportunities are influenced by information asymmetry. It is obvious that the current regulation of private placement still need to be improved, in order to lower the differences in retums due to the timing when assessing information, and further to reach the faimess of information disclosed and market transactions.