委託單驅動市場之委託單切割對長期記憶性的影響

研究成果報告(精簡版)

計 畫 類 別 : 個別型 計 畫 編 號 : NSC 97-2410-H-004-016- 執 行 期 間 : 97 年 08 月 01 日至 98 年 07 月 31 日 執 行 單 位 : 國立政治大學國際貿易學系 計 畫 主 持 人 : 山本市 報 告 附 件 : 出席國際會議研究心得報告及發表論文 處 理 方 式 : 本計畫涉及專利或其他智慧財產權,2 年後可公開查詢中 華 民 國 98 年 10 月 26 日

(97-2410-H-004-016- ) Dear Sir/Madam,

The title of my research agenda for the year 97 was “The impact of order-splitting on Long-Memory in an Order-Driven Market”.

Recent empirical research has documented long-memories of trading volume, volatility, and order-signs in stock markets (but yet, the market is informationally efficient in a sense that there is no persistence in returns).1 However, there is relatively less theoretical work to explain why and where these features are coming from. In my research project joint with Professor Blake LeBaron at Brandeis University, we conjectured that traders’ order-splitting is related to these empirical features.

It is a common practice in stock markets that stock investors split their large orders into smaller pieces and execute them incrementally to minimize price impact.2 Thus, the same sign of market orders enters the order book persistently. Bouchaud, Farmer, and Lillo [6] and Lillo, Mike, and Farmer [7] show that it is a source of a long-memory of order signs, however, they investigate the property of order signs only. We have examined how order-splitting is related to the previously mentioned long-memories and shown that we can replicate the dynamics of price and trading volume in our order-splitting economy. We concluded that order-order-splitting can be a possible cause for all long-memories.

We conducted simulations on our order-splitting model, which is built on an order-driven model first constructed by Chiarella and Iori [8]. Our model is a continuous double auction system which is one of the modern and standard market institutions for trading stock shares. Orders are executed immediately after they are entered into the

1

Lobato and Velasco [1] find the long-memory of volume. Ding, Granger, and Engle [2] demonstrate this for volatility, while Lillo and Farmer [3] and Bouchaud, Gefen, Potters, and Wyart [4] show the empirical features of the order signs in an informationally efficient market.

2

According to the estimation by Vaglica, Lillo, Moro, and Mantegna [5], large orders are cut into smaller pieces possibly 1,000 to 10,000.

(97-2410-H-004-016- )

order book and matched with limit orders in the book. Our market does not contain dealers or a specialist who intermediate in stock trading and/or trade for their own accounts so that all transactions are totally algorithmic. Thus, our market resembles in spirit the market after the opening session in the Tokyo Stock Exchange. This simplified set-up do not allow us to answer any institutional questions in a market where dealers or a specialist play a role, but does highlight the effect of order-splitting on a market.

LeBaron and Yamamoto ([9], [10]) show that agents’ herding behavior is critical to the generation of long-memory persistence in volume, volatility, and order signs. Both herding and order-spitting possibly operate at once in reality. However, we did not consider any imitative behavior of agents and instead focus only on the effect of order-splitting on the long-memories.

We have successfully replicated all long-memories subject to three critical conditions. First, order size needs to be power-law distributed with an exponent less than 1.2. Second, the distribution of the number of order splits also needs to follow a power-law with an exponent less than 1.28. Finally, splitting must be heterogeneous across agents. In other words the distributions of orders and order splitting must be sufficiently fat tailed to drive the long memory results. The limited empirical evidence available suggests that not all these conditions hold for financial time series. Vaglica, Lillo, Moro, and Mantegna [5] study the Spanish stock exchange, and find the exponent for the number of splits is 1.8. Lillio, Mike, and Farmer [7] estimate order size distributions by using a proxy variable, volume in the off-book market of the London Stock Exchange, and show that the average exponent for the individual stocks is 1.74. So in our framework order-splitting can be a possible cause for observed long-memories, but it may require scaling exponents which are not realistic in observed financial time series.

We have been completing this research project because our research paper titled “Order-Splitting and Long-Memory in an Order-Driven Market” has been accepted this month for a publication at European Physical Journal B (SCI, Impact factor: 1.568). The acceptance email and the paper have been attached to this report.

(97-2410-H-004-016- )

A year ago, our paper was quite undeveloped yet. However, with a financial support from NSC, I had an opportunity to present some results of our project at Econophysics Colloquium 2008 in Kiel, Germany, in August 2008. The program covered all areas dealing with the computational aspects (broadly defined) of economics, finance, computer science, and physics. The conference focused on topics covered by the field of Econophysics which applies methods from statistical physics and non-linear dynamics to macro/micro-economic modeling, agent based models, financial market analysis and social problems. and so on. The conference is interested in research topics like Agent-based models: Theory and Simulations, Econophysics, Socio-Economic Networks, Information, Bounded Rationality and Learning in Economics, Markets as Complex Adaptive Systems, Evolutionary Economics, Multiscale analysis and modeling, Non-linear Dynamics and Econometrics, Physics of Risk, Statistical and probabilistic methods in Economics and Finance, and Complexity.

At that time, we did not reproduce all long-memories in our order-splitting model. However, after the discussion with professors at the conference, we have somehow figured out an idea to replicate all long-memories in our order-splitting model and now have reached a conclusion that order-splitting can be a possible cause for all long-memories. In addition, some professors suggested that it would be more interesting if we can relate our order size distribution, which reproduces long-memories in our model, to the actual distribution in stock markets. Vaglica, Lillo, Moro, and Mantegna [5] and Lillio, Mike, and Farmer [7] are the papers to which we can compare our results.

Our paper dramatically improved after attending the conference, and now we got a publication to European Physical Journal B. I am grateful to NSC for funding me to have such great opportunities at the conference. I am also grateful to NSC who provided me funds to hire research assistants and buy stuffs, which were required to conduct my research. I believe that all opportunities that NSC provided to me have helped me greatly improve my paper.

(97-2410-H-004-016- ) Sincerely yours,

Ryuichi Yamamoto Assistant Professor

Department of International Business National Chengchi University

64 Sec. 2, Chih-nan rd., Taipei, Taiwan, 116

(Phone) 886-2-2939-3091 #88059 (email) ryuichi@nccu.edu.tw

References

1. I. Lobato, and C. Velasco, Journal of Business and Economic Statistics 18, 410 (2000) 2. Z. Ding, C.W.J. Granger, and R.F. Engle, Journal of Empirical Finance 1, 83 (1993) 3. F. Lillo, and J. D. Farmer, Studies in Nonlinear Dynamics & Econometrics 8 (3), article 1 (2004)

4. J. P. Bouchaud, Y. Gefen, M. Potters, and M. Wyart, Quantitative Finance 4, 176 (2004)

5. G. Vaglica, F. Lillo, E. Moro, and R. Mantegna, Physical Review E., 77:0036110, (2008)

6. J. P. Bouchaud, J. D. Farmer, and F. Lillo, in Handbook of Financial Markets: Dynamics and Evolution, edited by T. Hens and K. Schenk-Hoppe, (Elsevier: Academic Press, 2008)

7. F. Lillo, S. Mike, and J. D. Farmer, Phys. Rev. E 71, 066122 (2005). 8. C. Chiarella, and G. Iori, Quantitative Finance 2, 346 (2002)

9. B. LeBaron, and R. Yamamoto, Physica A 383, 85 (2007)

(97-2410-H-004-016- )

From:epjb@edpsciences.org To:ryuichi@nccu.edu.tw

Date:Thu, 15 Oct 2009 11:08:04 +0200 (CEST) Subject:EPJ B Acceptance manuscript B090144

15/10/2009

Acceptance B090144

Order-Splitting and Long-Memory in an Order-Driven Market

Dear Professor Yamamoto,

Thank you for your e-mail. We have received the source files of your manuscript entitled :

Order-Splitting and Long-Memory in an Order-Driven Market

Your article will be published in the forthcoming topical issue on Econophysics. The paper will also be published on line at www.epj.org. It is important to note that, after acceptance, no modifications can be made either to the text or to the figures.

The galley proofs together with the copyright form will be sent to you in .pdf format and should be returned by you promptly. Should you be absent during that period, you may assign one of your collaborators to do the proofreading for you.

Any further correspondence or inquiry concerning your article should be sent to EDP Sciences at: fuga@edpsciences.org

(97-2410-H-004-016- )

To conclude, we would like to thank you for choosing EPJB. If you have any suggestions on how we could improve the procedures for dealing the manuscripts, I would appreciate your comments.

Yours sincerely,

Nicolas Puyaubreau on behalf of Dr Simone Alfarano

Editor for EPJ B

IMPORTANT NOTES FROM THE EDITORIAL OFFICE: =========================================

In a short time, your article will be published on the web in the section "Online-first" :

http://www.edpsciences.org/articles/epjb/abs/first/contents/contents.html

Online-first is a procedure to speed up a publication but nevertheless it is a publication in every sense of the word : citable (with the e-print DOI reference) and definite (any changes will thus necessarily require an erratum to the same extent than for any paper published in EPJ).

________________ Editorial Office

The European Physical Journal B, D & E Universite Paris-Sud, Batiment 510 91405 Orsay Cedex, France

Tel : 33 (0)1 69 15 59 76 Fax : 33 (0)1 69 15 59 75 E-mail : epjb@edpsciences.org

(97-2410-H-004-016- )

Order-Splitting and Long-Memory in an Order-Driven Market

Ryuichi Yamamotoa * and Blake LeBaronba

Department of International Business, National Chengchi University, Taipei 116, Taiwan

b

International Business School, Brandeis University, Waltham MA 02453, USA

Abstract

Recent empirical research has documented long-memories of trading volume, volatility, and order-signs in stock markets. We conjecture that traders’ order-splitting is related to these empirical features. This study conducts simulations on an order-driven economy where agents split their orders into small pieces and execute piece by piece to reduce price impact. We demonstrate that we can replicate the long-memories in our order-splitting economy and conclude that order-order-splitting can be a possible cause for these empirical properties.

PACS. 89.65.Gh Economics; econophysics, financial markets, business and management

1. Introduction

An important feature of many financial markets is that high-frequency time series of trading volume, volatility, and order signs follow long-memory processes, and yet the market is informationally efficient in that returns are uncorrelated over time.3 Recent empirical research has demonstrated these results; however, there is relatively less theoretical work to explain why and where these features are coming from. This paper shows that traders’ order-splitting behavior can provide an explanation.

3

Lobato and Velasco [1] find the long-memory of volume. Ding, Granger, and Engle [2] demonstrate this for volatility, while Lillo and Farmer [3] and Bouchaud, Gefen, Potters, and Wyart [4] show the empirical features of the order signs in an informationally efficient market.

(97-2410-H-004-016- )

It is a common practice in stock markets that stock investors split their large orders into smaller pieces and execute them incrementally to minimize price impact.4 Thus, the same sign of market orders enters the order book persistently. Bouchaud, Farmer, and Lillo [6] and Lillo, Mike, and Farmer [7] show that it is a source of a long-memory of order signs, however, they investigate the property of order signs only. This paper examines how order-splitting is related to the previously mentioned long-memories and shows that we can replicate the dynamics of price and trading volume in our order-splitting economy. We conclude that order-order-splitting can be a possible cause for all long-memories.

We conduct simulations on our splitting model, which is built on an order-driven model first constructed by Chiarella and Iori [8]. Our model is a continuous double auction system which is one of the modern and standard market institutions for trading stock shares. Orders are executed immediately after they are entered into the order book and matched with limit orders in the book. Our market does not contain dealers or a specialist who intermediate in stock trading and/or trade for their own accounts so that all transactions are totally algorithmic. Thus, our market resembles in spirit the market after the opening session in the Tokyo Stock Exchange. This simplified set-up will not allow us to answer any institutional questions in a market where dealers or a specialist play a role, but does highlight the effect of order-splitting on a market.

LeBaron and Yamamoto ([10], [11]) show that agents’ herding behavior is critical to the generation of long-memory persistence in volume, volatility, and order signs. Both herding and order-spitting possibly operate at once in reality. However, this paper does not consider any imitative behavior of agents and instead focuses only on the effect of order-splitting on the long-memories.

The rest of the paper proceeds as follows. The next section introduces our order-splitting economy. The third section presents simulation results, and the final section gives our conclusion.

2. Market structure

4

According to the estimation by Vaglica, Lillo, Moro, and Mantegna [5], large orders are cut into smaller pieces possibly 1,000 to 10,000.

(97-2410-H-004-016- )

This section describes our order-driven market which is based on the market outlined in Chiarella and Iori [8] and Chiarella, Iori, and Perello [9]. Agents submit market or limit orders to an open order book sequentially, and once an order is matched, it is executed immediately. We assume that the transaction price, p , is observed by all agents all the t time. When no transaction takes place, the average of the best bid and ask prices is revealed to the market.

Our market consists of 500 heterogeneous agents indexed by i and each of them decides what types of orders to submit. We define the return at time t as:

1 log t t t p p r . (1)

All agents estimate a technical trading indicator by averaging the returns over the past

i

L periods where L is randomly assigned independently from a uniform distribution over i

the interval (1,Lmax):

i i L j t j j t i L p p L r 1 1 log 1 . (2)We assume that our agents observe a constant fundamental price, p . Agents f form their weighted forecasts on the future returns by combining fundamental-, technical-, and noise-based forecasts as follows:

t i L i t f i i t t

g

r

n

p

p

g

r

i

1 2 ,log

ˆ

, (3)where g1i, g2i, and n are weights for fundamentalist, chartist, and noise-induced i

components for agent i, respectively, and randomly assigned according to

| ) , 0 ( ~| 1 1 N gi , g2 ~N(0,2) i , and ni ~ N(0,n) .

Since this paper does not consider any evolution on their forecasts, we assume that these parameters are constant over time. The noise at t is given by t ~ N(0,1).

(97-2410-H-004-016- )

Agents expect future prices at time tby:

i t t r t i t

p

e

p

ˆ

ˆ, . (4)Agents decide to buy (sell) when they forecast the future price to increase (decrease). They submit their buy order at:

) 1 ( , i b i t t i t p k b (5)

and sell order at: ) 1 ( , i s i t t i t p k a . (6)

Agents are willing to trade shares at these prices or better. In particular, agent i prefers to buy (sell) an asset at bti(

i t

a ) or lower (higher). The spread variables, kbi and i s

k , take different values and are initially assigned independently from a uniform distribution over an interval [-0.5, 0.5]. Those are assumed to be constant over time, but vary over agents. When bti(

i t

a ) is above (below) the market best ask (bid), the agent places market orders. Otherwise, the order from agent i stays in the order book as a limit order at the requested price, bti(ati). The order is removed from the book once executed or expired at its lifetime .

Since kbi and i s

k are separately given and lie between [-0.5, 0.5], this set-up allows agents to place their bid and ask lower or higher than their expectations, while the strategies can be nearly symmetric in buy and sell orders. Order placement strategies would be associated with a trade-off between advantageous price and immediacy of execution.5 Agents submit their bid and ask higher than their risk neutral price when they seek a price improvement for selling a share whereas they would like to buy it

immediately. Agents choose positive kbi and negative i s

k so that their bid and ask can be lower than their expectations. In such a case, they prefer an immediate execution to sell, but would like to buy it at a better price. They place bid and ask prices in a symmetric manner when they do not have any differences in preference between buying and selling behaviors. These order placement strategies would be motivated by the traders’

5

Papers which explain the trade-off include Biais, Hillion, and Spatt [12], Griffiths, Smith,

Turnbull, and White [13], Hollifield, Miller, and Sandas

o

(97-2410-H-004-016- )

seeking behavior. Agents place their bid and ask higher (lower) than their expectations or symmetrically, because they think that they would achieve higher profits by doing so. However, in this paper we simply assume that the preferences of agents on immediacy of execution and advantageous price are initially given and constant over time, because agents’ strategies are not based on profits.

The size of orders i t

s is assumed to be power-law distributed and assigned to each agent when he enters the market each time as in Lillio, Mike, and Farmer [7]. Agent i places all his orders to the book as a limit order at his limit price i

t

b ( i

t

a ) given by

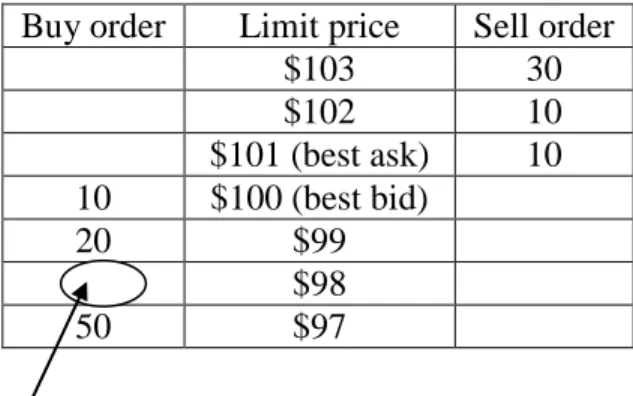

equation (5) (equation (6)), when bti(ati) is below (above) the market best ask (bid). For example, suppose that the order book is given as in Figure 1 where the best bid is $100 with 10 units and the best ask is $101 with 10 units. If agent i is willing to buy 30 units (=sti) at $98 (=bti), he will place all of his order at $98 since his limit price is below the best bid ($100).

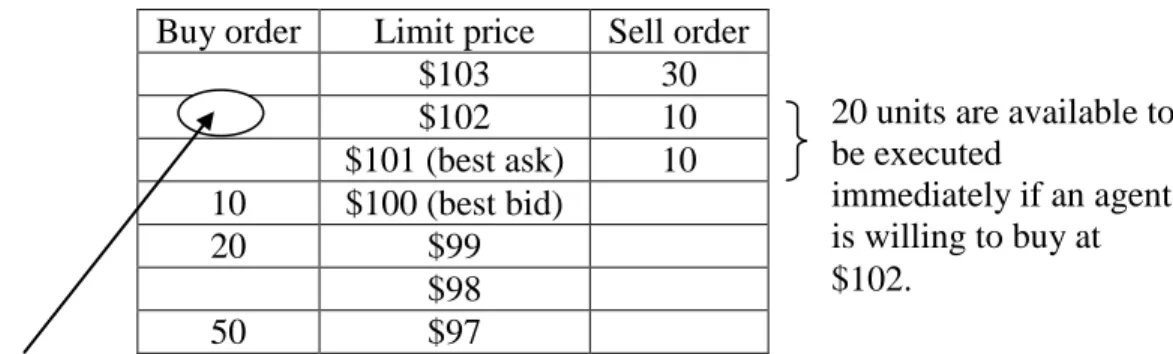

When bti(ati) crosses the best ask (bid), agent i submits a market order to buy (sell). Given his total order size sti, he decides the market order size in the following way.

We assume that agents can observe the limit order book. When an agent submits a market order, he can observe how many limit orders are currently available in the book which can possibly be executed at a price he is willing to trade (bti(

i t

a )). He tries to execute that amount immediately by placing a market order. However, if his total size of order stiis

more than the size of the market order, he will send the market order first and place the remaining orders as a limit order at his requested price, bti(

i t

a ), after executing all his market order. For example, suppose that the order book is given as in Figure 2 and agent i is willing to buy 30 units at $102. He observes the order book, and so he knows that there are 20 units on the ask side which can be matched at his requested price ($102) or lower. In other words, he knows that 10 units cannot be executed immediately. In this case, he will submit 20 units of a market order first and 10 units of a limit buy order at $102 after executing all 20 units of his market order.

When agents decide to place market orders, we assume that they split their market orders into smaller pieces and execute them incrementally, and the size of each split is

(97-2410-H-004-016- )

randomly assigned from an interval [1,10]. Each split size varies over agents, but is constant for each agent until he trades all of his splits. For example, if an agent is assigned 2 units for the size of one split and is placing 20 units of market orders, he will split the 20 units into 10 pieces and execute them incrementally. Since the split size is given over an interval [1,10], as agents have a larger size of market orders, they split them into more pieces. Since the total size of orders is power-law distributed, agents are more likely to execute a larger number of splits as the scaling exponent becomes smaller. We will examine economies with different degrees of scaling exponents and show that long-memory properties can be replicated as agents split their orders into many pieces.

We assume that agents can enter the market anytime while other agents are executing their splits. However, the probability that a new agent can place an order at t depends on how many pieces of market orders other agents are waiting to submit to the book as: t at submitted be to waiting buy sell to orders market of Number t 1 1 Prob . (7)

As other agents have multiple pieces of market orders being sent to the book, it is likely that more market orders will be placed to the book at time t. So, it will be harder for a new agent to place and/or execute his order at the same time t, because in our order book system only one order can be executed at each time. The more market orders are waiting to be submitted, the less likely a new order will arrive to the book and be executed at t.6 This mechanism generates a persistence in order flow coming from a given agent in that the order flow is less likely to shift to a new agent when more orders are waiting to be executed.

When agents submit splits of market orders, the ordering of his splits being executed is randomly determined. For example, one of the pieces for an agent may be transacted first, but he may trade the next one a few seconds later, and so other agents’

6

Our results are robust to changes in the impact of market orders in (7). Specifically we have tried,

Number of marketorderstosell buywaitingtobesubmitted att

t

1

1

Prob ,

(97-2410-H-004-016- )

splits will be transacted before his second split. This set-up reflects a situation where an agent prefers to wait for seconds to execute his splits. He can trade shares at a better price if he waits and limit orders are filled at a price inside the spread.

Our time step, t, is one click in which an agent transacts one split of his market order or places a limit order in the book. Since the price is recorded at each time and all agents can observe it, agents update their forecasts according to equation (3) every click. One round ends when all agents submit their orders. We shuffle the ordering of the agents for the next trading round.

3. Simulations

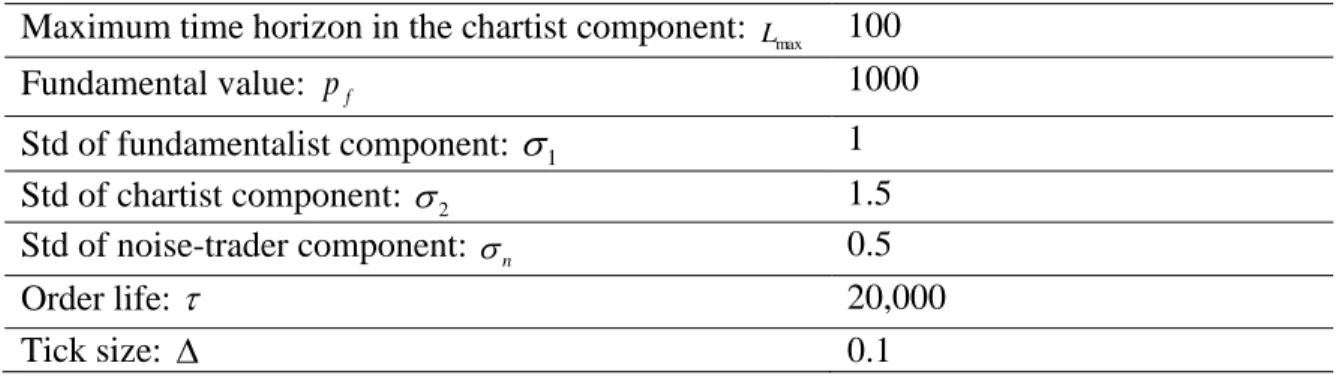

We run simulations on our order-splitting economy with parameter values in Table 1. We assume that the probability that the order size sti is larger than x is given by:

x x s

P ti ~ (8)

We use from 1 to 2 for the scaling exponents of the order size distribution , and set the minimum order size to 1. Lillio, Mike, and Farmer [7] estimate the scaling exponents for a proxy variable, i.e., volume of individual stocks in the off-book market of the London Stock Exchange, and show that the average is 1.74 over the individual stocks. Our scaling exponents are the values around their empirical scaling exponent.

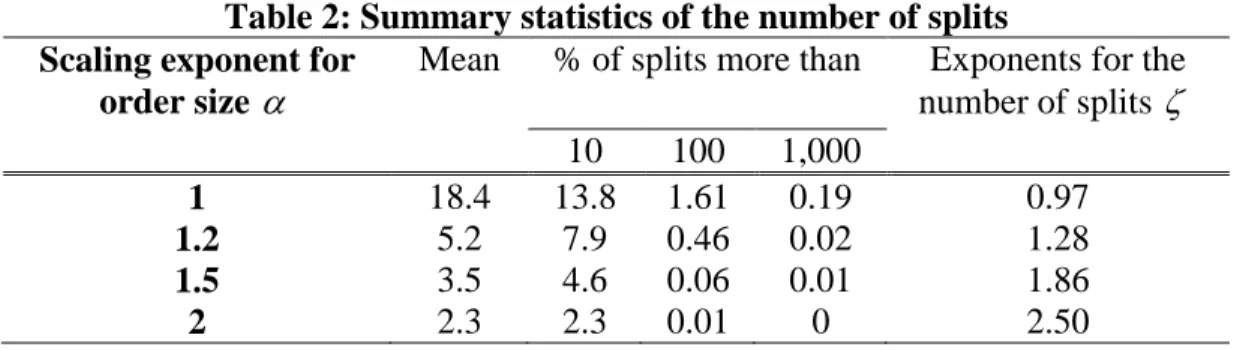

Table 2 provides summary statistics on the number of splits into which agents divide their market orders when the exponents are 1, 1.2, 1.5, and 2. Each statistic is calculated by using 50,000 samples on the number of splits. Since we assume that the total share size is power-law distributed and each size of a split is randomly drawn from an interval [1,10], agents are more likely to split their orders into larger number of pieces as the scaling exponent for the order size becomes smaller. For example, agents split orders into 5.2 pieces on average when the scaling exponent is 1.2, while they trade 18.4 splits on average at 1 for their scaling exponent. In addition, agents are not unlikely to have many splits when the exponent becomes 1.2 or 1. For example, 1.61 (0.46) % of agents have more than 100 pieces of splits when the exponent is 1 (1.2). The percentages of agents with more than 1,000 splits are 0.19 and 0.02% when the exponents are 1 and

(97-2410-H-004-016- )

1.2, respectively. However, almost none of them have 100-1,000 or more splits when the exponent is 2.

Assuming the distribution of the number of splits i

sp also obeys a power-law by:

x x sp

P i ~ , (9)

the scaling exponents are estimated in the last column in Table 2. The estimated scaling exponent is 0.97 when the exponent for the order size is 1. They are 1.28, 1.86, and 2.50 for order size scaling exponents of 1.2, 1.5, and 2. We will see later that all long-memory properties can be replicated in our market only when the scaling exponent of the order size becomes smaller than 1.2 or the exponent for the number of splits is less than 1.28.

We convert our clicks into wall-clock time. In particular, we consider 25 clicks as one wall-clock time. Returns are given by the percentage change in prices over 25 clicks, while we measure volatility by taking standard deviations of the log returns over the interval. Volume series is constructed by cumulating the number of shares traded over the interval. We assign +1 (-1) for order signs over each interval when the majority of the transaction is buyer- (seller-) initiated. We assign zero when the same numbers of buyers and sellers transact their shares. We simulate our economy for 11,000 wall-clock times and use the last 10,000 clock times for the long-memory analysis.

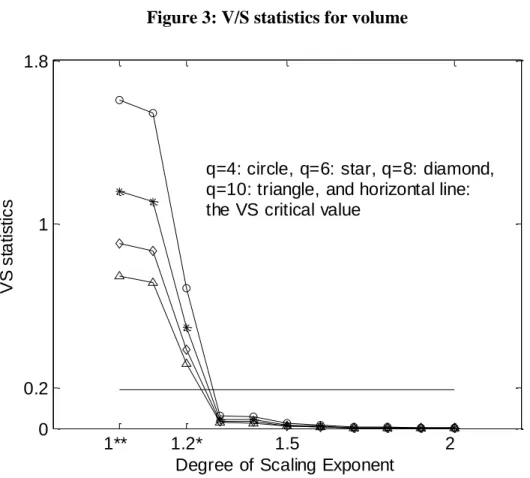

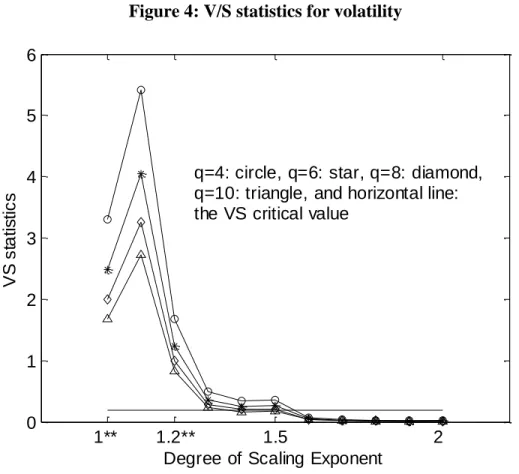

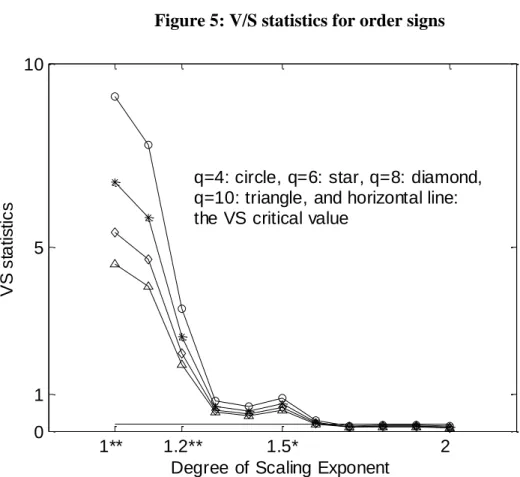

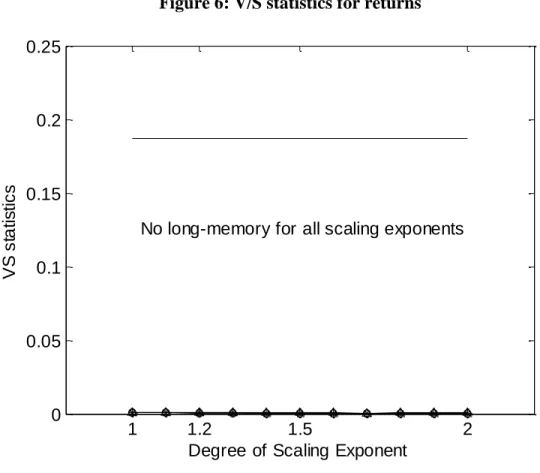

We conduct the rescaled variance (V/S) test to examine the long-memory

properties (Giraitis, Kokosza, Leypus, and Teyssiere [16]). The V/S test achieves a better balance of size and power than the Lo R/S test (Lo [17]) for different values of the bandwidth parameter q. We consider the weighted auto-covariance up to q lags (=4, 6, 8, and 10) to capture the effects of short-range dependence. Averages of the V/S statistics over 20 simulations are plotted over the different degrees of the scaling exponent for the order size in Figures 3-6.7 The short-memory null is rejected with 95% confidence when the V/S statistic is above the critical value, i.e., 0.1869. In Figures 3-6, ** next to the exponent in the x-axes indicates that we reject the null hypothesis of short-range

dependence at the 95% confidence level in 80% or more out of 20 simulations. * next to the exponent in the x-axes indicates the rejection of the null with more than 30% but less

7

(97-2410-H-004-016- )

than 80% of 20 simulations. When there is no sign of ** or * next to the exponent in the x-axes, it indicates the rejection of the null in 30% or less than 30% of the 20 simulations.

These figures show that all long-memories tend to be observed as the scaling exponent for the order size becomes less than 1.2, while the long-memory of order signs appears when the exponent becomes less than 1.5. We do not have the property in returns for all exponents.8’9 Long-memories are observed as agents split their orders into many pieces.10 The scaling exponent for the number of splits is less than 1.28 when we generate all long-memories, while the exponent less than 1.86 is small enough to reproduce the long-memory of order signs. The following explains why and where these long-memories are coming from in an informationally efficient market as the exponent becomes smaller.

Signs of market orders have a long-memory, because in our market more agents keep submitting larger numbers of splits of the same sign as the scaling exponent becomes smaller. When agents keep doing so, it persistently takes off liquidity from the book so that the book tends to be persistently sparser. The sparser order book generates larger price changes, and a persistently sparser order book will lead to persistently larger price changes. However, when an agent submits a very large size of a limit order, in particular within the spread, without executing any of them, the order book suddenly becomes thicker. As a result, the price changes become smaller and such smaller changes will persist for a while. Therefore, we can generate larger price changes followed by larger price changes and smaller price changes followed by smaller price changes.

8

Lillo, Mike, and Farmer [7] theoretically show that the scaling exponent of less than 2 for the order size distribution is crucial to produce the long-memory of order signs, while our model requires a slightly smaller value to generate it.

9

We have performed robustness checks on the parameters used in our simulations. In particular,

we have varied 1, the standard deviation of the fundamental forecasts from 0.5 to 1.5 from our

original value of 1. We have also varied 2 the chartist forecasting component from 1 to 2 from

the original value of 1.5, and the noise standard deviation,n, from 0.3 to 0.7 from our original

value of 0.5. We have also adjusted the interval of the spread parameter, kbi and

i s

k , from [-0.3,

0.3] to an interval [-0.7, 0.7]. Finally, we have tried our test on an economy with only 10 agents. In all these cases we find that our results do not change significantly.

10

In our order-splitting model, the long-memory of order signs results from the strong persistence of order signs coming from the same traders as shown in Bouchaud, Farmer, and Lillo [6]. We have plotted the autocorrelation functions of order signs from the same traders with 1,000 lags, and confirmed the strictly positive ACFs with the long lags when the exponent for the order size is small enough like closer to 1, although we do not show it here.

(97-2410-H-004-016- )

When an agent is randomly assigned a relatively larger size for a split, for example 10, he continuously executes this size until he trades all of his market orders. When an agent who has so many splits transacts 10 units each time continuously, the trading volume in wall-clock time will be relatively higher than the other periods. Although other agents can enter the market while an agent is executing his order, the probability that a new agent can place an order at t (equation (7)) is smaller as the agent has more pieces of market orders to submit. In this case, the maximum volume in one wall-clock time is 250 around those periods, since each clock time consists of 25 clicks and he trades 10 units each time for long periods. When the agent is assigned a smaller size for a split, for example 3, the trading volume in one wall-clock time will be much smaller than in the previous example, but it will persist for a while. Thus, the larger trading volume is followed by larger volume while smaller volume will be persistent for long periods. As a result, we can generate the long-memory of trading volume. The volume series looks clustered in this way, because different agents submit a series of splits with different sizes and each agent possibly executes many splits with the same size for long periods.

If the size of a split is the same for all agents, for example one unit for a split, we will not see such a clustered series of volume. A similar size of volume will be recorded over long times, and we will not see persistent periods of larger or smaller trading volume. The following shows an example of this. We fix the size of each split to 1, but the total share size still follows the power-law distribution so that agents possibly split their orders into many pieces. Table 3 summarizes the 20 run averages of the V/S statistics with the scaling exponents of 1 for the order size distribution. In our previous experiments, we generated long-memories of volume, volatility, and order signs when the exponent is 1. However, Table 3 shows that only the V/S statistics for volatility and order sign exceed their critical values. This means that we observe long-memory for volatility and order-signs only. We do not produce volume long-memory, because the size of each split is the same for all agents. As a result, we do not observe persistent trading volume in our simulations.

It is a stylized fact that volume and volatility both display persistence consistent with long-memory. However, the results in Table 3 show that volume and volatility can

(97-2410-H-004-016- )

have different properties in some simulated cases. Our results suggest that volume and volatility do not have the same empirical feature when agents do order-splitting and execute exactly the same amount of orders each time.

Our results of the V/S tests indicate that returns are not correlated over the long time span although the order signs are long-memory. The persistence of the order signs implies that the prices are likely to follow the past trend. However, our order-splitting economy is informationally efficient. In the following, we provide an analysis to support further the informationally efficient market in the presence of strong dependence in order signs as found in Lillo and Farmer [3] and Bouchaud, Gefen, Potters, and Wyart [4].

In an informationally efficient market a price series follow a random walk, implying that there is no arbitrage opportunity. It is well known that the variance of the increments in a random walk is linear in the sampling interval - that is, the variance of its q-differences is q times the variance of its first difference. Thus, if N observations

n

X X

X1, 2,..., of X at equally spaced intervals follow a random walk, 1/q of the t variance of Xt Xtq is the same for any integer q greater than 1. In addition, if 1/q of

the variance of XtXtq is greater than the variance of Xt Xt1for q (>1), it indicates the presence of a positive serial correlation in the series. A smaller 1/q of the variance of

q t t X

X than that of Xt Xt1 suggests the presence of a negative serial correlation (mean-reversion) in a series.

Following Lo and MacKinlay [18] and defining X as the log-price process, we t estimate the variance by using overlapping qth differences of X by: t

N q t q t t q t t X X q m X X 1 ˆ 2 var , whereN is the number of observations.

N q q N q m 1 1 and,

1

1 ˆ X X N N .(97-2410-H-004-016- )

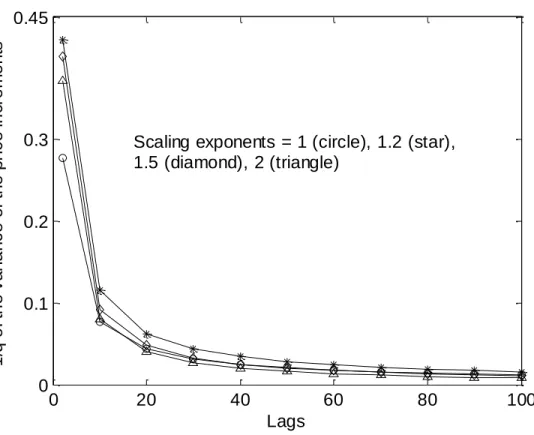

Figure 7 is the plot ofvar

Xt Xtq

/q, where we use log-transaction pricesforX . Lags q are from 2 to 100 clock times where one clock time is 25 ticks in our t

market. We plot the averages of the ratios over 20 runs with scaling exponents 1, 1.2, 1.5, and 2 for the order size distribution. For all scaling exponents, when q is small,

Xt Xt q

/qvar is relatively large, meaning that the price changes within a very short time are large for some periods while they are not for some other periods. This is possible for the following two reasons. First, the prices change a lot within a short period due to the presence of a bid-ask bounce. Since we use log-transaction prices, our price is bouncing up and down between the best bid and ask. Buy orders tend to increase the price, but once a sell order enters the book, the price is pushed down to the level of the current best ask. The price will decrease by that amount, even with one unit of sell order, which may be enough to cancel out the previous increase in prices.

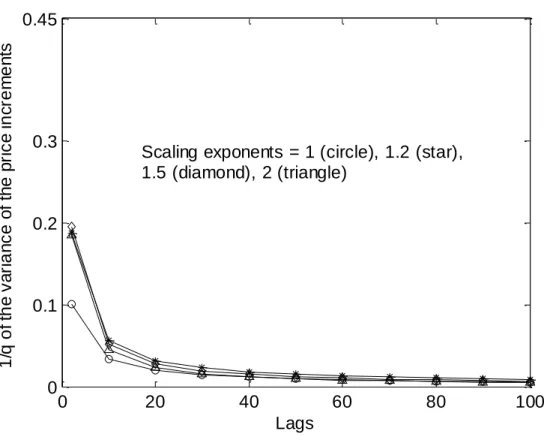

Second, in our market when agents place limit orders within the spread the price fluctuations suddenly decrease after that period. In Figure 8 we use the mid-quote series to remove the effect of the bid-ask bounce. Here, var

Xt Xtq

/q looks smaller for short lags than in Figure 7. However, we still see the larger price variations in short lags. Thus, in addition to the bid-ask bounce, placing limit orders within a spread would lead to the larger var

Xt Xtq

/q at short lags.In the figures, for relatively short lags, var

Xt Xtq

/q decreases as q becomes larger indicating the presence of mean-reversion in a series. However, the curves tend to be flatter (but strictly positive) once the lags become 20-40 or longer. This implies that the price moves back to the informationally efficient level in short time periods. Although the order signs follow a long-memory, our market is informationally efficient which is consistent with the findings of Lillo and Farmer [3] and Bouchaud, Gefen, Potters, and Wyart [4].4. Conclusion

This paper has investigated the sources of long-memories, and successfully replicated them subject to three critical conditions. First, order size needs to be power-law

(97-2410-H-004-016- )

distributed with an exponent less than 1.2. Second, the distribution of the number of order splits also needs to follow a power-law with an exponent less than 1.28. Finally, splitting must be heterogeneous across agents. In other words the distributions of orders and order splitting must be sufficiently fat tailed to drive the long memory results. The limited empirical evidence available suggests that not all these conditions hold for financial time series. Vaglica, Lillo, Moro, and Mantegna [5] study the Spanish stock exchange, and find the exponent for the number of splits is 1.8. Lillio, Mike, and Farmer [7] estimate order size distributions by using a proxy variable, volume in the off-book market of the London Stock Exchange, and show that the average exponent for the individual stocks is 1.74. So in our framework order-splitting can be a possible cause for observed long-memories, but it may require scaling exponents which are not realistic in observed financial time series.

Acknowledgements

We are grateful to two anonymous referees who provided useful suggestions and feedback.

References

1. I. Lobato, and C. Velasco, Journal of Business and Economic Statistics 18, 410 (2000) 2. Z. Ding, C.W.J. Granger, and R.F. Engle, Journal of Empirical Finance 1, 83 (1993) 3. F. Lillo, and J. D. Farmer, Studies in Nonlinear Dynamics & Econometrics 8 (3), article 1 (2004)

4. J. P. Bouchaud, Y. Gefen, M. Potters, and M. Wyart, Quantitative Finance 4, 176 (2004)

5. G. Vaglica, F. Lillo, E. Moro, and R. Mantegna, Physical Review E., 77:0036110, (2008)

6. J. P. Bouchaud, J. D. Farmer, and F. Lillo, in Handbook of Financial Markets:

Dynamics and Evolution, edited by T. Hens and K. Schenk-Hoppe, (Elsevier: Academic Press, 2008)

(97-2410-H-004-016- )

8. C. Chiarella, and G. Iori, Quantitative Finance 2, 346 (2002)

9. C. Chiarella, G. Iori, and J. Perello, Journal of Economic Dynamics and Control 33, 525 (2009)

10. B. LeBaron, and R. Yamamoto, Physica A 383, 85 (2007)

11. B. LeBaron, and R. Yamamoto, Eastern Economic Journal 34, 504 (2008) 12. B. Biais, P. Hillion, and C. Spatt, Journal of Finance 50, 1655 (1995) 13. M. Griffiths, B. Smith, D. Turnbull, and R. W. White, Journal of Financial Economics 56, 65 (2000)

14. B. Hollifield, R. A. Miller, and P. Sandas

o

, Review of Economic Studies 71, 1027 (2004)

15. A. Ranaldo, Journal of Financial Markets 7, 53 (2004)

16. L. Giraitis, P. Kokosza, P. Leypus, and R. Teyssiere, Journal of Econometrics 112, 265 (2003)

17. A. W. Lo, Econometrica 59, 1279 (1991)

(97-2410-H-004-016- )

Figure 1: An example for an agent placing limit orders Buy order Limit price Sell order

$103 30 $102 10 $101 (best ask) 10 10 $100 (best bid) 20 $99 $98 50 $97

(97-2410-H-004-016- )

Figure 2: An example for an agent placing market and limit orders Buy order Limit price Sell order

$103 30 $102 10 $101 (best ask) 10 10 $100 (best bid) 20 $99 $98 50 $97

Agent i whose total order size is 30 will place 20 units of a market buy order first and 10 units of a limit buy order at $102 after executing all of his market orders.

20 units are available to be executed

immediately if an agent is willing to buy at $102.

(97-2410-H-004-016- )

Figure 3: V/S statistics for volume

1** 1.2* 1.5 2

0 0.2 1 1.8

Degree of Scaling Exponent

V S s ta ti s ti c s

q=4: circle, q=6: star, q=8: diamond, q=10: triangle, and horizontal line: the VS critical value

(97-2410-H-004-016- )

Figure 4: V/S statistics for volatility

1** 1.2** 1.5 2 0 1 2 3 4 5 6

Degree of Scaling Exponent

V S s ta ti s ti c s

q=4: circle, q=6: star, q=8: diamond, q=10: triangle, and horizontal line: the VS critical value

(97-2410-H-004-016- )

Figure 5: V/S statistics for order signs

1** 1.2** 1.5* 2

0 1 5 10

Degree of Scaling Exponent

V S s ta ti s ti c s

q=4: circle, q=6: star, q=8: diamond, q=10: triangle, and horizontal line: the VS critical value

(97-2410-H-004-016- )

Figure 6: V/S statistics for returns

1 1.2 1.5 2 0 0.05 0.1 0.15 0.2 0.25

Degree of Scaling Exponent

V S s ta ti s ti c s

(97-2410-H-004-016- )

Figure 7: 1/q of the variance of the price increments (transaction price)

0 20 40 60 80 100 0 0.1 0.2 0.3 0.45 Lags 1 /q o f th e v a ri a n c e o f th e p ri c e i n c re m e n ts

Scaling exponents = 1 (circle), 1.2 (star), 1.5 (diamond), 2 (triangle)

(97-2410-H-004-016- )

Figure 8: 1/q of the variance of the price increments (mid-quotes)

0 20 40 60 80 100 0 0.1 0.2 0.3 0.45 Lags 1 /q o f th e v a ri a n c e o f th e p ri c e i n c re m e n ts

Scaling exponents = 1 (circle), 1.2 (star), 1.5 (diamond), 2 (triangle)

(97-2410-H-004-016- )

Table 1: Parameters Maximum time horizon in the chartist component: Lmax 100

Fundamental value: p f 1000 Std of fundamentalist component:

1 1 Std of chartist component: 2 1.5 Std of noise-trader component: n 0.5 Order life: 20,000 Tick size: 0.1(97-2410-H-004-016- )

Table 2: Summary statistics of the number of splits Scaling exponent for

order size

Mean % of splits more than Exponents for the number of splits 10 100 1,000 1 18.4 13.8 1.61 0.19 0.97 1.2 5.2 7.9 0.46 0.02 1.28 1.5 3.5 4.6 0.06 0.01 1.86 2 2.3 2.3 0.01 0 2.50

(97-2410-H-004-016- )

Table 3: Order-splitting in an economy of agents who execute one unit each time (scaling exponent = 1)

Volume Volatility Order Signs Returns

q=4 0.0027 4.5298** 10.0089** 0.0006

q=6 0.0019 3.4074** 7.3620** 0.0008

q=8 0.0015 2.7500** 5.8549** 0.0010

q=10 0.0012 2.3152** 4.8772** 0.0012

Averages of the V/S test statistics over 20 simulations. ** indicates that we reject the null hypothesis of short-range dependence at the 95% confidence level in 80% or more out of 20 simulations. When there is no sign of **, it indicates the rejection of the null in 30% or less than 30% of the 20 simulations.

計畫編號 97-2410-H-004-016-

計畫名稱 委託單驅動市場之委託單切割對長期記憶性的影響

出國人員姓名 服務機關及職稱

山本竜市 (Ryuichi Yamamoto), National Chengchi University, Department of International Business

會議時間地點 8/28-30, Kiel, Germany

會議名稱 Econophysics Colloquium 2008

發表論文題目 The impact of order-splitting on long-memory in an order-driven market 一、參加會議經過

I attended a conference, which was taken place in Kiel, Germany from August 28-30, 2008. The program covered all areas dealing with the computational aspects (broadly defined) of economics, finance, computer science, and physics. The conference focused on topics covered by the field of Econophysics which applies methods from statistical physics and non-linear dynamics to macro/micro-economic modeling, agent based models, financial market analysis and social problems. and so on. The conference is interested in research topics like Agent-based models: Theory and Simulations, Econophysics, Socio-Economic Networks, Information, Bounded Rationality and Learning in Economics, Markets as Complex Adaptive Systems, Evolutionary Economics, Multiscale analysis and modeling, Non-linear Dynamics and Econometrics, Physics of Risk, Statistical and probabilistic methods in Economics and Finance, and Complexity.

This is a great conference to attend. Many well-known professors attended the conferences and presented the latest results of a wide variety of research. The conferences brought together researchers and practitioners from diverse fields, such as computer science, economics, physics, and complex system theory for understanding emergent and collective phenomena in economic, organizational, and social systems, and to discuss on effectiveness and limitations of computational models and methods in social sciences.

Since I am doing research about the agent-based modeling for finance, it was really a good conference to attend and great opportunity for improving the quality of my paper. Moreover, I had many opportunities to talk with many professors in my field. Discussions with such professors further improved my research. I made an oral presentation of my paper, “The impact of order-splitting on long-memory in an order-driven market” joint with Professor Blake LeBaron at Brandeis University.

The paper examines how traders’ order splitting behavior is related to the long-memory properties in an order-driven market, i.e., long-memories in volume, volatility, and order signs (but yet, the market is informationally efficient in a sense that there is no persistence in returns). We conduct simulations on a simple automated order-splitting, and examine whether and under which conditions we can reproduce those properties with order-splitting.

LeBaron and Yamamoto (2007, 2008) show that that investors’ imitative behavior is so important for replicating all of the long-memories. Our order-splitting model does not assume any herding among agents; however, we show that it generated long-memories of order signs and volatility. This implies that imitation would not be the only source for the long-memories. However, order-splitting would matter in our market when agents split orders into so many pieces like 50 without allowing others to enter the market where there are only 100 agents. We conclude that we need to impose such a strict assumption to generate the long-memories with order-splitting, implying that order-splitting itself would not be the only source for these properties too.

The questions I had from the audiences there were all for the clarifications, including really basic stuff like what the order-splitting is and whether it is popular in stock trading. Stock investors often split their orders into small pieces to reduce transaction costs. But I think that more review (more detailed one) on these stuffs should have been given at the beginning of the presentation, in particular, at a conference with audiences from difference fields. This may be a small thing, but is one of which I learned at this conference.

We do not reproduce all long-memories in our current version. However, after the discussion with professors at the conference, I now think it would be more interesting to generate all of them in a model with order-splitting. We actually tried so many kinds of simulation, but it is our future goal to replicate all of them. In reality, there might be other reasons than herding to generate the long-memories.

The presentation I found interesting is a keynote speech by Professor Bornholdt from University of Bremen. He talked about a spin model which is, my friend of Econophysics said, one of the popular models in physics. Although the model itself is really simple (only a few equations), but can be applied to financial markets and describe cyclical behavior of return volatility. It replicates clustered volatility (but not asymmetric volatility). What I found interesting at this conference is that econo-physicists often use only simple and mostly only a couple of equations and figures, but replicate some important phenomena in financial markets. But they often do not explain details on agents’ behavior for those features.

References

LeBaron, B. and R. Yamamoto. “Long-Memory in an Order-Driven Market.” Physica A 383 (2007): 85-89.

LeBaron, B. and R. Yamamoto. “The Impact of Imitation on Long-Memory in an Order-Driven Market.” Eastern Economic Journal (forthcoming).