隱含流動性溢酬於退休給付選擇之研究 - 政大學術集成

全文

(2) 隱含流動性溢酬於退休給付選擇之研究 The study of embedded liquidity premium in pension benefit selections. 中文摘要 為因應人口老化及少子化趨勢所帶來之長期經濟生活保障問題,政府於 98 年 1 月 1 日施行新制勞工保險,將年金給付納入保險制度。對於 98 年 1 月 1 日 前有勞保年資且年資達十五年以上之勞工,於退休時可選擇舊制下的一次請領老 年給付或是新制的老年年金給付。因此,需探討以一次請領或年金給付方式何者 對勞工較為有利。本研究以流動性與內部報酬率之角度來分析探討勞工保險新制 下一次給付與年金給付之差異,比較年金給付理論上須提供之流動性溢酬 (liquidity premium)與勞保新制下年金給付實際上所提供的內部報酬率(隱含長壽 收益,ILY),以提供退休勞工選擇之參考。研究結果發現,在 1.5 到 3 的風險趨 避係數之間,無論投保年資、平均月投保薪資與性別,年金給付之隱含長壽收益 扣除無風險利率後皆高於所應提供之流動性溢酬,比例大約在 2 到 38.9。其中最 低投保年資十五年之 ILY 最高(1,984~2,633 b.p.),之後隨年資遞減,年資超過三 十年以上之 ILY 又開始遞增。在投保年資二十年以下,最低投保薪資提供較高的 ILY。比較男性與女性之差異,女性之流動性溢酬與 ILY 皆高於男性。由以上結 果顯示,勞工於退休時選擇請領老年年金給付方式較佳。. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. 關鍵字:勞工保險、一次給付、年金、流動性溢酬、隱含長壽收益.

(3) Abstract In order to build up a complete Labor Insurance pension protection system and offer the insured person or insured person’s dependents long term living care, the system has added pension benefits on January 1, 2009. After the implementation of Labor Insurance pension program, the insured that has insurance coverage before January 1, 2009 could select the old-age one-time benefit or monthly pension benefit when they retire. Therefore, which benefit approach is better is an important concern for retiree. In this study, we take the concept of the liquidity premium and the implied longevity yield (ILY) to compare the old-age one-time benefit and pension benefit. The results show the ILY minus the risk-free rate would greater than the liquidity premium no matter what the insurance coverage years, insurance salary, gender, and the coefficient of relative risk aversion from 1.5 to 3, the ratio of the ILY to liquidity premium is about 2 to 38.9. Second, the insured with 15 coverage years has highest ILY (1,984~2,633 b.p.). Then the insured with lowest insurance salary and less than 20 coverage years could earn the highest ILY. Finally, the results indicate the female have higher ILY from annuitized pension benefit than the male. Overall, we find out that the implied longevity yield is higher than the liquidity premium under the old-age pension benefit. It would encourage insured to choose the old-age pension benefit when he/she retires.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. i n U. v. Key word: Labor Insurance; old-age one-time benefit; pension benefit; liquidity premium; implied longevity yield.. engchi.

(4) Contents I.. Introduction ..........................................................................................1. II. Literature Review.................................................................................8 III. Methodology ......................................................................................12 3.1. Liquidity premium ...................................................................12. 3.2. Implied longevity yield............................................................14. IV. Empirical Results ...............................................................................17 V. Conclusion .........................................................................................26. 政 治 大. Appendix A. The 9th Period Taiwan Life Table ..................................28. Appendix B. Table of Grades of Insurance Salary .............................30. Appendix C. Labor Insurance Act ......................................................31. 立. ‧ 國. 學. References .................................................................................................38. ‧. n. er. io. sit. y. Nat. al. Ch. engchi. i. i n U. v.

(5) List of Tables Table11-1: ageing population......................................................................1 Table21-2: Life expectancy at age 0 ...........................................................2 Table31-3: Pension systems in Taiwan .......................................................4 Table41-4: Number of application cases ....................................................6 Table54-1: Liquidity Premium λ (basic point) ......................................17 Table64-2: Old-age benefit .......................................................................21 Table74-3: Implied Longevity Yield δ (basic point) .............................21. 政 治 大. Table84-4: Implied Longevity Yield minus risk-free rate (basic point) ...23. 立. Table94-5: The ratio of ILY to liquidity premium ....................................24. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. ii. i n U. v.

(6) List of Figures Figure11-1: Life expectancy at age 0 (1990~2060)....................................3 Figure24-1: Liquidity Premium λ (basic point)-Male, age 60 ...........18 Figure34-2: Liquidity Premium λ (basic point)-Male, age 60 ...........18 Figure44-3: Liquidity Premium λ (basic point)-age 60,. µ =10%, σ = 20% ................................................................19 Figure54-4: Implied Longevity Yield δ -Male, Female age 60 (basic. 政 治 大. point) ...................................................................................22 Figure64-5: Liquidity premium and Implied Longevity Yield (basic point). 立. ‧ 國. 學. -Male, age 60, µ =10%, σ = 20% ....................................23 Figure74-6: Liquidity premium and Implied Longevity Yield (basic point). ‧. -Female, age 60, µ =10%, σ = 20% .................................24. n. er. io. sit. y. Nat. al. Ch. engchi. iii. i n U. v.

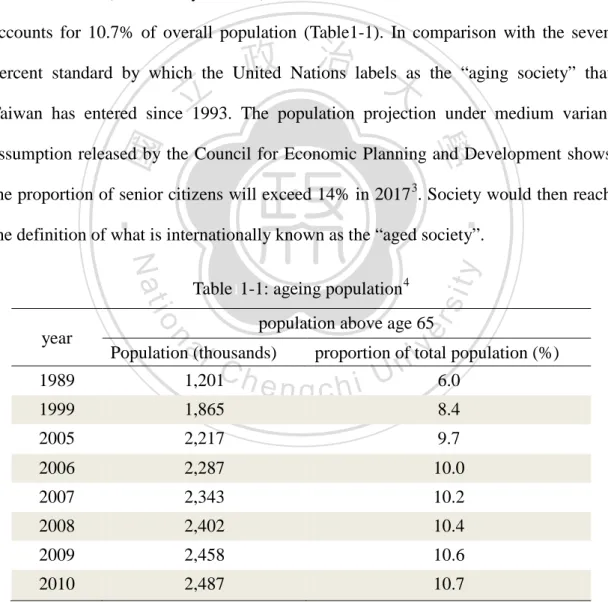

(7) I. Introduction In recent decades, due to the rapidly increasing economic growth rate and the advancements in medical technology, there has been a significant increase in the life expectancies of Taiwanese population. Like in many developed countries, the ageing population has now become a major policy concern in Taiwan because of the prolonging life expectancy and the lower fertility rates 1. Until 2010, the number of the senior citizens (above 65 years old) in Taiwan has risen over 2,480,000 2, which accounts for 10.7% of overall population (Table1-1). In comparison with the seven. 政 治 大. percent standard by which the United Nations labels as the “aging society” that. 立. Taiwan has entered since 1993. The population projection under medium variant. ‧ 國. 學. assumption released by the Council for Economic Planning and Development shows the proportion of senior citizens will exceed 14% in 2017 3. Society would then reach. ‧. population above age 65. n. al. sit. io. 1. Table11-1: ageing population 4. er. Nat year. y. the definition of what is internationally known as the “aged society”.. Population (thousands). Ch. i n U. v. proportion of total population (%). engchi. 1989. 1,201. 6.0. 1999. 1,865. 2005. 2,217. 9.7. 2006. 2,287. 10.0. 2007. 2,343. 10.2. 2008. 2,402. 10.4. 2009. 2,458. 10.6. 2010. 2,487. 10.7. 8.4. The fertility rate of Taiwan with the lowest fertility worldwide is 1.2 births per woman in 2004. Source: “2004 World Population Data Sheet”, Population Reference Bureau. 2 “Population Statistical Yearbook ”, Ministry of the Interior. 3 “Population Projections for Taiwan: 2010-2060”Council for Economic Planning and Development. 4 “Population Projections for Taiwan: 2010-2060”Council for Economic Planning and Development. 1.

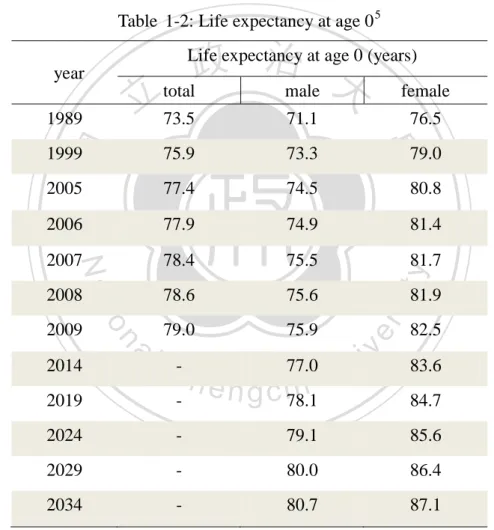

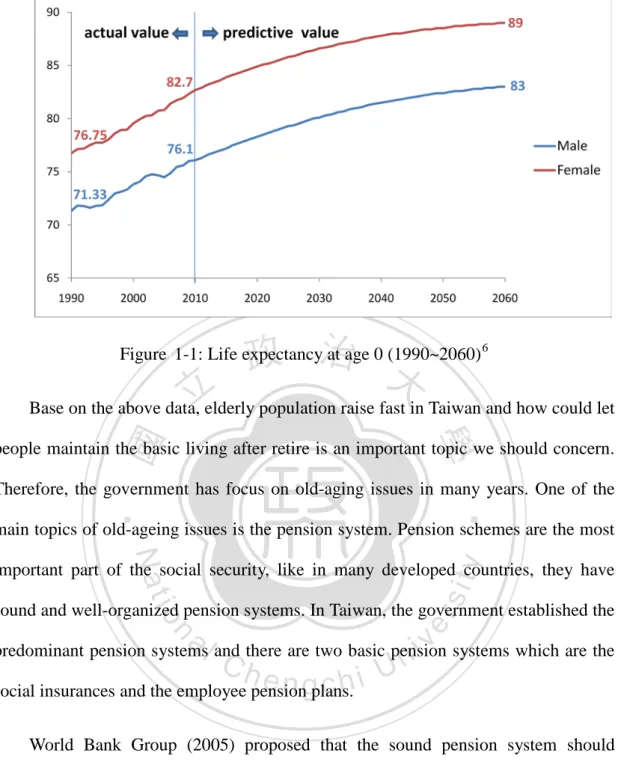

(8) According to the abridged life table in 2009, we know the male’s and female’s life expectancies are 75.9 and 82.5 years respectively. Compare with ten years ago, the male’s life expectancy has increased 2.6 years and female’s has increased 3.5 years. The study which is presented by the Council for Economic Planning and Development points out that the male’s life expectancy will be 80.7 years and female’s be 87.1 years under medium variant assumption in 2034 (Table1-2, Figure 1-1). Table21-2: Life expectancy at age 0 5. 政 治 大 total male. Life expectancy at age 0 (years). year. 立 73.5. 71.1. 1999. 75.9. 73.3. 2005. 77.4. 74.5. 80.8. 2006. 77.9. 74.9. ‧. 2007. 78.4. 75.5. 81.7. 2008. 78.6. 75.6. 79.0. 75.9. 5. n. 2019. C- h -. y. 81.4. sit. io. 2014. al. 79.0. 81.9. er. Nat. 2009. 76.5. 學. ‧ 國. 1989. n U e n g c h78.1i 77.0. female. iv. 82.5 83.6 84.7. 2024. -. 79.1. 85.6. 2029. -. 80.0. 86.4. 2034. -. 80.7. 87.1. “Population Projections for Taiwan: 2010-2060”, Council for Economic Planning and Development. The data from 1989-2009 is from the “Population Statistical Yearbook ” published by Ministry of the Interior, and 2014-2034 is the estimate value projected by the Council for Economic Planning and Development. 2.

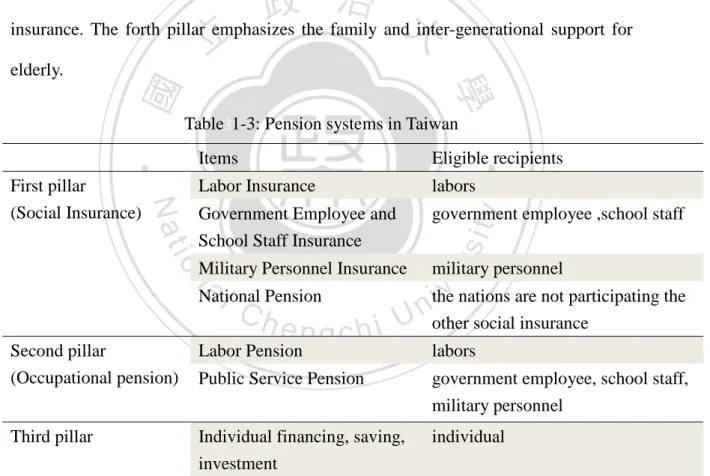

(9) 政 治 大. Figure11-1: Life expectancy at age 0 (1990~2060) 6. 立. Base on the above data, elderly population raise fast in Taiwan and how could let. ‧ 國. 學. people maintain the basic living after retire is an important topic we should concern. Therefore, the government has focus on old-aging issues in many years. One of the. ‧. main topics of old-ageing issues is the pension system. Pension schemes are the most. y. Nat. sit. important part of the social security, like in many developed countries, they have. n. al. er. io. sound and well-organized pension systems. In Taiwan, the government established the. i n U. v. predominant pension systems and there are two basic pension systems which are the. Ch. engchi. social insurances and the employee pension plans.. World Bank Group (2005) proposed that the sound pension system should consist of five pillars 7. Zero or basic pillar is the non-contributory social assistance to deal with the poverty alleviation objective in order to provide all of the elderly with a minimal level of protection. For example, there are the old-age farmers welfare allowance and the old-age citizens welfare allowance in Taiwan. The first pillar is in. 6. Data of 1990~2009 are from the abridged life table released by Ministry of the Interior; Data of 2010~2060 are from the projection by Council for Economic Planning and Development. 7 Robert Holzmann and Richard Hinz, Old-age income support in the 21st century, The Word Bank, 2005. 3.

(10) form of social insurance, participants have to take the responsibilities with the government to pay the premium to get the old-age payment when they retire and the systems include the National Pension, the Labor Insurance, and the Government Employee and School Staff Insurance. The second pillar is occupational pension plan, such as the Labor Pension and the Public Service Pension in Taiwan. These second pillar pension systems are called employee pension schemes and the main contributors are the employers. After the employee retired, they can obtain the retirement benefits from the employee pension schemes. The third pillar compensates. 政 治 大 insurance. The forth pillar emphasizes the family and inter-generational support for 立 for rigidities in the other systems, like individual saving, personal commercial. Table31-3: Pension systems in Taiwan. ‧. Eligible recipients. Labor Insurance. labors. Government Employee and School Staff Insurance. government employee ,school staff. Military Personnel Insurance. military personnel. Labor Pension. labors. Public Service Pension. government employee, school staff, military personnel. Individual financing, saving, investment. individual. a l Pension v nations are not participating the National the i n Ch e n g c h i U other social insurance. n. Third pillar. sit. io Second pillar (Occupational pension). y. Items. er. Nat. First pillar (Social Insurance). 學. ‧ 國. elderly.. Table 1-3 displays the first to third pillar of pension systems and the eligible recipients of each in Taiwan. After implementing National Pension on October 1, 2008, the whole nation is covered in social pension system, that Taiwan’s pension system is complete and sound till then.. 4.

(11) Since the ageing population is increasing fast in Taiwan, the government pays a lot of attention to revise and improve the pension schemes. The main reforming features are delaying the timing of retiring and annuitization. In order to decrease the financial burden of the government, the revision of the pension schemes is to postpone the retirement age. For instance, nations could draw the old-age benefit until 65 years old under the National Pension scheme. In pension systems, the Labor Insurance 8, National Pension, Labor Pension, and Public Service Pension all already have included annuitized payments. In addition, the Ministry of Civil Service. 政 治 大 Employee and School Staff Insurance in 2009. Hence, knowing the difference 立. proposes the draft about adding annuitized old-age benefit under Government. between the lump-sum payment and annuitized payment is the important issue for. ‧ 國. 學. retirees and that is what we want to analyze in this paper.. ‧. Since most pension schemes provide the choices between lump-sum payment. sit. y. Nat. and annuitized pension benefit, retirees have to concern which one is better. For. al. er. io. example, if the insured person has Labor Insurance coverage before January 1, 2009,. v. n. he/she could select the one-time old-age benefit or the old-age pension benefit 9. If the. Ch. engchi. i n U. insured person chooses the pension benefit, he/she could select the better one from the following two methods: (1) average monthly insurance salary × coverage years × 0.775% + 3,000; (2) average monthly insurance salary × coverage years × 1.55%. Otherwise, the insured person chooses the one-time benefit then he/she could take the product of average monthly insurance salary and issued months. For instance, an insured who retire at age sixty has thirty coverage years and $43,900 average monthly insurance salary. In case of selecting the annuitized pension 8. After the enforcement of Labor Insurance Pension on January 1, 2009, the monthly pension approach for claiming disability, old-age and death benefits has been added. 9 Since the revision of Labor Insurance Act is launched on January 1, 2009. Bureau of Labor Insurance http://www.bli.gov.tw/sub.aspx?a=fNYWGQMXNOw%3d 5.

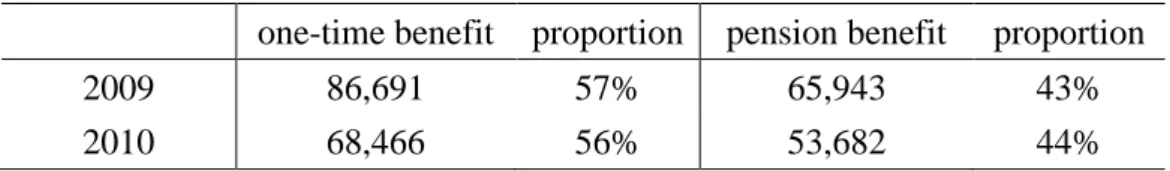

(12) benefit, he could obtain 20,414 monthly, or he could get 1,975,500 for the one-time benefit. It’s obvious that if the insured have been receiving monthly payments for nine years, the all amount of payments (2,204,712) would exceed the one-time benefit (1,975,500). However, we should incorporate the time value of money when we compare the cash flows under different time. The pension benefit is a long-term scheme, thus, we should take the interest rate, mortality rate, and the concept of liquidity into consideration. From the longevity risk perspective, the annuitized payment is better than the. 政 治 大 support after retiring (Boardman,. lump-sum payment. The retirees are advised to purchase the annuity and annuitize. 立. their wealth for the living. 2006). However,. ‧ 國. 學. Modigliani (1986), Friedman and Warshawsky (1990), Mirer (1994), Milevsky and Young (2007a) point out very few people would let their wealth be annuitized in. ‧. reality. According to the statistical data, the number of people select one-time benefit. sit. y. Nat. is more than who select pension benefit under Labor Insurance in 2009 and 2010. n. al. er. io. (Table1-4). Therefore, we want to provide the methodology to compare these two. i n U. v. types of benefit, and then recommend retirees to choose pension benefit, that is the. Ch. engchi. same as what government encourages labors.. Table41-4: Number of application cases 10. 2009 2010. one-time benefit. proportion. pension benefit. proportion. 86,691 68,466. 57% 56%. 65,943 53,682. 43% 44%. In this study we apply the financial theory to investigate the difference between the old-age pension benefit and one-time old-age benefit under the Labor Insurance in Taiwan. We take the concept of the liquidity to compare the two types of payments. If. 10. Annual Report 2009&2010, Bureau of Labor Insurance. 6.

(13) the retiree chooses the one-time benefit, he/she could manager his/her own account and do individual investment strategy. When the market performs well, he/she will earn the rate of return. On the other hand, if the retiree chooses the annuitized payment, then he/she would lose the opportunity to join the financial market and has liquidity constraints. Hence, the pension benefit should provide additional premium to compensate the retiree caused by its illiquidity feature. This premium is called the “liquidity premium” (Browne et al, 2003). The liquidity premium is the theoretical rate of return which annuitized benefit should compensate to the holder. We apply the. 政 治 大 In this paper, we estimate 立 the liquidity premium and compare to the actual rate of. implied longevity yield (Milevsky, 2005) to measure the actual return of the annuity.. ‧ 國. 學. return provided by the annuitized pension benefit. The numerical analysis could help the retiree with making decision to take the pension benefit or the one-time benefit.. ‧. Also, while estimating the liquidity premium, we use utility function and consider. sit. y. Nat. different risk preference of retirees. We could understand how the level of risk. n. al. er. io. aversion and the market conditions affect the liquidity premium.. i n U. v. This paper is organized as follows. In Section 2, we introduce the previous. Ch. engchi. literature related to the annuitization theme and our methodology. Section 3 proposes the model and in Section 4, we present numerical results. Finally, Section 5 would make a brief conclusion and summarize the paper.. 7.

(14) II. Literature Review Due to the future life expectancy of retirees is much longer and hard to estimate precisely, the retirees have difficulty to find the investment assets match the duration. Therefore, many researchers discuss how the retirees use their wealth to get stable payments each period after they retire. The simplest solution is to purchase the commercial annuity products. If they want to hold the annuity, the timing to purchase the annuity would be decided. Besides, they should construct the individual investment strategy to maximize the utility before the time receiving annual benefits.. 政 治 大 Most individuals concern that how much of their wealth should be annuitized at 立. the time they retire. Yarri (1965) and Ficher (1973) proposed that the retirees should. ‧ 國. 學. fully annuitize all their savings under market completeness assumption. However, in. ‧. reality, as Modigliani (1986), Friedman and Warshawsky (1990), Mirer (1994), and. sit. y. Nat. Milevsky and Young (2007a) have pointed out very few people would choose to. io. er. annuitize their wealth. That is, the economics theories suggest that retirees should enhance their welfare through buying annuities, but the empirical evidence find that. al. n. v i n C hon annuities. This Uis the so-called annuity puzzle. retirees do not place their wealth engchi. The causes of annuity puzzle problem are bequest motives, the expensive loading of the annuity, and liquidity consideration. (Friedman and Warshawsky, 1990; Vidal-Melia and Lejarraga-Garcia, 2006; Mitchell et al., 1999; Brown and Poterba, 2000; Brown, 2001a, b; Albrecht and Maurer, 2002; Browne et al., 2003) Life annuities are financial instruments allowing individuals to exchange a lump sum of wealth for a guaranteed income stream to last for the rest of the insured’s life. First, if individuals want to leave an inheritance to their children; they will find it’s not optimal to annuitize all of their wealth. Second, the insurance company is exposed 8.

(15) to the longevity risk, thus the inevitable fees will be charged by insurance company and the loading of annuity product is large. Due to these reasons, retirees prefer to construct their own investment strategies, getting constant stream of payments by themselves. (Kotlikoff and Summers, 1981;Kotlikoff and Spivak, 1981;Friedman and Warshawsky, 1990;Mitchell et al., 1999;Brown and Poterba, 2000;Brown, 2001a, b) When an individual purchases life annuities, he/she exchanges a lump sum of wealth for a guaranteed stream of payments that continue so long as the individual is. 政 治 大 financial market. That is, they 立 can do self-annuitization. Hence, the retiree holds the. alive. If an individual doesn’t hold annuity, he/she can invest all their wealth to the. ‧ 國. 學. annuity products will loss the liquidity of his/her own wealth. Liquidity problem would reduce annuity demand (Albrecht and Maurer, 2002; Browne et al., 2003).. ‧. The main approach to deal with the annuity puzzle problem are self-annuitization. y. Nat. sit. (Milevsky and Robinson, 2000; Albrecht and Maurer, 2002; Kingston and Thorp,. n. al. er. io. 2005) and delaying the timing of annuitization (Milevsky, 1998; Stabile, 2006;. i n U. v. Milevsky and Young, 2007a, b; Horneff et al., 2008). Self-annuitization means that. Ch. engchi. retiree do not purchase annuity products but manage his/her own account and withdraw constant amount each period until the account amount is zero or he/she dies. Therefore, the retiree should find the investment assets that can provide the equivalent amount each period in the financial market. In the part of delaying the timing of annuitization, we know that the older the retirees buy the annuity product with the same insurance amount, the lower price they spend on. Hence, the concept of delaying the time of annuitization is that retirees can invest their wealth in the market by themselves after they retire for a period, and then choose the perfect timing to buy the annuity products. Milevsky and Young (2007b) 9.

(16) find that the appropriate time to annuitize is between age 65-70 in the United State. The annuity holder transfers the longevity risk to the life insurers, the life insurers should pay annuity to the insured each period. If the retiree wants to do individual strategic asset allocation among the various investment classes, he/she would ensure their investment strategic will offer the same constant amount of pension to maintain his/her future consumption. Milevsky and Young (2007a) proposed that females wish to annuitize at older age compared to males because the mortality rate of females is lower at each given. 政 治 大. age. Also, the more risk averse individuals wish to annuitize sooner. And assuming. 立. annuitization can take place in small portions at any time; they find the. ‧ 國. 學. utility-maximizing retirees should acquire a base amount of annuity income and then annuitize additional amounts. Moreover, the retirees will purchase more annuities as. Nat. sit. y. ‧. they become wealthier and more risk averse.. io. er. Under the Labor Insurance, the retirees can’t select the timing of the annuitization since they should decide the type of payment at the time they retire. al. n. v i n prescribed by Labor Insurance C Act. In this study, weUfocus on the liquidity problem hengchi. then investigate the difference between the old-age pension benefit and the one-time old-age benefit. The amount of pension benefit the retiree acquires each period is related to the rate of mortality, assumed interest rate. When the market performed well, the rate of return is superior to the assumed interest of annuity. The retiree is unable to terminate getting payments and gets the rest of amount back to do individual investment. However, the retiree who selects the one-time old-age benefit could place the lump sum into the financial market to obtain the higher return. Therefore, the pension 10.

(17) benefit is illiquidity, so that the retiree loses opportunity to participate in the market. Because of this, the pension benefit should provide the additional premium to compensate the investor caused by its illiquidity feature. Browne et al. (2003) apply the utility function to measure the liquidity premium of the commercial annuity products. The liquidity premium is the additional premium provided by the annuity pension benefit theoretically. On the other hand, we apply the concept of implied longevity yield which is proposed by Milevsky (2005). The implied longevity yield is. 政 治 大 insurance program in Taiwan, 立 in order to offer the retiree long term living care, the. used to measure the actual rate of return of pension benefit. Under the social. ‧ 國. 學. annuity pension payment is better than the one-time payment in Labor Insurance. In this study, we estimate the liquidity premium and the implied longevity yield. ‧. of the annuity pension benefit then we could prove the annuity benefit is much better. y. Nat. n. al. er. io. payment.. sit. for the retiree. Hence, it would encourage the retiree to select annuity pension. Ch. engchi. 11. i n U. v.

(18) III. Methodology 3.1 Liquidity premium To compare the one-time old-age benefit and old-age pension benefit, we should measure the welfare loss from the pension benefits since a lack of liquidity. We refer to Browne et al. (2003) that apply the utility function to estimate the liquidity premium demanded by the retiree holding an illiquidity annuity pension benefit. We assume that there are a fixed immediate annuity and a variable immediate. 政 治 大 unit time, and a variable immediate annuity (VIA), which provides a payment per unit 立. annuity in the market. A fixed immediate annuity (FIA) provides a fixed payment per. time that varies depending on the value of some market asset Vt . If the retiree. ‧ 國. 學. selected one-time benefit, he could put all amounts into purchasing a variable. ‧. immediate annuity. On the other hand, the annuitized payment is equivalent to hold a. sit. y. Nat. fixed immediate annuity. Under these assumptions, we may evaluate the utility. io. n. al. er. functions respectively.. v. If w dollars of the FIA are purchased, the consumer is entitled to continuous payment stream of CtF =. Ch. engchi. i n U. w dollars per unit time, that CtF are all the same at ax ( r ). every time t , where the unit price of the FIA is ∞. a x ( r ) = ∫ e− rt ( t px )dt .. (1). 0. Here r denotes the risk-free interest rate, and. t. px is the probability that the. individual will survive to time t , conditional on being alive at the annuity purchase age x . Similarly, If w dollars of the VIA are purchased, at time t , payment accumulate at the rate of CtV =. we− htVt dollars per unit time, the value of market ax ( h). asset at time t discount to time 0 then annuitized it in future period, where h is the 12.

(19) assumed interest rate, and Vt is the price of market asset at time t , which obeys geometric Brownian motion : = dVt µVt dt + σVt dBt , V0 = 1 , where Bt is a standard Brownian motion, µ is the subjective growth rate of the market, and σ is the subjective volatility. This leads to Vt = e( µ −σ. 2. /2) t +σ Bt. .. Under other assumptions being equal, the liquid annuity would provide greater utility to the consumer. In order to compensate for this, the illiquid annuity must provide an enhanced rate of return which is on the FIA. The unit price of the FIA become a x ( r + λ ) , where λ is the demanded liquidity premium.. 政 治 大 consumer’s personal utility function 立. Suppose that the. c (1−γ ) , γ ≠ 1 , c is the consumption of each period, γ is coefficient of risk 1−γ. ‧ 國. 學. u( c ) =. of consumption is. aversion. Denote by φt and ϕt the number of units of the FIA and VIA held at time. ‧. t , and assume that h = r . Then the payment stream is C= φt + ϕt e− rtVt . Browne et al. t. y. Nat. denotes the optimal allocation to the risky asset.. n. al. Ch. engchi. φt that φt + ϕt e− rtVt. er. io. sit. (2003) derive the optimal choice of φt and ϕt obeys α * = 1 −. i n U. v. In the dynamic liquid case, the maximal level of expected utility is. = U*. ∞. e − rt t px E[u (Ct )]dt ∫= 0. w1−γ ax (r − β ) , (1 − γ )ax (r )1−γ. (2). where (3) In the static case, an initial allocation of α to the risky asset will result in a utility F (α , λ ) =. ∫. ∞. 0. e. − rt. w1−γ 1 − α α e( µ − r −σ / 2)t +σ p + t x ∫−∞ (1 − γ ) ax (r + λ ) ax (r ) 2. ∞. 13. tz. 1−γ. . 2. 1 − z2 e dzdt . (4) × 2π.

(20) Our goal is to find the liquidity premium λ such that maximizing F (α , λ ) . In this paper, we discuss two types of payment for old-aged benefit under Labor Insurance. We suppose the retirees choose pension benefit is equivalent to hold a 100% of FIA and choose one-time benefit is equivalent to purchase a 100% of VIA, just like participating in the financial market. Hence, the old-age pension benefit should provide additional liquidity premium λ and let the expected utility of wealth of two are equal. Under the one-time benefit, the expected utility is ∞. EU ( r | dynamic )= ∫ e. − rt t. px ∫. 1−γ. ( µ − r −σ 2 /2) t +σ t z. 立 (1 − γ ) −∞. . ax (r ). Under the old-age pension benefit, the expected utility is EU ( r + λ | static )= ∫ e. .. (5). 1−γ. − rt. 0. 1 w dt t px (1 − γ ) a x ( r + λ ) . ‧. ∞. 2. 1 − z2 e dzdt 2π. 學. ‧ 國. 0. 治 政 1 we 大 × . ∞. .. Nat. sit. y. (6). io. premium λ provided by the pension benefit.. n. al. Ch. 3.2 Implied longevity yield. engchi. er. Let these two functions be equal, and then we can derive the additional liquidity. i n U. v. In the preceding section, we compute the theoretical yield needed to compensate for the retirees select pension benefit. This theoretical yield is liquidity premium. However, we want to measure the actual rate of return the pension benefit provide. Following the Milevsky (2005), we apply the concept of the implied longevity yield that could be used to measure the actual rate of return of pension benefit. Milevsky (2005) measures the return from commercial life annuities which is called implied longevity yield (ILY) is defined equal to the internal rate of return 14.

(21) (IRR). Assume that there is an insured aged x purchases a life annuity that unit price is a1 , and at age x + τ the unit price of annuity is a2 , a2 < a1 . If the insured decided to forgo the purchase of a life annuity and instead invested a1 in portfolio and withdrew the same amount annum, this strategy is called self-annuitiazation. The required investment portfolio return should replicate the income payout from the annuity and still be able to let insured purchase the annuity priced a2 at x + τ . The required investment portfolio return is the implied longevity yield δ . Suppose that the retiree aged x has W0 = w dollars in marketable wealth. If. 政 治 大 per annum 立 for life. If, in contrast, the retiree decided to forgo. this retiree converted w into a lifetime flow, i.e. purchased annuity, he or she would be entitled to w / a1. ‧ 國. 學. purchasing the life annuity and instead self-annuitized by investing w in risky asset, the wealth dynamics would satisfy the following process:. er. io. al. w δt w )e + , Wt ≥ 0 δ a1 δ a1 .. sit. Nat. Milevsky (2005) derives the solution to Eq.(6) is: (w − Wt =. (7). y. w )dt , Wt ≥ 0 . a1. ‧. (δ Wt dWt =−. (8). n. v i n This investment portfolio is to C contain enough fundsUto purchase the annuity at age hengchi x + τ , so following relationship must hold:. w w δτ w , (w − )e + a2 = δ a1 δ a1 a1. (9). the right-hand side describes the evolution of wealth under a consumption rate of w / a1 and an rate of return δ . The cost of acquiring the payout flow w / a1 at age. x + τ , is the left-hand side value of ( w / a1 )a2 . Then dividing by w and multiplying by a1 , we get. 1 1 a2 − ( a1 − )eδτ − = 0 δ δ .. (10). Taking the data of commercial annuities into Eq. (9), Milevsky (2005) solves for 15.

(22) the implied longevity yield δ using numerical techniques. We consider the Labor Insurance and assume that the insured retire at age x and has wealth W0 = w which is equal to the one-time benefit they deserve to obtain. Following Milevsky (2005), we accumulate this fund each period by a rate δ , and subtract the consumption. It can be describe as following expression ,. (11). where Ct denotes the withdraw for consumption purpose, is equal to annuitized payment. When the retiree dies, the fund value should be zero. Then we can solve the Eq. (10) and get the δ .. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 16. i n U. v.

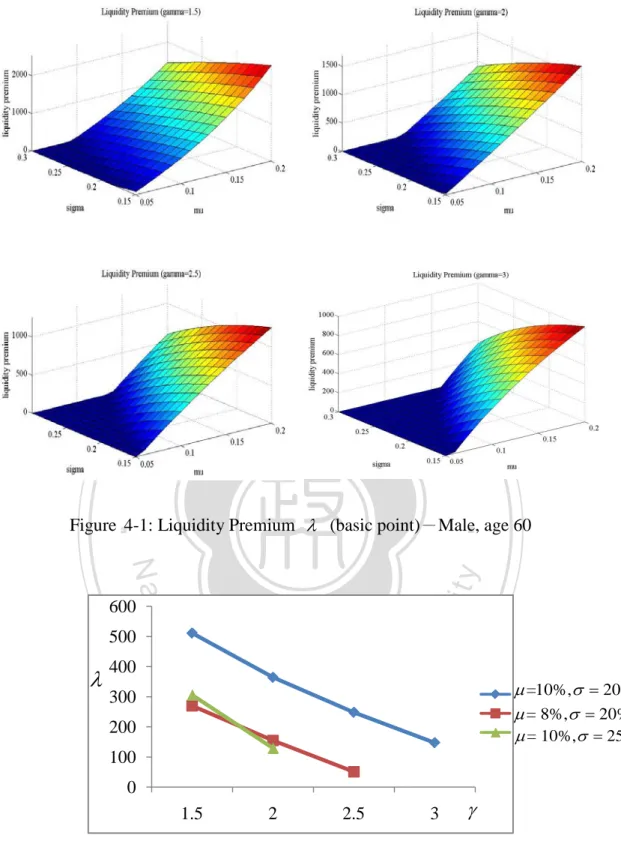

(23) IV. Empirical Results (1) Liquidity premium To measure the welfare loss from the old-age pension benefit since a lack of liquidity, we calculate the liquidity premium λ . We consider the following scenario to compare and analyze the results. The insured with the coefficient of relative risk aversion-1.5, 2, 2.5, and 3 retire at age 60 or 65 separately. As for the capital market parameters in our example, the risky asset is assumed to have drift µ =10% and volatility σ =20%, and set µ =8%, σ =25% to compare. The risk-free rate is. 政 治 大 the mortality rates, and set立 the highest age is 100 year-old. Take all the parameters. assumed to be 2.5%. In our study, we use the 9th Period Taiwan Life Table to carry off. ‧ 國. 學. into Eq.(4) and Eq.(5), and let these two functions be equal. We use the interior-reflective Newton method based on the non-linear least-squares algorithms to. ‧. solve the non-linear equations, and then we could obtain the value of the liquidity. sit. y. Nat. premium. The numerical results show in the following Table 4-1.. 1.5. Ch. 2 age 60. e n g c h364i U. er. al. n. γ. io. Table54-1: Liquidity Premium λ (basic point). v ni. 2.5. 3. 248. 147. µ = 10%. Male. σ = 20% µ = 8%. Female Male. 564 270. 400 155. 272 51. 161 0. σ = 20% µ = 10%. Female Male. 296 306. 169 129. 55 0. 0 0. σ = 25%. Female. 336. 140. 0. 0. 511. age 65. µ = 10%. Male. 506. 364. 250. 148. σ = 20% µ = 8%. Female Male. 557 269. 399 155. 272 51. 161 0. σ = 20% µ = 10%. Female Male. 294 305. 169 129. 55 0. 0 0. σ = 25%. Female. 334. 140. 0. 0. 17.

(24) 立. 政 治 大. ‧. ‧ 國. 學. Figure24-1: Liquidity Premium λ (basic point)-Male, age 60. sit er. al. n. λ. 400. io. 500. y. Nat. 600. 300. Ch. engchi. i n U. v. µ =10%, σ = 20% µ = 8%, σ = 20% µ = 10%, σ = 25%. 200 100 0 1.5. 2. 2.5. 3. γ. Figure34-2: Liquidity Premium λ (basic point)-Male, age 60. 18.

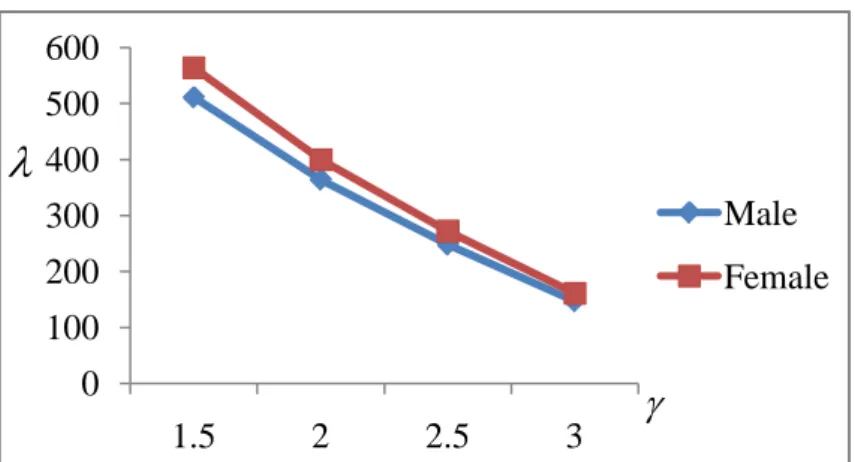

(25) 600 500. λ 400 300. Male. 200. Female. 100 0 1.5. 2. 2.5. 3. γ. Figure44-3: Liquidity Premium λ (basic point)-age 60, µ =10%, σ = 20% According to the Figure 4-1, 4-2, first we observe that a more risk averse insured. 政 治 大. requires less compensation for the illiquidity annuity for the same return and volatility. 立. of risky asset. The reason is the insured with grater aversion to risk is more unwilling. ‧ 國. 學. to take the additional market risk, thus they will require less liquidity premium. Second, the numerical results illustrate that the liquidity premium is an increasing. ‧. function of the market rate of return. Because when the market performs well, it will. y. Nat. sit. induce insured to do self investment, the annuity payment should provide higher. n. al. er. io. premium to compensate the insured. Third, we find the negative relationship between. i n U. v. the greater volatility and the required liquidity premium. The intuition is the insured. Ch. engchi. receives more risk while the risky asset is having higher volatility, so that the insured would prefer to hold the FIA. Fourth, comparing the liquidity premium between genders, the liquidity premium females require is higher than the males, since the female’s life expectancy is more than the males (Figure 4-3). Last, because the mortality is increasing by age, the latter the age of retire, the lower the liquidity premium. (2) Labor Insurance in Taiwan In this part, we use Labor Insurance to illustrate that pension benefit is better 19.

(26) than one-time benefit. Now, we brief introduce the Labor Insurance in Taiwan. The workers above 15 full years and below 60 years of age shall all be insured under this program compulsorily, with their employers, or the organizations to which they belong reckoned as the insured units. The insurance premium of Labor Insurance is calculated using the insured person's monthly insurance salary and insurance premium rate. The premium shall be paid by the insured person, insured unit, and the government in accordance with the percentage prescribed by the Labor Insurance Act (Appendix C). The insurance benefits include the permanent disability benefits,. 政 治 大 old, he/she could apply for the old-age benefit 立. old-age benefits, and medical care benefits, etc. When the insured retire at 60 years. ‧ 國. 學. There are two methods for retirees to get the pension payments: one-time old-age benefit and old-age pension benefit 11. If the insured person chooses the pension. ‧. benefit, he/she could select the better one from the following two formulas: (1). sit. y. Nat. average monthly insurance salary × coverage years × 0.775% + 3000; (2) average. n. al. er. io. monthly insurance salary × coverage years × 1.55%. Otherwise, the insured person. i n U. v. chooses the one-time benefit then he/she could take the product of average monthly. Ch. engchi. insurance salary product and issued months. (3) Implied longevity yield. Liquidity premium means the theoretical yield needed to compensate for the retirees select the pension benefit. In this part, we measure the actual rate of return the annuitized pension benefit provides which is called the implied longevity yield. Assumed the insured retiree at age 60, the coverage years are 15, 20, 30, and 35, 40. Refer to the Table of Grades of Insurance Salary (Appendix A), we choose the. 11. In this paper, we only consider the insured person has insurance coverage before January 1, 2009. 20.

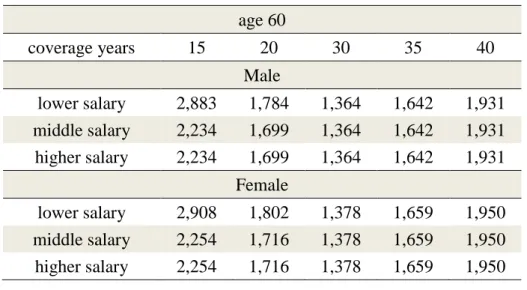

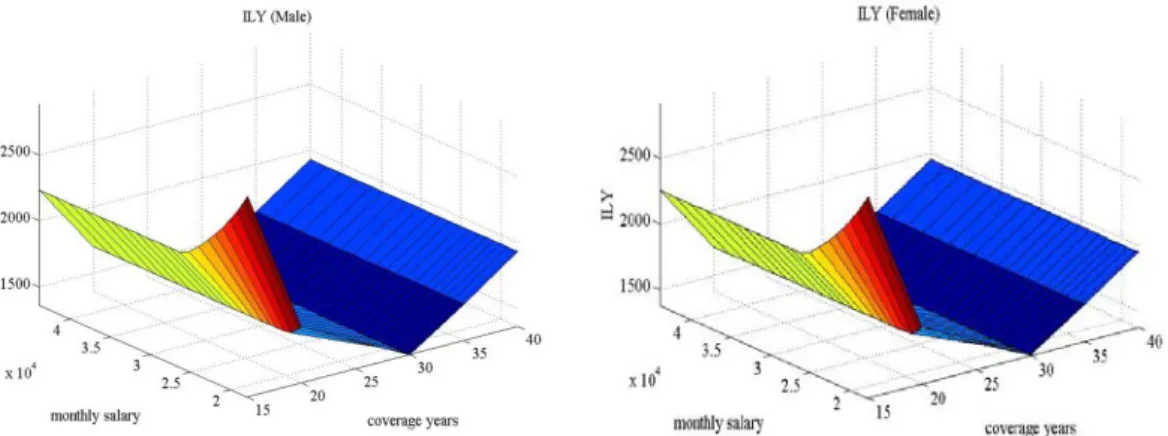

(27) lowest, middle, the highest grades monthly insurance salary, are 17,800, 27,600, and 43,900 separately. Due to these assumptions, we could understand how the length of coverage years and the amount of monthly insurance salary effect on the implied longevity yield. We assume the average monthly insurance salary under the pension benefit is identical to it under the one-time benefit. The benefit amount is showed in Table 4-2. Table64-2: Old-age benefit age 60 coverage years one-time benefit. 立. (17,880). 5,771. one-time benefit 414,000 pension benefit. 804,600. 804,600. 9,700. 11,086. 8,314. 690,000. 6,417. 40. 1,242,000 1,242,000 1,242,000. 8,556. 12,834. 14,973. 17,112. ‧. high salary (43,900). 5,079. 35. 學. middle salary (27,600). ‧ 國. pension benefit. one-time benefit 658,500 1,097,500 1,975,500 1,975,500 1,975,500 10,207. 13,609. 20,414. 23,816. 27,218. sit. Nat. pension benefit. y. low salary. 20 30 治 政 268,200 447,000 大 804,600 15. n. al. er. io. To simplify the calculation process, we transfer the monthly payment to. i n U. v. annuitized payment by let pension benefit multiplied by 12. Table 4-3 shows the. Ch. engchi. implied longevity yield (ILY) we derive from Eq.(10).. Table74-3: Implied Longevity Yield δ (basic point) age 60 coverage years. 15. 20. 30. 35. 40. 1,364 1,364 1,364. 1,642 1,642 1,642. 1,931 1,931 1,931. 1,378 1,378 1,378. 1,659 1,659 1,659. 1,950 1,950 1,950. Male lower salary middle salary higher salary. 2,883 2,234 2,234. 1,784 1,699 1,699 Female. lower salary middle salary higher salary. 2,908 2,254 2,254. 1,802 1,716 1,716 21.

(28) Figure54-4: Implied Longevity Yield δ -Male, Female age 60 (basic point) According to Table 4-3 and Figure 4-4, we find that the insured with lowest average monthly insurance salary earn the highest ILY under the coverage years less. 治 政 than 30, and ILY decreases by the greater monthly salary. 大However, the ILY values are 立 all the same between different monthly insurance salary if the coverage years which ‧ 國. 學. excess 30. Regardless the gender, the 15 coverage years corresponds to the highest. ‧. ILY value. And we notice the ILY value of over 30 coverage years is greater than ILY of 30 coverage years. The reason is that under the one-time benefit, for every one full. y. Nat. er. io. sit. year of insurance coverage, one month of average monthly insurance salary would be issued. For the part which is more than 15 years, 2 month of average monthly. n. al. Ch. i n U. v. insurance would be issued for every one extra year of insurance coverage, and the. engchi. highest limit is 45 months. Hence, the largest coverage years are 30 years under the one-time benefit, but the coverage years could increase over 30 years under the pension benefit. Besides, the female’s ILY values are greater than the male’s, since the mortality of female is lower than the male at any given age.. 22.

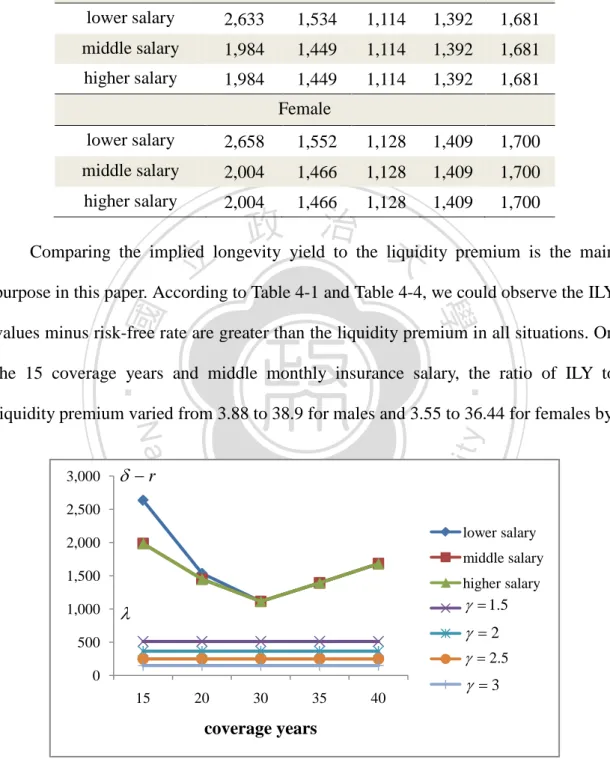

(29) Table84-4: Implied Longevity Yield minus risk-free rate (basic point) age 60 coverage years. 15. 20. 30. 35. 40. Male lower salary. 2,633. 1,534. 1,114. 1,392. 1,681. middle salary. 1,984. 1,449. 1,114. 1,392. 1,681. higher salary. 1,984. 1,449. 1,114. 1,392. 1,681. Female lower salary. 2,658. 1,552. 1,128. 1,409. 1,700. middle salary. 2,004. 1,466. 1,128. 1,409. 1,700. higher salary. 2,004. 1,466. 1,128. 1,409. 1,700. 治 政 大 premium is the main Comparing the implied longevity yield to the liquidity 立. purpose in this paper. According to Table 4-1 and Table 4-4, we could observe the ILY. ‧ 國. 學. values minus risk-free rate are greater than the liquidity premium in all situations. On. ‧. the 15 coverage years and middle monthly insurance salary, the ratio of ILY to. y. sit. n. al. 2,500 2,000 1,500 1,000. er. δ −r. io. 3,000. Nat. liquidity premium varied from 3.88 to 38.9 for males and 3.55 to 36.44 for females by. Ch. engchi. i n U. v. lower salary middle salary higher salary. γ = 1.5. λ. γ =2. 500. γ = 2.5. 0 15. 20. 30. 35. 40. γ =3. coverage years. Figure64-5: Liquidity premium and Implied Longevity Yield (basic point)-Male, age 60, µ =10%, σ = 20%. 23.

(30) 3000. δ −r. 2500 lower salary. 2000. middle salary 1500 1000. higher salary. γ = 1.5. γ =2. λ. γ = 2.5. 500. γ =3. 0 15. 20. 30. 35. 40. coverage years. 政 治 大 立age 60, µ =10%,σ = 20%. Figure74-6: Liquidity premium and Implied Longevity Yield (basic point)-Female,. ‧ 國. 學. the coefficient of relative risk aversion from 1.5 to 3. On the 20 coverage years, the ratio of ILY to liquidity premium varied from 2.83 to 28.41 for males and 2.6 to 26.65. ‧. for females. On the 30 coverage years, the ratio of ILY to liquidity premium varied. y. Nat. n. al. Male. 15 20. Ch. 3.88 ~ 38.9. engchi. 2.83 ~ 28.41. Female. er. io. coverage years. sit. Table94-5: The ratio of ILY to liquidity premium. 3.55 i v ~ 36.44 n U 2.6 ~ 26.65. 30. 2.18 ~ 21.84. 2 ~ 20.51. 35. 2.72 ~ 27.29. 2.5 ~ 25.62. 40. 3.29 ~ 32.96. 3.01 ~ 30.91. from 2.18 to 21.84 for males and 2 to 20.51 for females. On the 35 coverage years, the ratio of ILY to liquidity premium varied from 2.72 to 27.29 for males and 2.5 to 25.62 for females. On the 40 coverage years, the ratio of ILY to liquidity premium varied from 3.29 to 32.96 for males and 3.01 to 30.91 for females (Table 4-5). As the result, 24.

(31) the actual rate of return is greater than theoretical yield that the annuitized pension benefit should provide. Therefore, we propose that the annuitized pension benefit is better than the one-time benefit under Labor Insurance.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 25. i n U. v.

(32) V. Conclusion Due to the life expectancies getting longer in Taiwan, how could let people maintain the basic living after retiring is an important topic we should concern. In order to build up a complete Labor Insurance pension protection system and offer the insured person or insured person’s dependents long term living care, the system has added pension benefits on January 1, 2009. After the implementation of Labor Insurance pension program, the insured could select the old-age one-time benefit or monthly pension benefit when they retire. Therefore, which benefit approach is better is an important concern for retiree.. 立. 政 治 大. In this study, we apply the concept of liquidity premium (Browne et al, 2003). ‧ 國. 學. which measure the theoretical yield that annuitized benefit should provide to insured. ‧. and the implied longevity yield (Milevsky, 2005) that calculate the actual return of the. sit. y. Nat. annuitized benefit to compare the old-age one-time benefit and pension benefit under. io. er. Labor Insurance. Our main results are as follows: We find the lower level of risk aversion, higher market return, lower volatility, and younger retire age all appear to. al. n. v i n CCompare imply a larger liquidity premium. the implied longevity yield, assumed U h e n gwith i h c the insured retiree at age 60 have 15, 20, 30, and 35 coverage years and three different. insurance salaries. We observe the ILY values are greater than the liquidity premium in all situations. The 15 coverage years corresponds to the highest ILY value, then ILY decreased by age. But while coverage years exceed 30, ILY will be an increasing function of years. Concerning the insurance salary, the lower the insurance salary, the higher ILY will obtain as coverage years are less than 30. Last, the female’s ILY values are always greater than the male’s. According to the numerical results, we find the ILY that pension benefit provided 26.

(33) is greater than the theoretical yield needed to compensate for the retirees. In addition, the retiree chooses the pension benefit could get stable income each period, and pension benefit provide higher rate of return than many other investment assets. We would recommend the retiree to choose the annuitized old-age pension payment rather than the one-time old-age benefit.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 27. i n U. v.

(34) Appendix A The 9th Period Taiwan Life Table The 9th Period (1999~2001) Taiwan Life Table Age X. Probability of dying qx. Age. Probability of dying qx. Male. X. Male. Female. Female. 0. 0.00638. 0.00550. 25. 0.00118. 0.00045. 1. 0.00085. 0.00070. 26. 0.00122. 0.00046. 2. 0.00062. 0.00048. 27. 0.00130. 0.00049. 3. 0.00044. 0.00034. 28. 0.00139. 0.00052. 4. 0.00033. 0.00027. 29. 0.00147. 0.00055. 5. 0.00027. 0.00024. 30. 0.00059. 6. 0.00025. 0.00023. 0.00165. 0.00065. 7. 0.00025. 政 治31 大 0.00022 32. 0.00156 0.00178. 0.00071. 0.00019. 33. 0.00194. 0.00076. 0.00209. 0.00079. 0.00023. 0.00017. 34. 0.00023. 0.00017. 35. 0.00225. 0.00084. 0.00022. 0.00018. 36. 0.00243. 0.00091. 12. 0.00024. 0.00020. 37. 0.00263. 0.00098. 13. 0.00029. 0.00023. 38. 0.00283. 0.00105. 14. 0.00041. 0.00027. 39. 0.00301. 0.00114. 15. 0.00059. 0.00322. 0.00123. 16. 0.00079. 0.00349. 0.00132. 17. 0.00096. 0.00042. 42. 0.00377. 0.00144. 18. 0.00105. 0.00045. 43. 0.00404. 0.00157. 19. 0.00104. 0.00045. 44. 0.00428. 0.00171. 20. 0.00101. 0.00044. 45. 0.00457. 0.00186. 21. 0.00101. 0.00044. 46. 0.00489. 0.00199. 22. 0.00106. 0.00044. 47. 0.00516. 0.00211. 23. 0.00112. 0.00044. 48. 0.00537. 0.00223. 24. 0.00116. 0.00044. 49. 0.00565. 0.00240. io. n. Ch. 0.00031. 40. e n g c h41i. 0.00037. 28. y. sit. Nat. al. er. 11. ‧. 10. ‧ 國. 9. 學. 8. 立 0.00024. i n U. v.

(35) Age. Age. Probability of dying qx. Male. X. Male. Female. Female. 50. 0.00609. 0.00264. 80. 0.07148. 0.05484. 51. 0.00661. 0.00292. 81. 0.07763. 0.06068. 52. 0.00720. 0.00320. 82. 0.08413. 0.06700. 53. 0.00790. 0.00355. 83. 0.09093. 0.07385. 54. 0.00873. 0.00403. 84. 0.09804. 0.08126. 55. 0.00954. 0.00456. 85. 0.10555. 0.08930. 56. 0.01025. 0.00504. 86. 0.11359. 0.09805. 57. 0.01099. 0.00548. 87. 0.12277. 0.10801. 58. 0.01179. 0.00593. 88. 0.13263. 0.11892. 59. 0.01263. 0.00636. 0.14322. 0.13085. 60. 0.01359. 0.00690. 90. 0.15458. 0.14387. 61. 0.01478. 0.00764. 91. 0.16675. 0.15807. 0.01615. 0.00851. 92. 0.17977. 0.17352. 0.01760. 0.00945. 93. 0.19368. 0.19030. 0.01916. 0.01046. 94. 0.20853. ‧. 0.20850. Nat. y. X. Probability of dying qx. 0.22435. 0.22817. 0.24117. 0.24939. 0.02086. 0.01155. 95. 66. 0.02275. 0.01280. 96. 67. 0.02474. io. 0.01424. 97. 0.01588. 98. 69. 0.02866. 70. 0.03080. 0.01971. 71. 0.03328. 0.02191. 72. 0.03611. 0.02429. 73. 0.03932. 0.02688. 74. 0.04292. 0.02973. 75. 0.04690. 0.03288. 76. 0.05121. 0.03639. 77. 0.05575. 0.04030. 78. 0.06054. 0.04464. 79. 0.06576. 0.04949. n. 68. a 0.02670 l. sit. 65. er. 64. ‧ 國. 63. 學. 62. 立. 政 治 89大. C0.01769 h e n g c h i 99U n 100+. 29. 0.25904. i v 0.27797. 0.27222 0.29670. 0.29799. 0.32285. 1.00000. 1.00000.

(36) Appendix B Table of Grades of Insurance Salary. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 30. i n U. v.

(37) Appendix C Labor Insurance Act Last Amended on April 27, 2011 CHAPTER 1 GENERAL PRINCIPLES Article 1. This Act is enacted to protect workers' livelihood and promote social security. Matters not provided herein shall be governed by other relevant laws or regulations.. Article 2. The types and benefits of Labor insurance coverage are categorized as the following: 1. Ordinary insurance: There are five different kinds of benefits which are maternity benefits, injury or sickness benefits, disability benefits, old-age benefits and death benefits.. 學. ‧ 國. 2.. 政 治 大 Occupational accident insurance: There are four kinds of benefits 立 which are injury and sickness benefits, medical-care benefits, disability benefits and death benefits.. All labor insurance books and accounts, documents and operational receipts and payments shall be exempt from taxation.. Article 4. Council of Labor Affairs of the Executive Yuan and the municipal government shall be the competent labor insurance authorities.. ‧. Article 3. n. er. io. sit. y. Nat. al. Ch. engchi. CHAPTER 3 INSURANCE PREMIUM Article 13. i n U. v. The insurance premium of labor insurance is calculated using the insured person's monthly insurance salary and insurance premium rate. The ordinary insurance premium rate is 7.5% ~13% of the insured person's monthly insurance salary; the insurance premium rate was 7.5% when the amendments of this Act was promulgated and enforced on July 17, 2008, three years after the new regulation is enforced, the premium rate will be increased by 0.5%. Since then, 0.5% will be added to the insurance premium rate every year until the rate reaches 10%. From the year when the insurance premium rate reaches 10%, the rate will then be increased by 0.5% every two years until the rate reaches the upper limit of 13%. However, when the balance of the insurance fund is enough to pay 31.

(38) the benefits for the next twenty years, the insurance premium rate will not be increased. The occupational accident insurance premium rate is divided into two types which are Business Category Accident Premium and On and Off Duty Accident Premium. The occupational accident insurance rate will be prescribed by competent central authority, reported to the Executive Yuan for review and approval, and sent to the Legislative Yuan for reference; and shall be adjusted once every three years. For the insured units that employ a certain number of employees, the Business Category Accident Premium rate in the former paragraph will use Experience rate schedule which is calculated and adjusted annually by the insurer using the percentage of the total amount of occupational accident insurance benefit paid in the former three years to the total payable amount of occupational accident insurance premium payable according to the following regulations:. 立. 政 治 大. ‧. ‧ 國. 學. 1. For those exceed 80% of the total payable amount of occupational accident insurance premium payable, 5% of the applicable business category of occupational accident insurance premium rate will be additionally charged for every 10% increase until the premium rate reaches the 40% upper limit. 2. For those lower than 70% of the total payable amount of occupational accident insurance premium payable, 5% of the applicable business category of occupational accident insurance premium rate will be deducted for every 10% decrease.. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. The Experience Rate regulations shall be prescribed by the competent central authority. The insurer shall separately handle the accounting of occupational accident insurance.. Article 15. Labor insurance premiums shall be calculated and paid in accordance with the following measures: 1. As specified in article 6, paragraph 1, subparagraphs (1) to (6), inclusive, and article 8, paragraph 1, subparagraphs (1) to (3), inclusive, in the case of an insured person, twenty percent of the premium of ordinary insurance shall be borne by the insured person, seventy percent paid by the insured unit, and the remaining ten 32.

(39) percent shall be subsidized by the central government. The occupational accident insurance premium shall be borne in full by the insured unit. 2. As specified in article 6, paragraph 1, subparagraph (7), in the case of an insured person, sixty percent of ordinary and occupational accident insurance premiums shall be borne by the insured person, and the remaining forty percent shall be subsidized by the central government. 3. As specified in article 6, paragraph 1, subparagraph (8), in the case of an insured person, twenty percent of ordinary and occupational accident insurance premium shall be borne by the insured person, and the remaining eighty percent shall be subsidized by the central government. 4. As specified in article 8, paragraph 1, subparagraph (4), in the case. 政 治 大 of an insured person, eighty percent of ordinary and occupational 立 accident insurance premiums shall be borne by the insured person,. ‧ 國. 學. ‧. and the remaining twenty percent shall be subsidized by the central government. 5. As specified in article 9-1, in the case an insured person, eighty percent of the insurance premium shall be borne by the insured person, and the remaining twenty percent shall be subsidized by the central government.. n. er. io. sit. y. Nat. al. Section 6 Old-Age Benefits Article 58. Ch. engchi. i n U. v. An insured person who is at least 60 years of age and has any of the following conditions may claim to receive old-age benefits: 1. An insured person whose insurance coverage year reached over fifteen could claim for old-age pension benefit. 2. An insured person whose insurance coverage year has not reached fifteen could claim for a lump sum old-age benefit. For those who already have insurance coverage years before the promulgation and enforcement of the amendments for this Act on July 17, 2008 and conform to any one of the following regulations, the insured not only could claim for old-age benefit according to the regulation in preceding paragraph, he/she could also choose to claim for a lump sum old-age benefit. However, if the insurer has approved the 33.

(40) onetime payment, it could not be changed anymore. 1. An insured person at least sixty years of age or a female insured person at least fifty-five years of age who has been insured for at least one year and resigns; 2. An insured person whose insurance coverage reached over fifteen, who is at least fifty-five years of age and resigns; 3. An insured person who has been insured in the same insured unit for over twenty-five year and resigns; or 4. An insured person whose insurance coverage reached over twenty-five years, who is at least fifty years of age and resigns; 5. An insured person who has been employed for more than five year in physical hard labor, work of special character and who is at least fifty-five years of age and resigns.. 立. 政 治 大. ‧. ‧ 國. 學. An insured person who has claimed and received old-age benefits according to the preceding two paragraphs should be discharged from this labor insurance. The insured claim for old-age benefit is not bounded by the regulation of Article 30. On the tenth year after this amendment is promulgated and enforced on July 17, 2008, the age limit for claiming old-age benefit in first paragraph will be increase by one year and then the limit will be raised by one year for every two years until the limit reaches 65 years of age. An insured person who has received old-age benefits may no longer participate in the labor insurance. An insured person who has been employed for more than fifteen years in dangerous, physical hard labor or work of special character and is at least fifty-five years of age and resigns could claim for old-age benefit and is not bounded by the regulations in fifth subparagraph of this Article and Article 58-2. The meaning of dangerous, physical hard labor or work of special character in the fifth subparagraph of second paragraph and previous paragraph is to be defined by the competent central authority.. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Article 58-1 Old-age pension benefit will be calculated and chose one based on the most advantageous method of the following: 1. The monthly pension amount is calculated as 0.775% of average 34.

(41) monthly insurance salary for each single insurance coverage year plus 3,000 NT dollars. 2. The monthly pension amount is calculated as 1.55% of average monthly insurance salary for each single insurance coverage year. Article 58-2 Insured persons who have conformed with the old-age benefit claiming criteria in first subparagraph of first paragraph and fifth paragraph of Article 58 but have postponed in claiming the old-age pension benefit, extra 4% of the pension benefit amount calculated using the method in preceding Article will be granted for each year of pension benefit claiming postponement with the upper limit of 20% extra. An insured person who has more than fifteen years of insurance coverage but doesn’t reach the claiming age stipulated in first paragraph and fifth subparagraph of Article 58 could claim for old-age pension benefit. 政 治 大 within five years in advance. However, 4% of the pension benefit 立 using the method in preceding Article will be amount calculated. ‧ 國. ‧. Article 59. 學. deducted for each year of pension benefit claiming advancement with the upper limit of 20% deduction.. n. al. er. io. sit. y. Nat. An insured person who claims a lump sum old-age benefits payment in accordance with the provisions of subparagraph two of paragraph 1 and paragraph 2 of Article 58 shall receive one-month’s old-age benefits for each one of his/her insurance coverage years computed on the basis of his/her average monthly insurance salary; in case the insured person’s insurance coverage year exceeds fifteen years, the insured person shall receive two-month’s old-age benefits for each one of the excess years, provided that the maximum amount of old-age benefits payment shall not exceed forty-five months of insurance salaries. In case an insured person continues to work after attaining sixty years of age, his/her insurance coverage above that age shall not exceed five years. The maximum benefit payment amount shall not exceed fifty month’s insurance salaries including the old-age benefits receivable before he/she attained sixty years of age.. Section Eight. Ch. engchi. i n U. v. Application and Issuance of Pension Benefits. Article 65-1 The insured person or his/her beneficiary who conform to the claiming criteria of pension benefit should fill in an application and attach the related 35.

(42) documents to apply to the insurer. When the insured person or his/her beneficiary in previous paragraph has been examined by insurer as qualified, the pension will be issued monthly from the month of the application until the month of pension termination. In case the beneficiary of survivor's pension doesn’t submit application on the month they qualify for the benefits, the insurer should reissue the benefits to those who are entitled tracing back to five years before they submitted the application. However, for the part which already claimed by other beneficiary would not be included. Article 65-2 The insurer may verify the benefit applications made by the insured person or the survivors and suspend payment during the verification period. Once applications are verified and approved, payment during the suspension period shall be paid and regular payments shall resume.. 政 治 大 Once recipients are not qualified for receiving pension payments or die, they 立 themselves or the heir at law should present related documents and notify. ‧ 國. 學. ‧. the insurer within 30 days since the happening of the above facts. Pension payments will be terminated from the next month of the happening of the above facts. When benefit recipient dies and the payable benefit is not yet wired into the recipient’s account, the heir at law is entitled to present the copy of household registration transcript which marked the death of the applicant and the copy of household registration transcript for the heir at law to apply for the receiving of payment. When there are more than one people as the heir at law, they shall present warrant of joint-attorney and a recognizance entrusting one of them to apply for the receiving of the payment. When over pension payments resulted from recipient’s failure or the failure of heir at law to notify the insurer according to Paragraph 2, the insurer shall send written notices to the recipient of the over payment requesting repayment within 30 days. The insurer is also entitled to deduct the over payment from the account used in receiving the benefits.. n. er. io. sit. y. Nat. al. Ch. engchi. i n U. v. Article 65-3 The insured person or his/her beneficiary is entitled to apply for only one kind of benefits if he or she is qualified for disability pension, old-age pension payments, or survivor's pension benefit at the same time.. Article 65-4 The amount of pension for this insurance will be adjusted according to the 36.

(43) accumulated growth rate of Consumer Price Index published by the Budget, Accounting and Statistics institutions in the central government if the accumulated rate reaches 5%. Article 65-5 Should Insurer or Labor Insurance Supervisory Commission needs some necessary data for handling this insurance business, they could contact related government agencies to supply related data and those agencies could not reject such request. The insurer or Labor Insurance Supervisory Commission should ensure the safety check on the operation of information. All keeping, processing and utilization of such information shall follow the regulations of Computer-Processed Personal Data Protection Act.. 立. 政 治 大. ‧. ‧ 國. 學. n. er. io. sit. y. Nat. al. Ch. engchi. 37. i n U. v.

(44) References Albrecht, P. and R. Maurer, 2002, Self-annuitization, Consumption Shortfall in Retirement and Asset Allocation: The Annuity Benchmark. Journal of Pension Economics and Finance, 1, 269-288. Boardman, T., 2006, Annuitization Lessons from the UK: Money-Back Annuities and Other Developments. Journal of Risk and Insurance, 73, 633-646 Brown, J.R., 2001, Private Pensions, Mortality Risk, and the Decision to Annuitize. Journal of Public Economics, 82, 29-62.. 政 治 大 Journal of Risk and Insurance, 立 67, 527-554.. Brown, J.R., and J. Poterba, 2000, Joint Life Annuities Demand by Married Couples.. ‧ 國. 學. Browne, S., M.A. Milevsky, & T.S. Salisbury, 2003, Asset Allocation and the Liquidity Premium for Illiquid Annuities. Journal of Risk and Insurance, 70,. ‧. 509-526.. sit. y. Nat. Fischer, S., 1973, A Life Cycle Model of Life Insurance Purchases. International. n. al. er. io. Economic Review, 14, 132-152.. i n U. v. Friedman, B.M. and M.J. Warshawsky, 1990, The Cost of Annuities: Implications for. Ch. engchi. Saving Behavior and Bequests. Quarterly Journal of Economics, 105, 135-154. Horneff, W.J., R.H. Maurer, O.S. Mitchell, O.S., and I. Dus, 2008, Following the Rules: Integrating Asset Allocation and Annuitization in Retirement Portfolios. Insurance: Mathematics and Economics, 42, 396-408. Kingston, G., and S. Thorp, 2005, Annuitization and Asset Allocation with HARA Utility. Journal of Pension Economics and Finance, 4, 225-248. Kotlikoff, L.J., and A. Spivak, 1981, The Family as an Incomplete Annuities Market. Journal of Political Economy, 89, 373-391. Kotlikoff, L.J., and L.H. Summers, 1981, The Role of Intergenerational Transfers in 38.

(45) Aggregate Capital Accumulation. Journal of Political Economy, 89, 706-732. Milevsky, M.A. and C. Robinson, 2000, Self-annuitization and Ruin in Retirement. North American Actuarial Journal, 4, 113-129. Milevsky, M.A. and V.R. Young, 2007a, Annuitization and Asset Allocation. Journal of Economic Dynamics and Control, 31, 3138-3177. Milevsky, M.A. and V.R. Young, 2007b, The Timing of Annuitization: Investment Dominance and Mortality Risk. Insurance: Mathematics and Economics, 40, 135-144.. 政 治 大 To Annuitize or not to Annuitize? Journal of Risk and Insurance, 65, 401-426. 立. Milevsky, M.A., 1998, Optimal Asset Allocation towards the End of the Life Cycle:. Mirer, T.W., 1994, The Dissaving of Annuity Wealth and Marketable Wealth in. ‧ 國. 學. Retirement. Review of Income and Wealth, 40, 87-97.. ‧. Mitchell, O.S., J.M. Poterba, M.J. Warshawsky, and J.R. Brown, 1999, New Evidence. y. sit. io. er. 1299-1318.. Nat. on the Moneys Worth of Individual Annuities. American Economic Review, 89,. Modigliani, F., 1986, Life Cycle, Individual Thrift and the Wealth of Nations.. n. al. Ch. American Economic Review, 76(3), 297-313.. engchi. i n U. v. Stabile, G., 2006, Optimal Timing of the Annuity Purchase: Combined Stochastic Control and Optimal Stopping Problem. International Journal of Theoretical and Applied Finance, 9, 151-170. Vidal-Melia, C., Lejarraga-Garcia, A., 2006. Demand for life annuities from married couples with a bequest motive. Journal of Pension Economics and Finance 5 (02), 197-229. Yaari, M.E., 1965, Uncertain Lifetime, Life Insurance and the Theory of the Consumer. Review of Economic Studies, 32, 137-150.. 39.

(46)

數據

相關文件

As a byproduct, we show that our algorithms can be used as a basis for delivering more effi- cient algorithms for some related enumeration problems such as finding

Lemma 3 An American call or a European call on a non-dividend-paying stock is never worth less than its intrinsic value.. • An American call cannot be worth less than its

interpretation of this result, see the opening paragraph of this section and Figure 4.3 above.) 2... (For

21 Article 6(x): Where the financial sector is unduly protected from normal commercial and financial risks, serious prejudice in the sense of paragraph (c) of Article 5 shall

We obtain several corollaries regarding the computational power needed by the row player to guarantee a good expected payoff against randomized circuits (acting as the column player)

Article 40 and Article 41 of “the Regulation on Permission and Administration of the Employment of Foreign Workers” required that employers shall assign supervisors and

shall be noted. In principle, documents attached by the employer shall be affixed with the seals of application unit and owner. The application and list shall be affixed with

As for Deqing's structural analysis of the text of the Lotus Sūtra, inspired by a paragraph in the text, Deqing divided the main body of the text into four parts: teaching (kai 開)