從連動債糾紛探討銀行財富管理業務 - 政大學術集成

全文

(2) 從連動債糾紛探討銀行財富管理業務 A Review of Structured Note Investment Disputes - Impact on the Bank Wealth Management Business. 研究生:袁美華. Student: Yuan Mei Hwa. 指導教授:吳文傑. Advisor: Jack Wu. 立. 政 治 大. 國立政治大學. ‧ 國. 學. 商學院國際經營管理英語碩士學位學程 碩士論文. sit. y. ‧. Nat. A Thesis. er. io. Submitted to International MBA Program. n. al National Chengchi University iv. n U i e h n g of in partial fulfillment c the Requirements. Ch. for the degree of Master in Business Administration. 中華民國一○○年七月 July 2011 i.

(3) Dedication. I will like to dedicate this thesis wholeheartedly to my beloved family members, my parents Mr. Yuan Hsin Lai and Mrs. Yuan Liu Chiu Yin who have been all time praying and blessing me for good, sacrifice their leisure and devoted endlessly their loves, times and efforts to help and take care of my children for more than eighteen years; my husband Jack Wang Han-Ching, who had given me strength at all times and support me to pursue all my desires;. 治 政 大 David Ta-Wei and Tina and my three lovely children Raymond Shih-Chun, 立. Tin-An, you are all my proud and comforts; and my sister Rose Mei-Len,. ‧ 國. 學. brother in-law Yi-Chia, nephew Victor Chen and my brother Ken Fang-Yu and. ‧. sister-in-law Li-Ting, my niece Pei-Yun and my youngest brother Vincent. sit. y. Nat. Hsin-Chi, who had contributed to take care of the family members with patience and loves, all of you have accompanied me all the ways to overcome. er. io. the difficulties I have faced a and give me your hands warmly whenever I am in. n. iv l C n need. I love you all and feel deeply for everything you have devoted, h e ngratitude gchi U assisted and shared with me. My studies in National Chengchi University and completion of this thesis would not be a possible if it is without all of your full supports, understandings, cares and loves.. ii.

(4) Acknowledgments. Immersed with joy and excitement that I have passed the thesis oral examination and achieved another milestone of mine, I would like to express my greatest appreciation to my thesis advisor, Professor Jack Wu Wen-Chieh, who had showed his patience and guide me on the research directions and structure of my thesis; and most importantly, he had encouraged and urged me. 政 治 大. to complete my thesis within this semester which is relatively critical and. 立. meaningful to me; and I would like to convey a big thanks also to the thesis. ‧ 國. 學. oral examination committee members, Professor Kuo and Professor Ho, their valuable suggestion and advice have indeed inspired my thoughts greatly.. ‧. Special thanks to Lichi Ho, who had showed her enthusiasm at work and. y. Nat. io. sit. response promptly to any requests of mine, and the staff of OIP who had. n. al. er. rendered their full supports and assistance to me all the way.. Ch. en chi. i Un. v. g who had in many times and occasions Much appreciations also to many others assisted and work together with me to get through all the tough times during these periods, including my classmates in IMBA, Annie Wei, Kate Chang, Terry Sheng and Tony Lien, who had generously shared their thesis writing and oral examination experience with me; my boss, colleagues and subordinates at work who had showed positive attitudes about my studies, support and share the office tasks willingly.. iii.

(5) Abstract. A Review of Structured Note Investment Disputes - Impact on the Bank Wealth Management Business By YUAN MEI HWA Wealth Management Business had become a popular business sector to the Taiwan Financial. 治 政 Institution in recent year.大The 立. Law governing Bank. Conducting Wealth Management Business and Operating Guidelines were. ‧ 國. 學. promulgated by Financial Supervisory Commission in year 2005, since then. ‧. most of the Bank in Taiwan stepped into the wealth management business. y. sit. io. er. customer.. Nat. categories and commence to provide wealth management services to their. al. n. iv n C Through the wealth management h eservices i Utrust platform channel, foreign n g c hand Structured Note products were largely introduced by Investment Bank through Banks in local to their wealth management customers or even non-wealth management customers in year 2006. The broke out of the European financial tsunami, primarily the sub-prime issues in the United States, the announcement of the bankruptcy of Leman Brothers aroused the Structured Note Investment disputes in local financial market.. The disputes in Structured Note Investment had roused high attention of the iv.

(6) local regulators as the numbers of customer complaints received by FSC were more than ten thousands in year 2007 and 2008. Bank in Local were forced by public and local governing regulators to settle the disputes with customers. Eventually banks were ban by local regulators to cease foreign structured notes transactions in mid of 2009 and the Bank wealth-management business has slumped since then and impact directly to the performance of the Bank Wealth Management Business.. 政 治 大 disputes and from the studies 立 of the types of disputes models, we will further The objective of the thesis is to focus on the analysis of the Structured Notes. ‧ 國. 學. conduct a review on regulatory trends on the governing of the relevant business and hopefully, we aim to provide some of the recommendation on the. ‧. ways that Bank may adopt for its Wealth Management Business for the selling. sit. y. Nat. of the investment products, in particularly on the Structured Investment. n. al. er. io. Products in the future.. Ch. engchi. v. i Un. v.

(7) TABLE OF CONTENTS 1. Introductions .............................................................................................1 1.1 Background .................................................................................................1 1.2 Objective and Methodology .......................................................................2 1.3 Limitation of the study................................................................................3 1.4 Structure of the thesis .................................................................................3. 治 政 大 Environment .................5 2. Introduction of Wealth Management Business 立 2.1 Introduction of Wealth Management Business ....................................5. ‧ 國. 學. 2.2. Local Governing Laws and Regulations .............................................5. ‧. 2.3 Comparison of Local and Foreign Bank ..............................................7. sit. y. Nat. 3. Introduction of Structured Note.................................................................9. er. io. 3.1 Definition .............................................................................................9. n. 3.2 Local GoverningaLaws 15 iv l and Regulations ............................................ Ch. n engchi U. 4. Case Studies ............................................................................................... 17 4.1 Customer‟s Dispute Cases (models) identified by Bankers Association Committee on Leman Brother Structured Note. ........... 17 4.2 Structured Note litigation Cases with Civil Courts........................... 20 4.2.1. Taiwan District/High Court Civil Judgment on Structured Note Claims ...................................................................................... 20 4.3 Investigation Report of Foreign Governmental Bodies on Financial Institution .......................................................................... 39. vi.

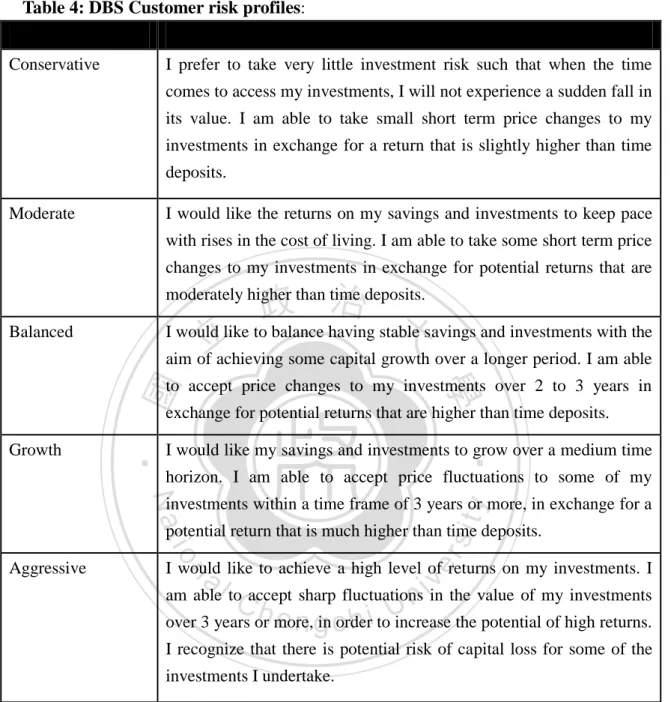

(8) 4.3.1 MAS Findings on Individual Distributor ................................ 39 4.3.1.1 ABN AMRO Bank N.V Singapore Branch ................... 40 4.3.1.2 DBS Bank Ltd( DBS) .................................................... 43 5. Management of the Wealth Management Business .............................. 47 5.1 Structured Note Dispute Impacts ...................................................... 47 5.1.1 A review of Customers Protection Scheme Adopted by T Bank47 5.1.2. A review of Customer Protection Scheme Adopted by C Bank52 5.2 New Laws and Regulations............................................................... 56. 政 治 大 5.2.2 Regulations 立for Banks Conducting Financial Derivatives. 5.2.1. Regulation Governing Offshore Structured Products ............. 57. ‧ 國. 學. Business (“the Regulations”) .................................................. 59 5.2.3 Regulations Governing the Scope of Business, Restrictions on. ‧. Transfer of Beneficiary Rights, Risk Disclosure, Marketing,. sit. y. Nat. and Conclusion of Contract by Trust Enterprises (“the. er. io. Regulation”) .............................................................................. 62. n. al 5.2.4 Other Supervisions ................................................................... 64 iv Ch. n engchi U. 5.3 Analysis and Recommendations .............................................................. 65 5.4 Conclusion ............................................................................................... 79 Reference................................................................................................. 80. vii.

(9) LIST OF TABLES Table 1: Risks Associated to structured notes commonly seen ................... 12 Table 2: Common key risks apply to structured notes............................... 14 Table 3: ABN Customer Risk Profiles .................................................... 40 Table 4: DBS Customer risk profiles ...................................................... 44. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. viii. i Un. v.

(10) 1. Introductions 1.1 Background Wealth Management Business boosted in Taiwan Financial Market after the announcement of the wealth management rulings by Financial Supervisory Committee (FSC) in year 2005. It is a new business area that Taiwan financial market has relied upon to cope with the low interest rate income at this times for the increase of bank‟s revenue. The need of wealth management services from local customer also drives the emerging of the wealth management service market. Banks provides wealth management advices, introduces. 治 政 investment products to their customers and charged 大 related services fees, handling fees 立 against its customers who conducted investment transaction or received investment advice ‧. ‧ 國. 學. related services.. sit. y. Nat. For the protection of local economics, local regulatory bodies set up stringent restrictions to. io. er. its people on offshore investment. The deregulation of offshore investment through Trust. al. Business platform and Wealth Management Services offered by the Bank, opened up the. n. iv n C door for Taiwan people that seek for to invest overseas. Subsequently, h ethen opportunities gchi U foreign Structured Note products were introduced to the Taiwan market by foreign investment Bank. Many investors that invested the Structured Notes look forwarding to. receiving a higher return from these offshore investments. Unfortunately, the recent US financial crisis-primarily the subprime mortgage crisis1 that broke out in July of 2008 has broken up these investor‟s dream of fortune.. 1. Subprime Mortgage Crisis (visited 28 December 2010) <http://en.wikipedia.org/wiki/Subprime_mortgage_crisis>. 1.

(11) As a result of the continuing subprime issues, Lehman Brothers Holdings Inc. (Lehman Brother) filed for Chapter 11 bankruptcy protection, which marked the largest bankruptcy in U.S. history. Leman Brother following the massive exodus of most of its clients, suffered drastic losses in its stock, and devaluation of its assets by credit rating agencies. The overwhelming of US bank solvency, declines in credit availability, and damaged investor confidence had an impact on global stock markets, resulted in the slowed down of economies worldwide during this period as credit tightened and international trade declined2. And inevitably, Structured Note investment crisis burst out in the year of 2008 subsequently.. 1.2. 政 治 大 Objective and Methodology 立. ‧ 國. 學. Wealth Management Business is a new Business sector in local market and it is deemed to be a business that may constitute great income revenue for banks, however the disputes of. ‧. Structured Notes investors has greatly impacted the perform of wealth management. Nat. sit. y. business of the Bank. Local investors suffered great losses from Structured Product. n. al. er. io. Investment and criticized bank‟s responsibility for providing wealth management service.. i Un. v. The purpose of the thesis is to look into the details of the Structured Notes disputes, and by. Ch. engchi. digging and analysis the causes of the disputes, we hope that we can work out some workable way to mitigate future argument in wealth management service and provides some thoughts and recommendation on the management of the wealth management business. Through the research on articles, studies, books and reading materials and information found on internet on the relevant topics, this thesis will review the development of the wealth management business, regulatory background of the wealth management business in. 2. Bankruptcy of Lehman Brothers (visited 28 December 2010) <http://en.wikipedia.org/wiki/Bankruptcy_of_Lehman_Brothers>. 2.

(12) Taiwan and through the introduce of the Structured Notes Product and the regulatory background for banks providing the service, the thesis will focus on the review and analysis of types of structured note investment disputes through the studies of the actual Structured Note disputes model findings by Bankers Association (“BA”) of Republic of China; and also Structured Notes Civil Judgments issued for the Structured Note dispute claim cases; and basing upon the findings on the investigation report issued by foreign governmental bodies on Structured Note disputes, and through the review of C and U Bank recent business strategy to sought out possible improvement and enhancement of the management. 政 治 大. for the wealth management business in Taiwan.. 立. ‧ 國. 學. 1.3 Limitation of the study. World economic after experiencing the US financial crisis has not yet fully recovered, and. ‧. as Structured Note disputes has not come to an end, so as following the introduce of. Nat. sit. y. relevant new Laws and Regulations governing the issuance of offshore Structured. n. al. er. io. Products, ,it is difficult to justify at this stage in this thesis, the successful of any bank‟s. i Un. v. business management strategy, the studies of the current Bank‟s wealth management. Ch. engchi. strategy or policy may not be a concrete supportive evidence to show or support the effectiveness of the bank‟s wealth management policies.. 1.4 Structure of the thesis The author begins with the definition of the wealth management and provides the local governing laws and regulations for reviewer‟s information in Chapter 2. Following the definition provided also for „Structured Note” in Chapter 3, we introduce the Structured Note Product features for reader‟s understanding. Through the case studies in Chapter 4, author further proceed to identify the Structured Note. 3.

(13) Investment disputes models via reviewing the disputes case with Bankers Association Committee, litigation cases with the Taiwan District/High Court and finally the Investigation Report from Singapore Financial Governing Authority.. In the last Chapter, author introduces and conducts a review of the business strategy on customer protection adopted by T and C Bank after the financial crisis, and then provides the latest development of the local laws and regulations on the respective areas. Author by applying the SWOT concepts, provides an analysis of the disputes model identified and. 政 治 大. provides suggestions and finally the conclusion of the thesis.. 立. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 4. i Un. v.

(14) 2. Introduction of Wealth Management Business Environment 2.1 Introduction of Wealth Management Business Definition According to the explanation found on the Wikipedia3, the free encyclopedia, Wealth Management is an investment advisory discipline that incorporates financial planning, investment portfolio management and a number of aggregated financial services. High Net Worth Individuals, small business owners and families who desire the assistance of a. 政 治 大 banking, estate planning, legal 立 resources, tax professionals and investment management.. credentialed financial advisory specialist call upon wealth managers to coordinate retail. ‧ 國. 學. Wealth managers can be an independent Certified Financial Planner, MBAs, Chartered Strategic Wealth Professional, CFA Charter holders or any credentialed professional money. ‧. manager who works to enhance the income, growth and tax favored treatment of long-term. er. io. sit. y. Nat. investors.. Wealth management is often referred to as a high-level form of private banking for the. n. al. Ch. i Un. v. especially affluent. One must already have accumulated a significant amount of wealth for. engchi. wealth management strategies to be effective.. 2.2. Local Governing Laws and Regulations. The Regulation Governing Bank Engaging in Wealth Management Business 4 (“the Regulation) was promulgated on 21 July 2005 by Financial Supervisory Commission (FSC),. 3. Wealth Management (visited 28 December 2010) <http://en.wikipedia.org/wiki/Wealth_management>. 4. 銀行辦理財富管理業務應注意事項(visited 30 May 2011) <http://law.banking.gov.tw/Eng/FLAW/FLAWDAT0202.asp>. 5.

(15) Executive Yuan of Republic Of China. The Article number 2 of the Regulation states that “The term "wealth management business" means the provision to high net worth customers by a bank through its wealth managers of financial planning or assets and liability allocation services that match the customer's needs, with a view to offering various financial products and services that the bank is legally authorized to provide.. An individual bank shall have discretion in determining its own thresholds for "high net worth customers" under the preceding paragraph based on its operational strategies.. 政 治 大 define the scope of financial products available for planning for or sale to high net worth 立. Notwithstanding the foregoing, the bank shall, for internal compliance purposes, clearly. ‧ 國. 學. and non-high net worth customers. The bank shall also avoid selling to non-high net worth customers financial products that are too risky or too complex in structure. And a bank shall. ‧. Nat. n. al. er. io. sit. business that involves operation of foreign exchange business.. y. obtain approval from the Central Bank of China for conducting wealth management. i Un. v. Basing upon the Regulations for Bank that wishes to engage Wealth Management Business,. Ch. engchi. they shall require to submit application to FSC for approval and obtained also CBC‟s for approval if foreign currency is involved in the transaction currencies. Under the Regulations, Bank engaging in the wealth management Business shall set up a specialized Department and equipped with professional wealth management personnel to provide the service to the customer. The specialized Department will be responsible for the planning of the Wealth Management Business strategies and the management of its Wealth Management Sales Representatives. The sales representatives of the wealth management shall need to pass the qualification test as required by local authorities and non wealth management department. 6.

(16) sales representative shall not provides wealth management products/services to its wealth management business.. Bank is required under the regulations to set up internal control and risk management policies when running the business. The aforesaid policies shall includes the sales representative management rules, Know Your Customer standard, monitoring of abnormal or suspicious transaction, marketing promotion and risk management of customer‟s account procedures, prevention of insider trading and conflict of interest mechanism and customer. 政 治 大 is governed by the Operating Rules for Banks Conducting Wealth Management Business . 立. disputes handling process. All details requirements of the internal and risks control process 5. ‧ 國. 學. 2.3 Comparison of Local and Foreign Bank. ‧. In view of different regulatory environments in governing banking business, the types of. y. Nat. er. io. sit. financial products and services provided by local banks and banks overseas in the wealth management business or the threshold of defining its wealth management customers may be. n. al. different.. Ch. engchi. i Un. v. Take Citibank Private Bank for example, the services includes investing financing, normal banking products and services, Wealth Advisory (including may be tax and accounting advice etc. services), Research and even Wealth Education6. While local Bank provides. 5. 銀行辦理財富管理業務作業準則(visited 30 May 2011) <http://law.banking.gov.tw/Chi/FINT/FINTQRY04.asp?N2=&sdate=&edate=&keyword=%B0%5D%B4I% BA%DE%B2z&datatype=etype&typeid=*&page=1&recordNo=6>. 6. Citi Private Bank ( visited 22 June 2011) <https://www.privatebank.citibank.com/cpb/cwslogin/external/publicsite/!ut/p/c5/04_SB8K8xLLM9MSSzPy 8xBz9CP0os3hjl2AXZzcPIwOLMH8TA0_H4DAnQ09_QwMDA_1wkA6zeAMcwNFA388jPzdVvyA7rxw AZtTjZg!!/dl3/d3/L2dBISEvZ0FBIS9nQSEh/>. 7.

(17) general traditional bank‟s products and services, such as deposit, credit card, remittance, sales of investment products (e.g. mutual fund, structured products etc.) etc. areas.. High net worth customers may be provided by Private Banking Services by the Bank. To be qualified as private bank customer for Citibank, their Asset Under Management (AUM) with the Bank shall at least meet the minimum threshold of USD1million (i.e. approximately NTD33millons). While for a general local bank‟s wealth management business, normally customers with AUM with NTD3millions or above shall be accepted by the banks as wealth management customers.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 8. i Un. v.

(18) 3. Introduction of Structured Note 3.1 Definition. As explained in the Wikipedia7, a structured note is a hybrid security that includes several financial products, typically a stock or bond plus a derivative (e.g. a two-year bond tied together with an option contract). The option contract in addition, changes the security's risk/return profile to make it more tailored to an investor's comfort zone.. 政 治 大. The introduction of the structured note provided by The Association of Banks in Singapore. 立. for investor‟s knowledge is extracted and provided as below for reference8.. ‧ 國. 學. A structured note is an investment with return that link to the performance of one or more reference asset(s) or benchmark(s). These reference assets or benchmarks typically include. ‧. interest rate, foreign exchange rate, market indices, equities, fixed-income products or any. y. Nat. io. sit. combination of the above. Investor may receive in return, the interest amount and/or. n. al. er. principal repayment, which are linked to the performance of the underlying asset(s) or. Ch. i Un. v. instruments. Investor may receive interest or returns at regular intervals throughout the. engchi. tenor for some of the notes. The payout may be a specified fixed coupon or subject to an equation described in the terms and conditions of the product.. At the maturity of the structured note, except where there is an early redemption, the investor will receive at maturity, either the whole original principal amount invested or an. 7 8. Structured Note ( visited 30 May 2011) < http://en.wikipedia.org/wiki/Structured_note> MAS Monetary Authority of Singapore. The Association of Banks in Singapore Making Sense of Structured Notes ( last modified 11/2/2010) pg1,3&4 <http://www.moneysense.gov.sg/resource/publications/guides_publications/MakingSENSEStructuredNotes.p df>. 9.

(19) amount calculated based upon the formula stipulated in the product term sheet. If the issuer of the note has the right to redeem or “call” the notes before the maturity date, the structured note is “callable” at issuer‟s discretion, and investor would normally be redeemed at the full value of the original investment amount for such note.. . Examples (types) of structured note:. - Credit-linked Note: The interest amount and/or principal repayment are linked to the creditworthiness of an. 政 治 大 etc.) of such entity or portfolio of entities 立. entity or portfolio of entities and /or market value of the debt obligations (e.g. loans, bonds. ‧ 國. 學. - Equity Linked Note:. ‧. They are Notes that linked to equity indices, e.g. S&P 500, Strait Times Index (STI), or. Nat. sit. y. share price of a company, or to a basket of shares or basket of stock indices. Investor may. n. al. er. io. receive shares instead of cash at the time principal is to be repaid.. Ch. engchi. i Un. v. Structured Notes may also structured to link with foreign exchange rate, interest rate (e.g. London Interbank Offered Rate (LIBOR)), commodities prices and other asset classes. And sometimes, there are notes with returns that are linked to two or more reference assets or benchmarks, for instance interest or principal return depending on both creditworthiness and share price of a group of companies etc.. Structured notes are typically embedded with derivatives instrument such as options or swap contracts. The issuer of the structure note may enter into a derivative contract with. 10.

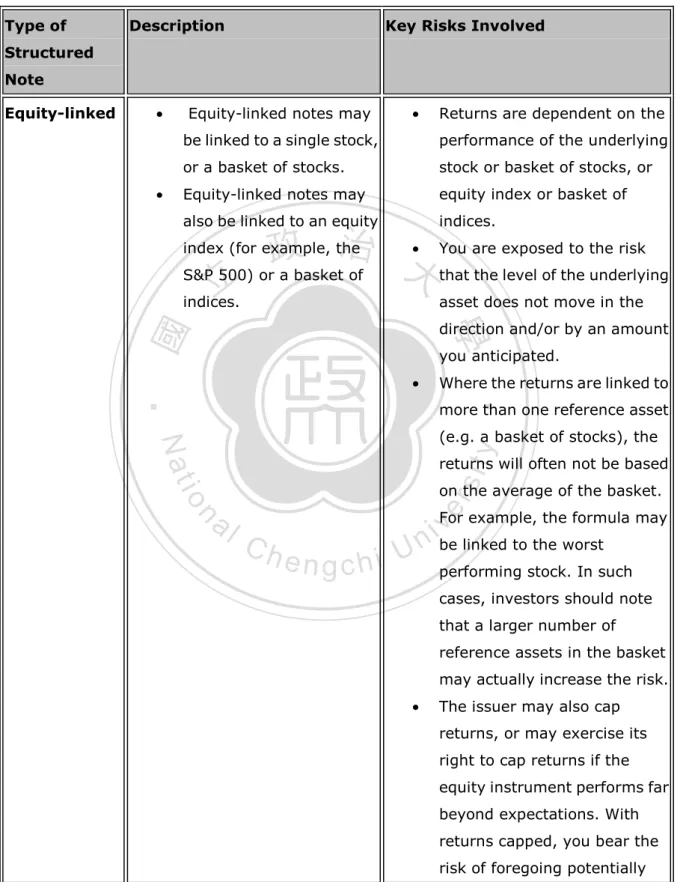

(20) another institution in some structures. As a result, the performance of a derivative instrument shall have a direct impact on the returns of the structured note. In simple, the performance of the underlying asset or bench mark (e.g. credit, equities and commodities) shall impact the note‟s overall return.. Sometimes, structured note may also be early redeemed in circumstances where there is occurrence of issuer default, i.e. issuer unable to meet payment obligations, or when there is force majeure or extraordinary event occurred, or if on payments are aroused from the. 政 治 大 is insufficient to secure any or all issuer‟s obligation under the structured note. 立. product or taxes are imposed on the issuer, or when market value of any collateral falls and In. ‧. ‧ 國. 學. consequence, investor may then receive less than the amount they initially invested.. Structured Note may be issued by a financial institution, e.g. a bank or by a special purpose. Nat. sit. y. vehicle that has been set up for the purpose of issuing structured note.. n. al. er. io. Generally, structured note investment involves risks, depending on the structure of the notes,. i Un. v. these risks may include risks such as early redemption risks, reinvestment risks, sub effect. Ch. engchi. of underlying risks, interest rate risks, liquidity risks, credit risks, exchange rate risks, event risks, country risks, inflation risks, call risks, settlement risks and minimum return risks etc.. The below table list some commonly seen structured note and risks associated to each type9.. 9. MAS Monetary Authority of Singapore. The Association of Banks in Singapore Making Sense of Structured Notes ( last modified 11/2/2010) pg5 <http://www.moneysense.gov.sg/resource/publications/guides_publications/MakingSENSEStructuredNotes.pd f>. 11.

(21) Table 1 Risks Associated to structured notes commonly seen Type of. Description. Key Risks Involved. Structured Note . Equity-linked notes may. . . Returns are dependent on the. be linked to a single stock,. performance of the underlying. or a basket of stocks.. stock or basket of stocks, or. Equity-linked notes may. equity index or basket of. also be linked to an equity. indices.. You are exposed to the risk 政 治 大 S&P 500) or a basket of that the level of the underlying 立 indices. asset does not move in the index (for example, the. 學. direction and/or by an amount. ‧ 國. you anticipated. Where the returns are linked to. ‧. . more than one reference asset. y. Nat. (e.g. a basket of stocks), the. io. sit. returns will often not be based on the average of the basket.. n. al. er. Equity-linked. Ch. engchi U. For example, the formula may v i n be linked to the worst performing stock. In such cases, investors should note that a larger number of reference assets in the basket may actually increase the risk.. . The issuer may also cap returns, or may exercise its right to cap returns if the equity instrument performs far beyond expectations. With returns capped, you bear the risk of foregoing potentially. 12.

(22) higher returns from investing directly in the underlying stock or basket of stocks. . Where the structured notes pay you in the form of shares, you may end up buying shares at a price that is higher than their current market price.. Interest. . Returns for such notes. rate-linked. . Your returns may depend on. are usually linked to a. the direction and/or amount. formula that makes. by which interest rates move.. 治 You are exposed to the risk 政 floating interest rate (for 大 that interest rates do not move 立 the Singapore example, in the direction or by the . interbank Offered Rate). The returns are linked to. amount you anticipated.. 學. . Your returns are exposed to. ‧. the credit risk of specified. known as a "credit event". entities and/or to the credit. (for example, if a. risk/market value of the. specified company. underlying collateral, if any. In. io. sit. y. Nat. the occurrence of what is. becomes insolvent or. n. al. defaults on its loans). Ch. engchi. and/or to the credit. risk/market value of the underlying collateral. er. Credit-linked. ‧ 國. reference to a specific. some cases, you may lose all,. iorv substantially all, of your n U. original investment amount.. . You will need to be able to assess the likelihood of a credit event occurring to the specified entities as well as the entities that constitute the underlying collateral.. 13.

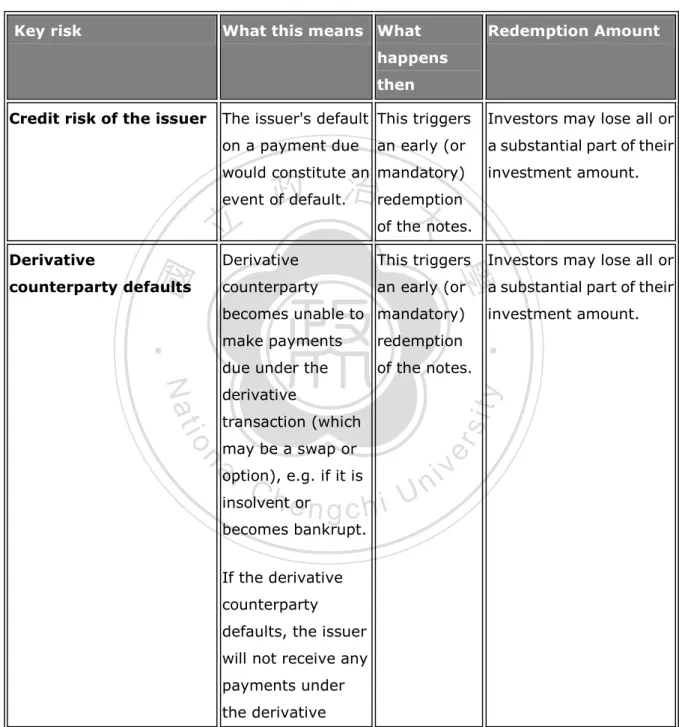

(23) In addition, some of the risks that apply generally to structured notes are listed below10. (p.s. this is not an exhaustive list.). Table 2 Common key risks apply to structured notes Key risk. What this means What. Redemption Amount. happens then Credit risk of the issuer. The issuer's default This triggers. Investors may lose all or. on a payment due. a substantial part of their. an early (or. would constitute an mandatory). investment amount.. Derivative. This triggers. Investors may lose all or. counterparty. an early (or. a substantial part of their. counterparty defaults. 學. becomes unable to mandatory). investment amount.. redemption. due under the. of the notes.. y. transaction (which. io. may be a swap or. sit. Nat. derivative. ‧. make payments. er. Derivative. ‧ 國. 治redemption 政 event of default. 大 of the notes. 立. n. aoption), iv l C e.g. if it is n h eorn g c h i U insolvent becomes bankrupt. If the derivative counterparty defaults, the issuer will not receive any payments under the derivative. 10. MAS Monetary Authority of Singapore. The Association of Banks in Singapore Making Sense of Structured Notes ( last modified 11 February 2010) at 6-7 <http://www.moneysense.gov.sg/resource/publications/guides_publications/MakingSENSEStructuredNotes. pdf>. 14.

(24) transaction and may not be able to meet its payment obligations under the notes.. Certain events adversely The assets. This triggers. Investors may lose all or. affecting the value or. constituting the. an early (or. a substantial part of their. performance of the. collateral suffer a. mandatory). investment amount.. collateral. loss in market value redemption thereby leading to a of the notes. loss in the market. 政 治 大 collateral as a 立 whole. The issuer of the. 學. ‧ 國. value of the. collateral (e.g.. ‧. bonds) becomes. io. its payment. y. sit. defaults on any of. er. Nat. insolvent or. n. aobligations. iv l C n hengchi U. 3.2 Local Governing Laws and Regulations. In according to the Guidelines for Bank Conducting Financial Derivatives Businesses11 Article number 2, it explain that “ the term “ financial derivatives” shall mean for contract values derive from an interest rate, exchange rate, stock price, index, commodity, or other interest, or from a combination thereof as well as Structured Products. The term “structured. 11. Directions for Banks Conducting Financial Derivatives Businesses (last Modified 2009.12.31) < http://law.banking.gov.tw/Eng/FLAW/FLAWDAT01.asp?lsid=FL006459>. 15.

(25) product” as used herein shall mean a combination transaction of fixed-income products and derivatives products sold by a bank to a client as counterparty to the transaction.. Structured Note Products were largely introduced by Banks to its wealth management customer or non-wealth customer starting from year 2005 to 2008 before the broke out of the financial crisis in US. Banks by applying trust license and approval sought from local authorities (i.e. FSC and Central Bank of China (CBC)) will be able to conduct structured notes business with its customers. Normally Bank‟s customer would need to open a trust. 政 治 大 products (offshore or internal structured note products) offered (issued) by offshore or in 立. account with the Banks before they are able to invest mutual fund or structured note. ‧ 國. 學. country investment bank, entities or financial institutions12. In general, Bank‟s would need to comply with the Regulations governing Bank Conducting Financial Derivatives. ‧. Businesses, Regulations for Bank Conducting Wealth Management( or Non-Wealth. Nat. sit. y. Management) Business, Operating Rules for Bank Conducting Wealth Management(or. n. al. er. io. Non-Wealth Management) Business, Trust Business Law and Regulation Governing Trust. i Un. v. Business In Managing Specified Trust fund( non-discretionary trust)to Invest In offshore. Ch. engchi. Securities13 and its relevant self disciplinary rules when providing offshore structured note product to its customers.. 12. 銀行銷售雷曼兄弟發行之連動債商品,有關投資人權益問答集 (visited 30 May 2011) <http://www.banking.gov.tw/Layout/main_ch/News_NewsContent.aspx?NewsID=19236&path=2995&Lan guageType=1>. 13. 信託業辦理特定金錢信託投資國外有價證券業務應遵守事項(visited 30 May 2011) <http://law.banking.gov.tw/Chi/FINT/FINTQRY04.asp?N2=&sdate=&edate=&keyword=%AFS%A9w%A A%F7%BF%FA%ABH%B0U&datatype=etype&typeid=*&page=1&recordNo=7>. 16.

(26) 4. Case Studies 4.1 Customer‟s Dispute Cases (models) identified by Bankers Association Committee on Leman Brother Structured Note14.. (1) Soon after the announcement of bankruptcy protection of the Leman Brothers on 15 Sept. 2008 in US, Financial Supervisory Commission (FSC) of Taiwan, Republic of China was overwhelmed with investor‟s complaints. According to FSC official records, there were around fifty-one thousand and more investors who had invested Leman. 政 治 大. Brother‟s related Structured Products. The total investments were around New Taiwan. 立. Dollars 40 Billions, and Taishin Commercial Bank and China Trust Commercial Bank. ‧ 國. 學. were the two largest Bank that stood for almost two- third of the total investment ( around 27.1 Billions). For investor‟s protection purpose, FSC at that time requested. ‧. those Banks that involved in the sales of the relevant Structured Notes to immediately. y. Nat. io. sit. carry out the following actions15:. n. al. er. (i)Bank should proactively inform customer who invested in Structured Note that. Ch. relates to Leman Brothers. engchi. i Un. v. (ii)Bank should assist investor to claim Leman Brother oversea and the legal costs incurred due to the action should be bore by the Banks. 14. 銀行公會雷曼兄弟連動債爭議處理態樣(visited 30 May 2011) <http://www.banking.gov.tw/Layout/main_ch/News_NewsContent.aspx?NewsID=21585&path=2995&Lan guageType=1>. 15. 陸倩瑤、孫中英,「雷曼兄弟連動債 銀行須幫客戶求償」聯合報,台北報導,民國九十七年九月十 八日<http://money.udn.com/wealth/storypage.jsp?_ART_ID=149504>. 17.

(27) (iii)Trust Association should set up in their website to provide latest updates of the Leman Brother Bankruptcy information, status of the incidence and work out a Frequently Asked Questions (Q&A) and answers for customer‟s information and awareness.. (iv)To work on establishment of an intermediately parties to resolves the disputes/ complaints between the customers and the distributor Banks.. 政 治 大 Republic of China has further figured out and release the “ nine common seen disputes 立. (2)Following all the actions as above-mentioned, FSC and Bankers Association of the. ‧ 國. 學. model”( 九大爭議態樣) of the Leman Brother‟s investments as below around mid of December 2008:. ‧. (i) Type One: Basing upon the terms of the Leman Brother‟s Structured Notes and the. Nat. sit. y. age of the investor, if the addition of the terms of the Structured Note Agreement and. n. al. er. io. age of the investor is more than 81 years for female or more than 75 years for male. i Un. v. investor, and that they did not have any previous Structured Note investment. Ch. engchi. experience or had they signed the customer consent letter to invest such products;. (ii) Type 2: Bank failed to inform customer at the time where the performance of the Structured Note triggered the lower capped protection threshold;. (iii) Type 3: Bank failed to inform customer that the issuer of the Structured Notes was changed to Leman Brothers or if the permitted redemption period of the Structured Note was later than the date Leman Brother had announced bankruptcy protection. 18.

(28) and customers who had requested to redeem before and yet Bank failed to negotiate the redemption with the issuer;. (iv) Type 4: Bank that did not provide monthly statement on the net value of the Notes or make public announcement so that customer may aware of their investment status or the latest value of the Structured Notes;. (v) Type 5: Untrue marketing material or Structured Note Investment Agreement was. 政 治 大. signed by the sales representative of the Bank;. 立. ‧ 國. 學. (vi) Type 6: Bank did not understand customer risk appetite in thorough, for customers that stated in written that they do not wish to sustain loss in their principal. ‧. investment amount or to undertake any investment risks and yet Bank still. sit. y. Nat. classified these types of customers as “Aggressive” investor and permitted these. al. n. Notes;. er. io. types of clients to invest in non-principal guarantee of Leman Brother‟s Structured. Ch. engchi. i Un. v. (vii) Type 7: Customer who is of high age and insufficient in knowledge, or customer‟s age is more than 70 years old at the time of investment and have no experience in either stock market or Structured Note investment experience and is of only high school education standard;. (viii) Type 8: Cases where after FSC inspection considered that there may not fully comply with local requirements;. 19.

(29) (ix) Type 9: Cases where there are actual facts that are enabled to show that Bank sales representatives have mis-sold the Structured Note Products to customers.. 4.2 Structured Note litigation Cases with Civil Courts. According to a non-official records announced by the BA, there were not more than ten cases with District Courts in R.O.C. that judgments were made in favour to the Structured. 政 治 大 that were normally found with the courts, we therefore choose to review three civil 立 Notes investors. In this Chapter as we would like to review the customers disputes models. ‧ 國. 學. Structured Note litigation cases with Taipei Court whereby the three claims we have chosen were cases where Judgments were in favourable to investors. The purpose is also to. ‧. understand the customer‟s dispute in common and from the review of the Judgment to. Nat. sit. y. understand some of the Judges‟ thoughts and attitudes on Structured Notes Investment. n. al. er. io. disputes between investors and Financial Institutions.. i Un. Ch. v. 4.2.1. Taiwan District/High CourteCivil n gJudgment c h i on Structured Note Claims (1) Case Number One16 (i)Brief Description of the Claim: Judgment Date: 5 Jan 2010 Judgment No: Taiwan High Court Judgment R.O.C. Year 99 Appeal No. 299 Appellor (i.e. Plaintiff): Mr. ABC (p.s. name replaced for data privacy reason). 16. 司法院法學資料檢索系統臺灣高等法院 裁判書 民事類,臺灣高等法院民事判決 98 年度上易字第 299 號 民國 99 年 1 月<http://jirs.judicial.gov.tw/Index.htm>. 20.

(30) Appellee (i.e. Defendant1): Ms. Money (employee of China Trust Commercial Bank) (p.s. actual name of the employee replaced for data privacy reason) Appellee (i.e. Defendant 2): China Trust Commercial Bank Brief of the Court Judgment: Defendant, China Trust Commercial Bank should pay Appellor (i.e. plaintiff) NTD720,377 plus an interest at 5% commencing from 17 Dec. 2008 until payment date. (ii)Summary of the facts alleged by Plaintiff: (a)Plaintiff Ms. ABC engaged into a Trust Contract with China Trust Commercial. 政 治 大 around November of year 2005. After then, Ms. ABC invested NTD 1 million in a 立 Bank (“the Bank”) through the introduction of the Bank‟s employee, Ms. Money. ‧ 國. 學. Structured Note (Name: CSF B3 HKD Tomorrow Star Structured Note 港幣明日 之星連動債) through the Bank.. ‧. Nat. sit. y. (b)Ms. ABC alleged that the Bank‟s employee understand that she would like to invest. n. al. er. io. only in hundred percent guarantee product but still, the employee by knowing that. i Un. v. the investment product was not hundred percent guarantee, induce and cheated her. Ch. engchi. to investment the Structured Note. Ms. ABC claims that she has wrong concept on the investment product due to the fraud behaviour of the employees, and therefore made the decision to invest such product Ms. ABC therefore wanted to revoke the investment contract and requested Bank to pay her back the entire investment amount and compensate her loss for such investment.. (c)Ms. ABC further alleged that Ms. Money did not play her obligation to act a trustee for her investment. Ms. Money failed to explain the product‟s nature or fully. 21.

(31) disclose the embedded risks in such investment and did not inform her of on fluctuation of the investment product risks performance and therefore she would considered that the employee of the Bank had violated the Trust law Article 22 and Civil law Article 535 i.e. to act in due diligence of a good administrator or appointed agent.. (d) Ms. ABC claimed that the Bank and employee should be held jointly liable for the amount of NTD0.89million and a 5% interest commencing from 17 Dec. 2008 until payment date.. 立. 政 治 大. ‧ 國. 學. (iii) Defense statement summary from Defendants:. Ms. Money denied of the fraudulent act as alleged by the plaintiff and therefore. ‧. would not be obliged to any compensation to the plaintiff. She stated that she has. Nat. sit. y. told Ms. ABC of the non-principal guarantee nature of the investment product and. n. al. er. io. all risks were fully disclosed to the investor.. Ch. engchi. (iv) Summary (Extract) of the Court Judgment:. i Un. v. (a) Agreed by both party, investment amount was HKD 1 million and matured date of the investment product was on 30 Dec. 2008. During the investment period, investor was paid with an interest amount of HKD27, 600. After the occurrence of the financial Tsunami, the redemption of the investment amount returned to the investor was only HKD41, 243.33. There were no argument on the content of the trust contracts, term sheet of the investment product and Bank‟s monthly statements that were delivered to the investor.. 22.

(32) (b) According to the Trust contract entered between the Bank and the customer, Bank by charging the Trust fees against the customer should act in due diligence as a good administrator of the investor based upon the Trust Enterprise Law Article 2217 and Civil law 53518. In particular, under the circumstances that Bank is aware that customer has requested principal guarantee products and no risks on lost of entire principal amount, Bank should have under control, the background of the customer that the customer did not have any offshore product investment experience and. 政 治 大 suitable investment service. This services 立. have no ability to suffer great loss from investment and therefore should provides customer. shall includes complete. ‧ 國. 學. explanation of the Structured Note Contract Terms and Conditions clause by clause and clear notice of associated risks on the nature of the Structured Note Product,. ‧. such as the possibility of the guarantee of investment principal, and the extent of. Nat. sit. y. the non-protection of the investment amount. Bank should not caused any. n. al. er. io. misunderstanding or doubts and during the investment period, to pay attention on. i Un. v. the changes of risks on the investment product and to inform customer of such. Ch. engchi. change at appropriate time so as to provide investor necessary information to avoid any investment risks. Court is with the view that the Bank did not act in due care as a good manager, Bank should not introduce non-principal protected structured note product to customer and that Bank had neglected to completely introduce and inform customer the product risks and non-principal protected nature of the. 17. Trust Enterprise Act Article 22:A trust enterprise shall handle trust activities with the care of a good administrator and in good faith 18 Civil Act 535: The mandatory who deals with the affair commissioned, shall be in accordance with the instructions of the principal and with the same care as he would deal with his own affairs. If he has received the remuneration, he shall do so with the care of a good administrator. 23.

(33) structured note causing misunderstanding from the customer that such Structured Product is principal protected. In additionally, Bank did not update the changes in the investment risks of the product periodically to the customers and failed also to proactively inform customer of the great change of the investment risks after the broke out of the financial tsunami, causing great loss to the customer. Court is of the view that Bank protest that monthly statement with investment information provided to the customer was not sufficient to support Bank‟s position to prove that Bank had acted in due diligence to have taken care of the customer‟s investment in this case.. 立. 政 治 大. ‧ 國. 學. (c) The Court further states that Bank could not provide evidence, such as record to prove that the employee of the Bank had conducted the introduction or explanation. ‧. of the Structured Note products, and the signatures on the Structured Note Terms. Nat. sit. y. Sheets would not either proved that Ms. Money had completely explained the risks. n. al. er. io. or non-principal protection nature or is it able to proof that customer had read and. i Un. v. understand the relevant terms and conditions on such Structured Note Contract.. Ch. engchi. Moreover, the font printed on the Structured Note contract and other relevant documents is apparently tiny and close together and English wording were also included in such documents, it is obviously not easy for customer to understand within a short period of time. As such if customer denied that Bank had given reasonable review time to the customer, Bank shall need to provide other supporting evidence to substantiate her defense statement. The statement model template without the investment information of the customer was unable to show that the Bank had informed customer on the change of the risks of customer‟s. 24.

(34) investment and therefore it is difficult for Court to consider that Bank had exercised her due care on this case.. (d) While for the responsibilities of the Bank‟s employee, court held the view that the employee was not the contract party of the investment contract and due to lack of evidence to proof that the employee has any fraud intention in this case, court is of the view that the employee should not be held responsible for customer‟s loss. The Court ordered that Bank should be held responsible for customer investment loss,. 政 治 大 term and principal customer had received after maturity of the Structured Note, 立. after deduction of the interest which customer had received during the investment. ‧ 國. 學. Bank should pay customer at NTD 720, 377 and interest calculated at 5% starting from 17 Dec. 2008 until payment date.. ‧ sit. y. Nat. (2) Case Number Two19. n. al. er. io. (i) Brief Description of the Claim: Judgment Date: 23 Nov. 2010. Ch. engchi. i Un. v. Judgment No: Taiwan High Court Judgment R.O.C. Year 99 Appeal No. 45 Appellor (i.e. Plaintiff): Ms. A, Ms. B and Ms. C Appellee (i.e. Defendant): China Trust Commercial Bank Brief of the Court Judgment: Defendant, China Trust Commercial Bank must pay appellor(i.e. plaintiff)Ms. A NTD433,840 and Ms. B NTD3,623,699 and Ms. C NTD 641,604 plus an interest at 5% commencing from 23 Sept. 2008 until payment date. 19. 司法院法學資料檢索系統臺灣高等法院 裁判書 民事類,臺灣高等法院民事判決 99 年度重上字第 45 號 民國 99 年 11 月 23 日<http://jirs.judicial.gov.tw/Index.htm>. 25.

(35) (ii)Summary of the facts Claimed by Appellor (Plaintiff): (a) The Appellors claims that the Bank‟s sales were aware that they have intension only to invest in hundred percent guarantee financial products and the Bank‟s sales have mentioned that all the Structured Notes introduce to them were all hundred percent guarantee and the interest were higher than normal Term Deposits. Furthermore, they have no awareness of the so-called “DM” or Trust Deed or have authorized to deduct any money or to withdraw money from their account for such. 政 治 大. investment. They claims that the Bank‟s sales had completed the withdrawal slip. 立. without their authorization and invested in different Structured Notes (CALYON 2. ‧ 國. 學. 年台幣連結全球銀行及保險公司連動債; 盧森堡 2 年美元日本類股連動債; 盧森堡 2 年台幣精品類股連動債; 盧森堡 2 年台幣日本類股連動債; JPI 台幣. ‧. 投資大亨連動債) for NTD3millions, USD30,000, NTD1milllion respectively on. y. Nat. io. sit. behalf of Ms. A, and NTD 700,000 for Ms, B and NTD10 millions for Ms. C. The. n. al. er. appellant claims that there were no agreement of such structured notes investment. Ch. i Un. v. and therefore the Structured Note Investment Agreements were never in place.. engchi. (b) Appellors further stated that even if the Structured Note contracts were deemed valid in law, however according to the terms and conditions of the specific Structured Products, they were not to be distributed in other countries publicly and were to be sold only to professional investors or institutions. The Bank had never released the above information or had explained to them they are investing Structured Note product or had they been notified that there were risks in principal loss. Appellors further claimed that neither did the Bank explain the contract clause. 26.

(36) by clause or did the Bank conducted the “Know Your Customer” process in thorough, and therefore they would revoke the contract that were made under misunderstanding conditions.. (c) Moreover, Appellors alleged that Bank had mis-sold, and did not perform well the obligations of trustee, and never showed them relevant legal documents completely or did they informed them of any investment risks and therefore Bank did not perform to act in due diligence as a prudent trustee should be and hence Appellors. 政 治 大 amount. Nonetheless, if Appellors were not permitted to revoke the contract, 立. claimed to revoke the trust contract and requested Bank to return their principal. ‧ 國. 學. Appellors considered that the Bank should compensate their investment loss according to Trust Law Article 23, breach of consumer protection act etc. laws.. ‧. Nat. sit. y. (iii) Summary of the defense statement from Defendant:. n. al. er. io. (a) Bank stated that the sales of the Bank had complied with the sales process by. i Un. v. introducing the issuance terms and conditions and investment risks of the. Ch. engchi. Structured Products, and after customers had showed their intention to invest, sale representatives then go through clause by clause again the issuance conditions and risks associated in such investment. Customers then signed on the relevant legal documentations (including product term sheet and trust agreement etc.). In additionally, Bank argued that it was clearly printed on the Structured Note Product term sheet that “This Structured Note is a non-principal protected Note, investor may suffered hundred percent loss in the principal amount” and “This Structured Note may at the time of maturity contain risk of hundred percent loss in the. 27.

(37) principal amount” therefore there were no way that customer could have misunderstood. In additionally, Bank had sent monthly statement which includes their investment details and Bank had also remit the interest paid by the issuer to the investor in accordingly; and also customers were able to find out their latest investment price information on their bank website.. (b) Bank further states that there are mutual agreements in such investments and that the Bank sales did not mislead their customer in anyway to believe that they are. 政 治 大. investing a “term deposit” products and not a non-principal protected structured. 立. note product.. ‧ 國. 學. (c) Bank further states that they were not the issuer or the guarantor of the Structured. ‧. Notes and does not involves in any further investment decisions of the Structured. Nat. sit. y. Note and that the depreciation of the underlying assets were due to the financial. n. al. er. io. crisis conditions and therefore there was no direct relationship between the. i Un. v. investment loss of the customers and the performance of the Bank, i.e. whether or. Ch. engchi. not Bank had acted in due diligence as a prudent trustee or not. Also, as customers had invested the Structured Note via Non-discretionary trust platform of the Bank, the investment performance of the customers would not be applicable to Customer Protection Law in anyway.. (iv) Extract (Brief) of the Court Judgment: (a) As agreed by other parties, the structured note related legal documents and investment amounts of the Appellors were the same as both parties have presented. 28.

(38) to the Court.. (b) With regard to the argument if contract is in force, from the chops and signatures of the Appellors that shown on the relevant legal documents, Court is of the view that all the investment contract between the customers and the Bank is valid in force. Appellors failed to provide strong evidence to the court that the employees of the defendant (i.e. the Appellee) have chopped the customer‟s personal seals on these documents without proper authorization from the customer.. 政 治 大 (c) Had Bank violate the due care obligation to act as a trustee? Can Appellors requests 立. ‧ 國. 學. compensation from the Bank for loss they had suffered in the investment? Court held the view that Bank should act in due diligence as a trustee to protect investors. ‧. at their best benefits and provide appropriate services to the customers, these shall. Nat. sit. y. include not to mislead or caused any misunderstanding of the customer or to have. n. al. er. io. customers investment on non-principal protected product if Bank is aware that. i Un. v. customer‟s risk appetites is not to invest non-principal protected products or have. Ch. engchi. any foreign investment experience. Additionally, Bank should pay attention to the performance of the customer investment and proactively inform customers with relevant information to enable customers to make appropriate judgment whether or not they should early terminate their structured note investment to mitigate their investment loss. Bank would not be considered had act in due diligence if important investment risks information were only released to the customers after Structured Note Investment value had fallen to the lower capped value of the Note.. 29.

(39) (d) Court considered that Bank was unable to prove that they have explained to the customers the risks and non-principal protected nature of the investments product or has given reasonable review time period to the customer and that the signatures on the relevant Structured Notes Contract could only manifest that customers have chopped their seals on these legal documents. In additionally, Court did not accept the defense from the Bank that the DM of the Structured Note product have clearly specified that “ the worst scenario is the total lost of the principal amount but fixed interest shall be paid at 8% per annum” and wordings such as “ Possible loss of all. 政 治 大 term sheets such as “ This Note is a non-principal protected types of Note, it is 立 principal amount” so as black and bold wording being highlighted in the product. ‧ 國. 學. possible that investor may suffered 100% loss at the time of maturity”. Court held the view that it is hard for customers to read such small wordings which was. ‧. squeezed together and English wordings in between the Chinese language unless. Nat. sit. y. sufficient time is given to the customer to read through every terms and conditions. n. al. er. io. on the legal document provided by the Bank. Court therefore was of the view that. i Un. v. under such conditions, customers would easily misunderstand that they will only. Ch. engchi. benefit from such kind of investment and may not have risks.. (e) Furthermore, it was clearly stipulated in the English Product Term Sheets that “The Note may not be sold or offered in the Republic of China” but it was not shown on Chinese translated product term sheets which were provided to the customers. The Judge of the case did not accept Bank‟s defense by saying that Bank was authorized by the customers to purchase such Note overseas as such kind of activity is same as if such Note were distributed and sold in Taiwan to the. 30.

(40) customer.. (f) Bank defense that they have act in due diligence as a trustee since monthly statement that shown the investment information were sent to the customer. Nevertheless, Judge was of the opinion that the information shown on the monthly statement were not sufficient to enable customer to aware of their investment performance as only investment amount and interest payment were shown on the statement. The lack of latest market price/value loss or gain reference index and the. 政 治 大 public internet for update investment information showed that Bank did not 立 small letter wordings specified on the statement to advise customers to access the. ‧. ‧ 國. trustee.. 學. proactively inform customer necessary information or have act in due care of a. Nat. sit. y. (g) Moreover the Court refuse to consider Bank‟s defense that besides the monthly. n. al. er. io. statement, they had indeed contacted customer by telephone to inform the. i Un. v. occurrence of the worst scenario of the investment products, Judge overruled. Ch. engchi. Bank‟s defense as Appellors denied to have receive such calls from the Bank and Bank was not able to provide any other supporting evidence to prove that Bank had made such phone calls.. (h) Bank had also defense that one of the Aappellors had experience in investing foreign mutual fund, but judge considered that mutual fund and Structured Note were different kind of products, there is no excuse of Bank to lessen its obligation to act in due care of these Structured Note investment.. 31.

(41) (i) Bank defense that they are not the issuer or guarantor of the Structured Note and that the performance of Structured Notes were subjected to stock market, economic and politician environment or the performance of underlying assets etc. reasons, therefore investment loss sustained by the customer has no relationship with the Bank and Bank should not be held responsible to reimburse customer‟s investment loss. However, Court did not accept Bank‟s statement but considered that if the sales of the Bank did not introduce such Structured Notes products to customer or. 政 治 大 investment products, general customers would not invest in such products and 立 has clearly explained the risks and non-principal protection nature of the. ‧ 國. 學. suffered investment loss, and therefore Court considered that the loss suffered by the customers were directly caused by the sales of the Bank for not acting in due. ‧. care to be a trustee of the customer.. sit. y. Nat. n. al. er. io. (3) Case Number Three20. (i)Brief Description of the Claim:. Ch. Judgment Date: 10 March 2011. engchi. i Un. v. Judgment No: Taiwan Tao-Yuan District Court- Civil Judgment R.O.C. Year 99 Civil Litigation No. 236 Plaintiff: ABC Company (p.s. Actual name replaced due to data privacy reason) Defendant 1: First Commercial Bank, Nan-Kan Branch Defendant 2: Ms. MM (First Commercial Bank‟s employee) (p.s. Actual name 20. 司法院法學資料檢索系統臺灣高等法院 裁判書 民事類,臺灣桃園地方法院民事判決 99 年度重訴字 第 236 號 民國 100 年 3 月 10 日<http://jirs.judicial.gov.tw/Index.htm>. 32.

(42) replaced due to personal data privacy reason) Extract (Brief) of the Court Judgment: Defendant First Commercial Bank should pay Plaintiff ABC Company USD185, 792 plus a 5% interest rate commencing from 29 June 2010 until payment date. (ii)Summary of the Plaintiff‟s statements: (a) Defendant Ms. M had recommended to Ms Sun (who had transferred the rights of the Structured Note to Plaintiff on 21 May 2010) around April of 2007 to transfer her USD term deposit to regular mutual fund investment and on 21 Sept. 2007 Ms.. 政 治 大 Structured Note Product (“二年期食全十美計價保本連動債”). Plaintiff alleged 立. MM signed an document which relates to a 2 years Principal Guarantee USD. ‧ 國. 學. that Ms. MM had covered the fact that the investment actually was issued by the American Leman Brothers Financial Company (“Leman Brother”) and that even on. ‧. the monthly investment statement that was sent by the Bank, there was no relevant. Nat. sit. y. information showing that her investment was related to Leman Brother Company.. al. n. with the Bank.. er. io. Ms. Sun thought that she had invested only the mutual fund and USD term deposit. Ch. engchi. i Un. v. (b) Only after 18 Sept. 2007 when Leman Brother announced bankrupt in US and Ms. Sun received a notification from the Defendant, she then realized that she had invested a Structured Note which was issued by the Leman Brother. Plaintiff claimed that Defendant Ms. MM should not mislead customer and that any marketing material should be clear and not misleading. The sales of the Bank should declared risks associated to the investments and explain all the terms and conditions on the Structured Note. Furthermore, to recommend such a professional. 33.

(43) and complicated product, Bank should conduct a “Know Your Customer “Process in order to evaluate customer‟s risk profile when recommending any investment product to customer. Plaintiff alleged that Defendant Ms. MM had covered the facts and did not explain the product to her causing her mistake to sign the structured note investment contract with the Bank.. (c) Moreover, Bank as a trustee of the customer should act in due diligence when recommending the investment product to client. Nevertheless, Bank did not either. 政 治 大 the Bank conducted the KYC customer risk assessment prior to sales of the product 立. declared the product terms or conditions to the client during sales process or had. ‧ 國. 學. and therefore Plaintiff was not given the chance to understand the product. Plaintiff therefore based on Trust Enterprise Act Article 22 and Civil Law Article 535 to. ‧. claim that Bank had failed to act as a trustee that shall administer the trust affairs. Nat. sit. y. with the care of a prudent administrator and consequently requested that Bank as a. n. al. er. io. employer should be held jointly responsible with her employee to compensate loss they had suffered.. Ch. engchi. i Un. v. (iii)Summary of the Defendants Statements: (a) Defendants state that Ms. Sun is an experienced Business Woman and according to the Bank‟s record, before Ms. Sun investment the Leman Brother‟s Structured Note in September, she had invested Structured Notes also on 30 April, 21 August and 31 August of 2007 and after Ms. Sun invested the Leman Brother‟s Structured Note, she had further invested another three Structured Note Products. And from the title of the Structured Note document, it clearly shown that it was “specified money. 34.

(44) trust (i.e. non-discretionary trust) investing Structured Note Product Terms and Conditions (特定金錢信託投資「連動債券」產品暨約定書), therefore defendant did not believe that customer is unaware of her investment.. (b) Defendant further argued that they had act in due diligence as a good trustee. The customer personal information form showed that they had done the KYC and from the monthly statement sent to the customer, they had exercised their obligation to declare investment related information to the customer. Defendant claimed that. 政 治 大 but it was released on the website, customer may access the Bank‟s internet also to 立 though net profit of the Structured Note was not shown on the monthly statement. ‧ 國. 學. inquiry weekly reference price of the product and that if customer had any query, they can at any time contact the sales representative of the Bank for related. ‧. Structured Note Product details.. sit. y. Nat. n. al. er. io. (c) In additionally, Defendant alleged that according to the trust agreement between. i Un. v. Bank and the customer, it clearly stipulated that trustee is not responsible for risk. Ch. engchi. on the payment of the principal or interest of the Structured Note issued. As such once Bank had delivered the interest to the Customer, they had fulfilled the obligation of a trustee, and therefore there is no breach of the trust agreement.. (d) Also, according to the Structured Note Product Term Sheet on the Risk Disclosure portion, it was clearly stipulated that “the issuer of this Structured Note is “American Leman Brother Financial Company”, and guarantor was “American Leman Brothers” (Standard & Poor rating A+; Moody‟s rating: A1; Fitch rating. 35.

(45) AA-), investor should bear the credit risks of the issuer and guarantor) so as to evaluate the credit risk of the issuer and guarantor. Moreover Defendant1 claimed that its sales representative has gone through all the possible risks that may associated to the investment to the client, and therefore it is unfair for client to transfer his/her loss to the Bank due to investment risks.. (e) With regard to the down grading of the Leman Brother rating, Defendant pointed out that upon receiving the down grade information of the Leman Brother, they had. 政 治 大 the duty of a trustee in prudent manner. 立. immediately notified client of the situation, which showed that they had performed. ‧ 國. 學. (f) Defendant further states that there was no problem on the product features or. ‧. inappropriate or untrue investment. The loss suffered by client was merely due to. Nat. n. al. (iv) Summary (Extract) of the Court Judgment. Ch. engchi. er. io. sit. y. the impact of the tremendous financial crisis that broke out in USA.. i Un. v. (a) Court hold the views that Defendant had failed to inform client the nature of the product and the risks associated in such product and did not perform customer risk tolerance assessment (i.e. KYC) and Defendant had failed to act in due care of a prudent administrator as they did not follow up to inform customer relevant information or risks after investment. The Court determined that Defendant should provide to court evidence that showed that the sales representative of the Bank did really disclosure the terms and conditions of the product and had inform to the client the risks that may involved in such investment once plaintiff denied. 36.

(46) receiving such information from the Bank. (b) Additionally, Court did not accept the argument that customer is experience in Structured note investment and therefore client should aware the risks of such investment. Judge considered that the risks may be different for different issuer or guarantor and therefore Bank should fully disclose and explain the terms and conditions and risks associated with the Structured Product concerned.. (c) Furthermore, as plaintiff‟s intention is to invest in low risk and principal guarantee. 政 治 大 introduce suitable product to the client and most importantly there should be no 立. product, Bank representative should consider customer‟s investment need and. ‧ 國. 學. doubts or misleading conditions. Bank should also at any time monitor change of the structure note status and provide any necessary information to the client to. ‧. avoid any risks. Judge is of the view that Bank did not properly conducted the. Nat. sit. y. KYC as Bank representative basing upon her memory on the conversation she had. n. al. er. io. with the customer and then completed the KYC ( i.e. Customer basic information. i Un. v. form) by her own. Subsequently, Judge therefore suspect that the result of such. Ch. engchi. KYC could possibly reflect plaintiff‟s investment knowledge, experience, financial status and the risk tolerance level.. (d) Judge further considered that Defendant did not provide plaintiff risks information at appropriate time to avoid any investment risks during the investment period. The mailing of the monthly investment report status would not be deemed sufficient as the information provided on the statement did not contain any risks warning or relevant information that informed customer of her investment risks. Judge is of the. 37.

(47) view that sales representative of a Bank should be more market sensitive and have more channel to obtain relevant financial information than original person, however the Sales of the Bank did not seems to have the ability to get hold of the relevant market information, and therefore it is obvious that the sales is unable to provide appropriate risks advice or information to the investor.. (e) From the trust contract which investor had signed, Judge is of the view that the information contain in the contract were relatively misleading that such kind of. 政 治 大 investment risks. As the contract did not clearly specify the risks involved in such 立. Structured Product is hundred percent principal guarantee and without any. ‧ 國. 學. Structured Note Product or is there any information that urge investor to take note on the credit risks on the issuer, guarantor or fluctuation risks on the performance. ‧. of the underlying assets.. sit. y. Nat. n. al. er. io. (f) In additionally, Judge also considered that the Bank did not act in due diligence as. i Un. v. a prudent trustee as during the investment period, the credit rating of the issuer and. Ch. engchi. guarantor were modified by the credit rating companies to a lower rating but such important credit and financial risks information of the issuer or guarantor were not released to the customer.. (g) In conclusion, Judge did not accept the view that the loss of the investor was attributable to the financial crisis broke out in US, i.e. the credit risks of the Leman Brother but considered that if Bank had conducted the sales of the Structured Note in due diligence manner, customer may not invest in such kind of Structured Note. 38.

(48) product and therefore no such loss will be suffered by the customer.. 4.3 Investigation Report of Foreign Governmental Bodies on Financial Institution21. On 7 July 2009, Monetary Authority of Singapore (MAS) issued an “Investigation Report on the Sale and Marketing of Structured Notes Lined to Lehman Brothers Report” (“the Report”), the Report provides the investigation result of MAS on ten financial institutions. 政 治 大 “Distributor”) who have. (“FIs”, including banks, stock broking firms and finance company, collectively termed “the. 立. Distributors” and each term a. ‧. ‧ 國. 學. structured notes related to Leman Brothers.. distributed the credit linked. The scope of the investigation by MAS covered the FIs due diligence on the Notes, the. Nat. sit. y. procedures in place at the point of sales, including how these FI ensured that the Notes were. n. al. er. io. sold to clients whose investment objectives and risk tolerance matched the risk profile of the. i Un. v. notes, and if training and supervision of the representatives and Local Financial Advisers in. Ch. engchi. relation to the Notes. In additionally, in the course of the investigations, the Authority also identified issues relevant to the FI‟s assessment of individual complaints, the complaints resolution framework/process22.. 4.3.1 MAS Findings on Individual Distributor. 21. MAS Monetary Authority of Singapore, 7 July 2009. Investigation Report on the Sale and Marketing of Structured Notes linked to Lehman Brothers 22 MAS Monetary Authority of Singapore, 7 July 2009. Investigation Report on the Sale and Marketing of Structured Notes linked to Lehman Brothers, page ii. 39.

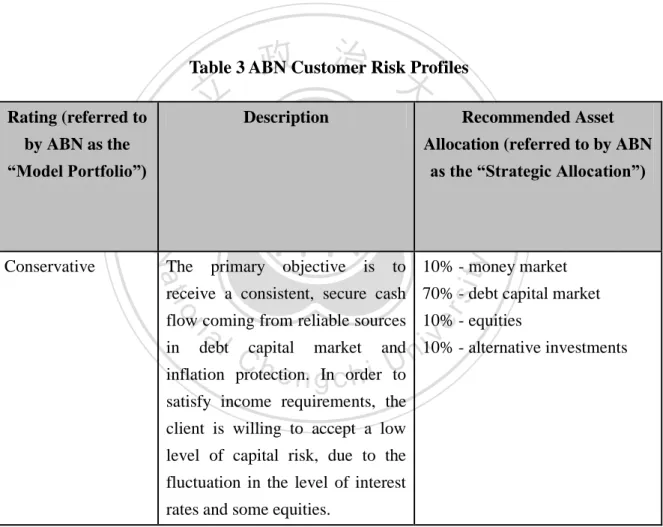

(49) 4.3.1.1 ABN AMRO Bank N.V Singapore Branch23. (1) ABN distributed the Minibond Notes in 2006, at the time of distribution; they had ranked the riskiness of the investments products in three classifications namely “Conservative (low risk)”, “Balanced (medium risk)” and “Growth (high risk)”. While their customers were categorized into corresponding investment risk profiles as follows:. 政 治 大. Table 3 ABN Customer Risk Profiles. 立. Rating (referred to. Description. Recommended Asset. ‧ 國. 學. by ABN as the. Allocation (referred to by ABN. “Model Portfolio”). as the “Strategic Allocation”). primary objective. is. to 10% - money market. sit. The. y. ‧. Nat. Conservative. er. io. receive a consistent, secure cash 70% - debt capital market flow coming from reliable sources 10% - equities. al. n. in. debt. inflation. i v - alternative investments market and n10% Ccapital h e n gIncorder protection. to hi U. satisfy income requirements, the client is willing to accept a low level of capital risk, due to the fluctuation in the level of interest rates and some equities.. 23. MAS Monetary Authority of Singapore, 7 July 2009. Investigation Report on the Sale and Marketing of Structured Notes linked to Lehman Brothers, page 22-27. 40.

數據

相關文件

You are given the wavelength and total energy of a light pulse and asked to find the number of photons it

Process: Design of the method and sequence of actions in service creation and delivery. Physical environment: The appearance of buildings,

Wang, Solving pseudomonotone variational inequalities and pseudocon- vex optimization problems using the projection neural network, IEEE Transactions on Neural Networks 17

volume suppressed mass: (TeV) 2 /M P ∼ 10 −4 eV → mm range can be experimentally tested for any number of extra dimensions - Light U(1) gauge bosons: no derivative couplings. =>

Define instead the imaginary.. potential, magnetic field, lattice…) Dirac-BdG Hamiltonian:. with small, and matrix

incapable to extract any quantities from QCD, nor to tackle the most interesting physics, namely, the spontaneously chiral symmetry breaking and the color confinement..

• Formation of massive primordial stars as origin of objects in the early universe. • Supernova explosions might be visible to the most

The difference resulted from the co- existence of two kinds of words in Buddhist scriptures a foreign words in which di- syllabic words are dominant, and most of them are the