中國大陸財政地方分權對社會保障效率的影響 - 政大學術集成

全文

(2) 謝. 詞. 光陰似箭,歲月如梭,研究所念兩年真的不夠啊!在這兩年的歲月中,首先 要感謝的就是我的指導教授,黃智聰老師,雖然老師在這兩年中十分地忙碌奔波, 但是在每個禮拜的會面中,指導論文之餘,老師還是不會忘記要關心我們的近況, 講講老師日常生活中發生的趣事,並不時地提醒我們留意待人處事的態度,也要 謝謝老師提供豐沛的資源和舒適的環境讓我得以完成學業與論文,真的很高興也 很榮幸能有這麼幽默風趣的老師來當我的指導教授,使我能夠更上一層樓。此外, 還要感謝口試委員陳欽賢老師和陳國樑老師,謝謝老師提供珍貴的建議與對我的 鼓勵,讓我更加完善我的論文。. 立. 政 治 大. 我還要感謝研究室的俊男學長,雖然這兩年中學長忙於開南的事務,但是學. ‧ 國. 學. 長還是會透過電話或 MSN 關心我的近況,揪甘心!另外,還要謝謝姵慧學姊和. ‧. 偉杰學長,謝謝你們的負責和包容,讓我碩一的生活可以爽爽過!還要不時地接. sit. y. Nat. 受我的電話騷擾!XD 至於呂暉鵬和林士傑......嘿嘿嘿,謝謝你們啦!謝謝你們. io. er. 和我一起分擔大大小小的繁忙工作,也謝謝你們陪我進行我最愛的活動,增添我 的生活樂趣!還有可愛的婷婷和帥氣的庭偉,謝謝你們幫我們分憂解勞,奴役你. al. n. iv n C 們!XD 還有我的研究所同學們,謝謝大家對我的照顧與陪伴,我們一起出遊的 hengchi U 畫面是我這兩年寶貴的回憶。還有還有,謝謝妮妮在這兩年中總是要忍受我稀奇 古怪(鬼靈精怪?)的脾氣,還是很有耐心地包容和照顧我,與我分享和傾聽生 活中的點點滴滴,真的很謝謝有你的陪伴,有你在我身邊是我的榮幸和福氣。 最後,我最要感謝的就是我的家人和 MEI MEI,謝謝爸媽總是給予我支持 和包容,謝謝我的阿氣姐姐總是傾聽我對生活大小事的訴說並給予我意見,謝謝 小咩洗總是忍受我對你的變態,不咬我,謝謝你們提供我這麼舒服優渥的環境與 照顧,讓我可以無憂無慮地當個死學生,我愛你們! 2011 年 7 月 12 日. 於家中.

(3) Abstract Title: The Influence of Fiscal Decentralization on the Efficiency of Social Security in China School: Graduate Institute of Public Finance National Chengchi University Advisor: Jr-Tsung Huang, Ph. D. Author: Ching-Wen Yuan Key Words: Fiscal Decentralization, Social Security Efficiency, DEA, Tobit Model. 政 治 大 on the efficiency of social security in China since the realization of social security was 立 The purpose of this study is to investigate the influence of fiscal decentralization. ‧ 國. 學. promoted and some relevant policies were implemented in 21 century. This study uses China’s provincial-level data of 31 regions from 2000 to 2009 and uses two inputs. ‧. and three outputs to calculate the efficiency scores as the dependent variables. The. sit. y. Nat. inputs are the proportions of expenditures for social security and employment effort to. io. er. total public expenditures and the proportions of hygiene, social security, and social. al. iv n C he of urban basic pension insurance, the coverage h i ofUunemployment insurance, and n g crate n. welfare employed people to total employed people. The outputs are the coverage rate. the coverage rate of urban basic medical care insurance. Then, this study establishes four specifications of the Tobit model. Other factors, gross regional product per capita (PGRP), the degree of openness (OPEN), the scale of provincial government (SOG), the quadratic term of the former (SOGSQ), area dummy variables, and time dummy variables, are added into the Tobit model. The primary finding of this study is that fiscal decentralization has a positively non-monotonic influence on the efficiency of social security. This contributes positively to the efficiency of provincial government’s social security, but this positive influence does not always exist.. I.

(4) CONTENTS CHAPTER 1. INTRODUCTION............................................................1 1.1 Research Background.......................................................................................1 1.2 Research Purpose.............................................................................................6 1.3 Research Framework and Process....................................................................8. CHAPTER 2. LITERATURE REVIEW..............................................11 2.1 Fiscal Decentralization Theory.......................................................................11 2.2 The Influence of Fiscal Decentralization on Social Welfare..........................17. 政 治 大. 2.3 The Determinants of Social Security with the DEA Approach......................21. CHAPTER 3. FISCAL DECENTRALIZATION AND SOCIAL. 立. SECURITY IN CHINA..................................................26. ‧ 國. 學. 3.1 The Process of Fiscal Reform in China..........................................................26 3.2 The Degree of Fiscal Decentralization...........................................................33. ‧. 3.3 The Circumstance of Social Security.............................................................37. Nat. sit. y. CHAPTER 4. METHODOLOGY AND VARIABLES.......................41. er. io. 4.1 Data Envelopment Analysis...........................................................................41. al. iv n C 4.3 Data and Variables..........................................................................................46 hengchi U n. 4.2 Tobit Model....................................................................................................45. CHAPTER 5. EMPIRICAL RESULTS................................................56 5.1 The Efficiency Score of Social Security.........................................................56 5.2 Determinants of the Efficiency of Social Security.........................................60 5.3 The Regional-Specific and Time-Specific Effects.........................................64. CHAPTER 6. CONCLUDING REMARKS AND POLICY IMPLICATIONS............................................................67 6.1 Concluding Remarks......................................................................................67 6.2 Policy Implications.........................................................................................69. REFERENCES.......................................................................................70. II.

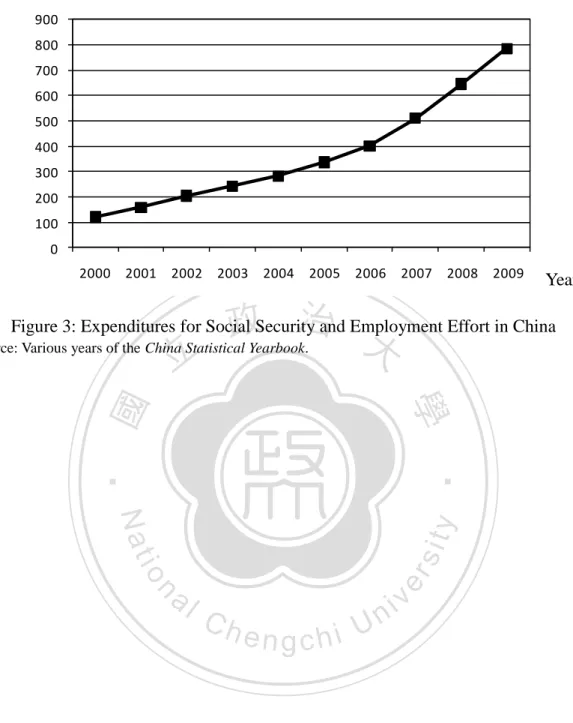

(5) Figures Figure 1: Share of Central and Local Fiscal Revenue..............................................3 Figure 2: Research Framework................................................................................10 Figure 3: Expenditures for Social Security and Employment Effort in China…40 Figure 4: The Relative Efficiency of DMUs with DEA Approach………………..44. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. III. i Un. v.

(6) Tables Table 1: Literatures About the Relationship Between Fiscal Decentralization and Social Welfare...............................................................................................20 Table 2: Literatures About the Determinants of Social Security with the DEA Approach.......................................................................................................24 Table 3: The Contents of China Tax Sharing System Reform in 1994.................31 Table 4: FD-value and Difference among Regions in Selected Year (%).............36. 政 治 大. Table 5: Statistics of Inputs and Outputs (%).........................................................48. 立. Table 6: Correlation Coefficient between Input and Output Factors...................49. ‧ 國. 學. Table 7: Variable Descriptions and Statistics in the Tobit Model..........................55. ‧. Table 8: The Efficiency Score of Social Security in Selected Years........................57. sit. y. Nat. io. n. al. er. Table 9: Empirical Results of the Tobit Model........................................................61. i Un. v. Table 10: The Regional-Specific Effect.....................................................................64. Ch. engchi. Table 11: The Time-Specific Effect...........................................................................66. IV.

(7) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. CHAPTER 1. INTRODUCTION 1.1 Research Background Since the implementation of the “open door” policy in 1978, China’s economy has grown rapidly. During 1978 to 2010, the growth of China’s gross domestic product has increased on average by more than 9% each year. Even in the global financial crisis of 2008 and the Asian financial turmoil of 1997, China still has maintained high economic growth rates, which is 9.6% and 9.3% respectively.1. 政 治 大 more important and attracted worldwide attention. Furthermore, many economists 立. Undoubtedly, the role that China has played in the global economic system has been. ‧ 國. 學. have been interested in the issue that why China has enjoyed such good economic performance. They found that fiscal decentralization has been one of the important. ‧. factors which have contributed to economic growth (Ma, 2000; Lin and Liu, 2000;. io. sit. y. Nat. Qiao et al., 2002).2. n. al. er. Besides, since the economic reform and opening to the world, China’s fiscal. Ch. i Un. v. reform has implemented a series of major fiscal reform in transforming from the. engchi. highly concentrated fiscal system to a decentralized one. The fiscal system of China underwent three stages. The following are the simple introductions. At the beginning, before 1978, China’s budgetary policy essentially consisted in generalized tax collection and profit remittances controlled by the central government and then redistributed as needed to the provinces. Then, during 1979 to 1993, China. 1. Data is based on the China Statistical Yearbook (State Statistical Bureau, SSB). Ma (1997) indicated that fiscal decentralization plays the important role of Chinese economic reforms and has a positive influence on economic developments. Lin and Liu (2000) also considered that fiscal decentralization, an important reform, is a key factor which contributed to such rapid economic growth. Similarly, Qiao et al. (2002) suggested that fiscal decentralization is the most important policy which accelerates the economy in China during the last three decades of economic reforms. 2. 1.

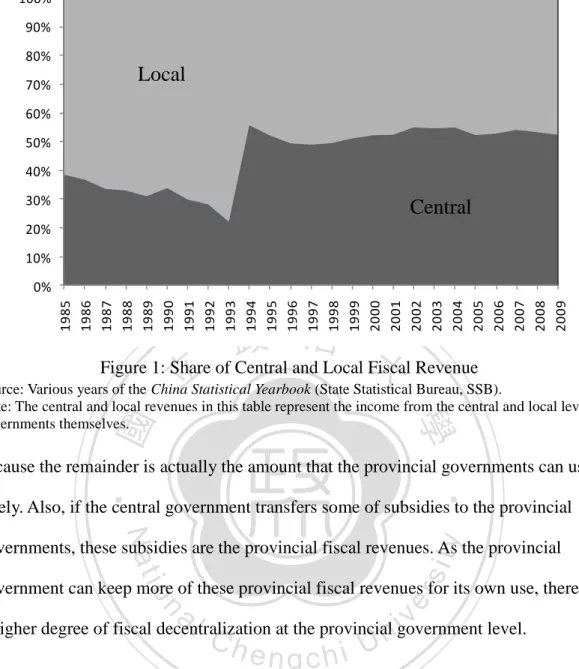

(8) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. intentionally broke down its concentrated fiscal management system by various forms of “fiscal contracting systems (FCS, hereafter)”. After 1994, China processed another fiscal reform that was relatively easy to identify revenues belonged to either the central or provincial governments through the “tax sharing system (TSS, hereafter)”. The kind of fiscal systems that Chinese authority chose obviously affected the degree of fiscal decentralization. According to Figure 1, the fiscal structures of the central and provincial governments have undergone tremendous change since 1994. In the year prior to the. 政 治 大 central and provincial governments were 22% and 78%, respectively. However, when 立. implementation of TSS in 1994, the shares of total fiscal revenue accounted for by the. ‧ 國. 學. TSS was implemented in 1994, these proportions became 55.7% and 44.3% respectively, and the share accounted for by the central government greatly increased. ‧. by 33.7%. Following this reform in 1994, the proportion of the total national fiscal. Nat. sit. y. revenue accounted for by the central fiscal revenue rose rapidly, while the proportion. n. al. er. io. of the total national fiscal revenue accounted for by the provincial fiscal revenue decreased by a large magnitude.. Ch. engchi. i Un. v. In the view of these changes in the fiscal revenues, the decentralization of fiscal power at the provincial government level most likely causes the provincial governments to suffer an insufficiency of tax revenue or a fiscal deficit. However, this does not imply that the degree of fiscal decentralization decreases because the degree of fiscal decentralization is expressed in terms of fiscal revenue autonomy.3 In China’s fiscal system, the provincial governments must pay amount of its fiscal revenues to the central government. When calculating the fiscal independence of each province, such payments should be deducted from the provincial total fiscal revenues 3. According to Huang and Cheng (2005). 2.

(9) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. 100% 90%. 80% 70%. Local. 60% 50%. 40% 30%. Central. 20% 10% 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009. 0%. 政 治 大 Figure 1: Share of Central and Local Fiscal Revenue 立Statistical Yearbook (State Statistical Bureau, SSB). Source: Various years of the China. ‧ 國. 學. Note: The central and local revenues in this table represent the income from the central and local level governments themselves.. because the remainder is actually the amount that the provincial governments can use. ‧. freely. Also, if the central government transfers some of subsidies to the provincial. y. Nat. io. sit. governments, these subsidies are the provincial fiscal revenues. As the provincial. n. al. er. government can keep more of these provincial fiscal revenues for its own use, there is. Ch. i Un. v. a higher degree of fiscal decentralization at the provincial government level.. engchi. Therefore, fiscal decentralization in China means that provincial governments must have an adequate level of revenues which are either raised by provincial governments or transferred from the central government and are deducted by payments from a province to the central government, so that the provincial authorities can make decisions about expenditures. As a provincial government has a higher degree of fiscal decentralization, which means that the provincial government has higher revenue autonomy. However, while China enjoyed such great economic performance because of the. 3.

(10) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. TSS and the higher revenue autonomy at provincial government level, highly developed economy also resulted in some problems about environments and social welfare. The aim which a country seeks for is not only economic development, but also other different issues, such as social welfare, the quality of living, environmental protection, hygiene, and health. As a provincial government has a higher degree of fiscal decentralization, does this improve the efficiency of social welfare, especially in the provincial social security side? The definition of efficiency here is the application of the Data Envelopment Analysis (DEA, hereafter), which is which is an approach of non parametric mathematical programming technique for estimating efficiency.. 治 政 Regarding the efficiency of local governments, many studies 大 have addressed this issue 立 and have concluded that fiscal decentralization increases the efficiency of local ‧ 國. 學. governments (Bahl and Linn, 1992; Bird and Wallich, 1993).4 But, how is about the. ‧. efficiency of social welfare, further social security?. Nat. sit. y. Recently, several surveys have paid attention to the issues concerning the. n. al. er. io. relationship between fiscal decentralization and the social welfare in China. Bardhan. i Un. v. (2002) thought that the decentralization of fiscal power raises the social welfare level. Ch. engchi. under the federal system. Comparing to the central government, local governments have more information about the preferences of local residents and the costs of providing public goods. Martinez-Vazquez et al. (2005) found that fiscal decentralization increases the proportion of educational and health expenditures to total public expenditures. In addition, this phenomenon is more obvious in developing countries than in developed countries. However, some scholars have had contrary considerations. West and Wong (1995) addressed that the public expenditures in 4. Bahl and Linn (1992) addressed that fiscal decentralization or the release of fiscal power can improve the efficiency of public sector. Bird and Wallich (1993) also indicated that fiscal decentralization, or the devolution of fiscal power, is seen as a way to improve the efficiency of the public sector, cut the budget deficit and stimulate economic growth. 4.

(11) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. hygiene and education reduced is resulted from fiscal decentralization in China. Especially in some rural areas, the social welfare of local residents aggravates more obviously. These above-mentioned literatures in the last paragraph are relevant to the social expenditures. However, after the realization of social welfare was promoted in China in 21 century, there were more policies about social welfare implemented, further social security, for example, urban basic pension insurance, unemployment insurance, and urban basic medical care insurance. Thus, the analysis between fiscal. 政 治 大 Acemoglu and Verdier (2000), even the best intervention of governments might 立 decentralization and social expenditures is not comprehensive. According to. ‧ 國. 學. appear corruption, and this corruption would result in the serious abuse and wrong distribution of social expenditures. Therefore, in order to increase the level of social. ‧. welfare and improve the living quality of residents cannot simply depend on the. Nat. sit. y. incremental expenditures of social security, but the efficiency of social security.. n. al. er. io. After the “open door” policy in 1978 and the implementation of the TSS in 1994,. Ch. i Un. v. China has developed its economy rapidly and prospered during the last ten years.. engchi. Meanwhile, the issue about social welfare in China has been more important and notable since 21 century. Nationals in China have been richer and more conscious of their social welfare, even the efficiency of social welfare. Although many scholars indicated that fiscal decentralization had a positive impact on economic growth and improved the efficiency of local governments, as mentioned above, the influence of fiscal decentralization on the efficiency of social welfare in China is still questionable. Thus, the issue of the relationship between fiscal decentralization and the efficiency of social welfare in China is well worth studying. This research will focus on the influence of fiscal decentralization on the efficiency of social security. 5.

(12) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. 1.2 Research Purpose As mentioned above, the issue about social welfare and its efficiency is getting valuable and notable in China. The impact of fiscal decentralization on the efficiency of social security in China is still questionable as well, therefore, the primary purpose of this paper is to investigate the relationship between fiscal decentralization and the efficiency of social security after the realization of social welfare was promoted last ten years in China. Through the statements of theories, the researches of important literatures and the application of some appropriate empirical regression models, the. 政 治 大. purposes that this paper tries to complete are as follows.. 立. First of all, according to Huang and Cheng (2005), this paper uses the revenue. ‧ 國. 學. autonomy to measure the degree of fiscal decentralization of provincial governments in China. Second, this paper adopts the Data Envelopment Analysis (DEA, hereafter),. ‧. which is an approach of non parametric mathematical programming technique for. y. Nat. io. sit. estimating efficiency, to estimate the efficiency of provincial governments’ social. n. al. er. security. Since the realization of social welfare was promoted last ten years, this paper. Ch. i Un. v. adopts the official data of 31 provinces/cities during the 2000-2009 period. This paper. engchi. uses the panel data from the China Statistical Yearbooks and the Finance Yearbooks of China to compress analysis and expects to understand the efficiency of social security in China. Finally, by establishing some empirical regression models, this paper expects to completely examine how fiscal decentralization influences the efficiency of social security. Meanwhile, this paper illustrates other factors that also affect the efficiency of social security. Moreover, this paper considers the time-specific effect and the regional-specific effect in order to investigate the change each year and observe the provincial characteristics. This paper is not only an international academic discussion and practical 6.

(13) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. application, but also offers Taiwanese government and businessmen primary information about the efficiency of social security in China. The empirical analysis results can be references when other countries draw up relevant policy. Also, Taiwanese authorities can understand the situation of China more when they have interaction with Chinese authorities in economy or public finance.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 7. i Un. v.

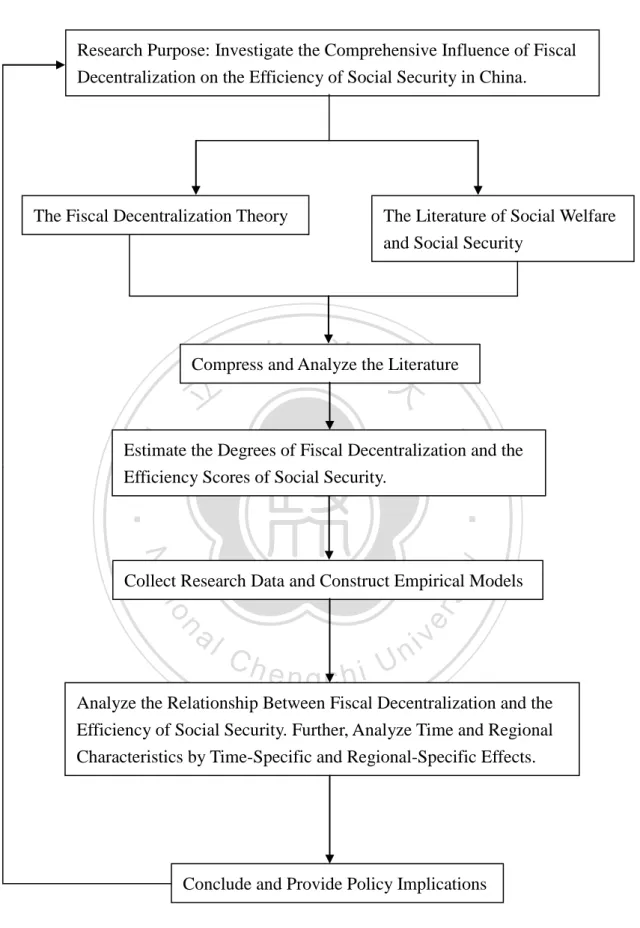

(14) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. 1.3 Research Framework and Process The primary issue of this study is how the degree of fiscal decentralization affects the efficiency of social security in China provincial governments after the realization of social welfare was promoted in 2000. Hence, after discussing the research background, purpose, and structure, this study generalizes the fiscal decentralization theory and the determinants of social security with the DEA approach. In addition, this study summarizes those literatures and introduces an estimation of social security with the DEA approach. Moreover, this study interprets the. 政 治 大. relationship between fiscal decentralization and social welfare in China.. 立. After analyzing the literatures, this study introduces fiscal decentralization. ‧ 國. 學. system and the circumstance of social security in China. Then, this study calculates degrees of fiscal decentralization of 31 provinces/cities from 2000 to 2008 and. ‧. efficiency scores of social security from 2001 to 2009 with the DEA approach.. y. Nat. io. sit. Subsequently, this study constructs some specifications of the Tobit model to examine. n. al. er. the role of fiscal decentralization playing in the efficiency of provincial government’s social security in China.. Ch. engchi. i Un. v. Thus, this study collects research data and constructs some empirical models in terms of previous literature. This study uses a regressive approach and attempt to explain the estimated result in order to understand the role of fiscal decentralization playing in the efficiency of social security. Furthermore, this study uses the regionalspecific and time-specific effects to illustrate whether the efficiency of social security is influenced by time and regional characteristics. Last but not least, this study uses the conclusion to provide several policy implications. Hence, this offers Taiwanese authorities a reference to better evaluate. 8.

(15) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. their interaction with China. Besides, Chinese authorities and other countries could draw up policies in terms of the conclusions. The following are the research framework. This study is divided into six chapters. Chapter1 is the introduction of this study, and it is divided into three sections, which are research background, research purpose, and research framework and process. Then, Chapter 2 is literature review, and it is divided into three sections, which are fiscal decentralization theory, the influence of fiscal decentralization on social welfare, and the determinants of social security with. 政 治 大 security in China, and it is also divided into three sections, which are the process of 立 the DEA approach. Subsequently, Chapter 3 is fiscal decentralization and social. ‧ 國. 學. fiscal reform in China, the degree of fiscal decentralization, and the circumstance of social security. Chapter 4 is methodology and variables. It introduces the method and. ‧. the meaning of variables that this study uses. It is separated into three sections, which. Nat. sit. y. are data envelopment analysis, Tobit model, and data and variables. Chapter 5. n. al. er. io. illustrates empirical results of this study, which is divided into the efficiency score of. i Un. v. social security, determinants of the efficiency of social security, and the. Ch. engchi. regional-specific and time-specific effects. Finally, Chapter 6 is separated into two sections, concluding remarks and policy implications. The research steps are illustrated in Figure 2.. 9.

(16) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. Research Purpose: Investigate the Comprehensive Influence of Fiscal Decentralization on the Efficiency of Social Security in China.. The Fiscal Decentralization Theory. The Literature of Social Welfare and Social Security. 政 治 大. Compress and Analyze the Literature. 立. ‧ 國. 學. Estimate the Degrees of Fiscal Decentralization and the Efficiency Scores of Social Security.. ‧ sit. y. Nat. io. n. al. er. Collect Research Data and Construct Empirical Models. Ch. engchi. i Un. v. Analyze the Relationship Between Fiscal Decentralization and the Efficiency of Social Security. Further, Analyze Time and Regional Characteristics by Time-Specific and Regional-Specific Effects.. Conclude and Provide Policy Implications. Figure 2: Research Framework. 10.

(17) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. CHAPTER 2. LITERATURE REVIEW As mentioned before, the purpose of this study is to investigate how the degree of fiscal decentralization influences the efficiency of social security in China’s provincial governments. Hence, this chapter is separated into three parts. First of all, this study discusses the fiscal decentralization theory. Second, this study compresses the relevant literatures that illustrated the influence of fiscal decentralization on social welfare. Third, this study refers to the determinants of social security with the DEA approach.. 治 政 2.1 Fiscal Decentralization大 Theory 立 ‧ 國. 學. If this study attempt to investigate the impact of fiscal decentralization on the efficiency of social security, it is necessary to briefly examine the fiscal. ‧. decentralization theory. The fiscal decentralization theory is the foundation for the. Nat. sit. y. empirical analysis. Rational allocation among governments is the important issue of. n. al. er. io. national politics and economic development. Basically, the adjustment of every fiscal. i Un. v. relationship among governments is in centralization and decentralization. The history. Ch. engchi. of fiscal decentralization has been highly developed for a long time, for example, the federal system of United States is the typical fiscal decentralization system. Since 1990, the world has flourished waves of fiscal decentralization, such as the implementation of TSS in China and the reform of fiscal decentralization in South America. In the earlier economic theory, the central government can provide public goods for residents to satisfy their demands and accomplish welfare maximum of the whole society. Multiple governments would not exist in countries under this framework. However, in reality, local governments have functions that the central government hard to possess. The theory of fiscal decentralization is the rational and. 11.

(18) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. necessary explanation to the existence of local governments. Initially, Hayek (1945) indicated that the local government is more effective than the central government in drawing up public policy because the local government can spend less cost to collect more information about local residents. This allows the local government to provide public goods and services that better match local preferences than the central government. Based on Samuelson (1954), Tiebout (1956) addressed that fiscal decentralization leads to greater variety in the provision of public goods, which are. 政 治 大. modified to better suit local residents. Here is his conclusion under seven assumptions:. 立. “If citizens are faced with an array of communities that offer different types or levels. ‧ 國. 學. of public goods and services, then each citizen will choose the community that best satisfies his or her own particular demands. In equilibrium, no individual can be made. ‧. better off by moving, and the market is efficient. It does not require a political. y. Nat. sit. solution to provide the optimal level of public goods.”5 Individuals effectively reveal. n. al. er. io. their preferences by “voting with their feet”, which means that people could choose a. i Un. v. local government that satisfies the local residents’ preferences of public services and. Ch. tax ratio by moving between areas.6. engchi. Subsequently, Stigler (1957) interpreted that the rationality of the local government existence could improve the resource allocation to achieve an efficient 5. The seven assumptions are as follows: 1. Citizens are fully mobile, and will move to that community where their preference patterns, which are set, are best satisfied. 2. Citizens are assumed to have full knowledge of differences among revenue and expenditure patterns and to react to those differences. 3. There are a large number of communities in which the citizens may choose to live. 4. Restrictions due to employment opportunities are not considered. It may be assumed that all people are living on dividend income. 5. The public services supplied exhibit no external economies or diseconomies between communities. 6. For every pattern of community services set by, say, a city manager who follows the preferences of the older residents of the community, there is an optimal community size. 7. Communities below the optimum size seek to attract new residents to lower average costs. Those above optimum size do just the opposite. Those at an optimum try to keep their populations constant. 6 If the local governments provide high quality and quantity public goods or services and impose a high tax ratio, local residents who need basic public goods or services will move to another area. 12.

(19) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. level. He used two principles to interpret the rationality, which are as follows. First, local governments are closer to their residents than the central government. Second, the residents have a right to choose by voting different kinds and quantities of public services. However, they did not consider what kind of public goods should be provided by the local or central governments. Musgrave (1959) complemented this concept. He pointed out that different kinds of public goods should be provided by different levels of government. In other words, the central government should provide national public goods, such as national defense.. 政 治 大 assignment of taxes and expenditures to the various levels of government to improve 立 He built a theory of fiscal federalism, stressing among other things the appropriate. ‧ 國. 學. welfare. This solves the problems which are the supply of public goods and the finance of public expenditure. In addition, he thought the local government is efficient. ‧. to treat regional public service.. y. Nat. io. sit. Then, based on Tiebout (1956), Oates (1972) used a model of fiscal. n. al. er. decentralization to prove that the local governments are more efficient than the central. Ch. i Un. v. government and achieves the Pareto efficiency. From this moment on, the fiscal. engchi. decentralization theory has a model basis. He suggested that local governments are better positioned than the central government to deliver public services and match local preferences and needs. In addition, Oates (1993) addressed that fiscal decentralization increases economic efficiency.7 The recent development in fiscal decentralization theory is mixed with the. 7. As mentioned in Oates (1993), “The basic economic case for fiscal decentralization is the enhancement of economic efficiency: the provision of local outputs that are differentiated according to local tastes and circumstances result in higher levels of social welfare than centrally determined and more uniform levels of outputs across all jurisdictions. There surely are strong reasons, in principle, to believe that policies formulated for the provision of infrastructure and even human capital that are sensitive to regional or local conditions are likely to be more effective in encouraging economic development than centrally determined policies that ignore these geographical differences.” 13.

(20) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. concepts of more aspects and more mature. Tresch (1981) based on the economics of information to reinforce the fiscal decentralization theory. He pointed out that preferences of residents would be misunderstood to verify the importance of fiscal decentralization. Assume that the information in a country is symmetric and complete, then, whether public goods is provided by the central government or local governments is the same. However, in reality, there is some asymmetric information in social economic activities. Hence, in this condition, the central government would provide too much or less public goods. Generally, local governments have more information than the central government so that they understand the preferences of. 治 政 residents more. He further concluded that a risk-averse大 society tends to let local 立 governments provide public goods. ‧ 國. 學. In addition, Brennan and Buchanan (1980), who are the representatives of the. ‧. Public Choice School, indicated that fiscal decentralization not only lets the power of. Nat. sit. y. the central government be effectively subjected to local governments, but also. n. al. er. io. accelerates fiscal competitions among local governments to avoid abusing power in. i Un. v. local governments. Therefore, even the fiscal power is divided between the central. Ch. engchi. government and local governments, though the efficiency of resource allocation is not improved, fiscal decentralization between the central government and local governments still could exist. Since fiscal autonomy can be the balanced function among governments as a mechanism. However, this comment is under the assumption that the gain of fiscal decentralization is larger than the efficiency loss. On the other hand, many fiscal analysts are worried about “the dangers of fiscal decentralization”. Musgrave (1959) and Oates (1972) suggested that inappropriate fiscal decentralization may induce a range of allocated distortions, regional inequality,. 14.

(21) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. and fiscal instability. As mentioned by Bird and Vaillancourt (1998),8 if people’s preferences are unlikely to be reflected in budget outcomes and the institutional capacity of existing sub-national (state and local) governments is close to nil,9 fiscal decentralization seems likely to result in increased costs, lessened efficiency in service delivery, and probably enlarges greater inequity and macroeconomic instability. Prud’Homme (1994) raised the experience of Tunisia, where the centralization of sewage services is proved to be more effective than delegating the provision of such services to local governments.. 政 治 大 welfare loss, due to lack of economies of scale that sometimes exists at the central 立. Besides, Prud’Homme (1995) stated that fiscal decentralization may lead to a. ‧ 國. 學. government, and the provision for most local public goods and services in a given city is independent of the provision in other cities, thereby implying minimal welfare. ‧. losses under fiscal decentralization. It may be further argued that corruption and. Nat. sit. y. inadequate capacities are likely to be more appeared at local governments rather than. n. al. er. io. at the central government (Prud’Homme, 1995; Tanzi, 1996).10 Moreover,. i Un. v. Prud’Homme (1995) cited Brazil as an example of fiscal decentralization leading to macroeconomic instability.11. Ch. engchi. Today, the arguments about fiscal decentralization theory still exist. How to. 8. However, Bird and Vaillancourt (1998) also indicated that fiscal decentralization can help local development, strengthen the responsibility of local governments and residents, accelerate the efficiency of local expenditures, and prosper local economy. 9 For example, with local politicians and bureaucrats likely to face increased pressure from local interest groups, then fiscal decentralization, under these or similar state of affairs, might undermine government efficiency. 10 Prud’Homme (1995) and Tanzi (1996) argued that there are many imperfections in the local provision of services that may prevent the realization of benefits from fiscal decentralization. For example, local bureaucrats may be poorly trained and thus inefficient in delivering public goods and services. 11 Fiscal decentralization leads to difficulty managing macroeconomic policy in Brazil due to the Centre’s decreased role in tax revenue-raising, and increasing each state’s discretion on tax rates. Therefore, based on arguments made by Prud’Homme (1995), the poor macroeconomic performance of Brazil in the 1990s is to be blamed on these fiscal decentralization measures. 15.

(22) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. divide the fiscal relationship between the central government and local governments as to reach the ideal fiscal system relies on more theories and practices. Because of different circumstances among countries, these theories could not apply to all. However, the understanding of these fiscal decentralization theories can make us know more about their advantages and disadvantages. Also, this can provide valuable and theoretical references about the fiscal relationship between the central government and local governments and the following survey.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 16. i Un. v.

(23) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. 2.2 The Influence of Fiscal Decentralization on Social Welfare After the introduction of the fiscal decentralization theory, this paper turns into the relationship between fiscal decentralization and social welfare. From the relevant studies about fiscal decentralization, most results showed that fiscal decentralization and competitions among local governments can increase the expenditures of social welfare, such as educational and hygienic expenditures. Bardhan (2002) thought that the decentralization of fiscal power raises the social welfare level under the federal system. Comparing to the central government, local. 政 治 大. governments have more information about the preferences of local residents and the. 立. costs of providing public goods. He also mentioned that the logic behind fiscal. ‧ 國. 學. decentralization is not just about weakening the central authority, nor is it about preferring local elites to central authority, but it is fundamentally about making. ‧. governance at the local level more responsive to the felt needs of the large majority of. er. io. sit. y. Nat. the population.. al. Martinez-Vazquez et al. (2005) used the unbalanced panel data of 45 developed. n. iv n C and developing countries from 1972hto 2000. They measured e n g c h i U degrees of fiscal. decentralization by proportions of local governments’ expenditures to the central government’s expenditures and measured proportions of educational and health expenditures to total public expenditures as the dependent variables. Then, they adopted five different econometric models to illustrate the relationship between fiscal decentralization and social welfare. They found strong evidence that fiscal decentralization increases the proportion of educational and health expenditures to total public expenditures. In addition, this phenomenon is more obvious in developing countries than in developed countries.. 17.

(24) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. In addition, Busemeyer (2008) used cross-section data and time-series data of OECD countries from 1980 to 2001 to survey the influence of fiscal decentralization on the public expenditures of education, pension and social welfare. He stated that public expenditures can be divided into two parts, which are national level and regional level, respectively. For example, the expenditures of education are regionally provisioned policies, and the expenditures of refund are nationally provisioned policies. As degrees of fiscal decentralization change, this has different effects on these two levels. The empirical results showed that fiscal decentralization has a positive effect on the expenditures of education and a negative effect on the. 治 政 expenditures of pension. Thus, he concluded that citizens 大in systems with an extensive 立 provision of local policies are more willing to delegate more fiscal power to the lower ‧ 國. 學. levels of government.. ‧. However, some scholars have had contrary considerations. Under fiscal. Nat. sit. y. decentralization system, the competitions among governments probably increase the. al. n. economies of scale.. er. io. loss of total social welfare because of asymmetric information and the lack of. Ch. engchi. i Un. v. West and Wong (1995) addressed that the public expenditures in hygiene and education reduced are resulted from fiscal decentralization in China. Especially in some rural areas, the social welfare of local residents aggravates more obviously. They provided evidence in terms of the disparities between Shandong and Guizhou in the basic services provided by local governments and used it to confirm the view that fiscal decentralization results in very large and growing interregional inequalities in China. Regional disparities in the provision of these services not only directly affect the welfare and living standard of the populace, but also lower investment in human resources in the poor provinces, such as Guizhou. 18.

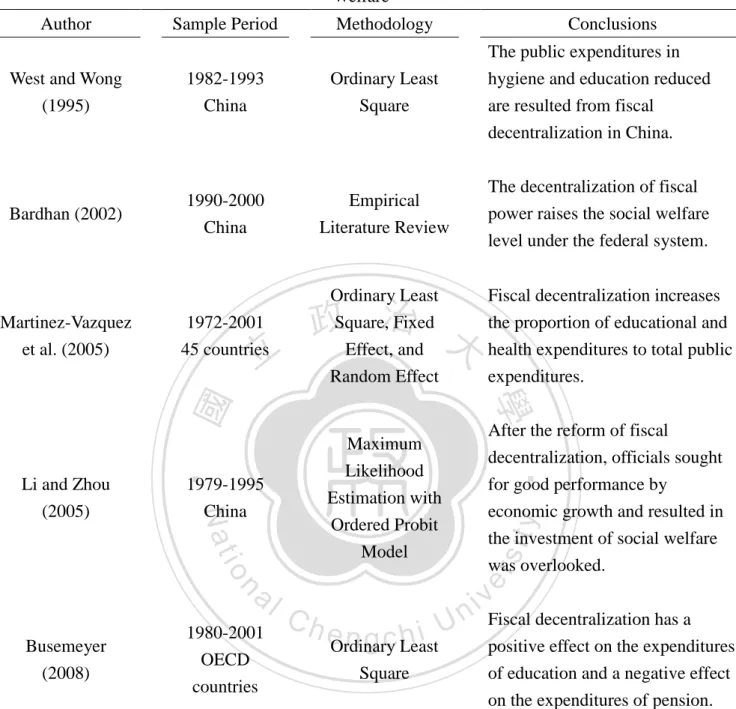

(25) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. Li and Zhou (2005) provided empirical evidence on the incentive role of personnel control in post-reform China. They used the turnover data of top provincial leaders in China from 1979 to 1995 and found that the likelihood of provincial leaders’ promotion increases with their economic performance, while the likelihood of termination decreases with their economic performance. This finding also supported the view that the Chinese central government uses personnel control to motivate local officials to promote local economic growth. They also found that the turnover of provincial leaders is more sensitive to their tenure-averaged performance than to their annual performance. This showed that after the reform of fiscal decentralization,. 治 政 officials sought for good performance in economic growth 大 which may lead to the 立 underinvestment in social welfare. 12. ‧ 國. 學. The above-mentioned literatures are relevant to fiscal decentralization and social. ‧. welfare and are arranged in Table 1. Concerning social welfare, these literatures. Nat. sit. y. mostly use the measurement of public expenditures, such as educational, hygienic,. n. al. er. io. and health expenditures. This study extends the concept of social welfare to the. i Un. v. efficiency of social welfare. After all, whether fiscal decentralization increases or. Ch. engchi. decreases the public expenditures of social welfare, residents still want to explore the efficiency of social welfare. This study focuses on the efficiency of social security in China and adopts the DEA approach to measure.. 12. Li and Zhou (2005) stated that different types of public expenditures have different impacts on regional economy. The investment of basic infrastructure can directly accelerate economy and appeal to capital, but the investment of social welfare, such as education, does not have obvious and short-run economic improvement. 19.

(26) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. Table 1: Literatures About the Relationship Between Fiscal Decentralization and Social Welfare. Ordinary Least Square. 1990-2000. Empirical. China. Literature Review. The decentralization of fiscal power raises the social welfare. 1972-2001 45 countries. Ordinary Least Square, Fixed Effect, and Random Effect. 立. Fiscal decentralization increases the proportion of educational and health expenditures to total public expenditures.. 學 Maximum. n. al. 1980-2001 OECD countries. After the reform of fiscal decentralization, officials sought. ‧. Likelihood Estimation with Ordered Probit Model. 1979-1995 China. io. Busemeyer (2008). level under the federal system.. 政 治 大. Nat. Li and Zhou (2005). 1982-1993 China. The public expenditures in hygiene and education reduced are resulted from fiscal decentralization in China.. for good performance by economic growth and resulted in the investment of social welfare was overlooked.. y. Martinez-Vazquez et al. (2005). Conclusions. sit. Bardhan (2002). Methodology. er. West and Wong (1995). Sample Period. ‧ 國. Author. Ch. eOrdinary hi n g c Least. iv n U Fiscal decentralization has a. Square. Source: this table is arranged by the author. Note: the list of the literatures orders according to the publish year.. 20. positive effect on the expenditures of education and a negative effect on the expenditures of pension..

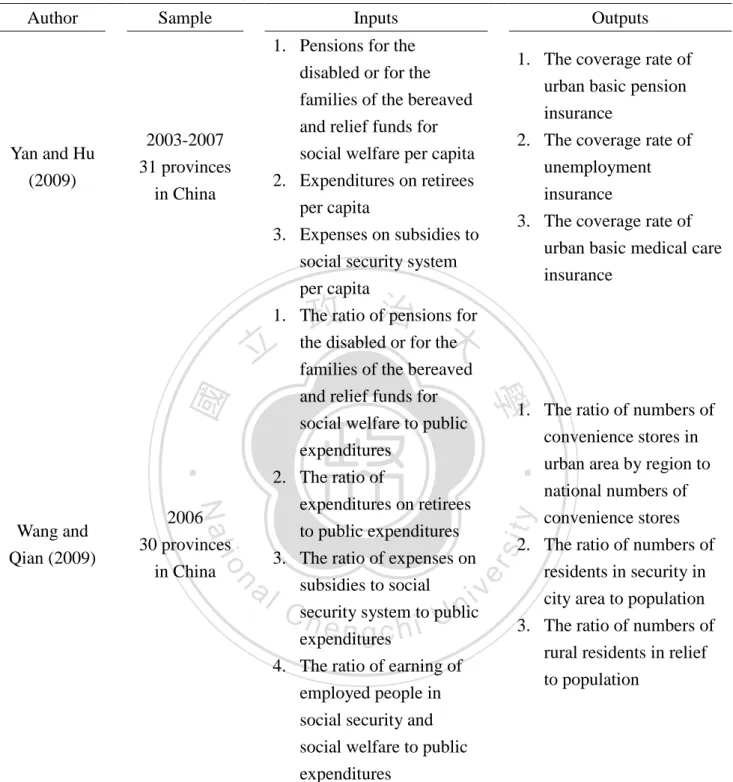

(27) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. 2.3 The Determinants of Social Security with the DEA Approach Recently, using the Data Envelopment Analysis (DEA) approach to measure the efficiency of social welfare has been very popular and extensive. The reason why the DEA approach is extensive is that the good characteristics of this approach. It avoids setting problems of models; meanwhile, it could deal with the evaluation of the efficiency based on multiple inputs and multiple outputs. These characteristics conform to the economic efficiency evaluation and let analysis become easier. Therefore, from this trend, the issue of the efficiency of social welfare through the. 政 治 大 security in China after the realization of social welfare was promoted and some 立. DEA approach is more noteworthy. This study specializes in the efficiency of social. ‧ 國. 學. relevant policies about social security were implemented in 2000. Yan and Hu (2009) used panel data of 31 provinces/cities in China from 2003 to. ‧. 2007 to measure the efficiency of public services of social security. They chose. y. Nat. io. sit. pensions for the disabled or for the families of the bereaved and relief funds for social. n. al. er. welfare per capita, expenditures on retirees per capita, and expenses on subsidies to. Ch. i Un. v. social security system per capita as inputs, and chose the coverage rate of urban basic. engchi. pension insurance, the coverage rate of unemployment insurance, and the coverage rate of urban basic medical care insurance as outputs. The empirical result showed that though fiscal expenditures in social security increase every year, the operating efficiency of social security funds is not improved yet. Wang and Qian (2009) researched the data of 30 provinces/cities in China in 2006.13 They measured the efficiency of fiscal social security expenditures by using the ratio of pensions for the disabled or for the families of the bereaved and relief funds for social welfare to public expenditures, the ratio of expenditures on retirees to 13. Expect Tibet. 21.

(28) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. public expenditures, the ratio of expenses on subsidies to social security system to public expenditures, and the ratio of earning of employed people in social security and social welfare to public expenditures as inputs, and using the ratio of numbers of convenience stores in urban area by region to national numbers of convenience stores, the ratio of numbers of residents in security in city area to population, and the ratio of numbers of rural residents in relief to population as outputs. They found that the efficiency of fiscal social security expenditures is affected by the regional economic development. Also, the difference of efficiency between provinces is large.. 政 治 大 expenditures, including hygiene, education, and social security through a two-stage 立. Chen and Li (2010) enlarged the discussed range about the efficiency of social. ‧ 國. 學. DEA-Tobit model. They used panel data of 31 provinces/cities in China from 2000 to 2008 and investigated three separate parts of social expenditures by efficiency scores.. ‧. The inputs and outputs which this literature used are as follows. Inputs are hygienic. Nat. sit. y. expenditures per capita, educational expenditures per capita, and social security. n. al. er. io. expenditures per capita. Outputs are divided into three corresponding parts. The. i Un. v. numbers of health care institutions per ten-thousand people, the numbers of beds in. Ch. engchi. health care institutions per ten-thousand people, and the numbers of medical technical personnel per ten-thousand people correspond to hygienic expenditures per capita, the net enrollment ratio of primary schools and the percentage of literate population to total aged 15 and over correspond to educational expenditures per capita, and the coverage rate of urban basic pension insurance, the coverage rate of unemployment insurance, and the coverage rate of urban basic medical care insurance correspond to social security expenditures per capita. They not only measured the direct efficiency of social expenditures by DEA approach but also analyzed the indirect factors of social expenditures’ efficiency by Tobit model. They found that there are remarkable. 22.

(29) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. differences of social expenditures’ efficiency between eastern, central, and western areas, namely, the inequalities in China are still serious. They also stated that the efficiency of social expenditures is positively relates to the citizens’ education level, urbanization, and population, while negatively relates to the government’s scale, corruption, income inequality, and GDP per capita. Xu and Zhao (2010) investigated the efficiency of social security expenditure of 27 provinces/cities in 2008.14 Inputs are the ratio of educational expenditures to public expenditures, the ratio of medical and health care expenditures to public. 政 治 大 to public expenditures. Outputs are the ratio of numbers of rural basic pension 立. expenditures, and the ratio of expenditures for social security and employment effort. ‧ 國. 學. insurance contributors to rural population, the ratio of numbers of basic pension insurance contributors to regional population, the numbers of doctors per. ‧. ten-thousand people, and the numbers of students per ten-thousand people. Their. Nat. sit. y. finding is same as Chen and Li (2010). The efficiency is the obvious differences in. n. al. er. io. areas of similar level of China’s social expenditures. Generally speaking, the areas of. i Un. v. high efficiency in social security expenditure concentrated in the developed regions.. 14. Ch. engchi. Tianjin, Hunan, Tibet, and Qinghai are excluded. 23.

(30) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. Table 2: Literatures About the Determinants of Social Security with the DEA Approach Author. Yan and Hu (2009). Sample. Inputs. Outputs. 1. Pensions for the disabled or for the families of the bereaved and relief funds for social welfare per capita 2. Expenditures on retirees per capita. 2003-2007 31 provinces in China. 1. The coverage rate of urban basic pension insurance 2. The coverage rate of unemployment insurance 3. The coverage rate of urban basic medical care insurance. 3. Expenses on subsidies to social security system per capita 1. The ratio of pensions for. n. al. Ch. engchi. i Un. social security and social welfare to public expenditures. 24. y. urban area by region to national numbers of convenience stores 2. The ratio of numbers of residents in security in city area to population 3. The ratio of numbers of rural residents in relief to population. sit. er. io. 2006 30 provinces in China. 2. The ratio of expenditures on retirees to public expenditures 3. The ratio of expenses on subsidies to social security system to public expenditures 4. The ratio of earning of employed people in. 1. The ratio of numbers of convenience stores in. ‧. Nat. Wang and Qian (2009). families of the bereaved and relief funds for social welfare to public expenditures. 學. ‧ 國. 立. 政 治 大 the disabled or for the. v.

(31) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. Table 2: Literatures About the Determinants of Social Security with the DEA Approach (Continued) 1. The numbers of health care institutions per ten-thousand people, the numbers of beds in health care institutions per ten-thousand people and the numbers of medical technical. 2000-2008 31 provinces. 立3.. in China. 政 治 大. Social security expenditures per capita. ‧ sit. n. er. io 2008 27 provinces in China. insurance, the coverage rate of unemployment insurance and the coverage rate of urban basic medical care insurance 1. The ratio of numbers of rural basic pension insurance contributors to. y. Nat. al. Ch. engchi. i Un. 1. The ratio of educational expenditures to public expenditures. Xu and Zhao (2010). the percentage of literate population to total aged 15 and over 3. The coverage rate of urban basic pension. 學. ‧ 國. Chen and Li (2010). personnel per ten-thousand people 2. The net enrollment ratio of primary schools and. 1. Hygienic expenditures per capita 2. Educational expenditures per capita. 2. The ratio of medical and health care expenditures to public expenditures 3. The ratio of expenditures for social security and employment effort to public expenditures. Source: this table is arranged by the author. Note: the list of the literatures orders according to the publish year. 25. v. rural population 2. The ratio of numbers of basic pension insurance contributors to regional population 3. The numbers of doctors per ten-thousand people 4. The numbers of students per ten-thousand people.

(32) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. CHAPTER 3. FISCAL DECENTRALIZATION AND SOCIAL SECURITY IN CHINA In this chapter, several reforms of fiscal system between the central and provincial governments are illustrated, especially the TSS implemented after 1994. Then, a measurement of fiscal decentralization is defined and calculated. This study uses this measurement to compress and analyze the degrees of fiscal decentralization in China and lets them be the primary independent variable. In the last section, the statement and some relevant policies of social security are introduced.. 政 治 大 3.1 The Process of Fiscal Reform in China 立. ‧ 國. 學. According to fiscal system, this study divided the process of fiscal reform in China into three stages as follows. The first stage is before the 1978 period, the. ‧. implementation of “conventional fiscal system”, which is the revenue remittance and. sit. y. Nat. redistributed to provincial governments by the central government. The second stage. io. er. is during the 1979-1993 period, the implementation of “fiscal contracting systems”.. al. v. n. The third stage is after the 1994 period, the implementation of “tax sharing system”.. i n C U h ereforms The following are the details of these i n g cbyhorder. 3.1.1 Before the 1978 Period. In the early 1950s, the Soviet model of central planning shaped the relationships between the central and provincial governments in China. The central authority exercised direct administrative control over provincial governments through three central planning mechanisms, which were the physical planning of production, centralized allocation of materials, and budgetary control of revenues and expenditures.15 Although concentration of power at the central government moved to. 15. According to Feltenstein and Iwata (2005). 26.

(33) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. decentralization in 1958, recentralization began in the early 1960s. Later a new movement of decentralization started in 1971. However, because of the economic destroy during the Cultural Revolution period, this decentralization reform still failed. As a matter of fact, before 1979, China’s budgetary policy essentially consisted in generalized tax collection and profit remittances controlled by the central government and then redistributed as needed to the provincial governments. This fiscal system was so-called the system of “eating from one pot” (chi da guo fan). This system was based on the “conventional fiscal system”, which was a central planning system. The main characteristic was that all fiscal policies were based on the national programs.. 治 政 Thus, the intervention of the central government was more 大 serious to provincial 立 governments. This resulted in an equal fiscal capacity among provinces, but ‧ 國. 學. provincial governments had no incentives and low efficiency to develop their local. sit. y. Nat. 3.1.2 During the 1979-1993 Period. ‧. economies due to lacking enough fiscal autonomy.. io. er. There were three primary reasons that China started to proceed the fiscal reform. al. iv n C enterprises grew up rapidly, such ashtown e nand h i Uenterprises, joint enterprises, g ctownship n. under market mechanism. First of all, more and more non-national operated. and private operated enterprises. Also, there were more and more national operated enterprises which undertaken a great loss and resulted in the large national fiscal burden. Second, the economic reform enlarged the powers of provincial governments and made provincial governments submit requests of fiscal decisions. Third, economic benefits affected the decisions of governments and promoted provincial governments to increase fiscal revenues and develop their local economies. Therefore, the fiscal change of centralization into decentralization was urgency.16. 16. According to Lin and Liu (2000). 27.

(34) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. Staring from 1979, China virtually began its fiscal decentralization reform, involving changes concerning how revenue is divided among the central and provincial governments through a major institutional innovation called the “fiscal contracting system (FCS, hereafter)” (cai zheng fen bao zhi), introduced between 1979 and 1993. From then on, the central and provincial governments each began to “eat in separate kitchens” (fen zao chi fan). In 1985, Chinese authority implemented the system of dividing the tax categories, appraising and ratifying the revenues and expenditures, and grading contracts. Furthermore, the FCS gradually formed into six contracting categories by 1988.17 During the period, the FCS gave the sub-national. 治 政 governments more and more powers to finance their needs, 大 encouraged them to 立 develop a regional economy and collect revenues, and gradually built up their ‧ 國. 學. accountability.. ‧. However, disadvantages of the FCS were mainly: (1) the fiscal contracting. sit. y. Nat. system caused the central revenues regressed,18 and (2) the different contracting. io. al. n. provinces.19. er. methods were too complicated and unjust, widening the fiscal gap between different. 3.1.3 After the 1994 Period. Ch. engchi. i Un. v. In 1994, China experienced another fiscal decentralization reform, called the “tax sharing system (TSS, hereafter)” (fen shui zhi). It fundamentally changed the way revenues were shared among the central and provincial governments. The TSS asserted that the income item that was relatively easy to identify belonged to either the 17. The six categories were as follows: incremental contracting, basic proportional sharing, proportional sharing and incremental sharing, remittance incremental contracting, fixed remittance, and fixed subsidy. 18 The central government was trapped by the fiscal contracting system, leading to the ratio of central governmental revenues to total revenues continually declining. According to statistics, the percentage of central governmental revenues to total revenues fell from 38.4% in 1985 to 22% in 1992. 19 The rich provinces with more bargaining power (such as Guangdong) benefited more than others from a favourable contracting system. In addition, under the fiscal contracting system, the central government always fell into an inefficient track bargaining with sub-national governments. 28.

(35) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. central or provincial governments. In fact, the system of fiscal decentralization was based on the jurisdiction that gave the corresponding government the right to impose tax. The major goal of the TSS implemented in 1994 was to construct a new fiscal system between the central and provincial governments by demarcating the different tax categories. As pointed out by Qiao et al. (2002), the key measures in the TSS included the introduction of a value-added tax (VAT, hereafter) as the major revenue source and the setting up of uniform tax-sharing rates for major taxes, including VAT. The uniform tax-sharing rates replaced the previous fixed-amount remittance scheme adopted in the FCS.. 政 治 大 Under this new system, the central and provincial governments each had clearly 立. ‧ 國. 學. assigned their “own revenues”, and all transfers become more transparent and objective by a rule-based method, rather than a negotiated percentage as before. ‧. (Wang, 1997). Therefore, each provincial government now had a greater. Nat. sit. y. responsibility for its provincial fiscal balance. Also, the tax structure was greatly. n. al. er. io. simplified.20 In addition, this reform achieved some notable successes: improving the. i Un. v. “two ratios”, which are the ratio of tax revenues to GDP and the ratio of the central. Ch. engchi. governmental revenues to the total governmental revenues. This result simplified the intergovernmental finance system and tightened fiscal control.21 Since the TSS replaced the previous six categories taxes of fiscal contracting system, which makes the fiscal system much easier. Meanwhile, the practical measure is that provincial governments must have an adequate level of revenues which are either raised by 20. The value-added tax replaced the turnover-based product tax, and has been implemented basically at a uniform rate of 17 per cent. The corporate income tax was unified to include all domestic enterprises, and the top rate has been reduced from 55 per cent to 33 per cent. Consumption taxes on tobacco, liquor, and other luxuries were introduced. The previous system of profit and tax contracts, under which SOEs negotiated annual transfers to the government budget, was largely eliminated (Ahmad et al., 2002; Wong 2000). 21 The establishment of National Tax Services (NTSs) in 1994 and 1995 offered a better control over general tax collection and local tax exemption policies. The interference of local authorities in tax administration and collection of central and shared revenues was substantially restrained. 29.

(36) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. provincial governments or transferred from the central government and are deducted by payments from province to central. In addition, the details of the TSS policy are illustrated in Table 3.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 30. i Un. v.

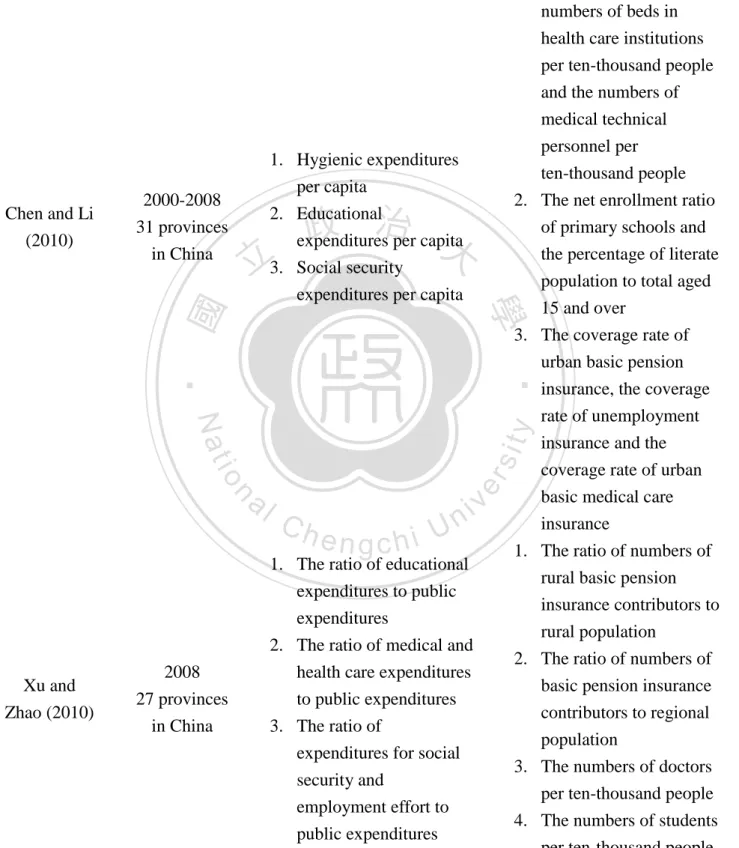

(37) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. Table 3: The Contents of China Tax Sharing System Reform in 1994 Process. Contents 1.. Dividing the jurisdictions and expenditures between the central and provincial governments. 2.. 1.. 立. 政 治 大 governments, and the local tax, respectively. 2.. Establishing two kinds of tax institutions which are the central and local tax institutions. The central tax institution levies the central tax and the shared tax between the central and. ‧ 國. ‧. sit. io. n. al. er. 1. 2.. Ch. 1.. Establishing the plan of budgets and the arrangement of funds. provincial governments. The local tax institution levies the local tax institution. The payment, transfer, and subsidy are remained from the previous system. Because of the range and amount expansions of the central fixed fiscal revenue, the central government established the fiscal transferring system from the central government to provincial governments.. y. Nat Establishing the fiscal transferring system between governments. operations and the expenses of development in economy and society. All taxes are divided into three kinds of taxes, which are the central tax, the shared tax between the central and provincial. 學. Dividing the revenues between the central and provincial governments. The central government is in charge of national security, diplomacy, the necessary expenses of central organizations’ operations and the expenses of adjustments in economic structure, regional development, and macroscopic control. Provincial governments are in charge of the necessary expenses of provincial organizations’. 2.. engchi. i Un. v. After the implementation of TSS, the central government and provincial governments plan budgets according to the new tax rates. Let the payments of provincial governments subtract from the transfers of the central government. Assign a rate of arrangement of funds, which is the proportion of the net amount to the expected revenue of the central consumption tax and the value added tax in the current year. According to this rate, the central 31.

(38) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. Table 3: The Contents of China Tax Sharing System Reform in 1994 (Continued) government distributes the central consumption tax and the value added tax to provincial governments. Source: Cheng (2005).. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 32. i Un. v.

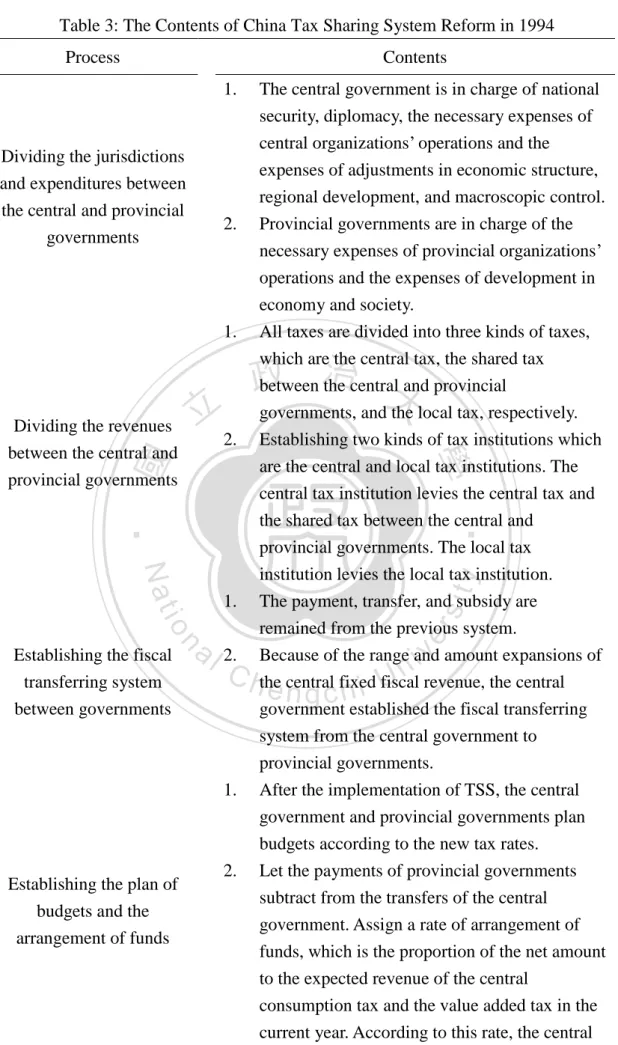

(39) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. 3.2 The Degree of Fiscal Decentralization According to the introduction of China’s fiscal system in section 3.1, it is found that fiscal decentralization might be an important factor to affect the efficiency of social security, particularly in China, since fiscal resources are the fundaments which the implementations of provincial policy depend on. This study adopts the degree of revenue autonomy to measure the degree of fiscal decentralization based upon the existing literature.22 Therefore, two variables FDA and FDB are used to measure the degree of fiscal decentralization and are added into the empirical models to confirm. 政 治 大. the consistency of empirical results. These two variables are specified as follows.. 立. FDAi ,t ( RRi ,t SUBMITi ,t ) REi ,t. (3.1). ‧ 國. 學. FDBi ,t ( RRi ,t SUBMITi ,t ) ( RRi ,t SUBMITi ,t TRANSi ,t ). (3.2). ‧. sit. y. Nat. In equations (3.1) and (3.2), FDAi,t denotes region i’s ratio of retained revenue to. io. er. total expenditure in period t, FDBi,t represents region i’s ratio of retained revenue to total revenue in period t. In addition, RRi,t represents region i’s revenue in period t,. al. n. iv n C SUBMITi,t is the amount region i should submit to theU central government in period t, hen gchi REi,t is region i’s total expenditure in period t, and TRANSi,t is the transfer from the. central government to region i in period t, where i=1, 2, . . ., 31; t=2000, 2001, . . ., 2008. The higher the value is of FDA or FDB, the higher the degree would be of fiscal decentralization. The figures of FDA and FDB for China’s 31 provinces/cities from 2000 to 2008 have been calculated in this study and selected years of FDA and FDB values for all 31 regions in China are presented in Table 4. In general, the FDB values are larger 22. This study refers the degrees of fiscal decentralization to Zhang and Zou (1998), Ma (2000), and Lin and Liu (2000). 33.

(40) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. than the FDA values. According to Table 4, it is shown that the disparity of fiscal decentralization among regions has been enlarged. The difference between the maximum and minimum value of FDA in 2008 is higher than its counterpart in 2000. The former is 73.18%, but the latter is 58.80%. This conclusion is also true while using FDB as an indicator for fiscal decentralization. The differences between the maximum and minimum value of FDB in 2008 and 2000 are 79.89% and 71.83%, respectively. The differences between the maximum and minimum value of FDA and FDB increase over time.. 政 治 大 2000 were Guangdong, Shandong, Beijing, Fujian, and Zhejiang by order. In 2005, 立. Regarding FDA in these three years, the top five provinces with higher FDA in. ‧ 國. 學. Beijing, Shanghai, Jiangsu, Guangdong, and Shandong were the top five provinces. However, in 2005, two of the top five provinces replaced Fujian and Zhejiang with. ‧. Shanghai and Jiangsu. In addition, the top five provinces in 2008 were Beijing,. Nat. sit. y. Shanghai, Jiangsu, Guangdong, and Zhejiang. In 2008, Zhejiang replaced Shandong. n. al. er. io. as the fifth top province again. The region with the lowest FDA was Tibet in these. i Un. v. three years. Provinces with lower FDA mostly belong to the western area, such as. Ch. engchi. Gansu, Qinghai, and Ningxia. In detail, Chongqing was the fifth bottom province in 2000, but, Guizhou replaced Chongqing as the fifth bottom province in 2008. Chongqing increased its fiscal autonomy with a rapid speed, from 29.36% to 42.56%. Furthermore, the degrees of revenue autonomy have increased during this period in 14 provinces, but decreased in 17 provinces. The top five provinces with higher increase of FDA during this period were Shanghai, Jiangsu, Beijing, Tianjin, and Liaoning, accordingly. However, the bottom five provinces with higher decrease of FDA during this period were Sichuan, Hainan, Guangxi, Hubei, and Xinjiang, accordingly. 34.

(41) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. Using FDB as the indicator to represent fiscal decentralization instead, the top five provinces with higher FDB in 2000 were Guangdong, Beijing, Fujian, Shandong, and Zhejiang by order. In 2005, Beijing, Shanghai, Guangdong, Zhejiang, and Jiangsu were one of the top five provinces. However, in 2005, two of the top five provinces replaced Fujian and Shandong with Shanghai and Jiangsu. In addition, the top five provinces in 2008 mostly remained the same as in 2005. Noteworthily, Zhejiang and Jiangsu had the same degree of fiscal decentralization, and Tianjin was the first time to be one of the top five provinces. The region with the lowest FDB was still Tibet in these three years. Provinces with lower FDB mostly belong to the western area, just. 治 政 like the provinces with lower FDA. 大 立 ‧ 國. 學. Furthermore, the degrees of revenue autonomy have increased during this period in 12 provinces, but decreased in 19 provinces. The top five provinces with higher. ‧. increase of FDB during this period were Shanghai, Tianjin, Jiangsu, Zhejiang, and. Nat. sit. y. Chongqing accordingly. However, the bottom five provinces with higher decrease of. al. n. accordingly.. er. io. FDB during this period were Hainan, Sichuan, Guangxi, Hubei, and Henan,. Ch. engchi. i Un. v. Based upon the above analysis, it is evident that regions with higher degrees of fiscal decentralization are located in the eastern area, while regions in the western area are more likely to have lower degrees of fiscal decentralization.. 35.

(42) The Influence of Fiscal Decentralization on the Efficiency of Social Security in China. Table 4: FD-value and Difference among Regions in Selected Year (%) FDA. Difference1. FDB. 2000. 2005. 2008. 2000. 2005. 2008. FDA. Beijing. 56.92 (3). 73.44 (1). 78.36 (1). 72.88 (2). 81.58 (1). 86.33 (1). ★21.44. 13.45. Tianjin. 40.86. 54.78. 61.36. 55.03. 65.17. 73.26 (5). ★20.50. ★18.23. Hebei. 43.71. 43.40. 43.75. 55.01. 50.26. 49.09. 0.04. -5.92. Shanxi. 39.10. 46.74. 46.59. 48.12. 52.78. 54.39. 7.49. 6.27. Inner Mongolia. 31.61. 35.12. 38.94. 36.68. 40.06. 45.24. 7.33. 8.56. Liaoning. 34.11. 41.86. 51.94. 45.84. 53.76. 59.80. ★17.83. 13.96. Jilin. 31.64. 27.39. 31.09. 38.57. 32.85. 35.69. -0.55. -2.88. Heilongjiang. 35.90. 32.25. 31.61. 45.05. 37.27. 36.24. -4.29. -8.81. Shanghai. 46.63. 68.85 (2). 73.77 (2). 59.90. 78.47 (2). 84.14 (2). ★27.14. ★24.24. Jiangsu. 46.37. 60.95 (3). 68.04 (3). 62.47. 75.27 (5). 80.11 (4). ★21.68. ★17.64. Zhejiang. 47.35 (5). 58.93. 80.11 (4). 14.53. ★15.60. Anhui. 40.52. 38.60. 43.72. -0.64. -7.07. Fujian. 54.64 (4). 57.96. 69.08. 3.41. -1.92. Jiangxi. 34.46. 32.99. 31.57. 48.01. 42.74. 39.24. -2.89. -8.77. Shandong. 57.59 (2). 59.82 (5). 61.20. 69.42 (4). 69.08. 69.44. 3.61. 0.02. Henan. 42.67. 41.61. 39.73. 52.48. 45.89. 42.80. -2.94. -9.68. Hubei. 40.02. 35.78. 33.69. 49.81. 42.42. 39.97. -6.33. -9.84. Hunan. 38.18. ‧ 國. Regions. 36.72. 33.71. 45.75. 42.73. 39.42. -4.47. -6.33. Guangdong. 65.48 (1). 60.54 (4). 65.60 (4). 79.22 (1). 78.20 (3). 0.12. 3.34. Guangxi. 43.99. 38.49. 33.97. 53.75. 43.70. 39.38. -10.02. -14.37. Hainan. 44.56. 36.54. 34.39. 57.09. 43.64. 39.82. -10.17. -17.27. Chongqing. 29.36. 39.09. 51.96. 13.19. ★15.29. Sichuan. 44.67. 39.44. 34.68. -12.80. -15.34. Guizhou. 34.73. 32.17. Yunnan. 38.18. Tibet. 64.51 (5) 76.41 (4) 治 政 39.88 50.79 大44.44 71.00 (3) 69.37 立58.05 61.88 (5). 學. er. io. sit. y. ‧. Nat. n. a l 42.56 36.67 47.07 iv n C 31.87h 43.76 e n g50.02 chi U. 82.56 (3). FDB. 29.40. 40.00. 35.14. 32.29. -5.32. -7.71. 37.26. 37.85. 42.89. 41.11. 41.76. -0.34. -1.13. 6.69. 5.19. 5.18. 7.39. 5.80. 6.44. -1.50. -0.95. Shaanxi. 34.17. 34.93. 36.20. 39.85. 41.10. 41.74. 2.03. 1.89. Gansu. 28.95. 25.62. 24.33. 32.28. 28.29. 26.26. -4.62. -6.02. Qinghai. 19.80. 15.26. 15.87. 22.60. 17.97. 18.60. -3.92. -4.00. Ningxia. 21.52. 21.91. 21.47. 28.91. 27.75. 27.98. -0.06. -0.93. Xinjiang. 37.93. 32.88. 31.62. 39.27. 34.26. 34.34. -6.31. -4.93. Average. 39.11. 40.86. 41.79. 48.43. 48.01. 48.58. 2.68. 0.15. Difference2 58.80 68.25 73.18 71.83 75.78 79.89 Source: Various years of the China Statistical Yearbook and the Finance Yearbook of China. Notes: 1. The difference between the value of FD in 2008 and 2000 in the same region. 2. The difference between the maximum and minimum value of FD in each year. 3. Numbers, shadows, and ★ in parentheses represent rankings, bottom five provinces with lower degrees, and higher decreases of fiscal decentralization and top five provinces with higher increases of fiscal decentralization. 36.

數據

Outline

相關文件

Reading Task 6: Genre Structure and Language Features. • Now let’s look at how language features (e.g. sentence patterns) are connected to the structure

Now, nearly all of the current flows through wire S since it has a much lower resistance than the light bulb. The light bulb does not glow because the current flowing through it

volume suppressed mass: (TeV) 2 /M P ∼ 10 −4 eV → mm range can be experimentally tested for any number of extra dimensions - Light U(1) gauge bosons: no derivative couplings. =>

O.K., let’s study chiral phase transition. Quark

• Formation of massive primordial stars as origin of objects in the early universe. • Supernova explosions might be visible to the most

This kind of algorithm has also been a powerful tool for solving many other optimization problems, including symmetric cone complementarity problems [15, 16, 20–22], symmetric

• Adds variables to the model and subtracts variables from the model, on the basis of the F statistic. •

(Another example of close harmony is the four-bar unaccompanied vocal introduction to “Paperback Writer”, a somewhat later Beatles song.) Overall, Lennon’s and McCartney’s