PACIS Proceedings

PACIS 2004 Proceedings

Association for Information Systems Year

Evaluating the Economic Impacts of

IT-Enabled Supply Chain Collaboration

Hsin-Lu Chang

∗Michael Shaw

†∗National Chengchi University

†University of Illinois at Urbana-Champaign

This paper is posted at AIS Electronic Library (AISeL). http://aisel.aisnet.org/pacis2004/41

Evaluating the Economic Impacts of IT-Enabled Supply Chain

Collaboration

Hsin-Lu Chang Assistant Professor

Department of Management Information Systems at National Chengchi University

kchang3@mis.nccu.edu.tw

Michael J. Shaw Hoeft Endowed Chair

Director of the Center for Information Systems and Technology Management at the

University of Illinois at Urbana-Champaign mjshaw@uiuc.edu

Abstract

The goal of this paper is to identify the value impacts of supply chain collaboration and design a measurement system to quantify them. Treating process sharing as a special form of supply chain collaboration, we focus on developing measures for evaluating the performance of RosettaNet technology. The empirical findings show that supply chain collaboration creates most value in the extended supply chain relationship, where most impacts are indirect. Further, corporate supply chain strategies determine how different value components affect the performance of supply chain collaboration. For instance, technology and relationship improvement are key values for non-adopters to improve their readiness for adoption. Adopters develop their expansion strategies by first putting their focus on improving their business processes and then on improving their interactions with industrial environments. Therefore, this valuation framework, extending from traditional IT valuation, provides companies a guideline for measuring the value they should target on, and thereby allows companies to draw the roadmap for better performance.

Keywords: Supply chain collaboration, IT standards, IT valuation, Technology adoption,

Inter-organizational systems, E-business strategies

1 Introduction

Facing the increasingly complex supply chain, companies are taking steps to develop collaborative e-business solutions with industry-wide standards (e.g. RosettaNet and ebXML). While supply chain collaboration1 is expected to provide great business value, it also reflects corporate needs to design different strategies for materializing collaboration values. Although positive implementation benefits are expected, transition from a competitive to a cooperative

1

business process still offers a set of difficult challenges to a firm.

First, typical advantages from supply chain collaboration such as reduction in transaction costs and delays, higher quality service, and improved operations management have not yet been confirmed empirically and there is very little empirical data to explore its value impacts on firm performance. In addition, supply chain collaboration involves many intangible values such as customer satisfaction and improved supplier relationships, which lack effective measures to translate them into real value. Their impacts on firm performance and relationships to collaboration effectiveness are not well known either. Moreover, value always comes to multiple trading partners who share the processes together; how to track and allocate the value within the relationship becomes a problem. Are the benefits derived from ‘leading’ firms such as Cisco and Intel also applicable to their collaborative partners whose technology readiness is falling behind?

Therefore key research questions that motivate our work are: what are the relevant metrics for studying the impacts of supply chain collaboration? How can we associate these impacts to the business performance of a firm in terms of market sales, growth, and cost reduction? What intangible values exist in IT-enabled supply chain collaboration and how can we transform them financially into firm performance? Are the relationships between the value impacts and firm performance different for various collaboration strategies?

The paper is organized as follows. We first proposed a set of metrics for the impacts of collaborative IT related to technology infrastructure, business processes, and inter-organizational relationships. We then collected data to validate these metrics and examined their relationships to firm performance, and the strength of the relationships. These relationships would also be investigated under different types of companies in terms of their collaboration level.

2 Review of Relevant Theories

2.1 Value of Inter-organizational Systems

The body of research that evaluates IOS performance is large and diverse. It can be summarized into two groups. The first group focused on an aggregate level of analysis, in which IT expenditures are directly related to outcome variables at the firm level (such as market share) through a microeconomic production function (Loveman 1988). These early studies led to the phrase “ IT productivity paradox, denying the paradox, solving the paradox, and burying the paradox.” (Thatcher and Oliver 2001). Some of these studies found sizable productivity gains from IT investments (Barua and lee 1997), while others were unable to identify productivity gains from IT (Rai 1997).

The second group comprises the work attempting to gauge the operational and strategic value of IOS and puts emphasis on the business processes. The former examined the impacts

at lower operational levels in an enterprise, e.g., the impact on inventory and quality (Mukhopadhyay et al. 1995), impact on shipping discrepancies (Srinivasan, et al. 1994), and impact on order processing (Mukhopadhyay, et al. 1995). The latter examined strategic implications of interorganizational systems, including how IOS enables a firm to maintain its overall cost leadership (Bakos and Treacy 1986), improves the business or manufacturing processes between firms in the supply chain (Chatfield and Bjorn-Andersen 1997), adds value to customers (Wiseman 1988), and enhances the dependence of customers and suppliers on the firm (Porter 1985).

While most of these studies target on pre-Internet IOSs such as EDI, they didn’t consider the value impacts associated with supply chain collaboration enabled by E-Business IT. Therefore there is a need to develop a new theoretical framework that can extend the focus on business processes and financial performance and represent the important features of supply chain collaboration. Further, although indirect benefits can include large financial savings, much of the attention on IOS valuation has focused on its impact on direct impacts (i.e. business operations). We think there will be a contribution to the literature while providing a generic valuation framework, which considers both direct and indirect impacts at the same time.

2.2 Theories for Inter-firm Collaboration

Three theoretical perspectives are particularly relevant in deriving value impacts of inter-firm collaboration. They are transaction cost theory, EDI adoption theory, and political economy theory. From the transaction cost theory perspectives, IT would bring efficiency benefits from reducing the governance costs of transacting with external parties relative to internal coordination costs (Williamson 1991). Therefore many companies attempt to increase the dependence of their trading partners by selling and buying through IOS links. The EDI literature states that IT support for relationships among established business partners contributes to high performance. The quality and interdependence of relationship improved by EDI depends on the adopters’ readiness in three firm’s context of technology, organization, and environment (Iacovou et al. 1995; Zhu et al. 2002) and the fits within the existing system of the initiators (Bensaou and Venkatraman 1995).

Political economy theory provides dimensions underlying collaborative uncertainties. In contrast with transaction cost theory, political economy theory asserts that costs are not only from transactions involving specific assets but also from the underlying social system which comprises interacting sets of internal and external economic and socio-political forces that affect collective behavior and performance (Markus and Christiaanse 2003). For lowering those costs and making the existence of the network economically feasible, Williamson (1979) and Jarillo (1986) assert that inter-firm collaboration which feature the ability to generate trust will survive greater stress and display greater adaptability.

While transaction theory does not consider the value impacts from the extended supply chains and neglect the interdependence and quality of prior relationships among trading partners and their interaction with IT capabilities, EDI concerns the benefits from document standardization, ignoring the collaboration value stemming from standardizing business processes, and thus only covers partial explanation about the potential economic values of participation. In addition, EDI models focus on the pair-wise relationship and neglect possible research issues about extended supply chain relationships, involving three or more members, which can be considered ‘network’ arrangements. Therefore, there is a need to extend the current study to examine the behavior of business partners, before and after supply chain collaboration. Furthermore, we should consider the value impacts not only within adopting organizations but also non-adopters, because their perception to participation value might promote/prevent the formation of a critical mass of participants in the supply chain collaboration and thereby determine its success.

3 Research Framework and Hypotheses

3.1 Research Framework

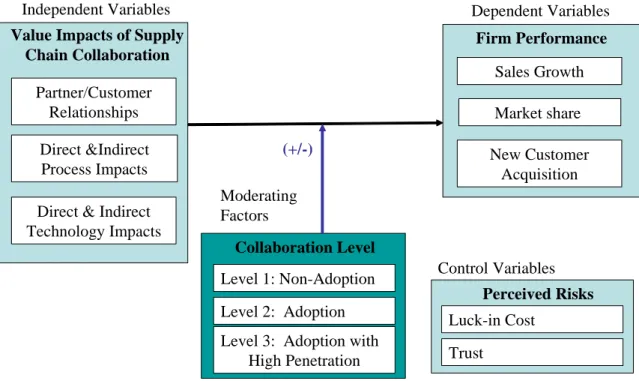

Based on the literature review, the research framework consists of the following theoretical constructs: value impact of supply chain collaboration, collaboration level, and firm performance. The framework is shown in Figure 1.

Collaboration Level

Moderating Factors

Value Impacts of Supply Chain Collaboration Independent Variables New Customer Acquisition Market share Sales Growth Firm Performance Dependent Variables (+/-) Level 1: Non-Adoption Level 2: Adoption Direct & Indirect

Technology Impacts Direct &Indirect

Process Impacts Partner/Customer

Relationships

Level 3: Adoption with High Penetration

Perceived Risks

Luck-in Cost Trust Control Variables

Figure 1. Research Framework for Assessing the Value of Supply Chain Collaboration

Value impacts of supply chain collaboration is the mix of direct and indirect technology, process, and inter-firm relationship impacts. Direct technology impacts of supply chain

collaboration refer to the improved IT capabilities because of the implementation. Indirect technology impacts of supply chain collaboration refer to IT learning and growth potential due to improved IT capabilities. Direct process impacts include operational improvement and information improvement due to the process automation. Indirect process impacts capture the benefits after the technology is integrated with back-office applications (e.g. ERP system) so companies can use information that resides in an enterprise system to improve relationships within their supply chain. The impacts on relationships include the improvement of customer relations and the improved relations with trading partners.

Facing different environment complexities, organizations, acting as an active unit, choose among collaboration strategies to achieve greater performance of supply chain collaboration. We include three corporate collaboration strategies in the construct of collaboration level, from non-adoption to a high level penetration. We also employed two control variables to account for technical risks and collaboration risks in terms of lock-in costs and trust issues respectively under the consideration that collaboration performance cannot be explained if uncertainty/risks are not appropriately applied (Kumar and Dissel 1996).

3.2 Hypotheses

The research framework is used to derive hypotheses for empirical testing. Our focus lies in the value impacts of extended supply chain relationships, the importance of indirect collaboration impacts, and critical values under different collaboration levels. This focus is not customary in past IOS studies or inter-firm collaboration theories.

The first hypothesis concerns the value impacts of extended supply chain relationships. Extended supply chain structure differs from a traditional linear supply chain relationship in two important ways: first, the formation of partnerships is not only based on contracts or organizational forms, but the partnerships are also information-based. For example, Cisco may not have direct transaction relationships with their tier-two or tier-three component suppliers, but its common IT platform shared with those suppliers enables Cisco to build an information relationship with them. Thereby, their valuable outputs are often intangible assets such as new knowledge. Second, a traditional supply chain structure simply optimized business within the focal firm, however the extended supply chain optimizes business across the networked value chain firms. As a result, maintaining a good relationship with supply chain partners, as well as customers becomes more important than ever in this extended structure. Thus, we argue the traditional process-focused enterprise IT evaluation model will be enhanced with the addition of a perspective of extended supply chain relationships. The following hypothesis captures this notion:

Hypothesis 1. The model that includes the metrics of extended supply chain relationships will have significantly greater explanatory power to firm performance than a model that includes only process metrics.

Now, we turn to the value impacts of supply chain collaboration. Supply chain collaboration enabled by IT creates both direct and indirect values to firms. Direct benefits include operational cost savings arising from automation of existing inter-firm information flows, for example, reduced paper work, data re-entry, and error rates. It often has relative short lag effect than indirect benefits. On the other hand, indirect benefits are opportunities that emerge from supply chain collaboration, which refer to the impact of supply chain collaboration on the business processes and relationships, e.g., improved customer service and the potential for process reengineering. Since it typically requires trading partners’ cooperation in undertaking joint economic action with the focal companies, such as new product design and just-in-time delivery of components, we assert that indirect benefits are more related with the effectiveness of collaborative efforts and thus constitute the main revenue stream of supply chain collaboration.

Hypothesis 2. Indirect value metrics of supply chain collaboration exhibit a more significant effect on firm performance than direct value metrics

Furthermore, the integration level of IOS is positively related to the types of benefits companies can receive. Usually, non-integrated IOS systems will offer companies direct benefits only, such as reduced transaction costs and higher information quality. Integrated systems, on the other hand, will offer both high direct benefits and the ability to take advantage of indirect benefits, such as increased operational efficiency, better customer service, and improved inter-firm relationships (Iacovou et al. 1995). Since supply chain collaboration requires high level of system integration among trading partners, we hypothesize that,

Hypothesis 3. The usage of collaborative IT enhances the indirect value impacts on firm performance

Next, we turn to the impact of firms’ collaboration strategies on firm performance. We propose that, firms constrained by the resources and capabilities would have their own value focus in different stage of supply chain collaboration. Non-adopters may primarily focus on technology value as there is a need to improve technology capability before they start to implement more expensive and complex systems for supply chain collaboration. In contrast, adopters are more able to realize the process and relationship values and translate them into firm performance as their high level of supply chain collaboration promise more in terms of ongoing operational savings and service enhancement to the target trading partners or

customers, even if such systems involve greater implementation costs.

Hypothesis 4a. For adopter firms, improved supply chain processes and better relationships may exhibit stronger association with firm performance while technology value impacts are stronger in non-adopter groups.

Among the adopters, we propose that when firms start to build collaborative information technology with low to medium scope and low penetration level, process value is relatively important to other values. The direct result of collaborative IT is a payoff in terms of improved responsiveness to market changes, shorter product development life-cycles, and better product quality, which are summarized as process values. After the technology has a broad scope of adoption, increasing penetration level of collaborative IT with adopters can be seen as part of an explicit strategy to tie-in customers or partners. The net result is reduced risks and uncertainties in trading relationships (i.e. relationship improvement), accompanied by a payoff in terms of improved input quality, satisfied customers, better customer retention rate, and reduced input costs.

Hypothesis 4b. For adopter firms, with the collaboration level increases, improvement in extended supply chain relationship has a stronger impact on firm performance than process improvement

4 Model Analysis and Results

To empirically test the research theory, we selected a sample population of RosettaNet current and potential member companies. The first survey was sent out to RosettaNet total 224 member companies (excluding the solution providers) in April 2003 and a second wave of the survey was sent out in June 2003. A total of 53 replies were received; the overall response rate was approximately 24%. The Cronbach’s alpha reliability coefficients were used to ensure model reliability. In this research, the Cronbach’s alpha coefficients, ranging from 0.61 for direct process value to 0.94 for firm performance. These scores are high enough to warrant the next phase of the research, focusing on empirical assessment of the research model and testing each of the hypotheses proposed earlier (Nunnally 1978).

4.1 Measures of extended supply chain relationships

To test the significance of extended supply chain relationship on the firm performance (i.e. Hypothesis 1), we employed hierarchical regression analysis (Zaheer and Venkatraman 1995). This procedure allows us to assess changes in the proportion of variance explained (R2) and the statistical significance of the changes with the introduction of the construct representing the value impact of extended supply chain relationship: relationship improvement. We began by regressing firm performance on the variables that explain value impacts from the perspectives of business processes – direct and indirect technology value and direct and

indirect process value – and added the relationship construct, assessing the significance of the change R2. Conceptually, the stages in the analysis can be represented by the following equations:

Firm performance = α0 + β1 direct technology impact + β2 indirect technology impact + β3

direct process impact + β4 indirect process impact + (controls) + ε (1)

Firm performance = α0 + β1 direct technology impact + β2 indirect technology impact + β3

direct process impact + β4 indirect process impact + β5 relationship

improvement + (controls) + ε (2)

As shown in Table 1, the construct of extended supply chain relationship adds significantly explanatory power to the model. Hypothesis 1 was supported. The R2 value was incremented by 0.658 to 0.758. The statistical significance of the increment to R2 was high, with the change in the F-statistic significant at p<0.01.

Table 1. Results of Hierarchical Regression Analyses (n=53)

Model Process Perspectives Process Perspective + Relationships

Equation (1) (2) R2 0.658 0.758 F 14.15 19.264 Sig. F 0.000 0.000 R2 change 0.1 Sig. F change 0.000 Independent variables b. b Direct Tech. Impact -0.105 -0.11 Indirect Tech. Impact 0.059 0.04 Direct Process Impact 0.044 -0.145 Indirect Process Impact 0.819*** 0.360** Relationship Improv. 0.699***

4.2 Measures of Direct and Indirect Value Impacts

Hypothesis 2 and 3 attempted to explore the relative importance between direct and indirect value impacts on firm performance and how the impacts would be influenced by firm’s collaboration strategies. Hence, the regression equation is expressed as follows,

Firm performance = α0 + Σβi DV i + Σβ j IDVj + β 6 Collaboration_Level + β 7 IDV ×

Collaboration_Level + (controls) + ε, (3) where DV i (i=1,2) represents the two direct value impacts of supply chain collaboration

identified earlier (i.e. direct technology and process value) and IDVj(j=1,2,3) are the three

indirect value impacts of supply chain collaboration – indirect technology and process value and relationship improvement. Two regressions are reported. The first one used the overall

value impacts, while the second one replaced them with the five value constructs in the regression.

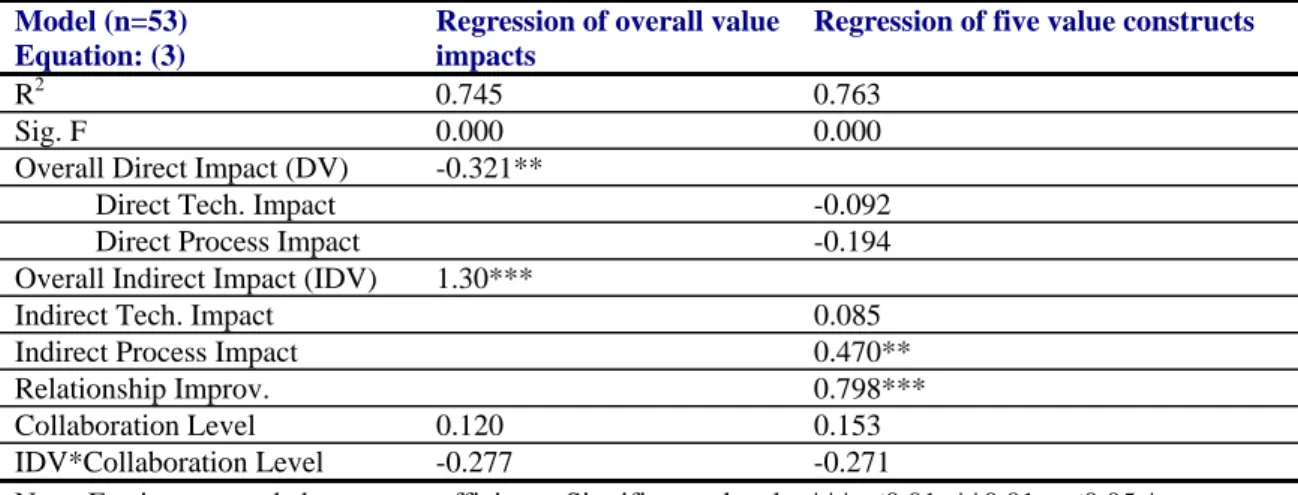

The results are presented in Table 2. We find that the values of the R2 for both regressions are above 0.7, suggesting that the value components can explain more than 70% of the variance of firm performance. The overall direct value impacts and indirect value impacts were found significant, indicating a positive association of these collaboration value impacts to firm performance. The result also showed that the p value of overall indirect value impacts is 0.000, significantly larger than the p value of direct value impacts (p=0.02). This suggests that indirect value impacts of supply chain collaboration are more associated with firm performance than direct value impacts. That is, regardless of firm’s collaboration strategies, companies that can realize more indirect collaboration values are more possible to obtain higher firm’s performance, lending support to Hypothesis 2.

Table 2. Regression Results for the indirect value impacts

Model (n=53) Equation: (3)

Regression of overall value impacts

Regression of five value constructs

R2 0.745 0.763

Sig. F 0.000 0.000 Overall Direct Impact (DV) -0.321**

Direct Tech. Impact -0.092 Direct Process Impact -0.194 Overall Indirect Impact (IDV) 1.30***

Indirect Tech. Impact 0.085 Indirect Process Impact 0.470** Relationship Improv. 0.798*** Collaboration Level 0.120 0.153 IDV*Collaboration Level -0.277 -0.271

Note. Entries reported above are coefficients. Significance levels: ***p≤0.01; **0.01<p≤0.05;* 0.05<p≤0.10.

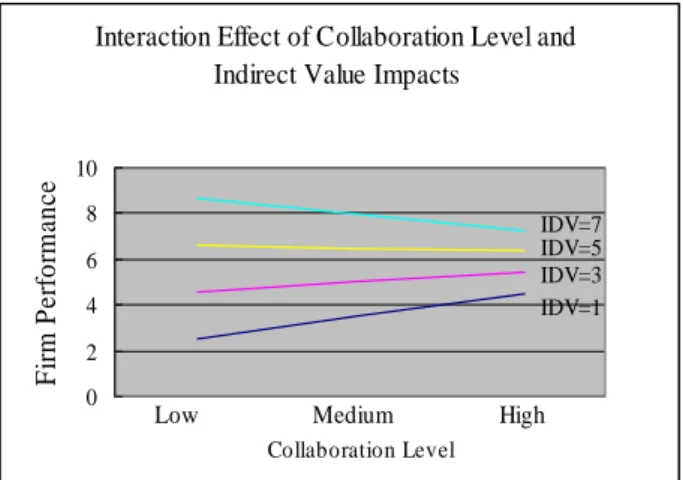

The moderating effect of collaboration strategies on indirect value impacts as proposed in Hypothesis 3 is negative to the firm performance but not statistically significant (p=0.359), hence we reject Hypothesis 3. Figure 2 depicts the moderating effect of collaboration strategies is mix. When little firm’s performance comes from indirect collaboration impacts (i.e. firms with low capability to realize indirect collaboration values), greater collaboration level (i.e. increasing collaboration usage) was positively associated with higher firm performance. This makes sense, in that, when the current IT does not support the realization of indirect collaboration values, improving the scope and penetration of collaborative IT enhance firm’s capability to realize indirect collaboration values. However increasing the usage of collaborative IT is not the only contributing factor to the performance of supply chain collaboration. The negative lines with higher IDV might imply an adjustment cost or additional collaboration needs incur with the process of realizing indirect values, which

large indirect collaboration impacts, technology investment on increasing collaboration levels can not make the collaboration more valuable. In contrast, non-technical factors such as organization complimentarity may be more important to consider.

Interaction Effect of Collaboration Level and Indirect Value Impacts

0 2 4 6 8 10 Collaboration Level Fi rm Pe rf o rm an ce

Low Medium High

IDV=1 IDV=3 IDV=5 IDV=7

Figure 2. Interaction Effect of Collaboration Level and Indirect Collaboration Impacts

4.3 Value Focus under Alternative Collaboration Strategies

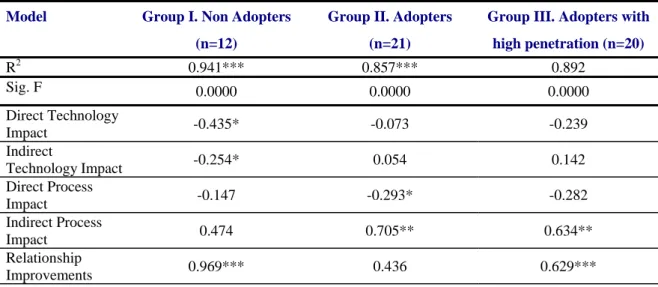

As discussed in Section 3, we propose that supply chain collaboration creates three impacts on firm performance: technology, process, and extended supply chain relationship. Driven by the mission and strategy of the potential and existing PIP partners, organizations at different collaboration stages will have different views about these value impacts. Therefore, if we can find which impact can create more firm’s benefits under the concern of different collaboration strategies, individual organizations can develop different roadmaps to maximize its overall performance.

To find value focus for each collaboration strategy, we divided the data into three groups: adoption (with low to medium scope of sharing), adoption with high penetration level, and non-adoption. The regression results are presented in Table 3. We find that the values of the R2 for the three models are all above 0.8, suggesting that the value components can explain more than 80% of the variance of market performance. Conceptually, the models in the analysis can be represented by the following equations.

Firm performance (sample: group I) = α0 + β1 direct technology value + β2 indirect

technology value + β3 direct process value + β4 indirect process value

+ β5 relationship improvement + ε, (4)

Firm performance (sample: group II) = α0 + β1 direct technology value + β2 indirect

technology value + β3 direct process value + β4 indirect process value

+ β5 relationship improvement + ε, (5)

technology value + β3 direct process value + β4 indirect process value

+ β5 relationship improvement + ε, (6)

Table 3. Value Focus for Alternative Collaboration Strategies

Model Group I. Non Adopters

(n=12)

Group II. Adopters (n=21)

Group III. Adopters with high penetration (n=20) R2 0.941*** 0.857*** 0.892 Sig. F 0.0000 0.0000 0.0000 Direct Technology Impact -0.435* -0.073 -0.239 Indirect Technology Impact -0.254* 0.054 0.142 Direct Process Impact -0.147 -0.293* -0.282 Indirect Process Impact 0.474 0.705** 0.634** Relationship Improvements 0.969*** 0.436 0.629*** * Note: Stage (I) sample of non-adopters, (II) sample of small to medium scope of sharing (less than 5

partners) at low penetration level (less than 10% transactions through PIPs), (3) sample of large scope of sharing at low to high penetration level (more than 5 partners and more than 10% transactions through PIPs)

The tests of group I focus on the significance of value impacts on firm performance when companies are non-adopters. We find a negative and significant relationship between direct technology impact and firm performance with a b value of -0.435 (p<0.1). The negative sign might imply a lag effect that makes the direct technology impact not immediately transferable to financial values. Indirect technology impact and relationship improvement have a positive and significant relationship with firm performance with b values of 0.474 (p<0.05) and 0.969 (p<0.01), respectively. Lastly, process impacts are insignificant to non-adopters. The b-values of –0.147 for direct process value and 0.254 for indirect process value are not significant. While the process impacts are not significant in non-adopter groups, the regression analyses of group II and group III show an opposite result. The b values for direct and indirect process impacts are -0.293 and 0.705 in group II, presenting a significant relationship with firm performance. For the group III, the indirect process impact and relationship improvement are positively and significantly related to the firm performance when the penetration level is high (b value is 0.634 for indirect process impact and 0.629 for relationship improvement; both have p value smaller than 0.01). The results support Hypothesis 4a.

For adopter groups, with the collaboration level increases (i.e. shifting from group II to group III), direct process impact becomes not significant with a b value of –0.281. On the other hand, relationship improvement becomes positively and significantly related to the firm performance with the b value of 0.629 (p <0.01), lending the support of Hypothesis 4b.

By examining substantive relationships of the supply chain collaboration measures to firm performance in the above section, we were empirically testing to see if the measures are consistent with theory. Such empirical assessment helps to establish nomological validity of the constructs (Zhu and Kraemer 2002). Together with the validity and reliability statistics discussed in section 4, we believe that the proposed valuation constructs for supply chain collaboration are validated and they can be used for further studies such as exploring different impacts on supply chain collaboration, so companies are able to optimize values. The constructs can also be used as a starting point to investigate corporate readiness for supply chain collaboration, so companies are able to develop roadmap for more values.

In addition, we have shown that improvement in extended supply chain relationships is the most beneficial impacts of supply chain collaboration, and thus maintaining a good relationship with supply chain partners, as well as customers becomes more important than ever in this collaborative structure. The result supports our proposition to emphasize three areas of valuation in e-business IT: relations with supply chain partners, relations with customers, and interaction with markets, on the top of the traditional enterprise IT evaluation. Further, while much of the attention on IOS valuation has focused on its impact on direct benefits (i.e. business operations), our result has shown that there is a need to provide a generic valuation framework, which considers both direct and indirect benefits at the same time. In the information age competition, business success is not only based on the efficient allocation of financial and physical capital in order to achieve economies of scale and scope (i.e. aiming for direct benefits), but also the ability to mobilize and exploit softer and less tangible intellectual assets underlying IT-enabled collaboration. Considering the indirect benefits enables us to augment the traditional cost-benefit model with a strategic dimension, and thereby achieve higher level of firm performance.

Lastly, our study pertains to the relative importance placed on the benefits of supply chain collaboration. Non-adopters primarily focus on technology value and relationship improvement, indicating that there is a need to improve technology capability and relationships before they are ready to adopt. On the other hand, adopters are those that are willing to invest in more expensive and complex systems. Such systems would not only improve the further diffusion of the systems, but also increase the likelihood of the process and relationship benefits described previously. After the technology has a broad scope of adoption, adopters would put more focus on relationship management to tie-in customers or partners via increasing penetration level of collaborative information technology. The observation that collaboration benefits varies significantly between adopter groups and non-adopter groups suggests the usefulness of measuring supply chain collaboration based on different stages that drive the performance. While past IT literature (Lucas 1989) suggests that the business value of IT should show a performance gain correlated with the deployment of an IT, this paper extends

the existing literature and provides a new valuation approach that the future researchers can work on.

6 Conclusion

This paper aimed to develop a set of metrics for evaluating the economic impacts of IT-enabled supply chain collaboration, which can be applied to examine the value of alternative e-business initiatives. The proposed framework contains three main features: (1) as traditional enterprise IT evaluation put its focus on process level, this valuation framework extends its focus to extended supply chain relationships to fully capture the value of supply chain collaboration. (2) For each perspective, the framework consists of lagging indicators (indirect impacts) and complementary short-term performance measures (direct impacts). That is, the measures are derived from a top-down process driven by the corporate mission and strategies to ensure they do not only tell the story of past events but also contain the way of guiding or evaluating organizational performance. (3) The proposed framework extends the earlier work and ideas of past IT valuation research by considering the impact of corporate collaboration strategies in terms of different levels of collaboration. Therefore, given the same set of performance measures, organizations at different collaboration levels will have various value focuses, and thus they can develop different roadmaps to maximize overall performance.

Overall, this research possesses two major strengths. First, the proposed measures are generally applicable, as their reliability and validity are empirically verified. Second, the influence of corporate collaboration strategies have been incorporated into the valuation model, allowing firms to gauge the most appropriate strategy and design roadmaps for achieving greater supply chain collaboration. For researchers who believe other impacts are significant to their field could apply these value constructs in their studies and follow the suggested procedures to derive focus values. Large-scale cross-industry surveys can be especially appropriate for addressing this issue. Data collected from different industries would allow researchers to develop different impact constructs for specific industrial needs, compare the differences, and finally, more objectively assess the value of supply chain collaboration.

7 Reference

Bakos, J. Y. and Treacy, M. E., “Information Technology and Corporate Strategy: A Research Perspective,” MIS Quarterly, (10:2), 1986, pp. 107-119

Barua, A., and Lee, B., “An Economic Analysis of the Introduction of an Electronic Data Interchange System,” Information Systems Research, (8:4), 1997, pp. 398-422

Bensaou, M and Venkatraman, N., “Configurations of Interorganizational Relationships: A Comparison Between U.S. and Japanese Automakers,” Management Science, (41:9), 1995, pp. 1471-1492

Chatfield, A. and Bjorn-Andersen, N., “The Impact of IOS-Enabled Business Process Change on Business Outcomes: Transformation of the Value Chain of Japan Airlines,” Journal of Management Information Systems, 1997, (14:1), pp. 13-40

Iacovou, C., Benbasat, I., Dexter, A., “Electronic Data Interchange and Small Organizations: Adoption and Impact of Technology, MIS Quarterly, December, 1995, pp. 465-485

Jarillo, J., “On Strategic Networks,” Strategic Management Journal, (9), 1988, pp. 31-41 Kumar K. and Dissel, H., “Sustainable Collaboration: Managing Conflict and Cooperation in

Interorganizational Systems,” MIS Quarterly, September 1996, pp. 279-300

Loveman, G. W., “An Assessment of the Productivity Impact of Information Technologies,” MIT Management in the 1990s Working paper no. 88-054, July 1988

Mahmood, M. A., Soon, S. K., “A Comprehensive Model for Measuring the Potential Impact of Information Technology on Organizational Strategic Variables,” Decision Sciences, (22), 1991, pp. 869-896

Markus, L. and Christiannse, E., “Adoption and Impact of Collaboration Electronic Marketplaces,” Journal of Information Systems and Electronic Business, 2003, forthcoming.

Mukhopadhyay, T., Kekre, S., and Kalathur, S., “Business Value of Information Technology: A Study of Electronic Data Interchange,” MIS Quarterly, (19:2) 1995, pp. 137-156

Nunnally, J. C., Psychometric Theory, New York: McGraw-Hill, 1978 Porter, M.E., Competitive Strategy, New York: The Free Press, 1985

Rai, A. “Technology investment and business performance,” Communication of the ACM, (40:7), 1997, pp. 89-97

Srinivasan, K., Kekre, S., and Mukhopadhyay, T., “Impact of Electronic Data Interchange Technology on JIT Shipments,” Management Science, (40:10), October 1994, pp. 1291-1304

Thatcher, M. and Oliver, J., “The Impact of Information Technology on Quality Improvement, Productivity, and Profits: An Analytical Model of a Monopolist,” 34th Annual Hawaii International Conference on System Sciences (HICSS), January 3-6, 2001, Maui, Hawaii Williamson, O. “Transaction-cost Economics: The Governance of Contractual Relations,”

Journal of Law and Economics, (22), 1979, pp. 223-261

Wiseman, C., Strategic Information Systems, Dow Jones Irwin, Homewood, IL, 1988

Zaheer, A. and Venkatraman, N., “Relational Governance as an Interorganizational Strategy: An Empirical Test of the Role of Trust in Economic Exchange,” Strategic Management Journal, (16), 1995, pp. 373-392

Zhu, K., Kraemer, K. and Xu, Sean, “A Cross-Country Study of Electronic Business Adoption Using the Technology-Organization-Environment Framework,” Twenty-Third International Conference on Information Systems, 2002, pp. 337-348