INTEREST RATE DERIVATIVES AND

RISK EXPOSURE:

EVIDENCE FROM THE LIFE INSURANCE

INDUSTRY

Authors: Hui Hsuan Liu Yung Ming Shiu

Outline

* Motivation * Purpose * Contribution

INTRODUCTION

* Effects of Risk on Derivatives Usage * Effects of Derivatives Usage on Risk LITERATURE

&

HYPOTHESIS

* Corresponding Models * Data Selection * Variables Summary

METHODOLOGY

EMPIRICAL RESULTS CONCLUSIONS

Motivation-1

M1: Corporate interest rate risk hedging in the United States is relatively important, especially for interest rate-sensitive firms, such as life insurers.

√ Bodnar et al. (1998) indicates the 76% use derivatives to hedge interest r ate risk in the US firms.

√ Bodnar and Gebhardt (1998) and De Ceuster et al. (2000) indicates US f

irms tend to hedge in order to reduce cash flow volatility.

√ Life insurance industry belongs to the long-term insurance industry; they must to consider the external environment factors (ex: inflation rate). If the market rate showed a very slight variation, the interest rate risk increased. Interest rate risk arises from mismatches in the rate sensitivity of the insure r’s inflows and outflows. An increase in interest rates causes the market va lue of the insurers’ assets to fall.

Motivation-2

M2: An important question that life insurance firms concern the role by derivatives played in the exposure to interest rate risk.

√ Firms can use different ways to manage theirs’ interest rate risk, one tec hnique is to match the rate sensitivities of their assets and liabilities as clo sely as possible (on-balance-sheet technique); the other is to use derivativ es (off-balance-sheet technique).

√ Most life insurers use financial derivatives either as part of a risk mana gement strategy or means of income generation.

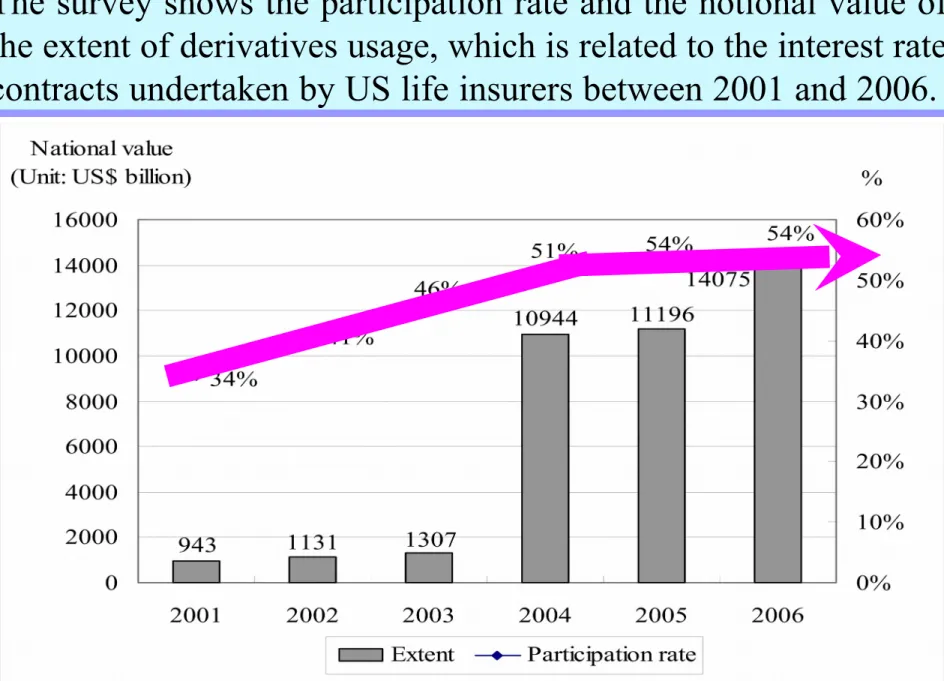

√ As shown in Figure 1, the survey indicates that US life insurers manage

their risk exposure by undertaking hedging with large derivatives positio ns, and thus this sample is suitable for this study.

FIGURE 1: The Participation Rate and Extent of Interest Rate Derivatives Usage by Life

The survey shows the participation rate and the notional value of the extent of derivatives usage, which is related to the interest rate contracts undertaken by US life insurers between 2001 and 2006.

Motivation-3

√ prior researches have documented the reverse causality from de rivative use to risk exposure (Reicher and Shyu, 2003; Bondnar a nd Marston, 1996; Sinkey and Carter, 2000; Gunther and Siems, 1 995), further Hirtle (1997) finds no significant relationship betwe en the extent of derivatives usage and interest rate risk exposure. The topic has not been well examined and empirical evidence vari es.

M3: We argue that a firm’s derivative use and risk exposure decisions are simultaneously determined.

Motivation-4

M4: In order to extend earlier works on the use of derivatives and risk exposure, this work focuses on the US life insurance industry.

√ Prior research related to the management of capital market risk only discussed fo r financial and non-financial firms (Ferreira Carneiro and Sherris, 2008; Purnanan dam, 2007; Bali, Hume and Martell, 2007; Daniel and Steven, 2005; Hentschel an d Kothari, 2001; Cummins, Phillips and Smith, 2001; Sinkey Jr. and Carter, 2000; Guay, 1999; Hirtle, 1997; Hentschel and Kothari, 2001; Tufano, 1996).

√Derivatives usage in the financial industry, especially in the insurance industry, t he research literature is very limited.

√Only in the US (Colquitt and Hoyt, 1997 and Cummins, Phillips and Smith, 200 1), the Australian (Ceuster, Flanagan, Hodgson and Tahir, 2003) and the UK (Phili p and Mike, 1999) is evidence available that documents derivative hedging practic es in the insurance industry.

Motivation-5

M5: We further motivate our work by extending these researches from the statutory reports of US life insurers during the period from 2001 to 2006.

√Prior studies just to find the determinants of firms' hedging and ha ve concentrated on one specific year (Colquitt and Hoyt, 1997 and Philip and Mike, 1999).

Purpose

examine the effects of interest rate risk exposure o

n derivative use and the reverse causality from deri

vative use to risk exposure using a data set on the

U.S. life insurers from 2001 through 2006

examine whether firm’s derivative use and risk exp

osure decisions can simultaneously determined

Research Contribution-1

√

Three prior studies that focus on non-financial

firms and closely connect to this paper. We further

research it completely.

Faff and Nguyen (2003)

Bali, Hume, and

Martell (2007) Property-liability insurers

find that there is little relationship between a firm’s risk exposures and the level of derivatives use

Guay (1999) discuss whether firms use derivatives to reduce risk

Faff and Nguyen

(2003) Property-liability insurers

explore the motivation of financial derivatives usage by both the participation and the extent model

Country characteristics of governance

derivative usage and risk exposure are simultaneously determinedCountry characteristics of governance

to extend the interest rate risk exposure to related to the both participation and the extent modelResearch Contribution-2

√ Use the Heckman two-stage sample selection model to test for the self-selection bias.

√ We eliminate the potential endogeneity bias of the time-invariant and rarely changing variables.

refer Plumper and Troeger (2007) to use the fixed effect vector decomposition (FEVD) technique to eliminate the pote ntial endogeneity bias and to check the robustness of the hypotheses .

Literature & Hypothesis

-Effects of Risk on Derivatives Usage-1

(1) risk reduction can be achieved with derivatives

√ Smith and Stulz (1985) show that hedging the interest rate risk can increase firm value by lowering the bankruptcy transaction c ost.

√Froot et al. (1994) argue that firms should hedge in order to avoi d the cost of external financing when they experience low interna l cash-flow.

Literature & Hypothesis

-Effects of Risk on Derivatives Usage-2

(2) Derivative users have an advantage in the risk-shifting process

√Hoyt (1989) points out that derivatives usage would be more appropri ate for life insurance firms than general insurers.

√Tufano (1996) supports the hypothesis that the gold mining industry c an use derivatives to reduce risks.

√Purnanandam (2007) indicates that derivatives usage can minimize th e risk of external shocks on a firm's operating policies.

√Singh (2009) provides a significant negative relation between the use of interest rate derivatives and interest rate risk exposure.

Literature & Hypothesis

-Effects of Risk on Derivatives Usage-3

(3) hedging with derivatives can limit the degree of interest rate risk e xposure that a firm has

√Brewer et al. (2007) note that interest rate risk exposure is an important fa ctor that influences the value of a life insurer, as the equity of such firms is sensitive to long-term interest rates.

√Daniel and Steven (2005) find that they tend to actively use interest rate d erivatives to offset this when firms have larger interest rate risk exposure.

√Hirtle (1997) finds that an increase in the use of interest rate derivatives c orresponds to greater interest rate risk exposure for a sample of US banks.

Literature & Hypothesis

-Effects of Risk on Derivatives Usage

Overall, we affirm that life insurers will use derivatives for hedging purposes if they face significant interest rate risk exposure. The interest rate risk exposure can affect the both the propensity to undertake such a strategy and the extent of interest rate derivatives usage. In order to examine the issues raised above in more detail, we construct the following hypothesis:

H1: Life insurers with a higher interest rate risk exposure still have a greater propensity to hedging using interest rate derivatives. H1: Life insurers with a higher interest rate risk exposure still have a greater propensity to hedging using interest rate derivatives.

Literature & Hypothesis

-Effects of Derivatives Usage on Risk-1

(1) a number of prior studies take the opposite view on the relat ion between derivatives usage and risk exposure

√Reichert and Shyu (2003) also find that the options usage increase s the interest rate risk exposure of banks.

√Bodnar and Marston (1996) examine the effects of using derivativ es on the volatility of firms' returns, and find that the use of derivati ves increases risk exposure.

√Sinkey and Carter (2000) and Gunther and Siems (1995) both find that increased use of derivatives by banks tends to result in higher le vels of interest rate risk exposure.

Literature & Hypothesis

-Effects of Derivatives Usage on Risk-2

(2) prior studies have found that firms’ risk exposure to variations in interest rate s is not directly related to their derivatives positions

√Stulz (2003) points out that carrying out risk management activities (such as hedging by using derivatives) does not increase firm value.

√ Hentschel and Kothari (2001) find that the use of derivatives by firms does not meas urably increase or decrease the volatility of their returns.

√Angbazo (1997) and Simons (1995) find no significant relationship between derivativ es usage and the interest rate risk exposure.

√Koski and Pontiff (1999) shows that there is no statistical difference in the risk measu red and return performance between derivatives users and nonusers in the mutual fund industry.

√Hirtle (1997) finds that there is no significant relationship between the extent of deriv atives activities and interest rate risk exposure.

Literature & Hypothesis

-Effects of Derivatives Usage on Risk-3

√

In sum, a review of the literature shows that whether or not inter est rate derivatives can be used to hedge against interest rate risk i s still inconclusive.√

The related arguments are quite different from established theori es of corporate risk.√

We thus speculate that even if life insurers use more derivatives to hedge, they can not completely remove the risks they face, and thus we present the following hypothesis:H2: Life insurers have a greater propensity to hedging using interest rate derivatives, they still with a higher interest rate risk exposure.

H2: Life insurers have a greater propensity to hedging using interest rate derivatives, they still with a higher interest rate risk exposure.

Methodologies

(1) two-equation simultaneous equations model

i t i t

i t t if

IREX

CV

e

IRDU

,

1 ,,

1, , 1

1, ,

i t i t

i t t if

IRDU

CV

e

IREX

,

2 ,,

2, , 1

2, ,√ represents a dummy variable (interest rate derivative user= 1; nonuser= 0) to represent the participation decision on interest rate derivative use or a continu ous variable to represent the extent decision by life insurer i in year t.

√ denotes the interest rate risk exposure of life insurer i in year t.

√CV1 and CV2 are two different sets of control variables

t i IRDU , t i IREX , 2SLS method

Methodologies

(2) model of measure the interest rate exposure

t i t m t i t t i t t i

IR

R

e

SR

,

0,

1, ,

2, , ,

,√ where is the common stock return of life insurer i in year t; a constant,

is the percentage change in the 6-month Libor rate in month t; is the monthl y returns on the CRSP equal-weighted index for month t, and is the error term.

√ represents the interest rate risk exposure measured as a percentage change in th e rate of return on the life insurer’s common stock due to a 1% change in interest rate s. The six-month Libor rate is used in the model because it is the benchmark used for most floating rate debt.

√ represents the rate of return on the CRSP equal-weighted market index for NYS E, AMEX, and NASDAQ firms.

t i SR , 0t, t IR Rm,t t i e , t i, , 1 t i, , 2

Data Collection-1

√ We mainly use the CRSP, COMPUST and Edgar database to re trieve the data to calculate the proxies for variables used in this re search.

√

Through the Edgar, we

hand-collect

the data of firms’ deri

vative activities from

notes to the firms’ financial statements

. If an insurer indicates that no hedge exists within the intere

st-rate contract, and then the contract is not included the mea

surement of hedging by the firm, the insurer is classified as

a "non-hedger.“

Data Collection-2

√

Of 45 these insurers,

41

disclose detailed derivatives

information in their 10-K filings and annual reports for the

period 2001 to 2006.

√ The sample is comprised of 41 life insurers from 2001 to 2006, with a total of 244 firm-years observations, 133 of which reported the relevant information about using interest rate derivatives, and 111 did not.

Variables Summary

Variable Definition

Panel A: Endogenous variables

Interest rate derivative participation

Participation decision: 1 for interest rate derivative users, 0 otherwise

Interest rate derivative usage Ratio of the year-end notional volume of interest rate derivatives by total assets

Interest rate risk exposure Ratio of the return on the life insurer’s common stock due to a 1% change in interest rates

Panel B: Control variables

Leverage Ratio of the book value of total liabilities to the market value of equity Convertible bonds Dummy variable = 1 if the life insurer use convertible bonds, 0 otherwise

Affiliation Dummy variable = 1 if the life insurer affiliates to a financial group, 0 otherwise Cash flow Ratio of the cash flow per share scaled by total assets

Firm size Natural logarithm of total assets

Floating rate debt Ratio of the floating rate debt to total long-term debt

Interest coverage ratio Ratio of the operation income before depreciation to the interest expense Quick ratio Ratio of quick assets to current liabilities

Underinvestment costs Ratio of the book value of equity capital to the market value of equity capital

EMPIRICAL

EMPIRICAL RESULTS

EMPIRICAL

EMPIRICAL

CONCLUSIONS-1

√ Consistent with our expectation, we find that life insurers with

higher interest rate exposure are motivated to participate in the interest rate derivative market and use more interest rate derivatives.

√ The derivative usage and risk exposure decisions are

simultaneously determined.

√ The rationale is that insurers can maximize firm value by

reducing financial distress costs and thus insolvency probabilities through derivative hedging (Cummins, Phillips, and Smith, 2001).

CONCLUSIONS-2

We also document the insurers that participate in the interest rate derivative

market and use more interest rate reverse causality from interest rate derivative use to risk exposure. We find that derivatives would have higher interest rate ris k exposure.

√ possibly because the use of interest rate derivatives allow the insurer to incre

ase their interest rate risk exposure but maintaining a certain level of solvency.

√ According to the Hoyt (1989), life insurers have long-term insurance contract s which are sensitive to interest rate fluctuations then general insurers. We infer that life insurers use derivatives for hedge is thus directly related to interest rate

risk exposure. Taken together, our evidence suggests that interest rate risk expo