1. Introduction

The IPCC AR5 (the fifth assessment report of the Intergovernmental Panel on Climate Change) stated that the human influence on the climate system is clear, and recent anthropogenic emissions of greenhouse gases (GHG) have been shown to be the highest in history. Recent climate changes have had widespread impacts on human and natural

systems (IPCC, 2014a). Annual anthropogenic GHG emissions increased by 10 GtCO2eq between 2000 and 2010, with this increase mainly coming directly from the energy supply sector (47%).

The IPAT and Kaya1 decomposition analysis in the IPCC AR5 (IPCC, 2014b) illustrated that the increased use of coal relative to other energy sources between 2000 and 2010 has reversed the long-standing trend of gradual decarbonization

Volume 6, No. 4, December 2019, pp. 411-424

The Impacts of Rising the Share of Renewable Energy in Electricity to Economic Growth and Carbon Emissions

in High Income Economies

Yen-Lien Kuo

1*Chun-Li Tsai

2Jhe-Ming Guo

3ABSTRACT

This paper is to investigate how the nuclear and renewable power affects economic growth and the environment. Our samples focus on high income and OECD (Organization for Economic Co-operation and Development) economies, and totally 29 countries from 1990 to 2012. We use the difference generalized method of moments (GMM) to estimate the effects of nuclear and renewable power on economic growth and CO2 emissions. The results provide us a threshold percentage, 18.66%, on the effect of renewable energy, that is, below 18.66% of non-hydro renewable energy used to supply electricity, an increase on using renewable energy can increase economic growth and can reduce CO2 emissions. Nuclear power can reduce CO2 emissions without threshold. The environmental Kuznets curves (EKCs) of CO2 existing in high income and OECD economies are subject to the same industrial structure. That means that higher incomes may result in a higher demand on environmental quality and the adoption of stricter environmental and/or energy policies.

Keywords:

renewable energy, CO2 emission, economic growth, environmental Kuznets curve.JEL:

O13, O44, Q43, Q54, Q56Received Date: February 18, 2019 Revised Date: April 10, 2019 Accepted Date: May 15, 2019

1 Associate Professor, Department of Economics, National Cheng Kung University.

2 Professor, Department of Economics, National Cheng Kung University.

3 Master, Department of Economics, National Cheng Kung University.

* Corresponding Author, Phone: +886-6-2757575#56327, E-mail: yenlien@mail.ncku.edu.tw

1 The IPAT (Ehrlich and Holdren, 1971) and Kaya (Kaya, 1990) identities provide two common frameworks in the literature for analyzing emission drivers by decomposing overall changes in GHG emissions into underlying factors. The Kaya identity is a special case of the more general IPAT identity. The IPAT identity decomposes an impact (I, e. g., total GHG emissions) into population (P), affluence (A, e. g., income per capita) and technology (T, e. g., GHG emission intensity of production or consumption). The Kaya identity deals with a subset of GHG emissions, namely CO2 emissions from fossil fuel combustion. The Kaya identity for territorial CO2 emissions can be written as:

Territorial CO2 emissions = population × (GDP/population) × (Energy/GDP) × (CO2 emission/Energy)

of the world’s energy supply. Decarbonizing (i.

e. reducing the carbon intensity of) electricity generation is a key component of mitigation strategies intended to achieve low-stabilization levels. The low-carbon electricity supply comprises renewable energy, nuclear power and CCS (carbon capture and storage). Since large-scale CCS has not been commercialized, renewable and nuclear energy mainly consists of the low-carbon electricity supply.

Renewable energies, such as solar photovoltaics and wind power, and nuclear energy emit no carbon dioxide and other air pollutants during the generation of electricity, therefore, renewable energy supposedly can reduce carbon emissions and improve air quality. However, two of Apergis’

studies (Apergis and Payne, 2014; Apergis et al., 2010) found that renewable energy increases carbon emissions. Their studies used “per capita renewable energy consumption” as an indicator on the econometric specifications and that cannot clearly separate the effects of total energy consumption and the share of renewable energy.

Besides, most countries set their renewable energy policy by regulating the ratio of renewable energy to the total electricity supply or total energy consumption by electricity supply companies, i.e., renewable portfolio standard (RPS) or Renewable Electricity Standard (RES). Thus, those measurements on the previous studies are not consistent with the actual energy policy. Here, we improve the earlier efforts by using the share of renewable energy in electricity to examine the effect of energy on economic growth and CO2, emissions.

Although the global agreement on mitigation [the Paris Agreement of the United Nations Framework Convention on Climate Change (UNFCCC)] had been achieved, the intended

nationally determined contributions (INDCs) of that is not like the strict commitments of the Kyoto Protocol, and there are fewer parties committed to the second commitment (2013-2020) of Kyoto Protocol. Comparing with nuclear energy, renewable energies, such as solar photovoltaics and wind power, are emergent industries and developing them is supposed to foster economic growth. However, the cost of electricity derived from most renewable energy sources is higher than the wholesale electricity price (OECD/IEA, 2014).

The marginal full cost of raising electricity supply from renewable energy is surely increased. This causes our concerns on the economic impact of using renewable energy to mitigate climate change.

Although the renewable energy emits no carbon dioxide during power generation, its emission is not zero in the whole lifecycle due to the emissions from infrastructure and supply chain (Schlömer et al., 2014). The output of certain renewable electricity generation technologies, such as wind and solar PV, is intermittent and dispatchable.

Growing shares of renewables will require modifications to the operation of the system and market, and eventually additional flexible reserves, in order to ensure system security is not impaired (OECD/IEA, 2010). The additional reserve margin may be provided by fossil fuels, such as coal, oil and natural gas, which generate carbon dioxide.

In this paper, we mainly concern how nuclear power and renewable energy affect economic growth and CO2 emissions for high-income economies. Most previous studies separately estimate the effect on economic growth from nuclear power and renewable energy, respectively.

Our study will improve the previous studies by using GMM model to simultaneously estimate the effect of nuclear and renewable energy on economic growth and CO2 emissions. Besides,

our model will obtain the a threshold percentage to provide us to understand whether the relatship between economic growth (CO2 emissions) and renewable energy is different above (below) this threshold value. Based on our econometric specifications, we can examine whether the growing shares of renewable energy for electricity supply always positively affect economic growth and carbon emissions.

2. Literature Review

Based on the nationwide and/or multi- national data, there is an abundance of literature discussing the relationship between energy, carbon emission and economic growth, and income and environment, but the previous literature less

investigates the effect of renewable energy on the carbon emission. Next section, we review the literature related to energy, GHG emission and economic growth, and subsequently review the literature related to income and the carbon emission.

2.1 The relationships between energy, GHG and economic growth

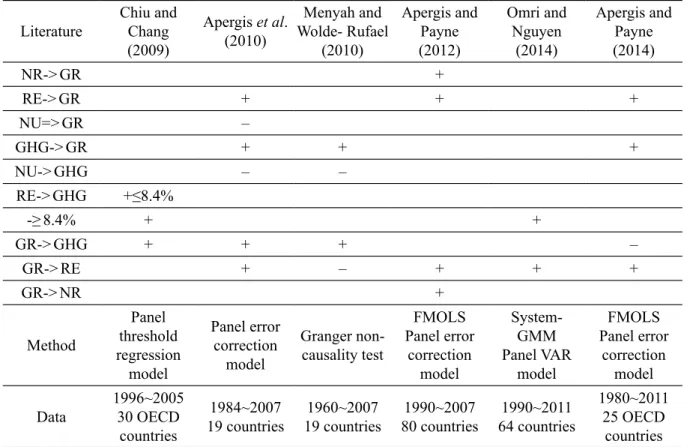

The literature on the relationships between energy, GHG and economic growth is summarized in Table 1. Apergis et al. (2010) found that consuming nuclear power decreases economic growth while adopting renewable energy increases economic growth. The other two papers - Apergis and Payne (2012, 2014) - also indicate that using renewable energy can increase economic growth.

Table 1. The Relationship between energy and economic growth (by authors)

Literature Chiu and Chang (2009)

Apergis et al.

(2010)

Menyah and Wolde- Rufael

(2010)

Apergis and Payne (2012)

Omri and Nguyen

(2014)

Apergis and Payne (2014)

NR->GR +

RE->GR + + +

NU=>GR ‒

GHG->GR + + +

NU->GHG ‒ ‒

RE->GHG +≤8.4%

-≥8.4% + +

GR->GHG + + + ‒

GR->RE + ‒ + + +

GR->NR +

Method

Panel threshold regression

model

Panel error correction

model

Granger non- causality test

FMOLS Panel error

correction model

System- Panel VAR GMM

model

FMOLS Panel error

correction model Data 1996~2005

30 OECD countries

1984~2007

19 countries 1960~2007

19 countries 1990~2007

80 countries 1990~2011 64 countries

1980~2011 25 OECD

countries Note: (a.) NR: Non-renewable energy; RE: Renewable energy; NU: Nuclear power; GHG: Greenhouse

Gas; GR: Economic growth; FMOLS: Fully Modified Ordinary Least Squares; VAR: Vector Autoregressions.

(b.) +: increases; ‒: decreases.

Menyah and Wolde-Rufael (2010) pointed out that nuclear power can reduce carbon emissions.

On Table 1, we find two studies provide the evidence renewable energy increases carbon emissions (Apergis and Payne, 2014; Apergis et al., 2010). However, Chiu and Chang (2009) indicated that the use of renewable energy increases carbon emissions when the use of renewable energy is less than 8.4% of the total energy supply, on the other hand, it will decrease carbon emissions when the use of renewable energy is more than 8.4% of the total supply. Thus, the impact of using renewable energy on GHG emissions has been inconsistent in previous literature. The impact of using a specific kind of energy may have diminishing marginal returns, and we need to set the quadratic terms to capture these effects. It motivates us to estimate the threshold percentage of renewable energy to supply electricity on the effect of economic growth and CO2, emissions.

Seeing Table 1, Apergis and Payne (2012) found that increased use of non-renewable and renewable energy will promote economic growth and that economic growth will increase the use of both non-renewable and renewable energy.

Many studies have found that more developing countries increases the consumption of renewable energy (Apergis et al., 2010; Apergis and Payne, 2012; Omri and Nguyen, 2014; Apergis and Payne, 2014). Many papers have found that there is positive inter-correlation between GHG emissions and income or economic growth, with the exception of Apergis and Payne , who indicated that economic growth can decrease GHG emissions. The literature shows that energy use has a high correlation with both GHG emissions and economic growth. The endogeneity of energy, economic growth and GHG should be treated in order to estimate the pure effects of energy.

We use the difference generalized method of moments (GMM) model to deal with problems of endogenous explanatory variables and time- varying omitted variables to estimate the effect of renewable energy on economic growth and CO2

emissions.

2.2 The relationship between income and carbon emission

The environmental Kuznets curve is a hypothesized relationship between environmental quality and economic development: various indicators of environmental degradation tend to get worse with economic growth until income reaches a specific point over the course of development.

Traditional EKC empirical research only estimates the relationship between per capita income and the concentration, the amount of a pollutant or the index of pollutants. If the coefficient of per capita income is positive but is negative for the quadratic income, the reverse U shape (EKC) between income and the pollutant is verified. The environmental Kuznets curve (EKC) literature on CO2 emissions is reviewed in Table 2. Many papers have found that EKC exists in GHG/

CO2 emissions, particularly in high and middle income countries (Huang et al., 2008a; Heerink et al., 2001; Cho et al., 2013; Huang et al., 2008b;

Ibrahim and Law, 2014). There have been some non-traditional EKC studies, such as Fujii and Managi (2013) and López-Menéndez et al. (2014), using the cubic income to explain CO2 emission, which found the coefficient of cubic income to be positive. The non-linear relationship between income and environmental quality was not revealed in previous studies of renewable energy, such as papers cited in Table 1.

EKCs are usually explained by the fact that at higher incomes, the economy relies more

on service industries that are less polluted and/

or demands for higher environmental quality by adopting more environmental protection policies. For example, De Bruyn (1997) found that environmental policy, fostered by international agreements, gives a better explanation of why Sulphur dioxide emissions move downward at high income levels. Since energy consumption is the source of combustible carbon emissions, the energy policy should be a major part of mitigation policies.

Concerning to the effect of renewable energy to economic growth, Apergis et al. (2010) and Apergis and Payne (2014) are causal relationship examination which cannot control factors of production, such as labor and capital, and Apergis and Payne (2012) which is like all studies in Table 1 use total or per capita renewable energy consumption to evaluate rather than use the share of renewable source in electricity which has direct policy implication. Traditional EKC studies (Table 2) only analyzed the relationship between income and an environmental indicator that makes they

cannot analyze the effects of energy, environmental policies or industrial structure changes. The impact of both low-carbon energy for electricity supply – nuclear power and renewable energy - on economic growth based on growth theory was reexamined in this paper.

According to the literature review, we propose two hypotheses as follows:

Hypothesis 1: The percentage of renewable energy to the electricity supply significantly increases economic growth which is measured by the change of GDP(Gross Domestic Product) per capita.

Hypothesis 2: The percentage of renewable energy to the electricity supply significantly lower CO2 emissions (metric tons per capita).

3. Methods and Data

This section describes the model, empirical econometric specifications, data, and provides definitions of the variables. It also describes the model that is used to analyze the influence of the Table 2. The relationship of income and GHG/CO2 emissions (by authors)

Heerink et al.

(2001) Huang et al.

(2008a) Huang et al.

(2008b) Shaw et al.

(2010) Cho et al.

(2013) Ibrahim and Law (2014)

Y->CO2 + + + + + +

Y2->CO2 ‒ ‒

- (Belgium, Canada,

Greece, Iceland, Japan,

Netherlands and the US)

‒ ‒ ‒

Method

Sys- and Diff- Panel VAR GMM

model

System-GMM Panel VAR

model OLS Panel OLS FMOLS Sys- and Diff-

GMM

Data 1960~1990

149 countries. 1971~2002 82 countries

1971~2003 41 countries

and EU

1992~2004 China

1971~2000 22 OECD

countries

2000~2009 72 countries Note: Y: inome; HI: high income counties; LI: low income countries; OLS: Ordinary Least Squares.

renewable energy on per capita income (economic growth) and CO2.

3.1 Models

Based on the exogenous and endogenous growth models, the per capita capital and the expenses related to research and development (R&D) are key factors related to economic growth.

If the production functions is a Cobb-Douglas function, it can be written as follows:

Yt = AKtα Lt1‒α, 0 < α < 1. (Eq.1) That is, there are constant returns to scale on production. On the other hand, price levels and wages are assumed to be variable; the quantity of labor at full employment as well as labor and capital are substitutable for each other, and there exists technical progress. When both sides in the above equation are divided by L, and then the equation is rewritten as

yt=Aktα , (Eq.2) where yt=Yt ⁄Lt , kt=Kt ⁄Lt . y and k denote the output per labor and capital per labor, respectively.

Assume that the population is a proxy of labor force. They become output and capita per capita.

Since most physical capital cannot work without energy, many studies have analyzed its relationship with economic growth, such as the studies of Menyah and Wolde-Rufael (2010), Apergis and Payne (2012) and Apergis and Payne (2014). The endogenous growth model proposed by Romer (1986), Lucas (1988), etc. holds that investment in human capital, innovation, and knowledge are significant contributors to economic growth. The energy and the expenses related to research and development are adopted as independent variables in the economic growth model. Concerning the demand for environmental

quality, the income and the price/cost of energy are independent variables based on the economics theory.

Two econometric specifications are estimated in this paper, which includes concerning the economic growth and CO2. The global data comes from the World Bank's World Development Indicators (WDI). UNFCCC requires signed countries to return either individually or jointly to their 1990 levels of anthropogenic emissions of carbon dioxide, and the first commitment period of the Kyoto Protocol was set to be from 1998 to 2012. In order to fully consider climate change mitigation efforts and the completeness of data on dependent variables, the data used for estimating the econometric specifications covers the period from1990 to 2012.

Econometric Specification 1:

Economic Growth

Firstly, we estimate the effects of nuclear and renewable power on economic growth, with the econometric specification set as follows:

ln(yi, t ) = β1 ki, t + β2 R&Di, t + β3 ei, t + β4 Ni, t + β5

Ni, t + β6 Ri, t + β7 Ri, t + β8 Pi, t + β9 KPt

+ ηi + υi, t , (Eq.3)

where i is country; y denotes GDP per capita; k denotes capital per capita; R&D (research and development) denotes the ratio of research and development to GDP, that is a measure of the degree of investment in research and development of a country and represents the technical factor;

e denotes the energy consumption per capita. N denotes the percentage of the nuclear power to total electric power consumption, and R is the percentage of renewable energy to the electricity supply. We also use the quadratic term of N and R to capture their non-linear relationship with GDP

per capita. P is the price of electricity. Then, the quantity, quality (source) and the price of energy and electricity are all considered. KP denotes the first Kyoto Protocol commitment period. KP is “1”

for the Annex I countries from 1998 to 2012. In Eq.3, ηi is an unobserved individual fixed effect, υi, t is a regression error. Since the first difference estimation method is adopted, the estimation of GDP per capita can be regarded as economic growth.

Econometric Specification 2: CO

2We use Eq.4 to estimate the impact of nuclear and renewable power on CO2 emissions.

lnCO2i, t = β1 lnyi, t + β2 lnyi, t + β3 R&Di, t + β4 Ni, t

+ β5 Ni, t + β6 Ri, t + β7 Ri, t + β8 Agi, t + β9

Sei, t + β10 Pi, t + β11 KPt +ηi+υi, t , (Eq.4) where CO2 denotes emissions per capita. Our econometric specification includes the one term, lny, and the second term, lny2, which capture the impact of income on carbon emissions. If the coefficient of lny is positive, and the coefficient of lny2 is negative, this means that the curve of income and CO2 is an inverted-U relationship where the increase in income will finally reduce CO2 emissions per capita. The income is the dependent variable of Eq.3, but Eq.3 and 4 are not sequential or hierarchical equations because both are estimated by panel data rather than one country. R&D, N and R, and their quadratic terms are the same as those in the Econometric Specification 1: economic growth. N and R are independent variables of Eq.3 but Eq.3 and 4 are not simultaneous equations because they are only a part of electricity sources and they are not decided

to optimize economic growth and carbon emissions at the same time. Two major sectors – agriculture and service – were added into the Econometric Specification 2: CO2 to control the industrial structure of the economy. Ag denotes the added value of the agriculture sector to the GDP ratio, and the agricultural sector is in accordance with the international standard industrial classification (ISIC) category sectors 1-5. Se denotes the added value of the services sector to the GDP ratio, where the services sector is in accordance with ISIC 50- 99.

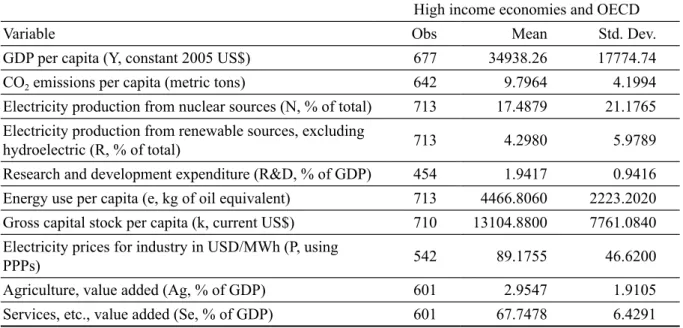

3.2 Data

The data of WDI is used to estimate the econometric specifications. The World Bank classified the world’s economies based on estimates of gross national income (GNI) per capita. Since the data of electricity price, i.e.

P in Eq. 3 and 4, is only available for OECD countries from IEA (International Energy Agency), econometric specifications are estimated for high income and OECD countries2. The classification of economic development of 2013 is adopted herein.

The GNI per capita for high income economies is higher than $12,616. The descriptive statistics of the variables are reported in Table 3. The GDP per capita has been converted to constant 2005 US$, and the CO2 emissions (metric tons per capita) are those stemming from the burning of fossil fuels and the manufacture of cement.

Although hydroelectric power is currently one of the major sources of renewable energy, hydropower was developed completely in the past in OECD countries (OECD/IEA, 2013). Thus, renewable energy growth in OECD countries can

2 Australia, Austria, Belgium, Canada, Chile, Czech Republic, Estonia, Finland, France, Germany, Greece, Ireland, Israel, Italy, Japan, Rep. of Korea, Luxembourg, Netherlands, New Zealand, Norway, Poland, Portugal, Slovak Republic, Slovenia, Spain, Sweden, Switzerland, United Kingdom, and United States.

be expected to be contributed by non-hydraulic renewable energy. The commercial use of nuclear power is all dedicated to the generation of electricity. In order to compare nuclear power and non-hydraulic renewable energy, electricity production from these two sources is adopted in this paper. Since the costs of these two energies are widely different, the price of electricity should be included. This paper, therefore, adopts the electricity price stated in the Energy Prices and Taxes (IEA, 2014). Since the industrial demand for electricity is greater than that of households alone, the industrial electricity price is adopted.

Based on the suggestion of Maddala and Wu (1999), the Fisher-type unit-root test is used for the two dependent variables. The results show that at least one panel of logged per capita GDP and CO2 emissions are stationary at a 1% degree of significance.

3.3 General methods and moments model (GMM model)

The literature review indicates that there might be an endogeneity between energy and income

(economic growth). The national endowment of renewable energies such as solar and wind power may be different and time-varying. In order to solve the problems of endogenous explanatory variables as well as omitted time-varying variables, we use the generalized method of moments (GMM) econometric model to estimate the effects of nuclear and renewable power on the CO2 emissions and economic growth.

The use of Arellano-Bond Dynamic GMM Estimators is applied to analyze our panel regression. In general, the basic model to generate data can be described as follows:

yit =αyi, t‒1 +xitβ + εit

εit =μi +vit

E[μi ]=E[vit ]=E[μi vit ]=0 (Eq.5) Here, the disturbances in the above equation are composed of the fixed effects, μi , and the error term of white noise assumption, vit . In this paper, we employ a first differencing GMM model as derived by Arellano and Bond (1991) and Arellano and Bover (1995) is used to eliminate fixed effects.

Table 3. Descriptive statistics (by authors)

High income economies and OECD

Variable Obs Mean Std. Dev.

GDP per capita (Y, constant 2005 US$) 677 34938.26 17774.74

CO2 emissions per capita (metric tons) 642 9.7964 4.1994

Electricity production from nuclear sources (N, % of total) 713 17.4879 21.1765 Electricity production from renewable sources, excluding

hydroelectric (R, % of total) 713 4.2980 5.9789

Research and development expenditure (R&D, % of GDP) 454 1.9417 0.9416 Energy use per capita (e, kg of oil equivalent) 713 4466.8060 2223.2020 Gross capital stock per capita (k, current US$) 710 13104.8800 7761.0840 Electricity prices for industry in USD/MWh (P, using

PPPs) 542 89.1755 46.6200

Agriculture, value added (Ag, % of GDP) 601 2.9547 1.9105

Services, etc., value added (Se, % of GDP) 601 67.7478 6.4291

∆ yit =α∆yi, t‒1 +∆xitβ+∆vit (Eq.6)

The lagged variable was chosen as the instrument variable.

4. Empirical Results

The GMM model is used to estimate three econometric specifications for high income and OECD economies. Both logged and non-log dependent models are estimated using the GMM, where the significant variables are the same.

Since the logged per capita GDP and CO2 models have more significance, the logged per capita income and CO2 are reported. All of the models passed the Sargan test with at least a 5% degree of significance, which means the instruments are appropriate. The results are elaborated as follows:

4.1 Economic Growth

The estimation result of the logged GDP per capita is shown in Table 4. The coefficients of lagged GDP per capita, R&D ratio, per capita total energy use (e) and capital (k) are significantly positive as expected. The coefficients of the share of nuclear power (N) and its quadratic term are not significant. This indicates the use of nuclear power for electricity supply will not significantly increase economic growth. The coefficient of the share of non-hydraulic renewable energy (R) is, 0.0268, significantly positive, and the coefficient of its quadratic term is, -0.025, significantly negative.

Our empirical results support Hypothesis 1. Since the GMM estimation in our paper is assumed to be linear, we can estimate the effect of the threshold percentage of the share of non-hydraulic renewable energy on economic growth. Our results find one threshold percentage of the share of non-hydraulic renewable energy is 18.66%. It indicates that

below 18.66%, an increase in the percentage of renewable energy significantly increases economic growth. The coefficient of the Kyoto Protocol is not significant. This means that the Kyoto mechanisms for climate change mitigation will not hinder economic growth. The coefficient of industrial electricity price is significantly negative.

This indicates higher electricity prices reduce economic growth.

4.2 CO

2The first column of Table 5 reports the impact of energy on CO2 emissions. The coefficient of logged income and its quadratic term are significantly positive (19.8775) and negative (-0.9073), respectively. The income Table 4. The Impact of nuclear and renewable energy

on economic growth (Eq.3) (by authors) Ln(y)

Ln(y(t-1)) 0.5431***

(0.0530)

R&D 0.0808*

(0.0510)

e 0.0001***

(0.0000)

k 0.0006***

(0.0000)

N -0.0015

(0.0070)

N^2 0.0001

(0.0001)

R 0.0268***

(0.0076)

R^2 -0.0025**

(0.0002) turning point 18.66%

P -0.0012***

(0.0004)

KP -0.0164

(0.0100)

Sargan test: chi2(22) = 32.13, Prob > chi2 = 0.075

***P < 0.01, **P < 0.05, *P < 0.1.

(GDP per capita) in Econometric Specification 2 is an independent variable because the GMM estimation eliminates endogeneity and omitted time-varying variables problems. That means the carbon emissions and income had an inverted U relationship, i.e. EKC. The Kyoto Protocol can significantly reduce carbon emissions. Since two major industrial sectors and the international environmental protection policy, i.e. the Kyoto protocol, are controlled, the EKC might be caused by increasing demand for better environmental quality at higher income. The R&D expense

ratio can significantly reduce carbon emissions.

This indicates that the expense of research and development can mitigate climate change.

The coefficients of nuclear and renewable energy are -0.0731 and -0.3733, significantly, respectively. It indicates an increase in the percentage of nuclear and renewable energy significantly reduces carbon emission, and the marginal effect of renewable energy, 0.0434, is higher than that of nuclear power, 0.0002. We also found the quadratic term of renewable energy is significantly positive. Therefore, our results support our Hypothesis 2. That is, it indicates an increase in the share of renewable energy in electricity reduces carbon emissions more effectively than an increase in the share of nuclear power but is subject to diminishing marginal returns. The threshold value of using renewable energy to reduce carbon emission is 23.25%. This result is similar to Chiu and Chang (2009) that the threshold of using renewable energy to mitigate exists but the threshold value is different. The first reason is that the data of carbon emissions adopted in Chiu and Chang (2009) is a national emission growth rate rather the per capita emission adopted in this paper. The second reason is that the data of renewable energy is the contribution of renewables to energy supply adopted in Chiu and Chang (2009) rather than the share of renewables in electricity adopted in this paper.

5. CONCLUSIONS

Renewable energy is prospective, and as a viable form of energy for mitigating climate change, it is usually challenged as a result of its costs compared with the other low-carbon source of energy - nuclear power. In addition to examining its economic and carbon emission Table 5. The impact of nuclear and renewable energy

on the environment (Eq.4) (by authors) Ln(CO2)t

Ln(CO2)t‒1 0.1050 (0.1046)

lny 19.8775**

(9.9303)

(lny)^2 -0.9073*

(0.5164)

R&D -0.0246*

(0.5886)

N -0.0731*

(0.0875)

N^2 0.0002

(0.0011)

turning point N.A.

R -0.3733***

(0.1243)

R^2 0.0434***

(0.0046) turning point 23.25%

Ag -0.0535

(0.1805)

Se -0.0533

(0.0373)

P 0.0025

(0.0037)

KP -0.4820***

(0.1800)

Sargan test: chi2(80) =84.92, Prob > chi2 = 0.332

***P < 0.01, **P < 0.05, *P < 0.1.

effects, this study was used to evaluate the effects of both low-carbon energies for the first time. The models of economic growth and CO2 emissions for high income and OECD economies were estimated using the GMM model that can eliminate endogeneity, the fixed effect of countries and omitted time-varying variables. The results show that the share of nuclear power and non-hydraulic renewable energy in electricity had positive impacts on reducing carbon emissions when labor, capital and energy consumption are controlled.

Using non-hydro renewable energy can increase economic growth, but using nuclear power cannot do this. For high income economies, raising the percentage of non-hydraulic renewable energy in electricity up to 18.66% can increase economic growth and reduce carbon emissions. The R&D expense ratio to GDP has similar effects, which can improve economic growth and environment.

The increases in the share of nuclear power can reduce CO2 emissions without threshold.

The EKC of CO2 existing in high income and OECD economies are subject to the same industrial structure. This means that the higher income may result in the higher demand for environmental quality and the use of environmental and/or energy policies to achieve this. The Kyoto Protocol can significantly reduce carbon emissions but it does not significantly affect economic growth.

Furthermore, total energy use per capita has a positive effect on economic growth, and the price of electricity has a negative effect on it. Therefore, in order to raise the share of renewable energy, the higher electricity price may offset its positive impact on economic growth. Investing R&D on renewable energy and adopting a cost-effective form of renewable energy up to 18.66% would be a no-regret policy.

References

Apergis, Nicholas and James E. Payne, 2012.

"Renewable and Non-renewable Energy Consumption-growth Nexus: Evidence from a Panel Error Correction Model." Energy Economics 34(3): 733-738. https://doi.

org/10.1016/j.eneco.2011.04.007. http://

www.sciencedirect.com/science/article/pii/

S0140988311000909.

Apergis, Nicholas and James E. Payne, 2014.

"The Causal Dynamics between Renewable Energy, Real GDP, Emissions and Oil Prices:

Evidence from OECD Countries." Applied Economics 46(36): 4519-4525. https://doi.o rg/10.1080/00036846.2014.964834. http://

dx.doi.org/10.1080/00036846.2014.964834.

Apergis, Nicholas, James E. Payne, Kojo Menyah and Yemane Wolde-Rufael, 2010. "On the Causal Dynamics between Emissions, Nuclear Energy, Renewable Energy, and Economic Growth."

Ecological Economics 69(11): 2255-2260.

https://doi.org/10.1016/j.ecolecon.2010.06.014.

http://www.sciencedirect.com/science/article/

pii/S0921800910002399.

Arellano, Manuel and Stephen Bond, 1991.

"Some Tests of Specification for Panel Data:

Monte Carlo Evidence and an Application to Employment Equations." The Review of Economic Studies 58(2): 277-297. https://doi.

org/10.2307/2297968. http://www.jstor.org/

stable/2297968.

Arellano, Manuel and Olympia Bover, 1995.

"Another look at the instrumental variable estimation of error-components models."

Journal of Econometrics 68(1): 29-51. https://

doi.org/10.1016/0304-4076(94)01642-D.

http://www.sciencedirect.com/science/article/

pii/030440769401642D.

Chiu, Chien-Liang and Ting-Huan Chang, 2009.

"What Proportion of Renewable Energy Supplies is Needed to Initially Mitigate CO2

Emissions in OECD Member Countries?"

Renewable and Sustainable Energy Reviews 13(6–7): 1669-1674. https://doi.org/10.1016/

j.rser.2008.09.026. http://www.sciencedirect.

com/science/article/pii/S136403210800172X.

Cho, C. H., Y. P. Chu and H. Y. Yang, 2013.

"An Environment Kuznets Curve for GHG Emissions: A Panel Cointegration Analysis."

Energy Sources, Part B: Economics, Planning, and Policy 9(2): 120-129. https://

doi.org/10.1080/15567241003773192. http://

dx.doi.org/10.1080/15567241003773192.

De Bruyn, Sander M., 1997. "Explaining the Environmental Kuznets Curve: Structural Change and International Agreements in Reducing Sulphur Emissions." Environment and Development Economics 2(04):

485-503. https://doi.org/doi:10.1017/

S1355770X97000260. http://dx.doi.

org/10.1017/S1355770X97000260.

Ehrlich, P. R., and J. P. Holdren, 1971. Impact of population growth. Science 171, 1212-1217.

doi: 10.1126 / science.171.3977.1212.

Fujii, Hidemichi and Shunsuke Managi, 2013.

"Which Industry is Greener? An Empirical Study of Nine Industries in OECD Countries."

Energy Policy 57(0): 381-388. https://doi.

org/10.1016/j.enpol.2013.02.011. http://

www.sciencedirect.com/science/article/pii/

S0301421513000967.

Heerink, Nico, Abay Mulatu and Erwin Bulte, 2001. "Income Inequality and the Environment: Aggregation Bias in Environmental Kuznets Curves." Ecological Economics 38(3): 359-367. https://doi.

org/10.1016/S0921-8009(01)00171-9. http://

www.sciencedirect.com/science/article/pii/

S0921800901001719.

Huang, Bwo-Nung, M. J. Hwang and C. W. Yang, 2008a. "Causal Relationship between Energy Consumption and GDP Growth Revisited: A Dynamic Panel Data Approach." Ecological Economics 67(1): 41-54. https://doi.

org/10.1016/j.ecolecon.2007.11.006. http://

www.sciencedirect.com/science/article/pii/

S0921800907005344.

Huang, Wei Ming, Grace W. M. Lee and Chih Cheng Wu, 2008b. "GHG Emissions, GDP Growth and the Kyoto Protocol: A Revisit of Environmental Kuznets Curve Hypothesis."

Energy Policy 36(1): 239-247. https://doi.

org/10.1016/j.enpol.2007.08.035. http://

www.sciencedirect.com/science/article/pii/

S0301421507003503.

Ibrahim, Mansor H. and Siong Hook Law, 2014.

"Social Capital and CO2 Emission—Output Relations: A panel analysis." Renewable and Sustainable Energy Reviews 29(0): 528-534.

https://doi.org/10.1016/j.rser.2013.08.076.

http://www.sciencedirect.com/science/article/

pii/S1364032113006163.

IEA, 2014. Energy Prices and Taxes. Paris, France:

OECD/IEA.

IPCC, 2014a. "Summary for Policymakers." In Climate Change 2014: Synthesis Report Contribution of Working Groups I, II and III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change, edited by Core Writing Team, R.K. Pachauri and L.A. Meyer. Geneva, Switzerland: IPCC.

IPCC, 2014b. "Summary for Policymakers." In Climate Change 2014: Mitigation of Climate Change Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change

edited by O. Edenhofer, R. Pichs-Madruga, Y.

Sokona, E. Farahani, S. Kadner, K. Seyboth, A.

Adler, I. Baum, S. Brunner, P. Eickemeier, B.

Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel and J.C. Minx. Cambridge, United Kingdom: Cambridge University Press.

Kaya, Y., 1990. Impact of Carbon Dioxide E m i s s i o n C o n t r o l o n G N P G r o w t h : Interpretation of Proposed Scenarios. Paris.

López-Menéndez, Ana Jesús, Rigoberto Pérez and Blanca Moreno, 2014. "Environmental costs and renewable energy: Re-visiting the Environmental Kuznets Curve."

Journal of Environmental Management 145(0): 368-373. https://doi.org/10.1016/

j.jenvman.2014.07.017. http://www.

sciencedirect.com/science/article/pii/

S0301479714003612.

Lucas, Robert E, 1988. "On the mechanics of economic development." Journal of Monetary Economics 22(1): 3-42. https://doi.

org/10.1016/0304-3932(88)90168-7. http://

www.sciencedirect.com/science/article/

pii/0304393288901687.

Maddala, G. S. and Shaowen Wu, 1999. "A Comparative Study of Unit Root Tests with Panel Data and a New Simple Test." Oxford Bulletin of Economics and Statistics 61(S1): 631-652. https://doi.

org/10.1111/1468-0084.0610s1631. http://

dx.doi.org/10.1111/1468-0084.0610s1631.

Menyah, Kojo and Yemane Wolde-Rufael, 2010.

"CO2 Emissions, Nuclear Energy, Renewable Energy and Economic Growth in the US."

Energy Policy 38(6): 2911-2915. https://

doi.org/10.1016/j.enpol.2010.01.024. http://

www.sciencedirect.com/science/article/pii/

S0301421510000303.

OECD/IEA, 2010. World Energy Outlook 2010.

Paris, France: International Energy Agency.

OECD/IEA, 2013. World Energy Outlook 2013.

Paris, France: OECD/IEA.

OECD/IEA, 2014. "Executive Summary." In Medium-Term Renewable Energy Market Report 2014 Market Analysis and Forecasts to 2020. 9. Paris, France: International Energy Agency.

Omri, Anis and Duc Khuong Nguyen, 2014.

"On the determinants of renewable energy consumption: International evidence."

Energy 72(0): 554-560. https://doi.

org/10.1016/j.energy.2014.05.081. http://

www.sciencedirect.com/science/article/pii/

S0360544214006483.

Romer, Paul M., 1986. "Increasing Returns and Long-Run Growth." Journal of Political Economy 94(5): 1002-1037. https://doi.

org/10.2307/1833190. http://www.jstor.org/

stable/1833190.

Schlömer, S., T. Bruckner, L. Fulton, E. Hertwich, A.

McKinnon, D. Perczyk, J. Roy, R. Schaeffer, R. Sims, P. Smith and R. Wiser, 2014. "Annex III: Technology-specific cost and performance parameters." In Climate Change 2014: Mitigation of Climate Change. Contribution of Working Group III to the Fifth Assessment Report of the Intergovernmental Panel on Climate Change, edited by O. Edenhofer, R. Pichs-Madruga, Y.

Sokona, E. Farahani, S. Kadner, K. Seyboth, A. Adler, I. Baum, S. Brunner, P. Eickemeier, B. Kriemann, J. Savolainen, S. Schlömer, C. von Stechow, T. Zwickel and J.C. Minx.

1335. Cambridge, United Kingdom and New York, NY, USA.: Cambridge University Press.

Shaw, Daigee, Arwin Pang, Chang-Ching Lin and Ming-Feng Hung, 2010. "Economic Growth and Air Quality in China." Environmental Economics and Policy Studies 12(3): 79-96.

高所得經濟體提高電力中再生能源比例對經濟成長 與碳排放之影響研究

郭彥廉

1*蔡群立

2郭哲銘

3摘 要

本文評估在電力系統中核能與再生能源如何影響經濟成長與環境。使用廣義動差法(GMM)估計

世界銀行界定高所得與經濟合作暨發展組織(OECD) 29個經濟體1990到2012年每人所得與碳排放資

料。結果顯示電力中非水利再生能源對經濟與環境的效果有閾值,佔18.66%以下時可以增進經濟成

長同時降低碳排放。核能佔比增加可以降低碳排放且沒有閾值。高所得與OECD國家在控制產業結

構下,每人二氧化碳排放量與所得具有倒U型的關係,即具有環境顧志耐曲線(EKC)。此結果表示

提高所得帶來的環境改善是因為對環境品質的需求提高。

關鍵詞:再生能源,二氧化碳排放,經濟成長,環境顧志耐曲線 JEL:O13, O44, Q43, Q54, Q56

收到日期: 2019年02月18日 修正日期: 2019年04月10日 接受日期: 2019年05月15日

1 國立成功大學經濟學系 副教授

2 國立成功大學經濟學系 教授

3 國立成功大學經濟學系 碩士

*通訊作者電話: 06-2757575#56327, E-mail: yenlien@mail.ncku.edu.tw