This article was downloaded by: [National Chiao Tung University 國立交

通大學]

On: 28 April 2014, At: 01:10

Publisher: Routledge

Informa Ltd Registered in England and Wales Registered Number:

1072954 Registered office: Mortimer House, 37-41 Mortimer Street,

London W1T 3JH, UK

Transport Reviews:

A Transnational

Transdisciplinary Journal

Publication details, including instructions for

authors and subscription information:

http://www.tandfonline.com/loi/ttrv20

Logistics opportunities in

Asia and development in

Taiwan

Cheng-Min Feng & Kai-Chieh Chia

Published online: 26 Nov 2010.

To cite this article: Cheng-Min Feng & Kai-Chieh Chia (2000) Logistics

opportunities in Asia and development in Taiwan, Transport Reviews:

A Transnational Transdisciplinary Journal, 20:2, 257-265, DOI:

10.1080/014416400295284

To link to this article: http://dx.doi.org/10.1080/014416400295284

PLEASE SCROLL DOWN FOR ARTICLE

Taylor & Francis makes every effort to ensure the accuracy of all

the information (the “Content”) contained in the publications on our

platform. However, Taylor & Francis, our agents, and our licensors

make no representations or warranties whatsoever as to the accuracy,

completeness, or suitability for any purpose of the Content. Any

opinions and views expressed in this publication are the opinions and

views of the authors, and are not the views of or endorsed by Taylor

& Francis. The accuracy of the Content should not be relied upon and

should be independently verified with primary sources of information.

Taylor and Francis shall not be liable for any losses, actions, claims,

proceedings, demands, costs, expenses, damages, and other liabilities

whatsoever or howsoever caused arising directly or indirectly in

This article may be used for research, teaching, and private study

purposes. Any substantial or systematic reproduction, redistribution,

reselling, loan, sub-licensing, systematic supply, or distribution in any

form to anyone is expressly forbidden. Terms & Conditions of access

and use can be found at

http://www.tandfonline.com/page/terms-and-conditions

Logistics opportunities in Asia and developm ent in Taiwan

²

CHENG-MINFENG³ and KAI-CHIEHCHIAInstitute of Tra c and Transportation, National Chiao Tung University, 4F, 114, Sec. 1, Chung Hsiao W. Road, Taipei, Taiwan

(Received 15 February 1999; accepted 2 March 1999 )

The economy in Asia is growing rapidly. As a consequence, transportation and communication technologies and the changing needs of customers and shippers have resulted in Asian and Taiwan’ s logistics being in transition. This paper discusses why logistics changes, and explores the opportunities for Asian logistics development. The issues of logistics perspectives of private sectors in Taiwan are then raised. Finally, logistics development in Taiwan is described.

1. W hy does logistics change?

Logistics has rapidly changed as a result of the growing globalization of business, changing technologies, organizational patterns, deregulation policies and govern-mental infrastructure. For example, the multinational com pany, which is engaged in multinational production, is the typical organization in the free enterprise world of today. Also multiple-site m anufacturing and assem bly is the usual practice.

There is a variety of reasons for the needs of production dispersal. One main reason is the existence of com parative advantage, which leads to trade between two regions. Trade is generally bene® cial if transport costs are relatively small compared with production cost. If the net gains from trade are considered to be positive, specialization in production will occur. Global trade, based on factor endowment and government regulations, covers the transfer of resources, including capital, labour, technology, managem ent and know-how, as well as raw materials, semi-manufactures, components and end-products, from one nation to the other. The supply-chains and the movements of all those materials and products are the subject matter of logistics.

2. Opportunities for Asian logistics

Some indicators (CEP D 1998, IATA 1997 ) used to show the growing Asian markets are as follows.

·

G ross domestic product (GDP ) for Asia-Paci® c will be higher than that for either North America or Europe by 2010. Among these three regions the market share of Asia-Paci® c will be 37.1% by 2010.·

Relaxation of government regulations on trade and transportation has resulted in free ¯ ow of cargoes, passengers, information and capital.² This article continues the Transpor t Reviews series in memory of Jim Cooper. [Editor] ³ e-mail: cm feng@sunwk1.tpe.nctu.edu.tw

Transport Review s ISSN 0144-1647 print/ISSN 1464-5327 onlineÓ 2000 Taylor & Francis Ltd

http://www.tandf.co.uk/journals/tf/01441647.htm l

TRA NSPORT REVIEW S, 2000, VOL. 20, NO. 2, 257 ± 265

·

According to the IATA , the Asia air cargo market accounted for well over one-half the world market (59% ) in 1992 , and is expected to continue to grow .·

According to Boeing W orld Air Cargo forecast (Bo eing 1998 ), the air cargo growth rate in 1992 ± 2010 is 9.3% for Intra-Asia, 7.9% for USA-Asia and 7.4% for Europe-Asia, all of which are above the world average of 6.8% . Intra-Asian growth has been the most rapid, due to the rapid m arket developm ent in Japan, Hong Kong, Taiwan, and China during 1980 ± 90.·

Asia air express cargo is also growing very fast, with volum e at least double that of other major markets. For example, the express cargo growth rate in 1991 ± 93 was 25% in Asia, 12% in Europe and 8% in North America. The customers in Asia rely heavily on the services of express carriers, especially on those of the integrated carriers.·

Between 1995 and 2010 , Asia-Paci® c international scheduled passenger tra c will grow at a projected average an nual rate of growth of 7.4% . At the same time, international scheduled tra c for the rest of the world is forecast to grow by 4.4% per an num on average.·

By 2010 , Asia-Paci® c tra c will am ount to 393 million passengers. This is an almost three-fold increase in the 15-year forecast period.·

The global share of Asia-Paci® c international scheduled passenger tra c increased from 26.2% in 1985 to 35.2% in 1995 . It will increase to nearly 50% by 2010.·

Europe was and will rem ain the most im portant world region for long-haul international passenger tra c to and from Asia-Paci® c. By 2010 , there will be 57.8 million passengers between Europe and Asia-Paci® c. The main region-pairs, within North-east Asia, between North-east ± east Asia and within South-east, will remain within the Asia-Paci® c Area.·

Asia is particularly attractive in container shipping because return on sales was 5.7% in 1992 for transpaci® c routes, the only pro® table long-haul routes, while it was Ð 22.3% for transatlantic routes and and Ð 6.8% for North Europe-FarEast routes.

According to the above indicators, opportunities for Asian logistics developm ent are as follows: (1 ) strong economic growth in Asia Paci® c area, (2 ) increasing disposable income, (3 ) intensi® cation of inter- an d intra-Asia-Paci® c trade, (4 ) continuing deregulation and liberalization policies and (5 ) signi® cant developm ent of transport infrastructures.

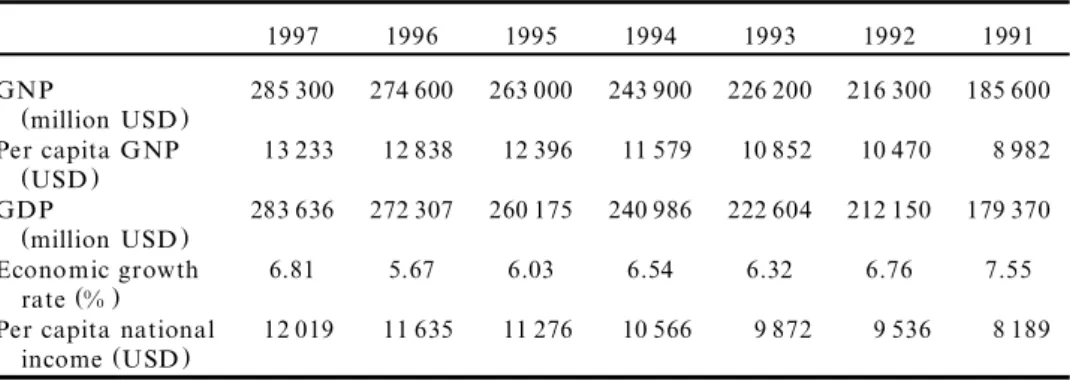

3. Perspectives on the private sector in Taiwan

The total area of Taiw an is 36 300 km2 (14 000 square miles ), which is slightly smaller than The N etherlands and Switzerland. Since the island is largely mountainous, Taiwan is the second-m ost densely populated country in the world, with a population of over 21 million, or 582 persons per km2. The change in industrial structure in Taiwan has been accompanied by sustained economic growth. Table 1 re¯ ects the growth of both GDP and G NP over the past few years.

Taiwan’ s economy is highly dependent on foreign trade. Accordingly, most major industries are export-oriented or are suppliers for export industries. The appreciation of the New Taiwan dollar and increasing wage costs mean that labour-intensive industries are facing ® erce competition from neighbouring lower-cost countries. Consequently, Taiwan is focusing increasingly on higher-value quality

258 C.-M . Feng and K.-C. Chia

products and on high-technology industries for domestic production and is moving labour-intensive industries to South-east Asia and M ainland China.

International trade is the mainstay of Taiwan’ s economy. Table 2 summ arizes major import and export com modities and trading partners. Taiwan has since the end of the 1980 s embarked on a policy of reducing or removing controls on imports and reducing import tariŒs.

Below is a summary of the report of the Council for Economic Planning and Development (CEPD ) of Taiwan, where Taiwan’ s existing strengths and weaknesses in developing into a regional centre in the Asia-Paci® c area are assessed through interviews (CEPD 1994 ). The selected managers of local and foreign private sectors are grouped into two categories: transportation logistics companies and production logistics companies. The former category represents companies whose core business is freight transportation, and with which the multinational has established a long-term relationship. Federal Express (FedEx ) and United Parcel Service, Inc. (UPS ) are two examples of these com panies. The latter category represents compan ies whose core business is supply chain-related m anufacturing and assembly, and the logistics function in these com panies may be operated by an in-house departm ent. Examples are the com puter companies of ACER and Compaq .

Table 1. GNP, GDP, NI and economic growth rate of Taiwan from 1991 to 1997.

1997 1996 1995 1994 1993 1992 1991 GNP (million USD ) Per capita GNP (USD ) GDP (million USD ) Economic growth rate (% ) Per capita national

income (USD ) 285 300 13 233 283 636 6.81 12 019 274 600 12 838 272 307 5.67 11 635 263 000 12 396 260 175 6.03 11 276 243 900 11 579 240 986 6.54 10 566 226 200 10 852 222 604 6.32 9 872 216 300 10 470 212 150 6.76 9 536 185 600 8 982 179 370 7.55 8 189

Source: Directorate-General of Budget, Accounting and Statistics (1998 ).

Table 2. Major trading commodities and partners. Major import

commodities

Oil, machinery, electrical products, chemicals, steel, steel work, beverages, tobacco, motor vehicles, delivery equipment, metal products, electrical machines

Major export commodities

Electronic products, garments, yarns, shoes, toys, sporting goods, base metal, metal products, machinery, motor vehicles, delivery equipment, plastics

Major trading partners

USA, Japan, Hong Kong, Germany, Singapore, UK

Source: CEPD (1994 ).

259 Logistics opportunities in Asia and Taiwan

The com ments on the perspectives of private sectors in Taiwan are as follows. (1 ) Transportation logistics companies

·

An air hub is needed in Taiwan to cope with the strong growth of the Asian market.·

A regional hub in Asia is needed to serve the rapidly growing Intra-Asia volumes.·

There is a growing opportunity in express air cargo for Taiwan to meet the needs of just-in-time (JIT ) delivery.·

Since the logistics business is very sensitive to time, the less time the transportation takes the better.·

Airports serving the express cargo business and providing e cient operations are needed. Those airports that have strict regulations will be signi® cantly less attractive.·

Customs services in airports operating on a 24-h basis are needed. Customs paperwork should be replaced with EDI (electronic data interchange ), which can immensely accelerate custom s clearance.·

A good network of ¯ ights would help provide ¯ exibility in scheduling and goods delivery. It is better to have direct access to M ainland China, which has a fast-growing market.·

Current regulations and restrictions constrain shipping operations in distribution activitities and in utilizing berth and warehouse capacity.·

Foreign ocean carriers demand to extend their marine transport to the inland trucking market on condition of reciprocity.To improve company com petitiveness, the Taiwan and foreign managers of express carriers call for their own facilities to get control over their cargo handling, e cient customs procedures and 24-h operations for fast throughput tim e, and frequent ¯ ights to many regional destinations, including China.

(2 ) Production logistics companies

·

Products can be developed quickly enough without a good industry infrastructure an d supplier network.·

A more open trade relationship is needed, especially with m ainland China.·

Partnerships with foreign multinational companies are needed.·

Attracting m ore foreign direct investment will help Taiwan to further improve productivity.·

Low cost of land and labour for manufacturing our products are required.·

Language barriers exist, as English is not su ciently used in many situations.·

An advanced information and telecommunications infrastructure is required.·

Entering the global trade economy and in particular joining the W orld Trade Organization (W TO ), is essential.The Taiwan and foreign managers of production ® rms require a good industry infrastructure and supplier network to manufacture competitive products, fewer restrictions on trade with mainland China,

260 C.-M . Feng and K.-C. Chia

extensive partnerships with foreign companies, low costs for land and labour for manufacturing, an advanced information and telecommu-nications infrastructure, and m embership in the global trade economy.

4. The development of logistics in Taiw an

Taiwan is an export-oriented country. Along with the increase of international trade and economic developm ent, the volume of logistics has increased rapidly. According to the 1996 survey of the Institute of Transportation, M inistry of Transportation and Communications, the total am ount of the logistics ¯ ow, including sea transport, ground transport and air transport, is nearly 13% of the total GDP with 973 billion NT dollars (nearly US$35.4 0 billion ) annually (Institute of Transportation, M OTC 1998 ).

4.1. The problems

Facing the quickly changing environm ents, som e problems of Taiwan’ s local logistics ® rms arise as follows:

(1 ) Infrastructure. Tra c congestion is an obstacle to the growth of logistics. The loading and unloading of cargoes during normal working hours is considered to be the main cause of congesion in urban areas. A lack of parking space and tra c congestion in urban areas has become a common phenom enon and leads to rapidly increasing transport costs. Consequently, as far as cost is concerned, the dom estic transport system may not support the JIT delivery requirements.

(2 ) Economic and ® nancial. M ounting demand and international competition have in¯ uenced the structure and location of industry as well as the local and international division of labour. Some advanced large companies in Taiwan could adopt new organizational structures and use advanced logistics services to maximize pro® t. However, most middle-sized and small logistics ® rms in Taiwan cannot react quickly to the changing market and new technologies. As a result, their competitiveness will not be based on e ciency but rather on drastically reduced prices.

The high land prices and land-use limitations are hindering the development of the logistics industry. The high cost of labour and labour shortage had resulted in increasing logistics costs.

(3 ) Legal and adminstrative. The current land-use regulations do not give enough incentives to the establishment of a distribution centre. The current regulations in the areas of Aviation and Harbour are outdated. The result is that airport and harbour pricing are less attractive and custom s procedures are not e cient.

To enhance e ciency and competitiveness, the logistics ® rms have focused on the following areas:

·

m aking smart investments on infrastructure equipment;·

supporting the usage of new technologies such as ED I to rationalize their distribution channels;·

encouraging multi-modal and cooperation between international logistics ® rms;·

developing joint distribution centres in the vicinity of metropolitan areas; 261 Logistics opportunities in Asia and Taiwan·

improving the existing distribution channels to achieve an ad vanced logistics system; and·

enhancing the safety of distribution process. 4.2. Governmental actionsIn addition to supporting a well-developed distribution and manufacturing centre in Asia-Paci® c region, Asia-Paci® c Regional Operation Centre (APROC ) plan has been in place for 3 years. However, government agencies have spared no eŒort in carrying out market liberalization and internationalization. The current logistics-related actions taken by governm ents are described as follows.

(1 ) Transport infrastructure construction. The infrastructure projects of air, sea and ground transport have been continuously undertaken an d governm ent agencies are engaged in the introduction and operation of new transport technologies to improve the service level of the transportation systems. (2 ) Developing Taiwan as the operation centre of the Asia-Paci® c region. The

purpose of developing Taiwan as an Asia-Paci® c operation centre is to attract enterprises to use Taiwan as their production, logistics and marketing bases for delivering high value-added goods to this region. The APROC plan will develop six specialized centres. In these, `software’ program s are being re-engineered for the purpose of revamping the legal and macro-economic environm ent on Taiwan. Of these six centres, three will be aimed at developing the air transport, see transport and telecommunications, which will lead to providing high quality infrastructure services to logistics ® rms.

(3 ) Civil aviation law amended. Revisions involving 117 articles of the Civil Aviation Law were adopted by the Legislative Yuan of Republic of China on 30 Decem ber 1997 , with two revisions directly aŒecting foreign airline companies. First, the new provisions stipulate that for air cargo-forwarding companies, ground stations and cargo distribution companies, foreign capital shares and the number of foreign board members may represent 50% of the total shares or board seats, compared with only one-third in the previous regulations. Second, airline companies can adjust their international ¯ ight fares on their own and later ® le a report with the authorities. This dispenses with the prior-approval system on pricing schedule for international ¯ ights. (4 ) Customs surcharge reduced. The M inistry of Finance (M OF 1998 ), under a customs regulation revision ® nalized in February 1998 , drastically reduced the custom s surcharge on export inspections to save time and to reduce costs of exporters.

(5 ) EH U (Express Handling Units ) clearance lim itations relaxed. E ciency of customs clearance should be improved. Reducing the present custom s clearance down to a par with Singapore’ s 2 ± 4 h or Hong Kong’ s 2 ± 6 h customs clearance is planned under which the average clearance tim e for air cargo will be reduced to 4 h from 3 days.

N ew clearance regulations which became eŒective in August 1997 scrapped the old rules that stipulated that EH U cargoes could not exceed NTD20 000 for non-export-and-im port-controlled goods. The new regula-tions only prescribe that EH U cargoes shall not exceed 70 kg compared with 40 kg in the old regulations. The value requirement has also been

262 C.-M . Feng and K.-C. Chia

scrapped. Goods that are subject to import and export control can also go through the EH U .

After the establishment of EHU at the CKS airport in Decem ber 1995 , incoming cargoes into the units increased by nine times and outgoing ones jum ped by 30-fold, representing 1.3% of the cargo handling in the airport. Adding those handled in the on-board-courier handling units (OBC ), cargoes handled at OBC and EHU accounted for 3.3% of the total air cargo volume of CKS airport.

(6 ) Twenty-four-hours customs clearance at CK S International Airport. The CK S international airport announced that 24-h cargo claims would be expanded to general com modities, which had been inspected and checked in the past. Those eligible for 24-h claim include cargoes that do not require paper veri® cation and inspection, cargoes which have passed paper veri® cation and inspection, and those imported to export processing zones and science-based industrial parks. The 24-h cargo claim operation is open 7 days a week.

(7 ) Pre-clearance system for air cargo. The implementation of preclearance system will signi® cantly improve the e ciency of import clearance. Under the new system, airline companies can send through a computer network the manifest, declaration paper and other documents to custom s before the arrival of cargo. Customs m ay inform the custom s agents whether those cargoes must proceed for inspection. If not, cargo can be cleared within 24 h of arrival.

(8 ) Harbour charges lowered and foreign investment lim itation reduced. The government ® nalized the revision of relevant rules in September 1997 and reduced the harbour construction fee from the previous 0.5% of cargo value to 0.4% . Also, the government raised the foreign investm ent ceiling in container yards.

In September 1997 , the M OTC adjusted m any tariΠchanges at international ports. The tugboat charge was reduced to 30% from 50% . W arehousing and container yard rental fees will be given a 20% discount. W arehousing charges will be voided for bulk carrier goods which stay in warehouses no more than 5 day s. The loading cost of refrigeration boats will be reduced by 10% , while the rental of cranes and other machinery will be reduced by 20% .

(9 ) W arehousing centres in Kaohsiung, Taichung launched. The Taiwan Export Processing Zone Administration formally established a branch o ce in Taichung Harbour and two branch o ces in Kaohsiung Harbour in December 1997 to promote the transforming of processing zones into warehousing centres.

The warehousing centre will attract high-tech manufacturing enter-prises, warehousing and distribution companies, and other related service ® rms.

(10 ) Airport city development plan. The airport city development plan was approved in October 1997 , and the local government started land acquisition. This marked the beginning of constructing a large-scale airport city, covering a total of 63 hectares of land around the CK S international airport, and accomm odating a projected cargo volume of 1.2 million tons per year, up 10.4% from the present 732 000 tons.

263 Logistics opportunities in Asia and Taiwan

The government plans the construction of the bonded warehouse, value-added operations and distribution centres. The primary construction plan will be ® nished by 1999. Private participation will be encouraged.

(11 ) Federal Express, UPS and DHL expand operations. The UPS Logistics Centre in Taiwan began operation in Novem ber 1997 to provide value-added distribution, inventory management and warehousing services to customers all over the Asia-Paci® c region. This could drastically reduce the time and cost of inland transport and warehousing.

The Federal Express CKS transport centre covering 1700 m2 began operations on 11 November 1997 . The transport centre provides 24-h customs clearance services. Its speedy sorting system can process 3000 pieces of cargo per h. The new centre will be able to provide more streamlined services.

D HL has upgraded its competitiveness by enhancing its point-to-point international courier services with distribution functions. It is constructing its distribution and inventory centre near the CKS Airport.

The integrated logistics ® rms, e.g. UPS, FedEx an d DHL, combine distribution, transport and advanced electronic-data-interchange (EDI ) know-how to serve industries in inventory management, warehousing, sorting or assembling, and overnight handling to provide fast delivery service for high-tech industries.

(12 ) Air cargo term inal privatized. Privatizing the cargo terminal in CKS airport is the government policy. It is expected that privatization and integrating the upstream an d downstream delivery services will make proper adjust-ments in hardware installation and will stream line procedures to upgrade clearance e ciency.

(13 ) New highway law takes eŒect. The revised Highway Law took eŒect on 1 November 1997 , opening the market for the leasing of small passenger cars, automobile cargo transport, and automobile container transport to foreign investors.

(14 ) Land use release. Some farm and open land will be released for use such as car parks and distribution operation centres by logistics ® rms.

5. Conclusion

W ith the growth of globalized business, advanced technologies development, international specialization of labour, continuing deregu lation and liberalization policies and governm ental infrastructure im provement, the logistics market opportunities in Asia are attractive. But the logistics services required by customers have also becom e increasingly more complex and demanding. Faster and more sophisticated logistics for companies are needed to meet the changing needs of custom ers and shippers.

The results of interviewing managers of logistics companies showed that the managers within transportation logistics companies recom mended that governm ent authorities continuously improve infrastructure facilities and develop regional hub operations to serve the rapidly growing freight demand. The express carriers’ managers call for e cient cargo handling and 24-h operations in airports to im prove com pany competitiveness.

On the other hand, the m an agers in production logistics companies focused on the macroscope recomm endations of Taiwan’ s logistics developm ent, such as

264 C.-M . Feng and K.-C. Chia

gradually eliminating political barriers with mainland China, establishing partner-relationships with multinational companies, and entering the international W orld Trade Organization (W TO ).

Following the perspectives of local and foreign logistics companies and reviewing the existing di culties of logistics development in Taiwan, governm ent agencies in Taiw an have taken several logistics-related actions to deal with aspects of the infrastructure, ® nance, legal regulations and administration to reduce the obstacles such as tariŒs, im port restrictions, etc. that the private sector encounters in conducting international business. Confronted with a ® erce and constantly changing competitive environment, even with numerous opportunities, the government still has to improve the hardware an d software performance to enhance the competi-tiveness of the logistics industry.

References

BOEINGCO. CO MM ER CIALAIRPLA NEGROU P, 1998, World Air Cargo Forecast: Signi® cant World

Airline TrendsÐ 1998 (Seattle: Boeing Co. ).

CEPD (COU NCIL FOR ECONO MICPLANN IN G AN D DEVELO PMENT), 1994, Developing Taiwan into a

Regional Operations Centre (Taiwan: CEPD ).

CEPD (COUN CIL FOR ECON OMIC PLANN IN G AND DEVELOP M EN T), 1998, Taiwan Statistical Data

BookÐ 1998 (Taiwan: CEPD ).

DIRECTO RATE-GENERAL O F BUD GET, ACCO U NTIN G AN D STA TISTICS, 1998, Statistical Abstract of

National Income in Taiwan Area of the Republic of China (Taiwan ).

IN STITU TE OFTRA NSPORTATION, MINISTRY OFTRAN SPO RTA TION ANDCOM M UN ICATIO NS, A Survey on

the Origin ± Destination Data of the Export ± Import Commodities in Taiwan Area

(Taiwan: MOTC ).

IN TERN A TION ALAIRTRANSPOR TASSOCIATION, 1997, Asia-Paci® c Air Transport Forecast (1980 ±

2010) (IATA ).

MOF (MINISTR Y OFFINA NCE), 1998, Monthly Statistics of Exports and Imports, Taiwan Area,

Republic of China (Taiwan: MOF ).

265 Logistics opportunities in Asia and Taiwan