國 立 交 通 大 學

交通運輸研究所

博士論文

自由貿易港區核心產業的選擇

Selecting Core Industries for Free Trade Zone

研究生:謝慧娟

指導教授:馮正民 博士

自由貿易港區核心產業的選擇

Selecting Core Industries for Free Trade Zone

研究生:謝慧娟

Student: Hui-Chuan Hsieh

指導教授:馮正民

Advisor: Dr. Cheng-Min Feng

國立交通大學

交通運輸研究所

博士論文

A Dissertation

Submitted to Institute of Traffic and Transportation

College of Management

National Chiao Tung University

in Partial Fulfillment of the Requirements

for the Degree of Doctor of Philosophy

in Management

March 2010

Taipei, Taiwan, Republic of China

中華民國九十九年三月

自由貿易港區核心產業的選擇

研究生:謝慧娟

指導教授:馮正民

國立交通大學交通運輸研究所

摘要

隨著產業的快速變化和高度競爭,港口的發展已重新定義其在價值鏈上的功能角 色,並逐漸建立港口成為自由貿易港區。為了提升自由貿易港區的競爭力及在自由貿 易港區有限的土地上作最有效的運用,選取適當核心產業成為自由貿易港區發展的一 項重要議題。 本研究首先由文獻回顧及各國自由貿易港區的比較來闡述自由貿易港區的意義及 內涵。由於自由貿易港區核心產業的選定有助於增進自由貿易港區的競爭力,故核心 產業的選責宜具有高附加價值,具有高度聯動國內相關產業及在國際市場上具有高度 市場佔有率之特性。因此,本研究經由以產業的“附加價值指標"、“市場佔有率指 標"、“產業關聯性指標"等三種指標分別選取各自的產業,而後再由“此三種指標 選出產業之交集產生自由貿易區的核心產業。 本研究透過所選取的核心產業及核心產業的關聯性產業,建議政府提供相關之政 策誘因,吸引其進入自由貿易港區內,並發揮加乘的效果,帶動區內及國內市場的發 展。此外,本研究以台灣自由貿易港區為例,分析其核心產業選取的過程。研究成果 顯示“卑金屬及其零組件業"、“電子電機業"、“化學及有關工業"為最適合自由 貿易港區的產業。關鍵詞:核心產業、自由貿易港區、附加價值、市場佔有、產業關聯

Selecting Core Industries for Free Trade Zone

Student: Hui-Chuan Hsieh

Advisor:

Dr.

Cheng-Min

Feng

Institute of Traffic and Transportation

National Chiao Tung University

Abstract

The growth of global business has brought about more intense global competition. In order to face this challenge, port’s development has redefined its functions and roles in value-driven chains, with ports being gradually established as free trade zones (FTZs). To enhance the competitiveness and efficient use of the limited land area of FTZs, the most critical issue is in selecting suitable core industries within the FTZs.

The study first explores the meaning and concept of FTZs by using literature review and the comparison of FTZs in different countries. One way to enhance the competitiveness of FTZs is to introduce high value-added industries, having strong linkage with domestic industries and high market share in a competitive market to the core industries. This study aims at selecting core industries in FTZs through the intersection set of three indicators, namely value-added, market share, and backward and forward industrial linkage in output analysis.

To attract core industries to move into FTZs in Taiwan, this study suggests some strategic incentives to these core industries and related industries, which may form industry clusters and benefit regional and domestic economic development. It is found from the empirical study that ′base metals and articles of base metals′, ′machinery and electronic components′, and ′products of the chemical or allied industries′ can be selected as the core industries in FTZs in Taiwan.

Key Words: value chain, value-added, input-output analysis, market share, Free Trade Zone

誌謝

終於畢業了,當初因為工作上的關係,業務內容盡是與運籌管理、自由貿易港區 等議題,為求進一步瞭解業務的情況下,毅然在工作繁重的情況下報考運研所,期間 雖歷經我及先生工作上的變動、懷孕安胎生子,在這漫長的路上,為求家庭、工作、 學業的平衡,不讓念書影響我陪伴孩子的時間與品質、不佔用工作時間,因此,伴著 我讀書的常是星空滿天及清晨的黎明,這一段漫長的路程其辛苦非外人所能體會。 在學期間,承蒙恩師馮教授正民在研究方向、邏輯思維引導、甚至是工作上的協 助、待人處事的方法的悉心指導,並給予學生在工作、家庭、學業無限的包容與體諒, 謹此深致謝忱。博士論文計畫書口試期間,承蒙毛教授治國、黃教授承傳等師長惠予 詳加細審,並不吝提供寶貴意見;論文學位口試時,陳教授武正、林教授建元、邊教 授泰明、黃教授承傳、黃教授台生、等師長的指導並惠賜諸多指正意見,均使本論文 更臻嚴謹,受益良多。感謝何小姐則屢屢在百忙中擔任起和老師溝通、聯繫的橋樑, 協助處理各項繁鎖事務;所辦洪小姐在退休前夕還趕忙助我辦理口試的各項作業、也 謝謝柳小姐的各項協助。而博班同學其華、昱凱、孟佑、世昌、嘉惠、易詩、承憲、 沛儒、昭弘、姿慧等在學業上協助或生活上的關懷打氣,均感受深刻。也謝謝智平特 別協助向海關索取分類貨品通關資料,這對本篇論文中有關國內自由貿易港區實際貿 易資料的分析有相當的幫助。 感謝進修期間家人的支持與陪伴,老公正豪老擔憂我的健康、心疼我在課業與工 作間忙碌與沉重壓力;女兒沛婕總乖巧的完成自己的功課,不讓我分心;小女兒沛晞 從在肚子裡陪著我參加資格考,到現在活潑可愛、童言童語是我最佳的開心果;感恩 我敬愛的父母及家人給予無限的關懷與生活上的支持。 最後謹以此論文獻給我摯愛的家人以及所有關心我、教導我的師長及週遭好友。 謝慧娟 謹誌 March, 2010,台北CONTENTS

Chapter 1 Introduction ...1

1.1 Background...1

1.2 Motivation and Objective ...4

1.3 Research Issue...5

1.4 Dissertation Framework...6

Chapter 2 Literature Review...7

2.1 New Paradigm of Port/Airport Logistics ...7

2.2 The Meaning and Concept of FTZ...12

2.2.1 The Meaning of FTZ...12

2.2.2 FTZ in Taiwan...19

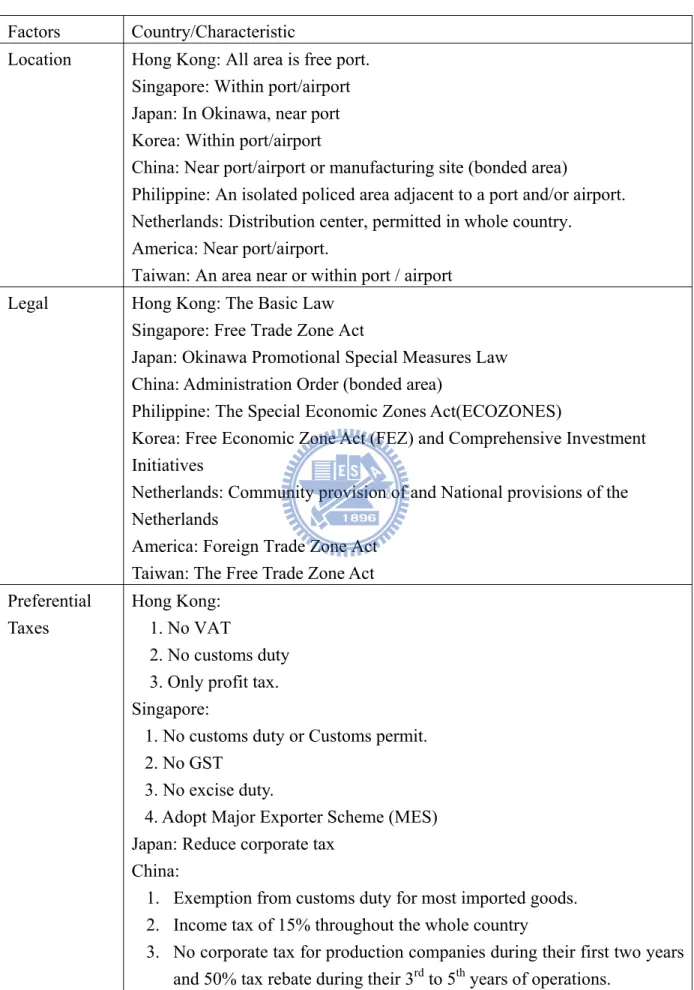

2.2.3 The Comparison of FTZ among Different Countries ...23

2.3 Summary...40

Chapter 3 Research Methodology...41

3.1 Research Framework ...41

3.2 Selection Indicators of Core Industries...44

Chapter 4 Selection of Core Industry...50

4.1 Measurement of Indicator...50

4.2 Real Industries in Taiwan’s FTZ...59

4.3 Managerial Implications ...67

Chapter 5 Conclusions and Suggestions ...69

5.1 Conclusions and Contributions...69

5.2 Suggestions ...71

LIST OF TABLES

Table 2-1 Literatures on Free Trade Zone ...15

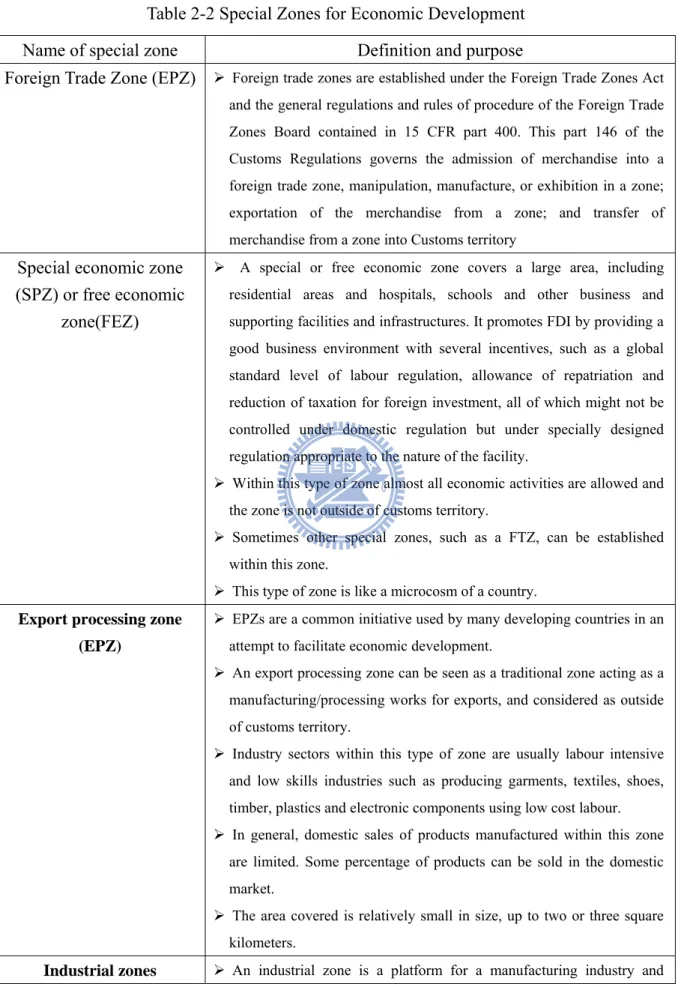

Table 2-2 Special Zones for Economic Development ...17

Table 2-3 Incentives of FTZ in Taiwan...22

Table 2-4 Incentives in Korea FEZs ...27

Table 2-5 Difference of FTZs between Taiwan and Other Countries...37

Table 3-1 The Cargo Growth Rate of Competition (Cargo) Ports...46

Table 3-2 Inter-industry Interdependency Linkage...49

Table 4-1 Industries with High Rate of Value-added Transshipment...51

Table 4-2 Industries with High Market Share among Competing Ports...52

Table 4-3 Industry with High Forward and Backward Linkages...53

Table 4-4 Score of Each Industry...54

LIST OF FIGURES

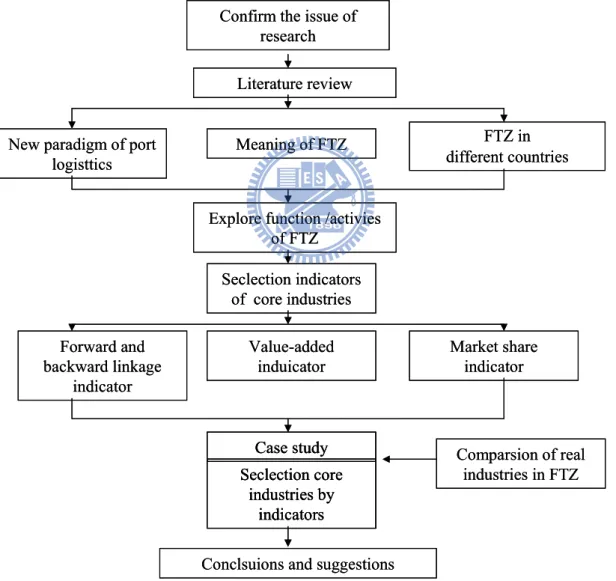

Figure 1-1 Flow-chart of Dissertation...6

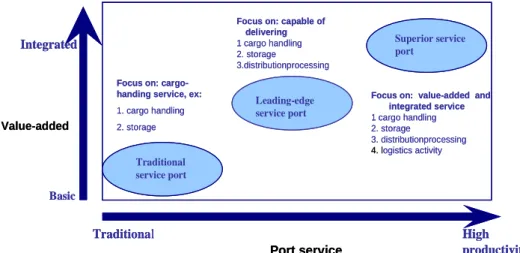

Figure 2-1 Matrix of Competitive Advantage and Service Function...8

Figure 2-2 Concept of FTZ in Taiwan ...20

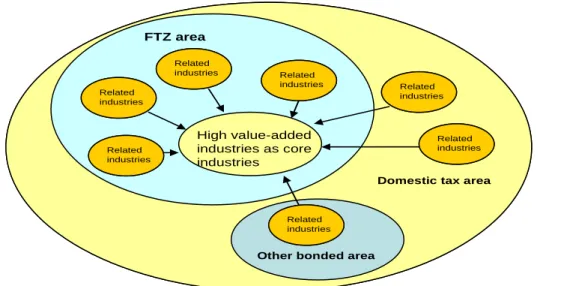

Figure 2-3 Interaction between Free Trade Zone and Other Areas...21

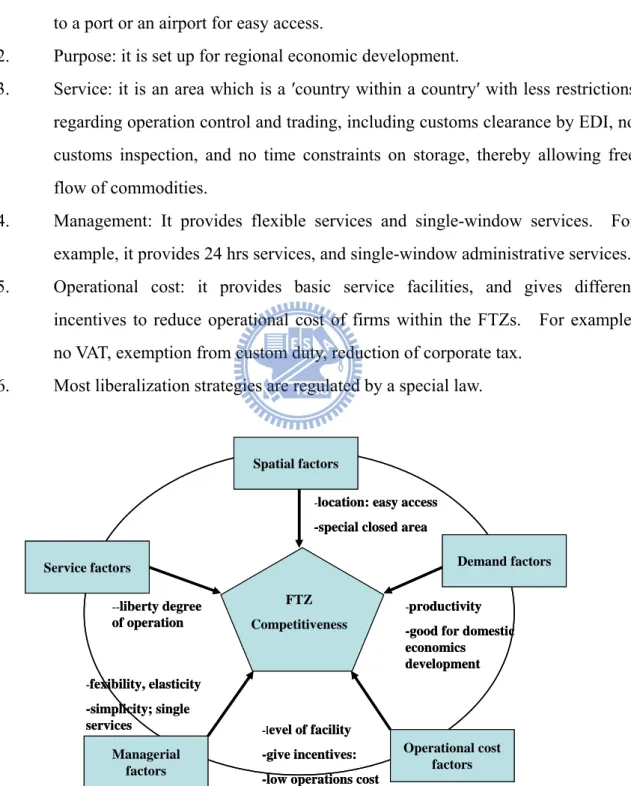

Figure 2-4 Influential Factors of FTZ Competitiveness ...40

Figure 3-1 Selection Indicators for Core Industries...42

Figure 3-2 Intersection Set of Core Industries Using Three Indicators ...43

Figure 3-3 Concept of Value-added Transshipment...45

Figure 4-1 Different Related Industries Enjoy the Benefit of Cluster ...56

Figure 4-2 Relationship Graph of Upstream and Downstream Industries of the Computer Peripherals Industry ...56

Figure 4-3 Applications of Flash Memory Products...57

Figure 4-4 Upper and Lower Relationship of Memory Module and Memory Card57 Figure 4-5 Upstream and Downstream of LCD Industry Relationship Graph ...58

Figure 4-6 Value Chain of LCD TV ...58

Figure 4-7 FTZs in Taiwan: Permitted Locations...59

Figure 4-8 Trading Volume in Different FTZs...60

Figure 4-9 Import Volume and Industries in Keelung FTZ ...61

Figure 4-10 Export Volume and Industries in Keelung FTZ ...61

Figure 4-11 Import Volume and Industries in Taoyuan FTZ ...62

Figure 4-12 Export Volume and Industries in Taoyuan FTZ ...62

Figure 4-13 Import Volume and Industries in Taichung FTZ ...63

Figure 4-14 Export Volume and Industries in Taichung FTZ ...63

Figure 4-15 Import Volume and Industries in Kaoshiung FTZ ...64

Figure 4-16 Export Volume and Industries in Kaoshiung FTZ ...64

Figure 4-17 Import Volume and Industries in Taipei FTZ...65

Chapter 1 Introduction

1.1 Background

With the growth of global business, firms are increasingly utilizing the global logistics management. For deriving benefit from their value-driven chain, firms apportion the raw material, technology development, manufacturing, warehousing and distribution between different countries while still maintaining close integration in order to obtain the cheapest and most efficient production and optimal resource allocation.

Since 1995, Taiwan government authorities, Council for Economic Planning and Development Executive Yuan (CEPD) launched a very large-scale economic development project: the Plan for Developing Taiwan as an Asia-Pacific Regional Operations Center (APROC Plan). The goals of the project are: (1) to enhance Taiwan’s economic liberalization and internationalization; (2) to strength the flows or personnel, goods, and funds; and (3) to attract multinational and domestic enterprise’s investments so that develop Taiwan as a base for expanding East Asia market. The implementation of this plan is divided into 7 parts: manufacturing sector, sea transportation center, air transportation center, financial center, telecommunications center, media center and macroeconomic perspective sector. Although APROC plan had adjusted the industrial Structure and improve the efficiency of government, it has had to respond to the tremendous impact of swiftly developing trade and economic relations across the Taiwan Strait. To take advantages on excellent location, high-quality human resources, and comparatively advantage electronic manufacture, the government promoted the Global Logistics Development Plan (GLP). The goal is to make use of the achievements accumulated under the former ′Asia-Pacific Regional Operations Center Plan′ in the area of sea and air transportation, as well as Taiwan’s outstanding geographic location and manufacturing-related advantages, to carry out integration and help enterprises establish the island as their global logistics base.

Because Taiwan is an export-oriented country, ASEAN (Association of Southeast Asian Nations) plus three (China, Japan, and South Korea) will form Free Trade Area.

Their Common Effective Preferential Tariff (CEPT) scheme will treat Taiwan’s treading. Taiwan was hard to sign other agreement under special political situation with Mainland China. In order to change this treatment, CEPD launched the Free Trade Zone Act to capture the trading with other Asian market in 2003. In this policy, CEPD wants to create the situation which production would move from previous OEM (Original Equipment Manufacturing), ODM (Original Design Manufacture) contract manufacture toward ODL/GL (Original Design Logistics/ Global Logistics) management. CEPD plans special zones that are ′inside national territory but outside customs′ to create an excellent environment for transnational business operations by lowering barriers to the flow of goods, commerce and people. These special zones combine the functions of seaports and airports with meeting all the needs for supply-chain management to offer the function of ′logistics, transshipment, and value adding′ and to strengthen users’ competitiveness. In FTZs, they provide some special feature of the system as follows (CEPD, 2007):

1. Efficiency side

¾ Free flow of goods: exempt from customs checking, inspection, and escort; adoption of reporting or monthly reporting system.

¾ Convenient business entry: convenient entry visa for business people, with facilities provided for exhibition and trade activities.

2. Service side

¾ Single-window administrative service: each FTZ has a single administrative services and management authority.

¾ Special coordinating mechanism: an FTZ Coordinating Committee is specially charged with deliberating on related policy and coordinating inter-zonal affairs.

3. Functional side

¾ Practical organizational form: can set up in a zone as a branch, office, operations department, etc.

¾ Diversified operational scope: can carry out rearrangement, processing, fabrication, etc.

4. Cost side

¾ Relaxation of foreign-working hiring ratio: foreign workers may constitute up to 40%of employees.

¾ Tax preferences: exemption from or reduction of related taxes and fees.

However, the results were weaker than expected. First, few firms move into FTZs. And the trading volume was too little. The type of value-added transshipment is still limited. These result are worthy of our serious reconsideration

1.2 Motivation and Objective

Ports, as important nodes in global supply chains, are now frequently transformed to Free Trade Zones (FTZs) to create added value. Examples for such FTZs include the Ports of Singapore, Yokohama (Japan), and Busan (Korea). As with many roles and functions, various activities and services can be performed by and within ports. Bichou and Gray (2004, 2005) observed that a modern-day port is more than a service provider to ships and cargoes. In addition to its traditional role as a sea/land interface, a port is not only a good location for strengthening value-added logistics but also for providing services for information, trade, and even leisure and property development.

Most FTZs are located within or adjacent to ports. Goods in these areas are approved for displaying, storing, warehousing, collecting and distributing, unpacking, assembling, labeling, packing, sorting and fabricating or processing with other material for transshipment to other countries. Before leaving FTZs for production or consumption in taxation areas of the host country, these goods are free of taxes and customs duties. Because FTZs are highly related to ports, identification of the core industries of FTZs is multi-facet and both port and non-port business activities need to be considered simultaneously. Although the previous research limited the core industries of ports to cargo handling only (Haralambides and Veenstra,2002), the World Bank (2007) suggested that the value-added services, including value-added logistics and value-added facilities, should be involved in port activities to determine the core industries.

For carrying out this policy of strengthening value-added logistics in Taiwan, the 'Act for the Establishment and Management of Free Trade Zone' was legislated in 2003. Although FTZs have been established in four seaports and one airport, the outcomes of investment promotion and operational benefit have not been as encouraging as expected so far. The firms which sign the Letter of Intent and really move into FTZs are limited, and most of them are the firms transformed from shipping companies. What’s wrong with the policy of FTZ? What kinds of industries will be the most suitable core industries of FTZs? How to appropriately select and attract core industries/firms into FTZs becomes one of the most crucial issues. The aim of this study is trying to identify the indicators and select core industries.

1.3

Research Issue

For selecting core industries, this study gets back to the original purpose of FTZ. We discuss the relationship between FTZ and ports, the meaning of FTZ, and difference between different FTZs in different countries. After analysis of the most benefit of FTZs, we set up the selection indicators of core industries and try to make Taiwan case for example. Here are two major issues as follows:.

Issue 1: Although there are different strategic and policies in different countries, we try to compare their differences in detail.

Issue 2: Although there is too little real operating data, we try from macroeconomic perspective to analyze the core industries which could match with the purpose of FTZ.

1.4

Dissertation

Framework

This dissertation is organized as follows:

Chapter 1 is the introduction, which gives an overview of this research in term of background, motivation and objective of this dissertation. Chapter 2 contains a brief review of the definition of FTZ and comparisons FTZs in different countries. Chapter 3 outlines the major research concept and identifies the selection indictors. Chapter 4 takes Taiwan as an example. The final chapter concludes the research and provides suggestions for future policy amendments. The flow chart of this dissertation is shown in Figure 1.1.

Figure 1-1 Flow-chart of Dissertation

Confirm the issue of research Literature review

Meaning of FTZ FTZ in

different countries New paradigm of port

logisttics

Explore function /activies of FTZ Seclection indicators of core industries Case study Seclection core industries by indicators Comparsion of real industries in FTZ

Conclsuions and suggestions Forward and backward linkage indicator Value-added induicator Market share indicator Confirm the issue of

research Literature review

Meaning of FTZ FTZ in

different countries New paradigm of port

logisttics

Explore function /activies of FTZ Seclection indicators of core industries Case study Seclection core industries by indicators Case study Seclection core industries by indicators Comparsion of real industries in FTZ

Conclsuions and suggestions Forward and backward linkage indicator Value-added induicator Market share indicator

Chapter 2 Literature Review

2.1 New Paradigm of Port/Airport Logistics

Most FTZs are located near port; lots of them are within port hinterland. Port hinterland is one of most important concepts in transport geography. Traditional spatial concepts of port hinterlands and forelands along with the related port-marketing terminology have become less relevant. Ports are influenced by the globalization, deregulation and privatization. The paradigms of ports were still changed. Before 1960s the ports were the morphological framework. In 1960s and 1970s, ports focused on the operational efficiency framework. And in early1980s, ports were as economic units and focused on ′economic principles′ framework. Between 1980s and 1990s, most researches showed that port governance and policy framework were most important. Recently, port shifted into a new paradigm as elements in value-driven chain system. UNCTAD (1999) also defined four- type generations, in which first and second generation ports are related to ship/shore and industrial interfaces, with second generation-types being reliant more on capital than labor. Third generation ports are a product of the unitization of sea-trade and multimodal cargo packing, which has led to the development of ports as logistics and intermodal centers offering value-added services. Four generation ports are mainly the result of port potential and functional change. Such classifications exemplify not only the functional evolution of ports, but also the diversification of port activities.

According to Bichou and Gray (2005), while a port can have many roles and functions, a variety of activities and services can also take place within ports, and different port operations create different value-added services. In traditional ports, the activities focus on cargo handling services, but port services have gradually edged towards handling logistics services. In order to show their competitive advantage, such ports have moved toward productivity-advantage leadership, or moved upwards, towards value-added service leadership. Moreover, they have integrated added value and logistics services within the port area (as seen in Figure 2-1). Nowadays, a number of ports have responded to this trend by focusing on value-added services as a means of gaining a competitive edge. Furthermore, many countries build Free Trade Zones within or close to ports to extend pure

logistics into a maritime logistics and manufacturing function, and thereby take advantage of trading within ports.

Figure 2-1 Matrix of Competitive Advantage and Service Function

Additionally, the growth of global business has made the value of maritime logistics services to the competitiveness of port. Different scholars have considered the concept of port value chain (such as Robinson, 2002; Bichou and Gray, 2004; 2005) and maritime /port logistics (Panayides and So, 2005; Panayides, 2006). Robinson (2002) argued that in the context of value networks, competition takes place along value chains as opposed to between individual ports. Robinson (2006) also noted that competitive advantage does not necessarily mean the maximization of profits, and the advantage could be gained in the long run at break-even or better than break-even point. Ports are one element involved in freight movement in end-to-end pathways or logistics pathways, and the notion of logistics pathways connotes a sequential set of separate logistics ′operations′, for example, warehouse, depot operation, shipping, trucking, and freight forwarding that deal with the end-to-end movement of freight. In fact, firms are increasingly competing not as individual firms but also within chains or supply chains; and supply chains, rather than individual firms, compete with supply chains. So, ports do not compete simply on the basis of operational efficiency or location, but on the basis that they are embedded in chains that offer shippers greater value (Robinson, 2006). Furthermore, the more value pools, the more set of functions are integrated into the landside logistics operations. In other words, integrated value-added services in the FTZs depend on ports providing more value

Traditional High productivity Basic Integrated Value-added Port service Traditional service port Leading-edge service port Superior service port

Focus on: cargo-handing service, ex:

1. cargo handling 2. storage

Focus on: capable of delivering

1 cargo handling 2. storage

3.distributionprocessing

Focus on: value-added and integrated service 1 cargo handling 2. storage 3. distributionprocessing 4. logistics activity Traditional High productivity Basic Integrated Value-added Port service Traditional service port Leading-edge service port Superior service port

Focus on: cargo-handing service, ex:

1. cargo handling 2. storage

Focus on: capable of delivering

1 cargo handling 2. storage

3.distributionprocessing

Focus on: value-added and integrated service

1 cargo handling 2. storage

3. distributionprocessing

pools. The concept of value networks in port environments argues that competition takes place among value chains as opposed to among individual ports. Port value chains thus are not limited on logistics channels, but can also be divided according to transportation system into route, forwarder of transportation and customer clearance, loading/unloading etc. All functions are integrated with deliverer (Bichou and Gray, 2005). Ports play an important role in integrating all three types of channel. Many organizations are involved or potentially involved in logistics and supply chain integration within and around ports, in the role of logistics channel facilitators (ocean carriers, land-based carriers, port operators, freight forwarders, port agents, etc.), trade channel members(shippers), and supply channel associates (manufacturers and retailers). Therefore, Bichou and Gray (2004; 2005) indicate that ports can provide more roles and perspective from integration within the role of logistics, trade and supply channel. These roles could be described as follows:

a. From a logistics channel standpoint, ports are very important node since they service as an intermodal/multimodal transport intersection and operate as a logistics center for the flow of goods (cargo) and people (passengers).

b. From a trade channel perspective, ports are a key location whereby channel control and ownership can be identified.

c. From a supply channel approach, ports not only link outside flows and processes but also create patterns and processes of their own. At this level, ports are one of the few networking sites that can bring together various members in the supply channel.

This new approach extends the traditional port system to an ′integrated channel management system′ where the port stands as a key location linking different flow and channels with their members.

Another concept in maritime /port logistics is that maritime transport concerns the transportation of goods and /or passengers between two sea ports. A supply chain consists of the series of activities and organizations that materials (raw materials and information) move through on their journey from initial supplier to final customer. Notably, maritime logistics is the concept of integration of physical (intermodal), economic/strategic (vertical integration, governance structure) and organizational (relational, people and process integration across organizations) (Panayides, 2006). It is crucial that logistics and other

added value services be provided at the right time and place to enhance production and delivery efficiency. The FTZ simply can serve this purpose.

Generally, ports are involved with both port and non-port business activities. Although some studies, for example, Haralambides and Veenstra (2002), limit the core business of ports to cargo handling only, the World Bank broadens port activities to include a range of value-added services (including both value-added logistics and value-added facilities). Nevertheless, port industries can be classified into two traditional types (Huang, 2006): (1) Port dependent industries, including shipping, fishery, ship repairing, international shipping companies, etc. and (2) Port related industries, including containerizing, customs clearance, trading and manufacturing. Following the functional change of ports, the activities of ports now place emphasis on a high degree of global production and the need for value-added logistics (VAL) services. These services include labeling, assembling, semi-manufacturing and some kinds of integrated services which combine logistics and industrial activities. However, most of these industries might tend to cluster within ports, and spatial clustering of such industries may enhance the competitive position of ports. A lot of research has been carried out regarding the link between industries and international competitiveness (Robinson, 2006; Rugman, 1991), and various subsidiaries or lower-cost, leading-edge clustering might have more international market scope (Birkinshaw and Hood, 2000).

Porter (1991) proposed a value chain analysis that divided all activities in the value chain into two kinds of activities: (1) Primary activities: referring to activities directly relating to production and sales, which create the largest profit for firms. These activities include inbound logistics, operations, outbound logistics, marketing and sales and after-sale services. Given the purpose of FTZs to create maximum added value to transshipment, the primary activities of FTZs are activities that could create added value to transshipment. (2) Support activities: referring to activities which support the primary activities. As for FTZs, support activities are firm infrastructures which support the whole value chain. Once the high value-added industries locate in FTZ, their major related industries might also locate within FTZ area in order to support their core activities. Hence, FTZs create maximum transshipment through these kinds of core industries and their related industries within FTZs. Due to limited space of a FTZ, some related industries may locate in other bonded area or

domestic tax area to neighbor with those core industries. High value-added industries as core industries Related industries Related industries Related industries Related industries Related industries Related industries Related industries

Other bonded area

Domestic tax area FTZ area High value-added industries as core industries Related industries Related industries Related industries Related industries Related industries Related industries Related industries Related industries Related industries Related industries Related industries Related industries Related industries Related industries

Other bonded area

Domestic tax area FTZ area

2.2 The Meaning and Concept of FTZ

2.2.1 The Meaning of FTZ

The world currently has over 850 Free Trade Zones (FTZs). Governments in Europe and the Americas, and in nearby Singapore and Hong Kong, are using free ports to offer commercial trade, industrial processing, technology development and logistics services in a single place. The name varies according to purpose and function, and could include foreign trade zones, free ports, transit zones, free perimeters, export processing zones, special customs privileges, special economic zones, etc. And these similar zone are shown in Table 2-1. All these zones are ′special zone′, and all are designed to create a situation in which goods could flow freely, attract foreign investment, and boost economic development. Free Trade Zone is an enclosed area in a seaport, an airport, or some other point areas where goods could be stored or processed, re-exported, assembled, manufactured, and offered more value-added logistics services (Firoz et al.,2003; Mathur and Ajami,1995; Pan,2005; Tansuhaj and Jackson, 1989; The World Bank, 2007; UN,1996) (as shown in Table 2-2). The purpose of FTZ, nowadays, is to enhance value-added processing, transshipment and just-in-time delivery for the largest profit.

Within FTZ, the potential benefits of FTZs for investors include: (1) no customs duties for goods entering FTZs; (2) preferential tariff treatment for parts assembled into finished products in FTZs and then entering the domestic market; (3) free and safe flow of goods in FTZs; (4) permissible transport of goods among different FTZs; (5) abundance of raw material; (6) cheap labor (Firoz et al., 2003; Tansuhaj and Jackson, 1989). Firms may seek good FTZ access to a port of entry to transportation domestic or foreign markets to optimize costs of manufacturing and of distribution and customer service caused by site location (Mathur and Ajamis, 1995). Enterprise can pursue high value-adding processing, and goods can be efficiently exported from nearby ports through simplified custom clearance (Calabro, 1982; Firoz et al., 2003; Mathur and Ajami, 1995).

One of the reasons for FTZ not located everywhere is that FTZ within or adjacent to ports has the direct transshipment and transportation cost advantage. The other is that FTZs are designed as special zones of ′a country within a country′ for all countries, because

of special tax and customs design.

Originally, FTZs were used for storage and trade, but recently the focus has shifted to manufacturing, processing and assembly. Merchandise entering FTZs is free of customs duties and quotas, and can be stored without time constraint. According to the definition of United States International Trade Commission (ITC), FTZ is an independent, bonded area in which merchandise for re-export is treated differently from that in ordinary customs territory, and merchandise may be admitted to the zone, without being subject to customs duties, unless and until the merchandise enters the domestic market. Mathur and Ajami (1995) observed that enterprises can pursue high value-adding processing and enjoy preferential treatment, though these benefits are offset by higher rent and administrative expenses. Following the value-adding process, goods can be efficiently exported from nearby ports through simpler custom clearance. Firoz et al. (2003) argued that trade restrictions have minimal effects on FTZs.

Additionally, Firoz et al. (2003) described FTZs as providing transportation, insurance, finance, and communication services. Therefore, FTZ can be created with several functions, including trade, finance, warehousing, logistics, value-added service, transshipment and manufacturing. FTZs in Taiwan offer all of these functions. Enterprises of FTZ in Taiwan are divided into FTZ and non-FTZ-enterprises according to their logistics activities, and offer different taxation rates and fee schedules. The detail analysis is described in section 2-2-2.

As above mention, all FTZ are intended to improve the competitive advantage of their respective regions. Porter (1990) observed that value chain could be used to analyze the resource of enterprise competitiveness. Value chain analysis can be applied to divide industries according to whether they are engaged in primary or support activities. Primary activities are the main source of profit for enterprises. Primary activities are what Hafreez

et al. (2002) termed core-competences or core businesses. From a value-chain point of

view, the competitiveness of FTZ lies in selecting the most suitable core business for transshipping and maximizing added value. Therefore, it is necessary to redefine port activities for ports that FTZs located from a value-chain perspective.

Generally, the enterprises on Foreign Direct Investment (FDI) determinants or location choice are concerned with the establishment of FTZ. For example, Woodward and Rolfe (1993) analyzed export-led companies and found that numbers of FTZ influence

their choice of location when investing in the Caribbean. Head et al (1995) gathered data on Japanese enterprises investing in America between 1980 and 1992 and found a positive correlation between enterprise in investing and the location of FTZ. Mathur and Ajami (1995) and Brenes et al. (1997) also indicated that firms seeking to locate their operations in FTZ should take several factors into account, including the quality of available manufacturing and warehousing facilities, access to air and sea ports, available transportation modes, onsite customs offices to expedite and simplify imported raw material clearing, and infrastructure quality. UN (2005) discussed FTZs aim to attract foreign investment, which is thought to have benefits in employment and growth. It is argued that FTZs promote a ‘critical mass’ of economic activity around ports. While past international experience with FTZs is mixed, successful FTZs are usually characterized by quality infrastructure, a supportive government, lighter regulation, a strong export focus, tax and customs exemptions and long-term stability. By contrast, some FTZs are failed by poor geographical location, weak government commitment, operational difficulties, poor management and inadequate promotion. Some researchers have indicated that the five criteria respondents consider most important for FTZ are political stability, corporate tax incentives, efficient government administration, labor and energy costs (Chen, 2003; Yang, 2003; Lu and Yang, 2006). Hu and Chen (1998) assessed investment in the Okinawa FTZ and found that both FTZ and new industry parks need research and government support, lower electricity, water and labor costs, and incentive which include tax and finance and construction with complete infrastructure. However, although these key successful factors are the most important determinants of productivity, the question of which industries are most suitable for stationing within a FTZ has not yet been considered. While, it is the most important activity in FTZ is to promote a highest value-added logistics industry (UN, 2005). Feng and Hsieh (2008) noted from a logistics point of view that FTZ competitiveness should depend on selecting the optimal core industries in terms of transshipping and adding value. Just as Robinson(2006)observed, the larger the number of value pools, the more sets of functions are migrated via landside logistics operations. Thus the management strategies used for FTZ should first decide the core industries to make advantage of resources, location and trading activity of FTZs.

industries. For pursuing the value-chain, we adopted Porter’s (Porter, 1991) theory and divided all activities in the value chain into two kinds of activities: (1) Primary activities: referring to activities directly relating to production and sales, which create the largest profit for firms. These activities include inbound logistics, operations, outbound logistics, marketing and sales and after-sale service. Given the purpose of FTZs to create maximum added value to transshipment, the primary activities of FTZs are activities that could create added value to transshipment. (2) Supporting activities: referring to activities which support the primary activities. With regards to FTZs, the supporting activities are provision of related services to support whole value chain. In this study, we attempt to identify the primary activities or core industries which could create added value to transshipment.

Table 2-1 Literatures on Free Trade Zone Authors Year Main discussion/ definitions

UNCTAD 1996 a freeport as a designated area within a port or airport where goods can be imported, stored or processed and re-exported, free of all customs duties.

Firoz 2001 FTZ is a ′country within a country′ from the customs point of view. Firoz et al. 2003 FTZs as enclosed and policies areas in seaport, airport, or some

other inland point where goods of foreign origin may be brought in for re-export by land, water, or air without the payment of customs duty. Usually these zones allow foreign traders to store, exhibit, sample, build, blend, mix, sort, re-pack, and manufacture various commodities within the zone zrea.

UN 2005 a FTZ is focused on international trade, especially value-added logistics activities involving light manufacturing and processing. The zone is outside of customs territory, and is a very similar to an Export Processing Zone. FTZs aim to attract foreign investment, which is thought to have benefits in employment and growth. It is argued that FTZs promote a ′critical mass′ of economic activities around activity around port. This is self-sustaining and also attracts further business.

Authors Year Main discussion/ definitions

which goods can be stored for prolonged periods without Customs duties, excise tax or inventory tax being paid on the goods. FTZs allow the goods owner Customs entry at its discretion, and complete access to the FTZ at all times. Customs Service appraisal and classification of the goods can be done either at entry to the FTZ, or at open exit into the market, whichever the manufacturer prefers. Duty is paid only when the goods are released into the territory. There is no limit on storage time. At no additional Customs expense, a FTZ operator may store, sell, exhibit, break up, repack, assemble, distribute, sore, grade, clean, mix with foreign or domestic goods, destroy, label and manufacture within the FTZ. FTZ Board 1983 The purpose of a FTZ is to help domestic industries take advantage

of a zone and defer customs duties until goods are ready to be marketed in the country where the FTZ is situated. It also has a ′pipeline effect′, in instances when the normal custom channels are congested due to the more complex processing involved with components parts, the movement of raw material through FTZ may saves a great deal of time.

Tansuhaj, S.T., Gentry J.W.

1986 FTZ is a small fenced off area within a country where foreign and domestic goods may enter in order to be stored, distributed, combined with other foreign and/or domestic products, or used in manufacturing operations. When foreign goods are re-exported without entering the US customs territory, they are not subject to quotas, duties, or federal and state laws concerning excise or inventory taxes.

Table 2-2 Special Zones for Economic Development Name of special zone Definition and purpose

Foreign Trade Zone (EPZ) ¾ Foreign trade zones are established under the Foreign Trade Zones Act and the general regulations and rules of procedure of the Foreign Trade Zones Board contained in 15 CFR part 400. This part 146 of the Customs Regulations governs the admission of merchandise into a foreign trade zone, manipulation, manufacture, or exhibition in a zone; exportation of the merchandise from a zone; and transfer of merchandise from a zone into Customs territory

Special economic zone (SPZ) or free economic

zone(FEZ)

¾ A special or free economic zone covers a large area, including residential areas and hospitals, schools and other business and supporting facilities and infrastructures. It promotes FDI by providing a good business environment with several incentives, such as a global standard level of labour regulation, allowance of repatriation and reduction of taxation for foreign investment, all of which might not be controlled under domestic regulation but under specially designed regulation appropriate to the nature of the facility.

¾ Within this type of zone almost all economic activities are allowed and the zone is not outside of customs territory.

¾ Sometimes other special zones, such as a FTZ, can be established within this zone.

¾ This type of zone is like a microcosm of a country.

Export processing zone (EPZ)

¾ EPZs are a common initiative used by many developing countries in an attempt to facilitate economic development.

¾ An export processing zone can be seen as a traditional zone acting as a manufacturing/processing works for exports, and considered as outside of customs territory.

¾ Industry sectors within this type of zone are usually labour intensive and low skills industries such as producing garments, textiles, shoes, timber, plastics and electronic components using low cost labour. ¾ In general, domestic sales of products manufactured within this zone

are limited. Some percentage of products can be sold in the domestic market.

¾ The area covered is relatively small in size, up to two or three square kilometers.

Name of special zone Definition and purpose provides industrial clusters.

¾ Domestic manufacturers and a few foreign investors establish their factories to take advantage of relatively good supporting facilities for manufacturing. For FDI, this type of zone often is transformed into an exclusive foreign investment zone for manufacturing.

¾ In general, this type of zone is not outside of customs territory.

Distribution zone ¾ Within a distribution zone logistics activities are carried out with public

warehouses. Usually this area is not considered as outside of customs territory.

¾ Inland container depots (ICD) are included this type of zone, but ICDs are generally outside of customs territory.

¾ Distribution zones are usually dedicated to consolidation and distribution and located in strategic inland areas to cover several domestic markets and to provide transportation to other transport nodes such as seaports, airport and rail stations quickly, conveniently and easily.

Costal Open Cities (COC) ¾ There are 14 COCs in China. These C OCs are important for both the

current economic development and for the potential future economic development. These COCs are selected due to their strategic location. They are either close to a major foreign country, or have political significance for China. Within these COCs, SEZs are located. For examples, In Guangzhou, which is a COC, three SSEZs are located: Shenzhen, Zhuhai and Shantou. Guangzhouis the capital of the Province of Guandgdong. The tax rate in COCs cannot exceed 15%. These COCs have power to approve individual projects in larger neighboring cities within projectd costs of less than $100 million. Source: 1. UN, 2005

2. http://ia.ita.doc.gov/ftzpage 3. Sargent and Matthews, 2001.

2.2.2 FTZ in Taiwan

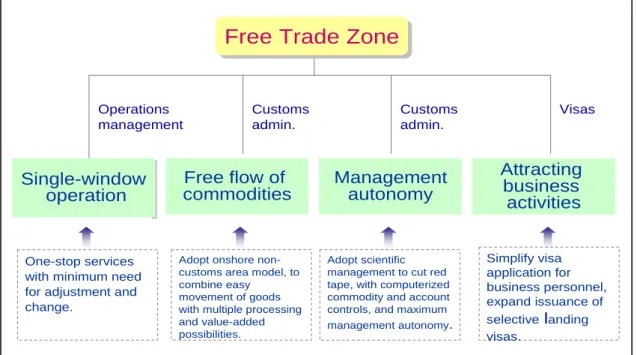

The concept of FTZ in Taiwan is followed the policy of ′Global Logistics Development Plan (GLP)′ in 2000. The policy of GLP is to take Taiwan’s advantages on excellent location, high-quality human resources, and comparatively advantage electronic manufactures. The government authorities, Council for Economic Planning and Development Executive Yuan (CEPD), thought that logistics management or supply chain management might have become highly important for multinational enterprises to enhance Taiwan’s global competitiveness. Although GLP might eliminate problems encountered by enterprises in the process of global logistics development, the enterprises need one defined zone which offered the lowest limit in the process of global logistics management. The first concept is to sign the Free Trade Agreement with major trading countries and to capture the growing Asian market. Under the special political situation with Mainland China, it is difficult issue to make any Free Trade Agreement. The CEPD structured another special zone to attract multinational enterprises to establish their headquarters, especial value-added operation centers, within FTZs. At first its objectives are as follows: (1) to extend the existing results of the Global Logistics Plan and to continuingly promote liberalization and internationalization; (2) to face the challenges from other neighboring countries’ FTZ; (3) to enhance the operating efficiency of harbors and airports and to bolster the development of high value-added trade activities; and (4) to facilitate the movement of foreign business personnel in and out of FTZ and reshape Taiwan’s environment as the operations centers for international enterprises. It has been emphasized that one of the most important factors to promote the FTZ program is to eliminate the customs clearance barrier. Within FTZs, they offer four major functions as follows: (1) single-window operation; (2) free flow of commodities; (3) management autonomy; and (4) attracting business activities (as shown figure 2-1).

Free Trade Zone

Free Trade Zone

Operations management Single-window operation Single-window operation Customs admin. Customs admin. Visas Free flow of commodities Free flow of

commodities Managementautonomy

Management autonomy Attracting business activities Attracting business activities One-stop services with minimum need for adjustment and change.

Adopt onshore non-customs area model, to combine easy movement of goods with multiple processing and value-added possibilities.

Adopt scientific management to cut red tape, with computerized commodity and account controls, and maximum management autonomy. Simplify visa application for business personnel, expand issuance of selectivelanding visas.

Figure 2-2 Concept of FTZ in Taiwan Source: CEPD

After all, ′Act for the Establishment and Management of Free Trade Zones′ was promulgated on the Taiwan government on 23 July 2003. This Act is enacted for the purpose of developing the mode of operation for a global logistic and management system, effecting aggressive promotion of trade liberalization and internationalization, facilitating the smooth flow of personnel, goods, finance, and technology, upgrading the national competitive power, and furthering the national economic development. According the act, FTZ is referred to an area which is situated within a controlled district of an international airport or an international seaport under the approval of government (the Executive Yuan), or of an adjacent area demarcated as a controlled area, and an industrial park, Export Processing Zone, Science-Based Industrial Park, and other areas approved by the Executive Yuan for the establishment of a controlled district for the purpose of conducting domestic and foreign business activities where the comprehensive goods tracking system can be connected with the controlled district of an international airport or seaport by means of technological facilities. Therefore, the ′adjacent area′ is to any of the following circumstances:

(1) A piece of land whose joining width with the land of a controlled district in an international airport or an international seaport is 30 meters or more;

(2) A piece of land being separated from a controlled district in an international airport or an international seaport by a road or a water-way in between, but still suitable for the formation of a controlled area; or

(3) A piece of land which may be connected with a controlled district in an international airport or an international seaport by a dedicated road having a length of less than one kilo-meter.

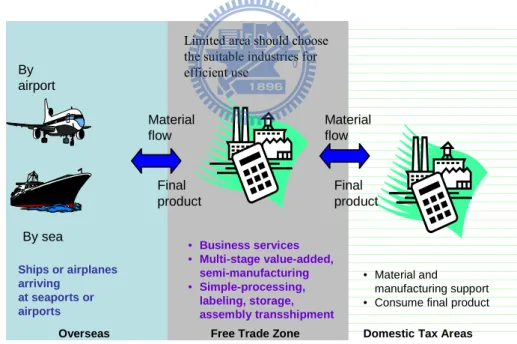

The concept of FTZ in Taiwan is that goods in these areas are approved for displaying, storing, warehousing, collecting and distributing, unpacking, assembling, labeling, packing, sorting and fabricating or processing with other material for transshipment to other countries. And, before leaving such FTZs, these goods are free of customs duties and will not be subject to tariff rules and import restrictions, unless they leave the FTZs for use or consumption in taxation areas of the host country. Additional, the domestic tax areas can stimulate local economies through supporting the productive activities (as shown in Figure 2-3).

Figure 2-3 Interaction between Free Trade Zone and Other Areas

Within FTZ, the enterprises are classified into two kinds. One is ′Free trade zone enterprises′. The other is ′Non-free-trade-zone enterprise′. ′FTZ enterprises′ are referred to the enterprises which have been approved to engage in trading, warehousing, logistics, collecting and distributing (cargo of) containers, transiting, transshipment, forwarding,

Free Trade Zone Domestic Tax Areas Overseas

By airport

By sea

Limited area should choose the suitable industries for efficient use Material flow Material flow Final product Final product • Business services • Multi-stage value-added, semi-manufacturing • Simple-processing, labeling, storage, assembly transshipment Ships or airplanes arriving at seaports or airports • Material and manufacturing support • Consume final product

customs clearance, assembling, sorting, packaging, repairing and fabricating, processing, manufacturing, displaying, or technological service within a FTZ. ′Non-FTZ enterprises′ are referred to any financial, stevedoring, catering, hotel, business conference, transshipment, and other enterprises which are not free port enterprises, but have been approved to operate within a FTZ. FTZs provide some incentives to attract enterprises (as shown in Table 2-3).

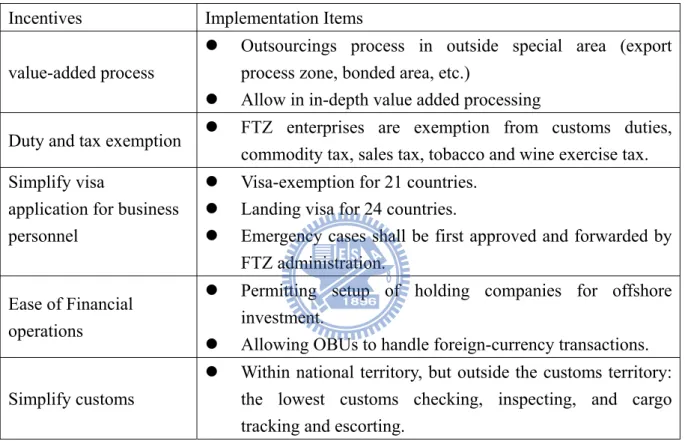

Table 2-3 Incentives of FTZ in Taiwan

Incentives Implementation Items

value-added process

z Outsourcings process in outside special area (export process zone, bonded area, etc.)

z Allow in in-depth value added processing

Duty and tax exemption z FTZ enterprises are exemption from customs duties, commodity tax, sales tax, tobacco and wine exercise tax. Simplify visa

application for business personnel

z Visa-exemption for 21 countries. z Landing visa for 24 countries.

z Emergency cases shall be first approved and forwarded by FTZ administration.

Ease of Financial operations

z Permitting setup of holding companies for offshore investment.

z Allowing OBUs to handle foreign-currency transactions.

Simplify customs

z Within national territory, but outside the customs territory: the lowest customs checking, inspecting, and cargo tracking and escorting.

2.2.3 The Comparison of FTZ among Different Countries

FTZs in different countries have different content and fulfill different functions. All FTZs aim to provide a liberal logistics center facilitating convenient trade of goods. The details of FTZ in different are shown as follows:

1. Hong Kong

Hong Kong follows the economic policy of free enterprises and free trade. There are no import tariffs and excise duties are levied only on four categories, including locally manufactured or imported tobacco, alcoholic liquors, methyl alcohol and hydrocarbon oils. A tax is also payable on first registration of motor vehicles. The Customs and Excise Department is assigned the tasks of fighting smuggling, collection of government revenues on dutiable goods, the detection and deterrence of narcotics trafficking and abuses of controlled drugs, and the protection of intellectual property rights.

For health and safety reasons, five kinds of commodities are subjected to licensing control of the Director-General of Trade and Industry according to the ′Import and Export Ordinance′, the ′Reserved Commodities Ordinance′, the ′Ozone Layer Protection Ordinance′ and their subsidiary legislation. Import license is required for radioactive substances and irradiating apparatus. Import and export licenses are required for the following commodities: (a) Pharmaceutical products and medicines (b) Reserved commodities (c) Strategic commodities (d) Ozone depleting substances.

Except for the above regulations, Hong Kong has no trade barrier. Any company, regardless its ownership, can operate in Hong Kong freely. It is very easy to set up a new company in Hong Kong in six working days. Hong Kong has a simple tax system and the profit tax is one of the lowest in the world (Shen and Yeung, 2004).

2. Singapore

FTZs in Singapore were first established in 1969 to facilitate entrepot trade in dutiable goods. Firms in FTZ benefit from various advantages provided by the ‘Free Trade Zones Act’. Singapore has seven free trade zones (FTZ), six for seaborne cargo and one for air cargo, within which a wide range of facilities and services are provided for storage and

reexport of dutiable and controlled goods. Goods can be stored within the zones without any customs documentation until they are released in the market. They can also be processed and re-exported with minimum customs formalities. FTZs in Singapore are primarily for transshipment cargoes, and the key characteristic of Singapore is that the whole country is similar to FTZs. This means that in examining the concept of an FTZ with reference to Singapore, the whole country system needs to be considered (UN, 2005).

All dutiable goods imported into or manufactured in Singapore are subject to customs duty and/or goods and services tax (GST). The broad categories of dutiable goods for customs duty in Singapore are intoxicating liquors, tobacco products, motor vehicles and petroleum products. GST is a tax on domestic consumption within Singapore. It is paid at the rate of 5% whenever customers buy goods or services from GST-registered businesses within Singapore. The FTZs provide 72 hour free storage for import/export of conventional and containerized cargo and 14 day free storage for transshipment/re-export cargo. The rental cost of FTZ facilities within port area is relatively expensive due to scarce land. Most logistics companies have facilities in FTZs both inside and outside the port, but relatively small space in the FTZs inside the port for goods requiring quick action.

3. Japan

A total of 22 Foreign Access Zones (FAZs) scattered throughout Japan offer air and sea ports close to regional markets, which helps traders to reduce transportation time and costs within Japan. Each FAZ offers a comprehensive range of facilities to efficiently handle imports at all stages, from customs clearance to product sorting, processing and distribution. In addition, FAZ-resident companies realize additional benefits bu cooperating in joint importing, ordering and marketing. Each FAZ is equipped with special facilities for import-related activities, including exhibitions, fairs, conventions, commercial negotiations and seminars, all of which help to expand opportunities for business development. Import-related information and proxy services are also available.

In order to reduce the rate of joblessness and promote industry and trade, Okinawa in Japan planned Special Free Trade Zone. The applicable law is ‘Okinawa Promotional Special Measures Law’ in 1999. The designated area is approximately 122ha (Approx. 89.6ha available for business use not including roads and green space). In SFTZ, it

provides some incentives as follows: ¾ National Tax incentives:

9 For newly established business within the SFTZ with 20 or more full time employees, 35% of income earned will be exempt from corporate tax, corporate business tax and corporate residence tax for the first 10 years following establishment.

9 For businesses installing or expanding facilities worth more than 10 million yen within the SFTZ, 15% of machinery and equipment costs and 8% of building costs will be deducted from the corporate tax (max 20% of corporate tax, carryover for up to 4 years, with a ceiling of 2 billion yen in investment amount).

9 For businesses installing or expanding facilities worth more than 10 million yen within the SFTZ, 50% of machinery and equipment costs and 25% of building costs will be approved as special depreciation.

¾ Duty

9 When shipping products to the domestic market after processing or manufacturing using raw materials from overseas, businesses can choose whether the duty will be applied to the raw materials or the products, with some exceptions.

9 The approval fee for bonded storage facilities, bonded factories, bonded exhibition facilities and general bonded areas will be reduced by half.

¾ Local Tax:For business installing or expanding facilities worth more than 10 million yen within the SFTZ,…

9 a portion of the business tax will be exempted for 5 years.

9 a portion of the real estate acquisition tax will be exempted (only the portion which is directly used for the business).

9 a portion of the fixed property tax will be exempted for 5 years (only the portion which is directly used for the business).

¾ Subsidy for employment of young Okinawa: a subsidy is granted to business operators who establish promises in Okinawa (limited to those established at a cost of 3 million yen or more) involving the long-term employment of three or more residents of Okinawa under the age of 35.

Minister of Health, Labor and Welfare (1/3 for small and medium enterprise owners).

9 Period of subsidy: One year (A subsidy for the second year may be granted if the employee retention rate is high).

9 Maximum amount: 1,200,000 per year per person.

¾ Subsidy for employment development: a subsidy is granted to business operators who establish promises in Employment Development and Promotion Regions (all areas of Okinawa Prefecture until March 31,2010) involving the employment of three or more residents of the region. The grant is made based on the number of workers and the cost of establishing the premises.

9 Amount of subsidy: Fixed amount (300,000 to 2.5 million yen) per year. 9 Period of subsidy: Three years (five years when specific requirements are met).

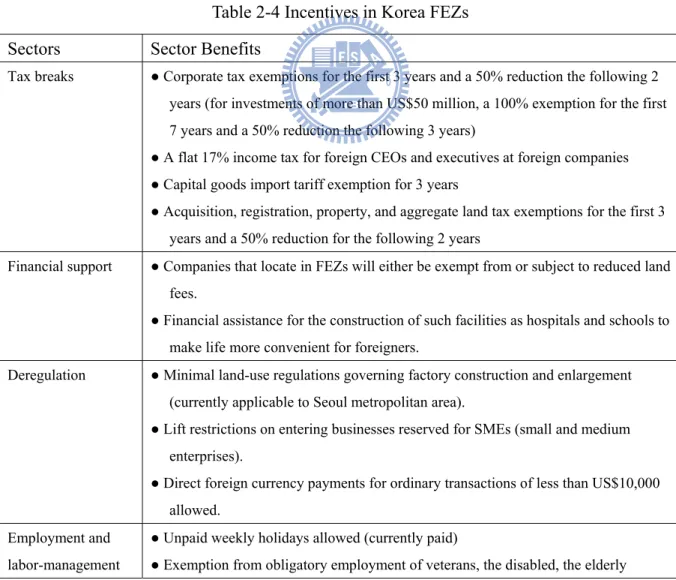

4. Korea

The government of Korea has also prepared a special tax incentive package for foreign-invested companies that locate in Fee Economic Zone (FEZs) to promote a key element of its plan to transform Korea into a Northeast Asia hub. Incheon International Airport (IIA) ranks third in air freight worldwide and tenth in passenger traffic in 2008 after just three and a half years of operation. The government continues working toi develop Busan New Port and Gwangyang Port into mega-ports as port of its Northeast Asian hub master plan. The surrounding areas will be developed into a logistics, assembly, trade and international business base. The three FTZs are being developed as Northeast Asian epicenters of business, logistical and high-tech services. Incheon FEZ, as air logistics business complex is built near IIA, including a 991,800 square meters customs free zone and a 495,900 square meters international business zone. By building new ports and logistical complexes in the surrounding areas, Busan and Jinhae FEZs are being developed to become Northeast Asian maritime logistics centers. An industrial complex for high-tech cutting-edge machinery, material and auto parts manufacturers are built in the vicinity of this FEZs to serve as a manufacturing center for southeast Korea complete with full R&D support services. The Gwangyang Bay FEZ is being developed into a maritime trans-shipment hub for cargo to China by building ports and logistics parks in the

surrounding area. The Yulchon Industrial Complex is being developed to include a petrochemical, auto parts manufacturing and steel mill industrial cluster. The government is striving to make FEZ business conditions more convenient for foreign investors and improve living conditions. In January 2004 the government announced a five-year plan to improve the management and living environment for foreign companies and workers. The government is in the process of completing 49 of the business-related tasks and 102 that involve living conditions. Mid- to long- corporate tax rates are being lowered to meet or beat those in competing countries. FEZ authorities are working to recruit world-renowned schools, hospitals and leisure facilities to provide non-Koreans residing there with high-quality services. FFEZ authorities are also engaged in inter-Korean economic cooperation and multinational negotiations that will create impetus for Northeast Asia to become a global economic hub.

Table 2-4 Incentives in Korea FEZs

Sectors Sector Benefits

Tax breaks ● Corporate tax exemptions for the first 3 years and a 50% reduction the following 2 years (for investments of more than US$50 million, a 100% exemption for the first 7 years and a 50% reduction the following 3 years)

● A flat 17% income tax for foreign CEOs and executives at foreign companies ● Capital goods import tariff exemption for 3 years

● Acquisition, registration, property, and aggregate land tax exemptions for the first 3 years and a 50% reduction for the following 2 years

Financial support ● Companies that locate in FEZs will either be exempt from or subject to reduced land fees.

● Financial assistance for the construction of such facilities as hospitals and schools to make life more convenient for foreigners.

Deregulation ● Minimal land-use regulations governing factory construction and enlargement (currently applicable to Seoul metropolitan area).

● Lift restrictions on entering businesses reserved for SMEs (small and medium enterprises).

● Direct foreign currency payments for ordinary transactions of less than US$10,000 allowed.

Employment and labor-management

● Unpaid weekly holidays allowed (currently paid)

Educational improvements

● Schools can be established by foreign investors. ● Domestic residents can attend foreign schools. Foreign hospitals

and pharmacies

● Foreign-financed hospitals and pharmacies for foreigners allowed

Foreign broadcasting

● The ratio of cable network foreign broadcasting retransmission channels expanded from the current 10 to 20%

Administrative support

● English allowed for processing of public documents. ● Foreign Investment Ombudsman’s office will be established Source: UN, 2005

5. China

Since 1980, China has established five special economic zones (SEZs) such as Shenzhen, Zhauhai and Shantou in Guangdong Province, Xiamen in Fujian Province and the entire province of Hainan. In 1984, China further opened 14 coastal cities to overseas investment: Dalian, Qinhuangdao, Tianjin, Yantai, Qingdao, Lianyungang, Nantong, Shanghai, Ningbo, Wenzhou, Fuzhou, Guangzhou, Zhanjiang and Beihai. In 1985, the state decided to expand the open coastal areas, extending the open economic zones of the Yangtze River Delta, Pearl River Delta, the Xiamen-Zhangzhou-Quanzhou Triangle, Fujian, Shandong Peninsula, Liaodong Peninsula, Hebei and Guangxi into an open coastal belt. In 1990, China decided to open the Pudong New Area in Shanghai and other cities along the Yangtze River Valley. In 1992, the State Council had opened 13 border cities, counties and towns, and opened all the capital cities of the inland provinces and autonomous regions. In addition during the 1990s China also established 15 FTZs, 56 state-level economic and technological development zones, and 53 new and high-tech industrial development zones. In these zones, they provide some incentives as follows:

¾ Tax incentives:

9 The prime income tax rate for foreign-invested enterprise (FIE) is 15% of profit. 9 The national government has standardized most preferential policies for FTZs,

including a package of tax incentives.

9 For the first two years of operations, companies are exempt from enterprise income tax. During the next three years, companies are taxed at 50% of the normal FIE tax rate of 15%. After five years, in-zone enterprises pay the full FIE tax rate. 9 If more than 70% of the finished product is re-exported outside China territory, any

remaining product is taxed at a reduced rate based on the original imported components.

¾ Customs duty incentives:

9 There are duty exemptions on all construction or infrastructure imports necessary for production and on all equipment, parts, and components imported for self-use. 9 Imports entering the FTZ from outside China proper are exempt from customs

duties and VAT (value-added tax); customs duties and VAT are assessed only after the finished products leave the FTZ for regions outside the bonded area.

9 All finished goods ‘imported’ from the FTZ into China proper will have customs duty and VAT assessed based on a ratio of locally sourced inputs to imported components.

¾ Local level incentives:

9 Each zone can, and often does, offer its own incentives on top of the central government ones.

9 Local authorities can establish land-use or utility incentives and may also decide to exempt in-zone enterprises from local income tax.

¾ No participation limit:

9 FTZs remain the only locations in which a foreign company may establish a wholly foreign-owned trading company; initially these wholly foreign-owned companies did not possess trading rights (the right to import and export). To sell products in mainland markets, these companies were required to engage agents with trading rights to handle customs procedures for transactions with the non-FTZ enterprise. This changed in June 2003 when the State Council, the Ministry of Commerce and Customs, issued a notice allowing enterprises in Futian-Shatoujiao, Tianjin, Waigaoqiao, and Xiamen Xiangyu FTZs to register for the right to conduct domestic trade without using an intermediary with trading rights, and the notice leaves the drafting of detailed application rules to the zones.

¾ Bonded Commodities Exchange Market or exhibition centre:

9 FTZs offer a Bonded Commodities Exchange Market or exhibition centre through which in-zone enterprises sell their products to Chinese buyers and distributors for sale in mainland markets.

9 Exchange market administrators clear the goods through Customs and issue VAT invoices.

Like other special zones, FTZs in China provide other advantages in addition to the preferential policies:

¾ simplified and efficient administrative structure ¾ one-stop service for official procedure settlement ¾ top-flight infrastructures

¾ professional service system on a par with international standards

¾ catering actively to the individual and diversified demands of different investors ¾ tailor-made service and the readiness to help investors overcome difficulties ¾ strategic locations.

6. Philippine

The government promotes the establishment of world-class, environment-friendly economic zones all over the country to respond to demands for ready-to-occupy locations for foreign investments. At the helm of this strategy is the Philippine Economic Zone Authority (PEZA), a government corporation established through legislative enactment known as ′The Special Economic Zone Act of 1995′. FTZ in Philippine is an isolate policed area adjacent to a port entry (as a seaport) and /or airport where imported goods may be unloaded for immediate transshipment or stored, repacked, sorted, mixed, or otherwise manipulated without being subject to import duties. However, movement of these imported goods from the free-trade area to a non-free-trade area in the country shall be subject to import duties. But all FTZ belonged to ECOZONES. ECOZONES are selected areas with highly developed or which have potential be developed into agro-industrial, Industrial tourist/recreational, commercial, banking, investment and financial centers. An ECOZONES may contain any or all of the following: Industrial Estates (IEs), Export Processing Zones (EPZs), Free Trade Zones, and Tourist/Recreational Centers. The Incentives for Enterprises are as follows:

¾ Income Tax Holiday (ITH) or Exemption from Corporate Income Tax for five years, extendable to maximum of eight years;