CORPORATE OWNERSHIP & CONTROL

Postal Address: Postal Box 36 Sumy 40014 Ukraine Tel: +380-542-698125 Fax: +380-542-698125 e-mail: alex_kostyuk@mail.ru alex_kostyuk@virtusinterpress.org www.virtusinterpress.org

Journal Corporate Ownership & Control is published four times a year, in September-November,

December-February, March-May and June-August, by Publishing House “Virtus Interpress”, Kirova Str. 146/1, office 20, Sumy, 40021, Ukraine.

Information for subscribers: New orders requests should be addressed to the Editor by e-mail. See the section "Subscription details".

Back issues: Single issues are available from the Editor. Details, including prices, are available upon request.

Advertising: For details, please, contact the Editor of the journal.

Copyright: All rights reserved. No part of this publication may be reproduced, stored or transmitted in any form or by any means without the prior permission in writing of the Publisher.

Corporate Ownership & Control ISSN 1727-9232 (printed version) 1810-0368 (CD version) 1810-3057 (online version) Certificate № 7881

Virtus Interpress. All rights reserved.

КОРПОРАТИВНАЯ СОБСТВЕННОСТЬ И КОНТРОЛЬ Почтовый адрес редакции: Почтовый ящик 36 г. Сумы, 40014 Украина Тел.: 38-542-698125 Факс: 38-542-698125 эл. почта: alex_kostyuk@mail.ru alex_kostyuk@virtusinterpress.org www.virtusinterpress.org Журнал "Корпоративная собственность и контроль" издается четыре раза в год в сентябре-ноябре, декабре-феврале, марте-мае, июне-августе издательским домом Виртус Интерпресс, ул. Кирова 146/1, г. Сумы, 40021, Украина. Информация для подписчиков: заказ на подписку следует адресовать Редактору журнала по электронной почте. Отдельные номера: заказ на приобретение отдельных номеров следует направлять Редактору журнала. Размещение рекламы: за информацией обращайтесь к Редактору. Права на копирование и распространение: копирование, хранение и распространение материалов журнала в любой форме возможно лишь с письменного разрешения Издательства. Корпоративная собственность и контроль ISSN 1727-9232 (печатная версия) 1810-0368 (версия на компакт-диске) 1810-3057 (электронная версия) Свидетельство КВ 7881 от 11.09.2003 г. Виртус Интерпресс. Права защищены.

EDITORIAL

Dear readers!

This issue of the journal is devoted to several issues of corporate governance.

Ilse Maria Beuren, Elza Terezinha Cordeiro Miiler verify how the Controllership institutionalization process takes place in corporate governance companies in Santa Catarina State – Brazil. Research was carried out by means of a multi-case study with a qualitative approach. Five companies were selected, but four answered the questionnaire, all listed in Bovespa’s corporate governance. The research found only one company underwent a restructuring process in controllership. In this, the institutionalization process involved the system and sub-systems used in the company, encompassing every task and practice. The institutionalization of controllership assured the implementations, controls, performance, goals and levels of commitment of those involved.

Andrea Lolli shows that the financial situation of a company and its future evolution are legally relevant when the distribution of dividends are concerned and if the company wants to avoid –as an exception to the general rule- the application of fair value criteria.. This I will argue is the case despite the fact that the EU has still not chosen to introduce a solvency test either as an alternative or as an additional system-to legal capital. The going concern principle as stated in Fourth Council Directive 78/660/EEC of 25 July 1978, and the financial information requested as part of the balance sheet by the EU Directive 51/2003, are the legal elements obliging the company to take into consideration the financial situation when the above mentioned decision is taken, in order to avoid liability for a decision which is inconsistent with the financial situation. The financial situation of the company is now particularly relevant for companies choosing to avoid the appliance of fair value criteria to financial instruments, as that choice presumes the ability to wait to sell that instrument on the market and that ability is very much dependent on the financial resources and the financial needs of the company. Tzong-Huei Lin, Ching-Chieh Lin, Yueh Cheng, Wen-Chih Lee explores whether asset impairment loss as stipulated in International Accounting Standards (IAS) No. 36 provides an opportunity for finance industry to engage in earnings management, and whether corporate governance mechanism can deter such behavior. Using a sample of Taiwan finance industry, our results show that the amounts of asset impairment losses are related to “income smoothing” incentive rather than “big bath” motive. We also find that directors/managers recognize asset impairment losses basing on self-interest consideration and corporate governance mechanism have significant effect on asset impairment decision. The result also shows that financial holding company recognizes less asset impairment losses than non-financial-holding financial institution. Our conclusions are robust to different model specification, and are free from

multicollinearity and outliers effects. This study contributes to understand the asset impairment behavior of finance industry and the behavior differences between financial holding company and non-financial-holding financial institution.

Michael J. Gombola, Amy Yueh-Fang Ho, Yi-Kai Chen investigate earnings management and long-term stock performance surrounding reverse stock splits. It is designed to provide evidence on the role of managerial pessimism and discretionary current accruals. Discretionary current accruals are used to measure earnings management. These discretionary current accruals are measured in our study using the balance sheet approach as well as the cash flow statement approach. We find consistent evidence of negative discretionary current accruals prior to reverse stock splits. Such negative discretionary accruals are consistent with managerial pessimism prior to a reverse stock split. Such pessimism is warranted by the observed negative market reaction to a reverse split announcement and the negative abnormal returns observed after reverse splits. Negative discretionary current accruals are also consistent with smoothing of earnings during difficult and challenging periods for the firm. Our study might provide an alternative to the opportunism explanation. It also provides additional evidence buttressing the role of managerial optimism and pessimism in explaining earnings management.

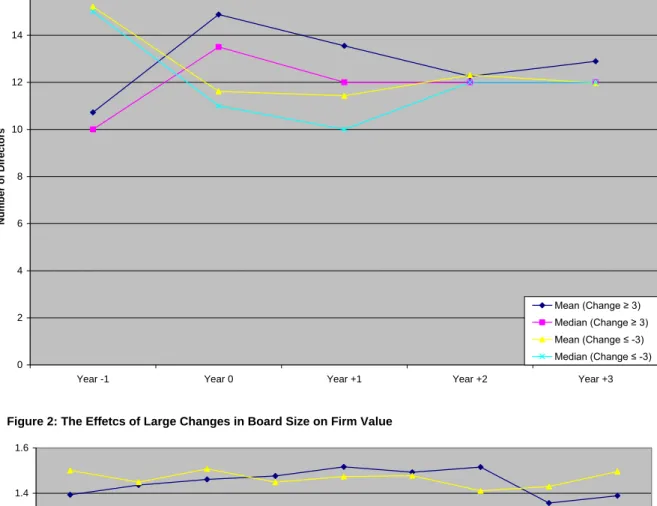

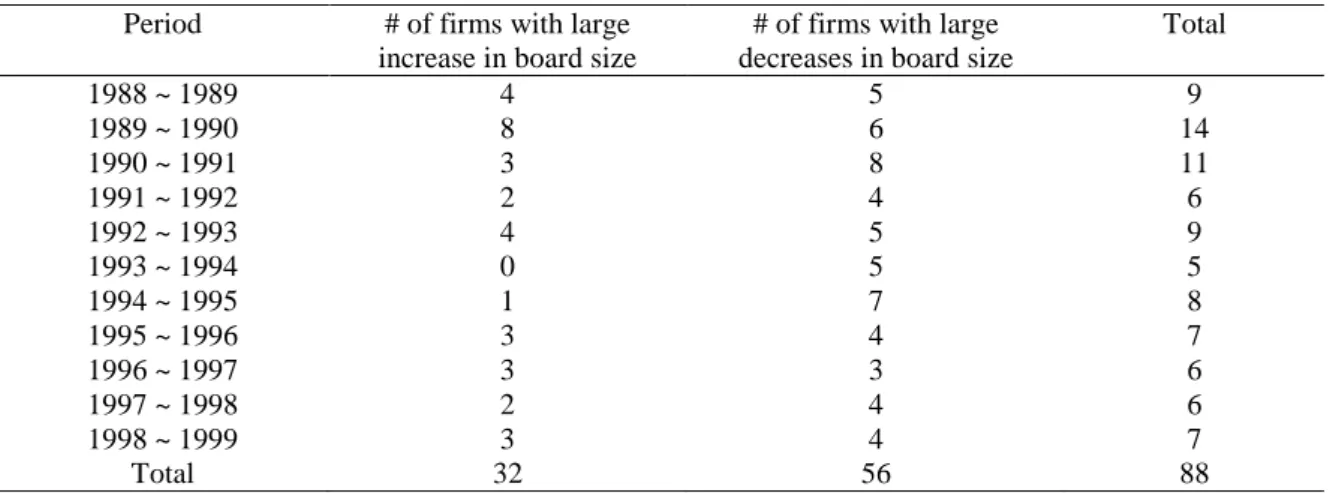

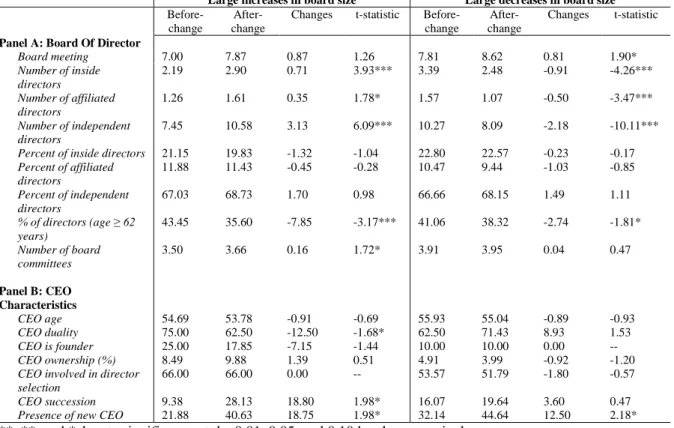

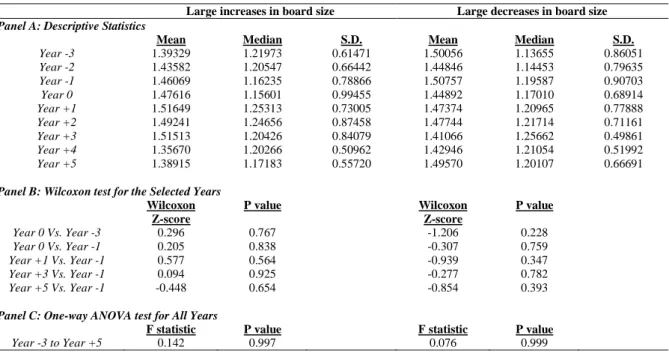

Yixi Ning, Massoud Metghalchi and Jonathan Du found that substantial changes in board size, either an increase or a decrease of three or more directors at one time, are permanent movements rather than temporary changes, but the large changes are followed by small reversal in the subsequent years. Empirical evidence shows that all types of directors (inside, affiliated, and independent) are strongly affected by board size expansions (or reductions). Large changes in board size provide a good opportunity for a firm to optimize its board structure by increasing board independence and retiring elder directors. Further analysis indicates that such substantial changes in board size are associated with more frequent board meetings, a higher likelihood of CEO transitions, and firm size expansions. However, we find no evidence that large decreases (or increases) in board size add (or destroy) firm value for shareholders in the long run.

CORPORATE OWNERSHIP & CONTROL

Volume 7, Issue 2, Winter 2009 (Continued - 4)

C

ONTENTS

Editorial

392

CONTROLLERSHIP INSTITUTIONALISATION PROCESS

OF CORPORATE GOVERNANCE IN BRAZILIAN COMPANIES 394

Ilse Maria Beuren, Elza Terezinha Cordeiro Miiler

MANDATORY RULES ON FINANCIAL SITUATION, DIVIDENDS

DISTRIBUTION AND FAIR VALUE ACCOUNTING IN THE EU IRFS REGULATION 406

Andrea Lolli

ASSET IMPAIRMENT AND CORPORATE GOVERNANCE:

EVIDENCE FROM THE FINANCE INDUSTRY 411

Tzong-Huei Lin, Ching-Chieh Lin, Yueh Cheng, Wen-Chih Lee

EARNINGS MANAGEMENT AND LONG-TERM PERFORMANCE:

EVIDENCE FROM REVERSE STOCK SPLITS 420

Michael J. Gombola, Amy Yueh-Fang Ho, Yi-Kai Chen

LARGE CHANGES IN BOARD SIZE,

CORPORATE GOVERNANCE AND FIRM VALUE 440

CONTROLLERSHIP INSTITUTIONALISATION PROCESS OF

CORPORATE GOVERNANCE IN BRAZILIAN COMPANIES

Ilse Maria Beuren*, Elza Terezinha Cordeiro Miiler**

Abstract

The aim of the article was thus to verify how the Controllership institutionalization process takes place in corporate governance companies in Santa Catarina State – Brazil. Research was carried out by means of a multi-case study with a qualitative approach. Five companies were selected, but four answered the questionnaire, all listed in Bovespa’s corporate governance. The research found only one company underwent a restructuring process in controllership. In this, the institutionalization process involved the system and sub-systems used in the company, encompassing every task and practice. The institutionalization of controllership assured the implementations, controls, performance, goals and levels of commitment of those involved.

Keywords: Controllership. Institutionalization process. Implementations. Controls. Performance. Brazilian companies

*Doctorate in Controllership and Accounting by FEA/USP, Professor in the Post-Graduate Accounting Program at Universidade Regional de Blumenau – PPGCC/FURB

Rua Antonio da Veiga, 140 – Sala D 202, Bairro Victor Konder – Caixa Postal 1507 CEP 89012-900 – Blumenau/ SC – Brasil

Phone: 55 21(47) 3321 0565 E-mail: ilse@furb.br

**Graduate of the Master’s Program in Post-Graduate Accounting at Universidade Regional de Blumenau – PPGCC/FURB, Rua Antonio da Veiga, 140 – Sala D 202, Bairro Victor Konder – Caixa Postal 1507, CEP 89012-900 – Blumenau/ SC – Brasil Phone: 55 21(47) 3321 0565

E-mail: elzam@proserv.com.br

1 Introduction

The concept of interdisciplinary studies is related to environmental changes and the need for both the updating and innovation of practices, which generally become unbalanced due to these changes. Lepri (2006) states that at the 58ª Annual Meeting of the Brazilian Society for the Progress of Science (SBPC) scientists were invited “to sow interdisciplinarity”, as they were concerned with increasing specialization in their disciplines and were seeking an antidote to the real-world difficulties it created. That antidote is interdisciplinary study, an incentive for greater communication between knowledge areas.

Controllership derives from a set of disciplines, mainly in accounting. Mosimann and Fisch (1999) report that there is a relation between mathematical Controllership and science, due to the use of symbols and methods for measuring economic events, although this does not characterize it as such. As with other sciences, Controllership absorbed some expressions in order to facilitate agreement, such as the anatomy of companies, examination of morbid

states, patrimonial embryology, by means of operations etc.

Interdisciplinarity depends on the influence of new concepts and paradigms in the necessary evolution and improvement of existing processes. Institutional theory, according to Guerreiro and Pereira (2005), is a sociological approach that has been applied in accounting in order to explain the established paradox. This theory focuses on managerial accounting as an institution within a company. Thus it is understood that the phenomenon of institutionalization brings about the approximation and strategic configuration of Controllership, as well as the interdisciplinary relationship of Controllership with other areas.

Nevertheless, incorporating the conceptual basis of Institutional Theory is not the exclusive province of accounting; other branches of knowledge also display evidence in this direction. Dirsmith, Timothy and Gupta (2000) call attention to how, in Economics, an institutional perspective is constituted to incorporate, within the logic of strategic agency, the concept of the social limits of rationality. The central point of this more recent source of institutionalism in

organizations seems to be the search for reconciling notions of institutionalization and strategic agency. The Theory of Agency is oriented toward the analysis of the relationships between participants in systems, in which ownership and control are given to different people or groups, which in turn leads to conflicts between the different interests and their respective parties (Jensen & Meckling, 1976 as cited in Segatto-Mendes & Rocha, 2005).

According to Crubellate, Grave and Mendes (2004, p. 39), there are several branches of institutional theory in organizations that can be systemized; they also suggest possible contributions that can be extracted from these branches in order to explain, or “re-explain”, strategic thought. In this perspective, institutional theory comes to be understood “as a social immersion product of organizational agents, i.e., as being conditioned or at least influenced by coercive, normative and cognitive standards predominant environmental context”.

In this sense, controllership considered as a sub-system within a company sub-system, is conditioned, or at least influenced by coercive, normative and cognitive patterns of the company system. However, it also establishes coercive, normative and cognitive patterns that condition or at least have influence in the company and possibly in its environmental context. Institutional Theory can contribute to deciphering these interactions – individual/organization, sub-system/organizational system and organization/individual, organizational system/sub-system – and how the standards and procedures used in the controllership of organizations influence or are influenced in the process of institutionalization.

In this manner, the general aim of this work is to verify how the institutionalization of the Controllership process happens at corporate governance companies in Santa Catarina State – Brazil. Based on the general objective, the following specific aims are elaborated: a) to investigate if companies underwent a re-structuring process in Controllership in the period between 2001 and 2006; b) verify if norms were implanted in Controllership; c) identify the occurrence of changes in procedures; d) analyze the internal and external acceptance in relation to the institutionalization of Controllership.

Four companies from the State of Santa Catarina, Brazil, were selected, all listed in Bovespa‟s (São Paulo Stock Exchange) corporate governance. This listing obliges them to display greater transparency in terms of administrative actions, leading to the supposition that they could present greater evidence of institutionalized controllership since that is the agent responsible for management of information within an organization. Based on the handbook of the Comissão de Valores Mobiliários (Securities and Exchange Commission), CVM (2002), corporate governance entails the set of practices whose aim is to optimize a company‟s performance and to protect all

interested parties, including investors, employers and creditors, facilitating access to capital.

Regarding different levels of corporate governance, according to Bovespa (2005), the new market is a listing segment used for negotiation of shares made by companies that have voluntarily committed to the adoption of extra corporate governance practices related to what is demanded by legislation. The basic difference between Level 1, Level 2, and the new market, are different rules of listing. Level 1 covers rules of transparency and share dispersal established in NM. Level 2 covers rules of transparency; share dispersal, and balancing legal rules between controlling and minority shareholders. The main difference of Level 2 for the New Market is the possibility of having preferential shares in the capital structure of the company.

The study is justified because of the need for better understanding of the role of controllership in organizations and the process of its institutionalization. By virtue of the fact that controllership does not possess a consolidated conceptual base, different conceptual approaches and pertinent attributions can be encountered. Furthermore, the way in which it is developed in organizations is also nebulous. It is possible that the implementation of standards and procedures changes habits and routines both in controllership and within the company in general.

The work presented is structured in six sections. It starts with this introduction, and is followed by the theoretical foundation, emphasizing institutional theory and institutionalization of Controllership. This is followed by methodological procedures, data analyses and interpretation and, lastly, by final considerations of the research.

2 Institutional theory

Institutional theory has brought about interest and attention in the study of organizations. According to Machado-da-Silva, Fonseca and Crubellate (2005), since the late 1970‟s there have been studies and critiques on institutional theory. They show that in the majority of such critiques lies the supposed identification of the institutional perspective of analysis, within the scope of what is called neo-institutionalism, emphasizing permanence, homogeneity, conformity and determinism, above all when studies focus on the investigation of organizational change or the institutionalization process.

According to Guerreiro et al. (2005), three focuses of Institutional Theory can be seen in the accounting literature: New Institutional Sociology (NIS); New Institutional Economics (NIE) and Old Institutional Economics (OIE). They point out that, “although these theories have different origins and diverse philosophical roots they share a common

interest through the themes institution and institutional change” (p. 97). The significance of these three focuses of Institutional Theory, according to Guerreiro et al. (2005) is summarized as:

a) NIS (New Institutional Sociology) focuses on organizations configured within a network of inter-organizational relationships and cultural systems. Beliefs, standards and traditions of the institutional environment influence the relationship the relationships of organizations. The institutional environment is characterized by the elaboration of rules, practices, symbols, beliefs and normative requirements to which individuals and organizations need to conform in order to receive support and legitimacy;

b) NIE (New Institutional Economics) focuses on the institutional environment as a set of social, legal and policy rules that establish the bases for production, exchange and distribution. The institutional environment is characterized as a central element for understanding the evolution of an industry and the strategies of the companies within it. The institutional environment exerts influence on the behavior of economic organizations;

c) OIE (Old Institutional Economics) focuses on the institution as the principal objective of analysis and no longer on rational, maximizing behavior of individual decision makers.

Scapens (1994, as cited in Guerreiro et al. 2005) conceives of institutionalization as a set of ideas contained in institutional theory (OIE) that structure an intellectual framework adequate for the understanding of managerial accounting systems. According to this author, the institutional approach should not be considered the only one, or even the best approach, but instead be presented as a valid structure for understanding managerial accounting practices as institutionalized routines and for exploring the interaction between managerial accounting and other social institutions.

Kostova (1998) warns that in order for institutionalization to take place successfully, signs of approval employee performance, their work satisfaction, their commitment to the organization and their feeling of psychological property connected to the practice all must be observed. He understands that institutionalization occurs at two levels: implementation and internalization. The level of implementation is the degree of formal, practical adoption in behavior and objective and explicit action. The level of internalization, on the other hand, relates to employee internalization of the values that the practice incorporates.

The institutional process is not only implantation of practices. According to Kostova (1998), “the institutional process continues after the implantation of the practices, going until when the employees give value to the new practices”. There are two elements that compose the process implanting

organizational practices: “the diffusion of a set of rules” and “the transmission or creation of a meaning for these rules” (p. 2).

According to Burns and Scapens (2000), the moment that the practices are constituted as organizational rules and routines the institutional process is initiated. In this way the authors demonstrate the organizational importance of routines and institutions in forming administration and accounting processes.

The term practices or routine in enterprise operations, as Prochnik and Fernandes note (2001) is used in the manner given by Nelson and Winter (1982): they enclose “from task set libraries of individual employees, carried through daily, to collective and much more complex and delayed tasks, such as set libraries, necessary to assure the quality in a production line” (p. 3).

The term habit, according to Quellette and Wood (1998), signifies trends for the repetition of answers, given a stable and facilitating context. The authors approach the subjects of habit and intention as consciousness in the daily lives of people, using a cognitive psychology approach. Crubellate, Grave and Mendes (2004) describe that recently in Brazil some studies have been developed in regard to these possibilities.

Vasconcelos (2004) elaborated a proposal of for a constructivist natural approach, with a focus on organizational institutionalism as a theoretical resource, for exploring of the strategies of organizations that perform on the Internet. Machado-da-Silva and Fonseca (1993) have made a synthetic rescue of the debate between differing perspectives of organizational strategy, making suggestions for understanding it based on cognitive and institutional theory.

In a more specific way, and already focusing on accounting, Guerreiro et al. (2005) approach the understanding of managerial accounting from the point of view of institutional theory. In another study, Guerreiro and Pereira (2005) investigated the evaluation of the change process in managerial accounting by means of an Institutional Theory case study approach of the Banco do Brasil. Furthermore, Guerreiro, Frezatti and Casado (2004) made a search into understanding the formation of the habits, routines and institutions of managerial accounting. Guerreiro, Pereira and Frezatti (2006) also published an article using an approach similar to this last work in an international periodical.

Based on what has been presented, it can be concluded that further studies on managerial accounting from the perspective of Institutional Theory are necessary, given the interdisciplinary relationship between managerial accounting and Organizational Theory. However, considering the focus of the present work, it emphasizes an approach geared towards controllership.

3 Institutionalization in controllership Mosimann and Fisch (1999) affirm that the basic role of Controllership “consists of coordinating the efforts to obtain a synergic global result, that is, superior to the addition of the results of each area” (p. 89) of the company. The company as a system is made up of people, whose actions are present in some subsystems.

A system, as Bertalanfy describes (1975) in his work General Theory of Systems, in “elaborated form would be a logical-mathematics discipline, purely formal itself, but applicable to some empirical sciences, and if we know the total of the parts contained in a system it can be derived from the behavior of the parts” (p. 61-62).

In a broad sense, according to Bertalanfy (1975), the “analysis of the systems of an industrial company, encloses, raw material, men, machines, buildings, entrance, monetary exit of products, values, good will and other imponderable ones, and this can lead to definite answers and practical indications” (p. 261).

In a narrower focus, Optner (1981) explains that as a system, the company can configure tasks and routines, which must congregate operations of technical level, in the direction to supply data necessary and useful to the internal controls. These controls must be tools that transform data into qualitative and quantitative information.

Control, according to Anthony, Dearden and Bedford (1989), is based on the managers and the administration itself: division managers work effectively when they insist on knowing the short-term and specific goals for a specific stated period; senior administration can help the administration of departments to decide problems and to define practical, day-by-day steps. Alternatively, departments make better decisions every day with the participation of the administration in the decision-making at each phase of the control process.

In regard to the control process, Kaplan and Atkinson (1998) establish three phases for administration of the process: planning of the action, execution of the action, and evaluation of the action. In order for the three processes of control to occur, accounting must report, describe and explain those aspects of risks and uncertainties that form part of its information.

In order to attend to the necessities and objectives of a company, Controllership practices must be continuous, using accounting information in the management process. The purpose must always be to assure the control and results of the company, which corresponds to the integration of the efforts in several areas, in accordance with the systems and subsystems used. This is the operational component of the concept of accountability.

According to Nakagawa (1995), accountability consists of the obligation to provide an account of the results obtained, as a function of the responsibilities

that result from the delegation of authority. The author calls attention to the delegation of authority since it can provoke rigid behaviors in some people and the habits they acquire in following a routine if it is not adapted to changes or new environments; people frequently are not even concerned with improving the form in which they carry out a given task, much less in defining strategies.

Merchant (1998) reminds us that after establishing strategies and deciding on planning, the first task of administration is to take measures to assure that these plans are implemented, which involves directing the activities of others. A good part of the function of control is to assure that others do what must be done. Often enough, due to the habits and beliefs of the people in a company, we end up generating inverse results and causing wrong actions. The function of controllership is to assure the fulfillment of what has been forecast.

Regarding the organization of Controllership, Tung (1976), understands that due to the diversity of business organizations, each needs a specific type of Controllership, but there essentially remains a structure common to all of them, whose characteristics are: a) executed the company‟s accounting functions under management of the accounts department; b) budget, control and analysis services grouped in one department alone; c) functions and registries separated from investigated functions, with audit services in a different department; d) department of systems and methods co-ordinates and makes uniform administrative processes of other departments of the company and is responsible for computing systems; e) other services will have to be grouped in a different department with responsibility falling to head or manager of the department.

Figueiredo and Caggiano (2004) understand that the increase of the governmental complexity modified the function and responsibility of the executive. They consider this to be the reason for the separation between the accounting function and the financial function, being the logical path taken to ensure the birth and development of a differentiated Controllership function. They point out that along the years, review of the literature and business practice has indicated that basic responsibilities and activities can be characterized of the following form: planning, control, information, accounting, other functions which manages and supervises each one of the activities that impacts company performance

Borinelli (2006) notes that even though companies differ in size or area of activity, “a certain set of activities will always be present. This implies that the functions of Controllership can thus suffer variations in the way they are developed and distributed, but not in types of functions that they develop” (p. 99). Tung (1976) points out that the task of

Controllership requires the application of sound principles, which encompass all of the company‟s the activities from planning to the attainment of the final result. Figueiredo and Caggiano (2004) understand that Controllership must be deeply involved with the search for organizational effectiveness, taking into account the style of management and activities developed in the company, aiming to reach definitive objectives and specific results.

It can be perceived from what has been discussed that fulfilling the mission of controllership depends on the need for its institutionalization in the company. According to Moisman and Fisch (1999), the beliefs and values of the owners “will have an impact on the beliefs and values of the entire organization because taken together with the expectations of investors they will convert themselves into master-guidelines that will direct the other sub-systems of the company system” (p. 22). Analogously, the interaction of the controllership members with other areas of the company influences them, while the obverse is also true. If the controllership is the manager of information in the company, it is worth remembering that its product depends on the habits and routines of the members of the organization. 4 Methodological procedures

The present work was developed by means of exploratory research. Gil (1999) explains that exploratory research is developed towards enabling a general vision concerning definitive fact. This type of research consists of the deepening of preliminary concepts on the theme to be studied.

The exploratory study was carried out by means of multi-case studies. According to Triviños (1987), multi-case study differs from comparative case study because it provides the researcher with the possibility of studying two or more subjects, organizations, etc. without the need to pursue objectives of a comparative nature.

Five companies from the State of Santa Catarina - Brazil were selected, each listed on the corporate governance levels of the São Paulo Stock Exchange, and each having the obligatory highest administrative transparency. Of these, four answered and returned the questionnaire, constituting an intentional sampling by accessibility that, in accordance with Gil (1999), is one in which the researcher selects the elements that furnish access to what may, in some form, represent the universe.

Data collection, which took place in August of 2006, consisted of field research carried out by applying a questionnaire composed of 10 open questions. After contact by telephone and email, an e-mail, a letter of introduction and the questionnaire

were sent out. The return of the questionnaires was also via e-mail.

In order to attend to the established objectives, questions relating to the already existing institutionalization process and procedures were elaborated. Respondents were asked to answer: If the company had gone through a reorganization process in the Controllership in the last 5 years (2001/2006)? What changes had been implemented in the Controllership? Were norms established from the changes implemented? Had those norms been implemented? What procedures had been modified with the new norms? Were procedures legalized? In what way had they been legalized? In what forms were the institutionalized norms divulged? How did the people from Controllership confront institutionalization? How did people from other areas in the company confront institutionalization?

In order to broaden knowledge of the companies in the study, documentary research was needed. To do so, available reports on administration available on the electronic page of the companies were checked and the annual and quarterly reports of the companies were studied. According to Raupp and Beuren (2006), the merit of documentary research in studies that involve accounting subjects lies in the fact that it is important “to not only verify the latest facts that can be useful, as a record of memories, but to also glimpse trends” (p. 90).

After data was collected, the responses of each company were analyzed by content analysis (Bardin, 2004). Care was taken to attend to the objectives of the research, using a qualitative approach to the data, as collating it with the theoretical foundations of this work. Colauto and Beuren (2006) describe that, theoretically it does not have specific norms or rules “that indicate the interpretative process of the data. However, because of concern in acquiring knowledge the researcher of the necessity is observed in literature to be always correlating the empirical data with the theory contemplated in its study” ( p.141).

In dealing with the limitations of the research made, it can be observed that everything stems from the strategy defined for the research. One of these limitations is due to the fact that the questionnaire was sent out in a complete form, without knowing if there had been changes in the controllership of the company. Another can be attributed to the manner in which the questionnaire was applied to the companies (without the researcher being present), which limited the possibility of exploring the answers further. A third limitation resulted from the exploratory research having been made by means of a multi-case study, meaning that the results cannot be extrapolated to other companies.

5 Analyses and data interpretation

In the analysis and interpretation of the data, the profile of the companies that had answered the questionnaire is first demonstrated: CELESC S.A., CIA. HERING, PERDIGÃO S.A. and WEG S.A.. Later, it refers to the profile of the respondents of the research and the answers to the questions. Close attention was paid to the objectives of the work,

correlating empirical data with the theory on which the study was based.

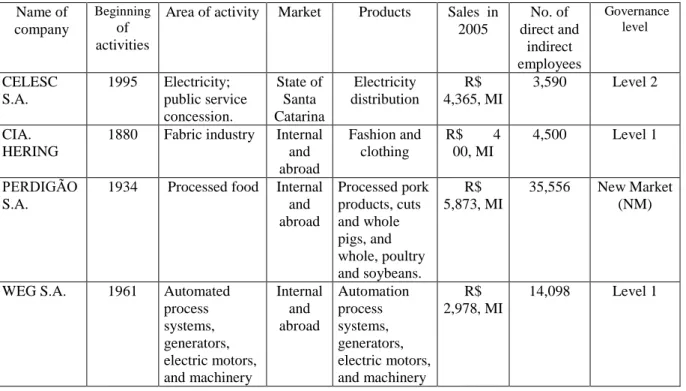

5.1 Profile of the searched companies Table 1, shows the profile of the researched companies, giving the company‟s name, the year it began its activities, branch of activity, market where they act, products they make and sell, annual sales, number of employees and level of corporate governance in the Bovespa‟s.

Table 1. Profiles of researched companies Name of

company

Beginning

of activities

Area of activity Market Products Sales in 2005 No. of direct and indirect employees Governance level CELESC S.A. 1995 Electricity; public service concession. State of Santa Catarina Electricity distribution R$ 4,365, MI 3,590 Level 2 CIA. HERING

1880 Fabric industry Internal and abroad Fashion and clothing R$ 4 00, MI 4,500 Level 1 PERDIGÃO S.A.

1934 Processed food Internal and abroad Processed pork products, cuts and whole pigs, and whole, poultry and soybeans. R$ 5,873, MI 35,556 New Market (NM)

WEG S.A. 1961 Automated process systems, generators, electric motors, and machinery Internal and abroad Automation process systems, generators, electric motors, and machinery R$ 2,978, MI 14,098 Level 1

Source: research data

.

CIA. HERING is the oldest company, acting in the clothes and fashion industry. At the end of 2005 it had 4,500 employees and average sales of four hundred million reais. According to the administrative report of December of 2005 (www.ciahering.com.br) it carried out such strategic movements as: reorganization and industrial flexibilization (wiring factions), retail approaches, replacement of the Hering trademark logo, development of exclusive distribution channels (surmounting), brand strengthening, reduction of number of brands, management of supply demand and financial reorganization.

PERDIGÃO S.A. has processed swine, poultry and soybeans since 1934. At the end of 2005 it had 35,556 employees and average sales of five billion, eight hundred and seventy three million reais.

WEG S.A. has acted in the market since 1961. It develops, makes and sells industrial motors, generators and electric components and automation processes systems. In January 2006 it revealed its

new organizational structure, made up of separate companies containing diverse segments of WEG S.A. As stated in its 2005 administration report (www.weg.com.br), the new structure enables gains in efficiency and quality of management, exploitation of operational and commercial synergies and optimization of administrative procedures. The report states that WEG S.A. now controls the following companies: WEG Equipamentos Elétricos S.A. (electro-electronic segment); WEG Indústrias S.A. (forest industrial activities, paints and varnishes); WEG Exportadora S.A. (TRADING of the Group). At the end of 2005, it had 14,098 employees and average sales of two billion, nine hundred and seventy eight million reais.

CELESC S.A., Concessionaire of the Public Service for Electric Energy, has acted in the domestic market since 1995, in the State of Santa Catarina, distributing its product, electric energy. It had an average billing in 2005 of four billion, three hundred

and sixty five million reais, and had 3,590 employees. According to it 2005 administrative report (www.celesc.com.br), it created the function of Controllership through Deliberation 0109/2002 in 30/04/2002.

It was further observed on the São Paulo Stock Exchange site (www.bovespa.com.br) that the four

companies which answered the questionnaire all adhere to corporate governance, with CIA. HERING and WEG S.A. at Level 1, CELESC S.A. at level 2. PERDIGÃO S.A.‟s administration report (www.perdigao.com.br), states the company went from Level 1 to the new market (NM) in the first semester of 2006.

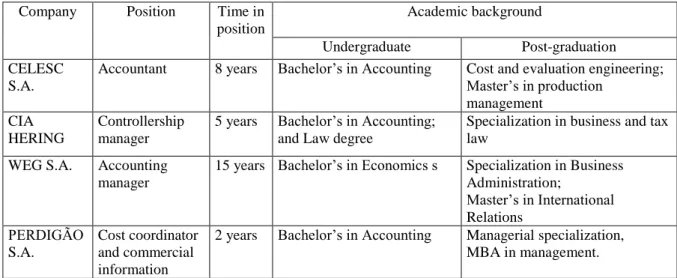

5.2 Profile of questionnaire respondents Table 2 presents the profiles of the respondents of the research, describing their position, time that they have been in the position and academic background. Table 2. Profiles of research respondents

Company Position Time in position

Academic background

Undergraduate Post-graduation CELESC

S.A.

Accountant 8 years Bachelor‟s in Accounting Cost and evaluation engineering; Master‟s in production management CIA HERING Controllership manager

5 years Bachelor‟s in Accounting; and Law degree

Specialization in business and tax law

WEG S.A. Accounting manager

15 years Bachelor‟s in Economics s Specialization in Business Administration; Master‟s in International Relations PERDIGÃO S.A. Cost coordinator and commercial information

2 years Bachelor‟s in Accounting Managerial specialization, MBA in management.

Source: research data

.

It can be seen that those responsible for the Controllership of CELESC S.A., CIA. HERING and of PERDIGÃO S.A., are all graduates in Accounting sciences. At WEG S.A., the person responsible for the Controllership is an Economics graduate. All had invested in further, Post-graduate education. The respondents from WEG S.A. and CELESC S.A. also indicate their participation in directly related Post-graduate education.

The data confirm the interdisciplinarity of Controllership pointed to by Miller (2002 as cited in Fragoso, Ribeiro & Libonati, 2006), where the accelerated changes in professional activities and the emergence of new fields of knowledge in an academic discipline develop the need to extend the limits of that discipline, in order to know new technologies, management tools and forms of analysis.

5.3 Process of Institutionalization of Controllership

The process of institutionalization of Controllership in the four companies under corporate governance in the State of Santa Catarina is presented in the following table. For the purpose of analysis, they are called companies, A, B, C, D, without any relation to the previous ordering, in order to preserve the confidentiality requested by the respondents. 5.3.1 Process of reorganization in the Controllership during the period 2001 to 2006

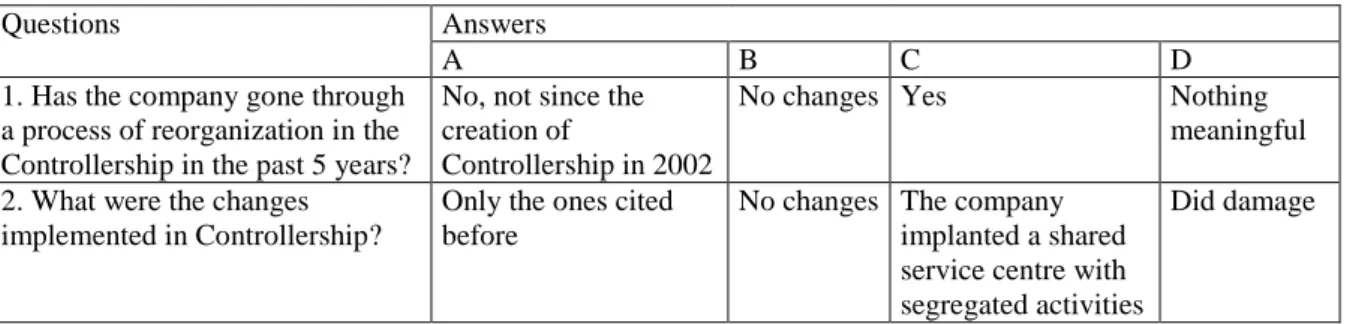

Table 3 reports the answers to questions 1 and 2 of the questionnaire, which investigate the process of reorganization in the Controllership during the period 2001 to 2006.

Table 3. Process of reorganization in the Controllership during the period 2001 to 2006

Questions Answers

A B C D

1. Has the company gone through a process of reorganization in the Controllership in the past 5 years?

No, not since the creation of

Controllership in 2002

No changes Yes Nothing

meaningful 2. What were the changes

implemented in Controllership?

Only the ones cited before

No changes The company implanted a shared service centre with segregated activities

Did damage

Source: research data

.

Analyzing the answers to the questions, the first one asks if the company went through a process of reorganization in the Controllership in the last 5 years, during the period 2001 to 2006. The reply of company “A” was no, because since the creation of the function of Controllership they did not have any process of reorganization. However, she says later that the objectives/mission, basic function and organizational attributions, previously executed by the old Controllership (DPCT) were transferred that year to the Department of Corporative Planning (DPPL), Division of Corporative development (DVDC) .

Company “B” answered that she did not have changes or reorganization in the Controllership in the researched period, thus several questions were answered as if they did not apply, since there were no institutionalized changes, or norms and new procedures in the Controllership of this company. However, one finds reorganization and industrial flexibilization, retail approach, replacement of logo, development of exclusive channels of distribution (surmounting), strengthening of the brands, reduction of nº of marks, management of demand supplies, financial reorganization in the administration report.

Company “D” also answered that there were no changes or reorganization in the Controllership in the researched period; the ones that had occurred were not considered significant. Thus other questions were answered as irrelevant or insignificant in terms of changes or norms and institutional procedures in the Controllership of this company. The quarterly administrative report of this company, as published on its Internet page, shows that in the first trimester of 2006, when the new organizational structure was divulged to the market, it is made up of separate companies in accordance with the diverse segments. The reason why this change was not considered significant was not asked.

Regarding the fact that companies B and D did not point out any reorganization in the Controllership during the period 2001 to 2006 to go with other events in management, attention is called in to the levels of corporate governance that they had on the São Paulo Stock Exchange. On the other hand, as these companies had not changed governance levels,

they had perhaps not thought it necessary to reorganize the Controllership and its processes.

These findings and answers to the research hurt analyses, but collating them with Machado-da-Silva, Fonseca and Crubellate (2005), we identify criticism in relation to institutionalization, regarding conformity and determinism, mainly in the focus of the inquiry on organizational change or the process of institutionalization. In company “C” the respondent indicated that the company went through a process of reorganization in the Controllership in the last 5 years, as shown in the reply to question number 1. According to the São Paulo Stock Exchange, this company entered the new market of corporate governance in the month of April of 2006, before then it was at governance Level 1. It is possible that the changes implemented in Controllership are also a result of the entry of the company into the new market.

In question number 2, which asks about changes implemented in the Controllership, the company “A” respondent refers only to those mentioned in the previous question, i.e. the transfer from the Division of Corporative Development (DVDC) of those organizational attributes executed by the old Controllership (DPCT) to the Department of Corporative Planning (DPPL). The company “C” respondent says that the company implanted a center of shared service, separating the operational activities of corporate centers (or strategic) and that the internationalization process was concluded.

The answers given by company “C” to questions 1 and 2, confirm the studies of Martin (1989). The author affirms that in the last decade, parallel with initiatives in other areas of administration that had started to take the strategic label: strategic engineering, strategic marketing, etc, he had himself taken note of the emergence of a movement in managerial accounting called strategic accounting, which uses the classic instruments with the objective of increasing the company‟s competitiveness.

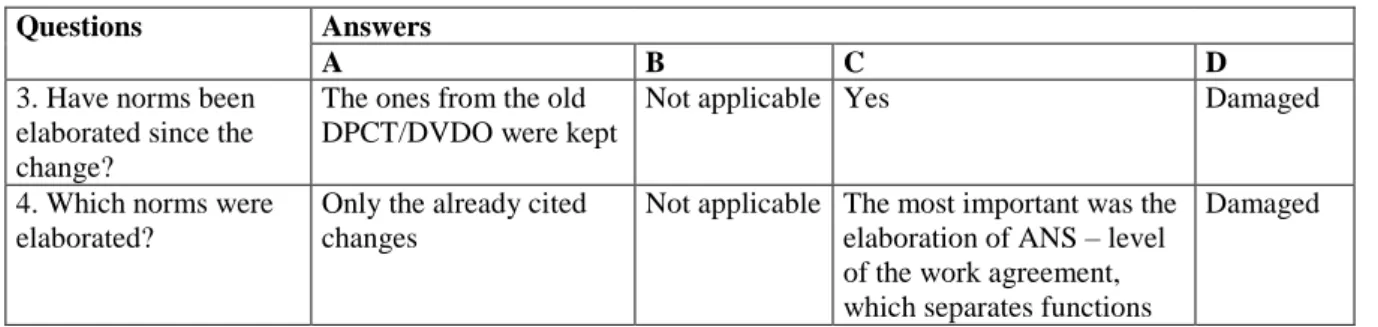

5.3.2 Implementation of norms in the Controllership period from 2001 to 2006 Table 4 presents the answers to questions 3 and 4 of the questionnaire, which investigate the

implementation of norms in Controllership in the period from 2001 to 2006.

Table 4. Implementation of norms in Controllership in the period from 2001 to 2006

Questions Answers

A B C D

3. Have norms been elaborated since the change?

The ones from the old DPCT/DVDO were kept

Not applicable Yes Damaged

4. Which norms were elaborated?

Only the already cited changes

Not applicable The most important was the elaboration of ANS – level of the work agreement, which separates functions

Damaged

Source: research data

.

The reply to questions 3 and 4 are affirmative in company “C”, with norms from the implemented changes that had been elaborated. The most important was the elaboration of the Agreement of Level of Service (ANS), which clarifies the attributes of the Center of Service and other areas (businesses and corporations).

These answers corroborate the theory under study, where Optner (1981) says that the company as a system can be configured for tasks and routines, that it must join together operations of a technical level, in the sense of supplying necessary and useful data to the internal controls. These controls must be tools that transform data into qualitative and quantitative information.

In company “A”, replies to questions 3 and 4 were “No” because the existing ones in the old DPCT/DVDO had been kept. The implemented norms were only the procedures that are mentioned in the transfer from the Division of Corporative Development (DVDC) of those organizational attributes executed by the old Controllership (DPCT) to the Department of Corporative Planning (DPPL). 5.3.3 Occurrence of changes in

procedures during the period 2001 to 2006

Table 5 shows the answers to questions 6 and 7 from the questionnaire, which investigate the occurrence of alteration in procedures in the period from 2001 to 2006.

Table 5. Occurrence of changes in procedures in the period from 2001 to 2006

Questions Answers

A B C D

5. Which procedures were modified?

Procedures had improved with the new normative instructions Not applicable No changes in procedures Damaged

6. Have the processes been modified?

Yes, see answer in table 4 Not applicable

Yes Damaged

7. How were they formalized? See answer in question 4 Not applicable

Through document (contract)

Damaged Source: research data

.

Questions 5, 6 and 7, investigate whether procedures had been modified with the new norms, if they were formalized and in what way they were formalized. The reply of company “A” was that the procedures had improved with the new normative instructions and, in accordance with the reply of the question of number 4, normative instructions had been formalized and authenticated for the Directing body. Company “C” answered that they did not have changes in procedures, but they did have segregation of activities, and that these had been formalized as procedures by means of documents in contract form.

The answers to these questions are related to what Burns and Scapens wrote (2000), in that from the moment that practices constitute organizational rules and routines, the institutional process is initiated; it also demonstrates the organizational importance of how routines and institutions form administration and accounting processes. In the study, the activities that were segregated are the routines and institutions molded to the process of company “C”, whereas in company “A” it was the organizational attributions that were legalized.

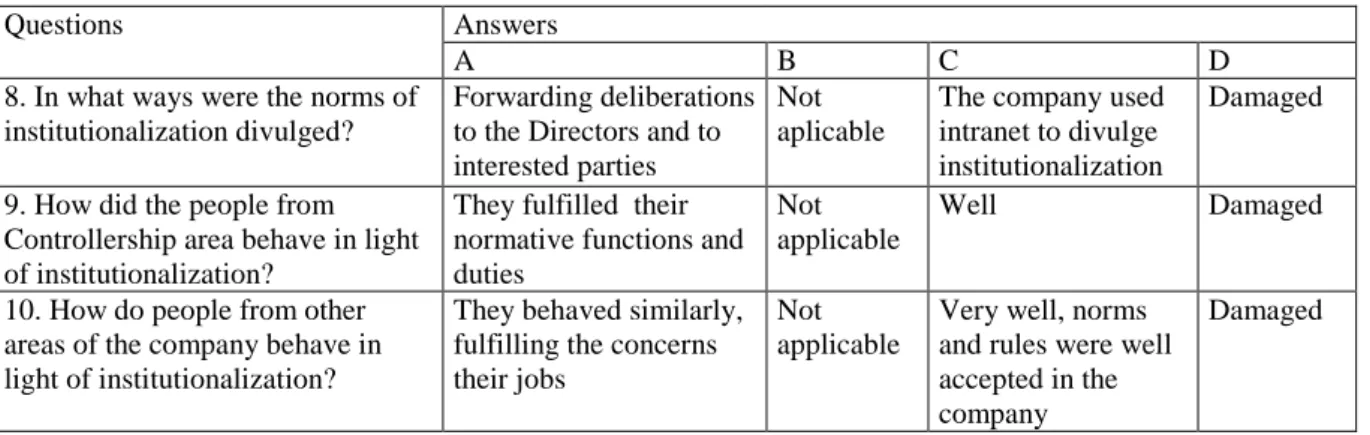

5.3.4 Internal and external acceptance of institutionalization of company

controllership

Table 6 presents the answers to questions 8, 9 and 10 from the questionnaire, which investigate the internal and external acceptance of the institutionalization of company Controllership.

Table 6. Internal and external acceptance of institutionalization of Controllership

Questions Answers

A B C D

8. In what ways were the norms of institutionalization divulged?

Forwarding deliberations to the Directors and to interested parties

Not aplicable

The company used intranet to divulge institutionalization

Damaged

9. How did the people from Controllership area behave in light of institutionalization?

They fulfilled their normative functions and duties

Not applicable

Well Damaged

10. How do people from other areas of the company behave in light of institutionalization?

They behaved similarly, fulfilling the concerns their jobs

Not applicable

Very well, norms and rules were well accepted in the company

Damaged

Source: research data

.

Question number 8 asked how the institutionalization of norms divulged. Company “C” answered that it uses the Intranet as a means of internal communication; some information is sent with security code (water mark or controlled numeration). In company “A”, information was divulged by means of guidelines from the Directors to all Departments Central office, Regional Agencies, etc. for the fulfillment of deliberations.

Collating it with what Kostova says (1998), in relation to the institutional process continuing after the implantation of practices, right up until the moment employees value the new practices, there are two elements that compose the process of the organizational practices: the diffusion of a set of rules and the transmission or creation of one meaning for these rules.

We can see that beginning with the divulgence of institutionalization of norms for internal and external knowledge of the institutional organization institutionalized practical indications are automatically defined.

In question 9, that asks how people from Controllership confront institutionalization, the respondent from company “C” affirmed that it was well accepted. When questioned on how the people of other areas in the company confronted institutionalization, the reply was in accordance with that of number 10, i.e., it went very well, norms and procedures are well accepted inside the company.

In relation to questions 9 and 10, the company “A” respondent informed that employees fulfilled the normative instructions in their respective work routines of work, and in the same way fulfilled deliberation concerning their functions.

Responses to this question confirmed the company vision of Kostova (1998), on the success of

the institutionalization of practices, in which he says that signs of approval of employee practices, their work satisfaction, commitment to the organization and their feeling of psychological identification with practices must all be observed.

6 Final considerations

The objective of the work was to inquire how the process of institutionalization of Controllership in companies of corporate governance in the State of Santa Catarina - Brazil occurs. In order to develop the work, a multi-case study was carried out, by means of questionnaire sent to five companies of corporate governance listed in the São Paulo Stock Exchange. Four companies answered the questionnaire, making up the companies of the multi-case study.

In terms of the profiles of the researched companies, it is evidenced that three companies act in the domestic and foreign markets, and one only in the domestic market, while the branch of activity and the products of the companies are different. CELESC S.A. is a concessionaire of the public service of electric energy; CIA HERING acts in the clothes and fashion industry; WEG S.A. develops, makes and sells electric motors, transformers, generators and industrial automation process, paint and varnishes; and PERDIGÃO S.A. processes foods, whole pigs and poultry, as well as pieces. Annual sales vary between companies, which can be attributed to their branch of activity, their products and the goals of each company, which has not been researched in the current work.

In respect to the profile of the respondents, it was verified that the person responsible for the Controllership of CELESC S.A. is an accountant. He has been in this position for eight years and has a

specialization in Engineering of Evaluation and Costs, and a Master‟s in Engineering of Production/Business-oriented Area of Management. In CIA HERING, the current Manager of Controllership has been in the position for five years and has a Bachelor‟s degree in Accounting, with a specialization in Business Management and Law. In PERDIGÃO S.A., the person responsible for Controllership is the Accounting Manager; he has been in the position for two years and has a specialization in Business Administration and Cost Management. In the WEG S.A., the person responsible has been coordinating costs and managerial information for 15 years; he has a Bachelor‟s in Economics, with a specialization in Business Administration and a Master‟s in Economics, social and international relations. This confirms the interdisciplinarity of Controllership with other areas of knowledge.

With respect to the institutionalization of Controllership, the results of the research show that only one of the companies passed through a reorganization process. The data collected evidenced that the company that passed through the reorganization process entered another level of corporate governance in the researched period, passing from Level 1 to the new market of governance. Another researched company established the function of Controllership in the period from 2001 to 2006, but was not yet was defined with clarity in that company. Both the company which reorganized the Controllership and the one that implanted it took the opportunity to state how the process of institutionalization of Controllership occurs.

Therefore, in the two companies we can identify the process of institutionalization of Controllership, highlighting the occurrence of changes in the procedures, attributes, divisions and segregation of activities, among others implementations that altered procedures. The internal and external acceptance of the institutionalization of Controllership was also analyzed; according to the company that underwent reorganization, institutionalization of Controllership area, was well accepted, both internally and externally.

It can be stated that the institutionalization process first occurs with the implementation of norms and procedures, while later formalization takes place by means of formal documents or types of authenticated contract and normative instructions. Later, these are divulged by means of Intranet, disseminating numbered and controlled information, and guidelines on deliberation to all directors and departments.

Thus we concluded that the institutional process involves the system and subsystems used in the company, encompassing all practical tasks which have an impact on the beliefs and values of the proprietors and the expectations of investors. The institutionalization of Controllership certifies

implementations, controls, performance, goals and the levels of commitment of the people involved in the institutional process. Therefore, collating the data of field research with the theoretical foundations of the present work confirmed the application of the theory to the practices of institutionalization of Controllership.

The starting supposition of the research was confirmed, viz. that companies obligated to display greater transparency in relation to administrative actions can present greater evidence of institutionalized controllership, since controllership is responsible for managing information within the company. However, those companies researched in Santa Catarina, Brazil that are listed in Bovespa‟s corporate governance, despite having made various administrative changes said changes were not implicated in reorganization of controllership, with the exception of one company. This may mean that they were already organized well enough or that the respondents did not remember any of the changes that were made.

As a suggestion for further research on the subject investigated, in relation to the questionnaires necessary for its accomplishment, it can be perceived that data collection made by means of the application of an interview script would have made enabled greater scope and quality of data. However, even with the limitations perceived in the form of the questionnaire applied to the companies, the work made it possible to broaden knowledge on the process of institutionalization of Controllership in companies under corporate governance.

References

1. Anthony, R.N., Dearden, J., & Bedford, N.M. (1989).

Management control systems, 6. ed., Homewood,

Irwin.

2. Bardin, L. (2004). Análise de conteúdo, 3. ed., Lisboa, Edições 70.

3. Bertalanfy, L.V. (1975). Teoria geral dos sistemas, Rio de Janeiro, Editora Vozes.

4. Borinelli, M.L. (2006). Estrutura conceitual básica de

controladoria: sistematização à luz da teoria e da práxis, Tese de doutorado não publicada, Programa de

Pós-Graduação em Ciências Contábeis da Universidade de São Paulo, São Paulo, Brasil. 5. Bovespa - Bolsa de Valores de São Paulo S.A. (2005).

Abertura de capital, Recuperado 3 agosto, 2006, de

http://www.abimaq.org.br/ceimaq/meta3/abertcapital_ doc_m.htm.

6. Bovespa - Bolsa de Valores de São Paulo S.A.

Regulamento do Novo Mercado, Recuperado 3 agosto,

2006, de

http://www.bovespa.com.br/pdf/RegulamentoNMerca do.pdf.

7. Burns, J. & Scapens, R.W. (2000). Research of administration Accounting, Management Accounting

8. Celesc – Centrais Elétricas de Santa Catarina S.A.,

Recuperado 14 julho, 2006, de

http://www.celesc.com.br/ri/dc/dc2005.pdf.

9. Cia. Hering, Recuperado 14 julho, 2006, de http://www.ciahering.com.br/investidores/Hering04.p df.

10. Crubellatte, J.M., Grave, P.S., & Mendes, A.A. (2004). A questão institucional e suas implicações para o pensamento estratégico, Revista Administração Contemporânea, v. 8, 1 Edição Especial, p. 39-60.

11. Colauto, R.D. & Beuren, I.M. (2006). Coleta, análise e interpretação dos dados, in: Beuren, I.M. (org.),

Como elaborar trabalhos monográficos em contabilidade: teoria e prática, São Paulo, Atlas, pp.

117-144.

12. CVM - Comissão de Valores Mobiliários (2002),

Recomendações da CVM sobre governança corporativa. Recuperado 14 julho, 2006, em

http://www.cvm.gov.br/port/public/publ/cartilha/cartil ha.doc.

13. Dirsmith, M., Timothy, F., & Gupta, P. (2000). Institutional pressures and symbolic displays in a GAO context, Organization Studies, v. 21, n. 3, p. 515-537.

14. Figueiredo, S. & Caggiano, P.C. (2004).

Controladoria: teoria e prática, 2. ed, São Paulo, Atlas.

15. Fragoso, A., Ribeiro Filho, J.F. & Libonati, J.J. (2006). Um estudo aplicado sobre o impacto da interdisciplinaridade no processo de pesquisa dos doutores em contabilidade no Brasil, Revista Universo

Contábil, v. 2, n. 1, p. 103-112.

16. Gil, A.C. (1999). Métodos e técnicas de pesquisa

social, 5. ed., São Paulo, Atlas.

17. Guerreiro, R., Frezatti, F., & Casado, T. (2004). Em busca do entendimento da formação dos hábitos, rotinas e instituições da contabilidade gerencial, Anais

do Congresso USP de Controladoria e Contabilidade,

São Paulo, Brasil, 4.

18. Guerreiro, R., Frezatti, F., Lopes, A.B., & Pereira, C.A. (2005). O entendimento da contabilidade gerencial sob a ótica da teoria institucional,

Organizações & Sociedade, 12 (35), p. 91-106.

19. Guerreiro, R. & Pereira, C.A. (2005). Avaliação do processo de mudança da contabilidade gerencial sob enfoque da Teoria Institucional: o caso do Banco do Brasil, Anais do Enanpad, Brasília, Brasil, 29. 20. Guerreiro, R., Pereira, C.A., & Frezatti, F. (2006).

Evaluating management accounting change according to the institutional theory approach: a case study of a Brazilian bank, Journal of Accounting & Organizational Change, v. 2, n. 3, p. 196-228.

21. Kaplan, R. & Atkinson, A. (1998). Advanced

management accounting, 3 ed., Upper Saddle River,

New Jersey, Prentice-Hall.

22. Kostova, T. (1998), Success of the transnational

transfer of organizational practices within multinational companies, International Business

Program Area, University of South Carolina, South Carolina.

23. Lepri, M.C. (2006). Semeando interdisciplinaridade.

Revista Ciência Hoje, v. 38, n. 228, p. 16-21.

24. Machado-da-Silva, C.L. & Fonseca, V. (1993). Homogeneização e diversidade organizacional: uma visão integrativa, Anais do Enanpad, Salvador, Brasil, 23.

25. Machado-da-Silva, C.L., Fonseca, V.S., & Crubellate, J.M. (2005). Estrutura e interpretação: elementos para uma abordagem recursiva do processo de institucionalização. Revista Administração Contemporânea, v. 9, 1 Edição Especial, p. 9-39.

26. Merchant, K. (1998), Modern management control

systems: text and cases, Upper Sadle River, New

Jersey, Prentice-Hall.

27. Mosimann, C.P. & Fisch, S. (1999). Controladoria:

seu papel na administração de empresas, 2. ed., São

Paulo, Atlas.

28. Nakagawa, M. (1995). Introdução à controladoria:

conceitos, sistemas, implementação, São Paulo, Atlas.

29. Optner, S.L. (1981). Análise de sistemas empresariais, Rio de Janeiro, LTC.

30. Prochnik, V. & Fernandes, T. (2001). Sucesso e fracasso em transferência internacional de rotinas para o Brasil, Anais Workshop em Internacionalização de

Empresas, Rio de Janeiro, Brasil, 2.

31. Quellette, J. A. & Wood, W. (1998). Habit and intention in everyday life: the multiple processes by which past behavior predicts future behavior,

Psychological Bulletin, v. 124, n.1, Section B, p.

54-74.

32. Perdigão S.A., Recuperado 14, julho, 2006, de http://www.perdigao.com.br/ri/port/index.asp?pasta=2 &arquivo=5.

33. Raupp, F.M. & Beuren, I.M. (2006). Metodologia da pesquisa aplicável às ciências sociais, in: Beuren, I.M. (org.). Como elaborar trabalhos monográficos em

contabilidade: teoria e prática, São Paulo, Atlas, pp.

76-97.

34. Segatto-Mendes, A.P. & Rocha, K.C. (2005). Contribuição da teoria de agência aos estudos dos processos de cooperação tecnológica universidade-empresa, Revista de Administração, v. 40, n. 2, p. 172-183.

35. Triviños, A.N.S. (1987). Introdução a pesquisa em

ciências sociais: a pesquisa qualitativa em educação,

São Paulo, Atlas.

36. Tung, N.H. (1976). Controladoria financeira das

empresas: uma abordagem prática, 5 ed., São Paulo,

Editora Universidade de São Paulo.

37. Vasconcelos, F.C. (2004). A institucionalização das estratégias de negócios: o caso das start-ups na internet brasileira em uma perspectiva construtivista,

Revista Administração Contemporânea, v. 8, n. 2, p.

159-179.

38. Weg S.A., Recuperado 14 julho, 2006, em http://www.weg.com.br/ri/port/index.asp?pasta=2&ar quivo=5.