行政院國家科學委員會補助專題研究計畫成果報告 ※ ※※※※※※※※※※※※※※※※※※※※※※※※ ※※※

高樓層建築物對土地使用模型影響之研究

※

※ ※ ※ ※※※※※※※※※※※※※※※※※※※※※※※※ 計畫類別:□x 個別型計畫 □整合型計畫 計畫編號:NSC 89-2415-H-004-059- 執行期間:89 年 8 月 1 日至 90 年 7 月 31 日 計畫主持人:劉小蘭 共同主持人:王大立 本成果報告包括以下應繳交之附件: □赴國外出差或研習心得報告一份 □赴大陸地區出差或研習心得報告一份 □出席國際學術會議心得報告及發表之論文各一份 □國際合作研究計畫國外研究報告書一份 執行單位:國立政治大學地政系 中 華 民 國 90 年 10 月 31 日行政院國家科學委員會專題研究計畫成果報告 高樓層建築物對土地使用模型影響之研究

A Study of the Impact of High-Rise Building to Urban Land Use Model 計畫編號:NSC 89-2415-H-004-059 執行期限:89 年 8 月 1 日至 90 年 7 月 31 日 主持人:劉小蘭 政治大學地政系 共同主持人:王大立 逢甲大學都市計劃系 一、中文摘要 隨著經濟的成長,都市化快速的發展,為 滿足都市化所帶來的大量住宅及產業用地 之需求,土地利用朝向立體化之發展之趨 勢,而相關土地法令、土地估價、稅收等 等多針對土地平面利用為考量點,因此對 於建物垂直利用之土地使用型態則產生考 慮不周或依法無據的情形。另一方面,有 關住宅市場價格之研究亦以平面的區位條 件探討為要;此外由於樓層價值之差異, 在土地使用模型中若不將此項因素納入考 慮,則會產生許多偏誤,因此不論由實務 或理論之角度觀之,對於高層建物各樓層 之價值問題有其研究之必要。 由於國內對於樓層差異而產生不同之 價格之研究,大都為實證之分析,而國外 之租金分析亦只探討平面區位之差異,並 未考慮立體之差異,本研究之主要目的在 擴充 Liu(1988)居民的效用函數將及 Fujita and Ogawa 的區位潛在機能為立體區位潛 在機能來探討建物立體價值之差異。結果 發現,如果考慮樓層價差,則都市密度分 布將較為分散。 關鍵詞:樓層價差、區位潛在機能 Abstract

With the rapid urbanization, the demand of office floor space is also increasing. Although, the high-rise building is very common in the urban area, the study of the rent of different story of high-rise building is relatively rare. Liu (1988) and Grimaud (1989) have applied agglomeration economies to study the density distribution in the urban area separately, but their studies

assumed that the floor rent in the same building is the same, even on different stories. This assumption about floor rent may not fully reflect the actual floor rent, as we should consider the formulation of floor rent of high-rise building and the effect on density distribution from the perspectives of theoretical completeness and practical usefulness.

This paper extends the Fujita and Ogawa’s locational potential function (1982) into two dimensions -- flat dimension and story dimension. The revision of locational potential function will then be applied to revise the Liu’s model. Finally, the office distribution and office rent distribution on the different stories in the CBD (central business district) will be discussed in the paper.

Keywords: Floor rent differential, Locational potential function

二、緣由與目的

Production within an urban area, especially within the central business district (CBD), is often characterized by “agglomerative economies.” Most existing models are to describe these economies are based on the application of the concept of spatial externalities to generate internal forces of spatial agglomeration (Borukhov & Hochman, 1977; Solow & Vickery, 1977; Hartwick, 1978; O’Hara, 1977; Ogawa & Fujita, 1980; Imai, 1982). In these studies, the authors all assumed uniform density for functions of firms. If we allow for the capital-land substitution, non-uniform distributions of firms shall obviously prevail. Thus, Tabuchi (1986), Liu (1988), Grimaud (1989), Liu and Fujita (1991) developed

variable density models. However, in their studies they assumed the floor rent in the same building as the same on the different stories. This assumption is not a satisfactory description of conditions in certain modern cities, as there are differences in floor rents within the same high-rise buildings, therefore, we should consider the formulation of floor rent in high-rise buildings and its effect on density distribution from the perspectives of both theoretical completeness and practical usefulness.

Generally speaking, the CBD configuration is result from the action of attractive and repulsive forces, i.e., attractive forces cause business firms to concentrate, while repulsive forces prevent them from over-concentration. The CBD configuration is determined as the physical manifestation of the balance between attractive and repulsive forces. Therefore Fujita and Ogawa (1982) developed a model based on the claim that the tendency to reduce the transaction cost of face-to-face transactions is the principle attractive force for business firms and the wish to avoid higher land rent due to the concentration of business firms is the major repulsive force. The total transaction cost of a business firm is the aggregation of the transaction cost with every other business firm in the city. It is a density weighted linear function of distance. In Fujita and Ogawa’s model this density is constant. Liu (1988) and Grimaud (1989) introduced a variable density into Fujita and Ogawa’s model. In their studies, the transaction cost is still a density weighted linear function of distance in that the floor rent of different stories in the same building is the same. This revision, however, cannot fully reflect the repulsive force in the model; in other words, the density distribution in Liu’s and Grimaud’s models may not fully describe the CBD configuration.

三、模型假設

A simple model of locational decisions within the CBD can be constructed on the following assumptions:

2.1 The CBD

A CBD is assumed to be developed on a long strip of homogenous agricultural land. As the city is very long, the transaction costs across the width are negligible. Thus, the CBD can be treated as a linear. Each location in the city is representable by a point,

x, on the line whose geographic center is the

origin. The story of the building is representable by y. The first story is 1 and

the highest story in location x is b(x).

2.2 The Business Firm

There are M identical business firms in

the CBD. All of them are profit maximizers. They produce some sort of services or goods, which will be exported at a constant price p.

Each business firm uses one unit of office space and one unit of fixed cost in order to produce a fixed positive amount of output, say Q.

Business firms are required to conduct transactions, such as information exchange, during production. It is assumed that business firms transact with each other equiprobably. The cost of transactions between any two business firms is not only linearly proportional to the horizontal distance, but also the story distance between them. Each transaction requires a separate trip, and all other firms are equally likely to be the other participant in the transaction. The travel occasioned by transactions produce no congestion. The round-trip cost of such travel is t per unit horizontal distance,

and τ per unit story distance. We assume that the cost of per unit of horizontal distance

t is higher than the story distance τ. Thus, the total transaction cost of a business firm locating at location x and story y is given as

[ ]

[

]

{

}

∫

[

∫ ∫

− + − + − − − + = − ) ( 1 ) ( 1 ( 1) ( 1) ( 1) ( ) , ( f bx f u b y du d y u x t y x T τ υ υ τ (2.1)where t : unit transaction cost of horizontal

distance,

τ : unit transaction cost among stories, T(x,y): total transaction cost of a

business firm locating at location x and story y,

b(x) : the stories of building at location x,

−f, f : the left and right urban fringes,

respectively.

The slope and curvature of the total transaction cost function are given by

) 1 )( ( ' 2 2 ) ( ) ( ) , ( y x b x du u b du u b t x y x T x f f x + − − − = ∂ ∂

∫

−∫

τ (2.2)[

2 ( ) 2]

2 ( )(1 ) ) , ( 2 2 y x b x b t x y x T = − + ′′ − ∂ ∂ τ (2.3)From (2.2), the transaction cost has extreme point at (0,1), on the first floor of CBD center building.

[

]

[

]

∫

− + − − = + − − = ∂ ∂ f fb u du y f b x M y f b x y y x T ) ( 2 ) ( 2 ) ( ) , ( τ τ τ τ (2.4) τ 2 ) , ( 2 2 = ∂ ∂ y y x T (2.5)Equations (2.4) and (2.5) are always positive, therefore the higher the floor is in the building the more transactions cost the business firm shall pay, and the increment of transaction cost will increase with the story.

Therefore, the profit of firm locating at location x and yth story is given

) , ( ) , ( ) , (x y =PQ−C−OR x y −T x y π (2.6) where OR(x, y): floor rent at location x and

yth story, C: fixed cost,

and others variables are defined as above.

Thus, the objective of each business firm is

to choose an optimal location x and story y by

taking into account the locations of all other business firms in the city so as to maximize its profit given by (2.6). Since all the business firms are assumed to be identical, the profit level of all firms must be the same at equilibrium regardless of their locations. Therefore, the floor rent is given

) , ( ) , (x y PQ C T x y OR = − −π − (2.7) 2.3 Constructor Sector

It is assumed that the absentee constructors supply office space to business firms. All the capital and labor used for the construction of office space come from outside the city. The construction cost function is assumed to be a function of office density such as 2 )] ( [ )] ( [b x b x K =α (2.8) where K : construction cost function,

α : construction cost parameter, where

α > 0.

Since, the market of office space is assumed to be perfectly competitive, the profit of each constructor should be zero in equilibrium:

) ( )] ( [ ) , ( ) ( ( ) 1 2 x R x b dy y x OR x bx c =

∫

−α − π (2.9) where πc(x): unit profit of a constructor at x,R(x): unit land rent at x.

When the constructors bid for the land at location x, they become the monopolist at

that location. The rent for office space at each location x and b(x)th story equals the

marginal cost of providing office space.

{

}

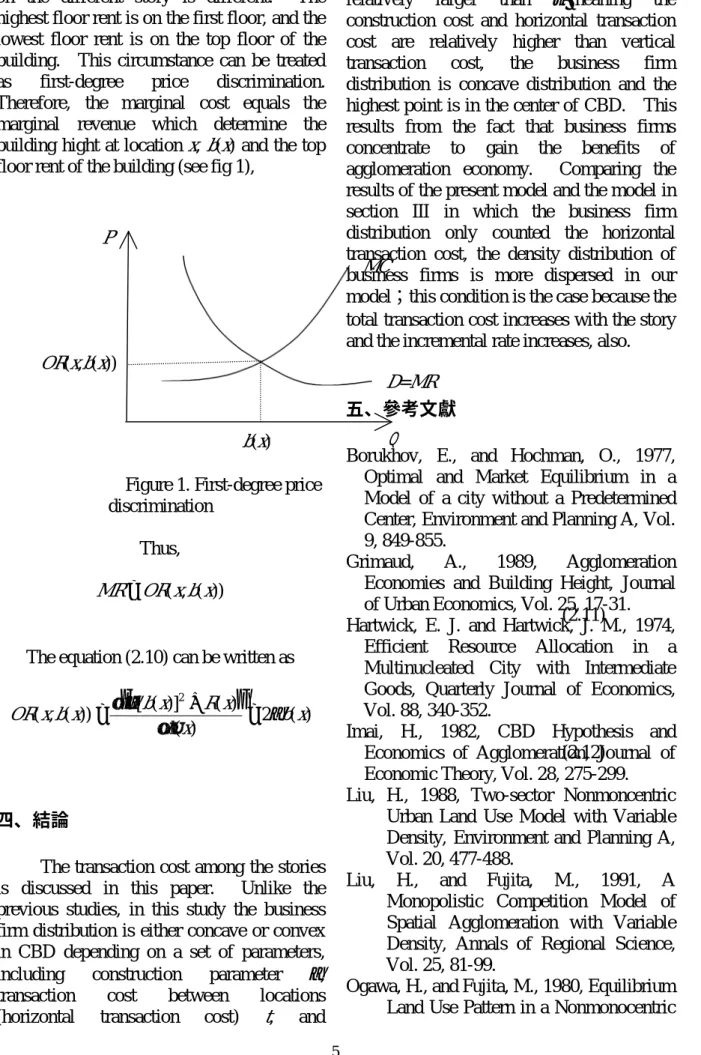

MR x b x R x b MC = ∂ + ∂ = ) ( ) ( )] ( [ 2 α (2.10)From equations (2.4), (2.5) and (2.7), we know that on the same location the floor rent on the different story is different. The highest floor rent is on the first floor, and the lowest floor rent is on the top floor of the building. This circumstance can be treated as first-degree price discrimination. Therefore, the marginal cost equals the marginal revenue which determine the building hight at location x, b(x) and the top

floor rent of the building (see fig 1),

Figure 1. First-degree price discrimination Thus, )) ( , (xb x OR MR= (2.11) The equation (2.10) can be written as

{

}

2 ( ) ) ( ) ( )] ( [ )) ( , ( 2 x b x b x R x b x b x OR α = α ∂ + ∂ = (2.12) 四、結論The transaction cost among the stories is discussed in this paper. Unlike the previous studies, in this study the business firm distribution is either concave or convex in CBD depending on a set of parameters, including construction parameter α, transaction cost between locations (horizontal transaction cost) t, and

transaction cost between stories (vertical transaction cost) τ. When α and t are relatively larger than τ, meaning the construction cost and horizontal transaction cost are relatively higher than vertical transaction cost, the business firm distribution is concave distribution and the highest point is in the center of CBD. This results from the fact that business firms concentrate to gain the benefits of agglomeration economy. Comparing the results of the present model and the model in section III in which the business firm distribution only counted the horizontal transaction cost, the density distribution of business firms is more dispersed in our model;this condition is the case because the total transaction cost increases with the story and the incremental rate increases, also.

五、參考文獻

Borukhov, E., and Hochman, O., 1977, Optimal and Market Equilibrium in a Model of a city without a Predetermined Center, Environment and Planning A, Vol. 9, 849-855.

Grimaud, A., 1989, Agglomeration Economies and Building Height, Journal of Urban Economics, Vol. 25, 17-31. Hartwick, E. J. and Hartwick, J. M., 1974,

Efficient Resource Allocation in a Multinucleated City with Intermediate Goods, Quarterly Journal of Economics, Vol. 88, 340-352.

Imai, H., 1982, CBD Hypothesis and Economics of Agglomeration, Journal of Economic Theory, Vol. 28, 275-299.

Liu, H., 1988, Two-sector Nonmoncentric Urban Land Use Model with Variable Density, Environment and Planning A, Vol. 20, 477-488.

Liu, H., and Fujita, M., 1991, A Monopolistic Competition Model of Spatial Agglomeration with Variable Density, Annals of Regional Science, Vol. 25, 81-99.

Ogawa, H., and Fujita, M., 1980, Equilibrium Land Use Pattern in a Nonmonocentric

Q b(x) X OR(x,b(x)) P MC D=MR

City, Journal of Regional Science, Vol. 20, No. 4, 455-475.

O’Hara, J. D., 1977, Location of Firms within a Square Central Business District, Journal of Political Economy, Vol. 85, 1189-1207.

Tabuchi, T., 1986, Urban Agglomeration Economics in a Linear City, Regional Science and Urban Economics, Vol. 16, 421-436.

Solow, R. M. and Vickrey, W. S., 1971, Land Use in a Long Narrow City, Journal of Economic Theory, Vol. 3, 430-447.