國立成功大學 會計學研究所

碩士論文

臺灣存託憑證投資與營運績效之研究

On the Evaluation of the Performance of Taiwan Depositary Receipts

研 究 生:鍾宛蓁 指導教授:簡金成

中國民國一百零三年六月

Abstract

The objective of this research is to evaluate the stock and operating performances of Taiwan Depositary Receipts (TDRs) following their listing on the Taiwan Stock Exchange (TWSE). We use seven indicators in the analysis of TDRs’ stock performance, including standard deviation of stock returns, Sharpe ratio, market beta, information ratio, Jensen’s alpha, Treynor ratio, and abnormal returns. In the analysis of TDRs’ operating performance, we adopt return on assets and return on equity. We also examine the level of earnings management for TDRs before and after listing, using performance-matched modified Jones Model (Kothari, 2005).

There are three main findings, as follows. First, TDRs underperform the capital market following the listing, which is consistent with the Taiwanese government’s policy of ceasing to promote TDRs on November 11, 2013. Second, the operating performance of TDRs significantly higher than that of the industry before the TDR listing, but significantly lower following the listing. Third, we fail to find supporting evidence for accrual-based earnings management surrounding the year of listing.

Keywords: Taiwan Depositary Receipt; Secondary listing; Stock performance;

Operating performance; Discretionary accruals

I

摘要

本研究之目的為探討臺灣存託憑證之投資績效及營運績效,我們採用七個指標 作為投資績效的衡量,分別為標準差、夏普比率、貝塔係數、信息比率、詹森指數、

崔納指數及異常報酬,以衡量臺灣存託憑證上市後的股票表現;在營運績效方面,

我們採用資產報酬率以及權益報酬率作為衡量指標,以衡量其在上市前後的營運績 效表現;另外我們使用 Kothari (2005) 裁決性應計項目模型檢測在上市前後臺灣 存託憑證之管理階層進行盈餘管理的程度,並探討該裁決性項目的盈餘管理是否為 績效變動的影響因素。

本研究結果有三項主要發現,第一,我們證實臺灣存託憑證之投資績效在上市 後表現平均低於一般上市櫃股票,此結果支持政府於 2013 年 11 月 11 日所發佈停止 推動臺灣存託憑證之政策;第二,其營運績效表現在上市前明顯優於一般上市櫃股 票,然而上市後卻大幅衰退;第三,我們並未發現臺灣存託憑證的裁決性應計項目 在上市前後存在顯著差異。

關鍵字: 臺灣存託憑證;第二上市;投資績效;營運績效;裁決性應計項目

II

誌謝

能夠進入成大會計研究所實在是十分幸運,在研究所期間,我接受了許多老師 的專業教導,學習到許多不曾瞭解的知識和財會實務,在諸多的教導下,幫助我最 多的是我的指導老師 簡金成 教授,簡老師總是能夠見微知著,不論是在高級財務 會計學的課堂上,或是指導論文的時候,都能提供我們實質明確的方向,並指引我 們應當思考的研究脈絡,簡老師不只給予我們論文的教導,同時也十分注重我們獨 立思考、口語表達、人生價值及其他領域知識的涉獵,而經常提點再三,簡老師期 許我們不只完成論文,也希望幫助我們獲取人生路上所需要的利器和寶藏,對簡老 師有著太多的欽佩和感謝,希望未來我能將所學學以致用,不負簡老師之栽培。

在寫論文的這段時間,十分感謝博班 邱碩志 學長一路相挺,碩志 學長總是用 最大的耐心來教導我,並帶領我通過寫論文過程中的每一個關卡,甚至經常熬夜為 我們解惑,感謝學長總是包容我的不足並細心的幫我檢視論文的錯誤,在過程中,

我學習到了許多以往所不懂的研究經驗和方法,相信對未來必然有諸多助益,再次 感謝 碩志 學長的提攜幫助,讓我得以順利完成論文,感謝論文路上情義相挺的好 夥伴 幸穎 、沅融 、家蓁 ,常常互相鼓勵、一起討論,陪伴我渡過失去動力的時刻,

感謝我的爸爸、媽媽,以及好友 郁珊 、芝帆 、晉銓 ,在我疲憊或倍感壓力的時後,

給我安慰鼓勵和無限的支持,你們是我最重要的精神食糧,最後,以誠摯的心,感 謝論文的口試委員 王明隆 老師及 林軒竹 老師,在百忙之中仍蒞臨指導學生的論文,

感恩所有給予我幫助的貴人,宛蓁 一定會銘記在心。

宛蓁 謹誌於國立成功大學會計研究所碩士班 民國一O三年六月

III

Table of Contents

Abstract ... I Chinese Abstract ... II Acknowledgments ... III Table of Contents ... IV List of Tables ... V List of Figures ... VI Appendices ... VII

1. Introduction ... 1

2. Institutional Background and Literature Review ... 9

2-1 Introduction of Depositary Receipts ... 9

2-2 The Background of TDRs ... 15

2-3 The Literature on TDRs ... 24

3. Predictions ... 26

4. Research Methodology ... 28

4-1 Research Design ... 28

4-2 Measurement Indices ... 29

4-3 Sample Selection and Descriptive Statistics ... 36

5. Empirical Results ... 40

6. Conclusion ... 55

Appendix ... 58

References ... 75

IV

List of Tables

Table 1 Listed TDRs on March 31, 2014 ... 7

Table 2 Benefits of Creating a DR Program ... 10

Table 3 Types of DRs by Listing Locations and Stock Exchanges ... 12

Table 4 The Comparisons between Sponsored and Unsponsored DRs ... 14

Table 5 Change in Total Number of TDRs Listed on the TWSE ... 19

Table 6 Examples of Delayed TDR Information Disclosure ... 22

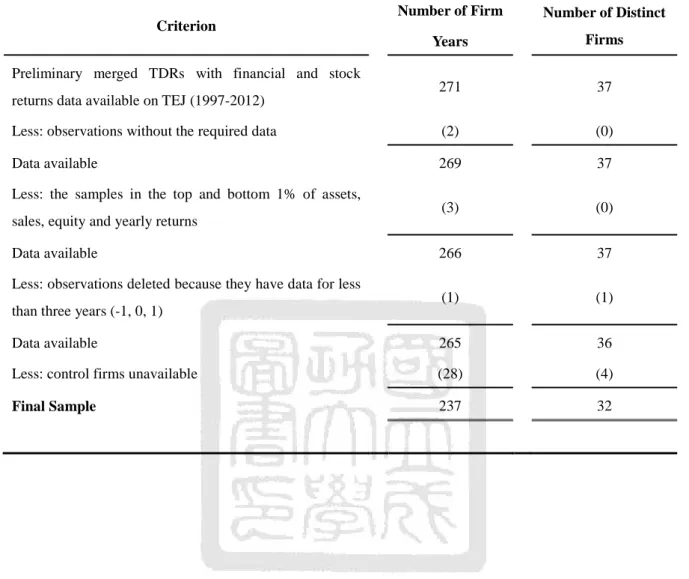

Table 7 Sample Selection ... 37

Table 8 Industry and Time Sample Distribution ... 39

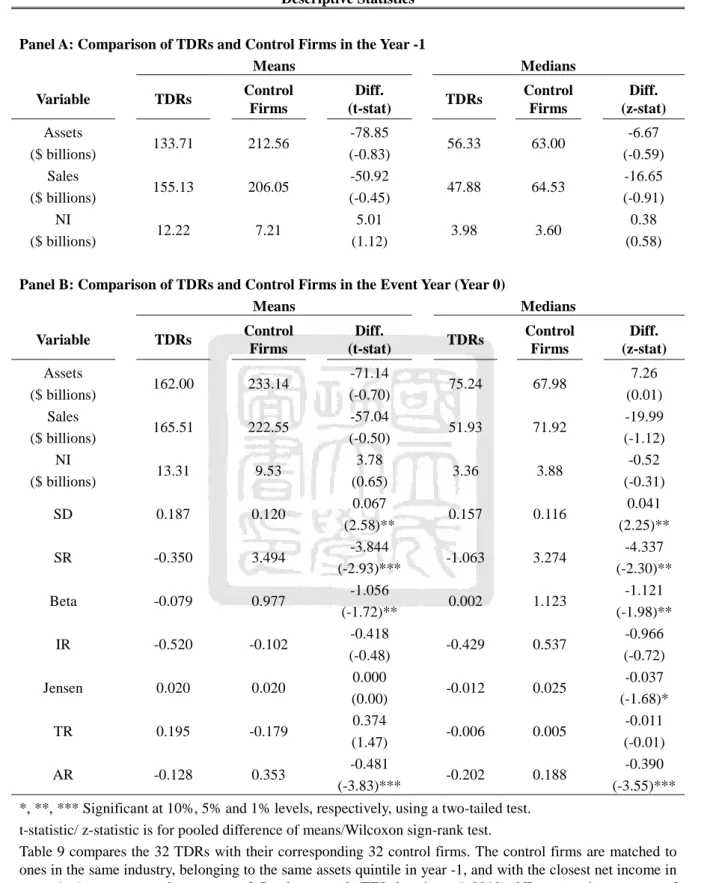

Table 9 Descriptive Statistics ... 43

Table 10 The Indices of Stock Performance for TDRs and Control Samples Following the Listing Years ... 47

Table 11 The Indices of Stock Performance for Full Samples Following the Listing Years ... 51

Table 12 The Indices of Operating Performance and Earnings management for TDRs and Control Samples around TDRs Listing ... 54

Table A-1 Market Capitalization of World’s Major Securities Markets ... 58

Table A-2 Market Capitalization/GDP of World’s Major Securities Markets ... 59

Table A-3 Price to Earnings Ratio of World’s Major Securities Markets ... 60

Table A-4 Turnover Rate of World’s Major Securities Markets ... 61

Table C-1 Rules on TDR Financial Statements ... 65

Table D-1 List of Matched Samples ... 69

Table E-1 The Indices of Stock Performance for TDRs and Control Samples Following 10 years of the Listing Years ... 71

Table E-2 The Indices of Stock Performance for Full Samples Following 10 years of the Listing Years ... 73

V

List of Figures

Figure 1 The Framework of this Study ... 6 Figure 2 The Depositary Receipts’ Issuance and Cancellation Procedures ... 11 Figure A-1 The Industrial Distribution of Listed Company Numbers in Taiwan in 2012 .. 62 Figure A-2 The Market Value Percentage of Taiwan Stock Held by Foreign Investors .... 63

VI

Appendices

Appendix A Summary of World’s Major Securities Markets... 58

Appendix B List of Foreign Stock Exchanges or Stock Markets Authorized by the Competent Authority ... 64

Appendix C Rules on TDR Financial Statements ... 65

Appendix D List of Matched Samples ... 69

Appendix E 10-year Stock Performance Following TDRs’ Listings ... 71

VII

1. Introduction

A depository receipt (DR), issued by depositary banks and held by custodian banks abroad, is a negotiable certificate that represents the ownership of a foreign stock, providing a more convenient way to achieve this than direct investments. For example, DRs are covered by local trading and settlement systems, and the dividends are paid to investors through depositary banks using local rather than foreign currency. However, a major disadvantage of DRs is the lack of sufficient and transparent information in comparison to that which available for domestic stocks, which may increase the risk faced by investors.

In addition, a number of high problems have been reported among the companies listed as Taiwan Depositary Receipts (TDRs). For example, BH Global Corporation Ltd.

(Stock Code: 911608) recognized a valuation loss of NT$67 million for a deception of the usage rights of 30 hectares of land that it purchased on Batam Island, Indonesia, in March, 2013.1 Another example is Oceanus Group Ltd. (Stock Code: 910579), an abalone seller. It received a disclaimer audit opinion from Deloitte & Touche because the auditors could not find supportive evidence in the substantive test for a large number of sudden deaths of abalones in 2011, which resulted in Oceanus’ delisting from Taiwan Stock Exchange (TWSE) on July, 2013.2 More recently, the Taiwan Financial Supervisory Commission found that Tingyi Holding Corporation (Stock Code: 910322), a beverages and instant food products supplier, issued TDRs to raise a total of NT$171 billion, of which NT$61 billion was used to obtain a 37% shareholding in the Taipei 101

1 See CNYES- http://news.cnyes.com/Content/20130329/KH6S5M3JI7VGI.shtml

2 See TWSE-

http://www.twse.com.tw/ch/about/press_room/tsec_news_detail.php?id=12018 Commercial Times-

http://m.md.ctee.com.tw/blogcontent.aspx?id=2759&pa=%2BRW%2FxEPpjhThX85A96gb2mZ1G NafloJiJ1dM9d8hXbU%3D

1

building and purchase nine mansions in Taipei. Such investments raised investor concerns as to whether Tingyi Holding Corporation really needed such financing, or if it just intended to speculatively invest in real estate.3 These examples motivate us to study this financial instrument-TDR.

The main reason why TDRs have attracted the attention of foreign companies and Asian financial analysts is the unique nature of Taiwan’s capital market, as seen in the following four characteristics. First, Taiwan is located in the center of the Asia-Pacific area and near the Chinese capital market, both of which represent geographical strengths.

Second, Taiwan’s capital market has outperformed other major capital markets around the world during the past decade, as seen in Figures A-1, A-2, A-3, and A-4 in Appendix A.

Although the market value of the Taiwanese stock market was only USD$735 billion in 2012, the ratio of market capitalization to GDP was fourth with regard to the major global capital markets, behind only to Hong Kong, Singapore and Malaysia.4 Moreover, the Price to Earnings ratios (P/E ratio) and turnover rates of the TWSE are also very attractive. For example, the P/E ratio of the TWSE was 18.04% in 2013, almost the same as that of the New York Stock Exchange. In addition, the turnover rate was 148.43% at the end of 2013, thus indicating very frequent stock trading on the TWSE. The third attractive characteristic of the Taiwanese market, as shown in Figure A-1, is the very high proportion (46.9%) of companies belonging to electronics industry in 2012, along with the presence of strong industrial clusters on the island.5 These clusters promote specialization and stimulate coordination and communication among firms, creating economies of scale and other benefits, such as greater economic growth and a more

3 See Taiwan News- http://www.taiwannews.com.tw/etn/news_content.php?id=2350264

4 We are unable to provide the 2013 Taiwan market capitalization to GDP ratio due to a lack of updates with regard to the TWSE database.

5 Industry clusters are groups of similar and related firms in a defined geographic area that share common markets, technologies, and employee skill needs, and which are often linked by buyer-seller relationships.

2

developed capital market. Finally, as shown in Figure A-2, the percentage of market value held by foreign investors has increased annually in recent years, reaching 33.14% by the end of 2013. In summary, it can be seen that Taiwan’s capital market has a number of features that make it attractive to foreign and offshore Taiwan companies, which are thus interested in listing on the TWSE.

TDRs, also known as secondary listings, are negotiable certificates issued by depositary banks in Taiwan, which represents a foreign stock’s ownership held in in custody by the bank abroad. TDRs offer several advantages for both issuers and investors.

For the issuers, the procedure of issuing TDRs is quick and easy, and the companies’

financial flexibility and visibility can be improved through issuance of these. Moreover, if a price difference exists between TDRs and their underlying stocks after the TDRs have been listed, shareholders may then revalue those companies, making their market value closer to their intrinsic value. For investors, TDRs provide a convenient and low cost way to invest in foreign stocks, with TDRs having the same rights as the underlying stocks.

Furthermore, cross-listed companies always have better corporate governance, due to dual supervision from the TWSE and their local stock exchanges, result in better investor protection. The first TDR (ASE Test Ltd., Stock Code: 9101) was listed on January 8, 1998. However, because there were many trade bans between Taiwan and Mainland China before 2008, hundreds of offshore Taiwan companies chose to list on the Hong Kong Stock Exchange (HKSE) rather than TWSE during 1998 and 2008.

Since 2008, many related policies have been gradually deregulated by the Taiwanese government, include the cancellation of investment ceilings in China, deregulation on the use of funds raised, more collaboration with foreign stock exchanges, and so on. Such moves gradually attracted more offshore Taiwan companies and foreign companies to list

3

as TDRs, with 57 companies having filed for the issuance of TDRs as of March 2014.6 Currently, there are 28 TDRs in the market, as shown in Table 1 (15 companies from Hong Kong, 10 from Singapore; two from Thailand, and one company from Malaysia).

Although many companies listed on the TWSE as TDRs from 2009 to 2011, in recent years there has been a rise in the number of delistings, and as of March 31, 2014, eight TDRs had left this market.7 Among the delisted firms, Want Want China Holdings Ltd., a beverages and instant food products supplier, delisted on October 15, 2013 astonished the market, since it was the TDR with the highest stock price and the best future prospects. This event led observers to note some potential problems that exist in the current TDR system. For issuers, the maintenance cost of the TDRs is high, as the TWSE imposes a 7% price ceiling and floor on the market, which is much stricter than that seen in many of the home markets of the TDR firms, with a limit of 30% in Malaysia and in Thailand, while there is no limit at all in Hong Kong and Singapore. This policy means that if the company releases good news then the TDR’s stock price will increase in a smaller range than its underlying stock, and thus the TDR presents at a discount. When such a discount exists, investors will have strong incentives to convert the TDR into its underlying stock in order to gain from the difference in prices. Such conversions make TDRs always have insufficient outstanding shares, and to maintain the status of being listed the issuers have to issue additional TDRs, which increases costs significantly. For investors, one problem with TDRs is the deferred information disclosure, as important information may be released later on the TWSE compared to the companies’ home markets, thus hurting the interests of investors.

6 See TWSE- http://www.twse.com.tw/ch/listed/listed_company/apply_listing_tdr.php?page=1

7 The delisted TDRs include ASE Test Ltd., Eastern Asia Technology Ltd., Mustek Ltd., Oceanus Group Ltd., Hwa Fong Rubber Public Company, Super Group Ltd., Want China Holdings Ltd., and ELPIDA Memory, Inc.

4

The purpose of this study is to investigate TDRs’ stock performance from 1998 to 2012 and to provide the related information to investors, the government, and the related authorities in order to help with their decision-making. We also examine the changes in operating performance before and after the listing year of TDRs, and whether these are related to earnings management via discretionary accruals. The results show that TDRs have lower stock performance compared to both the individual matched firms and the market, which supports the decision of the Taiwanese government to stop promoting TDRs on November 11, 2013. Moreover, the performance indicators obtained in this work can provide investors, the government, and related authorities with a more objective basis to make their decisions. We also find that TDRs’ operating performance (ROA and ROE) outperforms that of the individual matched firms before listings, but decreases significantly after listing on the TWSE. Finally, we fail to find supporting evidences for accruals earnings management surrounding the year of listing.

The rest of the paper is organized as follows: Section 2-1 gives an introduction of Depositary Receipts, Section 2-2 overviews the profile of TDRs, and Section 2-3 reviews prior research on TDRs. Section 3 discusses our predictions. Section 4 outlines our research design, defines the performance measurements, describes the matching procedure, and gives detail of the data. Section 5 then provides the empirical results of our research. Section 6 summarizes our findings and conclusions, and also present this study’s limitations and suggestions for future research. Figure 1 shows the framework used in this study.

5

Figure 1

The Framework of this Study

Research Background, Motivation, and Purpose

Institution and Literature Review 1. Introduction of Depositary Receipts 2. Overviews the profile of TDRs

Research Design and Measure Indices

Empirical Results

Conclusion

6

Table 1

Listed TDRs on March 31, 2014

Stock Code Company Name Home Market

MV of TDRs ($ NT million)

MV of Underlying Shares ($ NT million)

Trading Volume of TDRs (1000 shares)

Trading Volume of Underlying Shares

(1000 shares)

910069 Serial System Ltd. Singapore 115 2,944 0 320,000

9103 Medtecs International Corp. Ltd. Singapore 518 683 501 657,000

910322 Tingyi (Cayman Islands) Holding Corp. Hong Kong 2,064 489,750 325 8,943,000

910482 Sandmartin International Holdings Ltd. Hong Kong 499 1,373 396 90,000

9105 Cal-Comp Electronics (Thailand) Public Corp. Thailand 2,458 10,543 855 1,886,100

9106 New Focus Auto Tech Holdings Ltd. Hong Kong 255 7,546 101 5,808,000

910708 New Media Group Holdings Ltd. Hong Kong 88 881 3 215,000

910801 Golden Meditech Holdings Ltd. Hong Kong 954 0 5,659 10,384,000

910861 Digital China Holdings Ltd. Hong Kong 528 33,600 50 3,144,000

910948 Z-Obee Holdings Ltd. Singapore 118 1,800 47 30,000

9110 Vietnam Manufacturing and Export Process Holdings

Ltd. Hong Kong 234 1,770 95 175,000

911201 Kith Holdings Ltd. Hong Kong 115 722 0 NA8

911608 BH Global Corporation Ltd. Singapore 71 1,406 5 40,000

911609 Yangzijiang Shipbuilding (Holdings) Ltd. Singapore 588 100,378 71 11,637,000

8 Trading volume of underlying shares on March 31, 2014 is unavailable for Kith Holdings Ltd. in TEJ database.

7

Table 1

Listed TDRs on March 31, 2014

Stock Code Company Name Home Market

MV of TDRs ($ NT million)

MV of Underlying Shares ($ NT million)

Trading Volume of TDRs (1000 shares)

Trading Volume of Underlying Shares

(1000 shares)

911611 China Taisan Technology Group Holdings Ltd. Singapore 259 1,115 1,734 2,713,000

911612 Hu An Cable Holdings Ltd. Singapore 523 2,478 199 200,000

911613 Technics Oil & Gas Ltd. Singapore 139 3,970 17 240,000

911616 Dukang Distillers Holdings Ltd. Singapore 745 4,351 539 465,000

911619 HISAKA Holdings Ltd. Singapore 139 849 15 298,000

911622 Tycoons Worldwide Group (Thailand) Public Corp. Thailand 375 1,593 0 158,900

911626 Multi Sports Holdings Ltd. Malaysia 81 900 2 24,000

911868 Neo-Neon Holdings Ltd. Hong Kong 360 6,284 382 1,843,000

912000 SIM Technology Group Ltd. Hong Kong 163 3,785 56 3,290,000

912398 Good Friend International Holdings Inc. Hong Kong 456 3,871 53 10,000

9136 Ju Teng International Holdings Ltd. Hong Kong 2,948 25,238 3,195 4,539,000

913889 Global Sweeteners Holdings Ltd. Hong Kong 223 2,643 113 156,000

9157 Solargiga Energy Holdings Ltd. Hong Kong 331 4,689 172 8,530,000

9188 Yorkey Optical International (Cayman) Ltd. Hong Kong 227 2,740 55 940,000

Source: Taiwan Economic Journal Note: MV represents market value.

8

2. Institutional Background and Literature Review

2-1 Introduction of Depositary Receipts

The Nature of Depositary Receipts

International trading can be complicated because of the different regulations on securities, inconvenient payment of dividends, fluctuating foreign currency exchange rates, difficulties in obtaining information that may often be in a different languages, high commission fees, and so on. However, the demand for cross-national investments and financing have increased along with globalization. In consequence, many countries have relaxed restrictions on foreign companies’ investments and financing in their domestic markets, as well as those on domestic companies’ in foreign market. It was from such moves that Depositary Receipts (DRs) were developed.

DRs were created by J.P. Morgan for U.S. investors as a means of investment in British securities. A DR, issued by the depositary bank, is a negotiable certificate which represents the ownership of a foreign stock and is held by the bank in custody abroad.

After being registered with the local Stock Exchange, DRs can be traded as common stocks, providing a more convenient channel than direct investments in foreign stocks.

For example, DRs are applicable to local trading and settlement systems, while the dividends are paid to investors through depositary banks using local currency. Table 2 summarizes the advantages of DR programs for both issuers and investors.

9

Table 2

Benefits of Creating a DR Program For Issuers

Broaden and diversify a company’s investor base

Enhance a company’s visibility, status and profile internationally among institutional investors

Establish or increase global liquidity

Develop and increase market research coverage outside the home market

Get an international valuation

Offer a new avenue for raising equity capital

Meet internationally accepted corporate governance standards

For Investors

Easier to purchase and to hold than the issuer’s underlying shares

Trade easily and conveniently in domestic currency, and settle through domestic stock exchange

Facilitate diversification into securities of foreign issuers

Create accessibility of price, trading information and market research

Represent a way to provide international exposure for institutional investors despite restrictions against investing in certain countries or in foreign investment instruments

Eliminate unfamiliar custody safekeeping arrangements

Provide dividend payments in domestic currency and corporate notifications in local language.

Source: JP Morgan Global Depositary Receipts Reference Guide

Figure 2 shows five phases for the issuance and cancellation procedures of DRs. In the first phase of the issuance procedure, the investor calls their broker with an order to buy DRs. In the second phase, the broker can buy DRs from the international exchange on which they are trading. The broker can also purchase ordinary shares in the local market and convert them to DRs. If the broker chooses the latter approach, it will conduct

10

its trade via a local broker. The broker then notifies the depositary bank to expect the delivery of shares at the local DR custodian. The broker then requests the depositary bank to issue DRs to a specific account. In the third phase, the custodian credits the shares to the depositary bank’s account and notifies the depositary bank. In the fourth phase, the depositary bank issues DRs to the broker, subject to the investor’s payment of DR issuance fees. In the fifth phase, the broker delivers the DRs to the investor.

Likewise, in the first phase of the cancellation procedures, the investor calls broker with an order to sell DRs and delivers the DRs to the broker during the settlement period.

In the second phase, the broker sells DRs in the international exchange where they are trading or converts the DRs to the underlying shares, and then sells them in the local market. If the broker chooses the latter approach, the broker will conduct its trade via a local broker. The broker then delivers the DRs to the depositary bank. In the third phase, the depositary bank notifies the custodian for cancellation, subject to seller’s payment of DR cancellation fees. In the fourth phase, the custodian delivers shares, as instructed. In the fifth phase, the local broker receives shares and sells them on local market.

Figure 2

The Depositary Receipts’ Issuance and Cancellation Procedures

Source: JP Morgan Global Depositary Receipts Reference Guide

11

Types of Depositary Receipts

According to the different stock exchanges on which DRs are listed, they can be called American Depository Receipts (ADRs), European Depository Receipt (EDR), Global Depositary Receipt (GDR), Singapore Depositary Receipt (SDR), Hong Kong depositary receipt (HDR), and Taiwan depositary receipt (TDR), as shown in Table 3.

Table 3

Types of DRs by Listing Locations and Stock Exchanges

Types of DRs Listing Locations Listing Stock Exchanges

GDR

New York Europe

Asia

NYSE NASDAQ

Tokyo

London Luxembourg

Singapore

ADR New York

NYSE NASDAQ

EDR

London Luxembourg

London Luxembourg

Frankfurt

HDR Hong Kong Hong Kong

SDR Singapore Singapore

TDR Taiwan Taiwan

Source: Summary of Securities Issuance Practices

Another common classification of DRs is whether they are sponsored or unsponsored. If the DRs were initiated at the request of investors without the company’s authorization, then these are defined as unsponsored DRs. The individual consigners (which may be stockholders, banks, trust companies, security dealers, and so on) deposit their foreign shares in the custodian bank, and request the depositary banks to issue DRs

12

in the local market. The companies which issue the foreign stocks would be informed and asked to sign a no objection letter, but would not sponsor with the DRs. In contrast, sponsored DR are created by the issuance companies to raise funds or enhance visibility, and these pay the establishing and maintenance costs. The regulations on sponsored DR are stricter than on unsponsored ones. For example, the companies issuing sponsored DRs have to sign depository agreements with specified depository banks, and also need to provide periodic reports with regard to certain financial and policy information. Since the procedures of issuance and application are more complicated with sponsored DRs, and are examined more strictly by the related government bodies, this increases investor protection. Sponsored and unsponsored DRs are compared in Table 4.

13

Table 4

The Comparisons between Sponsored and Unsponsored DRs

Items Sponsored DRs Unsponsored DRs

Need agreement of DR companies

Required Not required, but have to inform the DR companies.

Applicants DR companies The individual consigners such as stockholders, banks, trust

companies, brokers, and so on.

Application documents Complicated Relatively simple

Contractual relationship The parties of the depositary agreement are the issuer and the depositary bank. The parties of the custodian agreement are the custodian bank and the depositary bank.

The depositary bank and custodian bank enter contracts of custody and delivery. The issuers do not enter such contracts.

Costs The issuance and cancellation fees are paid by the DR holders. The costs relate to the depositary bank or the custodian bank are paid by the DR companies.

All costs are paid by the DR holders.

The reports and notifications provide to the stockholders

All necessary information should be translated into the local language and sent to shareholders and the depositary bank, such as details of the annual meeting of shareholders, business reports, annual reports, and so on.

The business reports should be delivered to the depositary bank and custodian bank. The depositary bank has to decide whether the information from issuers is related to the rights of stockholders and needs to be translated into the local language.

The number of depositary bank Only one depositary bank Unlimited

The function of issuance The issuance can raise funds. The issuance cannot raise funds.

Source: Stock Market Theory and Practice/ Summary of Securities Issuance Practices

14

2-2 The Background of TDRs

Strict regulations on TDR listings during 1996-2008

The Taiwanese government has started to promote offshore Taiwanese companies and foreign companies being listed as TDRs on the TWSE in 1996, sending representatives to Kuala Lumpur in Malaysia and Silicon Valley in the United States to do this. In 1997, these promotional efforts extended to Singapore, and a further visits were also made to the United States. Due to those efforts, ASE Test Ltd. (Stock Code:

9101), a publicly held company in Singapore, became the first TDR on January 8, 1998.9 Although many Taiwanese companies listed on Hong Kong Stock Exchange (HKSE)10 were interested in a secondary listing on the TWSE, restrictions imposed on investments or financing with Mainland China made this difficult. There were three main restrictions on this, as follows. First, foreign companies that were more than 20% shares held by Chinese natural or legal persons, or substantially influenced by Chinese natural or legal persons, were not allowed to be listed on the TWSE. Second, the funds raised in Taiwan by foreign companies were not allowed to be directly or indirectly invested in China. Third, huge fines were imposed on Taiwanese natural or legal persons who invested in China and who delayed filings about these to the Investment Commission in the Taiwan Ministry of Economic Affairs. These limitations resulted that only four TDRs listed on the TWSE during the period 1999 to 2008, including those of Eastern Asia Technology Ltd. (Stock Code: 9102) listed on April 25, 2001, Medtecs International Corp.

Ltd. (Stock Code: 9103) listed on December 31, 2002, Mustek Ltd. (Stock Code: 9104)

9 See Cho, 2011, The market performance and issuing strategy of Taiwan depositary receipts

10 We focus on HKSE, but not other Chinese Stock Exchanges, because the HKSE is the only authorized stock exchange in Mainland China. The list of authorized stock exchanges is shown in Appendix B.

15

listed on January 20, 2003, and Cal-Comp Electronics Public Company Ltd. (Stock Code:

9105) listed on September 22, 2003. The following table summarizes the major events of TDRs before deregulation was carried out in 2008.

Year Major Events

1996

The government started to promote foreign companies and offshore Taiwan companies listing TDRs on the TWSE.

1998 The first TDR, ASE Test Ltd. (Stock Code: 9101) listed on the TWSE.

1999-2003 There were four TDRs listed on the TWSE.

2003-2008 There were no new TDRs listed on the TWSE.

The deregulation policies that increased TDR listings from 2008-2011

In order to meet the demands of greater globalization, the Taiwanese government started to deregulate TDRs in 2008, with the “Promoting overseas enterprises to list in Taiwan 123 Project”11 being announced on March 5, 2008. With regard to the term “123”

in this project, 1 represents promoting primary listing (F-shares) on the TWSE; 2 represents two markets for foreign and offshore Taiwanese companies to be listed on, namely the capital and over the counter market and the emerging market; 3 represents the following three advantages of TDRs: first, foreign enterprises and offshore Taiwanese companies will be closely tied to the Taiwanese market; second, the demands of investors will be met; and third, improved internationalization and competitiveness with regard to Taiwan’s capital market.

11 See TWSE- http://www.twse.com.tw/ch/listed/alien_business/download/plan.pdf

16

Thereafter, the authorities began to amend the related laws and regulations, with the Taiwanese Executive Authority approving the “Punitive Provisions for Illegal Licensing Investment in or Technical Cooperation with Mainland China”12 on March 11, 2008.

These lowered the fines imposed on offshore Taiwanese companies for make-up filing on investments in Mainland China.

The Taiwanese Executive Authority further approved the “Provision for Deregulation of Oversea Enterprise Listing on TWSE”13 on July 31, 2008. This removed the prohibition of foreign companies with more than 20% of their shares held by Chinese natural or legal persons, or substantially influenced by such persons, from being listed on the TWSE. This provision also lifted the restriction on the funds raised by foreign companies from the Taiwanese capital market being invested in China.

On October 27, 2008, the Taiwanese government relaxed the rules on stockholder equity, profitability, and mandatory dispersal of stock ownership for TDRs.14 The total amount of TDR stockholders’ equity was reduced from a minimum of NT$10 billion to NT$6 billion; the average amount of TDR earnings before taxes during the past two years was reduced from a minimum of NT$4 billion to NT$2.5 billion; and the requirement of dispersed of stock ownership for TDRs was cancelled. In the same year, the TWSE allowed foreign companies listing on the Hong Kong and Korean Stock Exchanges to file for TDRs.15 The following table summarizes major events in the deregulation of TDRs.

12 See Investment Commission, Ministry of Economic Affairs -

http://www.moeaic.gov.tw/system_external/ctlr?PRO=LawsLoad&id=16

13 See Mainland Affairs Council, Republic of China-

http://www.mac.gov.tw/ct.asp?xItem=67025&ctNode=5630&mp=1

14 See Taiwanese Executive Authority - http://www.ey.gov.tw/policy7/cp.aspx?n=418E479D85AAFFA3

15 The approved stock exchanges are shown in Appendix B.

17

Date Major Events in the deregulation ofTDRs

2008/03/05

Taiwanese Executive Authority passed “Promoting overseas enterprises to list in Taiwan 123 Project”.

2008/03/11

Taiwanese Executive Authority revised “Punitive Provisions for Illegal Licensing Investment in or Technical Cooperation with Mainland China”.

2008/06/27 TWSE approved Hong Kong Stock Exchange as a qualified stock exchange.

2008/07/31

Taiwanese Executive Authority passed “Provision for Deregulation of Overseas Enterprises Listing on TWSE”.

2008/09/11 TWSE approved the Korean Stock Exchange as a qualified stock exchange.

2008/10/27

The rules on stockholders’ equity, profitability, and mandatory dispersal of stock ownership were relaxed for TDR companies.

Due to these moves, the number of TDR listings increased significantly, and by December 31, 2011 there were a total of 35 TDRs listed on the TWSE (ASE Test Ltd.

delisted on July 14, 2008 and Eastern Asia Technology Ltd. delisted on January 17, 2011).

Table 5 summarizes the listing and delisting of TDRs since 1998, and it can be clearly seen that deregulation of this market attracted more offshore Taiwanese enterprises and foreign companies to issue TDRs.

18

Table 5

Change in Total Number of TDRs Listed on the TWSE

Year Number of Listing TDRs Number of Delisting TDRs

Total Number of TDR Firms Listed on the TWSE

1998 1 0 1

1999 0 0 1

2000 0 0 1

2001 1 0 2

2002 1 0 3

2003 2 0 5

2004 0 0 5

2005 0 0 5

2006 0 0 5

2007 0 0 5

2008 0 1 4

2009 10 0 14

2010 12 0 26

2011 10 1 35

2012 0 3 32

2013 0 4 29

2014/03/31 0 1 28

Source: Taiwan Economic Journal

The delisting trend of TDRs after 2012

MIn 2012 three TDRs were delisted, including Mustek Ltd. (Stock Code: 9104), Super Group Ltd. (Stock Code: 911606), and ELPIDA Memory, Inc. In 2013 another three TDRs delisted, namely Oceanus Group Ltd. (Stock Code: 910579), Hwa Fong Rubber Public Company Ltd. (Stock Code: 911602), and Want China Holdings Ltd.

(Stock Code: 9151). Most recent, and as of March 31, 2014, a further TDR, United

19

Envirotech Ltd. (Stock Code: 911610), had being delisted. Among these, Want Want China Holdings Ltd., a beverages and instant food products supplier, which delisted on October 15, 2013, was especially surprising, as it was the TDR with the highest stock price and the best prospects

There are two difficulties that TDR issuers face that may encourage them to delist.16 First, the maintenance cost of the TDRs is high, as the TWSE imposes a 7% price ceiling and floor on the market, much stricter than that seen in the home markets of the TDR companies, with 30% in Malaysia and Thailand, and no stock price fluctuation limit at all in Hong Kong and Singapore. If the company releases good news, the TDR’s stock price will increase within a smaller range than its underlying stock, which make the TDR presents at a discount giving investors a strong incentive to convert the TDR into its underlying stock and gain from the difference in prices. Such conversions then lead to insufficient outstanding shares being available for TDRs, and the related laws17 require TDRs to issue additional shares if they have had less than 10 million outstanding shares during the past three months. If within three months any additional issuance efforts are unsuccessful, the TDR will be compulsorily delisted from the TWSE. As a result, TDRs have significant costs with regard to maintaining their listing status. The second difficulty for issuers is the burdensome regulation following the delisting of ELPIDA Memory, Inc., on March 28, 2012, the Taiwanese government announced a new policy that requires that a TDR firm to repurchase all outstanding shares if they delist from the TWSE, making TDRs much unattractive to issuers.

For investors, the first problem that the level of information disclosure with regard to TDRs on the TWSE is often inconsistent with that in their home markets, and the

16 See Business Weekly - http://www.businessweekly.com.tw/KArticle.aspx?id=48509

17 See Operating Rules of the TWSE Corporation

20

resulting deferred disclosure can reduce their rights, as seen in the examples shown in Table 6. The other main problem is that TDRs have exemptions with regard to provide financial reports.18 If the home markets of the TDRs are Hong Kong or South Africa, they do not need to report first- or third-quarter financial statements, based on the regulations in their home countries. If the home markets of TDRs are Hong Kong, South Africa, Singapore or Malaysia, the first-quarter, third-quarter and semi-annual financial reports do not need to be audited or reviewed by certified public accountants, based on the regulations in their home countries. If the TDRs are registered with the Singapore Stock Exchange, the first-quarter and third-quarter financial statements need to be produced in accordance with the regulations of Singapore Stock Exchange.19

18 See Market Observation Post System- http://mops.twse.com.tw/mops/web/t132sb05

19 Appendix C provides details of the rules on TDR financial statements.

21

Table 6

Examples of Delayed Information Disclosure

Date Events

2009/08 Medtecs International Corp. Ltd. (Stock Code: 9103) received orders from Southeast Asian countries to produce 2 million isolation gowns in response to an outbreak of influenza, and buyers could raise their orders to 4 million units. The time gap in releasing this news on the Singapore and Taiwanese Stock Markets was one week.

2010/01/12 The underlying stock of Oceanus Group Ltd. (Stock Code: 910579) was suspended from trading in Singapore. However, this information was not announced on the TWSE, where the TDR stock price of the company even increased.

2010/08 Kith Holdings Ltd. (Stock Code: 911021) was suspended from trading on the Hong Kong Stock Exchange for releasing information that may affect its stock price. The news was announced at 10 am in Hong Kong, but announced at 1: 28 pm on the TWSE.

2010/10/20 Because of a delay in revealing important information, Mustek Ltd. (Stock Code: 9104) was judged as violating the regulations in relation to information disclosure, and was fined NT$50,000 by the TWSE.

2011/03/31 BH Global Corporation Ltd. (Stock Code: 9106) announced that the dividend of its TDR was $0.007 Singaporean dollar or NT$0.1635 per share, but the correct dividend was

$0.014 Singapore dollar or NT$0.327 per share. The correction was announced on April 10, 2011.

2011/04/26 Neo-Neon Holdings Ltd. (Stock Code: 911868) delayed filing the financial information required by the TWSE.

2012/07/27 olargiga Energy Holdings Ltd. (Stock Code: 9157) announced “predicted massive losses in the first half year” on the Hong Kong Stock Exchange, but the same news was not released on the TWSE until around 8 am July 30.

2013/02/06 Digital China Holdings Ltd. (Stock Code: 910861) provided false information in a case of government procurement, and was fined $3,918 yuan (about NT $16,000). It was then banned from government procurement for three years. Digital China Holdings Ltd. applied to suspend trading on the Hong Kong Stock Exchange, but this information was delayed for one hour before being released to the TWSE.

Sources: Law TW20, Liberty Times Net21/,UDN Money22, CNYES23

20 See

http://lawtw.com/article.php?template=article_content&parent_path=,1,1573,&article_category_id=204 9&job_id=177953&article_id=101473

21 See http://www.libertytimes.com.tw/2013/new/feb/7/today-e5.htm http://www.libertytimes.com.tw/2013/new/feb/7/today-e6.htm http://www.libertytimes.com.tw/2012/new/jul/31/today-e4-2.htm

22 See http://udn.com/NEWS/STOCK/STO2/5920731.shtml

23 See http://news.cnyes.com/Content/20101203/KCDDFNBI1CQFY.shtml

22

On November 11, 2013, the Taiwan Securities and Futures Bureau announced that because of the regulation24 requiring TDRs to maintain more than 10 million units of outstanding shares, seven TDRs had been delisted, and also that no companies had applied to issue TDRs in the previous two years. In addition, since the recent stock returns of TDRs had been poor, the authorities decided that although the system could continue, they would now encourage primary listings (F-shares)25 Instead of TDRs.

24 See Operating Rules of the TWSE Corporation

25 See Financial Manage of YAHOO-

http://tw.money.yahoo.com/news_article/adbf/d_a_131111_24_43znw

23

2-3 The Literature on TDRs

Because TDRs are a relatively unfamiliar investment instrument for investors and researchers, a number of studies have examined and summarized the history, regulations, and development if these instruments. Tai (2009) summarizes the deregulation of TDRs since 2008, while Chen (2010) summarizes the policies and problems in relation to Taiwanese companies that have operated in Mainland China and listed TDRs. Also, he compares the strengths and weaknesses of Taiwan’s capital market and those in Hong Kong, Singapore, Shanghai, and Shenzhen. Cho (2011) uses the methods of literature collection, foreign and domestic data collection, statistical analysis, and a cross-comparison of the literature and data, to analyze and summarize the DR conditions in the world’s major markets and the specific policies used in relation to TDRs.

Those studies provide comprehensive information about the development of TDRs, thus providing valuable insights to investors and enterprises.

Several studies compare TDRs with their underlying stocks. Liu and Huang (2011) use an event study approach and compare ten TDRs listed in 2009 with their underlying stocks, using abnormal returns, and the market risk, and examine the causal relationships.

The results show that underlying stocks have more significant abnormal returns at the TDRs’ announcement dates than the listing dates. Besides, compared to the underlying stocks, TDRs have higher returns and higher risks. The results of the causal analysis indicate that the underlying stock price impacts the TDR stock price, but that the reverse is not true. Finally, they recommend the waiting trading strategy with TDRs in order to achieve the anticipated profits. Huang (2011) examine the impact on the underlying stock from the issuance of a TDR using an event study. The results show that positive abnormal returns exist at the announcement date, but not significant at the approval date by Taiwan

24

Financial Supervisory Commission or listing date. He also finds that the price of the underlying stocks declined after the TDR listing, which indicates that the positive abnormal returns at the announcement date may due to speculation by investors, rather than any fundamental factors.

Some studies examine the determinants of the TDR stock price. Ji et al. (2012) examine three such factors, which are its underlying stock price, the currency exchange rate, and the Taiwan Weighted Stock Index, focusing on the TDRs issued by Hong Kong-listed companies. The results show that the underlying stock return and the Taiwan Weighted Stock Index are significant variables that affect the TDR stock price, but the currency exchange rate does not. Consistent with Ji et al. (2012), Umano (2013) examines TDRs samples by including the home markets in Hong Kong and Singapore.

He examines underlying stock price, price index on the original market, TWSE price index, and exchange rate, and how these affect the returns of TDRs. The results show that only the underlying stock price and TWSE price index have any moderately or weakly positive correlations with the price of TDRs.

A review of these earlier studies shows that, to date, no works have used multiple indicators to assess the stock and operating performances of TDRs, instead only examining TDR stock returns or abnormal returns. In addition, most studies have rather limited sample sizes and sample periods due to their specific research purposes, which might decrease the validity of the results with regard to all TDRs. To addresses these weaknesses, our study uses seven common indicators to evaluate TDRs stock performance and two operating performance measures. We also include 36 TDRs in our full sample tests, and 32 TDRs as our matched samples. The study period is from 1997 to 2012, including all the TDR information available in the Taiwan Economic Journal (TEJ) database at the time of writing.

25

3. Predictions

Prediction on the Stock Performance of TDRs

As noted earlier, the two main problems with regard to TDRs, from the perspective of investors, are deferred information disclosure on the TWSE, and exemptions from the timely filing of financial reports. Both of these issues may deter investors, and cause the stock performance of TDRs to underperform the market.

ADRs have similar disclosure regulations with regard to financial reports as TDRs.

The U.S. Securities and Exchange Commission (SEC) mandates disclosure practices on ADRs based on the Securities Act of 1933 and Securities Act of 1934. While U.S.

companies must file financial reports quarterly, the interim reports of ADRs are filed in accordance with the law of its domicile country, which is typically on a semi-annual basis.

Under the same status as TDRs, some studies find that ADRs underperform their benchmark firms. For example, Foerster and Karolyi (2000) examined the long-run performance of ADRs between 1982 and 1996, and find that ADRs from countries in Asia, Latin America, and Europe under-perform benchmark firms after issuance.

Likewise, Schaub (2003) reports that ADRs from Latin America, Europe, and the Asia Pacific underperformed the S&P 500 index in the first month of issuance between January 1987 and May 1998. For the three-year holding period after issuance, Latin American ADRs underperformed the S&P 500 index by nearly 30%, European ADRs by 8%, and Asia-Pacific ADRs by 23%.

Based on these earlier studies, we thus predict that the TDRs’ stock performance will underperform that of Taiwanese listed companies.

26

Prediction on the Operating Performance of TDRs

Several studies investigate whether there is a significant decline in operating performance after firms go public. Jain and Kini (1994) find that both the operating return on assets and operating cash flows deflated by assets of IPO firms decline relative to their pre-IPO levels. Mikkelson, Partch and Shah (1997) provide evidence that the operating return on assets and operating profit margin of IPO firms fall in the year after going public. The results in Lee and Lo (2002) also indicate a significant decline in return on equity of IPO firms after going public. Those studies provide supportive evidence that IPO firms have significant declines in operating performance after going public. Based on these earlier works, we consider whether there are similar results for secondary listings, and thus whether the operating performance of TDRs declined after they listed on the TWSE.

In contrast, Charitou and Louca (2009) provide evidence that ADRs have statistically significant improvements in operating performance after listing, relative to both non-cross-listed matched firms, and the pre-listing period. The indices of operating performance they examine include operating return on assets and operating profit margin.

Due to the conflicting results of earlier studies, we do not make a specific prediction with regard to the operating performance of TDRs.

27

4. Research Methodology

4-1 Research Design

The research is carried out in three parts, as follows. In the first, we examine matched TDRs’ stock performances after they listed, and compare the stock performances of matched TDRs with those of the matched stocks listed on the TWSE. Following previous studies26, we use seven indicators that are commonly used by financial analysts and investors to measure financial performance, as described in the following section. We perform a matching procedure to compare the indicators of TDRs and those of their counterparts. We match each TDR with a listed firm in the same industry (based on the industry classification system of the Taiwan Economic Journal) at the end of the year prior to listing (defined as year -1) in order to control for potential operating risks. We then match the sample firms belonging to the same total assets quintile in year -1 to control for potential size effects. Finally, a TDR is matched with its counterpart according to the closest net income in year -1 to control for profitability across firms.

In the second part, we examine the stock performance of full TDRs sample after they listed, and compare it with that of the market.

In the third part, we examine the relation between TDRs’ operating performance and earnings management from year -2 to year 2. The indices of operating performance are return on assets and return on equity, and the index of earnings management is the cross-sectional Jones (1991) model adjusted for lagged return on assets (Kothari 2005), which is used to estimate discretionary accruals.

26 Sharpe (1966), Treynor and Black (1973), Jensen (1968), and Treynor (1966).

28