Advertising Intensity and R&D Intensity: Differences across

Industries and Their Impact on Firm’s Performance

Trina Larsen Andras*

Department of Marketing, Drexel University, U.S.A. Srini S. Srinivasan

Department of Marketing, Drexel University, U.S.A.

Abstract

To compete successfully in the market place, organizations optimally utilize their in-puts and benchmark their key inin-puts and outin-puts against other successful firms. Two of the key inputs that organizations should effectively manage are marketing expenses and R&D expenses. In this research, we investigate a) if these two inputs systematically vary across consumer product and manufacturing product organizations, and b) if these two factors have an impact on firm’s performance. We find that consumer product organizations have higher advertising intensity than manufacturing product organizations. However, manufacturing product organizations have higher R&D intensity than consumer product organizations. Find-ings of this research also reveal that advertising intensity and R&D intensity are positively related to firm profit margins.

Key words: marketing expenditures; R& D expenditures; firm’s performance JEL classification: M30; M31; M37

1. Introduction

To stay ahead of competition and to deliver superior value to stakeholders, management constantly seeks to improve the distinctive competencies of the firm and to acquire new competitive advantages. While it is always important to the success of a firm, this search is very critical as the competitive environment becomes fiercer as is the current case due to recessionary conditions in the aftermath of September 11, 2001. Firms must selectively choose their markets and deploy their resources to create an edge and to achieve competitive advantage [Kerin, Mahajan and Varadarajan (1990)]. Firms compete, given the opportunities available, while

Received August 30, 2002, revised May 9, 2003, accepted October 17,2003.

*Correspondence to: Department of Marketing, Lebow College of Business, Drexel University, 32nd and Chestnut Streets, Philadelphia, PA 19104, U. S. A., Ph: (215) 895 4995, Fax: (215) 895 6975, Email: larsent@drexel.edu.

neutralizing threats and avoiding weaknesses [Barney (1991)] and they do so based on the value their products offer and the relative cost of delivering them to their customers. Thus, to be successful as competition heats up, there is heightened pressure on firms to produce better products and to effectively communicate their product’s advantages to customers, all while decreasing cost.

U.S. businesses seem to believe that advertising is important for success; they certainly spend a lot of money on it. Total spending for U.S. advertising in 2000 was almost 244 billion dollars [Ad Age.com (2001)]. Yet, when competition heats up and the economy winds down, the knee-jerk reaction of many corporate executives is to tighten belts and slash advertising budgets. This happens despite the Strategic Plan-ning Institute’s PIMS (Profit Impact of Market Strategy) study which found that companies that increased advertising during recession outperformed the average of all businesses by almost 250% and that the cost of spending had no significant effect on ROI. Additionally, another 10-year analysis from the 1970s found that high in-vestments in advertising were accompanied by high profits [Callahan (1982)]. Do these results from the 1970s and the 1980s still hold in the 21st century? Addition-ally, the industry structure varies across consumer product and manufacturing prod-uct organizations. Does advertising intensity, therefore, differ across these industries? It would seem reasonable that the financial commitments made to advertising rela-tive to the company’s annual sales is likely to differ across these industries [Balasubramanian and Kumar (1990), Farris and Buzzell (1979)]. An understanding of the differences across consumer and manufacturing product organizations, with regard to their investment in advertising relative to sales, would help managers by providing them another ratio-based benchmark to guide future decisions and to evaluate the efficiency and effectiveness of prior decisions. Executives continue to need guidance to effectively manage their advertising budgets.

Another avenue firms take to gain an edge over competitors is to offer prod-ucts/services with superior performance and innovative features. However, to achieve superior product performance, firms need to spend money on Research and Development (R&D) activities. As was the case for advertising expenditures, current accounting rules for R&D mean that those investments have an immediate negative impact on quarterly financial performance which prompts many executives to cut R&D investment during difficult economic conditions. Additionally, pressure may be exerted on managers to sacrifice R&D to maintain short-term earnings growth [Drucker (1986), Jacobs (1991), Porter (1992)]. This happens despite a recently re-ported study tracking 3500 companies between 1964 and 1998 that indicated that firms enjoyed a 4.3% increase in their mean market-to-book ratio with each 1% in-crease in R&D spending (a 1% inin-crease in advertising spending was associated with a 1.8% increase in the market-to-book ratio) [Pearl (2001)]. Additional evidence regarding the relationship between profits and R&D expenditures may help execu-tives withstand pressures to cut R&D in an effort to maintain short-term earnings. Moreover, as was the case for investment in the intangible advertising expense, the financial commitments made to R&D relative to the company’s annual sales is likely to differ across these industries. Thus, an understanding of the differences across

consumer and manufacturing product organizations would be of help to managers in their planning and budgeting efforts.

In summary, in an era of increasing competition and slowing economies, ex-ecutives are under strong pressures to perform, while at the same time to contain costs. Two budget areas, often, among the first to be targeted for cuts are advertising and R&D. Both of these intangible investments may, however, be critical to the long-term success of the firm. Additionally, there may be variations in advertising and R&D intensities across consumer and manufacturing product markets due to variations in industry structure. Therefore, the purpose of this study is to explore whether these variations in advertising intensities and R&D intensities do exist and if so, do they account for significant variations in company’s performance?

2. Resource-based View and Competitive Advantage

Recently, marketers have turned their attention to one of the most fundamental questions facing any organization over the long-term: How does one achieve and sustain a competitive advantage over other organizations [Hunt (2000)]? This is a question that is also at the heart of resource-based views of organizational success [Barney (1991)]. That is: What valuable, rare, inimitable and non-substitutable re-sources allow organizations to develop and maintain competitive advantages in or-der to achieve superior firm performance [Barney (1991), Collis and Montgomery (1995), Grant (1991)]? Market-based assets (which are resources that are marketing specific) may also be difficult to imitate and they may be relational or knowl-edge-based [Srivastava, Fahey and Christensen (2001)]. Two such market-based investments that may lead to sustained firm competitive advantage are marketing communications (advertising and promotion) and R&D. Investments in marketing communications may enhance the ongoing relationship between customers and a brand thus increasing the competitive advantage of the firm. Investments in R&D may lead to the development of new products with distinctive customer benefits in an environment of technological change also increasing the competitive advantage of the firm. However, investments in each of these assets needs to be justified in terms of long-term economic gains or shareholder value [Srivastava, Fahey and Christensen (2001)] and the resultant return on their investment needs to be better measured.

2.1 Advertising/Promotion and R&D Intensities

While there has been a great deal of research in the marketing literature over the years investigating the effectiveness (or lack of effectiveness) of investments in marketing and communications, the ROI of marketing and advertising investments are among the top research priorities of the Marketing Science Institute and the American Association of Advertising Agencies. In the past, researchers have sought to explain some of the confusion regarding the impact and effectiveness of marketing communications, most often focusing on advertising and promotional

expenditures. For example, Farris and Buzzell (1979) undertook the explanation of how and why differences in marketing communication intensity (as measured by advertising and promotion expenditures to sales) were related to some basic variables. That is, they attempted to identify the factors that empirically explain the variations in advertising and promotion to sales. Their study indicated that advertising and promotional expenditures expressed as a proportion of sales vary across industries, across firms within an industry and across time for a given firm. This finding was confirmed by Balasubramanian and Kumar (1990).

Zinkhan and Cheng (1992) again used the ratio of advertising and promotional expenditures to sales as a proxy for marketing communication intensity. They inves-tigated the variation of communication intensity due to the type of offering (product or service) and the type of market (consumer or manufacturing). They found that, both, the type of offering and the type of market affect the variation of communica-tion intensity. Their results indicated that consumer product firms spend more on advertising than manufacturing product firms.

Much of this research has examined primarily what practitioners are doing, not what they should be doing; they are descriptive rather than normative. That is, the impact of the variation of marketing and/or advertising and promotion intensities on performance was not always explicitly addressed. Today, as noted above, there is an increasing call for advertisers to be accountable for client’s product performance, as measured by ROI or profits [Grindem (2001)]. There has been a renewed focus on the performance results of marketing activities, especially the impact of marketing activities on profits. Executives want to be able to market more intelligently, more inexpensively and more effectively [Fattah (2001)]. A study from the 1970s, an analysis of consumer goods products and the retail chain industry, found that high levels of advertising are associated with high profits. However, this data is over 20 years old and did not consider manufacturing product firms [Callahan (1982)]. More recently, it has been shown that investing in intangible assets (such as advertising and R&D expenditures) has a tangible effect on a company’s performance [Pearl (2001)]. While investing in intangible assets reduces short-term profits, it can sig-nificantly boost long-term valuation.

Another recent study found that changes in advertising expenditures are sig-nificantly associated with earnings for up to five years [Graham and Frankenberger (2000)]. In that study, the longest lived asset values are in the manufacturing prod-ucts industry followed by the consumer prodprod-ucts industry suggesting that the effects of increasing or decreasing advertising expenditures in real terms can be very long lived. It also provides a strong indication of the contribution of advertising to earn-ings and market values and highlights the dangers involved in reducing short-term advertising expenditures to reduce current costs. Additionally, with regard to R&D expenditures, Kotabe (1990) found that there is a positive relationship between R&D intensity and firm’s performance.

2.2 Hypotheses

Consumer product organizations rely more on advertising than on their sales forces to reach end users since they are usually targeting a large, often geographi-cally dispersed, market. Consumers may be more susceptible to persuasion through advertising. On the other hand, manufacturing products are typically sold to a few large consumers [Herbig, Milewics and Golden (1994)] that are often geographically concentrated and most of the business-to-business marketing budget is spent on the personal selling effort with advertising supporting and supplementing that effort [Johnston (1994)]. As noted by Farris and Buzzell (1979), advertising as a percent-age of sales is likely to be higher for consumer product organizations than for manufacturing product organizations. These differences in advertising intensity are due to factors such as frequency of purchase, number of buyers in the market and buyer knowledge ability. Manufacturing product companies, when compared to consumer product companies, are likely to spend more of their resources in devel-oping newer technologies and newer processes to gain competitive advantage in the market place. As manufacturing products are more technical in nature, organizations tend to spend more money on R&D activities to compete in the market place. Hence we propose that:

H1: Consumer product organizations will report higher ratios of advertising intensity than manufacturing product organizations.

H2: R& D intensity will be higher for manufacturing product organizations than for consumer product organizations.

In general, for both consumer and manufacturing product firms, a firm’s ability to differentiate its products from competitors and to build successful brands is critical for success. As a result, firms may spend more on their marketing communications to increase sales by attracting more customers to the product category as a whole as well as by convincing current customers to switch their purchases from competitor’s products to the firm’s brand. Additionally, firms with strong brand names may be able to charge premium prices based on the added value of the brand which would also enhance the firm’s profitability. Thus, firms that engage in heavy marketing communication activities (advertising and promotion) may exhibit performance that is better than those investing less intensely in marketing communications.

Similarly, many researchers have found a significant positive relationship between investment in R&D intensity and firm’s performance [Kotabe (1990), Mansfield (1981), Hufbauer (1970)]. For example, Kotabe (1990) found that companies improve their performance by focusing on product design and development and by improving their manufacturing processes. Firms with superior product designs gain competitive advantage through product differentiation, which then may lead to greater profits. Additionally, manufacturing costs may be lowered due to improvements in processes resulting from R&D which may also lead to better

firm profitability. Thus, more intense investments in R&D may be expected to lead to better performance of a firm.

Hence, we hypothesize that:

H3a: The higher the advertising intensity of the firm, the higher its profit margin. H3b: The higher the R&D intensity of the firm, the higher its profit margin. 3. Method

The data was obtained from the COMPUSTAT database which contains firm level data on different industries. Data for companies (Division D of the SIC divi-sion structure – Two digit SICs 20 to 37) was extracted covering both consumer product and manufacturing product companies for the year 2000. Financial informa-tion for 196 consumer product companies and 876 manufacturing product compa-nies was collected. For each, data on the following variables was collected: a) Ad-vertising intensity - defined as the adAd-vertising expenditure divided by annual sales, b) R&D intensity - defined as the annual expenditure on R&D divided by annual sales, c) profit margin - measured as the ratio of profit to sales d) cost intensity - defined as the cost of goods sold divided by annual sales and e) Labor intensity - defined as the number of employees divided by annual sales in dollars. The actual number of com-panies reporting the data for the various variables is given in Table 1.

4. Empirical Analysis

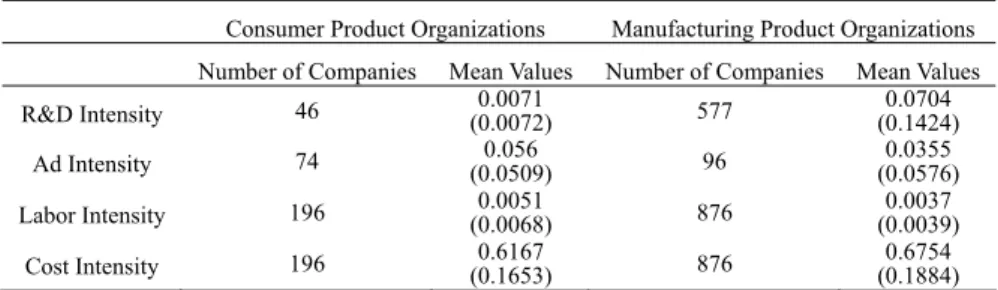

Hypotheses H1 and H2 are concerned with the differences between the mean values of advertising intensity and R&D intensity. T-tests were conducted to test for the differences among the various intensities across consumer product organizations and manufacturing product organizations. The means and standard deviations for the various companies are given in Table 1.

Table 1. Mean Values of R&D Intensity, Advertising Intensity, Labor Intensity and Cost Intensity

Consumer Product Organizations Manufacturing Product Organizations Number of Companies Mean Values Number of Companies Mean Values R&D Intensity 46 (0.0072) 0.0071 577 (0.1424) 0.0704

Ad Intensity 74 (0.0509) 0.056 96 (0.0576) 0.0355 Labor Intensity 196 (0.0068) 0.0051 876 (0.0039) 0.0037 Cost Intensity 196 (0.1653) 0.6167 876 (0.1884) 0.6754 Standard deviations are given in bracket

H1 posits that consumer product organizations will report higher advertising intensity than manufacturing product organizations. The average advertising

intensity for consumer product companies is 0.056 and for the manufacturing product companies is 0.035. This difference is statistically significant (t = 2.36, p<0.05). H2 posits that manufacturing product organizations will report higher R&D intensity than consumer product organizations. As noted in Table 1, the R&D intensity for manufacturing product companies is 0.0704 and for the consumer product companies it is 0.0071. Here too, the difference is statistically significant (t = 3.01, p<0.05). We collected data on cost intensity and labor intensity and did an exploratory analysis to investigate how these intensities differ across consumer and manufacturing product organizations. The mean values of cost intensity and labor intensity are reported in Table 1. We find that labor intensity for manufacturing product companies is lower than that for consumer product companies. However, consumer product companies exhibit a lower level of cost intensity than manufacturing product companies.

4.1 Impact of R&D Intensity and Advertising Intensity on Firm Performance: H3a and H3b posit that R&D intensity and advertising intensity will be posi-tively related to the profit margin of the firm. To test if variations in advertising in-tensity and R&D inin-tensity indeed explain variations in firm’s performance, we ran the following regression.

* *

0 1 2

i i i i

PERF =β +β ADINT +β RDINT +ε , (1)

where

i

PERF -Profit margin of firm i

i

ADINT -Advertising intensity of firm i

i

RDINT -R&D intensity of firm i.

Plotting residuals from OLS regression of the above equation revealed that er-rors have a higher variance at higher levels of R&D intensity. To correct for hetero-scedasticty, we used a GLS estimate with the inverse of R&D intensity as the weighting factor.

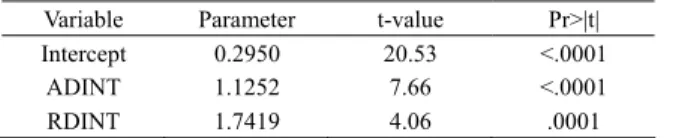

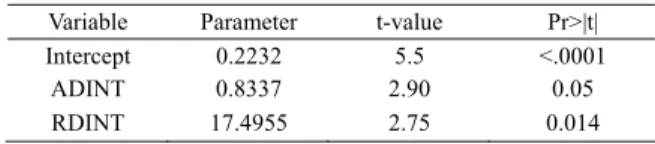

Results of the GLS regression for manufacturing product and consumer product organizations are given in Table 2 and Table 3 respectively.

The over all model is significant and both the parameters, β and1 β , are 2 positive and significant (p<0.05) for both consumer product and manufacturing product organizations.

Table 2. Profit Margins as a Function of ADINT, PDINT (Manufacturing Products)

Variable Parameter t-value Pr>|t| Intercept 0.2950 20.53 <.0001

ADINT 1.1252 7.66 <.0001 RDINT 1.7419 4.06 .0001 Adjusted R2 = 0.4853

Table 3. Profit Margins as a Function of ADINT, PDINT (Consumer Products)

Variable Parameter t-value Pr>|t| Intercept 0.2232 5.5 <.0001

ADINT 0.8337 2.90 0.05 RDINT 17.4955 2.75 0.014 Adjusted R2 = 0.4861

5. Discussion

In this study, we have examined the variation in the intensity of investment in two market-based assets in which organizations routinely invest in order to develop and sustain competitive advantage. Specifically, the study investigates how con-sumer product organizations and manufacturing product organizations differ across the intensity of their investment in each of marketing communication and R&D.

A better understanding of advertising/promotional and R&D intensities is im-portant since these are often used as benchmarks by managers, either to guide future market-based asset investment decisions or to evaluate the efficiency of current in-vestments in these assets. As noted by Zinkhan and Cheng (1992), advertisers and their agencies have shown considerable interest in tracking these ratios for specific industries and then comparing the resulting industry ratios with the budgeting deci-sions made within specific firms. We have shown that industries do vary the intensi-ties of their spending on, both, marketing communication and R&D relative to sales. That is, consumer product firms spend a greater amount on advertising relative to sales than manufacturing product firms, reflecting the difference in the nature and location of consumer product customers coupled with the additional need for brand support in consumer product industries. When R&D spending is considered, how-ever, the opposite result is found. That is, manufacturing product firms spend a greater amount on R&D relative to sales than consumer product firms. This is due to the greater technical nature of manufacturing products for the most part as well as the pressure to produce new innovations in, both, product and process in manufac-turing product industries in order to achieve competitive advantage over competitors. Thus, these findings indicate that firms can be grouped into consumer product and manufacturing product organizations in order to explain variations in the intensity of their investments in the market-based assets of marketing communication (advertis-ing and promotion) and R&D.

Though advertising is one of the most potent and effective marketing tools available to marketers for informing and persuading buyers, the efficiency and ef-fectiveness of advertisement spending is of considerable interest both to academi-cians and practitioners [Xueming and Donthu (2002)]. Perhaps the most important finding of this research is that the intensities of the investment in the two mar-ket-based assets, advertising and R&D, significantly explain variations in profit margins. Firms continually seek to develop and sustain a competitive advantage over the long-term in order to assure their very survival, as well as to maximize their performance. There are various types of assets vying for the funds allocated by

management. The internal competition for these funds can be quite fierce under the best of conditions, let alone during times of external environmental stress. While the market-based assets of advertising and R&D are often among the first areas to face budget cuts during times of competitive and economic stress, it should be remem-bered, given the results of this study, that both of these variables are positively and significantly related to firm’s performance.

5.1 Limitations and Directions for Future Research

The limitations of this research have to be kept in mind when interpreting the results of this paper. We compared the differences in advertising intensity and R&D intensity across consumer product and manufacturing product companies for a cross section of companies at one point of time. In this research we have not investigated the lagged impact of R&D intensity and advertising intensity on firm’s performance. Also, to confirm that these patterns hold over time, we need to replicate these analyses longitudinally for future time periods. Additionally, this research examines only advertising intensity and R&D intensity to explain the variation in performance across companies, while there are other variables such as management skill and luck which also have an impact on firm performance [Jacobson (1990)]. Future research-ers should incorporate other firm and industry level variables to explain variations in firm performance. Also, this investigation has not explored the variation across dif-ferent SICs within consumer product and manufacturing product organizations. Fu-ture researchers may want to extend this study by looking at the variation of these intensities across different SICs and by investigating other indicators of firm’s per-formance such as return on assets etc. Moreover, future researchers can investigate how R&D intensity and Advertising intensity affect other financial/accounting measures such as ROE and ROA.

References

Ad Age.com, (2001), www.adage.com/page.cms?pageId=454, November 15. Balasubramanian, S. K. and V. Kumar, (1990), “Analyzing Variations in Advertising

and Promotional Expenditures: Key Correlates in Consumer, Manufacturing, and Service Markets,” Journal of Marketing, 54, 57-68.

Barney, J. B., (1991), “Firm Resources and Sustained Competitive Advantage,”

Journal of Management, 15, 175-190.

Callahan, F. X., (1982), “Advertising and Profits 1969-78,” Journal of Advertising

Research, 22 (2), 17-22.

Collis, D. J and C. A. Montgomery, (1995), “Competing on Resources: Strategy in the 1990s,” Harvard Business School, July-August, 118-28.

Drucker, P., (1986), “A Crisis of Capitalism,” Wall Street Journal, September 30, 32. Farris, P. W. and R. D. Buzzell, (1979), “Why Advertising and Promotional Costs

Vary: Some Cross-Sectional Analyses,” Journal of Marketing, 43, 112-122. Fattah, H. M., (2001), “The Pursuit of Profits,” MC Technology Marketing

Intelligence, 21, 28.

Grant, R. M., (1991), “The Resource-based Theory of Competitive Advantage: Im-plications for Strategy,” California Management Review, 22, 114-35.

Graham, R. C. and K. D. Frankenberger, (2000), “The Contribution of Changes in Advertising Expenditures to Earnings and Market Values,” Journal of Business

Research, 50 (2), 149-55.

Grindem, C., (2001), “A Way to Solve Advertising ROI,” Advertising Age, 72 (3), 26.

Hufbauer, G. C., (1970), “The Impact of National Characteristics and Technology on the Commodity Composition of Trade in Manufactured Goods,” In Raymond Vernon, ed., The Technology Factor in International Trade. New York: Colum-bia University Press, 145-231.

Herbig, P., J. Milewics, and J. E. Golden, (1994), “Differences in Forecasting Be-havior between Manufacturing Product Firms and Consumer Product Firms,”

Journal of Business and Manufacturing Marketing, 9 (1), 60-69.

Hunt, S. D., (2000), A General Theory of Competition, Thousand Oaks. CA: Sage Publications.

Jacobs, M., (1991), Short-Term America: The Causes and Cures of Our Business

Myopia. Boston, MA: Harvard Business School Press.

Jacobson, R., (1990), “Unobservable Effects and Business Performance,” Marketing

Science, 9 (1), 74-85.

Johnston, W. J., (1994), “The Importance of Advertising and the Relative Lack of Research,” Journal of Business and Manufacturing Marketing, 9 (2), 3-4. Kerin, R. A., V. Mahajan, and R. P. Varadarajan, (1990), Strategic Market Planning.

Boston: Allyn and Bacon.

Kotabe, M., (1990), “The Relationship between Offshore Sourcing and Innovative-ness,” Journal of International Business Studies, 21 (4), 623-39.

Mansfield, E., (1981), “Composition of R&D Expenditures Relationship to Size of Firm, Concentration, and Innovative Output,” Review of Economics and

Statis-tics, 63, 610-15.

Pearl, J., (2001), “Intangible Investment, Tangible Results,” Sloan Management

Re-view, 43, (3), 13-14.

Porter, M., (1992), Capital Choices: Changing the Way America Invests in Industry. Boston, MA: Council on Competitiveness/Harvard Business School.

Srivastava, R., L. Fahey, and H. K. Christensen, (2001), “The Resource-based View and Marketing: The Role of Market-based Assets in Gaining Competitive Ad-vantage,” Journal of Management, 27 (6), 777-802.

Xueming, L. and N. Donthu, (2002), “Benchmarking Advertising Efficiency,”

Journal of Advertising Research, Forthcoming.

Zinkhan, G. M. and C. S. A. Cheng, (1992), “Marketing Communication Intensity across Industries,” Decision Sciences, 758-69.