Effects of conformity on success of the firm:

The moderated effect of partner diversity on venture

capital investments

企業從眾行為對績效的影響:在創業投資中夥伴多樣性的

干擾效果

Chun-Yun Cheng1

Department of Business Administration, Soochow University

Abstract: This study examines the determinants of success through the lens of

behavioral conformity and partner attributes beyond the firm’s boundaries. Using longitudinal investment data from 1980 to 2008 on venture capital (VC) in the U.S., we adopted logit models in a panel format with random effects. We find some evidence that investing with similar external partners enhances investment performance. We also explore the crucial role partner diversity plays in moderating behavioral conformity and success of the firm. Accessing divergent forms of external knowledge through inter-firm cooperation should curb a firm’s tendency to engage in exaggerated fashionable compliance and improve the quality of organizations’ decision making and subsequent success.

Keywords: Conformity, partner diversity, venture capital investment,

inter-organizational cooperation.

1. Introduction

Scholars from a variety disciplines have proposed numerous explanations of behavioral conformity in a firm. This convergence in behavior emerges from obtaining superior information (Abrahamson and Rosenkopf, 1993; Banerjee, 1992; Rogers, 2003; Strang and Macy, 2001), imitation of competitors to mitigate rivalry or risk (Lieberman and Asaba, 2006), or responses to

1

Corresponding author: Chun-Yun Cheng, Department of Business Administration,

Soochow University. No.56, Section 1, Kueiyang Street, Chungcheng District, Taipei City

100, Taiwan, E-mail: chunyunc@gmail.com.

institutional pressures (DiMaggio and Powell, 1983). When decision makers are unclear about the potential costs and benefits of conformity they may rely on others’ information and adopt their choices if doing so is perceived to be advantageous (Abrahamson and Rosenkopf, 1993; Banerjee, 1992; Rogers, 2003; Strang and Macy, 2001). This is especially the case when social information conveys the message that conformance is advantageous and progressive, and that it has enormous growth potential (Yue, 2012).

Research on business strategies suggests that firms often pursue homogeneity strategies, instead of differentiation strategies, when resource homogeneity causes intense competition. Matching behavior may be a way to enforce tacit collusion among rivals or maintain a relatively competitive position to minimize risk (Lieberman and Asaba, 2006). Scholars who study institutional theory interpret behavioral conformity as the response of individual actors to institutional and competitive bandwagon pressures (Abrahamson and Rosenkopf, 1993). Institutional bandwagon pressures occur because non-adopters fear appearing different from the many adopters, and the competitive pressures emerge because non-adopters fear below-average performance if many competitors profit from the adopting.

Scholars have examined not only the various antecedents of behavioral conformity but also its consequences. The effect of behavioral conformity on performance is an ongoing topic of dispute. For example, whereas conformance scholars, looking through the institutional lens, suggest that adoption is at best performance-neutral and might even be performance-diminishing (Meyer and Rowan, 1977), performance scholars argue that adoption helps the organization reap substantive benefits (Westphal, Gulati, and Shortell, 1997).

To disentangle these conflicting results, our study examined the crucial role that partner diversity plays in moderating conformity and the firm’s performance. Although conforming to the most fundamental rules of one’s field is essential for an actor to be considered legitimate (De Clercq and Voronov, 2009; Hargadon and Douglas, 2001) and this aspect of legitimacy has drawn the most research attention, a degree of distinctiveness or nonconformance might be beneficial or even necessary (Kjærgaard, Morsing, and Ravasi, 2011; Navis and Glynn, 2010, 2011; van Werven, Bouwmeester, and Cornelissen, 2015). This distinctiveness can be created not only internally, within a firm, but also externally, by fostering

relationships between firms and their partners. By orchestrating their partnerships, firms can enhance their ability to achieve institutionally endorsed distinctiveness (Zhao et al,, 2017). The literature documents that firms’ interactions with external partners often facilitate inter-organizational learning, which improves firm performance (De Clercq and Dimov, 2008; Lane and Lubatkin, 1998). Scholars have emphasized the importance of matching strategies in clarifying how partners’ attributes interact with one another to increase returns (Mindruta, Moeen, and Agarwal, 2016; Mitsuhashi and Greve, 2009). This line of research indicates that complementary and compatibility (or similarity) are two critical matching criteria of alliance formation and that good matches increase firm performance (Mindruta et al., 2016; Mitsuhashi and Greve, 2009). Following from these studies, we explored how partner attributes serve as contextual factors moderating the relationship between behavioral conformity and success of the firm. We propose that inter-organizational interactions among divergent partners curb a firm’s tendency to engage in exaggerated fashionable compliance, improve the quality of decision making, and lead to superior performance.

The virtual capital (VC) industry is an appropriate setting for studying the effects of fashions and access to information about other organizations on performance under conditions of uncertainty, for two reasons. First, there is considerable variability in how VC investments are structured. The VC industry consists of two types of organization: the independent VC (IVC) firm and the corporate VC (CVC) firm. IVC firms focus on financial returns and CVC firms on strategic goals (Cheng, 2012); the IVC-CVC dichotomy clearly represents the distinctiveness attribute of VC firms. It facilitates empirical research on how VC firms organize their knowledge of their partners in terms of how similarly they and their partners manage to cope with uncertainties and improve performance. A second reason to study investments in the VC-industry environment is that it can give us detailed information on specific investments at the project level, allowing us to measure the behavior of VC firms more precisely than prior studies have done.

This paper is organized as follows: in the next section, after reviewing the literature, we justify our hypotheses about the conditions under which an IVC investment is most likely to improve performance at the project level. The

hypotheses are focused on the importance of knowledge exploitation and its interaction with fashionable environments to cope with negative investment outcomes. This discussion is followed by descriptions of the operationalization of our measures and the statistical analyses of the data. We then present our empirical results on the determinants of the performance of IVC investments. A discussion of the results and their implications concludes the paper.

2. Theory and hypotheses

2.1 Conformity and performance

Researchers in sociology and economics have offered many explanations for behavioral conformity in a firm. Three substantial bodies of literature explain the processes underlying this conformity in different ways: (a) information-based theories, which propose that firms follow others that are perceived (sometimes erroneously) as having superior information (Lieberman and Asaba, 2006); (b) rivalry-based theories, which propose that firms imitate others to maintain competitive parity or limit rivalry (Lieberman and Asaba, 2006); and (c) institutional theories, which propose that firms face varying pressures to engage in isomorphism (DiMaggio and Powell, 1983).

The information-based theories are proposed in the field of information economics. The most prominent economic theory of herd behavior is called “information cascades” or “social learning” (Banerjee, 1992; Bikhchandani, Hirshleifer, and Welch, 1992, Chang, Chen, and Yang, 2015; Lieberman and Asaba, 2006). This stream of research explores primarily the public information that accumulates over time; it may be rational for followers to ignore their own prior information and imitate the previous decisions of others. For example, Banerjee (1992) suggested a sequential decision model, which proposes herd behavior that is generated by rational decision makers’ reliance on rates of adoption as indicators of the private information available to others.

A second set of theories stresses imitation as a response intended to mitigate competitive rivalry or risk (Lieberman and Asaba, 2006). Firms imitate other firms in an effort to maintain their relative position or to neutralize the aggressive actions of rivals. Abrahamson and Rosenkopf (1993) argued that

competitive bandwagon pressures occur because non-adopters fear below-average performance if many competitors profit from adopting. When resource homogeneity increases the likelihood of intense competition, matching behavior may be a way to enforce tacit collusion among rivals (Lieberman and Asaba, 2006). Other studies on economic strategies have tested predictions. Studies on action-response dyads suggest that matching a competitor’s moves indicates a commitment to defending the status quo, neither giving up the current position nor falling into mutually destructive warfare (Chen and MacMillan, 1992; Chen, Smith, and Grimm, 1992; Lieberman and Asaba, 2006).

A third theoretical approach explains widespread behavioral conformity (i.e., isomorphism) as the outcome of a process by which the firm attempts to acquire legitimacy (Meyer and Rowan, 1977). Institutional theorists argue that firms face various pressures — coercive, normative, and mimetic — to engage in isomorphism (DiMaggio and Powell, 1983). Powerful entities can exert coercive influence, and firms may adopt practices ceremonially in response (Weber, Davis, and Lounsbury, 2009). Normative pressures exist when fields professionalize in such a way that its members collectively dictate the criteria for membership or job performance (Heugens and Lander, 2009). Firms may ceremonially adopt substantive practices that are tied to performance or legitimacy outcomes (Weber et al., 2009). Finally, mimetic pressures exist when firms imitate rival firms that are highly visible, large, or successful (Heugens and Lander, 2009; Weber et al., 2009). They perceive this mimicry as performance-enhancing in the face of uncertainty (Oliver, 1991).

Scholars have examined not only the various antecedents of isomorphic behavior but also its consequences. Previous research has yielded conflicting results on the effect of behavioral conformity on a firm’s performance. When firms imitate one another in an uncertain environment, they place identical bets on the future, thereby raising the odds of either highly positive or highly negative outcomes. The information-cascade theory explicitly addresses the potential for bubbles and sudden reversals (Lieberman and Asaba, 2006). By reducing variation in a firm’s’ strategies and technological paths, imitation raises an industry’s collective risk. The risk of inferior outcomes is greatest if managers perceive a need to commit to collective practices before major uncertainties are resolved (Lieberman and Asaba, 2006).

The theories presented above suggest that rivalry-based imitation can reduce the intensity of competition in an industry — or increase it. Empirical studies suggest that, in most cases, rivalry-based imitation raises the intensity of competition and lowers profitability (Barreto and Baden-Fuller, 2006; Deephouse, 1999).

Heugens and Lander (2009) distinguish two opposite insights from institutional theory. Conformance scholars suggest that behavioral conformity is at best performance-neutral and might even be performance-diminishing (Heugens and Lander, 2009; Meyer and Rowan, 1977) since organizations adopt new templates for organizing primarily out of a desire to be perceived as acceptable and appropriate, but the functionality of such templates is not a consideration at the time of adoption (DiMaggio and Powell, 1983; Heugens and Lander, 2009). In contrast, performance scholars suggest that organizations are likely to favor templates that allow them to reap superior performance in addition to social acceptance (Deephouse, 1999; Westphal et al., 1997).

Because VC firms are less likely to select templates merely on account of their social acceptability, we argue that contextual factors influence the effects of behavioral conformity on performance. VC investments involve substantial uncertainties about the relationships between VC firms and the companies they invest in. Faced with environmental uncertainties, VC firms may follow others by investing in the start-up of an industry to imitate others that are perceived as having superior information, by mimicking others to maintain competitive parity or limit rivalry, or by adopting herd-like behavior in order to acquire legitimacy. Unlike CVC firms that adopt the strategic guidelines of their parent companies, IVC firms are likely to rely on social comparison to decide whether to invest in a specific industry. When their IVC peers are sufficiently similar in attributes and context, information about these peers choices has diagnostic value (Baum, Li, and Usher, 2000; Fiegenbaum and Thomas, 1995). Thus, monitoring the behavior of peers helps IVC firms interpret ambiguous environmental information and make sense of strategic choices. The common components of environmental uncertainties lead to market inferences about managerial abilities based on relative performance (Zwiebel, 1995). Institutional investors are likely to adopt the relative performance indicators that IVCs use to manipulate an investor’s inferences regarding the IVC’s ability to raise more money. Most fund

managers in IVC firms follow the industry’s norms when making investments, out of concern for their reputation regarding the ability to raise funds. Investing in industries that other VC peers have invested in, even if they ignore substantive private information, is a plausible strategy. Adhering to such conventions helps VC firms “identify with other actors, values, or symbols that are themselves legitimate” (Ashforth and Gibbs, 1990, p.181), thereby enhancing their own legitimacy as investors. Deviating from these conventions or not adapting when they change can put legitimacy at risk (Navis and Glynn, 2011).

In our study, we adopted the conformance perspective and expected a negative relationship between behavioral conformity and performance outcome, for three reasons. First, firms legitimately commit to common practices hastily, before major uncertainties have been resolved (Lieberman and Asaba, 2006). However, this conventional behavior makes firms suffer penalties (Glynn and Marquis, 2004; Navis and Glynn, 2011). For example, during the rise of internet commerce in the 1990s, widespread belief in the advantages of early movers led to a rash of Internet startups (Lieberman and Asaba, 2006). Eventually, as more information emerged about the prospects for Internet businesses, their stock prices collapsed and many of them failed (Lieberman and Asaba, 2006). Second, investing in isomorphism-enhancing behavior can come at a price. If the required resources have a higher investment value elsewhere, seeking isomorphism will result in poorer performance (Barreto and Baden-Fuller, 2006). Third, increased isomorphism lowers an organization’s capacity to meaningfully differentiate itself from its competitors, thereby lowering its ability to realize a sustainable competitive advantage (Deephouse, 1999; Heugens and Lander, 2009). Since the IVC is a mainstream organizational form in the VC industry (e.g., 92% of the investments in our sample were made by IVC firms), we tested hypotheses grounded in the IVC context. In an IVC context, following other VC firms by investing in a specific industry harms the quality of decision making, increases opportunity costs, and lowers the potential for differentiation from other firms. Thus, this kind of behavioral conformity leads to inferior IVC investment performance.

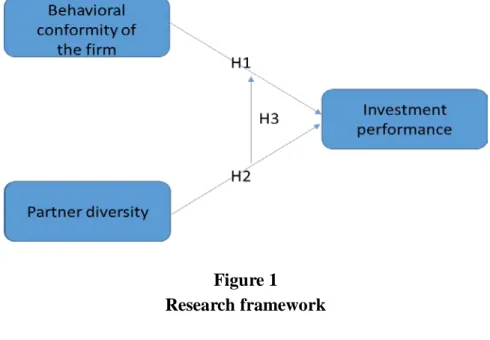

H1: The number of prior VC investments in a specific industry is negatively related to the performance of the IVC investments.

inter-firm cooperation schemes on firm performance. This line of research explores the conditions under which firms create value through inter-organizational collaboration (Anand and Khanna, 2000; Gulati, Lavie, and Singh, 2009; Merchant and Schendel, 2000). One of the most commonly discussed determinants of firm performance is partner characteristics (Beers and Zand, 2014). Scholars studying inter-firm relationships emphasize the importance of matching strategies in understanding how partners’ attributes interact with one another to increase returns (Mindruta et al., 2016; Mitsuhashi and Greve, 2009). They propose complementary and compatibility (or similarity) as the two critical matching criteria for alliance formation, and they argue that good matches improve firm performance (Mitsuhashi and Greve, 2009). Mindruta (2013) proposed that this matching is multidimensional, that is, the components complement one another in some aspects but can be substituted for (i.e., are similar to) one another in other aspects.

The networking literature suggests that a network’s structure, or the implicit combination of the partners’ attributes, are a critical determinant of an organization’s performance, because it provides information and capabilities that may not be available within the firm (Burt, 1992;Han, Chao, and Chuang, 2012). One of the central debates in the social network literature concerns different uses of social capital derived from homophily and heterophily. Homophilous social capital is associated with networks with high density or levels of closure; such networks promote trust and norms of cooperation (Coleman, 1988). As network density is highly correlated with homophily in the characteristics and resources of the actors (Burt, 1992; Homans, 1951; Lazarsfeld and Merton, 1954), such networks are associated with collective solidarity. In contrast, heterophilous social capital comes from sparse networks, which allow actors to access novel information and resources in a timely fashion through bridges (Burt, 1992).

In line with the literature, we consider partner attributes to bea possible determinant of a firm’s success. VC firms in particular seek inter-firm relationships by cooperating with other VC firms, so called “syndication,” to overcome uncertainties. These uncertainties accompany their investment projects because venture capital often finances risk, and early-stage start-ups are characterized by significant information asymmetries to a greater extent than publicly listed companies (Fama, 1991). Accordingly, we distinguish two major

types of VC firms: IVC firms and CVC firms whereas the quality of an IVC firm is determined by its ability to make sound investment decisions and reap financial returns for its investors, a CVC firm focuses on strategic goals and is likely to follow the strategy dictated by its corporate parent, such as familiarizing itself with a pioneering technology (Dushnitsky and Lenox, 2005, 2006; Noyes, Brush, Hatten, and Smith‐Doerr, 2013) or quickly establishing alliances in product markets (Dushnitsky and Lavie, 2010).

We argue that an IVC firm has a tendency to syndicate with other IVC firms with similar investment motives with respect to financial gain. This strategy facilitates alignment of goals among IVC firms and mitigates potential uncertainties. Besides, knowledge similarity between allied partners is perceived as more beneficial the closer the partner is in the knowledge space (Mindruta et al., 2016). This similarity facilitates knowledge transfer and minimizes coordination costs. Furthermore, the leading IVC firms tend to select IVC partners, because a homophilous partner is easier to interact and communicate with, and it’s easier to achieve consensus on the basis of a shared common code. By reducing coordination costs, VC firms are more likely to have investment success, other things being equal.

H2: The prior tendency of a focal IVC firm to syndicate with homophilous partners (other IVC firms) is positively related to IVC investment performance.

2.2 Partner diversity as a moderator

The fundamental reason why conformity occurs is that actors rely on social information to resolve uncertainties in decision making, and this results in a convergence of behavior (Yue, 2012). When firms make a common choice to invest in an industry in an uncertain environment, they place identical bets on the future, hence raising the odds of a highly positive or highly negative outcome (Lieberman and Asaba, 2006). A new industry acquires a threshold number of entrants; growth of the number of entrants increases legitimacy while making competition more intense (Carroll and Hannan, 1995; Hannan and Carroll, 1992). VC firms with similar attributes (i.e., IVC firms) rely on the same environmental resources and are affected by similar structural constraints. They are potential competitors for investment opportunities and threats, in the fashionable context in which the threshold number of entrants is promptly reached. This competitive

behavior among IVC firms stems from the quest for scarce but promising investment opportunities in emerging “hot” industries in a limited time frame. These industries may lock into inferior choices or greatly overshoot the optimum level of investment.

Looking for a way to curb the above-mentioned inferior outcome, we consider the notion of legitimate distinctiveness, a goal that investors in a VC firm seek to meet by comparing their firm to its peers before committing its money. Specifically, it compares them in broad terms and assigns them to relevant categories (i.e., markets or industries; King and Whetten, 2008; van

Werven et al., 2015). Once a firm has been determined to be a legitimate member of a particular category, investors will start making within-category distinctions between firms (Bitektine, 2011; Lamertz, Heugens, and Calmet, 2005; van Werven et al., 2015). A firm can enhance its legitimate distinctiveness by orchestrating its partnerships (Zhao et al., 2017). Critical resources often extend beyond a firm’s boundaries, requiring the firm to engage in inter-firm cooperation to develop and maintain competitive advantage (Al-Laham and Amburgey, 2005; Carayannopoulos and Auster, 2010; Dierickx and Cool, 1989; Powell, Koput, and Smith-Doerr, 1996).

The literature suggests that multiple instances of cooperation with a wide range of partners can be expected to increase the impact of RandD alliances on a firm’s innovation performance because of complementary information and synergy resulting from organizational learning (Beers and Zand, 2014; Lavie and Miller, 2008). Scholars who study organizations have documented that different kinds of information improve the quality of the organization’s decision making (Yue, 2012). When conformity locks the firm into inferior outcomes, divergent information from partners is likely to curb an actor’s tendency to engage in exaggerated social compliance or correct its course in decision making.

CVC firms possess information about related or complementary industries. This information broadens partner diversity. CVC firms serve as distinctive partners (defined as partners that have idiosyncratic attributes compared to those of IVC firms) by providing resources and capabilities that are useful primarily because of their relevance to the parent corporation and portfolio companies. Knowledge from related lines of business can help corporations select better ventures or add value to IVC firms once the investments are made (Gompers and

Lerner, 2004). IVC firms that access relevant knowledge from diverse industries through syndication with CVC firms should be expected to curb their tendency to engage in exaggerated fashionable compliance, improving the quality of their decision making. Moreover, behavioral conformity tends to be socially beneficial and potentially profitable when the actors complement one another (Lieberman and Asaba, 2006). Thus, IVC firms benefit from CVC firms’ industry-related knowledge, which is complementary to their own knowledge base, mitigating the downside risks of fashionable compliance, leading to superior performance.

H3: The negative relationship between the number of prior investments in a specific industry and IVC investment performance is moderated by the tendency of a focal IVC firm to syndicate with heterophilous partners (CVC firms).

Figure 1 Research framework

2.3 Empirical context: The venture capital industry in the U.S.

The VC industry is increasingly regarded as an important component of the U.S. economic landscape. Many successful new companies established in recent decades - for example, Apple, Google, Amazon, Federal Express, Intel, Microsoft, and eBay-have been backed by VC funds (Gompers and Lerner, 2004). Although VC firms finance only 1 or 2% of all new businesses in the U.S.,

the proportion of initial public offerings backed by such firms increased from around 10% in 1980 to over 50% in 2000 (Braunerhjelm and Parker, 2010). This growth has led to increased attention being paid to the VC industry by the popular press and academic researchers. VC firms are characterized as providing promising start-ups with the financing and business skills they need to explore and exploit market opportunities. Their investments tend to be concentrated in cutting-edge, innovative sectors of the economy such as information and communication technology (ICT), biotechnology, and health care. Raising funds primarily from institutional investors and wealthy individuals, VC firms identify and finance risky, early-stage start-ups (Cheng, 2012). High variability in the expected return on one’s investments makes the selection of investment opportunities a major function of VC firms (Cheng, 2012; Lockett and Wright, 1999). Such selection is problematic because the projects that are the targets of VC investment are characterized by significant informational asymmetries and uncertainties compared to what is faced by publicly listed companies.

VC firms have adopted various strategies for the addressing of uncertainties, deal selection, and monitoring (Cheng, 2012; Wright, 1998): one of these strategies is syndication. Syndication involves multiple VC firms each taking an equity stake in an investment. Members of the syndicate make a collective decision to invest in both lead and non-lead funds to obtain a payoff to be shared jointly among themselves (Lockett and Wright, 1999). Syndication activities make VC firms bundle their current and past investments into webs of relationships with other VC firms. About 50% of VC investment rounds are syndicated (Hochberg, Ljungqvist, and Lu, 2007).

3. Methods

To test our hypotheses specifying the conditions under which a VC investment is more likely to perform better at the project level, we first created separate datasets for IVC and CVC firms. To optimally estimate the likelihood of success of a particular IVC investment, we used a logit model and organized the data in a panel format. To account for the fact that some VC firms made more than one investment in a given year, and thus for possible non-independence of observations within each year, we included year dummies as well as robustness

estimates of the standard errors to adjust for possible clustering of the VC firms. Additionally, we concluded, based on the Hausman test, that a random effects model would be more appropriate for our dataset than a fixed effects model2.

3.1 Sample

The data for our analysis were taken from the Thomson Financial’s VentureXpert database, published by Venture Economics. We drew solely on investments by U.S.-based VC funds and excluded those made by angels and buyout funds. Most VC funds are closed-end, often 10-year, and limited partnerships. The typical fund spends its first three or so years selecting companies to invest in and then nurtures them over the next few years (Hochberg et al., 2007). In the second half of the fund’s life, successful portfolio companies go public or are acquired, generating capital inflows that are distributed to the fund’s investors (Gompers, Kovner, and Lerner, 2009; Hochberg et al., 2007).

Because follow-up investment decisions are different in nature from initial investment decisions (Podolny, 2001), and the syndication of follow-up investments involves diverse motivations and strategies (Lerner, 1994; Sorenson and Stuart, 2008), we focused on the initial investments made by each VC firm in each of its invested companies. Our sample includes 7,437 observations from portfolio company-IVC pairs and 622 observations from portfolio company-CVC pairs at the project level from 1980 to 2003. The performance of each investment was measured from time of the initial investment until 2008 within a 10-year time frame. After deleting observations with missing information, we ended up with 5,635 observations for IVC investments and 341 observations for CVC investments.

3.2 Measures Dependent variables

Because VC firms disclose their performance data only to their investors,

2

To decide between fixed or random effects, we run a Hausman test, where the null hypothesis is that the preferred model is random effects (see Green, 2008, Chapter 9). It basically tests whether the unique errors are correlated with the regressors, the null hypothesis being that they are not. If the probability of this correlation being real is significant (p < 0.05) based on a chi-square test, we choose the fixed effects model. In the present case, p = 0.72.

investment returns are not available. We thus followed Hochberg et al. (2007) by using a proxy, represented by a dummy variable coded 1 if the start-up had a successful initial public offering (IPO) or sale to another company (merge and acquisition), and 0 otherwise.

Independent variables

Behavioral conformity. This independent variable was defined as the cumulative number of investments in each industry during the year before the VC investment. The larger the number of investments in each industry-year, the more fashionable the investment environment. This variable captures the nature of frequency-based imitation that had already been adopted by many other organizations (Haunschild and Miner, 1997). Because the distribution was highly skewed and kurtotic, the numbers were log-transformed for regression analysis.

Partner attributes. To take into account the total availability of IVCs and CVCs, which precludes or makes possible any given choice pattern, we adopted the homophily measurement in Ibarra (1992) as a proxy for the degree of preference for similar partners for VC investments. The homophily metric corrected for availability bias by providing the following values for each IVC investment: (a) the number of investments the IVC firms syndicated with the other IVC investments, (b) the number of investments the IVC firms syndicated with CVC investments, (c) the number of IVC investments the focal IVC firm could have syndicated but did not, and (d) the number of CVC investments the focal IVC firm could have syndicated but did not. The homophily measure was then derived by the following calculation, which adjusts for both the availability of different-sized IVC/CVC groups and the firm’s choices:

) )( ( 14 d c c b a a d b b c a a S + − + + − + =

This calculation produces a measure ranging from -1 to 1; negative values indicate a tendency for an IVC firm to select CVCs, given their availability; a value of 0 indicates a balanced mix of IVC and CVC choices, again, given availability.

Control variables

The control variables are listed and defined in Table 1. We controlled for funds that VentureXpert classifies as seed or early-stage funds, on the assumption

Table 1

The list of control variables

Control Variables Definitions

Firm size the total amount of committed capital to all portfolio companies by a VC firm (log transformed)

Firm age the number of days between the VC firm’s first investment and current investment divided by 365(log transformed) Number of investors the total number of VC firms invested in a specific portfolio company

Number of rounds the total number of rounds invested in a specific portfolio company Received capital the total amount invested in a specific portfolio company (log transformed) Industries categories

ten categories:communications and media, computer hardware, semiconductor, biotechnology, health/medical, consumer-related business, internet specific business, computer software energy or industry business, and other business

Competitive conditions the aggregate amount of capital raised by other VC funds in the focal/lead fund’s vintage year (log transformed) Lead identified a lead VC firm as largest cumulative investment to a specific portfolio company

Early stage preference the categorization of stage preference for each VC from VentureXert Stake the percentage of a VC investment in a portfolio company

Specialization Herfindahl–Hirschman Index, the sum of the squares of the percentage of all previous investments in each industry Indegree let qji= 1 if at least one syndication relationship exists in which VCjis the lead investor and VC i is a syndication

member, and zero otherwise. VC i’s indegree then equals ∑j qji.

Cross-state investment coded them “1” if states of VC firms and their target companies were located in different states,”0” otherwise Cross-industry investment It was coded “1” if VC firms have never invested in portfolio companies’ industries and “0” otherwise Industry experience the percentage of previous investments whose industry is identical to current VC investment

Geographic experience the percentage of previous investments which is located in the same state as current VC investment Numbers of last year

investments in the industry the numbers of investments in each industry one year before a VC investment (log transformed) Control Variables Definitions

por at e Ma nage m e nt R ev ie w V o l. 3 7 N o. 2 , 201 7 15

that such funds invest in riskier companies and thus have relatively fewer successful exits, as suggested by Hochberg et al. (2007).

3.3 Results

Table 2 reports the descriptive statistics for both the IVC and CVC investments. An initial investment project stands for a portfolio-company–VC pair. The average stake for IVC investment projects is 45%, which is much higher than it is for CVC investments (35%). On average, 46% of IVC investments were seed or early stage, but only 23% of CVC investments were reported as early stage in our dataset. Compared to CVC investments, IVC investments are more exploratory in that the investors have less experience with industrial and geographical investments. CVC investments are more specialized than IVC investments. Table 3 presents correlations for all the variables of interest for IVC investments. The variables firm size, firm age, received capital, competitive conditions, and number of previous-year investments in the industry, have been log-transformed for logit regression analysis, because their distributions were highly skewed and kurtotic.

Table 4 shows the results of the random effects logit estimation for IVC investment projects. Model 1 is the baseline model containing only the control variables. Model 2 adds the main effects of conformity; Model 3 adds the main effects of partner similarity; Model 4 adds the interactions<Plural correct?> between conformity and partner similarity.

In contrast to previous published results linking specialization to performance, our results show that specialization at the VC firm level has no effect on investment performance. We used Model 2 to test H1, the relationship between effects of conformity and IVC investment performance, and the nonsignificant correlation means that H1 is rejected. H2 predicts that the prior tendency of a focal IVC firm to syndicate with similar partners is positively related to IVC investment performance. Whereas the correlation in Model 3 is nonsignificant, the coefficient in Models 4 is significantly positive, meaning that the tendency of a focal IVC firm to syndicate with similar homophilous partners (other IVC firms) is positively related to IVC investment performance. Thus, the results partially support H2. H3 predicts an interaction between conformity and

Table 2

Descriptive statistics for both IVC and CVC investments

por at e Ma nage m e nt R ev ie w Vo l. 3 7 N o. 2 , 201 7 17

Table 3

Correlations for IVC investments

Ef fe cts o f c o nf or m ity on suc ce ss of t h e firm

Table 4

Random effect logistitics regression for determinants of the success of IVC investments

(1) (2) (3) (4) Stake 0.119 (0.766) 0.120 (0.770) 0.085 (0.535) 0.106 (0.651) Stage preference -0.006 (-0.086) -0.006 (-0.090) -0.017 (-0.257) -0.020 (-0.313) Insdustrial experence -0.124 (-0.566) -0.117 (-0.530) -0.136 (-0.6097) 0.017 (0.071) Geographic experience 0.007 (0.051) 0.007 (0.051) 0.024 (0.180) 0.057 (0.398) Specialization 0.181 (0.634) 0.179 (0.626) 0.232 (0.793) 0.221 (0.756) California 0.091 (1.079) 0.092 (1.082) 0.090 (1.032) 0.063 (0.736) Firm size 0.008 (0.268) 0.008 (0.269) 0.008 (0.247) 0.006 (0.212) Firm age -0.056 (-1.616) -0.055 (-1.708) -0.045 (-1.266) -0.014 (-0.376) Lead -0.024 (-0.305) -0.024 (-0.305) -0.028 (-0.346) -0.032 (-0.389) Indegree 0.087 (0.531) 0.086 (0.525) 0.086 (0.510) 0.127 (0.773) Received capital 0.423*** (11.795) 0.422*** (11.793) 0.441*** (11.935) 0.440*** (11.753 Number of investors -0.049*** (-3.667) -0.049*** (-3.668) -0.055*** (-4.055) -0.052*** (-3.759) Number of rounds -0.050*** (-3.364) -0.050*** (-4.348) -0.068*** (-3.347) -0.070*** (-4.353) Competitive conditions -0.211 (-1.58) -0.210 (-1.579) -0.226* (-1.695) -0.163 (-1.096) Numbers of last year

investments 0.106 (1.403) 0.118 (q.347) 0.147* (1.668) 0.143 (1.585) Conformity -0.052 (-0.265) -0.071 (-0.350) 0.130 (0.610) Partner attributes -0.003 (-0.164) 0.394** (2.121) Partner attributes* conformity -0.069** (-2.138) N 6081 6081 5834 5635 T statistics in parentheses * p<0.1, ** p<0.05, *** p<0.01.

partner attributes on IVC investment performance. The significant negative coefficient from the test of Model 4 reveals that IVC firms’ prior tendency to syndicate with similar partners (other IVC firms) harms the performance of their investments if they are conventional. This result supports H3. Note that the variable “partner attributes” represents the IVC firm’s partnering pattern, a continuum from cooperation with homophilous partners to cooperation with heterophilous partners. Thus, the Model 4 result means that, contrary to other IVC firms, IVC firms should collaborate with divergent partners (CVC firms) to achieve good performance.

Although the predicted main effect of behavioral conformity on investment performance was surprisingly not found in our study, we also hypothesized an interaction between partner attributes and conformity when firms seek syndication with diverse partners. We argued that the benefits of accessing such partners restrain a firm’s excessive social compliance caused by exaggerated and inaccurate social information. Our results for VC investment performance reinforce some aspects of our conceptual framework and thus lead to a more nuanced understanding of the crucial role partner diversity plays in moderating behavioral conformity and success of the firm.

4. Discussion

4.1 Behavioral conformity and performance

The effect of behavioral conformity on firm performance is an ongoing topic of dispute from various theoretical perspectives. The above-mentioned three lines of research, based respectively on information-based theories, rivalry-based theories, and intuitional theories, have yielded conflicting results on the effect of behavioral conformity on a firm’s performance. Heugens and Lander (2009) used a meta-analysis of studies testing institutional theory to address this issue. They suggested that the foundational research on institutional theory (e.g., DiMaggio and Powell, 1983; Meyer and Rowan, 1977) predominantly supports the conformance perspective, that is, that a focal organization’s behavioral conformity is not related or is negatively related to its performance. However, they also found, surprisingly, that conformity to institutional ordinances

simultaneously improves the substantive performance of the organization, as proposed by performance theorists. Heugens and Lander (2009) suggested that one of the reasons for the conflicting results is a confounding of institutional isomorphism with competitive isomorphism, because different processes lead to the same end product. Our empirical results support arguments in the conformance literature by failing to demonstrate a relationship between behavioral conformity and the investment performance of VC firms. These results are inconsistent with H1 and more supportive of conformance scholars’ notion of performance neutrality. Future research should distinguish institutional isomorphism from competitive isomorphism to allow a more precise interpretation of the effect of behavioral conformity on the performance of a firm.

4.2 Partnership and performance

We build our arguments on the basis of the assumption that by establishing external partnerships, firms acquire necessary missing knowledge (Grant and Baden-Fuller, 2004) that they need to complete particular tasks (De Clercq and Dimov, 2008).Our findings are consistent with this expectation by demonstrating that the tendency to syndicate with homophilous partners enhances IVC investment performance.

The most interesting aspect of our results concerns the interplay between the benefits of partnership and organizational conformity. They show that when a firm imitated other firms by investing in a particular industry, collaborating with diverse but complementary partners was the most beneficial approach. That is, partner diversity serves as a moderator by improving the effects of organizational conformity on performance. Our study also sheds light on the mechanism through which partner diversity can curb a firm’s exaggerated and fashionable compliance and thereby improve performance further. This finding justifies the formation of external relationships and reinforces the importance of trustworthiness for the effective absorption of external knowledge (Dyer and Singh, 1998; Lane and Lubatkin, 1998).

4.3 Managerial implications

managers who are considering a compliance strategy to match the action of their rivals to extract external knowledge from diverse partners. However, this strategic action, which requires cooperation and coordination among organizations, is not cost-free. Cooperation presumes an alignment of interests, and coordination presumes an alignment of actions. Cooperation is facilitated when both parties have common or similar goals in pursuit of mutual interests. The costs of coordination are less when less effort is required to communicate and achieve consensus, because there is a shared common code. A divergent or complementary partner can bring extraordinary benefits to firms pursuing a compliance strategy, but the costs of cooperation and coordination are a “necessary evil.” Only when the contextual requirement of diversified resources and capabilities is high, and the benefits derived from cooperation and coordination outweighs the costs, can the firm reap rewards from access to external knowledge. The contextual factor in our study was a firm’s need to curb exaggerated fashionable compliance.

4.4 Limitations

Inevitably, as is the case with any empirical work, there were limitations in our study that provide opportunities for future research. The first concerns generalization of our results beyond the VC industry. Although the strategic decision making processes of VC firms share similarities with those of other industries, particularly the need to anticipate and respond to new technological trends and market developments, VC firms lack the structural complexity of other, more mainstream organizations. Second, our analyses relied on logit regression with a binary dependent variable and the conventional reduced form. There is an opportunity in future such research to apply the statistical tools of survival analysis, as developed by population ecologists. Third, the paper is ultimately silent on the determinants of external knowledge access. Future research could examine antecedents of such access, which may contribute to understanding the relation between external knowledge- building and outcome performance. Finally, if there were unobserved variables that influenced external knowledge access and performance in our study, there was a self-selection bias, and thus the normative implications drawn from these analyses might be incorrect. To adjust for sample-selection biases, future research should examine

performance implications across various industries or degrees of uncertainty and how firms’ strategic choices align with one another.

Funding

This research was supported by grants from the Ministry of Science and Technology in Taiwan (MOST 106-2410-H-031 -054 -MY2).

References

Abrahamson, E. and Rosenkopf, L. (1993). Institutional and competitive bandwagons: Using mathematical modeling as a tool to explore innovation diffusion. The Academy of Management Review, 18(3), 487-517.

Al-Laham, A. and Amburgey, T. L. (2005). Knowledge sourcing in foreign direct investments: an empirical examination of target profiles. MIR: Management International Review, 45(3), 247-275.

Anand, B. N. and Khanna, T. (2000). Do firms learn to create value? The case of alliances. Strategic Management Journal, 21(3), 295-315.

Ashforth, B. E. and Gibbs, B. W. (1990). The double-edge of organizational legitimation. Organization Science, 1(2), 177-194.

Banerjee, A. V. (1992). A simple model of herd behavior. Quarterly Journal of Economics, 107(3), 797-817.

Barreto, I. and Baden‐Fuller, C. (2006). To conform or to perform? Mimetic behaviour, legitimacy‐based groups and performance consequences. Journal of Management Studies, 43(7), 1559-1581.

Baum, J. A. C., Li, S. X., and Usher, J. M. (2000). Making the next move: How experiential and vicarious learning shape the locations of chains' acquisitions. Administrative Science Quarterly, 45(4), 766-801.

Beers, C. and Zand, F. (2014). R&D cooperation, partner diversity, and innovation performance: An empirical analysis. Journal of Product Innovation Management, 31(2), 292-312.

Bikhchandani, S., Hirshleifer, D., and Welch, I. (1992). A theory of fads, fashion, custom, and cultural change as informational cascades. The Journal of Political Economy, 100(5), 992-1026.

Bikhchandani, S., Hirshleifer, D., and Welch, I. (1998). Learning from the behavior of others: Conformity, fads, and informational cascades. The Journal of Economic Perspectives, 12(3), 151-170.

Bitektine, A. (2011). Toward a theory of social judgments of organizations: The case of legitimacy, reputation, and status. Academy of Management Review, 36(1), 151-179.

Braunerhjelm, P. and Parker, S. C. (2010). Josh Lerner: recipient of the 2010 Global Award for Entrepreneurship Research. Small Business Economics, 35(3), 245-254.

Burt, R. S. (1987). Social contagion and innovation: Cohesion versus structural equivalence. American Journal of Sociology, 92(6),1287-1335.

Burt, R. S. (1992). Structural Holes: The Social Structure of Competition. Cambridge, MA: Harvard University Press.

Carayannopoulos, S. and Auster, E. R. (2010). External knowledge sourcing in biotechnology through acquisition versus alliance: A KBV approach. Research Policy, 39(2), 254-267.

Carroll, G. and Hannan, M. T. (1995). Organizations in Industry: Strategy, Structure, and Selection. New York, NY: Oxford University Press.

Chang, C. Y., Chen, H. L., Yang, F. Y. (2015). The effect of herding behavior and the sentiments of investors on Taiwan stock index futures. Corporate Management Review, 35(1), 25-46.

Chen, M. J. and MacMillan, I. C. (1992). Nonresponse and delayed response to competitive moves: The roles of competitor dependence and action irreversibility. The Academy of Management Journal, 35(3), 539-570.

Chen, M. J., Smith, K. G., and Grimm, C. M. (1992). Action characteristics as predictors of competitive responses. Management Science, 38(3), 439-455. Cheng, C. Y. (2012). Determinants of early entry: governance choices and

syndicate networks in US venture capitals' Internet investments. The Service Industries Journal, 32(14), 2219-2232.

Coleman, J. S. (1988). Social capital in the creation of human capital. American Journal of Sociology, 94, S95-S120.

De Clercq, D., and Dimov, D. (2008). Internal knowledge development and external knowledge access in venture capital investment performance. Journal of Management Studies, 45(3), 585-612.

De Clercq, D. and Voronov, M. (2009). The role of domination in newcomers’ legitimation as entrepreneurs. Organization, 16(6), 799-827.

Deephouse, D. L. (1999). To be different, or to be the same? It's a question (and theory) of strategic balance. Strategic Management Journal, 20(2), 147-166. Dierickx, I. and Cool, K. (1989). Asset stock accumulation and sustainability of

competitive advantage. Management Science, 35(12), 1504-1511.

DiMaggio, P. J. and Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American Sociological Review, 48(2), 147-160.

Dushnitsky, G. and Lavie, D. (2010). How alliance formation shapes corporate venture capital investment in the software industry: A resource-based perspective. Strategic Entrepreneurship Journal, 4(1), 22-48.

Dushnitsky, G. and Lenox, M. (2006). When does corporate venture capital investment create firm value? Journal of Business Venturing, 21(6), 753-772.

Dushnitsky, G. and Lenox, M. J. (2005). When do firms undertake R&D by investing in new ventures? Strategic Management Journal, 26(10), 947-965. Dyer, J. H. and Singh, H. (1998). The relational view: Cooperative strategy and

sources of interorganizational competitive advantage. Academy of Management Review, 23(4), 660-679.

Fama, E. (1991). Efficient capital markets: II. Journal of Finance, 46(5), 1575-1617.

Fiegenbaum, A. and Thomas, H. (1995). Strategic groups as reference groups: Theory, modeling and empirical examination of industry and competitive strategy. Strategic Management Journal, 16(6), 461-476.

Glynn, M. A. and Marquis, C. (2004). When good names go bad: Organizational illegitimacy, and the dotcom collapse. Research in the Sociology of Organizations, 22, 147-170.

Gompers, P., Kovner, A., and Lerner, J. (2009). Specialization and success: evidence from venture capital. Journal of Economics and Management Strategy, 18(3), 817-844.

Gompers, P. and Lerner, J. (2000). Money chasing deals? The impact of fund inflows on private equity valuation. Journal of Financial Economics, 55(2), 281-325.

Gompers, P. A. and Lerner, J. (2004). The Venture Capital Cycle. Cambridge, MA: The MIT Press.

Grant, R. M. and Baden‐Fuller, C. (2003). A knowledge accessing theory of strategic alliances. Journal of Management Studies, 41(1), 61-84.

Gulati, R., Lavie, D., and Singh, H. (2009). The nature of partnering experience and the gains from alliances. Strategic Management Journal, 30(11), 1213-1233.

Han, I., Chao, M. C. H., and Chuang, C. M. (2012). Internal resources, external resources and environment, and firm performance: A study on Taiwanese small and medium sized firms. Corporate Management Review, 32(2), 135-169.

Hannan, M. and Carroll, G. (1992). Dynamics of Organizational Populations: Density, Legitimation, and Competition. New York, NY: Oxford University Press.

Hargadon, A. B. and Douglas, Y. (2001). When innovations meet institutions: Edison and the design of the electric light. Administrative Science Quarterly, 46(3), 476-501.

Haunschild, P. R. and Miner, A. S. (1997). Modes of interorganizational imitation: The effects of outcome salience and uncertainty. Administrative Science Quarterly, 42(3), 472-500.

Heugens, P. and Lander, M. (2009). Structure! Agency! (And other quarrels): A meta-analysis of institutional theories of organization. Academy of Management Journal, 52(1), 61-85.

Hochberg, Y., Ljungqvist, A., and Lu, Y. (2007). Whom you know matters: Venture capital networks and investment performance. The Journal of Finance, 62(1), 251-301.

Homans, G. C. (1951). The Human Group. London, England: Routledge.

Ibarra, H. (1992). Homophily and differential returns: Sex differences in network structure and access in an advertising firm. Administrative Science Quarterly, 37(3), 422-447.

King, B. G. and Whetten, D. A. (2008). Rethinking the relationship between reputation and legitimacy: A social actor conceptualization. Corporate Reputation Review, 11(3), 192-207.

of media influence on organizational identity construction in a celebrity firm. Journal of Management Studies, 48(3), 514-543.

Lamertz, K., Heugens, P. P., and Calmet, L. (2005). The configuration of organizational images among firms in the Canadian beer brewing industry. Journal of Management Studies, 42(4), 817-843.

Lane, P. J. and Lubatkin, M. (1998). Relative absorptive capacity and interorganizational learning. Strategic Management Journal, 19(5), 461-477. Lavie, D. and Miller, S. R. (2008). Alliance portfolio internationalization and

firm performance. Organization Science, 19(4), 623-646.

Lazarsfeld, P. F. and Merton, R. K. (1954). Friendship as a social process: A substantive and methodological analysis. Freedom and Control in Modern Society, 18(1), 18-66.

Lerner, J. (1994). The syndication of venture capital investments. Financial Management, 23(3), 16-27.

Lieberman, M. B. and Asaba, S. (2006). Why do firms imitate each other? The Academy of Management Review, 31(2), 366-385.

Lockett, A. and Wright, M. (1999). The syndication of private equity: evidence from the UK. Venture Capital, 1(4), 303-324.

Meyer, J. W. and Rowan, B. (1977). Institutionalized organizations: Formal structure as myth and ceremony. American Journal of Sociology, 83(2), 340-363.

Mindruta, D. (2013). Value creation in university‐firm research collaborations: A matching approach. Strategic Management Journal, 34(6), 644-665.

Mindruta, D., Moeen, M., and Agarwal, R. (2016). A two‐sided matching approach for partner selection and assessing complementarities in partners' attributes in inter‐ firm alliances. Strategic Management Journal, 37(1), 206-231.

Merchant, H. and Schendel, D. (2000). How do international joint ventures create shareholder value? Strategic Management Journal, 21(7), 723-737. Mitsuhashi, H. and Greve, H. R. (2009). A matching theory of alliance formation

and organizational success: Complementarity and compatibility. Academy of Management Journal, 52(5), 975-995.

Navis, C. and Glynn, M. A. (2010). How new market categories emerge: Temporal dynamics of legitimacy, identity, and entrepreneurship in satellite

radio, 1990-2005. Administrative Science Quarterly, 55(3), 439-471.

Navis, C. and Glynn, M. A. (2011). Legitimate distinctiveness and the entrepreneurial identity: Influence on investor judgments of new venture plausibility. Academy of Management Review, 36(3), 479-499.

Noyes, E., Brush, C., Hatten, K., and Smith‐Doerr, L. (2014). Firm network position and corporate venture capital investment. Journal of Small Business Management, 52(4), 713-731.

Oliver, C. (1991). Strategic responses to institutional processes. Academy of Management Review, 16(1), 145-179.

Podolny, J. M. (2001). Networks as the Pipes and Prisms of the Market. The American Journal of Sociology, 107(1), 33-60.

Powell, W. W., Koput, K. W., and Smith-Doerr, L. (1996). Interorganizational collaboration and the locus of innovation: Networks of learning in biotechnology. Administrative Science Quarterly, 41(1), 116-145.

Rogers, E. M. (2003). Diffusion of Innovations. New York, NY: The Free Press. Sorenson, O. and Stuart, T. E. (2008). Bringing the context back in: Settings and

the search for syndicate partners in venture capital. Administrative Science Quarterly, 53(2), 266-294.

Strang, D. and Macy, M. W. (2001). In search of excellence: Fads, success stories, and adaptive emulation. American Journal of Sociology, 107(1), 147-182. van Werven, R., Bouwmeester, O. and Cornelissen, J. P. (2015). The power of

arguments: How entrepreneurs convince stakeholders of the legitimate distinctiveness of their ventures. Journal of Business Venturing, 30(4), 616-631.

Weber, K., Davis, G. F., and Lounsbury, M. (2009). Policy as myth and ceremony? The global spread of stock exchanges, 1980-2005. Academy of Management Journal, 52(6), 1319-1347.

Westphal, J. D., Gulati, R., and Shortell, S. M. (1997). Customization or conformity? An institutional and network perspective on the content and consequences of TQM adoption. Administrative Science Quarterly, 42(2), 366-394.

Wright, M. R. K. (1998). Venture capital and private equity: A review and synthesis. Journal of Business Finance and Accounting, 25(5-6), 521-570. Yue, L. Q. (2012). Asymmetric effects of fashions on the formation and

1996-2006. Organization Science, 23(4), 1114-1134.

Zhao, E. Y., Fisher, G., Lounsbury, M., and Miller, D. (2017). Optimal distinctiveness: Broadening the interface between institutional theory and strategic management. Strategic Management Journal, 38(1), 93-113.

Zwiebel, J. (1995). Corporate conservatism and relative compensation. Journal of Political Economy, 103(1), 1-25.