The Political Economy of

Restructuring the Electricity Sector

in South Korea

C

HUNG-M

INT

SAIPublished

South Korea launched electricity reform in the 1990s but had con-tinued to struggle with instituting an effective free market. In order to bolster economic growth, the development of the electricity industry has long been a fundamental issue for the state. The case in Korea is distinctive because it is part of a large-scale privatization project as the political regime had just shifted to democracy. The state spun off and corporatized the state-owned power enterprise with very limited privati-zation. The Korean government has chosen to control the power compa-nies as the largest shareholder. Nonetheless, the reform process was suspended in 2004 without encountering major problems. This has created a major puzzle for analysts: why did the reform result in this outcome? I argue that as a politically driven reform project, power reform in Korea was destined to fail. The economic and social responses elicited by reform implementation all contributed to the failure of the power reform. This paper describes the dynamics of Korea’s electricity reform and details the industrial restructuring during the reform. It examines the political logic of the reform and how it shaped the power industry and in turn led

CHUNG-MINTSAI( ) is an associate professor of Political Science at National Chengchi University, Taiwan, R.O.C. His academic interests include comparative politics, political economy, and China studies. He has published papers in the China Quarterly, Asian Survey, Taiwanese Political Science, Chinese Political Science, and edited volumes. He can be reached at<cmtsai@nccu.edu.tw>.

© Issues & Studies and World Scientific Publishing Company DOI: 10.1142/S1013251116500041

to a stalled agenda. The paper concludes with a discussion of the broader implications for the roles of the state, industrial policy, and state-business relations.

KEYWORDS: South Korea; electricity reform; state-business relations; pri-vatization; state-owned enterprises.

* * *

The Korean electricity industry has undergone a sea of change in the past two decades due to technological development. A natural monopoly was broken, and economies of scale were no longer the major concern in the electricity business. Trends of privatization and lib-eralization of the electricity industry have prevailed since the 1990s (MacKerron & Pearson, 2000). Some countries have succeeded in the reform project while most continue to struggle with instituting an effective market mechanism in the electricity industry. South Korea (hereafter, Korea) is now among the latter. Because it is a prerequisite of bolstering economic growth, the development of the electricity industry has long been a fundamental issue for Korea. Although power reform is neither unique to Korea nor a recent occurrence, the Korean case is distinctive because the state has been forced to implement a reform strategy of spinning off and corporatizing the state-owned power enterprise with limited privatization. Although the leadership well appreciated the advantages of privatization and successfully pushed it through in many industries, the policy failed in the power sector. While other countries have privatized state power assets for improving efficiency and promoting better service quality, the Korean government was unable to implement privatization and adopted other re-form schemes instead. Nonetheless, the rere-form process was suspended in 2004 without major problems such as power shortages or sky-rocketing tariffs. This has created a puzzle for analysts: why has this outcome resulted? I argue that as a politically driven, compromised reform project, Korea’s power reform was destined to fail. While the political consider-ation and policy preferences bolstering the reform scheme were eliminated

as the leadership shifted, the entire reform plan came to an end. Moreover, the economic and social responses elicited by reform implementation, such as employment security, environmental protection, political contradictions, and debates on development models, all contributed to the failure of the power reform. The reform itself was moving in the wrong direction from the very beginning because the state initiated it based on political rather than economic concerns.

This paper begins by setting out a brief review on privatization. It delineates the reasoning and methods of privatization as the prevailing policy for restructuring the state sector. Next, it describes the dynamics of Korea’s electricity reform and details the industrial restructuring with pri-vatization. Then, it examines the logic of the reform and how it shaped the power industry and in turn led to a stalled agenda. The paper concludes with a discussion of the broader implications for the roles of the state, industrial policy, and state-business relations in Korea.

Privatizing the State Assets: Why and How

1Between the Industrial Revolution and early 20th century, the pri-vate sector had been the most important part of national economy in Western Europe and their colonies. Nonetheless, the Great Depression, World War II, and the collapse of colonial empires forced the state to take an active role by way of increasing state ownership and providing goods and services.2 Although the governments debated how deep it should involve in the national economy, they generally regard that they should own so-called “strategic” or “commanding heights” industries, such as oil, telecommunications, electricity, and gas utilities. In addition,

1This section of literature review is heavily based on Megginson and Netter (2001). For more

detailed discussion on privatization, see Megginson (2005).

2The case of Britain illuminates the logic of nationalization after the World War II (Pint,

state-owned banks usually enjoyed a monopoly or dominant status (La Porta et al., 2000). State ownership facilitated rapid growth through heavy investment in basic infrastructure (Rondinelli & Iacono, 1996). Thus, an enormous growth in the number of state-owned enterprises (SOEs) had spread throughout the world, which in turn led to large-scale privatization later (Yergin & Stanislaw, 1998). While the governments found that SOEs were not efficient and profitable, they decided to reduce interference in economy and introduce competition through privatization. In the post war era, Winston Churchill’s government first privatized the British steel industry in the early 1950s, and later in the early 1960s Germany launched a comprehensive“denationalization” program starting from selling out the majority stake in Volkswagen to small private inves-tors. When Margaret Thatcher came to power in Britain in 1979, she adopted the label“privatization” and initiated the most important program historically.3The British government divested SOEs through public share offering and aimed to improve economic efficiency and raise revenue for the state. The successful story in Britain inspired many other European countries to promulgate similar programs in the 1990s, such as France, Germany, Italy, and Spain. In Asia, Japan and India also began their pri-vatization programs in the late 1980s and early 1990s respectively. Many Latin American countries, including Chile, Mexico, Bolivia, and Brazil, executed divestment programs and greatly reduced the state sector in the 1990s. In Africa, substantial privatization was implemented in Nigeria and South Africa. After being independent from former Soviet Union, many Central and Eastern European countries comprehensively privatized their SOEs while transitioning to market economy (Megginson & Netter, 2001, pp. 3–6).

The most important reason for the states to privatize state assets is to improve efficiency and increase profits. According to economic theories, the state shall intervene in the way of state ownership when there are

3The term“privatization” was originally coined by Peter Drucker (Yergin & Stanislaw, 1998,

market failures, such as natural monopolies, externalities, and provision of public goods. Hence, privatization is a response while state ownership has failed. If in certain occasions, especially SOEs in competitive markets, the role of the state for eliminating market failure was weak, privatization would have a greater impact (Sheshinski & Lopez-Calva, 1999; Shirley & Walsh, 2000). The goals of SOEs are ambiguous and policy-oriented. They are not to maximize the profits and may shift as the administration changes. Hence, the efficiency is significantly reduced when the state fails to deliver credible policy commitments, let alone that policy goals are difficult to measure and most of time inconsistent with efficiency (Shleifer, 1998). Moreover, while facing no threat of bankruptcy (or evenfinancial distress) due to soft-budget constraints, SOEs have no motivation to remain efficient (Berglof & Roland, 1998; Kornai, 1992).4 By selling SOEs out, the state can either raise money or reduce deficit. A caveat about the effectiveness of privatization is that to what extent privatization can improve efficiency depends on institutional factors, such as the robustness of market and the strength of the private sector. After implementing privatization, the role of the state remains important but transforms from an asset-controller to an impartial regulator.

By examining the transition economies, some scholars conclude that when the state initiates reform agendas, SOEs improve their efficiency. Hence, privatization is not the only solution (Majumdar, 1998; Pinto et al., 1993). That is to say, we have other policy alternatives to privatization. For example, China has undergone a comprehensive economic reform with limited privatization. The Chinese state has increased the managers’ and workers’ incentives through differing contracts and bonus payment and linked the profits to the performance of the firms (Groves et al., 1994, 1995; Li, 1997). Reshuffling incentive structures may improve SOEs’ ef-ficiency but it is conditioned upon state’s commitment to contracts and monitoring ability.

4Some scholars argue that soft-budget constraints are not the major cause of SOEs’

ineffi-ciency. It is “policy burden” that makes the enterprises (both state-owned and private) inefficient (Lin et al., 1998).

From the experience of transitional economies in Central and Eastern Europe, Brada (1996) proposes four methods of privatization.5 The first method is privatization through restitution— returning expropriated property to either the original owners or their heirs. The second way is sale of state property. The state can directly sell the entire SOEs out or shares to the private investors, similar to initial public offerings (IPO) in the private sector. The third category is mass or voucher privatization. Eligible citi-zens use vouchers to bid for stakes in SOEs.6 The last method is privati-zation from below. The states, especially post-communist countries, removed the barriers to the market and let private business thrive. When a state plans to initiate privatization, the method it chooses is influenced by some other factors such as the state’s fiscal condition and regulatory ca-pacity and development of capital market. For example, if the state has a greater ability and credibility to commit to property rights, it is more likely to implement privatization through asset sales and the private sector is more likely to accept as well.

In short, in the past three decades, privatization has significantly reduced the role and number of SOEs in most countries, both developed nations and transitional economies. It is also regarded as the most effective way to improve efficiency and profitability as limited empirical evidence shows that non-privatization measures can improve the efficiency of SOEs. Issuing shares of SOEs and selling state assets are the two most popular ways in privatization programs.

We now turn to Korea’s electricity reform, which was initiated as part of large-scale privatization program, but it had stumbled and ultimately fallen.

An Overview of Electricity Reform

Korea’s electricity industry was launched by the emperor of the Chosun dynasty as part of the empire’s modernization plan and the

5About the methods of privatization, also see Graham (2003). 6For more discussion, see Bornstein (1999).

Hansung Electric Company was established in 1898, which was later managed by three corporations during Japanese colonization period.7 When the Korean military government took power in 1961, it integrated three private power enterprises into a single national company, Korea Electric Company (KECO), in order to guarantee power supply for state-led economic development. In December 1981, by purchasing 100% private stock, the Korean government turned KECO into a wholly state-owned entity and renamed it Korea Electric Power Corporation (KEPCO). The KEPCO was a colossal holding company that managed all aspects of the electricity business, including generation, transmission, and distribu-tion. Nonetheless, it was plagued by the common problem of inefficiency under government control. In order to improve management efficiency, the Korean state promulgated the“Legislation of Korea Electric Cooperation” and KEPCO was approved to be listed on the Korea Composite Stock Price Index and sold 21% shares to the public in 1989. It marked the first privatization program in Korea’s power sector. In 1994, the Korean gov-ernment further privatized KEPCO and listed it on the New York Stock Exchange, issuing 300 million American Depository Receipts as a symbol of globalization.8A proportion of government stock was sold again in 1998 to cope with the 1997financial crisis. Since then, the Korean government and Korean Development Bank together have constantly owned about 51% of KEPCO’s share. Hence, KEPCO is no longer fully state-owned but instead is a state-controlled enterprise.

With democratization, the political economic situation became more flexible. The Kim Young-Sam (KYS) administration decided to reform the state sector and designed a privatization scheme for major public corpora-tions, including KEPCO, to improve the SOEs’ efficiency. Based on an evaluation of KEPCO management conducted by the Economic Planning Board, the state initiated a restructuring plan in 1994 with a four-stage

7They are Chosun Electric Corporation in charge of generation and transmission sectors and

Kyungsung Electric Corporation and Namsun Electric Corporation responsible for the distribution sector.

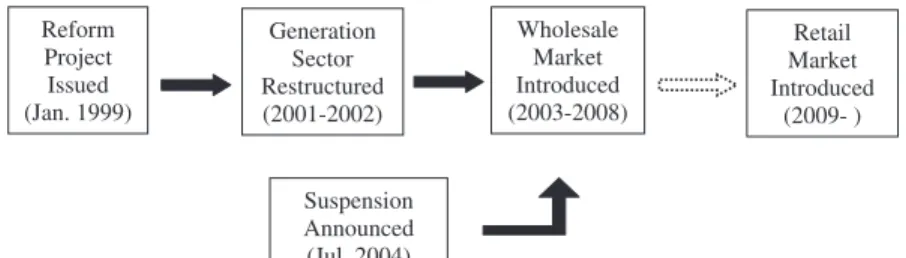

project to eventually privatize KEPCO by 2010. Nonetheless, it was criti-cized as it carried out the plan without sufficient investigation and imple-mentation was later suspended due to the Ministry of Trade and Industry’s (MTI) objection and later by campaign pressure in the coming presidential election (Lee & Ahn, 2006, p. 1117; see also Choi, 2008). In 1997, the Korean economy was worst hit by the Asian Financial Crisis. In response to the bailout plan engineered by the International Monetary Fund (IMF) during the crisis period, the Korean government organized the Restructuring Commission of the Electricity Industry (RCEI) with 12 members (from academic institutions, research entities, industry, etc.) under the direction of the MTI and proposed an ambitious, extensive restructuring plan for the power industry (Asia Pacific Energy Research Centre, 2000, pp. 103–116; Organization for Economic Co-operation and Development (OECD), 2000). The Kim Dae-Jung (KDJ) administration approved the reform project, the so-called“Basic Plan,” recommended by the RCEI in January 1999. The plan entailed three objectives: (1) to enhance efficiency by introducing competition into the electricity generation, (2) to finance new generation facilities, and (3) to increase consumer benefits and improve service quality. The core concerns were industrial reshuffling, state regulation, and market competition. Moreover, the government promulgated the Law for Promot-ing the RestructurPromot-ing of Electricity Industry and amended the Electricity Business Act on December 23, 2000 to support reshuffling (Korean Power Exchange (KPX), 2005, p. 10). The government planned a three-step strategy to reorganize the sector. The first step aimed to split electricity generation by 2002, create KPX, and introduce cost-based pool trading system. The second step had the distinct target of separating KEPCO’s distribution sector and divesting it into six distribution corporations (Dis-Cos), and introducing two-way bidding pool trading system and a wholesale market by 2008. The third step would have privatized six DisCos and established a retail market since 2009. However, the government announced the suspension of the reform project in 2004 (Chang, 2003) (see Figure 1). Three decisive actions transformed the industrial framework and state-business relations in the power industry in the first step. First, the

government divested KEPCO’s generation sector in order to break up the monopoly and establishedfive generation companies (GenCos).9There are five thermal-power enterprises, including Korea South-East Power Co. Ltd. (KOSEPCO), Korea Midland Power Co. Ltd. (KOMIPO), Korea Western Power Co. Ltd. (KOWEPCO), Korean Southern Power Co. Ltd. (KOSPO), and Korea East-West Power Co. Ltd. (KEWESPO). They were quite similar in their scales and revenues so that there was no dominant player in the power market (see Table 1). Additionally, Korea Hydro and Nuclear Power Co. Ltd. (KHNP) acquired both hydro and nuclear power plants. Nonetheless, the process of liberalization did not involve privatization as other countries have done. Thefive GenCos and KHNP remain KEPCO’s wholly-owned subsidiaries.

Second, the Korea Electricity Commission (KOREC) was created under the Ministry of Commerce, Industry, and Energy (MOCIE)10 as a regulatory entity to manage electricity affairs. It is responsible for pro-moting privatization, introducing competition, arbitrating disputes, moni-toring market activities, and protecting the rights and interests of

Generation Sector Restructured (2001-2002) Retail Market Introduced (2009- ) Wholesale Market Introduced (2003-2008) Reform Project Issued (Jan. 1999) Suspension Announced (Jul. 2004)

Figure 1. South Korea’s electricity reform.

Source: Data sources are based on the author’s compilation.

9The Korean government had contemplated the plans of creating four, five, or six

subsidiaries. Based on consideration of market competition and scale of economy, they eventually determined to havefive companies. For more detailed information, see Won (2007, pp. 5083–5084).

10The MOCIE was reorganized into the Ministry of Knowledge Economy (MKE) in 2008

and then reshuffled it into the Ministry of Trade, Industry and Energy (MOTIE) again in 2013.

consumers (Kim, 2001).11The KOREC is headed by a chairman and eight commissioners. Only one of them is a full-time commissioner who is the chief energy policy maker of the MOCIE (Lee, 2011, p. 3).

Third, in accordance with Article 35 of the Electricity Business Law, the KPX was created on March 29, 2001. It is a non-profit independent organization funded by directly collecting the transaction fees, serves as a power market to facilitate transaction and competition in the generation sector, and was designed to extend to the wholesale and retail sectors at the end of the reform project. The KPX also performs various functions, in-cluding ensuring quality management, supervising system operations, and planning future development projects (Park & Kim, 2005).

After three years of reform implementation, the government halted the whole project in 2004 after consulting a research report prepared by a special committee under the auspices of the Korea Tripartite Commission (KTC). The KTC organized a joint study team (JST) to conduct an in-tensive nine-month research between September 2003 and May 2004. The JST proposed that the alleged benefits of reform are uncertain while the costs and risks are substantial. In fact, the JST had difficulties in reaching

Table 1.

The Generating Capacity of GenCos in 2001

KOSEPCO KOMIPO KOWEPCO KOSPO KEWESPO KHNP Operating capacity 6,100 6,138 6,346 4,910 5,800 14,252 Capacity under construction 1,600 1,600 1,600 2,800 1,700 4,000 Total capacity 7,700 7,738 7,946 7,710 7,500 18,252 Number of plants 7 7 8 8 8 18

Source: Byrne et al. (2004, p. 504); International Energy Agency (IEA) (2006).

11Detailed information available at KOREC’s website <http://www.leadernews.co.kr/

consensus. There exist three different views among six members, who are all academic experts (university professors)— two delegates supporting state monopoly, two in favor of privatization, and two in neutral. Given these contesting positions, they were obliged to evaluate the state’s restructuring plan and make afinal policy recommendation. As a result, the critics had a majority of the votes (4:2). The JST then suggested that the reform plan should be stopped. In addition, it recommended the govern-ment to adopt a more secure and beneficial way to facilitate internal competition within KEPCO (Lee & Ahn, 2006, pp. 1118–1119).

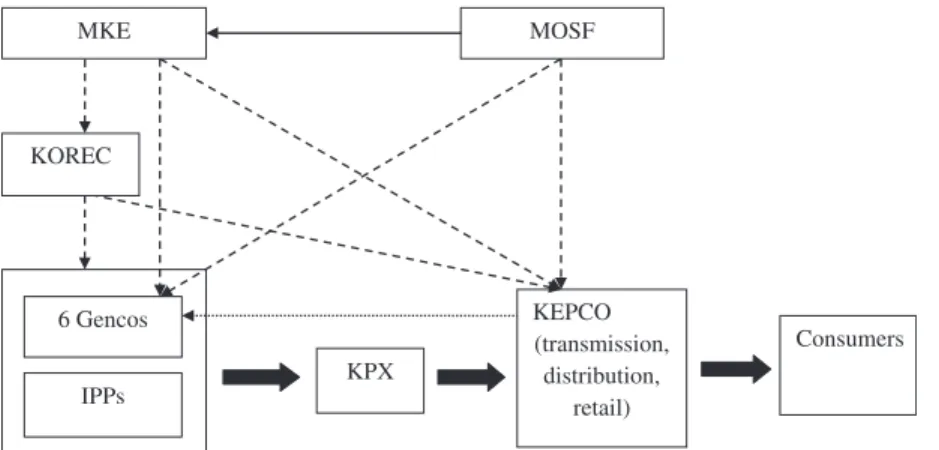

The KEPCO also provided a corporate perspective and suggested that the further restructuring shall be suspended due to uncertain benefits of separating the distribution sector and high potential risks (Park, 2011, p. 5). The incumbent President Lee Myung-bak proposed to continue a neoliberal reform in the power sector during his presidential campaign in 2007, but the idea has not materialized since he took office. Figure 2 shows the industrial structure of Korea’s electricity industry.

IPPs KPX KEPCO (transmission, distribution, retail) Consumers KOREC MKE 6 Gencos MOSF

Figure 2. The industrial structure of South Korea’s electricity sector.

Note: Bold Line: market relationship; Thin Line: consultative relationship; Broken Line: regulatory relationship; Dotted Line: ownership.

Political Leadership, Bureaucracy, and Ideology

By examining the dynamics of Korea’s power reform, it shows that the top leaders play a key role in pushing/impeding the electricity reform. Although Kim Young-Sam and Kim Dae-Jung came from different parties (the former in Democratic Liberal Party [DLP] and then Grand National Party and the latter in Millennium Democratic Party [MDP]), they were both pro-market and adopted neoliberal approaches to reform the SOEs. The KYS administration had planned a large-scale privatization of state sector, including 55 SOEs, but was stymied by the bureaucracy and intense lobbying by various interest groups. This failure has a root in the struggles between the politicians (especially a long-term opposition party leader) and independent bureaucracy. In the end, only 22 smaller SOEs were subject to privatization (Harvie et al., 2004, p. 128).

Although KDJ held leftist, progressive political ideology, he had a profound sense of national crisis and hastily welcomed the IMF prescrip-tion. The financial crisis and pressure from the IMF legitimized KDJ’s neoliberal reform and convinced various sectors and the conservatives. Nonetheless, the adoption of Anglo-Saxon model was not accompanied by the corresponding institutional rearrangement. Hence, visible successful achievement in restructuring banks and corporations has in fact inspired invisible failures of the tension in corporate governance and labor market (Lee et al., 2008). Moreover, KDJ government constructed a privatization plan but deliberately retained strategic intervention even after the disposal of state shares. KDJ eventually successfully privatized eight large SOEs.12 He tried to further privatize KOSEPCO but failed due to too few bidders under gloomy economic conditions and a month-long strike in 2002. Po-litical struggles between politicians and bureaucracy had become more radical during KDJ’s tenure because of bureaucratic reform and

12They are National Textbook Publishing in 1998, General Technology Finance Corporation

in 1999, Korea Pipeline Corporation, Pohang Iron and Steel, Korea General Chemical Corporation, Korea Heavy Manufacturing Corporation in 2000, and Korea Telecom, and Korea Tobacco and Ginseng Corporation in 2002.

regionalism. When evaluating the effectiveness of KEPCO restructuring plan, it shows that financial performance improved with the increasing financial leverage but the productivity decreased (Won, 2007). Hence, it is hard to say to what extent the liberalization and privatization had enhanced the electricity sector.

Things began to change with the inauguration of the new president, Roh Moo-Hyun (RMH), in 2003. Interestingly, RMH was from the same party with KDJ, but the RMH administration followed a very different economic orientation and eventually announced the suspension of power reform.13It shows that Korean politicians would form strategic coalitions in terms of election needs on the one hand,14 and policy making and implementation have closer relationship with political leadership than party lines on the other. RMH had been more conservative with privatization policy and placed a hold on further privatization of remaining three large SOEs, including KEPCO, Korea Gas Corporation, and Regional Heating Corporation (Harvie et al., 2004, p. 130).

Moreover, the frequent turnover in prime ministers demonstrated Korea’s fragile political stability and made it hard to commit policy con-tinuity in the long run. There were six prime ministers under the KYS administration, four prime ministers and seven acting prime ministers under the KDJ administration, and four prime ministers and three acting prime ministers under the RMH administration. In total, there were 14 prime ministers and 10 acting prime ministers between 1993 and 2008 with the average tenure being less than one year. We need more research to show how these short-lived prime ministers had real impact on reforming the SOEs in general and the case of KEPCO in particular, but it is clear that their roles were basically overlooked when discussing the relevant issues.

13Roh was the presidential candidate of the MDP, but he left the party soon after taking

power and formed a new party, the Uri Party, in 2003.

14Roh wasfirst the member of Democratic Reunification Party (DRP) led by KYS when

entering politics in 1988. He, however, became an independent politician in 1990 when DRP merged with the Democratic Justice Party to form the DLP. He joined in The National Congress for New Politics led by KDJ in 1997.

The political leaders and their economic doctrines were regarded as the deciding factors.

Unchanged Development Model

When Korea welcomed the bailout package from the international financial agencies, the rationale of economic planning and policy shifted greatly. The original “developmental state” model was replaced by a neoliberal prescription to open up the market. The power reform has demonstrated the line of thinking that electricity is a commodity to be traded on the market rather than a service provided by the state. Before the 1997 financial crisis, the relationship between the electricity sector and industrial economy was characterized as “synergistic development” — a process of reinforcing growth between them. The state had heavily invested in the power sector in order to support rapid industrialization (Han et al., 2004). While the strategy successfully achieved great economic develop-ment, it also forced KEPCO to carry a high level of debt, which comprised a record 47% and 42% of public-sector foreign debt in 1995 and 1998 respectively.15As the single largest source of international debt, KEPCO was undoubtedly the target of the reform engineered by the international financial agencies. The KDJ administration claimed that selling KEPCO could not only unload state’s heavy financial burden but also could not acquire capital to save the national economy. In the face of foreign pres-sure, the Korean government adopted a new, market-oriented policy par-adigm and opened its economy to global forces and practices (Byrne et al., 2004, pp. 502–503). Unfortunately, there is no clear evidence showing that reform implementation has been beneficial to the consumers. The Korean state should adopt a more reasonable pricing system prior to privatizing and liberalizing the electricity sector (Hwang & Lee, 2013).

15Data available at the website of the Ministry of Strategy and Finance of South Korea

Nonetheless, privatizing state sector would not be possible unless the conditions were clear and favorable to reform. In the early stage of Korea’s power reform, the uncertainty about reform implementation and macro-economic situation had discouraged potential buyers. Moreover, energy subsidies have long been a favorite tool of Korean state seeking to bolster economic development. Korea’s power tariffs have been kept artificially low and failed to reflect increasing generation costs and curb excessive demand. Therefore, it is rather clear that the model of synergistic devel-opment has not been abolished even after thefinancial crisis of 1997. The reform process in Korea has shown the legacies of the developmental state and the central state has remained to play a critical role in economic planning and sustaining growth.16

Social Responses

An unexpected result that has emerged is that the power reform process has brought about social and environmental issues. In fact, the liberalization of the electricity industry has advanced at the expense of labor and environment interests without promoting market operation. Employment Security

According to the reform plan, the generation and distribution sectors were to be completely separated from KEPCO and privatized. However, most workers opposed the reform measures due to their concerns over job security. The KEPCO has more than 35,000 employees and privatization would result in job losses and a significant shift in labor relations. Con-sidering possible layoffs and job insecurity, the Korean National Electrical Workers Union opposed restructuring and privatization in 1999. Although it reached a compromise with KEPCO later and agreed to implement the

16This phenomenon has been found not only in the power sector but also other industries,

first stage of reform, workers in the generation sector disagreed with the deal and formed a separate union — Korean Power Plant Industry Union (KPPIU) (Dubash, 2002, p. 108). In fact, before the divestiture of KEP-CO’s generation sector in 2001, labor relations had been quite stable according to the dispute-free record. After KPPIU was established, it en-gaged a large-scale strike for 37 days in early 2002 and its relationship with Gencos’ management teams has become very confrontational since then (Lee & Ahn, 2006, p. 1118).

Moreover, possible foreign ownership would antagonize the labor unions and prompt the unions to organize movements to claim their interests. Privatization as part of the reform project is obviously not wel-comed by the laborers. Even though the reform project has been stopped, labor union has reiterated their strong stand and made an announcement when protesting the relocation of KHNP’s headquarters: if the government planned to carry out privatization of KEPCO, conflicts were inevitable (Song, 2011). Interestingly, labor’s hostility has resonated with the gov-ernment’s lukewarm attitude toward privatization, although the two parties have different reasons and stand in opposition to each other.

Environmental Concerns

Environmental issues have been one of the most important concerns in the electricity industry, especially with regard to power plants and in-frastructure construction. Environmentalists disagreed with the govern-ment’s restructuring plan and argued that continuation of KEPCO’s monopoly and unregulated competition in the generation sector are inim-ical to energy conservation, improvements in efficiency, and environmental protection. Private ownership and effective regulation are essential to the next stage of reform. Environmental groups are seeking further institutional unbundling and substantial privatization, which are in direct opposition to the labor unions’ goals. Nevertheless, they both agree on one point: the state’s approach to electricity reshuffling should be rejected (Byrne et al., 2004, pp. 508–509).

Moreover, South Korea is one of the very few countries in the OECD which has continuously expanded nuclear power. The Korean government has promulgated pro-nuclear policies and attracted sustained opposition over the last three decades. Before democratization, the bureaucracy and nuclear power plants were justified by the rationales of rapid economic growth and energy security. In addition, the thermal power plants face a natural resource constraint and the vulnerability of depending on importing coal mainly from China. The protest against the construction of a nuclear waste storage facility at Anmyundo Island in 1990 was the first time that the government’s nuclear policy was challenged. The Korean Federation for Environmental Movements (KFEM) has exploited the electricity reform as an opportunity to criticize the privileged status of nuclear power and the long-standing rationale for nuclear power as a low-cost source of elec-tricity. In each phase of its construction and use, from raw material (ura-nium) mining to plant operation to waste storage and burial, nuclear power poses a potential threat to the environment (Byrne et al., 2004, pp. 506– 507). Although criticisms have been presented to the state, the govern-ment’s resolution to retain and promote nuclear energy has been proven by policies designed to increase installed capacity and generate more than 30% of total electricity from nuclear power.

The Situation After Reform Suspended

Korea’s power reform has been suspended since 2004 or, to be more specific, it only lasted for three years (2001–2004).17 After restructuring the generation sector and establishing KPX and KOREC, the state has not taken any other substantial steps. The configuration of the electricity sector has not changed in general. Thermal power plants and nuclear power plants remain the two major sources of electricity (see Table 2). The KEPCO is

17The incumbent president Park Geun Hye is thinking of initiating the reform again (Kim,

still a highly integrated utility company enjoying monopoly status and has more than 35,000 employees. It dominates the generation sector and controls transmission and distribution sectors. As of December 2010, six GenCos account for 86% of the installed capacity and generate 92% of Korea’s electricity (see Table 3). After having being established for more than a decade, market competition has not been inspired among the Gen-Cos: five thermal GenCos have similar market shares around 12% and KHNP holds 32% in market share with exclusive nuclear power and hy-dropower supply (Park, 2011, p. 19). That is to say, KEPCO is the only buyer in the market (KPX), and in fact it is buying the electricity from its own subsidiaries (GenCos). Although there are many independent power

Table 2.

Sources of Electricity in South Korea in 2011

Coal Nuclear Gas Oil Hydro Green

Installed capacity (MW) 31.8% 23.3% 25.5% 9.8% 7.3% 2.3% Generated electricity (GWh) 40.9% 31.3% 20.3% 5.3% 1.4% 0.8% Source: KEPCO website<http://www.kepco.co.kr/eng/>.

Table 3.

Overview of Korea’s Power Market

KEPCO IPPs

Self-Generation and Community

Energy Service Total

Entities Number 6 363 44 413 Share (%) 1 88 11 100 Installed capacity MW 65,559 8,452 2,067 76,078 Share (%) 86 11 3 100 Generated electricity GWh 435 31 8 474 Share (%) 92 6 2 100 Source: K.-S. Park (2011, p. 6).

plants (IPPs), they are too small to compete with their colossal rivals.18 Against this background, the Korean state shows no intention to push for comprehensive reshuffling of the power sector and has decided to maintain the existing structure in general according to the “Development Plan of Electricity Industry” published by MKE in 2010 (Seo, 2010).

Nevertheless, the Korean people and industries have not suffered from such market manipulation because the government has heavily sub-sidized KEPCO to maintain electricity tariffs at a very low level. While enjoying inexpensive electricity, consumers show no intention of asking for the reform to be reinitiated. When unprecedented nationwide blackouts occurred on September 15, 2011, public discontent centered on KEPCO’s inadequate investment in generating capacity and forced the Minister of Knowledge Economy, Choi Joong-Kyung, to resign (“Commerce Minis-ter,” 2011; “Freak Blackouts,” 2011). At that time, KEPCO’s previous Chief Executive Officer (CEO), Kim Ssang-Su, had already left and the position had not yet been filled. The new CEO, Kim Joong-Kyum was assigned right after the blackouts on September 16.19 People take for granted that the state is responsible for electricity affairs and never think of privatization, a policy that improves efficiency but may bring an increase in prices. Another fact showing state’s control over KEPCO is that both CEOs were not veterans in the industry and having no expertise but from other industries. Kim Ssang-Su was former vice-president of LG Electronics Ltd. and Kim Joong-Kyum was former CEO of Hyungdai Engineering and Construction Corporation. It is clear that the state has not abandoned the synergistic development model even after the introduction of neo-liberal reform ideas because of their insistence of public ownership, control over power corporate personnel management, heavy subsidies for the power companies, and greater investment in nuclear power.

18The scale of IPPs was constrained by the Korean government when having been

intro-duced into the industry. Hence, they were unable to expand and compete with other Gencos (Cho, 1996).

19According to corporate governance of KEPCO, the CEO is appointed by the Minister of

The later development in Korea’s power sector was that KEPCO proposed to increase the prices by 13.1% in April 2012 but was rejected by MKE. In early July, KEPCO tried to push for an even greater increase of 16.8% and was dismissed again. The KEPCO now made a third attempt to propose a 10.7% increase, but the Minister of Knowledge Economy rejected it and made it very clear that a 10% increase is not acceptable (Chung, 2012a,b; Lee, 2012). The unstable power supply in 2012 and possible price increase have led to rising public discontent in society. The MKE was working on a project to boost private investment in the generation sector and promote market competition. That is to say, the Korean state has kept the focus on liberalization without privatization (Yu et al., 2010).

Conclusion

Korea’s power reform has encountered an impasse; all the involved parties — state, industry, and civil society — have gone against the reform agenda for different reasons. The state under KYS and KDJ seemed to have become imbued with liberal economic ideas and tried to shift the national development model toward being more open and market-oriented. While the Asian Financial Crisis heavily hit Korea and the international organi-zations stepped in to bail it out, the reform agenda and its implementation demonstrate the dynamics of the state’s response to foreign pressure. The IMF’s intervention also provided KDJ’s strong neoliberal pro-market ori-entation a great opportunity to substantiate his promises. Nonetheless, when RMH took power, privatization was not a policy option that em-phasized the economic effects, but a political action with a focus on po-litical and social responses. Separating the generation sector from KEPCO had not really reshuffled the industrial structure of the power sector. Under the state umbrella, KEPCO’s dominant status was not changed, which showed that reform implementation was in vain. The synergistic devel-opment model has lasted, if not strengthened. The KEPCO still occupies a monopoly status and acquires the heavy state subsidiaries. The civil society that emerged during democratization in the 1980s has not, ironically,

pushed reform further but stymied its progress. Ironically, KEPCO is the only exclusive winner of the game.

There are some important lessons from Korea’s stalled power reform. Its strategy of liberalization without privatization has proven the inade-quacy of a corresponding political and economic advance and has ignored the emerging social and environmental responses. At the same time, pressure from international financial organizations has facilitated the pro-mulgation of a reform agenda but has not been able to continue when the new top political leader held the different economic doctrine. Overall, the Korean government still insists on the long-sustained “developmental state” model, or at least the line of thinking that electricity, as a basis of economic development, is not a tradable commodity available in a com-petitive market but a service for which the state is responsible. Interest-ingly, although under a different economic regime, China has the similar experience in reforming its electricity industry and encountered stagnation as well. Comparing these two countries will expand our knowledge of economic development in East Asia in the globalization era but more work needs to be done. While involving political struggles, a contest of the existing economic mode, and various social forces, the fate of Korea’s electricity reform would not have been resuming until a well-designed, convincing reform scheme is presented by a determined political leader.

Acknowledgment

The author thanks two referees for their valuable comments. Research for this article was supported by Ministry of Science and Technology (MOST 104-2410-H-004-108-MY3), Taiwan, Republic of China.

References

Asia Pacific Energy Research Centre. (2000). Electricity Sector Deregulation in the APEC Region. Institute of Energy Economics, Tokyo, Japan.

Berglof, E., & Roland, G. (1998). Soft budget constraints and banking in transition economies. Journal of Comparative Economics, 26(1), 18–40.

Bornstein, M. (1999). Framework issues in the privatization strategies of the Czech Republic, Hungary, and Poland. Post-Communist Economies, 11(1), 47–77. Brada, J. C. (1996). Privatization is transition — Or is it? Journal of Economic

Perspectives, 10(2), 67–86.

Byrne, J., Glover, L., Lee, H., Wang, Y.-D., & Yu, J.-M. (2004). Electricity at a crossroad: Problems in South Korea’s power liberalization strategy. Pacific Affairs, 77(3), 493–516.

Chang, H.-J. (2003). New horizons for Korean energy industry-shifting paradigms and challenges ahead. Energy Policy, 31(11), 1073–1084.

Cho, S.-B. (1996). The power industry in Korea: The business environment for the participation of the private sector. Energy Policy, 24(5), 471–475.

Choi, H. (2008). Gonggiup Minyounghua Baekjihua duena [Will privatization of public enterprises be in vain?]. Seoul Gyeongje [Seoul Economy]. Retrieved July 14, 2012 from http://economy.hankooki.com/lpage/economy/200803/ e2008031218271770070.htm.

Chung, J.-W. (2012a). Hanjeon“Beope Ddala Sanyepyong Jeongiyogeum 12.6% Olryuya” [KEPCO “The rates of industrial electricity will have a 12.6% increase according to the law”]. Money Today. Retrieved July 15, 2012 from http://www.mt.co.kr/view/mtview.php?type¼1&no¼20120710153042 45609&outlink¼1.

Chung, J.-W. (2012b). KEPCO proposes 10.7% hike in electricity charges. The Korea Herald. Retrieved July 15, 2012 from http://view.koreaherald.com/kh/ view.php?ud=20120710001336&cpv=0.

Commerce minister offers to resign. (2011). Korean Herald. Retrieved December 14, 2011 from http://www.koreaherald.com/national/Detail.jsp?news-MLId¼20110927000668.

Dubash, N. K. (Ed.). (2002). Power Politics: Equity and Environment in Electricity Reform. Washington, DC: World Resources Institute.

Freak blackouts plunge Korea into darkness. (2011). Chosunilbo. Retrieved December 14, 2011 from http://english.chosun.com/site/data/html_dir/2011/ 09/16/2011091600558.html.

Graham, C. (2003). Methods of privatization. In D. Parker & D. Saal (Eds.), International Handbook on Privatization (pp. 87–101). Cheltenham, England: Edward Elgar.

Groves, T., Hong, Y., McMillan, J., & Naughton, B. (1994). Autonomy and incentives in Chinese state enterprises. Quarterly Journal of Economics, 109(1), 183–209.

Groves, T., Hong, Y., McMillan, J., & Naughton, B. (1995). China’s evolving managerial labor market. Journal of Political Economy, 103(4), 873–892. Han, S.-Y., Yoo, S.-H., & Kwak, S.-J. (2004). The role of the four electric power

sectors in the Korean national economy: An input-output analysis. Energy Policy, 32(13), 1531–1543.

Harvie, C., Lee, H.-H., & Oh, J.-G. (Eds.). (2004). The Korean Economy: Post-crisis Policies, Issues and Prospects. Cheltenham, England: Edward Elgar. Hwang, W.-S., & Lee, J.-D. (2013). Profitability and productivity changes in the

Korean electricity industry. Energy Policy, 52, 531–542.

International Energy Agency (IEA). (2006). Energy Policies of OECD Countries: The Republic of Korea 2006 Review. Paris, France: Author.

Kim, J. (2001). Jeonlyuksanup Goojogaepyune Ddaleun Jeonchekjeok Guaje: Gyujecejeleul joongximelo [Policy issues on the restructuring of electricity industry: The regulatory system]. Gonggiup Nonchong [Public Enterprise Review], 13(1), 25–47.

Kim, Y. (2016). Monopolies in the energy sector may be reformed. Korea Joongan Daily. Retrieved July 15, 2016 from http://koreajoongangdaily.joins.com/ news/article/Article.aspx?aid¼3020027.

Korean Power Exchange (KPX). (2005). Korean Electric Power Market: Overview and Improvement Plan. Retrieved July 12, 2012 from www.kpx.or.kr/ english/down_data/presen/KPX_Presentation_20050509.pdf.

Kornai, J. (1992). The Socialist System: The Political Economy of Communism. Princeton, NJ: Princeton University Press.

La Porta, R., Lopez-de-Silanes, F., & Shleifer, A. (2000). Government Ownership of Banks. NBER Working Paper No. 7620. National Bureau of Economic Research, Cambridge, MA.

Lee, S.-H. (2011). Electricity in Korea. Paper Presented at the Symposium on APEC’s New Strategy for Structural Reform, Big Sky, MT. Retrieved from http://aimp.apec.org/Documents/2011/SOM/SYM/11_som_sym1_009.pdf. Lee, S.-W. (2012). Hong Seok-Woo: Jeongilyo Yinsang Pok Sooyonghagi

Elyu-woon Sanghwang [Hong Seok-Woo: It is difficult to accept the increase in power prices under current situation]. Yonhap News. Retrieved July 15, 2012 from http://app.yonhapnews.co.kr/YNA/Basic/article/new_search/YIBW_ showSearchArticle_New.aspx?searchpart¼article&searchtext¼%ed%99% 8d%ec%84%9d%ec%9a%b0&contents_id¼AKR20120714053600003. Lee, B.-H., & Ahn, H.-H. (2006). Electricity industry restructuring revisited: The

case of Korea. Energy Policy, 34(10), 1115–1126.

Lee, K., Kim, B.-K., Lee, C. H., & Yee, J. (2008). Visible success and invisible failure in post-crisis reform in the Republic of Korea: Interplay of global standards, agents, and local specificity. Development & Society, 37(1), 23–53.

Li, W. (1997). The impact of economic reform on the performance of Chinese state enterprises, 1980–1989. Journal of Political Economy, 105(5), 1080–1106. Lim, H. (2010). The transformation of the developmental state and economic

reform in Korea. Journal of Contemporary Asia, 40(2), 188–210.

Lin, J. Y., Cai, F., & Li, Z. (1998). Competition, policy burdens, and state-owned enterprise reform. The American Economic Review, 88(2), 422–427. MacKerron, G., & Pearson, P. (2000). The International Energy Experience:

Markets, Regulation and the Environment. London, England: Imperial College Press.

Majumdar, S. K. (1998). Assessing comparative efficiency of the state-owned, mixed, and private sectors in Indian industry. Public Choice, 96(1–2), 1–24. Megginson, W. L. (2005). The Financial Economics of Privatization. New York,

NY: Oxford University Press.

Megginson, W. L., & Netter, J. M. (2001). From state to market: A survey of empirical studies. Journal of Economic Literature, 39(2), 321–389. Organisation for Economic Co-operation and Development (OECD). (2000).

Regulatory Reform in Korea: Regulatory Reform in the Electricity Sector. Paris, France: Author.

Park, K.-S. (2011). The Korean electric power industry and corporate governance of KEPCO. Paper Presented at the 6th Meeting of the OECD Network on Corporate Governance of State-Owned Enterprises in Asia, Seoul, Korea. Retrieved from http://www.oecd.org/dataoecd/35/60/48049493.pdf.

Park, J.-K., & Kim, Y.-J. (2005). Status and prospective of electric power industry in Korea. In IEEE 2005 Power Engineering Society General Meeting, Vol. 3, New York: IEEE. pp. 2896–2899.

Pint, E. M. (1990). Nationalization and privatization: A rational-choice perspective on efficiency. Journal of Public Policy, 10(3), 267–298.

Pinto, B., Belka, M., & Krajewski, S. (1993). Transforming state enterprises in Poland: Evidence on adjustment by manufacturingfirms. Brookings Papers on Economic Activity, 24(1), 213–261.

Rondinelli, D., & Iacono, M. (1996). Policies and Institutions for Managing Privatization. Turin, Italy: International Labor Office.

Seo, U. (2010). Hanjeon-Baljoenjahuesa Jaetonghap “Yeopdeonyilo” [The inte-gration of KEPCO generation subsidiaries returned to the starting point]. Hanguk Gyeongje [Korea Economy]. Retrieved July 15, 2012 from http:// www.hankyung.com/news/app/newsview.php?aid¼2010082451971. Sheshinski, E., & Lopez-Calva, L. F. (1999). Privatization and Its Benefits: Theory

and Evidence. HIID Development Discussion Paper No. 698. Harvard University, Cambridge, MA. Retrieved from http://www.cid.harvard.edu/ hiid/698abs.html.

Shirley, M., & Walsh, P. (2000). Public vs. Private Ownership: The Current State of the Debate. Working Paper No. 2420. The World Bank, Washington, DC. Retrieved from http://elibrary.worldbank.org/content/workingpaper/10.1596/ 1813-9450-2420.

Shleifer, A. (1998). State versus private ownership. Journal of Economic Per-spective, 12(4), 133–150.

Song, H. (2011). Hepeuningelo ggeutnan jeonlyuksanup goojogaepyun jaechoojin nonlan [The debate on failed structural reform in the power sector]. Shin-donga. Retrieved November 1, 2012 from http://news.naver.com/main/read. nhn?mode¼LSD&mid¼sec&sid1¼101&oid¼262&aid¼0000003904. Vickers, J., & Yarrow, G. (1988). Regulation of privatised firms in Britain.

Won, G.-H. (2007). Electric power industry restructuring and ROE: The case of Korea Electric Power Corporation. Energy Policy, 35(10), 5080–5090. Yergin, D., & Stanislaw, J. (1998). The Commanding Heights: The Battle for the

World Economy. New York, NY: Free Press.

Yu, C.-S., Jo, J.-H., & Ham, B.-G. (2012). Sin Jeonlyuksanyeopgoojogyepyon Jinhyeng Jung [The restructuring of electricity industry is in progress]. Green Daily. Retrieved July 15, 2012 from http://www.greendaily.co.kr/news/arti-cleView.html?idxno¼20348.