諾基亞及小額信貸對印度之影響 - 政大學術集成

全文

(2) 諾基亞及小額信貸對印度之影響 Nokia and microfinance in India. 研究生:那狄楷. Student: Debendra Nath. 指導教授:吳文傑. 學. ‧ 國. 立. Advisor: Jack Wu 政 治 大. 國立政治大學. ‧. 商學院國際經營管理英語碩士學位學程. y. A Thesis. a. er. io. sit. Nat. 碩士論文. n. iv Submittedl to C International MBAnProgram. U. h. i e n g c hUniversity National Chengchi. in partial fulfillment of the Requirements for the degree of Master in Business Administration. 中華民國九十九年十二月 December 2010.

(3) Acknowledgement. I‘d like to thank Dr. Jack Wu as my advisor for this thesis. I very much appreciate his time, effort and suggestion. I would also like to thank all of those that have assisted me during my MBA education at National Chengchi University, as well as all of my mentors throughout my professional career. Gratitude must be expressed to Lichi Ho for her dedication to the program and continuously help IMBA students.. 治 政 大would not have been possible. My me to select a good thesis topic. Without her help, this project 立 love, gratitude and appreciation cannot be described in words. I dedicate my thesis to my son I must also give special thanks to my wife, who has given me much guidance and help. ‧ 國. 學. Divyash. My little Son also knows Papa is in school and waiting me patiently until 11PM. It‘s really very tough to manage time and responsibility between study, family and work, but my. ‧. wife makes all of those easy to manage.. n. er. io. sit. y. Nat. al. Ch. engchi. 1. i n U. v.

(4) Abstract This paper begins with an introduction to the concept of microfinance, lending models in India and key strengths of Indian MFIs. The term microfinance refers to small-scale financial services both credit and savings- that are extended to the poor in rural, semi-urban and urban areas. The poor need microfinance to undertake economic activity, smoothen consumption, mitigate vulnerability to income shocks (in times of illness and natural disasters), increase saving and support self-empowerment. This paper discuss about Nokia initiative to further increase mobile penetration in India via microfinance root. Nokia found most of the people living in village and they don‘t have. 政 治 大 microfinance to sell mobile phone which will help poor peoples. Microfinance sector has been 立. money to buy mobile phone by cash. Nokia had tied up with microfinance institutions SKS growing at upwards of 50 % per annum – even higher than the mobile phone industry.. ‧ 國. 學. The trend towards marketing in small, relatively poor communities on the part of. ‧. multinational corporations (MNCs) is picking up as microfinance increases purchasing power amongst rural consumers. This paper will discuss particularly Nokia‘s success in microfinance. y. Nat. er. io. sit. and how it helps Nokia to consider as number one (#1) most trusted brand in India. This paper also analyzes the conceptual framework of micro financing in India and. n. al. Ch. i n U. v. impact of microfinance on rural poor. The role of Self Help Group (SGH) , lending institutions ,. engchi. central bank and Government. The success and controversy faced by microfinance institutions. Many finance experts are discussing and commenting microfinance is India‘s subprime. The paper offers some suggestions on what it would take to reform these institutions with an eye to improving access for the poor and entrepreneur skill.. 2.

(5) TABLE OF CONTENTS CHARTS .............................................................................................................5 TABLE ................................................................................................................5 CHAPTER 1: AN INTRODUCTION TO MICROFINANCE ....................................6 1.1. What’s microfinance? ............................................................................................ 6. 1.2. Need for microfinance in India .............................................................................. 7. 1.2.1. Why the Bank Network has failed to deliver? .................................................... 7. 1.3. Microfinance market and its participants in India ................................................ 8. 1.4. Differentiating factors of MFIs .............................................................................. 9. 1.6. 學. ‧ 國. 1.5. 政 治 大 Lending model ........................................................................................................ 9 立 Legal structure ..................................................................................................... 10. CHAPTER 2: KEY STRENGTHS AND WEAKNESSES OF INDIAN MFIS ............ 12 Strong business growth, improving geographic diversity ................................... 12. 2.2. Healthy asset quality ............................................................................................ 14. 2.3. Key weaknesses found amongst many MFIs in India .......................................... 16. 2.4. Matter of concern ................................................................................................. 17. er. io. sit. y. Nat. Mission Drift ..................................................................................................... 17 a. n. 2.4.1. ‧. 2.1. l. iv. 2.4.2. n Use of Loans ..................................................................................................... 17 C. 2.4.3. Multiple-borrowing .......................................................................................... 18. 2.4.4. Quality Issues ................................................................................................... 18. hengchi U. CHAPTER 3: NOKIA AND MICROFINANCE .................................................... 19 3.1. Why Nokia initiate microfinance root to sell mobile phone in India? ................. 19. 3.2. Roots of SKS Microfinance .................................................................................. 19. 3.3. Bringing mobile closer to the next billion............................................................ 20. 3.4. Nokia bring new Mobile Phone Features for Rural Poor ................................... 21. 3.5. Success and challenge for Nokia microfinance ................................................... 23. 3.6. New Frontiers ...................................................................................................... 25. 3.7. Getting Crowded .................................................................................................. 26 3.

(6) 3.8. Most Trusted Brand ............................................................................................. 28. CHAPTER 4 : CURRENT CONTROVERSY ON MICROFINANCE ....................... 30 4.1. Micro Credit Bubble ............................................................................................ 30. 4.2. Microfinance industry draws scrutiny ................................................................. 31. 4.3. Microfinance in India is like subprime lending ................................................... 32. 4.4. Looking at microfinance, dispassionately............................................................ 33. CHAPTER 5: CONCLUSIONS .......................................................................... 36 5.1 Double bottom line .................................................................................................... 36 5. 2 Microfinance institutions need succour ................................................................... 37. 政 治 大. 5.3 Conclusions ............................................................................................................... 38. 立. REFERENCES ................................................................................................. 40. ‧ 國. 學. APPENDIXES .................................................................................................. 42. ‧. A. CRISIL List of Top 50 Microfinance Institutions in India by Loan Amount Outstanding for 2009....................................................................................................... 42 SKS Chart after IPO ................................................................................................ 43. C.. Glossary ................................................................................................................... 43. D.. Top 50 Most Trusted Brands in India ..................................................................... 46. n. al. er. io. sit. y. Nat. B.. Ch. engchi. 4. i n U. v.

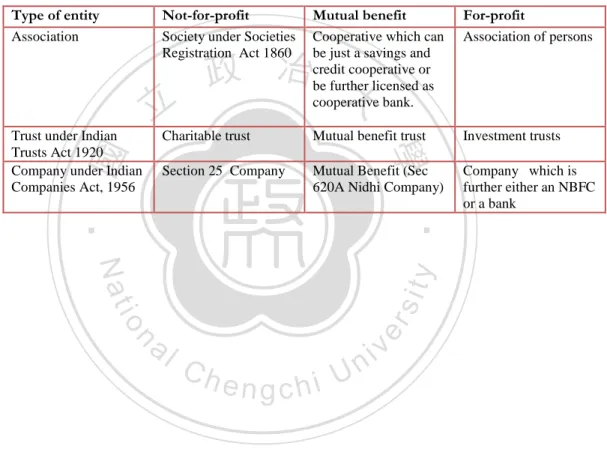

(7) Charts. CHART 1 : MFIS GROWTH TREND ........................................................................................................................ 13 CHART 2: TREND IN DISBURSEMENTS ............................................................................................................... 13 CHART 3: TREND IN ASSETS QUALITY ............................................................................................................... 15. Table. 立. 政 治 大. TABLE 1 : MICROFINANCE LEGAL STRUCTURE .............................................................................................. 11 TABLE 2 : MOVEMENT IN CURRENT PORTFOLIO ACROSS DIFFERENT LEGAL STRUCTURES (IN %) . 15. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 5. i n U. v.

(8) Chapter 1: An Introduction to Microfinance. 1.1. What’s microfinance?. The term microfinance refers to small-scale financial services both credit and savingsthat are extended to the poor in rural, semi-urban and urban areas. The poor need microfinance to undertake economic activity, smoothen consumption, mitigate vulnerability to income shocks (in times of illness and natural disasters), increase saving and support self-empowerment. Microfinance – the provision of loans and other financial services to those who have. 政 治 大 industry. Brought to the world‘s attention in 2006, when Muhammad Yunus and the Grameen 立 Bank won the Nobel Peace Prize for ―their efforts to create economic and social development. traditionally been denied access to the formal financial sector has grown from an idea into an. ‧ 國. 學. from below‖1, the rapid growth of the microfinance movement across the developing world has spurred both accolades and accusations. Those who promote microfinance, consider it a powerful. Nat. sit. y. ‧. tool in poverty alleviation and women‘s empowerment.. er. io. In 1997, then United Nations (UN) Secretary General, Kofi Annan, declared that,. al. n. v i n C h they become economic poorest, especially women receive credit e n g c h i U actors with power. Power to ―Microcredit is a critical anti-poverty tool - a wise investment in human capital. When the. improve not only their own lives but, in a widening circle of impact, the lives of their families, their communities, and their nations‖2. Press Release – Nobel Peace Prize 2006. Available at: http://nobelprize.org/nobel_prizes/peace/laureates/2006/press.html. 2 The Global Development Research Centre website. Available at: http://www.gdrc.org/icm/iym2005/index.html. 1. 6.

(9) 1.2. Need for microfinance in India The Reserve Bank of India (RBI) defines microfinance as ―the provision of thrift, credit. and other financial services and products of very small amounts to the poor in rural, semi-urban and urban areas for enabling them to raise their income levels and improve their living standards. It also serves as an umbrella term for the provision of financial access, through focused financial intermediaries, to those parts of the population that are not being served by mainstream financial services providers. The vicious cycle of ―low income → low savings → low investment → low income‖ can be broken with the injection of credit in the cycle. ―Credit intended for more investment → more income → more savings → more investment → more income‖ is the result. 政 治 大. that is sought through the credit intervention.. 立. Why the Bank Network has failed to deliver?. 學. ‧ 國. 1.2.1. In order to understand why most Indians are unable to borrow from formal financial institutions, there are combination of factors involving the banks and the clients themselves.. ‧. They argue that the banks are wary of the repayment capacity of poor borrowers, their volatile. y. Nat. income streams and incapability to provide collateral. The clients also make bad-borrowers as. sit. they typically avail of loans for consumption smoothing rather than investment in business and. er. io. when the loans are for entrepreneurial purposes the poor borrowers often lack the. al. n. v i n Ch transaction costs of rural loans are significantly i U the loan size is usually small, there e n ghigher c h since technical/business skills and market information to make their businesses viable. Further, the. is widespread illiteracy among poorer clients and they are spread over a large geographical area.. From the perspective of the borrowers, rural banks are unattractive for multiple reasons as well. As noted previously, the services offered by banks are not well suited to the non-uniform income patterns of the poor, compounded with the transaction costs and in some cases bribes to bank officials, banks begin to seem as tedious an option as usurious moneylenders. Borrowers also usually have to travel long distances from their villages to reach the bank, and alongside paying for the transportation cost, lose close to a day‘s wages due to the time spent travelling. Finally, bank loans take, on average, about 33 weeks to process, and are made out against collateral, making them unviable for poorer rural borrowers. 7.

(10) 1.3. Microfinance market and its participants in India. Microcredit is the most common product offering. Microfinance in India is synonymous with microcredit; this is because savings and micro insurance constitute a miniscule segment of the microfinance space. In India, most microfinance loans are in range of $110 to $450 (the Development Regulation Bill, 20073, defines microfinance loans as loans with amounts not exceeding $1000 in aggregate per individual/small enterprise). Its estimates that around 120 million households in India continue to face financial exclusion: this translates into a credit demand of around $240 billion4.. 政 治 大 microcredit. Other players that extend 立 microfinance services, in addition to their core businesses,. MFIs are the main players in the microfinance space in India their primary product is. ‧ 國. 學. include banks and insurance companies, agricultural and dairy co-operatives, corporate organizations such as fertilizer companies and handloom houses, and the postal network. Additionally, there are specialized lenders, called apex MFIs that both loans and capacity. ‧. building support to MFIs. National Bank for Agriculture and Rural Development (NABARD),. sit. y. Nat. Small Industries Development Bank of India, Rashtriya Mahila Kosh and Friends of Women's. io. n. al. er. World Banking are the apex MFIs in India.. Ch. engchi. i n U. v. 3. This bill, which envisages the regulation of the microfinance sector, is under the Parliament's consideration 4. The number of households facing exclusion has been arrived at by adding rural households facing financial exclusion (93 million) and urban below-poverty line (BPL) households (18 million). The average credit demand per household has been estimated at USD 220 per annum.. 8.

(11) 1.4. Differentiating factors of MFIs. 立. ‧ 國. ‧. Lending model. 學. 1.5. 政 治 大. y. Nat. sit. In terms of lending model, MFIs may be classified as lenders to groups or as lenders to. er. io. individuals. In India, MFIs usually adopt the group-based lending models, which are of two. al. v i n model. Under the SHG model, an MFIClends of 10 to 20 women. Under the SHG-bank h etonaggroup chi U n. types ― the self-help group (SHG) model and the joint-liability group (JLG)/solidarity group. linkage model, an NGO promotes a group and gets banks to extend loans to the group. Under the JLG model, loans are extended to, and recovered from, each member of the group (unlike under the SHG model, where the loan is extended to the group as a whole).. The model of lending to individuals is similar to the retail loan financing model of banks. In India, MFIs adopting the group-lending models extend individual loans to more successful borrowers who have completed a few loan cycles as part of a group (who have relatively large credit requirements and good repayment track record). Corporate and cooperatives, typically dairy farms and sugar mills, are also known to undertake microfinance by extending credit to farmers; this helps companies strengthen their procurement and distribution networks.. 9.

(12) MFIs are also differentiated on the basis of their loan repayment structures. Most MFIs following the JLG model adopt the weekly and fortnightly repayment structure; those under the SHG model have a monthly repayment structure. MFIs lending to traders in market places also offer daily repayment, while MFIs extending agricultural loans have bullet- and cash-flow based repayment structures depending on the crop patterns.. Most MFIs in India are solely engaged in extending microcredit: a few also extend saving/thrift, insurance, pension, and remittance facilities. For providing insurance facilities, MFIs have tied up with insurance companies and mutual networks (funds created by communityowned organizations); some MFIs also do underwriting on their own.. 政 治 大. MFIs offer savings services in two ways the savings are either collected by the MFI or. 立. the SHG. In the latter method, the MFI or the NGO encourages the SHG to collect savings/thrift. ‧ 國. 學. from each member of the group on a weekly/monthly basis and rotate the savings/thrift among members. An MFI collecting savings from borrowers may either make it compulsory for. ‧. borrowers/members to have savings with it, or offer voluntary savings services to both members /non-members. Only MFIs registered as cooperatives or depositing NBFCs can collect. y. Nat. sit. savings/deposits; a few MFIs registered as societies and trusts continue to accept. n. al. er. io. savings/deposits, and thus face regulatory risks.. 1.6. Legal structure. Ch. engchi. i n U. v. With respect to legal structure, MFIs may be classified as follows: . Not-for-profit MFIs o Societies (such as Bandhan, Rashtriya Seva Samithi, and Gram Utthan) o Public trusts (such as Shri Kshetra Dharmasthala Rural Development Project, and Community Development Centre) o Non-profit companies, section 25 company (such as Indian Association for Savings and Credit, and Cashpor Micro Credit). . Mutual benefit MFIs o Co-operatives registered under State or National Acts (such as Pustikar Laghu Vyaparik Pratisthan Bachat and Sakh Sahkari Samiti Limited) 10.

(13) . o Mutually-aided co-operative societies (MACS; such as Sewa Mutually Aided Cooperative Thrift Societies Federation Ltd) For-profit MFIs o Non-banking financial companies (NBFCs; such as Bhartiya Samruddhi Finance Ltd, Share Microfin Ltd , SKS Microfinance Ltd and Spandana Sphoorthy Financials Ltd) o Producer companies (such as Sri Vijaya Visakha Milk Producers Co Ltd) o Local area banks (the only such MFI is Krishna Bhima Samruddhi Local Area Bank). Table 1 : Microfinance Legal structure Type of entity Association. Not-for-profit Society under Societies Registration Act 1860. Mutual benefit Cooperative which can be just a savings and credit cooperative or be further licensed as cooperative bank.. For-profit Association of persons. Charitable trust. Mutual benefit trust. Investment trusts. Section 25 Company. Mutual Benefit (Sec 620A Nidhi Company). 立. ‧. ‧ 國. 學. Trust under Indian Trusts Act 1920 Company under Indian Companies Act, 1956. 政 治 大. n. er. io. sit. y. Nat. al. Ch. engchi. 11. i n U. v. Company which is further either an NBFC or a bank.

(14) Chapter 2: Key Strengths and weaknesses of Indian MFIs. 2.1. Strong business growth, improving geographic diversity. The microfinance market in India is expected to grow rapidly, supported by the Government of India's (GoI's) initiatives to achieve greater financial inclusion, and growth in the country's retail sector. MFIs have a grass-root level reach and understanding of the economic needs of the poor. The growing retail market in India provides opportunities for MFIs to act as intermediaries in the retail supply chain. The banking sector will also help the microfinance. 政 治 大. sector grow - banks are expected to use MFIs to meet their financial inclusion targets by allowing MFIs to open bank accounts, and distribute financial services and other structured. 立. products.. ‧ 國. 學. The microfinance sector has passed its evolutionary phase, when the profit-oriented. ‧. working model of MFIs was perceived by the market as exceptionable; acceptance for the same has increased gradually. Also, investors now have a wider choice of MFIs with scalable. Nat. sit. y. processes. NGO-MFIs have been acquiring dormant NBFCs for regulatory, financial, and. io. al. n. extending loans to individuals.. er. operational reasons. Many large players are now focused on urban microfinance, and have begun. Ch. engchi. i n U. v. The microfinance sector and MFIs in India are estimated to have total loans of Rs.160 to Rs.175 billion ($3.5 to $3.9 billion), and Rs.110 to Rs.120 billion ($2.4 to $2.7 billion), respectively, as on March 31, 2009. The microfinance sector in India is fragmented - there are more than 3,000 MFIs, NGOs, and NGO-MFIs, of which about 400 have active lending programmes. The top 10 MFIs are estimated to account for around 74 per cent of the total loans outstanding for MFIs; around 17 MFIs had outstanding loans of more than Rs.1 billion ($22 million) as on March 31, 2009, with the top three MFIs crossing Rs.10 billion ($220 million) in terms of outstanding loan portfolio on that date. As on March 31, 2009, its estimates MFIs' outstanding loans to have increased to Rs.114 billion - $ 2.5 billion (refer Chart 1) from Rs.60 billion ($1.3 billion) a year ago. The growth in 12.

(15) disbursements by MFIs was more than that of the SHG-bank linkage programme during 200708. (refers to financial year, April 1 to March 31); MFIs' disbursement have increased. aggressively, at a compound annual growth rate (CAGR) of 90 per cent, over the past four years. CRISIL estimates the overall disbursement during 2008-09 to be around Rs.287 billion ($6.4 billion), of which disbursements of Rs.185 billion ($4.1 billion) were made by MFIs (refer Chart 2). This is reflective of the increased acceptance of MFIs as commercially viable and their resultant ability to attract capital and resources during the past two years. Chart 1 : MFIs Growth Trend. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Chart 2: Trend in disbursements. Ch. engchi. 13. i n U. v.

(16) A majority of MFIs, including the larger players, operated mainly in South India till 2005-06. Since 2006-07, however, the large MFIs have extended their presence to states such as Maharashtra, Chhattisgarh, Orissa, Jharkhand, and West Bengal; over the past two years, the larger MFIs have established pan-India coverage. The growth of the microfinance sector in eastern India was driven primarily by capacity enhancement initiatives by the apex MFIs, and tapping of growth opportunities in the eastern market by South-India-based MFIs, and banks. Many of the large MFIs, nevertheless, continue to have a significant exposure to South India. 2.2. Healthy asset quality. 政 治 大. MFIs' asset quality, indicated by their current portfolio, and the portfolio at risk (PAR) by more than 30 days, has improved (refer Chart 3), and is healthier than those of other financial. 立. service players in India. The ―current portfolio” is the outstanding amount of all loans as on a. ‧ 國. 學. particular date, with no interest and principal over dues.. MFIs have maintained relatively healthy asset quality mainly because of strong group. ‧. pressure and efficient collection mechanisms, which have ensured high repayment rates. The. sit. y. Nat. 'current portfolio' improved significantly during the first half of 2008-09 over the corresponding period in 2007-08 and was at similar levels before March 2006. Delinquencies increased during. io. n. al. er. 2005-06 and 2006-07 as many leading MFIs were impacted by non-repayment by borrowers in. i n U. v. some coastal districts of Andhra Pradesh. This was triggered by the local administration of. Ch. engchi. Krishna District in Andhra Pradesh ordering an enquiry into the high interest rates charged by some MFIs in the district, and closing of a few branches of these MFIs for a brief period. This impacted the loan portfolios of MFIs not only in Krishna District, but also in the neighbouring districts.. 14.

(17) Chart 3: Trend in assets quality. 政 治 大. 立. ‧ 國. 學. Among MFIs, Section 25 companies and co-operatives tend to have average risk management practices; these entities, therefore, have typically higher delinquency levels.. ‧. Societies/trusts have demonstrated good collection efficiency supported by the credit-plus initiatives provided by this segment. Most MFIs are NGO-MFIs, which were set up to promote. Nat. sit. y. social development, and subsequently began extending financial intermediation to ensure. al. er. io. sustained livelihood for members. These social development activities and long relationships. n. with borrowers enhance the NGO-MFIs' influence over borrowers, and consequently, their. Ch. repayment efficiency and asset quality.. engchi. i n U. v. Table 2 : Movement in current portfolio across different legal structures (in %). 15.

(18) The MFIs current portfolio has improved on account of several factors. MFIs‘ business volume improved by around 46% during the first half of 2008-09 over 2007-08. Disbursement increased at a CAGR of 90 per cent, and the loan portfolio by 81 per cent, over the past three years. The collection efficiency of MFIs was supported by a loan waiver scheme in 2008-09, unlike in 2007-08, when most microfinance portfolios were transferred by MFIs registered as societies and trusts to NBFCs, with overdue loans retained with the societies and trusts; consequently, the asset quality appears to have improved. Most delinquent loans in 2006 in Krishna and the adjoining districts were managed by MFIs for a leading private sector bank. The bank did not invoke the loan default guarantee and since 2007-08, the MFIs have stopped tracking these overdue loans.. 立. Lack of a business orientation which limits sustainability – most MFIs in the region emerge. 學. . 政 治 大. Key weaknesses found amongst many MFIs in India. ‧ 國. 2.3. from NGOs with a social agenda. Perceive microfinance as extension of social development not financial intermediation –. ‧. . affects orientation/systems. y. Nat. Many are leader dominated institutions with centralised decision making, which. al. affects. er. io. receptivity to ideas, limits response to market opportunities.. sit. . Incomplete understanding of client needs/product design. . Poor loan tracking and follow up. . Lack of incentives for staff. . Accounting deficiencies. . Failure to take account of income accruals. . Rescheduling and refinancing of client loans (minor) cases of fraud undetected on account of. n. . Ch. engchi. poor MIS/internal audit process.. 16. i n U. v.

(19) 2.4. Matter of concern. 2.4.1. Mission Drift. In an environment where the measure for success often-times remains the number of loans disbursed or the number of clients acquired, the poor often become casualties rather than beneficiaries. Poor people have always been prey to unscrupulous and recalcitrant moneylenders or other bogus savings institutions. Therefore, there is a very real risk that in the guise of genuine MFIs, swindlers or worse incompetent people may injure them even further. 政 治 大 There is a latent assumption that micro-loans will lead to entrepreneurial and profit立 2.4.2. Use of Loans. generating activity, thereby perpetuating a virtuous cycle of poverty reduction. However, the. ‧ 國. 學. reality is that a large portion of loans are taken for non-productive activities, such as weddings, funerals, dowries, roof-repair, subsistence etc. This is not to say that such activities do no merit. ‧. loans, in fact, one of the primary merits of microfinance is that it makes the poor less vulnerable. y. Nat. to destitution by making available these small loans. It may also be argued that by smoothing. io. sit. over the expenditure on food consumption of a farmer for instance, a micro-loan may allow. n. al. er. him/her to work better in the fields, and is therefore eventually remunerative.. Ch. The clients of microfinance institutions have. engchi. iv n always U used. some of their loans for. purposes other than micro-enterprise investment. This may still be known as ‗misuse‘ by some agencies but most providers of microfinance services are coming to realize that money is fungible, and that their customers probably know better than they do how to best use their money. However, a cautionary note must be added that when micro-loans are made available of for non-remunerative purposes, by an over-zealous loan officer to a financially-uneducated client, they may engender a spiral of further poverty. The State of the Sector (SOS) Report 2009 explicitly warns against such loans and recommends that the ability of the client to repay the loan amount must be established prior to the disbursement of the loan.. 17.

(20) 2.4.3. Multiple-borrowing. Often when a borrower is unable to repay a micro-loan within the stipulated time, she may be forced to take another loan, from a different MFI in order to meet her commitment. The problem of multiple-lending has permeated most regions in southern India, where there is a high concentration of MFIs, and intense competition to woo the maximum number of clients. In such a scenario, it would be appropriate to cite that ‗micro-credit is also micro-debt‘ As MFIs expand and loan officer incentives are tied to client repayment, there may be a clash between profitability and sensitivity to client needs and circumstances. The most heinous consequence of taking a micro-loan and being unable to repay it was evident in the much. 政 治 大 debt-burden. However, to the credit of the microfinance community, there is a concerted effort 立 towards sensitizing field officers and higher management towards the needs of the microfinance publicized Krishna district debacle of 2006 where some farmers committed suicide due to the. ‧ 國. 學. clientele. In fact, Indian NBFC MFIs have come together to initiate the formation of a ‗creditbureau‘ in order to avoid the cataclysmic consequences being repeated elsewhere. Most MFIs. ‧. have some sort of procedure in place to re-schedule loan repayments in the face of genuine. y. sit. n. al. er. Quality Issues. io. 2.4.4. Nat. circumstances.. i n U. v. There have also been allegations against the quality of MFIs in India, many of which. Ch. engchi. suffer from weak governance and management structures, the absence of internal controls and the lack of financial discipline. This is particularly true of the many opportunistic start-up enterprises that are keen on cashing-in on the current microfinance boom. Attracted by the high returns that established MFIs have yielded for their investors, these start-ups are able to break even in a mere 18 months of operation, at the risk of providing poor quality services and charging high rates of interest to clients.. 18.

(21) Chapter 3: Nokia and Microfinance. 3.1. Why Nokia initiate microfinance root to sell mobile phone in India?. A major part of the global mobile device market volume and value growth is expected to come from low-income segments. Yet, in many emerging markets of the world, where the mobile phone can have an immense impact on people‘s lives, investing in a mobile phone can be impossible due to the cash barrier. Making products and services affordable is essential for this next generation of mobile technology consumers.. 政 治 大 income counterparts. They spend as they earn, so they may be willing and able to spend up to the 立 equivalent of US$5 per month in getting connected, but may never have this amount of cash at Lower income consumers tend to have a less structured cash flow than their middle. ‧ 國. 學. hand at any point in time. This is why it is so important to have an offer that is within their cash availability. Microfinance options enable people in remote areas with lower income to get. ‧. connected, using innovative payment options and affordable mobile solutions that aim at. sit. y. Nat. removing the cash barrier to ownership.. er. io. Collaborating with local and regional microfinance institutions, Nokia is working. al. diligently to create programs through which owning a mobile phone is within reach for many. n. v i n low-income consumers in emerging markets. C h MicrofinanceUinstitutions can also enable access to engchi difficult to reach, un-served markets. 3.2. Roots of SKS Microfinance. SKS Microfinance, the microfinance institution (MFI) partnered with Nokia to launch NLT, was founded in 1997 by Mr. Vikram Akula. SKS‘ mission is to provide financial services for the poor. The MFI has provided upwards of USD 1.1 billion in financing, and has maintained a lending book of up to USD 425 million. SKS finances income-generating jobs in the following sectors: agriculture, trade, production, livestock, and new age business. According to the MIX Market, the microfinance information clearinghouse, SKS currently has 3.5 million active. 19.

(22) borrowers, and a gross loan portfolio of USD 956 million. SKS reports total assets of USD 596 million, a debt-to-equity of 3.6, an ROE of 18.7%, and an ROA of 3.7%.. This year in Aug-2010, SKS Microfinance raised about $358 million in an IPO after pricing the sale at the top end of an indicated price band, signaling strong investor appetite and the likelihood of more such offers coming to market. 3.3. Bringing mobile closer to the next billion. Since 2006, Nokia is involved in a major pilot project in India with SKS Microfinance,. 政 治 大 project is to enable an SKS member to purchase a Nokia handset for an affordable weekly 立 installment.. one of the fastest growing microfinance institutions (MFI) in the country. The objective of the. ‧ 國. 學. Once the SKS member completes the identity proof and purchase documents and receives. ‧. approval, the paperwork is sent to local mobile operator, Airtel, for pre-activation of SIM cards. The handsets are delivered to SKS branch locations and then directly to the consumer during. io. sit. y. Nat. weekly meetings.. n. al. er. Consumers throughout rural India are beginning to experience the social and economic. i n U. v. benefits of mobile technology. A solid business model and partnerships in local markets will. Ch. engchi. ensure the development of the mobile world.. 20.

(23) 3.4. Nokia bring new Mobile Phone Features for Rural Poor. Nokia Life Tools (NLT). Life Tools is a range of services that covers Agriculture, Education and Entertainment. It enables you get upto-date, locally relevant information delivered straight to your mobile phone. See market prices, agricultural tips, and the weather forecast with the Agriculture services. Learn more and do better with the Education services, and get career information and tips, too. Have some fun with the Entertainment services which include ringtones, news, astrology, and more. . 政 治 大. ‧. ‧ 國. 學. Nokia bring立 new Mobile Phone Features for Rural Poor. Nokia again expand the microfinance with new phone features launch of Nokia Life. y. Nat. Tools (NLT) in 12 states across India. Nokia has teamed up again with Hyderabad-based SKS. sit. Microfinance, a non-banking finance company, to deliver these services. NLT is a feature. er. io. offered on Nokia 2323 and 2330 mobile phones, enabling subscribers to access agriculture-. al. v i n success‖ of a pilot project conductedCinhMaharashtra testing e n g c h i U the rural market for this feature, n. related information, educational resources, and entertainment applications. After the ―great. Nokia vice-president and chief development officer Mary McDowell announced preparations to introduce NLT throughout rural India. The Grameen Foundation, in partnership with Google Inc. and MTN Uganda, a multinational telecommunications group, launched Application Laboratory (AppLab) in rural Uganda . AppLab includes up-to-date health and agriculture information, as well as a virtual market for the purchase and sale of goods and services. These services can be accessed by individuals in Uganda who own their own mobile phones, as well as local Village Phone Operators (VPOs) and VPO service users.. 21.

(24) The idea of providing mobile phone services in remote villages was introduced by the Grameen Bank in 1997, with the Village Phone. A ―Village Lady‖ purchases a phone, making payments over several weeks, and sells airtime to locals. According to the Grameen Foundation, services like the Village Phone provide an opportunity for MFIs to introduce ―mobile communication services and new business opportunities to communities that may have been overlooked by traditional telecommunications access.‖ VPOs acquire a source of income, micro-entrepreneurs are enabled to purchase airtime, and MNCs turn over a profit. Furthermore, the status and earning power of rural women is strengthened due to the target of such services towards females.. 政 治 大 urban life. First, is the distribution 立of agriculture-related information to rural farmers, such as NLT entails a three-fold approach to bridging the information gap between rural and. ‧ 國. 學. local crop prices and weather conditions, guidance on efficient farming techniques, and costs of pesticides, seeds and fertilizers. Two additional features offered with NLT are educational resources and entertainment applications. Education includes English lessons, exam preparation,. ‧. advice on starting a career, and general knowledge . Entertainment includes sports updates,. sit. y. Nat. world news, politics, jokes, and ringtones. Nokia is partnering with Pearson, EnableM and. io. er. OnMobile to provide these services.. al. n. v i n Kaul, explains what he believes to C be h the benefits of NLT. e n g c h i U ―Agriculture is a local business Vice-President of Marketing at agri-business company Syngenta India Ltd., Kuldeep. where timely and relevant information dissemination to farmers can help them make better. decisions, helping to boost their productivity and raise farm incomes. Nokia Life Tools is designed to offer location-specific personalized information to individual farmers.‖ Amit Mehra of Reuters Market Light, a subdivision of information and consulting company Reuters, supported this statement with figures of 100,000+ farmers across 10,000 villages who have purchased RML services. ―Most farmers have made thousands of rupees in additional profit and reduced losses using the most accurate, comprehensive, timely and personalized information service.‖. 22.

(25) Nokia‘s launch of these new services operates on the assumption that the rural poor want to improve their access to information, and are rising to a position where they have the resources to do so. The role of microfinance is a key determinant in the decision of such MNCs to market their products and services to ‗untapped‘ rural markets. By involving MFIs in this process, some profits are invested in the communications system within rural economies. ―The microfinance institution, or other organization providing loans for the Village Phone business kit, gains revenue from loan interest and potentially from airtime sales and helps set into place a network of phones that can be used as a platform for future innovation.‖ While the use of mobile phones for voice communication has proven successful thus far,. 政 治 大. sceptics of NLT question its utility because of the underlying assumption that users are literate. The literacy rate amongst rural males in India is 58 percent, and 30 percent amongst females .. 立. While NLT may aim to fill a palpable information gap, the number of illiterate individuals in. ‧ 國. 學. these ―emerging markets‖ may make it difficult for useful consumption of this feature. A plausible alternative may be a voice-driven information system, such as IBM‘s Hyperspeech. people to surf the web and access relevant information in real time.. Nat. y. ‧. Transfer Protocol (HSTP). This system uses voice-activated transactions that allow even illiterate. io. sit. Despite Nokia‘s lack of any voice-activated information source, plans are still being. n. al. er. made to offer a micro financing scheme for NLT across India. The launch is begin in rural Indian. i n U. v. markets, particularly targeted at the female population, and will then expand into other parts of. Ch. engchi. Asia as well as Africa. The success of this plan will depend on several factors, one being the continued growth of microfinance on an international level. As the rural poor learn to earn for themselves, consumption of products and services will become more and more of a possibility, which in turn will help local economic growth. 3.5. Success and challenge for Nokia micro finance. For the past three years, Yellakandula Urmila of Bhongir village, near Hyderabad, has been banking with SKS Microfinance (MFI), India's largest lender. She first bought a loom to weave silk saris with a US$150 loan from MFI in 2007, which helped triple her family's monthly income to US$100. Then three months ago she took out another loan for US$26 to buy a Nokia 23.

(26) 1200 mobile phone with a prepaid Bharti Airtel connection, which she will have paid off in next month. "It's been a life-changing and time-saving experience," says Urmila, affectionately patting her gleaming silver handset and recalling how she used to have to walk a mile to a wireline public phone booth to call clients about orders. "Deals are now wrapped up in minutes," she says.. 立. 政 治 大. ‧ 國. 學. AFP/Getty Images (This photo shows an Indian farmer talking on his mobile phone as he discusses pricing of oranges at the Kothapeta fruit market on the outskirts of Hyderabad, India. ). ‧. Wooing rural consumers like Urmila while teaming up with local organizations have. sit. y. Nat. been a key part of the global strategy of the US$55 billion Finnish handset multinational since 2006. "Partnering with local stakeholders is a cool thing," "It is a neat innovation, which creates. io. er. buzz and brand equity for Nokia.". al. n. v i n C India That is one of the reasons why second-largest market with 2009 h e nis gtheccompany's hi U net sales of US$3.7 million, putting it behind China (with US$8 million), but well ahead of the UK in third place (with US$2.5 million). In the decade since it first set foot in India, Nokia has captured nearly 60% of the country's US$5.6 billion handset market and has a 62% share of GSM-based phones, according to research firm IDC. India -- and in particular, rural India -- has been good for Nokia. "We saw the rural opportunities ahead of competition," states D. Shivakumar, Nokia India's vice president and managing director. Though Samsung, LG, Sony Ericsson and Motorola have also been selling handsets in India, telecom observers say Nokia has stood out from the rest. 24.

(27) by having formally forged a company-wide "social inclusion" policy in 2006 to encompass lowincome consumers in its growth strategy, essentially using India as a laboratory for that strategy. Today, rural consumers account for 25% of Nokia phone sales in India, and the target next year is 30%. With mobile phone penetration in the rural market almost doubling to 20% over the past year -- to approximately 150 million, according to the Cellular Operator Association of India (COAI), a trade association -- Nokia has been aggressively pursuing an even more targeted expansion strategy in smaller towns and villages. "There's an insatiable hunger for mobile phones permeating all layers of society," says president of the COAI. "And Nokia has been developing the rural market with appropriate products for a long time, unlike. 政 治 大 But now, Nokia's first mover 立 advantage in rural India is being chipped away. Both home-. other players.". ‧ 國. 學. grown and foreign rivals are muscling in on Nokia's rural territory, beating it down on price. All eyes now are on Nokia, as it rolls out innovative services that can be sold alongside its handsets through a range of partnerships.. ‧ y. sit. New Frontiers. Nat. 3.6. er. io. It was a matter of time before the handset market, especially at the lower end, was. al. n. v i n consumers in the heartland. "It was aC given h ethat h i U telecom market in urban India n gthec fast-growing beginning to commoditize just as service providers were developing the infrastructure to reach. would reach a saturation point after a decade," as per consulting firm KPMG. "Some companies had the foresight to look at new frontiers." On the heels of India's rapid economic boom, the mobile revolution had an impact on both urban and rural penetration. Urban teledensity – which refers to the number of phone connections per 100 people -- has exploded from 65% in 2008 to more than 90% today (with cities like Mumbai and Delhi at more than 100%), while teledensity in rural areas grew from 14% to 30% over the same period. Nokia has been in the thick of this growth. A year after setting up a manufacturing facility in Sriperumbudur, near Chennai, in 2006, Nokia rolled out seven phones in India. Its goal 25.

(28) was to target emerging markets at prices ranging between US$45 and US$120. Nokia manufactured 300 million devices between then and October 2009, half of which were exported to 60 countries. "Nokia has been proactive as the market leader,". Nokia was the first mobile phone maker to set up a satellite R&D center in India as it began tailoring products for the rural terrain. The phones look as sleek as high-end models, but are also sturdy to withstand rough usage. They have seamless keypads to protect them from dust and special grips to make them easier to hold in India's humidity. Some phones -- Nokia 1200 and Nokia 1208 -- also double up as flashlights because of rural India's frequent power outages. Nokia has also embraced the country's plethora of languages, with interfaces in Hindi, Marathi,. 政 治 大 Along the way, Nokia has 立 learned important lessons that are crucial to any MNC's. Kannada, Telugu and Tamil.. ‧ 國. 學. survival in the hinterland. One of them relates to customer service. It‘s after-sales service includes some 700 care centers in urban India. But it's a different matter in rural India. Nokia has more than 300 vans staffed with sales representatives who regularly criss-cross the countryside.. ‧. It also set up low-cost collection points like chemist shops, where distributors and micro-. sit. y. Nat. distributors collect the phones and take them to the nearest care center.. er. io. But according to Nokia, customer service in rural markets such as India's can be just as --. al. n. v i n Cmust going wrong with digital products and U that care or service is just a call h e always h iassured n g c be. if not more -- important before rather than after a sale. "Consumers always worry about anything. away," says Shivakumar. "We needed to build care ahead of sales to provide a sense of trust and peace of mind." Now the vans are divided into two groups -- one to provide support and repairs and others to travel around with Nokia partners, ranging from Idea Cellular to SKS Microfinance, to promote their products and services while catering to novice mobile customers. "The rural market is still an area for a first-time user," says Shivakumar. 3.7. Getting Crowded. As all this happens, service providers have been slashing call rates and expanding their networks. That has had a cascading effect on the overall affordability of mobile telephony. Rates. 26.

(29) have plummeted from 32 cents a minute in 1998 to less than a cent today, cutting the average revenue per user from US$60 to US$4, one of the lowest in the world. Nokia is now facing competition across all its product segments. The big confrontation is at the low end, where a number of players are wooing entry-level users. Chinese phones costing US$20 have flooded the market, and a slew of local and foreign competitors -- like Simoco, Kyocera, Intex and Karbonn -- are aiming to do the same. Micromax Mobile, too, is a challenger. Since it launched two years ago, it has become the third-largest GSM phone vendor, with 6% market share, after Nokia (62%) and Samsung (8%). These changes offer Nokia another big lesson -- competing on price isn't the only avenue. 政 治 大 existing products, Nokia says it prefers 立 to focus on providing additional services. "Just selling a it can take as pressure intensifies in its rural markets. So rather than discounting prices on. ‧ 國. 學. device will not take you into the future,". This is where Nokia Life Tools comes in. Launched last autumn in India, it bundles a. ‧. handset with a service for farmers so that they can get access to crop prices and weather forecasts. y. Nat. as well as English lessons for a monthly fee beginning at 65 cents. Nokia claims Life Tools has. sit. attracted nearly one million users using just one service provider -- Idea Cellular, the telecom. al. n. other service providers.. er. io. arm of conglomerate Aditya Birla Group. It expects faster growth as it expands the tool using. Ch. engchi. i n U. v. The success of Nokia's rural value-added services, is based on a range of key performance indicators (KPIs) including volume, the number of outlets that sell the offering, the returns to the service provider and visibility. But there are greater KPIs that might not show up on its top or bottom line. As he sees it, Nokia in rural India is not just a brand, but a "vehicle for social and economic transformation.". 27.

(30) 3.8. Most Trusted Brand. Introduce Microfinance. #44 in 2006. #4 in 2007. #1 from 2008-2010. #71 in 2004. 政 治 大 Nokia brand awareness is tremendous, due to wide 立 reach to poor rural population. This awareness started ‧. ‧ 國. 學. from 2006 after Nokia introduces microfinance to sell mobile phone. Brand awareness gives Nokia a boost to reach such number one position.. Nat. sit. y. Now Nokia is #1 Most Trusted Brand in India for last 3-years5. Nokia on the other hand. er. io. managed its rapid rise up the charts after being launched in India as recently as 1995. It debuted at a respectable 71 in 2004, moved to 44 in 2006, 4 in 2007 and then shot up to number one — a. n. al. Ch. position that it has held three years running.. engchi. i n U. v. Nokia from a trust perspective is its robustness. The technology never lets the customer down. Sure there's competition and different interface points given the various operating systems. But what works in Nokia's favour is that it is tried and tested, and therefore trusted.". 5. Nokia: Hat-trick for Nokia will have to read pitch to stay No 1. http://economictimes.indiatimes.com/features/brand-equity/Nokia-Hat-trick-for-Nokia-willhave-to-read-pitch-to-stay-No-1/articleshow/6470687.cms. 28.

(31) A key building block to this is Nokia's extensive service network. Nokia claims that 70% of consumers who approach customer care are served within an hour, with 90% of phone issues handled within 24 hours. Even before environment friendliness became a really hot-button issue in India, Nokia developed a widely publicised recycling programme, run through its retail and collection points. Nokia brand awareness is tremendous, due to wide reach to poor rural population. This awareness started from 2006 after Nokia introduces microfinance to sell mobile phone. Brand awareness gives Nokia a boost to reach such number one position. As mention above Nokia was number 44 in 2006 and position improved lot to number four (4) positions in 2007 due to microfinance.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 29. i n U. v.

(32) Chapter 4 : Current controversy on microfinance. 4.1. Micro Credit Bubble. After SKS IPO, danger with so much capital, especially private equity, sloshing about is high valuations. SKS is valued at more than 6 times book value, or three times the global average, and higher than other Indian MFIs, according to The World Bank's Consultative Group to Assist the Poor. The good news is: MFIs are growing, they need capital. And investors want microfinance. 政 治 大 earnings expectations; they're due to excess capital flows. There are fundamentals backing these 立 valuations. It can only lead to disappointment. exposure. They're buying MFIs like they bought IT 10 years ago. But the valuations don't reflect. ‧ 國. 學. At least half a dozen large Indian MFIs, encouraged by the response to SKS, may be. ‧. contemplating IPOs. These may include Spandana Sphoorthy Financial Ltd, Share Microfin Ltd, Asmitha Microfin and Bhartiya Samruddhi Finance. Clearly, now that SKS has got this kind of. y. Nat. er. io. sit. valuation, others will be looking at similar or even higher valuations.. But the valuations don't reflect the risks inherent in the business model: rising costs,. n. al. Ch. i n U. v. worsening credit quality, risk of defaults, regulatory risks, high leverage levels and pressure on. engchi. yields, which leaves little scope for return ratios to expand. Listing will bring additional pressure to perform, he said. Muhammad Yunus, the Nobel Prize-winning pioneer of microfinance in Bangladesh, has warned that profit-making MFIs are no different from loan-sharking moneylenders. In India, the sector desperately needs credit bureau to maintain low delinquencies, and better governance, said World Bank‘s. With a potential base of 120 million unbanked homes, likely credit demand of about $240 billion is the highest in the world, concern is responsible lending. There's no discipline; the industry should be careful there is no over-heating, that there's no bubble. 30.

(33) Amid ongoing scrutiny of the sector in India, industry leader SKS announced that it was cutting rates for new loans in Andhra Pradesh to 24.55 percent annually, from 26.69 percent. The prospect of new regulation and negative publicity are expected to delay the IPO plans of several operators in India. New rules could also make it hard for them to attract the sort of multiples commanded by SKS, the only listed player in India, which was valued at more than six times book value, or three times the global average, when it listed in August 2010 in a heavily oversubscribed issue. Shares in SKS Microfinance have fallen 30 percent since 4th Oct 2010, in part because of ongoing media attention surrounding the firing of its chief executive just two months after its. 政 治 大 Samruddhi Finance are all planning 立IPOs, analysts told Reuters in August.. listing. Share Microfin Ltd, Spandana Sphoorthy Financial Ltd , Asmitha Microfin and Bhartiya. ‧ 國. 學. Spandana, the country's No.2 player, had hoped to raise as much as $400 million in an IPO early next year (Q1 2011), but sources with direct knowledge of the matter said the offer may be. ‧. delayed in the wake of recent industry developments. IPOs will come but they may not go for. y. sit er. Microfinance industry draws scrutiny. io. 4.2. Nat. such high valuations like SKS.. al. n. v i n C poor borrowers inUAndhra Pradesh, the hub of India's Reports of dozens of suicides by h engchi. microfinance sector, prompted the state to enact a rule against aggressive recovery practices by. lenders who make loans that average about $150 to poor customers at interest rates that can top 30 percent. On 28th Oct 2010, the finance minister said this week that he expects the industry to develop a code of conduct on interest rates and recovery practices, while the central bank recently set up a panel to study issues surrounding the sector. Several industry insiders and watchers said greater oversight is needed, although many worry about overregulation. The rise of for-profit microfinance has made billions of dollars in credit available to millions of poor people in India and elsewhere, but it has also spurred controversy. Commercial 31.

(34) microfinance makes lending attractive to poor borrowers who would otherwise be at the mercy of unregulated moneylenders who are known to charge interest rates as high as 100 percent. Critics are uncomfortable with high profit margins earned from poor borrowers, and worry that the social mission of microfinance has been sidelined in favor of profits. 4.3. Microfinance in India is like subprime lending Venugopal Reddy, former Reserve Bank of India (central bank) governor credited with. saving the nation‘s financial system from the 2008 meltdown, has said what many finance experts believed, but did not have the courage to admit publicly: microfinance is India’s subprime.. 立. 政 治 大. ―Ultimately, it‘s something like subprime lending,‖ Mr Reddy told Economic Times (ET). ‧ 國. 學. in an interview ahead of his book release on 23rd Nov 2010. ―The same incentives are operating here... it was securitization and derivatives that operated in the US. Here it is the priority sector. ‧. lending by banks‖. y. Nat. Subprime lending refers to loans extended to people with poor repaying ability that. io. sit. ultimately led to defaults. The $5.5 billion microfinance industry is facing tumultuous times ever. al. n. executive Suresh Gurumani.. er. since the biggest, SKS Microfinance, created a controversy two months ago by sacking chief. Ch. engchi. i n U. v. There was a confluence of woes for the sector when the Andhra Pradesh government came up with legislation curbing SKS Microfinance operations. Banks pulled back on lending as some of the institutions were behaving more like moneylenders and in some cases drove borrowers to suicide. Indian banks such as SBI, ICICI Bank and Axis Bank are estimated to have lent $3.5 billion to micro lenders. ICICI‘s lending is at $450 million, SBI‘s at more than $225 million and Sidbi‘s at $900 million, according to data from rating company Care. The financial magnitude may not be the same with the Indian microfinance industry being tiny compared with the subprime lending crisis that led to more than a trillion dollars of losses 32.

(35) and sank many venerable institutions. But there are similarities such as opaque practices, high salaries and commissions inducing unethical business, and leverage. ―Also, if you look at it, the resource is leveraged; it‘s not just money lending business. The moneylender normally lends out his own money, whereas here the MFI is actually borrowing money from depositors and lending the money. So essentially, he is a moneylender, but a leveraged moneylender.‖ These institutions are no more the not-for-profit ones as envisioned by Nobel Laureate Mohammed Yunus, so regulations are essential. Bangladesh-born Yunus had seen micro lending as a vehicle to lift people out of poverty rather than enhance returns of wealthy investors in private equity funds.. 立. 政 治 大. ―The idea that MFIs should be treated like banks but given soft regulations is dangerous,‖. ‧ 國. 學. said former central bank chairman Mr. Venugopal Reddy. Looking at microfinance, dispassionately. ‧. 4.4. y. Nat. Recently in late 2010, microfinance has lot of controversy in India. Part of the reason is. io. sit. that its deadly combination of high interest rates, coercive recovery processes and stories of. n. al. er. suicides by farmers, extravagant salaries paid to top microfinance brass and promoters making. i n U. v. huge sums selling their stake through initial public offerings gives the sector all the makings of a Bollywood potboiler.. Ch. engchi. The net result is that the Reserve Bank of India (RBI) has finally stepped in (reluctantly, perhaps) to try and do damage control. Never mind that the Bank really doesn‘t have much of a locus standi . As it warns in the press release announcing the setting up of an expert committee to look into the issue, it regulates only those Micro Finance Institutions (MFIs) that are registered with the RBI as non-banking finance companies (NBFCs) and more importantly, have systemic implications for financial sector stability. And the reality is that for all the noise being made, as of now MFIs do not pose a systemic risk to the financial sector. Nonetheless, given the high-decibel controversy, the central bank‘s expert committee has been given a wide mandate: review the definition of ‗microfinance‘ and 33.

(36) ‗MFIs‘ and make appropriate recommendations; examine the prevalent practices of MFIs in regard to interest rates, lending and recovery practices to identify trends that impinge on borrowers‘ interests; delineate the objectives and scope of regulation of NBFCs undertaking microfinance by the RBI and the regulatory framework needed to achieve those objectives. In short the RBI has been asked to see what can be done about the gathering storm clouds over the once-widely lauded microfinance sector. The move is well-intentioned. But the bottomline is can the RBI ensure proper enforcement of whatever regulations it may frame in a sector characterised by a large number of players and scattered, impoverished, often uneducated clientele who are unaware of their rights?. 政 治 大 jeopardise the safety of the banking 立 system since the latter rides on the implicit guarantee of. Or should it limit its role to ensuring the misadventures of microfinance sector do not. ‧. ‧ 國. to microfinance.. 學. taxpayer money. It could do this very simply by taking away the priority sector tag from lending. MFIs are essentially money-lenders, as the former RBI governor YV Reddy, who is known. y. Nat. for making the right, if not always politically correct, statements said recently. But if that is the. sit. case we also need to keep in mind the limited success we‘ve had with regulating money lenders. n. al. er. io. and design a suitable regulatory structure – one that lays down some broad prudential parameters without killing the sector altogether.. Ch. engchi. i n U. v. Too tight a regulatory framework will militate against the essence of micro-finance – informality and flexibility. And will be impossible to enforce in letter and spirit. The far better solution would be to ring-fence the banking system by removing the ‗priority sector‘ tag that provides easy access to funds to the microfinance sector and no less important, educate consumers. Remember there is no dearth of laws in this country; but when it comes to implementation and enforcement it is another story altogether. Think of all the laws on money-lending. Have any of them made an iota of difference? No, they have not for the simple reason that when people are poor and desperate they will go to money lenders, laws be dammed. Poverty, lack of education and social mores that sanction, any mandate, unproductive (wasteful?) expenses on occasions like funerals, marraige etc, make it 34.

(37) impossible for the formal banking system to step into the shoes of the money-lender. To the extent micro-finance meets the same kind of needs its place can never be taken by the formal banking system either. However between a situation like we have today with virtually no rules and one where there is a labyrinth of rules of the kind the Andhra Pardesh Ordinance has sought to impose, some kind of middle path that lays down some rules will at least provide a yardstick against which they can be measured might help. If regulations become like what the wag said about second marriages – the triumph of hope over experience – then we‘ll not get very far. The trick, as in much else in life, is to get the balance right. Dispassionately!. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 35. i n U. v.

(38) Chapter 5: Conclusions. 5.1 Double bottom line. Muhammad Yunus, the Nobel Prize-winning pioneer of microfinance in Bangladesh and founder of Grameen Bank, has expressed his displeasure about microfinance's move from its social mission to a commercial model. "The direction is very clear that microfinance institutions have to pass on the benefits of. 政 治 大. economies of scale and lower costs to clients in the form of lower interest rates," said Royston Braganza, chief executive of Grameen Capital India.. 立. ‧ 國. 學. Grameen Capital India is a Mumbai-based nonprofit consulting and investment banking firm that is a collaboration between Grameen Foundation , IFMR Trust and an arm of Citigroup.. ‧. Mexico's Compartamos became the first microfinance company to go public, in 2007,. y. sit. io. er. to the fore.. Nat. bringing the debate over the industry's dueling objectives -- the so-called "double bottom line" --. al. The business case for the existence of MFIs is so strong, you cannot finish it off. There is. n. v i n a huge market and there is a huge need are not able to meet. India is home to roughly Cthat U h ebanks i h n c g 400 microfinance lenders with a combined 207 billion indian rupees ($4.6 billion) in outstanding loans to 70 million poor people. The 10 largest players account for roughly 80 percent of the industry. With a potential base of 120 million unbanked homes, microcredit demand in India has the potential to rise sharply. New rules are expected eventually to bring down interest rates, and reduce aggressive lending and collection practices, potentially squeezing out smaller players. Ultimately, that could make the industry more transparent and accountable, if less profitable. If at the end of it, the unethical people are rooted out of the sector that will be good in long-run for MFI industry.. 36.

(39) 5. 2 Microfinance institutions need succour. In past budgets, microfinance has been overshadowed by heavyweight industries such as IT, autos, telecom, banking and infrastructure. But now microfinance is emerging as an influential and high-potential industry in its own right. C Rangarajan‘s committee on financial inclusion reported that microfinance institutions (MFIs) ―could play a significant role in facilitating inclusion, as they are uniquely positioned in reaching out to the rural poor.‖ The government has underscored financial inclusion as one way to reduce poverty. Microfinance clearly helps meet that goal by providing financial services — from small loans to. 政 治 大 microfinance sector from reaching its full potential. 立. insurance — to millions of unbanked households. However, several fiscal constraints keep the. ‧ 國. 學. Banks enjoy a host of beneficial tax reductions and exemptions but MFIs do not. MFIs also pay service taxes that our impoverished customers end up paying for even though they. ‧. should be exempt.. Nat. sit. y. If MFIs had a level playing field, they would be able to lower the interest rates, reach. io. er. more customers and help millions more lift themselves out of poverty.. al. n. v i n C banks. Yet banks and their middle-classhcustomers e n g c enjoy h i Upreferential fiscal policies that MFIs. MFIs are now well-regulated, supervised and follow the same kind of requirements as. and their poor clients do not.. To address the issue, the ministry of finance should waive service tax on all micro-loans, which are defined as less than USD 500, and on micro-insurance products that insure less than USD 500. The middle and upper classes get tax breaks on insurance premiums and on interest on housing loans. MFI customers, most of whom are illiterate and live in remote villages, do not file tax returns and therefore can‘t benefit from tax refunds. However, the poor still pay a 1% to 2% processing fee on their micro-loans as well as service taxes of 10.3% on their micro-insurance. 37.

(40) policies. They also end up paying a ―poverty premium‖ since they can‘t take advantage of tax breaks enjoyed by the middle and upper classes. Secondly, MFIs should be allowed to enjoy tax concessions on 40% of profits, as enjoyed by housing finance and infrastructure companies. The government has rightly identified housing and infrastructure as priority sectors. But rural development and financial inclusion are also priorities in achieving inclusive growth. Thirdly, banks and financial institutions get a tax deduction of 7.5% of gross total income for reserves kept against possible bad debts. Alternatively, banks can claim deductions of 10% on assets classified as doubtful or loss assets.. 政 治 大 If MFIs were given tax breaks already enjoyed by banks, they could lower their costs and 立 pass those savings onto our borrowers by reducing interest rates. Microfinance would be more. ‧ 國. 學. affordable for the poor and could flourish further across India.. ‧. 5.3 Conclusions. y. Nat. According to Professor C.K. Prahlad, renowned management expert, the bottom of the. io. sit. pyramid is the market of the future. And if the pot of gold is buried under the pyramid, then. er. MFIs are best placed to dig out this treasure that has been overlooked for far too long.. al. n. v i n C hprograms meet their Debates on whether microfinance goal of poverty reduction continue. engchi U ―More recently these debates have been extended to the possible implications of such programs for women‘s empowerment, with some evaluations claiming positive results while others suggesting that microcredit leave women worse off than before.‖ “Most business owners and managers, whatever the scale of their businesses, spend only. quite a small amount of their time thinking about how to raise finance, or dealing with bankers, moneylenders, family members or others who may be able to provide it. On a day-to-day basis they are more concerned with making or buying things, and then marketing and selling them.‖ This observation leads me to two important conclusions, namely that microfinance clients need not just the financial input, but often-times more importantly they require business 38.

(41) development services (BDS), skills-training, information about market conditions and access to markets. The second important is that besides simply procuring loans, clients also require other financial services, most significant among them insurance and savings. After two decades of focusing on providing banking services to the poor, practitioners are now working towards ‗livelihoods training‘, and teaching marketable skills and/or providing avenues for employment or marketing produce. The Microfinance India Summit 2009 was dedicated in part to re-conceptualizing the role of microfinance to tailor it to sustainable livelihood generation. There is definitely an awareness of these requirements among the leaders in the industry, but as of now, micro-insurance and savings constitute a meager part of the. 政 治 大. microfinance efforts. It is important to point out that most MFIs at the helm of affairs lack the financial and administrative expertise to execute these services properly. It is in order to fill this. 立. void that banks and insurance companies/agencies are required to enter into partnerships with. ‧. ‧ 國. 學. io. sit. y. Nat. n. al. er. MFIs.. Ch. engchi. 39. i n U. v.

(42) References. Nokia: Hat-trick for Nokia will have to read pitch to stay No 1 http://economictimes.indiatimes.com/features/brand-equity/Nokia-Hat-trick-for-Nokia-willhave-to-read-pitch-to-stay-No-1/articleshow/6470687.cms Press Release – Nobel Peace Prize 2006. Available at: http://nobelprize.org/nobel_prizes/peace/laureates/2006/press.html.. The Global Development Research Centre website. Available at:. 政 治 大. http://www.gdrc.org/icm/iym2005/index.html.. 立. ‧ 國. 學. Top 50 Microfinance Institutions in India by CRISIL http://www.crisil.com/pdf/ratings/CRISIL-ratings_india-top-50-mfis.pdf The 50 Top Microfinance Institutions (Forbes). Nat. Microfinance, Mega Impact. io. er. http://blogs.hbr.org/cs/2010/03/microfinance_mega_impact.html. sit. y. ‧. http://www.forbes.com/2007/12/20/microfinance-philanthropy-credit-bizcz_ms_1220microfinance_table.html. al. n. v i n Ch http://blogs.hbr.org/cs/2009/08/why_theres_no_credit_crisis_in.html engchi U Why There's No Credit Crisis in Microfinance. Vikram Akula CEO and founder of SKS Microfinance http://en.wikipedia.org/wiki/Vikram_Akula. The Economic Times http://economictimes.indiatimes.com/. Nokia Life Tools http://www.nokia.co.in/services-and-apps/nokia-life-tools/main. SKS India http://www.sksindia.com/. Reuters STOCKS SKS Microfinance Ltd (SKSM.BO) http://www.reuters.com/finance/stocks/chart?symbol=SKSM.BO. 40.

(43) Brand Equity Survey: India's top 10 most trusted brands http://economictimes.indiatimes.com/quickiearticleshow/6473544.cms. Professor C.K. Prahlad , The Fortune at the Bottom of the Pyramid: Eradicating Poverty Through Profits RBI NBFC http://www.rbi.org.in/scripts/BS_ViewNBFCNotification.aspx. Vikram Akula (2010). A Fistful of Rice: My Unexpected Quest to End Poverty Through Profitability. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 41. i n U. v.

(44) Appendixes A. CRISIL List of Top 50 Microfinance Institutions in India by Loan Amount Outstanding for 2009 1. SKS Microfinance Ltd (SKSMPL) 2 Spandana Sphoorty Financial Ltd (SSFL) 3 Share Microfin Limited (SML) 4 Asmitha Microfin Ltd (AML) 5 Shri Kshetra Dharmasthala Rural Development Project(SKDRDP) 6 Bhartiya Samruddhi Finance Limited (BSFL) 7 Bandhan Society 8 Cashpor Micro Credit (CMC) 9 Grama Vidiyal Micro Finance Pvt Ltd (GVMFL) 10 Grameen FinancialServices Pvt Ltd (GFSPL) 11 Madura Micro Finance Ltd (MMFL) 12 BSS Microfinance Bangalore Pvt Ltd (BMPL) 13 Equitas Micro Finance India P Ltd (Equitas) 14 Bandhan Financial Services Pvt Ltd (BFSPL) 15 Sarvodaya Nano Finance Ltd (SNFL) 16 BWDA Finance Limited (BFL) 17 Ujjivan FinancialServices Pvt Ltd (UFSPL) 18 Future Financial Services ChittoorLtd (FFSL) 19 ESAF Microfinance & Investments Pvt. Ltd (EMFIL) 20 S.M.I.L.E Microfinance Limited 21 SWAWS Credit Corporation India Pvt Ltd (SCCI) 22 Sanghamithra Rural Financial Services (SRFS) 23 Saadhana Microfin 24 Gram Utthan Kendrapara, 25 Rashtriya Seva Samithi (RASS) 26 Sahara Utsarga Welfare Society (SUWS) 27 Sonata Finance Pvt Ltd (Sonata) 28 Rashtriya Gramin Vikas Nidhi 29 Arohan Financial Services Ltd (AFSL) 30 Janalakshmi Financial Services Pvt Ltd (JFSPL) 31 Annapurna Financial Services Pvt Ltd 32 Hand in Hand (HiH) 33 Payakaraopeta Women‘s Mutually Aided Co-operative Thrift and Credit Society (PWMACTS) 34 Aadarsha Welfare Society(AWS) 35 Adhikar 36 Village Financial Services Pvt Ltd (VFSPL) 37 Sahara Uttarayan 38 RORES Micro Entrepreneur Development Trust(RMEDT) 39 Centre for Rural Social Action (CReSA). 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 42. i n U. v.

(45) 40 41 42 43 44 45 46 47 48 49 50. Indur Intideepam Federation Ltd (IIMF) Welfare Organisation for Multipurpose Mass Awareness Network (WOMAN) Pragathi Mutually Aided Cooperative Credit and Marketing Federation Ltd(PMACS) Indian Association for Savings and Credit(IASC) Sewa Mutually Aided Cooperative Thrift Societies Federation Ltd (Sewa) Initiatives for Development Bangalore, Foundation (IDF) Gandhi Smaraka Grama Seva Kendram (GSGSK) Swayamshree Micro Credit Services (SMCS) ASOMI Janodaya Trust Community Development Centre (CDC). B. SKS Chart after IPO. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. C. Glossary ADB BDS BRAC CGAP IPO JLG MFI MDG. Asian Development Bank Business Development Services Bangladesh Rural Advancement Committee Consultative Group to Assist the Poor Initial Public (Stock) Offering Joint Liability Group Microfinance Institution Millennium Development Goals. 43.

數據

相關文件

This shows that, up until the mid to late Tang Dynasty, objects made of glass and crystal still were both called liuli, whereas the term poli was used to refer to

•Last month I watched a dance class in 崇文 Elementary School and learned the new..

“Social welfare” if defined in a narrow sense refers to the services provided by the Social Welfare Department (SWD) and Non-governmental Organisations (NGOs),

Promote project learning, mathematical modeling, and problem-based learning to strengthen the ability to integrate and apply knowledge and skills, and make. calculated

Now, nearly all of the current flows through wire S since it has a much lower resistance than the light bulb. The light bulb does not glow because the current flowing through it

This kind of algorithm has also been a powerful tool for solving many other optimization problems, including symmetric cone complementarity problems [15, 16, 20–22], symmetric

It is useful to augment the description of devices and services with annotations that are not captured in the UPnP Template Language. To a lesser extent, there is value in

Microphone and 600 ohm line conduits shall be mechanically and electrically connected to receptacle boxes and electrically grounded to the audio system ground point.. Lines in