Research Note

Information technology innovation in India: The top 100 IT

firms

Yu-Lin Wang

a, Shihping Huang

b, Yen-Chun Jim Wu

c,⁎

aDepartment of Business Administration, National Cheng Kung University, Tainan, Taiwan b

Institute of Management of Technology, National Chiao Tung University, 30010 Ta Hsueh Road, Hsinchu, Taiwan cDepartment of Business Management, National Sun Yat-Sen University, Kaohsiung, Taiwan

a r t i c l e i n f o

a b s t r a c t

Article history:

Received 30 September 2010

Received in revised form 6 October 2011 Accepted 9 October 2011

Available online 17 November 2011

Patents serve as an indicator of the innovation capability of countries, industries, or firms. Many Indian firms are in a transition to move from labor intensive segments to areas with higher value added which has been reflected in this research. The purpose of this study is to analyze patents issued during the period of 1997–2009 from the European Patent Office database and the United States Patent and Trademark Office database from the top one hundred Indian information technology firms. This study represents a novel empirical look at information technology industry innovations in India. A comprehensive set of statistical patent analyses are presented to provide practitioners with valuable knowledge to assist in business strategic planning.

© 2011 Elsevier Inc. All rights reserved. Keywords:

India

Information technology industry Patents

Innovation Emerging market

1. Introduction

Innovation is being increasingly seen as a critical competitive advantage and has been recognized as an important trend[1–3].

Innovation is often characterized as a type of organizational“capital” and has been broadly defined as “an idea, a product or

process, system or device that is perceived to be new to an individual, a group of people or firms, an industrial sector or a society

as a whole”[4]. Innovation has become the engine of regional and national economic growth, especially in emerging markets such

as India. Since the 1990s, India has been forced to transform from a protected market to a liberalized business environment,

resulting in Indian industry facing ever stiffer competition from imported products[5]. To address this issue, India has made

efforts to facilitate technological innovations to effectively generate and sustain competitive advantages. Innovation in new product development, new process development, and new technological development has become the major marketing and

business strategy of the technology industry in India[6].

Governments generally view the high technology industry as the industry most central to promoting national economic

growth[7]. Since India attained freedom, the government recognized the economic value of the information technology (IT)

industry and began to invest in infrastructure to support and maintain its growth. These national innovation policies and strategies are aimed at creating a favorable environment for high technology firms to engage in innovation and research and development (R&D) work. Such innovation policies have not only been aimed at encouraging the supply and demand sides of

innovation but also at creating an environment conducive to the pursuit of innovation[8]. Of the varied government innovation

policies, the environmental side that emphasizes on building innovation infrastructure has contributed the most. Several research

laboratories, such as the Indian Institutes of Technologies (IITs) have been set up to facilitate basic research[9]. Overall, the Indian

government has consistently intervened in sponsoring innovation by creating a favorable environment for the IT sector to engage in R&D work.

⁎ Corresponding author at: Dept. of Business Management, National Sun Yat-Sen University, 70, Lienhai Rd, Kaohsiung 80424, Taiwan. Tel.: +886 7 5251005; fax: + 886 7 5254698.

E-mail addresses:ywang@mail.ncku.edu.tw(Y.-L. Wang),kevin1003@gmail.com(S. Huang),ycwu@faculty.nsysu.edu.tw(Y.-C.J. Wu).

0040-1625/$– see front matter © 2011 Elsevier Inc. All rights reserved. doi:10.1016/j.techfore.2011.10.009

Contents lists available atSciVerse ScienceDirect

In addition to the role of government as the main sponsor of innovation activities, the IT industry in India itself, with favorable technical workforce factors, low-cost, a large supply of qualified labor, and English-speaking scientific professionals, has become

an attractive offshore IT destination for US firms as well as other global markets[10]. With a well-established national innovation

system and infrastructure, IT is one the fastest growing industries in India[11–13]. Furthermore, the Indian IT industry has

emerged as the fastest growing and the fourth largest IT market in the Asia Pacific region[9].

With the continuous growth and expansion of the IT industry, scholars are interested in exploring the current Indian IT industry situation for future innovation development. The IT sectors in India have tended to rely predominately on patents as

the mechanism for protecting their innovations[14], and patents have been considered an important R&D index as technology

has developed over recent years[15,16]. Therefore, the research question,“what is the current innovation status of the Indian

IT industry from a patent searching perspective?” guides this study. To address the research question, patent analysis is adopted

in investigating the patent activity of Indian IT enterprises. 2. Literature review: Patent analysis

2.1. Patents in the IT industry

As new technology is developed, firms begin to protect their innovations in different ways. Patents are considered an index of

intellectual property [17], which cannot only enhance the value of an enterprise but can also be a strong bargaining chip in

dealing with strategic alliances. According to Cohen, Goto, Nagata, Nelson, and Walsh[18], patents have spillover effects on the

R&D activities of companies. Karki and Krishnan [19] adopted patent citation information to survey the latest technology,

technological competitiveness, and linkages among technologies. The primary advantages of patents are: 1. coverage of virtually all

kinds of technologies; 2. provision of detailed information of the technology; and 3. easy availability and access via IT[20]. Hence, IT

firms often establish their competitive advantage through filing patents to raise the competitive threshold and to charge royalty fees. From an active perspective, patents help an IT enterprise to hold on to a larger market share and a higher gross profit rate.

From a passive perspective, patenting analysis helps to lower unnecessary expenditure (by avoiding“patent land mining”). As

proposed by Vermeulen[21], patenting strategies can be investigated in terms of four aspects: marketing profit, profit source,

bargaining power, and industrial control. That is, in IT firms, patent strategies are centered around commercial profit by establishing comprehensive patent combinations, meaning holdings of closely related patents of certain key technologies, rather

than focusing on the sheer number of patents[22]. Therefore, patents grant an IT enterprise an outstanding competitive position,

and the development of the IT industry can be inferred from patent information. 2.2. Patent value and innovation

For a patent to be defined as valuable it must be novel, non-trivial, and useful in nature[22]. Patent data is valuable because it

reveals the radicalness of inventions. Patent citation also serves as an important measure which captures the radicalness and

novelty of an invention[23]. In addition, the value of a patent is also dependent of the firm's strategy. One of the main objectives

of patenting is to strategize a firm's competitive position[24]. In light of this objective, patent analysis has to accommodate the

institutional and organizational context in which patents are created[24].

Moreover, patent class has also been used to measure radicalness of an invention[23]. Patent class allows researchers to

cluster firms under similar technological activity against each other for in-depth comparisons[25–27]. The weakness with patent

class analysis is that categories are often reclassified and are determined by the patent office[23]. Patent classes are altered when

the innovation activity of a technology becomes more vibrant[23].

The challenge of analyzing patents as an indicator of innovation has long been a concern in management research. The major

problem is that not all inventions are patented or patentable[28,25]. As a response to this weakness, Griliches[25]suggests the

law of large numbers as a potential solution. In addition, some scholars have argued that the majority of patents have very little

monetary worth and only a handful of patents earn substantial revenue[24]. Although only a handful of patents generate

revenue, some firms still perceive patents as of strategic importance[29]. Patent holders are required to pay a renewal fee during

a given period after patent issue. The renewal fee will not be paid unless such renewal generates value that exceeds the costs[25].

From this perspective, average patent age becomes a crucial point of observation[30]. A firm's decision to renew a certain patent

has to align with its strategic position. The value of a patent might be more strategic rather than monetary. Therefore, patents are

often used to strengthen a firm's competitive positions[24].

2.3. Patent citations

As to the evaluation of innovation by using patent data, Bigwood[31]offers four indexes: amount of patents, citation rate,

quoting rate and patent family. Karki and Krishnan[19]adopted patent citation information to survey the latest technology,

technological competitiveness, and linkages among technologies. It has been found that the higher the value a patent is, the

higher the citation numbers it will have[32]. In other words, patent citation provides linkages with other related inventions.

Patent citation is also used to measure knowledge spillover[25,30]. The approach is to cluster firms into common patent

classifications and determine the relative patent activities, such as patent citations[25]. The identification of knowledge spillover

However, some scholars have questioned the validity of patent citation as an indicator of knowledge flow since patent

examiners exert substantial influence on patent citation[33]. Patent citations are mostly generated by the inventor's patent

attorney or the patent office examiner[34]. For the most part, inventors are not aware of the citations. Overall, patent examiners

added approximately 63% of citations to U.S. patents[33]. Forty percent of U.S. patents have no applicant citation[33]. Patent

examiner influence on patent citation did not reduce patent merit however. In fact, Hedge and Sampat [30]revealed that

examiner citations have higher renewal probabilities than applicant citations. Griliches[25]believes that examiner citation

provides better“objectivity”. Citations as a priori search criteria are costly and time consuming. Hence, patent citation is a sign

that reflects the patent holders’ motivation to defend a patent if challenged[24].

2.4. Patent analysis

Patent data can provide a useful information source for developing new technology[35]. Information extracted from patent data

can help firms to avoid waste in unnecessary expenditure of R&D resources by avoiding investment in redundant technology. Griliches

[24]argues that patent information is an effective indicator of inventive activity. Patents provide more details into R&D activities than

other available statistics[24]. That is, patent data can provide firms with information that may help in strategic planning efforts[5].

Patent analysis is an important tool and weapon for business, helping enterprises to hold on to their specific status[36]. The

significance of patent analysis has been well recognized by scholars including Karki and Krishnan[19]and Sternitzke et al.[37]in

terms of releasing the latest technology, accessing technology citations, technology mapping, competitive technological

information, technology links, etc. Stern, Poter, and Furman[38]also pointed out that patent analysis can be used to evaluate

the importance of innovations as well as to show differences in quality and value on the basis of patent rights features[39,40].

Patent analysis is necessary for understanding and using patents effectively, and for some small and medium sized enterprises,

patent information can be helpful in devising projects[41,42]. In addition, holding critical patent rights can enable an enterprise

to dominate key technologies in an industry or to support the fundamental technologies within an industry[43]. Therefore, the

main purpose of patent application is to ensure commercial competitive capacity and to enhance economic value[44]. Patent

rights, industrial structure, economic scale, business management, and intellectual resources can all be taken into account as

new revenue sources for business[45].

3. Method

The goals of this study were to explore the trends and patterns of patent applications in the Indian IT industry. The methodology applied patent map analysis to patents issued between January 1, 1997 and December 31, 2009 by the top 100 Indian IT firms (based upon the 2010 India business directory published by Amelia publications). Patent search methods and analytical software were utilized to analyze information obtained from the European Patent Office database and the United States Patent and Trademark Office database. Despite some variations existing among these two patent offices, the data collected for each patent included the following fields:

• Patent number • Patent title • Patent abstract • Date of application • Date of acceptance • Name of the patent owner • Name of the inventor • Country

• IPC/UPC classification codes • Citations

Since firm size may bias the validity of the study, the researchers examined the R&D spending of the top ten Indian IT firms. Number of employees is the main variable influencing firm performance for most industries, such as the manufacturing industry. However, given the specific characteristics, R&D spending has been viewed as one critical variable that may affect the patent

performance in the IT industry[25]. Therefore, to normalize the results with respect to firm R&D spending, the top ten Indian

IT firm's 2009 R&D spending data was collected. In adopting the Wilcoxon Signed-Rank test, the top ten Indian IT firm's 2009 patent numbers and 2009 R&D spending were ranked and differences were calculated. The results confirmed prior research in

that R&D spending has a significant impact on patent performance (t = 21.4, pb.01).

4. Results

4.1. Lifecycle analysis

In order to determine the stage that a technology was positioned in, such as introduction, growth, maturity, or decline, the

researchers examined patenting activity by year[46]. Such patent count analysis not only reveals patenting activity but also

provides valuable information for predicting future trends in the Indian IT industry. Fig. 1 demonstrates the technological

development life cycle pattern of the Indian IT industry during the period from 1997 to 2009. It is clear that the IT lifecycle

was active before 2008. Consistent with Vserve Solution's[13]findings, the Indian IT industry continued its robust growth during

the past ten years, enabled by IT exports[9]. However, this chronology of Indian IT patenting activity pointed out that growth in

the IT industry in India is slowing recently and may currently be experiencing a technical R&D bottleneck. Recent R&D spending shows evidence of a lag in Indian technological innovation. Research and development spending as a percentage of gross domestic product (GDP) in India is only 0.8% as compared to China's 1.23%. Developed countries such as the United States have

R&D expenditures of up to 3% of GDP[47]. As a result, although the IT sector has emerged as a major contributor to the Indian

economy, maintained growth is needed. In addition, the number of patent owners has decreased during the past three years. That is, most patents are dominated by a limited group of people.

4.2. Country analysis

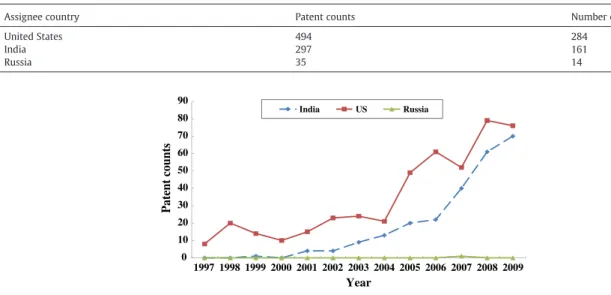

Table 1presents the top three origin countries for Indian IT patents. The number of patents owned by American firms with respect to the Indian IT industry is the highest, followed by Indian firms. Specifically, the number of patents owned by American firms is almost double of those owned by Indian firms. Foreign firms such as American enterprises have a tremendous stake in the Indian IT sector and place great emphasis on the development and application of technological patents.

In addition,Fig. 2demonstrates the top three origin countries for Indian IT patents by year. Indian IT patents are largely

dominated by the United States. Every year since 1997 the United States has had the most IT patents. The United States has

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 0 20 40 60 80 100 120 140 160 180 0 20 40 60 80 100 120 Patent counts

Number of patent owners

Fig. 1. Technology life cycle chart by issue year.

Table 1

Top three origin countries of Indian information technology patents.

Assignee country Patent counts Number of patent owners

United States 494 284 India 297 161 Russia 35 14 0 10 20 30 40 50 60 70 80 90 1997 India US Russia Patent counts Year 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998

viewed India as a major offshore IT destination due to the favorable workforce[10], being that country's most favored destination

for sourcing software and IT before 2004[13]. This is a reflection of the Indian IT industry adopting offshore outsourcing as their

business strategy early on.

Recently, although American enterprises continue to have a commanding lead, the gap in terms of patent ownership between American and Indian firms has narrowed significantly. Indian software companies have started to pursue potential acquisitions

both in the domestic as well as foreign markets[9]. Indian firms have shifted their business strategy to focus on their own

technological innovation, becoming more proactive in patent development.

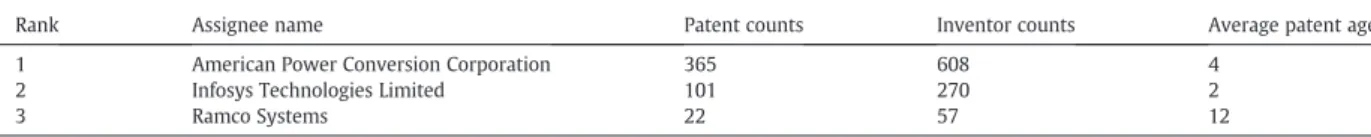

4.3. Patenting activities byfirms

Information technology firms tend to use patents to legally protect their research and development outcomes and further secure a competitive industry position. Patent analysis also helps firms to detect the technological strengthens

and weaknesses of competitors[39]. Firms in this industry are interested in exploring competitive patent data to modify

their own R&D policies and focus. Interestingly, patent ownership in the Indian IT industry is dominated by a few firms, with the number of patents owned by the top two firms accounting for more than fifty percent of all patents in the

industry.Table 2points out that American Power Conversion Corporation is the leader in both inventor and patent counts

in the Indian IT industry, likely due to the ability to attract and retain talented R&D personnel. It is not surprising that a foreign multi-national corporation plays such a significant role in Indian IT patent activity. Infosys Technologies Limited

and Ramco Systems ranked two and three, respectively. Despite Ramco Systems’ rank as number three in the Indian IT

industry, the inventor and patent counts are relatively weak compared with the other top two firms.

In addition, compared with the leading firm, American Power Conversion Corporation, Infosys Technologies Limited has a slightly lower average patent age. Firms only renew patents with strategic importance. The average patent age under Infosys is only two years which means these patents are yet to be renewed. It is unclear how Infosys perceives the

value of patents under its name. On the other hand, Ramco systems’ patents have longer average ages and have been

renewed which means these patents are of strategic importance to Ramco systems.

Fig. 3illustrates the number of patents the top three companies applied for during 1997–2009. As can be seen, the number of patents filed by Infosys Technologies Limited has increased rapidly since 2007. However, prior to 2004, American Power Conversion Corporation had patents issued continuously while Infosys Technologies Limited and Ramco System had none. American Power Conversion Corporation was the pioneer in launching R&D activities in the Indian IT industry and is still aggressively participating in this sphere as visible by its outstanding patenting performance. In 2004,

Infosys Technologies Limited ranked in the top nine firms in the global IT industry for the first time[13]. Moreover, though

Infosys Technologies Limited emerged late, its patents have a longer protection advantage. The increase in patent count is

consistent with Infosys’ strategy to strengthen its knowledge position.

4.4. Citation analysis

Hicks[48]developed several patent assessment analysis indicators from CHI Research (Haddon Heights, NJ), including, for

example, the Current Impact Index (CII). In addition to patent citation indicators, additional statistical analysis methods can be

Table 2

Top three patenting assignees.

Rank Assignee name Patent counts Inventor counts Average patent age

1 American Power Conversion Corporation 365 608 4

2 Infosys Technologies Limited 101 270 2

3 Ramco Systems 22 57 12 0 10 20 30 40 50 60 70 80 1997

American Power Conversion Corporation Infosys Technologies Ltd. Ramco SYSTEMS

Year Patent counts 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 2 0 11 24 19 22 40 56 44 70 71 2 0 1 24 34 40 12 2 0 1 7 3 3

conducted to compile a patent citations document. Such analysis of patent citations not only assesses the quality and impact of cited and citing patents but also show the contribution of a patent toward technological development.

Two important variables in measuring the value of patents are shown inTable 3; the average citation rate and technology

independence. The average citation rate is measured as the mean number of citations per patent. The technology independence indicator is calculated by the ratio of self-citations to total citations. A value of 1 indicates that all citations are self-citations, meaning a firm's inventions are totally independent of subsequent patents.

Table 3provides citation indicators for the top three firms previously mentioned. American Power Conversion Corporation had the highest number of citations for its own patents as well as the highest number cited by others. On the contrary, Infosys

Technologies Limited and Ramco Systems had no citations, whether self-citations or external. Despite the examiners’ involvement

in patent citation, patent citation is a sign of the patent holder's motivation to defend a patent if challenged[24]. Based onTable 3,

even for the top Indian IT firms, only American Power Conversion Corporation reveals some degree of motivation to defend its patents. One potential explanation for this phenomenon is the relative late entry of these firms, with Infosys Technologies Limited not generating a significant number of patents until 2007, and Ramco Systems with a first patent in 2005.

4.5. United States patent classification analysis

Patent class has also been used to measure the radicalness as well as technological activity of an invention[23,25]. The United States

Patent code system was employed to track technological trends in the Indian IT industry. To determine hot segments within the Indian

IT industry, two-tier UPC analysis was performed. As can be seen inTable 4for the IT field, the classification of UPC 307/066 on storage

battery and accumulators is the most competitive patent area. In addition, UPC 385/135 (splice box and surplus fiber storage/ trays/organizers/carriers) and UPC 454/184 (electronic cabinets) rank second and third for Indian IT patent areas, respectively. 4.6. International patent code analysis

Similar to the UPC, the international patent code (IPC) is a major classification system adopted worldwide. The IPC is an international classification system that is applied by fifty-two nations and four international organizations. The IPC is a hierarchical classification system consisting of sections, classes, subclasses, and groups (main groups and subgroups). The IPC divides all technological fields into sections (designated by a capital letter), each section into classes (designated by a two-digit number), and each class into subclasses (designated by a capital letter).

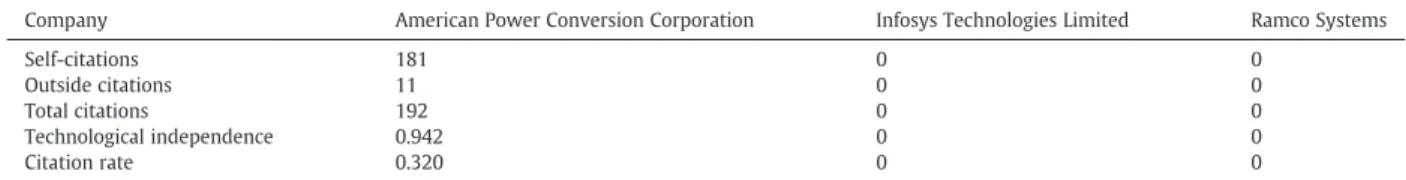

The three-tier IPC criteria (see Appendix Afor descriptions of each tier) were used for IPC area analysis (Table 5). Findings

indicated that G06F (electric digital data processing), H04M (transmission of digital information, e.g. telegraphic communication), and H04L (telephonic communication) are the top 3 IPC classes in order of patent counts, highlighting the active areas in the Indian IT sector. Clearly, all patents included within these classifications are related to IT. Half of all Indian IT patents are G06F, which is associated with software-related technologies, making this the most competitive patent area. The result is consistent with the orientation of India's IT industry as software based. On the other hand, the two categories H04M and H04L together account for half of total granted Indian

IT patents. H04 relates to“electric communication technique” which is concerned with software as well. Consistent with Mathur's[9]

statement, the Indian IT software industry is maintaining a steady pace of growth compared with the hardware industry. One of the reasons is the prioritization of the Indian government on the establishment of software technology parks.

Fig. 4displays Indian IT patents filed and issued during the period of 1997 to 2009. A clear trend is shown with an increase in G06F related patents. On the contrary, H04M ranked at the top at the beginning but experienced a rapid drop since 2000, with fewer patents each year. Information technology firms need to be aware of such trends for their corporate strategies.

Table 3

Citation counts for top three firms.

Company American Power Conversion Corporation Infosys Technologies Limited Ramco Systems

Self-citations 181 0 0 Outside citations 11 0 0 Total citations 192 0 0 Technological independence 0.942 0 0 Citation rate 0.320 0 0 Table 4

Top five U.S. patent code (UPC) classification areas.

Class Descriptions Counts

UPC 307/066 Storage battery or accumulator 29

UPC 385/135 Splice box and surplus fiber 18

UPC 454/184 Electronic cabinet 17

UPC D13/110 Transformer, rectifier or casing thereof (3) 17

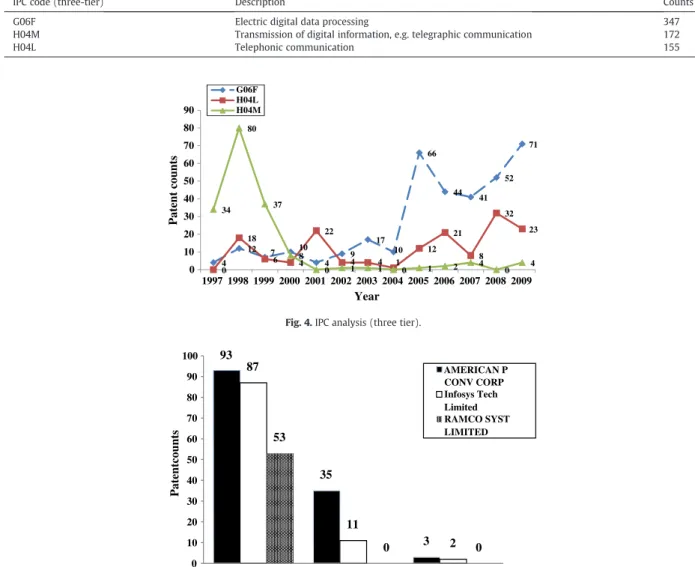

Fig. 5 presents an insightful pattern on how each of the top three companies places distinct emphasis on these IPC classification system segments. Clearly, each firm tends to focus highly on the G06F area. However, American Power Conversion Corporation dominates all three areas. In comparison, Ramco Systems merely files patents in the G06F area alone.

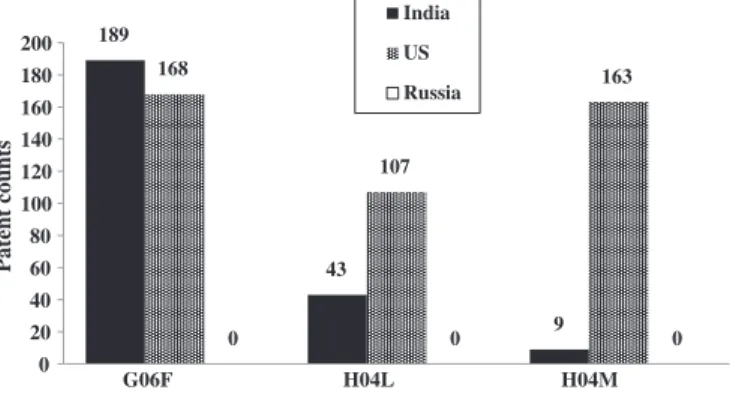

Fig. 6shows how each country places their distinct emphasis on these segments. The United States is the best performer in both the H04L and H04L areas. On the contrary, India shows comparatively high interest in the G06F area. Although the

United States ranked number one as the source of Indian IT patents with the highest counts (Table 1), India itself owned

the most patents in the G06F area, the most competitive patent area. In other words, despite most patents being registered under United States entities, the patents India registered are more critical to this industry.

5. Discussion

The IT industry in India has become knowledge intensive and innovative. To come up with new products, processes, and services, firms need to have access to detailed information on the technological innovations of their competitors. In addition to R&D spending and other innovation indicators of technology flows, patents and other intellectual property provide both financial and strategic

value for a firm's core technology assets[49]. Patent data provides a useful indictor of technological development and a measure

of firm innovation capability. This study endeavored to assess Indian IT innovation through patent analysis.

The growth of the Indian IT industry during 2001–2002 was reflected in the increase in patent activity (patent counts

versus inventors). However, the number of patents has slowly increased since 2008. It would appear that the pace of

4 12 7 10 4 9 17 10 66 44 41 52 71 0 18 6 4 22 4 1 12 21 8 32 23 34 80 37 8 0 1 41 0 1 2 4 0 4 0 10 20 30 40 50 60 70 80 90 G06F H04L H04M Year Patent counts 1997199819992000200120022003200420052006200720082009

Fig. 4. IPC analysis (three tier).

93 35 3 87 11 2 53 0 10 20 30 40 50 60 70 80 90 100 AMERICAN P CONV CORP Infosys Tech Limited RAMCO SYST LIMITED Patentcounts 0 0

Fig. 5. Top three competitors by IPC (three tier). Table 5

Top three International Patent Code (IPC) classification areas.

IPC code (three-tier) Description Counts

G06F Electric digital data processing 347

H04M Transmission of digital information, e.g. telegraphic communication 172

technological innovation in the Indian IT industry has slowed in recent years, as Indian firms are facing difficulties in developing new technologies. The results of this research have confirmed the recent decline in R&D activity in India.

The United States is the top origin country for Indian IT patents. That is, the Indian software industry has become a major U.S. offshore destination. The single top patenting entity in India is the American Power Conversion Corporation. Recently however, Indian IT firms have started to compete with their foreign counterparts. Indian firms are actively pursuing technological development as shown by the growth rate of patents granted. For example, Infosys Technologies Limited has ranked in the top two patenting assignees. Moreover, the number of patents owned by Infosys Technologies Limited is growing significantly compared with American Power Conversion Corporation.

The success of Infosys sets an example for Indian IT firms. Seven Indian IT engineers founded Infosys in 1981 and by 2007 Infosys’

net profits were $1.1 billion[50]. The initial strategy of Infosys was offshoring. Infosys was effective in providing offshoring services in

India for its foreign clients by leveraging the lower labor costs of software professionals in India[51]. Infosys realized that sustaining a

business model based on low labor costs is not viable in the long run as competition intensified[52]. Consequently, Infosys has to

move up the IT value chain by offering consulting and end-to-end solution services[51,52]. This transition means Infosys will face

not only local competitors such as TCS and Wipro but also a different set of global competitors such as IBM and Accenture[51]. Infosys

has to strengthen its knowledge position in order to compete against these world class competitors. Based on our patent analysis,

Infosys has intensified its patent activity in the past few years which reflects Infosys’ shift in its strategy.

Further, by analyzing UPC and IPC patent areas, the findings indicated that the top patent areas are all software related. Unlike hardware, communication systems and digital processing will continue to be a dominate feature of the Indian IT industry. Such a strong software foundation will enable Indian software firms to outsource embedded solutions for international independent software vendors.

The Indian IT industry, while experiencing a current slowdown in patent development, is expected to expand globally over the next few decades. Despite a large number of patents being from foreign firm, Indian firms have filed a significant number of patent applications. Therefore, the Indian IT industry has transformed from a reactive position, being the best outsourcing option from the foreign perspective, to a proactive position in pursuing innovations.

Acknowledgements

The authors would like to thank the anonymous reviewers for constructive comments that improved the quality and

presentation of the paper. In addition, this paper is particularly supported by “Aim for the Top University Plan” of the

National Sun Yat-Sen University and the Ministry of Education, Taiwan (NSC 99-2410-H-110-053-MY3). Appendix A

References

[1] J. Barsh, Innovation management: a conversation with Gary Hamel and Lowell Bryan, McKinsey Q. 3 (2007) 1–10. [2] R. Chapman, P. Hyland, Complexity and learning behaviors in product innovation, Technovation 24 (2004) 553–561.

189 43 9 168 107 163 0 0 0 0 20 40 60 80 100 120 140 160 180 200 G06F H04L H04M Patent counts India US Russia

Fig. 6. Top three IPC (three tier) areas for the top three origin countries.

G—Physics

G06—Computing; Calculating; Counting G06F—Electric digital data processing H—Electricity

H04—Electric communication technique

H04L—Transmission of digital information, e.g. telegraphic communication H04M—Telephonic communication

[3] G. Hamel, C.K. Prahalad, Corporate imagination and expeditionary marketing, Harv. Bus. Rev. 69 (1991) 81–92. [4] E. Rogers, Diffusion of Innovations, Free Press, New York, 1995.

[5] B.P. Abraham, S.D. Moitra, Innovation assessment through patent analysis, Technovation 21 (2001) 245–252. [6] S.K. Singh, A. Chaudhuri, The reality of India: folding constraints into business strategy, J. Bus. Strateg. 30 (2009) 5–16.

[7] J.S. Park, Opportunity recognition and product innovation in entrepreneurial high-tech start-ups: a new perspective and supporting case study, Technovation 25 (2005) 739–752.

[8] B.P. Mishra, Technology innovations in emerging markets: an analysis with special reference to Indian economy, S. Asian J. Manage. 14 (2007) 50–65. [9] S.K. Mathur, Indian information technology industry: past, present and future and a tool for national development, J. Theor.Appl. Inf. Technol. 2 (2006) 50–79. [10] E. Carmel, R.I.E. Agarwal, The maturation of offshore sourcing of information technology work, in: R. Hirschheim, A. Heinzl, J. Dibbern (Eds.), Information

Systems Outsourcing: Enduring Themes, New Perspectives and Global Changes, Springer, 2006, pp. 631–650.

[11] F. Castellacci, Innovation and the competitiveness of industries: comparing the mainstream and the evolutionary approaches, Technol. Forecast. Soc. Change 75 (2008) 984–1006.

[12] R.N. Kostoff, S. Bhattacharya, Assessment of China's and India's science and technology literaure: introduction, background, and approach, Technol. Forecast. Soc. Change 74 (2007) 1519–1538.

[13] Vserve Solution, Research Analysis Report on IT Industry in India and its future trendRetrieved from, http://www.vservesolution.com/pdf/ Information%20Technology%20Industry%20in%20India.pdf2010.

[14] I.P. Mahmood, J. Singh, Technological dynamism in Asia, Res. Policy 32 (2003) 1031–1054.

[15] Z. Griliches, B. Hallb, A. Pakes, R&D, patents, and market value revisited: is there a second technological opportunity factor? Econ. Innov. New Technol. 1 (1991) 183–201. [16] T. Saiki, Y. Akano, C. Watanabe, Y. Tou, A new dimension of potential resources in innovation: a wider scope of patent claims can lead to new functionality

development, Technovation 26 (2006) 796–806.

[17] A.L. Miele, Patent Strategy : The Manager's Guide to Profiting from Patent Portfolios, John Wiley & Sons, Inc., New York, 2000.

[18] W.M. Cohen, A. Goto, A. Nagata, R.R. Nelson, J.P. Walsh, R&D Spillovers, patents and the incentives to innovate in Japan and the United States, Res. Policy 31 (2002) 1349–1367.

[19] M.M. Karki, K.S. Krishnan, Patent Citation Analysis: A Policy Analysis Tool, World Pat. Inf. 19 (1997) 269–272.

[20] S. Jacobsson, J. Philipson, Sweden's technological profile: what can R&D and patents tell and what do they fail to tell us? Technovation 26 (1996) 245–253. [21] B. Vermeulen, Patent Strategyfrom,http://www.corp2l.com/PatentStrategyO3O726.pdf2003.

[22] W. Schoenmakers, G. Duysters, The technological origins of radical inventions, Res. Policy 39 (2010) 1051–1059.

[23] K. Dahlin, D. Behrens, When is an invention really radical? Defining and measuring technological radicalness, Res. Policy 34 (2005) 717–737.

[24] M. Gittelman, A note on the value of patents as indicators of innovation: implications for management research, Acad. Manage. Perspect. 22 (2008) 21–27. [25] Z. Griliches, Patent statistics as economic indicator: a survey, J. Econ. Lit. 28 (1990) 1661–1707.

[26] Y. Wu, P. Lee, The use of patent analysis in assessing ITS innovations: US, Europe and Japan, Transp. Res. A 41 (2007) 568–586.

[27] Y. Wu, H. Liu, Technological innovation assessment of business-to-business electronic marketplaces, J. Am. Soc. Inf. Sci. Technol. 57 (2006) 1093–1104. [28] M. Benner, J. Waldfogel, Close to you? Bias and precision in patent-based measures of technological proximity, Res. Policy 37 (2008) 1556–1567. [29] J. Klette, Z. Griliches, Empirical Patterns of Firm Growth and R&D Investment: a Quality Ladder Model Interpretation, The Economic Journal 110 (2000)

363–387.

[30] D. Hegde, B. Sampat, Examiner citations, applicant citations, and the private value of patents, Econ. Lett. 105 (2009) 287–289. [31] M.P. Bigwood, Patent trend analysis: Incorporate current year data, World Pat. Inf. 19 (1997) 243–249.

[32] D. Harhoff, F. Narin, F.M. Scherer, K. Vopel, Citation frequency and the value of patented inventions, Rev. Econ. Stat. 81 (1999) 511–515. [33] J. Alcacer, M. Gittelman, Patent citations as a measure of knowledge flows: the influence of examiner citations, Rev. Econ. Stat. 88 (2006) 774–779. [34] A.B. Jaffe, M. Trajtenbrg, M.S. Fogarty, The Meaning of Patent Citations: Report on the NBER/Case Western Reverse Survey of Patents, in, National Bureau of

Economic Research, Cambridge, MA, 2000.

[35] A. Plikington, R. Dyersion, O. Tissier, The electric vehicle: patent data as indicators of technological development, World Pat. Inf. 24 (2002) 5–12. [36] B. Spear, James Watt: the steam engine and the commercialization of patents, World Pat. Inf. 30 (2008) 53–58.

[37] C. Sternitzke, A. Bartkowski, H. Schwanbeck, R. Schramm, Patent and literature statistics—the case of optoelectronics, World Pat. Inf. 29 (2007) 327–338. [38] S. Stern, M.P. Poter, J.L. Furman, The determinants of national innovative capacity, NBER working paper, 2000, pp. 1–55.

[39] F. Narin, E. Noma, R. Perry, Patents as indicators of corporate technological strength, Res. Policy 16 (1987) 143–155. [40] F. Narin, E. Noma, R. Perry, Patents as indicators of corporate technological strength, Res. Policy 22 (1993) 108.

[41] H. Grupp, U. Schmoch, Patent statistics in the age of globalisation: new legal procedures, new analytical methods, new economic interpretation, Res. Policy 28 (1999) 377–396.

[42] C. lo Storto, A method based on patent analysis for the investigation of technological innovation strategies: the European Medical Prostheses Industry, Technovation 26 (2006) 932–942.

[43] B.H. Hall, R.M. Ham, The Patent Paradox Revisited: Determinants of Patenting in the US Semiconductor Industry 1980–94, Cambridge, 1999. [44] L. Mitkova, Marketing: a key element in patent management, Int. J. Technol. Transf. Commer. 4 (2005) 487–499.

[45] M.A. Bader, Extending legal protection strategies to the service innovations area: review and analysis, World Pat. Inf. 29 (2007) 122–135.

[46] H.M. Jarvenpaa, S.J. Makinen, M. Seppanen, Patent and publishing activitiey sequence over a technology's life cycle, Technol. Forecast. Soc. Change 78 (2011) 283–293. [47] The Financial Express, India lags China in R&D spending: Sibal, 2011from,http://www.financialexpress.com/news/India-lags-China-in-RampD-spending-Sibal/

283583/2008.

[48] D. Hicks, The Value of CHI's Analytical Patent Databases, in, CHI Research, Inc., Haddon Heights, NJ, 2001. [49] D. Kline, Sharing the corporate crown jewels, Sloan Manage. Rev. 44 (2003) 89–93.

[50] J. Birkinshaw, Infosys: computing the power of people, Bus. Strateg. Rev. 19 (2008) 18–23.

[51] T. Delong, Infosys: Strategic Human Resource Management, in, Harvard Business School Publishing, Boston, M.A., 2006.

[52] R. Garud, A. Kumaraswamy, V. Sambamurthy, Emergent by design: performance and transformation at Infosys Technologies, Organ. Sci. 17 (2006) 277–286. Yu-Lin Wang is an assistant professor in Department of Business Administration at National Cheng Kung University, Taiwan. Her research interests focus on organizational learning and entrepreneurship in small and medium enterprises.

Shihping Kevin Huang (PhD, Waseda University) is an assistant professor of Business Administration at Shih Hsin University. Huang's current research involves environmental disclosure, corporate social responsibility, and education for sustainability.

Yen-Chun Jim Wu (Ph.D., University of Michigan) is Professor of Business Management Department at National Sun Yat-Sen University, Taiwan. His papers have appeared in Sloan Management Review, IEEE Transactions on Engineering Management, International Journal of Operations & Production Management, Supply Chain Management, Management Decision, Journal of the American Society for Information Science and Technology, International Journal of Physical Distribution & Logistics Management, International Journal of Logistics Management, European Journal of Operational Research, Transportation Research Part A & E, International Journal of Technology Management, and Academy of Management Learning and Education, etc. His research interests include supply chain management, technology management, and lean manufacturing.