ELSEVIER

Available online at www.sciencedirect.com MATHEMATICAL

AND

SCI,'NC-, @Dla-'c r*

COMPUTERMODELLING Mathematical and Computer Modelling 41 (2005) 711-721

www.elsevier.com /locate/ mcm

M o t i v a t i o n and

R e s o u r c e - A l l o c a t i o n for

Strategic Alliances through

the D e Novo P e r s p e c t i v e

J I H - J E N G H U A N G

Department of Information Management National Taiwan University, Taipei, Taiwan

Gwo-HSHIUNG TZENG*

Institute of Management of Technologyand

Institute of Traffic and Transportation

Department of Business Administration, National Chiao Tung Universit, Hsinchu and

College of Management, Kai Nan University, Taoyuan, Taiwan C H O R N G - S H Y O N G O N G

Department of Information Management National Taiwan University, Taipei, Taiwan (Received August P003; revised and accepted May 2004)

A b s t r a c t - - I n recent years, there have been proposed many theories and models, such as transac- tion cost theory and the resource-based view, to explain the formation of strategic alliances. However, the perspectives are usually limited and incomplete. Additionally, the problem of resource allocation is also a serious issue when firms enter strategic alliances. This paper proposes a holistic perspective and provides an optimal resource portfolio by using the De Novo perspective. A numerical example demonstrates the criteria of strategic alliances and provides the optimal resource portfolio. (~) 2005 Elsevier Ltd. All rights reserved.

K e y w o r d s - - S t r a t e g i c alliances, Transaction cost theory, Resource-based view, Resource alloca- tion, De Novo perspective.

1. I N T R O D U C T I O N

I n t h e p a s t two decades, s t r a t e g i c alliances have b e e n an i m p o r t a n t issue, one a s p e c t of these is t h e f o r m a t i o n o f s t r a t e g i c alliances. A l t h o u g h m a n y theories a n d m o d e l s such as strategic perspective, o r g a n i z a t i o n learning, etc., have been p r o p o s e d t o explain t h e f o r m a t i o n of strategic alliances, their p e r s p e c t i v e s are usually limited a n d i n c o m p l e t e [1,2]. Additionally, t h e p r o b l e m of resource allocation is a n o t h e r crucial issue a n d previous p a p e r s seem t o t r y t o answer only t h e

*Author to whom all correspondence should be addressed.

0895-7177/05/$ - see front matter ~) 2005 Elsevier Ltd. All rights reserved. Typeset by .Ah/~S-TEX doi: 10.1016/j .mcm. 2004.05.007

712 J.-J. HUANG et al.

question of '~why strategic alliances should be formed?", but not "what to do next?" In contrast, this paper proposes a holistic perspective to explain the formation of strategic alliances and provides a method for optimal resource allocation between alliances.

In recent years, the mainstream of research can be summarized into the transaction cost theory and the resource-based view, and it has been used to explain the formation of strategic alliances. Of these two, transaction cost theory focuses on the aspect of cost (including transaction cost and product cost), whereas resource-based view emphasizes the combination of resources between alliances. In our view, both theories are partial reasons to form the strategic alliances, and so should be considered together.

Additionally, neither transaction cost theory nor the resource-based view provides a method to resolve the problem of resource allocation. Traditional mathematical programming, such as linear programming or dynamic programming, is a valid tool to provide an optimal solution in fields of operations research. However, when this tool is used to allocate the combined resources between alliances, synergies seem cannot be explain and display. The reason for this lies in the assumption of additivity. The assumption of resource independence does not allow the synergy effect, and so is not suitable in the situation of strategic alliances.

In this study, transaction cost theory and the resource-based view are combined, called the De Novo perspective, and used to explain the formation of strategic alliances. In additional, the problem of optimal resource allocation between alliances is proposed using De Novo program- ming. In order to demonstrate the criteria of strategic alliances and assign the optimal resource allocation, a numerical example is presented.

According to the numerical results, we show that the motivation for strategic alliances is determined by both transaction cost and firms' resources. However, whether firms enter into alliances depends on the necessary and sufficient conditions. When the necessary condition is satisfied, a firm has the motivation to form strategic alliances. But only when the sufficient is satisfied, a firm will enter into alliances. In addition, the results also show the optimal resource allocation between firms' resources.

The rest of this paper is organized as follows. Section 2 shows the motivations for strategic alliances. Section 3 describes the problem of resource allocation. The De Novo perspective is pro- posed in Section 4, and a numerical example is provided in Section 5. Discussions are presented in Section 6 and the final section presents conclusions.

2. M O T I V A T I O N S F O R

S T R A T E G I C A L L I A N C E S

A strategic alliance may be defined as a cooperative arrangement between two or more in- dependent firms that exchange or share resources for competitive advantage. There are many studies which discuss the formation of strategic alliances using various theories and models such as transaction cost theory [3], the perspective of strategy [4,5], resource dependence theory [6,7], organizational knowledge and learning [8,9] and the resource-based view [10,11]. However, pre- vious studies have not approached the problem from a holistic perspective.

These theories or perspectives can be summarized as follows. The perspective of strategy sug- gests seeking appropriate alliances which can increase a firm's competitive position or competitive advantage. In contrast, in resource dependence theory the motivations for strategic alliances are in search of valuable resources which firms themselves lack. Furthermore, organizational knowl- edge and learning focus on the reason that firms desire to acquire or learn others' organizational knowledge.

Recently, transaction cost theory and the resource-based view are mainly used to explain the formation of strategic alliances and the comparison of both theories are proposed one after another [1,12]. Since this paper combines the transaction cost theory and the resource-based view, these perspectives are thoroughly discussed in the next two sections.

Motivation and Resource-Allocation 713 2.1. T r a n s a c t i o n C o s t T h e o r y

Based on an economic approach, transaction cost theory was proposed by Coase [13] to explain the decision regarding markets or hierarchy in a firm's behavior. The main concepts are that when'the transaction cost of an exchange is high, the form of internalization will predominate, and vice versa. However, there is the restriction that transaction cost theory only explains the extreme conditions, and this limitation is extended by Williamson to explain the situation of strategic alliances [14-17].

This extension can describe how transaction cost theory uses transaction cost (e.g., writing or enforcing contract cost) and production cost (e.g., internal coordination or managing production cost) to determine markets or hierarchy. However, when the optimal total cost is neither in markets or hierarchy, strategic alliances should be the best way [18,19].

Additionally, Williamson suggests that transaction costs should include the direct costs of managing relationships and the possible opportunity costs of making inferior governance deci- sions. These concepts can be described as bounded rationality, opportunism, asset specificity and uncertainty [20-22].

Although transaction cost theory provides a useful explanation for the formation of strategic alliances, it has a major weakness in that the analysis focuses on single-party cost minimization rather than global cost minimization [23]. Furthermore, it does not assign a significant role to partner firms' resources in theorizing [11], which impelled the emergence of the resource-based view.

2.2. T h e R e s o u r c e - B a s e d View

A resource-based view [10,24-27] proposes the other perspective on strategic alliances, and states that the valuable resources that firms do not own are the motive for strategic alliances. In past papers, there are many classifications of the resources provided [10,11,24,28], the resources can generally be classified into tangible (e.g., financial and technological) and intangible (e.g., knowledge-based and managerial) resources. Additionally, heterogeneity is the reason why firms are distinctive, and is the basis of resource-based view [29]. In order to acquire competitive advantage and the ability to respond quickly to a dynamic environment, firms should consider how to construct and extend limited resources to develop a capability for sustainable competitive

advantage

[30].For both constructing and extending a firm's resources, there are three ways (i.e. hierarchy, market, or alliances) to execute this. However, the assumption of heterogeneity across firms causes the cost of hierarchy or markets to be high. In the resource-based view, firms seek complementary resources to create synergies and acquire sustainable competitive advantage [31,32]. When the degree of heterogeneity among firms increases, the higher probability of forming alliances creates rents [10]. In short, by way of strategic alliances, firms can gain their partners' complementary resources to enhance or reshape their internal processing to create synergies and competitive advantages within the market [33,34].

Although the resource-based view proposes a reliable perspective on a firm's resources to ex- plain the formation of strategic alliances, there are some notable questions which remain: what are the criteria to form alliances when firms lack any desired complementary resources? Obvi- ously, not every firm enters alliances in the real world, even though they lack some complementary resources. In addition, the firm may even gain its partner's resources. What should the firm do after making the alliance? Firms cannot gain anything unless they can use their newly-acquired resources well. In other words, the optimization of resource allocation is the key to whether firms can create synergies and competitive advantage.

Next, we describe the traditional method which has been used for the problem of resource allocation and point out its deficiencies in explaining the formation of strategic alliances. In

714 J.-J. HuANc et al.

Section 4, a complete solution, called the De Novo perspective, is proposed to overcome these problems.

3. P R O B L E M OF R E S O U R C E A L L O C A T I O N

Based on the above discussions, we know that resources play a central role in the formation of strategic alliances. However, neither transaction cost theory nor the resource-based view provides a method to conduct the problem of resource allocation. In operations research, the problem of optimal resource allocation has been a popular issue, and one of these notable methods is mathematic programming.

Mathematic programming is the technique which distributes limited resources to competing activities in an optimal way. Of the several mathematic programming techniques, linear pro- gramming is the most popular. Linear programming was developed by Kantorovich and Koop- mans [35], and the general matrix formulation of linear programming can be described as follows.

max Cx,

s.t. A x < b, (1)

x > 0 ,

where both C = Cq×n and A = A,,~xn are matrices, b = ( b l , . . . , b m ) T E R m, and x = ( x l , . . . , x j , . . . ,xn) T E R ~. Let the k th row of C be denoted by c k = (c kl,...,c~,...k ,c~) E R ~, so that ckx, k = 1 , . . . , q, is the k th criteria or objective function. There are several ways to solve this question, such as the simplex method or the interior-point algorithm, and the solutions indicate the optimal way to distribute limited resources.

Although mathematic programming provides a way to resolve the problem of resource alloca- tion, the basic assumption of additivity seems irrational when we extend this method to manage the resource of an alliance. This is because additivity presumes that all productive elements are independent and the total effects equal the summation of each individual effect. The most critical problem lies in that this assumption makes it impossible for firms to create synergies.

The famous case to describe the problem of element independence is the emergence of "mass customization". Traditionally, the firm has two ways to gain profit. One is to reduce unit cost by economic scaling with the same unit revenue. The other is to increase unit revenue by customization with higher unit cost. When element independence exists, it is impossible to reduce unit cost and increase unit revenue simultaneously. However, since the concept of mass customization has been proposed and used in practice, the restriction of element independence should be released.

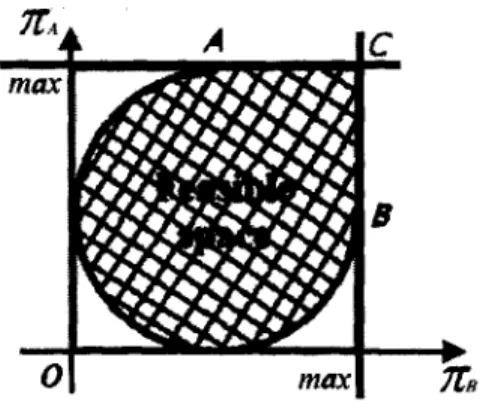

In Figure 1, we assume that an alliance in a market has two alliance members (A and B) and 7rA, and 7rs denote the profits in the firms A and B, respectively. The goal of firms is to optimize profit maximization, and the feasible solutions have circular section. Usually, compromise solutions are the best decision in traditional mathematic programming and they fall into A B . The options which points A, B, C contain including the ideal point, C, is an unavailable option and the unavailable solutions are caused by the assumption of additivity.

Based on the assumption of additivity, the combination of alliance resources allows only 1 + 1 = 2, rather than 1 + 1 > 2. However, synergies are usually the reason or result of strate- gic alliances. In other words, a firm is said resource constraints and cannot be changed if it produces individual, then traditional methodology of mathematical programming is rational and available [36]. However, when we can redesign or reshape system, the traditional methods are no longer suitable, and this usually happens in strategic alliances.

Next, we use De Novo programming to release the limitation of element independence and to solve the problem of an optimal resource portfolio in strategic alliances to achieve the aspira- tion/desired level.

Motivation and Resource-Allocation 715

A

i

C

OI

max|

Figure 1. T h e feasible options using linear programming.

4. D E N O V O P E R S P E C T I V E OF S T R A T E G I C A L L I A N C E S

De Novo programming was proposed by Zeleny [37,38] to redesign or reshape given systems to achieve a aspiration/desired level. The original idea was that productive resources should not be engaged individually and separately because resources are not independent. By releasing various constraints, De Novo programming attempts to break limitations to achieve the aspiration/desired solution. Herein, De Novo programming is extended, and called the De Novo perspective, in order to explain the formation of strategic alliances. The De Novo perspective combines transaction cost theory and the resource-based view to provide a holistic perspective for achieving an aspi- ration/desired level.Based on transaction cost theory, if the minimum cost lies between the transaction cost and the production cost, the firm should seek strategic alliances. Here, we add alliance cost (e.g., shared operation, negotiating and risk cost) to explain the formation of strategic alliances, and the rule of transaction cost theory can be modified as

N

if alliance cost < ~ individual firm's cost, then the firm seeks alliances.

i = l

From the resource-based view, firms seek strategic capabilities by linking to partner's resources to create synergies in a market. The rule of the resource-based view can be modified as

N

if alliance revenue > ~ individual firm's revenue, then the firm seeks alliances.

i = l

Now, we combine transaction cost theory and the resource-based view to form the De Novo perspective. If the firm only chooses hierarchy or alliances, for example between two firms (S and T), the rule of strategic alliances can be expressed as

if V ( S O T ) - U ( C s T ) > V ( S ) + V ( T ) - U(Cs) - U(CT), then the firm seeks alliances. If we extend this to a general form, the expression can described as

N

if V(Sl u s ~ . . . u s ~ ) -

U(Ca11,a.ce

cos,) > ~ [V (S,) -- U (S,)],i---1

i = 1 , 2 , . . . , N , (2)

where V(.) denotes the revenue function, U(.) denotes the cost function, C s and CT denote the total product cost in S and T, respectively, and CST denotes the alliance cost between S and T.

The probability of firms, S and T, seeking alliances can be expressed, respectively, as

1, A V ( S U T ) - OU(CsT) > V ( S ) - U ( C s ) , (3a) P (S) = O, A V (S U T) - OU (CsT) < V (S) - U ( C s ) ,

716 J.-J. HUANG et al. and

1, ( 1 - - 1 ) V ( S O T ) - - ( 1 - - 0 ) U ( C s T ) > V ( T ) - - U ( C T ) ,

P ( T ) = 0, ( 1 - 1 ) V ( S U T ) - ( 1 - 0 ) U ( C s T ) < V ( T ) - U ( C T ) , (3b) where A denotes the percentage of increasing alliance revenue in S, and 0 denotes the percentage of reducing alliance cost in S.

Now, we can shift the above discussions into De Novo programming and the problem of resource allocation can be expressed as

m a x V ( S U T ) - U ( C s T ) ,

s.t. w x < _ B , x>_0. (4) where w = p A = ( w l , . . . , W n ) e R n, and p : ( P l , . . . , P m ) E R m and B E R present the unit price of resources and the total available budget, respectively.

Then, the knapsack solution is

x * = [ O , . . . , B / C k , . . . , O ] T , (5)

where

o k / 4 =

3 and the optimal solution to (4) is given by (5) and

(6)

The final alliance profit (<~(S*)) in S is

b* = A x * . (7)

(8)

(S*) ~ - "'b*U ~ ~ I [--C;ST), "where i is the identity column vector. Based on equation (8), we can judge whether or not the firm seeks alliances by equations (2) and (3). Furthermore, using De Novo programming, we can easily allocate the optimal resources and create synergies between alliances.

The difference between traditional mathematical programming and De Novo programming lies in the ability of De Novo programming to redefine its boundaries or constraints through system redesign, reconfiguration or reshaping [39]. Figure 2 shows the difference in feasible options using De Novo programming.

The greatest difference between Figures 1 and 2 is that the unavailable solutions are now available through DeNovo programming. In other words, the ideal point, C, is now the optimal solution in alliances for achieving the aspiration/desired level.

OI

max I

Motivation and Resource-Allocation 717 5. N U M E R I C A L E X A M P L E

In this section, we use a numerical example which is modified from Zeleny [40] to demonstrate the profit difference between hierarchy and alliances, and propose the criteria for firms to enter strategic alliances.

For simplicity, we assume there are two firms, S and T, which b o t h produce the same two products; and have the same two productive elements and total p r o d u c t costs, U(Cs) and U(CT),

respectively. Then, firm S can determine its optimal resource allocation by using mathematical programming as follows, m a x f l = 400Xl + 300x2, m a x f2 = 6xl + 8x2, s.t. 4xl _< 10, 2Xl -}-6x2 _< 12, 12xl + 4x2 _< 30, 3x2 _< 5.25, 4xl + 4x2 < 13, Xl,X 2 > O,

where Pl -- 30, P2 -- 40, P3 -~ 9.5, P4 = 20, and P5 -- 10 are market price ($ per unit) of the resources bl through bs, respectively. Function f l and f2 denote the revenue of product 1 and product 2 respectively, and B = 1 3 0 0 denotes the firm's total budget.

Using traditional mathematical programming, we can easily solve the optimal distribution of a resource portfolio at Xl--2.125 and x2---1.125. Firm S can achieve total revenue by the summation function f l and f2 equal 1187.5 ÷ 21.75 -- 1209.25. Then, the profit of firm S can be expressed as 1209.25 - U(Cs). Using the same procedure, the profit of the firm, T, is 1209.25 - U(CT).

On the other hand, if the two firms enter an alliance the problem of resource allocation can be solved by De Novo programming as follows,

max f l = 400Xl + 300x2, m a x f2 = 6xl + 8x2, s.t. 4xl _< 20, 2Xl + 6x2 <_ 24, 12xl + x2 <_ 60, 3x2 < 10.5, 4Xl + 4x2 _< 26, x 1~ x 2 > 0. Let B--2600 denotes the total alliance budget.

First, we use traditional mathematical programming to solve the knapsack problem. For the m a x f l , we solve

m a x f l = 400xl + 300x2,

s.t. 354Xl + 378x2 _< 2600, x l , x 2 _> 0,

and the answer can be formed as x, ~ --- 2600/354 ~ 7.34, x~ -- 0, f l = 2937.85, and B 1 = 2600. For the max f2, we solve

m a x f2 -- 6xl + 8x2, s.t. 354xl + 378x2 _< 2600,

718 J.-J. HUANG e~ al.

and the solutions are x~ = 0, x~ = 2600/378 g 6.88, f2 = 55.03, and B 2 -- 2600.

After solving the above problems, we can find the ideal point, f** -- (2937.85, 55.03), the synthetic solution, x** -- (7.34, 6.88), and the synthetic budget B** -- 5200. The radio r** must be calculated to contract the synthetic solution to an optimal designed solution x*. The results can be shown as follows,

r** = B / B * * = 2600/5200 = 0.5,

x* = r** x x** = (0.5 × 7.34, 0.5 x 6.88) ~ (3.67, 3.44).

Then, the alliance revenue can sum functions f l and f2 as (400 x 3.67 + 300 x 3.44) + (6 x 3.67 + 8 x 3.44) = 2549.54. The alliance profit can be expressed as ~(S*) -- 2549.54 - U ( C s T ) .

However, although the alliance revenue is more t h a n the summation of individual firm's profit, it does not necessarily go to strategic alliances.

This is because the necessary condition of strategic alliances is

2549.54 - U ( C s T ) > 1209.25 - U ( C s ) + 1209.25 - U ( C T ) , (9) and when the formulation,

u (csr) <__

131.04+ (u (cs) + u (cT)),

(lO)

is satisfied, the firm has stimulus to seek strategic alliances.

However, equation (10) does not ensure t h a t the individual firm will enter strategic alliances, and the criterion depends on its sufficient condition.

For firm S, the sufficient condition of strategic alliances is

),- 2549.54 - OU ( C s T ) > 1209.25 -- U ( C s ) ,

(11)

and when equation (11) is satisfied, firm S enter alliances.

Note t h a t Shi (1995) [41] provides six kinds of optimum-path ratios to find the optimal solution in De Novo programming, whereas here, we demonstrate only one of the six. Other kinds of optimum-path ratios can also be calculated for alternatives in strategic alliances.

To extend our concept to a real-world case, the situation is much complex t h a n our exam- ple which m a y exist large-scale alliance situation or contain multiple criteria and multiple con- straints ( M C 2) problems. In a large-scale alliances situation, we can adopt the large-scale M C 2

algorithms proposed by Hao and Shi [42] or other heuristic algorithms such as multiobjectives evolution algorithms (MOEA) to overcome the problem.

On the other hand, De Novo can be extended to incorporate the problem of multiple criteria and multiple constraints such as

m a x 5' C x,

s.t. A x < DV,

x>_0,

where ~ and V denote the unknown relative and constraint level weight vector, respectively, and satisfy I1~[[ = 1 and [l~I[---- i.

Since several MC2programming methods has been proposed to solve the above problem [43], De Novo programming can be widely used in various strategic alliances. Even more, if strategic alliances can consider the situation of possible debt, the contingency plan should be used [44].

6.

D I S C U S S I O N S

As we know, cost or revenue is usually the motives determining whether or not firms seek strategic alliances or not. However, in the previous literatures, there has been no concrete

Motivation and Resource-Allocation 719

equation provided to judge whether firms go to alliances. In addition, the problem of resource allocation between alliances is also a difficult issue and the traditional mathematical programming seems to be unable to provide a sound solution.

In the previous section, we demonstrate a numerical example to solve the questions regarding the criteria for forming strategic alliances and making the optimal resource allocation in alliances. Neither transaction cost theory nor the resource-based view provide the criteria for firms to enter alliances. As we demonstrate, the criteria can be divided into the necessary condition and the sufficient condition. If the profit of alliances is satisfied be the necessary condition, firms have motives for strategic alliances. However, only when individual firm satisfy the sufficient condition, is an alliance formed.

Based on the numerical example, equation (10) can answer if a firm should consider strategic alliances. It indicates that only when the alliance cost

(U(CsT))

is lower than 131.04 +(U(Cs) +

U(CT)), will the firm consider seeking strategic alliances. Then, equation (11) provides the concrete answer to the question of whether the firm should enter an alliance. That is to say, if A- 2549.54 -

t~U(CsT)

> 1209.25 --U(Cs)

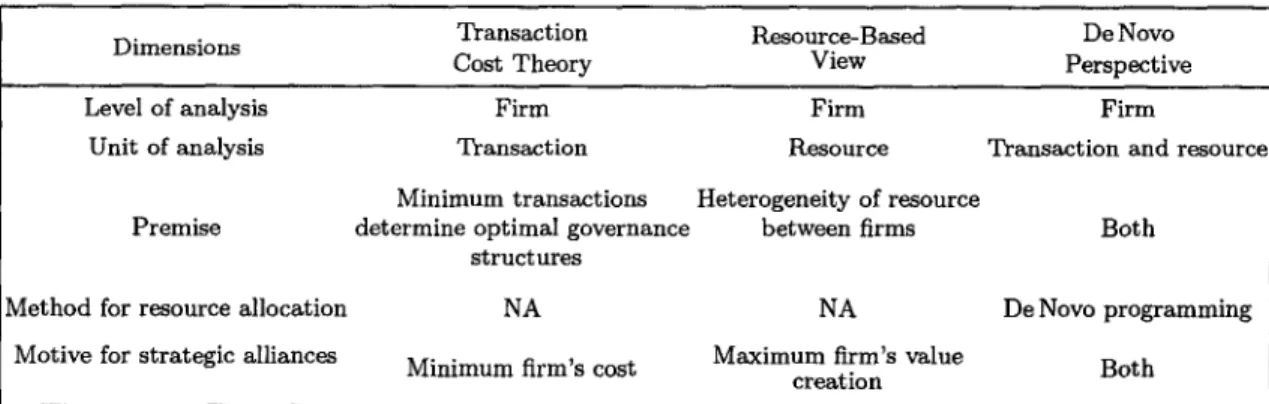

is satisfied, the firm will have economic rents when it enters a strategic alliance.Comparisons of transaction cost theory, resource-based view and De Novo perspective is made in Table 1.

Table 1. T h e comparisons of various perspectives.

Transaction Resource-Based De Novo Dimensions

Cost Theory View Perspective

Level of analysis F i r m F i r m Firm

Unit of analysis Transaction Resource Transaction a n d resource

Minimum transactions Heterogeneity of resource

Premise determine optimal governance between firms B o t h structures

Method for resource allocation NA NA De Novo programming

Motive for strategic alliances Minimum firm's c o s t Maximum firm's value Both

creation

In addition, for the second problem, traditional mathematical programming seems to be unable to create synergies in alliances. In contrast, through De Novo programming the optimal resource allocation is planned and the results show the effect of synergy.

To summarize, the De Novo perspective provides a complete explanation for strategic alliances and the alliance criteria are offered by mathematic equations in this paper. This can be easily calculated by firms to determine their action for strategic alliances, and the optimal distribution for alliances' resources also can be found.

7. C O N C L U S I O N S

Transaction cost theory uses minimum cost to explain the formation of strategic alliances and the resource-based view focus on seeking valuable resources to achieve a global optimal. In this paper, the De Novo perspective is proposed to explain the formation of strategic alliances and provide synergistic solutions for resource allocation in achieving the aspiration/desired level.

Clearly, a strategic alliance is a kind of multicriteria optimal system design (MCOSD) problem, rather than a multicriteria optimal system analysis (MCOSA) problem. Productive resources should not be engaged individually and separately because they do not contribute individually according to their marginal productivities. In this situation, the De Novo approach is more suitable than traditional mathematical programming.

The most critical problem with the De Novo approach is that the required budget will exceed the subject budget using De Novo programming in some situations. This may be a serious problem

720 J,-J. HUANG et el.

for i n d i v i d u a l firms, b u t in a l l i a n c e s t h e f i n a n c i a l l e v e r a g e effect c a n o v e r c o m e t h i s difficulty. I n a d d i t i o n , t h e p r o f i t f r o m e c o n o m i c o f scale c a n also b e seen in t h e r e s u l t s o f D e N o v o p r o g r a m m i n g . I n short~ t h e D e N o v o p e r s p e c t i v e p r o v i d e s a n o t h e r v i e w o n s t r a t e g i c a l l i a n c e s a n d gives t h e o p - t i m a l r e s o u r c e a l l o c a t i o n . U n l i k e t r a d i t i o n a l m a t h e m a t i c a l p r o g r a m m i n g , t h e D e N o v o a p p r o a c h d o e s n o t h a v e t h e l i m i t a t i o n o f e l e m e n t i n d e p e n d e n c e . T h i s c h a r a c t e r i s t i c a l l o w s t h i s o p e r a t i o n s r e s e a r c h t e c h n i q u e t o e x t e n d t o e x p l a i n s y n e r g i e s , e c o n o m i c s o f scale, a n d o t h e r s p i l l - o v e r effects.

R E F E R E N C E S

1. E.W.K. Tsang, Motives for strategic alliance: A resource-based perspective, Scandinavian Journal of Man- agement 14 (3), 207-221, (1998).

2. B. Borys and D.B. Jemison, Hybrid arrangements as strategic alliances: Theoretical issues in organizational combinations, Academy of Management Review 14 (2), 244-249, (1989).

3. E. Anderson and H. Gatignon~ Modes of foreign entry: A transaction cost and propositions, Journal of International Business Studies 17 (3), 1-26, (1986).

4. M.E. Porter, Competitive Strategic, Free Press, New York, (1980).

5. J. Hagedoorn, Understanding the rationale of strategic technology partnering: Interorganizational modes of cooperation and sectoral differences, Strategic Management Journal 14 (5), 371-385, (1993).

6. J. Preffer and P. Nowak, Joint ventures and interorganizational interdependence, Administrative Science Quarterly 21 (3), 398-418, (1976).

7. J. Preffer and G. Salancik, The External Control of Organizations: A Resource Dependence Perspective, Harper & Row, New York, (1978).

8. R.R. Nelson and S.G. Winter, An Evolutionary Theory of Economic Change, Harvard University Press, Massachusetts, (1982).

9. B. Kogut, Joint ventures: Theoretical and empirical perspectives, Strategic Management Journal 9 (4), 319-332, (1988).

10. J.B. Barney, Firm resources and sustained competitive advantage, Journal of Management 17 (1), 99-120, (1991).

11. T.K. Des and B.S. Tent, A resource-based theory of strategic alliances, Journal of Management 26 (1),

31-61, (2000).

12. H. Chen and T.J. Chen, Governance structures in strategic alliances: Transaction cost versus resource-based

perspective, Journal of World Business 38 (1), 1-14, (2003).

13. R.H. Coase, The nature of the firm, Eeonomica N. S. 4 (4), 386-405, (1937).

14. O.E. Williamson, Markets and Hierarchies: Analysis and Antitrust Implications, Basic Books, New York, (1975).

15. O.E. Williamson, The Economic Institutions of Capitalism, Free Press, New York, (1985).

16. O.E. Williamson, Comparative economic organization: The analysis of discrete structural alternatives, Ad- ministrative Science Quarterly 36 (2), 269-296, (1991).

17. O.E. Williamson, Strategizing, economizing, and economic organization, Strategic Management Journal 12 (8), 75-94, (1991).

18. R. Gulati, Alliances and Networks, Strategic Management Journal 19 (4), 293-317, (1998).

19. K. Ramanathan, A. Seth and H. Thomas, Explaining joint ventures: Alternative theoretical perspectives, In Cooperative Strategies, Volume 1, (Edited by P.W. Beamish and J.P. Killing), pp. 51-85, New Lexington Press, San Francisco, CA, (1997).

20. A. Rindfleisch and J.B. Heide, Transaction cost analysis: Past, present, and future applications, Journal of Marketing 61 (4), 30-54, (1997).

21. A. Parkhe, Strategic alliance structuring: A game theoretic and transaction cost examination of interfirm cooperation, Academy of Management Journal 36 (4), 794-829, (1993).

22. J.H. Dyer and H. Singh, The relational view: Cooperative strategy and sources of interorganizational com- petitive advantage, Academy of Management Review 23 (4), 660-679, (1998).

23. E.J. Zajac and C.P. Olsen, From transaction cost to transactional value analysis: Implications for the study of interorganizational strategies, Journal of Management Studies 30 (1), 131-145, (1993).

24. R.M. Grant, The resource-based theory of competitive advantage, California Management Review 33 (3), 114-135, (1991).

25. B. Wernerfelt, A resource-based view of the firm, Strategic Management Journal 5 (2), 171-180, (1984). 26. J. Barney, M. Wright and D. J. Ketchen, The resource-based view of the firm: Ten years after 1991, Journal

of Management 27 (6), 625-641, (2001).

27. J. Barney, Resource-based theories of competitive advantage: A ten-year retrospective on the resource-based view, Journal of Management 27 (6), 643-650, (2001).

28. D. Miller and J. Shamsie, The resource-based view of the firm in two environments: The Hollywood film studios from 1936-1965, Academy of Management Journal 39 (3), 519-543, (1996).

29. E. Penrose, The Theory of the Growth of the Firm, John Wiley, New York, (1959).

30. D.J. Teece, C. Pisano and A. Shuen, Dynamic capabilities and strategic management, Strategic Management Journal 18 (7), 509-533, (1997).

Motivation and Resource-Allocation 721 31. M.A. Harrison, R. E. Hoskisson and D. Ireland, Synergies and post acquisition performance: Differences

versus similarities in resource allocations, Journal of Management 17 (1), 173-190, (1991).

32. A. Lockett and S. Thompson, The resource-based view and economics, Journal of Management 27 (6), 723-754, (2001).

33. N. Nohria and C. GarcievPont, Global strategic linkages and industry structure, Strategic Management Jour- nal 12 (1), 105-124, (1991).

34. M.E. Porter and M.B. Fuller, Coalitions and global strategy, In Competition in Global Industries, (Edited by M. E. Porter), pp. 315-343, Harvard Business School Press, Boston, MA, (1986).

35. L.V. Kantorovich and T. C. Koopmans, Problems of Application of Optimization Methods in Industry,

Federation of Swedish Industries, Sweden, (1976).

36. Z. Babic and I. Pavic, Multicriterial production planning by DeNovo programming approach, International Journal of Production Economics 43 (1), 59-66, (1996).

37. M. Zeleney, Multiple Criteria Analysis: Operational Methods, (Edited by P. Nijkamp and J. Spronr), pp. 37-52, Grower Publisher Co., Hampshire, (1981).

38. M. Zeleney, Optimal system design with multiple criteria: De Novo programming approach, Engineering Cost Production Economics 10 (1), 89-94, (1986).

39. M. Zeleney, Optimal given system vs. designing optimal system: The De Novo programming approach, In- ternational Journal of General System 17 (3), 295-307, (1990).

40. M. Zeleney~ Trade-offs-free management via De Novo programming, International Journal of Operations and Quantitative Management 1 (1), 3-13, (1995).

41. Y. Shi, Studies on Optimum-Path Ratios in Multicriteria De Novo Programming Problems, Computers Math. Applie. 29 (5), 43-50, (1995).

42. X.l%. Hao and Y. Shi, Large-scale program: A C T ÷ program run on PC or Unix, In College of Information Science and Technology, University of Nebraska at Omaha, (1996).

43. Y. Shi, Optimal System design with multi-decision makers and possible debt: A multi-criteria De Novo approach, Operations Research 47 (5), 723-729, (1999).

44. Y. Shi, Multiple Criteria Multiple Constraint-level Linear Programming: Concepts, Techniques and Appli- cations, Chapter 14, World Scientific Publishing, (2001).